Invoice Template Services to Simplify Your Billing Process

Managing financial transactions can be a time-consuming task for any business. A well-organized method of documenting charges ensures clarity and professionalism in every exchange. Adopting the right approach to designing payment records can significantly reduce administrative overhead and improve cash flow.

With the right tools, businesses can customize their billing records to fit specific needs, ensuring that each document reflects the branding and structure desired. These solutions are flexible, allowing companies to create professional-looking statements that align with their operational workflows and client expectations.

Efficiency is the key benefit of utilizing these tailored solutions, as they help minimize errors, reduce delays, and streamline the overall process. Whether you are a freelancer, a small business owner, or part of a larger enterprise, these approaches can save valuable time while maintaining accurate financial documentation.

Invoice Template Services Overview

Efficiently managing financial records is crucial for businesses of all sizes. Solutions designed to automate and simplify the documentation of payments not only save time but also enhance accuracy and consistency in financial transactions. These tools are essential for maintaining professionalism in the billing process while ensuring that the necessary details are included in each document.

Key Features of Billing Solutions

Various features are included in customizable billing document solutions that cater to diverse business needs. Here are some of the most important aspects:

- Customization Options: Tailoring the design to suit branding or specific business needs.

- Automation: Streamlining the process by generating records automatically.

- Integration: Seamlessly working with accounting and other business management tools.

- Accuracy: Reducing human error and ensuring consistent information in each document.

Benefits for Businesses

Incorporating these tools into everyday operations offers numerous advantages, including:

- Time Efficiency: Automation eliminates the need for manual creation, speeding up the overall process.

- Consistency: Ensures that all records follow a uniform structure, which simplifies tracking and auditing.

- Professional Appearance: Helps businesses create polished, well-organized financial documents that leave a positive impression.

Benefits of Custom Invoice Templates

Customizable billing documents offer a wide range of advantages that can significantly enhance the efficiency and professionalism of financial record-keeping. By tailoring each document to meet specific business needs, companies can improve accuracy, maintain consistency, and create a more streamlined process for managing transactions. Custom solutions allow businesses to present a polished, personalized image to clients while ensuring important details are clearly communicated.

Improved Accuracy and Consistency

One of the main benefits of adopting customized billing documents is the reduction in human error. When details are pre-set and automatically generated, the chances of making mistakes such as incorrect dates, amounts, or client information are minimized. This consistency in the information presented helps avoid confusion and provides a more reliable method of managing financial data.

- Automated Fields: Predefined fields reduce the chance of input errors.

- Standardized Format: Ensures a uniform presentation, making it easier to track and reference documents.

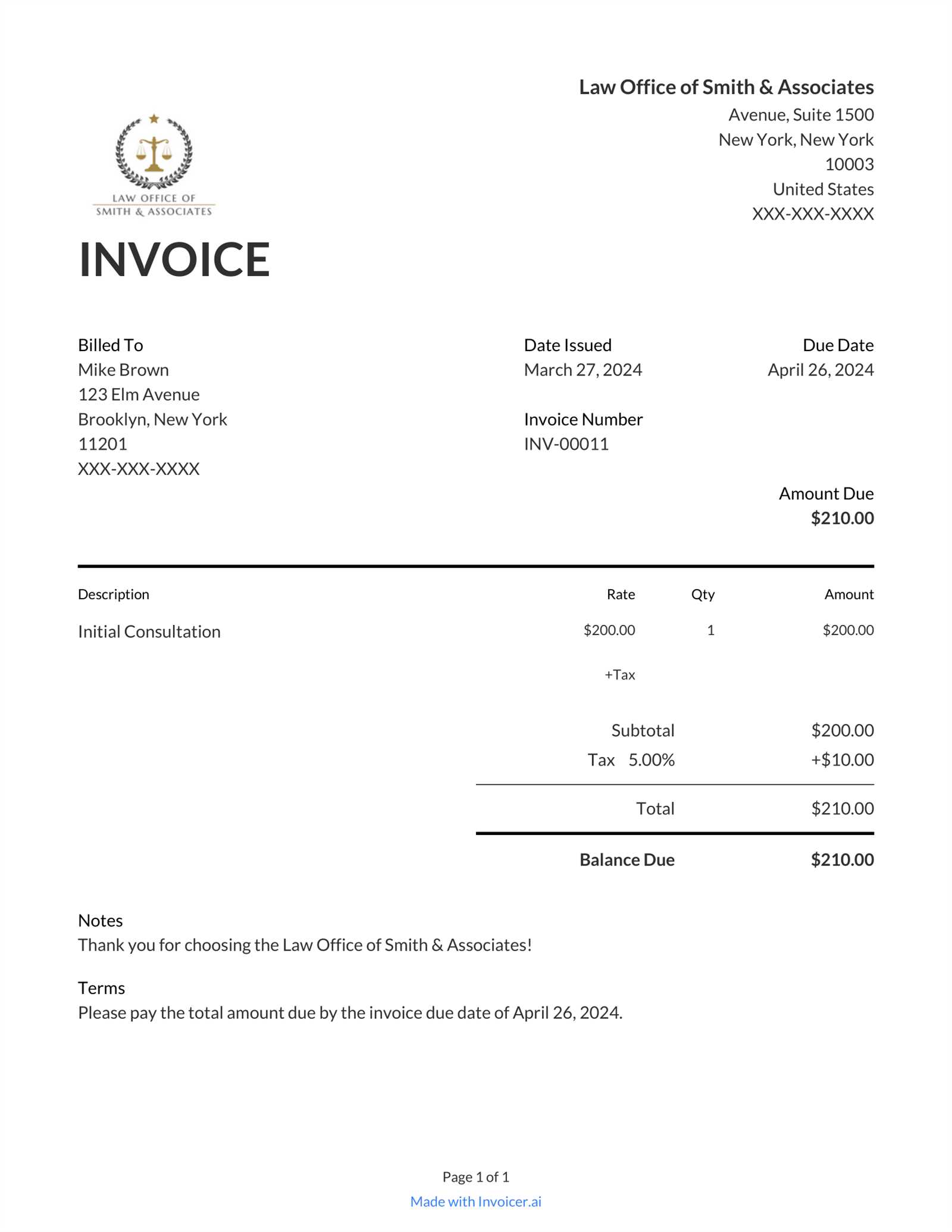

Enhanced Brand Image and Professionalism

Using custom documents tailored to a business’s unique branding gives a more professional impression to clients. A polished and cohesive look helps reinforce the company’s identity while presenting an image of trustworthiness and reliability. These small details make a significant impact on client relationships and can help differentiate a business in competitive industries.

- Brand Recognition: Incorporating logo, colors, and fonts into each document enhances brand identity.

- Client Trust: Clear, professionally formatted records increase client confidence in the business.

