How to Use an Invoice Template with VAT Number for Efficient Tax Management

For businesses, handling financial documentation is a critical task that requires attention to detail. One of the most important aspects of managing such documents is ensuring compliance with tax regulations. When creating legal forms for transactions, it’s essential to include all the required details that both protect the business and meet legal standards.

Understanding the key components of any official document is vital for avoiding errors and potential issues during audits. Specifically, when dealing with cross-border transactions or selling goods and services to customers, including all necessary identifiers and references is crucial. These details not only confirm the legitimacy of the exchange but also help businesses properly report their earnings and taxes to the relevant authorities.

In this article, we explore how to effectively manage these documents, ensuring that all critical data is present and formatted correctly. Whether you’re a freelancer, small business owner, or part of a large enterprise, implementing the right practices can save time, reduce risks, and streamline your financial workflows.

Why You Need an Invoice Template

Creating standardized documents for business transactions is essential for maintaining professionalism and ensuring consistency. These documents are not only a record of the services or goods exchanged but also a tool for proper financial management and tax reporting. A well-organized and clear format helps avoid confusion and ensures that all relevant details are included, making it easier for both the business and clients to track payments.

Here are some key reasons why having a pre-designed document is important:

- Time Efficiency: A pre-structured form allows you to quickly fill in necessary details, saving time compared to creating a new document from scratch each time.

- Accuracy: By using a set format, you reduce the risk of leaving out important information or making mistakes that could lead to confusion or errors in reporting.

- Consistency: Using the same layout ensures that your documents appear professional and uniform, which enhances your company’s credibility in the eyes of clients.

- Legal Compliance: A properly formatted document includes all the required fields needed for legal and tax purposes, reducing the risk of non-compliance or audits.

For businesses of all sizes, having a well-organized form for transactions can significantly streamline day-to-day operations. It simplifies accounting processes and helps avoid costly errors, contributing to smoother financial management and clear communication with clients.

Understanding VAT and Its Importance

In the world of business, taxes play a crucial role in ensuring that transactions are properly documented and reported. One of the most common forms of taxation applied to goods and services is a consumption tax, which businesses must collect on behalf of the government. Understanding how this tax system works and its impact on your business is essential for maintaining compliance and avoiding costly mistakes.

What Is Consumption Tax?

Consumption tax is levied on the value added at each stage of production or distribution. This system allows businesses to collect the tax from their customers while deducting what they have already paid on their own purchases. The result is that the tax burden is effectively passed on to the end consumer, making it a key element of business transactions.

The Importance of Proper Tax Management

Failure to manage this tax correctly can result in financial penalties and legal complications. Here are some key reasons why understanding and adhering to the rules is important:

- Ensures Legal Compliance: Adhering to the proper tax rates and regulations avoids legal issues with tax authorities.

- Improves Financial Transparency: Accurate documentation of taxable transactions helps maintain clear financial records, which is essential for auditing and reporting purposes.

- Avoids Overcharging or Undercharging: Correctly applying the right rate ensures you don’t charge your clients too much or too little, protecting your business reputation.

- Facilitates International Trade: Understanding tax rules when dealing with foreign clients or suppliers can simplify cross-border transactions and improve business operations.

In short, properly managing consumption tax is not only a legal requirement but also a fundamental aspect of running a successful business. By ensuring that all tax obligations are met, you help safeguard your company from potential fines and maintain a good standing with regulatory bodies.

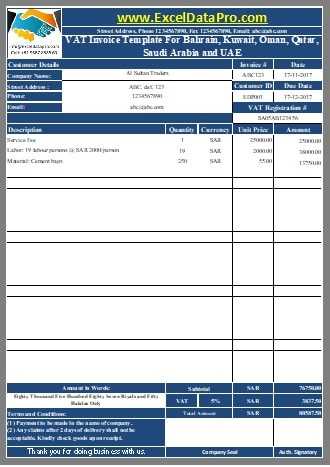

How VAT Affects Your Invoicing Process

When running a business, ensuring that the proper tax is applied during transactions is crucial for both compliance and accurate financial records. The process of applying this consumption tax to goods and services affects not only pricing but also the way documents are structured. These documents need to reflect the correct tax rates, exemptions, and other related details, which in turn can influence the entire invoicing workflow.

Here are some of the key ways in which the inclusion of tax impacts your transaction documentation:

- Tax Calculation: When applying tax, it’s essential to clearly separate the tax amount from the total price of the goods or services, ensuring transparency for both parties.

- Correct Tax Rate Application: Depending on your location or the nature of the product, different rates may apply. Ensuring the right rate is applied can prevent costly mistakes and legal issues.

- Client Identification: For businesses that deal with international clients, the tax rate might vary depending on the client’s location. It’s important to adjust the tax application accordingly, reflecting the rules of both the buyer’s and seller’s countries.

- Tracking Taxable Amounts: Accurately recording the taxable amounts makes it easier to manage reports, ensuring that you comply with tax laws and are able to calculate taxes owed at the end of a given period.

