How to Create an Invoice Template in Word

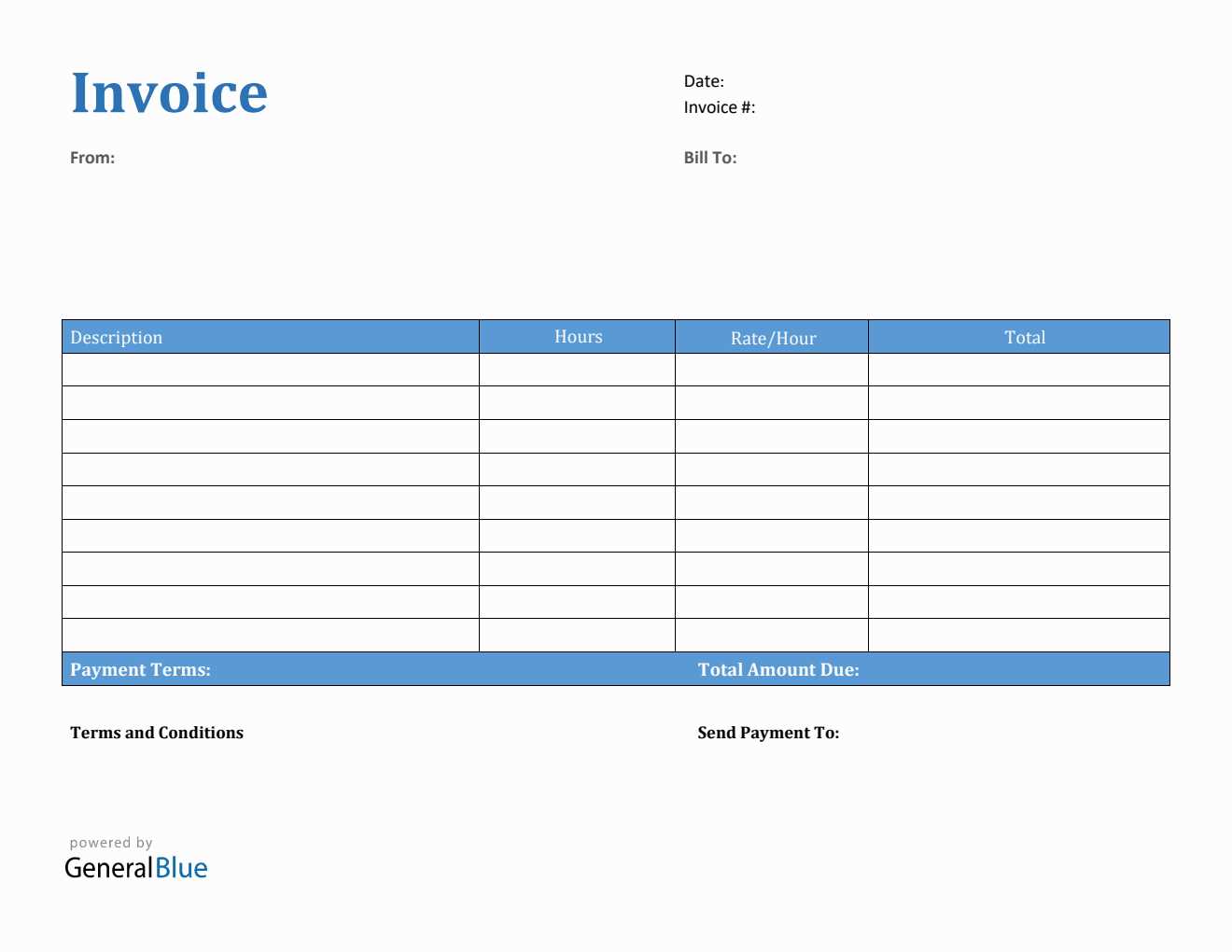

Designing clear and organized financial records is essential for any business. Whether you’re managing payments for services or products, having a reliable method to document transactions can help maintain professionalism and efficiency. A well-structured document not only streamlines communication but also ensures accuracy in financial dealings.

With the right tools, creating such records becomes a straightforward task. By using accessible software, you can create personalized forms that suit your business needs, making the billing process quicker and more consistent. In this guide, you’ll learn how to build a customizable document that suits your workflow and helps you stay organized.

