Top Invoice Template Services for Easy Billing and Financial Management

Managing financial records efficiently is a key aspect of running any business. Having well-structured documents to request payments and track transactions not only ensures timely reimbursements but also enhances your professional image. With the right tools, creating and organizing these essential documents becomes a seamless process, saving time and reducing errors.

From startups to large enterprises, businesses of all sizes can benefit from adopting structured billing formats. These tools help in creating consistent, clear, and legally sound documents tailored to specific needs. Whether you are handling payments for a small project or managing large-scale transactions, streamlined solutions can simplify the entire process and increase productivity.

In this article, we explore various options for simplifying financial documentation tasks. We’ll discuss how to choose the best solutions, their unique features, and how they can be customized for different industries and business models. By the end, you’ll have a clearer understanding of how to leverage these tools to enhance your billing system and optimize cash flow management.

Invoice Template Services Overview

When it comes to handling business transactions, having an organized and efficient system to request payments and track finances is crucial. There are numerous solutions available today that help businesses create professional and consistent documents tailored to their needs. These tools automate and simplify the process, making it faster and more reliable to generate financial records for a variety of purposes.

Most solutions in this area offer a wide range of features designed to meet different business needs. These tools can assist businesses in ensuring accuracy, saving time, and maintaining a professional appearance. Below are some key benefits and options available:

- Customization: Businesses can easily adjust the layout and content to match their branding and specific requirements.

- Automation: Automatically fill in details like dates, amounts, and recipient information to save time and reduce manual input.

- Legal Compliance: Many solutions are designed to meet legal and tax requirements, ensuring businesses stay compliant with regulations.

- Ease of Use: These platforms are typically user-friendly, with intuitive interfaces and minimal setup required.

- Integration: Integration with other accounting or business management software helps streamline the overall financial workflow.

Whether you are a freelancer, small business owner, or part of a larger company, there are solutions available that can improve the way you handle financial documents. These tools not only simplify the task but also enhance accuracy and efficiency across all your billing and payment processes.

Why Use Invoice Template Services

Maintaining an efficient and professional approach to billing is essential for businesses of any size. Using digital solutions to create well-structured payment requests can save time, reduce errors, and help ensure that all transactions are properly documented. These tools provide an organized method to manage financial communications, helping businesses streamline their workflow and improve cash flow management.

By relying on these solutions, businesses can quickly generate accurate records without needing to manually input information each time. This not only saves valuable time but also minimizes human error, which can lead to costly mistakes. Furthermore, such platforms often offer pre-built formats that meet industry standards, ensuring your documents are both professional and compliant with relevant regulations.

Another significant advantage is the ability to customize documents for specific needs. Whether you are handling payments for one-time projects, ongoing contracts, or large-scale transactions, having a system that adapts to your requirements can increase efficiency and consistency. Additionally, many tools offer automation features, making it easier to generate and send requests on time, helping to keep your operations running smoothly.

