Editable PDF Invoice Template for Easy Customization

When managing financial transactions, having a professional and customizable document is crucial for ensuring clarity and efficiency. These documents help streamline the payment process and reflect the brand’s professionalism. With the right tools, you can easily design and adjust these forms to suit your business needs.

Adjustable billing forms offer flexibility, allowing businesses to tailor details such as pricing, descriptions, and contact information. Whether for small projects or large contracts, these tools ensure that all necessary information is presented in a structured and clear manner.

By using simple formats, users can quickly fill in specific details and save time. Whether you’re a freelancer or a larger company, having access to a customizable document format is an essential part of maintaining smooth and accurate financial records.

Benefits of Using Editable Billing Documents

Customizable billing forms offer numerous advantages, particularly for businesses looking to streamline their payment processes and maintain a professional appearance. These flexible documents are designed to meet a wide range of business needs, from simple invoices to complex contracts, all while saving time and effort.

- Time-saving: With customizable forms, users can quickly fill in specific details, reducing the time spent on manual entry and calculations.

- Professional Appearance: Having a consistent, polished layout creates a positive impression and enhances your brand image.

- Cost-Effective: Free and low-cost options are available, making it affordable for businesses of all sizes to access high-quality documents.

- Accuracy: Templates help reduce human error by pre-formatting key fields and calculations, ensuring accuracy in every transaction.

- Flexibility: The ability to modify details like prices, descriptions, or terms allows businesses to adjust documents for different clients or services easily.

- Consistency: Using the same structure for all documents ensures a uniform approach across all transactions, making record-keeping and future reference easier.

These benefits make customizable forms an essential tool for any business looking to maintain efficiency, professionalism, and accuracy in its billing process.

How to Download a Billing Document

Getting access to a customizable billing form is a straightforward process. Many platforms offer free or paid options for downloading professional and easy-to-use documents that can be personalized with just a few clicks. The key is finding the right source and choosing a format that fits your business needs.

Choosing the Right Platform

Several websites offer free downloadable forms, ranging from basic options to more advanced designs with additional features. Ensure the platform you choose provides reliable and secure downloads. Look for websites that specialize in business documents or offer a wide selection of customizable options.

Steps to Download

Once you’ve chosen the appropriate platform, follow these steps:

- Browse the available options to find a layout that matches your needs.

- Click on the download button or link to get the form in your preferred format.

- Save the file to your device and open it with any compatible viewer to start customizing it.

After downloading the form, you can personalize it by adding necessary details such as pricing, contact information, and terms of service before using it for your transactions.

