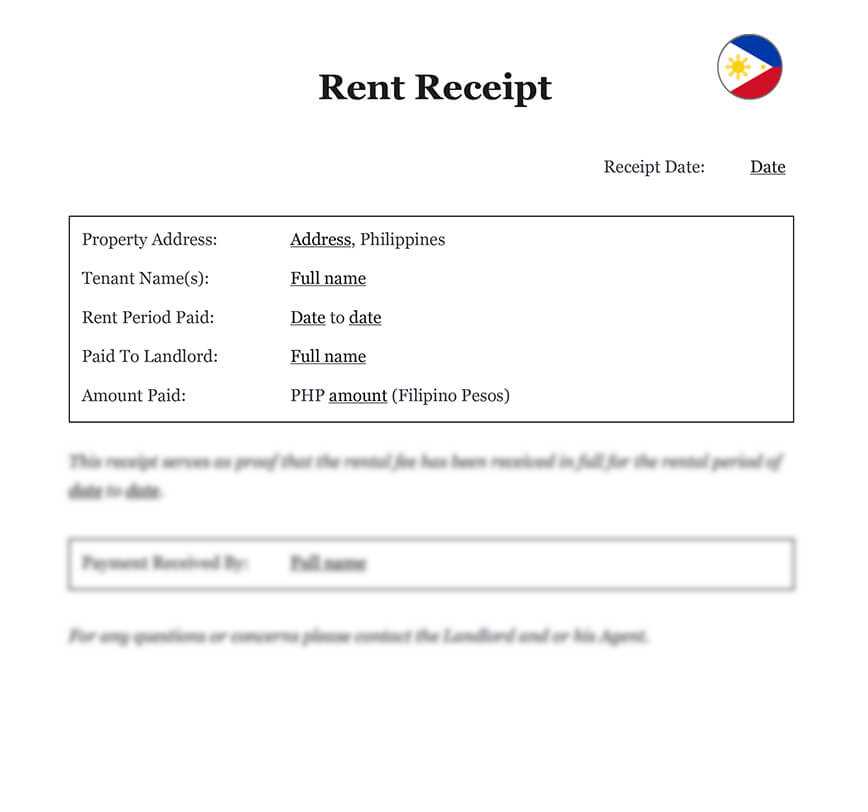

Invoice Template Philippines for Easy Billing

For any business, ensuring accurate and clear billing is essential for maintaining smooth financial operations. Having a structured document that outlines transactions and payment expectations helps prevent confusion and ensures timely payments. Properly designed forms not only streamline the process but also present a professional image to clients and partners.

Whether you are an entrepreneur, freelancer, or a company, it’s important to use an efficient system for tracking payments. A well-crafted billing form can be tailored to suit your business’s needs, ensuring it meets legal and operational requirements. By utilizing the right format, you can enhance your workflow and reduce errors in payment processing.

Choosing the right format for your forms will depend on your business type and the way you interact with clients. Simplifying the process with ready-made options or custom designs can save time and effort, letting you focus more on your core operations.

Invoice Template Philippines for Small Businesses

For small enterprises, having an organized and professional billing system is crucial for smooth financial management. By using structured documents for payments, businesses can maintain transparency and keep track of their revenue streams efficiently. This is especially important for businesses that deal with multiple clients, where accuracy and consistency are key to ensuring timely payments.

Why Small Businesses Need a Well-Designed Billing System

Effective billing helps to establish credibility and trust with clients. A clear and simple structure ensures that clients understand the payment terms and details without confusion. Additionally, it can simplify accounting tasks, making it easier for businesses to track income and comply with tax regulations.

- Improves payment tracking and transparency.

- Helps in organizing finances for tax purposes.

- Enhances professionalism and trust with clients.

