Top Invoice Template Program for Streamlined Billing and Customization

Efficient management of business finances requires a reliable tool that can handle the creation and organization of payment requests. This solution not only saves time but also ensures accuracy, allowing businesses to focus on growth while keeping administrative tasks in check.

By using automated systems for generating detailed payment requests, companies can improve their billing workflow and reduce the chances of errors. These tools offer customization features that cater to various industries, making it easier to create documents that reflect the unique needs of any organization.

Customizable solutions allow users to create professional-looking documents tailored to their preferences, ensuring that each interaction with clients is polished and clear. The ability to automate repetitive tasks makes the process faster and more consistent, offering significant advantages for small business owners and freelancers.

With these tools, businesses can ensure that their financial documents are always in order and professionally presented, paving the way for smoother operations and better client relationships.

Understanding Invoice Template Programs

Efficient financial management is crucial for any business, and having the right tools to generate and manage payment documents can make a significant difference. These tools help automate the creation of detailed billing documents, ensuring that each transaction is documented accurately and professionally.

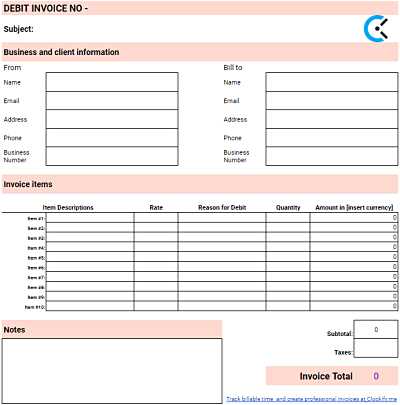

Such solutions allow users to create documents that are both functional and visually appealing, tailored to the specific needs of different industries. By utilizing pre-built structures and customizable fields, businesses can quickly generate necessary paperwork, reducing the time spent on manual entry and enhancing consistency.

Automated features can simplify tasks like number generation, tax calculations, and client information insertion, freeing up valuable time. Additionally, they offer a level of professionalism that might otherwise be difficult to achieve manually. With an easy-to-use interface, these tools are designed to accommodate both novices and experienced users alike.

Overall, these tools offer an accessible and reliable way to manage the financial documentation process, helping businesses stay organized and ensure timely payments.

How Invoice Templates Simplify Billing

Managing payment requests can be time-consuming and prone to errors without the right tools. Having a pre-structured solution in place greatly reduces the complexity of creating accurate and professional documents. With automated features, the entire billing process becomes more efficient and less stressful.

Such solutions help streamline the creation of detailed financial documents by eliminating the need to start from scratch each time. With customizable sections and predefined fields, businesses can easily fill in the necessary information without worrying about formatting or calculations.

Consistency and accuracy are key benefits of these tools, ensuring that every document looks the same and contains the correct details. By automating repetitive tasks like tax calculations and payment terms, they save time while also minimizing the risk of human error. This results in faster processing and more reliable record-keeping.

Ultimately, these tools not only simplify the workflow but also contribute to smoother operations, enabling businesses to focus more on their core activities while maintaining control over financial documentation.

Key Features of a Good Template

A well-designed tool for generating billing documents should have certain key features that make it both user-friendly and efficient. These features not only ensure ease of use but also guarantee that every document is accurate, professional, and customizable to suit the needs of any business.

Some of the essential elements that make these tools effective include flexibility, customization options, and automated functions. These characteristics allow users to tailor the output while reducing time spent on manual tasks.

| Feature | Description |

|---|---|

| Customizable Fields | Allows businesses to adjust sections based on unique needs, such as payment terms, client details, and item descriptions. |

| Automation | Automates repetitive tasks like tax calculations, date insertion, and numbering, reducing human error. |

| Professional Layout | Ensures that all generated documents maintain a clean, structured, and polished appearance. |

| Ease of Use | Features an intuitive interface that is simple for users of all experience levels to navigate. |

| Compatibility | Supports various file formats, allowing users to export documents to PDF, Word, or Excel as needed. |

By incorporating these features, businesses can ensure that they can quickly generate accurate documents, maintain professionalism, and save time on their administrative tasks.

Choosing the Right Program for Your Business

Selecting the ideal solution for generating financial documents is a critical decision that can significantly impact your business operations. The right tool can save time, improve accuracy, and provide a professional image, while the wrong one can lead to inefficiency and mistakes.

