Download and Customize Invoice Template for Microsoft Excel

Managing billing and payments can be a tedious task for any business. However, with the right tools, you can simplify the process and ensure accuracy in your financial records. A well-organized approach helps save time and reduce the risk of errors, making your business operations more efficient.

By using digital solutions that automate various aspects of invoicing, such as calculations and formatting, you can create professional documents quickly and without hassle. Customization features allow you to adjust the layout to suit your business needs, ensuring that each record is aligned with your branding and requirements.

In this article, we’ll explore how you can enhance your billing system by using accessible software to generate well-structured documents. Whether you are a freelancer, small business owner, or part of a larger enterprise, adopting this approach will improve your financial workflows and streamline operations.

Benefits of Using Excel Invoice Templates

Using digital tools to create professional financial documents offers numerous advantages, especially when it comes to simplifying the billing process. With the right tools, businesses can save time, reduce errors, and improve the overall efficiency of their financial workflows. Customizable features allow for flexibility in design, ensuring that each document meets specific business needs.

Time-Saving Features

Creating financial records manually can be time-consuming and prone to errors. Digital solutions streamline this process by automating calculations and formatting, allowing businesses to generate accurate documents in a matter of minutes. This frees up time for other important tasks, contributing to overall productivity.

Easy Customization

Customization is key when it comes to creating professional documents. With digital solutions, users can easily modify the layout, add logos, adjust fonts, and ensure that the final document reflects the business’s branding. This level of flexibility makes it easier to create personalized records while maintaining a professional appearance.

| Benefit | Description |

|---|---|

| Efficiency | Automates tasks like calculations and formatting to speed up the process. |

| Accuracy | Reduces human errors in calculations and data entry. |

| Customization | Allows businesses to tailor documents according to their needs and branding. |

| Cost-Effective | Offers an affordable alternative to paid solutions, especially with free options available. |

