Invoice Template with Tax Calculation for Effortless Billing

Managing financial transactions efficiently is crucial for any business, especially when it comes to ensuring correct amounts are charged and received. One of the essential tools in achieving this is a well-organized document that includes all necessary figures and adjustments. By automating the process of including extra fees or deductions, businesses can avoid human error and improve overall accuracy.

Creating a document that automatically includes these additional charges ensures that everything is calculated correctly from the start, saving time and effort for both businesses and clients. This tool not only enhances efficiency but also helps maintain clarity in all transactions. The use of such a document allows professionals to focus more on their work and less on manual calculations, leading to smoother interactions and faster payments.

Whether you are a small business owner or a freelancer, integrating these features into your billing process can significantly reduce the risk of discrepancies. The ease of use and flexibility offered by modern software solutions make this approach accessible to anyone, regardless of their technical expertise. This innovation simplifies complex financial processes and ensures that each interaction is as seamless as possible.

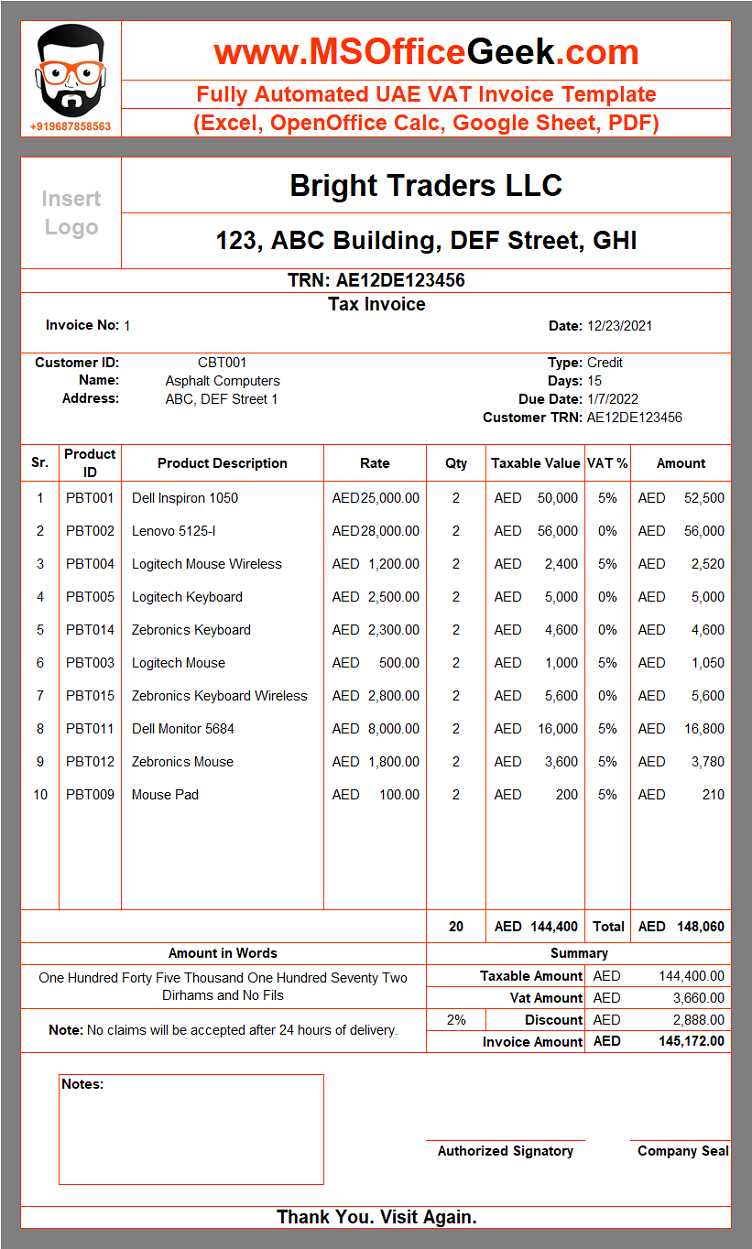

Invoice Template with Tax Calculation

Creating accurate billing documents that include all necessary charges is a crucial step in ensuring smooth financial transactions. For businesses of all sizes, having an efficient system in place to automatically compute additional fees and ensure precise totals is a major time-saver. This is especially important for those who need to apply specific rates depending on the region or service type.

By integrating automated features into the document creation process, users can eliminate common errors and streamline their operations. The document will not only display the basic amounts owed but also automatically adjust for applicable charges, offering a clear breakdown to clients and ensuring compliance with legal requirements. This type of system reduces manual effort and helps maintain consistent, transparent billing.

For freelancers, small business owners, or anyone involved in regular financial transactions, utilizing such a solution brings peace of mind. It removes the need to double-check calculations or worry about missing any necessary deductions. The flexibility of modern tools allows customization, whether you need to adjust for different regions or handle complex pricing structures, all while keeping the process simple and straightforward.

Why Tax Calculation Matters in Invoices

Accurate financial records are essential for any business, especially when it comes to properly determining the final amount owed. Including the correct additional charges in your documents ensures that both parties are clear about the total cost and avoids potential disputes. Properly reflecting these adjustments helps maintain trust and professionalism, both of which are key to long-term business success.

Ensuring Legal Compliance

Many regions have strict requirements regarding the inclusion of certain fees in sales documents. By automatically applying the correct adjustments, businesses can ensure they remain compliant with local laws, avoiding penalties and fines. Adhering to these rules helps prevent costly legal issues and builds credibility with clients.

