Invoice Template Without VAT Simple and Easy to Use

When managing finances for a business, clear and accurate billing is essential. For some transactions, it may be necessary to issue a statement that excludes certain charges. This type of document serves the purpose of keeping track of sales and purchases, while ensuring that customers are charged correctly according to specific regulations or agreements.

To achieve this, many opt for specialized formats that are simple to create and customize. These documents can be tailored to fit a variety of professional scenarios, from small businesses to large enterprises. The key is understanding how to structure the content and present the necessary information in a clear and organized manner.

In this guide, we will explore how to create such a document that meets all the required standards while offering flexibility for different purposes. Whether you are just starting out or looking to streamline your billing process, this approach can help you maintain professionalism and accuracy in your financial records.

Invoice Template Without VAT Guide

Creating accurate and professional billing documents is a fundamental aspect of maintaining clear business transactions. In certain situations, it is necessary to prepare a billing document that does not include additional charges typically associated with tax. These documents are particularly useful for businesses operating under special conditions, such as when dealing with international clients or exempt transactions.

Key Elements of a Professional Billing Document

When preparing a document for a transaction that excludes specific charges, it is essential to focus on the core details. Key components should include the recipient’s information, a description of the products or services provided, the total amount due, and any relevant dates. Always ensure the document is clear and simple to understand, while providing all the necessary legal and business details.

Customizing for Different Business Needs

Each business may have unique requirements when it comes to documenting transactions. For example, freelancers, small businesses, or large corporations may all need to adjust the layout, design, or content to suit their specific context. Customizing your billing document helps create a more professional appearance and ensures compliance with industry standards.

Remember, it is important to include disclaimers or notes regarding tax exemption, if applicable, so that there is no confusion between your client and your business. This will not only ensure transparency but also foster trust in your business practices.

What is an Invoice Without VAT

In business transactions, there are cases where certain charges are excluded from the total amount due. This typically occurs when a transaction does not require the addition of a specific tax or when an exemption applies. These types of documents are issued to reflect the agreed-upon price for goods or services, free from additional tax-related fees.

The purpose of this document is to clearly indicate the amount owed by the client while avoiding confusion about tax rates. It is especially useful for businesses that operate in regions where certain sales are not taxable or for transactions between companies registered under different tax laws.

- Exempt Transactions: Some goods and services are exempt from tax obligations under specific conditions.

- International Sales: Cross-border sales often involve tax exemptions or specific agreements regarding taxation between countries.

- Small Business or Freelancer Exemptions: Some small businesses or independent contractors may not be required to charge tax due to revenue thresholds.

In these cases, businesses may opt for a simplified document that omits the tax line, making it easier for both parties to process the payment without the need for tax calculations. It is essential that both the seller and the buyer clearly understand the terms of the transaction, particularly regarding the tax exemption, to avoid any misunderstandings.

Benefits of Using a VAT-Free Invoice

Issuing a billing document that excludes certain charges can offer several advantages to businesses and their clients. This approach simplifies the payment process and can help both parties avoid unnecessary complications with tax-related calculations. It is especially useful for businesses that operate under special circumstances, such as those in regions with specific tax exemptions or those that deal with international clients.

Cost Savings for Clients

For clients, one of the most notable benefits of using a document that omits additional charges is the reduction in the overall cost of the transaction. This can make products or services more affordable, especially for those who do not need to pay tax as part of the purchase price. In turn, this can help improve client satisfaction and encourage repeat business.

Simplified Accounting and Administration

For businesses, not including additional charges on the document streamlines internal accounting processes. With fewer variables to track, businesses can save time and reduce the risk of errors when preparing financial statements or reports. This can be particularly beneficial for small businesses or freelancers, who may not have dedicated accounting staff.

| Benefit | Impact on Business |

|---|---|

| Reduced Transaction Costs | Clients pay less, making products or services more attractive. |

| Faster Payment Processing | Eliminates tax calculations, speeding up payment procedures. |

| Improved Cash Flow | More straightforward financial management helps businesses plan effectively. |

| International Compatibility | Can be used in cross-border transactions where tax exemptions apply. |

Overall, adopting this simplified approach can enhance operational efficiency, improve customer relations, and reduce the potential for disputes, all while ensuring compliance with relevant tax regulations.

