NDIS Invoice Template for Simple and Compliant Billing

For businesses or individuals offering services to clients under government programs, maintaining accurate and compliant billing records is crucial. Ensuring that each statement meets the required standards and clearly outlines the services provided is essential for smooth transactions and timely payments. Whether you are a healthcare professional, a support worker, or another type of service provider, having a standardized method for documenting charges can save time and reduce errors.

With the right approach, you can easily manage your financial records while adhering to industry-specific regulations. By customizing your billing statements, you can reflect the services rendered, client information, and payment terms in a way that aligns with the established guidelines. This not only helps ensure that payments are processed correctly but also fosters trust between you and your clients.

Efficiency and clarity are the foundations of a good billing process. Implementing a structured system for preparing these documents helps avoid confusion and ensures that all necessary information is included in a professional format. This guide will show you how to create accurate and compliant billing statements, simplifying your accounting tasks and enhancing your client relationships.

NDIS Invoice Template Overview

When managing billing for services provided under government programs, it’s important to follow a structured and clear approach to ensure proper documentation. A well-organized billing document helps service providers maintain compliance with regulations while offering transparency to clients. These billing forms are designed to capture essential details, such as the services rendered, rates, and payment terms, all in a format that is easy to read and understand.

Key Elements of a Billing Document

To make sure the statement is complete and compliant, certain key elements must be included. These include, but are not limited to:

- Client details and service provider information

- Description of services provided

- Accurate dates of service

- Rates and pricing details

- Total amount due and payment terms

- Unique reference numbers or codes for tracking

Benefits of a Structured Billing Document

Having a standardized format for your billing records offers several advantages:

- Consistency: A standardized approach ensures all necessary information is included every time.

- Efficiency: Saves time in preparing and reviewing statements.

- Compliance: Helps adhere to government guidelines and requirements.

- Professionalism: Enhances your business image by using clear, easy-to-read formats.

By utilizing an organized system for billing, you streamline your workflow and reduce the risk of errors or delays in payment. This level of preparation benefits both the service provider and the client, ensuring that all parties are on the same page regarding costs and expectations.

Why Use an NDIS Invoice Template

Utilizing a structured billing document for services provided under government-funded programs offers numerous advantages. Such forms not only simplify the process of recording transactions but also ensure that all necessary details are included for smooth processing and payment. A well-organized format helps service providers maintain compliance with industry standards, avoid mistakes, and streamline administrative tasks.

Here are the primary reasons why using a standardized billing format is essential:

- Time Efficiency: A predefined structure allows you to quickly fill in the required information without needing to create each document from scratch.

- Accuracy: Pre-set fields reduce the likelihood of missing important details or making manual errors in calculations.

- Compliance: Government regulations often require specific information to be included in billing records. A ready-made format ensures all requirements are met.

- Professional Presentation: Using a polished and clear structure enhances your business’s reputation and ensures that your documents are easy for clients and auditors to understand.

- Consistency: A uniform approach to billing ensures that all your financial documents are aligned, making it easier to track payments and manage your records.

By relying on an established format, service providers can focus more on delivering quality support and less on managing paperwork, knowing that the billing process is efficient and error-free. This not only enhances the client experience but also ensures faster payment cycles and smoother financial operations.