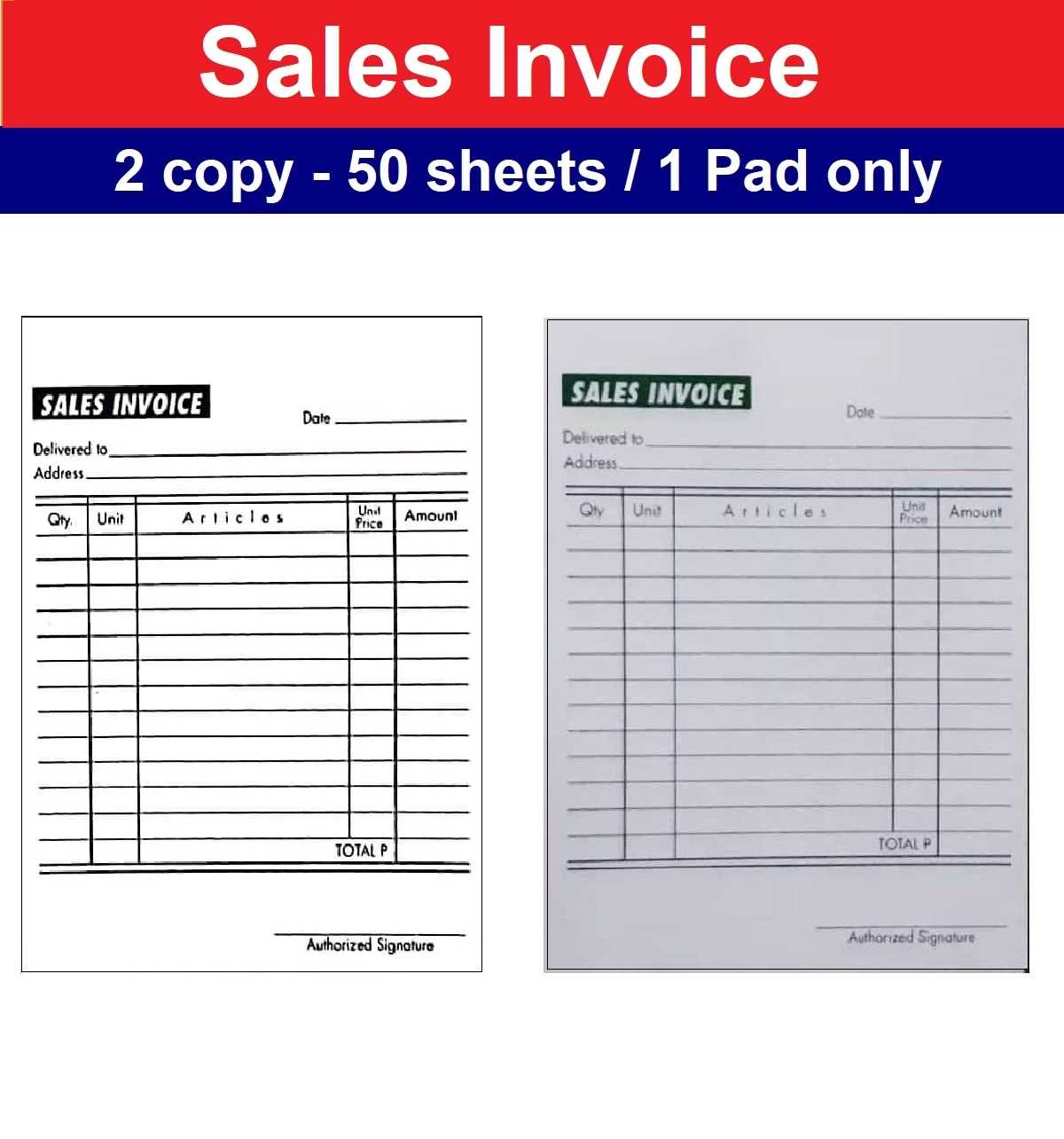

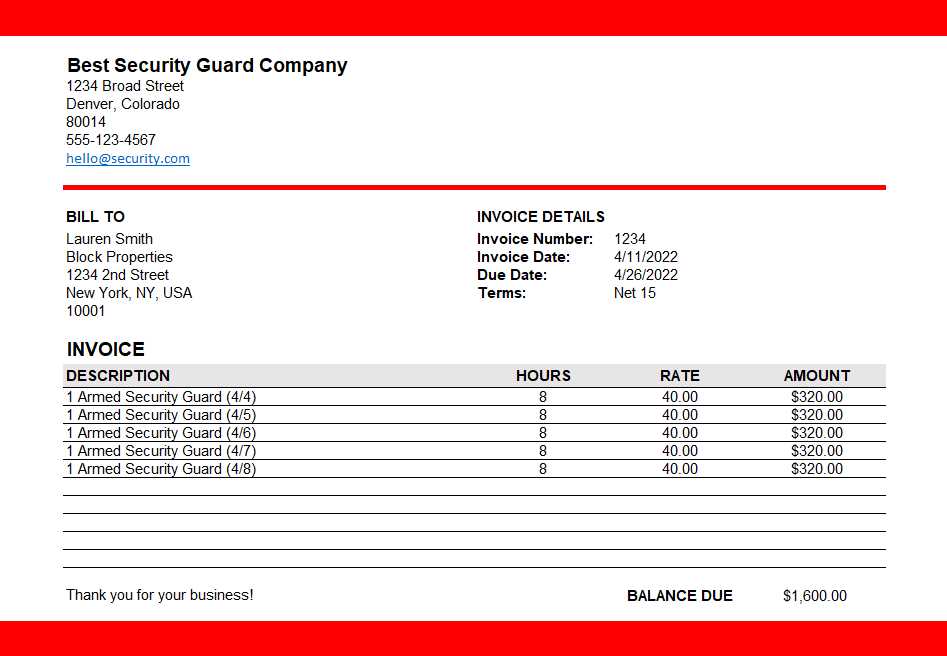

Key Features to Look for in a Billing Document

Small businesses should focus on a few key aspects when selecting or creating a billing document:

- Client Details: Clearly display client information, including name, address, and contact details.

- Itemized List: Include a detailed breakdown of products or services provided.

- Payment Terms: Set clear due dates and payment methods to avoid confusion.

- Unique Identifier: Use a reference number to track each transaction effectively.

Free Invoice Templates for Entrepreneurs

Entrepreneurs often face the challenge of managing their finances while focusing on growing their business. One of the most crucial aspects of financial management is ensuring that clients are billed correctly and promptly. Luckily, there are free solutions available that help streamline this process, making it easier for business owners to create professional and accurate documents without the need for costly software or design services.

Benefits of Using Free Billing Solutions

Free tools for creating billing documents offer several advantages to entrepreneurs, especially those just starting out. These resources allow users to save time and effort by providing pre-designed formats that are easy to customize and use. They also reduce the risk of errors and ensure consistency in the way payments are handled.

- Cost-effective for startups and small businesses.

- Easy to customize and adapt for various industries.

- Helps maintain professionalism when dealing with clients.

How to Find Free Resources

There are many free options available online for entrepreneurs looking for easy-to-use billing formats. Some resources offer downloadable documents in various formats, while others provide web-based tools that allow users to fill in and send documents directly from their browsers.

- Look for online platforms that offer free access to basic tools.

