Download Free Invoice Template PDF

For any business, managing payment requests efficiently is essential. Whether you’re a freelancer, small business owner, or part of a larger organization, having a well-structured document for requesting payments can save time and avoid confusion. A standardized approach helps maintain professionalism and ensures clarity for both the issuer and the recipient.

Creating professional documents for financial transactions doesn’t have to be complicated. With the right tools, you can easily generate customized records that meet your specific needs. These documents can be tailored to include all necessary details, such as amounts, dates, and recipient information, to ensure transparency and accuracy.

Utilizing accessible formats allows for easy sharing and storage. By selecting the appropriate layout and format, you can streamline the process while maintaining a high level of organization. This simple step can make a significant difference in managing your business finances effectively.

Why You Need an Invoice Template

Managing financial transactions efficiently is crucial for any business. A well-organized and professional payment request helps ensure timely processing and reduces the likelihood of errors. With a standardized approach, you can quickly create documents that contain all the necessary details, ensuring clarity and transparency between you and your clients.

Streamline Your Billing Process

Using a pre-designed format allows you to speed up your workflow. Instead of starting from scratch each time, you can focus on the specifics of the transaction, saving valuable time. Here’s how it benefits you:

- Consistency: Maintain uniformity in your records with a predefined structure.

- Efficiency: Quickly generate documents without having to create one from the ground up.

- Professionalism: Present a polished, well-organized request for payment that builds trust.

Minimize Common Errors

Starting with a fixed layout helps avoid typical mistakes that occur when creating financial documents. Using a predefined structure makes it easier to include all necessary fields and prevent omissions. This reduces confusion and ensures all required information is accurate, such as:

- Payment amount

- Client details

- Due date

- Service description

Understanding PDF Invoice Templates

When it comes to creating a document for requesting payment, having a standardized format is essential for consistency and professionalism. Using a structured layout allows you to organize crucial details clearly and present them in an easy-to-read manner. A reliable format can save time and help avoid errors that could delay transactions or create misunderstandings.

Why Choose a Digital Format?

The choice of a digital file format offers many advantages for managing financial documents. With a fixed layout, it ensures that all the text, numbers, and graphics remain in place, regardless of the device used to open the file. The most common reasons for choosing a digital format include:

- Accessibility: Easily shareable via email or other digital platforms.

- Compatibility: Supported across various devices and operating systems without formatting issues.

- Security: Files can be encrypted and password-protected for added privacy.

Customization and Flexibility

Even though the layout remains fixed, these documents are highly customizable to suit specific needs. You can adjust the content, font, and branding elements, allowing you to maintain a consistent visual identity across all financial records. This flexibility means that your documents can be tailored to match your business style while ensuring clarity and professionalism.

How to Download a Template

Getting access to a ready-made document layout is an easy process that can significantly simplify your billing routine. By obtaining a pre-designed structure, you can quickly start filling in relevant details without having to create a new document from scratch. Here’s a straightforward guide to acquiring such a file and using it for your financial needs.

Step 1: Start by searching for a trusted platform that offers free or paid versions of the layout you require. There are many websites that provide various designs suited to different types of businesses and preferences.

Step 2: Once you’ve found the right option, click on the appropriate link to access the file. Most sites offer a simple button or link to initiate the process, which might be labeled as “Get” or “Access File.”

Step 3: Depending on the source, you may need to provide some basic information or agree to terms before accessing the file. Once these steps are complete, the layout will typically be available for direct acquisition in just a few clicks.

Step 4: After obtaining the file, save it to your device. You can then begin editing and customizing it according to your specific requirements, ensuring that all necessary details are included before sending it out for payment.

