How to Use the Best Invoice Template for QuickBooks Online

Managing payments efficiently is crucial for the smooth operation of any business. With the right tools, the process of creating and sending payment requests can become faster, more accurate, and more professional. Whether you’re a freelancer or run a large enterprise, automating your billing system helps save time and reduces errors. By utilizing customizable solutions, businesses can tailor their payment requests to reflect their brand while maintaining clarity and professionalism.

In today’s digital landscape, various software options provide the ability to generate professional invoices with ease. These systems allow users to quickly adjust key details, from client information to payment terms, ensuring each request aligns with the needs of both the business and the customer. With automated reminders and integrated payment gateways, tracking and receiving payments becomes simpler, allowing you to focus on other essential aspects of your operations.

Embracing such technology can lead to significant improvements in financial management, boosting efficiency and enhancing client relationships. It not only simplifies accounting tasks but also creates a streamlined process for managing multiple clients, ensuring that no payment is overlooked.

Comprehensive Guide to QuickBooks Online Invoice Templates

Managing billing processes effectively is essential for any business, whether large or small. Having the ability to create well-structured, customizable documents that can be tailored to each client helps streamline administrative tasks. The right tools allow users to adjust various fields like amounts, due dates, and payment instructions with ease, ensuring that every transaction is handled professionally and accurately.

Modern billing systems offer user-friendly features that make it simple to craft personalized documents. With flexible options to include logos, specific payment terms, and detailed item breakdowns, these systems enable businesses to present themselves in a polished manner. The process becomes even more efficient when integrated features, such as automated reminders and direct payment links, are available.

By leveraging advanced solutions, companies can save time and reduce the risk of errors, providing a seamless experience for both business owners and clients. With a few clicks, you can generate professional documents, track payments, and ensure that all financial records are kept up to date without hassle.

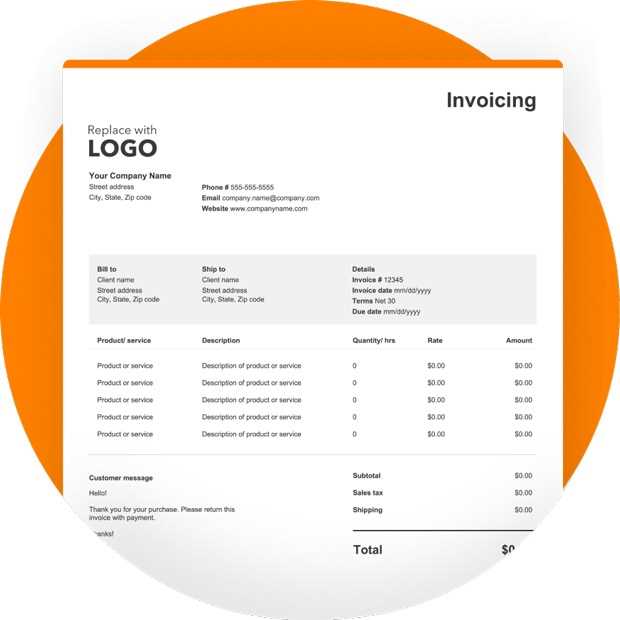

What Is an Invoice Template

A document that facilitates the billing process is essential for any business that deals with regular transactions. It serves as a standardized form that includes all the necessary details for requesting payment, such as the goods or services provided, pricing, and terms. This streamlined document can be easily customized to meet the specific needs of each transaction, ensuring consistency across all client communications.

By using a pre-designed structure, businesses can save valuable time and reduce the risk of errors in every payment request. This system allows for automatic inclusion of key details, such as contact information, payment instructions, and due dates, while also offering flexibility to modify specific fields as needed. It is an efficient way to manage transactions without having to recreate essential information from scratch each time.

Employing such a system helps create a professional appearance, fosters better communication with clients, and simplifies the overall financial management process. It’s an indispensable tool for any business looking to maintain accuracy and organization in their financial documentation.

Why Choose QuickBooks Online for Billing

When managing a business’s financial transactions, efficiency and accuracy are key. Using an advanced digital solution for payment requests provides the ability to automate many processes that would otherwise require time and effort. A cloud-based platform designed for managing financial documentation not only simplifies the creation of payment requests but also offers seamless integration with other business operations.

Streamlined Processes and Automation

With automated features, businesses can generate and send payment requests without manual intervention. This saves time and minimizes the chances of human error. The system automatically calculates totals, applies taxes, and keeps track of payment status, ensuring that everything is up-to-date and accurate.

Access Anywhere and Anytime

One of the main advantages of a cloud-based solution is accessibility. Whether in the office, at home, or on the go, you can manage your financial records from any device with an internet connection. This level of flexibility allows business owners to stay on top of their financial tasks regardless of location.

Choosing a system that offers these advanced features ensures your billing process remains smooth, professional, and efficient, ultimately enhancing the overall client experience.

Benefits of Using Invoice Templates

Utilizing pre-designed structures for payment requests offers numerous advantages that can significantly improve a business’s billing process. By adopting ready-made formats, companies can save time and ensure that all essential details are consistently included in every request. These solutions also reduce the likelihood of errors, offering a smoother experience for both business owners and clients.

Increased Efficiency and Accuracy

Pre-set structures streamline the entire process, allowing businesses to create professional documents quickly without having to input repetitive information each time. With all necessary fields already included, the chances of missing key details or making mistakes are minimized, leading to more accurate payment requests.

Consistency Across All Transactions

By using the same framework for every payment request, companies can maintain consistency in their communications. This uniformity helps reinforce professionalism and brand identity, making interactions with clients more seamless and reliable.

| Benefit | Explanation |

|---|---|

| Time-Saving | Pre-designed structures reduce the time spent creating payment requests from scratch. |

| Reduced Errors | Key fields and calculations are automated, decreasing the likelihood of mistakes. |

| Professional Appearance | Uniform documents help businesses maintain a polished and professional look. |

| Customization | Business-specific details such as terms and contact information can easily be adjusted. |

By leveraging such tools, businesses can enhance their workflow, improve client relations, and ensure smooth financial operations.