- Consider downloading editable formats like Word or Excel documents.

- Explore websites that provide easy-to-use forms with customization options.

How to Customize Your Invoice

Customizing your billing documents allows you to tailor them to your specific business needs and branding. By adjusting key details, you can create a more professional appearance and make the document easier for your clients to understand. Personalization also helps to ensure that all the required information is presented clearly, which minimizes the chance of confusion and delays in payment.

Here are some essential elements to consider when personalizing your billing document:

- Business Information: Include your company name, address, contact details, and logo to maintain brand consistency.

- Client Details: Clearly display your client’s information such as their name, address, and contact number.

- Unique Identification Number: Add a reference number for easy tracking of each transaction.

- Payment Terms: Specify the due date and acceptable payment methods to avoid confusion.

Formatting Tips: Ensure your layout is clean and easy to read. Use bold headings and spacing to separate sections, making the document more navigable. Highlight the total amount due so that it stands out.

By adjusting these elements to fit your business needs, you can enhance the appearance and functionality of your billing system, ensuring a smoother transaction process for both you and your clients.

Essential Information for Invoice Creation

When creating billing documents for your business, it’s crucial to include all necessary details to ensure accuracy and avoid any misunderstandings. The information you provide helps to establish clear expectations between you and your clients, ensuring smooth transactions and timely payments. Including the right data not only improves professionalism but also ensures compliance with local regulations.