- Tax Exemptions: Certain goods and services may be exempt from tax. Ensuring these exemptions are noted correctly on your documents helps prevent overcharging and confusion with clients.

Incorporating the appropriate tax details into every document helps maintain clear records, avoid mistakes, and remain compliant with relevant regulations. For businesses of all sizes, these practices can reduce errors, streamline the accounting process, and make tax reporting more efficient.

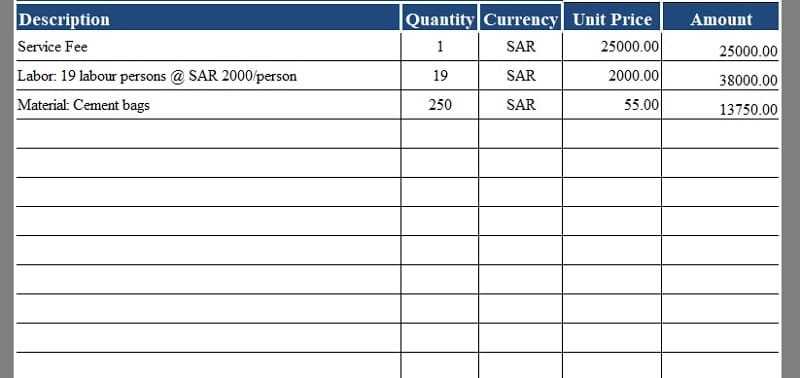

Key Elements of a Document with Tax Information

When preparing official documentation for business transactions, it is important to include all the relevant details that ensure clarity and compliance with tax regulations. A well-structured document not only helps to avoid confusion but also serves as a legal record for both the buyer and the seller. Properly including tax-related information is crucial to ensure that both parties are aware of the correct charges and can easily track payments.

The following are the essential components to include in your document when tax information is required:

- Business Information: Clearly display your business name, address, contact information, and any legal identification numbers. This allows the recipient to easily identify the source of the transaction.

- Client Details: Include the full name or business name of the customer, along with their address and contact details. This ensures that the document is tied to the correct party.

- Tax Identification: Ensure that the relevant tax identification code for both parties is included. This is essential for proper reporting and allows tax authorities to track the transaction.

- Description of Goods or Services: Provide a clear and detailed list of the items or services provided, including quantities, unit prices, and total amounts. This ensures transparency in what was purchased.

- Tax Amount: Specify the total amount of tax applied to the transaction. This should be calculated based on the applicable rate and added to the total cost, providing a clear breakdown of the charges.

- Payment Terms: Outline the terms of payment, including the due date, any late fees, and acceptable payment methods. This ensures that both parties understand the timing and process for completing the transaction.

- Document Date and Reference Number: Include the date of the transaction and a unique reference number for easy tracking and future reference.

Including all of these details ensures that the transaction is fully documented, providing clear information to both parties and complying with legal requirements. Accurate and well-organized records are essential for financial reporting and tax filing, making the process smoother and more transparent for everyone involved.

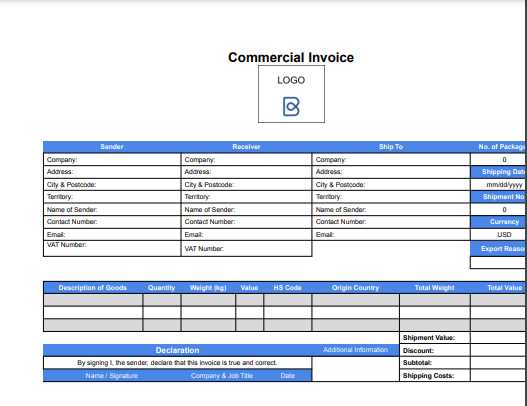

Customizing Your Document for Tax Compliance

Tailoring your business paperwork to meet legal and financial requirements is essential for smooth transactions and accurate record-keeping. A customized structure not only reflects professionalism but also ensures that all necessary information is easily accessible for both the business and clients. When tax-related details are involved, it becomes even more important to modify your documentation to include specific fields and calculations that comply with regulations.

Identifying Key Sections for Customization

When adjusting your documents for tax purposes, there are certain elements that must be carefully formatted to meet legal standards. These key sections ensure clarity and accuracy, providing all the necessary information for proper tax reporting:

- Tax Identification Codes: Make sure that both your business and your client’s identification details are prominently displayed. This ensures that each party is correctly identified for tax purposes.

- Clear Tax Breakdown: Specify the applicable tax rate and total amount due. Clearly separating the cost of goods or services and the tax applied helps avoid confusion and ensures transparency.

- Exemption Fields: If any goods or services are exempt from tax, include a section to highlight this. This helps avoid overcharging and clarifies which items are not subject to taxation.

- Legal Terms and Payment Instructions: Customizing the document to include precise payment instructions, due dates, and any tax-related legal clauses ensures compliance and sets clear expectations for the client.