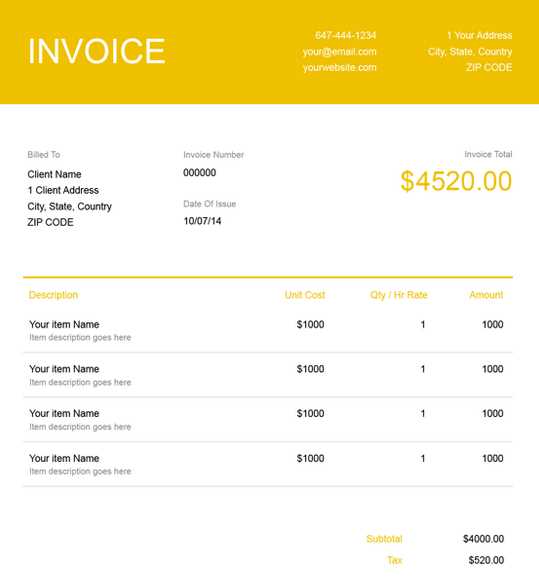

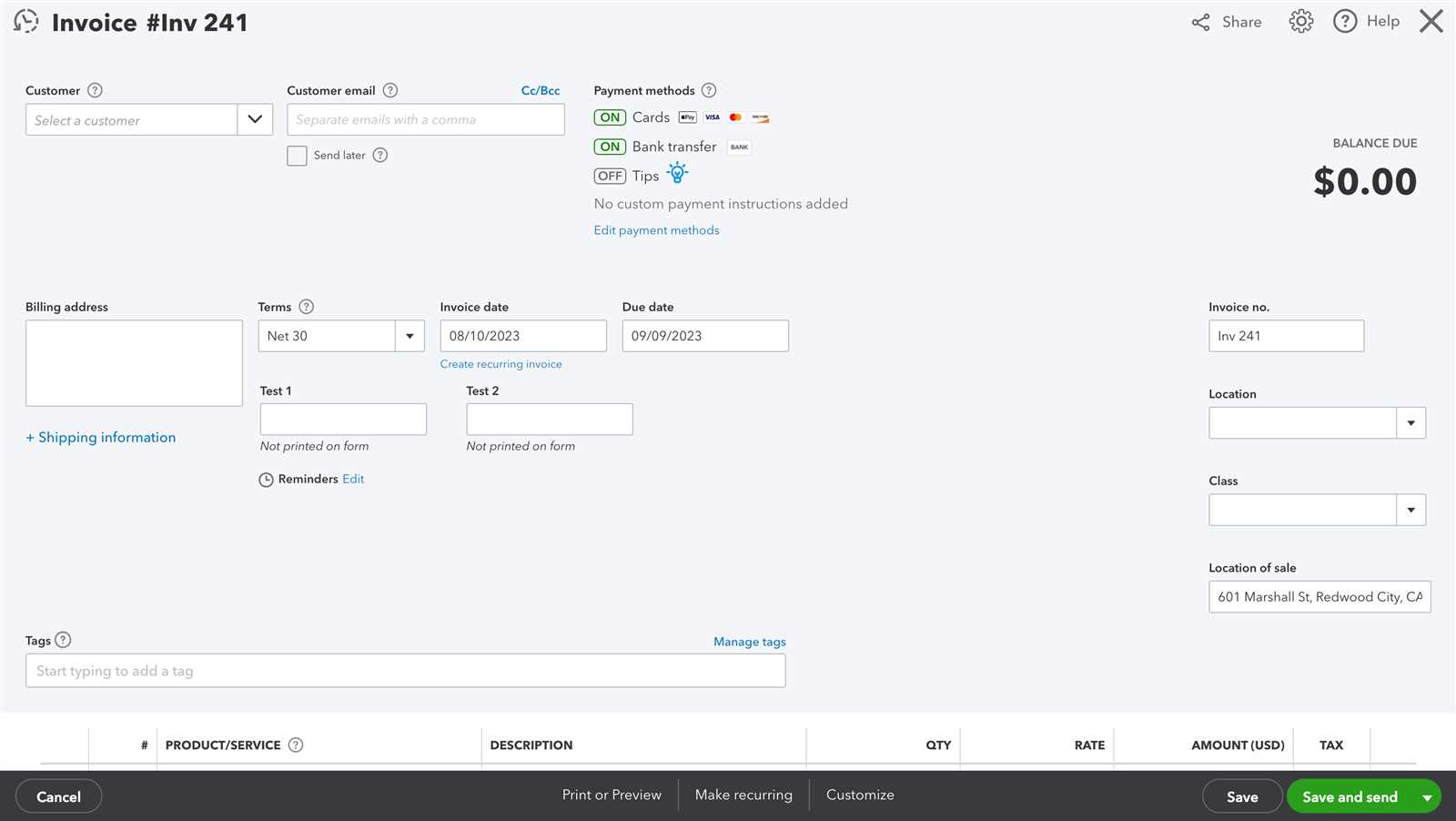

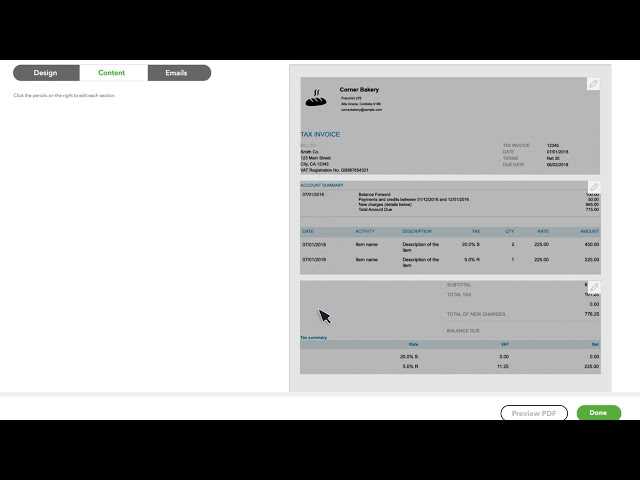

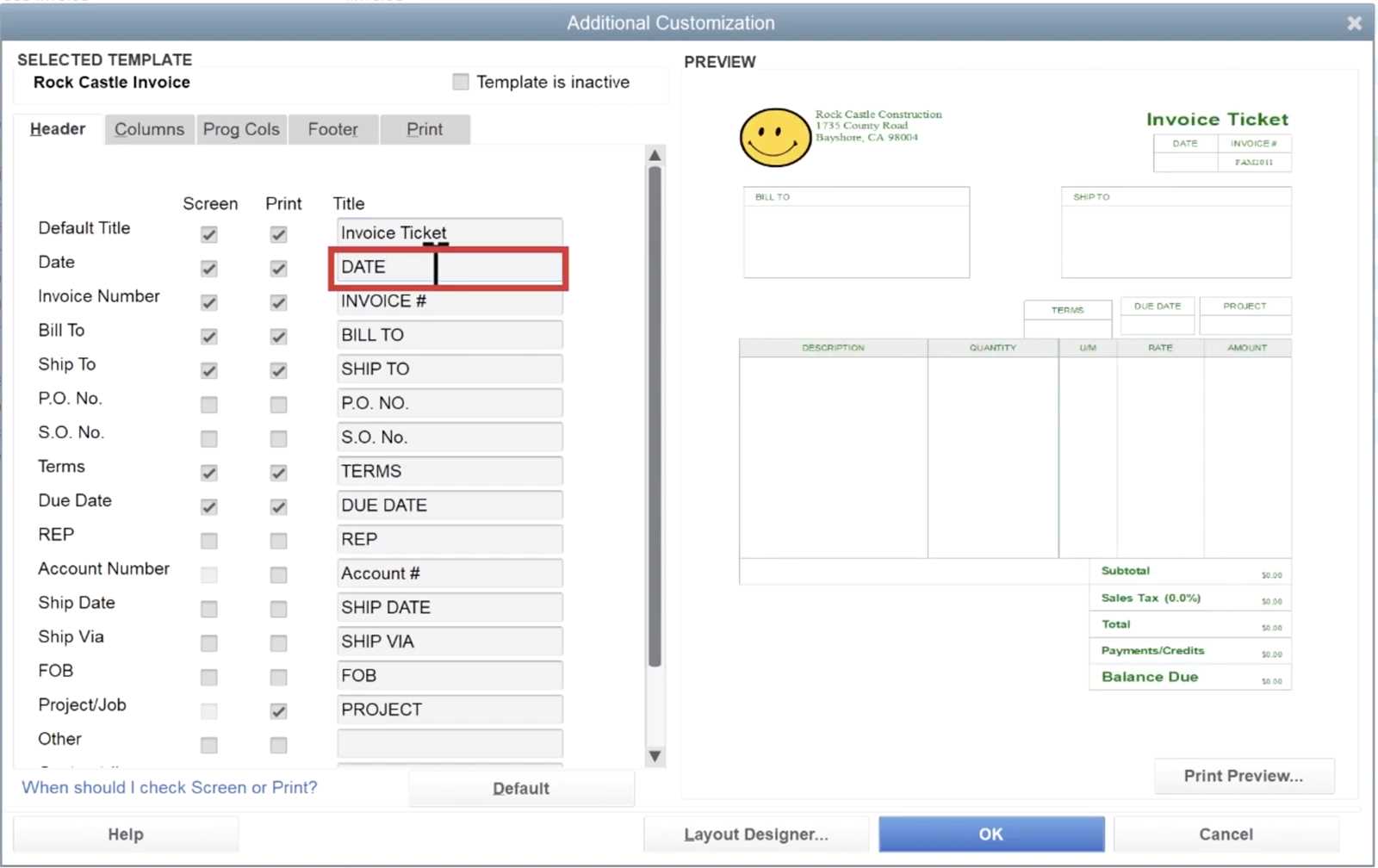

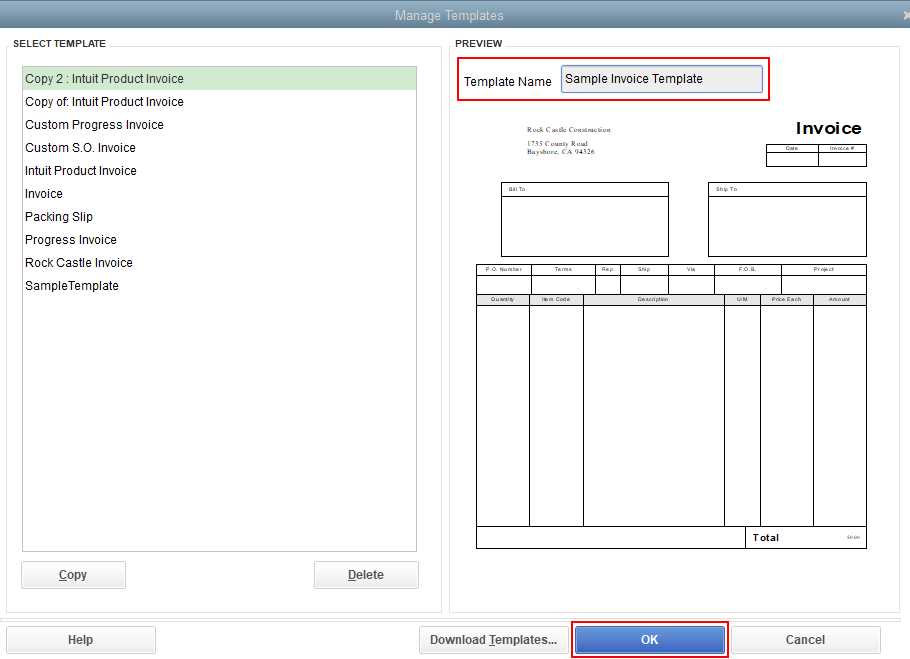

How to Create Custom Invoices

Creating tailored payment requests that meet the specific needs of your business is essential for maintaining professionalism and efficiency. Customizing these documents allows you to include the unique details relevant to each transaction, ensuring clarity and precision in all client communications. With a few simple steps, you can design and adjust these documents to suit your business’s branding and requirements.

To begin customizing, follow these basic steps:

- Select a framework that suits your needs and allows for easy modifications.

- Insert essential client information, including name, contact details, and address.

- Clearly outline the services or products provided, including quantities and prices.

- Define payment terms, such as due dates, discounts, and any applicable taxes.

- Customize the look by adding your company’s logo, color scheme, and preferred fonts.

- Ensure all details are accurate before finalizing and sending the document.

By adjusting these elements, you can create a polished, professional document that reflects your brand while meeting the needs of your clients.

Benefits of Customization

- Personalized touch: Adding unique details makes the document more relevant to each client.

- Brand recognition: Customizing the design reinforces your company’s identity.

- Improved clarity: Tailored information ensures clients understand exactly what they are being charged for.

Customizing your payment requests ensures that every transaction is handled with care and precision, helping to build trust and strengthen client relationships.

