How to Use an Invoice Template Timesheet for Efficient Time Tracking and Billing

Managing work hours and ensuring accurate payment can be a challenge for many professionals and businesses. The need for clear, organized documentation of time spent on projects or tasks is crucial for both employees and employers. Having a reliable system to track hours worked and automatically generate billing details can simplify administrative tasks and improve overall workflow efficiency.

Accurate records of time spent on various activities are essential not only for invoicing but also for tracking productivity and maintaining transparent financial practices. By utilizing structured documents, individuals and businesses can ensure they are paid fairly for their time, while also providing clients with clear breakdowns of services rendered.

Incorporating a system that allows for easy customization and flexibility can significantly reduce errors and save time. Whether for freelancers, contractors, or companies, a streamlined process for documenting hours worked and converting them into actionable billing information offers a straightforward solution to avoid mistakes and delays.

Understanding the Invoice Template Timesheet

When it comes to tracking work hours and ensuring accurate compensation, having an organized and efficient way to document time is essential. This process not only helps in maintaining transparency but also guarantees that both clients and workers are on the same page regarding services rendered. A structured document that combines time tracking with billing information simplifies the administrative workload and enhances clarity for both parties.

Key Components of a Time Tracking Document

Such a document typically includes several key elements that help facilitate seamless record-keeping and billing:

- Time Log: A section to record the start and end times of each task or project.

- Hourly Rate: An area where the rate of compensation is noted for each hour worked.

- Description of Work: A field to briefly describe the tasks performed during the recorded time period.

- Total Hours: A space to sum up the total time worked for each job or project.

- Billing Details: A section to calculate the total amount due based on the hours worked and rate of pay.

How it Simplifies Billing and Payments

By using a structured document that automatically generates the necessary calculations and organizes information, the time tracking and payment process becomes more streamlined. This approach reduces the chances of errors and confusion, making it easier for clients to understand the costs involved. It also provides workers with clear documentation of their hours, ensuring they are paid fairly and on time for the services they have provided.

What is an Invoice Timesheet Template

An essential tool for both freelancers and businesses, this document serves as a structured record for tracking work hours while simultaneously calculating the payment due. It simplifies the process of combining time spent on tasks with corresponding billing details, making it easier to manage client relationships and ensure accurate compensation. Such a system reduces the complexity of invoicing and helps avoid potential errors when documenting time worked.

Key Features of This Document

This type of document typically includes several core components that allow for accurate time tracking and billing, such as:

- Work Hours: A section dedicated to recording the number of hours spent on each task or project.

- Description of Services: A space to describe the work done during the recorded time period.

- Hourly Rate: A field where the payment rate per hour worked is noted.

- Total Amount: A final section that calculates the total amount due based on hours worked and the rate.

Why It’s Important

For both contractors and businesses, using such a document ensures transparency and helps avoid misunderstandings about payment. It provides clear evidence of how time was spent and the corresponding charge, making invoicing and financial management more straightforward. This organized approach saves time and fosters trust between the service provider and the client.

Benefits of Using an Invoice Template

Utilizing a well-organized document to track hours worked and generate billing details offers several advantages for both businesses and freelancers. With such a system in place, you can ensure consistency, reduce errors, and simplify the process of managing payments. By combining time tracking and financial information into one streamlined format, this approach saves valuable time and resources.

Efficiency is one of the key benefits of using a structured document for time tracking and billing. Instead of manually calculating hours or recreating the same layout for each client or project, you can quickly input data into pre-designed fields. This reduces administrative overhead and speeds up the entire process.

Accuracy is another significant advantage. With automatic calculations and clearly defined sections, there is less room for human error. The details of time worked, hourly rates, and total amounts due are organized in a clear, consistent manner, ensuring that all information is correct before sending it to clients.

In addition to these practical benefits, using such a system promotes professionalism. Clients appreciate the clarity and transparency that come with a neatly organized record of services rendered. It also reflects a higher level of attention to detail and fosters trust in your business practices.

Overall, this approach simplifies financial management and helps avoid potential misunderstandings, making it an invaluable tool for businesses and freelancers alike.

How to Set Up a Timesheet Template

Creating an organized document to track work hours and generate payment details is a straightforward process, but it requires attention to detail to ensure accuracy and efficiency. A well-designed record system helps capture the necessary information in an easy-to-understand format while automatically calculating the total amounts due based on time worked. Here’s how you can set up your own system to streamline the process.

