Top Invoice Template Service for Streamlined Billing

Managing payments efficiently is a key element of any business operation. The ability to quickly generate accurate, professional documents that ensure timely payment is essential for maintaining a smooth cash flow. With the right tools, invoicing can become a simple, automated task rather than a time-consuming chore.

Customized billing documents not only help ensure accuracy but also create a consistent, professional image for your brand. These documents serve as the official record of transactions, making it easier to track finances, resolve disputes, and maintain transparency with clients.

Whether you’re a freelancer, small business owner, or large enterprise, having the ability to quickly create and send out formal requests for payment can significantly improve your operational efficiency. By using modern tools, you can reduce errors, save time, and enhance the overall client experience.

Why Choose an Invoice Template Service

When it comes to managing financial transactions, having the right tools can make a significant difference. Generating clear, professional documents quickly can save both time and effort, while ensuring accuracy in every step. Using specialized solutions to create such documents can automate much of the process, reducing human error and enhancing productivity.

One of the key advantages of using these tools is the level of customization they offer. With predefined designs and fields, you can easily adjust the layout and content to meet your specific needs. This flexibility not only helps maintain consistency but also strengthens your brand identity, as each document can reflect your company’s style and professionalism.

Moreover, these tools often come with integrated features that can sync with your accounting software, helping you manage finances more effectively. This integration allows for streamlined tracking of payments, automatic calculation of totals, and instant updates, which means fewer manual entries and more accurate reporting. With these tools at your disposal, the entire billing process becomes more efficient and less prone to mistakes.

Benefits of Customizable Invoice Templates

Having the ability to personalize your billing documents offers significant advantages for businesses of all sizes. Customization not only helps you align documents with your brand’s identity but also ensures that the content reflects your specific needs. By modifying the layout, fields, and design elements, you gain complete control over the presentation and functionality of your financial records.

Professional Appearance and Branding

One of the major benefits of creating personalized documents is the ability to maintain a consistent, professional look. By incorporating your company logo, colors, and specific design elements, you present a polished and cohesive image to clients. A well-designed document helps establish trust and reinforces your brand’s credibility, making a lasting impression on your customers.

Efficiency and Accuracy

Customizable options also improve operational efficiency. With pre-set fields and automatic calculations, the risk of errors is minimized, leading to greater accuracy in billing. Additionally, the ability to save and reuse personalized layouts means you can quickly generate accurate documents for future transactions, saving both time and effort. This streamlining of the process helps businesses focus on core tasks while ensuring clients receive clear and correct details.

How to Create Professional Invoices Fast

Generating clear, professional billing documents doesn’t have to be a time-consuming task. With the right tools and approach, you can create and send out payment requests quickly without compromising on quality or accuracy. The key is to streamline the process and use resources that automate much of the work for you.

Steps to Speed Up the Billing Process

Follow these steps to create efficient and accurate financial documents in no time:

- Choose a Pre-Designed Layout: Start with a structured format that already includes common fields, such as client details, payment terms, and totals. This minimizes the need for manual entry.

- Customize the Content: Fill in the necessary details like service descriptions, rates, and due dates. Personalize each document to reflect the unique aspects of the transaction.

- Use Automation Features: Utilize automated calculation tools for taxes, discounts, and totals to reduce errors and speed up the process.

- Save and Reuse Documents: Save frequently used layouts and recurring client information, so you can quickly generate similar documents in the future.

Additional Tips for Efficiency

- Set Payment Terms in Advance: Establish clear payment expectations, such as due dates and late fees, to avoid confusion and ensure timely payments.

- Integrate with Accounting Tools: Sync your billing documents with accounting software to automatically track payments and simplify reporting.

- Save Time with Digital Delivery: Send documents instantly via email or an online portal to speed up the process and reduce administrative work.

Top Features to Look for in an Invoice Template

When selecting a solution to create billing documents, it’s essential to look for features that simplify the process and ensure accuracy. The right tool can save time, reduce errors, and offer customization options that align with your business needs. A well-rounded tool should offer flexibility, automation, and ease of use to ensure you can quickly generate professional documents without hassle.

Here are some key features to consider when choosing a tool for creating your financial documents:

- Customizable Layout: The ability to modify the design, adjust fields, and add your company’s branding elements, such as logos and colors, ensures that each document represents your business identity.

- Automated Calculations: Look for a solution that automatically calculates totals, taxes, and discounts. This reduces the chance of human error and speeds up the process, especially when dealing with complex billing structures.

