Customizable Invoice Template for Sole Traders

Managing payments and maintaining accurate financial records is essential for independent professionals and small business owners. Having a clear and organized method for requesting payments can significantly improve the efficiency of your operations and ensure you are paid promptly. A well-structured document that outlines the necessary details for your clients can save time and reduce errors.

Customizing your payment requests to reflect your business’s unique needs is an effective way to maintain professionalism while ensuring compliance with relevant regulations. From payment terms to client information, there are several aspects to consider when drafting such documents to keep your business running smoothly.

Using the right tools and techniques can help you automate many of these processes, making the entire system more efficient. Whether you’re just starting or have been running your business for years, having the proper format can save you from unnecessary stress and confusion down the line.

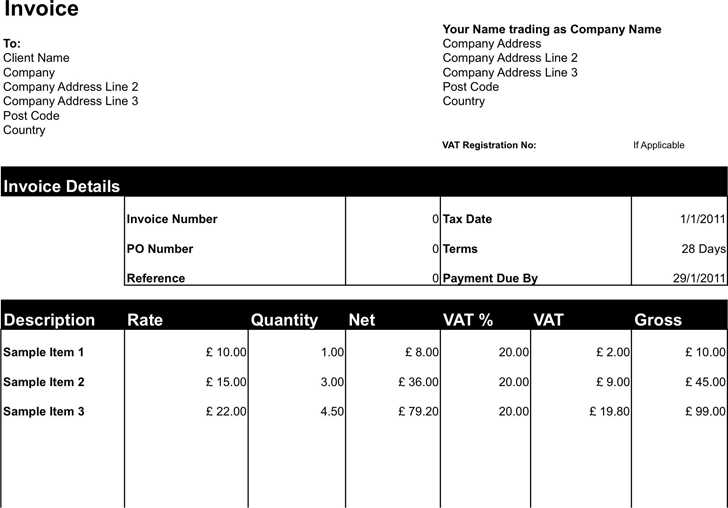

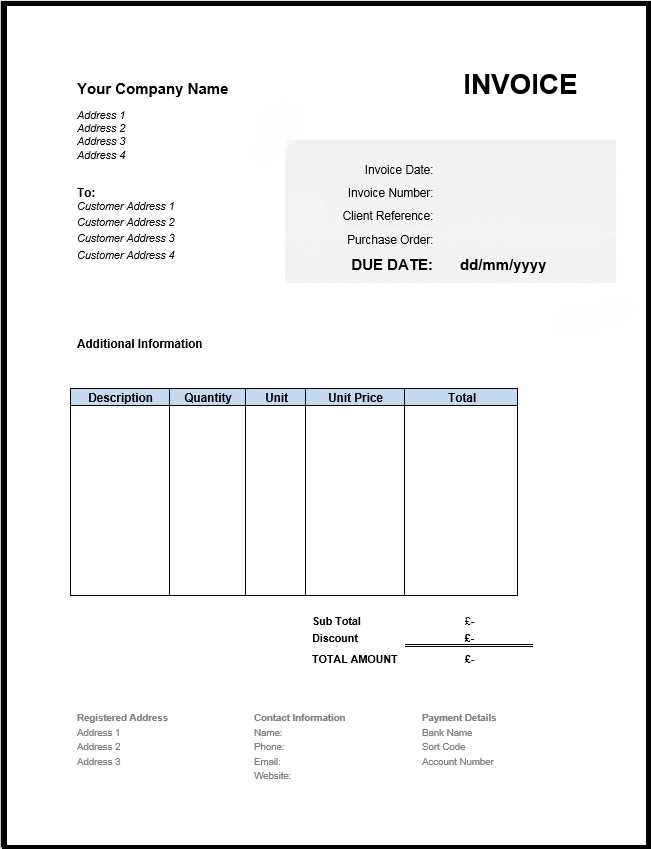

Essential Features of an Invoice Template

When creating a document to request payment for services or products, it’s important to ensure that it includes all the necessary details. A well-designed document not only communicates professionalism but also ensures that the client has all the information needed to process the payment smoothly. Key components of such a document are fundamental for both clarity and legality.

At a minimum, your document should include your business’s contact details, the client’s information, and a clear description of the goods or services provided. Additionally, specifying the payment terms, including due dates and accepted payment methods, will help avoid confusion and ensure timely payments. Including a unique reference number can also assist with tracking and organizing your financial records.

Another important feature is the inclusion of applicable tax information. This is essential for compliance with local regulations and helps both parties manage their tax obligations. Lastly, a section that clearly outlines any penalties for late payment can serve as a reminder to your clients of their financial responsibilities.

Why Every Sole Trader Needs an Invoice

For independent professionals, keeping clear and accurate records of services rendered or goods sold is essential for maintaining a successful business. An official document outlining the terms of each transaction helps ensure transparency between the service provider and the client. It also serves as a formal request for payment, detailing all necessary information in a clear and organized manner.