Avoiding Discrepancies and Errors

Manual calculations are prone to human error, which can lead to discrepancies between what was expected and what was actually charged. Having an automated system for these figures minimizes the risk of mistakes and ensures that each transaction is handled consistently. This process not only saves time but also strengthens the accuracy of your financial records.

Benefits of Using an Invoice Template

Utilizing a standardized document for billing offers numerous advantages that simplify and streamline the process. Whether you’re running a small business or working as a freelancer, having a ready-made structure ensures consistency and professionalism in every transaction. Below are the key benefits of relying on such a document for your financial records:

- Time Efficiency: Pre-designed structures save time by eliminating the need to create documents from scratch each time you need to charge a client.

- Consistency: A set format ensures that all important details, such as dates, amounts, and payment terms, are consistently included, reducing the chances of missing critical information.

- Professionalism: A clean and clear layout gives your clients a sense of professionalism and reliability, reinforcing your brand image.

- Reduced Errors: Automated fields and pre-filled sections minimize the risk of mistakes, helping you avoid issues with pricing or missing data.

- Customization: Modern solutions allow you to adjust details as needed, so you can easily tailor the document to fit your specific needs or to comply with different regulations.

Incorporating such a system into your workflow not only increases efficiency but also enhances your overall billing experience, ensuring that every transaction is documented accurately and professionally.

How to Calculate Taxes on Invoices

Accurately determining the additional charges on a billing document is crucial for both businesses and clients. When preparing a financial statement, it is important to include the correct figures that reflect the applicable rates based on the amount of goods or services provided. Below is a step-by-step guide on how to apply the necessary charges to ensure precision and compliance:

- Identify the Applicable Rate: First, determine which rate should be applied based on the region or industry regulations. Rates may vary depending on location, type of service, or product.

- Calculate the Base Amount: Begin with the total amount for the goods or services being provided. This figure will serve as the base for your additional charge.

- Apply the Percentage: Multiply the base amount by the relevant rate (as a decimal). For example, if the rate is 5%, multiply the base amount by 0.05 to find the correct additional charge.

- Add the Amount to the Total: Once you have calculated the extra charge, add it to the original sum to get the final total that the client owes.

- Review and Confirm: Double-check all figures to ensure that the correct percentage was applied and the final amount is accurate.

By following these steps, you can easily and efficiently calculate any additional fees, ensuring that all necessary charges are correctly included in your document. This process helps maintain transparency and reduces the risk of errors that could lead to disputes.