When evaluating different options, it’s important to consider the specific needs of your business. Some factors to consider include the size of your company, the volume of documents you need to process, and the level of customization required. Below are some key considerations to help you make the best choice:

- Ease of Use: Choose a solution with a simple and intuitive interface to minimize the learning curve for your team.

- Customization Options: Ensure the tool allows you to tailor documents to reflect your company’s branding and specific requirements.

- Integration Capabilities: Consider how well the tool integrates with your existing accounting software or payment systems.

- Cost: Evaluate the pricing structure, ensuring it fits within your budget without sacrificing important features.

- Customer Support: Make sure the provider offers reliable customer support in case you need assistance or face technical issues.

Ultimately, the solution you choose should align with your business’s workflow and help streamline your administrative tasks. With the right tool, managing financial documents becomes a seamless part of your daily operations, allowing you to focus more on growing your business.

Benefits of Customizable Invoice Templates

Having the ability to modify financial documents according to specific business needs offers numerous advantages. Customization allows companies to create documents that reflect their unique identity, maintain consistency, and cater to their operational requirements. With this flexibility, businesses can ensure that all details are presented professionally and accurately.

Customizable solutions also streamline the process by enabling quick adjustments to fields, layouts, and styles without starting from scratch each time. This flexibility improves both productivity and accuracy, while enhancing client relationships through professional and tailored communications.

| Benefit | Description |

|---|---|

| Branding | Allows businesses to incorporate logos, color schemes, and other elements that align with their brand image. |

| Flexibility | Users can easily adjust sections such as payment terms, tax rates, and item descriptions to suit different scenarios. |

| Professional Appearance | Ensures documents maintain a clean, polished look that instills confidence in clients and partners. |

| Time-Saving | Reduces time spent on creating documents by allowing users to reuse customized structures for future needs. |

| Accuracy | Helps minimize errors by allowing automated fields for numbers, dates, and other important data. |

Incorporating customizable features into your financial documentation process enhances efficiency and accuracy, making it easier to maintain control over client communications and financial tracking.

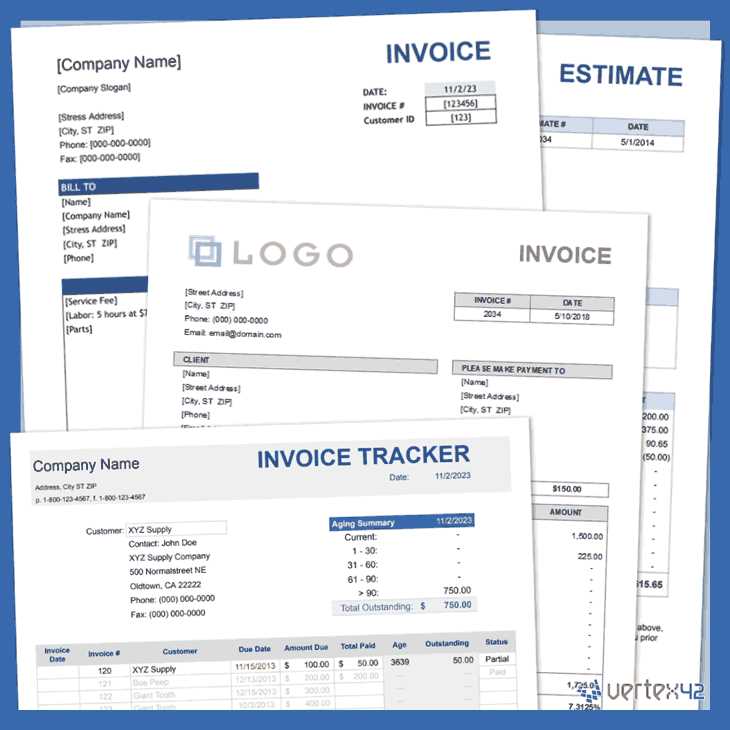

Top Invoice Template Programs Available

There are many tools on the market that assist businesses in creating professional and accurate billing documents. These tools offer a wide range of features, from customizable layouts to automated functions, designed to simplify the billing process. Choosing the right solution can save time, reduce errors, and improve the overall efficiency of your business’s financial operations.

Here are some of the top-rated tools available for streamlining your document creation process:

- FreshBooks: Known for its user-friendly interface and robust customization options, FreshBooks allows businesses to easily create professional documents while automating key tasks like tax calculations and payment reminders.

