Best Invoice Templates for Office 365 to Simplify Your Billing

Managing your business’s financial transactions can be a time-consuming and tedious task, but with the right resources, it becomes significantly easier. Instead of starting from scratch with each new billing cycle, you can rely on customizable documents that help maintain a professional look while saving you time. These documents can be tailored to your needs and quickly generated whenever required, making them a vital tool for any small business or freelancer.

Using advanced software solutions, you can create and personalize these documents to reflect your brand’s identity, ensuring that each communication with your clients is clear, consistent, and professional. The integration of powerful features like automated calculations, easy editing options, and secure sharing capabilities makes it easier than ever to manage your transactions efficiently. Time is money, and using the right resources allows you to focus on growing your business rather than spending hours on administrative tasks.

In this guide, we’ll explore how these tools can transform your billing process, offering a range of features that support both efficiency and accuracy. Whether you’re an entrepreneur or managing a larger team, having access to the right set of resources can streamline your workflow and enhance your financial management practices.

Invoice Templates for Office 365

When it comes to managing your billing documents, having a simple yet effective solution can save a lot of time. With the right tools, you can quickly generate documents that meet your professional standards without the need for starting from scratch each time. These tools are designed to provide easy-to-use, customizable formats, making the process faster and more efficient.

Why Use Pre-Designed Documents?

Utilizing pre-designed solutions provides several key advantages, including:

- Consistency: With pre-built structures, you ensure that all your communications maintain a uniform look, reflecting your business’s professionalism.

- Time-saving: Save time by not having to recreate documents each time you need them, which speeds up your billing process.

- Ease of Use: These formats are designed to be intuitive and simple, allowing you to customize details quickly and efficiently without requiring advanced design skills.

Key Features of Billing Tools

Modern solutions offer several features that can enhance your experience and streamline the process:

- Customizable Layouts: Modify the layout to fit your needs, adding logos, changing colors, or adjusting the structure of the document.

- Automated Calculations: Many tools come with built-in formulas that automatically calculate totals, taxes, or discounts, reducing the chance for errors.

- Multiple Export Options: Whether you need a PDF, Word document, or even a direct email, these tools often provide various export options for convenience.

By using these tools, you can not only save valuable time but also improve the accuracy and consistency of your billing communications. Whether for freelancers, small businesses, or larger enterprises, these resources can be a game-changer in managing your financial documentation efficiently.

Why Choose Office 365 for Invoices

When it comes to managing your financial documentation, finding a reliable and efficient platform is essential. A comprehensive suite of tools offers the flexibility to create, manage, and share professional documents seamlessly. With its integration across multiple applications, it enables users to easily customize their files, automate key processes, and ensure consistency in all communications with clients and partners.

One of the major benefits of using this suite is its ease of access and collaboration features. Whether you’re working alone or as part of a team, the ability to store, edit, and share documents in real time is invaluable. Cloud-based solutions ensure that your files are always up-to-date and accessible from any device, giving you the freedom to work from anywhere without losing control over your documents.

Another key advantage is the rich set of built-in features designed to enhance productivity. These tools offer powerful editing capabilities, automated data handling, and customizable options that make managing your financial records faster and more accurate. By leveraging these features, users can streamline their workflow, reduce errors, and improve the overall quality of their documentation.

In addition, seamless integration with other services makes it easier to connect and manage all aspects of your business. From tracking expenses to generating reports, the suite provides a unified approach to handling various administrative tasks, saving you time and effort.

How to Create Custom Invoice Templates

Creating personalized documents for your business transactions is easier than ever. With the right tools, you can design a professional format that fits your branding and meets all your operational needs. Customizing these files allows you to include relevant details, adjust the layout, and ensure that your communications are clear and consistent.

Step 1: Choose a Platform

Start by selecting the right software for designing your documents. Popular tools in the suite provide pre-built layouts that can be easily edited. These platforms allow you to start with a basic structure and modify it according to your needs, ensuring flexibility and ease of use.

Step 2: Personalize the Design

Once you’ve chosen a starting point, focus on customization. Consider the following:

- Add Your Branding: Incorporate your logo, business colors, and contact information to make the document recognizable.

