Top Microsoft Invoice Templates for Easy Billing

Creating professional financial documents can often be a tedious task, but with the right tools, it becomes a breeze. The ability to generate accurate, clear, and customizable statements is essential for any business. This guide explores how to simplify the creation of such documents, offering solutions that cater to both small and large enterprises alike.

Using pre-built formats in spreadsheet software is one of the most efficient ways to handle billing. These ready-made structures not only save time but also reduce the risk of errors. Whether you’re a freelancer or managing a growing company, these tools can provide a quick, organized way to keep track of transactions.

Flexible design options and easy customization allow you to tailor each document to your business needs. You can add specific fields, adjust styles, and include all necessary details, making it simple to produce accurate records each time.

Investing time in understanding how to utilize these resources can significantly enhance your workflow, improve consistency, and help maintain professionalism in your financial dealings. In the following sections, we will explore how to take full advantage of these helpful systems for efficient document management.

Invoice Templates for Microsoft Excel

Efficiently managing financial documentation is a crucial aspect of running a business. With the right tools, you can quickly generate organized, professional-looking documents that streamline your workflow. Excel offers an ideal platform for creating such documents, providing a range of options that are both easy to use and highly customizable. By leveraging ready-made formats, you can ensure accuracy and consistency without having to start from scratch each time.

Whether you’re tracking payments, issuing bills, or summarizing financial transactions, Excel’s built-in functionalities make it simple to adjust fields, customize the design, and meet specific business needs. The flexibility of this software allows you to create documents that are tailored to your branding and requirements, all while saving time and effort.

The following table outlines key benefits of using Excel for creating billing records:

| Benefit | Description |

|---|---|

| Customizability | Adjust fields, fonts, and layouts to suit your preferences and business needs. |

| Automation | Use formulas to automatically calculate totals, taxes, and discounts. |

| Data Integration | Seamlessly import data from other sources, such as customer databases or accounting software. |

| Professional Appearance | Create clean, structured documents that reflect a polished, professional image. |

| Time-saving | Save time by using pre-built designs and automating repetitive tasks like calculations. |

By utilizing these features, you can easily craft documents that meet your needs while maintaining a high level of accuracy and professionalism. Excel’s flexibility ensures that the process remains straightforward and efficient, no matter the size of your business.

Why Use Microsoft Invoice Templates

Managing business records efficiently is essential for maintaining smooth operations and ensuring accuracy. Pre-designed documents in popular software like Excel provide an excellent solution to simplify this process. These ready-made structures offer a fast, consistent, and reliable way to manage financial transactions, eliminating the need to create them from scratch every time. Using such tools can save time and effort, while also promoting professionalism.

Time Efficiency

One of the main advantages of using pre-configured formats is the amount of time saved. Instead of manually formatting and adjusting each document, users can focus on the content, such as entering client information and transaction details. The structure is already in place, so all you need to do is customize the relevant fields. This significantly speeds up the process, especially for businesses that need to generate multiple documents on a regular basis.

Customization and Flexibility

Customization is another significant benefit that makes these tools so appealing. The ability to adjust colors, fonts, and layout means you can create documents that align with your company’s branding and specific requirements. Whether you’re dealing with simple or more complex financial statements, these tools provide the flexibility to modify the design while maintaining accuracy and consistency.

By using these resources, businesses can quickly adapt their records to meet changing needs without sacrificing quality or detail. Whether you’re a freelancer or running a large enterprise, utilizing pre-built designs allows you to handle financial documentation efficiently, accurately, and professionally.

How to Customize Microsoft Invoice Templates

Customizing financial documents to suit your specific needs is a simple yet powerful way to ensure they align with your business requirements. By adjusting pre-built structures, you can easily modify the design, fields, and information to make them unique and relevant to your brand. Customization not only improves the overall look but also allows for the inclusion of specific details such as client preferences, payment terms, or tax calculations.

Modifying Fields and Layout

One of the first steps in personalizing your financial records is adjusting the fields. Most pre-designed formats offer editable sections that can be changed to reflect your particular business practices. For example, you may want to add new categories, remove unnecessary ones, or rearrange the layout to make the document more intuitive for your clients. Excel makes this process simple by allowing you to click and drag elements, or use basic editing tools to modify text and data columns.