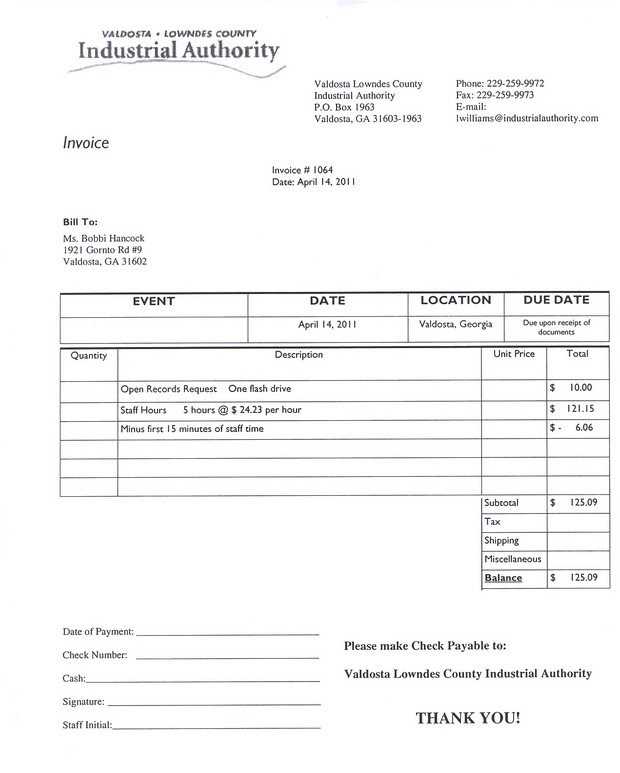

Here are the key elements to include when creating a billing document:

- Business and Client Information: Include your company name, address, phone number, and email address, along with your client’s corresponding details.

- Description of Goods or Services: Provide a detailed list of the products or services offered, including quantities, rates, and any applicable discounts.

- Total Amount Due: Clearly show the total amount owed, including taxes, fees, and any other applicable charges.

- Payment Terms and Due Date: Specify when payment is due and the accepted payment methods.

- Unique Document Number: Assign a reference or invoice number to help track transactions easily.

Ensuring that all these details are present will not only facilitate smooth financial exchanges but also help in record-keeping and fulfilling any tax obligations.

Popular Invoice Software in the Philippines

Managing financial transactions efficiently requires the right tools, especially when dealing with multiple clients and various payment methods. There are several software options available that can help businesses automate the creation and tracking of their billing documents. These platforms simplify the process, reduce errors, and ensure compliance with local requirements, making them an essential part of any business operation.

Here are some popular options for businesses looking to streamline their payment management:

- QuickBooks: A widely used accounting software that offers invoicing features, expense tracking, and tax management. Ideal for small to medium-sized businesses.

- Xero: Known for its easy-to-use interface, this cloud-based software helps users generate professional documents and track payments in real-time.

- Zoho Invoice: A cost-effective solution offering customizable templates, automated reminders, and integration with various payment gateways.

- Wave: A free platform offering invoicing, accounting, and receipt scanning, perfect for freelancers and small businesses with basic needs.

- FreshBooks: Designed with freelancers and small businesses in mind, this software provides customizable documents, time tracking, and reporting tools.

These tools not only enhance accuracy but also save time, allowing business owners to focus on growth rather than manual billing tasks.

Choosing the Right Invoice Format

Selecting the appropriate document layout is essential for ensuring that all necessary information is clearly communicated to clients. The format should reflect the professionalism of your business and make it easy for both you and your clients to track payments. Depending on the nature of your business and client preferences, there are various formats to consider. Each format can offer different benefits, so it’s important to understand which one works best for your specific needs.

Here are some common formats to consider:

| Format Type | Description | Best For |

|---|---|---|

| Basic Layout | Simple and clean design with minimal information, ideal for one-time services or small transactions. | Freelancers, small service providers |

| Itemized Layout | Includes a detailed list of products or services with quantities, rates, and taxes, providing clarity for clients. | Retailers, contractors, and wholesalers |

| Customizable Layout | Allows for flexibility in terms of design and content, suitable for businesses that require more advanced customization. | Businesses with specialized needs or unique branding |

Choosing the right format depends on the complexity of your transactions, the information you need to convey, and the expectations of your clients. By selecting the most suitable layout, you can enhance clarity and professionalism, which can ultimately lead to smoother business operations.

