Invoice Template Without Tax for Easy Billing

In any business, effective billing is key to maintaining smooth cash flow and building trust with clients. However, there are instances where standard charges may not apply, and you need to prepare a document that clearly lists the services or products provided, without adding any additional fees or levies. This is common in situations where businesses are not required to collect certain financial contributions, or where clients operate under specific exemptions.

Understanding the essentials of a clean and clear financial document can save time and prevent confusion. It’s important to focus on clarity, accuracy, and simplicity, especially when you’re working with clients who expect straightforward, no-frills paperwork. This type of document should allow for easy customization, so you can tailor it to meet your business needs while maintaining professionalism.

Creating such documents doesn’t have to be complicated. With the right approach, you can develop effective billing forms that meet your requirements and ensure that your clients have all the necessary details without any unnecessary complexity. This approach can streamline your workflow and improve client satisfaction, making it an essential tool for businesses of all sizes.

Invoice Template Without Tax Benefits

When running a business, it’s essential to have flexible billing options that cater to different needs. Certain circumstances may require a simpler document that focuses only on the core details of a transaction, eliminating the complexity of additional charges or financial contributions. This streamlined approach offers several key advantages that can help enhance the overall efficiency of your operations.

Clarity and Simplicity

One of the primary benefits of using a streamlined billing form is the clarity it provides. Clients are more likely to understand the cost breakdown when only essential items are listed, reducing the chances of errors or confusion. This can be particularly beneficial in situations where clients are not subject to extra fees or contributions, allowing them to easily see the exact amount due for the services rendered or goods provided.

Efficiency in Processing

Another significant advantage is the time saved during the creation and processing of these documents. By eliminating the need to calculate and include extra charges, businesses can focus on delivering the necessary information quickly and efficiently. This leads to faster invoicing cycles and an overall more streamlined workflow, reducing administrative overhead and potential delays in payments.

Overall, the simplicity and speed of such documents make them an excellent choice for businesses looking to optimize their financial operations while maintaining a high level of professionalism. Focusing on what truly matters allows both businesses and clients to avoid unnecessary complications, ensuring smoother transactions.

Why Choose a Tax-Free Invoice Template

In certain business scenarios, it’s essential to streamline your financial documents by removing unnecessary elements like additional fees or levies. This approach simplifies the billing process and ensures that both parties are clear on the amount due. By focusing solely on the core aspects of the transaction, you can create more efficient and straightforward paperwork that benefits both the seller and the buyer.

Simplified Communication

One of the main reasons to opt for a document that excludes extra financial charges is that it simplifies communication with clients. With no additional complexities, the total amount due is immediately obvious, making it easier for customers to understand and process the payment. This transparency helps build trust and reduces the likelihood of disputes or confusion about the charges.

Better Control Over Pricing

When you choose to exclude any extra financial contributions, you maintain full control over how your pricing is presented. This ensures that clients are only paying for the actual value of the goods or services provided, making it easier to manage pricing strategies. It also allows you to keep your billing consistent and predictable, reducing fluctuations that could lead to customer dissatisfaction.

Overall, this approach provides clarity and a sense of fairness for both parties involved. By eliminating unnecessary charges, you foster a smoother transaction process and increase the likelihood of timely payments, which can positively impact your business’s cash flow.

How to Create an Invoice Without Tax

Creating a billing document that excludes additional financial charges can be a simple and straightforward process. The key is to focus on providing essential information about the goods or services provided, while keeping the format clear and easy to understand. Follow these steps to create a clean, tax-free statement that meets your business needs.

