Invoice Template with Balance Due for Efficient Billing

When it comes to handling customer payments, having an organized method for documenting amounts owed is essential. Clear and structured documents not only help track what is due, but also streamline the process of collecting payments. This approach can save time and reduce errors, ensuring that businesses can focus on their operations rather than chasing payments.

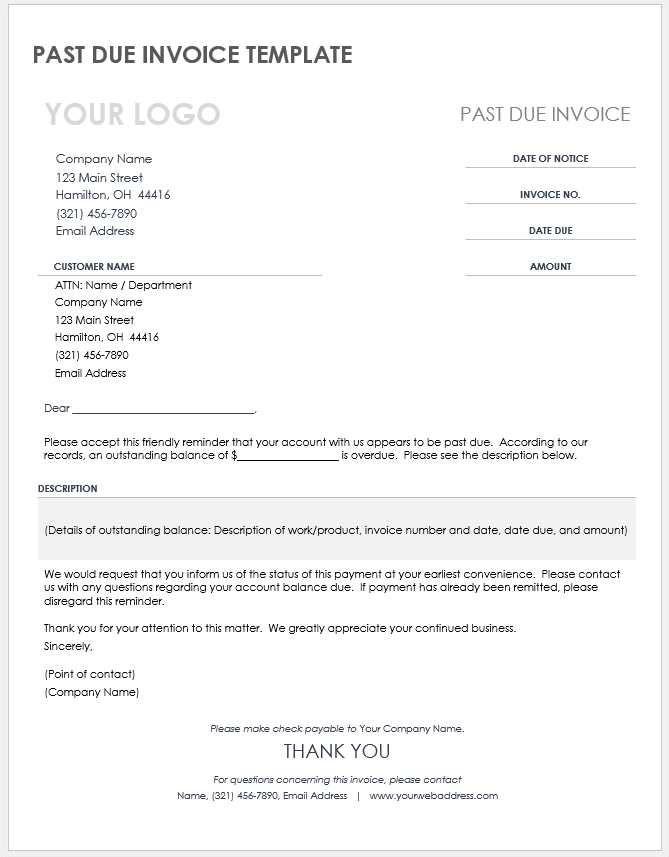

By using a customizable document, companies can present all necessary details to their clients in a professional manner. These documents typically include crucial information such as amounts owed, payment deadlines, and available payment methods. A well-crafted layout ensures clarity, helping customers easily understand what is expected of them and by when.

Setting up a straightforward system to monitor unpaid amounts is key to maintaining a healthy cash flow. By providing a clear record of what is owed, businesses can avoid confusion and improve their collection process. Whether used for small or large transactions, this method allows for better organization and efficiency in managing financial transactions.

Invoice Template with Balance Due

Creating a document that outlines amounts owed is crucial for maintaining financial clarity and transparency. Such records help both businesses and clients understand what has been paid and what remains unpaid. These structured files are especially useful for tracking outstanding amounts, ensuring that payments are processed on time.