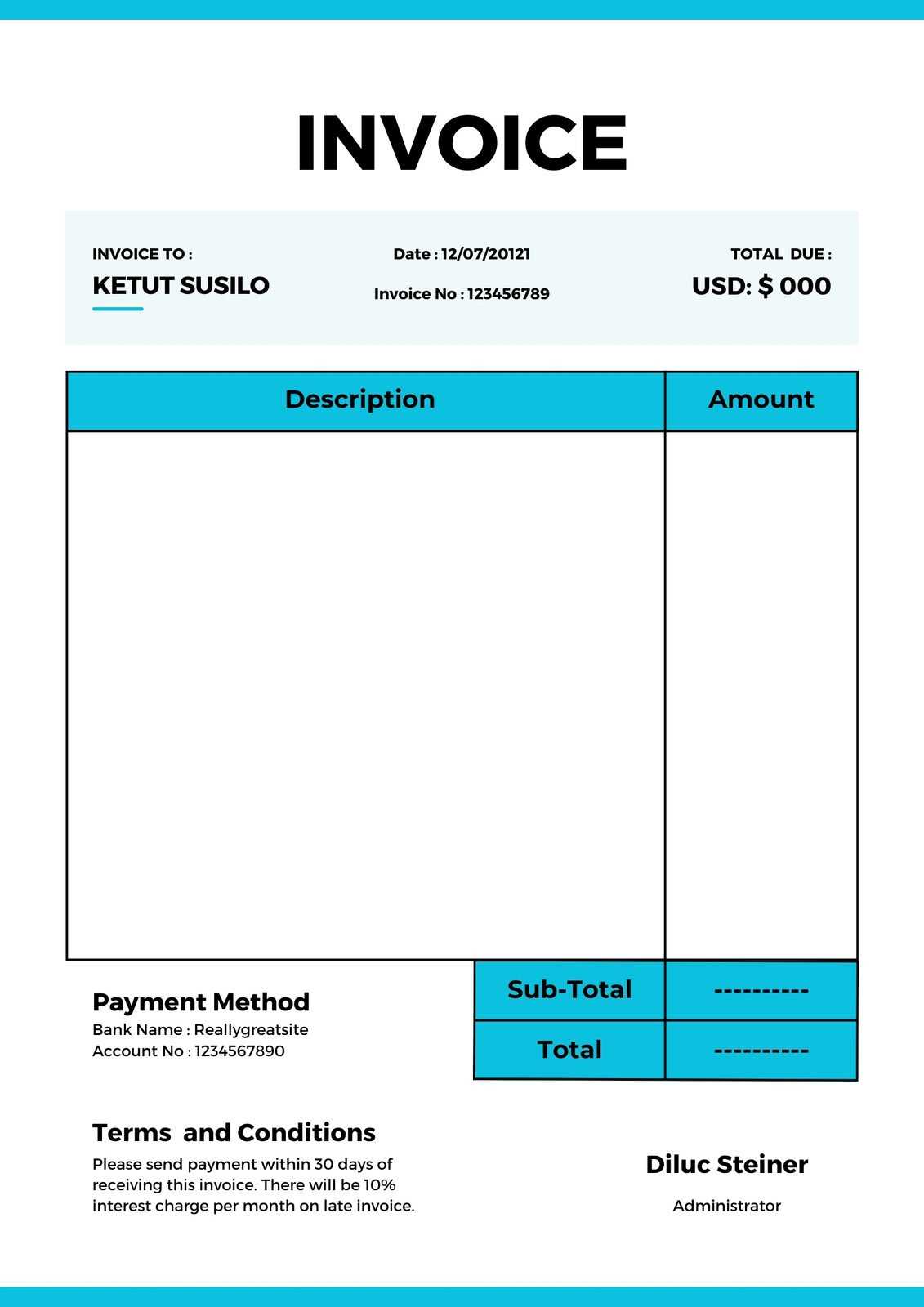

Customizing Your Invoice for Different Taxes

Businesses often need to adjust their billing documents to reflect varying charges based on location, service type, or product category. Customizing your financial records ensures that you can accommodate different rates or exemptions specific to the transaction. This process not only improves accuracy but also guarantees compliance with local regulations.

For example, some regions may require multiple rates for different product categories, while others may have special exemptions for certain services. To make this process seamless, it’s essential to build flexibility into your documentation, allowing you to easily apply the right rates for each scenario.

Here’s a basic example of how you might structure a document to handle multiple charges:

| Item/Service | Base Amount | Rate Applied | Additional Charge | Total Amount |

|---|---|---|---|---|

| Product A | $100.00 | 5% | $5.00 | $105.00 |

| Product B | $150.00 | 10% | $15.00 | $165.00 |

| Service C | $200.00 | 0% (Exempt) | $0.00 | $200.00 |

This example shows how different rates can be applied to various items or services, ensuring that each one is handled appropriately. Whether you need to adjust for multiple jurisdictions or specific products, customizing your document structure ensures that your financial records remain accurate and clear for both you and your clients.

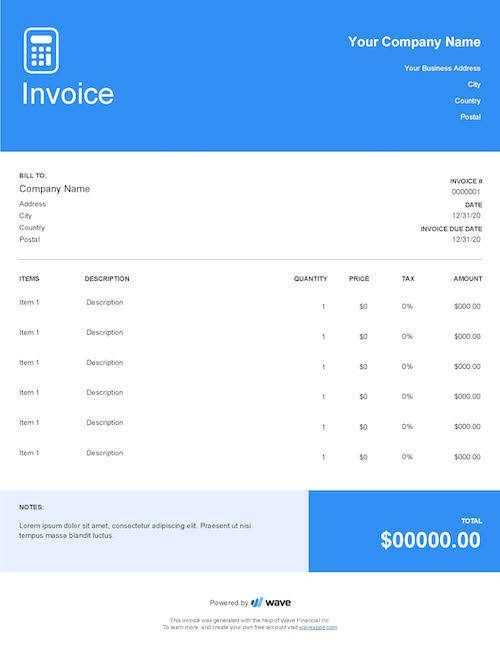

Free Tools for Creating Invoice Templates

Creating accurate financial records doesn’t have to be a complex or expensive process. There are a variety of free online tools available that allow you to easily generate professional-looking documents, complete with all the necessary details. These tools provide templates that can be quickly customized to fit your specific needs, saving you time and reducing the likelihood of errors.

1. Online Generators

Online generators allow you to create documents by simply filling in fields for the amount, service description, and other key details. Many platforms offer free access to basic features, making them an excellent choice for freelancers and small businesses.

- Invoice Generator: A simple tool that lets you create a document instantly by entering basic information. You can download the result as a PDF for easy distribution.

- Zoho Invoice: While primarily a paid service, Zoho offers a free version for small businesses that allows you to generate and send bills, track payments, and customize document layouts.

2. Spreadsheet Templates

If you are more comfortable using spreadsheets, several websites offer free downloadable files for creating custom forms. These can be particularly useful for tracking multiple transactions and creating complex reports.

- Google Sheets: Offers various free templates that can be customized for your specific requirements. With built-in formulas, this tool also helps automate calculations.

- Microsoft Excel: Many free templates are available within Excel, providing a professional format that can be tailored to meet specific business needs.

These free tools offer an easy way to streamline your billing process while maintaining professionalism and accuracy. Whether you’re a freelancer or a small business owner, they can save you both time and effort.

Common Mistakes in Invoice Tax Calculations

When preparing financial documents, errors in computing additional charges are all too common. These mistakes can lead to discrepancies between what the customer owes and what the business expects to receive. Such issues can damage relationships with clients and even result in legal complications. Being aware of the most frequent mistakes can help you avoid them and ensure that all figures are accurate.

Below are some of the most common errors people make when determining additional fees:

- Incorrect Rate Application: One of the most frequent mistakes is applying the wrong rate to the wrong item or service. Some businesses may use different rates based on the product category or location, and failing to adjust these can lead to undercharging or overcharging.

- Omitting Additional Charges: Sometimes, businesses forget to include the required extra fees, either because they are too complex or simply overlooked. This can affect the total amount due and create confusion during payment.

- Failure to Include Exemptions: Certain products or services may be exempt from additional charges, depending on the local regulations. Not accounting for these exemptions can result in applying charges to items that shouldn’t have them.

- Manual Errors: Many people rely on manual methods for adding up charges, which can easily lead to mistakes. Without automated systems, even simple miscalculations can multiply quickly.

- Incorrect Calculation of Discounts: Some businesses offer discounts that should be applied before the extra fees are added. Failing to adjust for this can result in charges being too high and cause discrepancies with clients.

By understanding these common mistakes, you can improve your process and ensure that all additional fees are correctly calculated, leading to more accurate and reliable documents for your business and clients.

