Best Invoice Templates for Businesses in Singapore

Managing finances effectively is essential for the success of any business. Clear, structured billing documents can enhance professionalism, streamline transactions, and establish trust with clients. By organizing billing formats thoughtfully, businesses can simplify payment processes and maintain accurate records.

Today’s digital tools offer various ways to design efficient billing documents suited to diverse business needs. Choosing the right structure for your documents can make a significant difference in payment processing speed, client satisfaction, and brand image. By tailoring documents to reflect your brand and meet local requirements, you set a solid foundation for smooth financial interactions.

Understanding the essentials of well-designed billing formats can help businesses avoid common mistakes, reduce errors, and ensure consistency. This guide explores ways to create practical billing documents, along with insights into customization, legal compliance, and best practices for seamless payment workflows. Whether you’re a small business or a freelancer, the right approach to billing can save time and promote financial clarity.

Understanding Invoice Templates for Singapore Businesses

For businesses, having structured billing documents is crucial for efficient and transparent transactions. These records are more than just requests for payment; they reflect professionalism, reliability, and help set clear financial expectations with clients. An organized billing approach not only aids in managing cash flow but also in building long-term client trust.

Choosing an ideal format for these documents means balancing clarity, compliance, and brand identity. Here are some key components and best practices that businesses should consider:

- Client Details: Clear identification of the recipient is essential. Include the full name, business name, and contact information of the client.

- Business Information: Providing complete details about your own business, including name, address, and registration number, is critical for transparency.