How to Create an Invoice Without VAT

Creating a billing document that excludes additional tax charges is a straightforward process that requires attention to detail. By focusing on key elements and ensuring all necessary information is clearly presented, businesses can easily prepare a document that meets their needs while staying compliant with relevant regulations. Here’s a step-by-step guide to help you get started.

Step-by-Step Guide

- Step 1: Gather the Required Information

Collect the necessary details such as the client’s name, address, and contact information. Be sure to include your business details, including your business name, address, and contact information. This ensures that both parties are clearly identified.

- Step 2: Provide a Detailed Description of Goods or Services

Clearly list the products or services provided, including quantities, unit prices, and any additional terms of the agreement. This helps the client understand exactly what they are being billed for.

- Step 3: Exclude Tax Details

In this case, you will omit any tax-related fields or percentages from the document. This is the main distinguishing feature, ensuring the total price is not increased by tax.

- Step 4: Specify the Total Amount Due

Sum up the cost of all items or services and provide a total amount owed, making it clear that no tax has been applied to the final price.

- Step 5: Include Payment Instructions

Be sure to include how and when the payment should be made, along with any necessary account information for bank transfers or payment platforms.

Additional Tips

- Ensure you note any legal requirements or exemptions applicable to the transaction, especially for international or cross-border sales.

- Double-check that all figures are accurate and that the layout is clear to avoid confusion or disputes later on.

- If necessary, include a disclaimer about the exclusion of tax to clarify any potential misunderstandings with the client.

By following these steps, businesses can create a clear and effective document that meets their clients’ needs while staying compliant with relevant rules and regulations.

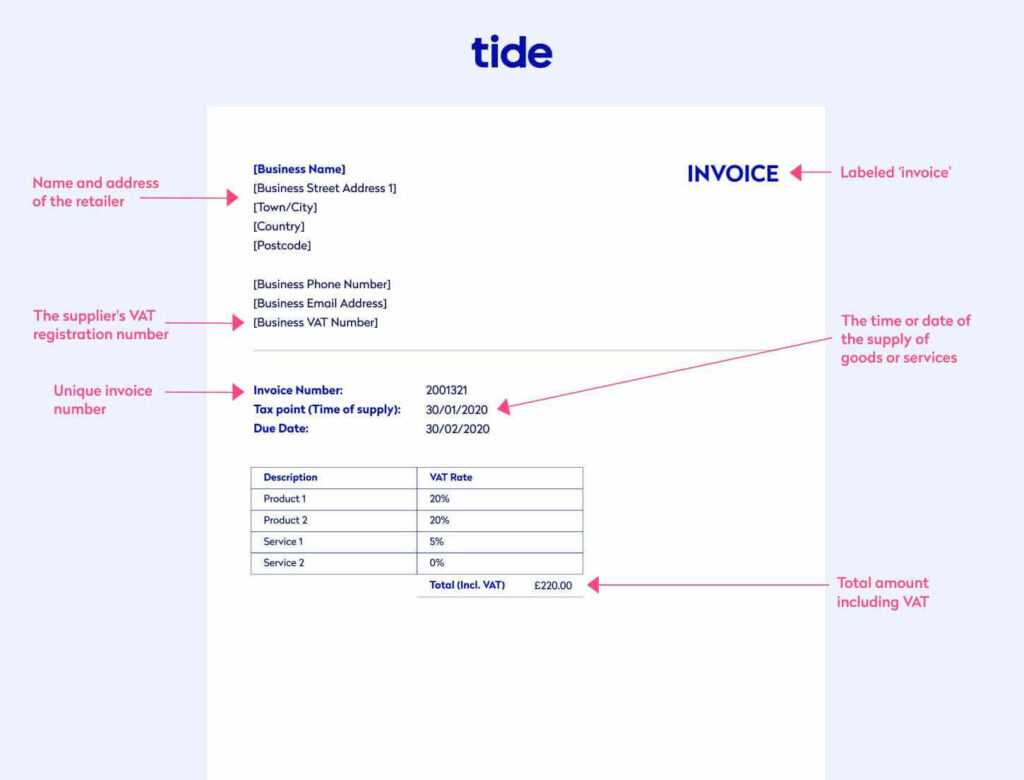

Essential Elements of a Non-VAT Invoice

When preparing a billing document that does not include additional charges, it is important to include certain key details to ensure clarity and professionalism. The structure of such a document is similar to a standard one, but it requires specific adjustments to reflect the absence of tax-related information. These elements help both the business and the client understand the terms of the transaction clearly.