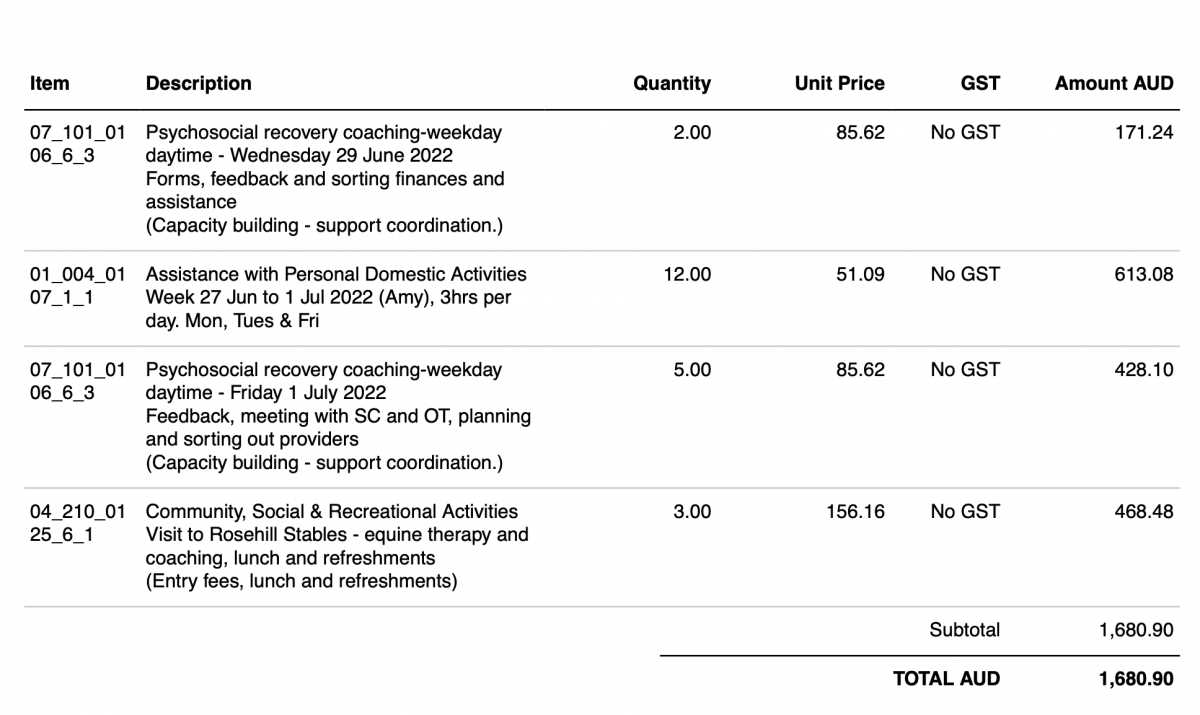

Key Features of an NDIS Invoice

A well-structured billing document is essential for ensuring smooth transactions and proper record-keeping. These documents should capture all the relevant details about the services provided, payment terms, and any necessary reference numbers. The key features of such a document help both the service provider and client easily identify the information required for accurate processing and payment.

Essential Elements of a Billing Document

To ensure clarity and avoid confusion, the following elements must be present in every billing document:

- Provider and Client Details: Clear identification of the service provider and client, including names, contact information, and any relevant identification numbers.

- Service Descriptions: A detailed list of services rendered, including dates, hours worked, and any relevant service codes or descriptions.

- Pricing Information: Clear breakdown of rates, including hourly or flat fees, as well as any additional charges or discounts.

- Total Amount Due: A concise summary of the total amount to be paid, ensuring no ambiguity in the final figure.

- Payment Terms and Methods: Clear instructions on how and when payment should be made, including payment methods accepted.

Why These Features Matter

Including these key elements ensures that both the provider and the client have a transparent record of the services rendered and the agreed-upon costs. A clear structure helps avoid disputes over charges, reduces the likelihood of errors, and speeds up the payment process. Moreover, ensuring compliance with industry standards through these features fosters a professional relationship and facilitates timely payments.