- Recurring Billing Options: If you work with clients on a subscription or retainer basis, the ability to set up recurring payments and automatic generation of documents saves time and ensures consistency.

- Multi-Currency and Multi-Language Support: For businesses dealing with international clients, having the ability to issue documents in different currencies and languages is a major advantage. This feature enhances global transactions and customer satisfaction.

- Integration with Accounting Systems: Seamless integration with accounting or payment software allows for better tracking of payments, syncing of data, and easy financial reporting, minimizing manual work.

- Mobile Accessibility: A mobile-friendly solution gives you the flexibility to generate, send, and manage documents from anywhere, at any time, which is particularly useful for freelancers or businesses with remote teams.

By selecting a solution that offers these features, you can ensure that your billing process is both efficient and professional, leading to faster payments and smoother business operations.

Understanding Different Invoice Formats

When managing billing documentation, it’s important to be aware of the various formats that can be used to present payment requests. Each format serves a different purpose and caters to the specific needs of a business, client, or industry. Choosing the right format ensures clarity, enhances professionalism, and makes the payment process smoother for both parties.

Here are some of the most common formats used for creating payment requests:

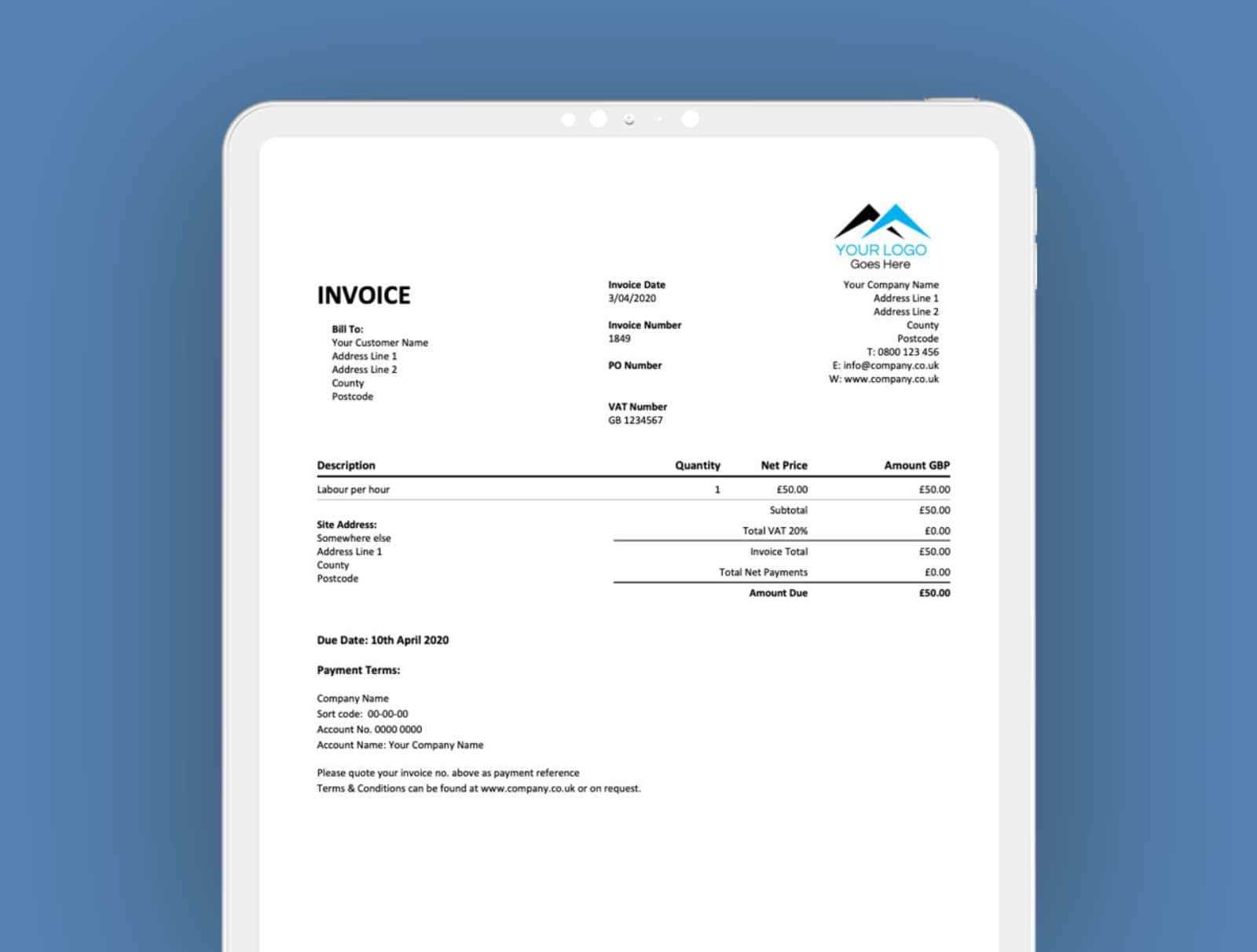

- Standard Format: This is the most basic and widely used format. It includes key information such as the buyer’s details, the seller’s contact information, a list of items or services, payment terms, and the total amount due. It’s ideal for most business transactions.

- Pro Forma Format: A preliminary version of a payment request, typically used before the final delivery of goods or services. This format outlines the expected charges and serves as a quote, helping clients understand the potential costs in advance.

- Credit Note Format: Used when a refund or adjustment is required, this format acts as a notification of changes to a previous transaction. It may reflect discounts, returns, or overpayments and is essential for maintaining accurate records.

- Recurring Billing Format: This format is used for ongoing services, subscriptions, or contracts. It allows businesses to set up regular payments at fixed intervals, such as monthly or annually, without needing to generate a new document each time.

- Mixed-Format: Some businesses use a combination of different formats depending on the transaction type. For example, an order confirmation may be sent in one format, while an adjustment for late fees or additional charges might follow a different format.

Each format serves a specific purpose, and understanding which one to use in different scenarios can help streamline the billing process and enhance customer satisfaction.

Invoice Template Services for Small Businesses

