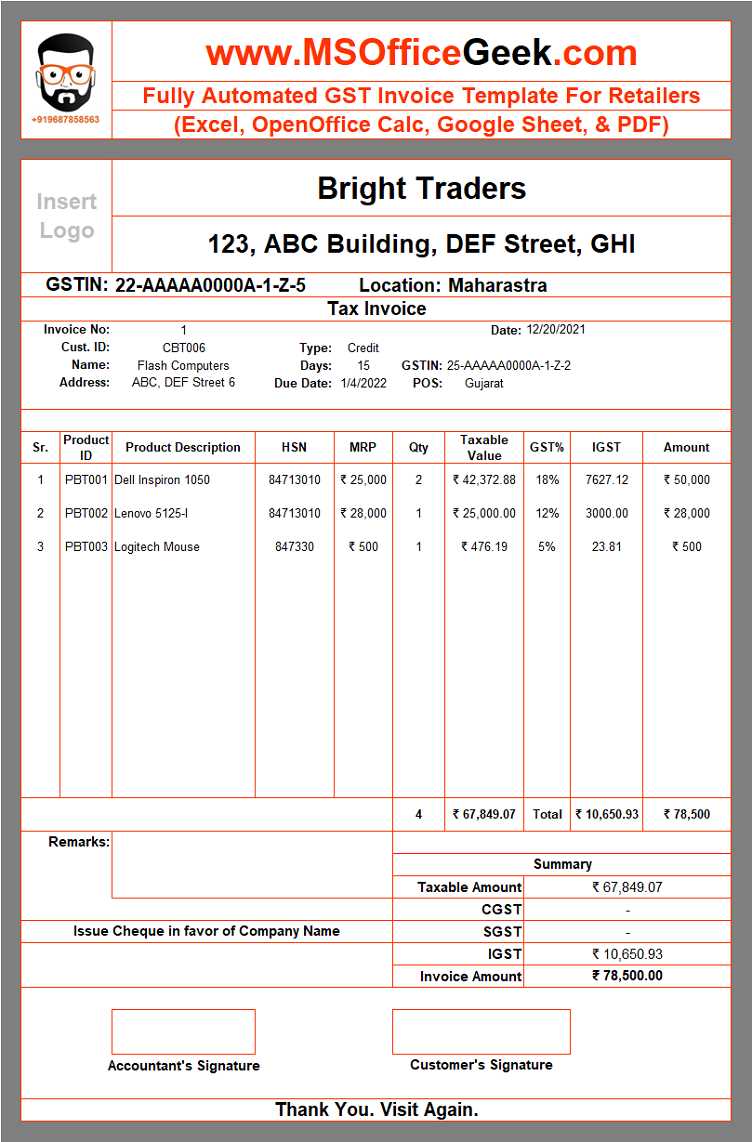

Invoice Template with GST India for Accurate Billing and Tax Reporting

Maintaining accurate and well-structured billing records is crucial for any business. Not only does it ensure smooth financial transactions, but it also plays a key role in complying with national tax regulations. A properly formatted billing document can make a significant difference in ensuring that you meet legal requirements and avoid errors in tax reporting.

With the implementation of the national tax system, businesses must adapt their documentation practices to comply with the rules governing goods and services. This includes incorporating essential elements such as tax details and transaction information, which are vital for both vendors and consumers. By using specialized formats, companies can streamline their processes, reduce errors, and ensure they meet all necessary guidelines.

Having the right format for your records not only simplifies the process but also helps maintain transparency and accountability in financial dealings. This article will explore how to create effective billing documents that align with tax obligations, offering practical advice and resources for businesses of all sizes.

Importance of GST Invoice Templates in India

Adopting a standardized format for billing is essential for businesses to ensure accuracy and efficiency in their financial transactions. A structured approach not only makes record-keeping easier but also aligns a company’s operations with the regulatory framework, reducing the risk of errors and penalties. This is especially crucial when it comes to transactions involving taxes on goods and services.

In a business environment where compliance is mandatory, using the right format for sales records is indispensable. Such documents must clearly outline transaction details, tax calculations, and other essential data, making them a vital tool for both the seller and the buyer. By adhering to prescribed formats, businesses not only facilitate smooth audits but also demonstrate their commitment to transparency and legal conformity.

For companies engaged in commercial activities, the need for clear, consistent, and legally compliant records is more pressing than ever. These documents are not just paperwork; they ensure that both parties involved are protected, and that tax authorities can easily verify transactions, minimizing the chances of discrepancies and misunderstandings.

