Invoice Template for Self Employed in the UK

When managing your own business, keeping track of payments and ensuring clients are billed correctly is crucial. A well-structured document can make this process much smoother, saving both time and effort. By creating a professional billing record, you not only simplify your workflow but also ensure transparency and clarity with your clients.

In the UK, having a clearly formatted bill that meets tax regulations and is easy to understand is essential for freelancers and independent contractors. Whether you’re providing services or selling goods, having a standardized form helps avoid confusion and potential disputes.

Understanding how to structure your billing statement and what details to include will give you more control over your finances. With the right approach, you can streamline your payment process, making it easier to maintain cash flow and keep everything organized. This guide will help you create a professional document tailored to your needs and compliant with UK requirements.

Invoice Template for Self Employed in the UK

For independent workers and business owners in the UK, creating a proper billing document is an essential task. A well-organized and clear statement ensures that clients understand the charges and payment terms, while also helping to maintain professionalism and transparency. The right document can prevent misunderstandings and contribute to smoother transactions with customers.

Key Elements of a Professional Billing Statement

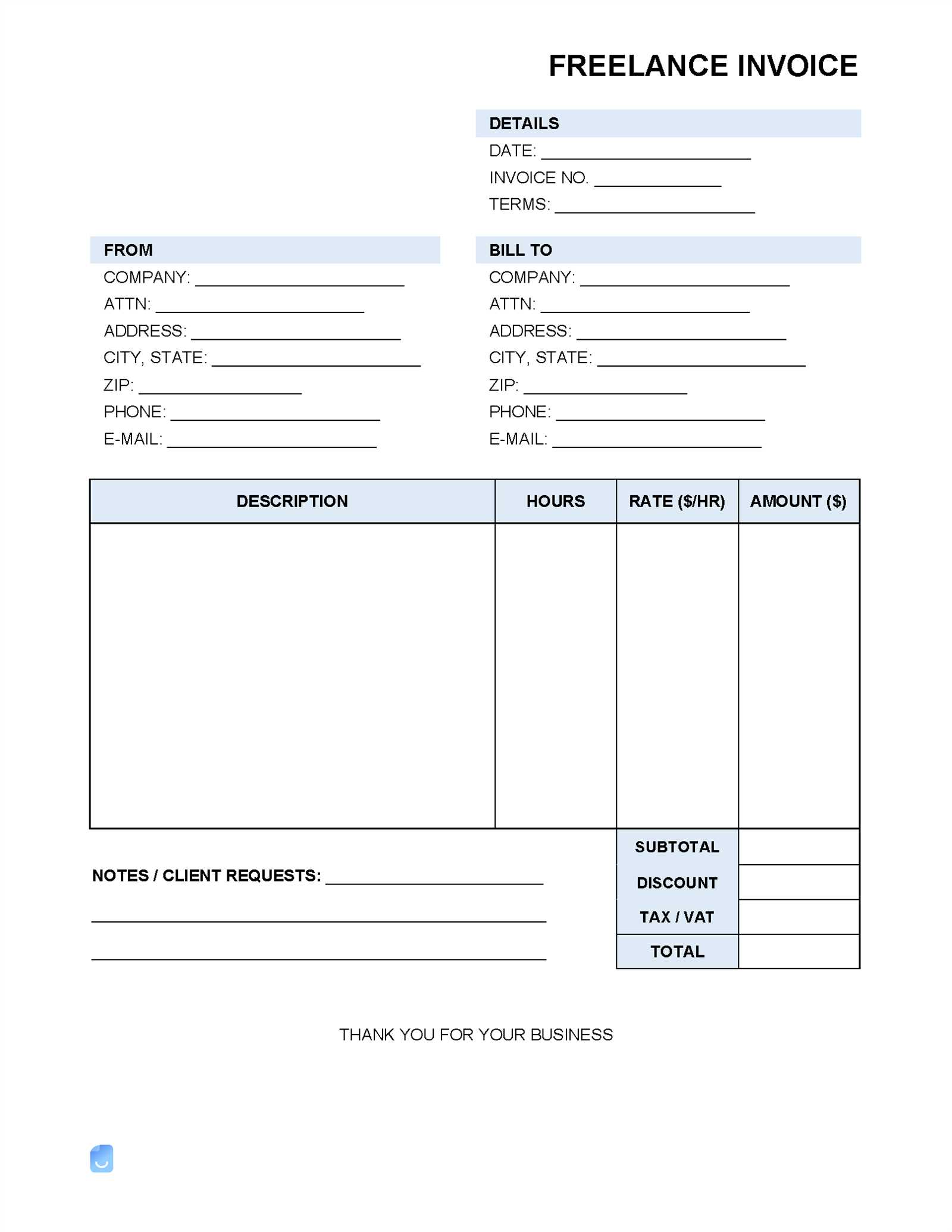

A correctly formatted billing document includes several important elements that help both parties. These include your business details, the client’s information, a description of the goods or services provided, and the payment due. Additionally, terms related to taxes, discounts, and payment deadlines must be clearly stated to avoid confusion.

Ensuring Legal Compliance and Accuracy

Complying with UK regulations when preparing your billing document is crucial for tax purposes. This means ensuring that all necessary information is included, such as your tax number if applicable, and following the correct procedure for documenting VAT if your business is VAT registered. Furthermore, make sure all amounts are accurate to avoid any potential disputes.

By following these guidelines, you can create a comprehensive billing record that aligns with the requirements of UK law while providing a seamless experience for both you and your clients.

Why You Need an Invoice Template

For independent professionals and small business owners, having a standardized billing document is essential to keep finances organized. It helps streamline the process of requesting payment, ensuring clarity in terms and reducing the risk of errors. A well-prepared record not only builds trust with clients but also helps maintain accurate financial records for tax purposes.