Steps to Customize Your Billing Document

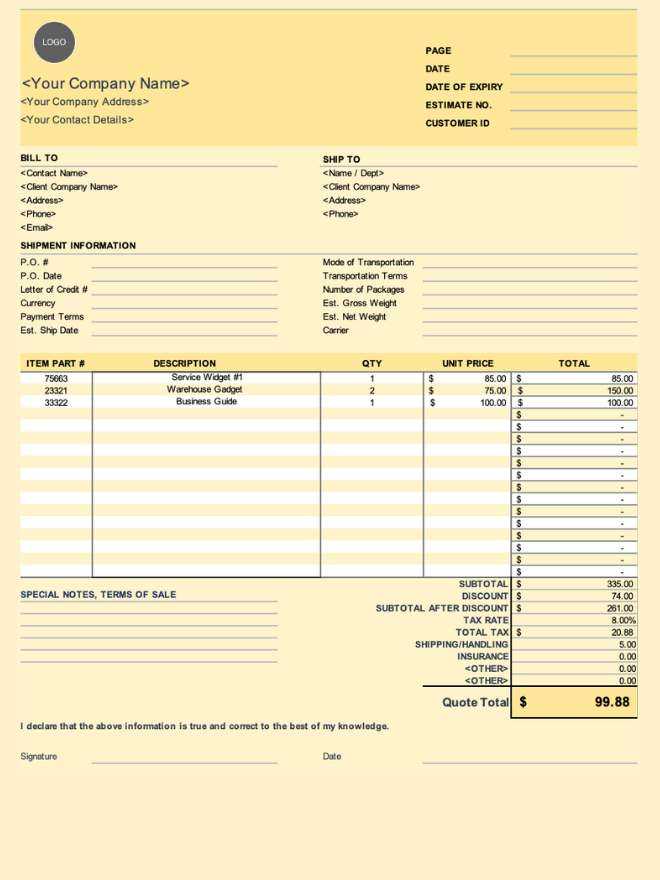

Personalizing your billing form is a simple process that ensures all relevant details are captured and presented in a professional manner. Customization allows you to tailor the document to your business needs, making it suitable for different clients or projects. By following a few straightforward steps, you can create a document that reflects your brand and ensures accuracy in every transaction.

Start with Basic Information: Begin by filling in the essential fields such as your company name, address, and contact details. This ensures that the document clearly identifies your business and provides the recipient with all necessary information.

Customize the Financial Details: Input specific details such as the amount due, payment terms, and item descriptions. Make sure to adjust the quantities, prices, and any applicable taxes to accurately reflect the products or services provided.

Review and Adjust Formatting: Check that all sections are aligned correctly and easy to read. You may want to adjust fonts, colors, or add your logo to maintain a consistent brand image. This step is important to ensure your document looks professional and is visually appealing.

Once you’ve made all the necessary changes, save the document and double-check the information for accuracy. Customizing your forms not only makes them functional but also helps establish a consistent, professional image for your business.