Creating a Professional Billing Document

Creating a professional record for transactions is essential for businesses of any size. A clean, clear, and well-organized document helps maintain a polished image and ensures that all financial details are properly conveyed. Whether you’re sending out records for products sold or services provided, the format and structure you choose are key to presenting your business in a professional light.

To create an effective and professional-looking document, it’s important to include all relevant details in an organized manner. Start by clearly listing your business information, the recipient’s details, and a breakdown of the charges. This way, all parties involved can quickly understand the terms and figures outlined.

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Service Charge | 1 | $100.00 | $100.00 |

| Product X | 2 | $50.00 | $100.00 |

| Subtotal | $200.00 | ||

| Tax (10%) | $20.00 | ||

| Total Amount Due | $220.00 |

Including all the essential details in a structured manner allows you to convey your information effectively. Always ensure the layout is clean and that the document is easy to read, with clear sections for charges, payments, and any additional information that may be necessary.

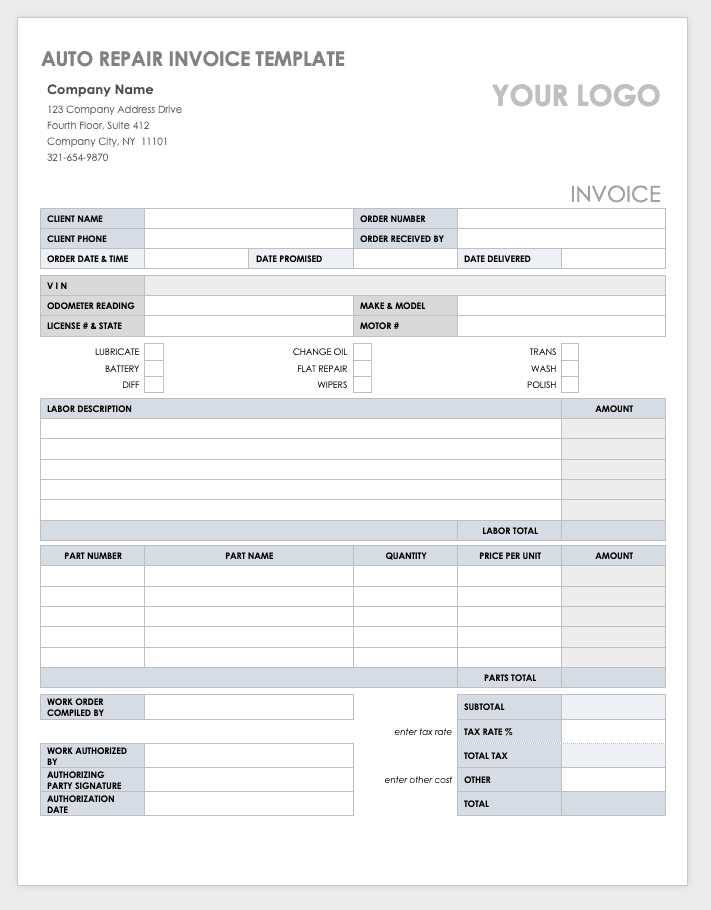

Choosing the Right Format for Your Document

Selecting the appropriate structure for your financial record is essential for ensuring clarity and professionalism. The layout should allow the recipient to easily identify key details, such as the amount owed, the services or products provided, and the payment terms. A well-chosen format not only improves readability but also reflects positively on your business.

Consider the nature of your transactions when determining the format. If you are providing a detailed breakdown of items, an organized list with columns for quantities, prices, and totals can help the reader understand the charges quickly. For simpler transactions, a more basic design may suffice, focusing primarily on essential contact information and amounts due.

Key considerations when choosing your structure:

- Clarity – Ensure that all necessary details are easy to find and clearly presented.

- Consistency – Use a consistent layout for all records to establish a recognizable format for your clients.

- Professional Appearance – Maintain a polished look to reflect the quality of your business.

Ultimately, the goal is to create a document that not only meets your needs but also impresses the recipient with its organization and attention to detail.