By using a structured format, you can avoid missing crucial details, such as payment terms or tax information, which could lead to misunderstandings or delayed payments. This system helps both you and your clients stay on the same page and minimizes the likelihood of disputes.

| Key Benefits | Description |

|---|---|

| Professionalism | Provides a consistent, organized format for presenting charges to clients. |

| Clarity | Ensures that all important details, such as payment terms and services provided, are clearly outlined. |

| Time-saving | Speeds up the billing process by using a pre-set structure, reducing the time spent creating each bill. |

| Legal Compliance | Helps meet tax requirements by including necessary details like VAT information and business registration numbers. |

Using a standardized billing document not only improves efficiency but also ensures that you maintain a professional image and adhere to regulatory requirements.

Key Features of a Self-Employed Invoice

A well-structured billing document is essential for independent professionals to ensure smooth transactions and accurate records. Certain key elements make a document effective, helping both parties clearly understand the details of the transaction. Including these features not only helps maintain professionalism but also ensures that all necessary information is provided to meet legal and financial requirements.

Essential Information to Include

When preparing a billing statement, it’s important to include specific details that clarify the nature of the transaction. These elements are vital for both you and your client to ensure that the payment is processed smoothly and accurately.

| Feature | Description |

|---|---|

| Your Business Information | Include your business name, address, and contact details so clients can easily reach you. |

| Client Information | Provide your client’s name and address to ensure the document is properly directed and identifiable. |

| Description of Services or Products | Clearly outline the services rendered or goods sold, along with quantities and rates. |

| Payment Terms | State the due date and any agreed-upon terms, such as payment method or late fees. |

| Tax Information | If applicable, include any tax details, such as VAT numbers or tax rates, to comply with local regulations. |

Why These Features Matter

Including these details ensures that there is no confusion regarding payment expectations. It also provides the documentation needed for tax purposes, ensuring compliance with UK regulations. These key features protect both parties and foster a clear, professional working relationship.

