Top Invoice Template Software for Contractors to Simplify Billing

For professionals managing their own business, staying on top of finances can be time-consuming and complex. The process of issuing accurate bills, tracking payments, and maintaining records requires an efficient system that saves time while ensuring accuracy. An effective solution is to use tools designed to simplify and automate this process, making financial management easier and less stressful.

With the right digital tools, creating and managing payment requests becomes quicker and more efficient. These tools allow users to customize documents, track due amounts, and ensure a professional presentation with minimal effort. The ability to tailor each document to reflect specific project details or client agreements makes it easier to maintain clear and transparent communication.

For those managing multiple clients or projects, having a reliable system is key to reducing administrative work. From automating repetitive tasks to tracking the status of payments, modern solutions offer a range of features that help professionals focus on the work that matters most, without worrying about the back-end processes. By embracing these digital options, individuals can streamline their business operations and improve overall productivity.

Invoice Template Software for Contractors

Professionals who offer services on a project basis often need a streamlined way to request payment and track financial records. The right tools can make this process much more efficient by automating tasks and ensuring that payment requests are clear, accurate, and professional. These tools are especially useful for managing multiple clients and keeping track of different project details without the need for complex manual work.

By using a specialized platform, professionals can simplify the creation of billing documents, reducing errors and saving time. These platforms often come with a variety of customizable options, allowing users to create documents that meet their specific needs, whether they require detailed descriptions of services rendered or quick, straightforward payment requests. The key features of such tools typically include:

- Customizable document formats – Choose from various layouts and designs to reflect your brand or style.

- Automatic calculations – Avoid manual errors with built-in calculations for rates, taxes, and discounts.

- Client management – Easily track contact information, payment history, and outstanding balances.

- Seamless integration – Sync your system with accounting tools and banking platforms for streamlined processes.

- Payment reminders – Automatically notify clients of upcoming or overdue payments.

These tools can significantly reduce the time spent on administrative tasks, allowing professionals to focus more on the work itself. With flexible options and the ability to easily update and track payment details, managing finances becomes less of a burden and more of a streamlined process that enhances business operations.

Why Contractors Need Invoice Templates

Professionals offering services on a project basis often face the challenge of maintaining a consistent and efficient way to bill clients. Managing payment requests, ensuring clarity, and staying organized can quickly become overwhelming without the right tools. Having a structured system to handle financial transactions is essential for maintaining professionalism, avoiding confusion, and ensuring timely payments.

For those working independently or managing multiple clients, it’s crucial to have a standardized method for documenting the work completed and requesting compensation. Using pre-designed forms to capture all necessary information can save time and prevent mistakes that might arise from starting from scratch every time. Some of the key reasons for adopting this method include:

- Professionalism – A well-designed document gives clients confidence that they are dealing with a reliable and organized individual or business.

- Time efficiency – With ready-made formats, users can quickly fill in project details and amounts, saving time on administrative tasks.

- Consistency – Ensuring all financial documents follow a uniform format prevents discrepancies and makes it easier to track payments across different clients.

- Accuracy – Pre-designed systems can automatically calculate totals, taxes, and discounts, reducing the chances of human error.

- Legal compliance – Standardized documents ensure that all necessary information is included, helping with tax filings and financial record-keeping.

By utilizing ready-to-use forms, professionals can focus more on their work and less on the administrative burden, ultimately streamlining the financial aspects of their business. This approach also helps foster transparency with clients, leading to better communication and smoother transactions.

Top Features to Look for in Invoice Software

When selecting a tool to manage payment requests and financial records, it’s essential to choose a solution that not only meets your basic needs but also enhances the overall efficiency of your business. The right system can simplify administrative tasks, improve accuracy, and help you stay organized, making it easier to focus on the core aspects of your work. Here are some key features to look for when evaluating a platform for managing billing and payment processes.

Customization options are crucial. Every professional has unique needs depending on the type of services offered and the clients served. The ability to tailor documents with your branding, project details, and specific terms helps create a more personal and professional appearance. This customization can extend to various aspects, such as layout, fonts, and included sections like payment terms or service descriptions.

Automatic calculations can significantly reduce the time spent on manual work and ensure that totals, taxes, and discounts are always accurate. Having a system that automatically updates amounts as changes are made to the document or client details can prevent costly errors and streamline the overall process.