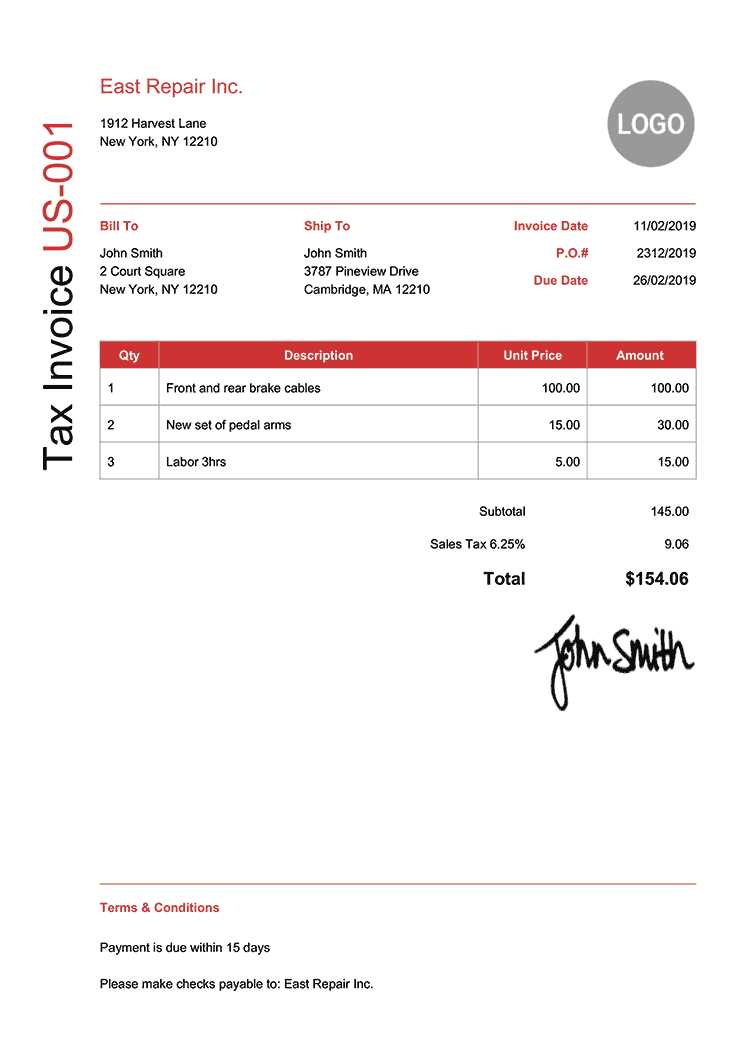

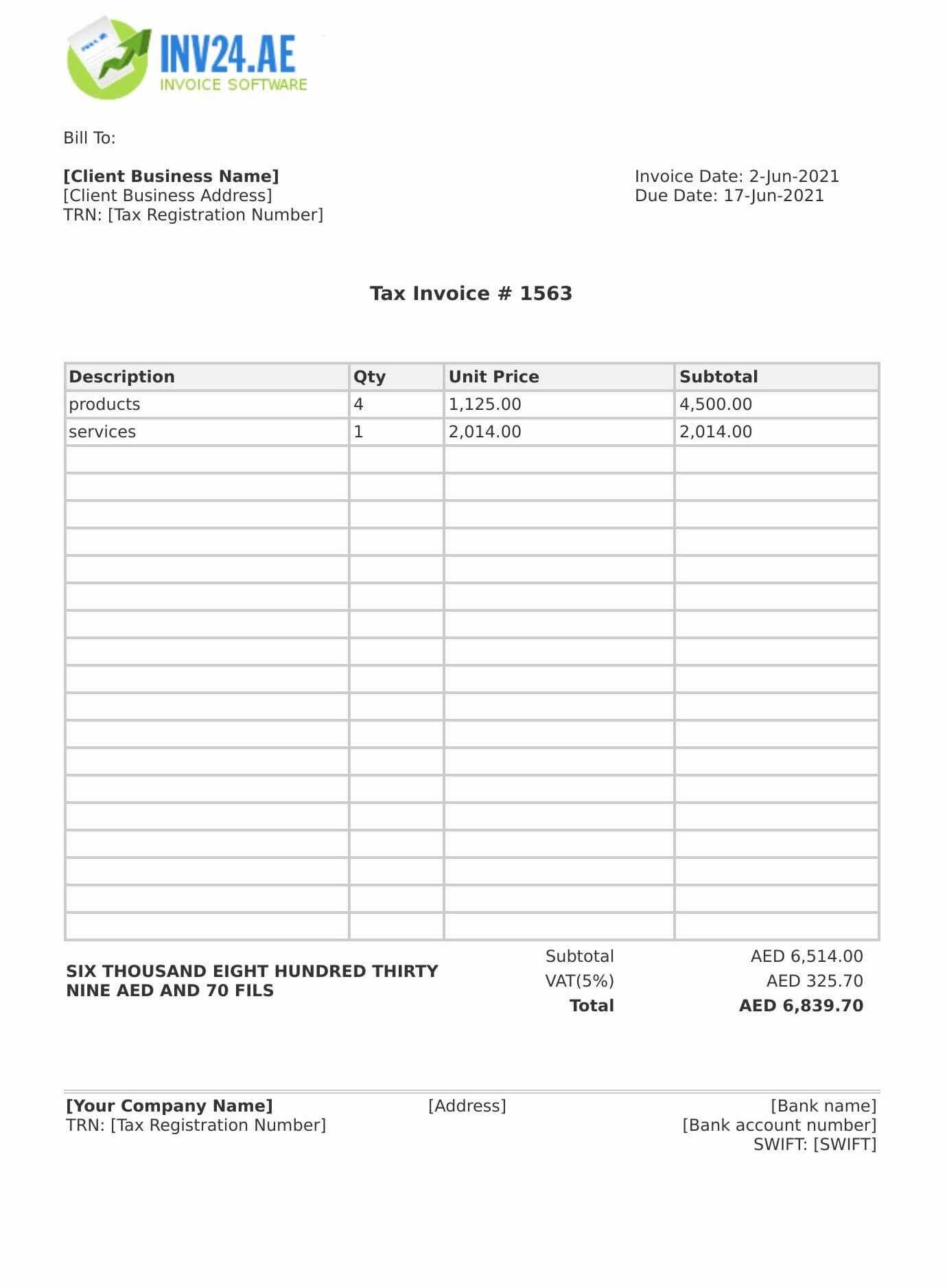

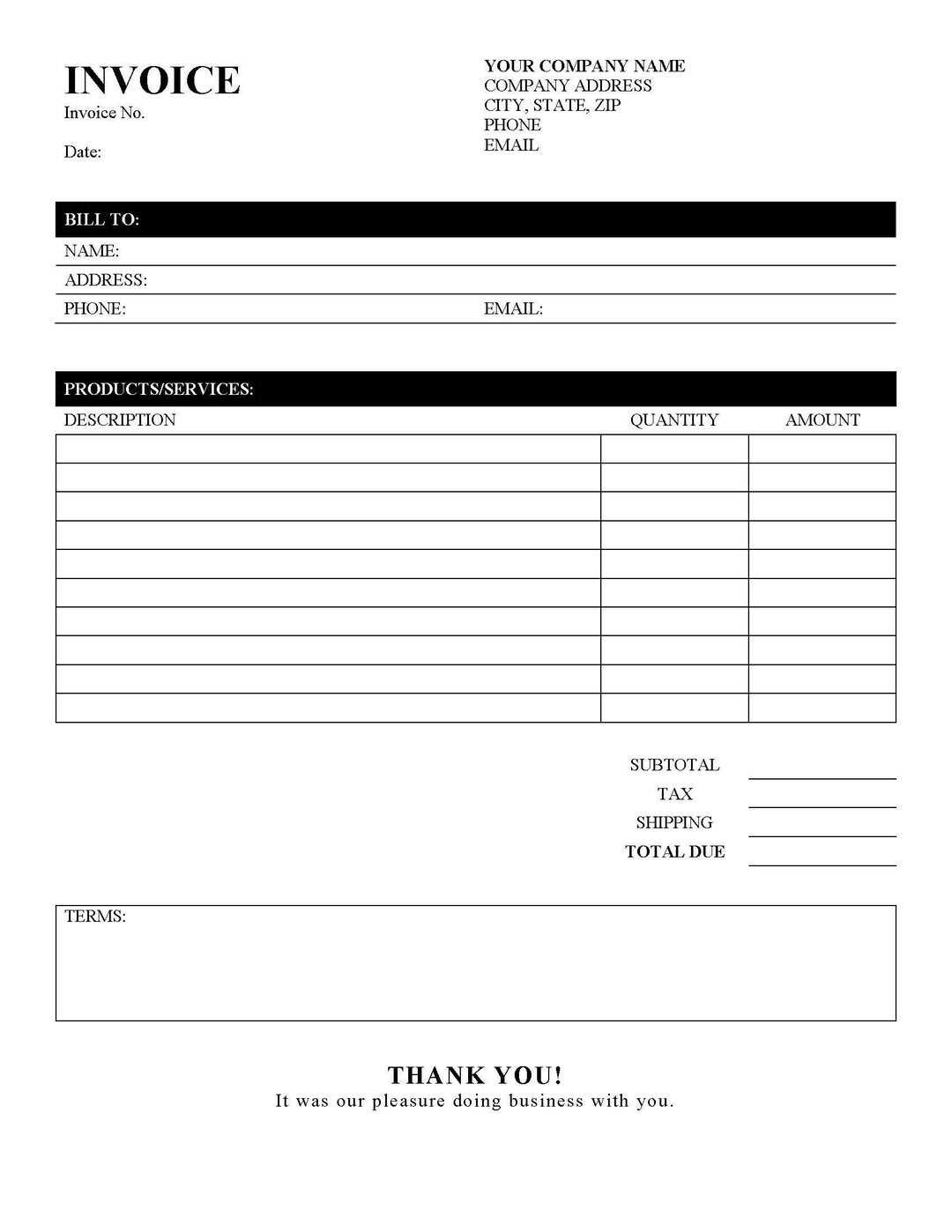

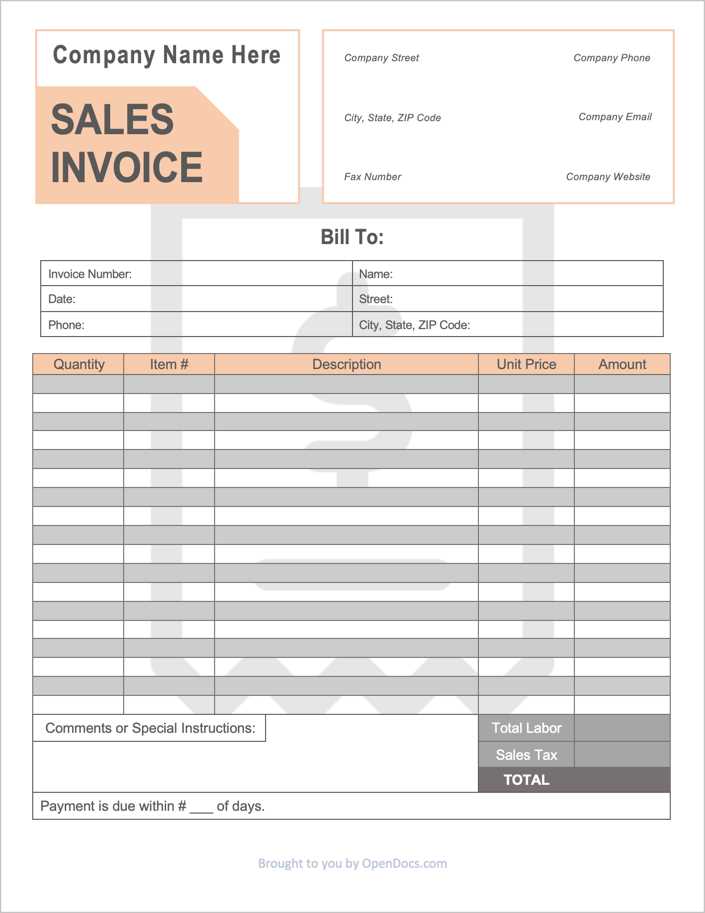

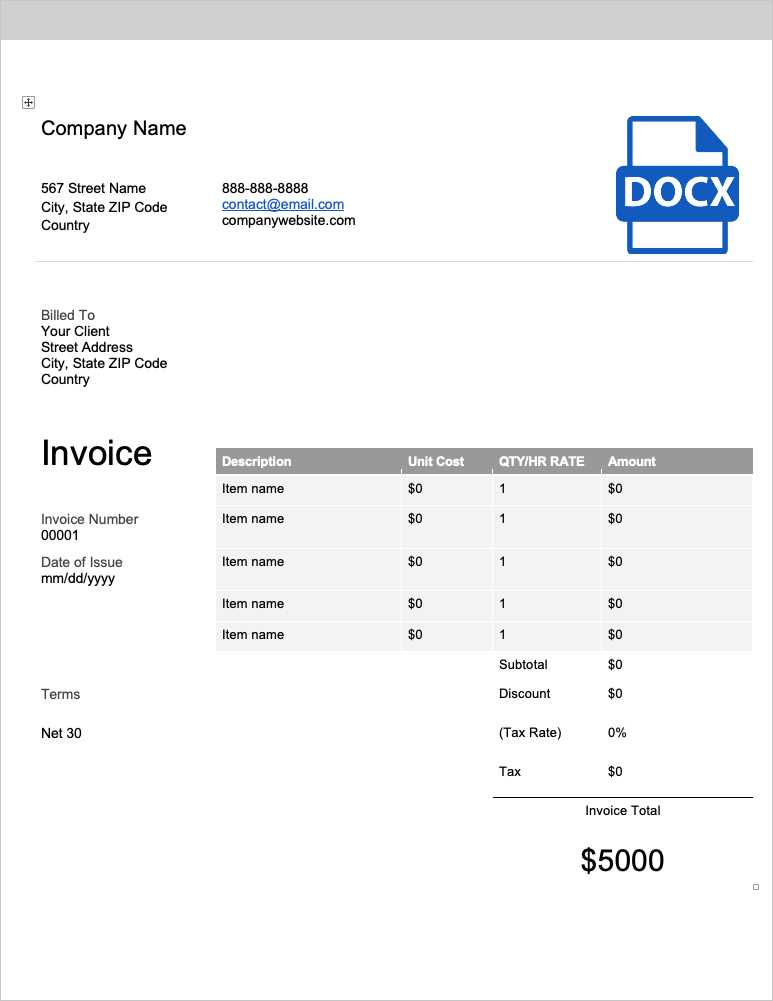