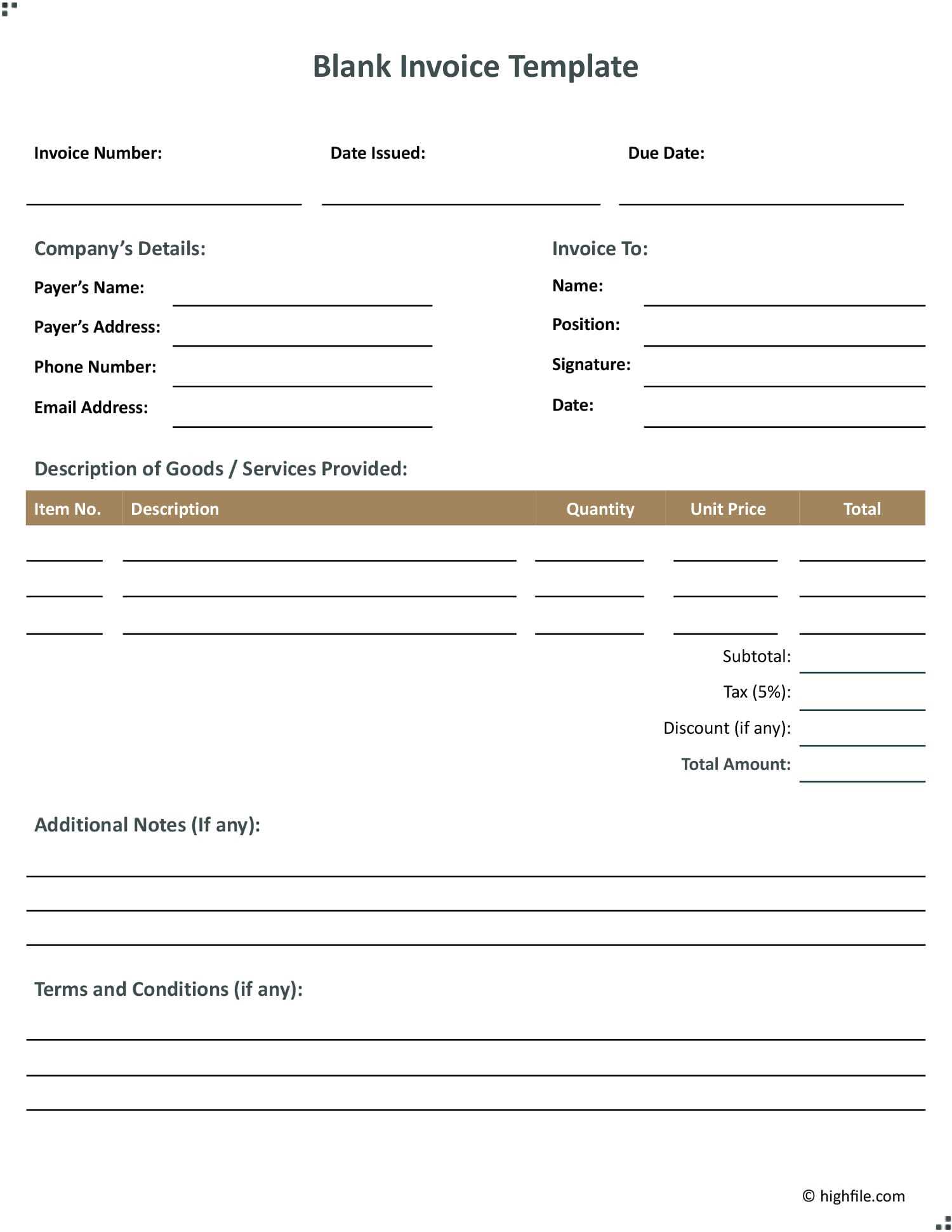

How to Choose the Right Template

Selecting the right solution to create payment requests and financial records is essential for ensuring that your billing process is both efficient and professional. There are several factors to consider when choosing the best option for your business, from customization capabilities to integration with other systems. The right tool should meet your specific needs while maintaining flexibility and ease of use.

One of the most important aspects to consider is customization. Ensure that the platform allows you to modify layouts, add your branding, and adjust content to reflect the nature of your business. Having this ability will help you present documents that align with your company’s style and are easy for clients to understand.

Another crucial factor is automation. Look for tools that allow you to automatically fill in client details, payment amounts, and dates. This feature reduces the risk of human error and ensures that you can generate documents quickly without manual input each time. Additionally, consider whether the solution integrates with other software you may already be using, such as accounting or CRM systems, to create a seamless workflow.

Finally, it’s important to evaluate the legality and compliance of the platform. The system should generate documents that meet legal and tax requirements in your region. This ensures that your financial records are both valid and accurate, helping you avoid potential legal issues down the line.