How to Create Your Own Invoice

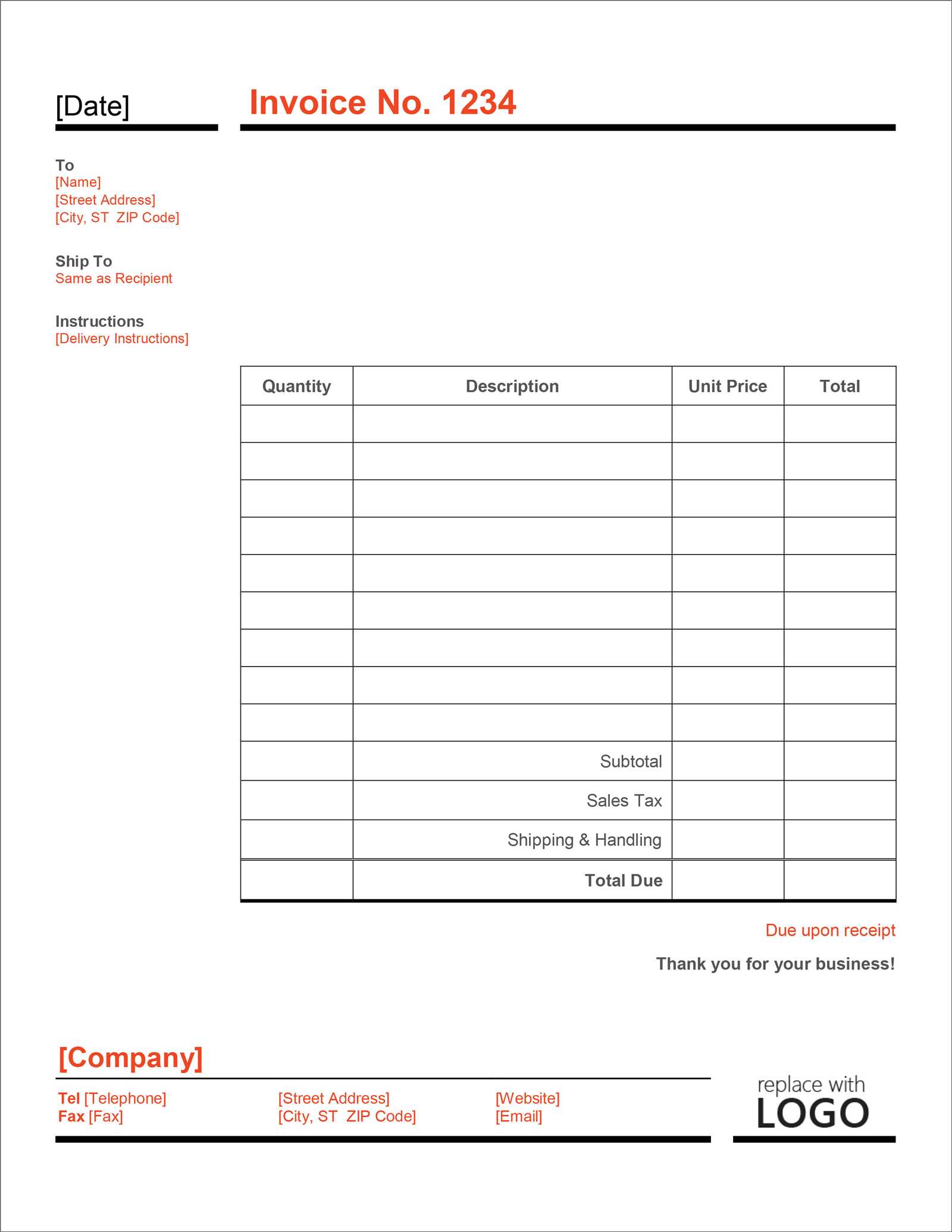

Creating your own financial document is easier than ever with the right tools. By following a few simple steps, you can design a professional and clear statement for your clients or customers. The key is to include all the necessary details while maintaining a clean and organized layout.

Step-by-Step Guide

Follow these steps to create your own record:

- Choose a Tool: Select a software or application that suits your needs for designing and calculating financial records.

- Set Up Basic Information: Begin by adding the date, a unique reference number, and the names or contact details of both parties involved.

- List the Services or Products: Provide a detailed description of the products or services, including quantities, rates, and total amounts.

- Include Payment Details: Clearly specify payment terms, due dates, and accepted payment methods.

- Finalize the Layout: Make sure the document is easy to read and visually appealing by adjusting fonts, alignment, and spacing.

Essential Information to Include

When designing your financial statement, be sure to incorporate these critical components:

- Business Information: Include your business name, address, and contact details.

- Client Information: Provide your client’s name, address, and contact information.

- Transaction Details: List each item, service, or product provided, along with the price.

- Total Amount Due: Clearly state the amount due after adding taxes or additional fees.

- Payment Terms: Specify when the payment is due and any penalties for late payments.

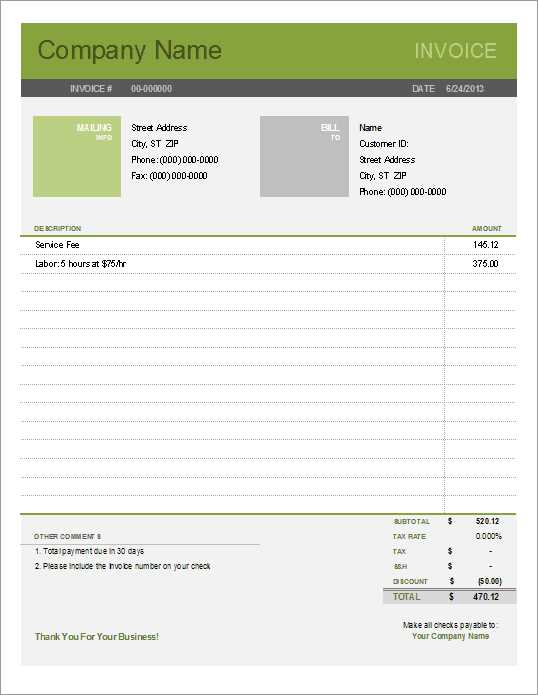

Customizing an Invoice Template in Excel

Personalizing your financial document allows you to match it with your business identity and meet specific needs. Adjusting the layout, adding branding elements, and tweaking the content can make your statements more professional and tailored to your workflow. With the right adjustments, you can ensure clarity, consistency, and ease for both you and your clients.

Simple Adjustments for a Professional Look

Making small tweaks to the format and appearance of your document can enhance its visual appeal and make it easier to read. Some of the key adjustments include:

- Font and Text Style: Choose readable fonts and adjust sizes for headings, subheadings, and body text.

- Branding Elements: Add your company logo, choose a color scheme that matches your brand, and place your business name and contact information prominently.

- Column Adjustments: Resize columns to fit your content and make sure the information is aligned correctly.

- Headers and Footers: Include important information, such as tax rates or payment terms, in the header or footer sections.