Formatting for Efficiency

Beyond the essential fields, it’s also important to organize your document in a way that makes it easy to read and process. A clean, well-structured layout helps your clients quickly understand the charges and ensures that there are no missed details. Using consistent formatting, such as aligning tax rates and totals in specific sections, makes your document easy to follow and reduces the risk of errors in calculations.

By customizing your paperwork to reflect all relevant tax-related information, you ensure that your business stays compliant, avoids mistakes, and builds trust with your clients. A clear, well-structured document not only simplifies financial tracking but also supports transparency and efficiency in your operations.

Steps to Create a VAT-Compliant Document

Ensuring that your transaction paperwork adheres to tax laws is essential for maintaining legal compliance and avoiding penalties. The process involves careful attention to detail and making sure all required fields are correctly included. Below are the necessary steps to follow to create a document that meets all tax regulations.

Follow these steps to ensure that your transaction records are fully compliant:

- Include Your Business Information: Always start by clearly listing your company’s name, address, contact details, and legal identification codes. This provides a clear reference for the recipient and establishes the legitimacy of the document.

- Client Information: Include the full name or business name of your client, along with their address and contact details. This step is essential to ensure that the document is correctly associated with the right customer.

- Document Identification: Add a unique reference number and the date of issue. This ensures that the document can be easily tracked for future reference, both by your business and the customer.

- Provide a Description of Goods or Services: Include a detailed breakdown of the items or services provided, including quantities, unit prices, and total amounts for each item. This helps the recipient understand the charges clearly.

- Tax Rate and Calculation: Clearly state the applicable tax rate and calculate the total tax amount. Ensure that the tax is separated from the total price to provide transparency.

- Payment Terms: Specify the payment due date, the total amount owed, and any applicable late fees. These details ensure that both parties understand the terms of the financial transaction.