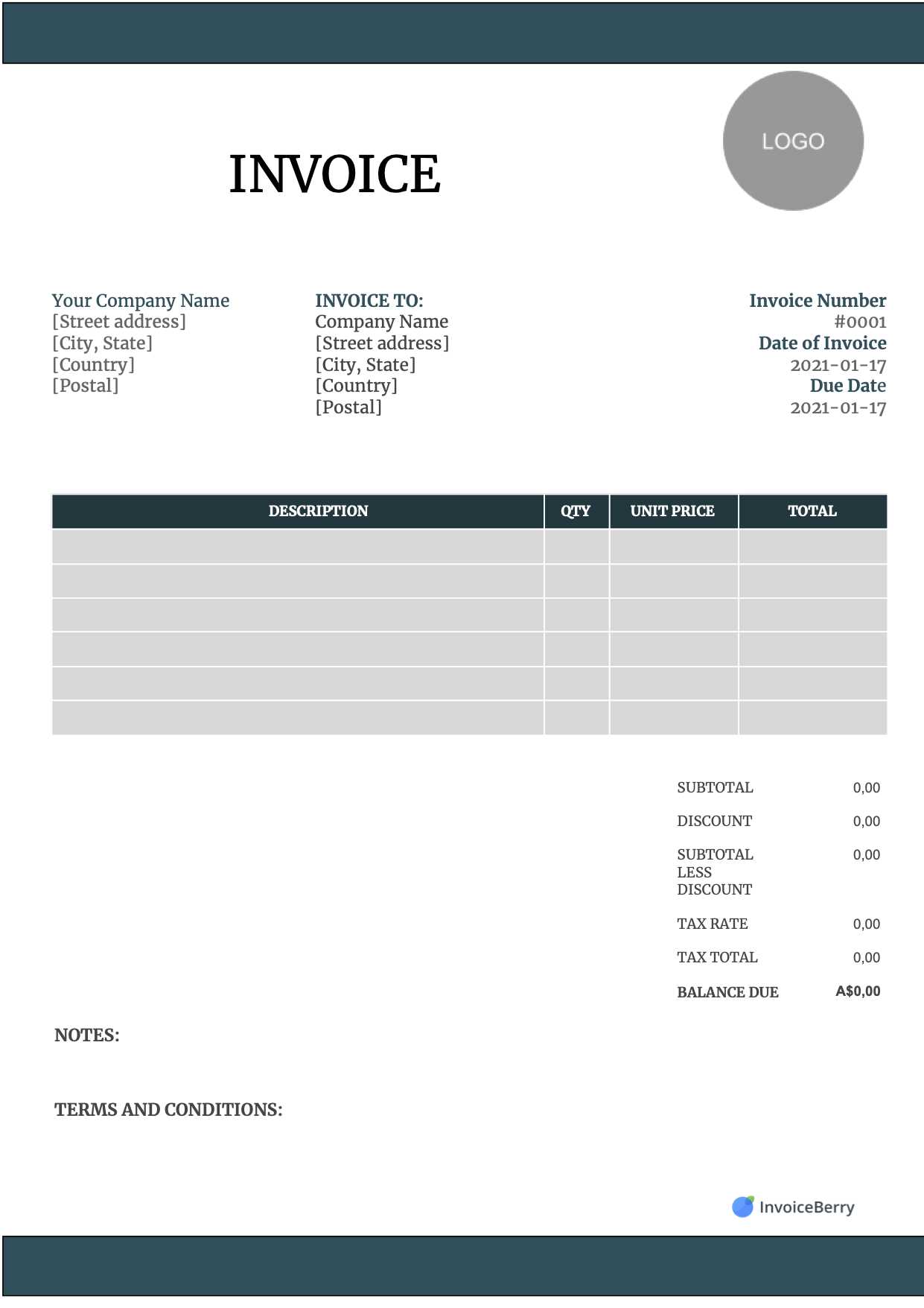

How to Customize Your Billing Document

Personalizing your billing document allows you to create a professional and functional tool that suits your business needs. Customization ensures that the document reflects your brand while also including the essential details for your clients. By adjusting the layout and information, you can make the document more efficient and tailored to your specific work processes.

Here are key elements to consider when customizing your billing document:

- Branding and Design: Add your business logo, choose your brand colors, and select fonts that reflect your company’s style. A clean and professional design helps establish trust with your clients.

- Business Information: Ensure that your business name, address, and contact details are prominently displayed. This helps clients know where to send payments or direct inquiries.

- Payment Terms: Clearly state the due date and accepted payment methods. You can also include late payment fees or discounts for early payments, depending on your agreement with the client.

- Service Descriptions: Customize the way you present the services or products provided. List them in a clear, concise manner with prices and any additional fees, such as delivery charges, if applicable.