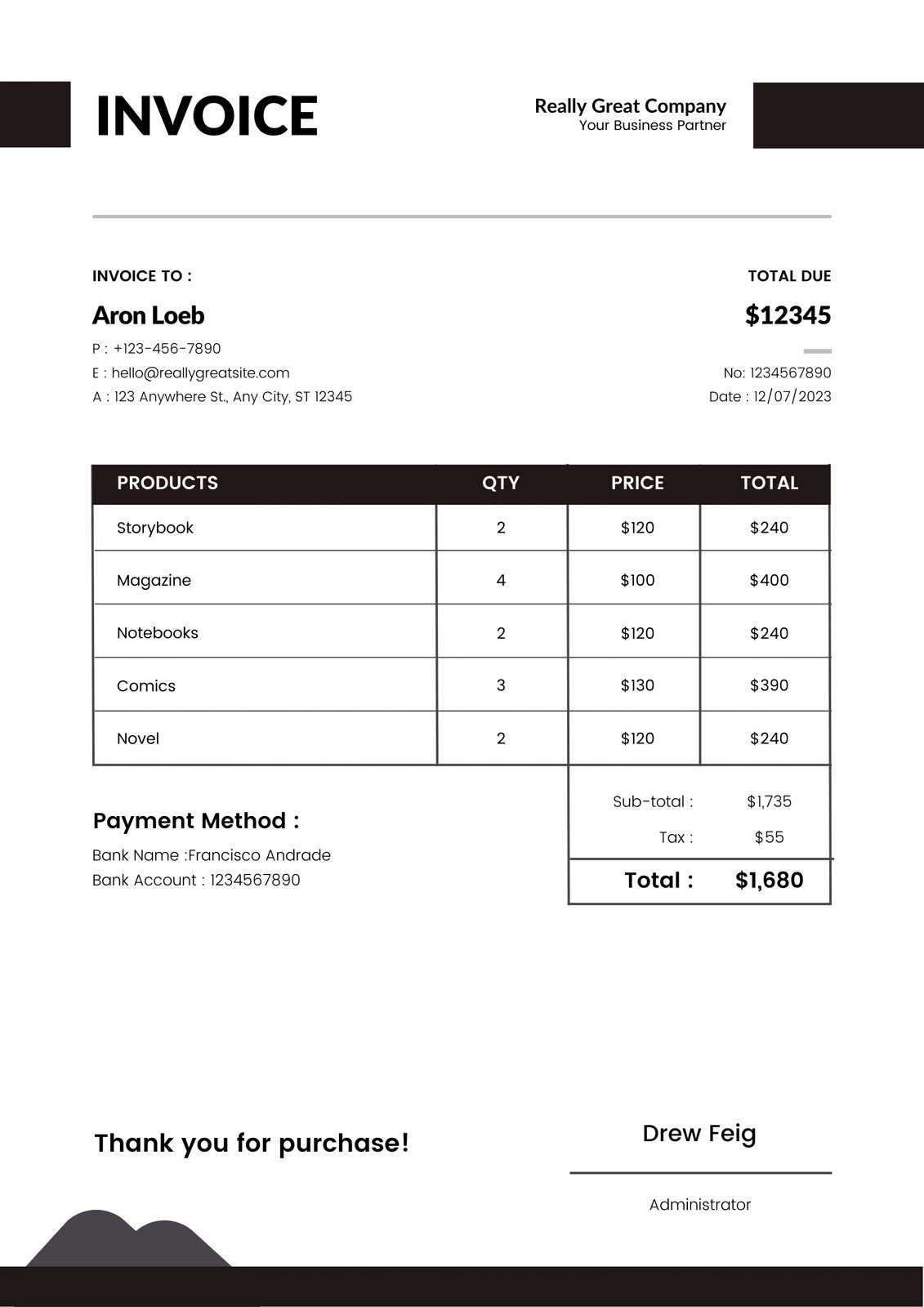

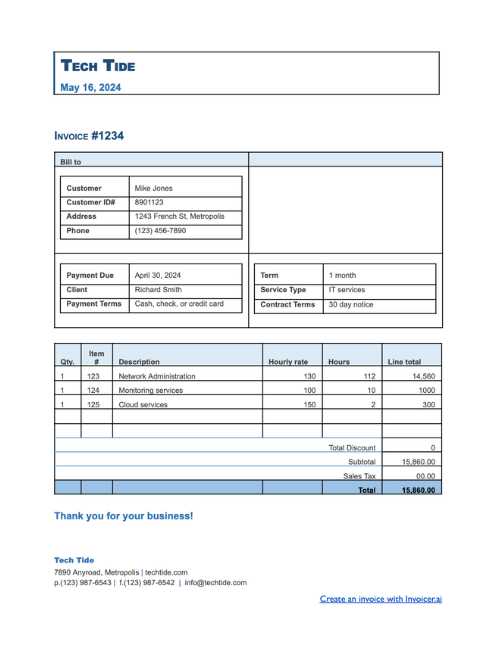

Customizable Invoice Templates for Your Business

Having a solution that allows you to personalize financial documents is essential for creating a professional and cohesive experience with your clients. Customization enables businesses to tailor each document to their specific needs, from adding logos and branding elements to modifying the layout and content. This flexibility not only reflects your business identity but also ensures that your documents are aligned with industry standards and your own operational requirements.

Why Customization Matters

Customization goes beyond simply adjusting the look of your documents; it is about ensuring they effectively communicate all necessary details in a clear and structured manner. A well-designed document can improve client relationships, as it conveys professionalism and attention to detail. Being able to modify fields, such as payment terms, service descriptions, and amounts, gives you the control to tailor each request according to the unique aspects of the transaction.

Key Customization Features to Look For

When evaluating solutions, consider the following features for greater control over your financial documents:

- Logo and Branding: Ability to insert your business logo, colors, and fonts for a cohesive, branded appearance.

- Editable Fields: Custom fields for details such as payment methods, discounts, and specific terms.

- Language Options: Some platforms allow for multi-language support, which is especially useful for international clients.

- Layout Flexibility: Adjust sections, fonts, and alignment to ensure that the most important information stands out.