How to Add Tax Rates to Your Template

Incorporating additional charges into your billing document is essential for ensuring you charge your clients accurately. By adding the correct rates, you can automatically calculate and reflect any applicable fees based on the value of the goods or services provided. This process helps maintain clarity and consistency across all transactions, reducing the risk of errors or misunderstandings.

To effectively add these charges to your document, follow these simple steps:

- Identify the Rate: Determine the rate that should be applied to each item or service. Different regions, product categories, or services may require distinct percentages. Ensure you have the right rate for each case.

- Enter the Rate in the Appropriate Field: If you’re using a digital tool, input the rate in a designated field. This will allow the system to automatically calculate the correct additional charge based on the amount for each item.

- Adjust for Multiple Rates: In some cases, different items may have different rates. Make sure that each line item in your document is matched with the correct rate. For example, some products may be subject to a higher fee, while others may have a lower or no fee at all.

- Consider Regional Variations: If you’re working across multiple locations, check for varying rates by region. Certain areas may have different rules for applying fees, so make sure your document structure allows for easy adjustments based on location.

- Review the Total Amount: After entering the rates, review the total to confirm the charges are applied correctly. This ensures that the final amount reflects the proper adjustments and there are no discrepancies.

Adding and adjusting these rates doesn’t need to be a complex process. With the right tools, you can automate and customize this feature to make sure each transaction is calculated accurately and efficiently, helping you maintain professionalism and avoid costly errors.

Understanding Tax Exemptions on Invoices

Certain goods or services may be exempt from additional charges due to various legal exemptions or specific conditions. Understanding when and why you can exclude these charges from your billing documents is essential for both compliance and transparency. Knowing which items or transactions are exempt allows you to avoid errors and ensures that you are adhering to local regulations.

There are a few key factors to keep in mind when handling exemptions:

- Product Categories: Some items, such as food or healthcare products, may be exempt depending on local laws. These exemptions vary greatly depending on the jurisdiction, so it’s important to research the applicable regulations in your area.

- Business Type: Certain businesses or nonprofit organizations may be eligible for exemptions, especially if they meet specific criteria set by the government or tax authorities. For example, educational institutions or charity organizations may qualify for reduced or zero rates.

- Location-Based Exemptions: Different regions or countries may have specific exemptions based on geographical areas. A product or service may be taxable in one state or region, but exempt in another, so understanding the local tax laws is crucial.

- Government Purchases: Sales to government entities or public organizations are often exempt from additional fees. Make sure you verify the buyer’s status to apply the proper exemptions.

- Sales for Resale: When selling goods to businesses that will resell them, these transactions may be exempt. A resale certificate is usually required to qualify for such an exemption.

To apply these exemptions correctly, it’s essential to have a clear understanding of the rules governing them in your area. Ensure that you accurately document any exempt transactions to avoid confusion and potential compliance issues.

Automation in Invoice Creation and Tax Calculation

Automating the process of generating financial documents and applying additional fees can significantly improve efficiency and accuracy for any business. By utilizing automated systems, businesses can eliminate repetitive manual tasks, reduce human error, and ensure that all relevant charges are applied consistently. This streamlines the entire billing process, allowing business owners to focus more on their operations and less on administrative work.

Automated tools can simplify several aspects of the billing process:

- Instant Calculation: Automation ensures that additional fees are applied immediately based on predefined rates, removing the risk of miscalculations. The system can automatically adjust based on the amount of goods or services provided.

- Customization: Many automated tools allow users to customize their documents to fit specific needs, such as adjusting rates, adding or removing line items, and incorporating discounts or exemptions, all with minimal effort.

- Integration with Other Systems: Automated solutions often integrate with other software, such as accounting or CRM systems, to ensure smooth data flow and synchronization across platforms. This reduces the need for manual input and ensures that all figures are up-to-date.

- Time-Saving: With automation, businesses can generate documents quickly and easily, saving valuable time. Once the system is set up, it can handle multiple transactions simultaneously, generating documents at the push of a button.

- Accuracy and Consistency: Automated processes help eliminate the inconsistencies that can occur when relying on manual calculations. This ensures that each document produced is accurate and consistent, making it easier to track and manage financial records.

By incorporating automation into your workflow, you can improve the efficiency of the billing process, reduce the risk of errors, and enhance your overall productivity, making your business more streamlined and reliable.