Customizing Your Billing Document Format

Personalizing your financial records is a crucial step in making them more aligned with your business needs and branding. By adjusting the layout and content, you can ensure the document reflects your company’s identity while maintaining a professional appearance. Customization also helps improve readability and allows you to highlight important details for your clients.

Adjusting Layout and Design

One of the first things to modify is the layout. You can move sections around, such as placing payment terms or contact information at the top, making them more accessible. Additionally, experimenting with fonts, colors, and logo placement can help match the design to your brand’s visual style. Ensure that the document remains clear and organized, even with these customizations.

Adding Business Details

Including your business information, such as logo, address, and contact details, is vital for clarity and professionalism. These elements should be placed in prominent areas so that they are easily visible. Adding a personalized message or terms of service can also enhance the document’s usefulness and create a more customer-friendly experience.

Tip: Keep in mind that while customization is important, it’s essential not to sacrifice clarity for aesthetics. The document should always be easy to read and contain all the necessary information in a logical order.

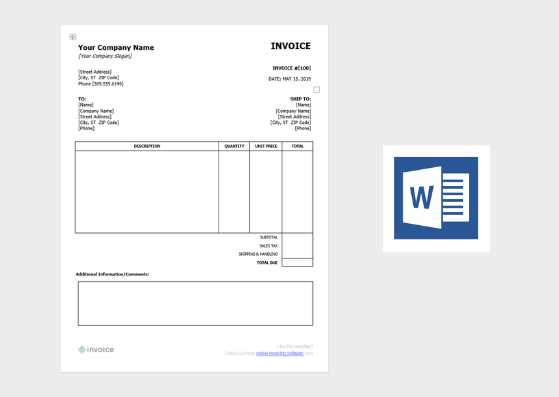

How to Add Business Details to Billing Documents

Including your business details in financial documents is crucial for maintaining clear communication and professionalism. These details not only help the recipient identify who the charges are from but also provide them with necessary contact information should they need further assistance. Adding these details ensures that your business is properly represented and makes it easier for clients to get in touch if needed.

The key elements to include are your company name, address, phone number, email, and website. These details should be placed in a prominent location, typically at the top of the document, to ensure they are easily accessible. You may also want to add your business logo to enhance your brand’s recognition and to give the document a polished look.

Important Information to Include:

- Company Name – Clearly state the name of your business for easy identification.

- Business Address – Provide your office or company location for reference.

- Contact Details – Include phone numbers and email addresses for client communication.

- Website – Adding your online presence ensures clients can access more information about your services.

These elements should be formatted clearly and consistently throughout your documents to present your business as trustworthy and professional.

Setting Up Payment Terms in Billing Documents

Clearly outlining payment expectations is an essential part of any financial document. By specifying terms, such as due dates and accepted payment methods, both you and the recipient can avoid misunderstandings and ensure a smooth transaction process. Setting up these terms is a straightforward way to communicate your business policies and maintain a professional relationship.

It’s important to detail the payment deadlines and specify any late fees or penalties for overdue payments. Providing different payment methods, such as bank transfers, credit card payments, or online platforms, can also offer convenience for the client. This clarity ensures that both parties are on the same page regarding financial expectations.

| Payment Term | Details |

|---|---|

| Due Date | Payment is due within 30 days of the issue date. |

| Late Fee | A 5% late fee will be applied for payments received after the due date. |

| Accepted Methods | Bank transfer, credit card, PayPal. |

| Early Payment Discount | A 2% discount is offered for payments made within 10 days. |

By including these payment details in your documents, you provide transparency and help establish clear guidelines for clients. This contributes to a more organized and efficient payment process for both parties involved.