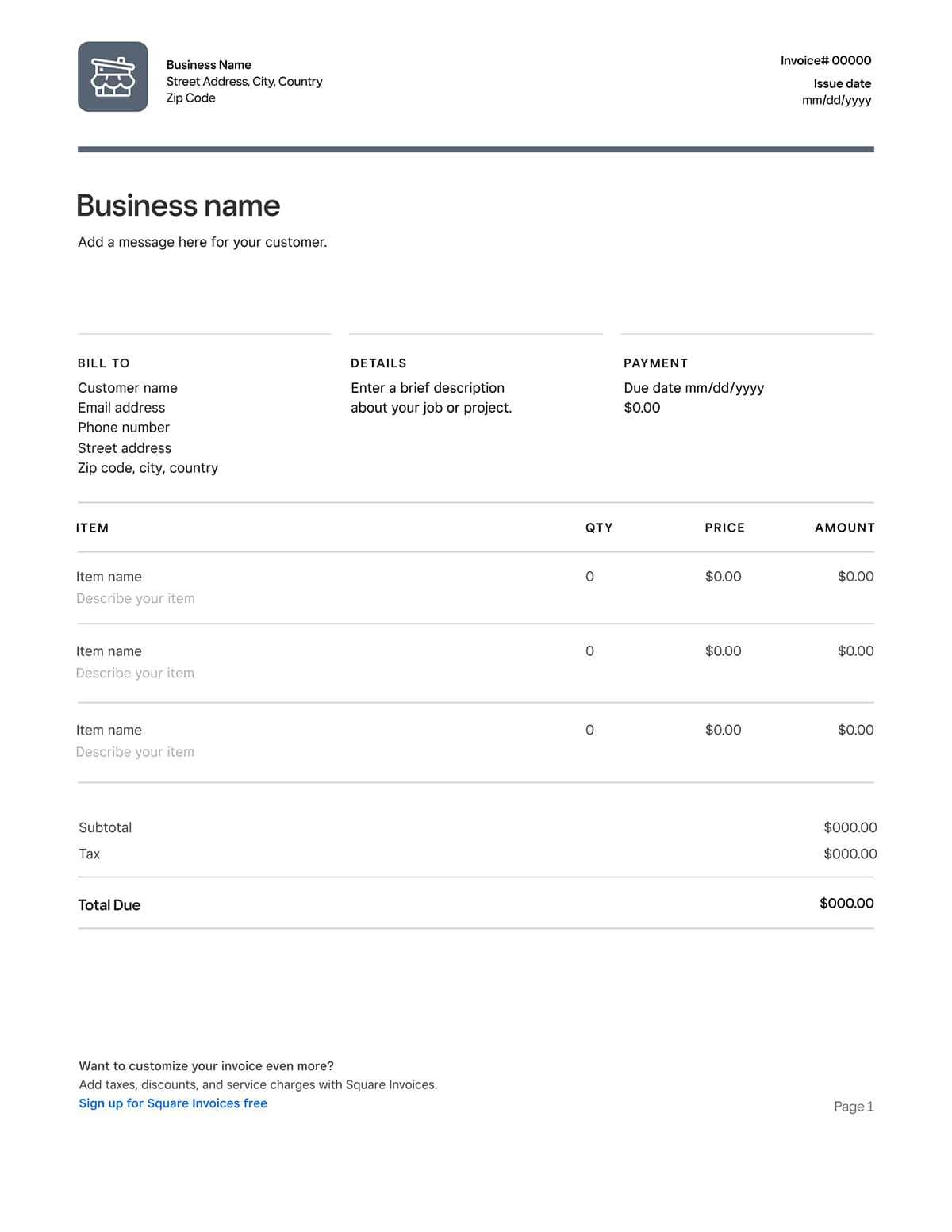

Why Choose PDF for Billing Documents

When it comes to creating professional and reliable documents for business transactions, the choice of format is crucial. One of the most popular formats for such documents is known for its consistency, security, and compatibility across different platforms and devices. It ensures that your documents appear exactly as intended, no matter where or how they are opened.

Universally Accessible: This format is widely supported by almost all devices and operating systems, which means that your document can be viewed without any issues, whether on a computer, tablet, or smartphone.

Consistent Layout: One of the key advantages of this format is that it preserves the layout and design. No matter where the file is opened, the structure, fonts, and images will remain exactly as you intended, ensuring a professional presentation every time.

Security Features: Files in this format can be easily encrypted or password-protected, adding an extra layer of security when dealing with sensitive financial information. This ensures that only authorized parties can access or modify the content.

Easy Printing and Sharing: Documents in this format are optimized for printing, ensuring that the printed version matches the on-screen version. They can also be easily shared via email or cloud storage, making distribution simple and efficient.

With these benefits, it’s clear why this format is a preferred choice for businesses looking to manage their documents efficiently and securely.

Free Billing Document Options Available

There are many platforms that offer free options for creating and downloading customizable billing documents. These resources are designed to help businesses of all sizes generate professional and efficient documents without incurring additional costs. Whether you’re a freelancer or managing a small business, you can find free solutions that cater to your specific needs.

Here are some of the best free resources for obtaining billing documents:

| Platform | Features | Customization Options |

|---|---|---|

| Free Invoice Generator | Quick and easy to use with basic fields for client, service, and payment details. | Customizable fields for company logo, pricing, and payment terms. |

| Invoice Home | Offers a variety of free designs and layouts for different business types. | Fully customizable with options for adding taxes, discounts, and itemized lists. |

| Zoho Invoice | Comprehensive tool for creating professional forms with no watermarks. | Ability to modify colors, fonts, and add your brand’s logo. |

| PayPal Invoicing | Simple, user-friendly interface integrated with PayPal for easy payment collection. | Limited customization, but ideal for quick, standard forms. |

These free tools allow you to create professional-looking documents that can be quickly personalized to meet your specific business requirements. Explore these options to find the one that best fits your needs and start streamlining your financial processes today.