Without a proper method of documenting sales, it becomes difficult to track income, manage taxes, and maintain professional relationships. A well-structured document not only provides the client with the necessary information to make payment but also offers the business owner a way to track financial transactions efficiently.

| Key Benefits | Description |

|---|---|

| Professionalism | Demonstrates a structured and organized approach to business dealings. |

| Legal Protection | Ensures clarity on the terms of the sale, protecting both parties in case of disputes. |

| Financial Tracking | Helps keep track of earnings and facilitates budgeting and tax calculations. |

| Payment Reminders | Clearly defines payment terms and deadlines to encourage timely payments. |

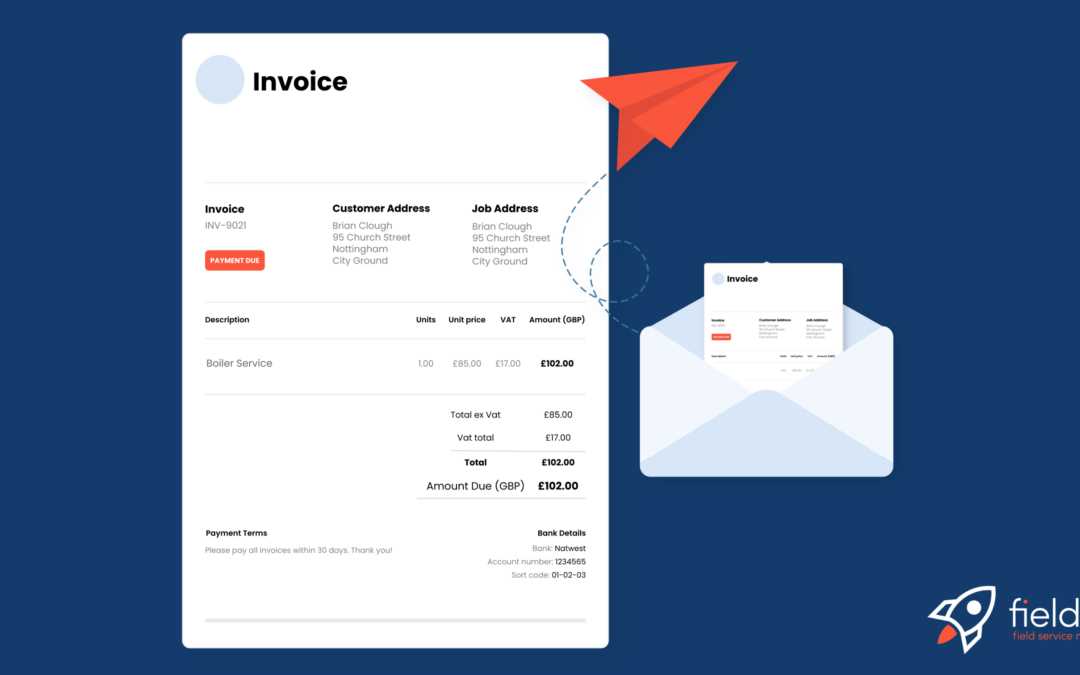

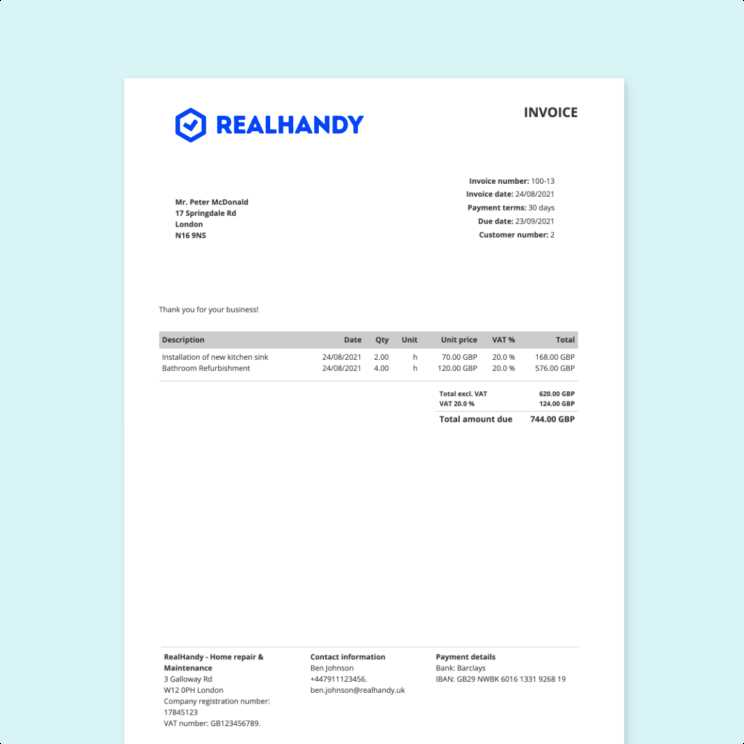

How to Create Professional Invoices

Crafting a polished and effective document to request payment requires careful attention to detail. A professional-looking document not only helps maintain your business’s image but also ensures clarity in the terms of the transaction. By following a simple yet structured approach, you can create a clear, easy-to-understand document that reflects the professionalism of your business.

