Invoice Template for Self Employed Professionals

Managing payments is one of the most crucial tasks for any independent professional. Having a structured approach to documenting and sending payment requests ensures timely compensation and helps maintain strong client relationships. With the right system in place, financial management becomes much more streamlined and efficient.

For those working on a contract basis or running their own business, a well-organized payment request format can save time and reduce errors. This not only helps in keeping track of what is owed but also makes the process of payment clearer for clients. Whether you’re offering services or selling goods, a professional approach to your billing documentation speaks volumes about your reliability and professionalism.

In this guide, we explore how you can create and customize your payment request documents to fit your business needs. We’ll cover everything from essential elements to design tips, ensuring that your documents are both effective and easy to use for any transaction.

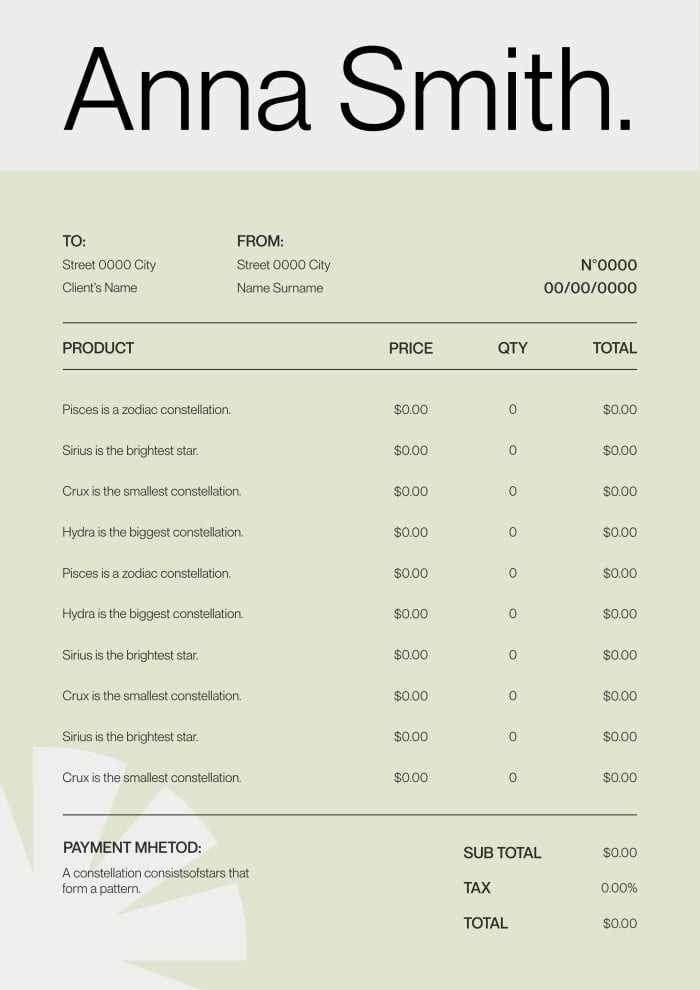

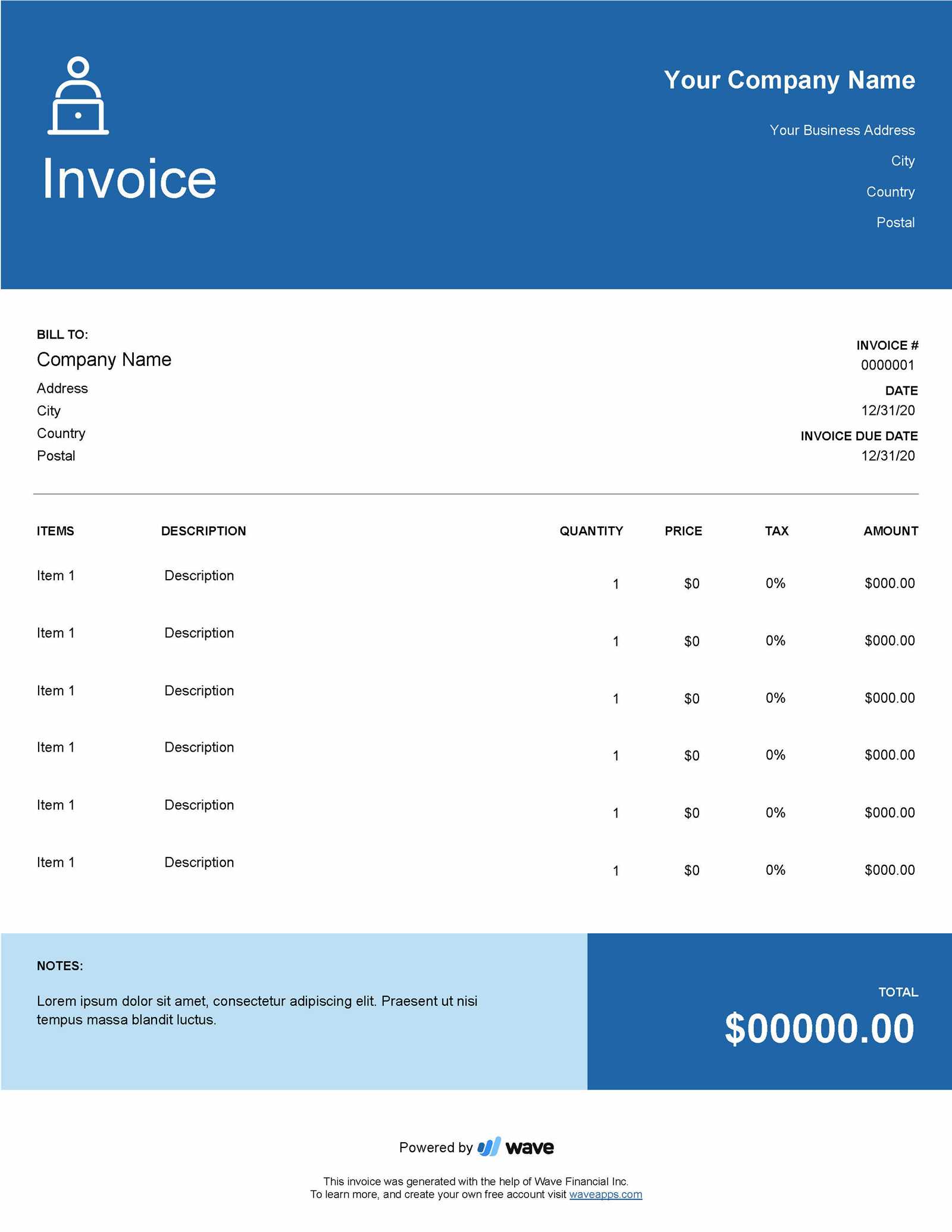

Essential Features of an Invoice Template

For any independent professional, a payment request document must include specific elements that ensure clarity and accuracy. These features help both the service provider and the client understand the terms of the transaction and avoid misunderstandings. By incorporating the right components, such documents can facilitate timely payments and keep financial records in order.