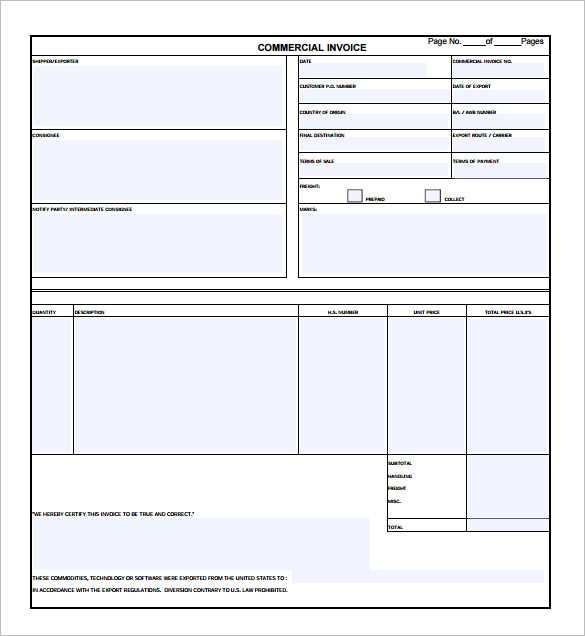

Common Fields in a Billing Document

Every professional billing form typically includes certain key fields to ensure that all the necessary details for a transaction are captured clearly and efficiently. These fields help both the sender and receiver understand the terms of the agreement and ensure smooth processing of payments.

- Business Information: Includes your company’s name, address, and contact details. This helps the recipient easily identify the source of the bill.

- Recipient Information: The name, address, and contact information of the person or organization being billed.

- Invoice Number: A unique identifier assigned to the document for tracking purposes.

- Issue Date: The date when the document was created and sent to the recipient.

- Due Date: The date by which payment is expected, helping to set clear expectations for both parties.

- Itemized List: A detailed breakdown of products or services provided, including quantities, descriptions, and individual prices.

- Total Amount: The overall amount due, often including taxes or discounts if applicable.

- Payment Terms: Any specific terms regarding payment, such as late fees or accepted methods of payment.

Including these standard fields ensures that all necessary information is communicated clearly and consistently, reducing the chances of confusion or errors in the billing process.

How to Add Your Company Logo

Including your business logo in billing documents not only enhances your brand’s professional appearance but also helps in recognizing your company. A logo serves as a visual identifier and can make your forms look more cohesive and aligned with your brand identity. Adding this graphic element is a simple yet effective way to personalize your documents.

Select the Right Format: Before adding your logo, ensure it is in a compatible format such as JPEG, PNG, or SVG. These formats work well for most document-editing software and ensure the logo appears crisp and clear on your forms.

Insert the Logo: In most document editing tools, you can easily insert an image by selecting the “Insert” option from the menu and choosing “Image” or “Logo.” Locate the logo file on your computer, and once it’s inserted, you can resize or move it to the appropriate position, typically the top left or top center of the page.

Adjust for Consistency: Ensure the logo is proportionate to the size of the document and doesn’t overcrowd other fields. You may also want to adjust its opacity if it appears too bold, allowing other content to stand out while maintaining a professional look.

Once added, your logo will not only personalize the form but also contribute to maintaining a consistent and professional image for your business in all your transactions.

Best Practices for Creating Professional Billing Documents

Creating professional and effective billing documents is essential for maintaining a strong relationship with clients and ensuring timely payments. By following a few best practices, you can ensure that your documents are clear, accurate, and professional, helping to foster trust and smooth business transactions.

1. Ensure Clarity and Accuracy

Make sure all the details in the document are accurate and easy to understand. Double-check for errors in client information, product descriptions, pricing, and payment terms. Clear and concise documents not only prevent misunderstandings but also help you avoid disputes and delays.

2. Maintain a Consistent Design

Your documents should reflect your brand identity, so it’s important to use consistent design elements such as colors, fonts, and logos. A well-designed document not only looks professional but also ensures that your business stands out. Keep the layout clean and organized, making sure that each section is clearly defined.

Include All Essential Information: Ensure your document contains all relevant details, including your business and client information, a unique reference number, payment terms, and a breakdown of products or services provided. This will help clients understand exactly what they are being billed for and reduce any confusion.

Stay Professional and Polite: Always maintain a professional tone in your communication, especially in payment instructions and terms. Be clear about deadlines, fees, and other requirements to avoid misunderstandings.

By adhering to these best practices, you can create billing documents that enhance your business’s credibility and facilitate smoother financial transactions.

How to Save and Print Your Billing Document

Once you’ve completed and customized your billing form, the next step is to save it for future reference and ensure it’s properly printed for distribution. Following the right process can help ensure that the document maintains its integrity and professionalism in both digital and printed formats.