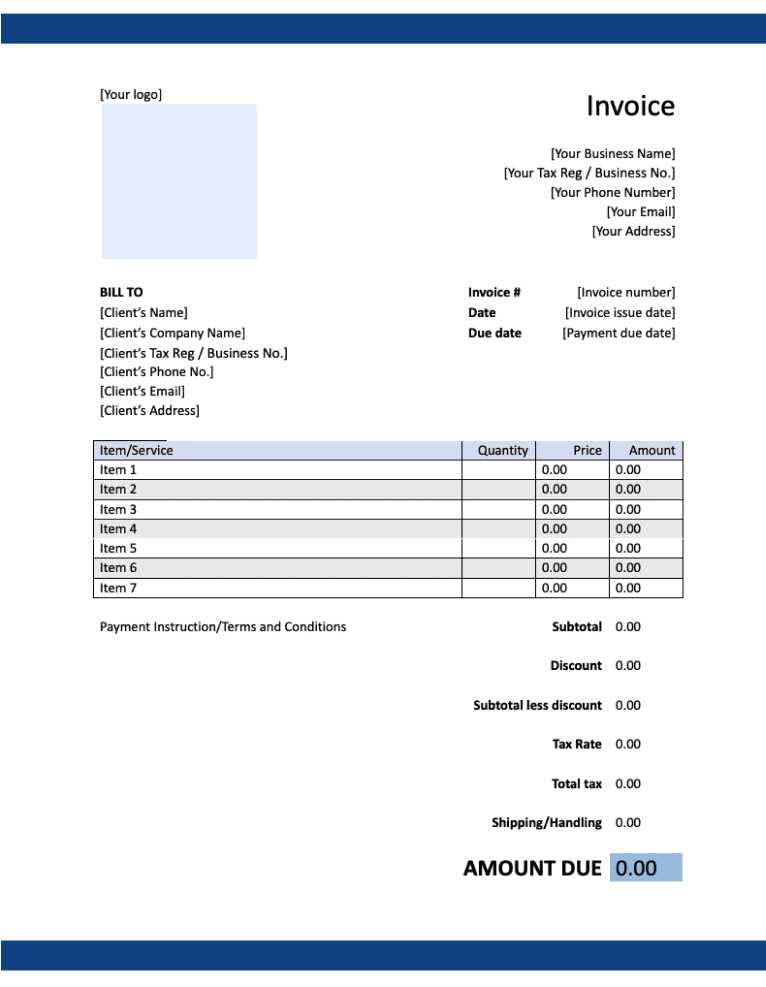

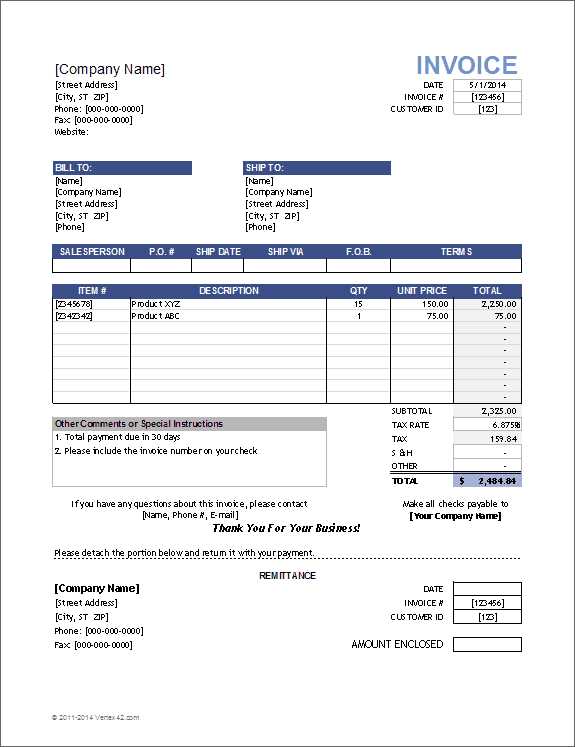

- Essential Elements of a Professional Invoice

Creating an effective billing document requires careful attention to detail and a focus on clarity. A well-structured document not only ensures timely payments but also enhances the credibility of your business. Including essential components in every billing format is key to maintaining consistency and making it easy for clients to understand and process payments.

The following elements are fundamental for a comprehensive and professional document:

- Company Information: Display your business name, address, contact details, and registration number prominently. This establishes authenticity and provides clients with a point of reference for any questions.

- Client’s Information: Include the full name, company name (if applicable), and contact details of the recipient. This personalization helps in ensuring that the document reaches the correct person and avoids confusion.

- Description of Products or Services: Provide a detailed list of the items or services provided, with quantities, rates, and a brief description where necessary.

Advantages of Using Ready-Made Invoice Templates

For businesses, efficiency and consistency in billing are essential. Pre-designed billing formats provide an easy way to maintain professionalism without investing excessive time or resources. These ready-made solutions are especially beneficial for small businesses and freelancers, as they simplify the process of creating clear and reliable payment documents.

One of the main advantages of using pre-structured billing documents is time savings. With a template, there’s no need to design from scratch, allowing businesses to focus on core tasks while still producing professional documents. A ready-made format streamlines the workflow, enabling faster completion and distribution of payment requests.

Additionally, consistency is a significant benefit. Using the same layout for each document ensures uniformity, which can enhance brand recognition and make tracking payments easier. Clients will appreciate the clarity and familiarity of a consistent format, helping build trust and reducing the likelihood of payment delays due to misunderstandings.

Another advantage is ease of customization. Most

How to Customize Your Invoice for Branding

Personalizing your billing documents can strengthen your brand identity and create a more memorable experience for clients. By incorporating elements that reflect your business’s unique style, you establish a professional image that aligns with your overall branding. Customizing these documents can also make them instantly recognizable, reinforcing client trust and promoting loyalty.

Here are some effective ways to add personal touches to your billing documents:

- Include Your Logo: Position your logo at the top of the document to make it immediately identifiable. This simple addition emphasizes professionalism and helps clients associate the document with your brand.

- Use Brand Colors: Apply your business’s color scheme to headers, borders, or key sections of the document. Consistent colors help in reinforcing brand identity and make the document look cohesive and polished.

- Choose

How to Customize Your Invoice for Branding

Personalizing your billing documents can strengthen your brand identity and create a more memorable experience for clients. By incorporating elements that reflect your business’s unique style, you establish a professional image that aligns with your overall branding. Customizing these documents can also make them instantly recognizable, reinforcing client trust and promoting loyalty.

Here are some effective ways to add personal touches to your billing documents:

- Include Your Logo: Position your logo at the top of the document to make it immediately identifiable. This simple addition emphasizes professionalism and helps clients associate the document with your brand.

- Use Brand Colors: Apply your business’s color scheme to headers, borders, or key sections of the document. Consistent colors help in reinforcing brand identity and make the document look cohesive and polished.

- Choose Appropriate Fonts: Select fonts that align with your brand style. A modern, clean font conveys a different impression than a classic or playful one. Ensure that the font remains easy to read for clarity.