Benefits of Using Invoice Templates

Utilizing pre-designed formats for generating billing documents can significantly enhance business efficiency and organization. These formats offer standardized structures that make it easier to create professional and consistent records, reducing the likelihood of errors and saving time. With the right design, businesses can streamline their processes, leading to quicker payments and a more professional image in the eyes of clients.

Here are some key advantages of using these ready-made formats:

| Benefit | Description |

|---|---|

| Time-saving | Pre-made layouts allow you to fill in necessary details without needing to start from scratch each time, reducing the time spent on document creation. |

| Consistency | Using a standardized format ensures that every document follows the same structure, making your records more professional and easier to track. |

| Reduced Errors | By using a well-organized layout, there’s less chance of missing important information, helping to minimize mistakes in billing and payment processing. |

| Customization | These formats can often be customized to fit your brand’s style or specific needs, allowing for a professional look without extra effort. |

| Improved Organization | With clearly defined sections for key information, these layouts help in keeping financial records organized, making them easier to reference and manage over time. |

By integrating these pre-designed formats into your workflow, you can save valuable time, maintain professionalism, and keep your financial operations organized and efficient.

How to Add Taxes in an Invoice

Adding taxes to a billing document is a crucial step in ensuring that your business complies with local tax regulations. Properly calculating and displaying the tax amounts helps clients understand the final price they need to pay and ensures that you are collecting the correct amount for tax purposes. It’s important to include all necessary information clearly to avoid confusion and ensure transparency.

Understanding Tax Rates

Before adding taxes, you must determine the applicable tax rate for your products or services. Tax rates can vary depending on your location, the type of goods or services you provide, and other factors like sales thresholds. Make sure to research local tax laws to apply the correct rate.

Steps to Include Taxes

- Calculate the Tax Amount: Multiply the subtotal (the sum of all items or services before taxes) by the tax rate to determine the tax amount.

- Include the Tax in the Total: Add the tax amount to the subtotal to calculate the final total amount due.

- Clearly Label the Tax: Display the tax amount separately in the document, indicating the specific tax rate used, so that it’s clear to the client.

- Consider Additional Taxes: Some regions may require more than one type of tax (e.g., sales tax, VAT), so ensure you include each type if applicable.

By following these steps, you can accurately include taxes and provide your clients with a transparent breakdown of the total amount due. Properly displaying tax information not only builds trust but also helps your business remain compliant with tax authorities.

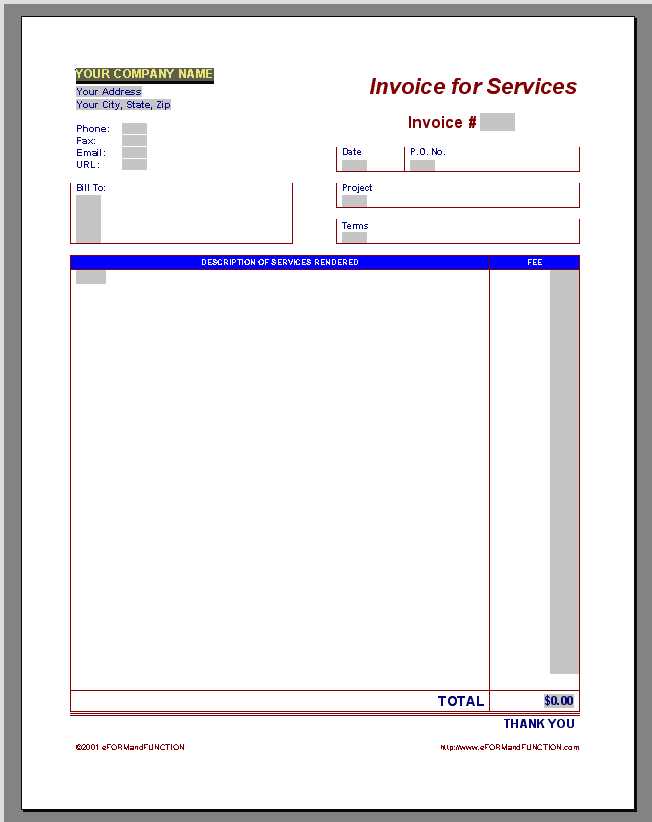

Creating Professional Invoices Easily

Generating well-organized and polished billing documents doesn’t need to be a complex task. By using the right tools and methods, you can create professional records quickly, ensuring accuracy and consistency. With a streamlined process, you can save time while maintaining a professional image that enhances client trust.