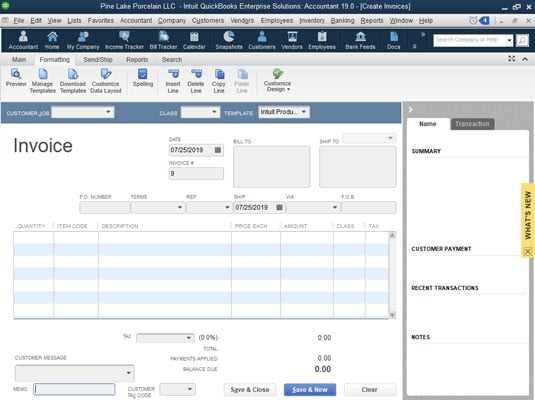

QuickBooks Online vs Traditional Billing Methods

In today’s business world, there are various ways to manage payment requests, each with its own advantages and challenges. While some businesses continue to rely on traditional, manual methods, others have shifted towards automated, cloud-based solutions to streamline the process. The choice between these two approaches can significantly impact the efficiency, accuracy, and overall success of managing financial transactions.

Efficiency and Time Management

Traditional methods often require more manual effort, from hand-writing or manually typing out each document to physically mailing or emailing them. This process can be time-consuming, especially when managing multiple clients or frequent transactions. On the other hand, cloud-based systems offer automation that reduces human intervention. With just a few clicks, payment details can be entered, calculated, and sent, saving time and reducing the likelihood of errors.

Accuracy and Flexibility

When using manual methods, businesses are more prone to mistakes, such as miscalculations or missed fields. In contrast, automated systems calculate totals, taxes, and other variables automatically, ensuring greater accuracy. These systems also offer flexibility, allowing businesses to quickly adjust payment requests to suit the specific needs of each client without starting from scratch every time.

Embracing automated solutions not only reduces administrative burdens but also enhances professionalism and consistency in client communications. By choosing the right tools, businesses can boost productivity and focus on more strategic areas of growth.

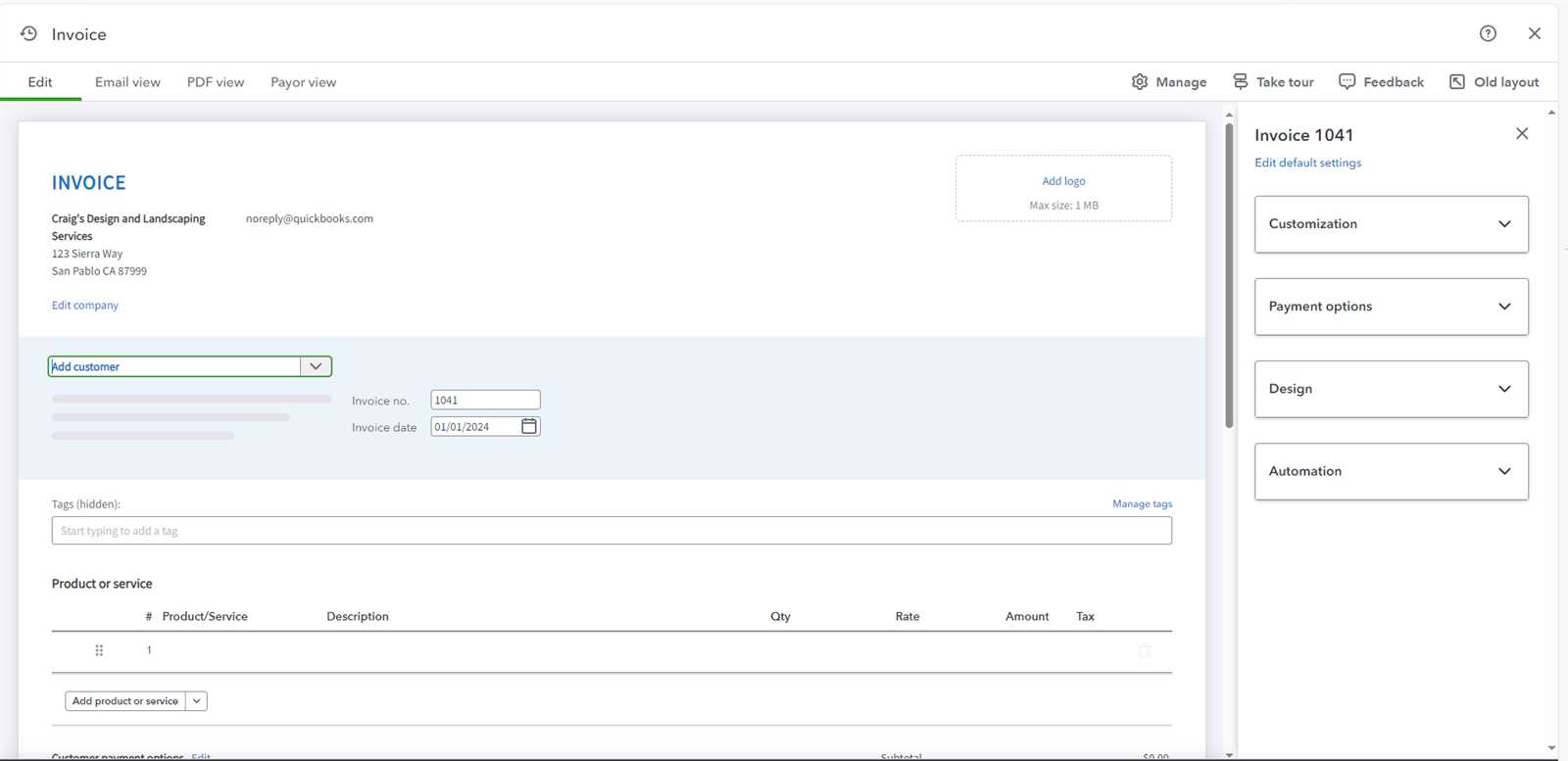

Top Features of QuickBooks Invoice Templates

When managing billing processes, the right tools can make all the difference in terms of efficiency, accuracy, and professionalism. Modern systems designed for generating payment requests offer a range of features that help businesses streamline the process, save time, and avoid errors. These powerful features are built to enhance the user experience while offering customization options to meet specific business needs.

Key Features to Consider

- Customization Options: Tailor the document layout with your logo, colors, and fonts to align with your brand identity.

- Automated Calculations: Automatically calculate totals, taxes, and discounts, reducing the chance of manual errors.

- Recurring Billing: Set up automatic billing cycles for clients with regular payments, saving time on repeated transactions.

- Payment Links: Include direct payment options for clients to easily pay online, speeding up the collection process.

- Real-Time Updates: Track the status of each payment request instantly and stay updated on paid or overdue items.

- Multi-Currency Support: Manage payments from international clients and accommodate various currencies seamlessly.

