Download Customizable Invoice Templates in PDF and Word Formats

Managing financial transactions efficiently is crucial for any business, whether you’re a freelancer, a small company, or a large enterprise. Having the right tools to generate professional and consistent records of payments and charges is essential. By using the right format for your billing documents, you can ensure clarity, accuracy, and a polished presentation for your clients.

There are various ways to create and manage these financial records, but some formats offer a balance of flexibility and ease of use. With the ability to modify content and maintain a uniform structure, these solutions help streamline the process, saving both time and effort. Whether you’re sending these documents digitally or printing them out, choosing the right structure is key to maintaining professionalism.

Customization and adaptability are at the core of creating documents that fit your business needs. From adding your branding to adjusting the layout, the process can be tailored to reflect your company’s unique style and requirements. With numerous resources available, it’s easier than ever to find a solution that aligns with your preferences.

Understanding the tools and options available to you is the first step toward improving how you handle billing and maintaining a clear financial record.

Invoice Template PDF and Word Overview

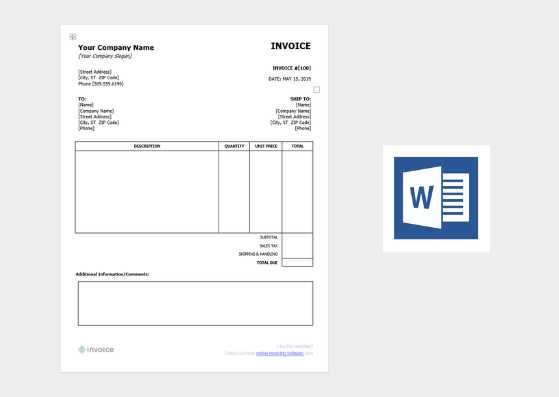

When it comes to creating billing documents, selecting the right format is crucial for both ease of use and professional presentation. There are two popular formats that many businesses use: one offers great flexibility for editing, while the other ensures that the document retains its appearance across all devices and platforms. Understanding the strengths of both options can help you choose the best solution for your needs.

Each format provides specific advantages for different use cases. For example, one is often preferred for quick editing and customization, while the other is ideal for ensuring that the document looks exactly the same, regardless of the viewer’s device or software. Below are the key features of these formats:

- Customizability: One format is easily editable, making it perfect for businesses that require frequent updates or changes to their documents.

- Consistency: The other format preserves its structure and appearance across different platforms, ensuring that it always looks professional and uniform.

- Ease of Use: Both formats are user-friendly, but one may be more intuitive for those who prefer to work with basic word processing tools, while the other may require specialized software for viewing or editing.

- Compatibility: Both formats are widely compatible, though one tends to be more universally accepted for sharing documents electronically, while the other might be preferred for printing or offline use.

Ultimately, the best choice depends on how you plan to use your documents. If you’re looking for something that can be quickly adjusted to suit specific needs, the more flexible option might be the best. On the other hand, if you require a document that maintains its appearance without alteration, the more static format could be the ideal solution.

Why Choose PDF and Word Templates

When creating professional documents for financial transactions, it’s important to choose a format that offers both flexibility and consistency. Using the right tools can save time, enhance accuracy, and ensure your records appear polished and reliable. These formats stand out because they strike the perfect balance between customization and security, making them ideal for a variety of business needs.

Flexibility in Customization

One key reason to opt for these formats is their ability to be easily customized. Whether you need to add logos, adjust layouts, or change text content, these options allow you to make changes quickly without compromising the document’s integrity. This level of flexibility makes them perfect for businesses that require documents to be tailored to different clients, products, or services.

Consistent Professional Appearance

Another major benefit is the consistent and professional appearance these formats offer. Once the document is created, it will maintain the same formatting and structure across different devices and platforms. This ensures that your documents always look polished when viewed by clients or colleagues, regardless of the software or device used to open them.

In summary, using these flexible yet stable formats provides both convenience and reliability. They offer an easy way to create, customize, and distribute high-quality financial documents while maintaining a professional standard that can be trusted by both parties involved in the transaction.

How to Create an Invoice Using Templates

Creating billing documents using pre-designed formats can save you valuable time and ensure consistency. By using a structured layout, you can quickly generate accurate records for transactions. Whether you’re working with a customizable file or a preset structure, the process is straightforward and can be done in just a few steps.