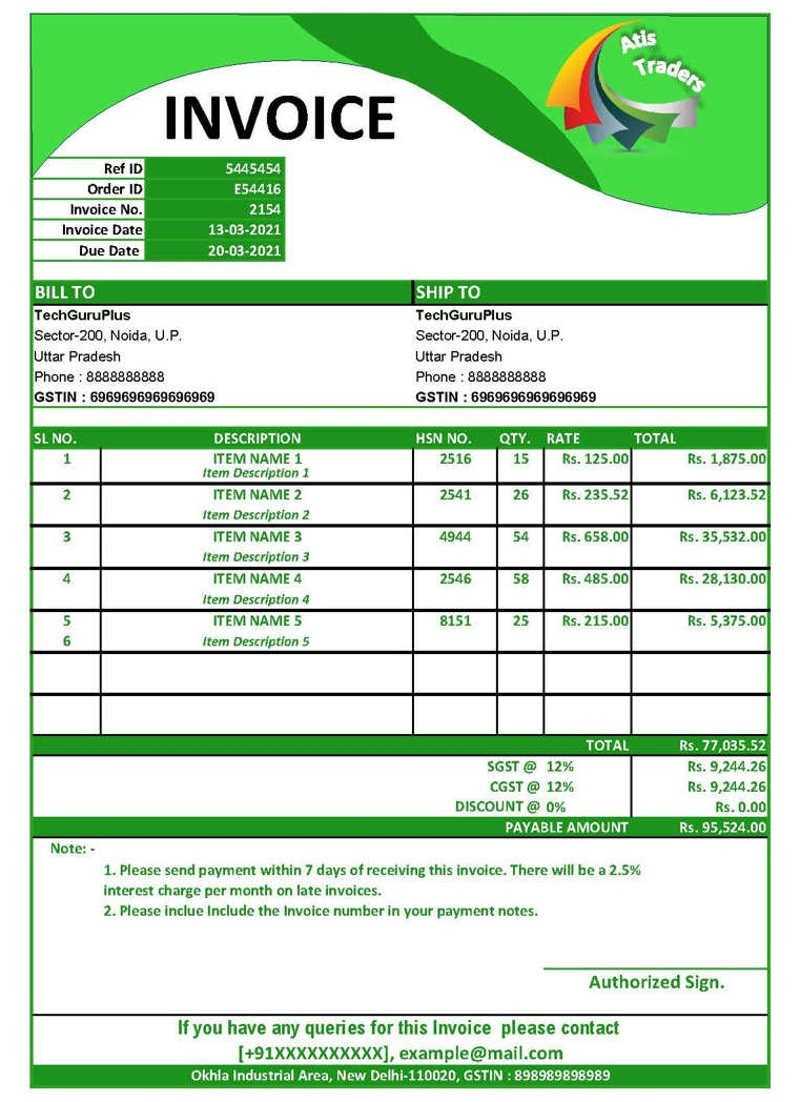

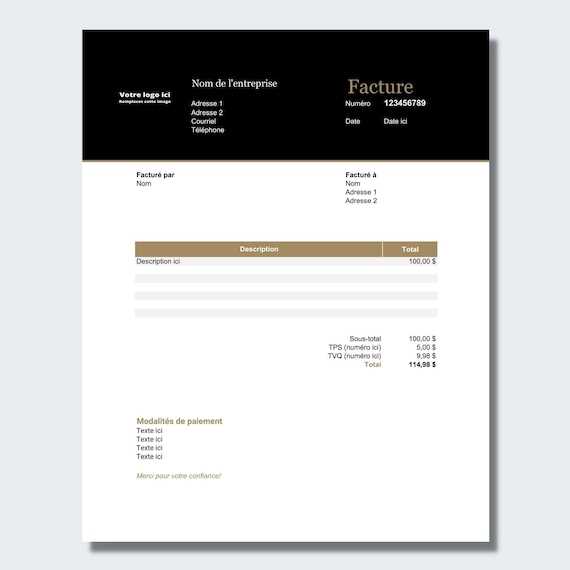

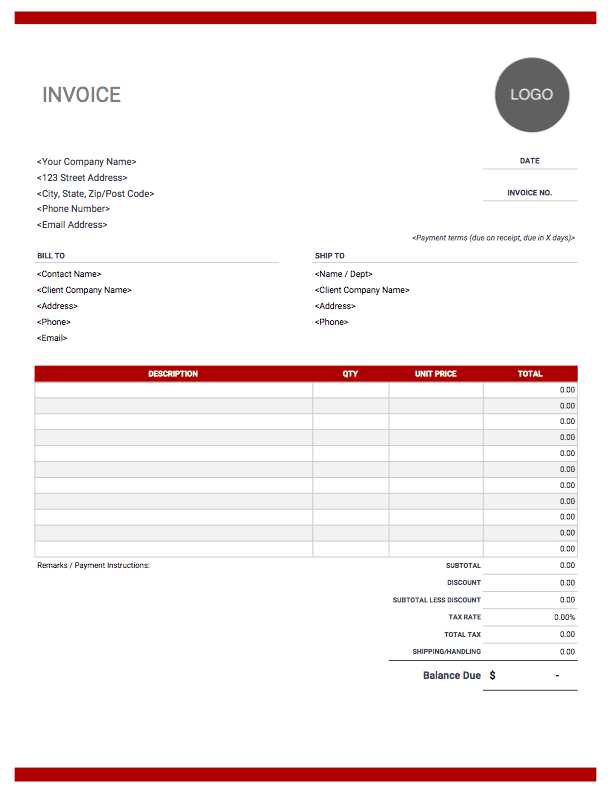

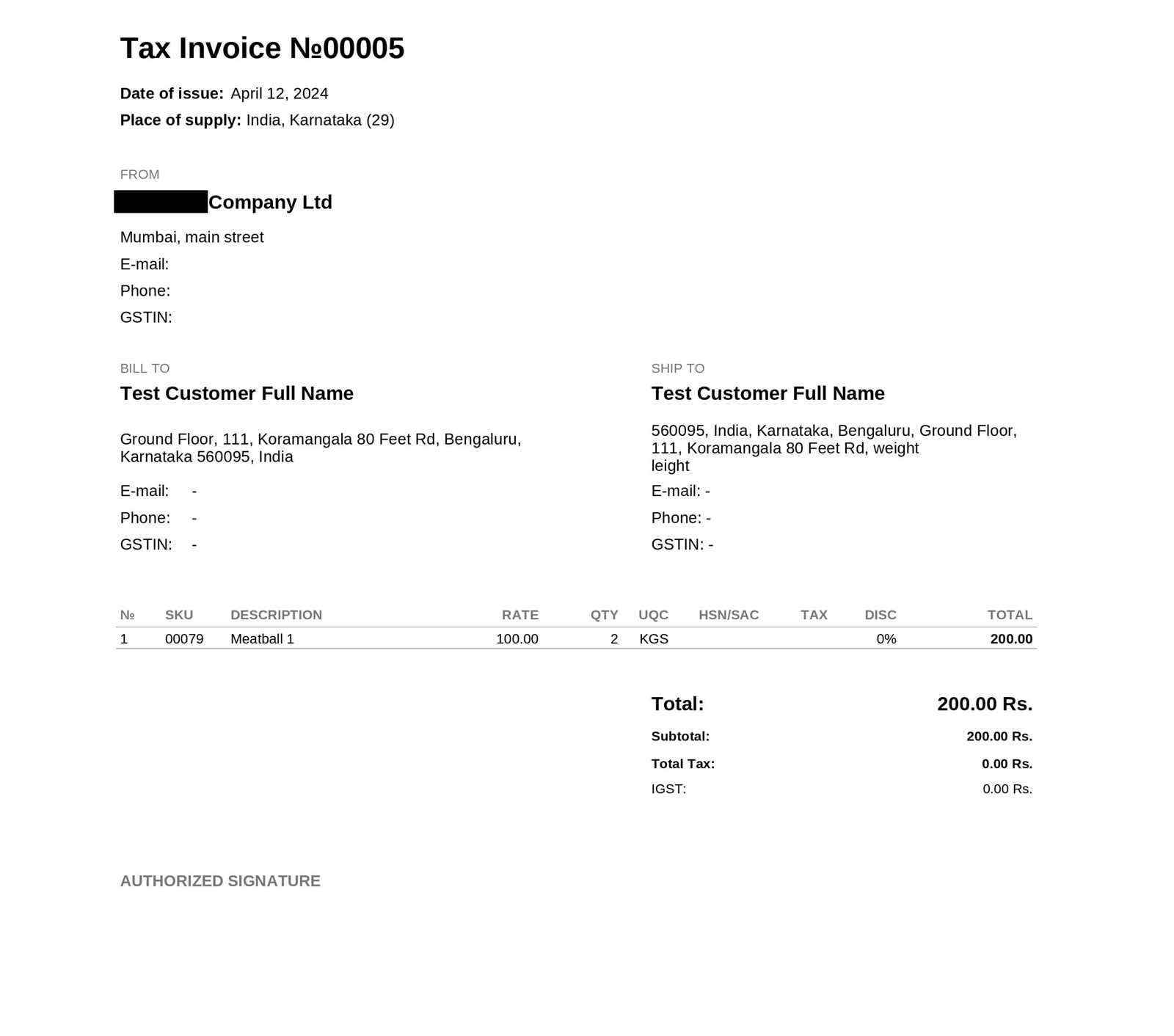

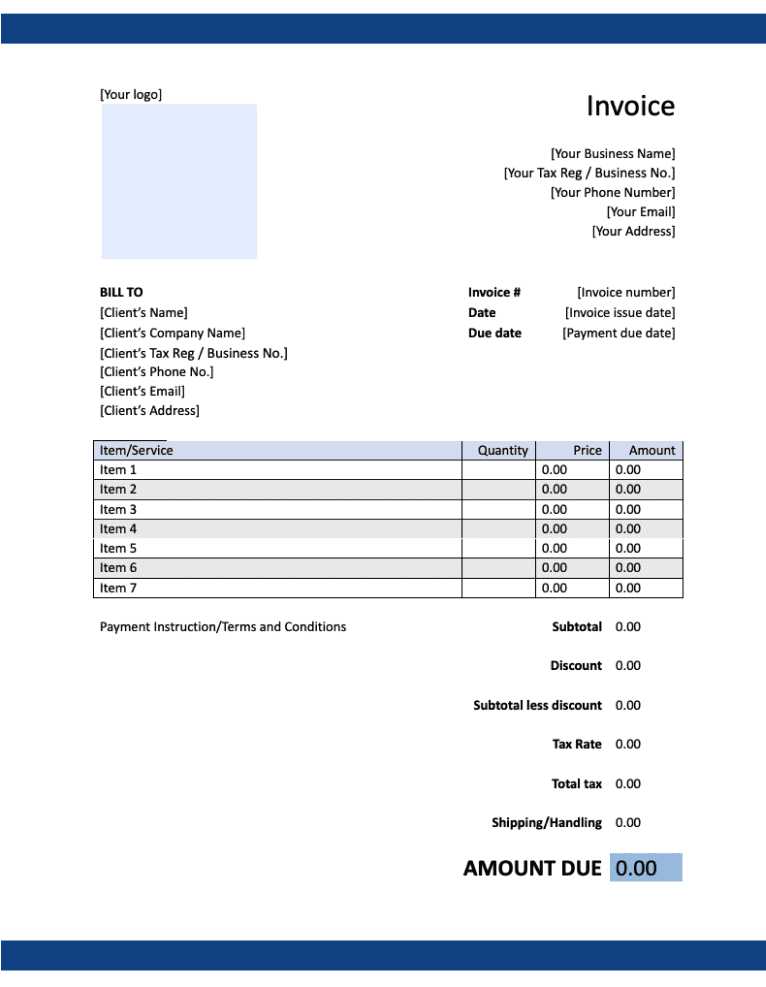

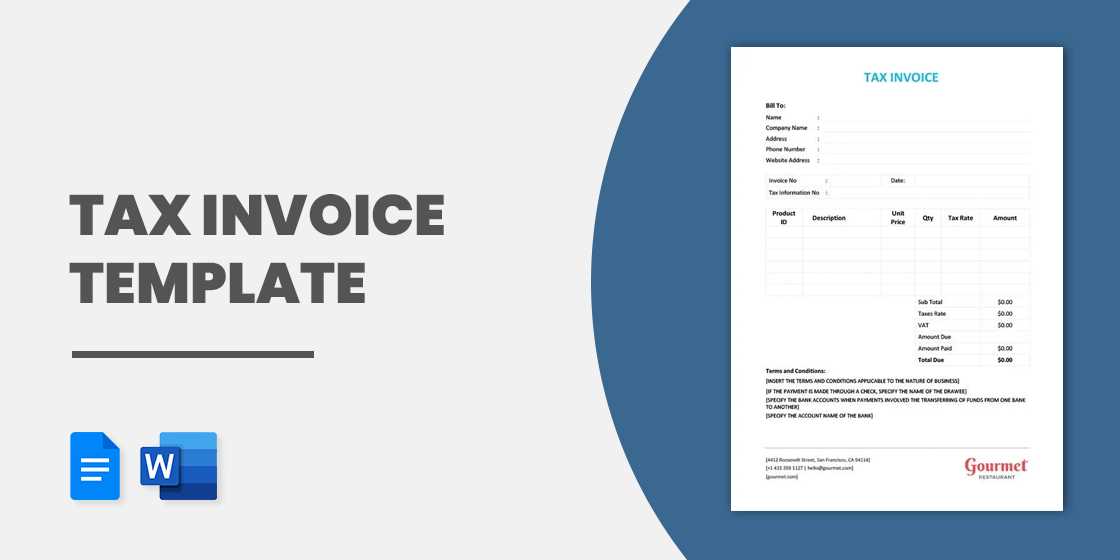

Essential Elements of a Taxed Invoice

When preparing a billing document that includes additional charges, it’s important to ensure that all necessary information is clearly outlined to avoid confusion and ensure compliance. A well-structured document should not only list the services or products provided, but also include detailed breakdowns of the amounts due, including any additional fees, rates, and exemptions. Below are the key elements to include in any document where additional charges are applied:

- Business Information: Always include your business name, address, contact details, and any relevant identification numbers (such as a VAT ID) to clearly identify your company and ensure compliance with regulations.

- Client Details: Include the name, address, and contact information of the client or company receiving the service. This helps avoid errors and ensures that the document is accurately linked to the right party.

- Unique Document Number: Every document should have a unique identification number for record-keeping and tracking purposes. This makes it easier to reference past transactions and maintain organized records.

- Itemized List of Goods or Services: Each product or service provided should be clearly described, along with the quantity, unit price, and total amount. This helps the client understand exactly what they are being charged for.

- Additional Fees Breakdown: Clearly state any extra charges being applied to the final amount. This could include shipping, handling, or any other relevant fees. Specify the rate being applied for transparency.