Step-by-Step Guide

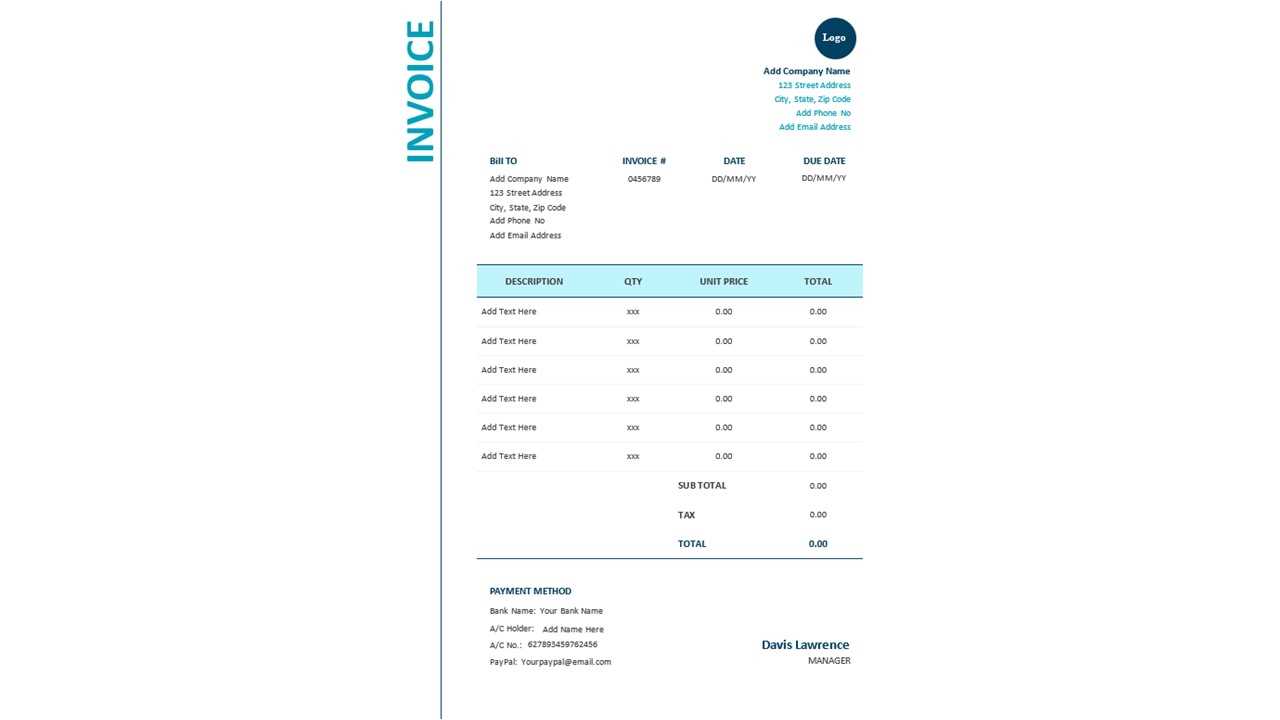

- Include your business name, address, and contact information at the top.

- List the client’s information, including their name, address, and contact details.

- Provide a detailed description of the products or services provided, including quantities and pricing.

- Specify payment terms, including the due date and accepted payment methods.

- Assign a unique reference number to help with tracking and organization.

Additional Tips for Enhancing Your Documents

- Use consistent fonts and colors to maintain a professional appearance.

- Consider including your business logo for added branding.

- Ensure all tax details are clearly stated, including applicable rates.

- Include clear instructions for payments and penalties for overdue amounts.