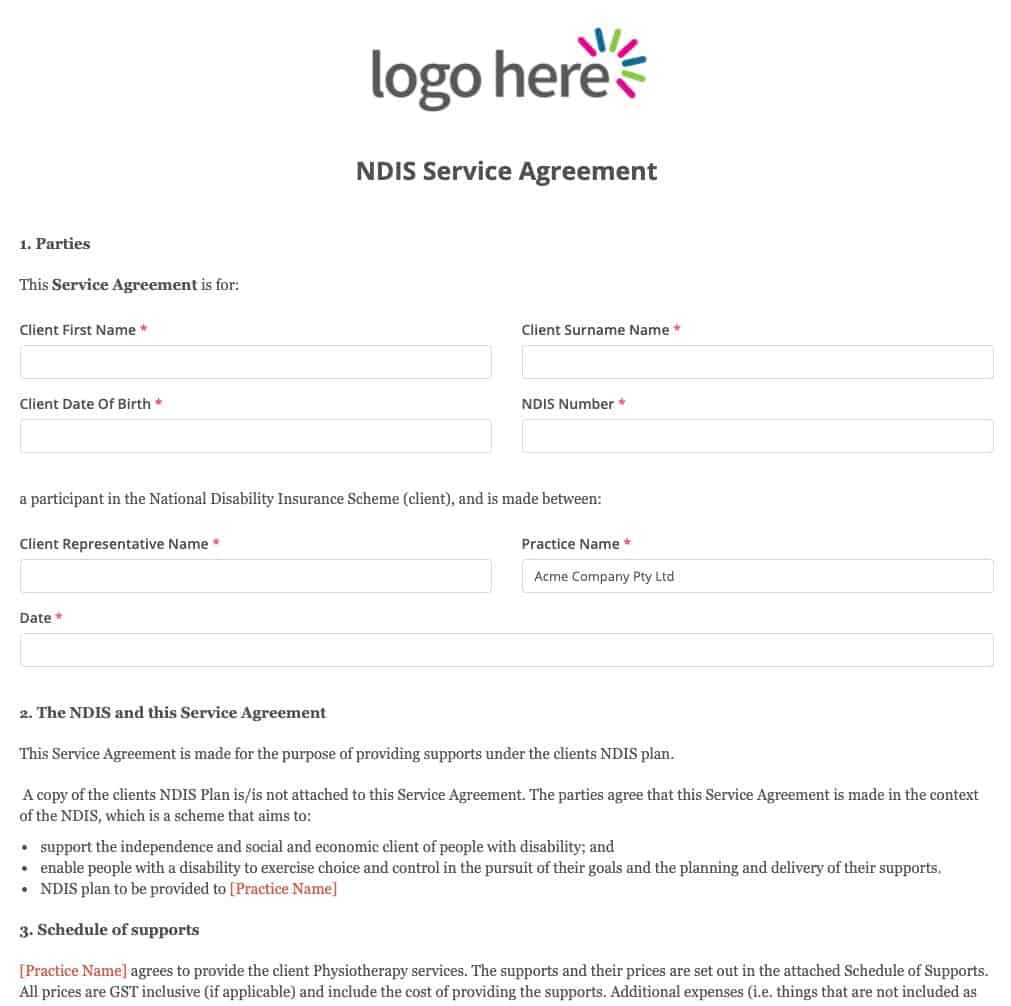

How to Customize Your NDIS Invoice

Customizing your billing document allows you to align it with your business needs while ensuring it meets all necessary requirements. Personalizing the format helps you create a professional and consistent look, while also making it easier to track payments and services. A customized document should reflect the specifics of the services you provide, the clients you serve, and the standards you follow.

Steps to Personalize Your Billing Document

Here are the key steps to follow when customizing your billing record:

- Include Your Branding: Add your logo, business name, and contact details to ensure the document reflects your professional image.

- Client Information: Include the client’s full name, address, and contact details, ensuring accuracy for proper record-keeping.

- Adjust Service Descriptions: Modify the service descriptions to match the specific support or care provided to each client. Use clear, concise language.

- Payment Instructions: Tailor the payment methods and terms to your business, ensuring that clients know exactly how to make payments and by when.

- Add Unique Reference Numbers: This helps both you and the client track the document easily in your accounting system.

Customizing the Layout and Format

The layout of your document plays a critical role in its usability. Here is an example of how to structure the sections effectively:

| Section | Details |

|---|---|

| Header | Include your logo, business name, and client identification details. |

| Service Description | List all services rendered with dates, duration, and individual costs. |

| Total Amount | Display the total charges, including any taxes, fees, or discounts. |

| Payment Information | Provide clear instructions for payment, including bank details or online payment options. |

Customizing your billing documents not only helps maintain a professional appearance but also ensures accuracy and clarity in your communications with clients. By following these steps, you can create a tailored billing system that works best for your business while meeting all regulatory requirements.