For small business owners, managing financial documentation efficiently is crucial for ensuring smooth operations. Having access to easy-to-use tools that streamline the creation of payment requests can save both time and effort. These solutions can simplify the billing process, reduce errors, and help maintain professionalism with clients. With customizable features, even small businesses can create high-quality documents that align with their unique needs and brand identity.

Why Small Businesses Need Automated Billing Solutions

Small businesses often operate with limited resources, so efficiency is key to staying competitive. Using automated tools to generate billing documents means owners can focus on more strategic tasks instead of spending valuable time on administrative work. By automating calculations and recurring payments, businesses can minimize human error, reduce the chance of disputes, and improve cash flow management. Moreover, these tools ensure that invoices are created quickly, allowing for faster payment cycles.

Key Features for Small Business Billing Solutions

Small business owners should look for solutions that offer the following:

- Customizable Layouts: Personalizing documents with the business logo and color scheme helps maintain a professional appearance and enhances brand recognition.

- Recurring Billing: For businesses with subscription models or long-term clients, automated recurring billing saves time and ensures consistency.

- Mobile Accessibility: With mobile-friendly tools, business owners can generate and send documents on the go, which is especially useful for freelancers or those working remotely.

- Payment Integration: Some tools allow direct payment links, so clients can pay instantly upon receiving the document, speeding up cash flow.

By choosing the right tool, small businesses can streamline their operations, reduce overhead costs, and improve overall efficiency in managing client transactions.

Save Time with Automated Invoice Creation

Automating the creation of financial documents can significantly reduce the amount of time spent on repetitive tasks. By leveraging tools that handle document generation automatically, businesses can free up valuable time to focus on more important activities. Automation eliminates manual entry, ensuring that documents are accurate and ready for delivery with minimal effort.

Here are some key ways automation can save time in your billing process:

| Benefit | Description |

|---|---|

| Instant Document Creation | Automation allows you to generate new documents in seconds using pre-set fields and recurring details, eliminating the need for manual entry. |

| Automatic Calculations | Built-in calculation tools automatically add up totals, apply taxes, and include discounts, reducing the chance of errors and saving time. |

| Recurring Billing | For clients on a subscription or contract basis, automated recurring document creation ensures that you don’t have to generate a new one every time a payment is due. |

| Quick Customization | Once you set up your default fields and layout, you can easily adjust any details, such as pricing or services, without starting from scratch each time. |

With these features, businesses can speed up their billing process, reduce administrative workload, and ensure a more consistent experience for their clients.