Key Components to Include

Here are the essential elements that should appear in a document that excludes tax charges:

- Business and Client Information: Include both your company’s and your client’s contact details, such as names, addresses, and phone numbers. This ensures that both parties are identified correctly.

- Description of Goods or Services: Clearly outline what has been provided, including any relevant details such as quantities, prices per unit, and total amounts.

- Exclusion of Tax Information: The document should not include any reference to sales tax, VAT, or other related charges. The total amount should reflect the price before any tax is added.

- Total Amount Due: Sum up the cost of the goods or services and specify the total amount due, clearly stating that no tax has been applied.

- Payment Terms: Include payment methods, due dates, and any additional instructions, such as bank account information for wire transfers or online payment options.

Additional Considerations

| Element | Purpose |

|---|---|

| Business Information | Ensures the transaction is linked to the correct party and meets legal requirements. |

| Client Information | Helps avoid confusion by clearly identifying the recipient of the goods or services. |

| Description of Goods/Services | Clarifies exactly what is being provided to the client, ensuring transparency. |

| Exclusion of Tax | Indicates that no additional tax has been added to the transaction, making it clear and simple. |

| Total Amount | Shows the full payment due, ensuring the client understands the cost. |

| Payment Instructions | Provides clear guidance on how and when the payment should be made, preventing delays. |

By including these key elements, businesses can create a document that is both legally compliant and easy to understand for clients, helping to maintain trust and efficiency in the payment process.

Choosing the Right Template for Invoices

Selecting the appropriate format for your billing documents is crucial for both professionalism and clarity. The right layout not only ensures that your clients understand the charges but also streamlines your internal processes. There are several factors to consider when choosing the ideal design, depending on the type of business, transaction complexity, and any specific legal requirements that may apply.

The key to making the right choice is understanding the specific needs of your business and how you want to present your information. Whether you are a small business, a freelancer, or a larger organization, the document should be clear, easy to follow, and customizable to suit your unique requirements.

| Factor | Consideration |

|---|---|

| Business Type | Choose a design that reflects the scale and professionalism of your company, whether you’re a small freelancer or a larger enterprise. |

| Design Simplicity | A clean and simple layout is often more effective, especially for businesses that need to send documents quickly and efficiently. |

| Legal and Tax Requirements | Ensure the format includes all necessary fields, such as business information, payment terms, and legal disclaimers where applicable. |

| Customizability | The ability to easily adjust fields and sections ensures that the format can be adapted to different clients or types of transactions. |

| Digital or Physical Use | Consider whether the document will be sent electronically or printed. The design should work well for both formats. |

By taking these factors into account, businesses can choose a format that suits their specific needs, helps maintain professionalism, and ensures that all necessary details are clearly presented to clients.

When to Use a VAT-Excluded Invoice

There are specific situations where it is appropriate to prepare a document that excludes tax charges. These cases typically arise when the transaction falls under certain exemptions or when the buyer and seller are subject to different tax rules. Understanding when to apply this approach is essential for maintaining proper documentation and compliance with tax regulations.

Common Scenarios for Excluding Tax

Here are a few scenarios where it may be necessary to exclude tax from the billing process:

- International Transactions: When goods or services are sold across borders, they may be exempt from local tax requirements. In such cases, the buyer’s location or status may influence whether tax is applied.

- Small Business Exemptions: In some regions, small businesses with revenue under a certain threshold may not be required to charge tax on their sales.

- Tax-Exempt Organizations: Sales made to organizations that are exempt from tax, such as charities or government bodies, may also be excluded from tax charges.

- Specific Product Exemptions: Some goods or services, such as educational materials or medical supplies, may not be subject to tax, depending on local regulations.