Integration with accounting tools is another important feature. Seamless connections with other business management platforms, such as accounting or banking apps, make it easy to track payments, generate reports, and reconcile financial records. This integration allows for better visibility of your cash flow and simplifies tax preparation.

Client management features are invaluable for businesses working with multiple clients or projects. A system that stores contact details, payment histories, and outstanding balances helps you stay organized and follow up efficiently when needed. Additionally, the ability to track the status of each request ensures that nothing falls through the cracks.

Finally, automated reminders can help ensure timely payments. Instead of manually reminding clients about overdue amounts, a system that sends automatic notifications can save time and reduce the chances of delayed payments. This feature can also improve your professional reputation by helping clients stay on top of their payment obligations without feeling pressured.

By selecting a platform with these essential features, you can create a more efficient, organized, and professional system for managing financial transactions. This will ultimately lead to a smoother workflow and greater business success.

How to Choose the Right Invoice Template

Selecting the right document design to request payment is essential for maintaining professionalism and ensuring that all necessary details are captured. A good structure not only makes the process easier for you but also helps your clients understand what’s due and why. When evaluating different options, it’s important to consider factors like customization, ease of use, and the specific features that will best support your needs.

Here are a few key points to consider when choosing the most suitable format for your billing needs:

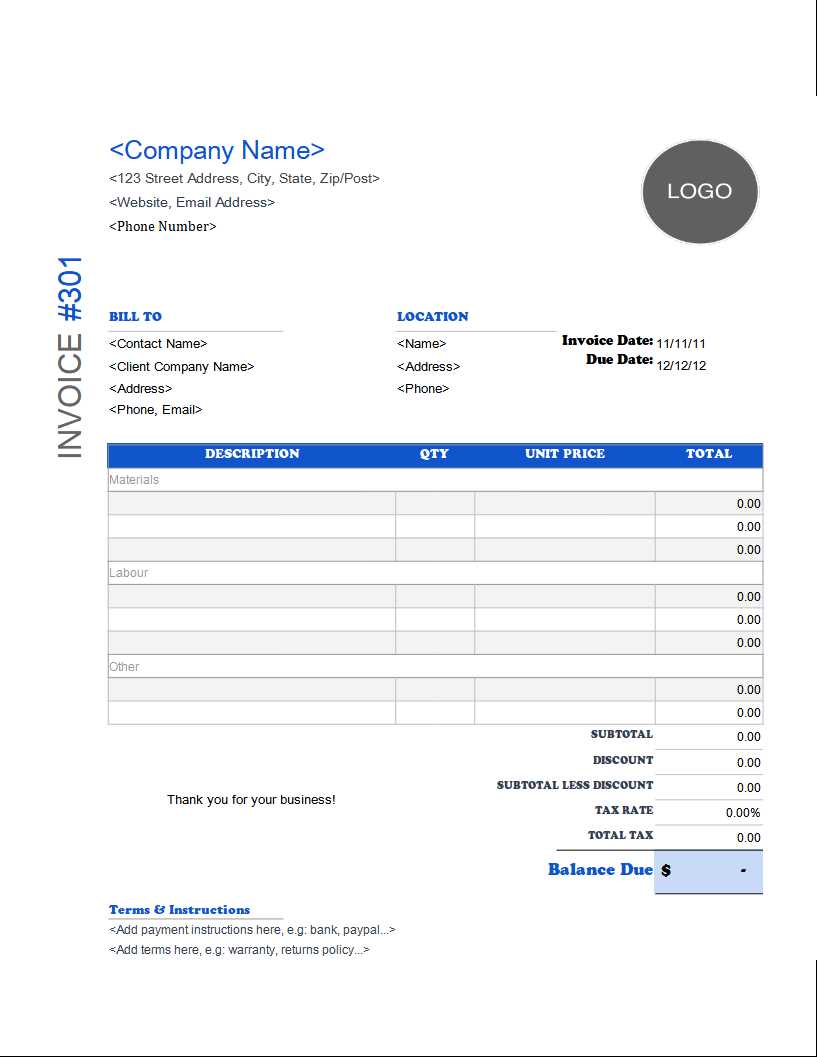

- Customizability – Choose a format that allows you to tailor the details. The ability to add your logo, project descriptions, or payment terms ensures your document reflects your branding and specific client requirements.