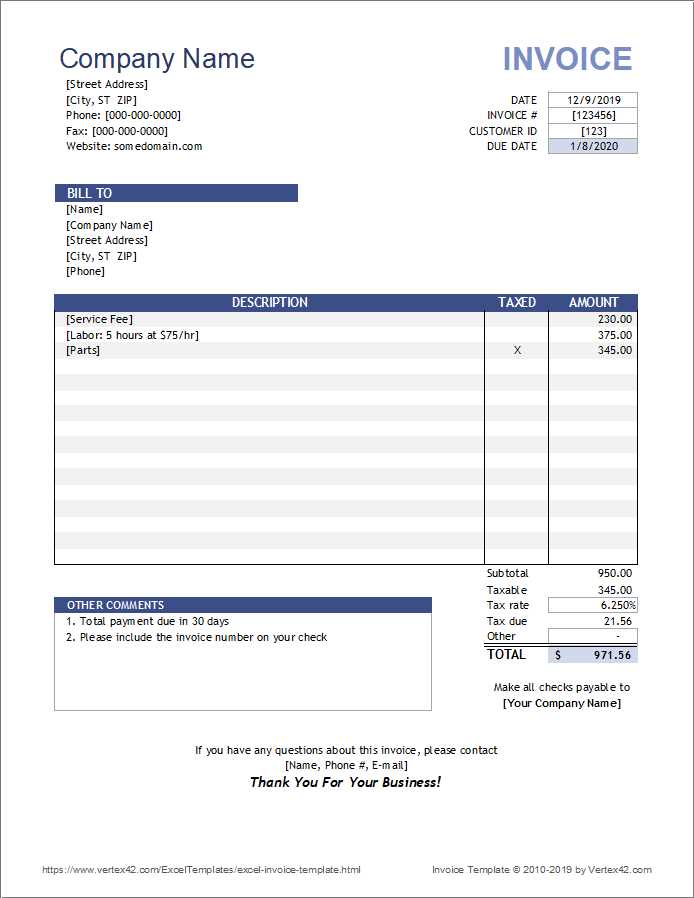

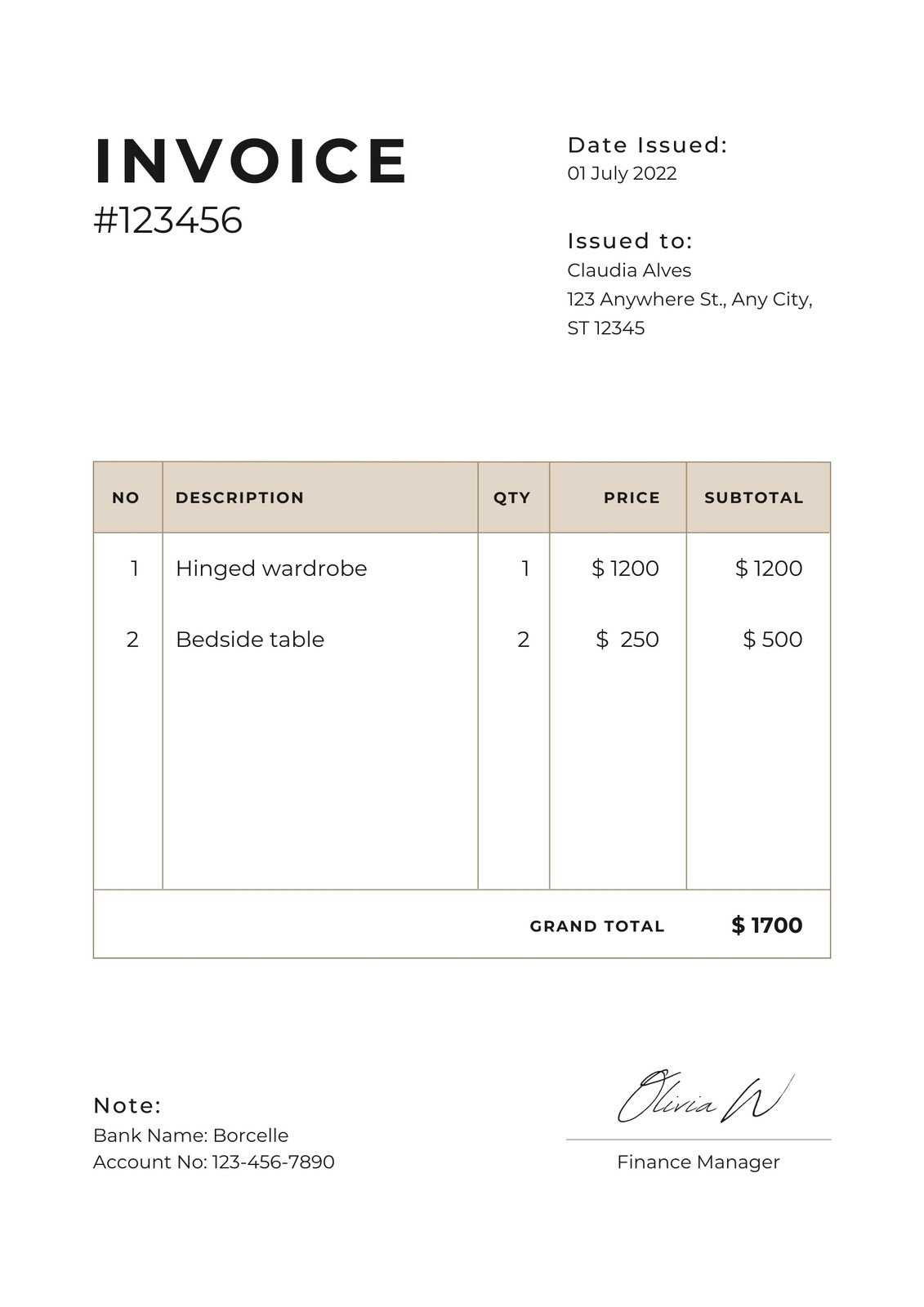

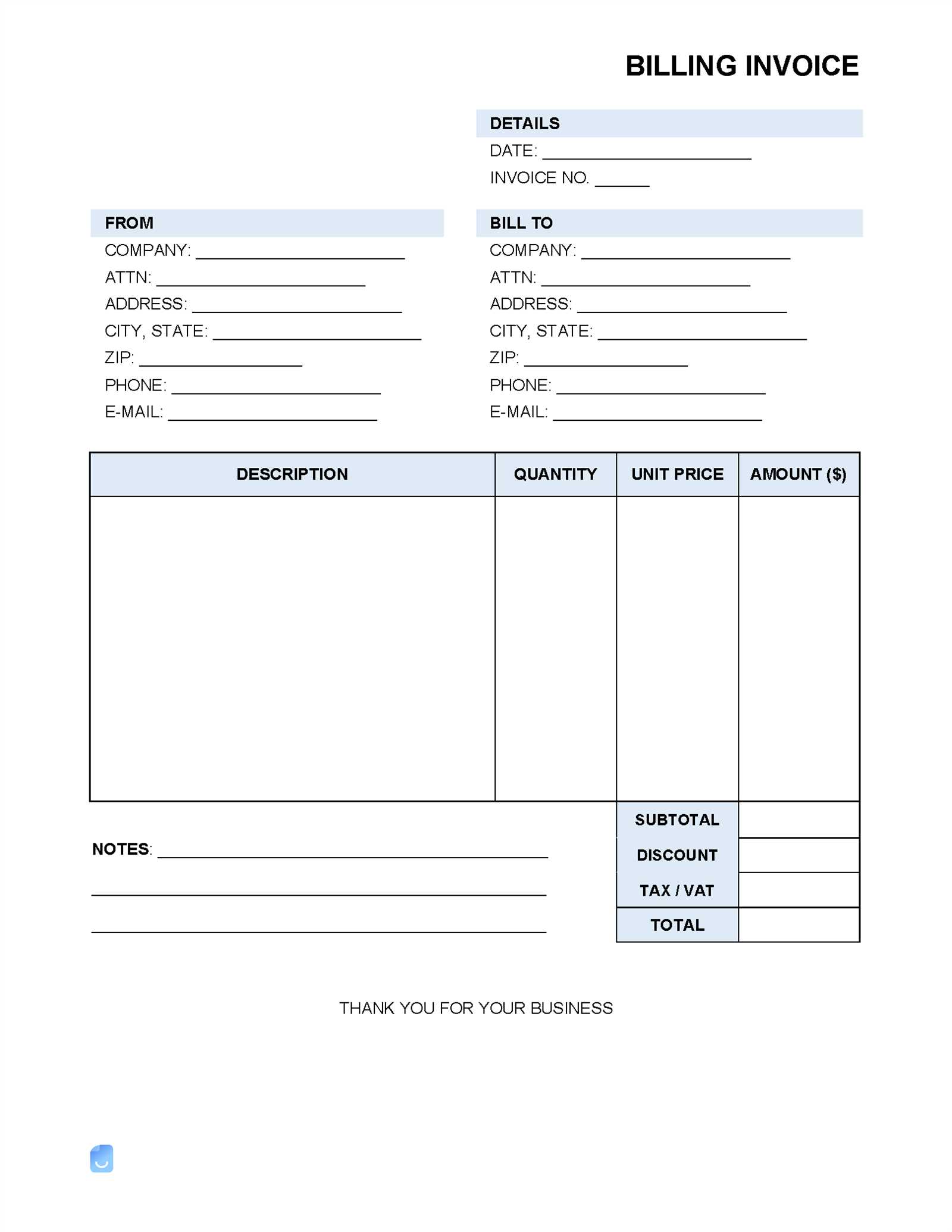

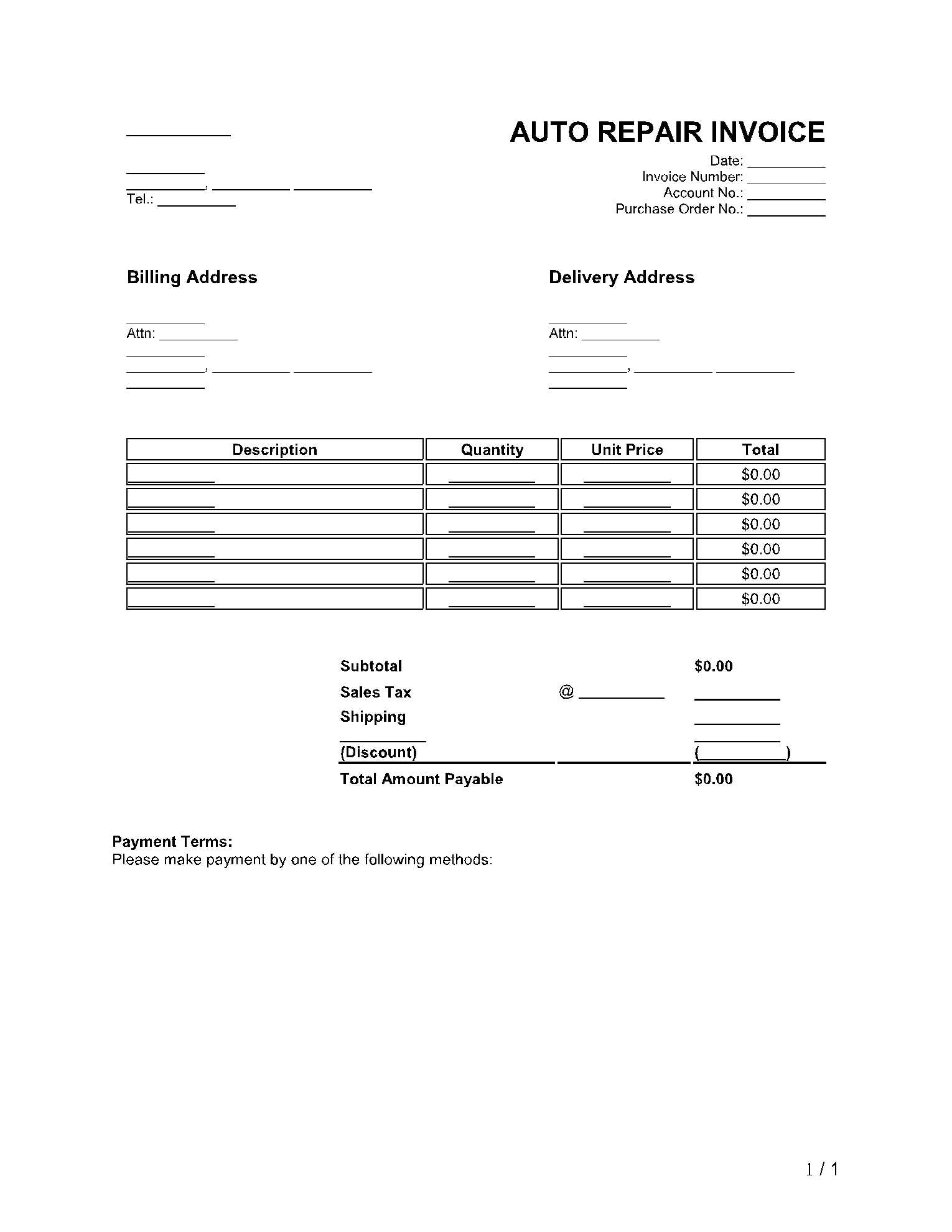