- Adjust the Layout: Modify the sections to suit your needs, such as adding space for terms, payment details, or due dates.

- Use Formulas: Implement automatic calculations to save time on manual input and reduce errors.

Customizing these features allows you to create a document that is both functional and aligned with your business image. With just a few tweaks, you can easily develop a professional-looking file that fits your specific requirements.

Free Invoice Templates in Office 365

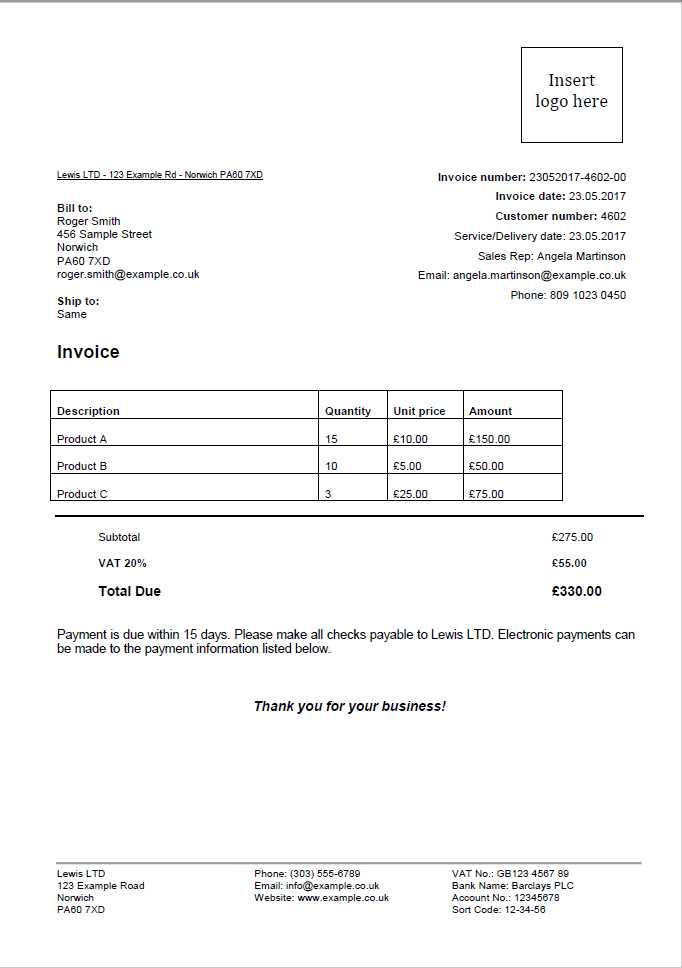

For businesses looking to save time and money, there are a variety of free, pre-built document designs available to streamline the process of creating professional communications. These ready-to-use formats offer a great starting point, allowing users to easily customize the content and structure without needing advanced design skills. With a range of options to choose from, you can select the best layout for your needs and get started immediately, saving valuable time while maintaining a polished and consistent look.

These free solutions are part of a larger suite of productivity tools that integrate seamlessly with other services. By leveraging these options, businesses can quickly generate personalized documents, perform calculations automatically, and share them securely–all without the need for expensive software. Whether you are a small business owner, freelancer, or part of a larger organization, these resources can significantly reduce the effort involved in managing day-to-day administrative tasks.

Benefits of Using Digital Invoices

Switching from paper-based documents to digital formats offers numerous advantages for businesses and individuals alike. Not only does it streamline your workflow, but it also ensures greater accuracy, efficiency, and security. Digital documents can be easily created, edited, and shared, reducing the amount of time spent on administrative tasks while enhancing your professional image.

Here are some key benefits of using digital records for your business transactions:

- Efficiency: Creating and sending documents digitally is faster and more convenient, allowing you to manage multiple transactions in less time.

- Cost-effective: By eliminating the need for paper, printing, and postage, businesses can significantly cut down on operational costs.

- Automated Processes: Many digital solutions allow you to automate certain elements, such as calculations or recurring transactions, reducing the likelihood of human error.

- Easy Accessibility: Digital documents can be accessed and edited from anywhere, at any time, on any device, giving you flexibility and control.

- Environmentally Friendly: Reducing paper usage helps lower your environmental footprint, making your business practices more sustainable.