Legal and Regulatory Considerations

Before opting for this approach, it’s important to confirm that you meet the legal criteria for excluding tax. Make sure that all necessary documentation or proof of exemption is provided to avoid any misunderstandings with your client or tax authorities.

Using this type of document in the appropriate scenarios ensures that you stay compliant with tax laws while maintaining clear and transparent financial records.

Free Invoice Templates Without VAT

For businesses that need to create billing documents that exclude additional charges, there are numerous free resources available online. These tools allow you to generate customized financial records without the need for tax calculations, ensuring both accuracy and simplicity. Using free designs can save time and money, especially for small businesses or freelancers looking to streamline their processes.

Advantages of Free Templates

Opting for free options provides a range of benefits:

- Cost-Effective: Free resources eliminate the need for expensive software or services, making them ideal for startups and small businesses.

- Easy Customization: Many free options are fully customizable, allowing you to adjust fields, add your logo, and tailor the document to your business’s needs.

- Time-Saving: Pre-designed formats simplify the creation process, helping businesses save time when preparing financial documents.

- User-Friendly: These tools are often easy to use, requiring no advanced technical skills to produce professional-looking documents.

Where to Find Free Resources

Many websites offer free downloadable formats that exclude tax charges. Some popular sources include:

- Online Software Platforms: Websites like Canva, Zoho, and Wave offer free designs that can be tailored for tax-exempt transactions.

- Spreadsheet Applications: Tools like Google Sheets or Microsoft Excel often provide free, editable formats with customizable fields.

- Freelancer Websites: Many freelance platforms offer free templates that are perfect for small-scale businesses and independent contractors.

These resources can make it easier to manage your billing while staying compliant with relevant regulations. Choosing the right design ensures that your documents look professional and meet your specific business needs.

Customizing Your VAT-Free Invoice Template

Personalizing your billing document is essential for ensuring it aligns with your business’s identity and meets the needs of your clients. Customization allows you to adjust the layout, content, and design to reflect your brand, provide clarity, and ensure the document includes all necessary details. Whether you are a freelancer, a small business owner, or part of a larger organization, making the right adjustments can enhance professionalism and help avoid any confusion during the payment process.

Key Areas to Customize

Here are the most important aspects you can modify in your billing record to make it fit your specific needs:

- Company Branding: Add your company logo, choose brand colors, and use a professional font to make the document reflect your business’s visual identity.

- Client Information: Ensure that the recipient’s contact details are accurate and clear. This includes their full name, address, and any other relevant contact information.

- Payment Terms: Specify the payment due date, acceptable payment methods (bank transfer, online payment systems, etc.), and any late fee policies.

- Clear Descriptions: Modify the fields where you list goods or services provided. Be as detailed as possible to avoid misunderstandings.

- Exclusion of Tax: Ensure that no tax-related lines or calculations appear, and clearly state that the price listed is the full amount due.

Tips for Streamlining Customization

When customizing your document, it’s important to maintain consistency and clarity. Here are some tips to ensure that the final product is both professional and easy to read:

- Keep It Simple: Avoid cluttering the document with unnecessary details. Focus on the essentials to maintain readability.

- Use Standardized Fields: Stick to commonly recognized categories such as “Description,” “Amount,” “Total,” and “Due Date” to make the document familiar to your clients.

- Include Contact Information: Make sure clients know how to reach you if they have questions or concerns about the document.

By customizing these elements, you can create a document that is not only aligned with your business needs but also enhances the professionalism and clarity of your financial communications.

Common Mistakes with VAT-Free Invoices

When creating billing documents that exclude tax, it’s easy to make mistakes that can lead to confusion, delays, or even legal issues. These errors often stem from misunderstanding the necessary fields or failing to ensure clarity in the financial details. Understanding the most common mistakes can help businesses avoid them and ensure their records remain accurate and compliant.

1. Failing to Clearly State the Exclusion of Tax

One of the most common mistakes is not clearly indicating that the document does not include tax charges. If the customer is expecting tax to be added, omitting this information can lead to misunderstandings or disputes. To avoid this, it’s essential to explicitly state that the amount shown is the full price due, and no tax has been applied.

- Solution: Include a line such as “No tax applied” or “Tax-exempt” to clarify the situation for the client.

