Invoice Template with Deposit for Simplified Payment Management

When managing client transactions, ensuring clear agreements on upfront payments can be crucial for smooth business operations. Many service providers and freelancers prefer receiving a portion of the payment before starting a project. This approach not only protects the business but also aligns expectations from the very beginning. Having a structured document to outline such arrangements helps avoid misunderstandings and delays.

A well-designed financial agreement can streamline the entire process, providing transparency for both the provider and the client. By specifying terms and amounts in advance, businesses can maintain a steady cash flow while clients can feel confident about the service they will receive. Utilizing a formalized system for capturing these initial payments helps organize the financial aspects of any project or service offered.

In this article, we’ll explore the various features of such documents, how to create them, and the benefits they bring to both parties. Whether you’re running a small business or working independently, having a reliable tool for managing initial payments can significantly enhance your financial practices.

Invoice Template with Deposit Overview

When offering services or products, it is common practice to request an initial payment before starting the work. This advance payment not only secures the commitment of the client but also ensures that the service provider has some financial assurance before dedicating resources. A clear, structured document that outlines this arrangement is essential for both clarity and smooth transactions.

These agreements serve several important purposes:

- They set clear expectations regarding payment terms and amounts.

- They help manage cash flow and ensure that businesses have funds for project initiation.

- They provide legal protection in case of disputes over financial matters.

In this section, we will discuss how such documents can be organized to best serve both parties involved. We will also cover the key components that should be included to avoid any confusion and ensure smooth payment processes. By the end of this guide, you will have a solid understanding of how to implement these agreements in your business operations.

Why Use a Deposit Invoice Template

Requesting an upfront payment is a common practice in many industries, especially for projects that require significant resources or time. Having a standardized document to formalize this initial financial commitment not only ensures clear communication between the client and the provider but also helps streamline the entire payment process. Without a reliable structure, confusion or disputes can arise, affecting both cash flow and client relationships.

Here are some key reasons why using such a financial agreement is beneficial:

- Clarity and Professionalism: A well-organized document sets a professional tone and ensures that both parties understand the agreed-upon terms from the outset.

- Financial Security: Requiring a portion of the payment upfront minimizes the risk for the service provider, especially in case of cancellations or non-payment.

- Improved Cash Flow: By securing funds early on, businesses can manage their cash flow more effectively, especially for larger or long-term projects.

- Avoids Misunderstandings: With clear terms laid out in writing, any potential misunderstandings regarding payment schedules are minimized.

Incorporating such agreements into business practices can save time, reduce stress, and help ensure that both parties are on the same page throughout the duration of the project.

Benefits of Using a Deposit Invoice

Requesting partial payment at the start of a project brings multiple advantages, both for the service provider and the client. By outlining the initial payment in writing, businesses can ensure they are financially protected while simultaneously improving the overall transaction process. The use of a clear, structured agreement benefits both parties in various ways.

Here are the key benefits of implementing this approach:

- Reduced Financial Risk: Requiring an initial payment helps safeguard against non-payment or last-minute cancellations, securing revenue before starting work.

- Improved Cash Flow: Early payments allow businesses to manage expenses more efficiently and avoid cash flow disruptions, especially for larger or ongoing projects.

- Clear Expectations: Having a formalized agreement ensures that both parties know the exact terms, reducing the chances of miscommunication about payment schedules.

- Increased Commitment: When clients make an upfront payment, they are more likely to remain committed to the project, which can lead to higher satisfaction and timely completion.

- Stronger Professional Image: A structured document establishes professionalism, showing clients that the business is organized and serious about managing its operations.

Incorporating these agreements into business practices not only provides financial security but also fosters a transparent and reliable relationship between the provider and the client, leading to better outcomes for both sides.