- Total Amount Due: The final sum should be clearly displayed at the bottom of the document, including both the cost of the items/services and any applicable extra charges. This ensures the client knows the exact amount they need to pay.

- Payment Terms: Include any terms related to payment deadlines, accepted payment methods, and late fees to avoid any confusion regarding the payment process.

- Legal Information: If applicable, include any legal disclaimers, exemptions, or statements required by law in your jurisdiction. This ensures full compliance with local regulations and avoids potential legal issues.

Including all of these elements ensures that your document is both clear and compliant, helping to foster trust between you and your clients while also ensuring smooth transactions.

How to Handle Multiple Tax Rates

In many cases, businesses need to apply different rates depending on the products or services being provided, or based on the geographical location of the customer. Managing multiple charges in a single document can be complex, but with the right approach, you can ensure accuracy and compliance. Understanding how to apply varying rates for different items or regions is crucial for smooth billing processes.

1. Identify the Appropriate Rate for Each Item

When dealing with multiple rates, the first step is to determine which rate applies to each product or service. Rates can differ based on several factors:

- Product Category: Certain goods or services may have higher or lower rates based on their classification. For example, luxury items might be taxed at a higher rate than everyday necessities.

- Region or Jurisdiction: If your business operates across multiple areas, be aware that rates can vary by location. Make sure you apply the correct rate based on the client’s region.

- Client Status: Some customers, such as non-profit organizations, government entities, or international clients, may be exempt from certain charges or eligible for special rates.