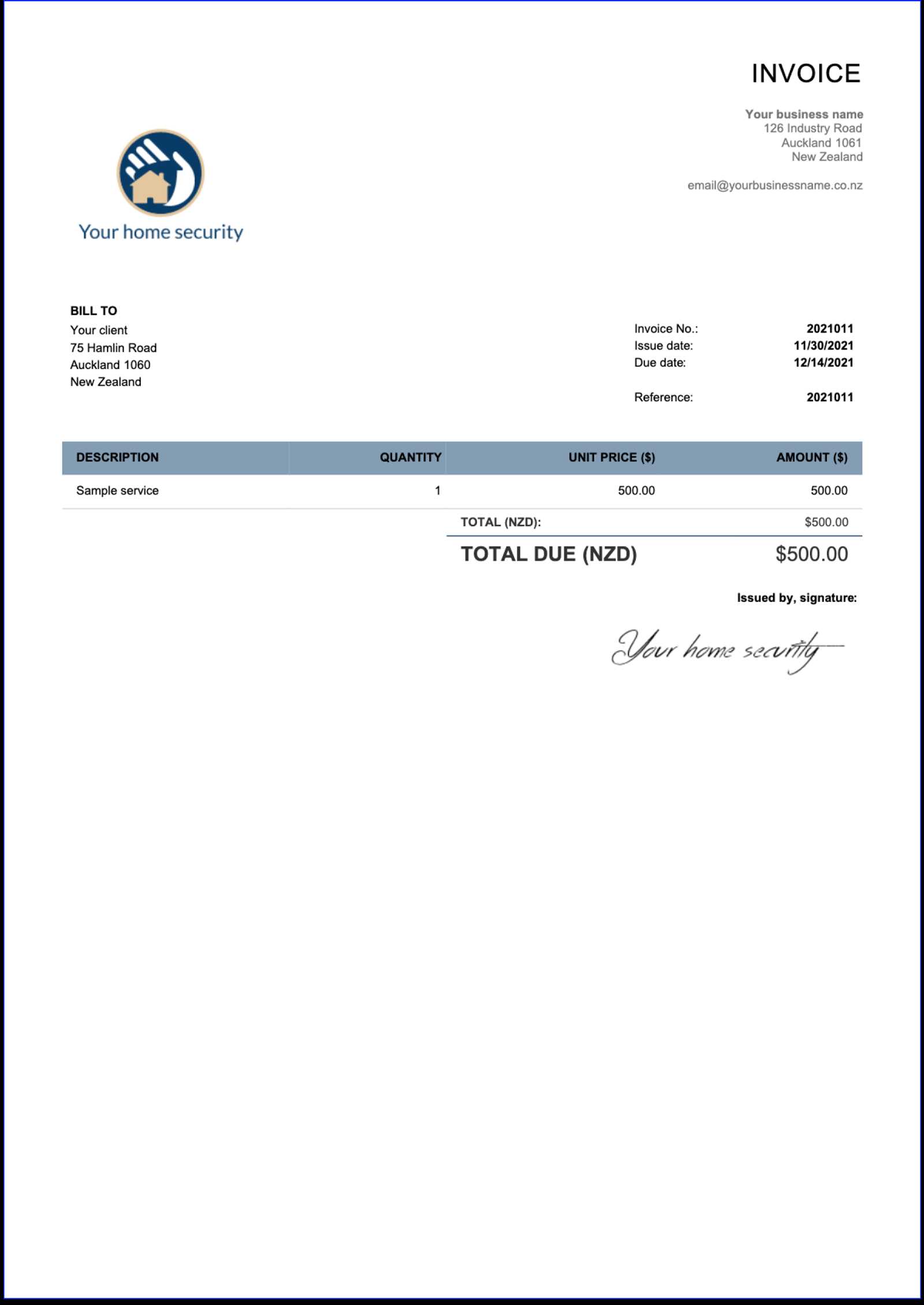

Choosing the Right Format for Invoices

Selecting the right format for your payment request document is crucial for ensuring clarity and professionalism. The format you choose will affect how easily your client understands the information and processes the payment. Whether you opt for a simple layout or a more detailed design, the key is to keep it organized and easy to navigate.

Factors to Consider

- Clarity: Ensure that the document is easy to read and all essential details are prominently displayed.

- Flexibility: Choose a format that can be easily customized to suit different clients and transactions.

- Branding: Opt for a format that reflects your business’s branding, including colors, fonts, and logos.

- Compatibility: Consider the software you will use to create and send the document. Choose a format that is compatible with the tools you are most comfortable with.

Popular Formats

- Digital Documents (PDF, Word): Ideal for sending via email, these formats maintain the integrity of your document’s layout across all devices.

- Spreadsheet (Excel, Google Sheets): A flexible option for those who prefer working with formulas to calculate totals and taxes.

- Online Platforms: There are various invoicing software and tools available that offer customizable formats with automated features.

Key Elements of a Complete Invoice

For any business transaction, having a comprehensive and well-organized document is essential. This document should cover all the necessary details to ensure clarity between the business and the client. A complete document serves not only as a formal request for payment but also as a legal record of the transaction, making it vital to include specific information that ensures both parties are clear on the terms.

At a minimum, this document should include the following key components:

- Business Details: Your business name, address, and contact information must be clearly visible at the top of the document.

- Client Information: Include the name and address of the client to ensure the request is correctly directed.

- Description of Goods or Services: Provide a detailed breakdown of what has been provided, including quantities, rates, and any relevant specifications.

- Pricing Information: Clearly list the cost for each item or service, along with any taxes or additional charges.

- Payment Terms: Specify the payment due date, acceptable payment methods, and any late fees or penalties for overdue payments.

- Unique Reference Number: This helps in tracking and managing your records efficiently.