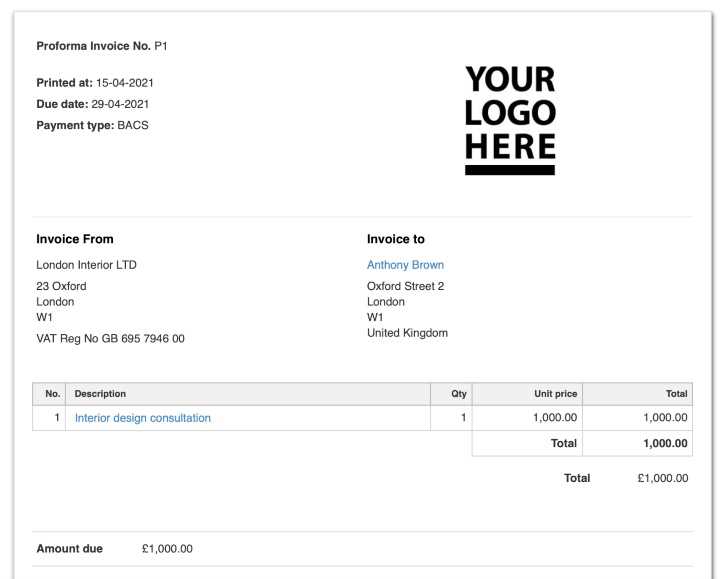

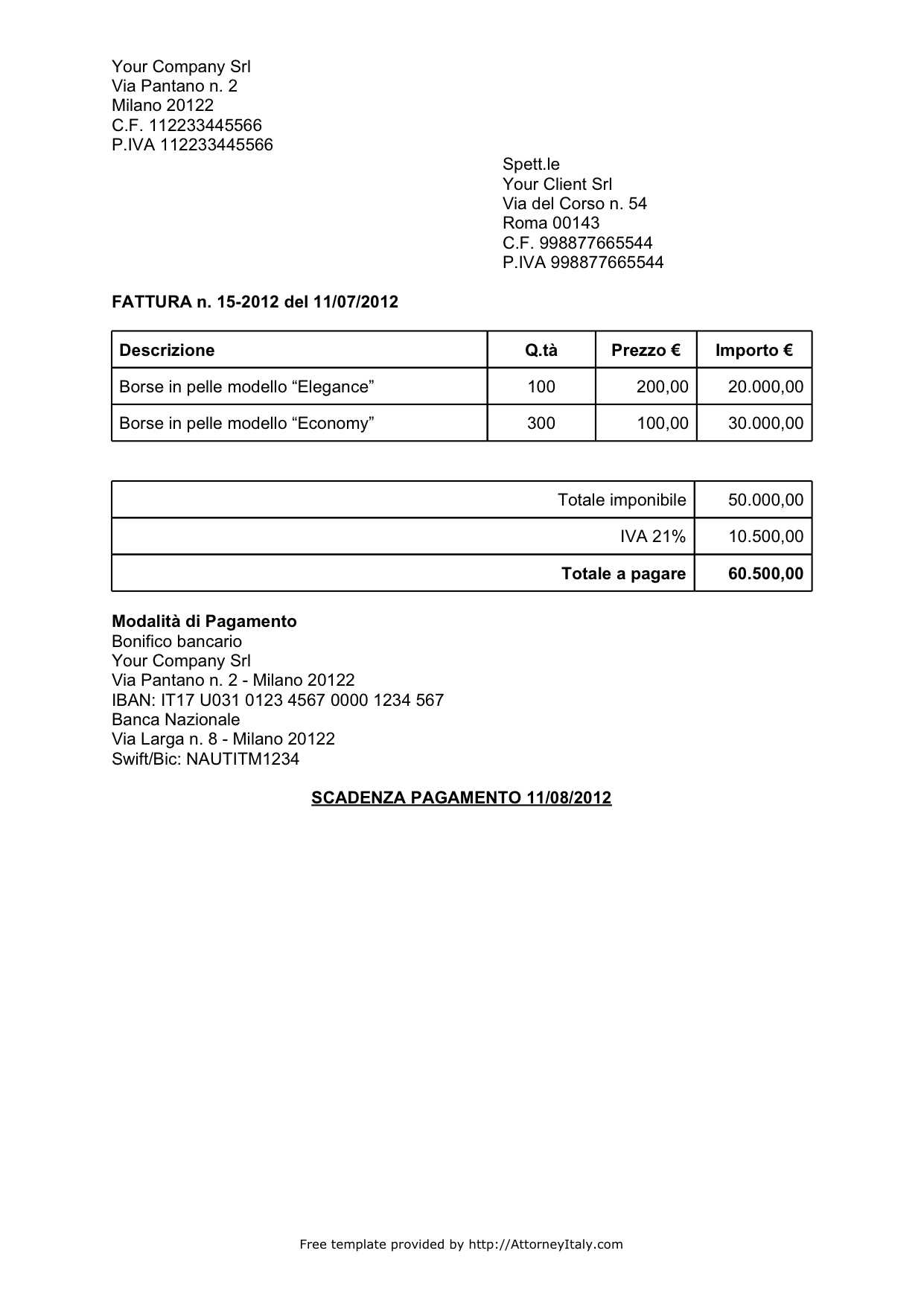

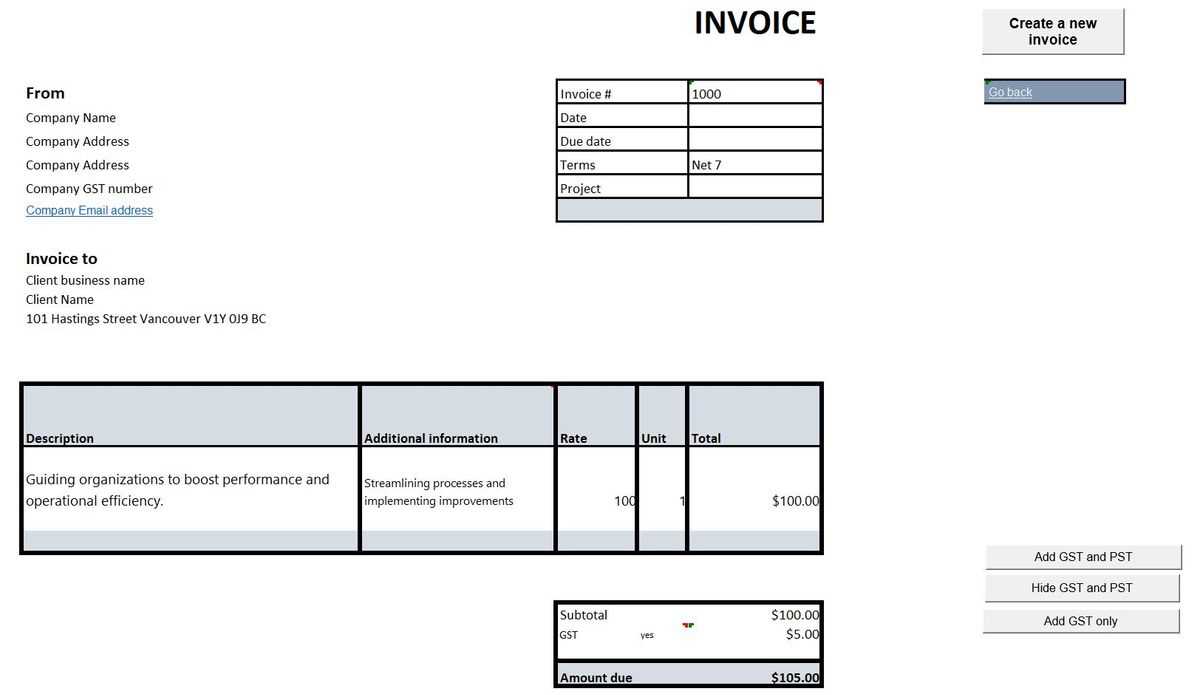

After collecting all the relevant details, it’s important to organize them in a clear and professional manner. Below is an example layout of the key elements that should be included:

| Details | Description |

|---|---|

| Business Information | Your company name, address, and contact info |

| Client Information | Client’s name, address, and contact info |

| Document Reference | Unique reference number and issue date |

| Goods/Services Description | Detailed list of products or services provided |

| Tax Breakdown | Tax rate and total tax applied |

| Payment Terms | Due date, total amount, and any late fees |

By following these steps and ensuring each field is correctly filled out, your documents will be ready to comply with tax regulations, providing transparency, reducing errors, and ensuring smooth financial operations.