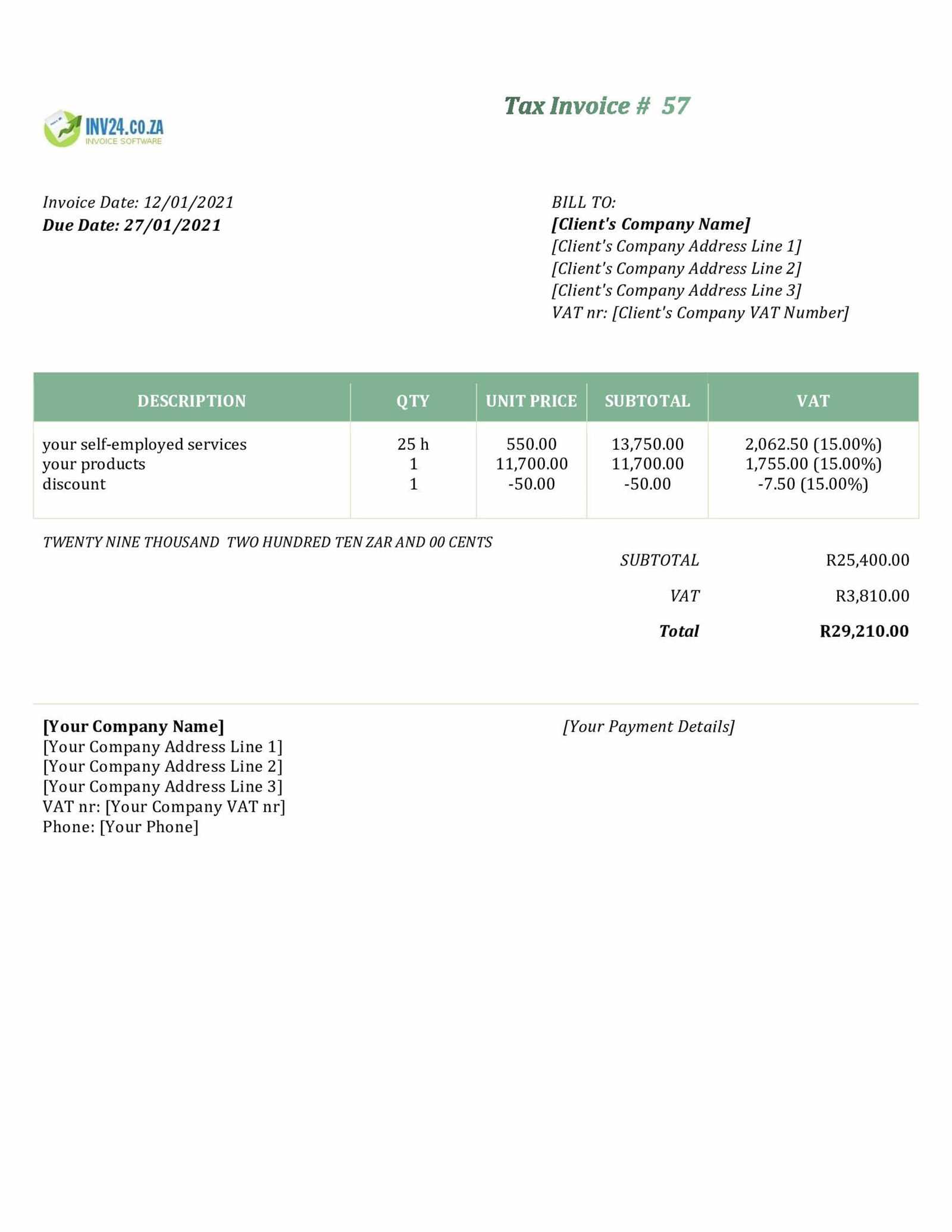

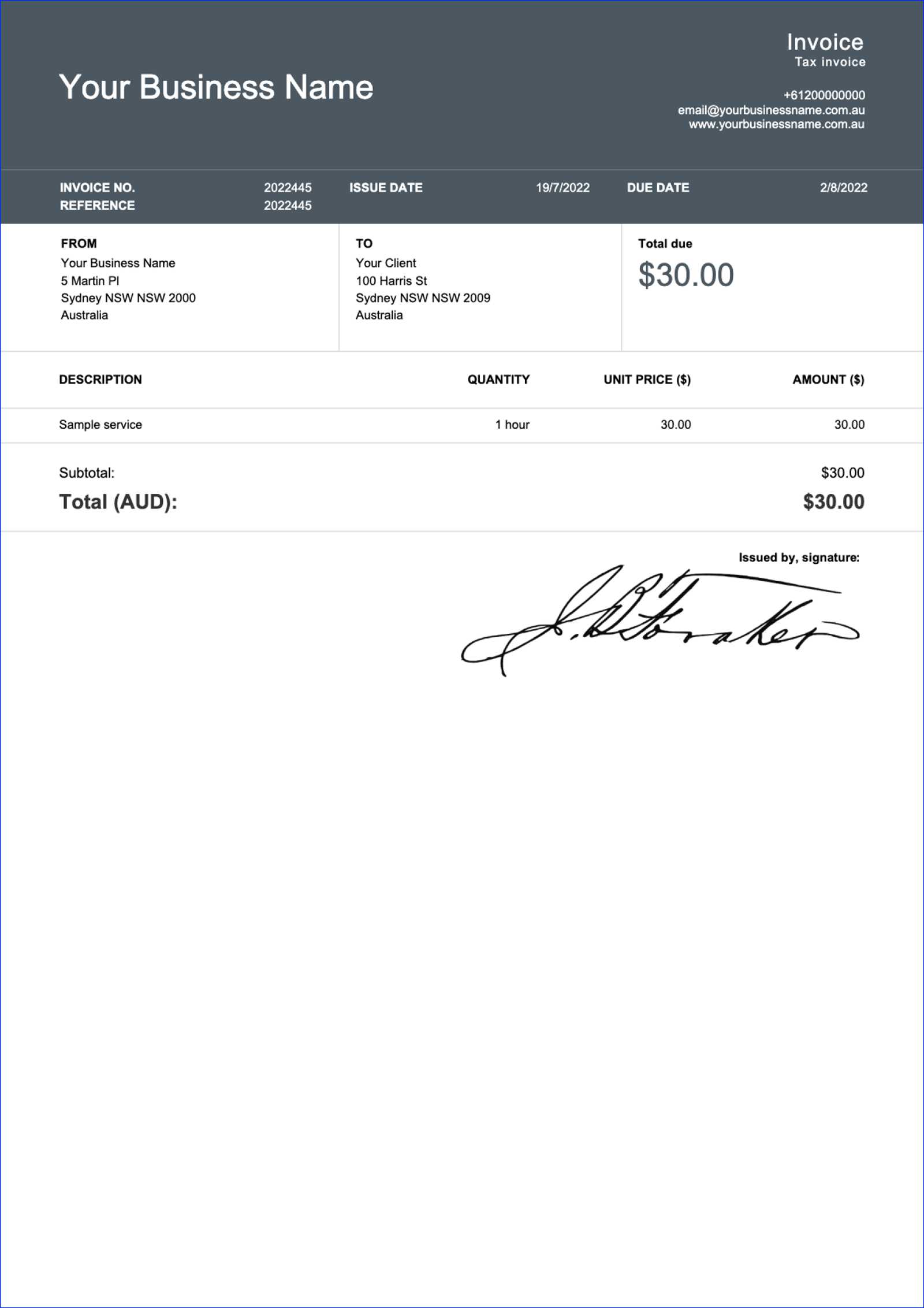

Firstly, the document should contain basic contact information, such as the name and address of both the service provider and the client. This is essential for identification and communication. In addition, clearly stating the date of issuance and a due date ensures that both parties are aware of when the payment is expected.

Another critical feature is a detailed breakdown of services rendered or products delivered. This section should outline the quantity, description, and price of each item, providing transparency and preventing confusion. Including a subtotal, applicable taxes, and the total amount due is equally important for a comprehensive overview of the charges.

Finally, payment terms and methods should be specified. This section clarifies how the client can pay and any late fees or discounts that may apply. Including this information upfront can speed up the payment process and avoid unnecessary delays.

Why Self Employed Need Professional Invoices

For independent professionals, maintaining a polished and structured approach to billing is essential. It not only ensures timely payments but also reflects the level of professionalism expected by clients. A well-designed document for payment requests can enhance credibility, simplify accounting, and foster better business relationships.

Here are some reasons why independent workers should use formal billing documents:

- Improved Client Perception: Sending a professional document shows clients that you are serious and organized, boosting trust in your services.

- Clear Payment Terms: A structured format allows you to clearly outline payment expectations, including due dates and methods, reducing confusion.

- Accurate Record Keeping: Proper documentation helps keep financial records in order, making tax season and audits much easier.

- Legal Protection: Well-crafted documents protect both parties by providing a record of the transaction and agreed-upon terms in case of disputes.

- Faster Payments: Clear, concise, and professional documents can encourage quicker payment from clients, helping you manage cash flow efficiently.

Using such documents is more than just a formality – it’s a critical part of running a smooth and successful business operation, ensuring you’re paid fairly and on time.