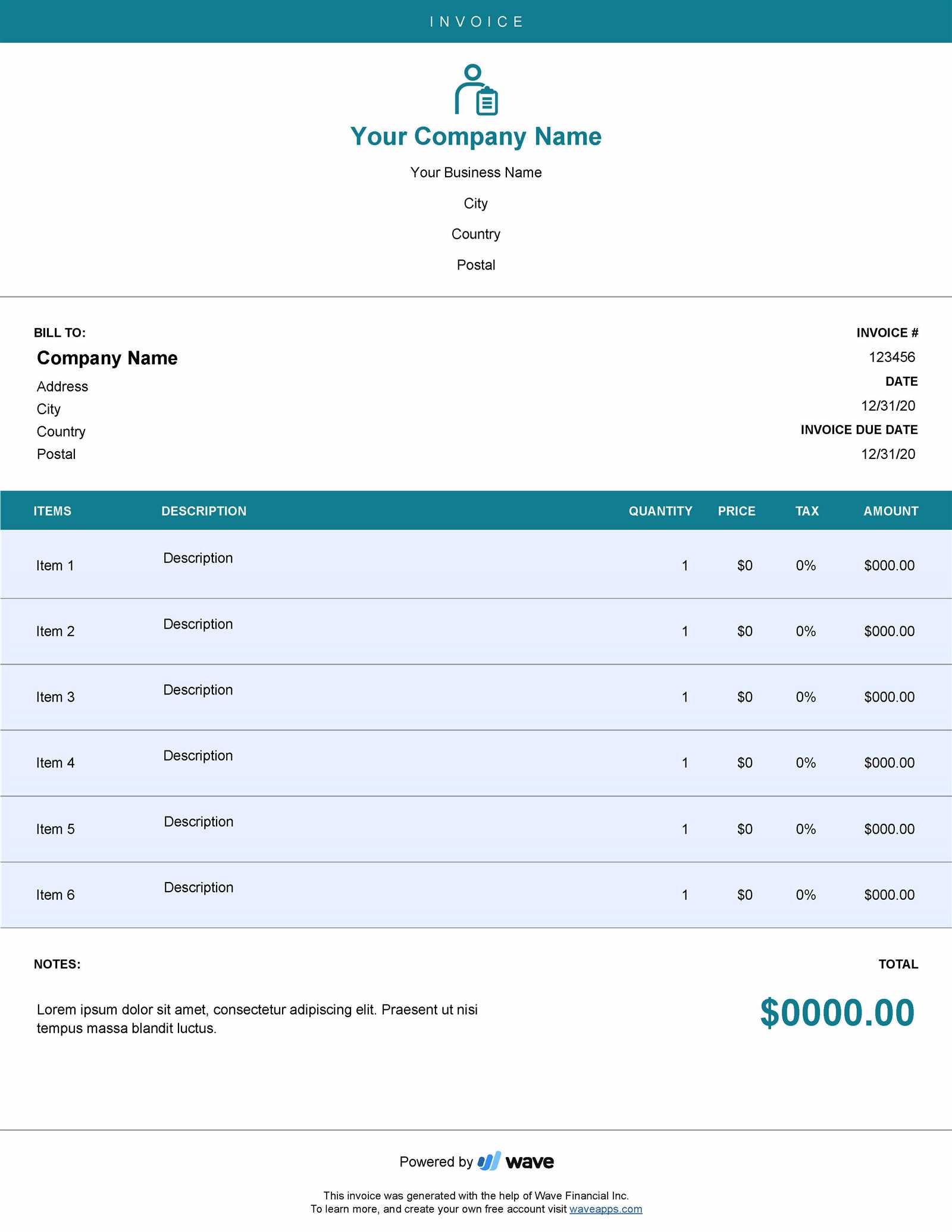

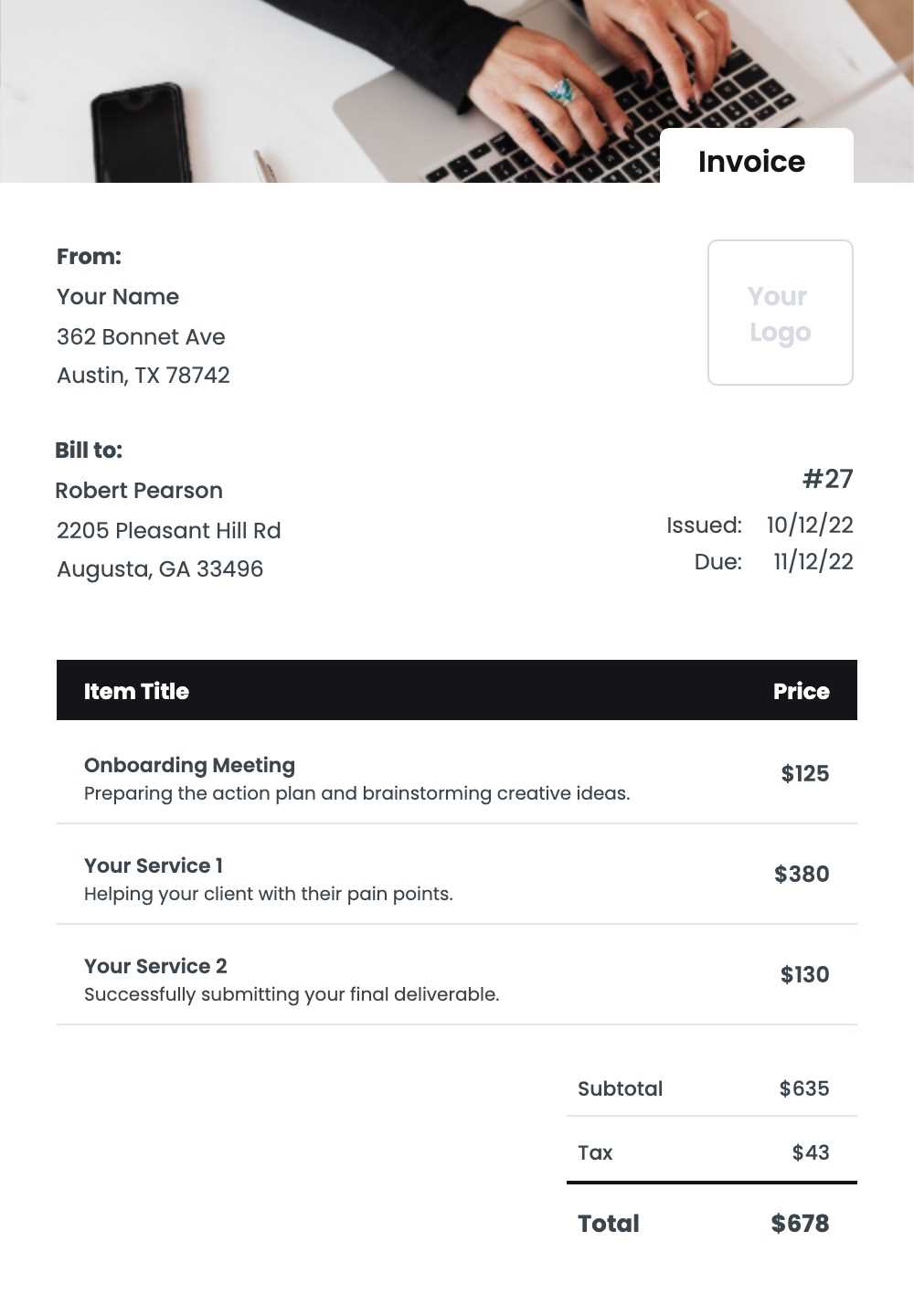

Tips for Customizing Your Invoice Template

Customizing your payment request document is essential for ensuring that it aligns with your business identity and reflects your professionalism. By adjusting the format and content, you can create a more personalized experience for your clients while maintaining clarity and efficiency. Tailoring the document to suit your specific needs will make it easier to manage and keep track of your transactions.

Branding Your Document

Incorporating your business’s logo, color scheme, and fonts can help strengthen your brand identity. A consistent look across all your documents not only makes your business appear more professional but also makes it easier for clients to recognize your materials.

Including Customizable Fields

Make your document more flexible by adding fields that can be easily updated for each transaction. These may include editable sections for product descriptions, quantities, pricing, and taxes. Additionally, providing space for specific client notes or custom terms can ensure that each request is tailored to the needs of the individual project.

Emphasizing Key Information: Use bold or highlighted text for important details such as due dates, payment terms, or any special instructions to ensure they are easily noticed by the client.

Streamlining for Efficiency: The more streamlined and easy-to-read your document, the less time both you and your client will spend reviewing it. Keep it clean and uncluttered while ensuring all necessary details are present and easily accessible.

Legal Considerations for Invoice Templates

When creating a formal document for requesting payment, it is essential to ensure that it meets all legal requirements. A well-crafted document can protect both the business and the client in case of disputes. Understanding the legal aspects of such documents is crucial for staying compliant with local regulations and avoiding potential issues down the line.

Key legal considerations include:

- Tax Information: Ensure that the appropriate tax details are included, such as the applicable rates and tax identification number if required by law.

- Payment Terms: Clearly define the payment due date, late fees, and any other conditions regarding payment to avoid misunderstandings and ensure timely settlements.

- Client Details: Accurately list the client’s name and address. Inaccurate information could cause problems in the event of a dispute or legal review.

- Unique Reference Number: Including a reference number not only helps with tracking but is often a legal requirement for proper record-keeping and tax reporting.

By including all the necessary legal details and adhering to local business laws, you can ensure that your payment request document is both professional and compliant with the law.