- Integrated Reminders: Automatically send reminders for overdue payments, ensuring you don’t miss any follow-ups.

By taking advantage of these features, businesses can improve not only their billing process but also their overall client experience. These tools help ensure consistency and accuracy in financial documentation while also making it easier to manage ongoing transactions.

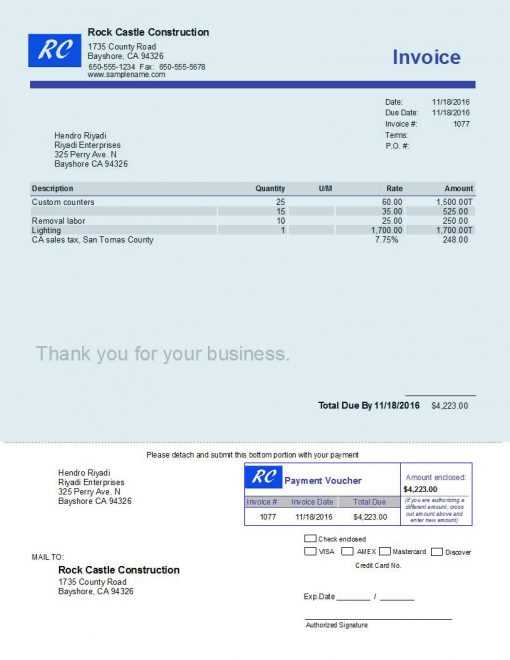

Integrating Payment Options in Invoices

Offering various payment methods in your billing documents not only enhances convenience for your clients but also helps ensure faster payments. By providing multiple ways for customers to settle their bills, you reduce barriers and improve the overall payment experience. Integrating diverse payment options directly within your payment requests allows clients to choose the method that works best for them, whether online or offline.

Including payment links, bank details, or mobile payment options ensures flexibility and encourages timely transactions. With modern tools, you can automatically embed payment buttons or direct bank transfer details, making the entire payment process as seamless as possible. This integration can save time for both your business and clients, reducing the need for follow-up reminders or delays.

Key benefits of offering multiple payment methods include faster payment processing, improved cash flow, and greater customer satisfaction. Clients appreciate having a choice, especially in today’s fast-paced world where convenience plays a major role in business transactions.

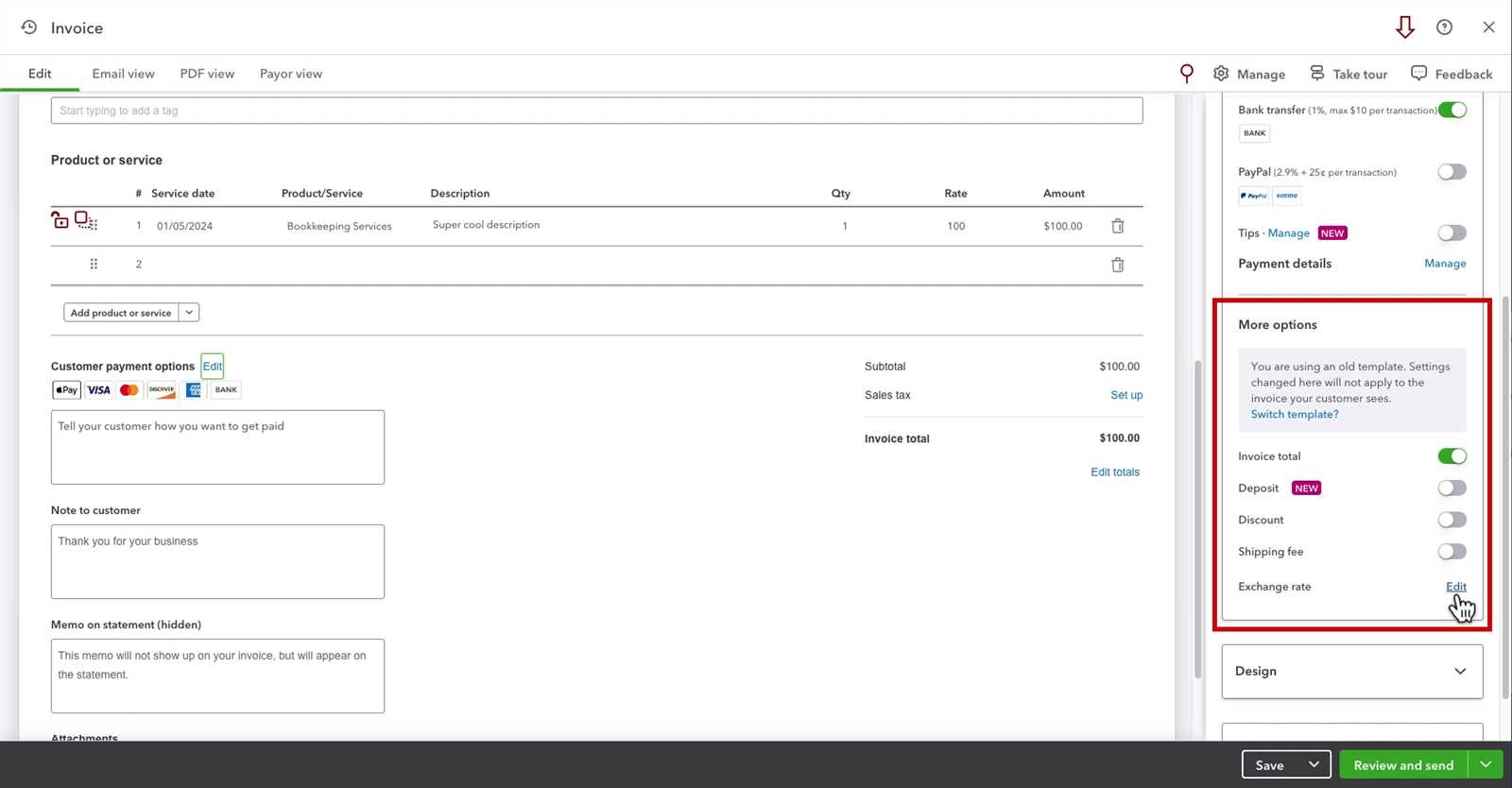

How to Automate Invoicing with QuickBooks

Automating the process of creating and sending payment requests can greatly improve the efficiency and accuracy of your business operations. By setting up automated workflows, businesses can ensure that clients are billed promptly and consistently without needing to manually create each document. This automation not only saves time but also reduces the risk of human error, ensuring a smoother experience for both business owners and clients.