2. Break Down the Charges Clearly

Once you’ve identified the appropriate rates, it’s essential to display them clearly on your document. Here’s how to handle this effectively:

- Itemize Each Line: List each product or service with its corresponding rate and the additional charge calculated. This helps maintain transparency and allows the client to see exactly what they are being charged for each item.

- Show the Total for Each Rate: If multiple rates are applied, break them down separately. For example, if two items are taxed at 5% and 10%, show the charge for each rate and then the combined total at the bottom of the list.

- Use a Clear Summary: At the end of the document, include a summary of the different charges. This should clearly state the total amount before and after any additional charges have been applied, helping the customer understand the final total.

By following these steps, you can accurately manage and apply multiple charges in your documents, ensuring clarity for your clients and compliance with local laws.

Integrating Invoice Templates with Accounting Software

Connecting your billing process to accounting software can significantly streamline your business operations. By integrating document creation tools with accounting platforms, you can automate and synchronize data, reducing manual errors and saving valuable time. This connection allows for smoother financial management, from tracking payments to generating accurate reports, all while maintaining consistency across documents and records.

Here are a few benefits of integrating document creation tools with accounting systems:

- Automatic Data Sync: Integration ensures that all information, such as client details, product or service descriptions, and amounts, are automatically transferred to the accounting software. This eliminates the need for manual data entry, reducing the chances of errors.