Using Tables for Clear Organization

One of the easiest ways to maintain a clean layout is to organize the content within a table. Here is an example of how to use tables to display your details:

| Item/Service | Description | Unit Price | Quantity | Total |

|---|---|---|---|---|

| Service A | Consulting Service | $100 | 2 | $200 |

| Service B | Design Service | $150 | 1 | $150 |

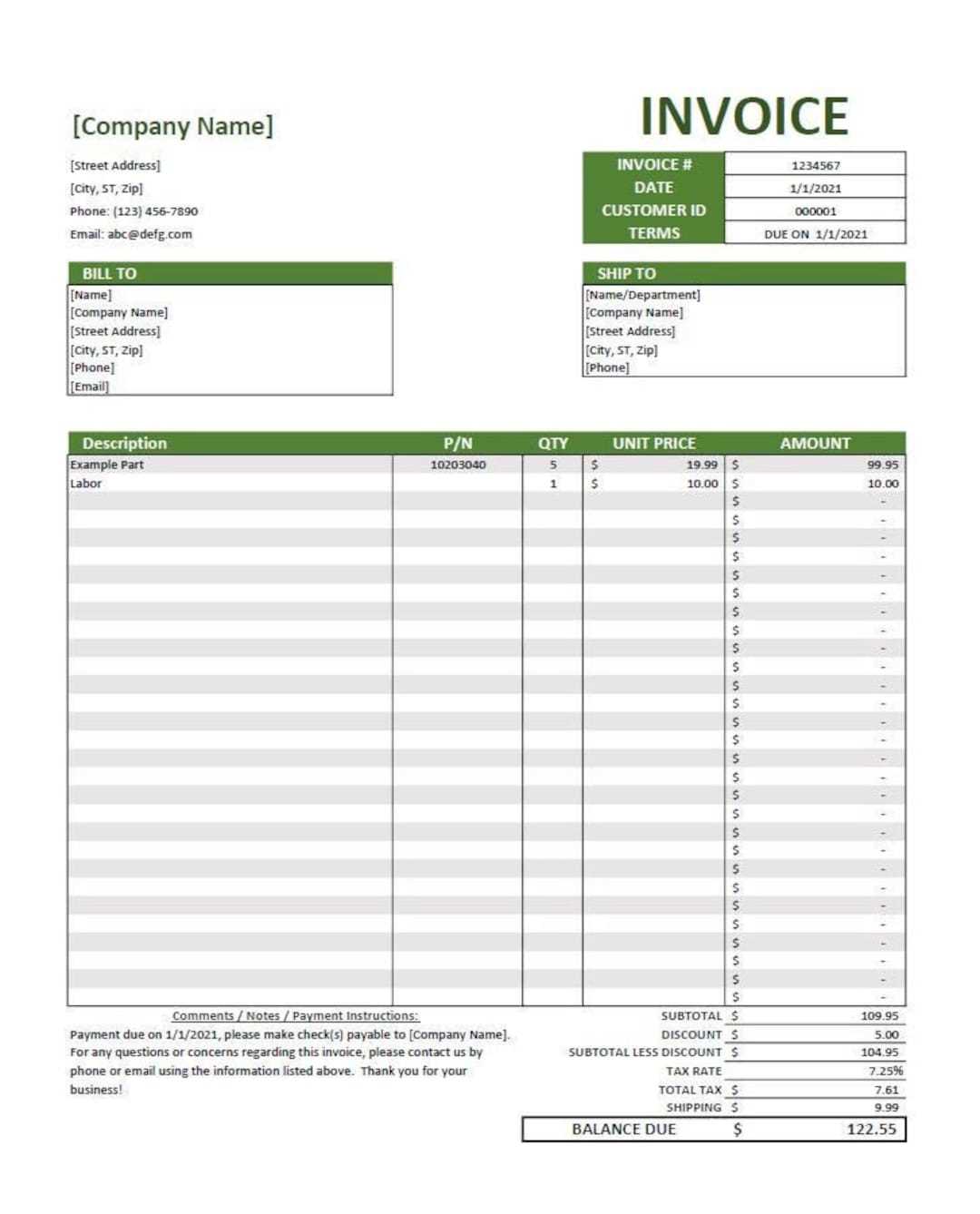

Top Features of Excel Invoice Templates

When designing professional billing records, certain features make the process faster, more efficient, and error-free. These characteristics are essential for ensuring that the document is both functional and visually appealing. Whether you are running a small business or managing a large enterprise, these key aspects will help streamline the process and improve your overall workflow.