Steps to Create Professional Documents

Creating a polished document involves more than just filling out basic details. Following a structured approach ensures that the final document is clear, professional, and error-free. Here are a few key steps to follow:

- Choose the Right Layout: Select a clean and simple design that aligns with your business brand, making the document easy to read.

- Include All Key Information: Ensure that all necessary details such as business name, client name, items/services provided, and amounts are included.

- Highlight Important Sections: Use bold or underlined text to make critical sections, like the total amount due or due date, stand out.

- Check for Accuracy: Double-check all numbers, dates, and details to avoid mistakes that could lead to confusion or delayed payments.

Tools to Help You Streamline the Process

Several software options and online tools can help you generate professional billing records with ease. Here’s a simple comparison of some popular choices:

| Tool | Features | Pros |

|---|---|---|

| Online Generators | Pre-built formats, easy to use | Fast, free, no installation required |

| Accounting Software | Automated calculations, client tracking | All-in-one solution, saves time |

| Spreadsheet Templates | Customizable formats, manual entry | Flexibility, easy to customize |

With these tools, you can easily generate accurate and visually appealing billing documents, helping you save time and maintain a professional image with minimal effort.

Common Mistakes to Avoid in Invoices

When preparing billing documents, it’s essential to ensure that all details are accurate and professionally presented. Mistakes can lead to confusion, delayed payments, or even damage to your business reputation. By being aware of common errors, you can create documents that are clear, precise, and trustworthy.

Frequent Errors in Billing Documents

There are several mistakes that can undermine the professionalism and clarity of your billing records. It’s crucial to avoid these common pitfalls:

- Missing Contact Information: Not including the proper contact details for both the sender and recipient can cause communication delays and confusion.

- Incorrect Dates: Always double-check the issue date and due date to avoid confusion regarding payment terms.

- Inaccurate Item Descriptions: Failing to provide clear descriptions of goods or services can lead to disputes over what was provided or delivered.

- Not Including Taxes or Fees: If applicable, ensure that taxes, discounts, and additional charges are correctly applied to prevent misunderstandings about the final amount due.

- Omitting Payment Terms: Clearly state your payment conditions, including due date, accepted payment methods, and any late fees for overdue payments.

How to Prevent Common Mistakes

Implementing a checklist or automated systems can help minimize errors. Below is a comparison of ways to streamline the billing process:

| Action | Benefit | Tool |

|---|---|---|

| Review Before Sending | Prevents errors from going unnoticed | Manual checks or peer review |

| Use Automation | Reduces human error and speeds up process | Billing software, online platforms |

| Maintain a Standard Format | Ensures consistency and professionalism | Standardized templates or systems |

By paying attention to these details and using the right tools, you can avoid common mistakes and improve the efficiency and professionalism of your billing process.

Legal Requirements for Invoices in the Philippines

In any business transaction, it’s crucial to follow legal regulations to ensure that all documents meet governmental standards. Proper documentation not only facilitates smooth transactions but also prevents legal issues. There are specific requirements for business documents that need to be complied with, particularly in relation to taxes and business registration. Familiarity with these regulations ensures that the records are legally valid and can be used for official purposes like tax filing or audits.

Key Elements for Compliance

For your business records to be legally accepted, certain details must be included. Below are essential components that are required for legal documents:

- Tax Identification Number (TIN): Ensure that the business’s TIN is clearly stated in every document.

- Business Name and Address: Include the registered name and the physical location of the business.

- Customer’s Details: Properly list the name and address of the client or recipient of the goods and services.

- Description of Products or Services: A clear breakdown of the items or services provided must be included.

- Amount and Taxes: The total amount due should be clearly listed, including applicable taxes or other fees as per the regulations.

- Official Receipt Number: Each document must have a unique receipt number for tracking purposes.

Additional Compliance Considerations

It’s important to note that different business types or sectors may have specific requirements for documentation. However, the following are general practices to observe:

- Electronic Submission: Some businesses may be required to submit documents electronically to the tax authorities, following the rules set by the Bureau of Internal Revenue (BIR).