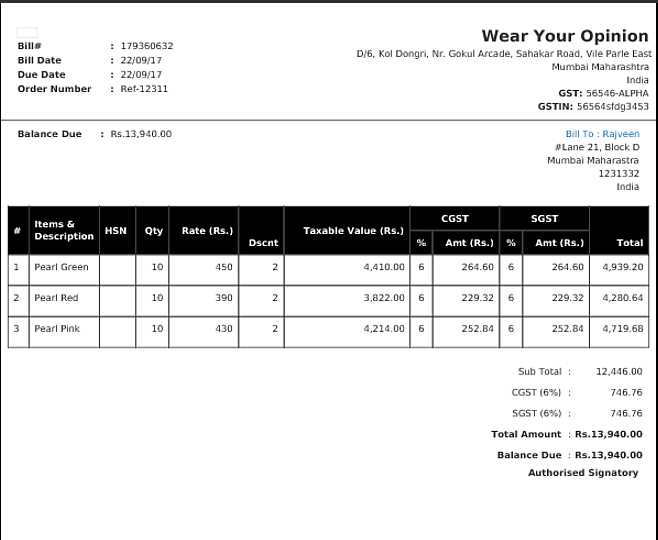

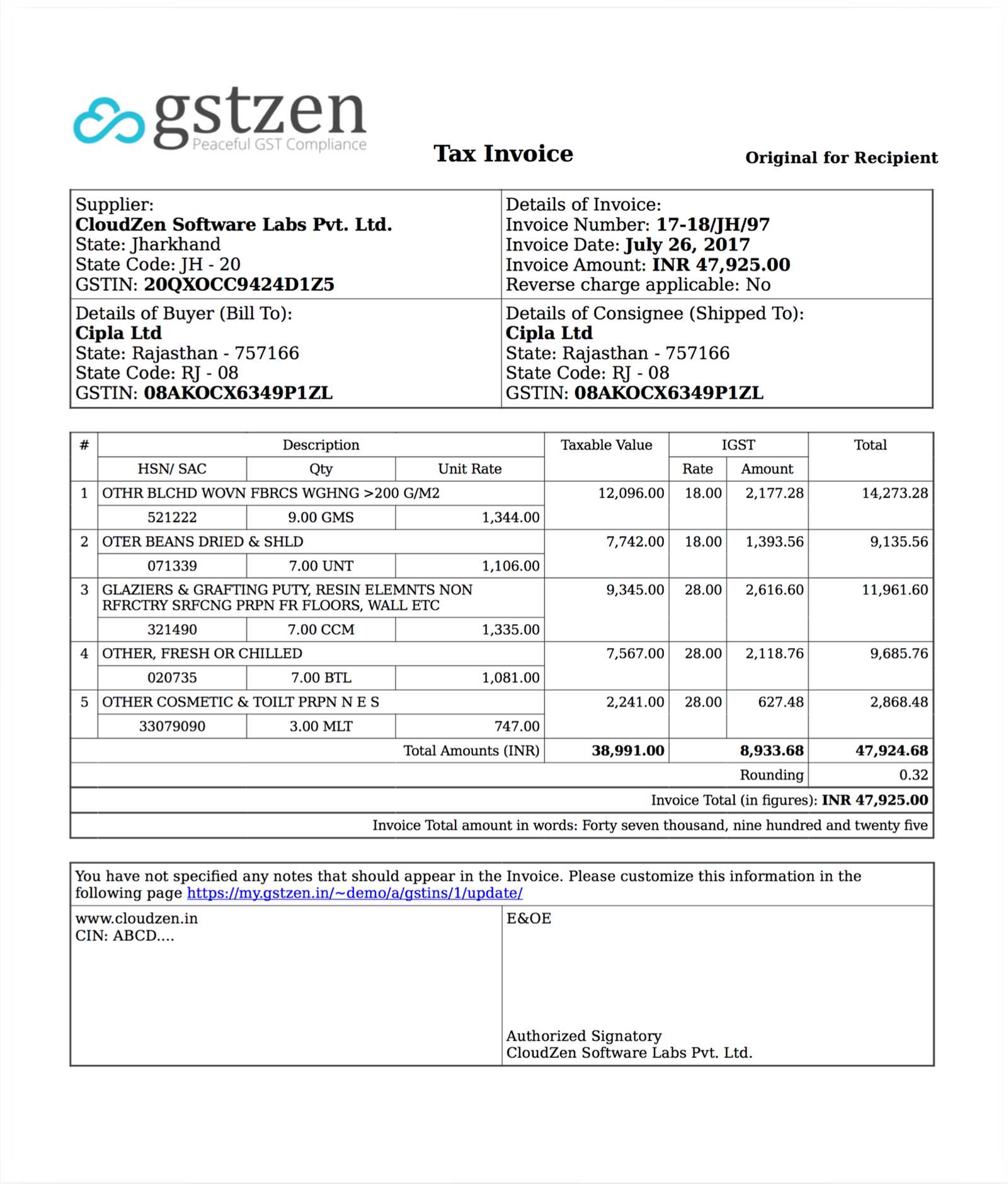

How GST Affects Your Invoices

The introduction of a national tax system has had a profound impact on how businesses document their transactions. Under this system, companies are required to provide specific details regarding the taxes applied to their sales, making it necessary to follow a more structured approach in preparing transaction records. This ensures that both buyers and sellers are aligned with the legal framework and that taxes are appropriately accounted for and collected.

One of the key changes brought about by the new tax structure is the inclusion of specific tax rates, which must be clearly outlined in every business transaction. This shift affects the way information is presented on sales documents, with a focus on transparency and accuracy. Vendors must now include tax identification numbers, apply correct tax rates, and itemize charges based on the new rules. Failure to comply with these requirements can result in penalties or complications during tax audits.

Furthermore, businesses must now ensure that their records are easily understandable by tax authorities, making the correct documentation of charges and rates crucial. The overall process becomes more streamlined and less prone to errors when appropriate details are included, ultimately helping businesses stay compliant and avoid costly mistakes.

Benefits of Using GST Compliant Templates

Using a standardized format that meets tax requirements offers several advantages for businesses. By adopting such formats, companies can streamline their operations, ensure accurate financial reporting, and reduce the risk of compliance issues. These formats are designed to simplify the documentation process, making it easier for businesses to maintain transparency and consistency in their records.

Here are some key benefits of utilizing formats that align with tax regulations:

- Enhanced Accuracy: Properly structured documents reduce the chance of errors in tax calculations, ensuring that all applicable charges are correctly applied and reported.

- Time Efficiency: Pre-designed formats save time by eliminating the need for manual adjustments or recalculations during document creation.

- Streamlined Audits: With all necessary details clearly outlined, tax audits become quicker and less prone to complications, helping businesses maintain a smooth relationship with authorities.

- Improved Compliance: Using standardized formats ensures that your business complies with the latest tax regulations, reducing the risk of penalties or disputes.

- Better Record Keeping: Consistent documentation helps businesses maintain organized and accessible records, making future reference and tax filing easier.

By integrating such structured formats into everyday business practices, companies not only simplify their internal processes but also foster trust with customers and regulatory bodies, ensuring long-term operational success.

Step-by-Step Guide to Creating GST Invoices

Creating proper records for every sale or service transaction is essential for maintaining transparency, ensuring tax compliance, and avoiding errors. Following a clear and organized process to generate these documents helps ensure that all necessary details are included and tax requirements are met. Here’s a step-by-step guide to creating accurate and compliant sales records for your business.

1. Include Business Details

The first step in creating a proper document is to include the key details about your business and your customer. This helps identify both parties involved in the transaction and ensures that all contact and tax information is accurate.

- Company name and address

- Tax identification number (TIN) or business registration number

- Customer’s name and contact information

- Customer’s tax identification number (if applicable)

2. Add Transaction Information

Once the business details are included, you need to list the specifics of the transaction, such as the products or services sold, the quantity, and the price. This information should be detailed to avoid any confusion or discrepancies later on.

- Description of the products or services provided

- Quantity and unit price

- Total value of the transaction

- Applicable taxes and rates

3. Apply Tax Details

The next step is to apply the correct tax rates based on the nature of the goods or services sold. Depending on the tax bracket, you may need to calculate taxes separately or include them in the final price.

- Specify the applicable tax rate (e.g., 5%, 12%, 18%)

- Breakdown the tax amount for clarity

- Ensure taxes are calculated based on the correct value of goods or services

4. Provide Payment Terms and Due Date

Clearly state the payment terms and due date to avoid confusion or delays in payment. This ensures that both parties are on the same page about when the payment should be made and what methods are accepted.

- Payment terms (e.g., due within 30 days)

- Accepted payment methods (e.g., bank transfer, cheque)

- Late fees or penalties for overdue payments (if applicable)

5. Review and Finalize

Before finalizing the document, make sure to double-check all details to ensure there are no errors. Verify that the correct tax rates have been applied and that the total amount matches the breakdown of charges. Once everything looks good, save the document and send it to the customer.