By leveraging the

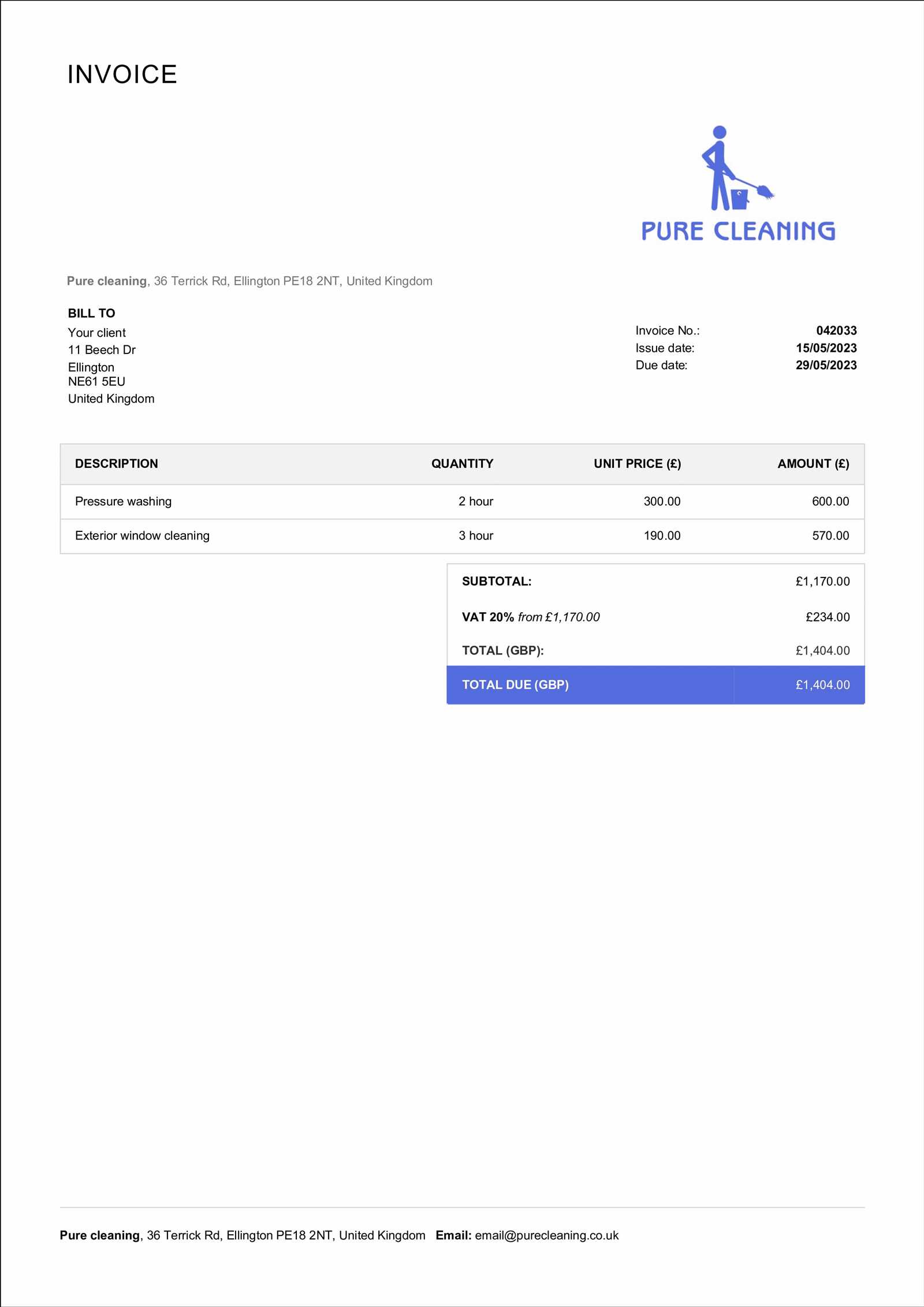

Benefits of Using Online Invoice Generators

Online tools for creating financial documents offer businesses a convenient, efficient way to manage payments and track transactions. These platforms simplify the process by providing pre-designed structures that can be quickly customized to meet specific needs. As a result, they save time and reduce errors, ensuring a smooth workflow for both businesses and clients.

Convenience is one of the most significant advantages. With access from any device, users can generate required documents anytime, eliminating the need for manual creation. This accessibility is especially beneficial for entrepreneurs and small businesses that may not have a dedicated accounting team.

Cost-effectiveness is another key factor. Many platforms offer free versions or affordable pricing options, making them a budget-friendly choice for startups. There’s no need to invest in expensive software or hire external professionals, reducing overall expenses.

Customization also plays a vital role in enhancing professionalism. Users can personalize each document with their branding elements, ensuring that the final product reflects their company’s image while remaining functional and organized.

Free vs Paid Invoice Template Options

When it comes to generating professional financial documents, users have a choice between free and paid options. Both types of solutions offer distinct features, catering to different needs and budgets. While free tools are accessible and provide basic functionalities, paid options often come with advanced features designed to enhance usability and customization, making them suitable for businesses with more specific or complex requirements.

Advantages of Free Tools

Cost-effective is the most obvious benefit of free platforms. These solutions allow businesses to create and send essential documents without any upfront costs. For small businesses or freelancers just starting, free options can provide all the basic features needed to maintain a professional appearance and handle financial transactions effectively.

Benefits of Paid Tools

On the other hand, paid tools often offer more advanced features, such as greater customization options, integrated payment solutions, and better customer support. These platforms allow for enhanced flexibility, enabling users to tailor their documents in line with their brand identity. Additionally, paid versions may include automation options that streamline repetitive tasks, saving time and reducing the chance for human error.

Choosing between free and paid options depends on the size of your business, the complexity of your needs, and your available budget. For a more professional approach with additional capabilities, investing in a paid solution can offer a significant advantage in the long run.

