Invoice Template with Thank You for Your Business Message

In every transaction, clear communication and a personal touch can make a lasting impression. When wrapping up a deal, it is essential to not only provide a detailed summary of the goods or services rendered but also show appreciation for the client’s trust. Adding a thoughtful message of gratitude is a simple yet powerful way to build rapport and foster long-term relationships.

Designing a document that conveys professionalism and acknowledges the client’s support is more than just a routine task. With the right structure, it can reflect the care and attention that businesses put into their work. Whether it’s a simple gesture or a more elaborate acknowledgment, this act can enhance customer satisfaction and set the tone for future engagements.

In this guide, we explore how to create a polished document that not only serves as a record of the transaction but also expresses your genuine appreciation. With the right approach, it becomes a tool that strengthens client loyalty while maintaining professionalism in every interaction.

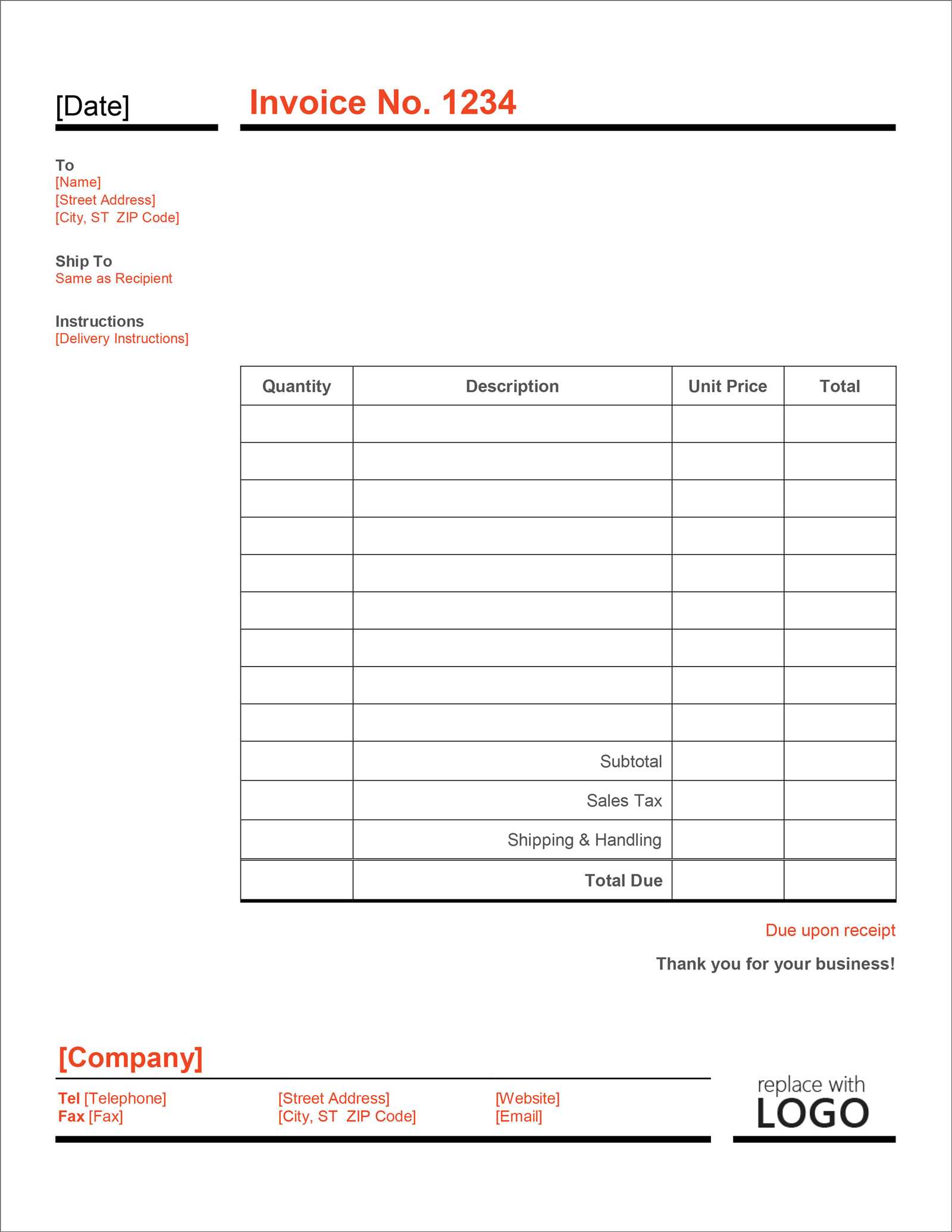

How to Create Professional Invoices

Creating well-organized and polished documents is a critical part of maintaining a professional reputation and ensuring smooth transactions. A well-crafted document serves as both a record of the exchange and a reflection of your professionalism. To leave a positive impression on clients and ensure clear communication, it’s important to structure these documents effectively and include all necessary details.