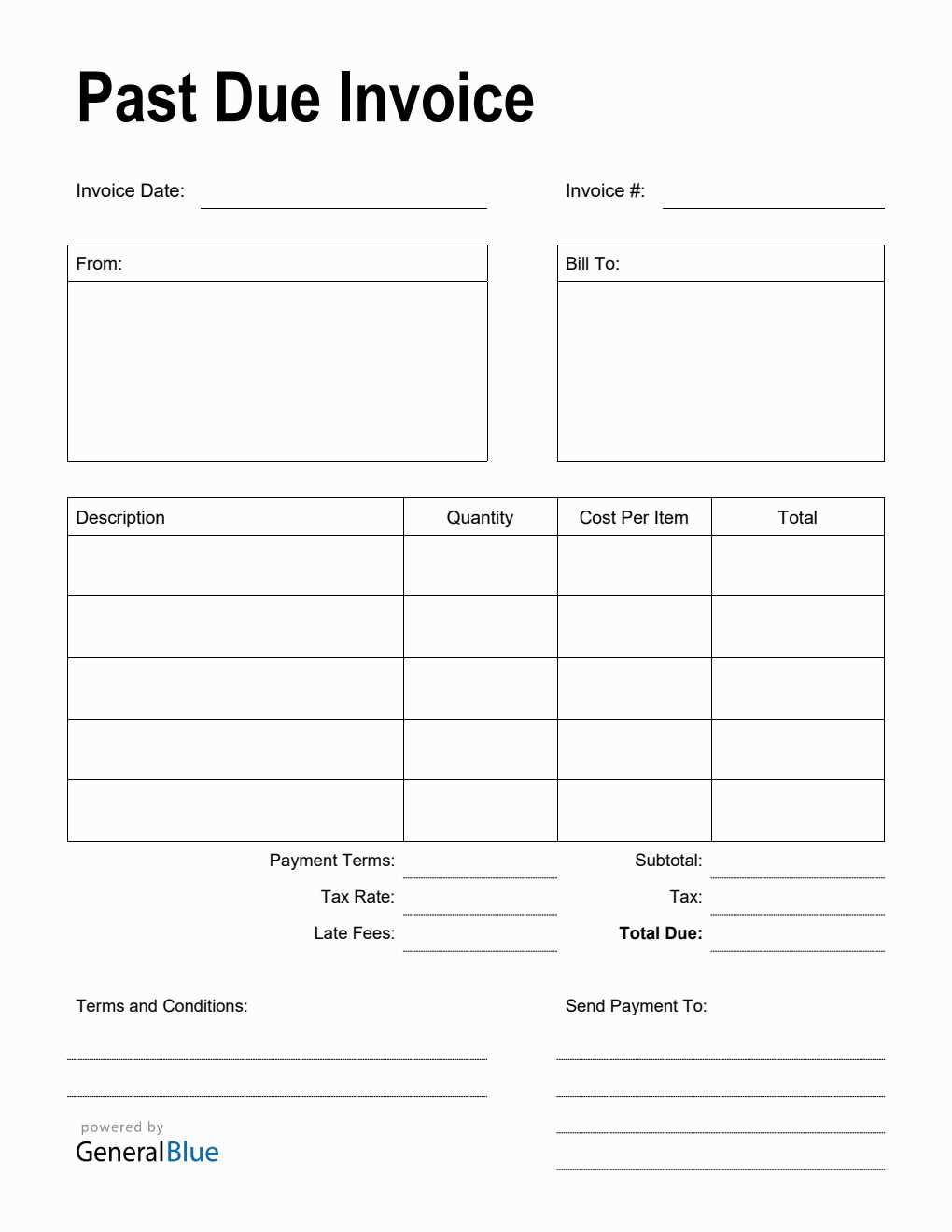

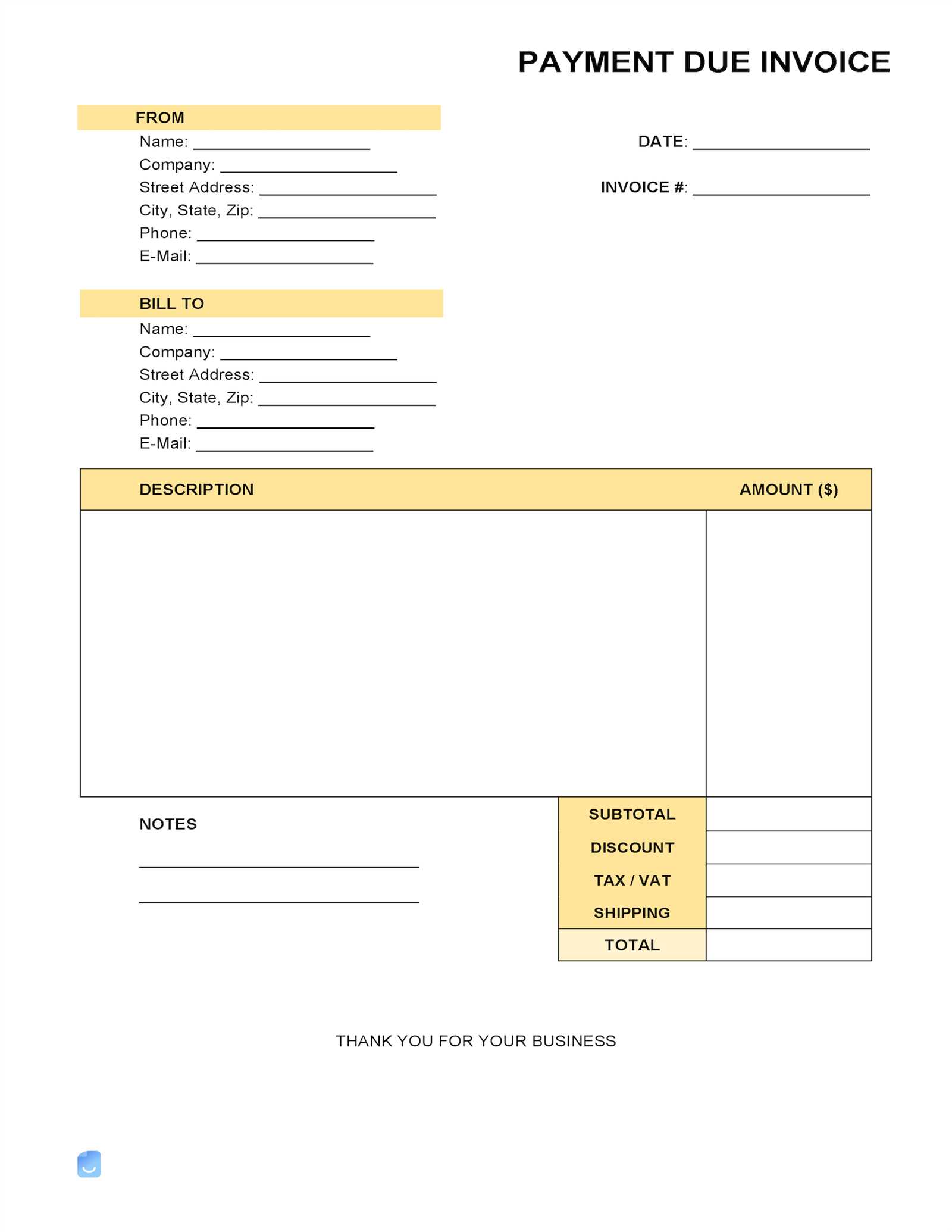

To build an effective document, consider including the following key elements:

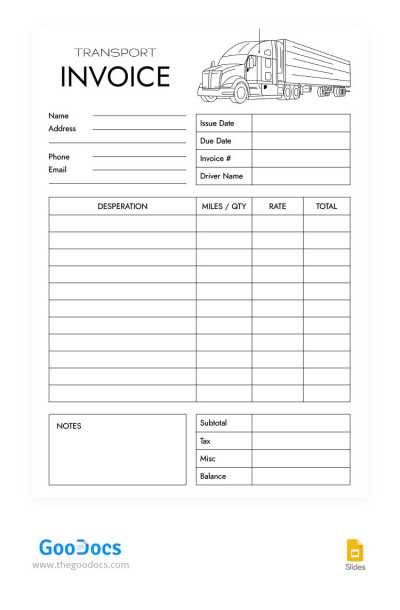

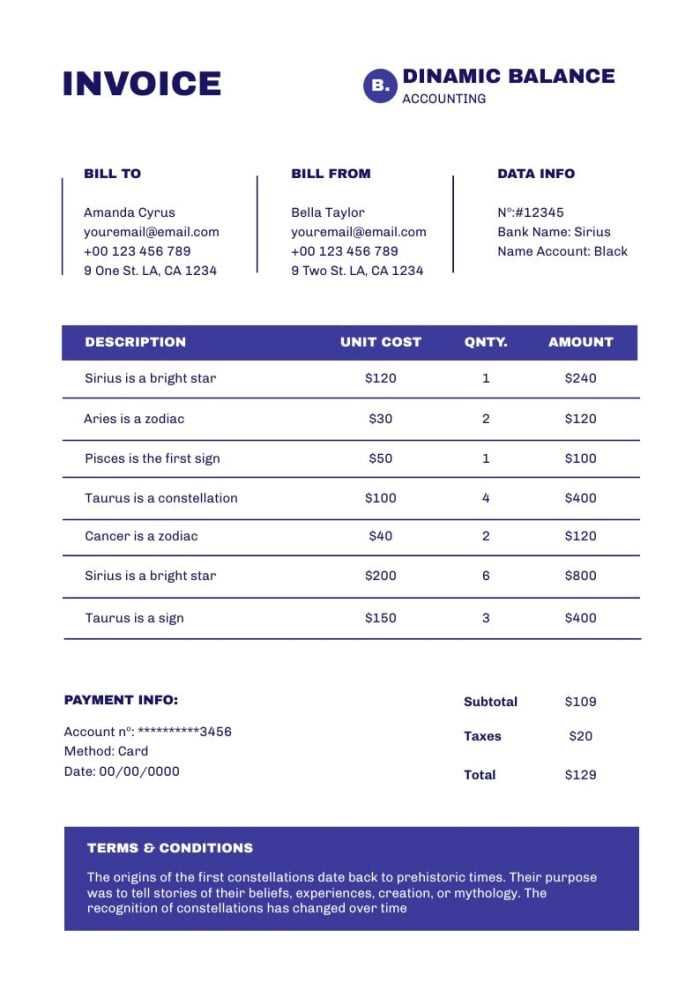

- Client Details: Include the name, address, and contact information of the client.

- Transaction Information: Clearly list the goods or services provided along with their costs.

- Payment Terms: Indicate the expected payment timeframe and any penalties for late payments.

- Outstanding Amount: Clearly show the remaining amount that needs to be paid.

- Payment Methods: Offer various options for payment to make the process more convenient for the client.

By incorporating these elements, businesses can create a concise and professional document that clearly communicates what is expected from the client. This makes the entire payment process more efficient, reducing the likelihood of missed payments or confusion regarding amounts owed.

Additionally, such documents can be easily customized for different clients or transactions, ensuring that each record is tailored to meet specific needs. Using a consistent format across all records also enhances professionalism and fosters trust between businesses and clients.

Why Use an Invoice Template

Having a standardized document for tracking outstanding payments offers numerous advantages for businesses. It simplifies the process of managing financial transactions and ensures consistency in communication. Whether you are a small business owner or managing a larger organization, using a clear and uniform format can streamline your billing practices.

Benefits of Using a Standardized Document

By using a ready-made format, businesses can save time, reduce errors, and maintain professionalism. The following table highlights the key benefits:

| Benefit | Description |

|---|---|

| Time Efficiency | A ready-to-use layout eliminates the need to create documents from scratch for each transaction. |

| Accuracy | Predefined sections ensure all necessary details are included and calculated correctly, reducing the chance of errors. |

| Professional Appearance | Using a consistent format helps create a polished and credible image for your business. |

| Customization | Documents can be easily tailored to fit specific client needs or transaction types while maintaining a structured approach. |

Reducing Administrative Work

Instead of manually designing each document, using a predefined format saves valuable time for your team. By automating this aspect of business operations, you free up resources to focus on more critical tasks, such as client relations or expanding services. This also leads to fewer administrative mistakes, further improving efficiency.

Key Features of a Payment Invoice

For any business transaction, having a clear and structured document that outlines financial obligations is essential. These documents not only record the details of the exchange but also provide all necessary information for payment processing. A well-designed document ensures that both the business and the client are on the same page, reducing confusion and ensuring timely payments.

Essential Components of a Payment Record

To be effective, a financial document must include certain key elements. These components ensure that the recipient has all the information needed to fulfill their payment. The main features include:

- Client Information: Name, contact details, and billing address to clearly identify the recipient.

- Transaction Details: A detailed list of products or services provided, including their costs.

- Payment Terms: Clear instructions on when and how payments should be made, including any late fees if applicable.