- Check for accurac

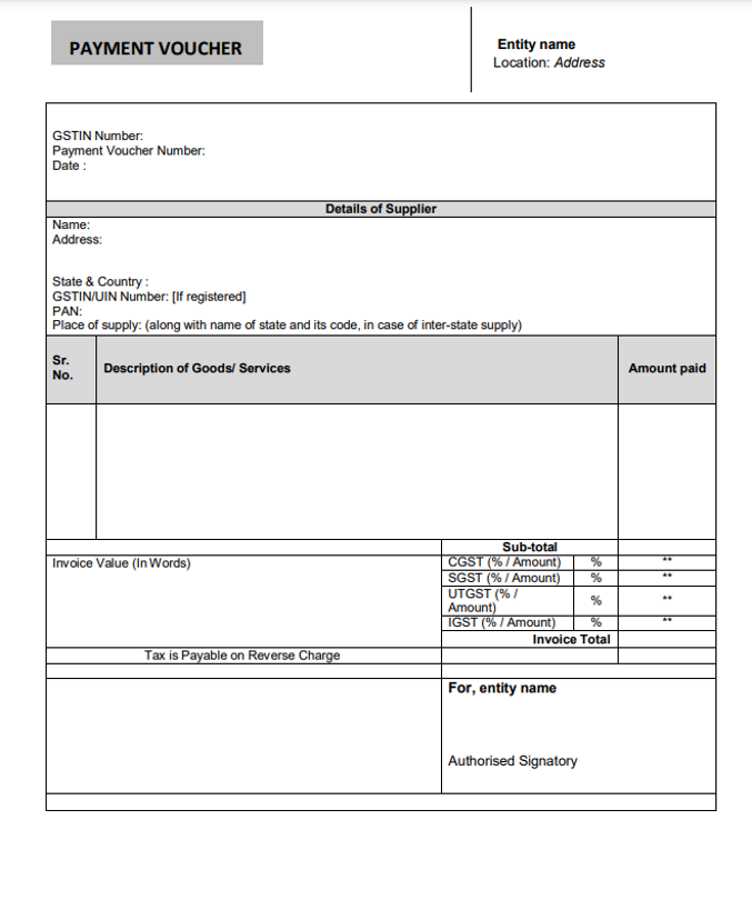

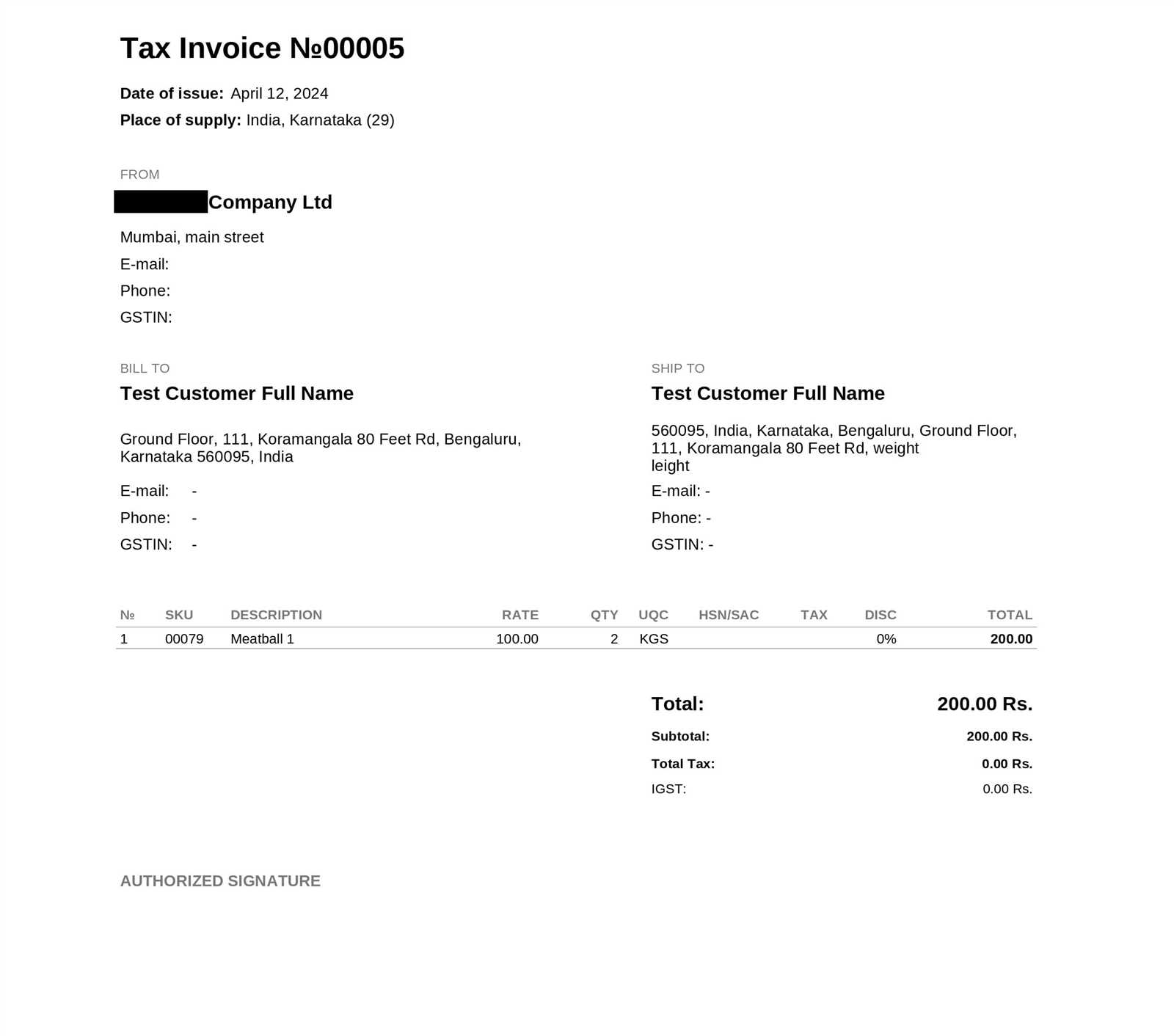

Key Elements of a GST Invoice

When preparing financial records for transactions, it is essential to include all required details to ensure accuracy and compliance with tax regulations. Each document must contain specific information that reflects the sale or service accurately and accounts for taxes properly. These key elements help in verifying the legitimacy of the transaction, making the document essential for both the buyer and the seller.

1. Business and Customer Information

Both the seller and buyer’s details must be clearly stated to identify the parties involved in the transaction. This ensures that both sides can be easily referenced in the event of an audit or a query.