How Invoice Templates Simplify Billing Processes

Streamlining the billing process is crucial for maintaining efficient business operations. By using pre-designed solutions that structure financial documents, businesses can reduce the time spent on manual tasks and eliminate common errors. These solutions ensure that all necessary information is included in each document, helping to avoid mistakes and ensuring consistency across every transaction.

Here’s how pre-built billing formats can simplify your financial workflow:

- Consistency and Accuracy: Using a standardized layout ensures that every document contains the same fields in the same order, reducing the likelihood of missing or incorrect information.

- Faster Document Creation: With pre-configured fields and formulas, creating financial documents becomes a matter of filling in the details rather than starting from scratch each time.

- Time Savings: The ability to reuse the same format for different clients or transactions saves significant time compared to creating a new document each time. Automation of common fields like client names and pricing can speed up the process even further.

- Professional Appearance: Ready-made formats are designed to look polished and professional, providing a high-quality document that reflects well on your business, without requiring design expertise.

- Easy Customization: These solutions offer the flexibility to quickly adjust certain elements, such as pricing or service details, to fit the specific needs of each client or transaction.

By leveraging these pre-configured solutions, businesses can minimize the time spent on administrative tasks and ensure that their financial documents are both accurate and professional, leading to smoother billing cycles and improved customer satisfaction.

Choosing the Right Invoice Design for Your Brand

The appearance of your billing documents plays a crucial role in how your business is perceived. A well-designed document can help establish trust, reflect professionalism, and enhance your brand identity. Choosing the right design ensures that the document not only communicates necessary information but also aligns with your business values and aesthetic.

When selecting the right design, consider how the layout, colors, fonts, and overall style can represent your brand effectively. A good design can also make the document easier to read and ensure clients understand the key details without confusion.

Key Factors in Choosing the Right Design

Here are some important factors to keep in mind when selecting a design for your business documents:

| Factor | Description |

|---|---|

| Brand Consistency | Choose a design that reflects your brand’s color scheme, logo, and visual style to ensure consistency across all communication materials. |

| Clarity and Readability | A simple and clean layout with clear sections and legible fonts makes the document easy to read, improving customer understanding. |

| Professionalism | The design should convey professionalism, aligning with the nature of your business. For example, creative industries may opt for a more artistic design, while corporate businesses may prefer a minimalistic approach. |

| Customization Options | Look for a solution that offers flexibility in layout, allowing you to easily adjust the design to fit the unique needs of each client or transaction. |

Matching Design with Client Expectations

When choosing a design, also consider the expectations of your target clients. If you’re working with creative professionals, a bold, unique layout might resonate well. However, for corporate clients, a clean and straightforward design is typically more appropriate. Understanding your audience will help you select a design that not only reflects your brand but also appeals to your clients’ expectations.

Free vs Paid Invoice Template Services

When choosing a solution to create professional billing documents, businesses often face the decision between free and paid tools. While free options may seem appealing at first, paid tools typically offer more robust features and greater customization. It’s important to weigh the benefits of both to determine which option aligns best with your business needs.

Free tools often come with basic features and may limit your ability to customize or automate certain aspects of the document creation process. On the other hand, paid options tend to offer more advanced features such as integrations with accounting systems, recurring billing, and customer support. Below is a comparison to help you understand the key differences between free and paid solutions.

| Feature | Free Tools | Paid Tools |

|---|---|---|

| Customization Options | Limited design flexibility and fewer options to add branding elements. | Highly customizable layouts with the ability to add logos, colors, and personalized fields. |

| Automation | Basic or no automation; manual data entry is required for each document. | Advanced automation options, including automatic calculations and recurring billing setups. |

| Customer Support | Minimal or no support; often relies on community forums or FAQs. | Dedicated customer support, including live chat, phone support, and in-depth resources. |

| Integrations | Limited or no integration with accounting or payment systems. | Seamless integration with accounting software, CRM systems, and payment gateways. |

| Security | Basic security features, with less protection for sensitive client data. | Enhanced security measures, such as encryption and secure cloud storage for client information. |

Ultimately, the decision between free and paid tools depends on your business’s specific needs. If you’re a freelancer or small business with basic requirements, a free solution may suffice. However, for larger businesses or those seeking advanced functionality and more professional features, investing in a paid option could provide significant long-term benefits.

How to Customize Your Invoice Templates

Customizing your billing documents allows you to align them with your brand identity and ensure that they meet the specific needs of your business. By adjusting the layout, design, and fields, you can create a unique document that communicates professionalism and clarity to your clients. Customization not only improves the aesthetic appeal but also enhances the efficiency and functionality of the document, making it easier to manage and process payments.