- Total Amount: A breakdown of the total sum owed, including applicable taxes, discounts, or other charges.

- Payment Methods: The different payment options available to the client, such as bank transfer, online payments, or checks.

How These Features Benefit Both Parties

Including these key elements helps maintain transparency, which is crucial for building trust between the business and the client. A document that clearly outlines all necessary details ensures the client understands their responsibilities and avoids potential disputes. For the business, these documents serve as a legal record of the transaction and can be easily referenced if any issues arise.

Moreover, using a structured format makes it easier to track payments and outstanding amounts, ensuring a smoother cash flow management process. By incorporating all of these important features, a business can streamline its billing system and enhance its professional image.

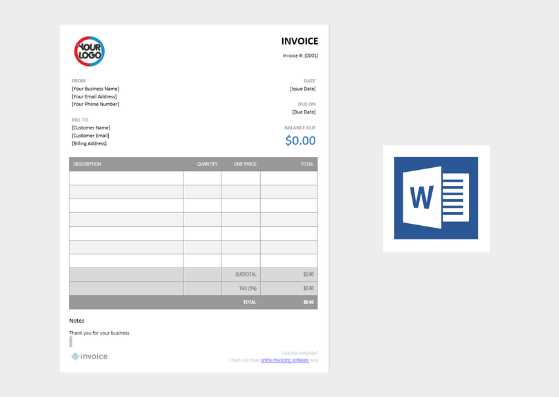

How to Customize Your Invoice

Personalizing a document that tracks outstanding payments allows businesses to reflect their unique branding while maintaining clarity. Customization ensures that the document fits the specific needs of the business and the client, making the payment process smoother and more professional. By adjusting key elements, you can tailor the layout and content to suit your company’s style and communication preferences.

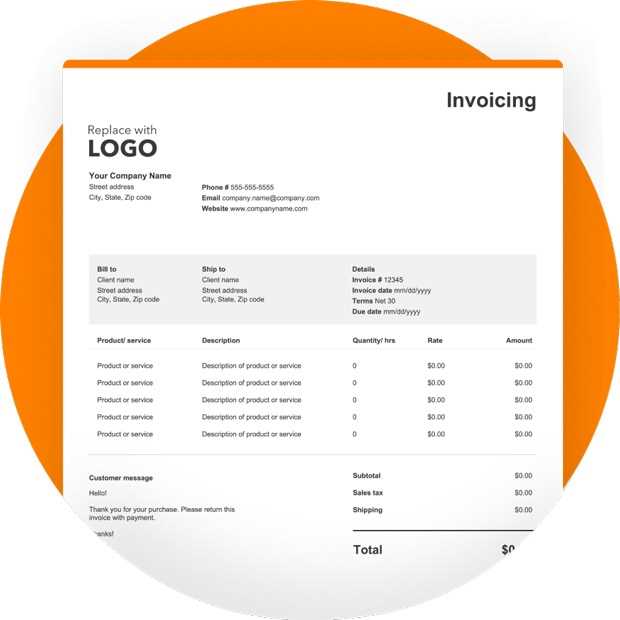

Step 1: Adjusting the Layout

One of the first things to customize is the layout of the document. A clear, easy-to-read structure ensures that the recipient can quickly find the information they need. Consider the following adjustments:

- Header Design: Include your company logo and name at the top to create a professional appearance.

- Section Organization: Arrange the content in logical sections (e.g., contact information, transaction details, total amount). Use headings or bold text to separate each part for easy reference.

- Fonts and Colors: Choose readable fonts and consistent colors that match your brand’s style. Avoid overly complex designs that may distract from the important information.

Step 2: Personalizing Content

Beyond the layout, you can customize the content to ensure that it matches your business’s specific requirements. This includes:

- Client-Specific Information: Always include the client’s correct contact details and address to avoid confusion.

- Service/Product Descriptions: Provide clear descriptions of the goods or services delivered, along with the respective prices, quantities, and any applicable discounts or promotions.

- Terms and Conditions: Adapt the payment terms to reflect your company’s policies, including payment deadlines, accepted methods, and late fee penalties if necessary.

Customizing these details not only enhances the professional appearance of the document but also ensures that it serves its purpose effectively. A personalized format creates a better experience for your clients and helps maintain a smooth transaction process.

Importance of Clear Payment Terms

Establishing precise expectations for financial transactions is crucial for any business relationship. Clear payment guidelines not only inform clients of what is expected from them but also help prevent misunderstandings that could delay or complicate the payment process. When both parties are fully aware of the terms, it fosters trust and ensures smoother operations for both businesses and their clients.

Setting specific conditions for payments provides several benefits, such as:

- Preventing Miscommunication: Clear guidelines leave no room for ambiguity, reducing the likelihood of disputes regarding the amounts owed or the timing of payment.

- Encouraging Timely Payments: Defining clear due dates and consequences for late payments motivates clients to pay on time, improving cash flow for the business.

- Maintaining Professionalism: Transparent terms present your business as organized and reliable, which can lead to better client relationships and repeat business.

- Reducing Administrative Effort: Well-defined terms streamline the tracking and follow-up process, saving time and effort in managing unpaid amounts.

By clearly outlining expectations, businesses can avoid common payment-related issues and ensure a more efficient financial management process. Clients are more likely to comply with the terms when they understand the conditions upfront, leading to fewer late payments and better overall satisfaction on both sides.