Here’s a simple guide to help you get started with creating a billing document:

- Select the Right Format: Choose the file format that best suits your needs. Some formats offer easy editing capabilities, while others ensure a polished, non-editable final document.

- Customize the Document: Add your business details such as company name, address, and contact information. Be sure to also include the client’s information to ensure proper identification.

- List the Products or Services: Clearly list the items or services provided, including quantities, rates, and total costs. Make sure all information is accurate to avoid any misunderstandings.

- Include Payment Terms: Specify the payment due date, methods of payment, and any other important terms regarding the transaction.

- Review the Document: Double-check for errors in calculations or missing information. A thorough review ensures that the document is accurate and ready to be sent.

- Save and Share: Once you’re satisfied with the document, save it in your preferred format and send it to your client electronically or print it for physical delivery.

Using these steps, you can quickly create professional-looking documents that are easy to manage and share. Customizing pre-designed structures allows you to maintain consistency while ensuring the document meets all your business requirements.

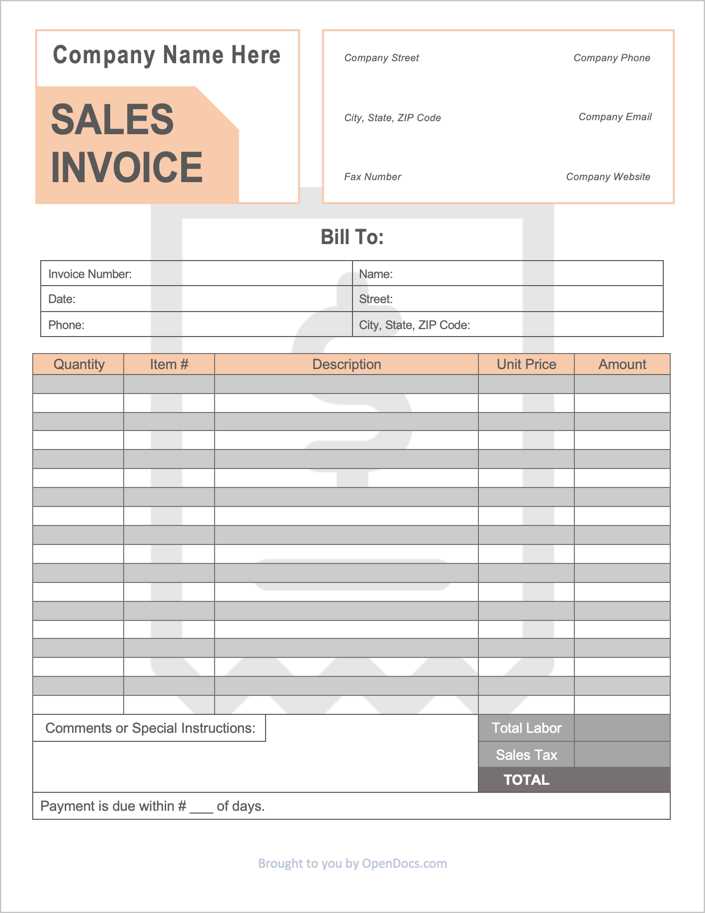

Customizing Invoice Templates for Your Business

Customizing your billing documents allows you to tailor them to fit your business’s unique needs, creating a professional look that aligns with your brand. Whether you’re adding your logo, adjusting the layout, or incorporating specific terms, making these documents reflect your business’s identity helps strengthen your professional image and improve client trust.

Here are some key customization options you can consider when creating billing documents:

| Customization Aspect | Why It’s Important |

|---|---|

| Company Branding | Adding your logo, color scheme, and business name enhances recognition and professionalism, making your documents look more polished. |

| Contact Information | Ensure your business address, phone number, and email are clearly displayed for easy communication and future reference. |

| Payment Terms | Clearly state payment due dates, late fees, and accepted payment methods to avoid confusion and set expectations. |

| Itemized List of Services or Products | Provide detailed descriptions of products or services, quantities, prices, and total costs to ensure clarity and accuracy. |

| Footer Section | Include any legal disclaimers, business registration numbers, or additional notes that may be relevant to the transaction. |

By incorporating these custom elements, your documents will not only look professional but will also convey important information clearly to your clients. A well-structured, customized document can enhance your reputation and streamline communication in all your business transactions.

Benefits of Using Digital Invoice Templates

Using digital formats for creating billing documents offers numerous advantages for businesses of all sizes. These formats simplify the process of generating, managing, and sharing documents, while also ensuring consistency and accuracy. With the right digital solution, businesses can streamline their workflow and save valuable time on administrative tasks.