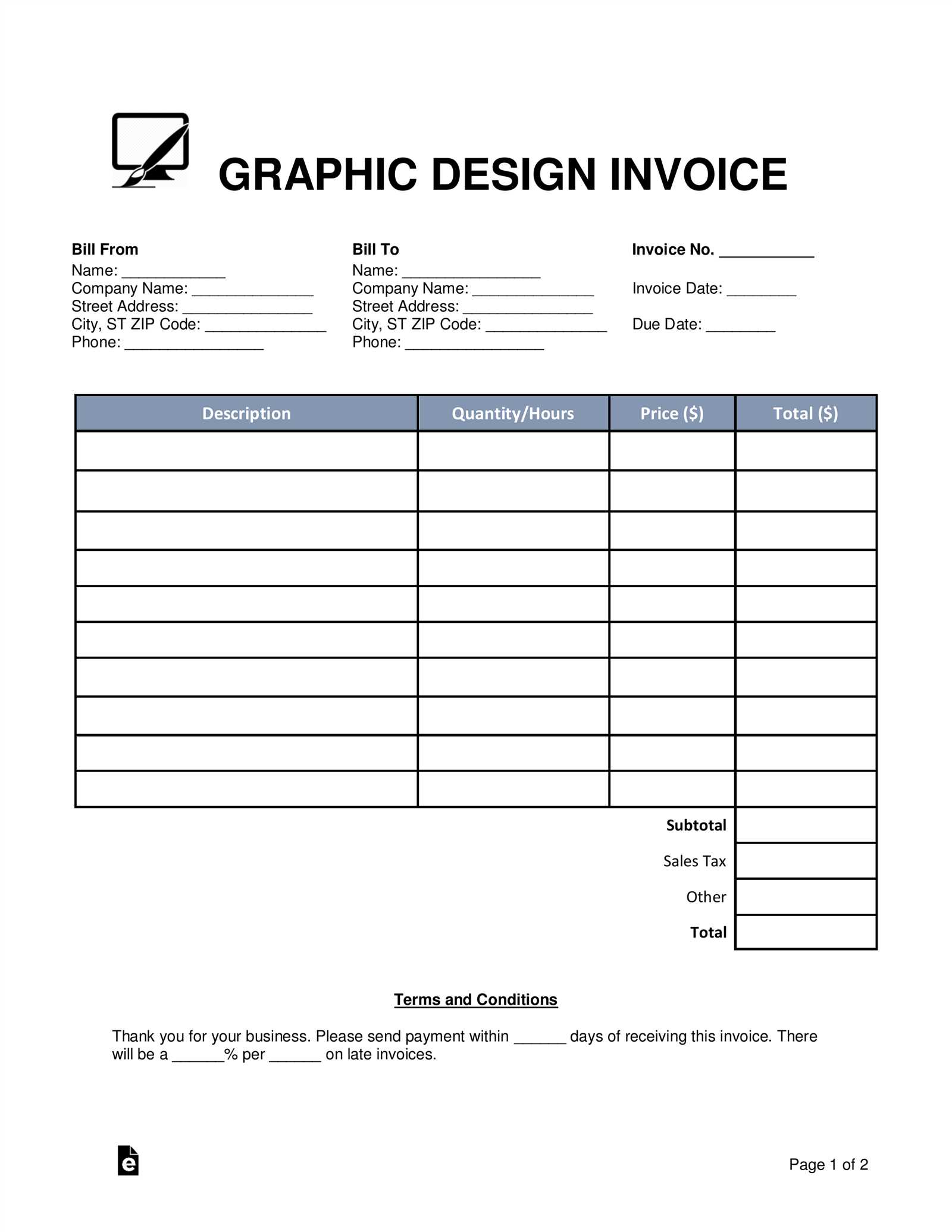

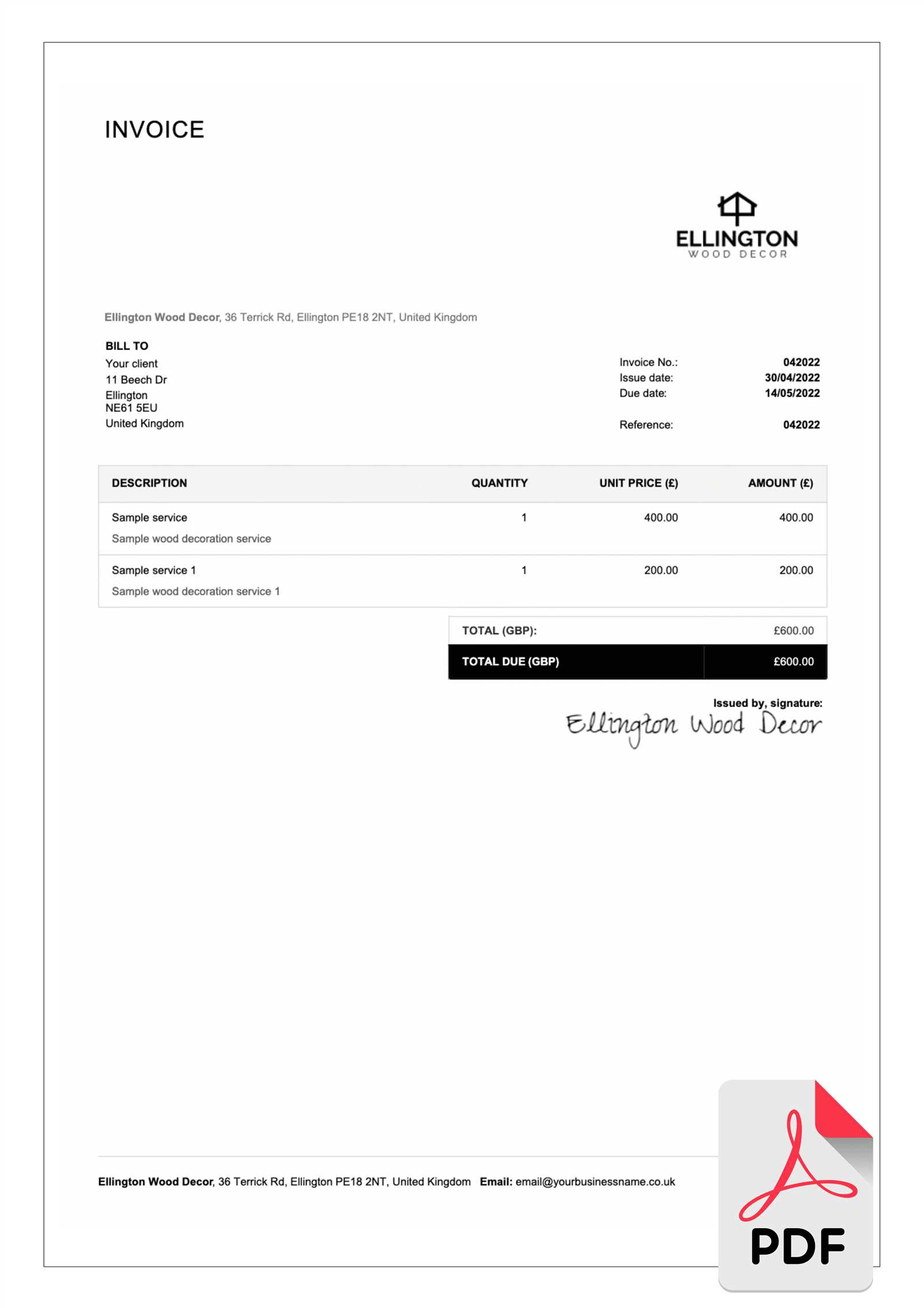

Choosing the Right Invoice Design

When selecting a structure for your payment request, the design plays a crucial role in ensuring clarity and professionalism. A well-thought-out layout not only conveys essential information but also reflects the nature of your business. The design should be functional, visually appealing, and easy for both you and your clients to navigate.

Factors to Consider in Design

There are several important aspects to keep in mind when choosing a layout that suits your needs:

- Clarity: Make sure that key details like amounts, dates, and services are easy to locate.

- Branding: Incorporate your company’s logo and colors to create a consistent brand identity.

- Flexibility: Choose a design that can be customized to meet various client or project requirements.

- Professionalism: Ensure the design gives off a polished, credible image for your business.