Start by defining the key sections that your document will need. A typical setup includes:

- Date and Time: Sections to record the start and end times for each task or project.

- Work Description: A field to briefly describe what was done during the recorded hours.

- Hourly Rate: An area to specify the rate you charge per hour of work.

- Total Hours Worked: A place to total up the hours for each task or project.

- Total Amount: A section that automatically calculates the amount to be paid based on hours worked and hourly rate.

Next, decide on the format that best suits your needs. You can create this document manually, use a spreadsheet application like Excel, or opt for specialized software that automates the calculations and allows for customization. Ensure that the layout is simple and easy to fill out, with clear headings and sections.

Finally, review and adjust the system as needed to ensure that it works efficiently for your specific use case. Once set up, this document will help save time, reduce errors, and ensure timely payments.

Customizing Invoice Templates for Your Business

Tailoring billing documents to fit the unique needs of your company can enhance professionalism and streamline financial processes. The ability to adjust layout, information fields, and design elements ensures that each bill reflects the brand identity while providing all the necessary details for your clients. Customization also improves clarity and helps avoid confusion, which is essential for smooth transactions and effective communication.

Adjusting Layout and Design

When designing billing documents, start with the structure. The arrangement of information should be logical, ensuring that customers can easily find essential details such as the amount due, services provided, and payment instructions. You may want to include your company’s logo, colors, and other branding elements to make the document instantly recognizable. A clean and professional appearance promotes trust and can leave a positive impression on your clients.

Incorporating Specific Information

Every business has different needs, and this is where customization can really add value. You might need to include project codes, hours worked, or additional terms and conditions. Incorporating these elements into your billing documents makes them more specific and relevant to each transaction. Using clear and consistent terminology also reduces the risk of misunderstandings.

By adjusting these key components, you can create a system that reflects your business’s unique character while ensuring clarity and professionalism in all communications with clients.

How to Track Hours with a Timesheet

Efficiently tracking work hours is essential for both employees and employers. Accurate records not only help in calculating payments but also ensure that projects are progressing as planned. By consistently logging hours worked, businesses can gain insights into productivity, allocate resources effectively, and identify any discrepancies or inefficiencies.

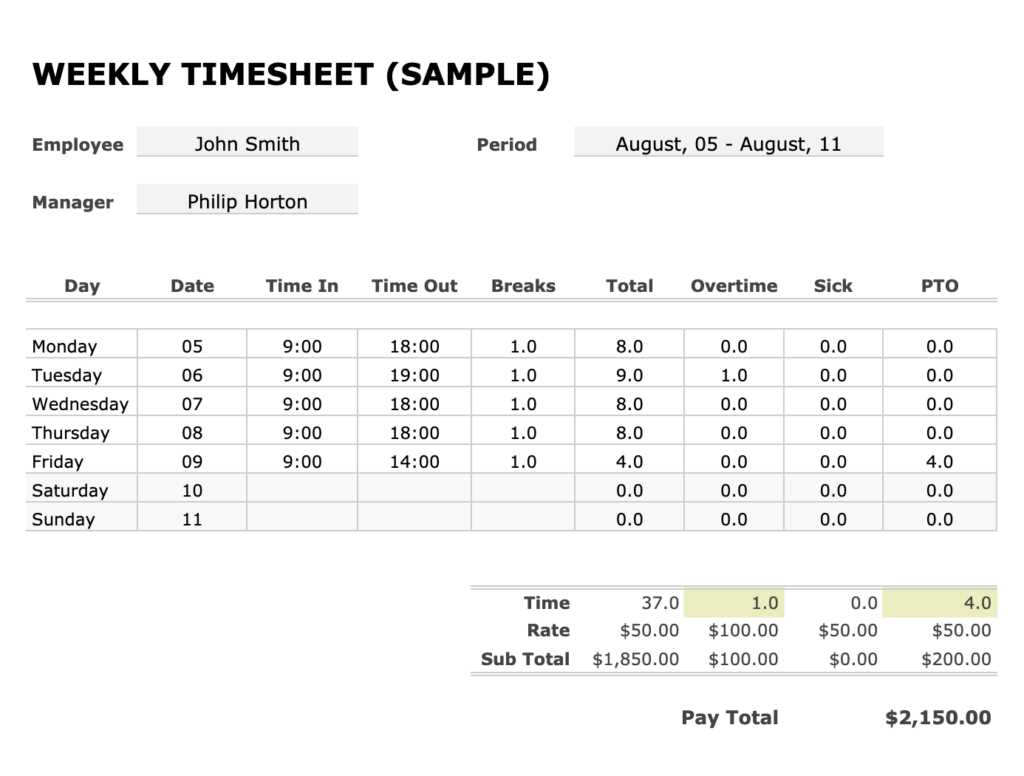

Step-by-Step Guide to Logging Work Hours

To track time accurately, it’s important to include basic information for each work period, such as the date, the number of hours worked, and a brief description of the tasks completed. The following table provides an example of a simple structure for recording daily work hours:

| Date | Task Description | Hours Worked |

|---|---|---|

| 2024-11-01 | Client meeting and project planning | 3 |

| 2024-11-02 | Design and development work | 6 |

| 2024-11-03 | Code review and testing | 4 |

Recording detailed time entries like this can help ensure that all hours are accounted for. It’s also important to regularly update the log to maintain accuracy and avoid errors when compiling totals.

Benefits of Consistent Tracking

By tracking work hours consistently, businesses can better understand time allocation across different tasks, improve time management, and ensure that employees are compensated fairly for the work performed. Additionally, having an organized record allows for easier reporting and analysis, contributing to more informed decision-making for future projects.

Incorporating Billing Information in Templates

Including accurate and comprehensive financial details in your business documents ensures clarity and prevents confusion between you and your clients. By systematically adding all required elements such as payment terms, itemized charges, and due dates, you create a transparent process that builds trust and facilitates smooth transactions. Properly structured documents not only provide the necessary financial information but also enhance professionalism and reduce administrative errors.

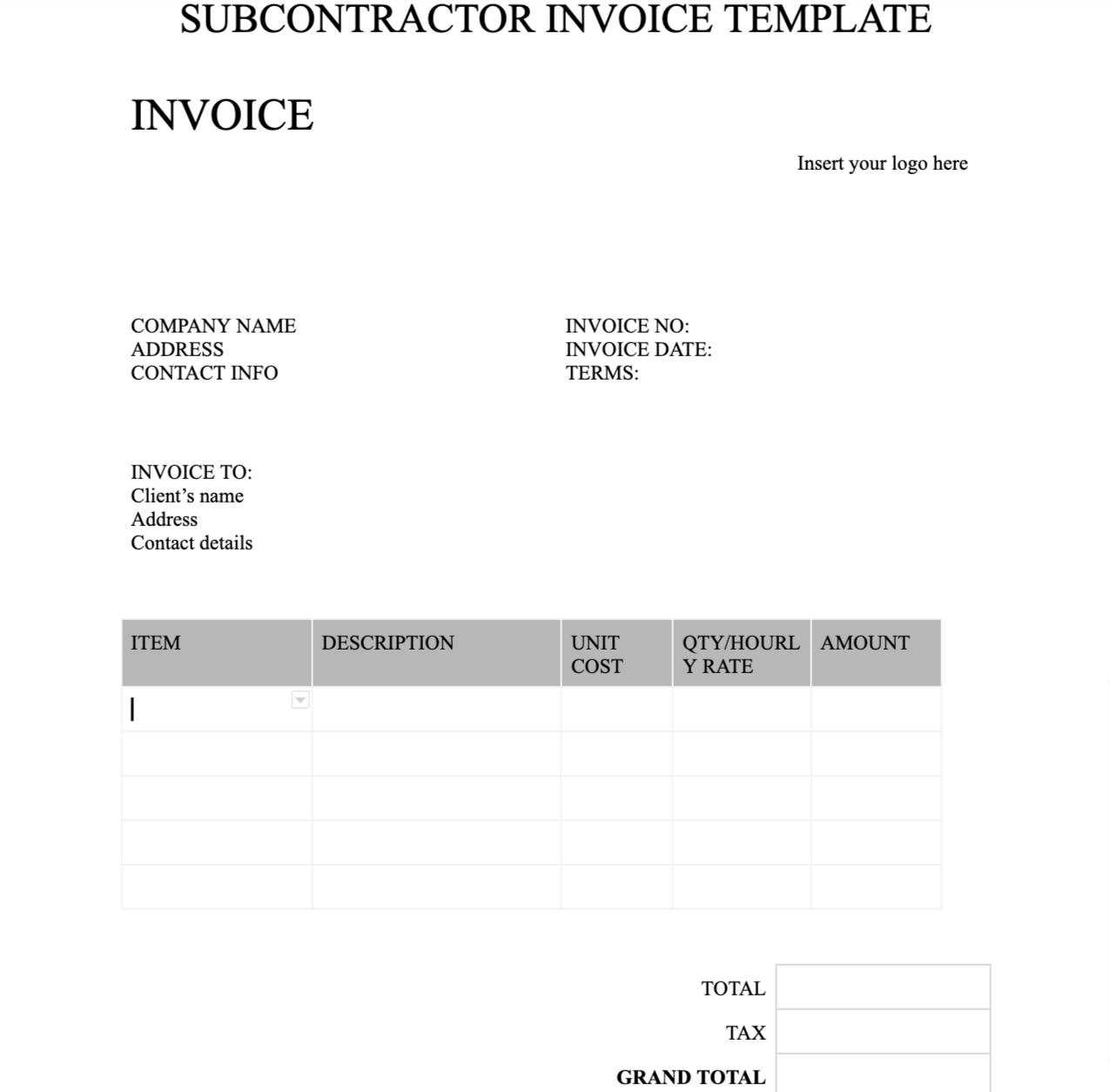

Essential Elements for Clear Financial Records

When incorporating financial details, there are several key components that should always be included. These elements ensure that your client has all the information they need to process payments promptly and correctly:

- Contact Information: Your company’s name, address, and contact details should be easily accessible.

- Payment Terms: Clearly state when the payment is due, including any early payment discounts or late fees.

- Itemized List: Break down the services or products provided, including quantities, descriptions, and individual costs.

- Amount Due: The total sum to be paid should be highlighted for easy identification.

- Payment Methods: Specify the accepted methods for payment, such as bank transfer, credit card, or digital platforms.

Customizing Financial Sections for Your Business

Different industries and business models may require slight adjustments in how financial information is presented. For example, service-based businesses may need to include hours worked or project milestones, while product-based businesses may need to specify product codes or quantities. By tailoring these sections to fit your specific needs, you ensure that both you and your client are on the same page regarding payment expectations and terms.

Incorporating these essential billing elements into your business documents helps streamline the financial process, reduces misunderstandings, and enhances the overall experience for both parties.

Best Practices for Time Tracking Invoices