- Use of Registered Books of Accounts: Companies must keep accurate records using approved ledgers or accounting systems to comply with auditing procedures.

- Retention Period: Businesses are required to keep records for a minimum of three years, as stipulated by law, for reference during audits.

Understanding and adhering to these legal requirements not only ensures compliance but also promotes transparency and trust in business operations. Make sure to regularly update your practices to stay aligned with any changes in regulations.

How to Track Payments with Invoices

Keeping track of payments is an essential part of managing a business. Accurate tracking ensures that all transactions are properly recorded, which helps avoid discrepancies and ensures that you are paid in a timely manner. By maintaining clear records of each transaction, businesses can easily track amounts due, received, and outstanding. This process not only simplifies accounting but also helps you maintain healthy cash flow and build trust with clients.

Important Details to Track

To ensure that payments are correctly tracked, it is crucial to include specific information in each document. The following elements should be carefully recorded:

- Payment Due Date: Always specify the date by which the payment should be made. This ensures both parties are aware of the timeline for the transaction.

- Payment Status: Clearly indicate whether the payment has been made, is pending, or is overdue.

- Amount Due and Paid: Record both the total amount due and the amount that has already been paid. This will help track partial payments if applicable.

- Transaction Reference: Include a reference number for each transaction, so both you and the customer can easily reference the payment in case of any issues.

- Method of Payment: Record how the payment was made, whether by bank transfer, credit card, check, or other methods.

Organizing and Monitoring Payments

Efficient tracking involves not only capturing the payment details but also organizing them in a way that is easy to monitor. Here are a few methods to help with this:

- Use Accounting Software: Invest in accounting tools or software to automate the process and generate reports on the payments you have received. This will save time and help you avoid manual errors.

- Create a Payment Log: Maintain a log of all payments, noting down the date received, the amount, and the client’s name. This log can be used for future reference and auditing.

- Set Up Payment Reminders: Utilize reminders or alerts for upcoming or overdue payments, ensuring you follow up promptly and keep the payment process smooth.

- Regular Reconciliation: Periodically reconcile your payment records with your bank or payment gateway statements to ensure everything matches up and is accounted for correctly.

By following these methods, you can stay on top of your financial transactions and maintain a clear overview of your business’s cash flow. Consistent payment tracking is key to ensuring smooth operations and maintaining healthy business relationships.

Best Practices for Invoice Design

Creating clear and professional documents is crucial for maintaining a positive relationship with clients and ensuring timely payments. A well-organized layout, effective use of information, and aesthetic elements can make a significant impact on how your business is perceived. Design plays an essential role in conveying professionalism and providing the necessary details in an easily accessible format. Here are some best practices to follow when designing your documents.

Keep it Simple and Clean

A clean, simple design ensures that the key information stands out and is easy to find. Avoid cluttering the document with unnecessary graphics or overly complex fonts. Focus on clear typography and ample white space to create a balance that is visually appealing and easy to read. The main goal is for the recipient to quickly absorb the necessary details without confusion.

- Use a legible font: Choose fonts that are easy to read, such as sans-serif or classic serif fonts. Avoid using too many font types; stick to one or two for consistency.

- Maintain clear headings: Make sure that sections such as item descriptions, totals, and payment instructions are clearly labeled with headings that stand out.

- Provide ample spacing: Ensure there is enough space between sections and text to prevent the layout from feeling cramped.

Include All Necessary Details

For a document to be effective, it should include all the essential details required for a smooth transaction process. These details should be placed logically and be easy to find. Organizing information correctly helps avoid misunderstandings and facilitates quicker processing.

- Header Information: Include your business name, address, and contact details, as well as the client’s information for easy identification.

- Itemized List: Provide a clear, itemized breakdown of products or services provided, including prices and quantities, to ensure transparency.

- Payment Terms: Clearly state the payment due date, any applicable taxes, and accepted payment methods to prevent confusion.

By adhering to these design practices, you can create professional documents that not only represent your brand well but also facilitate smooth financial transactions and communication with clients.

Invoice Payment Terms Explained

Understanding payment terms is essential for both businesses and clients. These terms clarify the expectations surrounding the timing and methods of payment, helping to avoid confusion and disputes. Clear communication of these details ensures that both parties are aligned on the payment process. This section will cover the key elements of payment conditions commonly used in business transactions.