Benefits of Using an NDIS Invoice

The utilization of standardized billing documents offers numerous advantages for both service providers and recipients. By adopting a uniform approach to financial transactions, organizations can streamline their processes, enhance clarity, and foster better communication regarding services rendered.

Firstly, employing a consistent billing format reduces the likelihood of errors and misunderstandings. When all parties adhere to a predefined structure, it becomes easier to verify details and ensure accuracy in financial exchanges. This leads to timely payments and minimized disputes.

Additionally, using such documents helps maintain compliance with relevant regulations and guidelines. Providers can ensure that all necessary information is included, which can simplify audits and assessments by regulatory bodies.

Moreover, a clear and professional billing document reflects positively on the organization’s image. It demonstrates a commitment to transparency and professionalism, which can enhance trust and foster long-term relationships with clients.

Finally, the implementation of these standardized documents can significantly improve efficiency. Automation tools can be utilized to generate and manage them, freeing up valuable time for service providers to focus on delivering high-quality care.

Understanding NDIS Billing Requirements

Complying with specific billing guidelines is essential for any organization that provides services within regulated frameworks. These guidelines ensure that transactions are handled with accuracy, transparency, and consistency, benefiting both service providers and their clients.

Accurate record-keeping is a crucial aspect of meeting these requirements. Each billing document must include comprehensive details of the services provided, from dates to descriptions, to ensure a clear and auditable trail. This minimizes discrepancies and helps to resolve any questions that may arise regarding the nature or timing of services rendered.

Another key element is the inclusion of relevant client and provider information. By following these standards, organizations ensure that all necessary identifiers are present, which facilitates efficient processing and assists in maintaining accountability.

Furthermore, adhering to billing guidelines simplifies the reconciliation process. When details align with required structures, it streamlines payment handling and reduces administrative burdens, allowing providers to allocate more time and resources to client care.

How to Ensure NDIS Invoice Compliance

Adhering to established billing standards is essential for maintaining trust, transparency, and regulatory alignment in service transactions. Ensuring that all documentation meets these standards not only reduces errors but also supports a seamless payment process.

Include All Necessary Details

To comply with official requirements, each billing document should contain clear and complete information about the services provided. This includes specific service descriptions, accurate dates, and itemized costs. Such details help create a transparent record that both service providers and clients can reference, minimizing potential misunderstandings.

Verify Client and Provider Information

Accurate identification of both parties involved is crucial for compliance. Each record should feature relevant identifiers, such as unique client codes and provider registration details. This ensures easy traceability and accountability, which are key components of regulatory standards.

Regular audits of billing practices can further support compliance. By routinely checking documents for completeness and accuracy, organizations can proactively address any issues and maintain consistent adherence to guidelines. This diligence contributes to smoother processing, prompt payment

Common Mistakes in NDIS Invoicing

Inaccuracies in billing documents can lead to delays, payment disputes, and unnecessary complications for both service providers and recipients. Identifying and avoiding these common errors is essential for smooth and efficient financial transactions.

Missing or Incorrect Service Details

A frequent mistake is omitting essential information about the services provided. Each document should contain precise descriptions of services, specific dates, and clear cost breakdowns. Failing to include these details can result in misunderstandings and delays in processing.

Inaccurate Client or Provider Information

Another common error is inaccurate or incomplete identification of the parties involved. Incorrect client codes, missing registration numbers, or errors in contact information can complicate record-keeping and delay payments. Ensuring that all identifiers are double-checked before submission can prevent such issues.

By paying close attention to these aspects and implementing regular checks, service providers can minimize errors and improve the reliability and clarity of their billing practices. This contributes to a more effective and professional approa

Creating Professional NDIS Invoices

Producing a well-organized billing document is essential for maintaining credibility and ensuring that financial transactions are handled smoothly. A professional approach to formatting and content not only reflects positively on the provider but also facilitates efficient communication with clients.