- Incorporate Taglines or Slogans: If your business has a tagline, consider placing it in a header or footer. A well-placed slogan adds personality and makes the document more distinctive.

- Organize Information for Readability: Arrange sections in a way that flows logically and is easy to follow. Clear organization not only enhances the client’s experience but also reflects your commitment to detail.

- Add Contact Information: Ensure your contact details, including phone number, email, and website, are prominently displayed. This accessibility fosters a sense of reliability and invites clients to reach out easily if needed.

Customizing your billing documents doesn’t require significant design skills, but these simple adjustments can have a substantial impact. By aligning each detail with your brand, you create a consistent, professional impression that leaves a lasting mark on your clients.

Common Mistakes to Avoid in Invoices

Ensuring accuracy and professionalism in billing documents is crucial for maintaining good client relationships and securing timely payments. However, some frequent oversights can lead to confusion, delayed payments, or a negative impression. Understanding these common pitfalls can help businesses avoid them and create clear, effective documents every time.

Here are some typical errors and ways to prevent them:

Mistake Why It Matters How to Avoid Missing Key Details Omitting necessary information, like dates or payment terms, can cause confusion and delays in payment processing. Always double-check for completeness, including client details, dates, and a clear breakdown of charges. Incorrect or Misleading Amounts Mis Common Mistakes to Avoid in Invoices

Ensuring accuracy and professionalism in billing documents is crucial for maintaining good client relationships and securing timely payments. However, some frequent oversights can lead to confusion, delayed payments, or a negative impression. Understanding these common pitfalls can help businesses avoid them and create clear, effective documents every time.

Here are some typical errors and ways to prevent them:

Mistake Why It Matters How to Avoid Missing Key Details Omitting necessary information, like dates or payment terms, can cause confusion and delays in payment processing. Always double-check for completeness, including client details, dates, and a clear breakdown of charges. Incorrect or Misleading Amounts Miscalculations or ambiguous item descriptions may lead to payment disputes or require follow-up communication. Ensure calculations are accurate, and clearly label each item, rate, and applicable tax. Using Unclear Language Complicated wording or industry jargon can confuse clients and make the document harder to understand. Use simple, direct language, and explain any terms that may be unfamiliar to the client. Lack of Branding Documents without logos or brand colors may look unprofessional, making them easier to overlook or misplace. Add logos, brand colors, and a consistent format to reinforce your business identity and make the document more recognizable. Unclear Payment Instructions If the payment process is not straightforward, clients may delay payment or become frustrated. Specify payment methods, deadlines, and account details prominently to guide the client smoothly through the process. Missing Contact Information If clients have questions but can’t reach you easily, it can lead to frustration and payment delays. Always include contact details, like a phone number and email address, in a visible location on the document. By paying attention to these common mistakes, businesses can improve their billing process, minimize payment delays, and strengthen client satisfaction. Clear, accurate, and branded documents not only look professional but also make the payment process smoother for both parties involved.

Popular Software for Creating Invoices

In today’s fast-paced business environment, many organizations rely on software to streamline the creation and management of billing documents. These tools offer a range of features that can save time, improve accuracy, and ensure that businesses present a professional image. With numerous options available, it’s important to choose a platform that aligns with your specific needs and workflow.

Key Features of Billing Software

When evaluating software for generating billing documents, consider the following features:

- Customizable Design: Allows you to personalize your documents with logos, brand colors, and layout options.

- Automated Calculations: Automatically calculates totals, taxes, and discounts to reduce the risk of errors.

- Multiple Payment Options: Supports various payment methods, making it easier for clients to settle invoices.

- Tracking and Reporting: Provides insights into outstanding payments, overdue invoices, and customer history.

- Cloud Integration: Allows you to access documents from anywhere and securely store them online.

Popular Platforms for Managing Billing Documents

Here are some widely used software solutions for businesses looking to generate professional billing documents:

- QuickBooks: A robust accounting tool that offers easy billing creation along with financial tracking features.

- FreshBooks: A user-friendly platform ideal for small businesses and freelancers, offering customizable invoices and time tracking.

- Zoho Invoice: Known for its clean interface and extensive automation options, including reminders for overdue payments.

- Wave: A free tool suitable for startups and small businesses, offering customizable document generation and payment management features.