Design Options Comparison

Different designs serve different purposes. Here’s a comparison of various layouts to help you decide which is the most appropriate for your needs:

| Design Style | Best For | Features |

|---|---|---|

| Minimalist | Small businesses | Simplified fields, clean layout, easy to customize |

| Corporate | Larger businesses | Formal layout, multiple sections, detailed information |

| Creative | Freelancers, artists | Bold colors, unique fonts, personalized design |

Benefits of Using a PDF Format

When it comes to creating and sharing important business documents, choosing the right format is crucial. A file format that ensures consistency and maintains the integrity of your layout across various platforms can save you time and avoid potential errors. The flexibility and reliability of certain file types, especially when sharing professional documents, are key to streamlining processes.

Consistency across devices is one of the main advantages of using this type of file. Unlike other formats that might change depending on the device or software used to view them, this format ensures that all elements–text, images, and layout–remain exactly as you designed them, no matter the operating system or program used to open the document.

Security is another compelling reason to choose this format. Files can be encrypted, password-protected, and restricted from being edited, ensuring that sensitive information remains safe. This is particularly important when sending business-related content that needs to be kept confidential.

Convenience is a benefit that users can rely on when working with this format. Files are easy to share through email or cloud storage services without worrying about compatibility issues. The format is universally accepted, meaning it can be opened on nearly any device, from computers to smartphones, without the need for specialized software.

Customizing Your Invoice Template

Personalizing your payment request structure allows you to tailor the document to suit your business needs and create a more professional appearance. By adjusting key elements, you ensure that your documents reflect your brand identity and provide all the necessary details for a smooth transaction process. Customizing the format helps maintain consistency across all your financial records.

Key Elements to Customize

There are several key components you can modify to make your document fit your specific requirements:

- Branding: Add your business logo, colors, and contact information to reinforce your brand identity.

- Layout: Choose from different designs that suit your style, whether it’s simple or more detailed.

- Text Fields: Adjust text areas to fit your business needs, including payment instructions or service descriptions.

- Legal Information: Include terms and conditions, tax rates, or any necessary legal disclaimers relevant to your region.

Tools for Easy Customization

Many platforms provide user-friendly tools that allow for quick and efficient adjustments. Some common options include:

- Text Editors: Modify descriptions and add any extra information or notes.

- Drag-and-Drop Features: Easily move sections or elements to rearrange the layout.

- Predefined Fields: Use editable placeholders for client names, payment details, or due dates.

Free vs Paid Invoice Templates

When selecting a document format for your payment requests, it’s important to weigh the pros and cons of both free and paid options. While both offer convenience, the features and level of customization can vary greatly. Understanding the differences between these two choices can help you decide which one best fits your business needs.

Free options are typically more accessible and can be a good starting point for small businesses or individuals just beginning to manage their billing. These formats usually include basic functionality, allowing you to input essential details such as amounts, dates, and recipient information. However, the customization options may be limited, and the design might be less polished compared to premium versions.

Paid options generally provide more advanced features and greater flexibility. These formats are often designed with a higher level of professionalism, making them ideal for businesses that want to project a polished image. Paid versions may offer additional tools such as automated calculations, custom branding, and more intricate design choices. They also tend to have better customer support and more frequent updates.

Key Features of a Professional Invoice

A well-crafted document for requesting payment is essential to maintaining professionalism in business transactions. A clearly structured form not only ensures that all necessary details are conveyed but also promotes trust between you and your clients. By incorporating the right elements, you can create a document that is both functional and visually appealing.

Clarity and Organization are the foundation of any professional document. All necessary details, such as payment terms, services rendered, and amounts owed, should be easy to read and logically organized. A well-structured layout helps ensure that your client can quickly understand the information without confusion.

Accurate Information is crucial. Make sure to include the correct client details, the date, and any relevant reference numbers. This helps avoid misunderstandings and ensures a smooth transaction process. Providing accurate information also demonstrates your attention to detail and commitment to professionalism.

Design Consistency plays an important role in building your brand image. The inclusion of your company logo, consistent colors, and branded fonts creates a cohesive identity that clients will recognize. A professional design speaks volumes about the reliability and credibility of your business.

Legal Terms are an important component of professional documents. Including payment terms, penalties for late payments, and any legal disclaimers ensures that both parties are aware of their obligations and responsibilities, preventing potential conflicts down the line.