2. Incorrect or Incomplete Client Information

Another frequent error is providing inaccurate or incomplete details about the client. This can create confusion or delays, especially if contact information is missing or incorrect. Having complete and accurate client details is essential for both billing and record-keeping purposes.

- Solution: Double-check the client’s name, address, and contact details to ensure they are accurate before issuing the document.

3. Not Including Clear Payment Terms

In many cases, businesses forget to specify when and how payment should be made. Without clear payment terms, clients may not know when the payment is due or how they should settle the amount. This can lead to delayed payments or misunderstandings.

- Solution: Include a section outlining the payment due date, acceptable payment methods, and any late fee policies if applicable.

4. Forgetting to Keep Accurate Records

In some cases, businesses may forget to keep a proper record of the transactions that exclude tax. This can create issues with accounting and tax filings. Proper documentation is vital, even when tax is not being applied, to ensure transparency and accuracy in financial reporting.

- Solution: Maintain a detailed and organized record of all transactions, even those that do not include tax charges, for auditing and future reference.

By being aware of these common mistakes and taking proactive steps to avoid them, businesses can ensure that their billing processes are smooth, efficient, and compliant with regulations.

How to Avoid VAT on Invoices

In some cases, businesses are not required to include additional tax charges in their billing documents. However, this can be a complex area, as it depends on various factors such as the nature of the business, the location of the customer, and specific exemptions that may apply. Understanding when and how to legally exclude tax charges is essential for businesses looking to streamline their billing process while ensuring compliance with tax laws.

Here are some strategies to ensure you avoid including tax on your financial records when it is not applicable:

1. Understand Exemption Criteria

In many regions, businesses can be exempt from adding tax to their sales under certain conditions. For example, small businesses with annual revenues below a certain threshold may not be required to charge tax. Similarly, some types of products or services, such as exports or sales to charitable organizations, may be tax-exempt.

- Action: Research the tax exemption rules in your region or consult with a tax professional to ensure your business qualifies for exemption.

2. Verify Customer’s Tax Status

When dealing with international transactions or sales to tax-exempt organizations, verify the customer’s tax status before excluding any tax. Certain customers, such as businesses in other countries or government bodies, may be entitled to purchase goods or services tax-free.

- Action: Request documentation from your customers that proves their eligibility for tax exemption, such as tax exemption certificates or proof of business registration.

3. Clearly State Exclusion of Tax on Documentation

Even if you are legally allowed to exclude tax from a transaction, it is important to make this clear in your records. Failing to clearly communicate that no tax has been applied can lead to confusion and possible disputes with clients or tax authorities.

- Action: Include a statement such as “No tax applicable” or “Tax-exempt” on your documents to make it clear that no additional charges are included in the total price.

4. Keep Accurate Records for Audits

It’s essential to maintain proper documentation of why tax was excluded in each case. This will protect your business in case of an audit and ensure that all exclusions are justified and legally sound.

- Action: Keep records of all relevant transactions and customer communications that demonstrate the reason for tax exemption, such as export receipts or tax-exemption certificates.

By carefully following these steps, businesses can confidently exclude tax from their billing documents when appropriate, while ensuring they remain compliant with local tax regulations.

Legal Considerations for Non-VAT Invoices

When creating billing documents that exclude tax charges, it is crucial to ensure that all legal requirements are met. Tax regulations vary by region, and certain criteria must be satisfied in order to properly exclude tax from transactions. Failing to adhere to these rules can result in penalties or disputes with tax authorities, so it is important for businesses to understand the legal framework surrounding such documents.

1. Tax Exemption Eligibility

To legally exclude tax from a transaction, businesses must be aware of the conditions under which they are eligible for tax exemptions. These conditions often depend on factors such as the business’s size, location, or the nature of the products or services provided. For example, in many countries, small businesses below a certain revenue threshold are exempt from charging tax. Similarly, certain types of transactions, such as exports or sales to tax-exempt organizations, may not require tax to be added.

- Action: Research the specific tax exemption rules in your country or region and consult with a tax expert to ensure compliance.

2. Proper Documentation of Tax-Exempt Transactions

For transactions where tax is excluded, it is essential to maintain proper documentation to justify this decision. Without appropriate records, businesses risk facing challenges during audits or legal inquiries. Certain customers, such as non-profit organizations, may require special documentation, such as exemption certificates or proof of their tax-exempt status.