- Real-Time Updates: When a transaction occurs, such as a payment or new order, your accounting system is instantly updated, reflecting the latest financial data. This real-time synchronization makes it easier to track cash flow and monitor outstanding balances.

- Improved Reporting: With integrated systems, you can easily generate financial reports, such as profit and loss statements, sales summaries, and tax reports. This helps provide a clear overview of your business’s financial health without additional manual effort.

- Seamless Reconciliation: Automated integration helps you reconcile your accounts more easily. You can quickly match payments to corresponding documents, simplifying the process of tracking and confirming financial transactions.

- Time Efficiency: By automating both document creation and financial record-keeping, businesses save time on administrative tasks. This enables business owners and employees to focus on more strategic activities and growth initiatives.

Integrating tools for creating financial documents with accounting software is a smart way to enhance accuracy, streamline processes, and ensure that your financial records are always up to date. With these systems working together, you can minimize errors, improve efficiency, and maintain a smoother workflow overall.

Why Digital Invoices Save Time and Money

Switching from traditional paper-based billing to digital solutions offers significant advantages for businesses looking to streamline their operations and cut unnecessary costs. Digital documents can be created, sent, and processed faster than their paper counterparts, making the entire financial workflow more efficient. These advantages are not only time-saving but also help reduce overhead costs in the long run.

1. Speed and Efficiency

Digital documents can be generated instantly, without the need for printing or manual handling. The automation of creating and sending documents reduces the time spent on administrative tasks, allowing employees to focus on more strategic activities.

- Instant Delivery: Digital documents can be emailed or sent through automated platforms immediately, reducing delays that typically occur in postal mail.

- Quick Adjustments: Changes to the document, such as updates to pricing or quantity, can be made easily without the need to reprint or resend physical copies.

2. Cost Reduction

Moving to digital processes helps eliminate costs associated with paper, ink, and postage. It also reduces the need for physical storage, as digital records can be easily stored and accessed from anywhere. This transition leads to savings in both material costs and labor time.

- Lower Printing Costs: By eliminating the need for paper, ink, and other printing supplies, businesses save money on resources.

- No Shipping Expenses: Sending physical documents can be costly, especially when dealing with international clients. Digital files reduce or eliminate these expenses.

By adopting digital tools for financial documents, businesses can save both time and money while improving accuracy, flexibility, and accessibility in their operations. The shift to digital processes represents a modern approach to financial management that supports long-term sustainability and growth.

Tax Compliance When Using Invoice Templates

Maintaining compliance with local and international regulations is a critical aspect of managing any financial documents. When preparing billing records that include additional charges, it is essential to follow the legal requirements of your jurisdiction to avoid penalties and ensure transparency. This includes accurately reflecting applicable rates, exemptions, and the proper handling of all necessary details to meet regulatory standards.

Here are the key elements to consider when ensuring compliance while preparing your financial documents:

| Key Compliance Factor | Details |

|---|---|

| Correct Identification Numbers | Ensure that both your business and your client’s identification numbers, such as VAT or GST numbers, are clearly stated. This is often required for reporting and verification purposes. |

| Proper Rates | Apply the correct rates for different categories of products or services. Rates can vary by location, product type, or client status (e.g., nonprofit or international buyers). Always check for the most up-to-date rates. |

| Exemptions and Reductions | Be aware of any legal exemptions or reduced rates that apply to specific items, sectors, or clients. For example, certain goods or services may qualify for tax exemptions, so you must correctly apply these adjustments. |

| Clear Breakdown | Provide a clear and itemized breakdown of all charges, including the additional fees and the base price. This ensures transparency and helps avoid disputes in case of audits or customer inquiries. |

| Documentation and Record-Keeping | Maintain accurate and complete records of all financial documents. These should be available for audit purposes and must comply with the relevant retention laws in your jurisdiction. |

By following these guidelines and staying informed about your local legal requirements, you can ensure that your financial documentation remains compliant and avoid unnecessary risks. Being proactive about tax compliance is not only essential for legal reasons but also helps build trust with your clients and regulatory bodies.

Improving Accuracy in Tax Calculations for Invoices

Ensuring precise calculations for additional charges is vital for any business to maintain trust and compliance. Even small errors can lead to discrepancies in payment or legal complications. By taking proactive steps to improve accuracy, businesses can minimize mistakes and create a smoother financial process. Here are some strategies to ensure that your financial records are calculated correctly.

1. Implement Automated Tools

One of the most effective ways to improve accuracy is by using automated software. Automated tools reduce human errors that often occur when calculations are done manually. These systems can quickly apply the correct rates to items, manage exceptions, and update as regulations change.

- Real-Time Updates: Automated systems can instantly reflect changes in the law, ensuring that you are using the most up-to-date rates and exemptions.

- Error Reduction: By eliminating manual input, you reduce the risk of typographical errors or incorrect entries.

2. Double-Check the Numbers

Even when using automated tools, it’s crucial to regularly verify the calculations to ensure they align with your expectations and local regulations. A simple manual check can catch inconsistencies that software may miss, especially with complex pricing models.

- Review Totals: Always cross-check the final amount, ensuring that it aligns with the sum of individual line items and additional charges.

- Cross-Reference Regulations: Double-check that the rates applied match the legal requirements in your jurisdiction, especially if there have been recent updates to tax laws.

By combining automated systems with regular oversight, you can greatly enhance the accuracy of your calculations, ensuring that both your business and your clients remain satisfied and compliant with legal standards.