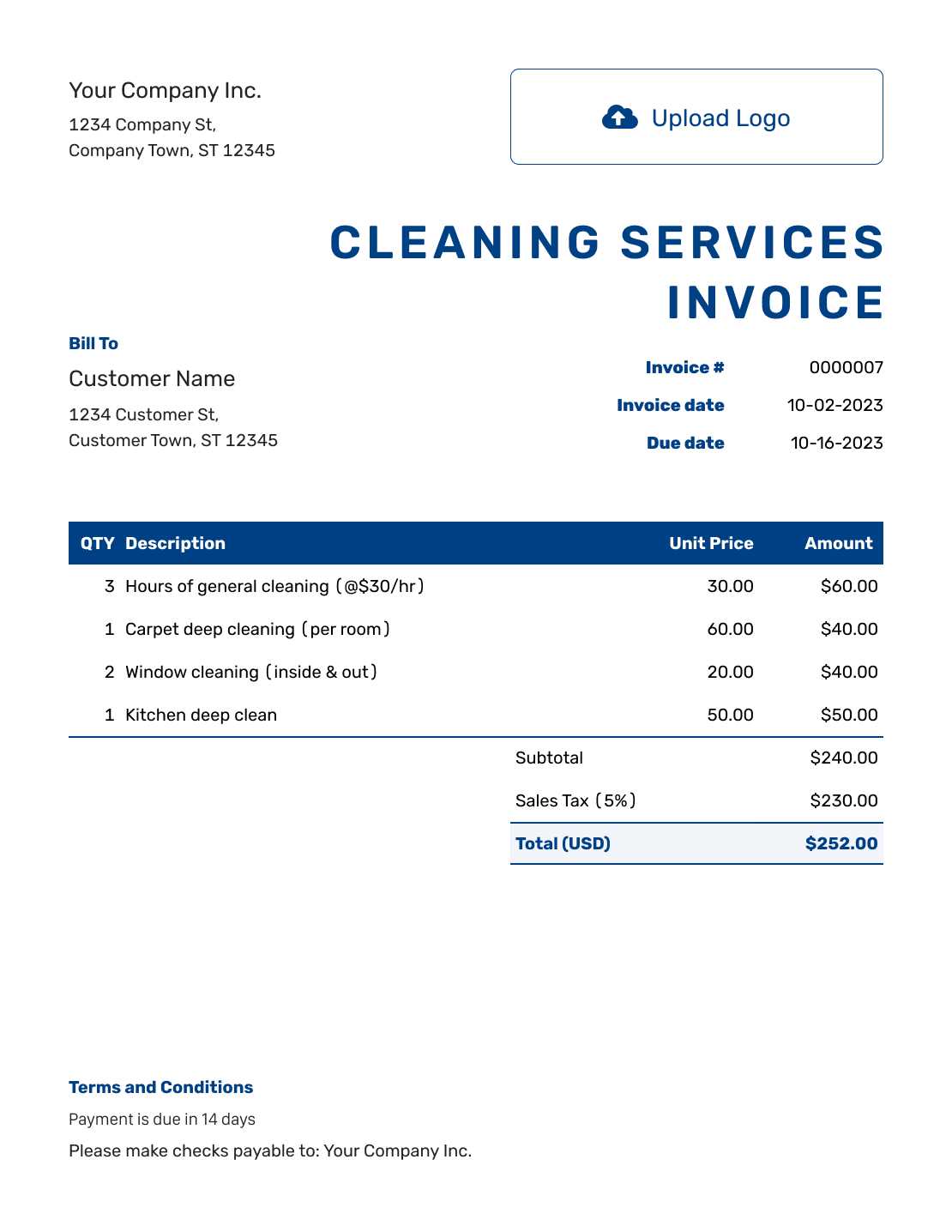

Creating Professional Invoices Quickly

For businesses and freelancers, generating professional financial documents in a timely manner is crucial. Speed and accuracy are key to maintaining positive relationships with clients and ensuring smooth cash flow. With the right tools and processes, creating polished, error-free documents can be done in just a few minutes, allowing more time to focus on other important tasks.

Automated features offered by modern tools streamline the entire process. Pre-designed structures and built-in calculations eliminate the need for manual entry, reducing the risk of mistakes. These platforms allow users to input basic details, such as client information, services rendered, and payment terms, and automatically generate a polished document ready to send.