- Seller’s name, address, and contact details

- Buyer’s name, address, and contact information

- Seller’s and buyer’s tax identification number (if applicable)

2. Transaction and Tax Details

Including accurate transaction details, such as item descriptions, quantities, and prices, is necessary to ensure that both the buyer and the seller understand the scope of the transaction. Additionally, tax details should be clearly outlined, showing the breakdown of applicable charges.

- Unique document number for reference

- Date of the transaction

- Detailed description of the goods or services provided

- Quantity and unit price of items or services

- Applicable tax rates and amounts for each item or service

- Total amount before and after taxes

3. Payment and Terms

Clear terms regarding payment expectations must be included to avoid any confusion between the buyer and the seller. This section outlines the due date, acceptable payment methods, and any penalties for late payments.

- Payment due date

- Accepted payment methods (e.g., bank transfer, cheque)

- Late fees or interest on overdue payments (if applicable)

By ensuring that all these key elements are included in every document, businesses can maintain accurate records, reduce errors, and stay compliant with legal and tax requirements. Proper documentation also simplifies the auditing process, saving time and preventing unnecessary complications.

Common Mistakes in GST Invoice Generation

Creating accurate and compliant financial records is crucial for any business. However, even small mistakes can lead to significant issues, including penalties or delays in payments. Many businesses struggle with ensuring that all the necessary details are correctly included, or they might overlook important regulations, leading to errors. Understanding the most common mistakes can help you avoid complications and ensure a smoother process for generating documents that meet legal requirements.

1. Missing or Incorrect Tax Details

One of the most frequent mistakes is failing to include the correct tax information or miscalculating tax rates. This can lead to discrepancies in the total amount due, causing confusion for both the buyer and the seller.

- Incorrect tax rate applied to products or services

- Omission of tax calculation or total

- Failure to update tax details for changes in rates or rules

2. Incomplete or Incorrect Business Information

Accurate business and customer information is vital for creating legitimate records. Missing or incorrect details can lead to disputes or difficulties during audits, especially if tax identification numbers or addresses are incorrect.

- Missing or incorrect tax identification numbers

- Omission of business address or contact details

- Incorrect or incomplete customer information

3. Failure to Include Unique Reference Numbers

Every record must have a unique identifier to distinguish it from others, especially for tracking purposes. Neglecting to include this reference number can cause issues when it comes to matching transactions during audits or for payment tracking.

- Not assigning a unique reference number to each transaction

- Using duplicate or incorrect reference numbers

4. Omitting Payment Terms

Failing to clearly outline payment terms can lead to confusion regarding the due date, accepted methods, or penalties for late payments. This omission can cause delays in payment or disputes between the buyer and the seller.

- Not specifying payment due dates

- Failure to mention late payment penalties

- Omitting payment methods accepted by the seller

5. Inaccurate Quantity or Price Details

Incorrect pricing or quantity details can lead to financial discrepancies and affect the buyer’s trust in the business. Ensuring that product descriptions, prices, and quantities match exactly what was agreed upon is essential for proper documentation.

- Incorrect quantity of items listed

- Mistakes in unit prices or total amounts

- Failure to update prices for new products or services

By being aware of these common mistakes and taking steps to avoid them, businesses can create accurate, compliant records that streamline financial operations and help maintain good relationships with both customers and tax authorities.