- Clear Layout – Select a design with a clean, easy-to-read structure. It should clearly differentiate between services provided, rates, taxes, and any other relevant charges. A cluttered document can confuse clients and cause delays in payment.

- Automatic Calculations – Look for a format that automatically updates totals, taxes, and any discounts or adjustments. This eliminates the risk of errors and ensures that your figures are always accurate.

- Professional Appearance – The format should look polished and credible. Well-designed layouts can enhance your reputation and make a lasting impression with clients.

- Flexibility for Different Services – Choose a structure that can accommodate various project types or service offerings. If your work varies from one client to the next, having a flexible format that can adjust to different needs is crucial.

- Client Communication Features – Ensure the structure allows you to include all relevant payment details, such as due dates, payment instructions, and contact information. These elements can improve communication and help ensure timely payment.

By considering these factors, you can select a design that works seamlessly for your business and ensures smooth transactions with clients. A well-structured document helps convey professionalism and simplifies financial management, leading to better relationships and fewer delays in payment.

Benefits of Customizable Invoice Templates

Having the ability to modify billing documents to suit your needs offers significant advantages in terms of both efficiency and professionalism. A flexible format allows for easy adjustments to reflect the specifics of each project or client, helping you manage a wide range of tasks more effectively. The freedom to customize your documents ensures that all essential information is presented clearly and consistently, enhancing the client experience and improving your business operations.

Key Advantages of Customizable Documents

Customizing your billing documents provides the following benefits:

| Benefit | Description |

|---|---|

| Brand Consistency | The ability to add your logo, colors, and fonts ensures that all documents reflect your company’s unique identity, strengthening brand recognition with clients. |

| Tailored Information | Adjust the layout to include project-specific details, client instructions, and payment terms that are relevant to each job, ensuring accuracy and clarity. |

| Improved Client Relations | A well-tailored document enhances transparency, helping clients understand charges, deadlines, and payment methods, ultimately fostering better communication. |

| Time Efficiency | Customizable options allow you to quickly create consistent, professional documents without starting from scratch each time, saving you valuable time. |

| Flexibility for Different Services | Whether you’re offering hourly rates, fixed fees, or a combination of both, customizable layouts make it easy to adjust billing details for various service types. |

Why Customization Matters

In a competitive business environment, standing out and providing clear, well-structured payment details is essential. Customized documents not only improve the appearance of your financial paperwork but also enhance the overall client experience. The ability to quickly adapt documents to different clients or projects ensures that your business remains organized and professional, helping to build trust and streamline your financial processes.

Saving Time with Automated Invoices

Managing the financial side of a business can quickly become overwhelming, especially when dealing with multiple clients and ongoing projects. One of the most effective ways to reduce the administrative burden is by automating the billing process. Automation not only saves time but also ensures consistency, accuracy, and timely delivery of payment requests, allowing professionals to focus more on their core work.

By automating key aspects of the billing process, tasks that would traditionally take up valuable time are handled effortlessly. These automated systems allow for quicker generation of payment requests, reducing the need for manual input and eliminating the risk of common errors. The main time-saving features include:

- Pre-filled Client Information – Once client details are entered, they are automatically populated into future payment requests, eliminating the need to re-enter the same information repeatedly.

- Recurring Billing – For clients with ongoing contracts or subscription-based services, automated systems can generate payment requests on a set schedule without requiring manual intervention.

- Built-in Calculations – Automated tools calculate totals, taxes, and discounts instantly, saving time and ensuring accuracy in every request.

- Instant Delivery – After a request is created, automated platforms can immediately send it to clients via email or other preferred methods, streamlining communication and reducing delays.

- Automatic Reminders – Systems can send payment reminders to clients based on preset intervals, reducing the need for manual follow-ups and ensuring timely payments.

With these time-saving features, the entire process of managing financial documents becomes significantly more efficient. Instead of spending hours on each request, professionals can generate and track payments in just a few clicks. This leads to fewer administrative tasks, fewer errors, and more time available for actual project work, ultimately increasing productivity and client satisfaction.

Creating Professional Invoices in Minutes

Creating a polished and professional payment request doesn’t have to be a time-consuming process. With the right tools, you can generate clean, well-organized documents in just a few minutes, ensuring that all necessary details are included without spending unnecessary time on formatting or calculations. This quick turnaround is especially beneficial for busy professionals who need to maintain a high standard while managing multiple clients and projects.