Common Mistakes in VAT Invoicing

Handling financial documents involving tax can be challenging, and even a small mistake can lead to costly consequences. Whether you’re a small business owner or a large enterprise, being aware of common errors in tax documentation can help you avoid penalties and maintain smooth business operations. Understanding where mistakes typically happen is the first step toward ensuring that all transactions are properly documented and compliant with the law.

Common Errors in Tax Documentation

There are several common mistakes that businesses often make when creating documents for taxable transactions. These errors can range from minor oversights to significant issues that could lead to compliance problems. Below are the most frequent mistakes to watch out for:

- Incorrect Tax Rate: Applying the wrong rate is one of the most common errors. Different regions or product categories may have varying tax rates, and it’s crucial to apply the correct one for each specific case.

- Missing Tax Identification Codes: Failing to include the necessary tax identification codes for both the seller and the buyer can lead to delays or confusion during tax audits.

- Omitting Exemptions: Some goods or services may be exempt from tax. Not accounting for these exemptions correctly can result in overcharging clients and potential legal issues.

- Incorrectly Calculating Tax Amount: Errors in calculating the tax amount based on the total price or incorrect rounding practices can lead to discrepancies that complicate financial reporting.

- Failing to Include Payment Terms: Omitting clear payment terms, such as due dates or late fees, can lead to misunderstandings and delayed payments.

- Not Including a Unique Reference Number: Not assigning a unique reference or transaction number makes it difficult to track documents, especially if an issue arises later.

- Failing to Issue Proper Documentation for Cross-Border Transactions: International transactions require additional information such as customs duties or different tax rates. Not providing the correct documentation for such deals can cause legal complications.

How to Avoid These Mistakes

To prevent these common errors, businesses should implement a system that ensures all required fields are filled out correctly. Training employees on the importance of tax compliance, using reliable accounting software, and double-checking each document before submission can greatly reduce the risk of mistakes. Additionally, maintaining up-to-date knowledge of tax regulations will help you stay compliant with ever-changing rules and requirements.

By being proactive and avoiding these mistakes, businesses can ensure that their transactions are properly documented, reducing the risk of audits or penalties and streamlining the financial process for both clients and companies.

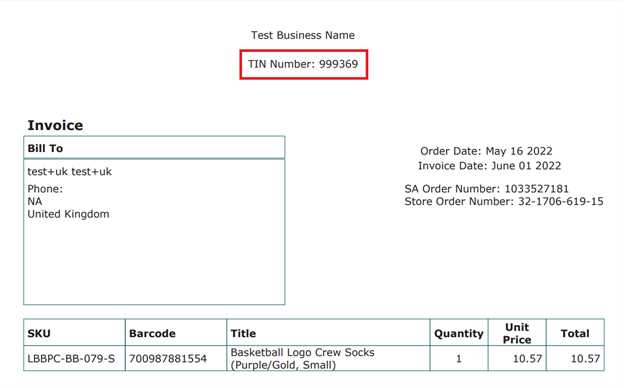

How to Include a Tax Identification Code on Documents

When conducting business transactions, it is essential to include the correct tax identification code for both the seller and the buyer. This helps ensure transparency and compliance with tax laws. A proper inclusion of this code on your transaction documents ensures that your business is correctly recognized by tax authorities, streamlines your reporting process, and protects your business from potential penalties.

Where to Place the Tax Code

Incorporating the tax identification code into your documentation is simple but requires careful attention to detail. Here are the key areas where this information should be included:

- Seller’s Details: The tax identification code of your business should be placed alongside your name, business address, and contact information. This ensures that your company is easily identifiable for tax purposes.

- Buyer’s Details: If applicable, the buyer’s tax identification code should also be included. This is particularly important for international transactions or for clients who are also registered for tax purposes.

- Clear Identification of the Code: It’s important to label the field where the code appears. For example, using terms such as “Tax ID” or “Business Identification Number” helps clarify the purpose of the code and prevents confusion.

Steps to Include the Code Correctly

To avoid mistakes, follow these steps to properly include the tax identification code on your transaction documents:

- Ensure Correct Format: Make sure the code is formatted according to the regulations of your country. Some countries have specific formats, such as a set number of digits or a combination of letters and numbers.

- Double-Check the Accuracy: Double-check that the tax identification code is entered correctly to avoid errors that could cause delays or legal issues.

