How to Use an Invoice Template on iPhone for Easy Billing

In today’s fast-paced world, managing financial tasks while on the move has become essential for many professionals. With the right tools, creating and sending professional documents for payments is quick and hassle-free, even when away from the office. Mobile solutions offer flexibility and ease of use, allowing businesses to stay organized and keep track of transactions without the need for complicated software or systems.

Creating well-organized payment requests on your mobile device provides a streamlined approach to managing business finances. Whether you’re a freelancer, small business owner, or contractor, having the ability to generate accurate, professional documents anytime and anywhere can save time and improve efficiency. These solutions are designed to be user-friendly, ensuring that even those with minimal tech experience can quickly adopt them.

Choosing the right mobile tools can make a significant difference in how effectively you handle client payments. With features like automatic calculations, customizable fields, and the ability to quickly send documents, your billing process can be both efficient and professional. This section will explore how to leverage these mobile options for seamless financial management wherever you are.

Invoice Template on iPhone

For business owners and freelancers, the ability to quickly generate professional payment documents on a mobile device has become a game-changer. With just a few taps, you can create accurate, clear, and well-organized billing statements, all from the convenience of your phone. The process has been streamlined to ensure that generating financial documents doesn’t require specialized software or long hours at a desk.

Using mobile applications designed for creating payment requests, you can customize the document layout, include necessary details, and send them directly to clients in minutes. These tools provide essential features such as automatic calculations, custom fields for your services, and options to include business logos. Whether you’re on a client site or working remotely, managing your financials has never been easier.

| Feature | Description |

|---|---|

| Customizable Layout | Adjust the design to match your brand or specific needs. |

| Automatic Calculations | Ensure accuracy by letting the app handle math for you. |

| Client Information Storage | Save client details for faster future billing. |

| Secure Sharing Options | Easily send documents via email or messaging apps securely. |

| Cloud Syncing | Access your documents from any device, ensuring no data loss. |

By utilizing these mobile tools, managing your client payments becomes a seamless part of your workflow. Whether you’re on the go or working from home, creating and sharing financial documents is simplified, allowing you to focus more on grow

Why Use an Invoice Template on iPhone

Having the ability to create professional financial documents directly from your mobile device offers numerous advantages. The convenience of generating accurate, clean, and professional payment requests anytime and anywhere can greatly improve productivity. For freelancers, small business owners, or anyone managing client payments, using a mobile solution ensures that important tasks are never delayed or forgotten, even while on the go.

One of the key benefits of using mobile tools for this purpose is efficiency. Instead of relying on complex software or desktop applications, mobile solutions are often designed to be quick and user-friendly. With features like automatic number calculations, pre-filled client data, and customizable sections, generating a payment request takes just a few minutes. This enables faster turnaround times and ensures that you don’t miss important billing cycles.

Additionally, mobile applications allow for seamless sharing. Once a document is created, it can be easily emailed or sent via messaging apps, providing clients with an immediate and professional experience. This helps improve cash flow and reduce the time spent waiting for payments.

Top Features of iPhone Invoice Templates

Mobile applications designed for creating financial documents offer a range of features that make the billing process more efficient and professional. These tools are packed with functionalities that simplify every step of the creation, customization, and sharing process. Whether you are a small business owner, a freelancer, or a contractor, these advanced features can significantly enhance your workflow and save time.

From automatic calculations to customizable fields, mobile tools ensure that you never have to worry about errors or formatting issues. Many apps also allow seamless integration with cloud storage, enabling you to access your documents from anywhere, at any time. Below are some of the top features that make these mobile solutions so effective:

| Feature | Description |

|---|---|

| Customizable Layout | Easily modify designs to reflect your branding or specific business needs. |

| Automatic Calculations | Automatically handle tax rates, discounts, and totals, reducing the risk of errors. |

| Client Database | Store and quickly access client information for faster billing. |

| Secure Sharing Options | Send documents directly via email or secure messaging apps for instant delivery. |

| Cloud Integration | Access and manage your documents from multiple devices with cloud syncing. |

| Multilingual Support | Create documents in multiple languages to cater to international clients. |

These powerful features make mobile billing solutions not only efficient but also versatile, adapting to a wide range of business needs and ensuring that every document sent is accurate, professional, and timely.