- Tax Information: If applicable, include your VAT registration number and the tax rate. This ensures transparency and compliance with local tax laws.

By modifying these sections, you can create a document that suits your specific business needs while maintaining professionalism and clarity.

Additionally, many online tools and software offer templates that can be easily adjusted to fit your requirements, saving you time while ensuring accuracy.

Legal Requirements for Self-Employed Invoices

When managing your own business and requesting payments from clients, it is crucial to comply with the legal requirements set by the government. These regulations ensure that the billing process is transparent and accurate, preventing potential issues with tax authorities or disputes with clients. A properly structured document not only protects your business but also builds trust with your clients.

In the UK, certain details must be included in your billing document to meet legal standards. These include:

- Business Information: Your business name, registered address, and contact details should be clearly listed. If you are VAT registered, you must also include your VAT number.

- Client Information: The name and address of the client receiving the services or products must be included to ensure that the document is properly directed.

- Invoice Number: Every document must have a unique reference number. This helps in organizing your records and ensures compliance with tax authorities.

- Detailed Description of Services or Goods: Include a clear and itemized list of the goods or services provided, including dates and quantities where applicable.

- Payment Terms: Clearly state the payment due date and any late fees or discounts for early payment. This prevents confusion and sets clear expectations.

- Tax Information: If VAT applies, include the applicable rate and the amount of tax charged. Ensure that these figures are clearly itemized so clients can see the breakdown.

Ensuring these details are present helps to avoid complications with the tax authorities and maintains a smooth professional relationship with clients. Failure to comply with these requirements could lead

How to Add VAT to Your Invoice

If your business is VAT registered, including the correct tax information in your billing documents is essential for both compliance and clarity. Adding VAT ensures that you adhere to legal obligations and makes it easy for your clients to understand the total amount due. Properly calculating and displaying VAT also helps to avoid any disputes regarding payment amounts.

Step-by-Step Process to Include VAT

Here’s a simple guide to including VAT in your billing record:

- Check Your VAT Registration: Ensure that your business is VAT registered and that you have the appropriate VAT number. This should be displayed on your billing statement if applicable.

- Calculate the VAT Amount: Multiply the cost of each service or product by the VAT rate. In the UK, the standard rate is 20%, but this can vary depending on the type of goods or services provided.

- Show VAT Separately: It is important to show VAT as a separate line item. This ensures clarity for your client and helps them understand how the final amount is calculated.

- List Total Amount: After adding the VAT, clearly state the total amount due, including the VAT, so the client knows exactly what they need to pay.

VAT Breakdown Example

| Description | Amount |

|---|---|

| Service/Product Cost | £100.00 |

| VAT (20%) | £20.00 |

| Total Amount Due | £120.00 |

By following these steps and providing a clear breakdown, you ensure that your client understands the tax charges and that your business complies w

Understanding Payment Terms for Invoices

Clear and well-defined payment terms are crucial for maintaining smooth financial transactions with clients. These terms outline the expectations regarding when and how payments should be made, helping to avoid confusion and delays. By setting clear guidelines, you protect your business from late payments and ensure timely cash flow.

What to Include in Payment Terms

Payment terms should cover several key aspects to ensure both you and your client have a clear understanding of the expectations:

- Due Date: Specify the date by which the payment should be made. Common terms include “Net 30” (30 days from the issue date) or “Due on Receipt”.

- Accepted Payment Methods: Clearly state which payment methods are acceptable, such as bank transfers, credit cards, or PayPal.

- Late Fees: Mention any penalties for overdue payments. This encourages clients to pay on time and helps cover the costs of delayed payments.

- Discounts for Early Payment: Offering a discount for early payment can encourage prompt settlement of bills.

Why Payment Terms Matter

Having clear payment terms protects your business by establishing the ground rules for every transaction. This minimizes disputes, helps with cash flow management, and builds trust with clients by ensuring transparency. Moreover, well-defined terms can be legally binding, providing a basis for taking action in case of non-payment.