- QuickBooks: This comprehensive financial tool offers a variety of billing features, including templates that are easy to adjust, helping users manage not just invoicing, but also expenses, taxes, and payroll.

- Zoho Invoice: Zoho stands out for its highly customizable templates and integrations with other business tools, allowing for seamless billing operations across platforms.

- Wave: A free solution for small businesses, Wave offers an intuitive interface with customizable document features, perfect for freelancers and startups looking to manage invoicing and accounting on a budget.

- Invoice Ninja: Ideal for freelancers and small businesses, Invoice Ninja provides a variety of templates, automated reminders, and integration with payment gateways for easy tracking and payment collection.

Each of these tools offers a unique set of features and pricing models, ensuring that businesses of all sizes can find the right fit for their needs. By selecting the right tool, companies can streamline their billing processes and maintain a professional image when communicating with clients.

How to Create an Invoice with Templates

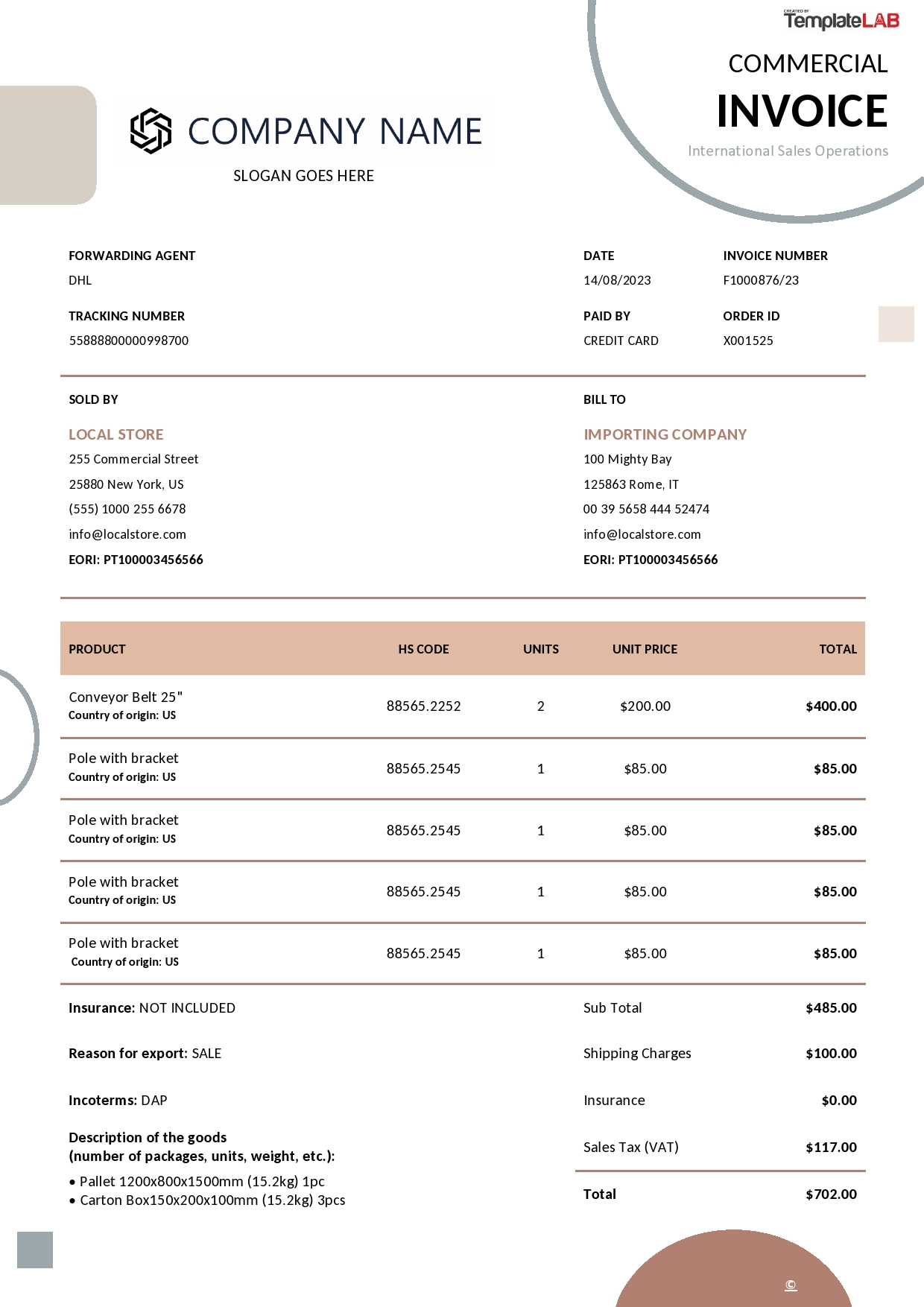

Generating a professional financial document is an essential task for any business. By using pre-designed structures, companies can save time and ensure consistency across all documents. These tools allow users to quickly fill in necessary details such as items, prices, and payment terms, resulting in a polished, accurate document ready for sending.