By making the switch to digital, you can simplify your financial processes, improve your overall productivity, and contribute to a greener planet. It’s a smart choice for businesses of all sizes looking to modernize and stay competitive in today’s fast-paced world.

Step-by-Step Guide to Using Templates

Creating professional documents doesn’t have to be a time-consuming task. With pre-designed structures, you can quickly generate customized materials that meet your business needs. These ready-made formats are simple to modify, enabling you to add your details, make adjustments, and ensure consistency across all your communications.

Follow these easy steps to begin using these customizable layouts:

- Step 1: Choose the Right Platform – Start by selecting a platform that offers a wide range of customizable formats. Make sure it’s compatible with your existing tools and workflows.

- Step 2: Select a Starting Design – Browse through available options and choose a layout that fits the style of your business. Most platforms offer a variety of designs to suit different industries.

- Step 3: Customize the Content – Replace the placeholder information with your specific details, such as company name, address, and transaction data. Adjust the sections as needed to fit your requirements.

- Step 4: Add Key Features – Implement additional elements like payment terms, due dates, and other important notes. Many platforms also allow you to add logos or branding elements to personalize your document.

- Step 5: Review and Save – Once you’ve made your changes, double-check for accuracy. After reviewing, save the document in your preferred format for easy sharing or printing.

By following this simple process, you can create professional and customized documents in minutes, improving efficiency and consistency across your business operations.

Top Features of Office 365 Invoice Tools

When it comes to managing financial documents, the right set of tools can make a significant difference in efficiency and accuracy. Office 365 offers powerful features designed to streamline the process, making it easier to create, customize, and track documents with minimal effort. These tools provide a range of functionalities that can automate repetitive tasks, ensure consistency, and help you stay organized, all while offering flexibility and ease of use.

Key Benefits of Using Office 365 Tools

The tools available in the suite come with several useful features that improve productivity and accuracy:

| Feature | Description |

|---|---|

| Cloud Integration | Access your documents from anywhere, on any device, ensuring that your records are always up to date and available in real-time. |

| Customizable Layouts | Modify the design to fit your brand’s identity, adding logos, adjusting colors, and rearranging sections to suit your needs. |

| Automated Calculations | Save time and reduce errors with built-in formulas that automatically calculate totals, taxes, and discounts. |

| Secure Sharing | Easily share your documents with clients or team members, ensuring that sensitive information is protected with secure access controls. |

| Integration with Other Tools | Connect seamlessly with other applications such as spreadsheets, accounting software, and email clients to manage your workflow more efficiently. |

Why These Features Matter

These capabilities significantly enhance the overall user experience, reducing time spent on manual tasks and improving the overall accuracy of your financial records. With a user-friendly interface, cloud access, and powerful automation, these tools make managing your business operations easier, more efficient, and more secure.

How to Customize Your Invoice Layout

Personalizing the structure of your business documents allows you to create a more professional and cohesive appearance while reflecting your brand identity. Customization ensures that your documents are tailored to your specific needs, whether it’s adding your logo, adjusting text placement, or incorporating additional sections for specific information. By making these adjustments, you not only improve the visual appeal of your materials but also enhance clarity and readability for your clients.

Follow these simple steps to customize the layout of your business documents:

- Choose the Right Structure: Start by selecting a format that aligns with your needs. Choose a layout that suits the type of transaction you’re handling, whether it’s for a one-time purchase or a recurring service.

- Incorporate Your Branding: Add your company logo, business colors, and contact details at the top. This ensures that your documents reflect your brand and are easily identifiable.

- Adjust the Sections: Customize the sections to match the information you need. Common sections include item descriptions, quantities, prices, terms of payment, and due dates. You can add or remove sections as needed.

- Modify Text and Fonts: Change font styles, sizes, and alignments to match your brand’s aesthetic. Ensure that key information stands out clearly, such as due dates or payment terms.

- Use Automatic Calculations: Set up fields that automatically calculate totals, taxes, or discounts. This saves time and ensures accuracy without having to manually input figures.

Once you have made your adjustments, you can save your layout for future use, allowing you to create consistent, professional documents quickly and easily. Customizing your documents will help establish a polished, cohesive look that your clients will appreciate.