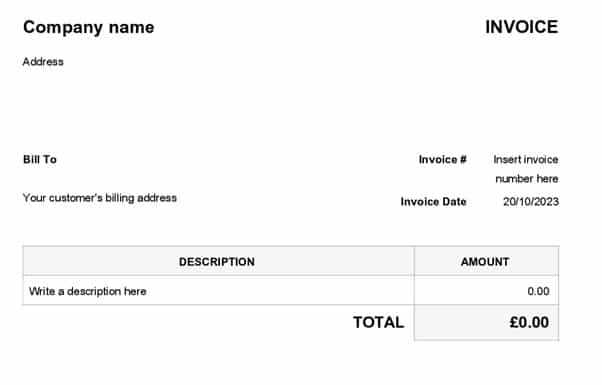

Tips for Professional Invoice Design

A well-designed billing document not only ensures clarity but also reflects your professionalism and attention to detail. A clean, organized layout helps clients understand the charges and fosters trust in your business. By focusing on simplicity, readability, and branding, you can create a visually appealing document that makes a strong impression.

Keep It Simple and Organized

Overly complex layouts can confuse clients and make it difficult to locate important information. Aim for a simple, clear structure that allows clients to quickly find the details they need. Here’s what you can focus on:

- Clear Sections: Divide the document into logical sections like services, totals, and payment terms to improve readability.

- Legible Fonts: Use easy-to-read fonts that ensure the text is clear and professional.

- Minimalist Design: Avoid cluttering the document with excessive graphics or text. Focus on the essentials, such as business details, charges, and due date.

Include Your Brand Identity

Including your business’s branding elements, such as logo, colors, and fonts, reinforces your identity and creates a cohesive experience for clients. Your design should align with the overall aesthetic of your brand, making the billing document instantly recognizable as coming from your business.

- Logo: Place your logo prominently at the top of the document to establish your brand presence.

- Consistent Colors: Use your brand colors in headings, borders, or accent areas to maintain consistency across your materials.

- Professional Layout: Align elements neatly to give the document a polished, corporate look.

By following these design principles, you ensure your document is both functional and visually appealing, enhancing your professionalism in the eyes of your clients.

How to Include Your Business Details

Including your business information is essential for transparency and professionalism in your billing process. Providing accurate and comprehensive details ensures that your clients can easily contact you and verifies the legitimacy of your business. Additionally, it is a requirement for legal and tax purposes in many regions, including the UK.

Here’s what you need to include when presenting your business information:

- Business Name: Ensure your official business name is clearly visible, typically at the top of the document. This lets clients know immediately who they are doing business with.

- Business Address: Include the full address of your business. This can be your physical location or the address you use for correspondence.

- Contact Information: Provide a phone number and email address so clients can reach you with ease. It’s important to offer multiple ways of contact.

- VAT Number (if applicable): If your business is VAT registered, display your VAT number. This is required for VAT compliance and helps clients verify the tax information on the document.

- Company Registration Number (if applicable): If your business is a limited company, include the registration number issued by the Companies House.

By ensuring these details are clear and correctly displayed, you provide your clients with all the necessary information they may need to confirm your business identity, process payments, or resolve any issues.

Common Mistakes to Avoid in Invoices

Even a small mistake in your billing document can lead to confusion, delayed payments, or even disputes. To maintain professionalism and ensure timely payments, it’s important to avoid common errors that can undermine your credibility. By addressing these issues proactively, you can streamline the payment process and build stronger relationships with your clients.

Common Mistakes to Avoid

- Incorrect or Missing Information: Failing to include your business details or client’s information can create unnecessary confusion. Always double-check for accuracy in names, addresses, and contact details.

- Failure to Specify Payment Terms: Not clearly stating when and how the payment is due can lead to misunderstandings. Always include the payment due date and acceptable methods of payment.

- Not Including a Breakdown of Charges: Clients should always be able to see a detailed list of the services or products provided, along with the cost. Failing to do so can make the document appear unprofessional and cause unnecessary questions.

- Missing Tax Information: If VAT or any other taxes apply, they should be clearly stated. Omitting this can create confusion or potential tax issues later on.

- Incorrect Totals: Double-check the math! Simple mistakes in adding or calculating the total amount due can result in delayed payments and disputes.

- Unclear Formatting: A cluttered, difficult-to-read document can frustrate clients. Ensure that the layout is clean, with logical sections for key information like services, charges, and payment terms.