Key Advantages of Using Digital Tools

Some of the most valuable features available in digital billing systems include:

- Automated Calculations: Automatic summing and tax calculations reduce human error and save time.

- Pre-Formatted Design: Ready-to-use layouts make it easy to generate clean and professional records instantly.

- Customizable Fields: Modify elements such as the payment terms, client details, and items without needing technical knowledge.

- Data Tracking: Keep track of past transactions and payments, making financial management more organized.

Customization and Flexibility

Along with functionality, these systems also provide flexibility to meet specific needs:

- Branding Options: Insert your company logo and adjust colors to maintain a consistent brand image.

- Multiple Currency Support: Easily switch between different currencies to cater to international clients.

- Reusable Structure: Save and reuse layouts for multiple records, reducing the need to start from scratch each time.

- Professional Formatting: Adjust fonts, margins, and spacing for clear, easy-to-read content.

Saving Time with Automated Templates

Automation is one of the most effective ways to streamline repetitive tasks and increase productivity. By utilizing digital solutions, businesses can reduce the time spent on creating financial records, as many processes are handled automatically. This allows you to focus on more important aspects of your business while maintaining accuracy and consistency in your documents.

Automatic Calculations ensure that all totals, taxes, and discounts are added up without manual input, reducing the chance of errors. Pre-set Layouts mean you don’t need to design from scratch every time, making the process faster and more efficient. With these automated features, you can generate a document in minutes instead of spending time formatting, calculating, and adjusting each entry.

Data Reusability is another benefit. Once your layout is set, you can reuse it for multiple clients or transactions, eliminating the need to enter the same information repeatedly. This consistency saves both time and effort, enabling you to handle a larger volume of work with fewer resources.

Choosing the Right Template for Your Business

Selecting the right document design for your business is essential for maintaining professionalism and ensuring clarity in your financial records. The right choice will not only reflect your brand but also streamline your process, making it easier to manage transactions and maintain accurate records. Different types of businesses require varying features, so it’s important to identify which layout best fits your needs.

Consider Your Business Type

The first step in choosing a suitable design is understanding your business type. For example, service-based businesses may need a layout that emphasizes time tracking and hourly rates, while product-based businesses might focus on quantity and itemized descriptions. A clear understanding of what your business requires will help narrow down the options.

Look for Key Features

When evaluating different designs, keep an eye out for features that will save you time and enhance functionality. Some of the most important attributes include:

- Customization: The ability to adjust fields and add specific information such as taxes, discounts, or shipping details.

- Branding Options: Options to incorporate your business logo and adjust colors to reflect your company’s image.

- Automated Calculations: Features that help you calculate totals, taxes, and discounts automatically, reducing the chances of errors.

- Clear Layout: A layout that ensures all information is easy to read and understand by your clients.

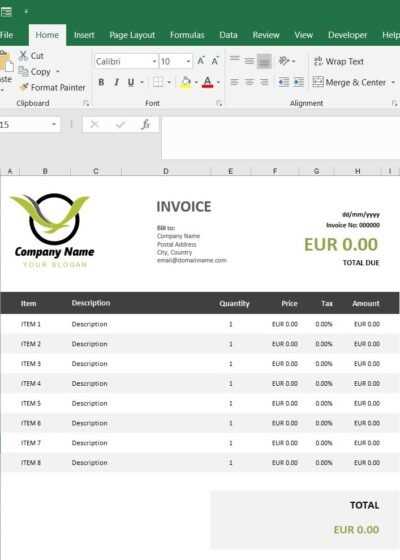

Adding Company Branding to Your Invoice

Incorporating your company’s branding into financial documents is a key way to present a professional and cohesive image. By customizing elements like logos, color schemes, and fonts, you can make these documents not only functional but also a reflection of your business identity. This attention to detail enhances credibility and reinforces your brand’s presence with every transaction.

Steps to Integrate Branding

Follow these simple steps to personalize your documents with your company’s unique branding:

- Add Your Logo: Position your company logo at the top of the document, usually near the header, to make it immediately visible.

- Customize Colors: Adjust the color scheme to match your company’s official colors. This can be applied to headings, borders, or background sections.

- Choose Appropriate Fonts: Select fonts that align with your branding guidelines. Ensure they are readable and professional.

- Incorporate Contact Information: Include your business name, address, phone number, and website in a prominent location for easy access.