Steps to Personalize Your Billing Documents

Here are some key steps to customize your documents:

- Add Your Branding: Incorporate your company’s logo, color scheme, and font style to make your documents reflect your brand identity. This creates a more cohesive and professional appearance.

- Adjust the Layout: Customize the layout to suit the type of services or products you offer. Include relevant sections like item descriptions, taxes, and payment terms, and ensure the flow of information is logical and easy to follow.

- Include Custom Fields: Add personalized fields that are specific to your business needs, such as discount codes, project names, or service duration. This allows for flexibility in your documentation.

Advanced Customization Tips

For even more control over your documents, consider the following advanced customization options:

- Set Default Information: Pre-fill common fields like client names, payment terms, or business address to save time on future documents.

- Automate Calculations: Set up automatic tax and discount calculations to ensure accuracy and minimize manual entry errors.

- Enable Multiple Payment Options: Add various payment methods, such as bank transfer, PayPal, or credit card, to make it easier for your clients to pay.

By customizing your documents, you can streamline your billing process, improve client communication, and present a more polished, professional image to your customers.

Invoice Templates for Freelancers and Contractors

For freelancers and independent contractors, managing payments is an essential part of staying organized and ensuring timely compensation. Using pre-designed solutions to create billing documents can help streamline the process, making it easier to track payments and maintain professionalism with clients. These documents are vital not only for requesting payments but also for maintaining a clear record of services provided and funds received.

Why Freelancers and Contractors Need Custom Billing Solutions

As a freelancer or contractor, you often work with multiple clients, which means managing various projects, deadlines, and payment schedules. Having a customized billing solution helps you stay organized by ensuring that all necessary details are included in each document. This reduces the likelihood of errors and makes it easier for clients to understand what they are being charged for. Additionally, professional-looking documents enhance your credibility and can improve client relationships.

Essential Features for Freelance Billing Documents

When creating billing documents, freelancers and contractors should look for solutions that include the following features:

- Clear Payment Terms: Set clear and concise payment terms that outline deadlines, accepted payment methods, and any late fees. This helps avoid confusion and ensures clients know what to expect.

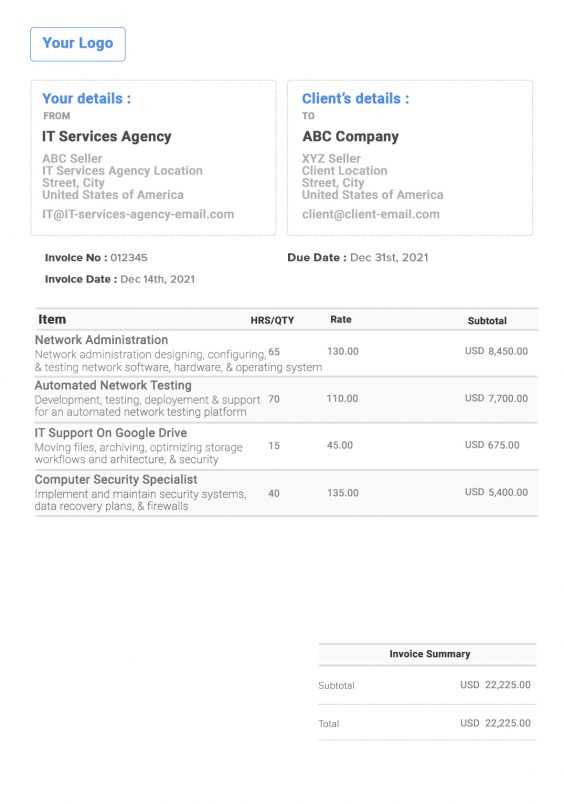

- Hourly and Project Rates: Easily list hourly rates or fixed project costs to ensure transparency for clients. Some solutions even allow for tracking of hours worked or milestones completed.

- Professional Design: The design of the document should reflect your professionalism, featuring your logo and contact information. A well-designed document can leave a positive impression on clients.

- Customizable Fields: Tailor the document to suit specific needs, such as including job descriptions, project codes, or client-specific requirements.

- Recurring Billing Options: For ongoing work or long-term contracts, recurring billing features help automate the process of generating new documents for each payment cycle.

By using the right solution, freelancers and contractors can save time, maintain professionalism, and ensure they are compensated promptly for their work.