- Place in Prominent Locations: Ensure the tax code is clearly visible and easily accessible on the document, either near the business details or in a dedicated section labeled for tax information.

- Update for Changes: If your tax identification code changes (such as in cases of business restructuring), be sure to update your documents promptly to reflect the new information.

By properly including the tax identification code in the correct sections of your transaction documents, you ensure smooth transactions, maintain compliance with tax laws, and minimize the risk of errors that could lead to audits or penalties.

The Role of Tax Identification Code in Business Transactions

In the context of commercial dealings, ensuring that all parties involved are properly identified is crucial for both legal and financial clarity. One key element in achieving this is the inclusion of a tax identification code. This code not only serves as a means to verify the legitimacy of the business but also plays a vital role in the proper application of taxes, especially in cross-border transactions. Understanding the importance of this code can help businesses navigate regulatory requirements and facilitate smoother transactions.

Why the Tax Identification Code is Essential

Incorporating a tax identification code into business documentation serves several essential purposes. Here are the main roles it plays:

- Ensures Legal Compliance: A valid tax code is necessary for businesses to comply with tax regulations and avoid penalties. It allows tax authorities to track transactions for proper tax collection.

- Streamlines Tax Reporting: For businesses that are required to report taxes regularly, the tax identification code makes it easier to track transactions and submit accurate reports.

- Supports International Trade: For cross-border transactions, a tax identification code is often required to facilitate the exchange of goods and services between businesses in different jurisdictions. It ensures the correct application of local tax laws.

- Builds Trust with Clients: Displaying a valid tax code on business documents assures clients that your company is legitimate and complies with legal obligations, which can build confidence and trust.

How the Tax Identification Code Functions in Practice

Understanding the practical application of this code can help businesses navigate its usage effectively. Here’s an example table showing how this code functions in business documents:

| Scenario | Purpose of Tax Code |

|---|---|

| Domestic Transactions | Ensures proper tax collection and legal documentation within a single country. |

| International Transactions | Facilitates the correct application of local tax rates, ensures compliance with customs regulations, and supports cross-border invoicing. |

| Tax Reporting | Streamlines the reporting process, making it easier for businesses to track sales and pay the correct tax amounts on time. |

In summary, the tax identification code plays a significant role in ensuring compliance, maintaining accurate financial records, and building credibility in both local and international markets. By properly incorporating this code into business documents, companies can minimize risk, enhance transparency, and ensure smoother, legally-compliant operations.

Benefits of Using Professional Transaction Documents

For any business, having a standardized and well-organized approach to documenting financial transactions is crucial. Using professionally designed documentation not only enhances your company’s image but also ensures accuracy and efficiency. By utilizing well-structured records, businesses can streamline their processes, avoid errors, and foster trust with clients. The benefits of adopting such documents go beyond mere aesthetics, contributing significantly to operational smoothness and compliance.

Efficiency and Time Savings

One of the most significant advantages of using professionally designed business records is the time saved in creating and managing them. Custom templates allow you to input relevant details quickly, reducing the need for manual formatting and ensuring all the necessary fields are included automatically. This speeds up the process of generating financial documents and minimizes the risk of errors from manual entry.

Enhanced Professionalism and Trust

Well-crafted transaction documents convey professionalism, which can have a significant impact on how clients and partners perceive your business. A polished and consistent layout not only makes your documents look more credible but also ensures that clients can easily understand the charges, payment terms, and other relevant details. This transparency helps build trust, which is vital in maintaining long-term business relationships.

By incorporating professionally designed business records into your processes, you position your company as organized, reliable, and serious about its operations. The clear presentation of transaction details, such as services provided, charges, and payment deadlines, makes it easier for clients to engage with your business confidently.

Furthermore, professional templates can be easily customized to fit your company’s branding, offering a consistent look across all client-facing documents. This creates a cohesive brand identity and reinforces your company’s reputation for attention to detail and quality.

Compliance and Accuracy

Incorporating a pre-designed structure helps ensure that all necessary legal and financial elements are included, especially when dealing with regulatory requirements. Professional records are designed to meet industry standards and are often created with tax and legal compliance in mind, which reduces the risk of errors. With automated fields for tax calculations, dates, amounts, and terms, these documents help ensure that all financial transactions are documented correctly, making audits and tax filings more straightforward.

Free Documents for Tax Reporting

Businesses that need to maintain proper financial records often seek easy-to-use, cost-effective solutions. Free resources for creating tax-compliant records are invaluable, as they help streamline operations while ensuring legal accuracy. These documents typically include essential fields such as transaction details, tax rates, and identification codes, which are necessary for transparent and compliant business dealings. Utilizing free resources can save time, reduce costs, and ensure that your financial records meet all regulatory requirements.

Many platforms offer downloadable or customizable versions of such documents, providing an ideal solution for businesses of all sizes. These free resources are especially helpful for small businesses or freelancers who are just starting and may not have the budget for specialized accounting software. By using a ready-made design, you can quickly create professional, tax-compliant records without the need for extensive expertise or additional costs.