Adding Branding and Personal Details

Customizing the appearance of your documents is equally important for creating a professional, cohesive brand identity. Changing colors, fonts, and adding logos can help your documents align with your overall branding strategy. These minor adjustments can make a significant difference in how your records are perceived. Furthermore, adding personal details such as your business address, contact information, or payment terms helps to ensure your client is well-informed at all times.

The following table shows key areas where customization can be applied:

| Customization Area | Suggested Modifications |

|---|---|

| Logo and Branding | Insert your company logo, adjust color scheme, and match fonts to your brand identity. |

| Layout | Rearrange fields, resize sections, or remove unnecessary columns to simplify the design. |

| Client Information | Update contact details, include billing/shipping addresses, or add custom notes for specific clients. |

| Payment Terms | Adjust payment methods, due dates, or late fee policies to match your business practices. |

These simple customizations help you maintain control over the presentation and content of your documents. Whether you’re running a small business or a large organization, the ability to tailor each document ensures that they meet your exact needs while maintaining a professional image.

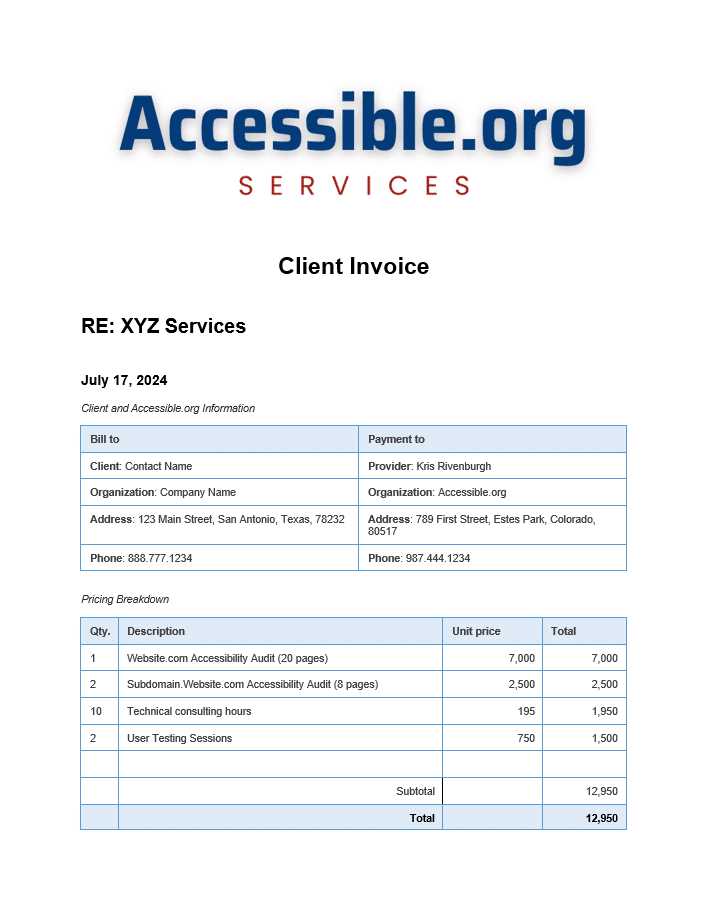

Best Free Invoice Templates for Excel

When it comes to managing financial documents, finding the right tools that offer both functionality and ease of use is essential. For businesses looking for a cost-effective solution, free pre-built formats can be a game-changer. These ready-made structures for Excel not only save time but also offer a high degree of customization to suit different business needs. Many of these formats come with various features, from automatic calculations to user-friendly designs, making them an excellent choice for both small businesses and freelancers.

One of the major benefits of using free options is the variety of designs available. Whether you’re looking for a simple layout or something more comprehensive, there are numerous options to explore. These free resources often include templates that allow you to track multiple transactions, manage taxes, and even add payment terms, all while maintaining a professional appearance.

Additionally, these templates are easily adaptable to any business type. Whether you’re offering services or products, you can easily adjust the fields to match your unique needs, such as incorporating discounts, itemized lists, or specific tax rates. The best part is that all of this can be done without spending any money, providing excellent value for businesses on a budget.

Here are some of the top features that make free Excel designs stand out:

- Automatic Calculations: Save time with built-in formulas that automatically calculate totals, taxes, and discounts.

- Easy Customization: Adjust colors, fonts, and fields to reflect your branding or specific requirements.

