Top Invoice Template for Malaysia to Streamline Your Billing

Managing financial transactions efficiently is crucial for any business. Having a professional and organized method for documenting payments ensures smooth operations and helps build trust with clients. A well-structured approach to billing can also make tax reporting and record-keeping much simpler.

In this guide, we will explore the benefits of using an organized document format to handle business transactions. You will learn how to create and customize these records to suit your specific needs while maintaining accuracy and compliance with local regulations. Whether you’re a small business owner or a freelancer, a reliable system will save you time and reduce errors in your financial processes.

Invoice Template Malaysia Guide

Setting up a clear and effective system for tracking payments and client transactions is essential for business success. Whether you’re a freelancer or running a small enterprise, adopting a structured format for documenting financial exchanges will not only help maintain professionalism but also ensure that all necessary details are captured correctly. This guide will walk you through the key elements to consider when creating a business document for client payments.

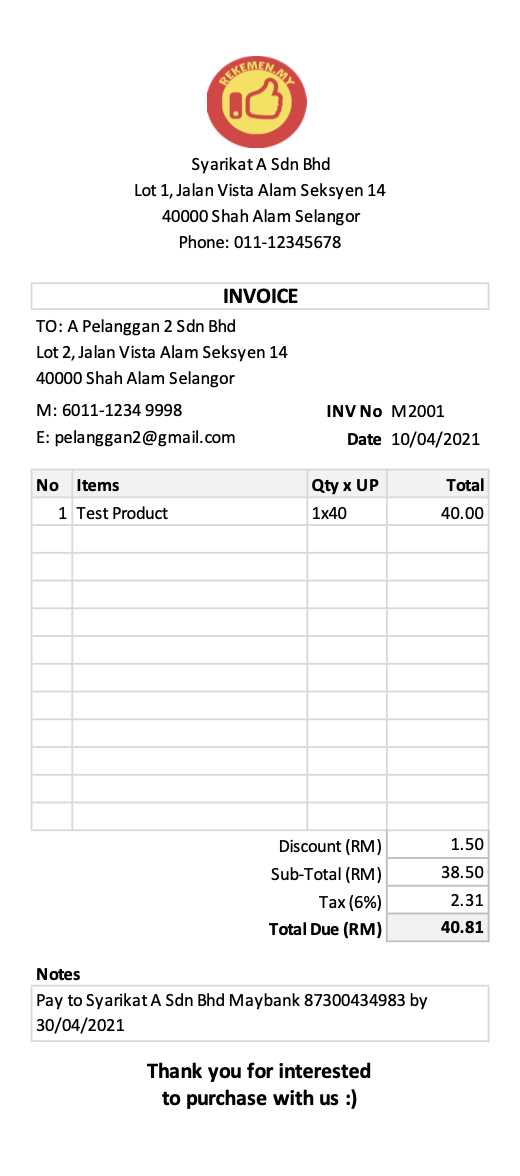

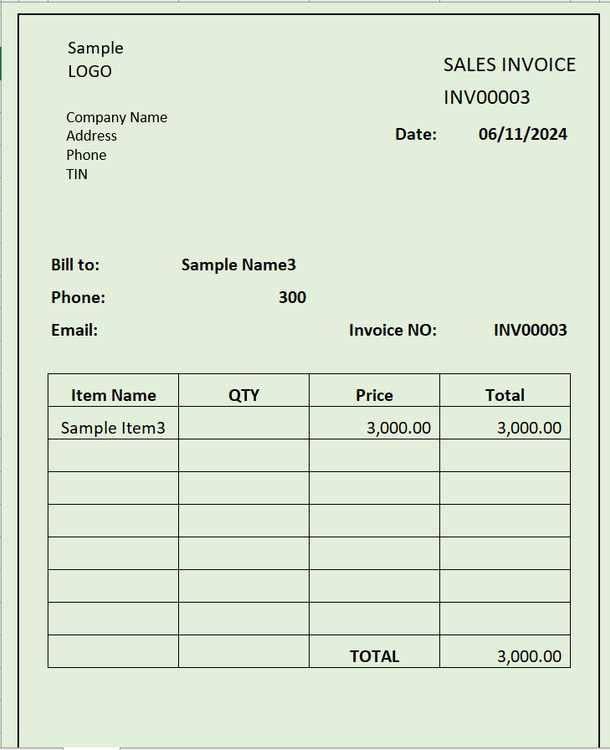

Key Elements to Include in Your Billing Document