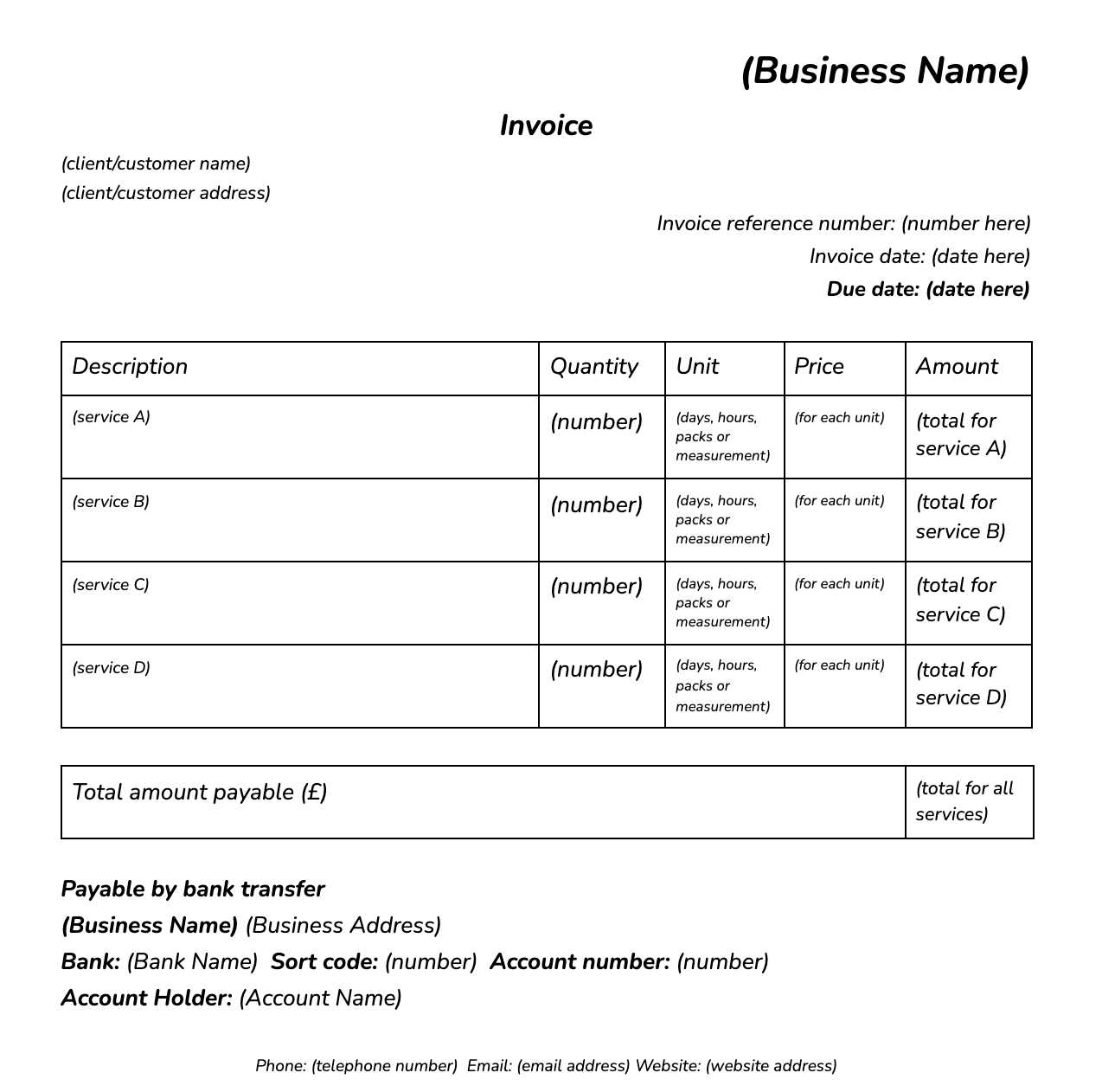

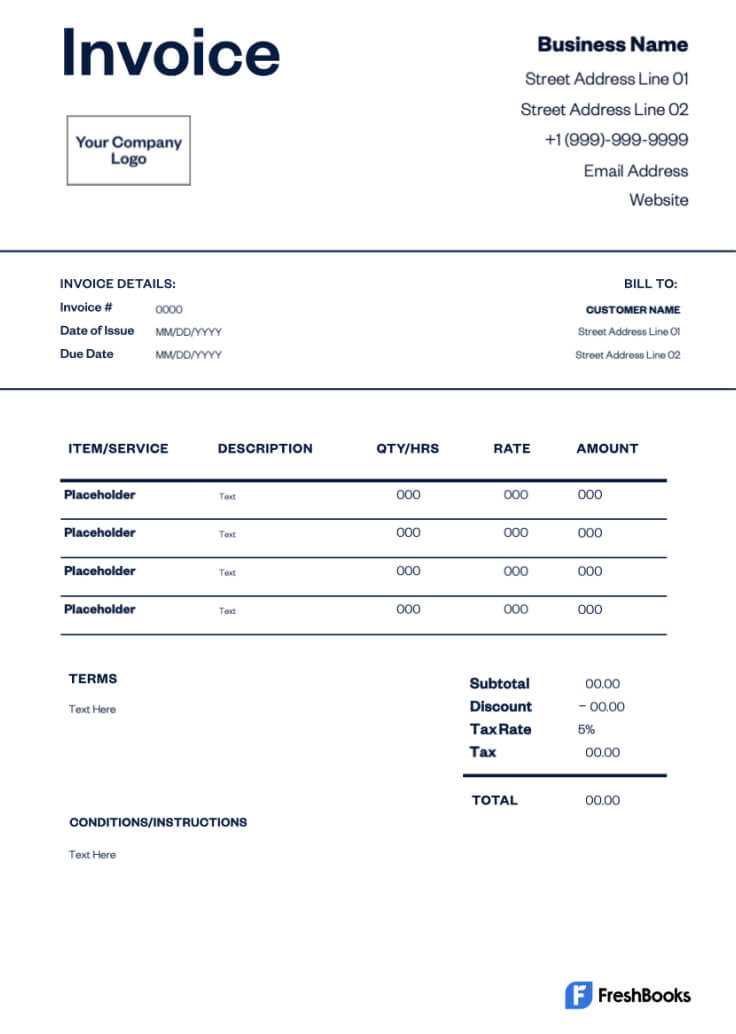

How to Create an Invoice from Scratch

Creating a payment request document from scratch requires attention to detail and a clear structure. It’s important to include all necessary information to ensure the process is smooth for both the service provider and the client. By following a step-by-step approach, you can build a professional and functional document that serves its purpose effectively.

Here’s how to create a well-organized payment request:

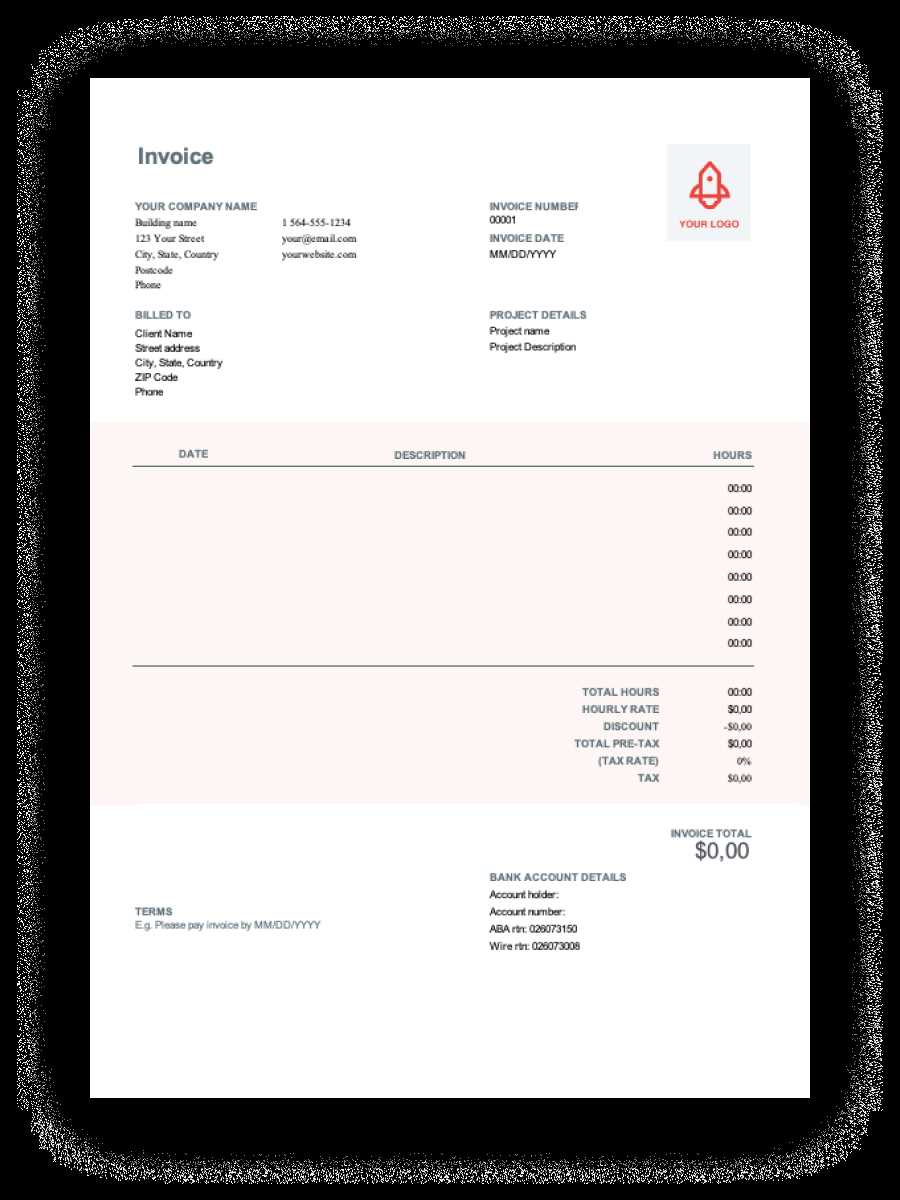

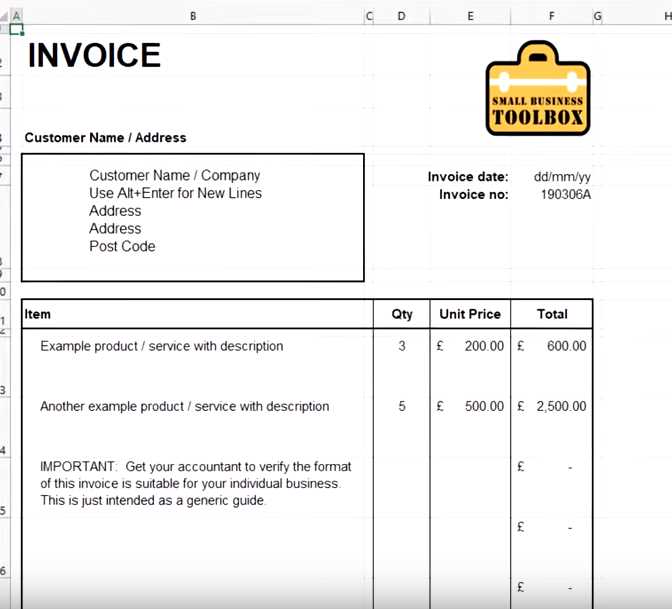

- Header Information: Include your name or business name, contact details, and your client’s information at the top of the document. This establishes who is involved in the transaction.

- Issue and Due Dates: Clearly mention the date the document is issued and the expected payment date to avoid confusion.

- Description of Services or Products: Provide a detailed list of the services rendered or items delivered. Specify quantities, unit prices, and any additional charges.

- Payment Terms: Specify payment methods (bank transfer, PayPal, etc.) and the agreed-upon terms, such as penalties for late payments.

- Total Amount Due: Include a subtotal, tax details, and the final amount that the client is required to pay.

Here’s an example of how this structure looks in practice:

| Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Consulting Service | 5 hours | $50 | $250 |

| Web Design | 1 project | $500 | $500 |

| Subtotal | $750 | ||

| Tax (10%) | $75 | ||

| Total Amount Due | $825 | ||

By including these essential elements and following this structure, you’ll create a clear and professional document that outlines the transaction effectively.

Customizing Your Invoice for Clients

Personalizing your payment request documents for each client is an important step in maintaining professionalism and building stronger business relationships. Customization allows you to tailor the details to suit individual client needs and preferences, while also reflecting your unique brand. This makes the payment process smoother and enhances communication.

Here are a few key ways to customize your payment documents:

- Client Information: Ensure that each document includes the correct client name, address, and contact details. This ensures proper identification and makes the document feel more personalized.

- Service or Product Description: Adapt the description section to reflect the specific services or products you provided to that client. Detailed explanations create transparency and help avoid confusion.

- Payment Terms: Adjust payment terms based on the client’s preferences or previous agreements. For example, you might offer different payment methods or extend payment deadlines depending on the client relationship.

- Logo and Branding: Adding your logo or business name, along with colors and fonts that align with your branding, can make your document look more professional and cohesive with your overall business identity.

- Custom Messages: Including a thank-you note or a personalized message can help strengthen client relationships. A simple “Thank you for your business” or a note of appreciation adds a personal touch.

By customizing your payment request documents, you not only make the transaction process easier but also show that you are attentive to detail and committed to providing an excellent client experience.

Common Mistakes in Freelance Invoices

When creating payment request documents, it’s easy to overlook details that can cause issues down the line. Even small mistakes can delay payments or lead to confusion between the freelancer and client. Understanding these common errors will help you avoid pitfalls and ensure smooth transactions.

Missing Key Information

One of the most frequent mistakes is not including all the necessary details in the payment request. Here are some items that should never be overlooked:

- Contact Information: Ensure that both your and your client’s contact details are correct and complete.

- Payment Due Date: Always specify when the payment is expected to avoid delays.

- Breakdown of Charges: Clearly list the services or products provided, along with their costs, so there’s no ambiguity.

Incorrect Payment Terms

Another common issue arises from unclear or missing payment terms. This can cause confusion or disagreements between you and your client. Some common mistakes to avoid include:

- Unclear Payment Methods: Always specify the payment methods you accept (e.g., bank transfer, PayPal, etc.).

- Failure to Include Late Fees: If late fees apply, make sure they are clearly outlined in the document to avoid misunderstandings.

- Ambiguous Discount or Early Payment Terms: If you offer discounts for early payments, mention the percentage and conditions clearly.

By avoiding these common mistakes, you can ensure your payment documents are professional, clear, and help facilitate timely payments.