- Professional Layouts: Well-designed structures ensure your financial records look clean and organized.

- Multiple Options: Choose from various styles, from minimalistic designs to detailed itemized lists.

- No Cost: Free access to high-quality, ready-made documents without the need for subscriptions or purchases.

By using these free options, businesses can create professional documents that are both practical and efficient, ensuring consistency and saving time in the process.

Key Features of Microsoft Invoice Templates

When it comes to generating professional financial documents, pre-designed structures offer several powerful features that can streamline the process and improve overall efficiency. These ready-made formats are specifically built to handle a wide variety of business needs, ensuring that you can easily create accurate and polished records without starting from scratch each time. With built-in tools and customizable options, these resources are tailored to help businesses save time and maintain consistency.

Automation and Accuracy

One of the standout features of these pre-built designs is automation. With many of these structures, calculations such as totals, taxes, and discounts are performed automatically, reducing the chances of human error. This means that once the necessary data is entered, the rest of the work is handled by the system, ensuring precise results every time.

Customization and Flexibility

Another major advantage is the level of customization available. You can easily adjust fonts, colors, and layout to match your business’s branding or personal preferences. Whether you need to add additional fields for specific client information or rearrange sections for better clarity, these designs offer flexibility to ensure that every document meets your unique needs.

These key features not only improve the overall functionality but also enhance the professionalism of your financial records. Whether you’re managing a large business or handling individual transactions, having access to these built-in tools allows for greater efficiency, consistency, and accuracy in every document you create.