- Choose the Right Format: Start by selecting a clear, easy-to-read format. You can create one from scratch or use a pre-designed layout for quick setup. Ensure the document is clean and professional.

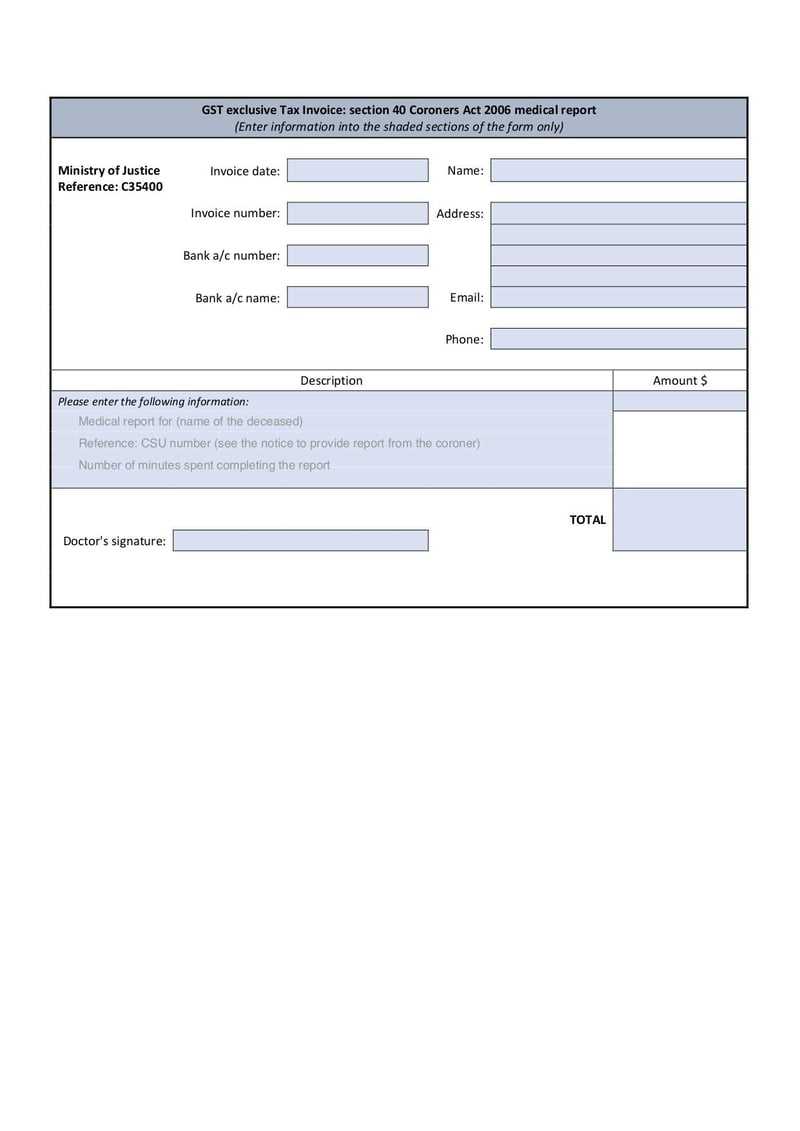

- Include Business Information: Make sure to list your business name, contact details, and any relevant identification numbers (such as VAT or registration numbers) at the top of the document.