Efficiency and Time-Saving

One of the main benefits of using digital formats is the time saved in creating, customizing, and sending documents. Instead of manually designing each document, you can use pre-designed structures that only require minimal adjustments. This process allows you to quickly generate accurate documents with just a few clicks.

- Quick Setup: Pre-designed structures save you from having to create a new document each time, significantly speeding up the creation process.

- Easy Editing: You can make changes quickly and easily, whether it’s adding new line items, adjusting prices, or modifying payment terms.

- Automated Calculations: Many digital formats allow you to automatically calculate totals, taxes, and discounts, reducing human error.

Consistency and Professionalism

Digital formats ensure that every document you create looks polished and uniform. Once you customize the design, the layout and formatting remain consistent, regardless of how often you create new documents. This consistency enhances your brand image and helps establish trust with clients.

- Uniform Appearance: Each document will follow the same professional layout, giving your business a consistent image.

- Branding Integration: You can easily add your logo, business name, and colors to align with your company’s branding, creating a cohesive look.

- Clear Communication: Pre-designed structures make it easier to include all necessary information in a clear and structured manner.

In addition to these advantages, digital formats offer greater convenience in managing and storing documents, making them an essential tool for businesses aiming to maintain efficiency, accuracy, and professionalism in their billing processes.

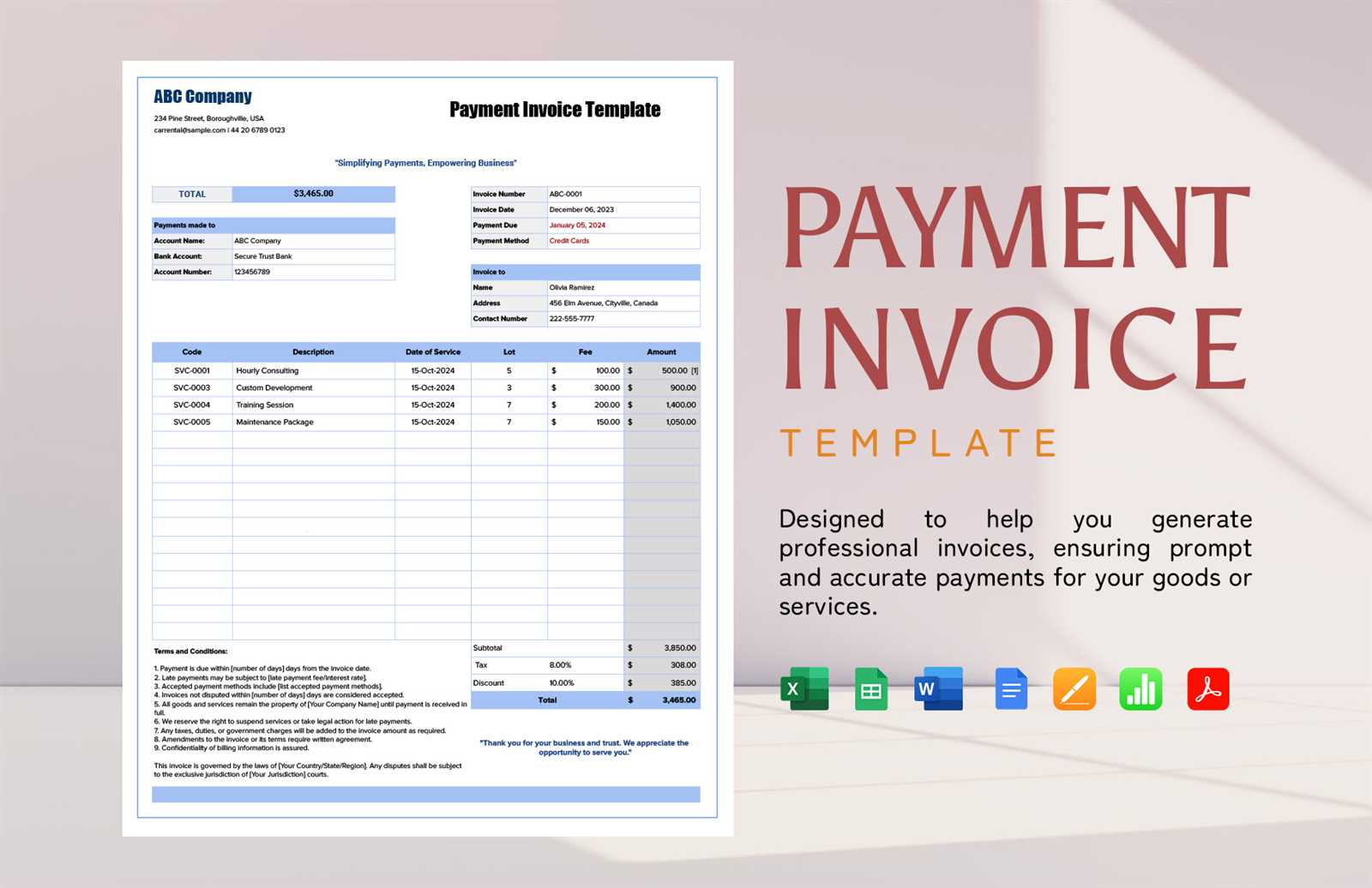

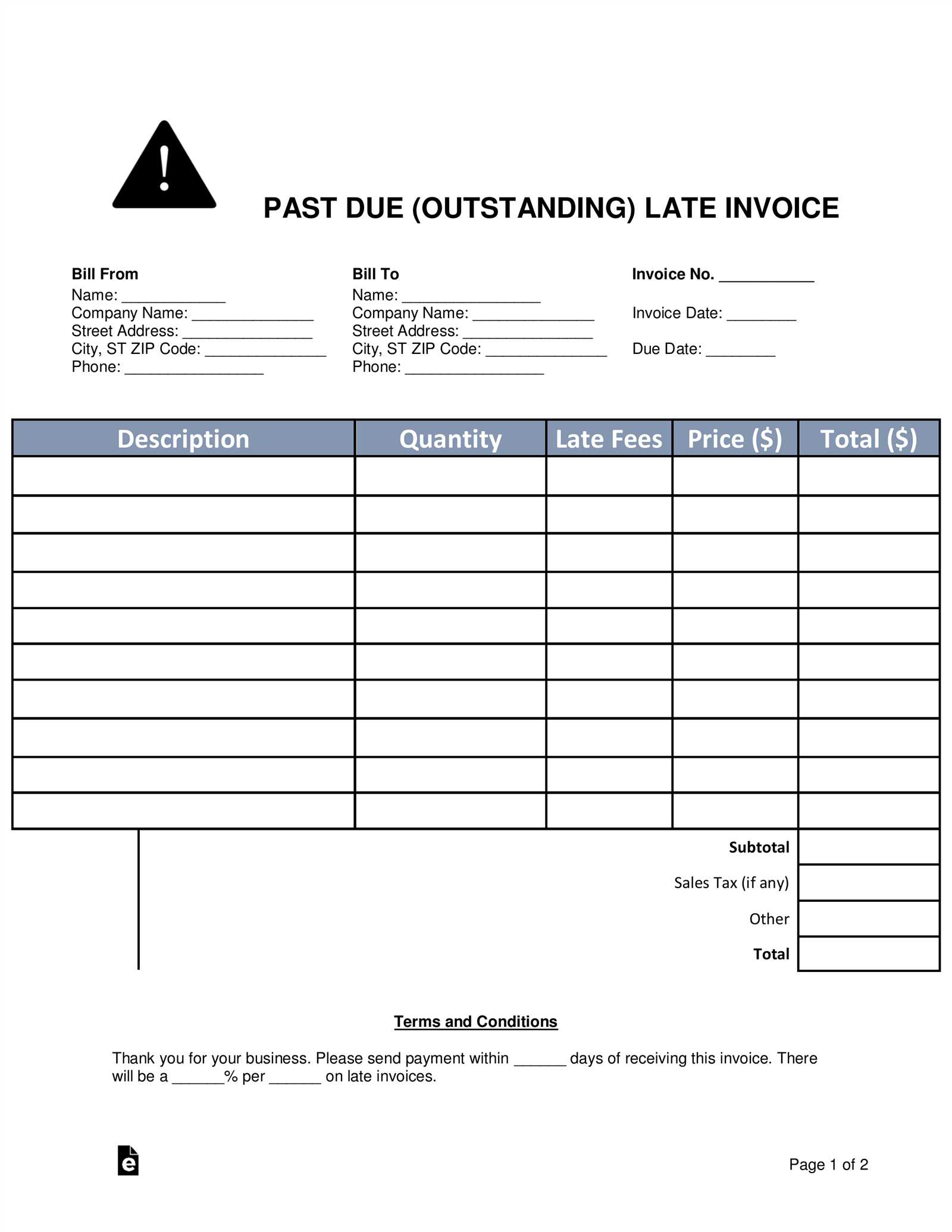

Common Features in Invoice Templates

Billing documents share several common elements that are essential for maintaining clarity, accuracy, and professionalism. These features ensure that all necessary information is included, making it easy for both the business and the client to understand the details of a transaction. Regardless of the format, these elements are typically present to facilitate efficient communication and record-keeping.