Calculating the Balance Due Correctly

Accurate calculation of the amount remaining to be paid is essential for maintaining proper financial records. When the outstanding amount is calculated incorrectly, it can lead to confusion, delays, and potential disputes with clients. To ensure smooth transactions, it’s important to apply the correct method for determining what is owed after considering all relevant factors such as partial payments, discounts, and taxes.

Here are some key steps to follow when calculating the remaining amount:

- Start with the Total Amount: Begin by noting the full cost of goods or services provided, including any applicable taxes or extra charges.

- Account for Payments Made: Subtract any payments already received from the total amount. This helps determine how much is still outstanding.

- Apply Discounts or Adjustments: If any discounts, promotions, or adjustments are applicable, subtract these from the total amount owed.

- Consider Additional Fees: Include any late fees, processing fees, or other charges that may apply if the payment is not received by the specified date.

After following these steps, you will have an accurate figure for the amount that remains to be paid. By ensuring that this calculation is done correctly, you can avoid confusion, prevent errors, and help clients understand exactly what is expected of them. This clarity is vital for maintaining professional relationships and encouraging timely payments.

Best Practices for Invoice Design

Creating a professional document that tracks outstanding payments involves more than just listing the amounts owed. The design plays a significant role in ensuring that the document is easy to read, visually appealing, and effective in communicating essential information. A well-structured layout can enhance clarity, reduce errors, and create a positive impression of your business.

Here are some best practices to follow when designing a financial record:

- Keep It Simple: Use a clean, uncluttered layout. Avoid excessive text or graphics that could distract from the key details, such as the amount owed and payment instructions.

- Organize Information Logically: Arrange details in clear sections–client information, services rendered, and payment terms. Group related content together to make it easy to navigate.

- Use Clear Typography: Choose easy-to-read fonts and appropriate font sizes. Ensure that headings and important figures stand out through bold or larger text, making them easy to identify at a glance.

- Incorporate Your Branding: Add your company logo, colors, and other brand elements to create a consistent look and feel. This adds a personal touch and strengthens brand recognition.

- Ensure Proper Alignment: Align text and numbers consistently. Proper alignment not only enhances readability but also creates a more professional appearance.

- Leave White Space: Use margins and space between sections to avoid a cramped layout. White space improves readability and gives the document a polished, organized look.

By adhering to these design principles, businesses can produce professional, effective documents that communicate clearly with clients and maintain a positive brand image. A well-designed document can make a significant difference in ensuring timely payments and fostering long-term client relationships.

How to Include Due Dates on Invoices

Establishing clear deadlines for payment is essential for maintaining a smooth cash flow and preventing misunderstandings. A well-defined due date informs clients of when their payment is expected, helping to ensure timely transactions. It also outlines any penalties or incentives associated with early or late payments, creating clear expectations for both parties.

To include due dates effectively on your payment requests, follow these key steps:

| Step | Action |

|---|---|

| 1 | Clearly State the Due Date: Include the specific day when payment is expected. For example, “Payment is due by [MM/DD/YYYY].” |

| 2 | Specify Payment Terms: If offering a grace period or early payment discount, make sure to mention this alongside the due date (e.g., “A 10% discount applies if payment is made within 7 days”). |

| 3 | Highlight the Consequences: Clearly indicate any late fees or penalties for overdue payments. This can be stated as “A late fee of 5% will be charged for payments made after [MM/DD/YYYY].” |

| 4 | Emphasize the Date: Make the due date stand out by bolding or underlining it, ensuring that it catches the client’s attention. |

By clearly specifying the due date and payment terms, you can reduce confusion and set clear expectations. This encourages clients to make payments on time, improving your business’s cash flow and maintaining healthy client relationships.

Legal Considerations for Invoice Templates

When preparing documents for financial transactions, it is essential to understand the legal requirements that govern the contents and structure of these records. Not only do these documents serve as proof of the services or goods rendered, but they also establish legal obligations between the provider and the client. Failing to comply with legal standards can lead to disputes, delayed payments, or even legal consequences. Therefore, it is important to ensure that the document is both clear and legally sound.

Key Legal Factors to Consider:

- Correct Information: Always include your business details, such as name, address, and contact information, as well as those of your client. This ensures the document is legally valid and can be used in case of disputes.

- Tax Identification: Depending on your location and the nature of your business, you may be required to list your tax identification number (TIN) or VAT registration number.

- Payment Terms: Clearly outline the payment expectations, including the date by which payment should be made and any penalties for late payments. This establishes the legal timeframe for fulfilling the payment obligation.

- Descriptions of Goods or Services: Provide clear and specific descriptions of the products or services provided. Vague or inaccurate descriptions can lead to misunderstandings or legal challenges.

- Incorporating Legal Disclaimers: Consider including disclaimers regarding any additional terms or conditions that apply to the transaction. This could include warranties, return policies, or payment handling procedures.

Additional Legal Considerations:

- Jurisdiction: Specify the jurisdiction that governs the agreement, especially if you are working with clients in different legal regions.

- Retention Period: Keep in mind any local regulations regarding how long you need to retain copies of financial records, in case of audits or legal disputes.

- Consumer Protection Laws: Ensure compliance with consumer protection laws that govern the sale of goods and services, including how disputes are handled and how refunds or returns are processed.

By addressing these legal considerations, businesses can avoid potential issues and ensure that all financial transactions are handled according to the law. This not only builds trust with clients but also safeguards your company against legal challenges.