By using an efficient platform, you can easily input the essential information and have a finished document ready for delivery in no time. The process can be broken down into simple steps, allowing you to generate professional-looking payment requests with minimal effort:

- Easy Input Fields – Simply enter key details such as service descriptions, client information, and payment amounts into pre-designed fields.

- Customizable Layouts – Choose from a variety of pre-built designs or adjust the layout to reflect your unique brand and style, making sure the document looks polished and consistent.

- Automatic Calculations – Let the system handle tax calculations, discounts, and totals to ensure accuracy without manual effort.

- Fast Delivery Options – Once the document is ready, you can instantly send it to your client via email or other preferred channels, reducing wait times and speeding up the billing cycle.

This streamlined process ensures that you spend less time on paperwork and more time on your actual work, improving both efficiency and client satisfaction. In just a few steps, you can create documents that look professional, are free from errors, and help establish trust with your clients. With these tools at your disposal, generating high-quality payment requests becomes an easy and quick task.

Integrating Invoice Software with Accounting Tools

For professionals managing their own business, streamlining financial processes is key to maintaining organization and improving efficiency. One of the most effective ways to simplify your workflow is by connecting billing systems with accounting tools. This integration helps ensure that all financial data is synchronized across platforms, eliminating the need for manual data entry and reducing the risk of errors.

By linking your payment request system with accounting applications, you can seamlessly transfer information between the two, making tasks like tracking expenses, managing taxes, and preparing financial reports much more efficient. Here are some of the key benefits of integrating these systems:

- Automated Data Syncing – When payment requests are generated, the details automatically update in your accounting records, saving time on manual input and preventing discrepancies between documents.

- Real-Time Financial Overview – Integration provides instant access to up-to-date financial data, helping you monitor cash flow, outstanding payments, and profits without switching between different tools.

- Simplified Tax Preparation – Having all financial transactions in one place makes it easier to track deductions, expenses, and income for tax filing, ensuring accuracy and reducing the time spent on tax-related tasks.

- Streamlined Reporting – With integrated systems, you can generate comprehensive reports that combine payment data, tax information, and expenses, providing a clearer view of your overall financial health.

- Better Financial Planning – Real-time synchronization helps with forecasting and budgeting, as you can more accurately track income and expenditures, making it easier to plan for future projects or investments.

Integrating your billing system with accounting tools not only simplifies your financial management but also reduces administrative stress, giving you more time to focus on growing your business. By automating data syncing and providing a comprehensive view of your finances, you can ensure better accuracy and efficiency in every aspect of your financial operations.

Best Invoice Template Options for Freelancers

Freelancers often juggle multiple projects and clients, which makes it crucial to have a quick, easy, and professional way to manage payment requests. Choosing the right document format can simplify the billing process, ensuring accuracy and timeliness while presenting a professional image to clients. With various designs and features available, it’s important to select the one that best suits your business style and needs.

Top Options for Freelancers

The following options offer flexibility, simplicity, and essential features to help freelancers streamline their billing process:

| Option | Description | Best For |

|---|---|---|

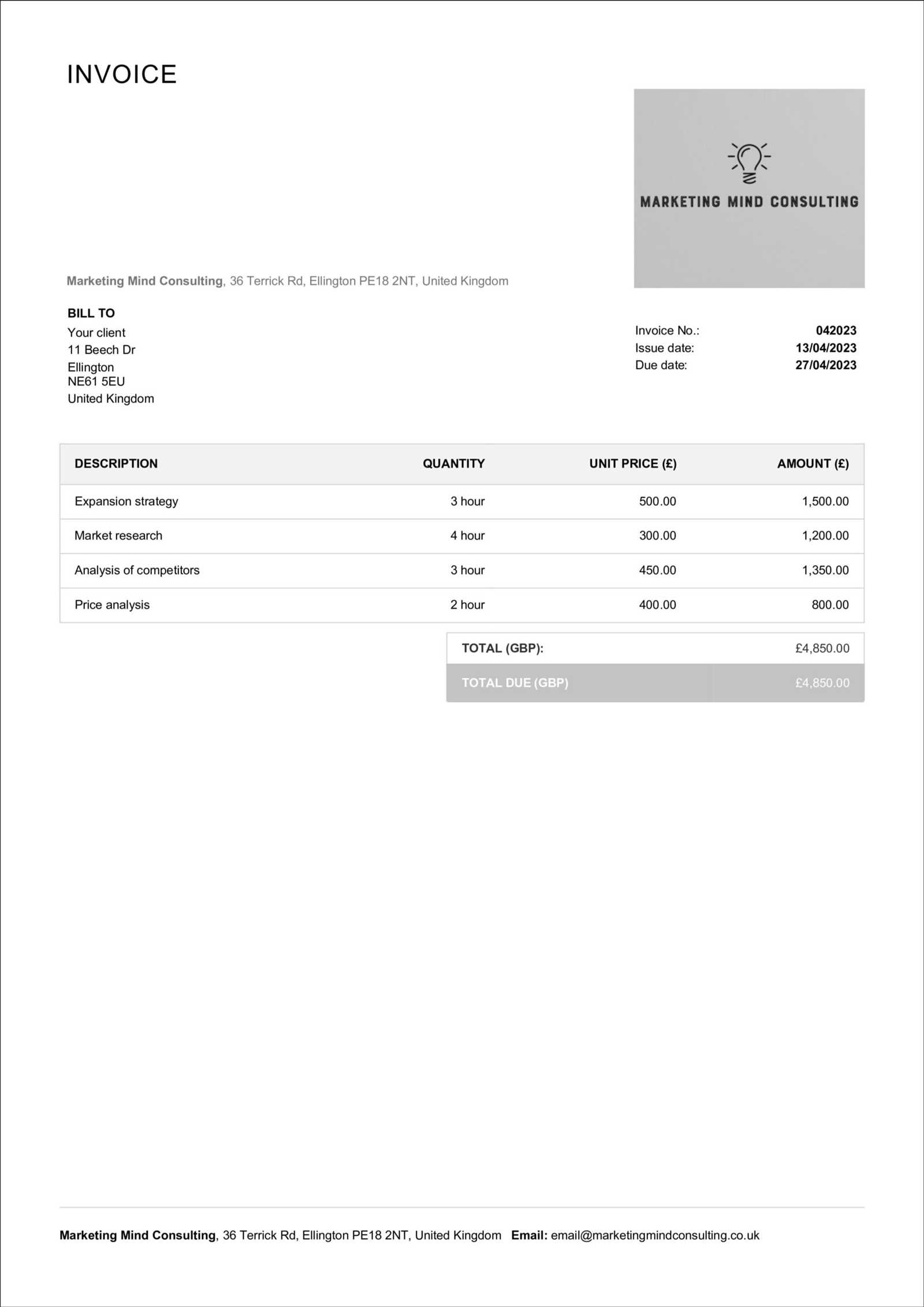

| Basic Layout | A simple and clean format with the necessary fields such as service description, total amount, and payment terms. | Freelancers who need a straightforward, no-frills document for quick billing. |

| Itemized Breakdown | Includes detailed itemized sections where freelancers can break down services, hours worked, and rates. | Freelancers offering complex or hourly-based services that require detailed billing. |

| Branding-Friendly | Allows for easy customization with logos, colors, and fonts to reflect your personal brand. | Freelancers looking to maintain a consistent brand image in all business communications. |

| Recurring Billing | Pre-set formats for freelancers with clients on retainer or subscription-based services. | Freelancers with long-term clients or recurring service arrangements. |

| Multi-Currency Support | Supports different currencies, making it ideal for international clients. | Freelancers working with clients from different countries or regions. |

Why Choose the Right Format?

Selecting the appropriate design not only makes your billing process more efficient but also enhances your professional image. Whether you need a simple layout for quick tasks or a more detailed format for long-term projects, the right choice helps ensure accuracy, clarity, and consistency in every payment request. By customizing your documents to fit your business model, you can save time while delivering a polished experience for your clients.

How Invoice Templates Improve Payment Tracking

Managing payments efficiently is crucial for maintaining healthy cash flow and ensuring that no transaction is overlooked. By using a structured approach to billing, professionals can easily track outstanding payments, monitor due dates, and keep a clear record of completed transactions. A well-organized document layout significantly enhances the ability to track payments, reducing the risk of missed or delayed payments and improving financial oversight.