How to Manage Invoice Numbers Effectively

Properly managing reference numbers for your payment requests is essential for keeping your financial records organized and ensuring smooth tracking of transactions. An effective numbering system helps both you and your clients stay on top of payments and provides a way to easily reference specific transactions if needed. Implementing a clear and consistent system will also simplify tax reporting and audits.

To manage reference numbers effectively, consider the following strategies:

| Strategy | Description |

|---|---|

| Sequential Numbering | Use a simple, sequential system (e.g., 001, 002, 003) to easily track each document and avoid confusion. |

| Include Date | Incorporate the date of issue (e.g., 2024-01-001) to make it easier to identify when a payment request was made. |

| Client-Specific Prefix | Add a prefix or code specific to each client (e.g., ABC-001) to simplify sorting and organization by customer. |

| Avoid Gaps | Ensure that the numbers are consecutive and there are no skipped numbers. This prevents confusion and maintains a clean record. |

By following these strategies, you can maintain a streamlined system that ensures accurate tracking, reduces the risk of errors, and makes referencing past transactions quick and easy.

Payment Terms to Include in Invoices

Clearly outlining payment terms in your formal documents is essential for avoiding misunderstandings and ensuring timely payments. These terms define how and when payment should be made, as well as any consequences for late payments. Being transparent with your clients about payment expectations can prevent disputes and help maintain a smooth financial process for your business.

Some of the key payment terms to include are:

- Due Date: Specify the exact date by which the payment must be made. This helps avoid delays and keeps both parties on the same page.

- Late Fees: Include information about any penalties or fees that will be charged if the payment is not received by the due date. This can encourage clients to pay on time.

- Accepted Payment Methods: Clearly state the methods through which payments can be made, such as bank transfers, credit card payments, or online payment systems.

- Discounts for Early Payment: Offer a discount to clients who pay before the due date. This can incentivize quicker payments and build stronger client relationships.

- Partial Payments: If you allow clients to make partial payments, include the terms for this option, such as the schedule and any additional fees involved.

By including these essential details, you can create clear and professional documents that set expectations and make the payment process easier for both you and your clients.