Ensuring that time logs are accurate and clearly presented is crucial when creating billing documents based on hourly work. The key to a smooth transaction process lies in providing a well-structured summary that highlights worked hours, services rendered, and payment terms. By following best practices, you can avoid misunderstandings and maintain a professional relationship with your clients, ensuring that you’re compensated fairly for your time.

Be Detailed and Transparent

It’s essential to include clear and specific details for each entry. Rather than just listing the total hours worked, break them down into individual tasks or milestones completed. This helps the client understand exactly what they’re paying for and ensures no confusion arises over charges. Include descriptions of the services provided, the hours spent on each task, and any additional notes or explanations that may be relevant to the client.

Set Clear Payment Terms

Clear payment terms are vital for ensuring timely and accurate compensation. Specify the due date for payment, any applicable late fees, and the accepted methods of payment. It’s also helpful to mention whether any discounts apply for early payment. By being upfront about these terms, both parties can avoid unnecessary delays and ensure that the payment process is straightforward.

By adhering to these best practices, you create a transparent and professional system that promotes trust and reduces disputes. Accurate time tracking and clear documentation not only streamline your billing process but also reinforce your commitment to delivering quality work.

Common Mistakes to Avoid in Timesheets

When it comes to tracking hours worked, small errors can lead to significant problems. Whether you’re calculating payments or managing project timelines, inaccuracies in your records can result in misunderstandings, delayed payments, or lost revenue. Identifying and correcting common mistakes early on is crucial for maintaining accuracy and building trust with clients and employees alike.

Overlooking Specific Task Descriptions

One of the most frequent errors in time tracking is failing to provide detailed descriptions for each task completed. Without a clear explanation of what was done during the recorded hours, the documentation can appear vague and incomplete. This lack of clarity can lead to disputes or questions from clients. Make sure that each entry includes a concise, yet thorough, description of the work performed.

Incorrect Hour Calculations

Simple math errors can undermine the reliability of your time logs. Whether it’s adding up total hours or calculating partial hours worked, inaccuracies in these calculations can result in undercharging or overcharging. Always double-check your calculations to ensure accuracy. Using automated tools can help minimize these mistakes, but manual verification is still important.