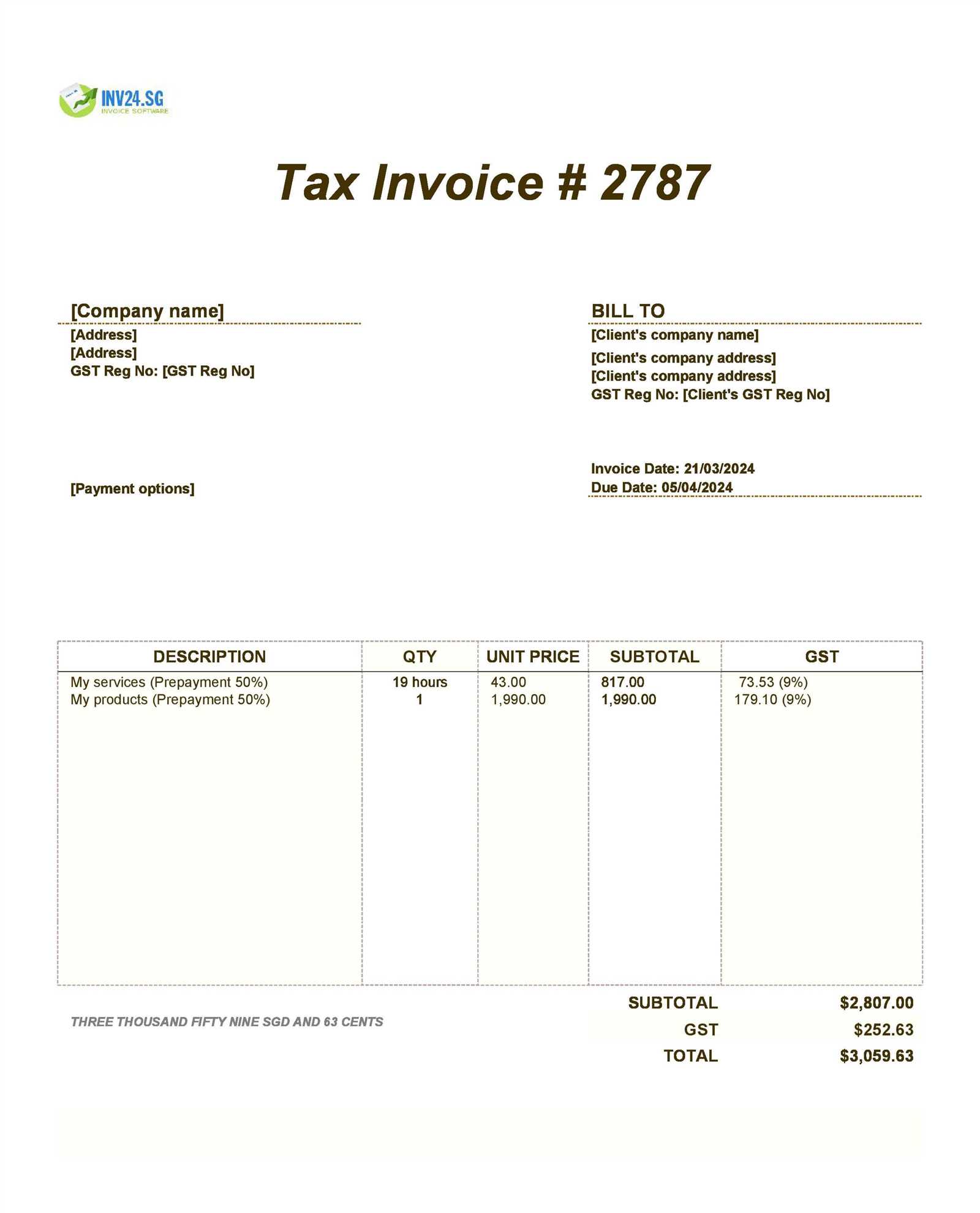

When creating a financial record, there are certain details you must always include to ensure that the document serves its purpose. Client information such as name, address, and contact details, along with a unique reference number, helps keep everything organized. Additionally, a clear breakdown of the goods or services provided, along with the agreed-upon price, is critical for transparency. If applicable, include the payment terms and due dates to avoid any confusion or delays.

Choosing the Right Format for Your Business Needs

There are various formats available to choose from, depending on your preferences and the scale of your operations. Some businesses prefer digital solutions that allow easy edits and storage, while others might choose physical records for a more traditional approach. You can opt for pre-designed systems, or customize one to fit your specific business needs. What matters most is that the chosen format is easy to understand, clear, and legally compliant with local regulations.

Why Use an Invoice Template in Malaysia

Maintaining accurate and organized records for financial transactions is essential for any business. Using a structured approach to document payments helps ensure clarity, prevent errors, and maintain consistency in client communications. By adopting a standardized format, businesses can save time and reduce the risk of misunderstandings.