How a Deposit Improves Payment Security

When entering into a financial agreement, especially for large or long-term projects, ensuring payment security is essential. By requesting an upfront portion of the agreed amount, businesses can minimize the risk of non-payment and avoid financial strain. This practice provides both the client and the service provider with a sense of security, as it establishes clear financial terms from the outset.

Minimizing Risk for Service Providers

For service providers, the primary benefit of securing an initial payment is reducing the likelihood of financial loss. When no advance is required, there is a greater risk of clients backing out or refusing to pay after the work is completed. A portion paid upfront signals commitment and helps ensure that work will proceed as agreed.

Building Trust with Clients

For clients, an upfront payment can help solidify the terms of the agreement, allowing them to feel more secure in their investment. By clearly stating the expectations and payment structure, both parties are more likely to trust each other throughout the course of the project.

| Benefit | How It Improves Security |

|---|---|

| Risk Mitigation | Secures a financial commitment from the client before work begins, reducing the likelihood of unpaid invoices. |

| Financial Protection | Ensures that service providers can cover initial project costs, even if the client cancels or defaults. |

| Commitment from Clients | An upfront payment ensures that both parties are committed to completing the project as agreed. |

By implementing this strategy, both service providers and clients can confidently proceed with their business relationship, knowing that the terms are clear and the financial commitment is in place to protect both sides.