The table below illustrates how small errors in time tracking can impact billing. For example, failing to log correct hours or descriptions can lead to discrepancies in totals.

| Date | Task Description | Hours Worked | Total Hours (Corrected) |

|---|---|---|---|

| 2024-11-01 | Client consultation | 2.5 | 3 |

| 2024-11-02 | Design and implementation | 4 | 4 |

| 2024-11-03 | Testing and debugging | 3.5 | 3.5 |

Taking extra time to ensure that the information is complete and accurate will prevent these issues and improve the overall quality of your work logs.

Choosing the Right Invoice Template Format

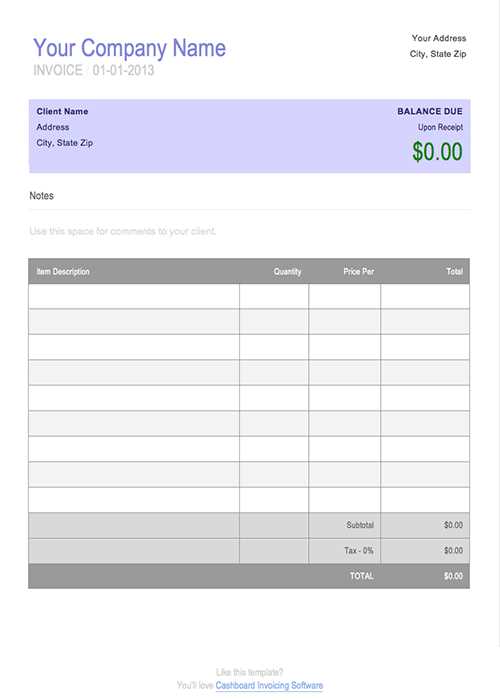

Selecting the appropriate layout for your billing documents is essential for maintaining professionalism and ensuring clarity. The right format not only makes your records easier to understand but also aligns with your business style and client preferences. Whether you choose a simple design or a more detailed structure, the format should be functional, easy to navigate, and able to accommodate all necessary information without being overwhelming.

Simplicity vs. Detail

When deciding on a format, consider the nature of the services or products you offer. If you run a service-based business with variable hourly rates, a simple design with clear time tracking and pricing sections might be sufficient. However, if you provide multiple products or complex services, a more detailed format with itemized lists, descriptions, and additional terms might be necessary. The goal is to strike a balance between simplicity and the need for detailed information, so your clients can easily understand the charges.

Customizing for Client Needs

Each client may have different preferences regarding how they like to see billing details presented. For some, a straightforward document with minimal design elements is ideal, while others may appreciate a more polished, branded layout that includes your business logo and colors. Always consider the specific needs of your clients when choosing a format. Customizing your documents for each client can help establish a stronger professional relationship and ensure smoother transactions.

Ultimately, the right format should be clear, concise, and adaptable to your business’s needs, enhancing both the appearance and functionality of your billing records.

How to Calculate Hourly Rates on Invoices

Calculating accurate hourly rates is essential for ensuring that you are fairly compensated for the time spent on a project or service. The rate should reflect not only the hours worked but also the complexity and value of the work being performed. Properly calculating this amount can prevent undercharging, help you manage your finances, and foster trust with your clients.

Steps for Calculating Hourly Rates

To calculate the correct hourly rate, start by determining your desired earnings and the total number of hours you expect to work. You should also factor in any overhead costs, such as business expenses and taxes. Here is a simple formula to calculate your hourly rate:

Hourly Rate = (Desired Earnings + Overhead Costs) ÷ Total Hours Worked

For example, if you want to earn $50,000 per year and anticipate working 2,000 hours, and you have $10,000 in business expenses, your hourly rate would be calculated as follows:

| Description | Amount |

|---|---|

| Desired Earnings | $50,000 |

| Overhead Costs | $10,000 |

| Total Hours Worked | 2,000 |

| Hourly Rate | $30 |

In this case, you would need to charge $30 per hour to cover both your earnings and business expenses. Keep in mind that this rate may need to be adjusted based on market conditions or the specific client you’re working with.

Additional Considerations

While the basic calculation is straightforward, you may also want to consider other factors, such as industry standards, your level of expertise, and the scope of the project. Some clients may require additional work or more complex services, which could justify a higher rate. Always review the details of each project before finalizing your rate to ensure it aligns with the value you’re providing.