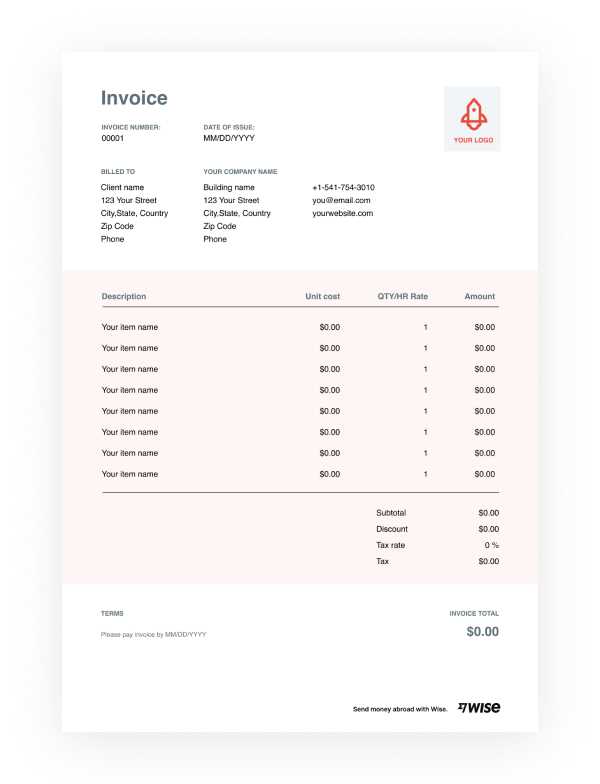

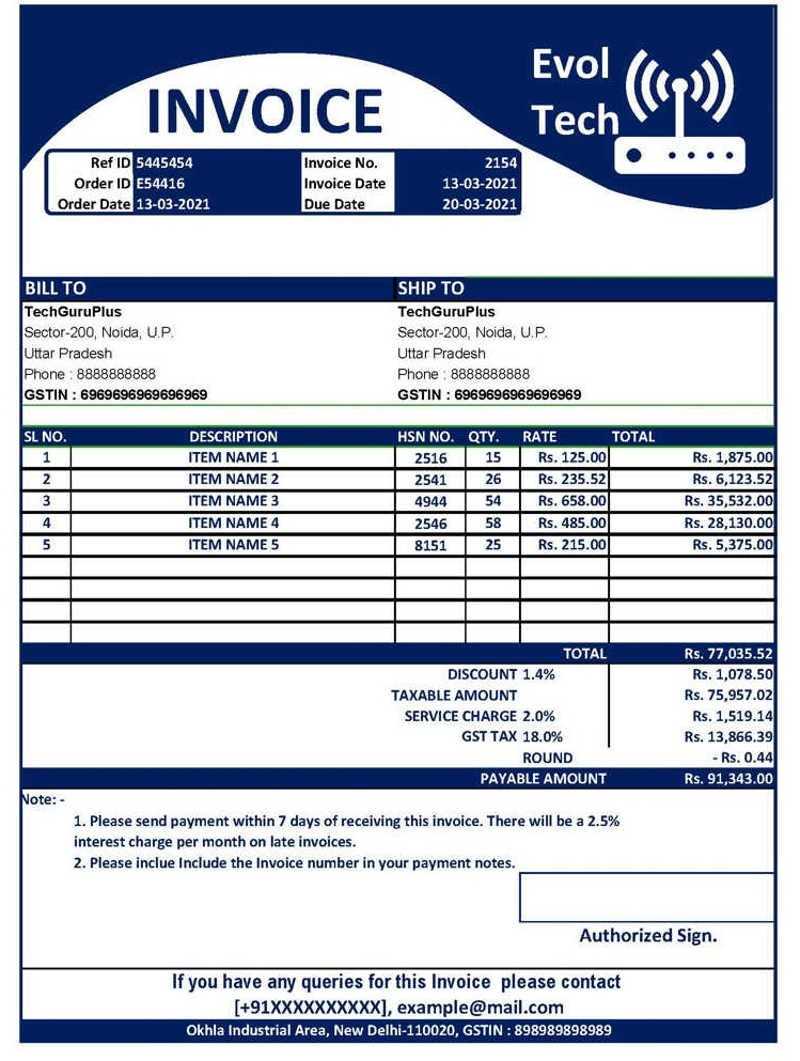

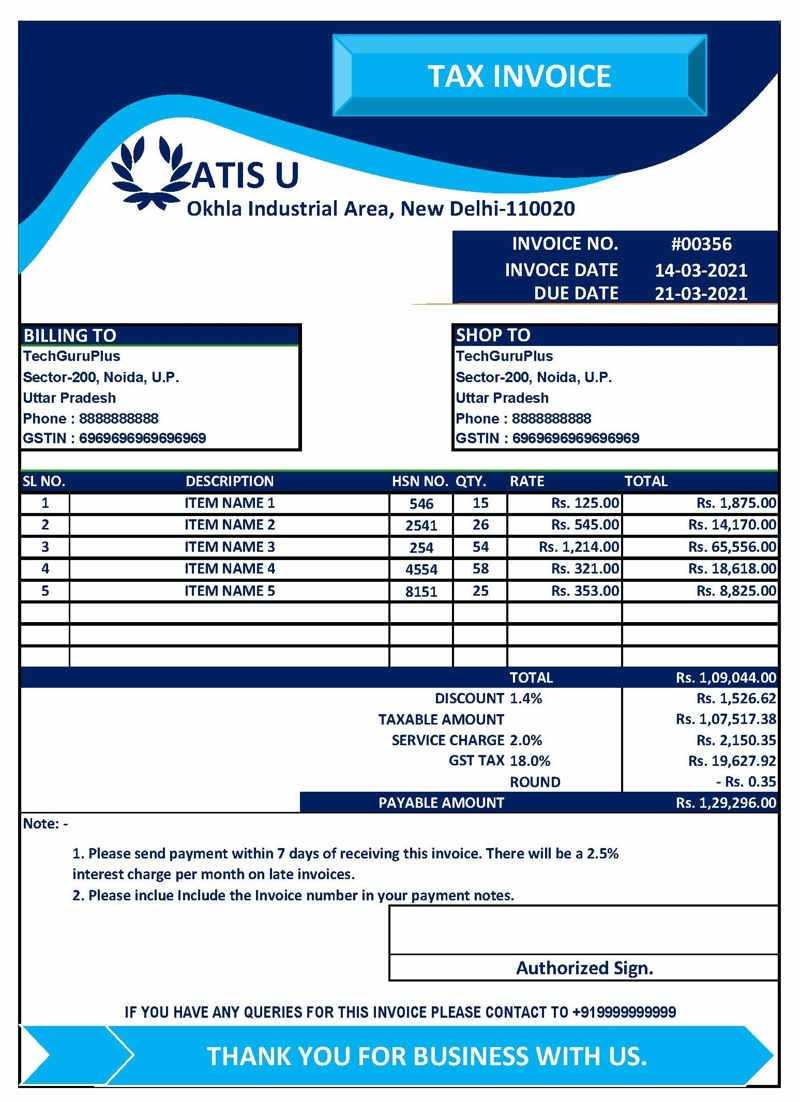

How to Customize Your Invoice Template

Creating a tailored document that reflects your business’s unique needs is essential for maintaining professionalism and ensuring consistency in financial transactions. Customizing the format of your sales records allows you to include all relevant details, improve clarity, and make the process more efficient. A personalized format can help in streamlining your documentation while adhering to legal and regulatory requirements.

Here are a few steps you can follow to customize your format:

1. Add Your Branding

Including your company’s logo, name, and contact information is an excellent way to make the record look professional and easily recognizable. This is an important step to establish your brand identity.

- Insert your company logo at the top

- Include the business name, address, and phone number

- Provide your website and email address for easier communication

2. Define the Layout and Design

The layout should be clean and organized, with clear sections for each necessary detail. Customize the design to suit your business style, but make sure it remains easy to read and professional.

- Choose a clear, easy-to-read font and appropriate size

- Use color sparingly to highlight key sections without overwhelming the reader

- Ensure there is enough space between each section for clarity

3. Customize Section Titles

Each part of the document, such as the product or service description, tax calculation, or payment terms, should be clearly labeled. Customizing these section titles helps in identifying key information at a glance and can be adjusted to suit your business’s specific needs.

- Modify headings like “Item Description” or “Total Amount” to better reflect your business language

- Include specific terms or legal requirements relevant to your industry

4. Adjust Payment Details and Terms

Clearly outlining payment terms is crucial for avoiding misunderstandings. Tailor the payment section according to your preferred payment methods, due dates, and any applicable late fees or discounts.

- Specify payment terms (e.g., “Net 30 days” or “Due upon receipt”)

- List acceptable payment methods (bank transfer, cheque, online payment options)

- Include any discounts for early payment or late fees for overdue amounts

5. Incorporate Legal Information

Ensure that your records meet all local legal requirements by including necessary tax information, business registration numbers, and any other legal disclaimers required in your area of operation.