How to Avoid These Mistakes

- Use a Clear Template: Make sure your document structure is consistent and includes all necessary details. A structured format helps to minimize errors.

- Double-Check Your Work: Before sending, review every detail–especially totals, dates, and calculations. Consider using tools or software to automate parts of the process.

- Ask for Feedback: If you’re unsure about certain elements, ask a colleague or trusted client to review the document before sending it out.

By avoiding these common errors, you can ensure

How to Track Payments on Invoices

Keeping track of payments is crucial for maintaining healthy cash flow and ensuring that you are paid on time. By monitoring the status of payments, you can identify any overdue amounts, follow up with clients, and prevent any potential financial issues. Proper tracking also allows you to maintain accurate records for tax purposes and manage your business finances more effectively.

There are several ways to stay on top of payment statuses:

- Create a Payment Log: Maintain a log of all payments received, noting the invoice number, amount paid, and the date of payment. This can be done manually or through accounting software.

- Use Payment Terms and Deadlines: Clearly state payment terms and due dates on each document. By doing so, you make it easy for both you and your client to track when payments are expected.

- Mark Payments as Received: When a payment is made, update the document or system with the payment status. Marking it as “paid” or “partially paid” helps you track the progress and avoid confusion.

- Automate Payment Reminders: Consider setting up automatic reminders through your accounting system or email service. This way, clients are notified about overdue payments without you needing to manually send follow-ups.

- Use Online Payment Methods: Using online payment platforms can simplify tracking, as they often provide built-in payment records and notifications, making it easier to monitor payments in real time.

By implementing these tracking practices, you can ensure smooth transactions, reduce the likelihood of missed payments, and have better control over your financial operations.

Using Online Tools to Create Invoices

Creating professional and accurate billing documents is now easier than ever thanks to a variety of online tools. These platforms simplify the process, allowing you to generate well-organized and legally compliant documents in just a few clicks. With customizable features and user-friendly interfaces, online tools offer a convenient solution for freelancers and business owners alike.

Online tools often provide the following benefits:

- Ease of Use: Many platforms have intuitive interfaces that require little to no technical expertise. Templates and predefined fields make it simple to create a professional document quickly.

- Automation: You can save time by automating repetitive tasks such as numbering documents, calculating totals, and adding tax rates. This reduces the chances of errors.

- Cloud-Based Accessibility: Since most tools are cloud-based, you can access your documents from anywhere, ensuring you can manage your finances while on the go.

- Customization Options: You can customize the appearance and content of your documents, from adding your logo to choosing the color scheme, giving them a professional and branded look.

- Integrated Payment Solutions: Some online tools allow you to add direct payment links, making it easy for clients to pay instantly upon receiving your document.

Popular Online Tools to Consider

- FreshBooks: A comprehensive accounting solution that includes a user-friendly billing system for creating custom documents and tracking payments.

- Wave: A free platform that offers invoicing and accounting features, ideal for small businesses and freelancers looking for a straightforward solution.

- QuickBooks: A robust accounting tool with invoicing functionality and a variety of customizable features to suit various business needs.

By using these online tools, you can streamline your billing process, save time, and ensure that your documents are both professional and accurate.

How to Send Invoices to Clients

Sending professional and timely billing documents to clients is an essential part of managing your business’s finances. Ensuring that your clients receive their payment requests in a clear, organized manner can help maintain strong business relationships and ensure that you are paid promptly. There are several methods available to send these documents, each offering various benefits depending on your preferences and the nature of your business.

Here are some common ways to send payment requests to clients:

- Email: One of the most common and efficient ways to send billing documents is via email. Attach the document as a PDF or another suitable format, and include a brief, professional message outlining payment instructions and due dates.

- Online Payment Systems: Many businesses integrate online payment systems like PayPal or Stripe, which allow you to send payment requests directly to your clients. These platforms often allow clients to pay directly from the email, streamlining the process.

- Postal Mail: While less common today, sending hard copies of payment requests may still be necessary for certain clients. Ensure that your documents are properly formatted, and use reliable mailing services to avoid delays.

Steps to Effectively Send Payment Requests

- Double-Check the Details: Before sending, verify that all details on the document are correct, including the amount, payment terms, and client information.