- Xero: A cloud-based solution offering detailed invoice creation, tracking, and integration with other financial tools.

Choosing the right software can greatly enhance your billing process, reduce administrative workload, and ensure that your documents are consistently professional and well-organized. With the variety of options available, finding the best fit for your business has never been easier.

Why Singapore Businesses Need Tax-Compliant Invoices

For businesses, maintaining accurate and tax-compliant financial records is essential for smooth operations and avoiding legal complications. In particular, the local tax authorities require businesses to issue documents that meet specific criteria to ensure the correct calculation and collection of taxes. These documents not only facilitate proper reporting but also protect businesses from potential audits or penalties.

Understanding the Importance of Tax Compliance

Tax-compliant financial documents play a critical role in several areas:

- Accurate Tax Reporting: Ensures businesses report the correct tax amounts to the authorities, preventing discrepancies and penalties.

- Avoiding Legal Risks: Adhering to tax rules reduces the risk of legal issues, audits, and fines associated with improper tax documentation.

- Building Trust with Clients: Proper documentation boosts credibility with clients and shows professionalism, which may lead to better business relationships.

- Efficient Financial Management: Tax-compliant records help businesses organize their finances effectively, making it easier to track revenue, expenses, and taxes due.

Key Elements of Tax-Compliant Documentation

To meet tax regulations, financial documents should contain the following essential elements:

- GST Registration Number: The business must display its Goods and Services Tax (GST) registration number if applicable.

- Accurate Tax Breakdown: A clear and accurate breakdown of goods or services provided along with applicable tax rates is necessary for transparency.

- Date of Issue: The document should include the date of issuance to ensure proper tracking of payment schedules and tax periods.

- Unique Reference Number: Each document must have a unique reference number for easy identification and record-keeping.

- Client Details: Correctly displayed client information, including name and address, helps ensure the document is legally valid.

Incorporating these elements not only helps in compliance with tax regulations but also ensures the smooth flow of business operations. By issuing legally sound documents, businesses avoid complications with authorities, build client trust, and maintain financial order.

Step-by-Step Guide to Filling Out an Invoice

Creating an accurate financial document is an important task for any business. This ensures that both parties involved understand the transaction clearly and that proper records are maintained for tax purposes. Below is a detailed guide on how to correctly complete the essential fields in a financial document, ensuring it is both professional and compliant with local regulations.

Step 1: Include Business Information

The first step is to include all relevant business details. This helps in identifying the business issuing the document and ensures that the recipient knows who they are dealing with.

- Business Name: The full name of your business as registered.

- Contact Information: Include the phone number, email address, and physical address.

- GST Registration Number: If applicable, include the business’s GST registration number to confirm tax compliance.

Step 2: Add Client Information

Next, include the recipient’s details to avoid any confusion about who the payment is being made to. This also ensures that the document is correctly linked to the correct party for accounting purposes.

- Client Name: The full name or company name of the person or business you’re invoicing.

- Client Address: The business or residential address of your client.

- Client Contact: A phone number or email address for the client.

Step 3: Provide Transaction Details

Next, list the products or services provided. Make sure this section is clear and easy to read to avoid any confusion or disputes about what was delivered.

- Description of Goods or Services: Clearly describe each item or service provided.

- Quantity: Specify the number of items or hours worked.

- Price per Unit: List the price for each individual item or service.

- Total Cost: Calculate the total for each item or service by multiplying the quantity by the price.

Step 4: Include Tax Information

For compliance with tax laws, include any applicable taxes in your document. This will ensure both you and the client are aware of the final cost, including taxes.

- Tax Rate: Indicate the percentage of tax applied to the total cost.

- Total Tax Amount: Show the amount of tax that will be added to the overall sum.

- Total Amount Due: Include the grand total that the client must pay, including both the items/services and the tax.

Step 5: Payment Terms and Due Date

Be clear about when and how you expect to be paid. Include the payment methods and a due date to avoid any misunderstandings.

- Due Date: The date by which payment must be made.

- Payment Methods: Specify the accepted methods of payment, such as bank transfer, credit card, or cash.

- Late Fees: Mention any penalties if payment is not made on time.

By following these steps, you ensure that your financial document is both comprehensive and easy for the recipient to understand, facilitating smoother transactions and reducing the risk of errors or disputes.