- Client Details: Include the client’s name, address, and contact information. This helps in personalizing the document and ensures it is directed to the correct person.

- Describe Products or Services: List the items or services provided, along with a brief description of each, the quantity, and the unit price. Exclude any additional fees or charges that would typically be added.

- Calculate the Total Amount: Add up the cost of the goods or services and present the total amount due. Ensure there is no mention of taxes, contributions, or other charges.

- Provide Payment Terms: Specify the payment method, due date, and any additional instructions or terms. Clear payment instructions can help ensure timely processing of the payment.

By following these steps, you can create a straightforward document that focuses on the core value of the transaction. Eliminating unnecessary elements makes it easier for your clients to understand and process the payment efficiently, ensuring smoother transactions for your business.

Key Features of Tax-Free Invoices

Documents that exclude additional financial contributions are often simpler and more direct. These forms typically focus on the core details of the transaction, providing a clear breakdown of the goods or services delivered. Here are the key characteristics that make such documents effective and beneficial for both businesses and clients.

Clear and Transparent Information

- Simplicity: The main feature of a tax-free statement is its straightforward structure, ensuring that the customer sees only the price for the provided goods or services.

- Direct Cost Breakdown: All items or services are clearly listed, showing their individual prices, quantities, and total cost, with no additional fees or contributions added.

- Transparency: Customers appreciate knowing exactly what they are paying for, without any surprises or added financial obligations.

Efficient and Fast Processing

- Quick Generation: These forms are easier and faster to create, as they require fewer calculations and fewer components to be included.

- Faster Payment Cycles: With no additional contributions to account for, these documents can be processed more quickly, resulting in faster payment turnaround times.

- Less Administrative Work: By excluding complex calculations, businesses save time on paperwork and focus more on operations, leading to better overall efficiency.

Overall, these features make such documents a preferred choice for businesses aiming to simplify their billing processes. Clarity, efficiency, and ease of use ensure that both businesses and clients benefit from a smooth and uncomplicated transaction experience.

When to Use an Invoice Without Tax

There are specific situations where it’s appropriate to create a billing document that doesn’t include any additional fees or levies. These instances typically arise when businesses or clients are not subject to extra charges, or when an exemption applies. Understanding when to use such documents can help streamline your financial processes and ensure compliance with applicable laws.

Here are some common scenarios where a billing form might be issued without any additional financial contributions:

| Situation | Description |

|---|---|

| Exemptions for Small Businesses | Small businesses that fall under a certain revenue threshold may be exempt from charging additional fees, allowing them to issue straightforward documents. |

| International Transactions | For cross-border transactions, certain countries may not require extra financial contributions, making a simple statement more appropriate. |

| Non-Taxable Services | Some services or products are categorized as non-taxable under specific regulations, meaning they can be billed without any extra financial obligations. |

| Government Contracts | In some cases, contracts with government agencies may not require additional charges or contributions, especially if the payment terms are already set by law. |

| Export Sales | Sales of goods for export may be exempt from additional levies in certain jurisdictions, meaning no extra charges need to be included. |

Using such a document in these circumstances ensures that the transaction remains clear and compliant. Eliminating extra charges helps both businesses and clients understand the exact costs and reduces the chance of confusion or disputes over payment details.

Customizing Your Tax-Free Invoice Template

Tailoring a billing document to fit your specific business needs is crucial for maintaining a professional and efficient workflow. By customizing the layout and content, you can ensure that your customers have a clear understanding of what they are being charged for, without any added complexities. A well-designed document can reflect your brand’s identity while providing all the necessary details for smooth transactions.

Steps to Personalize Your Billing Document

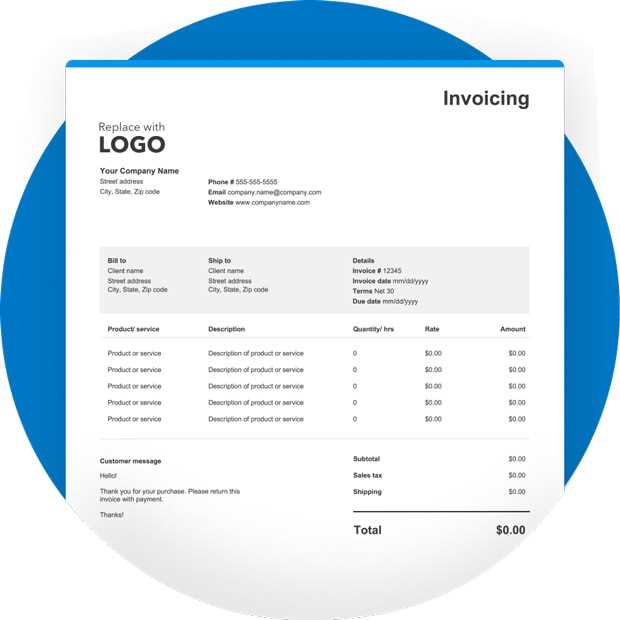

- Branding and Design: Add your company logo, business name, and contact information to create a professional and branded document. Choose colors and fonts that align with your brand’s aesthetic.

- Itemized Breakdown: Customize the list of goods or services by including specific descriptions, quantities, and unit prices. This makes it easier for your customers to identify each line item.

- Payment Details: Clearly specify your payment terms, methods accepted, and due date. If you offer discounts or early payment incentives, include this information to encourage timely payments.

- Additional Notes: Include any relevant notes or instructions, such as terms of service, return policies, or delivery information. These extra details can help avoid confusion and set expectations for both parties.

- Legal Information: If applicable, add legal or regulatory information, such as business registration numbers or industry-specific disclaimers. This adds credibility and ensures compliance with local regulations.

Benefits of Customization

- Improved Professionalism: A customized form that reflects your brand helps build trust and ensures that you appear professional to your clients.

- Efficiency in Communication: By customizing the content, you make it easier for your customers to quickly understand the charges and payment terms, reducing the chance of errors or misunderstandings.

- Consistency: A consistent design and structure across all your documents helps maintain brand identity and provides a uniform experience for your clients.

Overall, customizing your document ensures that your communication with clients is clear, professional, and aligned with your business needs. Tailoring each element allows you to create a document that not only meets legal requirements but also reflects your business values and makes the transaction process smoother.