- Use a Professional Message: Accompany your document with a polite and clear message, ensuring your client understands the purpose of the communication and the due date for payment.

- Provide Multiple Payment Options: Offer a variety of payment methods to make it easier for clients to settle their dues quickly.

- Set Reminders: If the payment is overdue, send polite reminders to encourage prompt payment without damaging the business relationship.

By choosing the right method for sending billing documents, you can make the payment process smoother and more

Managing Multiple Invoices as a Freelancer

As a freelancer, handling multiple billing documents can quickly become overwhelming without a proper system in place. Whether you’re working with several clients or juggling multiple projects at once, staying organized is key to ensuring timely payments and avoiding mistakes. Establishing a method for tracking and managing your payment requests can save time and reduce stress, allowing you to focus on your work.

Here are some strategies to efficiently manage multiple billing requests:

- Use Accounting Software: Digital accounting platforms like QuickBooks, Xero, or FreshBooks provide easy-to-use tools to track and manage multiple billing documents. These tools offer features like automated reminders, easy customization, and payment tracking, helping you stay on top of your financials.

- Create a Payment Schedule: Set clear deadlines for each payment request to help you stay organized and prioritize tasks. By maintaining a schedule, you can ensure timely follow-ups with clients who may have missed their payment deadlines.

- Track Outstanding Payments: Maintain a list or use software to track the status of each payment. This will help you know which clients have paid and which invoices are still pending. Sending polite reminders for overdue payments can help speed up the process.

Best Practices for Handling Multiple Billing Documents

- Group Payments by Client: If you’re working with a client on multiple projects, try grouping their payments into one document to make it easier to track and follow up on.

- Organize by Due Date: Sort your payment requests by due date, so you can prioritize invoices that need to be paid soonest and avoid late fees.

- Keep Communication Clear: Always communicate the terms and deadlines clearly with your clients to prevent misunderstandings or delays in payment.

By implementing these strategies, freelancers can effectively manage multiple payment requests, keeping their financial processes organized and ensuring they’re paid on time.

How to Handle Invoice Disputes

Disputes over payment documents can arise for a variety of reasons, from misunderstandings about the scope of work to disagreements over pricing. Handling such conflicts promptly and professionally is essential for maintaining positive client relationships and ensuring that you receive payment. Addressing these issues in a clear, calm, and structured manner can help resolve matters quickly and avoid further complications.

Here are steps to manage disputes effectively:

- Review the Agreement: Always begin by revisiting the terms of the contract or agreement. Ensure both parties are on the same page regarding the work provided, the payment amount, and the deadline. This can help clarify misunderstandings and provide a solid foundation for resolving the dispute.

- Communicate Openly: Reach out to the client directly to discuss the issue. Keep the tone professional and avoid being confrontational. Listen to their concerns and explain your perspective clearly.

- Provide Supporting Documentation: If necessary, share relevant documents such as project timelines, emails, or proof of services rendered. This can serve as evidence to support your claim and clarify any confusion.

Steps to Resolve Invoice Disputes

- Negotiate a Compromise: Sometimes, a middle ground can be found by negotiating the terms. This may involve adjusting the payment amount or offering a small concession to resolve the issue amicably.

- Escalate if Necessary: If the dispute cannot be resolved directly, consider sending a formal letter or involving a mediator. In extreme cases, legal action may be the only option, but this should be a last resort after all other avenues have been exhausted.

By taking a proactive and professional approach to payment disputes, you can protect your income while maintaining positive relationships with your clients.

Best Practices for Invoicing in the UK

When managing payments and billing clients in the UK, it’s essential to follow best practices to ensure timely payments, maintain professional relationships, and stay compliant with local regulations. Establishing clear guidelines from the outset can make the process smoother for both you and your clients. Adhering to a consistent invoicing routine helps avoid confusion and strengthens your reputation.

Here are some key practices to keep in mind when billing clients in the UK:

- Provide Clear Payment Terms: Always include clear terms regarding payment deadlines, accepted payment methods, and any penalties for late payments. This reduces the likelihood of misunderstandings and helps clients understand their obligations.

- Include Essential Information: Ensure that each document includes the necessary details such as your business name, contact information, payment due date, and a description of the goods or services provided. This makes the document professional and legally sound.