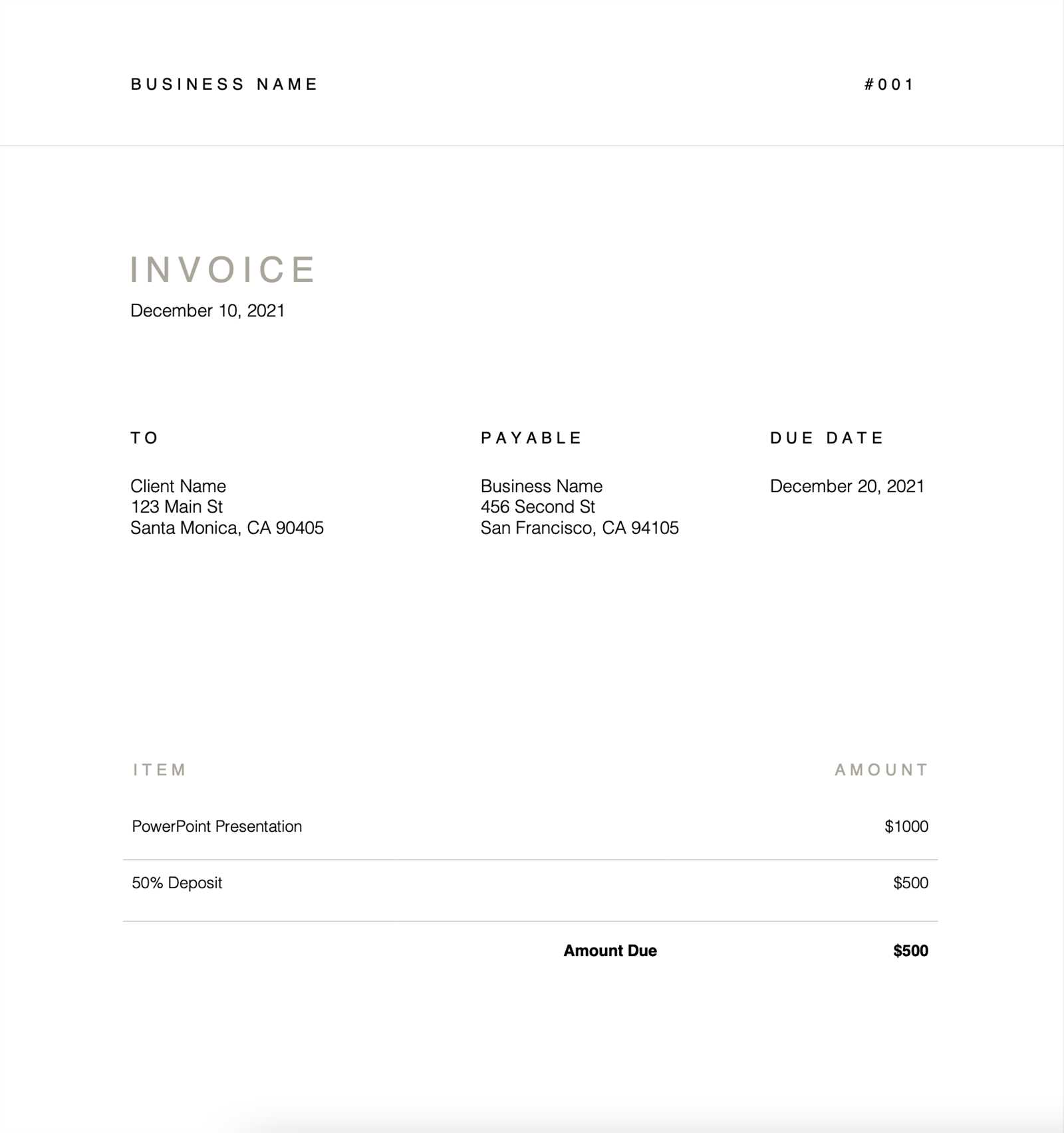

Invoice Design Best Practices

Creating a clean and professional design for your payment request documents is crucial for making a positive impression on clients. A well-structured layout ensures that all important details are easy to find, enhancing clarity and reducing confusion. By following design best practices, you can improve the effectiveness and professionalism of your documents.

Key Elements to Include

When designing your payment request document, make sure to include these essential components:

- Contact Information: Your details and those of the client should be easily visible at the top, making it clear who the transaction is between.

- Transaction Details: Clearly list the services or products provided, including quantity, unit price, and total cost.

- Payment Instructions: Clearly specify the due date, accepted payment methods, and any relevant terms.

- Tax Information: If applicable, include a breakdown of taxes to ensure full transparency.

Design Tips for Clarity and Professionalism

Here are some design tips to keep in mind for a visually appealing and functional document:

- Use a Clean Layout: Organize information in a way that’s easy to scan. Avoid clutter and focus on simplicity.

- Choose Legible Fonts: Use simple, readable fonts. Stick to one or two font types to maintain consistency and professionalism.

- Incorporate Your Brand: Add your logo and use your brand’s colors to make the document feel more cohesive with your business identity.

- Ensure Proper Alignment: Align text, numbers, and sections neatly to improve readability and structure.

By following these design principles, you’ll create documents that not only look professional but also make it easy for your clients to process and understand the payment details.

Key Information to Include in Invoices

When preparing a payment request document, it is crucial to include all relevant details to ensure clarity and smooth processing. Missing or incomplete information can delay payments and cause confusion between you and your client. Knowing exactly what to include in your document will help you avoid misunderstandings and maintain a professional image.

Essential Details for Clear Communication

Every payment request document should contain the following key components to make the transaction clear and efficient:

- Your Contact Information: Include your name, business name (if applicable), address, phone number, and email. This allows clients to easily contact you if needed.

- Client’s Information: Include the name, address, and contact details of the client you are billing. This ensures proper identification and reduces the risk of errors.

- Unique Reference Number: Assign a unique identifier or number to each document for easier tracking and record-keeping.

- Service/Product Description: Clearly describe the goods or services provided, along with quantities, unit prices, and total amounts. This helps clients understand exactly what they are paying for.

- Payment Due Date: Clearly indicate the date by which payment should be made. This helps clients prioritize and make timely payments.

- Payment Methods: Specify the accepted payment methods (e.g., bank transfer, credit card, PayPal) to give clients clear instructions on how to pay.