Clear Payment Documentation

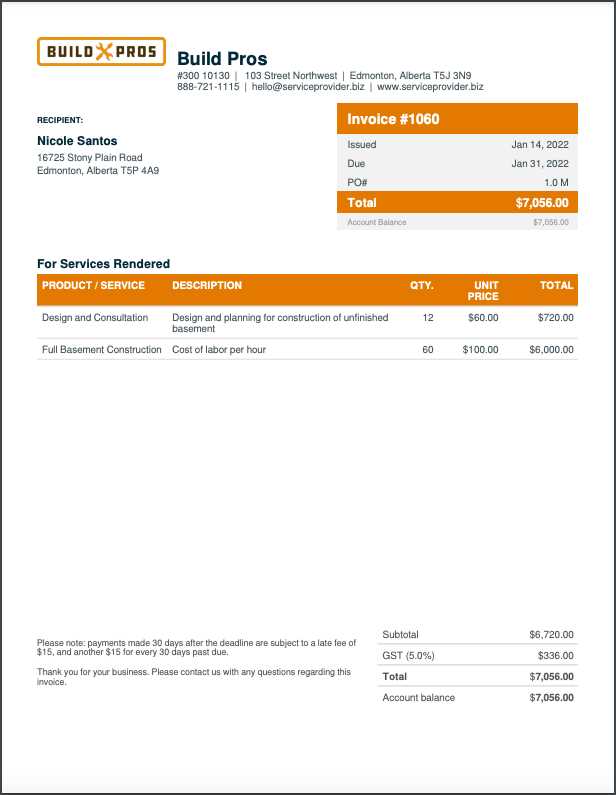

When creating payment requests with predefined formats, essential details like payment due dates, service descriptions, and amounts owed are automatically included. This clarity not only helps clients understand exactly what they’re being billed for but also makes it easier for professionals to track outstanding amounts. With all the key data in one place, it’s simpler to follow up on overdue payments or identify discrepancies in payment history.

Automated Payment Status Updates

Many structured billing systems automatically track the status of payments, updating the payment request as soon as the client makes a payment. This integration ensures that you always know whether a client has paid in full, partially paid, or not yet paid, without the need for manual checks. Some systems even allow for automatic reminders to be sent to clients for overdue payments, helping to speed up the collection process and reducing the administrative effort required to follow up on unpaid bills.

With these tools in place, professionals can more effectively manage their financials, ensuring that all transactions are accounted for and reducing the time spent on chasing late payments. Whether managing multiple clients or ongoing projects, using an organized approach to billing significantly improves payment tracking and helps maintain smooth cash flow.

Ensuring Legal Compliance with Invoices

For any business, ensuring that payment documents adhere to legal standards is essential for avoiding disputes and ensuring smooth financial operations. By following the necessary guidelines and including required information, you can prevent potential legal issues related to billing. Compliance not only protects your business but also builds trust with your clients by showing that you adhere to the regulations governing transactions in your industry or region.

Essential Legal Elements to Include

To maintain legal compliance, payment documents should include specific details that are often required by tax authorities or financial institutions. These include:

- Business Identification – Include your legal business name, registration number (if applicable), and contact details to establish your legitimacy.

- Client Information – Clearly state the client’s full name or company details, as this information is necessary for both parties’ records.

- Unique Reference Number – Every document should have a unique number to easily track transactions and avoid confusion.

- Detailed Description of Services – A clear breakdown of the products or services provided is essential for avoiding disputes and ensuring transparency.

- Payment Terms – State the payment due date, accepted methods, and any penalties or late fees for overdue payments to help manage expectations.

- Tax Information – Depending on your location, it may be required to include tax registration numbers and applicable taxes or VAT on each payment request.

Why Legal Compliance Matters

By ensuring that your payment documents include all necessary legal information, you not only reduce the risk of fines or penalties but also demonstrate your professionalism to clients. Having compliant documents can also make tax reporting and audits smoother, as all the required details will be clearly outlined and easy to track. Adhering to legal guidelines helps avoid any misunderstandings with clients or regulators and ensures that you are operating within the framework of the law.

Tracking Project Costs with Invoice Software

Effective cost management is essential for the success of any project. By using automated tools to manage billing and track expenses, professionals can gain real-time insights into the financial health of a project. These systems help keep a clear record of all charges, from labor to materials, and ensure that all costs are accounted for, reducing the risk of overspending and ensuring profitability.