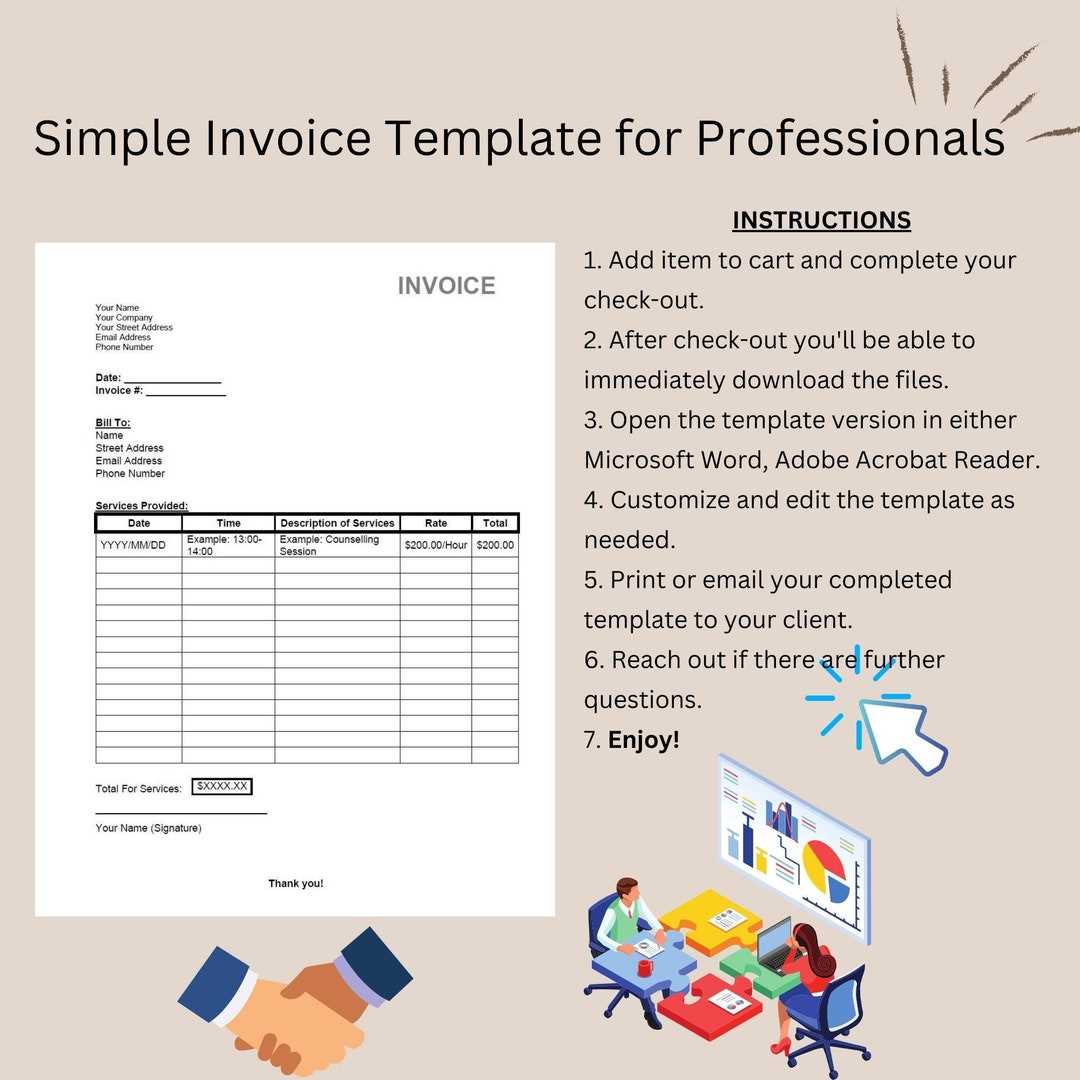

How to Choose the Right Template

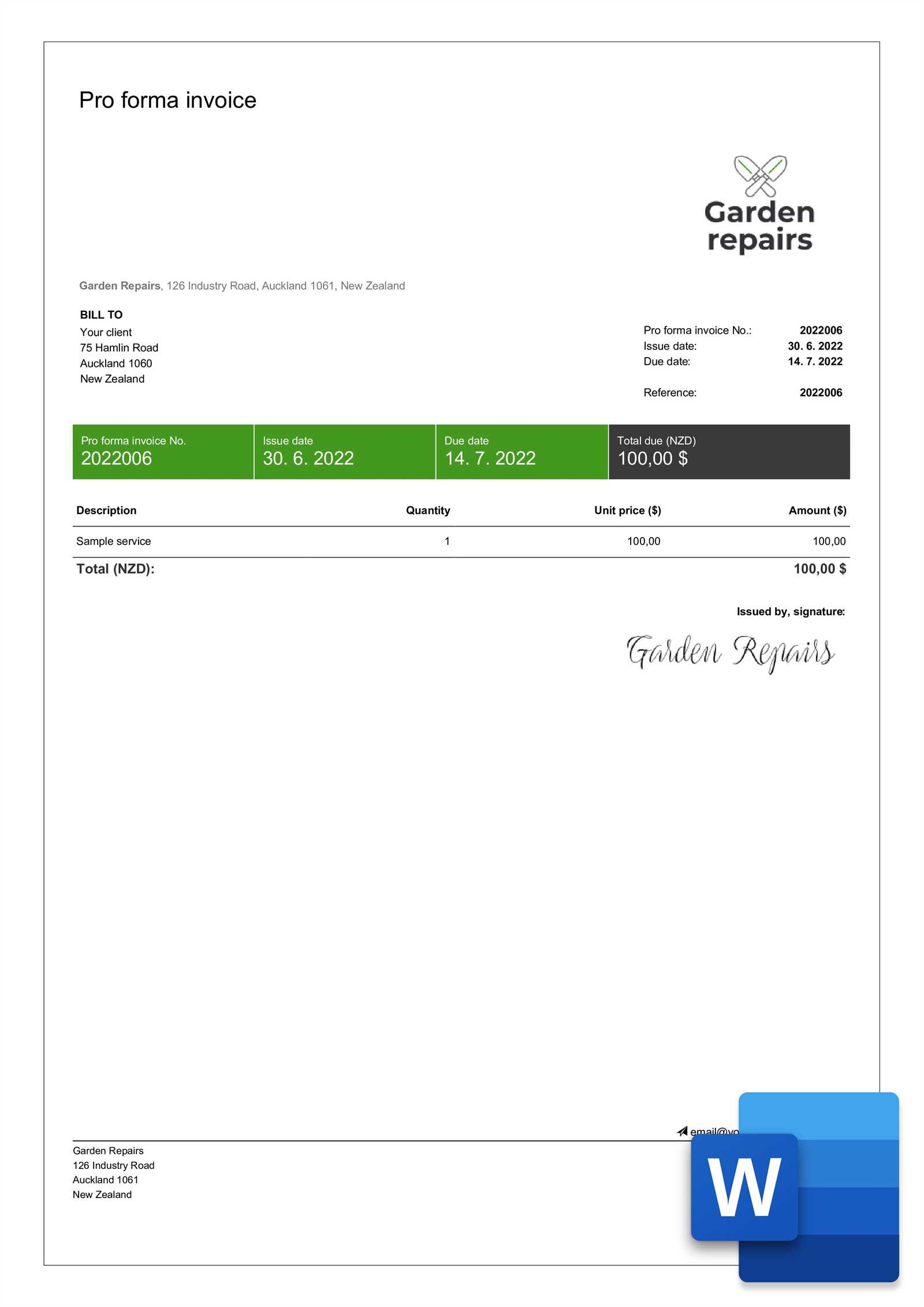

Selecting the appropriate billing document design is crucial for ensuring a smooth financial process. The right structure not only simplifies record-keeping but also ensures that all essential details are clearly conveyed. Different businesses have unique requirements, and understanding those needs is key when choosing the ideal layout for your documents.

When evaluating your options, it’s important to consider both functionality and aesthetics. The chosen design should reflect your brand while being easy to use and customize according to specific needs. Additionally, ensure that the chosen solution integrates well with your existing systems and workflows.

Consider Business Type and Size

The nature of your business plays a significant role in selecting the best document structure. Small businesses might prefer simple, minimal designs, while larger enterprises may require more complex layouts to include additional fields and features. Be sure to choose a design that aligns with your operations and your clients’ expectations.

- Simple Design: Ideal for freelancers or small businesses with straightforward billing needs.

- Advanced Design: Suitable for larger companies with detailed billing requirements and various clients.

Evaluate Customization Features

Customization options are essential for tailoring the layout to fit your specific needs. Look for solutions that offer flexibility in terms of fields, logos, and other design elements. This ensures that your financial documents reflect your business branding and include all necessary information.

- Field Customization: Ability to add or remove fields based on the type of transaction.

- Design Flexibility: Modify colors, fonts, and logos to match your business’s brand.