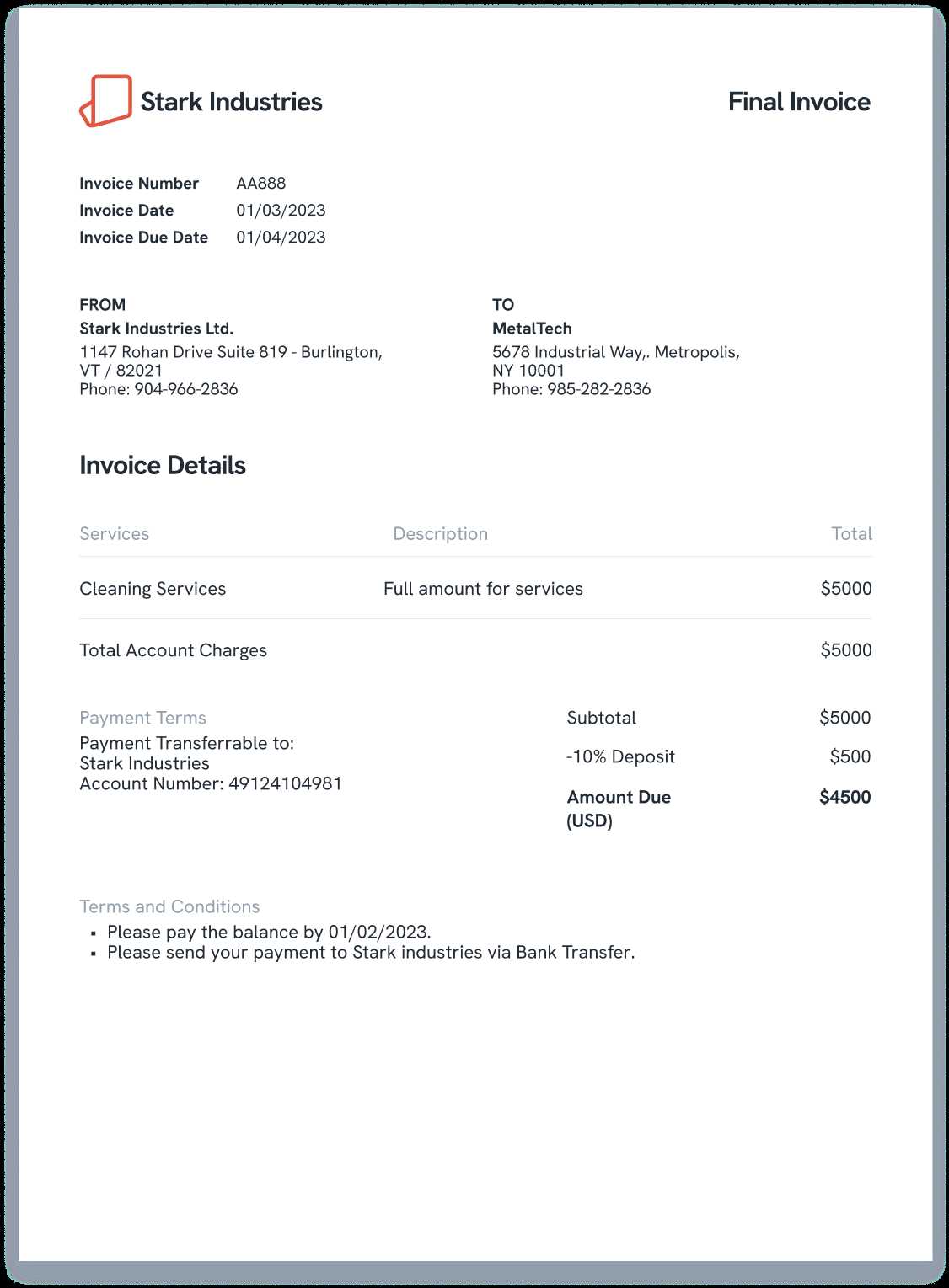

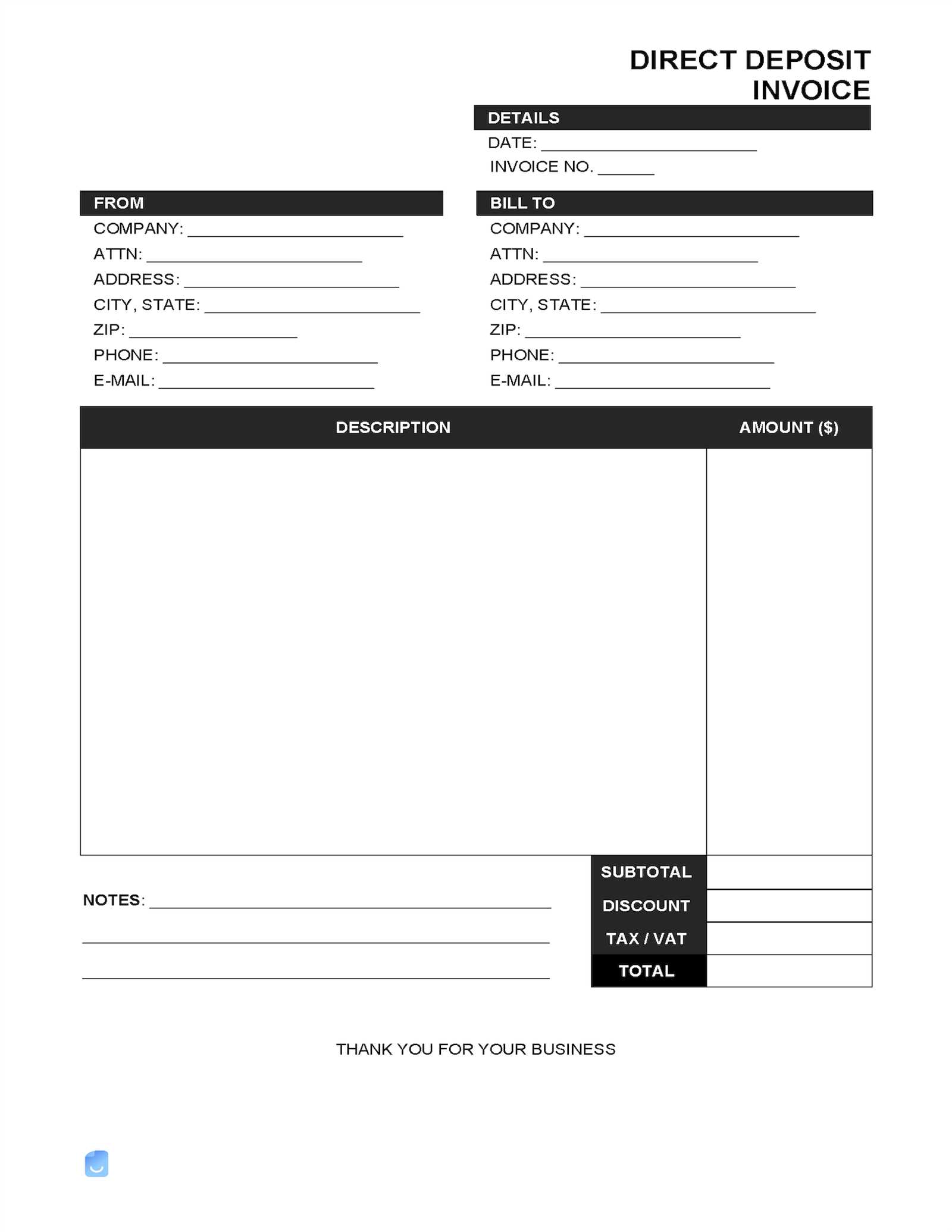

Key Elements of a Deposit Invoice

To ensure that payment terms are clearly understood, a well-structured document is essential when requesting an initial payment for services or products. This document should outline all relevant financial details and set expectations for both parties. Including key information ensures transparency and reduces the risk of misunderstandings throughout the project.

Essential Information to Include

The most important elements that should be present in this document include the payment amount, due dates, and the specific conditions tied to the advance. These details help both parties stay on track and avoid disputes. Additionally, the document should be easy to read and reference, offering a professional way of tracking financial transactions.

Structuring the Payment Terms

It’s also vital to clearly outline how the remaining balance will be settled once the initial payment has been made. This clarity provides security and peace of mind for both the provider and the client, ensuring that both know what to expect at every stage of the project.

| Element | Description |

|---|---|

| Client Information | Include the name, address, and contact details of the client for clear identification. |

| Project or Service Description | A brief but clear description of the work to be performed or goods to be delivered. |

| Payment Amount | State the upfront payment required, as well as the total cost of the service or project. |

| Payment Schedule | Clearly define when the initial payment is due and the dates for any subsequent payments. |

| Terms and Conditions | Outline any relevant terms, such as what happens if payments are delayed or the work is canceled. |

By ensuring these elements are clearly stated and easy to understand, both the client and the service provider can confidently move forward, knowing the financial terms are transparent and agreed upon.