- Insert your tax identification number or business registration details

- Include any legal disclaimers, warranties, or terms specific to your business

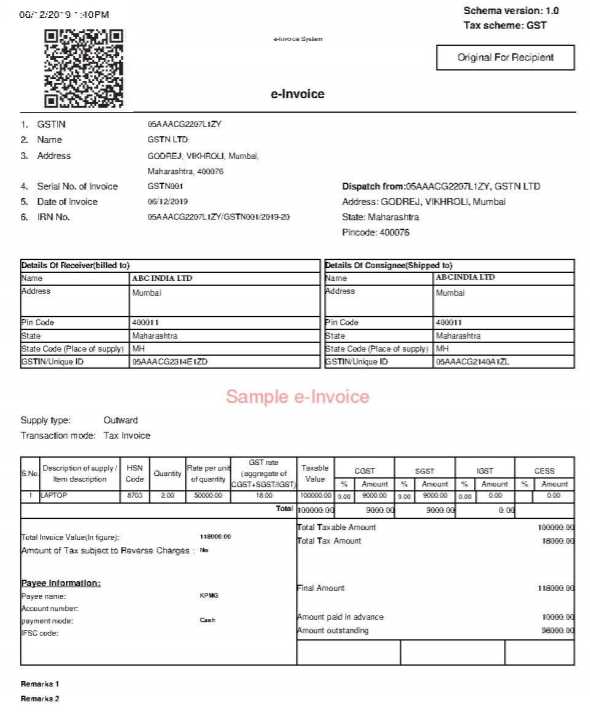

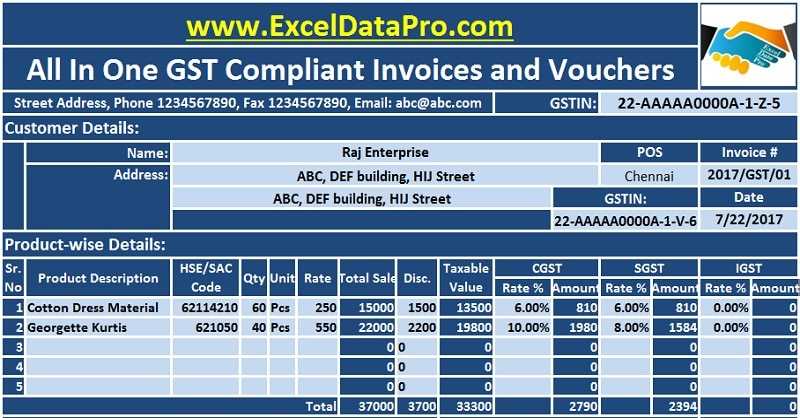

Free GST Invoice Templates for Businesses

Many businesses, especially small and medium-sized enterprises, seek cost-effective solutions for creating professional financial documents. Free resources are available online that allow businesses to generate legally compliant transaction records without the need for expensive software or design tools. These free options are convenient, easy to use, and can be customized to meet the specific needs of your business.

Here are some benefits of using free resources for creating your transaction records:

- Cost-Effective: Free solutions eliminate the need for purchasing expensive software or hiring a designer, making them ideal for startups and small businesses with limited budgets.

- Easy to Use: Many free resources are user-friendly and do not require advanced technical skills. You can easily input data and generate accurate records.

- Customization Options: Most free tools offer customization features that allow you to add your branding, modify layouts, and include necessary legal details.

- Time-Saving: Pre-designed formats save you time compared to creating documents from scratch, allowing you to focus on running your business.

- Compliant with Regulations: Free resources are often updated to ensure compliance with the latest tax laws and regulations, minimizing the risk of errors or penalties.

Free resources typically come in various formats, such as:

- Excel Spreadsheets: These offer flexibility and allow you to manually enter and calculate details. They can also be saved and edited as needed.

- Word Documents: Simple and easy-to-use, these documents can be tailored to fit your business’s style, and you can easily add or remove sections.

- Online Generators: Websites offering free online generators let you input details directly into pre-designed forms and download your documents in a ready-to-use format.

- Google Sheets or Docs: Cloud-based options allow easy access and sharing, ensuring that you can create and store documents from anywhere.

When choosing a free resource, make sure that the format you use meets all necessary legal requirements and includes the essential details such as tax information, payment terms, and business data. While free tools can be a great starting point, always double-check that your documents comply with local regulations to avoid future complications.

Choosing the Right Invoice Format

Selecting the appropriate format for your business’s transaction records is essential for maintaining clarity, accuracy, and compliance with legal requirements. A well-structured document not only reflects professionalism but also simplifies the process of tracking payments, managing taxes, and meeting regulatory standards. The right format should be adaptable to your specific needs while ensuring that all necessary details are included and easy to understand.

When deciding on the most suitable format for your records, consider the following factors:

1. Business Type and Industry

The type of business you run may influence the layout and complexity of your records. For instance, a retail business may need a simpler design, while a service provider may require more detailed descriptions. Tailor the format to match the specific needs of your business operations.

- Retail: Simple format with basic product details and pricing

- Services: More detailed format with descriptions of services provided and time durations

- Freelancers: Customizable layouts that accommodate hourly rates, project-based charges, and milestones

2. Legal and Tax Requirements

Your format should comply with local regulations to avoid penalties or legal issues. The document must clearly outline tax calculations, applicable rates, and other mandatory information as required by law. Make sure that your chosen format supports these details and can be easily adjusted if regulations change.

- Include fields for tax identification numbers

- Ensure correct calculation and display of tax amounts

- Check for compliance with current local or national tax laws

3. Ease of Use

The format should be user-friendly and simple to fill out. Avoid overly complex designs or unnecessary fields that might cause confusion. A clean and intuitive layout will save time when creating documents and help avoid mistakes.

- Predefined fields for all necessary information

- Simple structure with clear sections for each detail

- Easy-to-fill options for quick customization

4. Customization and Flexibility

Choose a format that allows for customization according to your branding and specific business needs. The ability to personalize sections, such as adding your company logo or modifying payment terms, can improve your documents’ appearance and clarity.

- Include company logo and brand colors

- Adapt layout for additional fields or custom terms

- Modify text and structure to reflect your business style

Ultimately, the right format should be a balance between professionalism, ease of use, and the ability to meet all legal and operational requirements. A well-designed document will streamline your business processes and ensure that you maintain compliance while providing clear, transparent information to your clients.

How to Manage GST-Related Documentation

Properly managing your financial records is a critical aspect of running a compliant business. Accurate documentation not only helps maintain transparency but also ensures that your business meets the necessary legal requirements. Effectively organizing your transaction records, especially those involving taxes, requires a systematic approach that allows you to track, store, and retrieve documents as needed, reducing the risk of errors and improving overall efficiency.

Here are some essential steps to manage your tax-related documents effectively:

1. Organize Your Records by Category

It’s crucial to classify your documents based on different categories such as sales, purchases, and tax filings. This ensures easy retrieval and avoids confusion when you need specific information, whether for auditing purposes or tax submission.

Category Documents to Include Sales Transaction records, payment receipts, delivery slips, and sales contracts Purchases Purchase orders, supplier bills, receipts for goods or services Tax Filings Tax return forms, payment receipts, tax deposit challans Refunds Refund request forms, approved refund details, communication with customers 2. Maintain Digital and Physical Copies

While keeping physical copies of documents is important, transitioning to digital records can streamline the process of storing and retrieving information. Digital records are easier to manage, take up less space, and can be securely backed up to prevent loss of data. However, always ensure that physical records are stored safely in an organized manner for legal and auditing purposes.

- Digital Records: Store documents in a secure, backed-up system such as cloud storage or encrypted servers.

- Physical Records: Organize physical documents in labeled folders or filing cabinets to easily identify and access them when necessary.

3. Track Deadlines and Compliance Dates

Meeting deadlines for tax payments and submissions is essential to avoid penalties. A reliable tracking system can help ensure that you never miss a deadline. Use reminders or digital tools to stay on top of compliance dates.