Common Payment Terms

Payment terms refer to the conditions under which payments are expected for goods or services provided. They can vary depending on the nature of the transaction and the agreement between the business and client. Below are some of the most common terms:

- Net 30: Payment is due 30 days from the date the transaction is completed or the bill is issued.

- Net 60: Payment is due within 60 days, often used for larger or more complex projects.

- Due on Receipt: Payment is expected immediately upon receiving the bill or statement.

- Installment Payments: The total amount is split into smaller payments made over an agreed period.

- COD (Cash on Delivery): Payment is made at the time of delivery of goods or services.

Why Payment Terms Matter

Clearly defined payment conditions are vital for maintaining healthy cash flow and ensuring that both parties are clear on their financial obligations. Properly communicated terms help businesses avoid delays and potential conflicts, while also providing customers with the necessary time to manage their payments effectively. Setting clear payment expectations can build trust and streamline the business transaction process.

Using Digital Invoices for Convenience

In the modern business landscape, adopting digital solutions for financial transactions can offer significant advantages. Digital documents streamline the billing process, reduce errors, and offer a more efficient way to manage records. This section highlights the convenience and benefits of using digital methods for processing payments and managing business transactions.

Benefits of Digital Billing

Digital invoicing provides several advantages that traditional paper-based methods cannot match. Here are some of the key benefits:

- Efficiency: Digital documents can be created, sent, and processed instantly, reducing the time spent on manual paperwork.

- Accessibility: Both businesses and customers can access digital records from anywhere, as long as they have internet connectivity.

- Cost-Effective: There are no printing, postage, or storage costs associated with digital methods.

- Environmentally Friendly: By going paperless, businesses contribute to reducing paper waste and lowering their carbon footprint.

- Security: Digital documents can be encrypted and stored securely, reducing the risk of loss or theft compared to physical paperwork.

How to Use Digital Documents Effectively

To fully leverage digital solutions, it is important to implement proper practices for creating, managing, and storing electronic records. Here are some key tips for effective digital record-keeping:

- Use Reliable Software: Choose trustworthy platforms that offer customizable features to meet your business needs.

- Ensure Compliance: Make sure digital documents meet any legal or industry-specific standards for record-keeping.

- Track Payments: Utilize tracking and reminder systems to ensure timely payments and reduce the risk of overdue balances.

- Backup Regularly: Store digital records in secure, cloud-based systems and back them up periodically to prevent data loss.

Managing Invoice Records for Tax Purposes

Maintaining accurate financial records is essential for businesses, especially when it comes to complying with tax regulations. Properly organizing and tracking financial documents ensures that businesses are prepared for audits and can meet tax obligations in a timely manner. This section focuses on best practices for managing records that will be used for tax purposes.

Why Proper Record-Keeping is Essential

Efficient record management is not only vital for meeting tax requirements but also for improving the overall financial health of a business. Here are the key reasons why proper documentation is important:

- Tax Compliance: Keeping accurate records helps businesses comply with tax laws and avoid penalties or fines.

- Financial Transparency: Well-maintained records provide clear visibility into business operations, helping management make informed decisions.

- Audit Preparation: In the event of an audit, organized records ensure that a business can easily provide the necessary documentation to support its tax filings.

How to Manage Tax Records Effectively

Here are some best practices for organizing and managing financial documents for tax purposes:

- Store All Transactions: Record every business transaction, including sales and expenses, to ensure that all activities are captured.

- Use Accounting Software: Leverage digital tools and software that automate record-keeping, making it easier to categorize and track financial data.

- Maintain Clear Categories: Categorize records based on income, expenses, and taxes, making it easier to retrieve specific information when needed.

- Regular Backups: Regularly back up records to prevent data loss, and store backups securely to protect sensitive information.

- Consult with Professionals: Consider working with accountants or tax advisors to ensure that all financial records are compliant with relevant tax laws.

Example of Organizing Records

| Record Type | Details to Include | Retention Period |

|---|---|---|

| Sales Receipts | Date, customer details, product/service, amount | 7 years |

| Expense Records | Date, supplier details, item description, amount | 7 years |

| Tax Returns | Tax period, tax calculations, payment details | 7 years |