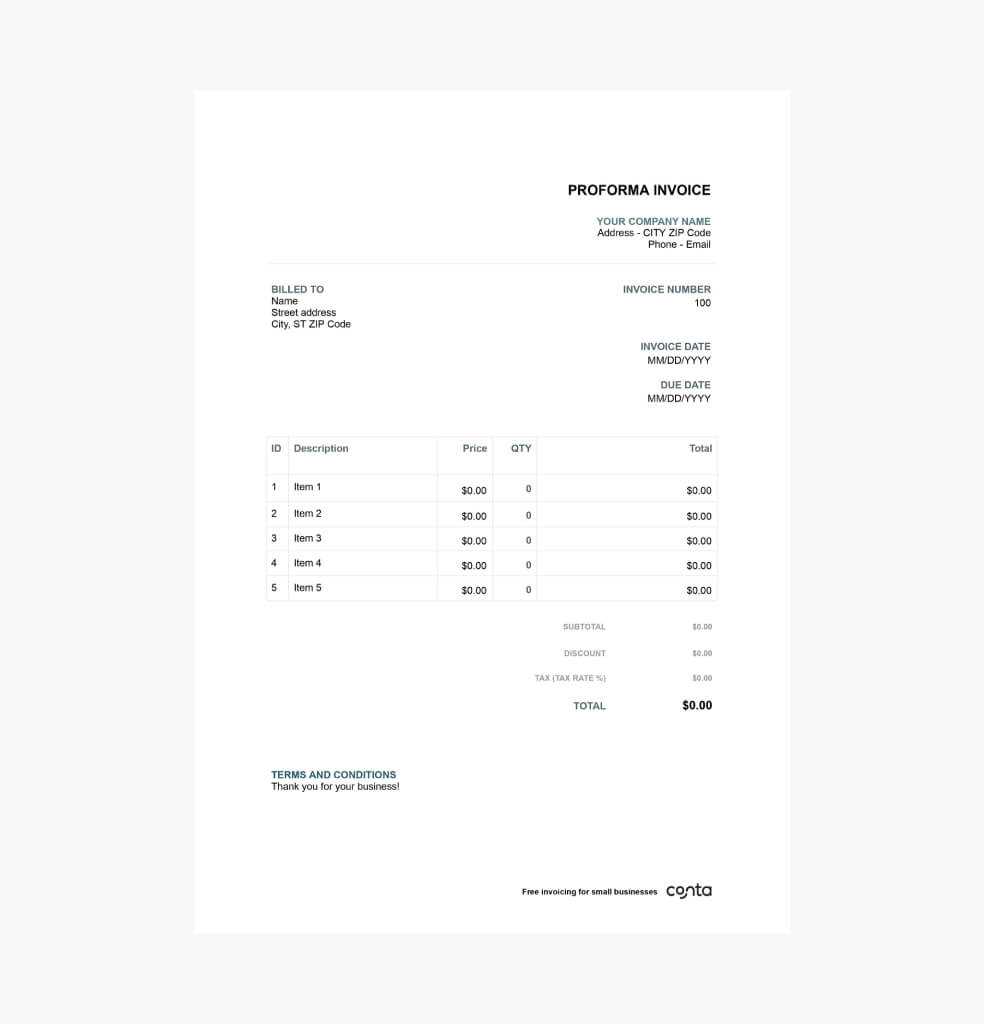

Step-by-Step Guide to Create Invoices

Creating financial documents from scratch can seem daunting, but with the right approach, it becomes a straightforward process. By following a few simple steps, you can produce professional and accurate records every time. This guide will walk you through the necessary stages, from setting up the basic structure to customizing the document for your specific needs.

Step 1: Set Up the Basic Structure

Start by opening a new document in your preferred spreadsheet software. Use pre-designed formats or begin with a blank sheet. The essential components should include sections for your business details, client information, a description of services or goods, payment terms, and totals. Ensure there’s space for all necessary fields such as dates, invoice numbers, and amounts.

Step 2: Enter Your Business Information

At the top of the document, include your company name, address, phone number, and email. This ensures your client knows exactly who the document is from. Make sure this section is clear and easy to read, as it’s crucial for communication.

Step 3: Add Client Details

Next, input the client’s name, address, and contact information. This helps to avoid confusion and ensures that the document is correctly directed. Be sure to check that the information is up-to-date to avoid any mistakes in the future.

Step 4: List Products or Services

Clearly outline the items or services provided, including quantity, unit price, and any applicable taxes or discounts. Organize this section into a table for clarity, and make sure the descriptions are precise and easy to understand. This part will form the core of the document and ensures transparency.

Step 5: Calculate the Total

After listing all items, calculate the total amount due, including taxes and any discounts. Ensure that the math is correct, either by using automated formulas or double-checking manually. The total should be clearly highlighted to avoid any confusion.

Step 6: Add Payment Terms

Include details about the payment deadline, accepted methods, and any late fees that might apply. Providing this information upfront helps avoid misunderstandings later. You may also want to include bank account details or other payment instructions for convenience.

Step 7: Review and Finalize

Before sending the document, take a moment to review all the details. Check for any errors in spelling, math, or client information. Make sure the format is clear and easy to read. Once you’re satisfied, save the document and prepare to send it to your client.

By following these simple steps, you can easily create accurate and professional financial documents tailored to your needs. This process will not only save you time but also ensure consistency in all your records.

Benefits of Using Excel for Invoices

Excel is one of the most versatile and widely used tools for creating and managing financial documents. Its functionality and ease of use make it an excellent choice for handling various business tasks, including tracking transactions, calculating totals, and organizing data. By utilizing Excel for generating records, businesses can save time, increase accuracy, and maintain a professional appearance without the need for specialized software.

Efficiency and Automation

One of the key advantages of using Excel is its built-in automation features. With the help of formulas, users can quickly calculate totals, taxes, discounts, and other important values. This eliminates the need for manual calculations, reducing errors and speeding up the process. Additionally, the ability to set up recurring calculations for similar documents further enhances efficiency, making Excel an ideal tool for businesses that need to generate numerous records on a regular basis.

Customization and Flexibility

Excel also offers unparalleled flexibility when it comes to customizing your financial documents. Whether you need to adjust the layout, add specific fields, or modify the design, Excel allows you to personalize every aspect to suit your business’s needs. This flexibility ensures that your records not only meet your operational requirements but also align with your company’s branding and style. With just a few adjustments, you can create documents that are unique to your business.

By leveraging Excel’s features, businesses can streamline their documentation process, ensuring greater accuracy, consistency, and ease of use, all while maintaining a professional standard. Whether you’re a small startup or a large enterprise, using Excel offers numerous benefits that help you manage your financial records with confidence.

How to Save Time with Templates

Using pre-built structures for financial documents can significantly speed up your workflow. Instead of starting from scratch every time you need to create a new record, ready-made designs allow you to focus on the important details, such as client information and transaction specifics. These resources are designed to save time and reduce the risk of errors, helping businesses operate more efficiently and stay organized.