Legal Considerations for Tax-Free Invoices

When creating financial documents that exclude additional charges or contributions, it is crucial to ensure compliance with relevant laws and regulations. Depending on your location, industry, or the nature of the transaction, certain legal requirements may dictate how you should issue such forms. Understanding these legal considerations will help avoid potential issues and ensure that your billing practices remain transparent and accurate.

Here are some important legal aspects to consider when issuing a document with no additional financial charges:

| Legal Aspect | Description |

|---|---|

| Exemption Criteria | In many jurisdictions, certain businesses or transactions may be exempt from charging additional fees. Familiarize yourself with local laws to confirm that your business qualifies for such exemptions. |

| Business Registration | Some regions require businesses to be registered in order to issue legally valid financial documents. Ensure that your business has the proper licenses and registration numbers if needed. |

| Compliance with Local Tax Regulations | Even if you’re not charging extra fees, your business may still be subject to other tax obligations. It’s important to know the tax regulations specific to your industry to ensure you’re compliant with all applicable laws. |

| Jurisdictional Rules for Exports | For cross-border transactions, be aware of the specific tax laws related to international sales. Some countries may not require additional charges, while others may have different criteria based on the destination of the goods or services. |

| Record Keeping | Proper documentation is essential for legal and auditing purposes. Even if extra financial charges are excluded, businesses are typically required to maintain accurate records of all transactions for tax or reporting purposes. |

Understanding the legal landscape will help you make informed decisions when issuing such documents. Ensuring that your business complies with local regulations reduces the risk of legal complications and helps maintain a professional relationship with clients and authorities alike.

How to Format Your Invoice Properly

Proper formatting is essential when creating a financial document, as it ensures clarity, professionalism, and easy readability for your clients. A well-organized layout helps prevent misunderstandings and makes it easier for both parties to verify the details of the transaction. Follow these guidelines to format your document in a way that is both functional and visually appealing.

Basic Elements to Include

- Business Information: Start with your business name, address, phone number, and email at the top. This makes it easy for clients to identify the source of the document.

- Client Details: Include the name, address, and contact details of the client to ensure the document is directed to the correct recipient.

- Document Title: Clearly label the document with a descriptive title, such as “Billing Statement” or “Payment Request,” depending on your preference.

- Transaction Date: Specify the date the transaction was completed or the date the document is issued to avoid confusion about payment deadlines.

- Itemized List: Include a clear breakdown of the products or services provided. List each item with a description, quantity, and price per unit.

Advanced Formatting Tips

- Readable Fonts: Use clean, professional fonts such as Arial or Times New Roman. Keep font sizes between 10 and 12 points for easy reading.

- Use of Tables: Utilize tables to organize the itemized list, ensuring that each column is clearly labeled (e.g., Description, Quantity, Unit Price, Total). This improves the document’s structure.

- Clear Totals: Highlight the total amount due by making it bold or placing it in a larger font size at the bottom of the document.

- Payment Instructions: Provide detailed payment instructions, including accepted methods (e.g., bank transfer, credit card) and due dates. Make this section easy to find by using bullet points or a separate box.

By following these formatting guidelines, you can ensure that your document is not only legally sound but also visually appealing and easy for clients to understand. Proper structure and attention to detail will help build trust with your clients and create a positive experience for both parties.

Common Mistakes in Tax-Free Invoicing

When creating a document that excludes additional charges, it’s easy to overlook some key details. These errors can lead to confusion, delayed payments, or even legal issues. Being aware of common mistakes will help ensure your paperwork is clear, accurate, and professionally presented.

Frequent Errors to Avoid

- Incorrectly Excluding Charges: Sometimes, businesses mistakenly leave out charges that should be included. Make sure you’re aware of all the regulations governing which fees can be excluded in your region or industry.

- Missing Client Information: Failing to include accurate client details, such as the name, address, and contact number, can create confusion and delay the payment process.

- Vague Descriptions: If the goods or services aren’t clearly described, clients might question the charges. Always provide specific details for each line item to avoid misunderstandings.

- Not Specifying Payment Terms: Some documents lack clear instructions for payment, such as methods accepted, due dates, or late fees. This can lead to delayed payments or disputes.

- Overlooking Legal Information: Even without additional charges, there may be required legal details (e.g., business registration numbers or tax exemptions) that should be included for compliance and credibility.

- Confusing Formatting: Poorly structured documents with inconsistent fonts, missing totals, or disorganized data can make it harder for clients to understand the charges and quickly process payments.

How to Prevent These Mistakes

- Double-check all details: Ensure that both business and client information is accurate and complete.

- Provide clear descriptions: Describe every product or service with clarity to avoid confusion.

- Include payment instructions: Always specify payment methods, terms, and deadlines.

- Review legal requirements: Familiarize yourself with any laws or regulations that require additional information on your document.

- Use a consistent format: Make sure your document is easy to read by using clear fonts, logical structure, and well-labeled sections.

Avoiding these common mistakes can significantly improve the efficiency and professionalism of your transactions. By ensuring clarity and accuracy, you help build trust with clients and make the payment process smoother for everyone involved.

How to Avoid Tax Confusion in Invoices

One of the main challenges in preparing financial documents is ensuring that there is no confusion regarding additional charges or fees. Whether you are exempt from including extra charges or simply choose not to apply them, it’s essential to clearly communicate this to your clients. A well-structured document can prevent misunderstandings and ensure that both parties are on the same page when it comes to payment terms.

Steps to Minimize Confusion

- Clearly State the Exclusion: If no extra fees are being applied, make sure to specify this clearly in the document. Use simple, direct language such as “No additional charges” or “Exemption applied.” This eliminates any assumptions about hidden fees.

- Provide a Detailed Breakdown: Ensure that all goods or services are clearly listed with their respective prices. This transparency helps clients understand exactly what they are paying for and reduces confusion.

- Highlight the Total Amount: Place the total amount due in a prominent position at the bottom of the document, ensuring that there are no hidden costs or surprises. This makes it easy for clients to quickly understand what they owe.

- Use Simple, Clear Language: Avoid jargon or technical terms that might confuse your clients. The simpler and more straightforward the language, the less likely there will be any misunderstandings.

- Provide Payment Instructions: Clearly specify the payment method, due date, and any late fees if applicable. This helps clients know exactly how to settle the balance without any ambiguity.

Best Practices for Clear Communication

- Consistent Formatting: Use a uniform structure with clear headings and easy-to-read fonts. This makes it easier for clients to find key information at a glance.

- Explicit Exemptions: If your business is exempt from additional charges, ensure that this is clearly mentioned, along with the legal or regulatory reason if necessary.

- Offer Contact Information: Include a phone number or email where clients can reach out if they have questions or concerns about the charges. This opens the door for communication and helps prevent confusion before it arises.

By following these simple steps, you can ensure that your financial documents are clear and easily understood, eliminating the possibility of tax-related confusion. Transparency and clarity help build trust with your clients, ensuring a smooth and efficient payment process.