Time Tracking Tools for Invoice Templates

Using effective tools to monitor and record work hours can significantly simplify the process of generating accurate billing documents. These tools help streamline the collection of data, reduce errors, and save time when preparing final statements. The right software can automatically track time, categorize tasks, and even calculate the amount due, which makes the entire billing procedure more efficient and reliable.

Features to Look for in Time Tracking Software

When selecting a time tracking solution, consider the following features to ensure it integrates well with your workflow:

- Automatic Time Logging: The ability to automatically start and stop timers based on activity can save time and reduce mistakes.

- Task Categorization: Grouping time by project or task can help generate more detailed reports, making it easier to show clients exactly what they’re being charged for.

- Reports and Summaries: Generating accurate summaries of hours worked is essential for transparency and helps in the preparation of final billing statements.

- Integrations with

How to Automate Your Invoice Process

Automating your billing and payment collection process can save time, reduce errors, and streamline your business operations. By leveraging the right software tools and setting up automated workflows, you can eliminate much of the manual work involved in tracking hours, calculating totals, and sending out payment requests. Automation ensures that your clients receive accurate and timely statements, while you can focus on more critical tasks.

Key Steps to Automate Your Billing Process

To get started with automation, follow these essential steps:

- Choose the Right Software: Select a platform that integrates time tracking, task management, and payment processing. This allows you to automate the entire process, from logging hours to sending final payment requests.

- Set Up Recurring Billing: For ongoing projects or retainer clients, configure recurring payment schedules. This feature ensures that invoices are generated and sent automatically at regular intervals without manual intervention.

- Integrate Payment Gateways: Set up automated payment gateways like Stripe or PayPal to allow clients to pay directly through the billing document. Integration ensures quick processing and reduces follow-up emails or reminders.

- Customize Notifications: Automate reminders for clients before the due date, and set up notifications for overdue payments. This helps you stay on top of collections without manual follow-up.

Benefits of Automation

Automating your billing workflow offers several advantages, including:

- Time-Saving: Automation reduces the time spent on repetitive tasks, allowing you to focus on growing your business.

- Accuracy: With automation, you minimize human errors such as incorrect calculations or missed entries.

- Consistency: Regular and timely billing ensures that your clients are always kept up to date with their payments.

By incorporating automation into your billing system, you can create a more efficient, reliable, and professional process that benefits both you and your clients.

Creating Professional and Clear Invoices

When managing financial transactions with clients, it is essential to present clear, concise, and professional documentation. Properly structured records of services or goods provided not only reflect professionalism but also ensure accurate tracking for both parties involved. Clear statements help prevent misunderstandings and facilitate smooth processing of payments. In this section, we will discuss how to create well-organized, easy-to-understand records that leave a positive impression.

Key Elements of a Well-Structured Document

A well-crafted record should include all necessary details while maintaining simplicity. To ensure clarity, start with essential client information, such as their name, contact details, and the date of the transaction. Next, list the services provided or items delivered with corresponding quantities and prices. It’s also important to include payment terms, deadlines, and any other relevant notes to avoid confusion.

Formatting for Readability

For easy navigation, use clean formatting. This includes separating key sections with clear headings, utilizing bullet points or tables, and leaving enough white space for readability. It’s crucial that each section is distinct and that important details are highlighted. A clutter-free, logical layout will not only make it easier for your clients to understand the details but also leave a lasting impression of your business’s attention to detail.

Description Quantity Unit Price Total Consulting services 10 hours $50 $500 Web design 5 hours $70 $350 By maintaining a consistent and straightforward structure, you will build trust and enhance the professional appearance of your business communications.

Integrating Timesheets with Accounting Software

Seamlessly connecting work records with financial tracking systems streamlines the entire process of monitoring labor and expenses. By automating the flow of data from activity logs to accounting platforms, businesses can reduce errors, save time, and enhance accuracy. This integration allows for faster processing and real-time updates, ultimately improving efficiency in financial management.

Benefits of Integration

Integrating work logs with financial tools provides numerous advantages. It eliminates the need for manual data entry, reducing the risk of mistakes and inconsistencies. With automatic synchronization, businesses can ensure that hours worked, rates, and total costs are consistently reflected in the financial system. This leads to more accurate reports and timely payments, benefiting both the business and its clients.