Additional Important Information

Depending on your agreement with the client, there may be additional information that needs to be included to ensure both parties are on the same page:

- Late Fees or Discounts: If applicable, mention any late payment fees or early payment discounts to avoid confusion later on.

- Tax Details: If your service or product is subject to tax, ensure the tax rate is clearly indicated, along with the total amount of tax applied.

- Terms & Conditions: Include any terms and conditions related to the transaction to clarify both parties’ rights and obligations.

Including these essential elements in your payment request document not only ensures clarity but also establishes a professional and transparent approach to managing financial transactions with your clients.

How to Calculate Taxes on Invoices

Understanding how to calculate taxes on payment request documents is essential for ensuring compliance and accuracy in your transactions. Properly calculating taxes helps you avoid overcharging or undercharging clients, which can lead to financial or legal issues. The process varies depending on your location and the type of service or product you’re offering, but the general principles remain the same.

Steps to Calculate Taxes

Here’s a straightforward approach to calculating taxes on your payment request documents:

- Identify the Tax Rate: Determine the appropriate tax rate based on your location and the nature of your product or service. Tax rates can vary by region and industry.

- Calculate the Taxable Amount: If applicable, calculate the total amount subject to tax. This may involve excluding non-taxable items, such as shipping fees or discounts.

- Apply the Tax Rate: Multiply the taxable amount by the applicable tax rate to determine the tax amount. For example, if your taxable total is $200 and the tax rate is 10%, the tax amount would be $20.

- Add the Tax to the Total: Add the tax amount to the original total to get the final amount due. In this example, the total amount owed by the client would be $220 ($200 + $20).

Different Types of Taxes

There are different types of taxes that may apply to your payment request documents, depending on the nature of your business:

- Sales Tax: The most common tax applied to goods and services. The rate depends on local regulations.

- Value Added Tax (VAT): A tax applied to goods and services at each stage of production or distribution, commonly used in many countries outside the U.S.

- Service Tax: A tax specifically applied to services, often seen in industries such as consulting or freelancing.

By following these steps and understanding the tax rules applicable to your business, you can ensure that your payment request documents are accurate and compliant, helping you avoid issues with tax authorities and clients alike.

When to Send an Invoice as a Freelancer

Timing is crucial when it comes to sending payment requests, especially for freelancers. Knowing when to send a request for payment can help you maintain a professional relationship with your clients while ensuring timely compensation for your work. Sending a payment request too early or too late can affect cash flow and lead to misunderstandings.

Best Time to Send a Payment Request

Generally, the best time to send a payment request depends on the nature of the work you’ve completed and the terms of your agreement with the client. Here are some common scenarios:

- After Project Completion: If the work is project-based, it’s typically best to send a payment request once the project is finished, and the client is satisfied with the outcome.

- At Regular Intervals: For ongoing projects or retainer-based work, you may send payment requests on a regular basis, such as weekly, bi-weekly, or monthly.

- Upon Milestone Completion: If the project is large or broken into phases, it’s common to send a payment request after reaching specific milestones, ensuring you are paid incrementally as the work progresses.

Agreed Payment Terms

Always take into account the payment terms you’ve agreed upon with your client. Some important factors to consider include:

- Due Date: Make sure to send the payment request in advance of the agreed-upon due date. This gives the client enough time to process the payment.

- Late Payment Penalties: If your contract includes penalties for late payment, ensure the client is aware of these terms and send a reminder if the deadline is approaching.

By choosing the right moment to send your payment request, you can streamline your cash flow and foster good relationships with your clients. Always keep track of deadlines and follow through on your agreements for a smooth transaction process.

Understanding Payment Terms on Invoices

Clear and well-defined payment terms are essential for ensuring smooth and timely transactions between you and your clients. Without proper payment terms, misunderstandings can arise, leading to late payments or disputes. Establishing these terms upfront helps manage expectations and protects your business interests.

Key Components of Payment Terms

Payment terms outline the expectations for both parties, including when the payment is due and how it should be made. Some of the most common elements include:

- Due Date: This specifies the exact date by which the payment must be made. Common due dates include “Net 30,” meaning payment is due within 30 days of the request, or “Due Upon Receipt,” meaning the payment is due immediately upon receiving the payment request.

- Late Fees: Many freelancers include penalties for late payments, such as a fixed fee or a percentage of the total due for every day or week the payment is overdue.

- Discounts for Early Payment: Offering a small discount for clients who pay early (e.g., within 10 days) can encourage quicker payments and strengthen client relationships.

Types of Payment Terms

There are several common payment term structures that freelancers may use. These include:

- Net 30/45/60: A popular option where the client has 30, 45, or 60 days to make payment after receiving the payment request.

- Due Upon Receipt: The client is expected to pay immediately upon receiving the payment request.

- Installment Payments: For large projects, payments can be broken down into installments, with each payment due at specific milestones or intervals.

By clearly communicating your payment terms at the start of a project and including them in your payment requests, you can ensure that both you and your clients are on the same page, reducing the likelihood of delays and disputes.

How to Track Unpaid Invoices

Managing unpaid payments is an essential part of maintaining healthy cash flow for your business. Staying on top of overdue amounts not only ensures that you get paid for your work but also helps in building professional relationships with clients. It is crucial to develop an effective system for tracking outstanding balances to avoid any missed payments or prolonged delays.

Methods to Track Unpaid Amounts

There are various ways to keep track of unpaid balances, each with its own advantages depending on your business needs. Here are some of the most common methods:

- Manual Record Keeping: This involves using a physical ledger or a spreadsheet to track payments. While this method is simple, it can become cumbersome as the volume of clients or projects increases.

- Accounting Software: Using specialized software allows you to track unpaid amounts automatically. Many programs also send reminders to clients for overdue payments, saving you time and effort.

- Dedicated Invoice Tracking Systems: There are services designed specifically for tracking outstanding balances. These systems can provide alerts for overdue amounts and help you monitor payment progress.

Setting Up Reminder Systems

It’s important to remind clients of unpaid balances in a professional manner. Here are some strategies for setting up reminders:

- Send Friendly Reminders: If a payment is overdue by a few days, send a polite reminder email. Often, clients simply forget and will pay once reminded.

- Automated Payment Reminders: Many accounting tools allow you to automate reminders, sending a follow-up email or notification automatically when the payment is due or overdue.