Clear and Detailed Service Descriptions

Each document should include specific descriptions of services provided, with clear dates and timeframes. This level of detail helps clients understand exactly what they are being billed for and reduces the likelihood of misunderstandings. Organizing these details in a logical order also enhances readability.

Consistent Format and Readable Layout

Using a standardized layout contributes to a polished appearance and makes the document easier to review. A professional document should feature sections that are easy to identify, with clearly marked contact information, service details, and cost breakdowns. Consistency in design helps recipients quickly locate important information, which can expedite the payment process.

By prioritizing clarity,

Free NDIS Invoice Templates to Download

Access to ready-made billing formats can simplify the process of preparing professional and compliant documents. These downloadable resources allow providers to focus more on service delivery by reducing the time spent on administrative tasks.

Advantages of Using Pre-Designed Billing Formats

Pre-made layouts provide a structured approach to documenting transactions, ensuring that all necessary fields, such as service descriptions, client details, and payment information, are easily accessible. This consistency helps prevent errors and ensures that all required information is included.

Customization Options for Unique Needs

Many downloadable options come with customizable fields, allowing providers to adapt the format to their specific requirements. Whether it’s adjusting layout elements, adding logos, or tailoring sections for particular services, these flexible formats offer both convenience and personalization.

With these ready-to-use resources, providers can maintain a high standard of professionalism in their documentation, ensuring that every transaction is clear, complete, and easy for cl

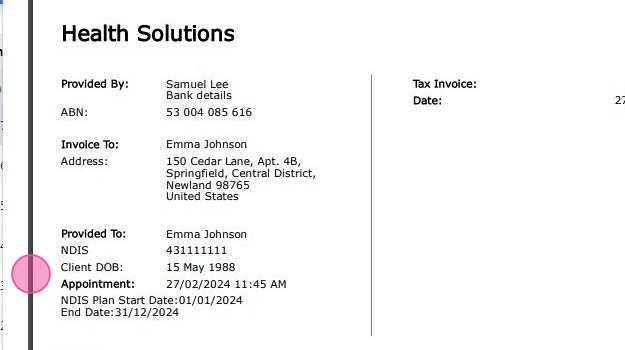

NDIS Invoice Template for Service Providers

For professionals offering services under regulated frameworks, utilizing a structured billing document is crucial for maintaining efficiency and clarity. A well-organized document not only simplifies the billing process but also ensures compliance with relevant guidelines.

Here are some essential components that service providers should include in their billing documents:

- Service Provider Information: Include your business name, contact details, and registration number.

- Client Details: Clearly state the client’s name, address, and any relevant identification numbers.

- Service Descriptions: Provide detailed descriptions of the services rendered, including dates and timeframes.

- Cost Breakdown: Itemize the costs associated with each service to enhance transparency.

- Payment Terms: Specify the payment methods accepted and the due date for payment.

Using a structured format that incorporates these elements allows for greater accuracy and reduces the risk of disputes. Additionally, a clear and professional presentation can improve communication with clients and foster trust in the services provided.

By adhering to these guidelines, service providers can create effective billing documents that not only meet regulatory requirements but also enhance their professional reputation.

How to Track NDIS Payments Efficiently

Efficient monitoring of financial transactions is crucial for maintaining healthy cash flow and ensuring timely payments for services rendered. By implementing systematic methods for tracking payments, service providers can minimize delays and streamline their financial processes.

Here are some effective strategies for monitoring payments:

| Strategy | Description |

|---|---|

| Utilize Accounting Software | Invest in reliable accounting tools that automate payment tracking, helping to manage records effortlessly. |

| Maintain Detailed Records | Keep comprehensive records of all transactions, including payment dates, amounts, and client details to ensure accuracy. |

| Regular Reconciliation | Conduct frequent reconciliations between accounts and payments received to identify discrepancies promptly. |

| Set Payment Reminders | Establish reminders for upcoming payments or overdue accounts to encourage timely actions. |

| Client Communication | Maintain open lines of communication with clients regarding payment expectations and follow up on outstanding amounts. |

By adopting these practices, service providers can enhance their ability to track payments effectively, leading to improved financial stability and stronger relationships with clients. Streamlined payment monitoring is essential for maintaining trust and ensuring smooth operational processes.