How to Choose the Best Invoice Template

Choosing the right mobile solution for creating payment documents can have a significant impact on the efficiency of your business processes. The right tool should not only meet your specific needs but also be user-friendly, customizable, and capable of streamlining the entire billing workflow. It’s essential to select a platform that aligns with the type of business you run and the level of professionalism you want to convey to your clients.

Consider the ease of use when selecting a tool. It should allow you to quickly input essential details without overwhelming you with unnecessary features. Look for a solution that offers a clean and intuitive interface so that you can focus on your work, not on navigating through complicated options. Customization options are also important, as they allow you to adjust the layout, add your logo, and tailor the design to reflect your brand.

Another key factor is the tool’s ability to integrate with other systems. If you already use accounting software or cloud services, choose an app that can seamlessly sync with those platforms. This will allow you to easily store and access documents, track payments, and manage financial records without switching between different apps.

Finally, consider the level of customer support provided. A reliable support team can make all the difference if you run into issues or need assistance with advanced features. Make sure the mobile solution you choose offers timely and helpful support to ensure you can quickly resolve any challenges that arise.

Free Invoice Templates for iPhone

For businesses looking to minimize costs while still maintaining professionalism, free tools for creating payment documents are an excellent solution. These free mobile apps offer a range of features, including customizable layouts, automatic calculations, and the ability to store client information, all without requiring a subscription or one-time purchase. By leveraging these free tools, you can handle financial documentation effectively without impacting your budget.

Many mobile applications provide a variety of pre-designed formats that are ready to use and easy to customize. Whether you need a simple, minimalist design or something more detailed, these free solutions can be tailored to fit your needs. Additionally, they often support various formats for sharing documents, such as email or messaging apps, ensuring that your payments can be quickly processed and sent to clients.

| App | Key Features |

|---|---|

| Invoice Maker | Customizable fields, no watermarks, instant PDF export, and free to use. |

| Easy Invoice Generator | Pre-designed templates, quick editing, cloud storage integration, and free options available. |

| Zoho Invoice | Free for small businesses, automatic calculations, and professional designs. |

| PayPal Invoicing | Seamless PayPal integration, basic design customization, and free for PayPal users. |

Using these free mobile applications for creating payment documents not only saves money but also ensures that you can maintain a professional appearance, even with limited resources. While the features offered by free apps may be more basic compared to paid versions, they are still more than adequate for small business owners or freelancers who need an efficient and simple solution for their billing needs.