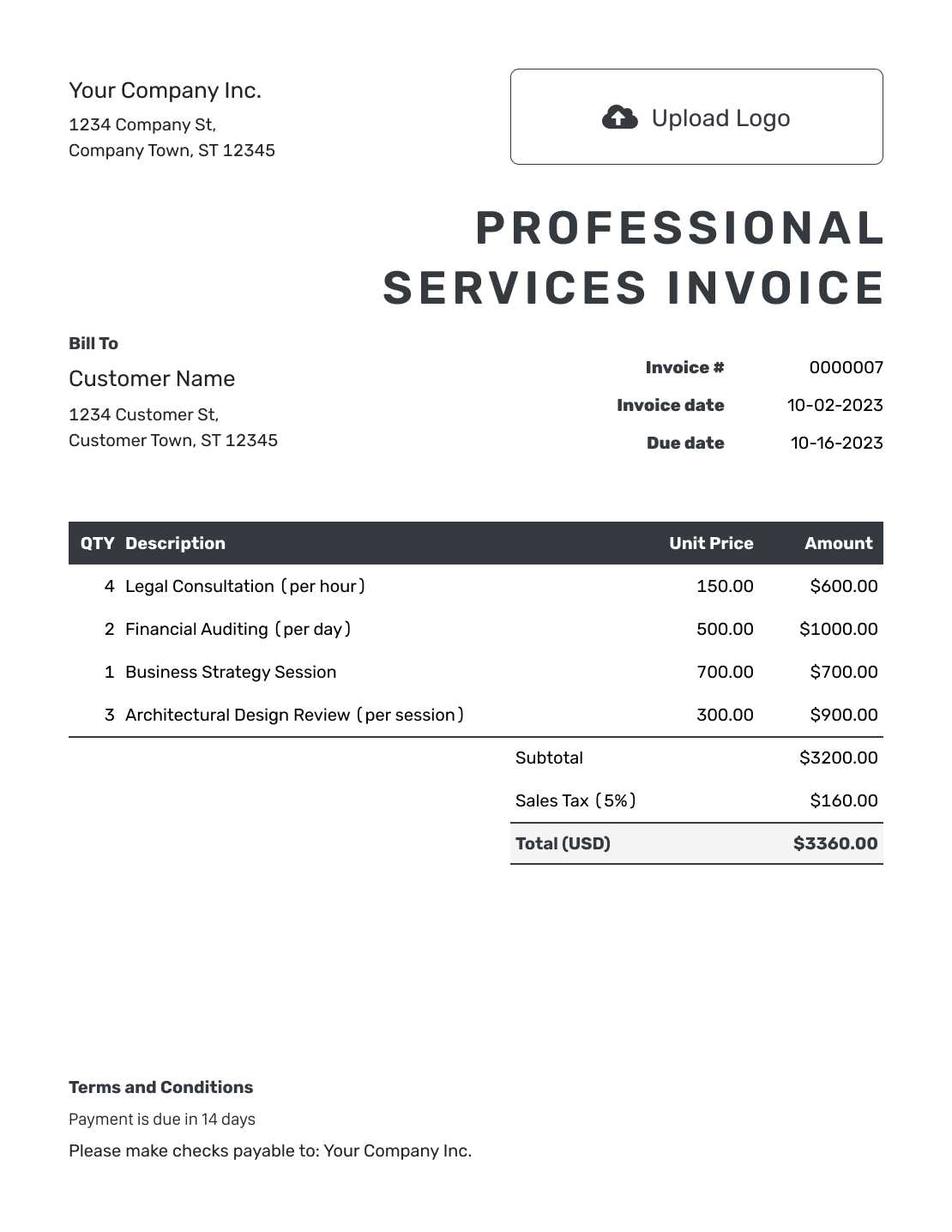

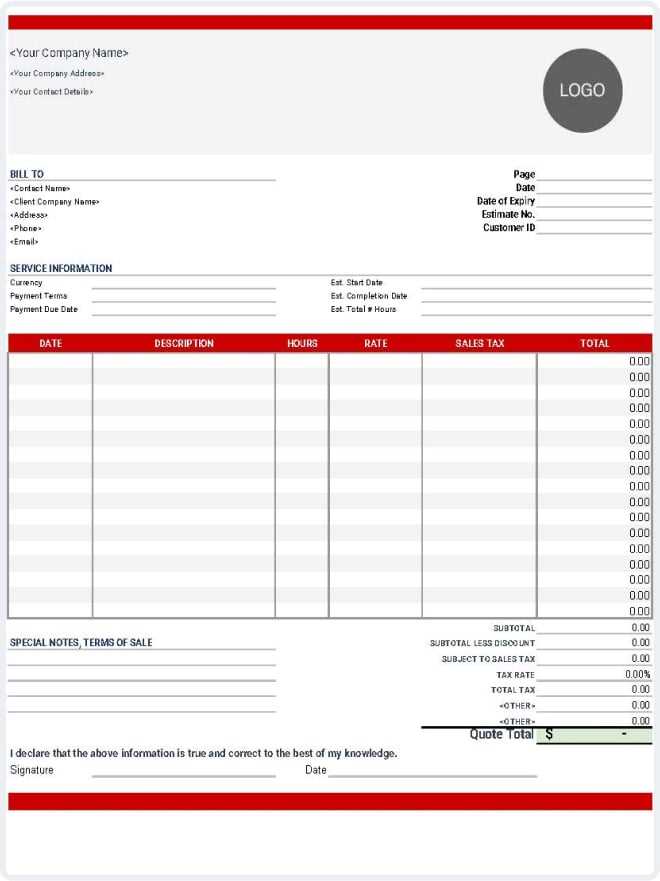

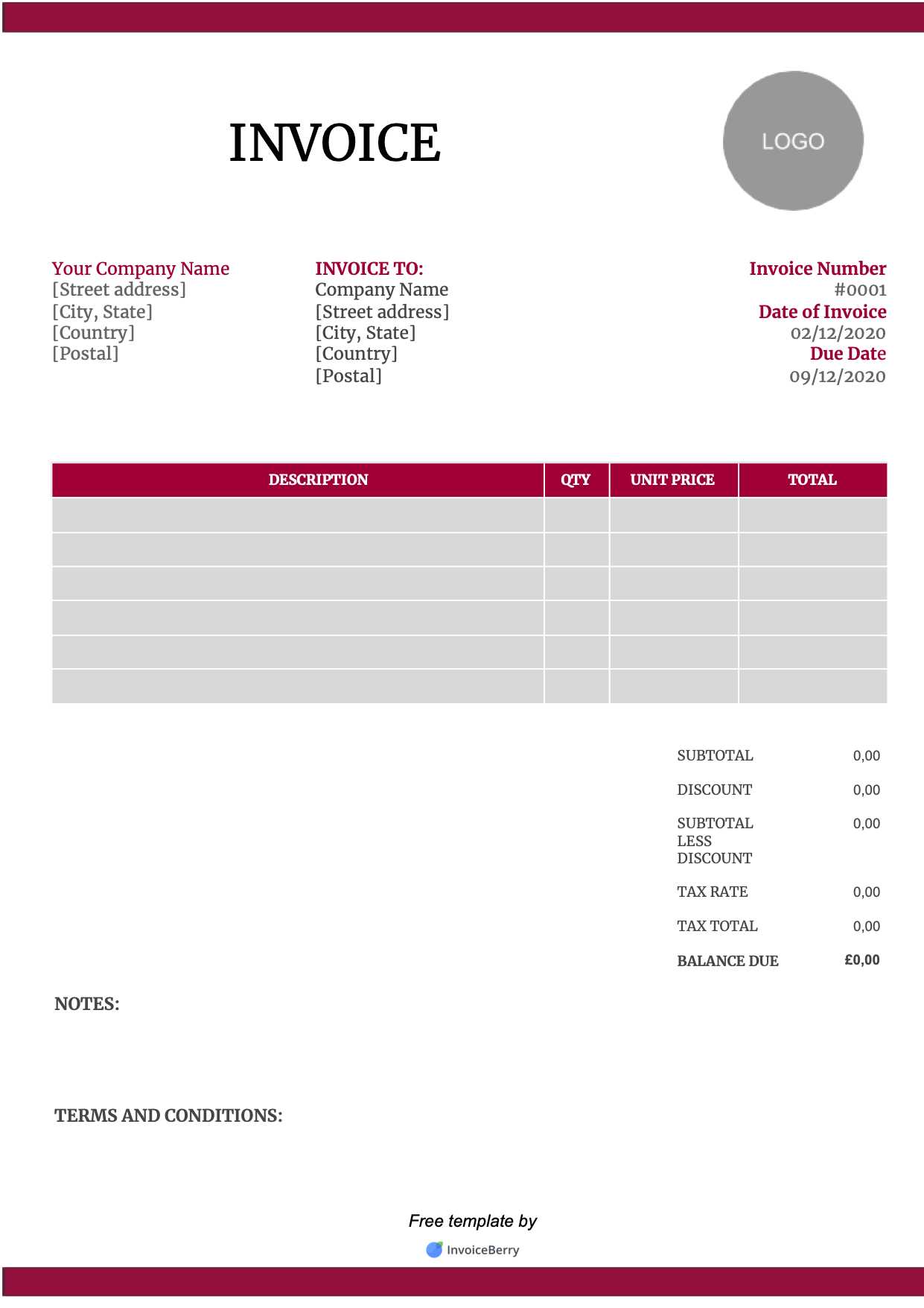

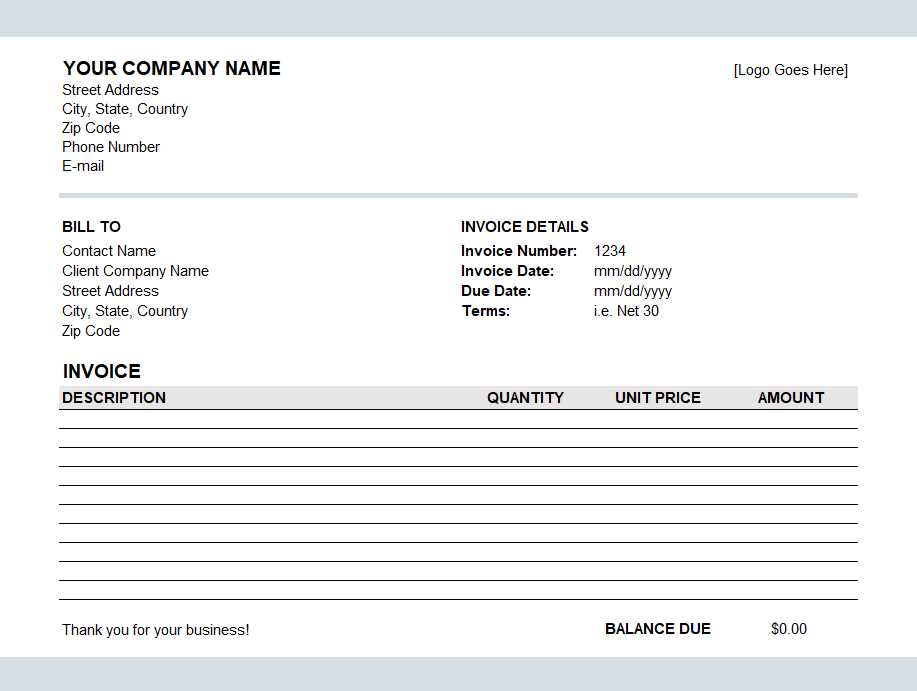

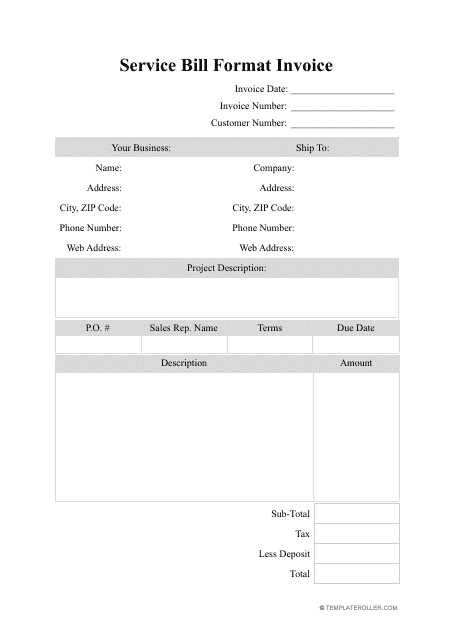

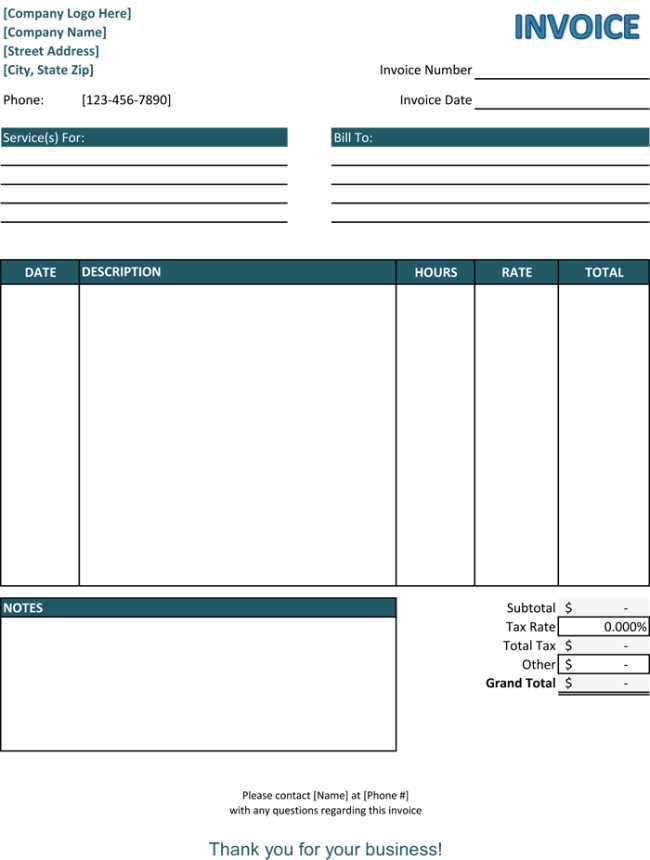

Key Features in Billing Documents

When selecting a design for your business’s payment records, certain features are essential for ensuring both functionality and clarity. These elements help create a professional appearance while maintaining efficiency in handling financial transactions. A well-structured document allows for easy customization and smooth integration with other business processes.

Key aspects of an effective billing document include flexibility, ease of use, and the ability to present all necessary details in a clear and concise manner. By understanding these features, you can choose a layout that best meets your operational needs while enhancing your business’s image.

Customization Options

One of the most important features is the ability to adjust various aspects of the layout to meet specific business needs. This includes the option to modify fields, add custom branding, and adjust the design to reflect a company’s identity.

- Logo Placement: Easily insert your company logo to enhance brand recognition.

- Field Customization: Add or remove fields to capture all relevant information.

- Color and Font Adjustments: Customize colors and fonts to match your company’s visual identity.

Automation Features

Automated generation of payment records is a major time-saving feature. With automated tools, you can quickly create documents that include pre-populated information, such as dates, client details, and transaction amounts. This ensures consistency and reduces the risk of human error.

- Auto-Population: Pre-filled fields like client details and pricing help reduce manual input.

- Recurring Billing: Set up automatic generation of similar records for repeat clients.

- Integration with Other Tools: Sync data across accounting and business management software for streamlined operations.

Common Mistakes to Avoid

When managing financial records, even small mistakes can lead to confusion, delays, or errors in the documentation process. It’s important to be aware of common pitfalls that can compromise the accuracy and professionalism of your documents. By recognizing these missteps, you can ensure that your billing process runs smoothly and effectively.

Failure to Include Essential Details

Omitting important information can lead to misunderstandings or delayed payments. Every record should include all necessary details such as transaction dates, client information, and payment terms. Missing these components can cause confusion or force clients to follow up for clarification.

- Missing Contact Information: Ensure all relevant contact details for both parties are listed.

- Omitting Payment Terms: Clearly state the due date and any late fees to avoid confusion.

- Incorrect Amounts: Double-check that the amounts and totals are accurate before finalizing the document.

Inconsistent Design and Format

Having a document that lacks a consistent structure or professional appearance can give a negative impression. A disorganized or hard-to-read format may lead clients to question the reliability of your business. Maintaining a clean, consistent layout helps reinforce your brand identity and improves client confidence.