Saving Time with Automated Invoice Generation

Manual creation of business documents can be a time-consuming task, especially when you’re handling multiple transactions every day. Automating the process not only saves time but also reduces the chances of human error. With the right tools, you can set up automated workflows that generate these documents with minimal input, freeing up time to focus on more important aspects of your business.

How Automation Simplifies the Process

Automating document creation ensures that the same data is consistently used across all transactions, eliminating the need for repetitive manual entry. Here’s how automation can help:

- Pre-filled Information: Set up standard fields such as client details, payment terms, and pricing so that they are automatically populated each time you generate a document.

- Recurring Transactions: For subscription-based services or regular payments, automation can schedule and generate documents on a set date, without the need for intervention.

- Instant Calculations: Automated tools can calculate totals, taxes, and discounts in real-time, reducing the time spent on manual math and preventing errors.

- Automatic Reminders: Set up automatic reminders for clients with outstanding payments, saving you the effort of manually tracking overdue accounts.

Benefits of Automation

By automating your document generation, you can increase efficiency and improve accuracy. This not only reduces the time spent on repetitive tasks but also helps maintain consistency across all documents. The result is faster processing, fewer errors, and more time to focus on growing your business.

Integrating Invoice Templates with Excel

Integrating business document formats with spreadsheet software can significantly enhance your workflow. By combining the power of data management with customizable document creation, you can automate many aspects of your financial transactions. With tools like Excel, you can streamline processes, ensure accuracy, and reduce the time spent on repetitive tasks.

Excel offers a range of features that allow you to link data between spreadsheets and your professional documents. This integration enables you to use data directly from your spreadsheets, such as client information, product details, or pricing, and automatically populate these fields in your customized documents. Here’s how you can integrate these tools for a smoother workflow:

- Importing Data Automatically: Use Excel to store client data and transaction history. With the right settings, you can pull this information directly into your documents, reducing the need for manual data entry.

- Automated Calculations: By linking your spreadsheet to your document, you can automatically calculate totals, taxes, and discounts, ensuring accuracy and saving time.

- Consistent Data Updates: When you update client or product details in Excel, these changes are reflected in your documents, helping to maintain consistency across all records.

- Template Synchronization: Once set up, you can easily generate new documents by syncing them with your spreadsheet data, making the process faster and more efficient.

By integrating these tools, you can work more efficiently, improve accuracy, and reduce the manual effort involved in creating professional business documents. Whether you’re working with a small team or managing a larger operation, this integration can simplify your workflow and boost overall productivity.

Using Word for Professional Invoices

Microsoft Word is a versatile tool that can help you create professional-looking documents for your business needs. With its user-friendly interface and a wide range of customization options, Word allows you to design polished documents that reflect your brand while including all necessary details in a clear and organized manner. Whether you’re dealing with clients, vendors, or customers, Word offers the flexibility to generate high-quality business correspondence quickly and efficiently.

By using Word, you can create customized layouts, incorporate your business logo, and add dynamic elements such as dates, payment terms, and itemized lists. Word also allows you to save your work as a reusable file, so you don’t have to start from scratch each time. Here are some ways Word helps streamline the process of generating professional business documents:

- Customizable Layouts: Word offers various design options, from simple to more elaborate formats, enabling you to personalize documents to your preferences.

- Text and Data Management: You can easily input and organize key information such as customer details, products, or services, while Word’s formatting options ensure everything remains visually appealing.

- Document Automation: Use Word’s fields and automated functions to update data like dates and totals without having to manually enter this information every time.

- Ease of Sharing: Word documents can be saved and shared in a variety of formats, including PDF, making it easy to send documents electronically while ensuring they look professional when printed.

By leveraging the features of Word, you can produce high-quality, customized documents that maintain your professionalism and save time, all while ensuring your clients have all the information they need in one clear and concise format.

Creating Recurring Invoices in Office 365

Managing regular payments for services or subscriptions can be time-consuming, but automating this process makes it much more efficient. By setting up recurring documents, you can ensure that your clients receive the correct charges on time without needing to manually create each record. This is especially helpful for businesses that work with ongoing contracts, monthly billing, or subscription-based services.