NDIS Invoice Format and Layout Tips

Creating a well-structured billing document is essential for ensuring clarity and professionalism in financial transactions. The layout and format of such a document play a significant role in enhancing readability and conveying important information effectively.

Here are some valuable tips to consider when designing your billing document:

- Consistent Formatting: Use a uniform font style and size throughout the document to maintain a cohesive look. This consistency helps in making the document easy to read.

- Logical Layout: Organize information in a clear hierarchy. Start with your contact details, followed by client information, service descriptions, and payment details. This structure allows for quick reference.

- Clear Headings: Use bold and larger fonts for headings and subheadings to differentiate sections. This aids in guiding the reader through the document.

- White Space: Incorporate ample white space between sections and around text blocks. This improves readability and prevents the document from feeling cluttered.

- Visual Elements: Consider adding a logo or branding elements at the top of the document. This not only enhances professionalism but also reinforces brand identity.

By following these tips, you can create an effective billing document that facilitates understanding and ensures that all necessary information is easily accessible. A professional appearance will contribute to building trust with clients and streamline the financial process.

Updating Your NDIS Invoice Template

Regularly refreshing your billing documents is crucial for maintaining accuracy and relevance in your financial processes. An updated format not only reflects current regulations but also enhances professionalism and clarity in communication with clients.

Reasons to Update Your Billing Document

Here are several compelling reasons for revising your billing document:

- Compliance with New Regulations: Changes in industry standards or legal requirements may necessitate adjustments in your documentation.

- Improved User Experience: Regular updates can enhance the overall user experience for both clients and providers, making it easier to navigate and understand.

- Incorporation of Feedback: Client or staff feedback may highlight areas for improvement, helping to make the document more effective.

- Branding Refresh: If your business undergoes a rebranding, updating your financial documents ensures that all materials reflect the new branding.

Steps to Update Your Billing Document

Follow these steps to effectively update your billing document:

- Review current guidelines and regulations to ensure compliance.

- Gather feedback from clients and team members on the existing document.

- Make necessary changes to the layout, format, and content based on feedback and new requirements.

- Test the updated document to ensure it is user-friendly and meets all criteria.

- Implement the new version and inform clients about the changes, if necessary.

By keeping your billing documents up to date, you foster professionalism and trust in your services. Regular revisions will ensure that your financial processes remain efficient and effective.

Managing Multiple NDIS Invoices

Effectively handling numerous financial documents can be a challenging task, especially for service providers managing various clients and services. A systematic approach is essential to ensure accuracy, organization, and timely payments.

Strategies for Efficient Management

Here are several strategies to help streamline the management of your financial documentation:

- Use Software Solutions: Implementing accounting or billing software can automate many processes, making it easier to generate and track documents.

- Standardize Formats: Consistent formats across all documents simplify the management process and make it easier for clients to understand the information presented.

- Maintain Organized Records: Keep detailed records of each document issued, including dates, amounts, and services rendered. This helps in tracking payments and following up on overdue accounts.

- Set Reminders: Utilize reminders or alerts for payment deadlines to ensure timely follow-ups and reduce late payments.

- Review Regularly: Regular audits of issued documents can help identify any discrepancies or areas for improvement in your billing practices.

Communicating with Clients

Clear communication with clients is essential when managing multiple financial documents. Consider the following:

- Provide clients with a summary of services and corresponding financial documents for transparency.

- Be proactive in addressing any questions or concerns regarding charges and payments.

- Establish clear payment terms and conditions to avoid misunderstandings.

By implementing these strategies, you can effectively manage multiple financial documents, ensuring a smooth billing process that benefits both you and your clients.