Whether you are dealing with domestic transactions or cross-border sales, these free documents can be customized to reflect the tax details relevant to your business. By taking advantage of these tools, businesses can ensure they are properly documenting their transactions, calculating applicable charges, and adhering to tax regulations.

How to Generate Transaction Records with Tax Automatically

For businesses aiming to simplify their financial processes, automating the generation of tax-compliant transaction records can save considerable time and effort. With the right tools and systems in place, the creation of these documents becomes streamlined, allowing you to focus more on business growth rather than administrative tasks. Automation ensures consistency, reduces human errors, and guarantees that tax details are always accurately included in each record.

Steps to Automate Document Creation

Here’s how you can set up a system to automatically generate transaction documents that include the necessary tax details:

- Choose the Right Software: Select an accounting or invoicing software that supports automatic tax calculations and document generation. Many platforms offer templates that automatically calculate taxes based on predefined rules and rates.

- Set Up Tax Settings: Configure the software with your local tax rates, applicable exemptions, and other relevant details. This setup ensures that the tax information is correctly applied to every generated document.

- Input Client and Transaction Details: Once the software is configured, input your client’s information and the products or services provided. The system will automatically apply the appropriate tax calculations based on the entered data.

- Generate Documents: With all the necessary fields configured, the system will generate the required documents at the click of a button, including all tax information and any other relevant details.

- Send or Store Automatically: Many platforms also allow you to automate the delivery of these records to clients via email or store them in your system for future reference.

Benefits of Automated Document Generation

Implementing automation for generating tax-compliant records offers several key advantages:

- Time Savings: Automating the process significantly reduces the time spent on creating documents manually, allowing you to focus on other business activities.

- Consistency: Automated systems ensure that all documents are consistent in format and content, reducing the risk of errors or missed details.

- Accuracy: Tax calculations are done automatically, eliminating the risk of human error and ensuring compliance with tax regulations.

- Scalability: As your business grows, automation allows you to handle a lar

Legal Requirements for Tax Documentation

When managing business transactions, it’s essential to ensure that all documents meet the legal requirements set by tax authorities. This ensures compliance with tax regulations and avoids potential fines or legal issues. These documents must contain specific details to verify the transaction and the tax applied, as well as to facilitate accurate reporting. Understanding the legal obligations involved in documenting taxable transactions is crucial for maintaining smooth business operations and ensuring that you remain compliant with local and international laws.

Key Elements for Compliance

To ensure that your transaction records are legally compliant, certain information must be included. Here are the most important components that must appear in tax-related documents:

- Tax Identification Codes: Both the seller and the buyer must have their unique tax identification codes included in the document. This allows tax authorities to trace the transaction back to the involved parties.

- Accurate Tax Rate: The correct tax rate must be applied based on the jurisdiction of the business or the type of goods/services being sold. Any errors in this could lead to fines or other legal complications.

- Clear Itemization of Goods or Services: A detailed description of the products or services provided, including quantities and prices, should be included. This ensures transparency and helps verify that the tax is being applied correctly.

- Transaction Date: The date when the transaction occurred must be recorded. This is important for reporting purposes and for aligning the documentation with tax periods.

- Amount Before Tax: The document must clearly show the total amount before tax is applied, as well as the tax amount itself and the final total after tax.

- Payment Terms: It is essential to include the agreed payment terms, including the due date, any applicable late fees, and the payment methods accepted.

Why Compliance is Crucial

Ensuring that your transaction documentation meets the legal requirements is not just about avoiding penalties, but also about maintaining your business’s reputation and credibility. Properly documented transactions help prevent misunderstandings with clients and authorities, and provide a transparent record that is easy to reference in case of an audit or dispute. Additionally, tax compliance helps your business maintain trust with customers and keeps your operations running smoothly.

For businesses engaging in cross-border trade, it’s especially important to understand the specific requirements for each country,

Tracking and Managing Tax for Small Businesses

For small businesses, managing tax obligations effectively can be a challenge, especially when dealing with fluctuating sales and varying tax rates. Keeping track of tax applied to sales and purchases, as well as ensuring accurate reporting, is essential to avoid penalties and stay compliant. Establishing a clear system for handling these calculations not only ensures that your business meets legal requirements but also helps you maintain financial clarity and operational efficiency.

Key Strategies for Managing Tax

Here are a few effective strategies small businesses can use to manage their tax-related tasks:

- Use Accounting Software: Modern accounting software can automate tax calculations, making it easier to track transactions and apply the correct rates. Many platforms also allow you to generate tax reports for filing purposes.

- Keep Detailed Records: It’s essential to track both the sales tax you charge on client transactions and the tax you pay on your own purchases. Proper record-keeping will make it easier to calculate net tax liability at the end of each period.

- Regularly Review Tax Rates: Tax rates can change, especially for certain goods or services. Stay updated on any changes in your jurisdiction to ensure that you’re charging the correct rate and reporting accurately.