Key Components to Include

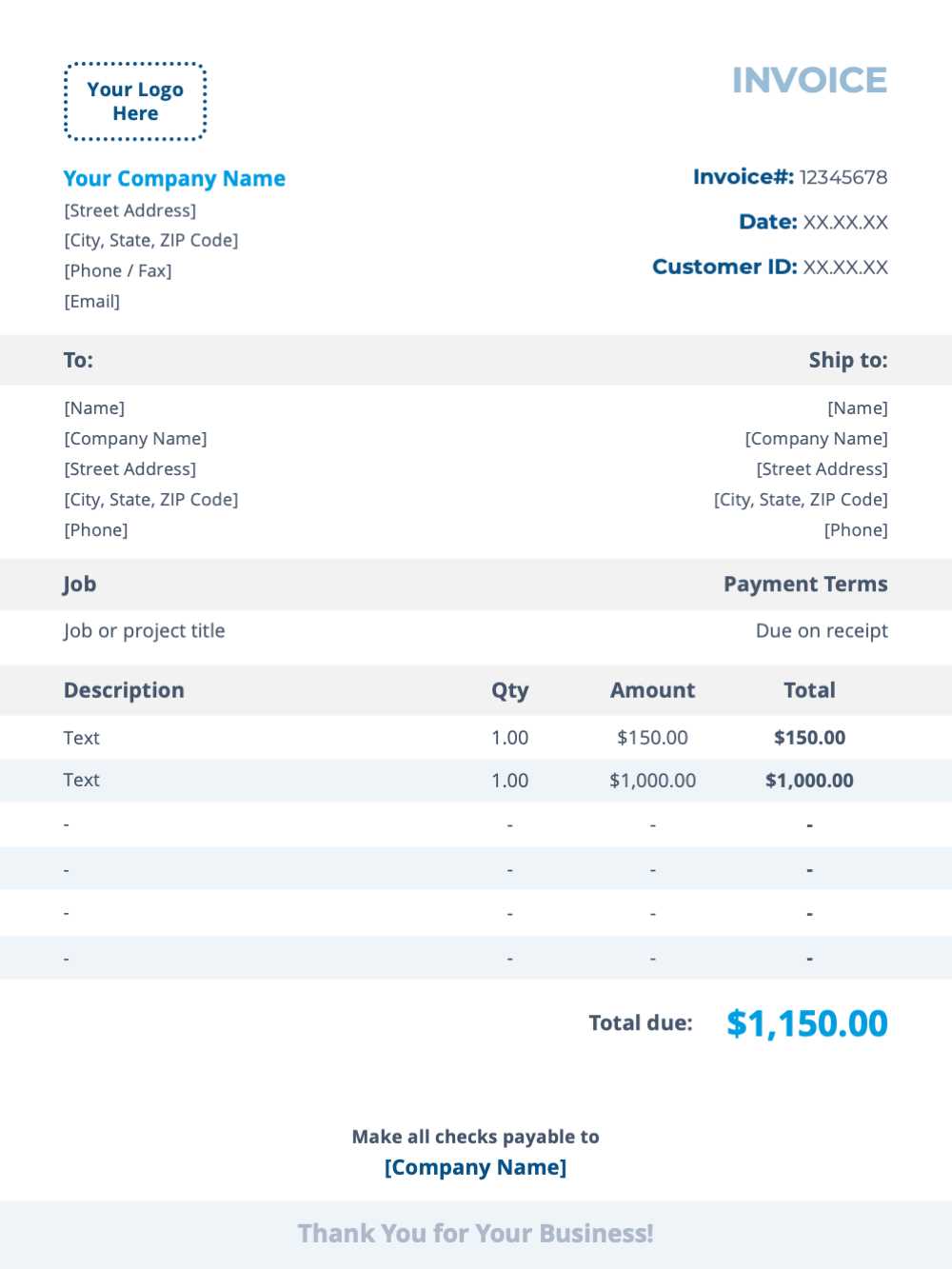

Every professional document should contain specific elements to make it clear, concise, and legally sound. Consider the following key components when drafting:

- Header Information: Ensure your company’s name, contact information, and logo are visible at the top.

- Client Details: Include the recipient’s full name or company name, address, and contact details.

- Date: Clearly mark the date of issue and the due date for payment.

- List of Goods or Services: Provide a detailed breakdown of what was delivered, including quantities, descriptions, and prices.

- Total Amount: Clearly state the total amount due, including applicable taxes or discounts.

- Payment Instructions: Provide easy-to-follow payment methods and terms.