- Action: Always keep records of the customer’s tax-exempt status, including any relevant certificates or official documents that validate the exclusion of tax.

3. Clear Communication on Billing Documents

It is essential to clearly state that no tax is being charged in the billing document. This helps avoid confusion and ensures transparency with the client. If the document does not include tax, a clear statement such as “Tax-exempt” or “No tax applicable” should be included in the payment details section.

- Action: Include a note on the document indicating that no tax is included, and ensure that this is explained to your customer before finalizing the transaction.

4. Stay Updated on Changes in Tax Laws

Tax laws are subject to change, and it is essential for businesses to stay informed about any updates that may affect their eligibility for excluding tax from certain transactions. Failing to comply with new laws can lead to legal issues or financial penalties. Regularly reviewing tax regulations or seeking advice from a legal professional can help businesses remain compliant.

- Action: Keep track of any changes in tax regulations that might impact your ability to exclude tax, and adjust your billing practices accordingly.

By adhering to these legal guidelines, businesses can ensure that they remain compliant with tax laws while providing clear and accurate financial records for their clients.

Examples of VAT-Free Invoice Templates

For businesses that do not need to include tax charges in their billing documents, it is essential to have clear and simple formats that ensure accuracy. These formats provide businesses with the structure they need to list their products or services, include the correct payment details, and indicate that no tax has been applied. Below are some examples of how such documents can be structured for different types of transactions.

Example 1: Simple Service Agreement

This format is ideal for freelancers or service providers who offer services without the need to apply tax charges. It includes essential fields such as service description, client details, payment due date, and the total amount due.

- Client Name and Address: Always ensure your client’s details are accurate for proper communication and record-keeping.

- Service Description: A clear, detailed explanation of the services provided helps avoid confusion.

- Amount Due: The final price is stated clearly, with no tax included.

- Payment Terms: Include the date by which payment is due and any payment methods available.

- Tax Exemption Statement: A note indicating that no tax has been applied, such as “No tax applicable.”

Example 2: Product Sale Document

This layout is useful for businesses selling goods that are exempt from tax, either due to the product category or the buyer’s status (e.g., a non-profit organization). This example lists the product details, quantities, and final total.

- Product Description: List each item being sold with a clear description and quantity.

- Unit Price: State the price per unit clearly, with no tax added to the final amount.

- Subtotal: The total amount for the items before final calculation.

- Total Due: The grand total, which reflects the price of the goods, without any additional tax.

- Exemption Statement: Make sure to include a line such as “Tax-exempt” or “No tax applied” to clarify the exclusion of tax.

These examples help ensure clarity and transparency, giving both businesses and clients an understanding of the financial transaction while confirming that no tax is being applied. Using these simple, clear formats will help prevent any confusion or errors in the billing process.

How to Handle International Invoices Without VAT

When dealing with cross-border transactions, businesses often face the challenge of managing tax regulations that vary between countries. In some cases, tax charges may not be applicable, either due to the nature of the transaction or the location of the buyer. Understanding how to correctly handle these situations ensures smooth transactions and compliance with international tax laws.

1. Understand International Tax Exemption Rules

Tax laws differ significantly from one country to another, and many jurisdictions have specific rules for international transactions. For instance, goods sold to buyers outside the seller’s country may be exempt from additional tax charges, depending on the region’s tax code and international trade agreements.

- Action: Research the tax rules for both your country and the buyer’s country to determine when tax can be excluded.

- Action: Understand how international treaties, such as VAT exemptions for exports, apply to your specific situation.

2. Include the Right Documentation for Exempt Transactions

When goods or services are sold internationally without tax, it’s important to ensure the proper documentation is in place. This helps both parties maintain transparency and avoid legal or financial complications. Buyers, particularly from other countries, may need to provide proof of their business status or eligibility for tax exemptions.

- Action: Request documents such as VAT registration numbers or tax exemption certificates from your international clients.

- Action: Retain all proof of transaction, including shipping receipts or export documentation, to validate that the transaction qualifies for a tax-exempt status.