- Separate Business and Personal Finances: Keeping business finances separate from personal expenses can simplify tax reporting and help prevent confusion during tax filing periods.

- Consult a Tax Professional: If your business grows or your tax obligations become more complex, consulting a tax professional can ensure that you’re handling tax matters correctly and efficiently.

Sample Tax Calculation Table

Here’s an example of how a small business might track taxes on sales and purchases:

Transaction Type Amount Before Tax Tax Rate Tax Amount Total Amount Sale to Client $500 10% $50 $550 Purchase from Supplier $300 10% $30 $330 Net Tax Payable — $20 In the exampl

Integrating Tax-Inclusive Transaction Records with Accounting Software

For businesses, automating the process of managing financial records can greatly improve efficiency and reduce human error. By integrating transaction documentation that includes tax details into accounting software, businesses can seamlessly track sales, apply the correct tax rates, and maintain accurate financial reporting. This integration allows for real-time updates and ensures that all transactions are properly categorized, making financial management smoother and more efficient.

Benefits of Integration

Integrating tax-inclusive transaction records into accounting platforms offers numerous advantages for businesses of all sizes:

- Automatic Tax Calculations: Accounting software can automatically calculate and apply the correct tax rates to transactions, ensuring that the amounts are accurate and compliant with current tax laws.

- Real-Time Financial Data: With integration, your financial data is updated in real time, allowing you to track profits, liabilities, and tax obligations without delay.

- Streamlined Reporting: The software can generate accurate financial reports with tax details already included, reducing the need for manual adjustments during the reporting process.

- Reduced Risk of Errors: Automation minimizes the risk of mistakes in tax calculations, which is especially important during audits or when preparing tax returns.

- Time Savings: By automatically transferring transaction data to your accounting system, you save time spent on manual data entry, allowing your team to focus on other important tasks.

How to Integrate Transaction Records into Accounting Software

Integrating tax-inclusive documentation into accounting software is a straightforward process when you follow these steps:

- Choose the Right Accounting Platform: Select accounting software that supports integration with your current invoicing or sales system. Many modern platforms offer plugins or direct integration options for seamless data transfer.

- Connect the Systems: Once you’ve selected the appropriate software, set up the integration by connecting your invoicing platform to the accounting system. This often involves linking your accounts via an API or using built-in integration tools.

- Configure Tax Settings: Ensure that the tax rates and other relevant financial settings are configured correctly in both the invoicing and accounting systems. This will ensure consistency in tax calculations and reporting across both platforms.

- Automate Data Transfer: Set up automated data transfers between your invoicing system and accounting software. This will allow transaction records to be automatically updated in your accounting system as soon as a transaction is completed.

- Monitor for Errors: Regularly review your records to ensure that the integration is working as expected. Check that the tax amounts are being calculated correctly and that all transaction details are accurate

How to Stay Compliant with Tax Regulations

Ensuring that your business complies with local and international tax laws is crucial for avoiding penalties and maintaining good standing with tax authorities. Understanding and adhering to the regulations regarding the collection, reporting, and remittance of taxes can be challenging, but it is an essential part of running a successful business. Staying compliant requires consistent effort, attention to detail, and the implementation of proper systems to manage your tax obligations.

Steps to Ensure Compliance

To stay compliant with tax laws, businesses should follow these best practices:

- Understand the Tax Requirements: Familiarize yourself with the tax regulations specific to your country or region. Different jurisdictions may have varying rules regarding rates, exemptions, and reporting requirements.

- Register for Tax Purposes: Make sure that your business is properly registered with the appropriate tax authorities. This will provide you with the necessary tax identification and ensure that you are recognized as a taxpayer by the government.

- Correctly Apply Tax Rates: Always ensure that the appropriate tax rates are applied to each transaction. This includes knowing when and where to apply the tax, as well as which products or services are taxable or exempt.

- Keep Accurate Records: Maintain detailed and accurate records of all transactions, including sales, purchases, and tax collected. Proper record-keeping is essential for accurate reporting and for potential audits by tax authorities.

- File Reports on Time: Timely and accurate filing of tax returns is vital. Make sure you are aware of the deadlines for filing and remitting taxes to avoid late fees or penalties.

- Use Automated Tools: Invest in accounting or financial software that can automate the tax calculation and reporting process. Automation reduces the risk of human error and ensures that calculations are accurate and timely.

- Consult a Tax Professional: If you’re unsure about tax obligations or need guidance on complex tax matters, consider consulting a tax advisor or accountant. A professional can help ensure compliance and offer advice on tax-saving strategies.

Regular Compliance Checks

Staying compliant with tax laws requires ongoing attention. Here are a few ways to keep your business in check:

- Monitor Changes in Tax Laws: Tax laws and regulations can change frequently. Keep yourself informed about any new developments or amendments to ensure that you remain compliant.

- Conduct Periodic Audits: Regularly audit your financial records to ensure that all transactions are being reported accuratel