Automating Repetitive Tasks

One of the main ways to save time is through automation. Pre-designed layouts often come with built-in formulas that automatically calculate totals, taxes, and other important values. This eliminates the need for manual calculations, reducing the chance of mistakes and speeding up the overall process. Once you input the necessary data, the software takes care of the rest.

Consistency and Reusability

Another time-saving benefit is the consistency that pre-made structures offer. By using the same design each time, you ensure that all documents follow the same format and include the necessary fields. This consistency makes it easier to track records and maintain a professional appearance. Plus, many of these resources are reusable, allowing you to save time by simply adjusting the details for each new transaction.

- Pre-set Layout: Skip the formatting and design process by using a ready-made structure.

- Automatic Calculations: Quickly add up totals, taxes, and discounts with built-in formulas.

- Reusability: Use the same design repeatedly without having to recreate documents each time.

- Consistency: Ensure uniformity in all your records, making them easier to manage and understand.

By utilizing these pre-built designs, businesses can streamline their documentation process, saving valuable time and resources. The ability to generate accurate, professional documents quickly is a huge advantage for any company looking to improve efficiency and reduce administrative workload.

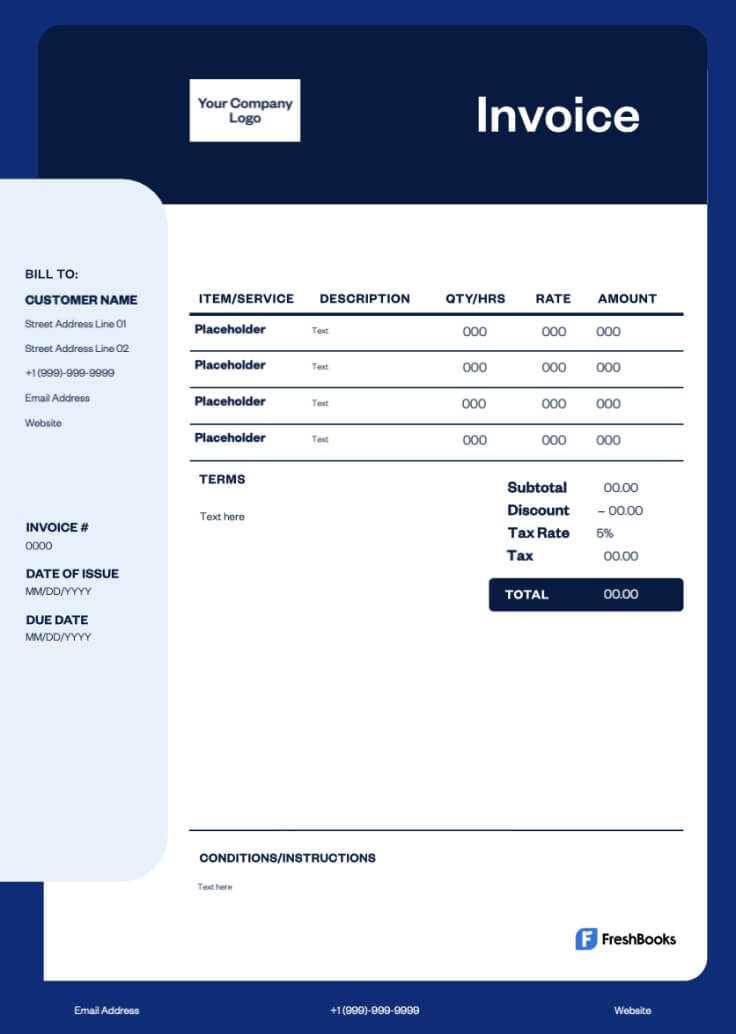

Choosing the Right Invoice Template

Selecting the appropriate format for your financial records is essential to ensure that your documents are clear, professional, and tailored to your business needs. The right structure not only helps in organizing the required information but also reflects your brand identity and simplifies your administrative tasks. With so many options available, it’s important to consider various factors before choosing the right one for your business.

Key Considerations When Selecting a Format

There are several key elements to keep in mind when deciding which layout will work best for you:

- Business Needs: Consider the complexity of your transactions. If you deal with a large number of items or services, choose a layout with detailed itemized lists.

- Branding: Ensure the design complements your company’s logo, colors, and overall branding. A cohesive look makes your documents appear more professional.