Using Templates for Faster Billing

Automating the process of generating financial documents can significantly speed up billing procedures, making it easier to issue payment requests quickly and accurately. By using pre-designed formats, businesses can save time on repetitive tasks, reduce human errors, and ensure that important details are consistently included in every transaction record.

Here are some advantages of using pre-designed formats for billing:

| Benefit | Description |

|---|---|

| 1 | Efficiency: Templates allow for quick input of client details, product descriptions, and pricing, eliminating the need to create each document from scratch. |

| 2 | Consistency: A standardized format ensures that all documents follow the same structure, reducing the likelihood of missing or inconsistent information. |

| 3 | Professional Appearance: Pre-designed formats give your documents a polished and cohesive look, enhancing the professionalism of your business. |

| 4 | Accuracy: Templates often include built-in fields for taxes, totals, and due dates, helping to avoid errors in calculation and ensuring all required elements are present. |

| 5 | Customization: Many pre-designed formats are customizable, allowing you to modify them to suit your specific business needs while still saving time on the overall design. |

By integrating pre-designed documents into your billing process, you can enhance the speed and accuracy of each transaction, ensuring that payment requests are sent promptly and with all necessary information. This streamlines the financial workflow, allowing your business to focus on other important tasks while maintaining a professional approach to billing.

How to Track Outstanding Balances

Keeping track of unpaid amounts is crucial for managing cash flow and ensuring that all transactions are settled on time. By monitoring unpaid amounts systematically, businesses can stay on top of outstanding payments and take timely action when needed. There are various methods and tools available to help businesses maintain an organized record of pending payments and manage collections more efficiently.

Here are some practical ways to track amounts still owed:

- Use Financial Software: Many accounting systems come with built-in features for tracking unpaid amounts. These tools automatically update the status of each payment and provide real-time information on outstanding debts.

- Create Payment Reminders: Automated reminders, whether via email or messaging platforms, can help prompt clients to settle outstanding amounts. Setting up recurring reminders ensures that you don’t forget to follow up on overdue payments.

- Maintain a Detailed Record: Keeping a manual or digital log of each unpaid transaction helps you stay organized. Include relevant details such as the client’s name, the amount owed, the date of the transaction, and the agreed payment date.

- Implement Payment Schedules: For larger debts or ongoing projects, breaking the payment into smaller installments can make it easier to track and manage payments. Regularly updating the status of each installment ensures you have an accurate record of the remaining balance.

- Monitor Payment Trends: Tracking payment patterns over time can help identify clients who frequently pay late. This information allows you to adjust your credit policies or negotiate more favorable terms for future transactions.

By actively tracking unpaid amounts, you can avoid cash flow problems and take proactive steps to recover outstanding payments. Whether through software or manual methods, keeping a clear overview of pending transactions is essential for maintaining financial health in any business.

Ensuring Accuracy in Your Invoice

Accurate documentation is essential for smooth financial transactions. Errors in payment requests can lead to delays, disputes, and client dissatisfaction. Ensuring that every detail is correct not only helps build trust with clients but also minimizes the risk of payment discrepancies. By adopting careful practices and verifying key details, businesses can maintain high levels of accuracy in all financial documents.

Here are a few tips to help ensure your records are error-free:

- Double-Check Client Information: Always verify the recipient’s name, address, and contact details before sending any financial document. Incorrect contact details could lead to missed communications and delays in payments.

- Verify Product or Service Descriptions: Ensure that each item or service is clearly described, along with the correct quantity and pricing. Vague or incorrect descriptions can cause confusion and disputes later.

- Review Dates: Always double-check transaction and payment dates to avoid confusion regarding timelines. Ensure that any deadlines or terms are clearly specified and correct.

- Cross-Check Calculations: Mathematical errors in calculations can lead to disputes and delays. Double-check all totals, taxes, discounts, and other amounts to make sure they add up correctly.

- Include Clear Payment Instructions: Provide easy-to-follow payment methods and instructions, along with any necessary reference numbers. This ensures that the client understands how to complete the transaction accurately.

- Maintain Consistency: Use the same format and structure for every document. This consistency helps you quickly identify any inconsistencies or mistakes and promotes a professional appearance.

By following these best practices, businesses can ensure that every payment request is accurate, clear, and professional. Accuracy not only helps avoid delays but also fosters positive client relationships and enhances the overall efficiency of your financial processes.

Integrating Invoice Templates with Accounting Tools

Linking payment documents directly with accounting software can significantly streamline financial management. By integrating your billing systems into the broader financial software, businesses can reduce manual data entry, avoid errors, and ensure smooth tracking of transactions. This connection allows for seamless updates of account balances, helps track overdue payments, and automates many aspects of the financial workflow.

Here’s how this integration can enhance your financial processes:

Streamlining Data Entry

When a document is automatically linked to your accounting software, key data such as amounts, customer details, and transaction dates are transferred directly into your system. This eliminates the need for manual input and reduces the likelihood of mistakes, saving both time and resources.