Best Software for Creating Tax-Free Invoices

Choosing the right software to generate billing documents that exclude additional fees is essential for businesses aiming to streamline their financial processes. With the right tools, you can easily create professional, clear, and compliant documents while saving time and reducing human error. The software options available today offer a variety of features tailored to different business needs, from simple invoicing to full-scale accounting solutions.

Top Software Options for Simple and Efficient Billing

- FreshBooks: Known for its user-friendly interface, FreshBooks is perfect for small businesses and freelancers. It offers customizable billing forms that allow you to exclude any unnecessary charges while maintaining a professional look.

- QuickBooks: QuickBooks is a comprehensive accounting tool with robust invoicing features. You can easily configure it to create billing documents that exclude additional charges, ensuring clarity in every transaction.

- Wave: Wave is a free accounting software that includes invoicing capabilities. It allows you to quickly create clear, professional documents, making it ideal for freelancers and small businesses on a budget.

- Zoho Invoice: Zoho’s invoicing software provides easy customization options and helps you create detailed, tax-free billing forms. It also offers integrations with other Zoho apps for broader business management.

- Invoicely: A highly flexible and free invoicing tool, Invoicely allows you to create and send custom billing forms with ease. It provides the option to omit any additional financial charges and focuses solely on the cost of the product or service.

Key Features to Look For

- Customization Options: Ensure the software allows you to easily modify the layout, text, and fields to meet your specific business needs, such as excluding additional charges.

- Integration with Payment Gateways: Look for software that integrates with various payment platforms to streamline the payment process, especially if you’re offering multiple payment options.

- Multi-Currency Support: If you work with international clients, choose a solution that supports multiple currencies, allowing for seamless cross-border transactions.

- Automation Features: Some software allows you to automate recurring payments or reminders, reducing the manual effort involved in following up with clients.

- Legal Compliance: Make sure the software complies with local regulations and provides the necessary legal details, such as business registration numbers or compliance notes, for your region.

By selecting the right software, you can simplify the process of creating professional documents that are c

How to Handle International Invoices Without Tax

When dealing with cross-border transactions, creating financial documents that do not include additional fees can be tricky. Different countries have varying rules regarding exemptions and regulations for international sales. Understanding how to handle such documents correctly ensures compliance while maintaining clear communication with international clients. It’s crucial to account for both the legal framework of your business’s home country and the destination country’s regulations when preparing these documents.

Key Considerations for International Transactions

- Check Local and International Laws: Different jurisdictions may have different rules regarding exemptions from additional charges. Some countries may require that all foreign transactions be exempt from extra fees, while others may apply different standards for certain industries or products.

- Correctly State Currency: Always use the correct currency for the destination country and ensure it’s clearly indicated in your document. This avoids any confusion and helps clients understand the exact amount owed.

- Shipping and Handling Costs: If you are excluding any additional fees, ensure that shipping costs or other potential charges are either clarified or excluded. Be transparent about what the price covers and what may be subject to extra fees.

- Customs and Import Fees: For international transactions, clearly state that customs duties or import taxes are the responsibility of the buyer. This avoids any confusion if clients are unaware of their own country’s customs regulations.

Best Practices for International Transactions

- Provide Clear Payment Instructions: Include clear instructions on how international clients should make payments, including acceptable methods such as wire transfers, PayPal, or credit cards. Ensure that you provide any required payment details such as SWIFT codes or IBAN numbers.

- Include a Disclaimer: If your business is exempt from additional charges based on international sales agreements or tax laws, include a brief disclaimer that specifies this exemption to prevent confusion or disputes.

- Be Transparent About Delivery Times: International transactions can sometimes take longer for delivery or processing. Make sure to outline realistic delivery timelines and any potential delays caused by customs or international shipping issues.

- Use Professional Language: Always use clear, professional language that avoids any ambiguity. This ensures that the buyer understands what is being charged and what isn’t, as well as any additional costs they may incur upon receipt of goods or services.

By following these steps, you can streamline the process of creating clear and accurate financial documents for international clients, ensuring compliance wit

Using Invoice Templates for Small Business

For small business owners, managing billing and payment collections can often become time-consuming and complex. Utilizing a standardized document to request payment simplifies this process significantly. It helps ensure that all necessary details are included, minimizing mistakes and misunderstandings with clients. By customizing the document to fit your specific business needs, you can create a professional and consistent approach to handling payments while saving valuable time.

Why Small Businesses Should Use Pre-Designed Documents

- Time-Saving: Pre-designed formats allow you to quickly create documents without the need to start from scratch every time. This is particularly beneficial for small businesses with limited resources.

- Professional Appearance: Consistent and polished documents help build trust with clients. A professional layout creates a positive impression and can contribute to a better client relationship.

- Minimized Errors: With set fields for necessary information, such as client details, service descriptions, and payment terms, there is less chance of overlooking essential information.

- Easy Customization: Many solutions offer customizable fields, enabling small businesses to adjust the document to their needs, whether it’s for one-time projects or recurring services.

Key Features of a Good Billing Document for Small Businesses

| Feature | Description | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Client Information | Ensure that all client details, including their name, address, and contact information, are clearly stated. | ||||||||||||||

| Product/Service Description | List all items or services provided with a clear description to avoid confusion. | ||||||||||||||

| Payment Terms | Clearly specify payment methods, due dates, and any late fees to ensure prompt payments. | ||||||||||||||

| Contact Information | Include your business contact details for any questions or clarifications regarding the document. | ||||||||||||||

| Branding | Incorporate your logo and business colors to maintain brand consistency and professionalism. |

| Step | Action |

|---|---|

| Understand Local Regulations | Research and understand the tax laws in your jurisdiction. This includes knowing which services or products are subject to additional charges and when exemptions apply. |

| Accurate Documentation | Ensure that all transaction details are correctly recorded, with clear descriptions of services or products provided, and if applicable, any exemptions noted. |

| Timely Updates | Stay updated with changes in local and international tax laws. Regulations can evolve, and being proactive helps you remain compliant and avoid mistakes. |

| Consult a Tax Professional | If you’re uncertain about compliance, it’s wise to consult a tax advisor or legal professional to ensure that your business practices align with regulations. |

| Maintain Proper Records | Keep a detailed record of all transactions, including documents that outline amounts owed, payment terms, and any charges applied. This can help resolve any future discrepancies and serve as evidence in case of an audit. |

| Review Your Pricing Strategy | Ensure that your pricing strategy is aligned with legal requirements, especially if certain products or services are exempt from additional fees under specific conditions. |

Why Compliance Matters

- Avoiding Penalties: Non-compliance can result in fines, interest charges, and even legal action. By staying informed, businesses can avoid these costly consequences.

- Building Client Trust: Clients expect businesses to adhere to legal standards. Ensuring compliance can help build and maintain trust, ensuring long-term relationships.

- Protecting Reputation: A business’s reputation is closely tied to its adherence to regulations. Non-compliance can harm a company’s public image, impacting future business opportunities.

- Efficient Financial Managem