- Unorganized Layout: Ensure that information is arranged logically for easy readability.

- Inconsistent Branding: Use uniform colors, fonts, and logos to maintain a cohesive appearance.

- Cluttered Design: Avoid overloading the document with excessive details or unnecessary information.

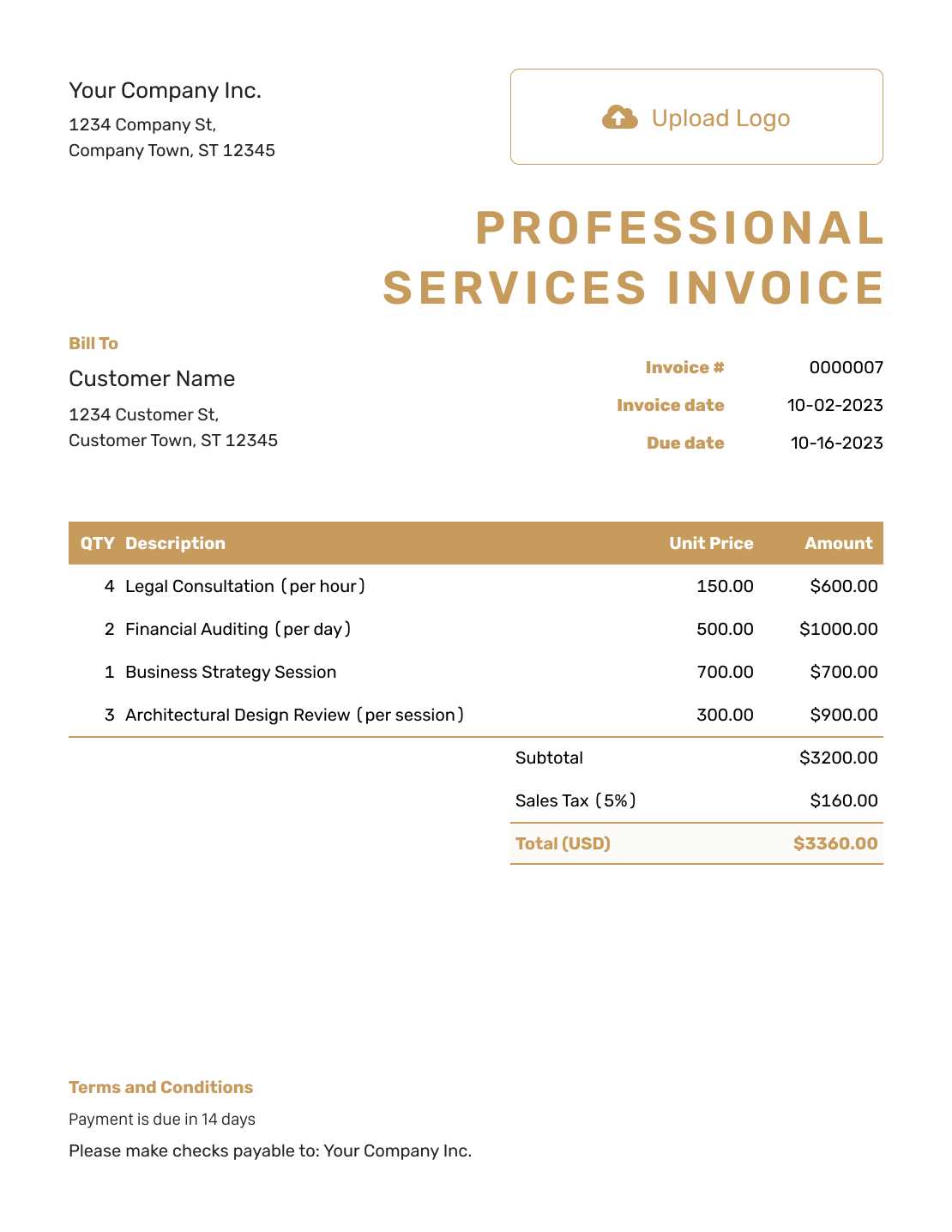

Invoice Templates for Different Industries

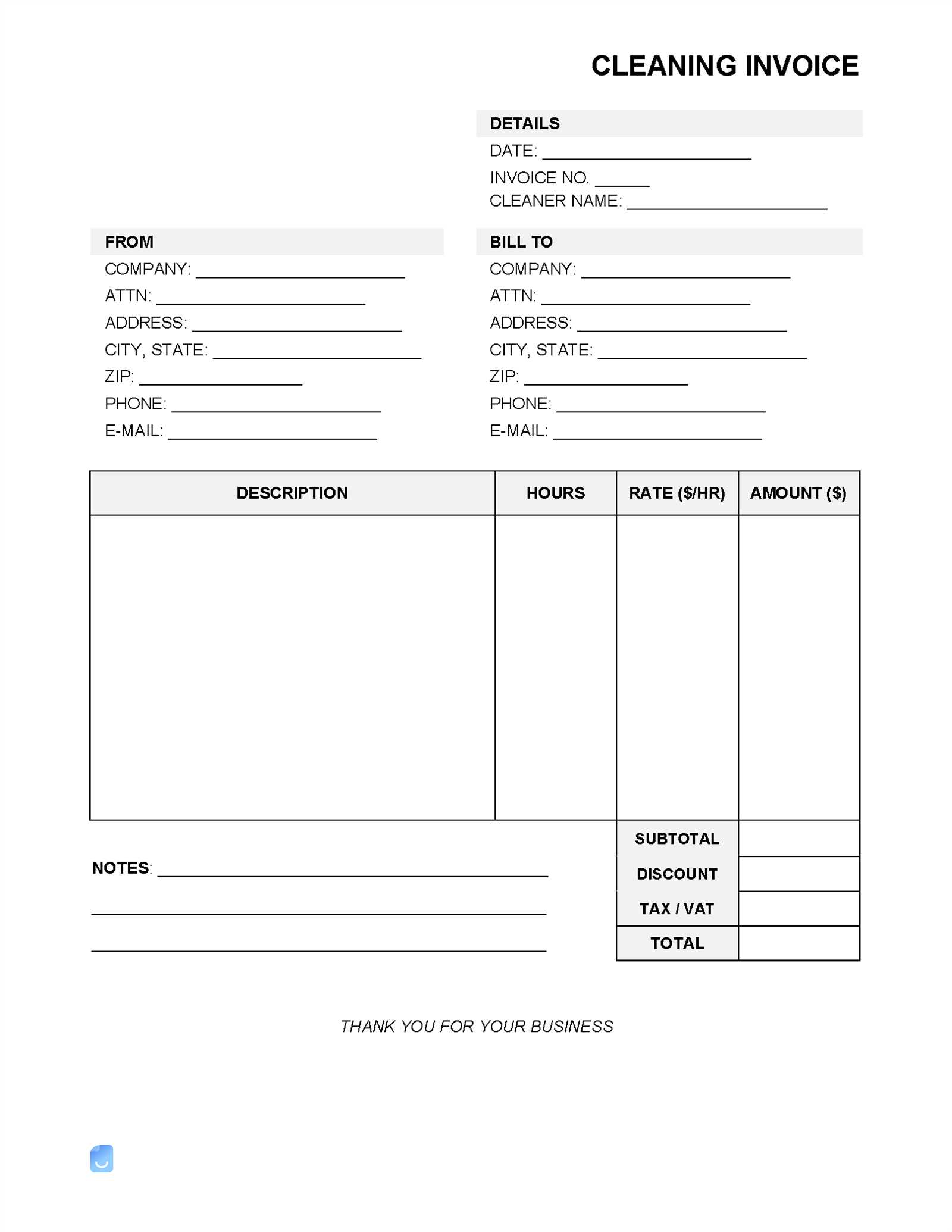

Each industry has unique requirements when it comes to documenting transactions. Tailored solutions are essential to ensure that all the necessary information is included and formatted according to the standards of a particular field. By customizing billing documents to meet industry-specific needs, businesses can ensure that their records are both professional and compliant with relevant regulations.