- Specify VAT Information: If you are VAT registered, it’s crucial to display your VAT number and show the VAT rate applied. This keeps you compliant with UK tax laws and makes it easier for your clients to process payments.

Effective Communication with Clients

- Send Timely Documents: Make sure that your billing statements are sent promptly after the service is completed or the product is delivered. Delaying this can cause confusion or disrupt your cash flow.

- Follow Up on Late Payments: If a client has missed the payment deadline, don’t hesitate to follow up professionally. A polite reminder is often enough to get things back on track.

Stay Organised

- Keep Accurate Records: Maintain a record of all sent billing documents, payments received, and any communication regarding payments. This ensures you have the necessary data if disputes arise or for tax purposes.

- Use Professional Tools: Consider using invoicing software to automate and streamline the billing process. This can help you save time, reduce errors, and provide a more polished service to clients.

By following these best practices, you’ll build trust with your clients, ensure timely payments, and operate your business more efficiently within the UK’s regu

Invoicing for Different Types of Work

When it comes to requesting payment for services or products, the approach can vary significantly depending on the nature of the work. Different industries or types of tasks require specific details to be included in the billing documents. Understanding these nuances helps ensure that you’re compliant with regulations and that your clients know exactly what they’re paying for.

Here’s how you can approach billing for various types of work:

Hourly or Project-Based Work

For tasks charged by the hour or as a one-time project, it’s important to include detailed descriptions of the work done, including the number of hours worked or milestones completed. This method is common among contractors, consultants, and freelancers who charge based on the time or effort invested in a project.

- Hourly Rate: Clearly state the hourly rate and the number of hours worked, breaking down the services performed during that time.

- Project Rate: If you charge per project, list the key phases or deliverables of the project along with the agreed-upon price for each milestone.

- Time Tracking: For hourly work, it’s useful to provide time logs to show how many hours were spent on each task. This adds transparency for your clients.

Ongoing or Retainer Work

For clients on ongoing contracts or retainer agreements, the billing structure might differ. Rather than charging by the hour or project, you’ll likely bill for a set period or amount of services. This is common among professionals providing regular services, such as marketing experts or IT consultants.

- Fixed Fee: If you have a regular fee, be sure to specify the services covered and the period for which the fee applies (e.g., weekly, monthly).

- Payment Schedules: Establish clear schedules for when payments are due (e.g., monthly or quarterly). Regular invoicing helps maintain a consistent cash flow.

Goods and Products

For businesses selling goods or products, the process is straightforward but requires attention to detail in listing quantities, item descriptions, and prices. This is crucial for both your financial records and the client’s understanding of the cost breakdown.

Free vs Paid Invoice Templates: What’s Best? When creating billing documents for your business, you have the option to use either free or paid options. Both come with advantages and drawbacks, and the right choice largely depends on your specific needs and the level of customization required. Understanding the differences between these two choices can help you determine which is the best fit for your business operations.

Free Options

Free billing documents are a great option for those just starting or for small-scale businesses that need a simple, no-frills solution. While these options are readily available and easy to access, they often come with limitations. Here’s what you should know:

- Cost-Effective: As the name suggests, these options are free, which is ideal for those on a tight budget.

- Basic Features: Free options usually offer standard designs with minimal customization features.

- Limitations: You may find fewer options in terms of design or functions, such as automated reminders or integration with accounting software.

- Quick Setup: These are often ready to use immediately, making them a convenient choice for quick billing.

Paid Options

Paid solutions offer more advanced features, making them suitable for those who need more customization or automation. Businesses that want to streamline their billing processes may find paid options more effective. Here are the benefits:

- Advanced Features: Paid options often include features like automated payment tracking, custom branding, recurring billing, and more.

- Professional Designs: You can access more polished, professional designs, making your documents look more refined.

- Customization: Paid solutions offer a higher level of customization, allowing you to tailor your billing documents to your brand’s identity.

- Integration: Many paid options can integrate with accounting or financial software, streamlining your overall workflow.

Ultimately, the choice between free and paid billing documents comes down to your specific needs. If you’re just starting and need something simple, free options may suffice. However, if your business is growing and requires more