Real-Time Expense Tracking

One of the key advantages of using automated tools for billing is the ability to track expenses as they occur. Each transaction or charge can be entered into the system, allowing you to see how costs accumulate throughout the project. This real-time tracking provides a clear picture of where the money is going, helping to identify any unexpected expenses early on and make adjustments as needed. Features like categorizing costs and adding detailed descriptions for each entry can further enhance the ability to monitor spending.

Project Financial Overview

With automated systems, you can easily generate comprehensive reports that provide a snapshot of your project’s financial status. These reports typically include data on total earnings, outstanding payments, and any additional costs incurred during the project. Having all this information in one place helps with budgeting and forecasting, allowing you to plan future projects more accurately and avoid financial surprises.

By integrating cost tracking into your billing process, you can ensure better oversight and control over your projects. This not only helps keep expenses within budget but also ensures that you can make informed decisions about pricing and resource allocation. With the right tools, managing project finances becomes an organized, streamlined process that supports long-term business success.

How Invoice Templates Help with Client Communication

Clear and effective communication with clients is essential for maintaining strong professional relationships and ensuring smooth project execution. When it comes to billing, having a structured and consistent way to present payment requests can enhance clarity and avoid misunderstandings. Using a standardized format not only helps convey the necessary information but also shows professionalism and reliability, which fosters trust and transparency.

Consistency in Communication

One of the key benefits of using pre-designed billing formats is the ability to maintain consistency in how information is presented to clients. With a consistent layout, clients can quickly find and understand the details of the transaction, such as the amount due, the services provided, and payment terms. This reduces the likelihood of confusion and ensures that both parties are on the same page. A well-structured document helps reinforce your professionalism and builds confidence in your business practices.

Improved Transparency and Clarity

A clear, standardized format helps prevent disputes by ensuring that all necessary details are included, such as a breakdown of services, payment schedules, and any additional charges. This level of transparency allows clients to understand exactly what they are being billed for, which is especially important for ongoing projects or when working with new clients. By providing complete and accurate documentation, you create a transparent communication channel, which encourages clients to address concerns upfront and promotes quicker resolution of any potential issues.

Ultimately, using a structured approach to billing not only helps with day-to-day communications but also strengthens your reputation as a reliable and organized professional. Clients are more likely to trust and maintain a long-term working relationship with someone who consistently provides clear, transparent, and timely documentation.

Using Invoice Templates for Tax Season

During tax season, managing financial records becomes crucial for businesses and professionals who need to ensure that their earnings and expenses are accurately documented. One of the most effective ways to stay organized and simplify tax preparation is by using structured billing formats that clearly track payments and transactions. These well-organized documents can make the process of filing taxes much easier, reducing the risk of errors and saving valuable time.

Why Structured Billing Helps in Tax Season

Having a consistent and clear method of documenting payments ensures that you have all the necessary data when it comes time to prepare tax filings. When each transaction is recorded accurately and systematically, it becomes much easier to:

- Track Income – Structured billing makes it easy to see exactly how much money you’ve earned throughout the year, making it simpler to report income and avoid discrepancies.

- Organize Expenses – Including detailed descriptions of services, fees, and taxes helps you clearly categorize business expenses, which can be important for deductions and reporting.

- Verify Tax Information – With clear documentation of amounts, taxes collected, and client details, you can easily verify tax-related information when preparing returns or during an audit.

- Prepare Reports Quickly – Instead of sifting through disorganized records, you can quickly generate reports that summarize your earnings, taxes, and other financial details in a structured format.

Key Features to Look for During Tax Season

To ensure your records are as useful as possible for tax filing, look for specific features in your billing system that will help with organization and reporting:

- Automatic Tax Calculations – Many billing formats include automatic tax calculation, helping you ensure the right amount of tax is included and making it easier to track tax payments.

- Expense Categories – Having the ability to categorize your expenses (e.g., travel, materials, services) helps streamline the process of claiming business-related deductions.

- Payment Status Tracking – Being able to quickly check which payments are outstanding, paid, or overdue ensures that you have accurate records of cash flow for the tax year.

- Export Options – Some systems allow you to export records directly into tax preparation tools or accounting software, making the process even more efficient.