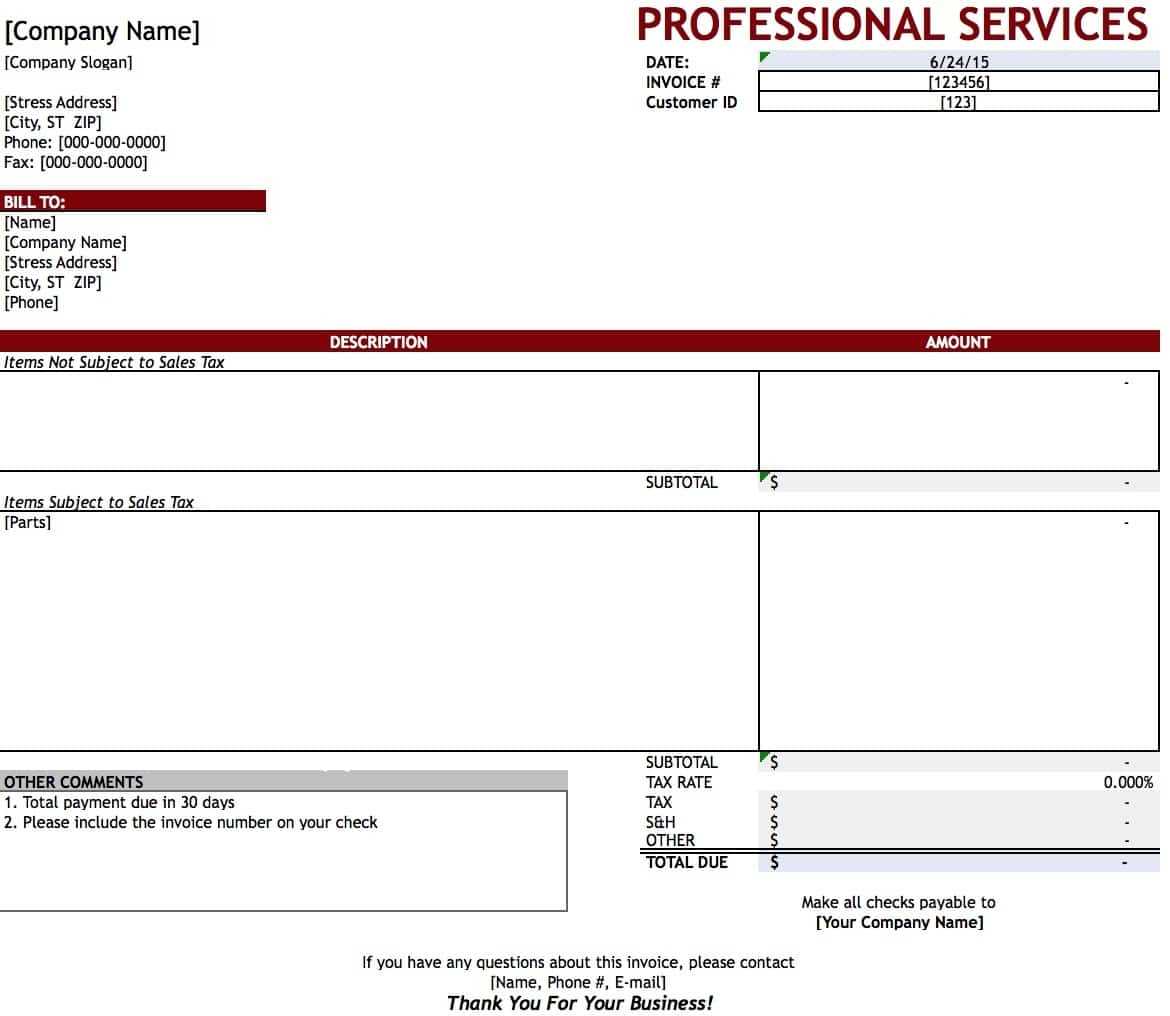

Design and Presentation Tips

While content is key, the overall presentation is just as important. A visually clean and well-organized document reflects positively on your company. Here are some design tips to consider:

- Use Consistent Fonts: Choose professional, easy-to-read fonts that are consistent throughout.

- Align Elements Clearly: Ensure that headings, amounts, and key sections are aligned properly for easy reading.

- Keep it Simple: Avoid clutter. A simple, clean design will make the document easier to understand.

- Include Branding: Incorporate your company logo and colors to reinforce your brand identity.

By following these guidelines, you can create professional documents that not only fulfill their purpose but also enhance your company’s image and customer relationships.

Benefits of Using Invoice Templates

Using pre-designed documents can significantly streamline administrative tasks, save time, and ensure consistency in every transaction. By relying on structured formats, businesses can avoid errors, reduce manual work, and maintain a professional appearance. These ready-made solutions provide a solid foundation, making it easier to generate professional records without starting from scratch each time.

Time Efficiency is one of the main advantages. By eliminating the need to design documents from the ground up, employees or business owners can focus on more important tasks, saving valuable time. Customizable formats allow for quick edits to suit specific needs without sacrificing quality.

Consistency is another key benefit. With a set structure, every document looks professional and adheres to company standards, ensuring that clients receive clear, organized records th

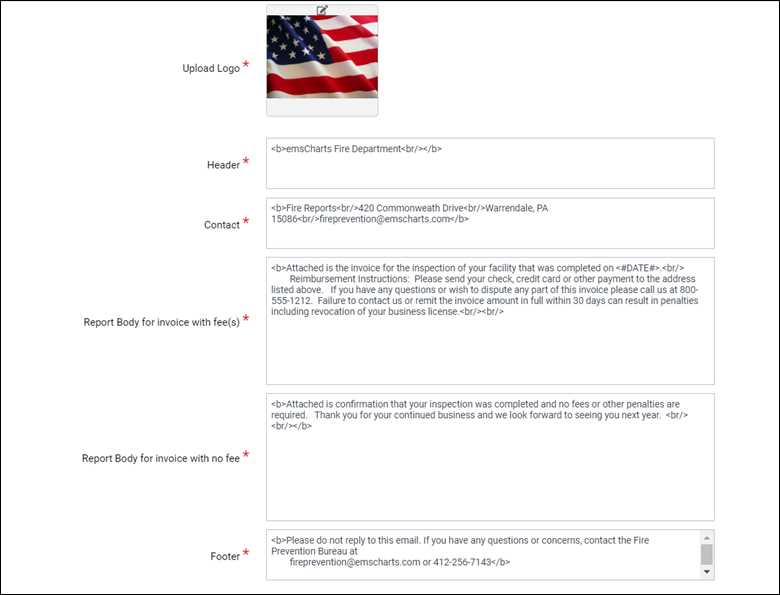

Customizing Your Invoice for Clients

Personalizing the documents sent to clients not only enhances professionalism but also creates a positive impression. Customization ensures that the content aligns with the client’s specific needs, preferences, and expectations, making the transaction feel more tailored and thoughtful. A well-adjusted document can reflect your attention to detail and strengthen the business relationship.

Key Areas to Personalize

There are several aspects you can modify to ensure each document feels unique and relevant to the recipient:

- Client Information: Always update the client’s name, address, and contact details to ensure accurate records.

- Description of Services or Products: Customize the list of products or services based on the specific agreement. Tailor descriptions, quantities, and pricing to reflect the terms of the contract.

- Payment Terms: Adapt the payment instructions to match the client’s preferred methods, whether they are bank transfers, credit cards, or online payment systems.

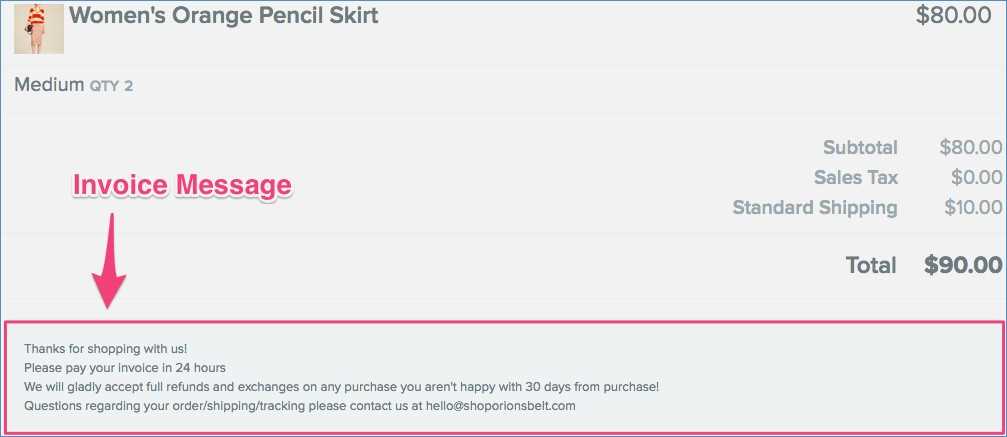

- Personalized Message: Add a short, friendly note expressing appreciation for the client’s continued trust or highlighting specific aspects of the transaction. This small gesture can foster goodwill.