Tips for Fast Payment Through Invoices

Ensuring timely payments is crucial for maintaining healthy cash flow in any business. By optimizing the way you create and send financial documents, you can encourage faster settlements from clients. Here are some useful tips to help speed up the payment process and avoid delays.

Make Your Payment Terms Clear

One of the key factors in getting paid quickly is ensuring that your payment terms are clearly stated. Clients need to know exactly when and how to pay.

- Set Clear Due Dates: Always include a clear due date for payment to avoid confusion. A well-defined deadline prompts quicker action from clients.

- Specify Payment Methods: Offer multiple, easy-to-use payment options, such as bank transfers, online payment platforms, or credit cards.

- Late Payment Penalties: Mention any penalties for late payments. A gentle reminder of these consequences can incentivize clients to pay promptly.

Provide Complete and Accurate Information

Incomplete or unclear details in your financial documents can lead to delays. Make sure all necessary information is present and easy to understand.

- Include Detailed Descriptions: Describe the goods or services clearly, along with quantities and prices.

- Ensure Accurate Client Information: Double-check that the recipient’s contact and address details are correct to prevent delivery or communication issues.

- Use Professional Language: A well-organized, polite tone increases the likelihood of prompt payment.

Send Documents Promptly

Timely delivery of the financial document is crucial for quick payment. The sooner you send the request, the sooner the client can act.

- Send Right After Service: Issue the document as soon as the service is completed or goods are delivered to start the payment process immediately.

- Use Electronic Methods: Sending documents via email or online platforms speeds up the process compared to traditional mail.

- Send a Reminder: If the payment due date is approaching, consider sending a polite reminder a few days before the deadline.

By following these practices, you can significantly reduce the time it takes for clients to settle their payments, improving your business’s overall financial efficiency.

How to Choose the Right Invoice Format

Selecting the appropriate structure for your billing documents is essential for ensuring clarity and professionalism. The right layout can make a significant difference in how clients perceive your business and how quickly payments are processed. Different industries and business models require specific formats, so it’s important to understand your needs before making a decision.

Consider Your Business Needs

Your industry and the complexity of your transactions should guide the choice of structure. Some businesses may need simple documents, while others might require more detailed ones.

- For Simple Transactions: If you mainly deal with straightforward transactions, a basic format with essential information like client details, item descriptions, and total amounts will suffice.

- For Detailed Transactions: If your business involves multiple items or services, it’s better to choose a detailed format that includes itemized lists, terms, and conditions to avoid any confusion.

Ensure Compliance and Professionalism

It’s important to select a structure that meets legal requirements, particularly regarding tax calculations and business registration numbers. This ensures that you remain compliant with local regulations while maintaining professionalism.

- Incorporate Legal Details: Your documents should include your business registration number and tax-related information, such as VAT registration if applicable.

- Design for Clarity: A clear and well-organized layout makes it easier for clients to read and process the document, improving the likelihood of prompt payments.

Choosing the right format ensures not only that you meet regulatory requirements but also helps maintain a smooth workflow in your business operations, fostering better client relationships.

Freelancers’ Guide to Simple Invoice Templates

For freelancers, organizing payments and ensuring prompt transactions can be simplified with the right billing structure. A straightforward approach to creating payment requests is essential for maintaining clarity, professionalism, and efficiency. In this section, we’ll explore how to use basic, easy-to-understand formats that suit the unique needs of freelancers.

As a freelancer, you might have varying clients and projects. Your billing documents should reflect the details of the work performed while keeping the format clear and concise. A simple, no-fuss layout helps both you and your clients focus on the important details–such as the payment amount and due date–without unnecessary complexity.

Essential Information for Freelance Billing

Even with a minimalist structure, it’s crucial to include key elements that ensure both parties are on the same page. These basic components are needed for clarity and efficiency:

Component Description Client Information Include your client’s name, address, and contact details. Project Details Describe the work you completed, including the type of service and any relevant dates. Payment Amount Clearly state the amount owed, and specify any payment terms such as hourly rates or flat fees. Due Date Set a deadline for payment to keep things on track and prevent delays. Payment Methods Provide your preferred methods of payment to make the process seamless for your client. Incorporating these essential elements into a simple structure will help you maintain professionalism and make the payment process easier for everyone involved. By keeping your billing process straightforward, you can save time, reduce confusion, and ensure quicker payments for your freelance work.