Customization options also help enhance the professional look of each document. Many tools allow for easy personalization with logos, color schemes, and custom fields, ensuring that each document aligns with your brand identity. This professional touch not only makes a positive impression but also builds trust with clients.

How to Streamline Your Billing Process

Efficient management of financial documentation is essential for maintaining a smooth business operation. By automating key tasks and adopting structured workflows, businesses can simplify their billing processes, reduce manual errors, and save valuable time. Streamlining this aspect of your operations ensures that payments are tracked effectively, and administrative work is minimized.

One effective strategy is to integrate automated tools that generate documents quickly and accurately. These platforms allow for faster creation, easier tracking, and seamless client communication. Below is a simple comparison of manual versus automated approaches to help illustrate the benefits:

| Process | Manual Approach | Automated Solution | ||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Document Creation | Time-consuming, manual input | Instant, with pre-filled details | ||||||||||||||||||||||||||||||

| Tracking Payments | Requires manual follow-up | Automatic payment reminders and status updates | ||||||||||||||||||||||||||||||

| Customization | Limited options without specialized tools | Full customization with branding, fields, and formats | ||||||||||||||||||||||||||||||

| Client Communication | Separate emails or calls needed | Automated emails with document attached |

| Tracking Method | Manual Approach | Automated Solution | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Record Keeping | Paper or spreadsheet-based, prone to errors | Centralized digital storage, easy access and retrieval | |||||||||||||||

| Payment Tracking | Requires manual updates and follow-ups | Automatic status updates and reminders | |||||||||||||||

| Reporting | Time-consuming, requires manual calculations | Instant reporting with detailed financial insights | |||||||||||||||

| Accuracy | Prone to human error | Automated calculations

Integrating Invoice Templates with Accounting SoftwareFor businesses looking to streamline their financial processes, integrating document creation tools with accounting software can significantly improve efficiency. This integration allows for seamless data transfer between platforms, eliminating the need for manual entry and reducing the likelihood of errors. By linking your documents with accounting systems, you can automate many aspects of financial management, from tracking payments to generating reports and maintaining up-to-date financial records. The integration of these tools can provide a centralized solution that combines both the creation of financial records and their management in one place. This not only saves time but also ensures consistency and accuracy across all financial documentation. Below is a comparison of manual versus integrated approaches to handling financial records:

With integrated solution Secure and Reliable Invoice Template ServicesWhen it comes to managing business finances, security and reliability are of utmost importance. Using online platforms to create and manage financial documents requires a level of trust, as sensitive information such as payment details and client data are involved. To ensure that your business remains protected while maintaining smooth operations, it’s crucial to choose tools that prioritize security and offer consistent, reliable performance. Data Protection and EncryptionSecurity features are essential in safeguarding your data. The best tools employ encryption protocols to protect sensitive information, both during transmission and storage. Look for platforms that offer SSL encryption, ensuring that any information shared between you and your clients is securely transmitted. Additionally, many reputable services also provide secure cloud storage, giving you peace of mind knowing your records are safe from loss or theft. Reliability and UptimeConsistent performance is another crucial aspect when selecting a platform. Frequent downtimes or system failures can disrupt your workflow, leading to missed deadlines or loss of important data. Trusted tools are built on robust infrastructure, with high uptime guarantees, ensuring that your business is always operational. Make sure the platform offers reliable backups and easy recovery options in case of any unexpected issues. By choosing a secure and dependable platform, businesses can confidently manage financial documents while minimizing the risk of data breaches and ensuring that all operations run smoothly. Tips for Personalizing Your Invoice Templates