- Branding: Adjust the document’s branding to reflect any seasonal promotions, or update logos and colors based on the specific client’s preferences, if applicable.

Tools for Customization

There are various tools and software available to streamline the customization process, from simple word processors to more advanced accounting platforms. Many of these tools allow you to easily update text fields, adjust layout options, and save client-specific templates for future use. By utilizing these tools, businesses can ensure consistency while still providing personalized documents each time.

Tailoring these documents to individual clients not only enhances their experience but also increases the likelihood of repeat business and positive referrals. A little effort in personalization can go a long way in fostering strong, long-term relationships.

Why Add a Thank You Message

Including a message of appreciation in official records not only humanizes the transaction but also strengthens the relationship between the service provider and the client. It’s a simple yet effective way to show gratitude, which can have a lasting impact on customer satisfaction and loyalty. Personal gestures can make clients feel valued and more likely to return or recommend your services to others.

A well-crafted note of appreciation goes beyond business transactions–it builds rapport and creates a positive experience for clients. Whether it’s acknowledging a long-term partnership or expressing gratitude for a first-time order, these small but meaningful gestures can go a long way in enhancing client retention and fostering goodwill.

Key Benefits of Including a Gratitude Message

| Benefit | Description |

|---|---|

| Builds Customer Loyalty | Expressing genuine appreciation can make clients feel valued, increasing the chances of repeat business. |

| Improves Customer Experience | A personal message enhances the overall experience, making clients feel recognized and respected. |

| Strengthens Relationships | By acknowledging clients’ trust, you foster a stronger connection, improving long-term business relations. |

| Encourages Positive Referrals | Satisfied clients are more likely to recommend your services, helping to grow your network and client base. |

Incorporating a brief expression of appreciation creates a positive impression that can be remembered long after the transaction is completed. This practice is a small but impactful way to show clients they are more than just numbers, and that their support is truly valued.

Choosing the Right Invoice Format

Selecting the correct layout for transaction records is crucial for clarity, accuracy, and professionalism. A well-organized structure ensures that both the service provider and the client can easily understand the details of the transaction. The right format not only enhances communication but also reflects the company’s standards and commitment to quality.

Factors to Consider

When deciding on the best format, it’s important to take several factors into account:

- Client Needs: Some clients may prefer a more detailed breakdown, while others might only need a summary. Adjust the structure based on the client’s preferences or industry standards.

- Legal Requirements: Ensure that the layout includes all legally required information, such as tax identification numbers, payment terms, and service details. The format should comply with local regulations.

- Clarity and Simplicity: The layout should be easy to read and navigate. Avoid clutter and make sure key information like payment deadlines, amounts, and descriptions are clearly presented.

- Branding: The design should align with your company’s brand identity. Consistent fonts, colors, and logos reinforce your professional image and make the document instantly recognizable.