- Business Information: The document typically includes the name, address, and contact details of the business issuing the document. This information helps identify the company and ensures the recipient can reach out if needed.

- Client Information: It’s important to include the client’s name, address, and other contact information to clearly specify who is receiving the goods or services.

- Document Number: A unique reference number is assigned to each document for tracking and organizational purposes. This makes it easier to locate and refer to specific transactions.

- Date of Transaction: Including the date the goods or services were provided ensures a clear record of when the transaction took place and helps both parties keep track of payment terms.

- Description of Goods or Services: A detailed list of what was provided, including quantities, rates, and any applicable discounts, is crucial for transparency and accurate billing.

- Total Amount Due: A clear and detailed breakdown of the total cost, including taxes, shipping, or other fees, ensures both parties are on the same page regarding the financial aspect of the transaction.

- Payment Terms: Payment deadlines, methods, and any late fees should be specified to avoid misunderstandings and ensure timely payment.

- Legal Terms or Disclaimers: Some documents include additional legal notes or disclaimers, such as return policies or business registration details, which provide clarity on the terms of service.

These common elements not only provide essential details about the transaction but also help establish trust between the business and its clients. By ensuring these components are present, businesses can create clear and effective documentation that meets legal, financial, and operational requirements.

How to Convert Word Invoices to PDF

Converting documents from one format to another is a common practice to ensure compatibility and security. When it comes to billing records, turning editable documents into non-editable files is important for maintaining a consistent appearance and protecting sensitive information. The process of converting editable files to a fixed format can be done in just a few simple steps, ensuring that the document looks the same across all devices and platforms.

Methods to Convert to a Secure Format

There are several easy ways to convert an editable document to a fixed, non-editable format. Below are a few common methods you can use to perform this conversion:

- Using Built-in Export Features: Many word processing software programs have a built-in export feature that allows you to save a document as a fixed file. In most cases, this option can be found under the “File” menu. Simply choose “Save As” or “Export” and select the desired format.

- Using Online Converters: Numerous free online tools are available to convert editable files to a non-editable format. Upload your document to the converter, select the output format, and download the converted file.

- Printing to a File: Some programs allow you to “print” a document directly to a file. By selecting a virtual printer, you can save the document as a fixed-format file rather than sending it to a physical printer.

Benefits of Converting to a Fixed Format

There are several reasons why converting your editable documents into a fixed format is beneficial:

- Uniform Appearance: Once converted, the document’s layout and formatting remain the same across all platforms, ensuring consistency and professionalism.

- Security: Fixed files cannot be easily altered, which helps protect sensitive information and ensures that your documents are tamper-proof.

- Compatibility: Fixed formats are universally accepted and can be easily shared, viewed, or printed by clients, customers, and colleagues without compatibility issues.

By following these steps, you can easily convert your documents to a fixed format, ensuring they are professional, secure, and easily shareable.

Free Invoice Templates for Small Businesses

Small businesses often face tight budgets, and managing administrative tasks like billing can be time-consuming. Using pre-designed formats for generating financial records can save both time and money. Luckily, there are many free resources available that offer easy-to-use designs for creating professional billing documents without the need for expensive software or a designer.

These free options come with a variety of features, making them suitable for businesses of different industries. Whether you’re a freelancer, a small retail shop, or a service-based company, these pre-built designs can help you maintain a consistent and polished look for your records. Here’s why these free solutions are a great choice for small businesses:

- No Cost: Many online platforms and software programs offer free options that require no upfront investment, making them accessible for even the smallest businesses.

- Easy to Use: These resources are typically designed to be user-friendly, allowing you to fill in your details quickly without any specialized skills or training.

- Customizable: Many free solutions allow you to add your branding elements, such as logos and business names, making it easy to personalize documents for your business.