Setting Up Recurring Billing

One of the key features of automated payment request systems is the ability to schedule recurring billing. This is ideal for businesses with clients who require regular payments, such as subscriptions or membership fees. Once set up, the system will automatically generate and send payment documents at pre-determined intervals, saving you the effort of manually tracking and issuing these requests.

Integration with Payment Systems

For further automation, integrating your payment requests with online payment systems allows clients to settle their bills directly from the document itself. With payment links or buttons embedded into the request, clients can complete the transaction quickly and securely, further streamlining the entire process.

By automating your billing process, you can ensure that your business runs more efficiently, reduces administrative costs, and enhances customer satisfaction by providing a hassle-free way to manage payments.

Common Mistakes in Invoice Creation

When preparing payment requests, it’s easy to overlook important details, which can lead to confusion, delayed payments, and unnecessary follow-ups. Common errors in the process can cause frustration for both business owners and clients, making it essential to pay attention to accuracy and clarity in each document. By being aware of these common pitfalls, you can ensure a smoother and more professional billing experience.

Frequent Errors to Avoid

- Missing or Incorrect Contact Information: Always double-check client details, including name, address, and contact information to avoid delays in communication.

- Failure to Include Clear Payment Terms: Be specific about due dates, late fees, and any discounts to prevent misunderstandings.

- Not Breaking Down Charges: Clearly itemize products or services to show exactly what the client is being charged for.

- Incorrect Totals: Ensure that calculations, including taxes, discounts, and totals, are accurate to avoid disputes or delays.

- Omitting Payment Options: Include multiple payment methods or instructions to make it easy for clients to settle their accounts.

- Unprofessional Formatting: Use a clean, organized layout to improve readability and maintain a professional appearance.

Addressing these common mistakes can help streamline your billing process, reduce errors, and improve client satisfaction. A clear, well-structured payment request ensures that you get paid promptly and maintains strong, professional relationships with your clients.