Creative and Design Industries

For businesses in the creative sector, such as graphic designers, photographers, or marketing agencies, the emphasis is often on clear, visually appealing documentation that reflects the brand’s identity. These professionals need flexibility in terms of customization and design, allowing them to incorporate logos, images, and project-specific details.

- Customizable Fields: Room for client names, project descriptions, and hourly rates.

- Visual Design: Option to include branding elements like logos and colors.

- Flexible Payment Terms: Clearly defined payment schedules, especially for large projects.

Retail and E-Commerce Businesses

For businesses in retail and e-commerce, accuracy in listing products, quantities, and prices is critical. Billing records need to be clear and concise to prevent misunderstandings. These companies often require detailed descriptions of purchased items, along with sales tax calculations and shipping information.

- Product Listings: Detailed item descriptions and pricing for each product sold.

- Tax Calculations: Automatic inclusion of sales tax based on location and product type.

- Shipping Information: Space to include shipping costs and tracking numbers.

Time-Saving Tips for Invoice Management

Efficient management of financial records is essential for any business. By implementing time-saving strategies, businesses can streamline their documentation processes, reduce manual work, and avoid errors. These tips focus on optimizing your workflow, helping you save valuable time while maintaining accuracy and professionalism in all transactions.

Automating Repetitive Tasks

Automation is a powerful tool in managing financial records. By automating repetitive tasks such as generating reports or sending reminders, businesses can free up time to focus on other important tasks. Using automated tools ensures consistency and reduces the chances of human error.

| Task | Automation Tool | Time Saved |

|---|---|---|

| Generating Payment Records | Automated Billing Software | Minutes per document |

| Sending Payment Reminders | Automated Email System | Hours per week |

| Updating Client Information | CRM Integration | Minutes per update |

Organizing Client Information

Keeping client details organized is essential for reducing the time spent searching for information. Using a well-structured database or customer management system allows for quick access to contact details, payment histories, and other relevant information, reducing the time spent on administrative tasks.

- Centralized Database: Store all client data in one easily accessible location.

- Custom Fields: Use fields that capture only the most relevant information for faster searches.

- Regular Updates: Keep client details current to avoid confusion or delays.

How to Personalize Your Invoice

Customizing your billing records can significantly enhance your business’s professionalism and foster better client relationships. A personalized document helps reflect your brand, making it instantly recognizable while also allowing you to include specific details tailored to each transaction. Personalization not only strengthens your brand identity but also ensures that your clients feel valued and informed.

When personalizing your payment documentation, consider several aspects such as branding elements, client-specific details, and the overall structure. Each of these components can be adjusted to make your documents unique and aligned with your business’s needs.

Incorporating Branding Elements

One of the most effective ways to personalize your records is by incorporating your business’s branding elements. This includes using your logo, color scheme, and fonts that align with your brand identity. A well-designed document can create a cohesive and professional image that resonates with your clients.

- Logo: Include your company’s logo at the top for instant recognition.

- Brand Colors: Apply your business’s color scheme to key elements like headers, borders, and highlights.

- Typography: Use your company’s fonts to maintain consistency with other marketing materials.

Customizing Client Details

Tailoring each document to include relevant client-specific information is another way to personalize it. This could include unique payment terms, specific project details, or custom messages. By adding such personal touches, you make it easier for your clients to understand the details of their transaction and feel more engaged with your business.

- Client Name: Ensure the client’s full name and contact details are clearly displayed.

- Personalized Message: Add a brief message thanking the client or offering a discount for future services.

- Customized Payment Terms: Adjust the payment terms based on the specific agreement with each client.

Integrating Invoice Templates with Accounting Software

Seamlessly connecting your billing documents with accounting software is a key step toward improving efficiency and accuracy in financial management. By integrating these systems, you can streamline processes, reduce manual data entry, and ensure that your financial records are automatically updated with every transaction. This integration can save time, minimize errors, and provide a clearer view of your business’s financial health.

When your documents are linked with accounting tools, it allows for smooth tracking of income, expenses, and taxes without the need for repetitive manual input. Additionally, such integration helps ensure that all transaction data is consistent and available for real-time reporting.

Benefits of Integration

- Time-Saving: Automatically transfer transaction details between the billing system and the accounting software, eliminating the need for duplicate data entry.

- Accuracy: Ensure consistency in figures and calculations, reducing the chances of errors in your financial records.

- Real-Time Financial Tracking: Gain immediate access to up-to-date financial reports, providing a clearer understanding of your business’s financial status.

How to Implement Integration

To integrate your billing documents with accounting software, follow these key steps:

- Choose Compatible Software: Select an accounting software solution that supports integration with your billing tools.

- Sync Data Fields: Ensure that essential fields, such as client names, amounts, and payment dates, are mapped correctly between the two systems.

- Automate Data Flow: Set up automatic synchronization to transfer data instantly, reducing the need for manual updates.

By following these steps, you can easily integrate your billing documents with accounting software, ensuring that both systems work together efficiently and seamlessly.

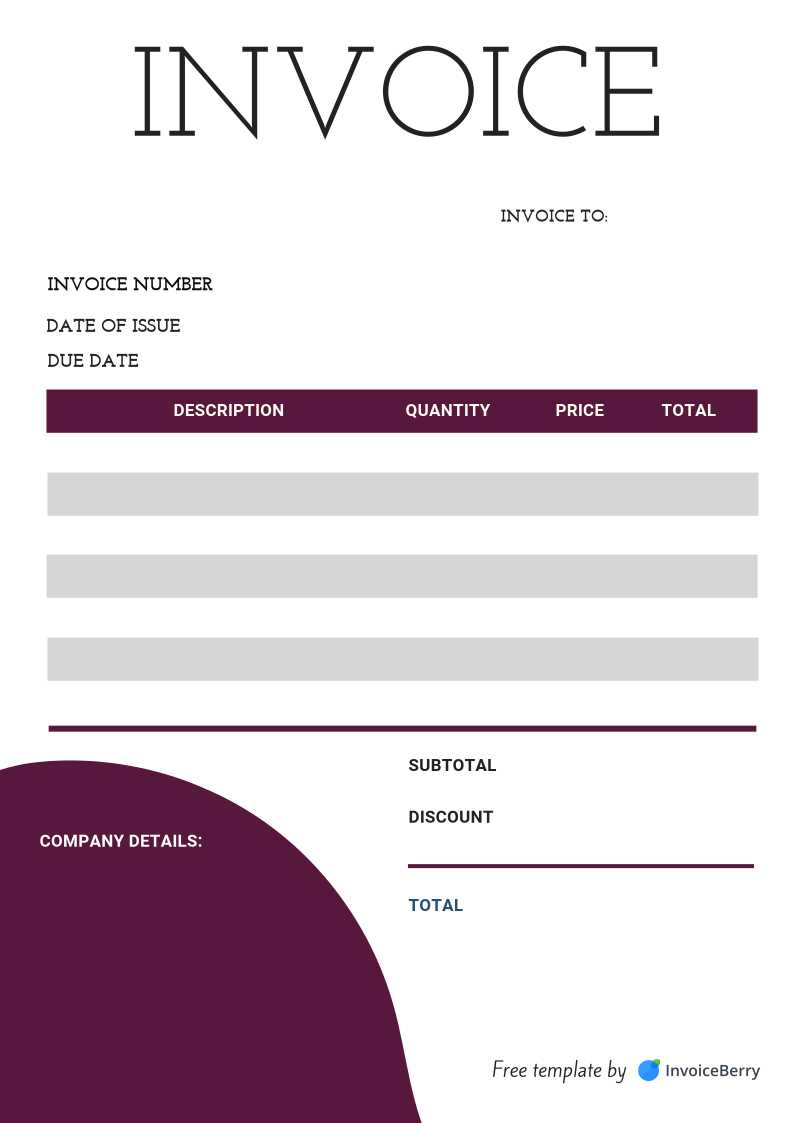

Understanding Invoice Layout and Design

Effective design and layout of billing records play a crucial role in ensuring clarity and professionalism. A well-structured document not only helps to present financial information in an organized manner but also enhances the overall user experience. The layout should be simple, visually appealing, and easy to navigate, ensuring that both the business and the client can quickly identify and understand the essential details of the transaction.