- Variety of Designs: Free resources often come with multiple layout choices, allowing you to pick the one that best matches your business style and needs.

With just a few simple steps, you can start creating accurate, professional records that will help you maintain good financial practices and communicate clearly with your clients.

Professional Invoice Templates for Freelancers

For freelancers, presenting a professional image is essential when dealing with clients. One of the simplest ways to do this is by using well-designed billing documents. These documents not only ensure clarity and transparency but also help establish credibility with clients. Using structured and polished formats can enhance your reputation and make your business appear more organized and reliable.

Why Freelancers Need Professional Billing Formats

As a freelancer, you’re often managing multiple clients and projects at once. Having a standardized document to record transactions saves time, reduces mistakes, and makes the billing process more efficient. A professional layout also reflects your business’s attention to detail and helps maintain a positive working relationship with clients.

- Clear Payment Terms: A professional design allows you to outline payment expectations, such as due dates and accepted payment methods, in an easy-to-understand format.

- Project Breakdown: Detailed descriptions of the work completed, including hours worked or project milestones, help clarify what the client is being charged for, reducing the chances of confusion.

- Consistency: Using a consistent format for every billing document helps create a sense of professionalism and organization, making it easier for both you and your clients to track payments and documents.

Benefits of Using Pre-Designed Billing Formats

Opting for pre-designed billing formats specifically tailored to freelancers offers several key advantages:

- Time-Saving: Pre-built formats allow you to quickly fill in the necessary information without needing to create documents from scratch each time.

- Customization Options: Many of these solutions let you add your personal branding, including logos, colors, and business details, ensuring your documents reflect your unique style.

- Easy to Use: These formats are designed to be simple and intuitive, even for those with little experience in design or document creation.

By using these professional resources, freelancers can streamline their billing processes, ensuring they present a polished and consistent image to their clients while also maintaining clarity and organization in their financial records.

Ensuring Accuracy with Invoice Templates

Maintaining precision in your financial documents is critical for avoiding disputes and ensuring smooth transactions. Errors in billing records, whether in pricing, quantities, or calculations, can lead to misunderstandings and even loss of trust with clients. Using well-structured formats can significantly reduce the risk of mistakes, providing a reliable framework for generating accurate documents every time.

Pre-designed formats are specifically crafted to ensure that every important detail is included and formatted correctly. These layouts often feature clear sections for each piece of information, from client details to itemized lists of services or products, minimizing the chances of oversight.

- Built-in Calculations: Many formats include automatic total calculations, tax rates, and discounts, which helps to prevent manual calculation errors.

- Clear Item Descriptions: Itemizing services or products with clear descriptions, quantities, and prices ensures transparency, leaving no room for ambiguity.

- Standardized Layouts: Structured formats allow for consistent presentation of information, reducing the likelihood of missing or misplacing important details.

By using well-organized formats, businesses can ensure that their financial documents are not only easy to create but also accurate, consistent, and professional. This reduces errors and makes tracking payments and transactions simpler and more reliable.

How to Add Your Branding to Invoices

Incorporating your brand elements into financial documents is an effective way to enhance your business identity and create a more professional appearance. Customizing your records with your logo, color scheme, and business details not only makes them look more polished but also reinforces your brand image. Whether you’re sending out digital or printed copies, branded documents help build recognition and trust with clients.

Key Elements to Include for Branding

To make your documents reflect your business identity, consider the following branding elements:

- Logo: Adding your business logo to the top of the document establishes immediate brand recognition and professionalism.

- Business Name and Contact Information: Include your company name, phone number, email, and physical address in a prominent location for easy client access.

- Color Scheme: Use your brand’s colors for accents, headings, and borders. This helps make the document visually appealing while maintaining consistency across all your business materials.

- Custom Fonts: If you have a specific font associated with your brand, incorporate it into the document for a cohesive look.

Where to Place Your Branding Elements

Placement of your branding elements is crucial to ensure visibility and a clean layout. Here’s where to position them:

- Header: Place your logo and business name at the top of the document to ensure they are the first thing your client sees.

- Footer: You can include additional contact details or legal disclaimers in the footer, maintaining a neat, organized appearance.

- Text and Borders: Highlight headings, totals, and important notes in your brand’s colors to create a strong visual impact without overwhelming the layout.

By incorporating these branding elements into your financial documents, you can ensure that your business maintains a professional and cohesive image while making a lasting impression on your clients.