How to Edit PDF Invoices

Editing a document that’s meant for requesting payment is a straightforward task when you have the right tools. Whether you need to update a client’s details, adjust the amounts, or modify other sections, making changes is simple with the appropriate software. Here’s how you can quickly make adjustments to ensure your document is accurate and professional.

Tools for Editing

There are various tools available that make editing easy. Some popular options include:

- PDF Editors: Software like Adobe Acrobat or other specialized editing tools allow you to directly modify text and images.

- Online Services: Platforms like Smallpdf or PDFescape enable you to edit documents without installing any software. These are ideal for quick adjustments.

- Word Processors: Some word processors, like Microsoft Word or Google Docs, offer basic PDF editing capabilities once the document is converted into a compatible format.

Steps to Edit

Follow these steps to ensure a smooth editing process:

- Open the Document: Use your chosen tool to open the file you want to modify.

- Make Changes: Update the text, change dates, adjust amounts, or alter other details as necessary.

- Save Your Work: After making changes, save the document to prevent losing any edits. Be sure to use a unique file name if you need to preserve the original version.

- Review: Double-check your changes to make sure all the details are correct before sharing the updated document.

Saving and Storing Your Invoice Files

Efficiently saving and organizing your payment request documents is essential for easy access and future reference. Proper storage ensures that you can quickly retrieve information when needed and helps maintain a well-organized financial record system. Whether you store these files on your computer or in the cloud, it’s important to have a clear, reliable method in place.

File Naming is one of the first steps in organizing your documents. Use consistent naming conventions that include relevant details, such as the client’s name, the date of the transaction, and a unique reference number. This will make it easier to search and locate specific files later on.

Backup Methods are essential to prevent the loss of important documents. Storing copies of your files on multiple devices or in cloud storage ensures that you always have access, even if one storage option fails. Regularly backing up your files also reduces the risk of losing critical information due to technical issues.

Folder Organization plays a significant role in maintaining a clean file system. Create dedicated folders for each client or project, and organize files by year or month for quick reference. Consider using subfolders for different types of documents, such as sent requests, paid ones, or those still pending payment.

Invoice Template for Small Businesses

For small business owners, having a well-organized payment request format is crucial for maintaining cash flow and professionalism. A simple yet effective document can help streamline the billing process, ensuring that clients receive clear and concise information. Customizing such documents to reflect your business needs and brand identity can also contribute to a more polished and trustworthy image.

Simple and Clear Design is essential when creating a payment request for your small business. Focus on a layout that is easy to read and navigate, with sections for client details, service descriptions, and amounts clearly outlined. Avoid cluttering the document with unnecessary information, and ensure that the most important details stand out.

Customization Options allow you to tailor your document to reflect your unique business operations. Add your company’s logo, colors, and contact details to reinforce your brand. You can also include specific payment terms, discounts, or other conditions that are relevant to your business model.

Ease of Use is another factor to consider. Choose a format that can be easily filled out and updated, allowing you to quickly generate new payment requests without much effort. Some small business owners opt for simple word processors or online tools that offer quick access and easy editing features.

Common Mistakes to Avoid in Invoices

When creating a document to request payment, accuracy and clarity are key to maintaining professionalism and ensuring timely payment. Even small errors can cause confusion, delays, or frustration for both you and your clients. Avoiding these common mistakes will help streamline your business operations and maintain positive client relationships.

Missing or Incorrect Details

Ensure all necessary information is included: Double-check that all fields, such as client names, addresses, and payment terms, are accurate and up-to-date. Omitting critical information or including incorrect details can cause delays in processing payments or even lead to misunderstandings with clients.

Unclear Payment Terms

Clearly define payment expectations: One of the most frequent mistakes is not specifying the payment due date or terms clearly. It’s important to include clear instructions about when and how the payment should be made, as well as any late fees or discounts for early payments. Ambiguous payment terms can lead to unnecessary confusion and late payments.