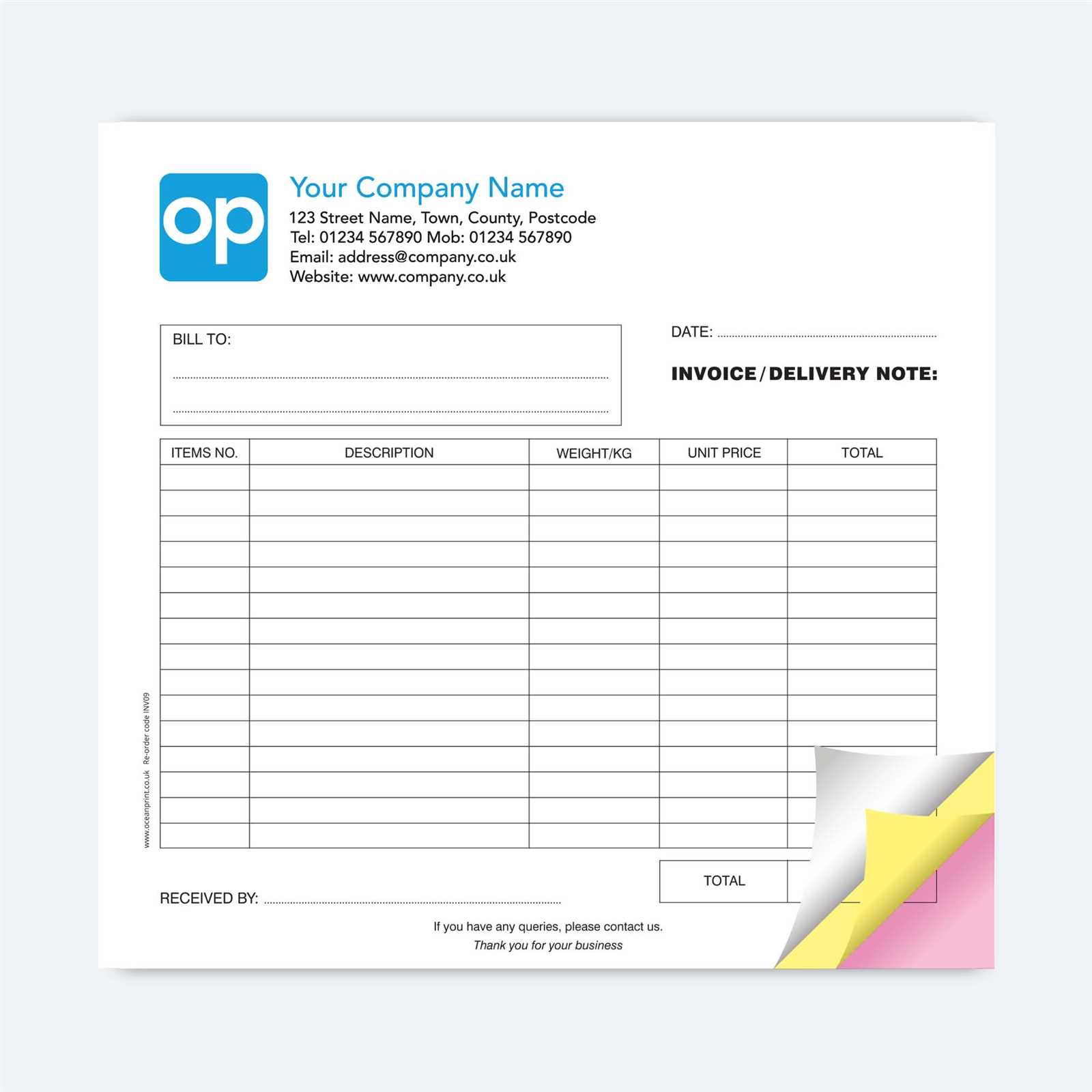

Types of Formats

There are a variety of formats available depending on the nature of the transaction and client preferences. Some common formats include:

- Standard Layout: A simple, no-frills design that includes essential details like service descriptions, amounts, and payment terms.

- Itemized Breakdown: Ideal for detailed transactions, this format provides a line-by-line list of services or products with prices and quantities.

- Minimalist Style: A clean, modern format that emphasizes the most important details with a streamlined design. Ideal for clients who prefer simplicity.

Ultimately, choosing the right layout depends on the client’s expectations, the nature of the services provided, and your company’s standards. A thoughtfully chosen format can make your records easier to read, improve understanding, and enhance the professional image of your business.

Design Tips for Effective Invoices

The layout and design of official transaction documents play a crucial role in conveying professionalism and clarity. A well-designed document helps ensure that all the necessary information is easy to find and understand, reducing confusion for both the client and the service provider. A clean, organized structure can make a lasting impression, reinforcing the company’s commitment to quality and attention to detail.

Key Design Elements to Consider

To create effective records, focus on the following elements that contribute to both form and function:

- Clear Header: The top of the document should feature your company’s name, logo, and contact information. This makes it easy for the recipient to quickly identify the source of the document.

- Legible Fonts: Use simple, professional fonts that are easy to read. Stick to one or two font styles to avoid clutter and maintain consistency.

- Ample White Space: Don’t overcrowd the document. White space improves readability, making it easier for the recipient to scan through the content without feeling overwhelmed.

- Well-Structured Layout: Arrange the key sections–such as service descriptions, amounts, and payment details–in a clear, logical order. This will help the reader quickly find relevant information.

- Visual Hierarchy: Highlight important sections such as totals and due dates with bold text or larger font sizes to draw attention where needed.

- Color Scheme: Use color sparingly to accentuate key information or align with your company’s branding. Ensure that the colors you choose do not overwhelm the content.

- Professional Footer: The footer should include payment instructions, terms, and any other legal or regulatory information in a clean and unobtrusive way.

Additional Design Tips

In addition to the core design elements, consider these additional tips to enhance the overall impact of your document:

- Consistent Alignment: Align text, amounts, and columns consistently to create a polished, organized appearance.

- Customizable Fields: Ensure that the document includes customizable fields for client names, services, quantities, and pricing, so it can be easily tailored to each transaction.

- Digital Compatibility: If the document is shared electronically, ensure that it is compatible with digital platforms and can be easily opened, read, and printed across different devices.

By focusing on these design principles, you can create documents that not only look professional but also enhance the overall client experience, ensuring clarity, trust, and a positive business relationship.

Common Invoice Mistakes to Avoid

While creating official transaction records might seem straightforward, there are several common errors that can lead to confusion, delays in payment, or even damage to your professional reputation. Paying attention to detail and avoiding these mistakes ensures that all the necessary information is clear and that the client has no reason to question the accuracy of the document.

Frequent Errors in Document Creation

Here are some of the most common mistakes that businesses often make when preparing transaction summaries:

- Incorrect Client Information: Ensure that the client’s name, contact details, and address are accurate. Errors in this section can delay payment and reflect poorly on your professionalism.

- Missing or Incorrect Dates: Failing to include the date of issue or the due date can lead to confusion about payment terms. Always ensure these are clearly marked.

- Unclear or Incomplete Descriptions: The breakdown of services or products should be specific and detailed. Vague descriptions can result in misunderstandings and disputes over the provided goods or services.

- Omitting Payment Terms: Always include clear payment instructions, such as accepted payment methods, account numbers, and any late fees. Failing to mention these details can cause delays in processing payments.

- Mathematical Errors: Double-check all calculations, including prices, quantities, taxes, and totals. Simple mistakes can cause frustration for the client and delay payments while corrections are made.

- Unprofessional Format: A cluttered, inconsistent, or hard-to-read layout can make it difficult for clients to locate key information. A clean, organized structure reflects professionalism.

How to Avoid These Mistakes

To prevent these common errors, consider the following tips:

- Proofread Every Document: Always review the document before sending it to ensure all details are correct. Even a small mistake can create unnecessary complications.

- Use Reliable Software: Use trusted software or tools to automate calculations, which helps eliminate the risk of human error.

- Double-Check Client Details: Verify client contact information and the specifics of the transaction to ensure accuracy before finalizing the document.

- Standardize Your Process: Create a standardized workflow for drafting and reviewing documents, which can help reduce the chances of missing important details.

By paying close attention to these areas, you can avoid the most common mistakes and ensure your transaction records are clear, professional, and efficient, leading to smoother transactions and better client relationships.