Office 365 tools provide features that enable you to create and schedule recurring transactions easily. With just a few simple steps, you can set up your system to automatically generate and send out these documents according to your preferred frequency. Here’s how to get started:

- Set Up Templates for Recurring Data: Create a base format for your regular transactions, including all standard details like client name, service description, and pricing. Once set, you can easily apply it each time a new document is due.

- Automate Data Input: Use linked spreadsheets or databases to pull in the latest client details and transaction information automatically. This eliminates the need to manually update each document.

- Schedule Automatic Generation: Many platforms within the suite allow you to schedule when documents should be generated, so they are created and ready to be sent at the right time without additional intervention.

- Ensure Consistent Communication: By automating recurring transactions, you ensure that all communications are consistent and professional, helping to build trust with your clients.

By automating the creation of recurring business documents, you not only save valuable time but also reduce the risk of errors. This setup allows for smoother cash flow management and a more efficient billing process, giving you more time to focus on growing your business.

Tracking Payments with Invoice Templates

Efficient payment tracking is essential for maintaining healthy cash flow and staying on top of outstanding transactions. By using pre-designed business document formats, you can easily keep track of which payments have been received and which are still pending. With the right tools, you can automate much of the tracking process, ensuring that no transaction goes unnoticed and that reminders are sent out on time.

How Automated Tracking Can Help

By utilizing built-in tracking features, you can quickly monitor the status of payments and ensure that all outstanding amounts are accounted for. Here’s how to improve your tracking process:

- Real-time Payment Updates: Link your document system with accounting or financial software to receive real-time updates about paid and overdue transactions.

- Automated Status Indicators: Set up status tags such as “Paid,” “Pending,” or “Overdue” that are automatically updated as payments are received or processed.

- Custom Reminders: Schedule automatic reminders to be sent to clients who have overdue payments, reducing the need for manual follow-ups.

- Detailed Payment History: Keep a detailed record of all transactions associated with each client, allowing you to quickly refer to past payments and identify any discrepancies.

Benefits of Tracking Payments Efficiently

With a robust payment tracking system in place, you can reduce administrative burden, improve cash flow, and ensure timely collections. By automating the process, you also minimize the chance of human error, ensuring that all payments are correctly recorded and monitored. This streamlined approach saves time and helps maintain professional relationships with clients by keeping payment-related communication organized and clear.

How to Share Invoices Efficiently

Sharing business documents with clients, partners, or team members quickly and securely is a crucial part of maintaining smooth operations. Whether you’re sending a payment request or providing a detailed statement, it’s important to choose the right method to ensure the document reaches the recipient without delay and remains accessible. Efficient sharing not only saves time but also reduces the chances of errors or miscommunications.

Here are some key strategies to ensure that your documents are shared efficiently:

- Use Cloud Storage: Storing your documents in the cloud ensures that they are easily accessible from any device, anywhere. Platforms like OneDrive or Google Drive make it simple to share documents via a secure link, so the recipient always has access to the latest version.

- Send via Email with Clear Instructions: When sharing documents through email, ensure the message is clear and includes any necessary instructions, such as payment terms or deadlines. Attach the document in a common format like PDF for easy viewing and security.

- Leverage Automated Systems: Set up automated workflows that send out documents as soon as they are generated. This reduces the time between creation and delivery, making the process seamless for both you and your client.

- Ensure Document Security: Use password protection or encryption when sending sensitive information. This ensures that only the intended recipient can access the document, safeguarding confidential details.

- Track Document Delivery: Use tools that allow you to track when the document is opened or downloaded. This feature helps you stay informed about the recipient’s engagement with the document and follow up if necessary.

By streamlining how you share business documents, you can speed up processes, avoid delays, and keep your workflow organized. Choosing the right method for sharing not only improves efficiency but also ensures that your professional materials are delivered in a timely, secure, and clear manner.