Why Accurate Tax Details Matter

Providing precise tax information in your formal payment requests is not only important for transparency but is also essential for legal compliance. Accurate tax details ensure that both you and your clients adhere to the appropriate laws, and they help avoid potential issues during audits or tax filings. A well-documented record also protects your business in case of any future disputes or questions regarding payments.

Key Reasons Why Accuracy is Crucial

- Legal Compliance: Correct tax information ensures that your business complies with local tax regulations and avoids penalties.

- Preventing Errors: Incorrect tax details could lead to overcharging or undercharging, which can affect client relationships and lead to financial discrepancies.

- Streamlined Tax Reporting: Accurate details make it easier to complete tax returns, as everything needed for reporting is clearly outlined and easily accessible.

- Building Trust: Providing clear and accurate tax information enhances your professionalism and helps build trust with your clients.

What to Include in Tax Information

- Tax Identification Number (TIN): Make sure your business’s TIN is clearly listed for both your company and the client, as required by law.

- Applicable Tax Rate: Clearly state the tax percentage applied to the sale, whether it’s sales tax, VAT, or any other relevant tax.

- Tax Amount: Include the exact amount of tax charged on the transaction to avoid confusion.

By ensuring accuracy in tax details, you not only keep your business on the right side of the law but also enhance the credibility and reliability of your operations.

Integrating Branding into Your Invoices

Incorporating your brand’s identity into your payment requests is a powerful way to enhance professionalism and leave a lasting impression on your clients. By customizing your documents with your logo, colors, and overall brand style, you create a cohesive experience that reinforces your business’s identity. A well-branded document not only looks more professional but also helps with recognition and trust-building among your clients.

Why Branding Matters

- Consistency: Consistent branding across all business materials, including payment requests, strengthens your brand’s identity and helps your clients easily recognize your business.

- Professionalism: A polished, branded document reflects a level of professionalism that can differentiate your business from competitors.

- Client Trust: Well-designed payment requests that align with your brand can instill confidence in your clients, making them feel secure in their business dealings with you.

How to Integrate Branding Effectively

- Logo: Place your logo at the top of the document for immediate brand recognition.

- Colors and Fonts: Use your brand’s color palette and fonts consistently throughout the document to maintain a visually appealing and cohesive look.

- Tagline or Business Name: Including your tagline or full business name can further personalize the document and ensure your brand is front and center.

- Custom Design Elements: Consider incorporating design elements such as borders, icons, or patterns that reflect your brand’s visual style.

By integrating these elements, you can transform a simple payment request into a strong branding tool, reinforcing your identity while ensuring professionalism in every communication.

Tracking Payments with Your Invoice

Effectively managing payments is crucial for maintaining a steady cash flow in any business. Including tracking information in your formal payment documents helps you monitor which payments have been received and which are still pending. This simple practice can save you time and reduce the risk of overlooking late payments, ensuring your business runs smoothly and remains financially secure.

To efficiently track payments, consider including the following details in your document:

- Payment Status: Clearly indicate whether a payment has been made, is pending, or overdue. This helps both you and your client stay informed about the payment status.

- Payment Reference Number: Use a unique reference number for each payment. This allows for easy tracking and matching of payments to specific transactions.

- Payment Date: Include the date when the payment was received. This will help you keep accurate records for your financial reporting and tax purposes.

- Outstanding Balance: Display the remaining balance if the full amount hasn’t been paid yet. This provides clarity for the client and helps avoid confusion.

By tracking payments effectively, you not only ensure timely financial management but also build trust with your clients, as they can clearly see the payment status of their outstanding balance. Consistent tracking and clear communication make it easier to address any discrepancies promptly and maintain positive business relationships.

Common Mistakes to Avoid in Invoicing

Managing payments effectively is a key component of running any business. However, there are several common mistakes that can disrupt the invoicing process, leading to confusion, delayed payments, and even legal issues. Being aware of these pitfalls and taking steps to avoid them can help ensure that your financial transactions are handled smoothly and professionally.

Common Pitfalls in Payment Requests

- Incorrect Payment Details: Providing incorrect payment information such as the wrong bank account number or missing payment methods can delay transactions and cause frustration for both parties.

- Missing or Inaccurate Dates: Failing to include an accurate issue date and payment due date can create confusion regarding payment deadlines, leading to late payments.

- Lack of Clear Payment Terms: Without clearly defined payment terms, clients may be unsure of when or how to pay, resulting in misunderstandings and delays.

- Unclear Item Descriptions: Vague or incomplete descriptions of services or products provided can lead to disputes or confusion about the amounts being charged.

How to Avoid These Mistakes

- Double-Check All Details: Always verify that payment information, dates, and amounts are accurate before sending out payment requests.

- Be Specific About Services: Ensure that each item or service is described clearly, including quantities and unit prices, to avoid any confusion.

- Set Clear Terms: Define your payment terms clearly, including accepted methods, due dates, and any late fees that might apply.

- Keep Records: Maintain detailed records of all transactions to prevent discrepancies and ensure that you can quickly resolve any issues if they arise.

By avoiding these common errors and paying close attention to the details of each payment request, you can ensure smoother transactions and maintain strong, professional relationships with your clients.