1. Saving Your Document

To ensure you can easily access your document later, it’s important to save it in the right format and location. Here are a few steps to follow:

- Select the Right Format: Save the file in a format that preserves the layout and allows for easy sharing, such as a common file type that is universally accessible.

- Choose a Clear File Name: Use a descriptive file name that makes it easy to identify the document later, such as including the client name and the date.

- Organize Your Files: Store your documents in an organized folder system for easy retrieval. Categorize by client, month, or project for better management.

2. Printing Your Document

When printing your billing form, it’s important to ensure that the layout remains intact and that the document looks professional. Follow these steps:

- Check Print Preview: Always use the print preview feature to ensure everything looks as expected before printing.

- Adjust Print Settings: Make sure to select the correct paper size and margins, and ensure that the resolution is high enough for a clear printout.

- Use Quality Paper: Printing on high-quality paper ensures that your document looks more professional when presented to your client.

By saving and printing your document correctly, you ensure that it is both easily accessible and professionally presented when needed.

Editing Billing Documents on Mobile Devices

With the rise of mobile technology, the ability to edit financial documents on the go has become an essential feature for many businesses. Mobile devices offer flexibility and convenience, allowing you to make quick adjustments to your forms anytime and anywhere. Whether you’re working from the office, on the road, or from home, editing these forms on mobile devices is now simpler than ever.

1. Using Mobile-Friendly Apps

Many mobile apps are designed specifically for creating and modifying billing documents, making it easy to input data directly from your smartphone or tablet. These apps typically offer intuitive interfaces with drag-and-drop functionality and customizable fields, ensuring your documents are updated quickly and accurately. Here’s a quick overview of features you may find in these apps:

| Feature | Benefit |

|---|---|

| Cloud Integration | Allows you to save and access documents from multiple devices without the need for manual file transfers. |

| Customizable Fields | Enables you to add, remove, or edit sections such as dates, amounts, or contact information with ease. |

| Signature Option | Many apps allow you to digitally sign the document directly from your mobile device, streamlining the approval process. |

2. Making Quick Edits on Mobile

When editing a document on your mobile device, it’s important to ensure the process is both efficient and accurate. Here are a few tips to help you make quick edits:

- Use Auto-Fill Features: Many apps allow you to save client details and use auto-fill features to populate repetitive fields, saving time on data entry.

- Optimize for Touchscreen: Ensure the app is compatible with touch gestures, such as pinch-to-zoom and swiping, to enhance usability.

- Check Formatting: After making edits, always preview the document to ensure that the layout and alignment remain intact, especially when transitioning from desktop to mobile versions.

Editing documents on mobile devices has never been easier, thanks to modern apps and tools that streamline the entire process. This flexibility allows business owners to stay on top of their finances and make updates on the go, without sacrificing professionalism or accuracy.

Customizing Billing Documents for Different Services

When managing various services or products, it’s crucial to tailor your financial documents to reflect the specific needs of each offering. Customization ensures that clients receive clear, accurate, and professional representations of the services provided, making the process more efficient and transparent. By adjusting fields, adding details, or reformatting the structure, you can create documents that are aligned with the type of service rendered.

Below are some essential elements to consider when customizing financial forms for different services:

| Service Type | Customization Options |

|---|---|

| Consulting Services | Include hourly rates, detailed descriptions of the hours worked, and a breakdown of consulting tasks. |

| Product Sales | List itemized products with unit prices, quantities, and tax details for each item purchased. |

| Freelance Work | Specify project milestones, rates per milestone, and detailed descriptions of the work completed for each phase. |

| Subscription Services | Include recurring billing details, renewal dates, and payment schedules to keep the client informed about ongoing charges. |

By adjusting your document’s structure and content according to the service you’re offering, you ensure that the client is fully aware of what they are being charged for and why. This level of customization helps build trust and enhances the professionalism of your business communications.

Managing Multiple Billing Documents Efficiently

Handling numerous billing documents at once can quickly become overwhelming, especially as your business grows. To keep track of all financial transactions, it’s important to implement efficient strategies for organization, tracking, and timely follow-up. By streamlining processes and utilizing the right tools, you can ensure that no document is overlooked and that payments are processed smoothly.