By using organized billing formats throughout the year, you can make tax season much less stressful. The right tools ensure you have everything you need to file on time, stay compliant, and maximize deductions, all while maintaining accuracy and professionalism in your financial records.

Cloud-Based vs. Desktop Invoice Software

When choosing the right tools for managing billing and financial tasks, one of the most important decisions is whether to go with cloud-based or desktop solutions. Both options offer their own set of advantages, depending on your needs and business environment. Cloud-based solutions offer flexibility and easy access from anywhere, while desktop systems provide a more traditional and secure method of managing documents locally. Understanding the differences between the two can help you make an informed choice that best suits your workflow and budget.

Advantages of Cloud-Based Systems

Cloud-based tools have become increasingly popular for businesses due to their accessibility and ease of use. Here are some of the main benefits:

- Accessibility from Anywhere – Cloud systems allow you to access your documents from any device with an internet connection, which is ideal for businesses that need to manage finances on the go or from multiple locations.

- Automatic Updates – These solutions are frequently updated with the latest features and security patches, ensuring your system is always up-to-date without any manual effort.

- Collaboration Features – Cloud-based tools often include features for team collaboration, allowing multiple users to access, edit, and manage documents simultaneously, which is especially useful for teams working remotely or on large projects.

- Data Backup and Security – Since data is stored in the cloud, it’s automatically backed up, reducing the risk of losing important information due to local hardware failures.

Advantages of Desktop Systems

For those who prefer to keep their documents offline and under tight control, desktop tools still hold significant value. Some of the benefits include:

- Data Security – Desktop solutions store data locally, providing a sense of security for users who prefer to avoid online storage. This can be especially important for those with strict privacy concerns.

- One-Time Cost – Many desktop programs require a one-time purchase, which might be more cost-effective in the long run for businesses that don’t want ongoing subscription fees.

- Offline Access – Unlike cloud tools, desktop solutions don’t require an internet connection to access and edit documents, which can be a key advantage for those in areas with unreliable internet service.

- Customization – Desktop systems can often be more customizable, allowing businesses to fine-tune features and settings according to their specific needs and workflow.

Choosing between cloud-based and desktop options ultimately depends on your business model, security concerns, and how you prefer to manage your documents. Cloud solutions offer flexibility and real-time collaboration, while desktop tools may be better for businesses seeking more control and security over their data.

Common Mistakes to Avoid with Invoicing

Effective billing is key to maintaining cash flow and ensuring smooth business operations. However, many professionals make avoidable errors when creating payment requests that can result in delayed payments, confusion, or even legal issues. Being aware of these common mistakes and taking steps to avoid them can help you maintain professionalism and ensure you are paid promptly for your work.

1. Failing to Include Essential Information

One of the most common mistakes is not providing all the necessary details in a payment request. Without clear and complete information, clients may delay payments or question charges. Below is a list of essential elements that should always be included:

| Essential Information | Description |

|---|---|

| Client Details | Ensure the client’s full name or company name, address, and contact information are included. |

| Clear Breakdown of Services | List all the services or products provided, with corresponding prices or fees. |

| Payment Terms | State the due date and any late fees or penalties for overdue payments. |

| Unique Reference Number | Include a unique number for each payment request to make it easier to track and reference. |

2. Not Setting Clear Payment Terms

Another mistake is failing to clearly outline payment terms. Without setting expectations regarding when payments are due and what happens if payments are delayed, confusion can arise. Clients may not realize the urgency of paying on time or may dispute charges due to lack of clarity. Always be clear about:

- When payments are due (e.g., within 30 days of receiving the request).

- Accepted payment methods (e.g., bank transfer, credit card, etc.).

- Late fees or penalties for overdue payments.

3. Overlooking Tax Information

Not including or correctly calculating taxes is a common pitfall. This can cause discrepancies in the amount the client is required to pay and may lead to legal issues or problems with tax authorities. Always double-check that:

- Sales tax or VAT is correctly applied (if applicable).

- Your business’s tax identification number is included, if required.

- Tax rates match the client’s location or applicable laws.

4. Making Errors in Numbers and Dates

Small errors in numbers or dates can lead to confusion and delay payments. For instance, typing an incorrect amount, miscalculating taxes, or listing the wrong due date could cause clients to question the payment request. To avoid this, always:

- Double-check the amounts and calculations.

- Verify that the due date aligns