How to Create Custom Invoices on iPhone

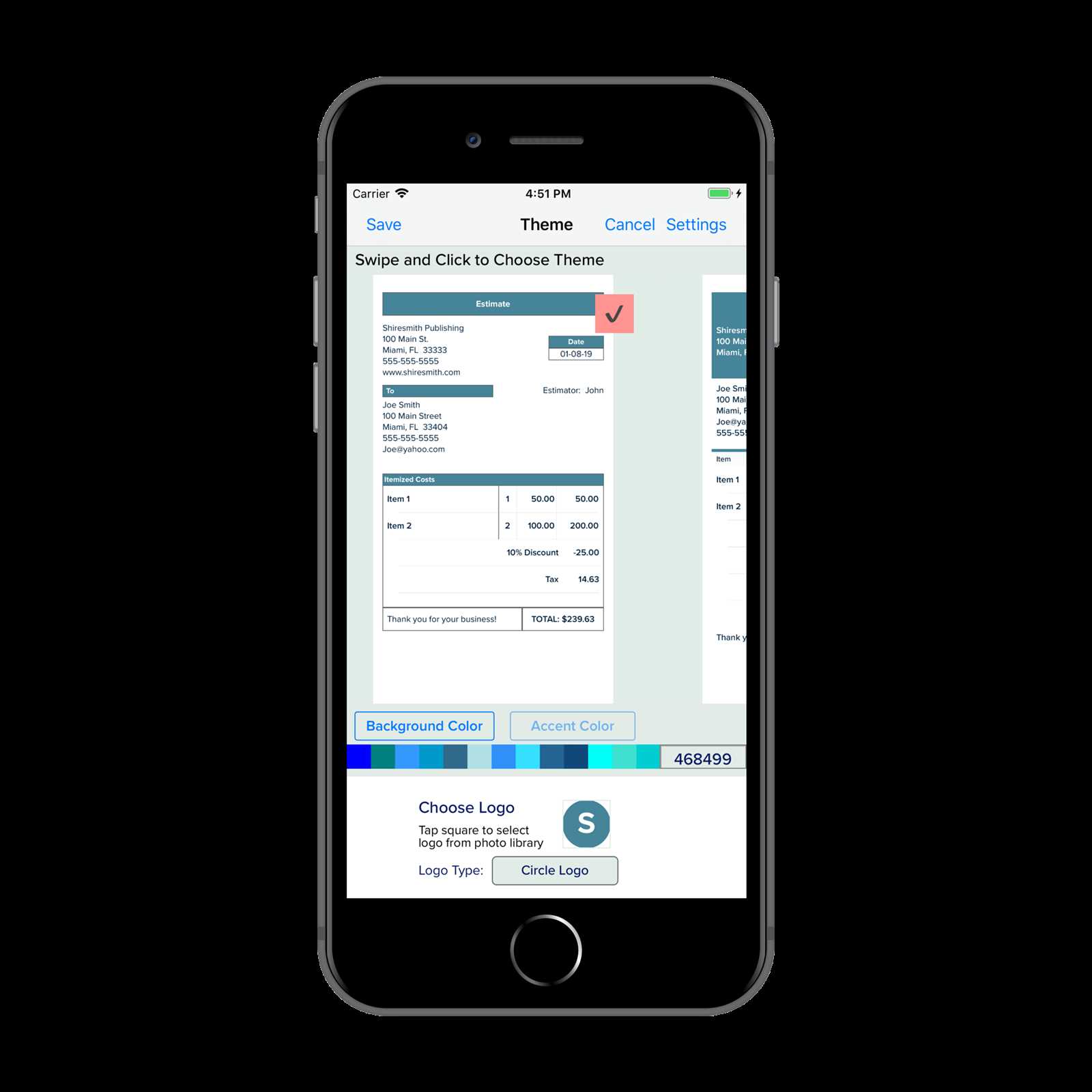

Creating personalized billing documents on your mobile device allows you to tailor each payment request to your specific needs. Customization options give you the flexibility to add details such as your company logo, payment terms, and unique service descriptions, ensuring that each document reflects your brand and maintains a professional appearance. Whether you are working from home, on-site with a client, or traveling, the ability to generate personalized requests on the go makes financial management simpler and more efficient.

To create a custom document on your phone, start by selecting an app that offers flexible customization features. Once you open the app, you will typically find pre-designed layouts that can be edited to fit your needs. From here, you can input your client’s information, adjust the currency or tax rate, and add any specific items or services rendered. Most apps also allow you to include additional notes or payment instructions, making it easy to customize each document as needed.

After entering all the necessary information, you can preview the final result to ensure everything looks correct before sending it. Many tools also offer the ability to save custom settings for future use, which speeds up the process for recurring clients or services. Once satisfied, simply export or share the completed document via email or messaging apps directly from your mobile device.