- Customizability: Look for a format that allows you to easily adjust fields, such as adding new sections for discounts, taxes, or terms of service.

- Ease of Use: Choose a design that is simple to navigate and doesn’t require excessive time to learn or modify.

- Automation: Formats with built-in formulas can help calculate totals and taxes automatically, saving you time and reducing errors.

Types of Layouts to Consider

Different businesses have different needs, so it’s important to choose the right kind of structure:

- Basic Layout: Ideal for small businesses or freelancers, this format includes simple fields like the date, client details, and total amounts.

- Itemized Layout: Useful for businesses that provide products or services that need to be listed separately, with quantities, prices, and descriptions.

- Comprehensive Layout: Suitable for larger enterprises, this design offers more space to include multiple fields, such as shipping information, payment instructions, and advanced tax calculations.

- Minimalist Layout: Perfect for businesses that prioritize a clean, streamlined look with only the most essential information included.

By understanding your business needs and selecting the right structure, you can ensure that your financial records are not only functional but also present a polished and consistent image to your clients. Making the right choice will save you time, reduce errors, and improve the efficiency of your workflow.

How to Edit Pre-made Templates in Excel

Using pre-designed structures in Excel can save a lot of time and effort, but personalizing them to meet your specific business needs is essential for ensuring the final document reflects your brand and requirements. Editing these ready-made layouts is a simple process, and with just a few adjustments, you can modify the content, design, and functionality to make them uniquely yours. This guide will show you how to easily make changes to pre-built formats in Excel to suit your needs.

Modifying Fields and Data

When editing a pre-built layout, the first step is usually adjusting the fields to match your business needs. Most formats come with predefined sections like “Client Name” or “Amount,” but you can modify these to suit your specific requirements. To do this:

- Select the cell or range of cells you want to edit.

- Delete the placeholder text and enter the relevant data (e.g., the client’s name, the service description, etc.).

- If necessary, resize the columns to ensure everything fits neatly.

- For more advanced editing, you can add or remove rows/columns depending on your needs.

Customizing the Design

Excel provides plenty of options to modify the design of your document. You can adjust fonts, colors, borders, and alignments to ensure the structure reflects your business’s style. Here’s how:

- Select the cells you want to format.

- Use the “Home” tab to change the font style, size, and color.

- Apply borders or shading for sections that require emphasis.

- Adjust cell alignment to center text, align to the left or right, or distribute the data evenly across the columns.

Automating Calculations

If your pre-built layout includes numeric values, Excel can automatically calculate totals, taxes, and other financial metrics for you. Here’s how you can adjust the built-in formulas:

- Click on the cell where you want to apply the formula.

- Enter the necessary formula (e.g., SUM, TAX, etc.) or modify the existing formula if needed.

- Ensure the ranges in the formula are correct to include all relevant data.

Once you’ve edited the fields, design, and formulas, the document is ready to be saved and used. You can save it as a template for future use or export it to other formats such as PDF for easy sharing with clients.

The table below shows common areas you might want to edit when personalizing your document:

| Area | Suggested Edits | ||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Business Information | Update the business name, address, contact info, and logo. | ||||||||||||||||||||||||||

Client Information

Invoice Templates for Small BusinessesFor small businesses, managing financial records efficiently is crucial for staying organized and maintaining a professional image. Pre-designed layouts can help simplify the process, allowing entrepreneurs to focus more on their core operations rather than spending time creating documents from scratch. These structures not only save time but also ensure accuracy and consistency across all financial communications with clients. Small businesses often operate with limited resources, so using ready-made formats allows owners to generate professional-looking documents quickly and without the need for advanced software or design skills. Whether you’re billing for products or services, these layouts offer flexibility to adjust fields, include payment terms, and calculate totals automatically, reducing the potential for errors. Additionally, these pre-made formats are customizable, meaning you can tailor them to reflect your business’s branding. You can easily add your logo, adjust colors, and modify sections to meet your specific needs. From freelancers to small startups, using these resources helps businesses maintain a polished and consistent appearance in all financial dealings. By using these layouts, small business owners can ensure they are sending clear, professional, and accurate records to clients, making it easier to manage finances and build lasting business relationships. Designing Professional Invoices in ExcelCreating polished and professional documents for financial transactions is essential for businesses to maintain credibility and trust with clients. Excel offers a simple yet powerful platform to design custom records that look professional, are easy to understand, and effectively communicate the details of a transaction. With its flexibility, Excel allows you to personalize the layout, add necessary details, and automate calculations, ensuring both accuracy and efficiency. To start designing a clean and professional document, it’s important to focus on both functionality and presentation. You should include all relevant fields such as business and client information, a description of the services or products, and the total amount due. With Excel’s customizable features, you can adjust the layout, fonts, and color schemes to match your brand’s identity. Here’s a basic structure you can follow when designing a financial document in Excel:

Excel’s ability to automatically calculate totals, apply taxes, and customize fields makes it a great tool for ensuring all the necessary details are included. The final result is a clean, organized, and professional-looking document that enhances your business’s credibility and helps foster a stronger relationship with clients. Common Invoice Mistakes to AvoidWhen managing financial documentation, accuracy and clarity are essential. Mistakes in your documents can lead to confusion, delayed payments, and a lack of professionalism. By being aware of common errors, you can ensure that your records are clear, correct, and effective in facilitating smooth business transactions. Avoiding these mistakes will help maintain trust and ensure timely payments from clients. Missing or Incorrect InformationOne of the most frequent errors in financial records is the omission or inaccuracy of crucial details. Make sure that all essential fields are included, such as the client’s name, business contact information, and accurate descriptions of services or products provided. Double-check that the amounts and payment terms are correct to avoid misunderstandings. Failure to Include Payment TermsClearly stating payment terms is vital to avoid confusion regarding when the payment is due. Not specifying deadlines, interest rates for late payments, or accepted payment methods can result in delays. Ensure that your documents outline the due date, any applicable late fees, and available payment methods, such as bank transfer or credit card, so there’s no ambiguity for the recipient.

By avoiding these common mistakes, you ensure that your financial documents are professional, clear, and effective, helping to avoid unnecessary delays and confusion. Clear, well-structured documents will help build trust with clients and ensure that payments are processed quickly and accurately. How to Calculate Taxes in Invoice TemplatesCalculating taxes accurately is a crucial aspect of creating financial documents. Whether you’re dealing with sales tax, VAT, or other types of taxes, it’s important to apply the right rate and ensure the totals are calculated correctly. Many pre-designed structures have built-in fields and formulas that simplify this process, but understanding how to set up the calculations can save you time and help you avoid errors. Steps to Calculate Taxes CorrectlyTo calculate taxes on your financial records, follow these steps:

Using Excel Formulas for Tax CalculationExcel’s built-in formulas can automate the tax calculation process, making it faster and more accurate. Here’s how to set it up:

By using these steps and formulas, you can quickly and accurately calculate the tax amounts on any financial document. Automating this process with formulas reduces the chances of errors and ensures your documents are always accurate and professional. Setting Up Invoice Numbers in Excel

Assigning unique identifiers to your financial records is essential for tracking transactions, ensuring organization, and preventing any confusion. Excel allows you to easily set up a numbering system that will automatically generate sequential numbers for each new document. This process ensures that each record is unique, properly tracked, and easy to reference for future use. Here are some steps to help you set up a numbering system in Excel: Steps to Set Up Automatic Numbering

Using Excel Formulas for Sequential Numbering

With these simple methods, you can efficiently generate a numbering system for your financial records. This ensures consistency and easy tracking for future reference, helping maintain an organized record-keeping system. Free vs Premium Microsoft Invoice TemplatesWhen creating financial records for your business, you have the option to choose between free and premium options. Both have their advantages and drawbacks, depending on your specific needs. Free options can be a great starting point for small businesses or individuals on a tight budget, while premium versions offer more features and customization. Understanding the differences can help you decide which is best suited for your business operations. Comparing Free and Premium OptionsFree versions often come with basic functionality, which may be enough for simple transactions. They typically offer standard layouts, with limited customization options and fewer advanced features. On the other hand, premium versions are designed to provide more flexibility, including advanced features such as automatic calculations, additional design options, and customizable branding. Premium options may also include customer support, more advanced templates, and regular updates. Key Differences Between Free and Premium Options

Choosing between free and premium options depends on the complexity of your needs and your budget. If you’re looking for something simple and cost-effective, the free versions may suffice. However, if your business requires more advanced functionality and frequent updates, investing in a premium option could be the better choice for long-term use. |