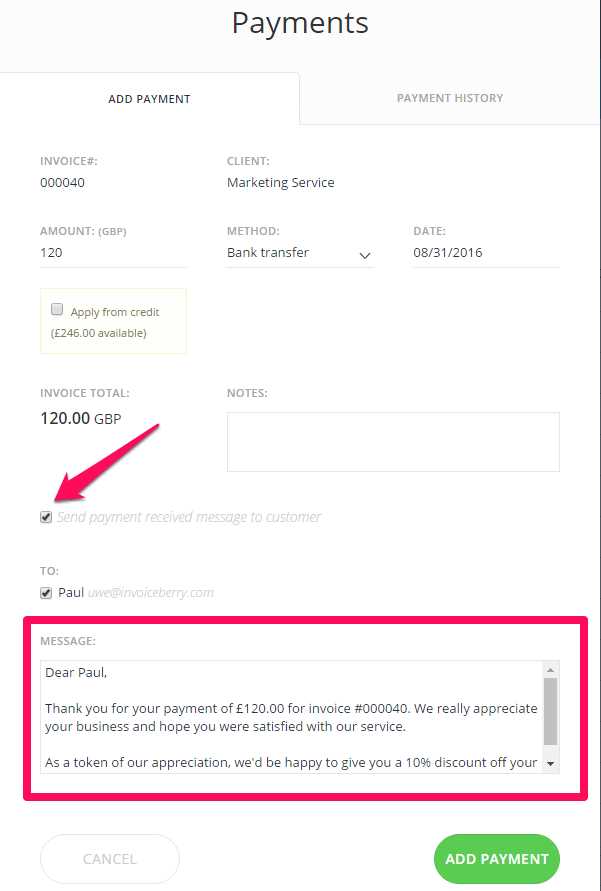

How to Include Payment Terms

Clear and well-defined payment terms are essential for ensuring that clients understand when and how they need to pay for the services or goods provided. Including these details helps set expectations, reduce confusion, and avoid payment delays. By clearly outlining payment instructions, you protect your business interests while maintaining a professional relationship with your clients.

Key Elements of Payment Terms

When including payment instructions, it is important to cover the following components to ensure clarity and prevent any misunderstandings:

- Due Date: Clearly specify the date by which payment is expected. This helps establish a timeline and avoids delays. Common terms include “Net 30” (payment due in 30 days) or “Due upon receipt” for immediate payments.

- Accepted Payment Methods: List the acceptable ways clients can make payments. Whether it’s via bank transfer, credit card, PayPal, or another method, make sure all options are clearly mentioned.

- Late Payment Fees: Specify any late fees or penalties for overdue payments. This incentivizes clients to pay on time and protects your business from extended cash flow issues.

- Discounts for Early Payment: Offering a discount for early payments (e.g., “2% discount if paid within 10 days”) can encourage faster settlements and improve your cash flow.

- Currency and Amount: Indicate the currency in which payment is expected and make sure the total amount due is clearly stated, including any taxes or additional charges.

How to Format Payment Terms Effectively

Payment instructions should be concise yet comprehensive. Place this section in a prominent position on the document so it is easily visible. For example, the bottom or near the total amount is ideal. Use bullet points or bold text to highlight key details like due dates and payment methods. Keep the language clear and professional to avoid any ambiguity.

Including payment terms in your transaction records not only ensures that clients are aware of their obligations but also protects your business’s cash flow. Clear instructions help to foster trust and reduce any potential conflicts related to payments, resulting in smoother transactions and stronger client relationships.