Creating a document with a pre-built structure typically involves the following steps:

| Step | Description |

|---|---|

| Select a Structure | Choose a pre-designed structure that suits the nature of your business and the type of transaction. |

| Customize the Layout | Adjust the design to reflect your company’s branding by adding logos, colors, and custom text. |

| Enter Transaction Details | Fill in information such as client details, item descriptions, quantities, and prices. |

| Apply Taxes and Discounts | Use automated fields to calculate taxes or apply discounts based on preset rates. |

| Review and Save | Double-check all details for accuracy before saving or sending the document to your client. |

Once you’ve completed these steps, your document is ready to be sent out. Using a pre-made design structure streamlines the process, reduces errors, and ensures a professional appearance every time. With the right tool, creating accurate financial documents becomes a quick and effortless task.

Integrating Invoice Templates with Accounting Software

Seamlessly linking financial document creation with accounting tools can significantly streamline business operations. By connecting these two systems, businesses can automate data entry, reduce errors, and maintain a unified view of financial records. Integration allows for efficient transfer of information, such as payment statuses, client details, and transaction history, from the document generator directly into the accounting system.

This integration offers numerous benefits, including:

- Time Efficiency: Automation of repetitive tasks like data entry and calculations saves valuable time for businesses.

- Consistency and Accuracy: Automatically syncing information between platforms minimizes the risk of manual errors.

- Better Financial Overview: Real-time updates between billing and accounting systems provide a clearer, more accurate picture of financial health.

- Improved Workflow: By eliminating the need for duplicate entries, employees can focus on other critical tasks that drive business growth.

To successfully integrate these systems, businesses typically need to use software solutions that are compatible with each other. Many accounting platforms offer pre-built integrations or API access to facilitate smooth data exchange. Once set up, the integration can be a powerful tool to enhance both the billing and accounting processes, making them faster, more efficient, and more reliable.