Legal Considerations When Using Invoice Templates

When generating financial documents for your business, it’s important to be aware of the legal aspects involved in the process. These documents are not just a way to request payment, but they also serve as official records of transactions and can have legal implications. Ensuring that the right information is included and formatted correctly is essential to avoid potential disputes and ensure compliance with tax regulations and other business laws.

Key Legal Information to Include

Regardless of the format or design you choose, your billing documents must contain certain mandatory details to be legally valid. Failing to include these can lead to complications if a dispute arises. Here are some key pieces of information that should always be included:

- Full Business Information: Always include your business name, contact details, and any applicable registration numbers, such as your tax identification number or VAT registration number.

- Client Information: Ensure that the name, address, and contact details of the client receiving the goods or services are clearly listed.

- Clear Payment Terms: Specify payment deadlines, accepted payment methods, and any late fees or penalties for overdue payments. This helps avoid misunderstandings and provides legal grounds for enforcing timely payments.

- Itemized List of Services or Products: Break down what is being billed, including descriptions, quantities, and individual prices. This level of detail is important for transparency and resolving any potential disputes.

Compliance with Tax Regulations

One of the most important legal considerations is ensuring that your billing documents comply with local tax laws. This includes properly calculating taxes, including the relevant tax rates, and making sure that the document aligns with any specific requirements set by the tax authorities in your jurisdiction. For instance, some countries or regions may require a breakdown of the tax on the document, while others may require additional information for businesses operating under specific tax regimes.

Using the right solution to create your documents can help ensure that all necessary legal details are included, reducing the risk of non-compliance and potential legal issues down the road.

Integrating Invoice Templates with Accounting Software

Integrating your financial document creation process with accounting software can significantly improve efficiency and reduce manual data entry. By connecting your billing documents to an accounting system, you streamline tasks such as tracking payments, managing expenses, and generating financial reports. This integration helps ensure that all your financial data is accurate and up to date, allowing you to focus more on growing your business rather than spending time on administrative work.

When you connect your documents to accounting software, information such as client details, payment status, and transaction history can be automatically updated. This reduces the risk of errors and inconsistencies, and ensures that your records are always aligned with your financial system.

Here are some benefits of integrating your financial document creation with accounting software:

- Automation of Data Entry: Automatically transfer details from your financial documents to your accounting system, eliminating the need to manually input data and reducing the chance for human error.

- Real-Time Tracking: With integration, you can track the status of payments, invoices, and expenses in real time, providing you with up-to-date financial insights at any moment.

- Seamless Reporting: Financial data from your billing documents is automatically synced with your accounting software, making it easier to generate reports and stay on top of your financial health.

- Improved Efficiency: The integration helps you save time by automating repetitive tasks, allowing you to focus on higher-value activities such as client relationships and business development.

By integrating your billing process with accounting software, you not only improve accuracy and efficiency, but you also gain greater insight into your financial operations, helping you make more informed business decisions.

Why Invoice Templates Are Crucial for Cash Flow

Managing cash flow is essential for any business, as it ensures that you have the funds needed to cover operating expenses, invest in growth, and remain financially stable. Efficient billing practices are key to maintaining a steady cash flow. Using structured billing documents not only helps ensure timely payments but also facilitates smoother financial management by providing clear records of transactions. Proper documentation and timely invoicing directly impact your ability to predict and control cash flow.

When businesses create clear and professional documents for each transaction, they encourage clients to pay on time, reducing the risk of delayed payments. Consistent and accurate billing also ensures that you are paid for all services rendered, further stabilizing cash flow.

| Factor | Impact on Cash Flow |

|---|---|

| Clear Payment Terms | Helps avoid confusion and ensures clients understand when payments are due, encouraging prompt payment. |

| Professional Document Design | Projects professionalism and increases the likelihood that clients will prioritize your payment, leading to faster processing. |

| Timely and Consistent Billing | Regular and on-time invoicing reduces delays and keeps cash flow predictable, making it easier to manage financial obligations. |

| Itemized Breakdown | Provides transparency and clarity, reducing disputes and ensuring that clients pay for the exact services provided, speeding up the payment process. |

| Easy Payment Methods | Offering various payment options and simplifying the payment process increases the likelihood of on-time payments, helping maintain steady cash flow. |

By using well-structured and professional documents, businesses can improve their chances of getting paid on time, which directly enhances their cash flow and financial stability.