The design elements you choose should align with your brand’s identity and focus on readability. By considering factors such as typography, spacing, and placement of key information, you can create a document that is not only functional but also contributes to building trust with your clients.

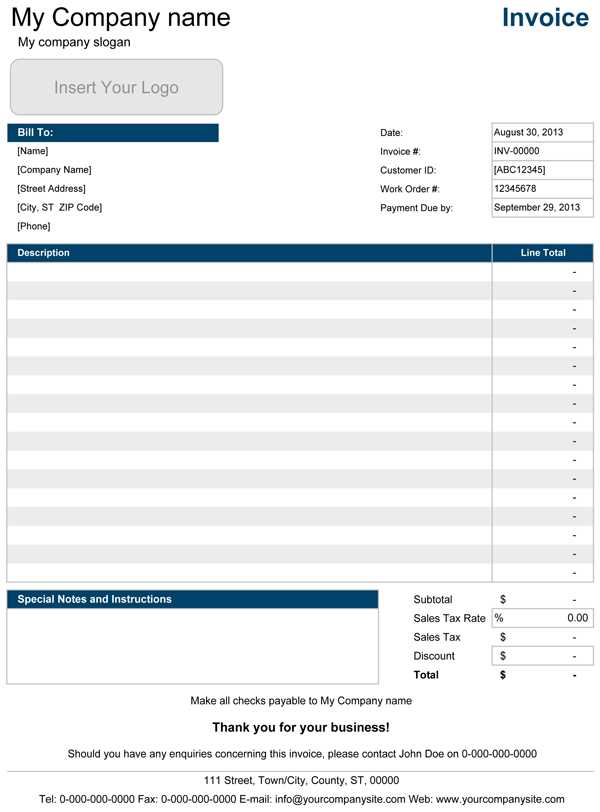

Key Elements of a Good Layout

- Clear Header: Your business name, contact details, and logo should be prominently displayed at the top.

- Legible Fonts: Use easy-to-read fonts and appropriate font sizes to ensure the document is clear and professional.

- Logical Sections: Divide the document into clear sections, such as client details, transaction description, and payment terms.

- Spacing and Alignment: Ensure enough white space between sections and proper alignment of data to make the document visually appealing.

Visual Hierarchy and Readability

Establishing a strong visual hierarchy is essential for guiding the reader through the document. By making key information stand out through bold fonts, larger text, or distinct colors, you help clients quickly focus on what’s most important. This also reduces the likelihood of confusion and enhances the document’s overall effectiveness.

- Highlight Important Information: Use bold or larger fonts for key details like total amounts and due dates.

- Use Color Wisely: While maintaining brand consistency, use color to draw attention to critical sections, such as payment due dates or late fees.

- Consistent Formatting: Ensure consistent use of fonts, colors, and spacing throughout to maintain a polished and professional appearance.

Top Tools for Creating Invoices

Creating professional billing documents is easier than ever thanks to various software and online platforms designed to streamline the process. These tools offer customizable features that help businesses generate detailed, accurate, and professional records with minimal effort. Whether you’re a small business owner or managing a large company, choosing the right tool can save time, improve efficiency, and reduce errors in your financial documentation.

The best tools for generating billing documents come with a range of features such as automated calculations, customizable layouts, and easy integration with accounting systems. Here are some of the top options available to help you create polished and effective billing records.

Top Features of Invoice Creation Tools

| Tool | Key Features | Best For |

|---|---|---|

| Tool 1: FreshBooks | Customizable designs, automated reminders, client tracking | Small businesses, freelancers |

| Tool 2: QuickBooks | Integrated accounting, expense tracking, reports | Medium to large businesses |

| Tool 3: Zoho Invoice | Multiple templates, recurring billing, multi-currency support | Global businesses, e-commerce |

| Tool 4: Wave | Free billing system, accounting features, cloud-based | Startups, small businesses |

| Tool 5: Invoice Ninja | Custom invoices, task management, online payment integration | Freelancers, small businesses |

Choosing the Right Tool for Your Business

When selecting a tool, consider factors such as your business size, the volume of transactions, and the level of customization you need. For instance, freelancers and small businesses may benefit from tools like Wave or FreshBooks due to their user-friendly interfaces and affordability. On the other hand, larger businesses or those needing advanced reporting and accounting capabilities may prefer QuickBooks or Zoho Invoice.

By choosing the right software, you can simplify your document generation process, minimize human error, and enhance the professionalism of your billing communications.

How to Automate Invoice Creation

Automating the process of generating financial records can significantly reduce administrative work and improve accuracy. With the right tools and workflows, businesses can streamline their billing process, saving time and ensuring consistency across all documents. Automating document creation allows you to focus on growing your business while leaving the repetitive tasks to technology.

There are several methods and tools available that can help automate the creation of these documents. These tools often integrate with existing systems such as accounting software, payment platforms, and customer databases. By setting up triggers, templates, and automated workflows, businesses can ensure that bills are created and sent on time with minimal manual effort.

Steps to Automate Document Creation

- Choose the Right Tool: Select software or an online platform that integrates with your existing business tools (like accounting or CRM systems). Popular choices include QuickBooks, FreshBooks, or Zoho Invoice.

- Create Custom Workflows: Set up automated actions, such as creating and sending documents when a specific event occurs (e.g., when a product is shipped or a service is completed).

- Set Payment Terms: Define payment due dates and set up reminders that are automatically sent to clients before or after the payment deadline.

- Automate Client Information Entry: Integrate your system with a customer relationship management (CRM) tool so that client information is pulled automatically to create accurate and personalized documents.

- Utilize Recurring Billing: For ongoing transactions, set up recurring invoices that are automatically generated and sent to clients at regular intervals without any manual input.

Benefits of Automating Billing Processes

- Efficiency: Save valuable time by eliminating the need for manual data entry and repetitive tasks.

- Accuracy: Automated systems minimize human error, ensuring that all financial data is correctly recorded.

- Timeliness: Ensure that documents are sent promptly, avoiding delays that can affect cash flow.

- Improved Client Relationships: By sending accurate, timely, and professional documents, you help build trust with your clients.

By automating the creation of financial documents, businesses can operate more smoothly, reduce administrative overhead, and ensure that they maintain an efficient, streamlined process. The result is greater time savings, fewer errors, and a better overall experience for both the business and its clients.

Choosing Between Free and Paid Templates

When selecting tools to create professional documents, one of the key decisions businesses face is whether to opt for free or premium options. Both types offer advantages, but each comes with its own set of features, limitations, and potential costs. Understanding the difference can help you make an informed choice based on your specific needs and budget.

Free tools are often a great starting point for small businesses or freelancers who are just beginning and need a simple, no-cost solution. However, while free options may seem attractive, they might lack some essential features or customization options that businesses might need as they grow. Paid tools, on the other hand, offer more advanced features, support, and flexibility, making them ideal for businesses that require higher-level functionality.

Advantages of Free Tools

- No Financial Investment: Free tools are ideal for businesses on a tight budget, offering basic functionality without any upfront costs.

- Quick Setup: Many free options are simple to use, allowing you to get started immediately without the need for extensive training.

- Good for Small-Scale Operations: Free tools often provide all the necessary features for freelancers or small businesses that don’t require complex functions.

Benefits of Paid Tools

- Advanced Features: Paid options often include advanced functionalities, such as automation, recurring transactions, and advanced reporting tools, which are essential for larger operations.

- Customization: Premium tools allow for more extensive customization, enabling businesses to tailor documents to their branding or specific needs.

- Customer Support: With paid options, you often get access to dedicated customer service, which can be crucial if you encounter any issues.

- More Integrations: Premium platforms tend to offer greater integration with other software, making it easier to sync data across various business functions.

Ultimately, the decision between free and paid tools depends on the size and needs of your business. If you’re just starting out or only need basic functionality, free tools may be sufficient. However, if you’re managing a growing business or need specialized features, investing in a premium solution could be the right choice for long-term success.