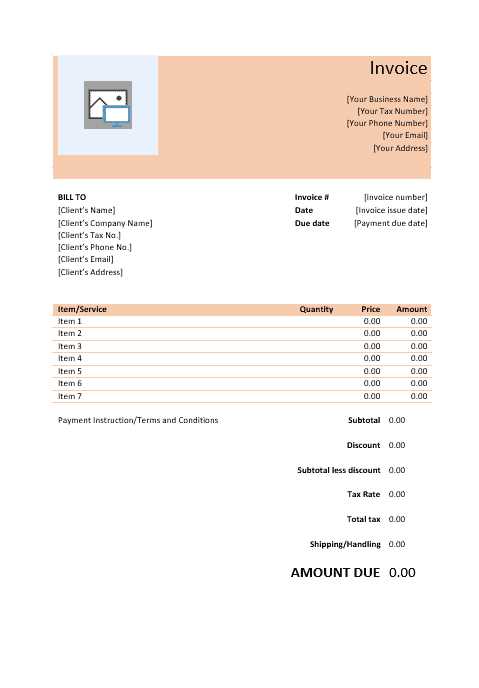

Incorporating Taxes and Discounts on Billing Documents

Accurately reflecting taxes and discounts in financial records is essential for ensuring transparency and compliance with regulations. Taxes must be clearly calculated and shown to avoid any confusion for the recipient, while discounts should be clearly stated to highlight any savings the client is entitled to. Including these details helps maintain clarity and promotes trust between the business and its clients.

When adding taxes, it’s important to specify the tax rate applied and the total tax amount. This ensures the recipient knows exactly how much they are paying in taxes. Discounts, on the other hand, can be presented either as a percentage or a fixed amount, depending on the agreement. Clearly stating the terms of any discount, such as early payment or bulk purchase discounts, can help encourage timely payments.

For example, the taxes and discounts should be calculated and presented like this:

| Description | Amount |

|---|---|

| Subtotal | $500.00 |

| Tax (8%) | $40.00 |

| Discount (5%) | -$25.00 |

| Total Due | $515.00 |

By including taxes and discounts in your records in a clear and organized manner, you ensure the recipient has a complete understanding of the charges, fostering transparency and improving the overall professionalism of your financial communications.