Overcomplicated Layouts can also be a pitfall. A cluttered or overly complex design can make it difficult for the recipient to quickly find key information like the total amount due or the breakdown of services. Keep the format clean, organized, and easy to navigate.

How to Use Invoice Templates Effectively

Using a pre-designed document to request payments can save you time and ensure consistency. However, to maximize the effectiveness of such tools, it is important to understand how to customize and apply them properly to suit your specific business needs. By following a few simple guidelines, you can create professional and accurate payment requests with ease.

Customize for Your Business

Make sure to adjust the document to reflect your company’s identity and specific requirements:

- Branding: Include your business logo, colors, and contact details to ensure the document aligns with your overall branding.

- Personalization: Tailor the layout to include relevant sections for your services, pricing structure, and payment terms.

- Consistency: Use the same style for all your payment documents to maintain a professional and uniform appearance across all communications.

Regular Updates and Accuracy

Keeping your document accurate and up-to-date is essential for maintaining professionalism and avoiding errors:

- Update Client Details: Always ensure that client information, such as names and addresses, is current and correct.

- Adjust Pricing: Review your pricing structure periodically and make sure it reflects any changes in your services or rates.

- Double-Check Details: Before sending out any payment requests, verify that the total amount, payment terms, and service descriptions are accurate.

By using a well-structured and updated format, you can simplify the billing process, enhance client satisfaction, and ensure that your business stays organized and professional.