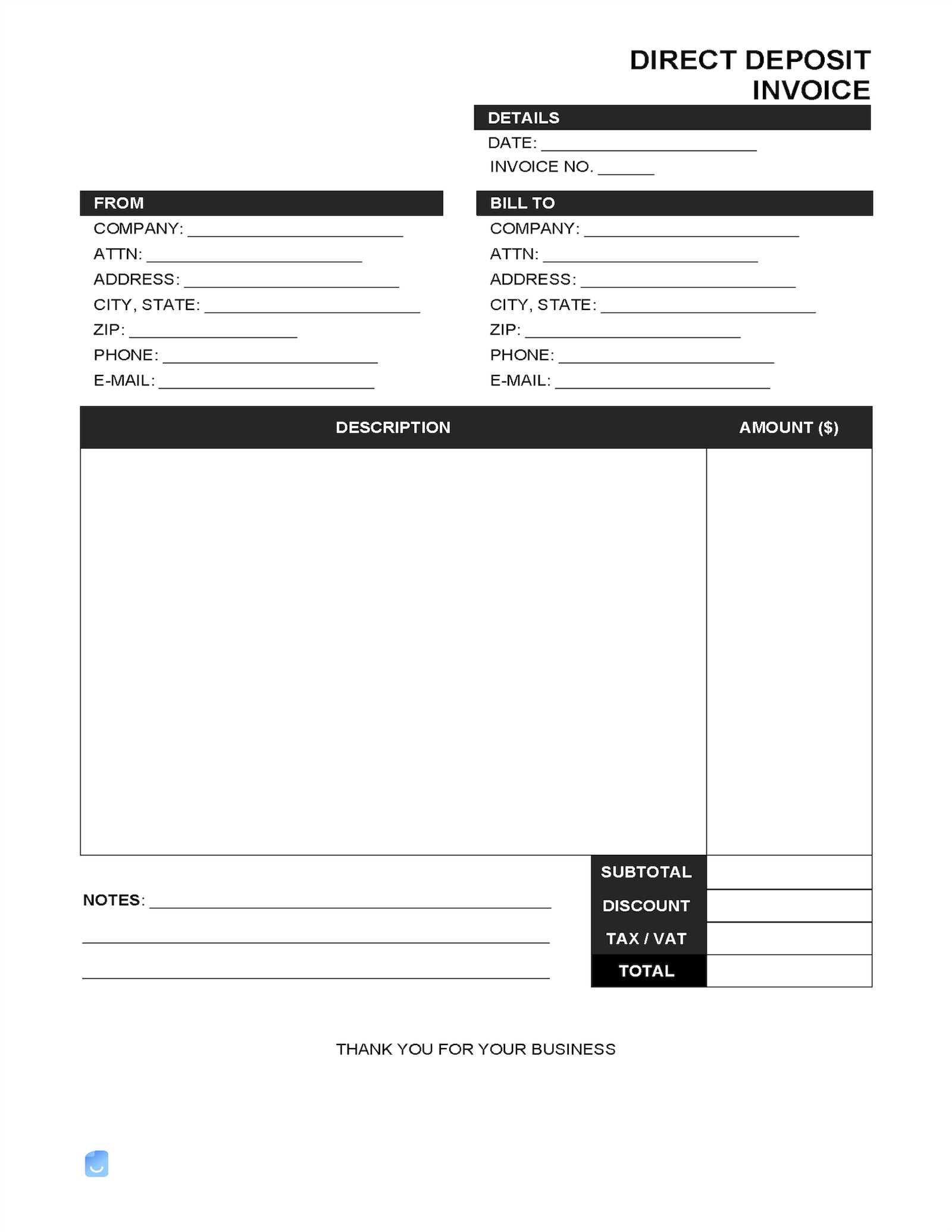

Essential Elements of a Business Invoice

Creating professional and clear documentation for transactions is essential for maintaining a smooth financial process. To ensure accuracy and avoid confusion, certain key elements must be included in every document sent to clients. These elements not only help organize the transaction but also protect both parties by clearly outlining the details of the exchange.

Key Components to Include

To create a comprehensive record, make sure the following components are present:

- Header Information: Include your company name, logo, and contact details, as well as the client’s name, address, and contact information. This ensures that both parties are clearly identified.

- Document Number: Assign a unique identification number to each transaction. This helps track payments and serves as a reference in case of disputes.

- Issue Date and Due Date: Clearly indicate the date the document was issued and the date payment is due. This helps both parties stay on track with timelines and deadlines.

- Description of Goods or Services: Provide a detailed list of what was provided, including quantities, descriptions, and individual pricing. This ensures that both parties are on the same page regarding what was delivered.

- Total Amount Due: Clearly state the total amount, including any taxes, discounts, or additional fees. This ensures transparency in the financial transaction.

- Payment Terms: Specify the agreed-upon terms for payment, including methods accepted (e.g., bank transfer, credit card), any late fees, or early payment discounts.

- Notes or Additional Information: Use this section to include any other relevant details, such as warranties, return policies, or legal disclaimers that may apply to the transaction.

Why These Elements Matter

Each of these components plays a vital role in ensuring that both the service provider and the client understand their responsibilities and expectations. The document serves as a legal agreement and financial record, making it critical for both accuracy and clarity. When all necessary details are included, it helps prevent disputes and improves the chances of prompt payment, contributing to a positive business relationship.

How to Personalize Your Invoice

Personalizing transaction documents can help create a more meaningful connection with clients. By customizing the details and presentation, you show that you value the relationship, making the entire process feel more tailored. Personalization not only adds a touch of professionalism but can also encourage prompt payment and future business opportunities.

Ways to Add a Personal Touch

Here are some effective ways to make each document feel unique and client-focused:

- Client’s Name and Contact Information: Always address the recipient by name. Personalizing communication strengthens the bond and shows attention to detail.

- Personalized Message: Include a short note of appreciation or acknowledgment. A simple line such as “We appreciate your continued partnership” or “Looking forward to working together again” can make a big difference.

- Custom Service Descriptions: Instead of generic descriptions, tailor the list of services or products to reflect the specific work or items provided. This reinforces the value and relevance of the transaction.

- Company Branding: Include custom logos, color schemes, and fonts that align with your company’s branding to make the document feel consistent with your business identity.

- Customized Payment Terms: Adjust payment instructions to fit the client’s preferences, such as specifying a preferred payment method or including a unique reference number for easy tracking.

Why Personalization Matters

Tailoring these elements shows that you care about the individual client, fostering stronger relationships and enhancing trust. Personalization also makes it easier to create lasting impressions, contributing to customer loyalty and higher satisfaction rates. By going the extra mile with personalized details, you demonstrate both professionalism and a commitment to quality service.

Why Invoices Enhance Customer Relationships

Transaction records play an essential role in fostering transparent, professional, and trusting relationships with clients. By providing clear and accurate documentation of the services or products provided, you not only ensure that payments are processed smoothly but also demonstrate reliability and accountability. These documents serve as an ongoing reminder of the value you provide and can help strengthen client loyalty over time.

How Proper Documentation Builds Trust

Here’s how sending detailed and well-structured records contributes to better customer relationships:

- Transparency: By outlining the specifics of each transaction–such as the services rendered, costs, and payment terms–you provide clarity, reducing any potential misunderstandings or disputes.

- Professionalism: Well-crafted records reinforce your credibility as a reliable and organized service provider. Clients are more likely to return for future projects if they feel confident in your attention to detail and business practices.

- Clear Communication: Detailed documentation ensures that both parties are on the same page regarding what was delivered, what is owed, and when payment is expected, fostering better communication throughout the business relationship.

- Record Keeping: Keeping accurate transaction records allows clients to easily track their payments and budgets. This can help build goodwill and show that you care about providing them with the information they need for their own financial planning.

Building Long-Term Loyalty Through Documentation

When clients see that you consistently provide accurate, professional, and easy-to-understand documentation, it helps build their confidence in your business. Clear records not only improve the client’s experience but also help create long-term relationships, encouraging repeat business, referrals, and overall satisfaction. By making documentation an integral part of your service process, you ensure that each client interaction is positive and contributes to a lasting business partnership.

Invoice Template Tools for Businesses

For any organization, creating professional and consistent transaction records is essential for maintaining a smooth operation. Fortunately, there are numerous tools available to help businesses generate clean, accurate, and customized documents quickly. These tools allow businesses to automate the process, reduce human error, and maintain a professional appearance in every transaction.

Popular Tools for Generating Transaction Documents

Here are some of the most popular tools that can help streamline the creation of formal transaction records:

- Online Invoice Generators: Websites and cloud-based platforms offer easy-to-use templates with customizable fields for creating documents quickly. These tools often allow you to input client details, services, and payment terms, and automatically calculate totals and taxes.

- Accounting Software: Many accounting platforms such as QuickBooks, Xero, or FreshBooks come with built-in features for generating transaction summaries. These tools can also help track payments, manage client accounts, and integrate with financial reporting systems.