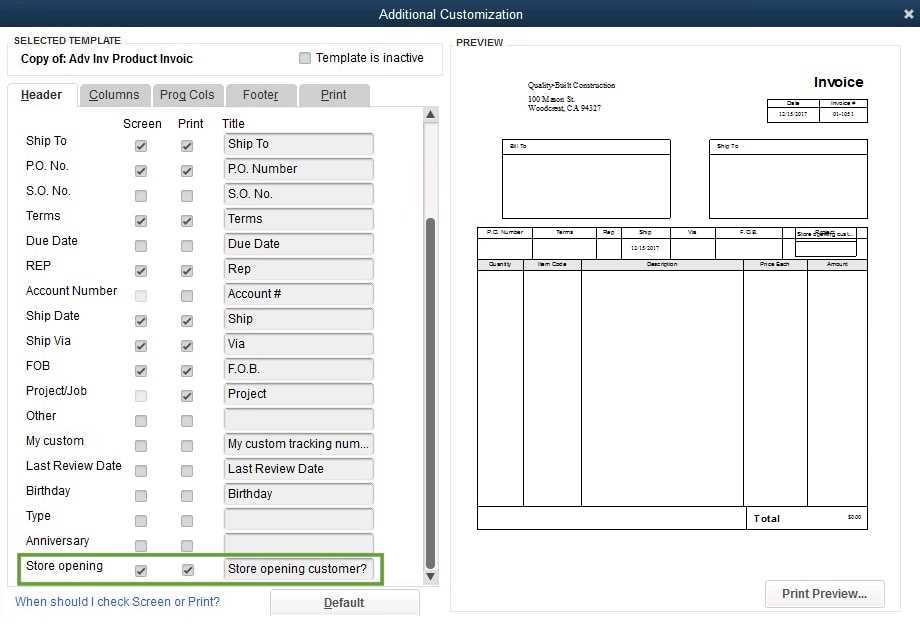

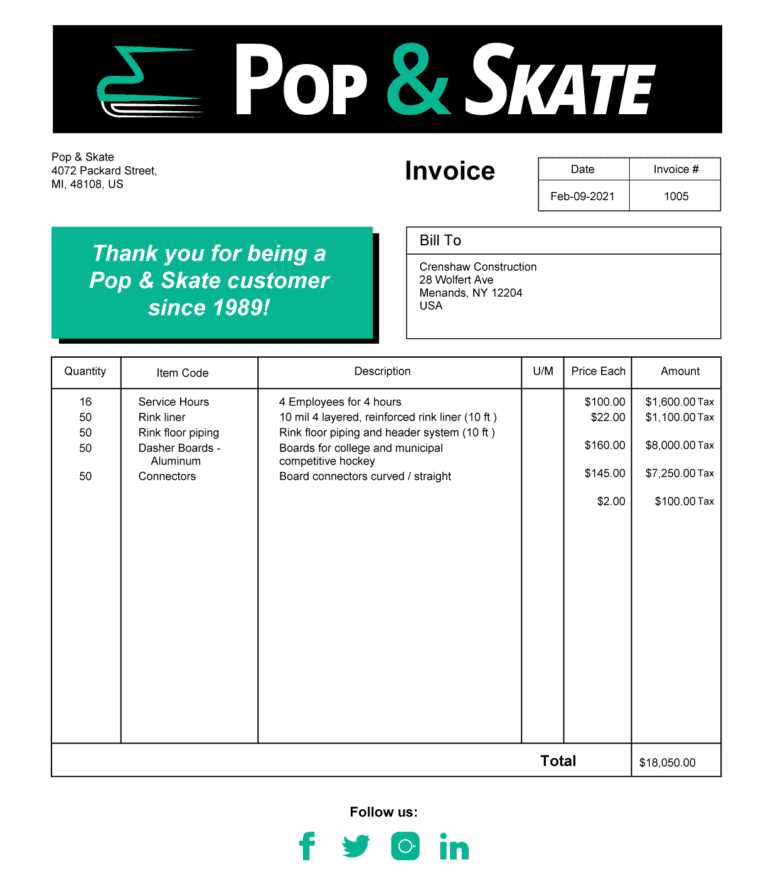

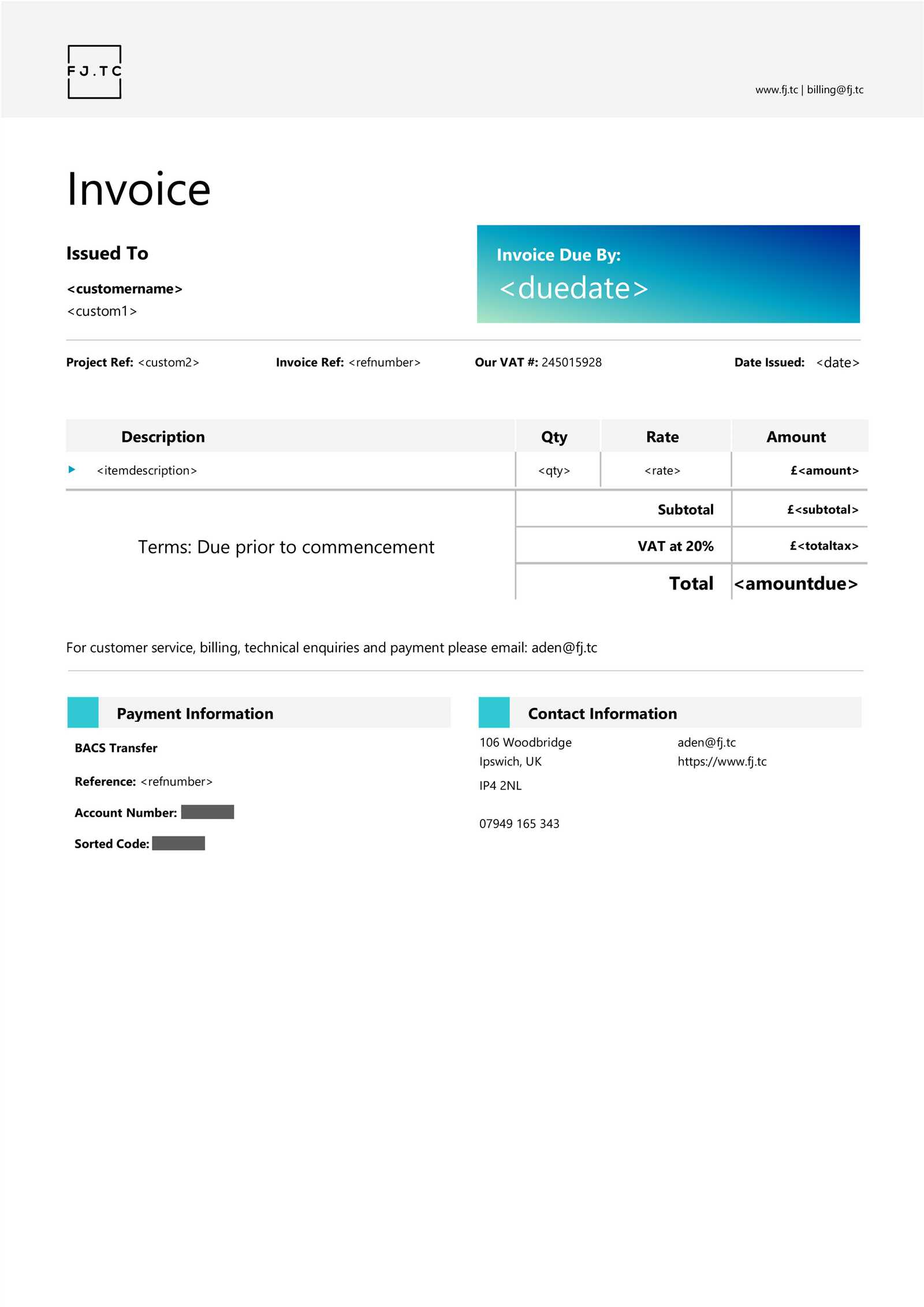

How to Adjust Invoice Templates for Your Business

Customizing payment request documents to fit your business needs is essential for ensuring consistency and professionalism. Tailoring these documents can help convey your brand identity while providing all the necessary details for your clients. Adjusting the format, content, and layout according to your specific requirements will not only streamline your process but also improve client interactions by offering a clear and personalized experience.

Key Customization Areas

- Branding Elements: Customize the layout to reflect your company’s visual identity by adding your logo, colors, and preferred fonts.

- Payment Terms: Clearly define your payment policies, including due dates, penalties for late payments, and any discounts for early settlements.

- Product and Service Descriptions: Be specific in outlining the goods or services provided, including quantities, unit prices, and any special offers.

- Additional Fields: Add custom fields for specific requirements like order numbers, client references, or project names that are relevant to your business.

Table Example for Customization

| Custom Field | Description | Example |

|---|---|---|

| Client Reference | Unique code or project reference for the client. | Project #1234 |

| Payment Terms | Clearly define payment deadlines and conditions. | Due in 30 days, 5% discount for early payment |

| Item Details | Detailed description of the goods or services provided. | Web design services – 10 hours @ $50/hour |

By adjusting these elements, you create a more organized and professional experience for

Enhancing Professionalism with Customized Templates

Customizing your billing documents is a powerful way to enhance the professionalism of your business. When these documents reflect your brand identity and meet specific client needs, they make a strong impression, reinforcing trust and reliability. Tailoring the format, content, and appearance of each request ensures that clients receive clear, consistent, and polished communication, which can positively impact client relationships and payment turnaround.

Key Elements to Customize

- Brand Identity: Incorporating your company’s logo, colors, and fonts helps establish a professional and cohesive visual presence in all your communication.

- Contact Information: Clearly displaying your business contact details, including phone numbers, email addresses, and website links, ensures easy access for your clients.

- Payment Details: A well-defined section for payment terms, including due dates, late fees, and discounts, makes it easier for clients to understand your expectations.

- Clear Layout: A neat, organized structure that highlights essential details like services rendered and amounts owed reflects your attention to detail and professionalism.

Why Customization Matters

- Client Confidence: Personalized documents convey that you are serious about your business and value your client’s time.

- Consistency: A uniform appearance across all documents helps build a strong brand identity and creates a cohesive experience for your clients.

- Better Communication: By making documents easy to read and understand, you reduce the chances of misunderstandings and enhance clarity.

Investing time in customizing your documents not only improves professionalism but also fosters stronger business relationships and smoother transactions.

How to Track Payments with QuickBooks

Keeping track of client payments is essential for maintaining a healthy cash flow and ensuring that you can quickly identify outstanding amounts. By using efficient tools and methods, you can easily monitor paid and unpaid balances, reducing the risk of errors and missed payments. With the right system in place, you can automate payment tracking, streamline your accounting process, and gain valuable insights into your business’s financial health.

One of the best ways to track payments is by utilizing a digital record-keeping system that automatically updates when a payment is made. This method allows you to track incoming funds, mark completed transactions, and generate reports that offer an overview of your accounts receivable.