Additional Branding Ideas

To further align your financial records with your brand identity, consider these options:

- Tagline or Mission Statement: Add your company’s tagline or mission statement near the footer or header for added impact.

- Watermark: Place a subtle watermark of your logo behind the text to reinforce your brand without distracting from the content.

- Professional Signature: Include a digital signature or a professional closing statement to personalize each document.

How to Track Payments with Excel

Keeping an organized record of incoming payments is essential for managing cash flow and ensuring timely follow-ups. With the right setup, you can use digital spreadsheets to monitor each transaction, categorize them, and easily view outstanding amounts. By tracking payments effectively, businesses can improve financial clarity and streamline their accounting process.

Setting Up a Payment Tracker involves creating a straightforward table to organize all necessary details. Begin by setting up columns for each relevant aspect of the payment, such as client name, date, amount, and status. This structured layout provides a clear overview of each transaction’s status.

Key Columns to Include:

How to Track Payments with Excel

Keeping an organized record of incoming payments is essential for managing cash flow and ensuring timely follow-ups. With the right setup, you can use digital spreadsheets to monitor each transaction, categorize them, and easily view outstanding amounts. By tracking payments effectively, businesses can improve financial clarity and streamline their accounting process.

Setting Up a Payment Tracker involves creating a straightforward table to organize all necessary details. Begin by setting up columns for each relevant aspect of the payment, such as client name, date, amount, and status. This structured layout provides a clear overview of each transaction’s status.

Key Columns to Include:

- Client Name: Keep a record of each client’s name or ID to easily reference past transactions.

- Payment Date: Include the date payment was received or is expected, helping you monitor deadlines and follow up if needed.

- Amount Paid: Track the amount received from each client to match it against outstanding balances.

- Payment Status: Use labels like “Paid,” “Pending,” or “Overdue” to indicate the current status of each entry.

- Method of Payment: Note whether the payment was made via bank transfer, credit card, or other methods to help with record-keeping.

Using Formulas to Automate Tracking can make the process even more efficient. Simple formulas can calculate totals, identify overdue payments, or highlight outstanding balances. By automating these calculations, you can save time and reduce manual errors.

Setting up regular reviews of your payment tracker also helps maintain accuracy, ensuring that each transaction is properly recorded and up-to-date. This proactive approach to monitoring payments not only supports cash flow management but also reinforces client relationships by keeping all records transparent and accurate.

Using Excel to Manage Multiple Invoices

Handling numerous financial records can quickly become overwhelming without an organized approach. Digital spreadsheets offer an efficient way to track, organize, and retrieve details for multiple transactions, making it easier to manage large volumes of data while minimizing errors. With a few setup adjustments, you can use these tools to streamline the entire process, ensuring that each record is easily accessible and up-to-date.

Setting Up a Multi-Record Tracker

Start by creating a structured table to manage all transaction data in one place. This allows for easy sorting, filtering, and updating. Below is a sample layout for setting up a tracking system:

| Client Name | Date Issued | Due Date | Total Amount | Amount Paid | Status | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ABC Corp |

| Client Name | Date Issued | Due Date | Total Amount | Amount Paid | Status |

|---|---|---|---|---|---|

| ABC Corp | 2024-10-01 | 2024-10-15 | $500 | $500 | Paid |

| XYZ Ltd | 2024-10-05 | 2024-10-20 | $300 | $150 | Partial |

This table allows you to store key details about each record, helping you stay organized. Customize the columns as needed to match your specific requirements, adding fields like “Payment Method” or “Notes” for extra information.

Using Filters and Sorting for Quick Access

Filters and sorting functions make it easier to navigate large datasets. For example:

- Filter by Status: View only “Paid” or “Pending” records to quickly assess outstanding balances.

- Sort by Date: Arrange records by issue or due date to prioritize follow-ups.

- Group by Client: Filter by client name to review transaction history for a specific client.

Utilizing these simple tools makes managing multiple financial records easier, ensuring that you can track all transactions efficiently and keep your records organized.

Integrating Excel Invoices with Accounting Software

Combining digital spreadsheets with accounting software can help streamline financial management and enhance accuracy. By linking your records to accounting tools, businesses can automate data entry, track payments more efficiently, and simplify reconciliation processes. This integration reduces manual tasks and keeps financial information consistent and up-to-date across platforms.