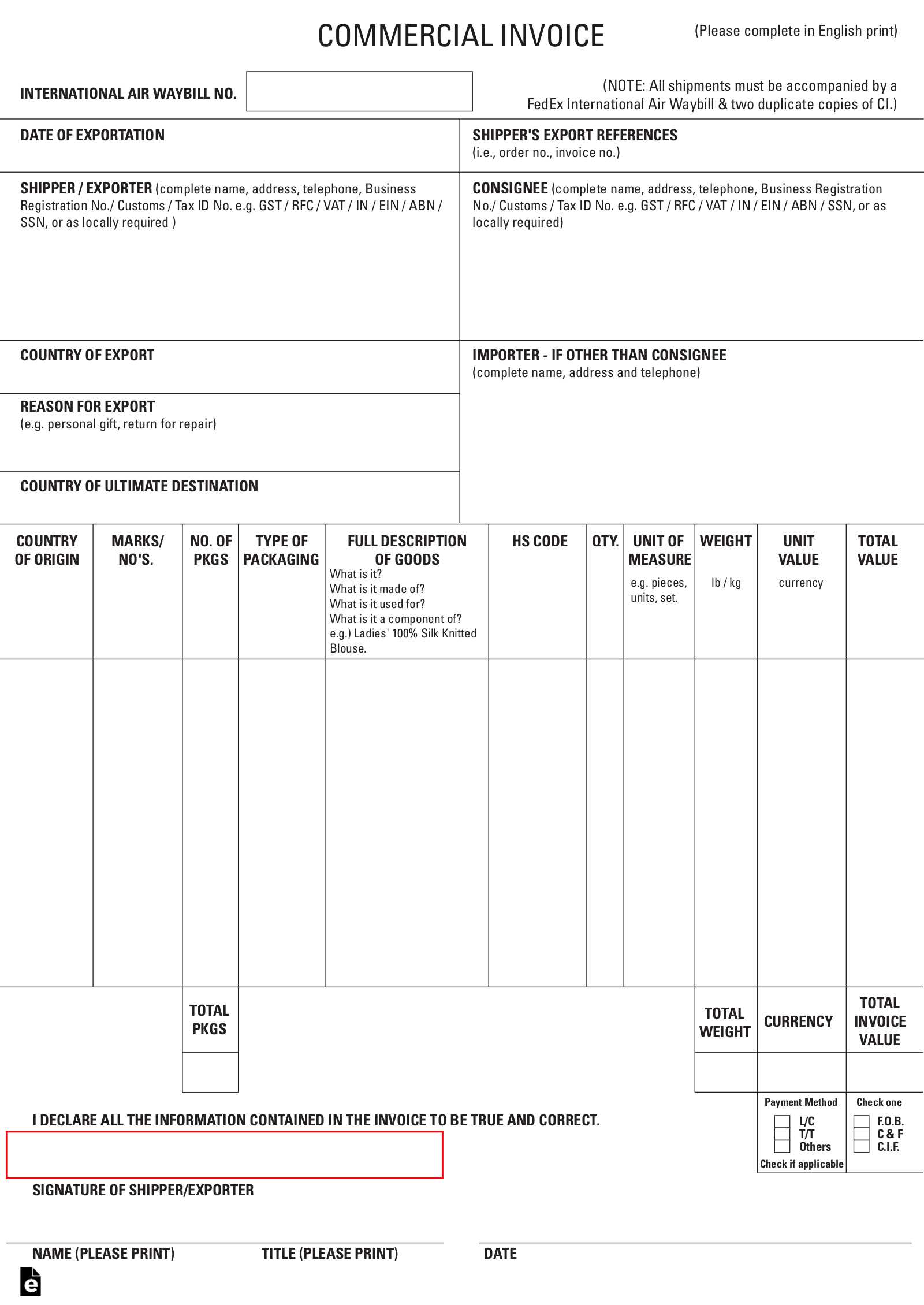

Legal Requirements for Invoices

For businesses, creating accurate and legally compliant payment requests is essential. There are certain regulations and standards that must be followed to ensure that your billing documents are valid and enforceable. Understanding these requirements will not only help you avoid legal issues but also ensure that your business operates smoothly and professionally.

Essential Information to Include

In order to comply with legal standards, make sure your document contains the following information:

- Business Details: Include your company name, address, and contact information, as well as your tax identification number if required by law.

- Client Information: Ensure the client’s name, address, and contact details are accurate and up to date.

- Unique Document Number: Assign a unique identifier to each request to track transactions and avoid confusion.

- Date of Issue: Clearly state the date the payment request was created and, if applicable, the due date for payment.

- Detailed Breakdown: Provide a clear description of the products or services provided, along with corresponding costs.

- Payment Terms: Outline the agreed-upon payment conditions, such as deadlines, accepted payment methods, and any penalties for late payment.

Tax Compliance and Regulations

Depending on your location and industry, there may be additional legal requirements related to taxes:

- Tax Identification Number (TIN): Many jurisdictions require businesses to include their tax number on payment requests for tax reporting purposes.

- Sales Tax: If your business is required to charge sales tax, make sure to include the appropriate tax rate and total tax amount on your document.

- Currency and Amounts: Always state the amounts in the correct currency and ensure they align with applicable exchange rates if dealing internationally.

By ensuring compliance with these legal requirements, you protect your business and ensure that all transactions are processed correctly and in accordance with the law.

Where to Find Reliable Invoice Templates

For businesses looking to streamline their billing process, finding trustworthy resources for creating payment documents is crucial. Whether you’re a small startup or an established company, using a solid framework ensures that you maintain professionalism while meeting legal and financial standards. There are multiple platforms where you can find dependable and customizable options suited to your needs.

Online Platforms and Marketplaces

Many online platforms provide access to high-quality, customizable billing documents, often for free or at a minimal cost. Some of the most reputable sources include:

- Freelance Websites: Sites like Upwork and Fiverr offer both free and paid resources for businesses, with options tailored to specific industries.

- Office Suite Providers: Programs like Microsoft Office or Google Docs offer built-in templates that are easy to customize and use regularly.

- Accounting and Finance Tools: Software such as QuickBooks or FreshBooks offer pre-made solutions that integrate with your financial system, making the process more seamless.

Customization and Flexibility

Choosing the right platform not only ensures that you have access to high-quality documents but also provides flexibility. Many resources allow you to:

- Customize Layout and Fields: Tailor the design and details according to your specific business requirements.

- Incorporate Branding: Add your company logo, colors, and fonts for a personalized touch that aligns with your brand identity.

- Ensure Compliance: Choose options that meet local tax and legal requirements to avoid potential issues down the line.

By selecting a reliable source, you can ensure that the documents you create are not only professional but also designed to suit your specific business needs and legal obligations.