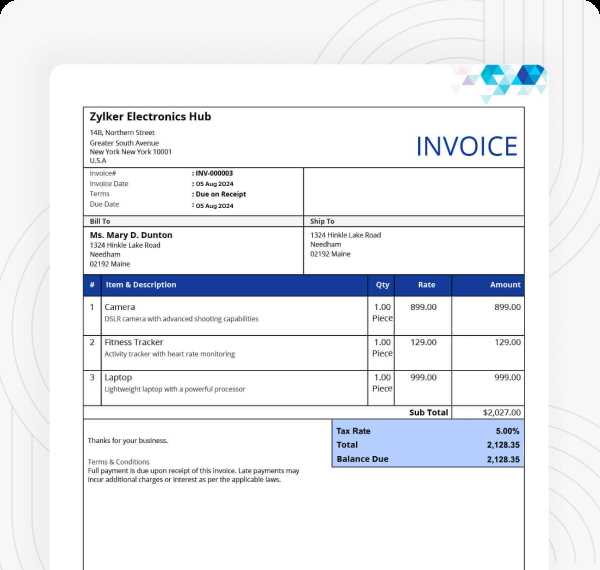

Best Practices for Invoice Design

Creating a professional and easy-to-read document is crucial for establishing trust with clients and ensuring that the terms of the transaction are clear. The design of your business documents should be clean, organized, and visually appealing, while ensuring that all necessary details are easy to find. A well-designed document reflects your professionalism and helps facilitate smooth communication with your clients.

Key Elements of Effective Document Design

When designing your business documents, certain elements should be prioritized to enhance clarity and ensure all necessary information is included. Below are some best practices for creating an effective layout:

- Consistency in Formatting: Use consistent fonts, headings, and spacing to maintain a cohesive look. This ensures that the document looks polished and is easy to read.

- Clear Sectioning: Organize your document into clear sections, such as “Client Information,” “Services Provided,” and “Payment Terms.” This allows recipients to quickly find what they are looking for.

- Professional Branding: Include your company logo and business colors to reinforce your brand identity. A professional design adds credibility and makes your document recognizable.

- Legible Font Size: Use legible fonts and appropriate font sizes. Ensure the text is large enough for easy reading, but not so large that it becomes visually overwhelming.

Using Tables for Clear Organization

Tables can help you organize detailed information such as products, quantities, and prices in a way that is visually appealing and easy to follow. Below is an example of how to structure this information in a table format:

| Item | Description | Quantity | Unit Price | Total |

|---|---|---|---|---|

| Service A | Detailed description of service A | 1 | $100 | $100 |

| Service B | Detailed description of service B | 2 | $50 | $100 |

Using a table like this helps break down information clearly, ensuring your clients can easily review the items or services provided and their corresponding costs. The organization of the content helps avoid confusion and promotes transparency.

By following these best practices for document design, you can ensure that your documents look professional, are easy to read, and provide all the necessary information in a clear and concise manner.

Common Mistakes to Avoid with Invoices

Even the most experienced business owners can make mistakes when creating essential financial documents. These errors can cause delays in payments, miscommunications with clients, and in some cases, financial losses. Avoiding common pitfalls in document creation can help ensure that your records are accurate, clear, and professionally presented.

Key Mistakes to Avoid

Here are some of the most common mistakes that can occur during the process of preparing business documents, and how to avoid them:

- Missing or Incorrect Client Information: Failing to include the correct contact details for your clients or using outdated information can delay communication and payments. Always double-check names, addresses, and contact information before sending out any documents.

- Inaccurate Payment Terms: Not specifying clear payment terms (e.g., net 30, net 60) or including the wrong payment due dates can cause confusion and missed deadlines. Be sure to clearly state when payment is due and how it should be made.

- Omitting Important Details: Leaving out crucial information such as the description of services or items, quantities, or pricing can make it difficult for your clients to understand what they are being charged for. Ensure that every detail is included and easy to read.

- Using Unprofessional Language: Using informal or unprofessional language in your documents can undermine your business’s credibility. Keep your tone polite and formal, and avoid slang or overly casual expressions.

- Overcomplicating the Design: While it’s important to look professional, overly complex designs can confuse the reader and make it hard to find important information. Stick to simple, clean layouts that highlight key details clearly.

How to Avoid These Mistakes

To prevent these common errors, take the time to double-check every document before sending it out. It helps to have a standard checklist for each document you create, including the following:

- Client’s name and contact information

- Clear breakdown of services or products provided

- Accurate payment terms and due dates

- Professional, readable design

- Correct spelling and grammar

By avoiding these simple mistakes and adhering to best practices, you can ensure that your documents are professional, clear, and conducive to smooth business transactions.