Best Practices for Invoice Design

Designing clear and professional billing documents is essential for ensuring smooth transactions and positive client relationships. A well-organized document not only enhances your brand image but also makes it easier for clients to understand payment details, reducing the chances of errors or confusion. Following best practices in layout, content organization, and visual appeal can help you create documents that are both functional and aesthetically pleasing.

Organizing Key Information Effectively

To ensure clarity and prevent misunderstandings, it’s crucial to structure the content of your billing documents logically. Here are some tips for organizing your information:

- Use Clear Sections: Divide the document into distinct sections such as “Client Information,” “Services Provided,” and “Payment Summary” to help readers easily locate the details they need.

- Prioritize Important Details: Place essential information like the total amount due, payment due date, and client contact details in prominent positions, such as the top of the document.

- Itemize Charges: Break down each service or product with specific details, including quantities, rates, and total costs, to avoid any confusion about what the client is paying for.

Visual Appeal and Consistency

In addition to a functional layout, maintaining visual appeal can help reinforce your brand and create a professional impression. Here are some design tips:

- Keep It Simple: Avoid cluttering the document with excessive text or graphics. A clean, minimal design helps ensure that the information is easy to read and digest.

- Use Consistent Branding: Stick to your company’s colors, fonts, and logo to create a cohesive look that aligns with your brand identity. This consistency makes your documents instantly recognizable to clients.

- Readable Fonts: Choose clear, easy-to-read fonts. Use a larger font for headings and a smaller size for detailed information to create a clear visual hierarchy.

By adhering to these best practices, you can create billing documents that are both effective in conveying the necessary details and visually appealing, helping you maintain a professional reputation and reduce the risk of payment delays or misunderstandings.

Where to Find High-Quality Templates

Finding well-designed and professional billing documents can save a lot of time and effort for business owners. Instead of creating a layout from scratch, you can take advantage of pre-designed formats that provide all the necessary sections and calculations. These resources can help ensure consistency and professionalism, all while reducing the chances of errors and speeding up the billing process. Below, we’ll explore several reliable sources where you can find high-quality options for your business.

Top Sources for Pre-Designed Formats

Here are some of the best places to look for ready-made designs that can be customized for your business:

| Source | Features | Cost |

|---|---|---|

| Online Marketplaces | Wide range of customizable designs, suitable for various industries | Free or Paid |

| Business Software | Pre-built layouts with automated calculation features | Paid (often with subscription) |

| Template Websites | Free and premium designs available for immediate download | Free or Paid |

| Graphic Design Platforms | Highly customizable designs with drag-and-drop functionality | Free or Paid |

Other Useful Resources

If you’re looking for a wider variety of options or something more unique, consider these additional sources:

- Freelance Design Platforms: Hiring a designer to create a custom document might be a great option if you need a personalized touch.

- Cloud Storage Services: Some services offer pre-made layouts that can be easily shared and edited online.

- Open Source Websites: For budget-conscious businesses, open-source platforms often offer free templates that can be customized to your needs.

Whether you’re seeking a basic layout or a sophisticated, feature-packed design, these sources offer a variety of options that can help you create the perfect document for your business. With these resources, you can quickly find and customize a solution that reflects your brand and meets your needs.

How to Automate Invoice Generation

Automating the process of creating billing documents can significantly reduce the amount of time spent on administrative tasks and eliminate errors. With the right tools and systems in place, you can streamline the entire process from tracking services or products to sending out payment requests. This not only saves time but also ensures consistency and accuracy across all documents.

By integrating automation tools into your workflow, you can generate billing documents quickly and efficiently, while minimizing manual input. Whether you’re managing a few transactions or dealing with a high volume of clients, automation can help keep your operations running smoothly. Here are a few ways to automate the creation and management of your billing documents:

- Use Accounting Software: Many modern accounting programs offer automated billing features. These platforms can generate documents based on pre-set templates, pull in client information from a database, and calculate totals automatically.

- Set Up Recurring Billing: If you provide subscription-based services or have ongoing contracts, setting up automatic billing schedules can save time by generating documents at regular intervals without manual input.

- Integrate Payment Gateways: Integrating a payment gateway with your document generation system can help automate the entire process, from creating the document to collecting payments, reducing the risk of human error.

With the right tools and automation processes in place, you can focus more on growing your business and less on repetitive administrative work, making your operations more efficient and accurate in the long run.