Steps for Successful Integration

To integrate digital spreadsheets with your accounting software, follow these basic steps:

- Check Compatibility: Ensure that your accounting software supports importing or syncing data from spreadsheets. Most modern accounting tools offer built-in options for this.

- Set Up Standardized Formats: Format your data consistently to ensure compatibility. This includes column names, data types, and organization, which make it easier for the accounting software to recognize and use the data.

- Use Import/Export Features: Many systems allow you to import or export records as files. Regularly exporting updates helps maintain accurate records in both tools.

Benefits of Integration

Connecting your records with accounting software offers several

Free vs Paid Invoice Templates for Excel

When choosing between no-cost and premium options for financial document templates, it’s important to consider both the immediate needs and long-term goals of your business. While free templates provide an accessible solution for basic use, paid versions often come with added features and customization options that can streamline operations and enhance professionalism. Understanding the differences can help in selecting the most suitable option for your requirements.

Benefits of Free Options

Free templates are widely available and provide a simple, ready-to-use solution for many small businesses or individuals:

- Accessibility: No upfront cost makes these templates an affordable choice for startups and freelancers.

- Basic Features: Most free options include essential fields and basic formatting, which work well for straightforward needs.

- Quick Setup: Free templates are often preformatted, allowing users to quickly add information without setup time.

Advantages of Paid Versions

Invoice Template Formatting Tips for Clarity

Designing financial documents with a clean and structured layout is essential for readability and professionalism. Well-organized formatting not only improves clarity for clients but also ensures that all critical information is easily accessible, reducing the chance of misunderstandings or errors. Here are some key tips for creating a clear and effective layout.

Key Formatting Guidelines

- Use Consistent Font Styles: Choose a professional, easy-to-read font and maintain uniform font sizes across similar sections. For example, use a larger, bold font for headers and a smaller, regular font for details.

- Highlight Important Sections: Draw attention to key elements such as due dates and totals by using bold or colored text. This helps critical information stand out at a glance.

- Utilize Borders and Shading: Separate sections visually with bord

How to Protect Your Excel Invoice Files

Securing financial documents is crucial to maintain the privacy of sensitive data and prevent unauthorized access. Implementing protective measures on digital records ensures that client and business information stays confidential and limits access to only those who need it. Here are several effective methods to safeguard your financial files.

Key Protection Techniques

- Set a Password: Apply a strong password to restrict access. This can be done through the file’s security settings, which help prevent unauthorized users from opening or editing the document.

- Enable Read-Only Mode: Configure your files to open in read-only mode. This prevents accidental changes and ensures the original document remains unaltered, especially if multiple people need to view it.

- Use File Encryption: Encrypting your files adds an extra layer of security, making it harder for unauthorized users to read the contents without the co

Excel Invoices for Freelancers and Contractors

For freelancers and contractors, clear and organized financial records are essential for smooth transactions and maintaining professional relationships with clients. Customizing a financial document to fit individual needs can make the payment process straightforward and allow for easy tracking of services rendered.

Freelancers often handle a variety of projects with unique payment terms, so having a well-organized record that is adaptable to different clients and project specifics is invaluable. These files can be tailored to include essential details such as hourly rates, project milestones, and deadlines, allowing for efficient, personalized management of work.

Benefits for Independent Professionals

Using structured financial documents provides several advantages:

- Professional Presentation: A clear, well-designed format leaves a positive impression, reinforcing trust with clients.

- Simple Customization: Easily add fields for specific project details, making it easier to tailor each document to individual projects.

- Efficient Tracking: Keep records of past work, payments, and ongoing projects, helping manage workload and income.

For contractors and freelancers, an

Common Mistakes When Using Excel Invoices

Creating structured financial documents can be an effective way to manage client transactions, but there are some common errors that can disrupt the flow and accuracy of these records. Avoiding these pitfalls helps ensure a smoother process, minimizes confusion, and enhances professionalism.

Frequent Errors to Watch Out For

- Missing Key Details: Forgetting essential elements such as dates, descriptions, or contact information can cause misunderstandings and delay payments. Always double-check that all necessary fields are completed.

- Incorrect Calculations: Manually entering totals or taxes without automated formulas can lead to errors. Utilize functions to ensure accuracy and consistency in financial data.

- Unclear Formatting: Poor layout choices, such as inconsistent fonts or alignment, make documents harder to read. A clean, organized structure improves clarity and reduces the likelihood of confusion.

- Overwriting Files: Failing to save each document with a unique identifier, like a date or client name, can result in data loss. Always use distinct file names for different records.