Here are some strategies for managing multiple billing forms with ease:

- Use Cloud-Based Systems: Storing your documents in the cloud allows easy access from any device, anytime. This ensures that all your records are centralized and securely backed up.

- Automate Repetitive Tasks: Automating the generation and sending of billing forms can save you a significant amount of time. Many platforms allow you to set up recurring bills for regular customers.

- Organize by Categories: Categorize your documents by client, project, or date to keep everything in order. This way, you can easily find specific documents when needed.

- Set Up Reminders: Set up automated reminders to follow up on unpaid balances. This helps you stay on top of collections without manually tracking each account.

By adopting these methods, you can streamline the process of handling multiple billing records, reduce errors, and ensure that all financial matters are managed efficiently. This will allow you to focus more on your core business activities while maintaining clear and accurate records.

Security Tips for Handling Billing Documents

When dealing with financial records, it’s crucial to prioritize security to protect sensitive information. These documents often contain personal, business, and payment details that could be exploited if compromised. Implementing secure handling practices can help prevent unauthorized access, reduce fraud risk, and ensure that all transactions remain confidential.

Encrypt Files for Protection

Encryption is one of the most effective ways to secure your financial documents. By encrypting your files, you add an additional layer of security that prevents unauthorized users from accessing the content. Always use strong encryption protocols to safeguard your records during storage and transmission.

Limit Access to Documents

Restrict access to your files by assigning permissions only to trusted team members or stakeholders. This reduces the risk of accidental or malicious exposure. Additionally, regularly review access rights to ensure that only authorized personnel have permission to view, edit, or share these documents.

Incorporating these practices into your workflow will enhance the security of your financial records and give you peace of mind knowing that sensitive information is protected from unauthorized access or misuse.

How to Use Billing Documents for Freelancers

For freelancers, creating professional documents is essential to ensure clear communication about the services provided and payments due. Using well-organized forms can simplify the billing process, making it easier to track payments and maintain a professional image. By customizing these documents to fit your specific needs, you can present a clear breakdown of your services, rates, and payment terms.

Here are some key steps for effectively using billing documents as a freelancer:

- Customize for Your Services: Tailor your forms to reflect the details of the work you’ve completed. Include descriptions of the tasks, hours worked, or milestones achieved to help clients understand what they’re paying for.

- Include Payment Terms: Always specify payment terms, such as due dates and acceptable methods of payment. This ensures both parties are clear about when and how the payment should be made.

- Maintain a Consistent Format: Use a standardized format for all your billing records. This makes it easier for clients to understand the layout and quickly find key information, such as amounts owed and payment deadlines.

- Keep Records Organized: Stay organized by numbering your documents or categorizing them by client or project. This will help you track payments and ensure that no document is overlooked.

By following these tips, freelancers can streamline their billing process, maintain transparency with clients, and present themselves as organized professionals. A clear and professional approach to billing helps build trust and fosters long-term working relationships.

Integrating Billing Documents with Accounting Software

Integrating billing documents with accounting software streamlines financial management by reducing manual entry and minimizing the chances of errors. This integration allows you to automatically populate data, track payments, and keep records up to date without needing to duplicate information across multiple platforms. By connecting these two systems, you can maintain a more organized and efficient workflow.

Here are a few advantages of integrating your billing process with accounting software:

- Automation of Data Entry: By syncing your documents with accounting tools, you can automatically transfer details such as amounts, payment dates, and client information, saving time and effort.

- Accurate Record-Keeping: Integration ensures that all financial data, including payments received and outstanding balances, is updated in real time, reducing the risk of discrepancies.

- Easy Tax Reporting: Accounting software can automatically generate tax reports and summaries, making it easier to prepare for tax season without manually sifting through documents.

- Improved Client Communication: Sending clients direct links to their billing records or even generating reports directly from your accounting system fosters professionalism and transparency in your business transactions.

By integrating these tools, you create a seamless process that not only improves efficiency but also enhances the accuracy and reliability of your financial data. This connection between billing and accounting systems allows for better management of finances, ultimately leading to a smoother business operation.