Securing Your Invoices in Office 365

When handling sensitive financial documents, security is paramount. Ensuring that your records are protected from unauthorized access or potential breaches helps maintain the confidentiality of your transactions and builds trust with your clients. Fortunately, modern tools offer several methods for securing your documents, making it easier to safeguard important data.

Methods for Enhancing Document Security

There are a variety of ways to secure your business records in digital formats. Implementing the following measures can help protect your files:

- Password Protection: One of the easiest ways to secure your documents is by setting up password protection. This ensures that only authorized individuals can access or modify the document.

- Encryption: Encrypting your files provides an additional layer of security. Even if someone gains access to the file, encryption ensures that the contents remain unreadable without the correct decryption key.

- Restricted Access Permissions: With cloud-based storage, you can restrict access to your documents by setting permissions for specific individuals or teams. This ensures that only those with the appropriate authorization can view or edit the files.

- Audit Trails: Enabling audit trails allows you to monitor who has accessed your documents and what changes have been made. This is particularly useful for tracking unauthorized access or detecting potential issues quickly.

Best Practices for Secure Document Sharing

While securing the documents themselves is important, sharing them securely is just as critical. Consider these best practices when sharing your financial records:

- Use Secure Platforms: When sharing documents, always use secure, trusted platforms that provide end-to-end encryption and ensure the integrity of your files during transmission.

- Limit External Sharing: Avoid sharing sensitive records with third parties unless absolutely necessary. If you must, ensure that the recipients are trustworthy and that access is temporary, with clear guidelines on what can be shared and when.

- Set Expiration Dates: Many cloud-based platforms allow you to set expiration dates for links to documents. This feature ensures that files are not accessible indefinitely, reducing the risk of unauthorized access over time.

By adopting these security measures, you can significantly reduce the risk of unauthorized access to your financial records, ensuring the safety and confidentiality of your transactions.

Additional Tools to Enhance Invoicing

To streamline the process of managing financial transactions, there are several powerful tools available that can help businesses create, send, and track payment requests more efficiently. These tools are designed to automate repetitive tasks, improve accuracy, and ensure that both business owners and clients can easily manage payment-related activities. By integrating these tools into your workflow, you can save time, reduce errors, and improve overall productivity.

Essential Tools to Boost Your Workflow

Here are some additional tools that can enhance your document management and payment processes:

- Automated Payment Reminders: Sending reminders manually can be time-consuming. Automated systems can send reminders to clients when payments are due, ensuring that deadlines are met without requiring constant follow-up.

- Online Payment Gateways: Integrating an online payment system, such as PayPal, Stripe, or Square, allows clients to pay directly through the document or via a secure link, simplifying the process for both parties.

- Cloud-Based Document Management: Storing your documents in the cloud makes it easier to access, edit, and share files securely. It also provides backup options, so you never have to worry about losing critical financial records.

- Expense Tracking Software: Using specialized software to track your expenses can help you generate reports, analyze your spending habits, and ensure that you’re charging correctly for all the services you provide.

- Accounting Integrations: Connecting your financial documents with accounting software like QuickBooks or Xero enables seamless synchronization of payment records, making it easier to track income and manage taxes.

Advanced Features for Professional Management

For businesses that require more advanced features, there are tools that offer greater customization and more comprehensive functionalities:

- Customizable Branding: Some tools allow you to fully customize the look of your financial documents, adding logos, colors, and custom text, which helps reinforce your brand’s professional image.

- Time-Tracking Integration: If your services are billed by the hour, integrating time-tracking software like Harvest or Toggl can automatically calculate the total amount based on the hours worked, reducing the chances of errors.

- Recurring Payment Setup: For ongoing services, many tools allow you to set up recurring billing schedules. This ensures that clients are billed automatically on a regular basis without the need to manually create new documents each time.

- Mobile Apps for On-the-Go Management: With mobile invoicing apps, you can create and send documents from anywhere, ensuring that business operations continue smoothly even when you’re out of the office.

By integrating these tools into your invoicing system, you can significantly improve efficiency, reduce administrative burden, and ensure a more professional experience for both you and your clients.