One of the main advantages of using a predefined structure for your billing records is the ability to keep everything streamlined and professional. This method ensures that all necessary details, such as client information, payment terms, and itemized costs, are included without the need for manual adjustments each time. Furthermore, it can help you comply with local tax regulations and financial standards.

In addition to simplifying administrative tasks, having a reliable system can also improve cash flow management. By clearly stating payment deadlines and other important conditions, businesses can encourage timely payments and avoid disputes. This practice also enhances the company’s reputation by conveying professionalism and reliability to clients.

Essential Features of a Good Invoice

A well-designed document for tracking payments must be clear, organized, and professional. It should include all necessary details to ensure transparency and avoid misunderstandings. The goal is to create a document that accurately reflects the services or products provided, the agreed-upon amounts, and payment terms, while also being easy to read and process for both parties involved.

Key Information to Include

To ensure your records are complete and effective, here are the essential components to include:

| Feature | Description |

|---|---|

| Unique Identifier | A unique reference number helps track the document and simplifies record-keeping. |

| Client Information | Client name, contact details, and address should be clearly listed to avoid any confusion. |

| Itemized List | Clearly break down the goods or services provided, with corresponding prices and quantities. |

| Payment Terms | Clearly state the payment due date and any relevant terms such as late fees or early payment discounts. |

| Tax Information | If applicable, include tax rates, amounts, and total sums to ensure compliance with local tax laws. |

| Total Amount Due | The total sum, including taxes and any additional charges, should be clearly stated for the client’s reference. |

Why These Elements Matter

Including these key elements in your document ensures that both you and your client have a mutual understanding of the transaction. It also helps avoid de