- Set reminders for monthly, quarterly, and annual filings

- Maintain a calendar for payment deadlines and document submission

4. Audit and Review Your Documents Regularly

Regularly auditing your records ensures that everything is in order and that you can easily respond to inquiries or audits. Periodic reviews also help spot discrepancies or mistakes early, preventing complications down the road.

- Conduct quarterly or annual audits to verify document accuracy

- Review tax filings and paymen

Best Practices for Invoice Numbering

Consistent and organized numbering for your transaction records is vital for maintaining clarity, tracking, and ensuring compliance. A well-thought-out numbering system helps you keep an accurate and chronological record of your sales, facilitating smooth audits and improving overall record-keeping practices. Proper numbering also reduces the risk of duplication or missing records, which can create confusion and lead to financial errors.

Here are some key practices to follow when creating a numbering system for your records:

1. Use Sequential Numbering

Always use a sequential numbering system for your transaction records. This makes it easy to follow the order of the documents, ensuring that nothing is overlooked or duplicated. Sequential numbers help track each transaction in a logical sequence, which is essential for maintaining accurate business records.

- Start from a specific number and increase it incrementally (e.g., 1001, 1002, 1003, etc.)

- Ensure no gaps or duplicates in the numbering sequence

- Choose a starting number that makes sense for your business, such as starting at 1 or 1001

2. Include Year or Date in the Number

Incorporating the year or date into your numbering system helps quickly identify when a transaction occurred. This is especially useful for sorting and referencing documents for specific fiscal periods or during audits.

- Use a format like YYYY-XXXX (e.g., 2024-0001) to track documents by year

- Alternatively, include the month, such as YYYY-MM-XXXX (e.g., 2024-08-0001), to organize transactions monthly

- This practice helps differentiate between records from different years and simplifies filing

3. Avoid Reusing Numbers

Each record number should be unique and assigned only once. Reusing numbers can cause confusion and lead to serious issues when tracking transactions or during audits. Keeping each number distinct ensures that each document is identifiable and traceable.

- Never recycle or reuse a number for a new record

- Ensure each document has a unique identifier, even for voided or canceled records

4. Incorporate Prefixes or Suffixes for Easy Identification

Using prefixes or suffixes can help categorize your documents or make them easier to identify based on certain parameters, such as type of transaction or department. This helps streamline your workflow and keeps records organized for different purposes.

- Add a prefix like “SALE” or “PUR” for sales and purchase records (e.g., SALE-1001, PUR-1001)

- Consider using department-specific codes (e.g., HR-1001 for human resources transactions)

- Implement a suffix to distinguish different types of documents (e.g., 1001-INV for standard sales and 1001-CN for cancellations)

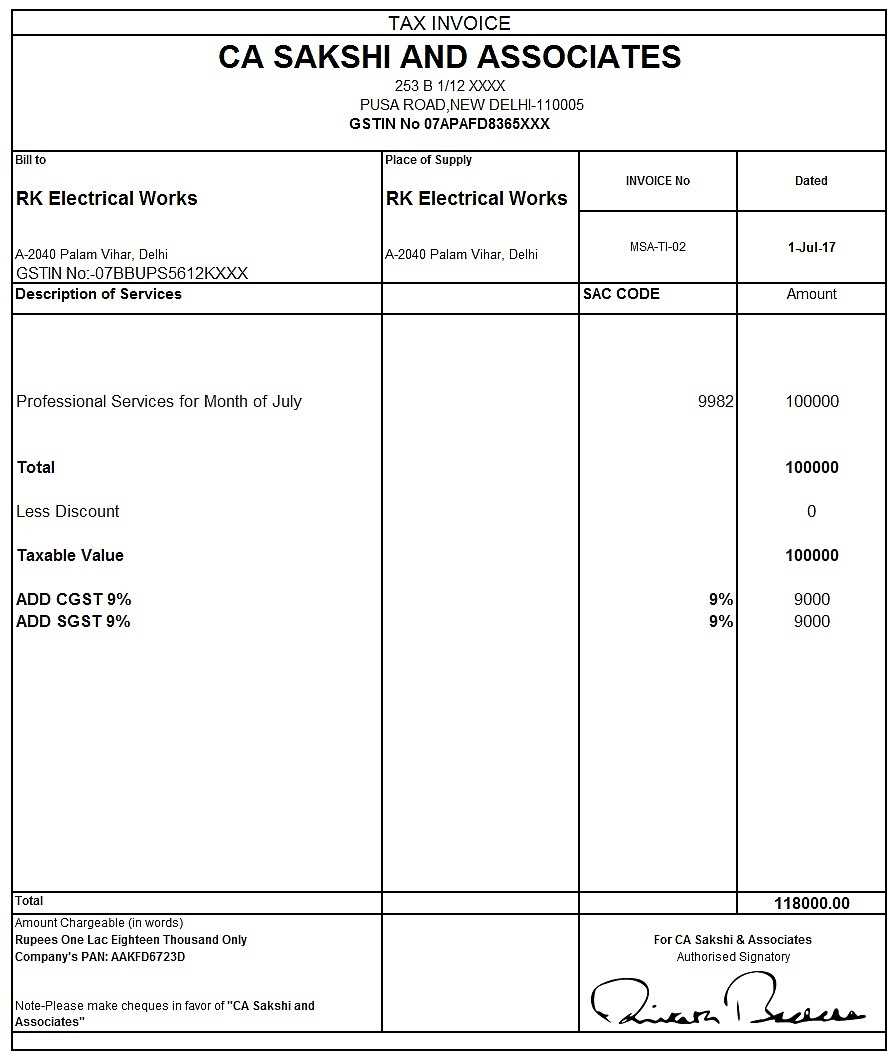

GST Invoices for Service Providers

For service-based businesses, creating accurate transaction records is essential for maintaining compliance and ensuring transparency. Service providers must ensure that their documents meet the legal requirements, including the proper calculation of taxes, to avoid penalties. These records should clearly outline the services rendered, payment terms, and tax details while adhering to local regulations.

When generating transaction records for services provided, there are several key elements that must be considered to ensure compliance:

1. Service Description and Details

Unlike product-based transactions, service records need detailed descriptions of the work performed. This helps both the service provider and the client clearly understand what was delivered and its corresponding value.

- Include a clear description of the service provided (e.g., web development, consulting, design work)

- List the service duration, if applicable (e.g., hourly, daily, project-based)

- Specify any additional costs or fees associated with the service

2. Tax Calculation for Services

Service providers are subject to tax regulations that require accurate tax calculations to ensure compliance. The tax rate may vary depending on the nature of the service and the client’s location. It’s important to ensure that the correct tax rate is applied and clearly shown on the document.

- List the applicable tax rate for the service provided

- Ensure the total tax amount is clearly separated from the total amount due

- If there are different tax rates for different services, itemize each service and its corresponding tax rate

3. Payment Terms and Due Date

Clear payment terms help avoid misunderstandings and ensure that clients know when and how to make payments. This section should include the due date, accepted payment methods, and any applicable late fees or early payment discounts.