Steps to Integrate Effectively

To successfully connect your tracking system with accounting software, start by selecting compatible platforms. Many accounting tools offer built-in integrations with popular work log systems. After setting up the integration, map the relevant fields between the two platforms to ensure smooth data transfer. Regularly test the connection to ensure it remains accurate and up to date.

Legal Considerations for Time Invoices

When preparing documentation for services rendered, it is important to be aware of the legal aspects that govern financial records. Properly structured statements not only ensure smooth payment processing but also protect both parties from disputes. Understanding the legal requirements and best practices can help avoid complications and maintain transparent business operations.

Key Legal Requirements

- Clear Agreement on Terms: Ensure both parties agree on the payment terms, rates, and deadlines before services are provided. This agreement should be documented in a contract or service agreement.

- Accurate Record Keeping: Maintain accurate records of hours worked, services performed, and agreed-upon rates. Misreporting can lead to legal complications and loss of trust.

- Compliance with Local Laws: Depending on your location, specific laws may govern how payments for services should be documented and taxed. Ensure you are familiar with these regulations to avoid penalties.

- Timely Submission: Submit statements promptly to avoid late fees or interest charges. Legal disputes often arise when there is a delay in invoicing or unclear payment expectations.

Protection for Both Parties

Properly prepared records can serve as evidence in case of disputes. To protect both the service provider and the client, it is recommended to include the following elements:

- Client and service provider details, including contact information and legal entity names.

- Clear descriptions of services or goods provided, along with associated costs.

- Payment terms, including deadlines, late fees, and accepted payment methods.

- Signatures or electronic agreements acknowledging mutual understanding of the terms.

By adhering to legal guidelines and maintain

Ensuring Accurate Billing with Templates

Achieving precise financial records requires consistency and clarity, especially when documenting the work performed. By using structured forms, businesses can standardize the process, reduce errors, and ensure that all relevant details are included. This approach not only saves time but also ensures that both the service provider and the client are on the same page regarding charges and expectations.

Key Elements for Accuracy

- Clear Service Descriptions: Each entry should accurately describe the work completed, including the scope, time spent, and rate applied. This ensures transparency for the client.

- Correct Quantities and Rates: Always double-check the quantities and unit rates to avoid overcharging or undercharging. Accurate calculations are vital to maintain trust.

- Proper Date Notation: Make sure that all dates are clearly stated to avoid confusion about the timeframe of services provided or the due date for payment.

- Comprehensive Contact Information: Include both parties’ contact details and any necessary references, such as project names or contract numbers, to link the record to the correct agreement.

Benefits of Structured Records

- Consistency: Using a uniform format for all records ensures that every detail is captured in the same way, making the process faster and less prone to mistakes.

- Efficiency: Pre-built formats speed up the billing process by eliminating the need to create new documents from scratch every time.

- Transparency: Both parties benefit from clear, easy-to-understand documents that make it simple to verify charges and payments.

By incorporating a well-organized approach to your billing process, you can improve accuracy, reduce disputes, and foster stronger professional relationships.

Improving Efficiency with Digital Templates

Utilizing digital forms for documenting work details can greatly enhance the efficiency of your billing and reporting process. These structured digital formats automate repetitive tasks, reduce human error, and allow for faster processing. By moving away from manual documentation, businesses can streamline workflows, ensuring both accuracy and timely delivery of records.

Benefits of Digital Solutions

- Time-Saving: Pre-designed digital formats eliminate the need to start from scratch each time. This allows you to quickly fill in necessary information and generate reports in seconds.

- Reduced Errors: Automated calculations and standardized fields help prevent common mistakes, such as miscalculations or omissions, ensuring more accurate records.

- Easy Access and Storage: Digital records can be stored securely and retrieved easily. You no longer need to manage paper files or worry about losing important documentation.

- Enhanced Customization: Digital forms can be easily tailored to fit specific business needs. You can modify fields, add new sections, and adjust layouts without having to redesign the entire structure.

Maximizing Efficiency with Automation

One of the greatest advantages of digital systems is automation. Features such as auto-population, data syncing, and integration with other business tools can save significant time. For instance, once client information is entered, it can be automatically inserted into future records, reducing the need for repetitive data entry. Additionally, automated reminders for payment deadlines or overdue balances can help businesses stay on top of cash flow.

By embracing digital solutions, businesses not only improve their operational efficiency but also create a more professional experience for their clients, fostering long-term trust and satisfaction.