Customizing Templates for Client Needs

Adapting documents to meet the specific preferences and requirements of clients is crucial for maintaining professionalism and ensuring satisfaction. By tailoring the layout, information fields, and design elements, businesses can create personalized documents that align with their clients’ branding and unique expectations. Customization not only enhances client relationships but also streamlines processes by providing clear, relevant information in a format that suits their needs.

When customizing, it’s important to consider several factors, such as the client’s industry, their preferred method of communication, and any specific details they require. For example, some clients may want additional fields for project details or payment terms, while others may require a more minimalistic layout. Understanding these needs helps ensure that the final document is both functional and visually appealing, contributing to a positive business relationship.

Key Customization Options

- Branding and Logos: Incorporating the client’s logo, color scheme, and fonts ensures the document reflects their brand identity.

- Information Fields: Tailoring sections to include or exclude specific data such as purchase orders, discounts, or product descriptions helps make the document more relevant to the client’s operations.

- Terms and Conditions: Including customized terms or payment conditions can make the document more precise, aligning with the client’s agreement.

- Layout Adjustments: Modifying the arrangement of sections and fields can enhance readability and streamline the information flow for better user experience.

Ensuring Consistency Across Documents

- Template Libraries: Storing customized documents in a library allows for easy reuse and consistency across multiple projects and clients.

- Automation Tools: Using software that supports custom fields can automate the process of generating documents while keeping all elements consistent and aligned with the client’s preferences.

- Regular Updates: Periodically reviewing and updating customization options ensures that the documents stay in line with evolving client needs and industry standards.

Ultimately, taking the time to customize documents not only helps meet specific client needs but also contributes to building stronger, long-lasting business relationships.

Ensuring Legal Compliance in Invoices

Adhering to legal requirements when creating financial documents is essential for businesses to avoid potential disputes and penalties. Properly structured documents not only help maintain transparency but also ensure that both parties are protected by clear terms and conditions. Legal compliance covers various aspects such as tax rates, necessary legal information, and clear payment terms, which must be accurately reflected in every transaction record.

Each jurisdiction may have its own set of rules regarding what must be included in a transaction record, such as business registration numbers, VAT identification numbers, and specific terms for payment. Businesses must be aware of these regulations and ensure that their records comply with local laws to avoid issues during audits or disputes with clients.

Key Compliance Factors to Consider

- Business Information: Ensure that the document includes the legal name of the company, registration number, and contact information, which may be required by law in many regions.

- Tax Information: Clearly state applicable tax rates and amounts, including VAT or sales tax, depending on your location and the nature of the transaction.

- Payment Terms: Clearly outline due dates, late fees, and accepted methods of payment, which are often required by law to ensure both parties are informed of their obligations.

- Product or Service Details: Provide a detailed list of the items or services being exchanged, including descriptions and quantities, which can be critical in case of disputes.

Keeping Up with Legal Changes

- Regular Audits: Conducting internal reviews ensures that all documents align with changing tax laws and local regulations, minimizing the risk of non-compliance.

- Software Integration: Using accounting software that is regularly updated with legal changes can help automate compliance, ensuring that all required fields are included in each document.

- Consulting Legal Advisors: Seeking professional advice, especially when expanding into new regions, can help navigate complex legal landscapes and ensure that your records are always compliant.

By paying attention to the legal details in each document, businesses can avoid unnecessary legal complications and maintain trust with their clients.

Maintaining Consistency in Invoicing

Consistency in financial documentation is crucial for establishing professionalism and ensuring smooth business operations. When every transaction record follows a similar structure and format, it becomes easier for both businesses and clients to understand and manage financial matters. A well-maintained and consistent approach helps reduce confusion, ensures accurate tracking, and strengthens trust between both parties.

Uniformity in documentation also plays a significant role in streamlining accounting and tax-related tasks. By sticking to a predefined format, businesses can easily track payments, reconcile accounts, and provide necessary information during audits. Furthermore, consistent documents allow for quicker identification of any discrepancies, helping to resolve issues promptly.

Steps to Ensure Consistency

- Standardize Layouts: Use the same structure and design for every document. This includes a consistent font, color scheme, and arrangement of information, which makes the document familiar and professional.

- Automate Processes: Implement software or tools that automatically generate records based on a consistent format. This reduces human error and saves valuable time.

- Define Clear Fields: Ensure that all necessary information is included in every document, such as business details, item descriptions, payment terms, and total amounts, while avoiding redundant information.

Benefits of Consistency

- Improved Efficiency: Consistent documentation minimizes the time spent on formatting and reviewing, allowing employees to focus on other important tasks.

- Better Client Relations: Clients appreciate clarity and reliability, and maintaining consistency helps build strong professional relationships based on trust.

- Accurate Record Keeping: When all documents follow the same format, it’s easier to track and manage financial records, making it simple to audit or retrieve past transactions.

By maintaining consistency in your documentation practices, you ensure not only smoother operations but also a more organized and professional approach to handling client transactions.

Improving Payment Turnaround with Templates

Timely payments are essential for maintaining healthy cash flow in any business. One effective way to speed up the payment process is by using standardized documents that streamline the communication and transaction process. A well-structured document not only makes it easier for clients to understand their financial obligations but also ensures that all necessary information is clear, reducing the chances of delays or misunderstandings.

By adopting a consistent and professional approach to generating financial requests, businesses can foster quicker responses from clients. When the required details are laid out clearly and concisely, it allows for easier review and faster action. Using a structured approach saves time and can prevent issues such as missing information or confusing terms that could cause payment delays.

Key Elements That Improve Turnaround Time

| Element | How It Improves Payment Turnaround |

|---|---|

| Clear Payment Terms | Clearly stating due dates, late fees, and payment methods helps the recipient know exactly when and how to pay, avoiding confusion and delays. |

| Accurate Financial Details | Providing precise information, such as amounts due, itemized breakdowns, and total amounts ensures that clients have all the details needed to approve payments quickly. |

| Simple Formatting | A well-organized layout that uses headers, bullet points, and sections makes it easier for clients to read and understand, reducing the time spent on reviewing documents. |

| Automated Reminders | Setting up automatic reminders for clients who are approaching their payment due dates increases the likelihood of timely payment. |

By incorporating these key elements into financial documents, businesses can expect faster payment cycles and improved relationships with clients, ultimately helping to maintain cash flow and reduce administrative delays.

Best Practices for Invoice Follow-Ups

Ensuring timely payments requires effective follow-up practices. After sending a request for payment, it’s crucial to stay proactive and maintain communication with clients to avoid delays. A thoughtful and professional approach to follow-ups can help ensure that payments are received on time while preserving positive business relationships.

Following up in a timely and respectful manner is essential for maintaining a smooth financial process. It’s important to strike a balance between being persistent enough to get the payment, but not too aggressive as to harm client relations. Clear and consistent communication helps clients feel more comfortable with the process and reduces the likelihood of missed payments.

When to Send Follow-Up Reminders

Timing is critical when following up on unpaid bills. Sending reminders at the right intervals can significantly improve the chances of receiving prompt payment. Here are some best practices for determining when to follow up:

- Immediately after the due date: Send a polite reminder the day after the payment is due. This serves as a gentle nudge and keeps the matter fresh in the client’s mind.

- One week after the due date: If the payment hasn’t been received, send a second reminder. Reiterate the original payment terms and any late fees that might apply.

- Two weeks after the due date: By this time, it may be necessary to escalate the tone slightly while still being professional. Offering assistance in case there are any issues with the payment can show that you’re willing to work with the client.

Key Tips for Successful Follow-Ups

- Be clear and concise: Clearly state the amount due, the payment method, and any relevant details in each follow-up. Avoid ambiguity to minimize confusion.

- Stay polite: Always maintain a respectful tone, regardless of how overdue the payment is. A positive, understanding approach encourages the client to act promptly.

- Offer flexible payment options: Providing multiple payment options, such as bank transfer, online payment, or credit card, can make it easier for the client to settle the amount.

- Use automated reminders: Many systems offer automated reminders that can reduce the manual effort needed to send follow-up messages and ensure timely communication.

By following these best practices, businesses can streamline their follow-up process and encourage faster payments, while also maintaining strong client relationships.