3. Specify Exemption Clearly in the Financial Record

For international transactions where tax is excluded, it is essential to explicitly state this on the billing record. A simple note stating that the transaction is exempt from local taxes helps to avoid confusion and ensures that both parties are clear about the payment amount.

- Action: Include a statement such as “Exempt from local tax” or “International sale – no tax applied” on the record.

- Action: Ensure that the total amount reflects the price agreed upon, with no additional tax charges, to avoid any misunderstandings.

4. Consider Currency and Payment Methods

When creating documents for international transactions, it’s important to consider the currency used for the transaction. Depending on the country of the buyer, you may need to offer payment options in different currencies or provide information on currency exchange rates. Additionally, specify the accepted payment methods, whether via wire transfer, credit card, or international payment services.

- Action: Clearly state the currency in which the transaction is to be completed, and include any exchange rate information if applicable.

- Action: Outline the available international payment methods to streamline the payment process for the customer.

By understanding international tax rules, ensuring proper documentation, and clearly stating exemptions, businesses can confidently manage global transactions while avoiding tax complications and ensuring compliance with international regulations.

Accounting for Transactions Without VAT

When handling financial records for transactions that exclude tax, it’s essential to keep accurate and clear documentation. These transactions require proper classification and tracking in accounting systems to ensure compliance with financial reporting standards and tax regulations. Correctly managing such records not only avoids potential errors but also protects the business during audits and ensures transparency in its financial dealings.

1. Record the Total Amount Without Tax

For transactions where tax is not applied, it’s important to record the full payment amount as it is agreed upon, without any additional tax charges. The absence of tax should be reflected in your accounting system, ensuring that the total amount paid is clearly understood and correctly accounted for.

- Action: Ensure the total amount is entered as the sum agreed between the parties, with no tax added to the base price.

- Action: Mark the transaction as “tax-exempt” or “no tax applied” in your accounting software or records to clarify that no tax was included.

2. Track Exempt and Taxable Sales Separately

For businesses dealing with both taxable and tax-exempt sales, it’s important to distinguish between the two types of transactions in your records. Maintaining separate records for these transactions will help you stay compliant with tax regulations and provide clarity during audits. It also allows for accurate reporting of both taxable and non-taxable income.

- Action: Create distinct categories or accounts in your accounting system to track taxable and non-taxable transactions separately.

- Action: Regularly reconcile your records to ensure that tax-exempt transactions are correctly classified and that taxable sales are reported with the appropriate tax amount.

3. Maintain Supporting Documentation

To substantiate that no tax was charged, businesses must maintain supporting documentation for each transaction. This could include contracts, tax exemption certificates, shipping documentation, or any other relevant paperwork that demonstrates eligibility for exclusion from tax. Keeping these records on hand will ensure that your accounting practices align with legal requirements and protect the business from potential disputes.

- Action: Keep all supporting documents, such as purchase orders, contracts, and customer tax exemption certificates, in an organized and easily accessible manner.

- Action: Ensure that your accounting system is updated with references to these documents for easy retrieval in case of an audit.

4. Report Accurately in Financial Statements

When preparing financial statements, it is important to correctly report transactions that exclude tax. Ensure that these sales are clearly labeled in your profit and loss statements and other relevant financial reports. Accurate reporting helps stakeholders understand your business’s financial health and can prevent legal issues with tax authorities.

- Action: When preparing your financial reports, make sure to clearly identify the total sales amount and exclude tax from the final figures.

- Action: Ensure that all

Tracking Payments on Non-VAT Invoices

Effectively managing and tracking payments for transactions that exclude tax is essential for maintaining accurate financial records. Whether the sale is a one-time payment or involves a payment plan, it’s important to ensure that payments are recorded properly, so the business can maintain clarity in cash flow and stay organized for future audits. Accurate tracking also helps in reconciling accounts and ensuring that all amounts are paid on time.

1. Set Up a Payment Tracking System

To keep track of payments, it’s critical to implement a robust payment tracking system. This system should include key details such as the payment due date, amount, and status of each transaction. Whether using accounting software or a manual spreadsheet, having an organized record of payments ensures that no payments are overlooked and that clients are reminded when necessary.

- Action: Use software or tools that automatically track outstanding payments and send reminders to clients before the due date.