- Escalate Communication: For clients who continue to delay payments, consider escalating your communication to a more formal tone or even contacting them by phone to resolve the issue.

By staying organized and proactive in tracking unpaid balances, you can ensure that your cash flow remains steady and that you get paid for your hard work without unnecessary delays.

Benefits of Using an Invoice Template

Using a standardized format for payment requests brings numerous advantages for business owners. It helps streamline the billing process, maintain professionalism, and ensure consistency across all transactions. By relying on a pre-designed structure, you can avoid errors and focus more on the core aspects of your work.

Here are some key benefits:

- Time Savings: Having a ready-made structure saves time as you don’t have to create a new format from scratch for each client. This allows you to focus more on your core tasks rather than administrative work.

- Consistency: Using the same structure for all your payment requests ensures that they look professional and uniform. Clients will know exactly where to find the important details, making the process smoother for both parties.

- Reduced Errors: Pre-built formats reduce the risk of omitting important information such as payment terms, due dates, or client details, which can lead to confusion or delayed payments.

- Better Tracking: With a standard format, it becomes easier to keep track of payments and monitor your financial records. You can quickly identify which clients have paid and which still owe, streamlining the process of following up on outstanding amounts.

Moreover, using a pre-designed layout can enhance your reputation by presenting your business as organized and professional. The ease and accuracy of using a structured approach can contribute significantly to maintaining smooth financial operations.

| Benefit | Description |

|---|---|

| Time Savings | Reduces the need to create new formats, saving time for other tasks. |

| Consistency | Ensures all requests are uniform and professional. |

| Reduced Errors | Minimizes mistakes by keeping essential details intact. |

| Better Tracking | Helps easily monitor unpaid amounts and manage client payments. |

By adopting a structured approach to payment requ

Free vs Paid Invoice Templates for Freelancers

When choosing a billing system, freelancers are often faced with a decision: should they use a free or a paid solution? Both options offer distinct advantages, but the right choice depends on the individual’s needs, business type, and frequency of transactions. Understanding the differences between these two options can help make the best decision for your business.

Advantages of Free Billing Systems

Free billing systems are often ideal for freelancers just starting out or those with limited budgets. They offer a straightforward approach with basic features that cover the essentials of creating and sending payment requests. Here are some of the benefits:

- No Cost: As the name suggests, free solutions come at no cost, which is particularly beneficial for those just beginning their freelancing journey.

- Easy to Use: Most free systems are designed to be simple and user-friendly, making them accessible even for those with limited technical knowledge.

- Basic Features: Free options usually cover the core features needed to send basic payment requests, such as client information, amounts, and due dates.

Advantages of Paid Billing Systems

Paid options, on the other hand, offer more advanced features and greater customization. These solutions are designed for freelancers who require a more professional approach and want to streamline their billing process. Here are some reasons why freelancers might opt for a paid system:

- Advanced Features: Paid systems often include features like automatic payment reminders, integration with accounting software, and tax calculations, which can save time and improve accuracy.

- Customization: With a paid solution, you have more control over the design and content of your payment requests, allowing you to tailor them to match your brand.

- Support: Paid systems typically offer better customer service, providing assistance when issues arise or questions need answering.

In conclusion, the choice between free and paid systems depends on the complexity of your business needs. For simple billing, free options might suffice. However, for freelancers managing multiple clients or requiring advanced features, a paid solution might be a better long-term investment.

How to Make Your Invoices Look Professional

Creating well-designed payment requests is a key part of maintaining professionalism in any business. A polished and organized document not only reflects your attention to detail but also builds trust with your clients. By focusing on a few essential elements, you can ensure that your billing process leaves a positive impression.

1. Include Clear and Accurate Information

One of the most important aspects of a professional billing document is clarity. Every detail should be easily readable and correctly formatted. Include the following essential details:

| Item | Description |

|---|---|

| Business Information | Your name, address, and contact details should be clearly displayed at the top. |

| Client Details | Make sure to include the client’s name and address for a more personalized document. |

| Detailed Breakdown | Provide a clear breakdown of the services rendered, including dates, hours worked, and rates. |

| Payment Terms | State the due date, payment methods accepted, and any late fees if applicable. |

2. Choose a Clean and Professional Layout

How your payment request looks is just as important as the information it contains. A clean, well-organized layout gives a sense of professionalism and helps your client quickly locate key details. Here are some tips:

- Use Consistent Fonts: Choose clear, easy-to-read fonts and maintain consistency throughout the document.

- Avoid Clutter: Keep the design minimalistic. Avoid excessive colors or graphics that could distract from the core information.

- Include a Logo: If you have a business logo, include it at the top to reinforce your brand identity.

By following these simple steps, you can ensure that your payment requests not only look professional but also effectively communicate the necessary details in an organized, clear manner.

Using Invoice Software for Independent Professionals

Managing financial documents can be a time-consuming task for independent professionals. Utilizing specialized software can streamline this process, making it easier to generate, track, and manage all payment requests. With the right tools, you can automate many tasks, reduce errors, and focus more on delivering excellent services to your clients.

Key Benefits of Using Invoice Software

Using software to handle billing offers numerous advantages. Here are some of the main benefits:

- Time-Saving: With pre-designed features, you can create payment requests quickly, saving valuable time that can be used for other business tasks.

- Professional Appearance: Software often provides customizable templates, allowing you to create professional-looking documents that reinforce your brand image.

- Accuracy: Automated calculations reduce the risk of errors, ensuring that your records are accurate and up-to-date.

- Easy Tracking: Invoice software usually includes tracking features, so you can easily monitor paid and unpaid requests, helping you stay organized.

- Reports and Analytics: Many tools offer detailed reporting features, allowing you to track your income and identify trends over time.

How to Choose the Right Invoice Software

Not all software solutions are created equal. To ensure you’re using the right one, consider the following factors:

- Ease of Use: Look for a platform with a user-friendly interface, so you can start creating payment documents without a steep learning curve.

- Customization Options: Choose software that allows you to tailor invoices to your business needs, such as adding your logo, terms, or payment methods.

- Integration with Accounting Tools: If you use other accounting or bookkeeping software, check if the invoicing tool can integrate with them to streamline your financial management.