Tracking Payments Automatically

Integrating your payment records ensures that all transactions are immediately recorded and updated. This means you can easily track whether payments have been made, monitor overdue accounts, and create detailed reports for financial analysis.

| Feature | Benefit |

|---|---|

| Automatic Updates | Transaction data automatically updates your financial records, saving time on manual entry. |

| Real-time Insights | Monitor unpaid amounts and completed transactions in real-time, improving cash flow management. |

| Consistency Across Systems | Ensure all financial documents are aligned and consistent across your business platforms. |

By linking your billing documents to accounting software, you eliminate the inefficiencies of manual entry, improve data accuracy, and allow your team to focus on higher-value tasks. Whether you’re tracking outstanding payments or generating financial statements, this integration makes the process faster and more reliable.

Why Automated Invoices Improve Efficiency

Automating the process of generating and sending payment requests can significantly enhance operational efficiency. By removing the need for manual creation and sending, businesses can reduce time spent on administrative tasks and decrease the likelihood of human error. Automation allows for consistent and timely delivery, ensuring all clients are billed promptly without delay.

Key Benefits of Automation

Here are the main advantages of implementing automation for your payment requests:

- Time Savings: Automation speeds up the entire billing cycle, reducing the time spent on each transaction.

- Accuracy: Automatic generation ensures that all necessary details are correctly included without risk of human error.

- Consistency: Automation ensures that all clients receive the same professional document format, maintaining a consistent brand image.

- Cost Efficiency: Reducing manual work means lower labor costs, freeing up resources for other important business tasks.

- Improved Cash Flow: Timely and accurate billing leads to quicker payments and helps prevent overdue amounts from slipping through the cracks.

How Automation Enhances Workflow

By integrating automated systems into your payment processes, you can also streamline your overall workflow. Automation integrates well with accounting tools and CRM systems, ensuring that every transaction is recorded accurately and instantly. This seamless flow of information reduces administrative workload and supports better decision-making, giving you more time to focus on growing your business.

In conclusion, automating the process of generating and managing payment requests brings many operational benefits. By improving efficiency, reducing errors, and streamlining workflow, businesses can focus more on what matters most: providing value to clients and growing their operations.

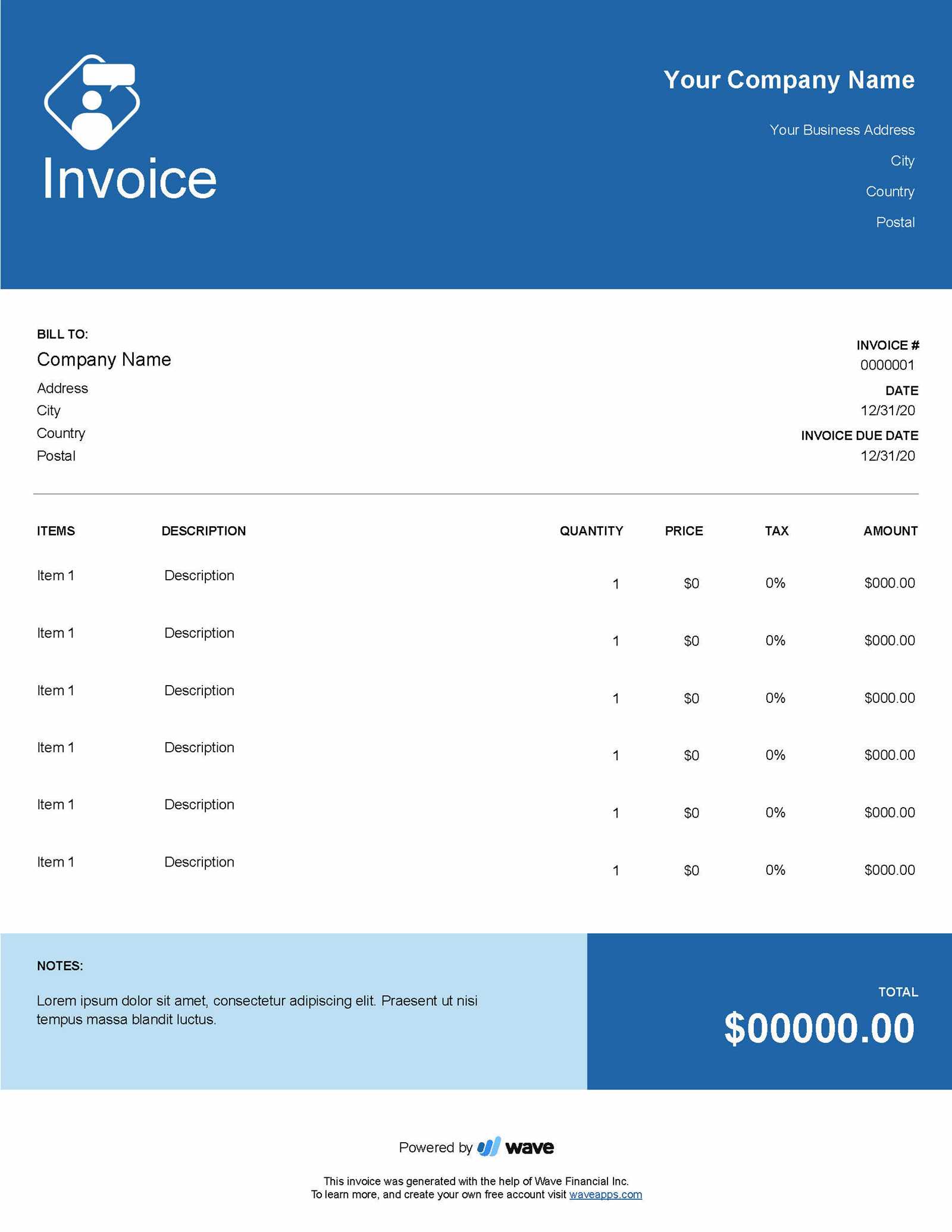

Creating Professional Invoices for Clients

Designing polished and well-structured payment requests is essential for maintaining a professional image and fostering strong business relationships. A clear and organized request for payment not only facilitates prompt payments but also reflects the credibility of your business. It’s important to ensure that all necessary details are included and presented in a way that is easy for clients to understand and process.