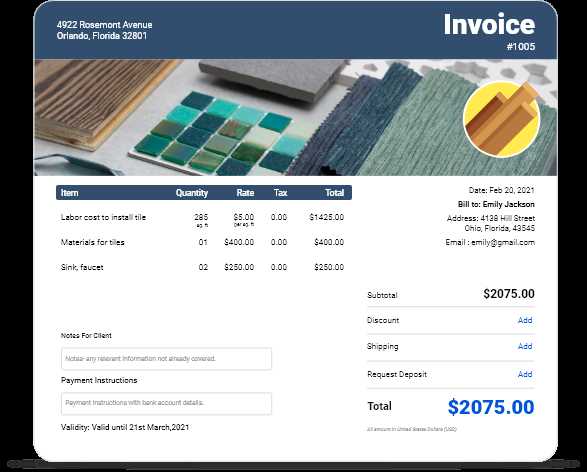

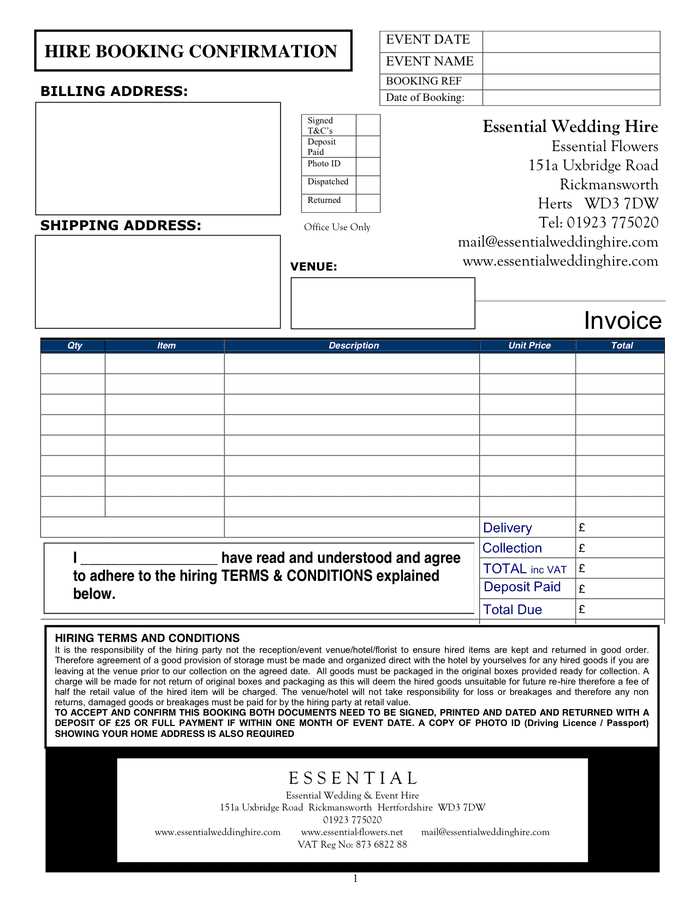

Customizing Your Invoice Template for Deposits

Creating a financial document that includes an upfront payment requires customization to fit the unique needs of your business and the specifics of each transaction. By tailoring the structure and design of this document, you can ensure it accurately reflects your terms and gives clients a clear understanding of what is expected. Personalizing these details not only streamlines the process but also reinforces professionalism and transparency.

Here are several ways to customize this type of financial document to suit your business:

- Branding and Design: Add your company logo, color scheme, and contact information to make the document easily recognizable and professional.

- Clear Payment Terms: Specify the exact amount required upfront, payment methods accepted, and the deadline for the advance.

- Personalized Project Details: Include a brief description of the specific service or product being provided, as well as any project milestones tied to the remaining payments.

- Flexible Payment Options: Offer different payment methods (bank transfer, credit card, online payment gateways) to make it easier for clients to comply with the terms.

- Automatic Calculations: Use formulas that automatically calculate the remaining balance after the initial payment is made, saving time and reducing errors.

These customizations not only make the document more user-friendly, but they also help reinforce the terms of the agreement, making it easier for both you and your clients to stay organized and aligned throughout the course of the project. By offering a personalized, clear, and professional experience, you ensure smoother transactions and stronger client relationships.

Legal Considerations for Deposit Invoices

When requesting an upfront payment as part of a service agreement, it is essential to be aware of the legal implications of such financial arrangements. Clear terms and conditions help protect both the provider and the client by defining the rights and responsibilities of each party. Failing to outline these details properly can lead to disputes, financial loss, and even legal challenges.

Terms of Agreement and Legal Protection

Including specific terms regarding the upfront payment in the agreement ensures that both parties are legally protected. These terms should cover:

- Payment Schedule: Clearly define when the advance is due, how it should be paid, and what happens if the payment is delayed.

- Refund Policy: Establish whether the advance is refundable and under what conditions, such as project cancellation or changes in scope.

- Cancellation Terms: Specify the consequences if either party decides to terminate the agreement before the work is completed, including any retention of the advance.

Compliance with Local Laws

Different jurisdictions have varying regulations regarding upfront payments and service contracts. It is important to ensure that any financial arrangement complies with local laws and industry regulations. Some key considerations include:

- Consumer Protection Laws: Some regions have laws that protect consumers from unfair business practices. Be sure that your terms are fair and transparent to avoid any legal issues.