How to Save Time with Automated Invoicing

Handling financial transactions manually can be time-consuming, especially when you have a growing number of clients. Automating the process of generating and sending payment requests can free up significant time, allowing you to focus on more critical aspects of your business. Automation ensures accuracy, reduces administrative work, and enhances efficiency in managing payments.

Benefits of Automation

- Streamlined Workflow: Automating the creation of payment requests eliminates the need to manually fill in customer details, amounts, and dates each time, reducing repetitive tasks.

- Consistency and Accuracy: Automated systems reduce the chances of human error, ensuring that all the necessary details are consistently included and correctly calculated.

- Quick Payment Reminders: Automation allows you to send reminders for pending payments without delay, ensuring timely follow-ups and improving cash flow management.

- Reduced Paperwork: By automating and using digital payment records, you cut down on physical paperwork and streamline your filing and tracking systems.

How to Get Started

- Choose the Right Software: Select an automation tool or software that aligns with your business needs and integrates well with your payment system.

- Set Up Recurring Templates: Create templates for commonly used payment documents to save time. These can be customized for each client but follow a consistent format.

- Track Payments Automatically: Use automated systems to track received and outstanding payments, sending reminders to clients as necessary.

- Leverage Integration: Integrate your payment processing software with your accounting system to automatically update records and streamline financial reporting.

By incorporating automated systems into your financial processes, you can save valuable time, reduce errors, and maintain a professional approach to handling client payments.

Improving Cash Flow Through Invoicing

Efficient management of payment requests plays a critical role in maintaining healthy cash flow for any business. Ensuring that payments are processed quickly and accurately can help reduce delays in receiving funds, which in turn supports the timely execution of operations and investments. By optimizing the process of issuing payment requests, businesses can create a steady flow of income, reducing financial stress and enhancing growth potential.

Timely Issuance of payment requests is essential for maintaining consistent cash flow. The sooner a payment request is sent out after a service is provided or a product is delivered, the sooner you can expect payment. Delays in sending out these documents can extend the time it takes to receive funds, potentially impacting your ability to pay bills or reinvest in your business.

Clear Payment Terms are another key factor in encouraging prompt payments. By specifying clear deadlines, preferred payment methods, and penalties for late payments, you set expectations for your clients upfront. Clients are more likely to pay on time when they know the exact terms and potential consequences of missing the deadline.

- Incentivize Early Payments: Offering discounts for early payments can encourage clients to settle their dues sooner. This creates a win-win situation where clients benefit from savings, while you receive the funds earlier to support your business operations.

- Monitor Outstanding Payments: Regularly tracking outstanding balances allows you to identify clients who are consistently late and take appropriate action. Setting up automated reminders for overdue payments ensures that you stay on top of the collection process.

- Offer Multiple Payment Methods: Providing clients with a variety of payment options, such as online transfers, credit cards, or digital wallets, makes it easier for them to pay on time, potentially improving cash flow.

Follow-Up Systems are critical to ensuring that delayed payments don’t linger. Having a system in place for timely reminders and follow-up communication helps you maintain control over your finances, ensuring that overdue accounts don’t negatively impact your cash flow.

By fine-tuning your payment processes and improving communication around payment expectations, you can foster stronger financial health for your business and ensure that your operations remain uninterrupted.

Free vs Paid Invoice Templates for Sole Traders

When managing business finances, selecting the right tools for creating payment requests can have a significant impact on efficiency and professionalism. There are various options available, ranging from free resources to more advanced paid options. Understanding the differences between free and paid solutions can help business owners decide which option is best suited for their specific needs.

Advantages of Free Payment Request Solutions

Free options are generally more accessible and provide a straightforward way for small businesses to get started with managing payments. These solutions are often simple and easy to use, making them ideal for those who are just beginning their business journey. Free resources typically include basic features that cover essential elements of a payment request, like contact details, dates, and amounts.

- Cost-effective: Free resources require no upfront cost, making them ideal for businesses with limited budgets.

- Ease of Use: Most free options are designed to be simple, with intuitive interfaces that require little to no training.

- Quick Setup: Since they are often basic, free solutions allow for a fast setup with minimal customization required.

Advantages of Paid Payment Request Solutions

Paid solutions tend to offer more comprehensive features that can save time and enhance the professionalism of your payment requests. These resources often come with customization options, automated systems, and integrated tools that help with bookkeeping and accounting. For business owners who need advanced features or wish to stand out from the competition, investing in a paid solution might be worthwhile.

- Customization: Paid solutions offer greater flexibility for customizing the look and feel of your documents to align with your brand.

- Automation: Many paid options allow for automated reminders and recurring billing, which can save time and reduce administrative work.

- Advanced Features: Integration with accounting software and more detailed tracking features can help streamline financial processes.

Key Differences Between Free and Paid Options

| Feature | Free Solutions | Paid Solutions |

|---|---|---|

| Customization | Limited | Extensive |

| Automation | None or Basic | Advanced |

| Integration with Accounting Software | Not Available | Available |

| Cost | Free | Subscription/One-time Payment |

Ultimately, the choice between free and paid solutions depends on the needs of your business. If you have a limited budget and only need basic functionality, free options may be sufficient. However, if your business is growing and requires more advanced features, investing in a paid solution could be a wise choice to improve efficiency and enhance your financial management processes.