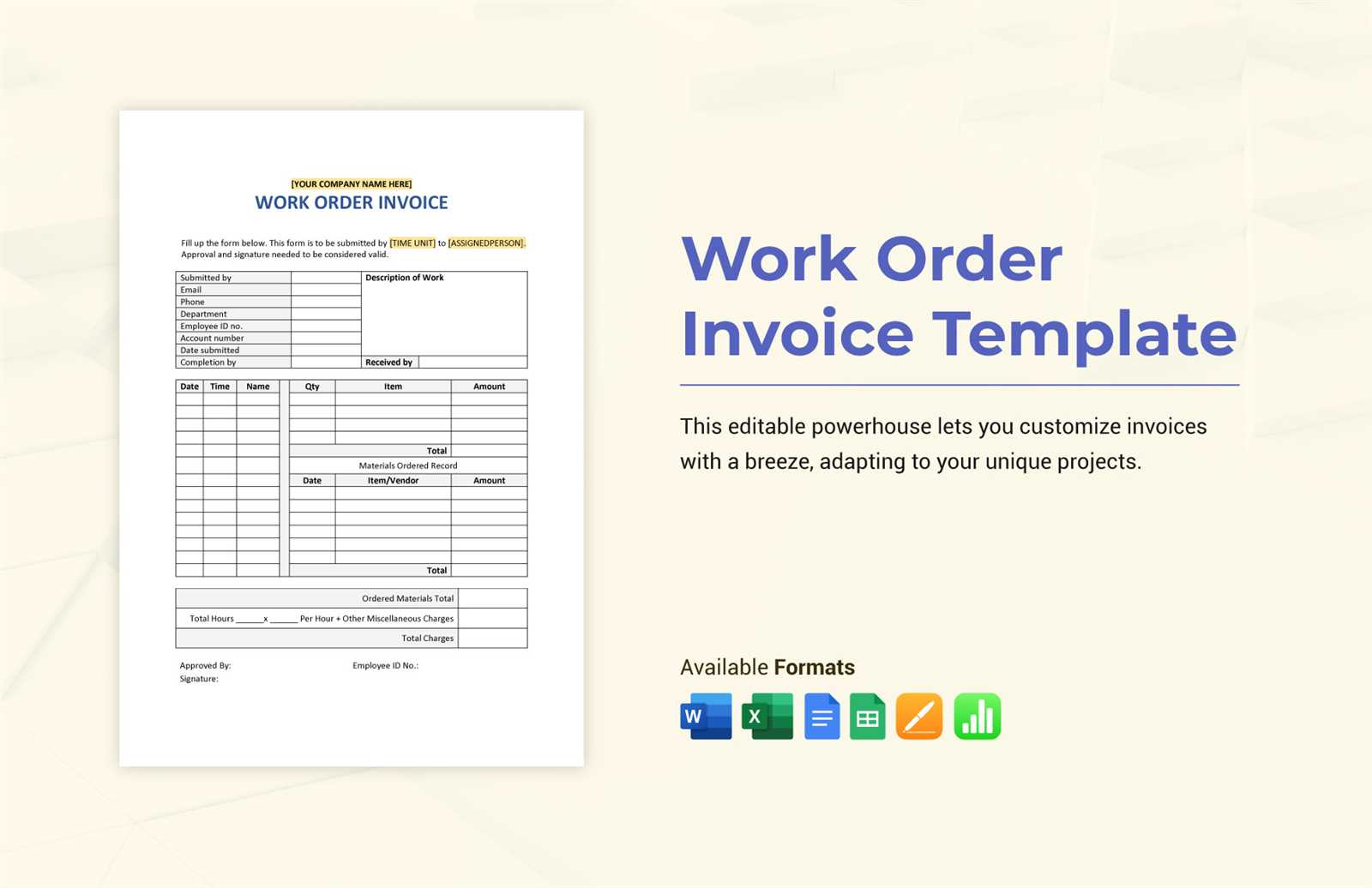

Adding Itemized Lists for Services and Products

Providing a detailed breakdown of goods and services helps ensure that clients understand exactly what they are being charged for. An itemized list allows you to clearly present individual items, their quantities, and their respective costs. This level of transparency not only helps avoid confusion but also improves the professionalism of your financial documents.

For services, each task or service provided can be listed with a brief description and its associated cost. For products, including item names, quantities, and unit prices will ensure everything is clear. This method allows clients to review each individual charge and ensures they are fully informed about the details of their purchase.

Example of an Itemized Service List

| Description | Cost |

|---|---|

| Web Design Consultation | $200.00 |

| Website Setup | $500.00 |

| SEO Optimization | $150.00 |

| Total Services | $850.00 |

Example of an Itemized Product List

| Item | Quantity | Unit Price | Total |

|---|---|---|---|

| Wireless Mouse | 2 | $25.00 | $50.00 |

| Bluetooth Keyboard | 1 | $75.00 | $75.00 |

| Total Products | $125.00 |

By itemizing the details of both services and products, you provide a clear and professional breakdown of the charges, making it easier for clients to verify the accuracy of the amounts and creating a transparent relationship between you and your customers.

Formatting Your Document for Clarity

Clear and organized presentation is key when creating financial documents. Proper formatting helps ensure that all relevant details are easy to read and understand, avoiding any confusion. By using a clean layout, consistent fonts, and well-structured sections, you can ensure that recipients can quickly grasp all necessary information.

When structuring your document, it’s important to focus on the following aspects:

- Consistent Layout: Make sure that all sections follow a logical order, from contact information to itemized details and totals.

- Readable Fonts: Use simple, professional fonts such as Arial or Times New Roman to enhance readability.

- Clear Headings: Use bold headings to separate sections and guide the reader through the document.

- Logical Grouping: Group related items together, such as all products or services, and ensure the totals are easy to find.

Additionally, avoid cluttering your document with unnecessary information or complex designs. Simplicity is key to ensuring that the reader can focus on the important details.

Here’s a simple structure that can help with clarity:

- Header: Business name, address, and contact information.

- Recipient details: Name and contact information.

- Itemized list: List of products or services with individual costs.

- Summary: Subtotal, taxes, discounts, and total due.

By following these formatting guidelines, you ensure your document is both professional and easy to navigate, fostering clear communication with your clients.

How to Save and Reuse Invoice Designs

Having a pre-made document design allows for faster processing and consistency across all financial communications. Once a structure is established, it can be saved and reused for future transactions, saving you valuable time. By creating a reusable format, you can ensure uniformity and reduce the risk of errors in every document you produce.

Steps to Save Your Document Design

To save a design for future use, follow these steps:

- Complete your document with all necessary fields and details.

- Save the file using a relevant name that indicates it’s a base template.

- Store it in an easily accessible location on your device or cloud storage for quick retrieval.