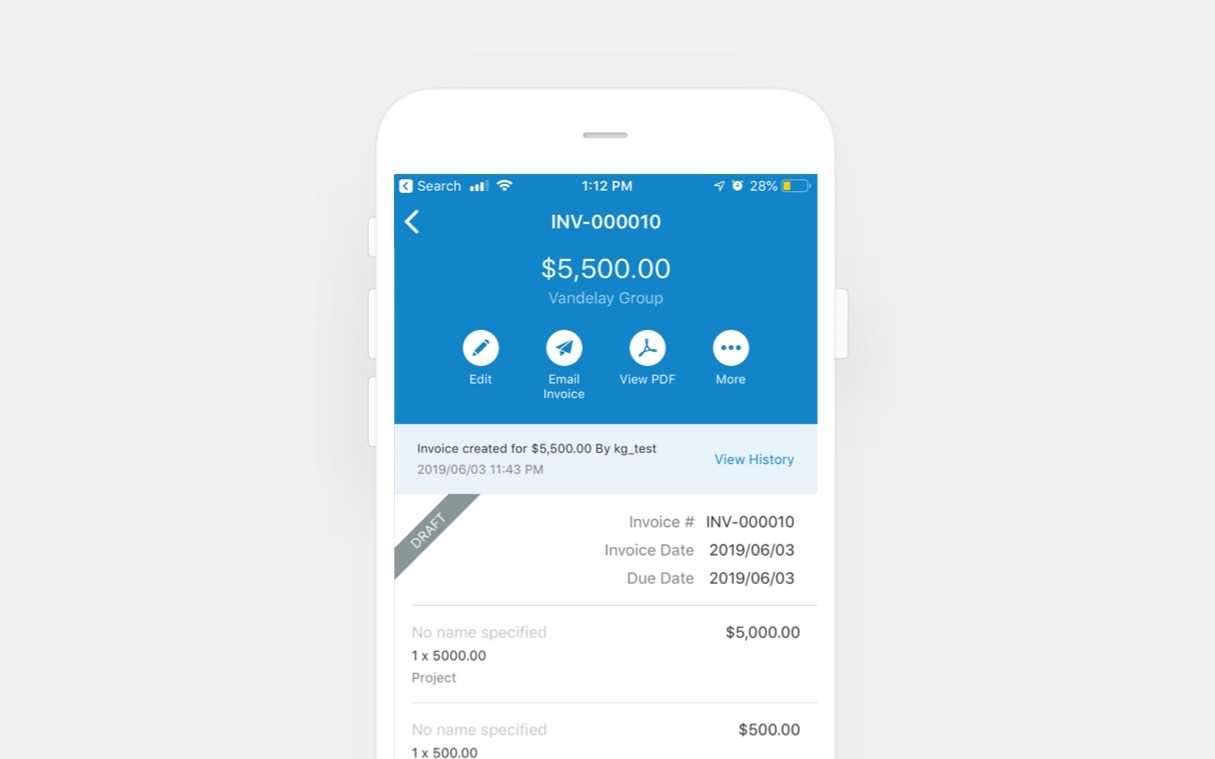

Mobile Invoicing Apps for iPhone

Mobile apps designed for creating payment documents provide an easy and efficient way to manage billing tasks directly from your phone. These applications offer a wide range of features, from creating professional requests to tracking payments, all without the need for a computer. Whether you’re a freelancer, a small business owner, or a contractor, using a mobile app can save you time and make the billing process more seamless and accessible.

When selecting a mobile app for managing your financial documents, it’s important to choose one that aligns with your business needs. Look for apps that offer customizable features, such as the ability to add your company logo, select specific payment terms, and adjust design layouts. Easy sharing options are also essential, allowing you to quickly send your completed documents to clients via email, text, or even directly through payment platforms.

Additionally, many apps offer tracking capabilities, so you can monitor payments, send reminders, and manage multiple clients or projects in one place. The best apps also support cloud storage integration, meaning you can access your documents from any device, ensuring you never lose important records. With all these features, mobile invoicing apps are an ideal solution for modern businesses looking to streamline their billing processes while maintaining a professional edge.

Benefits of Using iPhone for Invoicing

Using a mobile device for creating and managing billing documents offers a range of benefits, especially for busy professionals and small business owners. The portability of a smartphone means you can handle financial tasks from anywhere–whether you’re at a client’s office, traveling, or working remotely. This level of flexibility ensures that you can maintain a streamlined workflow without needing access to a desktop or laptop.

Increased Efficiency and Time Savings

One of the key advantages of using a mobile device for payment management is the speed and efficiency it offers. Most apps allow you to generate professional documents in a matter of minutes, reducing the time spent on administrative tasks. With features like pre-filled client details, customizable fields, and automatic calculations, the process becomes quick and error-free, helping you focus on what matters most–your business.

Seamless Access and Sharing

Another significant benefit is the ease of access and sharing. Once a document is created, you can instantly send it via email, messaging apps, or directly to a client’s payment platform. With cloud storage integration, you can also securely store and retrieve your files from any device, ensuring you never lose important records. This makes it easier to keep track of your financials and maintain clear communication with clients.

Using a mobile device for financial documentation not only improves efficiency but also enhances professionalism. With the ability to create, customize, and share payment requests at any time, you ensure that your business looks polished and responsive, helping to build trust and credibility with clients.

Step-by-Step Guide to Creating Invoices

Creating professional payment documents on your mobile device is a simple process that can be done in just a few steps. With the right tools, you can quickly generate accurate and clean documents tailored to your specific needs. This guide will walk you through the essential steps to create and send a payment request, ensuring that your documents look polished and are ready for immediate delivery.