Steps to Effectively Track Payments

- Record Payment Transactions: When a client makes a payment, log the transaction immediately, noting the payment method, amount, and date.

- Update Payment Status: Mark each transaction as “paid” to keep your records up-to-date and avoid confusion.

- Generate Payment Reports: Use reporting tools to generate detailed reports that track all payments, helping you identify trends and overdue amounts.

- Set Up Payment Reminders: Automate reminders to notify clients of pending payments or overdue amounts, encouraging timely settlements.

Tracking Example: Payment Record Table

| Client Name | Amount Due | Payment Received | Payment Method | Status |

|---|---|---|---|---|

| John Doe | $500 | $500 | Credit Card | Paid |

| Jane Smith | $300 | $0 | Bank Transfer | Pending |

| Acme Corp. | $1,200 | $1,200 | Cheque | Paid |

By following these steps and using a systematic approach, you can ensure accurate tracking of all incoming payments and have a clear overview of your fina

Tips for Faster Invoice Processing

Efficiently handling payment requests can significantly improve your cash flow and reduce administrative burdens. Streamlining the process helps ensure timely payments and prevents bottlenecks that can slow down your operations. By adopting a few strategic practices, you can speed up the process, minimize errors, and keep both you and your clients satisfied.

Best Practices for Expediting Payments

- Use Pre-designed Formats: Start with a well-structured, easy-to-use document format that eliminates the need for repetitive manual entry. A consistent layout reduces time spent on each request.

- Automate Reminders: Set up automatic notifications to remind clients of upcoming or overdue payments. Automated reminders help reduce the need for manual follow-ups and ensure clients stay on track.

- Provide Multiple Payment Methods: Make it easy for clients to pay by offering various payment options. The easier it is for them to pay, the quicker you’ll receive your funds.

- Send Requests Promptly: Send out payment requests as soon as services or products are delivered. The sooner a request is made, the sooner it can be processed and paid.

Tech Tools to Help Speed Up Processing

- Accounting Software: Utilize digital solutions that automatically generate, track, and send out payment requests. These tools eliminate much of the manual work and reduce errors.

- Cloud-Based Systems: Storing and sharing documents through the cloud allows for real-time updates, easy access, and quicker processing from any location.

- Integrated Payment Options: Include direct payment links in your requests, allowing clients to settle their balances instantly, reducing delays in the payment cycle.

By implementing these strategies, you can significantly reduce the time spent on managing requests, ensuring a smoother, faster process and improved business efficiency.

Managing Multiple Clients with One Template

Handling multiple clients with a single document structure can significantly simplify your administrative tasks. By utilizing a standardized format, you can streamline the process and ensure that each request remains consistent while still catering to the unique needs of each client. This approach helps save time, reduce errors, and maintain professionalism across all client communications.

When managing various clients, it’s crucial to personalize the information without compromising efficiency. With a versatile format, you can easily customize specific details, such as payment terms, service descriptions, and client contact information, while still maintaining a consistent overall structure.

Key Elements to Customize for Each Client

| Element | Customization |

|---|---|

| Client Information | Adjust contact details, billing addresses, and client-specific notes. |

| Service or Product Details | Modify descriptions, quantities, and pricing according to each client’s needs. |

| Payment Terms | Set personalized payment deadlines, discounts, or special terms for different clients. |

| Due Dates | Tailor due dates based on your agreement with each client, ensuring flexibility. |

By creating a flexible document structure, you can easily manage multiple clients with minimal effort while keeping each client’s information organized and tailored to their specific requirements. This not only saves time but also enhances client satisfaction, as each client will receive an accurate and well-presented request.

How to Save Time with Invoice Templates

Efficiently managing client requests and financial transactions is crucial for businesses looking to streamline their operations. One of the most effective ways to save time in this process is by utilizing pre-designed document structures. These ready-made solutions allow you to quickly input necessary details, ensuring both speed and accuracy without the need for starting from scratch each time.

By automating repetitive tasks and offering easy customization, these structures enable you to focus more on growing your business rather than getting bogged down by manual paperwork. Whether you’re dealing with regular clients or managing multiple projects, the time savings are significant, freeing you up to focus on other important aspects of your business.

Key Benefits of Using Pre-Designed Documents

- Efficiency: Reduce the time spent on formatting and organizing content for each new task.

- Consistency: Maintain a professional appearance and uniformity across all documents.

- Accuracy: Minimize errors in calculations and ensure important information is never overlooked.

Tips for Maximizing Time Savings

- Set Up Standardized Fields: Use fixed fields for recurring elements such as company details, payment terms, and services offered.

- Use Automation Tools: Leverage tools that automatically fill in details based on client history or project type.

- Customize for Efficiency: Tailor the document structure to suit the specific needs of your business, enabling you to quickly adjust for various scenarios.

Incorporating these time-saving strategies into your daily workflow not only simplifies document creation but also ensures that you can manage a higher volume of requests without sacrificing quality or accuracy.

Getting the Most Out of QuickBooks Features

To fully optimize your financial management process, it’s essential to harness the capabilities of software solutions designed for efficiency and accuracy. These platforms offer various tools that can automate mundane tasks, streamline workflows, and enhance decision-making. By understanding and implementing these features, you can unlock the full potential of your system and improve your business operations.

From automated calculations to detailed reporting and customer management, maximizing the use of these tools will allow you to save time and reduce errors. Here, we will explore how to best utilize key functionalities and ensure that you are getting the most out of your financial platform.

Key Features to Focus On

- Automation of Routine Tasks: Set up recurring transactions and automate payment reminders to reduce manual work.

- Comprehensive Reporting: Use the reporting tools to track financial health, identify trends, and make informed decisions.

- Client Management: Keep client details organized and easily accessible, enhancing customer service and communication.

Using Advanced Functionalities

Taking advantage of more advanced features will help you refine your processes and improve your ability to manage different aspects of your business, from invoicing to financial analysis. Consider using tools like integrations with payment systems and automated tax calculations to further streamline your operations.

| Feature | Benefit |

|---|---|

| Recurring Billing | Save time by automating repeat transactions, improving cash flow management. |

| Expense Tracking | Easily monitor and categorize expenses to gain a better understanding of your financial situation. |

| Client Portal | Enable clients to view and pay their bills online, reducing manual follow-ups. |

By focusing on these features, you’ll not only improve the efficiency of your operations but also enhance your ability to manage business finances with greater ease and accuracy. Understanding and fully utilizing your platform’s features is key to simplifying your financial tasks and ensuring the success of your business.