Key Elements of a Professional Payment Request

When creating a payment document, there are several essential components to include:

- Clear Business Information: Ensure your company name, address, and contact information are prominently displayed.

- Client Information: Include the client’s name, address, and contact details for reference.

- Unique Identification Number: Assign a unique number to each request to help track transactions.

- Detailed Breakdown of Services or Goods: Provide a detailed list of what is being charged, including quantities and prices.

- Payment Terms: Specify when the payment is expected and any late fees or discounts for early payment.

- Total Amount Due: Clearly state the amount that needs to be paid, ensuring there are no ambiguities.

- Payment Methods: List the acceptable methods for making payments, such as bank transfers, credit cards, or online payment platforms.

How to Enhance Client Experience

Presenting a professional-looking payment document can significantly enhance your client’s experience. Here are some ways to improve the process:

- Use Clear and Concise Language: Avoid jargon or complex terms; make sure the client understands every section.

- Ensure Readability: Use a clea

How to Handle Late Payments

Late payments can be a common challenge for businesses, but it’s important to manage them in a way that maintains professional relationships while ensuring timely compensation for services or goods provided. Handling overdue payments effectively requires a mix of clear communication, firm policies, and sometimes, a gentle reminder to clients about their obligations.

Set Clear Expectations from the Start

Before any payments are missed, it’s essential to establish clear payment terms. Ensure that all clients are aware of the agreed-upon deadlines, penalties for late payments, and available payment methods from the outset. When the terms are explicitly stated in contracts or agreements, there is less ambiguity regarding what is expected.

Send Friendly Reminders

When a payment becomes overdue, start by sending a polite and friendly reminder. Many clients simply forget, and a courteous email or phone call can resolve the issue quickly. It’s important to keep the tone professional and respectful while gently nudging the client to settle the outstanding amount.

- Check that the payment details are correct in the communication.

- Offer assistance in case the client is facing issues with processing the payment.

- Set a new, clear deadline for the payment to be made.

Enforce Late Fees or Penalties

If reminders are ignored and the payment is still not settled, it may be necessary to enforce late fees or other penalties as outlined in the original agreement. Make sure that these fees are reasonable and compliant with any legal regulations. The idea is to encourage timely payment, not to alienate clients.

Offer Payment Plans

If a client is struggling to pay in full, consider offering a payment plan. This approach shows flexibility and can help maintain the business relationship. The terms of the payment plan, such as the installment amount and due dates, should be clearly outlined in writing to avoid further confusion.

Consider Legal Action if Necessary

As a last resort, if all other efforts have failed, it may be necessary to seek legal action to recover the funds. Before taking this step, it’s important to review the situation, consult legal counsel, and ensure that this decision will not harm the overall business relationship. This should always be viewed as a last option after all other avenues have been exhausted.

By handling late payments professionally and consistently, businesses can minimize the impact of overdue accounts while maintaining positive relationships with their clients. Clear communication and firm policies a

Tips for Maintaining a Payment System

Effective management of a payment system is essential to ensure smooth cash flow and avoid potential disruptions in your business operations. Maintaining a reliable process not only helps streamline financial transactions but also minimizes errors and delays in payment processing. Here are some strategies to optimize and maintain an efficient payment system.

1. Automate Payment Reminders

One of the best ways to ensure payments are made on time is to automate the reminder process. Setting up automatic notifications allows clients to be reminded of upcoming payments and reduces the likelihood of missed deadlines. These reminders can be sent through email, text, or other preferred communication channels.

- Set reminders a few days before the payment deadline.

- Send follow-up reminders if the payment has not been received by the due date.

- Ensure reminders include clear payment instructions and contact information for any issues.

2. Offer Multiple Payment Options

Providing a variety of payment methods can increase the likelihood of clients paying promptly. Some may prefer credit card payments, while others may opt for bank transfers or digital wallets. The more options available, the easier it is for clients to settle their accounts quickly.

Payment Method Advantages Credit Card Instant processing, easy for clients Bank Transfer Secure, often preferred for larger amounts Digital Wallets Convenient, fast, and secure for online payments 3. Set Clear Payment Terms

Having clearly defined payment terms ensures both you and your clients know what is expected. Include information on deadlines, payment methods, penalties for late payments, and any additional charges. This transparency reduces misunderstandings and promotes timely payments.

- Make sure payment terms are outlined in every contract or agreement.

- Ensure clients understand the consequences of late payments.

- Provide clients with clear invoices, including all payment details.

4. Regularly Reconcile Accounts

To maintain an efficient payment system, regularly reconcile your accounts. This ensures that all payments are accurately recorded and that any discrepancies are quickly identified. Keeping up with financial records helps prevent errors, keeps track of outstanding payments, and simplifies tax reporting.

5. Invest in Payment Software

Investing in robust payment management software can automate many tasks, from generati