- Specify the payment due date

- List the accepted payment methods (e.g., bank transfer, online payment, check)

- Include any discounts for early payments or penalties for late payments

4. Additional Information and Customization

Service providers often have unique needs, and your documentation should reflect that. For example, if you offer ongoing services or subscriptions, it’s helpful to include details about the terms of renewal or cancellations. Additionally, customization options like branding elements can make the document more professional.

- Provide clear renewal or cancellation terms for ongoing services

- Add your business logo and contact information for a personalized touch

- Ensure that all custom clauses or agreements are explicitly mentioned

By following these guidelines, service providers can generate accurate and compliant records for all transactions. This not only helps maintain business transparency but also simplifies the process of tax filing an

How to Handle GST Filing with Invoices

Managing tax filings can be complex, especially for businesses that need to comply with specific financial regulations. One crucial aspect of this process is ensuring that all transactions are documented correctly, as they are directly tied to the taxes owed. For businesses involved in transactions subject to tax laws, maintaining accurate records is essential for smooth filing and avoiding penalties. Proper documentation of every sale or purchase helps track your tax liabilities and allows for efficient reporting.

Handling your filings begins with proper documentation of each transaction. Here are the steps to manage tax filings effectively:

1. Organize Your Records

Before filing, it’s important to organize your transaction details by categorizing them into sales and purchases. You must also ensure that each transaction is linked to the corresponding tax obligations, such as the tax amount collected or paid.

Category Documents Needed Tax Calculation Required Sales Sales receipts, contracts, and payment details Tax collected on each transaction Purchases Supplier bills, receipts for services or products Tax paid on each purchase 2. Calculate the Tax Amount

Each document must clearly indicate the tax amount related to the transaction. For sales, this will be the tax collected, while for purchases, it will be the tax you paid. Ensure these amounts are calculated accurately and can be cross-referenced against your records.

- For sales, ensure the tax amount is clearly separated and calculated based on the applicable rate

- For purchases, track any tax paid to suppliers to claim appropriate credits

- Accurate tracking of tax helps avoid discrepancies when filing and makes it easier to adjust the returns

3. File Your Returns on Time

Once the documents are properly organized and tax amounts are calculated, the next step is to file your returns on time. Missing filing deadlines can result in penalties, so it’s critical to stay on top of the filing schedule. Your filing should include details about both the tax collected on sales and the tax paid on purchases, allowing you to determine the balance and any amount owed or refundable.

- Set reminders for monthly, quarterly, or annual filing deadlines

- Ensure all relevant documents are included to support your tax return

- Review filings carefully to ensure accuracy and avoid errors that could trigger audits

4. Keep Records for Audits

Integrating Invoice Templates with Accounting Software

Integrating transaction documents with accounting tools can greatly enhance the efficiency and accuracy of financial management. By combining invoicing processes with automated accounting systems, businesses can reduce manual errors, streamline workflows, and ensure that financial records are up-to-date in real time. This integration allows for seamless tracking of sales, expenses, and tax obligations, ensuring that all financial data is organized and easily accessible for reporting and audits.

By connecting invoicing systems to accounting software, businesses can simplify their overall financial operations. Below are some key considerations and benefits of integrating these tools:

1. Streamlined Workflow

Integrating invoicing processes into your accounting software ensures that all data flows automatically into your financial system. This eliminates the need for manual data entry, reducing errors and saving valuable time.

- Automatically transfer transaction data to your accounting system, minimizing the chances of input mistakes

- Real-time synchronization between invoicing and accounting helps maintain accurate financial records

- Save time by eliminating redundant tasks and allowing your software to generate financial reports instantly

2. Enhanced Accuracy and Compliance

Integration helps ensure that your transaction details, tax rates, and payment records are correctly entered into the accounting system. By doing so, the risk of miscalculations and discrepancies in reporting is significantly reduced. Additionally, integration can help ensure that your financial records are compliant with local tax regulations.

- Ensure that all transaction amounts, tax rates, and totals are automatically calculated and recorded

- Stay compliant with legal requirements by ensuring all documentation includes necessary tax information

- Prevent errors from manual data entry and improve audit accuracy

3. Improved Reporting and Analysis

Accounting software that integrates transaction documentation offers powerful reporting tools. These tools can generate detailed financial statements, track sales, and provide insights into business performance, all of which are invaluable for decision-making.

Report Type Description Benefits Profit and Loss Summarizes income and expenses over a period of time Helps track overall business performance and profitability Balance Sheet Shows a snapshot of your assets, liabilities, and equity Provides insight into financial health and stability Common GST Invoice Errors and How to Avoid Them Accurate documentation is crucial for businesses to comply with tax regulations and avoid financial penalties. Common mistakes in transaction records can lead to discrepancies during audits, tax filing issues, and even legal consequences. By understanding and addressing these errors, businesses can ensure smoother operations and stay compliant with all regulatory requirements. Below, we highlight the most common mistakes and provide tips for avoiding them.

1. Incorrect Tax Calculation

One of the most frequent errors is incorrect tax calculation. This can occur when the wrong tax rate is applied to the transaction or when the tax is not calculated correctly based on the value of the goods or services provided. Such errors can lead to overcharging or undercharging clients, which can result in financial penalties.

- Solution: Always double-check the tax rates and ensure that they are applicable to the specific product or service being provided. Use automated tools to calculate taxes accurately.

- Solution: Review all transaction details to verify that the tax calculation aligns with the applicable tax laws and regulations for the specific location.

2. Missing or Incorrect Business Information

Another common mistake is failing to include the correct business details, such as the business name, address, and tax registration number. This can create confusion and potential issues when clients or authorities review the records.

- Solution: Ensure that all business information is complete and accurate, including the business’s legal name, address, and unique tax identification number.

- Solution: Keep your business details up-to-date in your system, especially when changes occur, to avoid mistakes in documentation.

3. Omitting or Misclassifying Goods or Services

Incorrectly describing the goods or services provided or omitting necessary details about the transaction can lead to confusion and errors during audits. Misclassification can also result in incorrect tax calculations or delayed payments.

- Solution: Always include a clear and detailed description of the product or service provided. Use standardized descriptions to avoid confusion.

- Solution: Make sure that the classification of goods or services aligns with the tax codes, as misclassifying an item can result in incorrect tax rates.

4. Missing or Incorrect Due Dates

Not specifying the due date for payments or listing incorrect deadlines can create payment delays and confusion for both the buyer and the seller. Missing due dates may also lead to late fees and disrupted cash flow.

- Solution: Always include a clear and accurate due date for payments, and ensure that both parties are aware of it.

- Solution: Set reminders or automa