How to Reuse and Customize Your Design

When reusing your saved design, it’s essential to customize each new document to suit the specific transaction. You can modify the customer’s information, itemized list, and any relevant payment terms. Here’s a table with common modifications:

| Section | Modification |

|---|---|

| Contact Details | Change recipient name, address, and contact information. |

| Items/Services | Update product/service list and prices. |

| Total Amount | Adjust totals according to any discounts or added taxes. |

By following this simple process, you can efficiently reuse your document designs while ensuring each one is tailored to the specific details of the transaction. This method not only saves time but also maintains consistency across all of your communications.

Sharing Your Document Directly from Word

Once your financial document is complete, sharing it promptly is crucial for efficient communication and payment processing. By leveraging the sharing features available in most text editing programs, you can easily send your finalized document to clients or colleagues without the need for external software. This ensures a streamlined process, saving time and effort.

Steps to Share Your Document

Follow these simple steps to share your completed document directly from the editing program:

- Complete all the necessary fields in the document.

- Ensure that the document is saved and ready for sharing.

- Click on the “Share” button, typically located in the top-right corner of your editing program.

- Select the recipient by entering their email address or choosing from your contact list.

- Choose the file format you wish to send, such as PDF for easy viewing.

- Click “Send” to deliver the document instantly.

Alternative Sharing Methods

If you prefer not to use the built-in sharing features, you can also share your document in the following ways:

- Email it as an attachment directly from your file storage location.

- Upload it to a cloud service and share a link for easy access.

- Use messaging apps or collaboration tools to share the file with others in real-time.

These methods allow you to quickly distribute your documents, ensuring that recipients have the necessary information without delays. Whether you’re sending to a single person or a group, the process is quick, secure, and simple.

Creating Recurring Invoices with Word

For businesses that provide ongoing services or products, it’s essential to have an efficient system in place for creating and sending regular billing statements. By setting up recurring billing documents, you can ensure that payments are requested consistently, without the need to manually generate each statement from scratch.

With the right approach, you can streamline this process using document creation programs, making it easy to update and reuse a structure for future cycles. This saves time and reduces the risk of errors.

Steps to Create Recurring Billing Statements

To create recurring billing documents, follow these basic steps:

- Start by designing a structure for the first document, including fields for essential details like client information, services rendered, and payment terms.

- Save the document as a base format, ensuring that all reusable information is easily editable, such as amounts, dates, and descriptions.

- Set up a regular schedule for updating the document, such as weekly, monthly, or quarterly, depending on your billing cycle.

- Each time a new cycle arrives, simply open the saved file and make necessary updates to reflect the current period’s charges.

- Save the updated document and distribute it to clients promptly.

Automating the Process for Efficiency

To further enhance your process, consider automating recurring billing reminders using calendar tools or project management systems. This can ensure that the right documents are created and sent out at the correct time without manual tracking. Additionally, integrating an online payment method can allow clients to pay directly from the billing statement, streamlining the entire financial process.

By following these steps, businesses can efficiently manage regular payments and ensure their clients are billed correctly every time, without having to create a new statement from scratch for each cycle.

Ensuring Invoice Accuracy and Professionalism

When creating financial documents for clients, it’s crucial to maintain both accuracy and professionalism. These records reflect your business practices and serve as a critical point of reference for clients. Incorrect details or a poorly presented document can undermine trust and create confusion.

To ensure your documents are accurate, start by double-checking all essential information. This includes verifying the client’s name, contact details, and any agreed-upon terms. Ensure the listed items, amounts, and dates are correct, and review your calculations to avoid mistakes that could result in disputes.

Professional Formatting is equally important for leaving a positive impression. A clean, organized layout will help clients navigate the details quickly. Use clear headings, bullet points, and a consistent font style to enhance readability. Additionally, include your business logo and contact details to give the document a polished appearance.

Consistency is key. Maintaining the same structure for all your documents ensures that your clients are familiar with the format, making it easier for them to review and understand the content. By consistently providing clear and professional documents, you reinforce your business’s reliability and credibility.

Ultimately, ensuring both accuracy and professionalism in your financial documents helps build trust with clients and fosters long-term business relationships.