- Action: Make sure to update the payment status as soon as a payment is received and ensure this information is easily accessible for future reference.

2. Record Partial and Full Payments

Sometimes, customers make partial payments on their transactions, especially for larger sums. It’s essential to track these payments accurately. When partial payments are made, update the payment records immediately and adjust the outstanding balance accordingly. This ensures that both the business and the customer have a clear view of what is still due.

- Action: In your tracking system, record the amount paid, update the remaining balance, and note the date of payment.

- Action: Clearly mark any transactions that have been partially paid to avoid confusion, and ensure all records reflect the current balance owed.

3. Provide Clear Payment Receipts

After receiving payments, provide clients with clear receipts that show the total amount, any payments made, and the remaining balance (if applicable). This is important for both record-keeping and customer transparency. A receipt that includes all of this information ensures both parties have a mutual understanding of the payment status.

- Action: Issue receipts with details such as payment method, date of payment, and the amount paid.

- Action: Include a statement showing that no tax has been applied, if relevant, for clarity.

4. Regularly Reconcile Payments

Reconciliation is a crucial step in tracking payments. Regularly compare your payment records with your bank statements to ensure all payments are accounted for. This process helps prevent errors and discrepancies and provides peace of mind that your financial records are accurate and up-to-date.

- Action: Set a schedule for reconciling payments, whether it’s weekly, bi-weekly, or monthly.

- Action: Ensure all payments are accurately recorded and matched with bank deposits to prevent any discrepancies in your financial statements.

By keeping careful track of payments and maintaining accurate records, businesses can stay organized, manage their cash flow effectively, and avoid any potential misunderstandin

Best Practices for VAT-Free Billing

When managing transactions that do not include tax charges, it is crucial to follow best practices to ensure clarity, compliance, and professionalism. Properly handling these types of transactions not only streamlines business operations but also reduces the likelihood of misunderstandings or legal issues. Below are some key recommendations for ensuring smooth billing and maintaining accurate financial records in tax-exempt transactions.

1. Confirm Eligibility for Tax Exemption

Before proceeding with any billing that excludes tax, it is important to verify that the transaction meets the criteria for exemption. This could involve checking the buyer’s tax status, ensuring that the transaction is eligible under local tax laws, or confirming whether the product or service qualifies for tax exclusion under international agreements.

- Action: Request and validate necessary documentation, such as tax exemption certificates or registration numbers, from customers who qualify for tax-free transactions.

- Action: Stay updated on the latest tax laws and international trade agreements that may impact eligibility for tax exemptions.

2. Clearly State the Exemption on Billing Documents

It is essential to clearly indicate that no tax is being charged on the billing record. Doing so helps avoid confusion for both parties and ensures that the financial documentation reflects the true nature of the transaction. Transparency is key in maintaining a positive relationship with clients and complying with tax regulations.

- Action: Include a statement such as “Tax exempt” or “No tax applied” on all relevant documentation.

- Action: Ensure that both parties are aware of the tax status before the transaction is finalized to prevent misunderstandings.

3. Maintain Comprehensive Records

To comply with tax laws and ensure transparency, it is important to keep thorough records of all transactions that do not include tax. This includes maintaining digital or physical copies of any documents that prove the legitimacy of the exemption, such as purchase orders, contracts, or shipping documents. Proper record-keeping is vital for audits and can serve as proof in case of disputes.

- Action: Organize and store supporting documents in an easily accessible manner to facilitate audits or reviews.

- Action: Regularly update and back up all transaction records to ensure they are preserved for the required retention periods.

4. Stay Transparent with Clients

Open communication with clients about tax-exempt transactions is essential for maintaining trust and avoiding confusion. Inform customers upfront about the status of their purchase, especially if there are no tax charges involved. This helps set expectations and ensures both parties are on the same page.

- Action: Discuss any potential tax exemptions early in the sales process, before finalizing the sale.

- Action: Provide clear explanations to clients regarding the absence of tax and any necessary supporting documentation.

5. Regularly Review Tax Compliance

Tax laws and exemptions can change over time, so it is important to regularly review and ensure your billing practices remain compliant. Stay informed about changes in tax codes, particularly those related to cross-border tran