Customizing your billing documents can help you make a lasting impression and build a professional relationship with your clients. A well-tailored design not only reflects your brand’s identity but also makes transactions smoother and more transparent. Personalization goes beyond adding a logo–it’s about creating a document that aligns with your business values and communicates professionalism. 1. Use Your Brand Colors and Logo Incorporating your brand’s color scheme and logo into the design creates a cohesive look and reinforces your business identity. This will help clients instantly recognize your brand, which can lead to better brand recall and trust. Choose colors that align with your brand’s personality and ensure they are easy on the eyes when combined with text. 2. Tailor the Layout for Clarity A clean, well-organized layout ensures that your billing documents are easy to understand. Group similar information together, such as payment details and services provided, and avoid cluttering the page with unnecessary elements. Use headings and subheadings for clear section separation. 3. Add a Personal Touch with Custom Notes Adding a personalized message can make your communication feel more human. Whether it’s a simple thank you note or a reminder of a follow-up, custom messages can help maintain positive client relationships. This small gesture adds a touch of friendliness while maintaining professionalism. 4. Include Client-Specific Information Personalizing each document with the client’s specific information–such as their name, address, or special discounts–shows attention to detail and care. It’s a sign that you’re not sending a generic, mass-produced document, but one tailored to their needs and situation. 5. Make Payment Terms Clear and Consistent Ensure that your payment instructions and deadlines are easy to find and understand. Avoid using jargon, and make the process as straightforward as possible. Consistency in how payment terms are presented on each document helps set clear expectations and reduces confusion. 6. Provide Multiple Payment Methods Offering various payment options shows flexibility and convenience for your clients. Include different methods like credit cards, bank transfers, or digital wallets, and make sure each option is clearly explained. This reduces friction and encourages timely payments. 7. Include Legal Information as Needed Depending on your industry and location, it may be necessary to add certain legal disclaimers or tax details. These additions not only ensure compliance but also demonstrate that your business operates with transparency and professionalism. How to Avoid Common Invoice MistakesEnsuring accuracy and clarity in your billing documents is essential for maintaining professionalism and avoiding unnecessary delays in payment. Small errors can lead to confusion, delays, or even disputes with clients. By following a few key practices, you can minimize mistakes and streamline the entire billing process, making it smooth for both parties. 1. Double-Check for AccuracyOne of the most common mistakes is providing incorrect or incomplete information. Always verify that the client’s name, contact details, and payment information are accurate. Similarly, double-check the list of services or products provided, along with the corresponding amounts. A single typo can cause confusion or miscommunication that may delay payment. 2. Avoid Ambiguous Payment TermsVague or unclear payment terms can lead to misunderstandings. Be specific about due dates, late fees, and accepted payment methods. If discounts or promotional rates are included, ensure they are clearly stated, with the criteria for eligibility outlined. Consistency in how payment expectations are presented reduces the likelihood of confusion and late payments. By paying attention to detail and ensuring your billing documents are precise, clear, and consistent, you can avoid common pitfalls and improve client satisfaction. A small investment in accuracy can lead to smoother transactions and stronger professional relationships. Invoice Templates for Freelancers and ContractorsFor independent professionals and contractors, managing financial transactions can be a daunting task. Properly structured billing documents are essential for maintaining a professional image and ensuring timely payments. Customizing your paperwork to suit your specific needs not only saves time but also helps streamline the process of tracking work completed and payments due. Freelancers and contractors often work with a variety of clients, each with different requirements and expectations. Having a flexible yet consistent document that includes all necessary details–such as hours worked, project milestones, and payment terms–ensures that both parties are on the same page. Clear and accurate billing can foster trust and help you get paid on time, every time. Additionally, it’s important to include your payment preferences, such as bank account details or online payment methods, which makes it easier for clients to settle their dues promptly. Personalizing the design with your brand identity and contact information adds a professional touch, enhancing your reputation and increasing client satisfaction. Saving Time with Automated Invoice TemplatesFor busy professionals, streamlining administrative tasks is crucial to maintaining productivity. Automating the creation of financial documents allows you to focus more on your core work, while reducing the time spent on repetitive paperwork. By utilizing automated tools, you can quickly generate customized billing statements, track payments, and ensure accuracy without manual effort. 1. Reduce Human Error

Automated systems eliminate the risk of common mistakes such as incorrect calculations or missing details. With preset formulas and pre-filled client information, the chances of errors are minimized, ensuring that your documents are always accurate. This reduces the time spent reviewing and correcting mistakes, allowing you to send documents promptly. 2. Streaml

|