- Word Processors & Spreadsheets: While more manual, programs like Microsoft Word or Excel also offer simple templates that can be customized to fit the needs of your business. They allow for detailed customization but may require more effort to maintain consistency.

- Mobile Apps: Several mobile apps are designed to create transaction records on the go. Apps like Zoho Invoice or Invoice2go allow you to generate and send documents directly from your smartphone or tablet, making it easy to manage transactions remotely.

- Customizable PDF Templates: Some businesses prefer using PDF editors or form builders that allow them to create static yet professional documents that can be saved and sent to clients. These tools help maintain consistency across multiple transactions.

Why Use These Tools?

Using specialized tools not only saves time but also ensures consistency and professionalism in every document. These platforms typically allow for quick customization, ensuring that each record aligns with branding and specific business needs. Additionally, many of these tools integrate with payment processors and accounting systems, allowing for seamless financial management and reducing the risk of errors in calculations or data entry.

By utilizing the right tool for generating formal records, businesses can improve their overall efficiency, ensure timely payments, and create a positive impression with clients, all while reducing administrative work and errors.

Automating Invoicing for Efficiency

Managing financial transactions manually can be time-consuming and prone to errors. Automating the process of creating and sending payment records allows businesses to save valuable time, reduce human error, and maintain consistency. By integrating automation into your workflow, you can ensure that every client receives the appropriate documentation in a timely manner, all while freeing up resources for more important tasks.

Benefits of Automating the Process

Automating financial documentation offers several advantages for businesses of all sizes:

- Time Savings: Automated systems can generate and send records at the click of a button, eliminating the need for manual data entry or repetitive tasks.

- Reduced Errors: By minimizing the chance of human error, automated systems ensure that calculations, dates, and client details are accurate every time.

- Consistency: Automated tools ensure that every record follows the same structure and format, giving your transactions a uniform and professional appearance.

- Improved Cash Flow: Automating reminders and due dates can encourage clients to pay on time, leading to faster payments and better cash flow management.

- Scalability: As your business grows, automation allows you to handle more transactions without the need to increase administrative effort, providing flexibility and scalability.

How Automation Works

Automation tools can be integrated with existing business systems to streamline the process. Here’s how the process typically works:

| Step | Description |

|---|---|

| 1. Set Up Templates | Create standardized formats that can be customized for each client, saving time and effort for every transaction. |

| 2. Input Client Information | Input client details once, and automation will populate relevant fields across all future documents for that client. |

| 3. Automate Reminders | Set up automated reminders for upcoming payments, reducing the chances of late payments and follow-ups. |

| 4. Generate and Send | With just a few clicks, automated systems generate payment records and send them directly to clients via email or other communication channels. |

By embracing automation, you not only streamline your operations but also enhance the overall client experience. Timely, accurate, and consistent records make it easier for clients to track payments and avoid any confusion, leading to stronger and more reliable business relationships.

How to Track Paid and Unpaid Invoices

Effectively managing payments is a key component of maintaining smooth financial operations for any business. Keeping track of which transactions have been settled and which are still outstanding ensures that cash flow remains healthy and helps avoid confusion with clients. By using simple strategies and tools, you can easily monitor the status of each transaction, ensuring timely follow-ups and reducing the risk of late payments.

Tracking Paid Transactions

Once a payment has been received, it’s crucial to document and mark the transaction as complete. Here are a few methods to track payments efficiently:

- Update Status in Financial Software: Many accounting platforms allow you to mark a transaction as paid, which automatically updates the status across all relevant records.

- Use Payment Receipts: Issue a receipt once payment is made. This not only serves as proof of payment for clients but also helps you track settled transactions for your records.

- Maintain a Payment Log: Keep a running log of payments received. This can be a simple spreadsheet that lists each transaction along with the payment date and amount.

Managing Unpaid Transactions

Unpaid balances need to be tracked carefully to ensure timely follow-up. Here’s how you can keep track of outstanding payments:

- Set Payment Due Dates: Always include a clear payment due date on every transaction. This makes it easy to determine which records are overdue.

- Automated Payment Reminders: Use automated tools that send payment reminders when the due date approaches or if the balance remains unpaid past the due date.

- Monitor Unpaid Balances: Keep a detailed record of all outstanding transactions, including the amount due, the due date, and any communication with clients regarding overdue payments.

By actively monitoring both paid and unpaid transactions, businesses can ensure their financial records are up to date and that all clients are accounted for. This helps reduce the administrative burden and improves cash flow by enabling quicker identification of overdue payments.

Best Practices for Invoice Management

Managing transaction records effectively is essential for maintaining organized financial processes and ensuring timely payments. Implementing best practices for handling these documents can save time, reduce errors, and enhance overall operational efficiency. By establishing clear procedures and utilizing tools designed for efficient tracking and organization, businesses can streamline their entire workflow, from creation to payment receipt.

Organizing and Categorizing Documents

One of the most important steps in managing transactions effectively is to maintain clear organization. Here are key practices for managing these records:

- Use a Standardized Format: Ensure consistency by using a uniform layout for all records. This makes it easier to process and track each one, while also projecting a professional image to clients.

- Maintain a Centralized Record System: Keep all transaction documents in one accessible location, whether digital or physical. This allows for easy retrieval when needed and reduces the chances of losing important details.

- Categorize and Sort: Sort records by client, date, or project type. This enables efficient tracking and helps to quickly identify outstanding balances or recent transactions.

Timely Follow-Ups and Communication

Efficient communication is critical for managing overdue or pending balances. Here’s how to handle follow-ups effectively:

- Set Clear Payment Terms: Always specify the payment deadline upfront, so clients know when to expect payment and are more likely to comply with the terms.

- Send Regular Reminders: Use automated systems to send reminders before and after the due date. Gentle reminders encourage clients to take action and reduce the need for manual follow-ups.

- Stay Professional: Maintain a polite and professional tone when sending reminders or discussing overdue balances. This helps preserve client relationships while still ensuring payments are made.

By adopting these practices, businesses can ensure smooth and efficient management of their financial records. Clear organization and consistent communication will help avoid delays and errors, keeping cash flow healthy and clients satisfied.