Securing Your PDF Invoice Files

Ensuring the safety and privacy of your financial documents is crucial in maintaining trust with clients and protecting sensitive business information. As you generate and share billing records, taking proactive steps to secure these files from unauthorized access or tampering is essential. Implementing the right security measures not only protects your data but also reinforces your professionalism and reliability as a business.

There are several methods you can use to secure your files and prevent them from being altered or accessed by unauthorized individuals. Below are key strategies to keep your documents safe:

| Security Method | Description | Benefits |

|---|---|---|

| Encryption | Encrypting files converts them into unreadable text unless the proper decryption key is used. This adds an extra layer of protection when sending files through email or storing them online. | Prevents unauthorized access, even if the file is intercepted. |

| Password Protection | Adding a password requirement to your files ensures that only those with the correct password can open or edit them. | Limits access to authorized users and prevents unauthorized modifications. |

| Digital Signatures | Including a digital signature verifies the authenticity of the document and ensures that the contents have not been altered since it was signed. | Ensures integrity and authenticity, adding a level of trust to the document. |

| Secure File Storage | Storing files in encrypted cloud services or secure servers helps prevent unauthorized access and data loss. | Reduces the risk of loss or theft and provides reliable backup options. |

By implementing these security practices, you can ensure that your financial documents remain safe from unauthorized access, tampering, or data breaches. Protecting sensitive business information not only helps you avoid potential legal and financial issues but also builds trust with your clients and partners.

How to Send Invoices Electronically

Sending billing documents electronically offers a faster, more efficient way to manage payments and communicate with clients. With digital delivery methods, you can ensure timely transmission, reduce paper usage, and streamline the entire payment process. Whether you’re sending documents via email or through specialized platforms, electronic delivery is a reliable and convenient option for businesses of all sizes.

Methods of Sending Documents Digitally

There are several effective ways to send your billing records electronically, depending on your needs and the tools you have at your disposal:

- Email: The simplest and most common method is attaching your document to an email. Ensure the file is in a standard format that clients can easily open, such as a secured file with a password or a digital signature for verification.

- Cloud Storage Links: If the document is large or you want to ensure safe access, uploading the document to a cloud storage service like Google Drive or Dropbox and sharing the link can be a good option.

- Invoice Management Platforms: Many businesses use specialized software or platforms that allow you to generate, send, and track billing documents automatically. These systems often offer secure delivery and allow clients to make payments directly through the platform.

Best Practices for Electronic Delivery

When sending documents digitally, it’s essential to follow some best practices to ensure security, clarity, and professionalism:

- Use Secure Formats: Choose formats that protect the integrity of your document, such as using encryption or password protection to prevent unauthorized access or changes.

- Confirm Delivery: Always request a read receipt or follow up to ensure that your client has received the document and is aware of the payment details.

- Provide Clear Instructions: Make sure that payment instructions and deadlines are clearly outlined, so clients know exactly what steps to take next.

By adopting electronic methods for sending your billing documents, you not only save time but also provide a more efficient and environmentally friendly solution for your business operations.

Legal Considerations for Invoice Templates

When creating billing documents for your business, it’s essential to ensure that they comply with relevant laws and regulations. These documents not only serve as a record of transactions but also play a crucial role in maintaining legal and financial accuracy. Understanding the legal requirements for these documents helps prevent disputes, ensures proper tax reporting, and protects both your business and clients.

While the specifics can vary depending on your location and industry, there are several key considerations you should keep in mind when designing or using pre-made formats for your billing records:

- Correct Business Information: Make sure that all the necessary details about your business, such as your legal business name, tax identification number, and contact information, are included in every document. This information may be required for tax reporting and legal purposes.

- Accurate Tax Information: Depending on your jurisdiction, you may need to include specific tax rates or tax registration numbers on the document. This ensures that your billing records are in compliance with local tax laws.

- Clear Payment Terms: Your payment terms should be clearly stated, including the amount due, payment due date, any late fees or interest charges, and acceptable payment methods. This transparency helps avoid misunderstandings and ensures legal enforceability if payment is delayed.

- Legal Compliance with Data Protection: If you store or share sensitive information through your documents, ensure compliance with data protection regulations, such as GDPR or CCPA, depending on your location. Use encryption and secure storage practices to protect client and business data.

By considering these legal aspects when creating and distributing billing documents, you ensure that your business operations run smoothly, comply with legal standards, and maintain trust with your clients. Always consult a legal professional or accountant to ensure your documents meet local and industry-specific regulations.