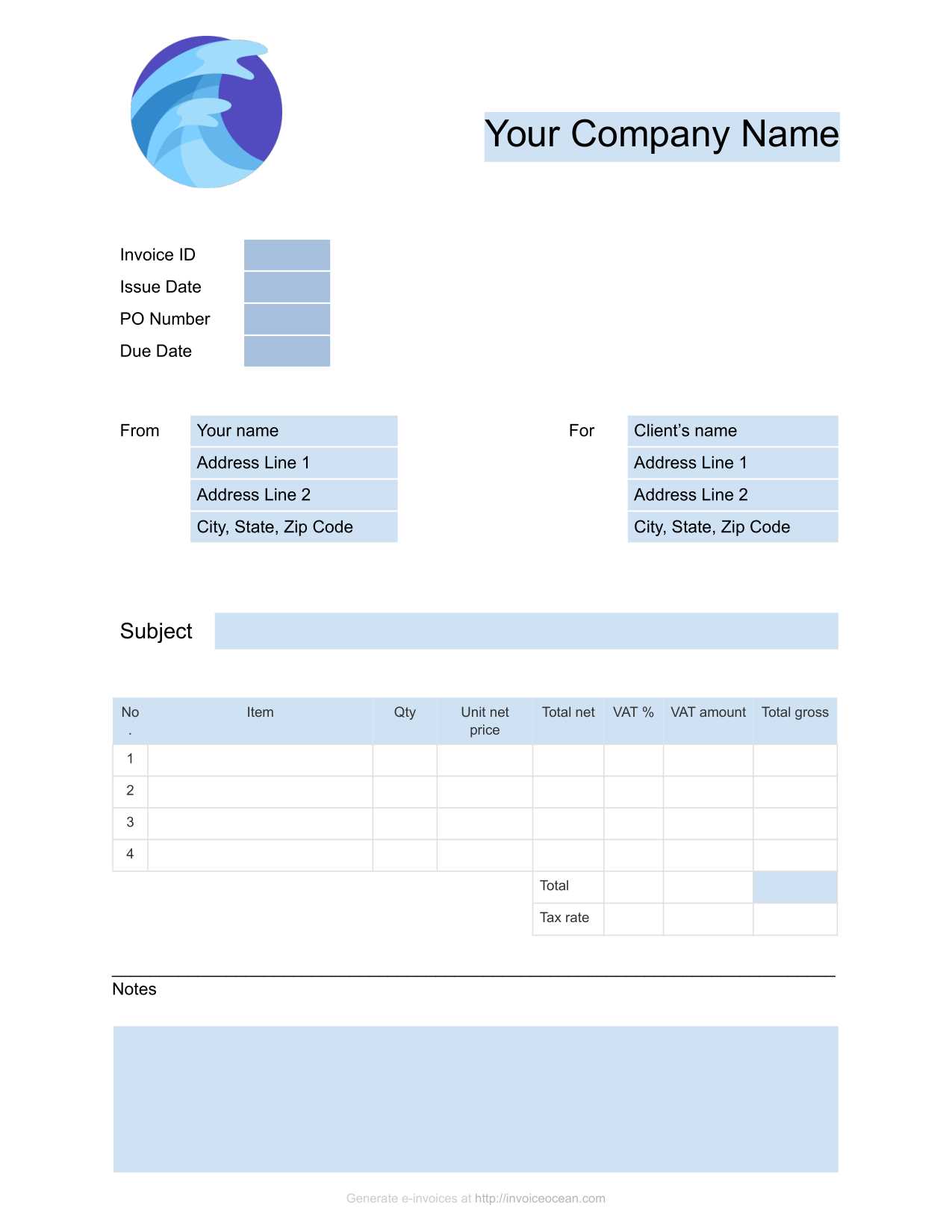

Invoice Templates for Freelancers and Small Businesses

Freelancers and small businesses often face unique challenges when it comes to managing their finances. Having a reliable system to create professional documents ensures that they can maintain a steady cash flow while presenting a professional image to clients. Customized solutions that cater to specific business needs can save time and effort, allowing for more focus on the core aspects of the business.

For freelancers and small businesses, using a pre-designed structure offers many advantages, such as:

| Benefit | Description |

|---|---|

| Quick Setup | Ready-made structures save time, allowing users to generate professional-looking documents without starting from scratch. |

| Easy Customization | Modify the structure to include your business branding, terms, and conditions, making it fit your specific needs. |

| Cost-Effective | Freelancers and small businesses often work with tight budgets. Using pre-built solutions reduces the need for expensive software or outsourced services. |

| Consistency | Ensure a consistent appearance across all documents, which builds credibility and professionalism with clients. |

Whether you’re managing one project or handling multiple clients, using a ready-to-use structure simplifies the process, ensuring that you can quickly create detailed financial documents. With these tools, freelancers and small businesses can focus on what matters most–growing their business and providing high-quality services to their clients.

Common Mistakes to Avoid with Invoice Templates

Creating accurate and professional financial documents is crucial for maintaining business operations and ensuring timely payments. However, even with pre-designed structures, mistakes can occur that may affect the clarity and effectiveness of the documents. Avoiding common errors can improve the accuracy of transactions and the professional image of your business.

Missing Key Information

One of the most frequent mistakes is omitting essential details, such as client information, payment terms, or itemized charges. Failing to include this can lead to confusion and delayed payments. Always double-check that all relevant fields are filled out correctly, such as:

- Client name and contact details

- Service or product descriptions

- Payment terms, due dates, and amounts

Inconsistent Formatting

Inconsistent formatting can make documents appear unprofessional and difficult to read. It is essential to use a uniform layout for all your records, ensuring that clients can quickly understand the charges and payment terms. Always keep the following in mind:

- Use a consistent font size and style

- Align text and numbers correctly

- Maintain a clean and organized structure

By being mindful of these common mistakes, you can improve the quality and efficiency of your financial documentation. This not only ensures smoother transactions but also strengthens your business’s credibility and trust with clients.

How Invoice Programs Save Time and Money

Automating billing and financial documentation can significantly reduce manual efforts, allowing businesses to allocate resources more effectively. By utilizing digital tools for creating and managing financial records, business owners can streamline their workflow, minimize errors, and ensure prompt payments. These tools offer various features that contribute to time savings and cost reduction in the long term.