- Tax Implications: Ensure that the upfront payment is properly documented for tax reporting purposes. The way you handle the payment may affect your tax liabilities or accounting practices.

By addressing these legal considerations in advance, you can avoid misunderstandings and ensure that both parties understand their rights and obligations. A well-crafted agreement provides clarity and legal security, allowing both the service provider and the client to proceed with confidence.

How to Set Deposit Amounts Effectively

Determining the right amount to request as an upfront payment is crucial for protecting your business and ensuring smooth project execution. If the amount is too low, you may not cover initial costs or secure the client’s commitment, while a high amount could discourage potential clients. Striking the right balance requires understanding your costs, the project scope, and industry standards.

Factors to Consider When Setting Amounts

Several key factors should be considered when deciding on the appropriate portion to request before starting any project:

- Project Size and Complexity: Larger or more complex projects often warrant a higher advance. This ensures that you have sufficient funds to cover the initial stages of the work, including materials or preliminary labor.

- Client History and Relationship: For returning clients or those with a strong track record of timely payments, a lower upfront payment may be sufficient. New clients, however, may require a higher initial commitment.

- Market Standards: Research what other businesses in your industry typically ask for as an upfront payment. This helps ensure your terms are competitive while still protecting your financial interests.

- Business Cash Flow: Evaluate your own cash flow needs. If your business relies on a steady stream of payments to cover operational costs, consider requesting a higher percentage to maintain financial stability.

Best Practices for Setting the Right Amount

To effectively set an upfront payment, follow these guidelines:

- Be Transparent: Clearly communicate why the payment is necessary and what it covers. This helps clients understand the value of their commitment.

- Provide Flexible Options: Offering different payment plans (e.g., 30%, 50%, or 70% upfront) can accommodate various client preferences while still ensuring you are financially protected.

- Consider Project Milestones: For long-term projects, it might make sense to break the payment into smaller installments tied to specific deliverables or milestones.

By setting a deposit amount that reflects the nature of the project and your business needs, you ensure that both you and your clients are on the same page from the start, minimizing financial risks and enhancing trust in the working relationship.

Common Mistakes with Deposit Invoices

When requesting an upfront payment for services, it’s crucial to handle the financial agreement carefully to avoid misunderstandings and potential conflicts. Mistakes in the way the terms are communicated or structured can lead to frustration for both the service provider and the client, affecting the overall relationship and even the success of the project. Being aware of common errors and how to prevent them can ensure smoother transactions and better client trust.

Frequent Errors to Watch Out For

There are several mistakes that many businesses make when establishing financial terms for an initial payment. These errors can cause confusion, delays, or disputes:

- Unclear Payment Terms: Not clearly stating when and how the payment is due can lead to confusion and missed deadlines. Always be specific about payment dates, methods, and amounts.

- Lack of Refund Policy: Failing to outline what happens if the project is canceled or if the client decides to withdraw can result in legal disputes or a loss of trust. It’s important to clarify the conditions under which the advance is refundable.

- Incorrect Amounts: Asking for too little or too much can create problems. A low amount might not cover initial costs, while a high amount may deter clients. Ensure the upfront portion is reasonable and aligns with the size of the project.

- Not Accounting for Taxes: Failing to include taxes or not specifying whether the amount is taxable can cause complications when it’s time to reconcile the payment.

- Overcomplicating the Document: A document that’s too complex or filled with jargon can confuse clients. Keep the terms simple, clear, and to the point to avoid any misunderstandings.

How to Avoid These Mistakes

To ensure smooth transactions, here are a few best practices for setting up a clear and effective financial agreement:

| Common Mistake | How to Avoid It |

|---|---|

| Unclear Payment Terms | Specify the exact due date, payment methods, and total amount, including tax, in clear language. |

| Lack of Refund Policy |