Best Practices for Invoice Numbering

Properly numbering your financial documents is essential for maintaining order and tracking transactions effectively. A well-structured numbering system can help ensure that each document is easily identifiable and avoids any confusion or duplication. Implementing a clear numbering sequence not only enhances organization but also streamlines record-keeping for both businesses and clients.

Use a Sequential System

One of the most important practices is to use a sequential numbering system. Start with a unique number for each document and increment it for every new entry. This approach helps prevent duplication and ensures that every record is distinct. Avoid skipping numbers or reusing previous ones, as this can create confusion and make tracking difficult.

Include Relevant Information

To further improve document organization, consider including additional identifiers within the numbering system. For instance, you can incorporate your company’s initials, the year, or even the month. For example, “ABC-2024-001” could represent the first document of the year 2024. This practice provides both a unique identifier and context, making it easier to categorize documents by date and type.

By adhering to these best practices, you can ensure that your financial documentation is well-organized, easy to track, and professionally presented to your clients.

Adding a Company Logo to Your Invoice

Incorporating your company’s logo into financial documents enhances branding and adds a professional touch. A logo not only establishes your business identity but also helps in building trust with clients. It provides a visual reminder of your business and reinforces your brand’s presence on every document you send.

Choose the Right Position

The placement of your logo is crucial for maintaining a clean and organized look. Commonly, it is positioned at the top of the page, either centered or aligned to the left. Ensure that it doesn’t overpower the content, but is still visible enough to be recognized easily. A logo that is too large may distract from important details, while one that is too small might not be noticeable enough.

Maintain Consistency in Size and Quality

Ensure that the logo is of high quality and resolution, especially when sharing documents digitally. A blurry or pixelated logo can negatively affect the perception of your business. Additionally, keep the size consistent across all documents to maintain a professional appearance. This consistency will ensure that every document sent is aligned with your company’s branding strategy.

By carefully adding your company logo, you not only reinforce your brand but also create a lasting impression with your clients.

Common Mistakes to Avoid on Invoices

Creating clear and accurate financial documents is essential for maintaining professionalism and ensuring timely payments. However, errors in formatting, information, or calculations can lead to confusion or delays. Understanding the most common mistakes helps avoid these pitfalls and ensures that your documents are effective and reliable.

Incorrect or Missing Payment Details

One of the most critical elements to include is the correct payment information. Make sure to provide clear instructions for how payments should be made, including the payment method, bank account details, or online payment options. Failing to include these details or listing incorrect information can result in delays and misunderstandings.

Failure to Itemize Products or Services

Providing a detailed breakdown of the products or services being charged helps both you and your client understand exactly what is being paid for. Failing to clearly list each item, its cost, and any applicable taxes or discounts can lead to confusion or disputes. Ensure all relevant information is included and clearly presented.

By avoiding these common mistakes, you can create more professional and efficient documents that foster trust and ensure prompt payments.

How to Use Word for Client Invoicing Efficiently

Managing financial documentation can be a time-consuming task, but with the right approach, it can become much more efficient. Using a word processing software to create and manage your billing statements allows for streamlined processes, reduced errors, and a more professional presentation. Below are some tips to optimize your workflow when preparing documents for clients.

1. Utilize Built-in Features for Quick Creation

Most word processing applications have built-in tools that can help speed up the creation of your financial documents. These include:

- Pre-designed layouts: Use built-in designs to quickly structure your document.

- Tables: Create neat, organized lists for products, services, and costs.

- Automatic date insertion: Automatically add current dates and due dates to ensure accuracy.

2. Save Custom Layouts for Future Use

Once you have designed your preferred format, save it as a custom document. This allows you to reuse the structure for future clients without needing to redesign from scratch. To do this:

- Save as a template: Use the “Save As” option to save your file as a reusable template.

- Organize by client: Save templates or documents with clear client identifiers to easily access and update.

3. Proofread and Double-Check Information

Before sending any document, always double-check for accuracy. Ensure that the payment terms, client details, and any discounts or additional charges are correctly stated. Also, verify that the dates and amounts align with what has been agreed upon.

By incorporating these efficient practices, you can ensure that your billing process is seamless, organized, and professional, ultimately saving time and fostering client trust.