Efficiency in Document Creation

Using automated systems to generate financial records eliminates the need for repetitive data entry and reduces the risk of errors. By customizing the structure and design to meet specific business needs, users can create accurate documents in less time. Key benefits include:

- Quick generation of accurate records

- Automated calculations and summaries

- Consistent and professional appearance

Reducing Administrative Costs

By minimizing the manual effort involved in creating and tracking payments, businesses can reduce administrative costs. With tools that track payments and send reminders, fewer human resources are required for follow-up, freeing up staff for more value-added tasks. Here’s how:

| Benefit | Impact |

|---|---|

| Automated reminders | Reduce the need for constant follow-ups and late payment tracking |

| Centralized data management | Decreases time spent on organizing and retrieving financial documents |

Incorporating such tools into daily operations ensures more efficient use of time and resources, ultimately saving money and improving cash flow.

Free vs Paid Invoice Template Programs

When choosing the right tool for creating financial documents, businesses often face a decision between free and paid options. Each has its own advantages and limitations, and the best choice depends on the specific needs and size of the business. While free tools may offer basic functionality, paid solutions typically come with additional features and support that can help streamline operations and provide a more customized experience.

Free tools are often appealing for small businesses or individuals with minimal invoicing needs. However, paid options generally offer more advanced features, including customization, integration, and enhanced security. Below, we compare both options to help you make an informed decision.

| Feature | Free Tools | Paid Tools |

|---|---|---|

| Customization Options | Limited customization; templates may be fixed | Advanced customization for branding and design |

| Automation Features | Basic features such as basic calculations | Automated reminders, recurring billing, and payment tracking |

| Customer Support | Minimal or no customer support | Access to dedicated customer service and technical support |

| Integration | Limited or no integration with other business tools | Seamless integration with accounting, CRM, and other systems |

Choosing between free and paid options ultimately depends on the complexity of your invoicing needs and your willingness to invest in additional features. Free tools can be an excellent choice for individuals or businesses with simple requirements, while paid solutions are better suited for those who need advanced functionality and long-term scalability.

Automating Invoices with Template Programs

In today’s fast-paced business world, automating the creation and sending of financial documents can save time and reduce human error. By utilizing software that offers predefined structures, companies can quickly generate detailed billing statements without the need to manually input information every time. Automation in this context enables businesses to streamline their billing cycle and ensure consistency in their operations.

Automating this process not only accelerates invoicing but also helps improve cash flow management. By setting up recurring billing, automatic reminders, and easy tracking, businesses can maintain a steady revenue stream without the need for constant oversight. The integration of automation features allows for more accurate and efficient management of financial tasks.

Benefits of Automating Financial Documents

Automation provides numerous benefits to businesses of all sizes:

- Time Savings: Automating repetitive tasks reduces the time spent on administrative duties.

- Consistency: Predefined formats ensure that every document looks professional and contains the necessary information.

- Accuracy: Automation reduces the chance of human error, leading to more accurate billing and payment processing.

- Improved Cash Flow: With automated reminders and due dates, businesses can ensure timely payments and avoid delays.

How to Automate Financial Statements

To successfully automate financial statements, businesses should follow these steps:

- Choose the Right Tool: Select a solution that aligns with your business needs and integrates well with your accounting system.

- Set Up Recurring Invoices: For subscription-based or regular clients, set up automatic invoicing for fixed amounts at defined intervals.

- Enable Reminders: Use automated reminders to notify clients of upcoming due dates or overdue payments.

- Track Payments: Keep track of payments automatically and generate reports to analyze your business’s financial health.

By implementing an automated invoicing system, businesses can reduce manual labor, enhance efficiency, and focus more on strategic growth while ensuring smooth financial operations.

Ensuring Professional Design in Invoices

A well-designed billing statement not only enhances the professionalism of your business but also ensures clarity and easy understanding for your clients. A structured, clean layout can significantly impact the way your company is perceived, fostering trust and reinforcing credibility. It is essential to incorporate elements that make the document easy to navigate and understand while maintaining a cohesive look aligned with your brand identity.

Key elements such as typography, color scheme, and alignment contribute to the overall aesthetic, but the most important factor is the logical arrangement of information. A professional design should prioritize readability and make sure that all necessary details–like payment terms, amounts, and contact information–are clearly visible. In addition, keeping the design simple yet effective ensures the document serves its purpose without overwhelming the recipient.