Step 1: Choose the Right App

Start by selecting an app designed for generating financial documents. There are plenty of free and paid options available, each with different features. Look for an app that is user-friendly, customizable, and offers necessary functionalities such as automatic calculations, customizable fields, and secure sharing options. Once you’ve chosen your app, open it and get ready to start creating your document.

Step 2: Enter Client and Service Details

Next, input the essential information for your document. Begin with the client’s name, address, and any relevant contact information. Then, add the details of the products or services you provided, including quantities, rates, and any applicable taxes. Most apps will automatically calculate totals and taxes, saving you time and reducing the risk of errors.

Once all the information is filled in, review the document to ensure accuracy. Customize the design if necessary, adding your company logo, payment terms, or any additional notes you may want to include. After making the final adjustments, your document is ready to be sent.

By following these simple steps, you can easily create professional-looking payment documents from your mobile device, keeping your workflow smooth and efficient no matter where you are.

Exporting and Sharing Invoices from iPhone

Once you’ve created a professional payment document on your mobile device, the next step is to export and share it with your client. The process is simple and can be done in just a few taps, allowing you to quickly send your documents for review or payment. Mobile apps designed for this purpose typically offer various export and sharing options, making it easy to deliver your completed documents securely and efficiently.

There are several methods available for exporting and sharing your payment documents, depending on the features of the app you are using. Below are some of the most common options:

- Email: One of the easiest ways to send your document is by attaching it to an email. Most apps allow you to directly email your document to your client in PDF or other formats.

- Messaging Apps: For quicker communication, you can send the document via SMS, WhatsApp, or other messaging platforms that support document sharing.

- Cloud Storage: Save your document to cloud storage (like Google Drive or iCloud) and share the link with your client for secure access to the file.

- Payment Platforms: If you use services like PayPal, some apps allow you to send your payment document directly through the platform, streamlining the payment process.

After selecting the preferred method, simply follow the prompts to export or send the document. Many apps allow you to track whether the client has received or viewed the document, adding another layer of convenience to the process.

By utilizing these options, you can easily ensure that your completed documents are shared quickly and professionally, keeping your workflow efficient and your clients satisfied.

How to Add Your Business Logo

Including your business logo in financial documents is a simple yet effective way to create a more professional and branded appearance. Many mobile apps that allow you to create payment documents provide an easy way to add your logo directly to the design. This ensures consistency in your brand identity, even when managing your finances on the go. Adding a logo also helps clients immediately recognize your brand, making your documents look more polished and credible.

Step 1: Prepare Your Logo

Before adding your logo to your document, make sure it is in an appropriate file format, such as PNG or JPG. The file should have a high resolution for clarity, but also be small enough in size to upload easily. Most apps will allow you to upload an image directly from your phone’s gallery or cloud storage.

Step 2: Add Your Logo to the Document

Once you have your logo file ready, follow these steps to add it to your payment document:

- Open your chosen app and create a new payment request or select an existing one.

- Navigate to the customization or branding section of the app.

- Look for an option to upload or insert your logo into the document.

- Select the logo file from your phone or cloud storage and adjust its size and position if needed.

- Save the changes and preview the document to ensure your logo is displayed correctly.

Most apps will allow you to move, resize, or even change the alignment of your logo to fit the layout of the document. Make sure it is placed in a prominent yet unobtrusive position, usually at the top of the page or in the header area.

| Step | Action | ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Prepare a high-resolution logo in PNG or JPG format. | ||||||||||||||||||||

| 2 | Upload the logo from your device or cloud storage. | ||||||||||||||||||||

| 3 | Resize and position the logo to fit the document. | ||||||||||||||||||||

| 4 | Save your document and review the final

Common Mistakes When Using Invoices on iPhoneWhile mobile apps designed for creating payment documents are incredibly convenient, there are a few common mistakes that users often make when working with them. These mistakes can lead to errors in your records, missed payments, or unprofessional-looking documents. By being aware of these pitfalls, you can ensure that your financial documents are accurate and reflect your business’s professionalism. Here are some of the most frequent mistakes to avoid when generating and sending payment documents from your mobile device:

Avoiding these common mistakes can help you create accurate, professional-looking payment documents that reflect positively on your business. Taking a few extra minutes to review your documents and settings can save time and trouble in the long run. How to Manage Invoice Templates on iPhoneManaging pre-designed payment document formats on your mobile device allows you to streamline the process of creating and sending billing requests. By organizing and customizing these formats, you can quickly generate accurate and professional documents tailored to each client’s needs. This section will guide you through the steps to efficiently manage your documents on your mobile device, ensuring you can create and store them without hassle. Step 1: Organize Your Saved FormatsFirst, it’s essential to keep your formats organized. Most apps allow you to save and categorize different designs for future use. You can create separate folders or labels based on your client types or services offered. This ensures that when you need to generate a document, you can quickly find the right format without searching through multiple options.

Step 2: Customize and Update Your DocumentsOnce your formats are organized, you can easily customize them for each new document. Most apps allow you to modify the details such as client information, items or services provided, and payment terms. You can also adjust the layout, add your logo, or change the color scheme to maintain a consistent look across all your documents. Additionally, it’s important to periodically update your formats to reflect any changes in your business. This could include adjusting tax rates, payment terms, or adding new services. Keeping your designs up to date ensures that every document you send is accurate and relevant. By managing your payment document formats efficiently on your mobile device, you’ll save time and ensure that your business remains organized and professional when communicating with clients. Tracking Payments with iPhone Invoice TemplatesTracking payments for your services or products is an essential part of managing your business finances. With mobile apps designed for generating billing documents, you can easily monitor the status of each payment, ensuring you never miss a due amount or forget a pending transaction. By using these apps to track payments, you can maintain a clear overview of your cash flow and quickly identify outstanding balances. Many mobile apps designed for creating financial documents offer built-in features to help you track payments effectively. These features allow you to mark invoices as paid, send reminders for overdue payments, and even generate reports on your financial history. Below is a table outlining how you can use these features to stay on top of your payments:

Using these tracking features not only helps you stay organized but also allows you to quickly address any payment issues with your clients. By having a clear view of your financial status, you can avoid cash flow problems and ensure your business runs smoothly. Syncing Invoices Across Multiple DevicesEfficiently managing your financial documents across multiple devices is key for staying organized and responsive to client needs. Syncing payment records ensures that no matter where you are or what device you’re using, you have immediate access to up-to-date and accurate documents. Whether you’re at your desk, on the go, or working remotely, syncing allows you to create, edit, and share documents seamlessly across all your devices. To synchronize your payment documents, you typically need to enable cloud integration or use apps that support multi-device sync. This ensures that any changes made to a document on one device will be reflected instantly across all others. Below are some key benefits of syncing payment records across multiple devices:

Most apps designed for financial documentation offer easy syncing options, allowing you to connect your account to cloud services like Google Drive, Dropbox, or iCloud. By setting up automatic syncing, you’ll ensure your documents are always up-to-date, no matter what device you use. Enhancing Invoice Security on iPhoneWhen handling financial documents on your mobile device, security is a top priority. Protecting sensitive data, such as payment details and client information, is essential to prevent unauthorized access and ensure privacy. Fortunately, there are several ways to enhance the security of your documents on your phone, making it more difficult for unauthorized users to access or tamper with your records. Here are some key practices to improve the security of your payment documents when using your mobile device:

By implementing these security practices, you can safeguard your financial documents and reduce the risk of data breaches, ensuring that your business and client information remains private and secure. Integrating Invoicing with Accounting SoftwareIntegrating your payment document management system with accounting software can significantly streamline your financial processes. By linking the two, you can automatically transfer data from billing records to your accounting system, reducing the need for manual entry and minimizing the chance of errors. This integration helps you maintain accurate financial records, track income and expenses in real-time, and generate reports more efficiently. When you integrate your billing processes with accounting software, you can synchronize data such as payment amounts, client details, and due dates directly to your financial management system. This allows for smoother reporting, tax calculations, and financial planning. Here’s a simple comparison table showing the benefits of such integration:

Integrating these two systems is typically straightforward, with many popular accounting software tools offering built-in connectors to well-known billing apps. If you use cloud-based solutions, the setup process often involves linking your accounts, allowing them to sync automatically. With this integration, you can spend less time on administrative tasks and more time focusing on growing your business. |