Core Elements of a Professional Design

| Design Element | Importance |

|---|---|

| Clarity and Simplicity | A clean, uncluttered layout ensures that important details are immediately noticeable. |

| Brand Identity | Incorporating your logo, business name, and brand colors reinforces your company’s image. |

| Logical Structure | Organizing sections clearly allows recipients to easily locate necessary details, such as amounts and payment terms. |

| Professional Fonts | Readable and elegant fonts help present a polished appearance and improve comprehension. |

Additional Tips for a Professional Look

Incorporating these tips into your design will make a noticeable difference in how your statements are received:

- Consistency: Maintain the same font styles, colors, and formatting across all documents for uniformity.

- Whitespace: Allow for sufficient spacing between sections to avoid overcrowding and improve readability.

- Accurate Alignment: Properly align text and numbers, ensuring they follow a clear and consistent pattern.

- Contact Information: Ensure that your contact details are easy to find, making communication with clients seamless.

A professional design enhances the user experience and instills confidence, making it easier for clients to process the information and pay promptly. By paying attention to these details, businesses can ensure their financial statements reflect their professionalism.

Protecting Your Invoices with Secure Templates

When creating and sending financial documents, safeguarding sensitive information is essential. It’s not only about ensuring that the data is correct, but also about protecting it from unauthorized access and tampering. Utilizing secure formats for your financial documents is a critical step in maintaining confidentiality and integrity. This can be achieved by adopting various tools and strategies that allow you to lock or encrypt your statements, keeping your business and clients’ information safe.

Beyond just securing the files, it is also important to use systems that monitor and track when these documents are accessed, modified, or shared. This added layer of protection ensures that you have control over who views and uses the documents, reducing the risk of fraud or accidental leaks of sensitive data.

Methods to Secure Your Documents

- Password Protection: Applying password security to your financial documents prevents unauthorized individuals from viewing or editing them.

- Encryption: Encrypting your files ensures that even if someone gains access to them, they cannot read the content without the correct decryption key.

- Watermarking: Adding watermarks to documents can act as a deterrent to unauthorized sharing, as it marks the document with your business identity.

- Digital Signatures: Digital signatures help authenticate the document’s source and ensure that its content has not been altered after creation.

Additional Security Considerations

In addition to using secure file formats, businesses should also consider the following measures to enhance document security:

- Regular Software Updates: Ensuring that any software you use for creating or sending financial documents is up-to-date helps protect against vulnerabilities.

- Two-Factor Authentication: Using two-factor authentication for systems that store or manage these documents adds an extra layer of protection.

- Controlled Access: Limiting access to financial documents based on user roles within your business helps mitigate the risk of unauthorized viewing.

Implementing these security measures will not only safeguard your financial documents but also build trust with your clients by demonstrating that you take their data privacy seriously.

Future Trends in Invoice Template Programs

The future of financial documentation is evolving rapidly as businesses seek more efficient and automated ways to manage transactions. As technology continues to advance, various trends are emerging that promise to enhance how businesses handle their billing and payment processes. These trends focus on increasing automation, improving customization, and integrating new technologies to streamline workflows and ensure accuracy in all aspects of financial management.

- Automation and AI Integration: The integration of artificial intelligence into financial documentation systems will significantly reduce manual effort. AI can help automatically generate, categorize, and send documents based on predefined criteria, saving businesses considerable time and minimizing errors.

- Cloud-Based Solutions: With the shift towards remote work, cloud-based tools are becoming essential. These solutions allow businesses to access and manage their documentation from anywhere, offering greater flexibility and real-time collaboration.

- Mobile Optimization: As mobile devices become more integral to business operations, tools designed for mobile-first use will grow in popularity. Optimized mobile interfaces will allow business owners and employees to create, send, and track documents on the go.

- Blockchain for Security: Blockchain technology promises to provide secure, tamper-proof documentation. By leveraging blockchain’s transparency and immutability, businesses can ensure that their financial records are safe and verifiable.

- Customizable Automation Features: Businesses are increasingly demanding more flexible customization in their automation tools. These features will allow users to design and automate processes that fit their unique business needs, from branding to specific billing schedules.

As these trends continue to shape the landscape, businesses will benefit from more streamlined, secure, and efficient systems for managing their financial operations. The ability to embrace these changes will ultimately lead to more optimized workflows, faster transactions, and better customer experiences.