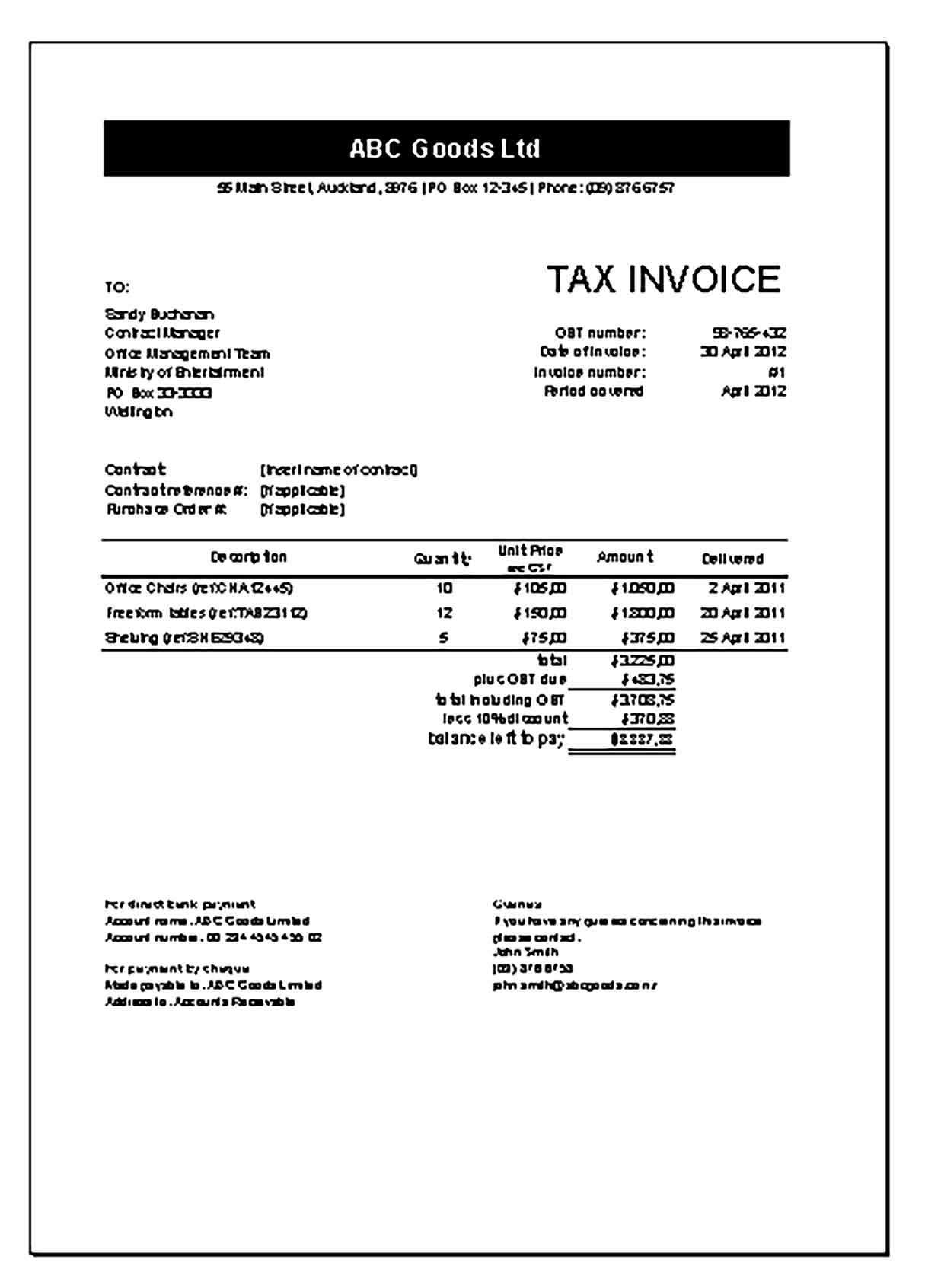

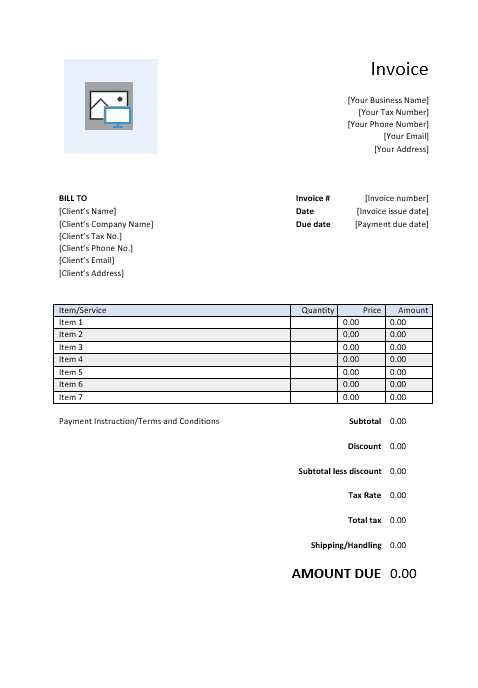

How to Customize an Invoice Template

Personalizing your billing document allows you to align it with your brand’s identity and the specific needs of your business. Customization helps you create a consistent, professional appearance while ensuring that all relevant details are included and easy to find. By adjusting certain elements, you can make the document work seamlessly for your operations, whether you’re a freelancer, a small business, or a larger enterprise.

Step-by-Step Customization Process

When you begin customizing, start with the basics and focus on the most important details. The first thing to consider is branding. Your document should reflect your business’s visual identity, including the logo, color scheme, and font style. This will make your communications look more polished and easily recognizable. Next, customize the layout to suit your preferences: adjust the positioning of information like client details, descriptions, and prices to match the flow you find most intuitive.

Incorporating Key Information

Once the basic design is in place, move on to adding necessary information. Ensure the document includes client contact details, a list of services or products with prices, and any additional charges or discounts. If your business operates with specific payment terms, such as early payment discounts or late fees, clearly state these conditions. Finally, include any relevant tax information and the total amount due. Customizing these details makes your document not only more professional but also more functional for your particular business model.

Free vs Paid Invoice Templates

When it comes to creating a document for client payments, businesses often face the decision of whether to use a free or paid option. Both have their advantages and limitations, and the choice depends largely on the specific needs of your business. Understanding the key differences between the two can help you make an informed decision that best suits your operational requirements.

Advantages of Free Options

Free solutions can be a great choice for small businesses or freelancers with limited budgets. They often come with the basics needed for clear, functional records. Here are some benefits of opting for free options:

- No Cost: The most obvious advantage is that they are free to use, making them ideal for startups or those who need a simple solution.

- Easy Access: Free options are widely available online, and many are simple to download and start using immediately.

- Simplicity: These formats are typically straightforward, with minimal customization, making them easy for users with little to no experience in creating payment documents.

Advantages of Paid Solutions

Paid options offer more flexibility and features, making them a good fit for businesses looking for a professional, long-term solution. Here are the key benefits:

- Customization: Paid solutions often allow greater flexibility, such as the ability to add your logo, choose specific fonts, and rearrange sections for better presentation.

- Advanced Features: Many premium options come with built-in features like automatic calculations, integration with accounting software, and client management tools.

- Customer Support: Paid options often provide access to customer service and technical support, which can be helpful if you run into any issues.

- Professional Appearance: With more advanced designs, these formats tend to offer a more polished, business-ready look, which can enhance your company’s image.

Ultimately, the choice between free and paid solutions depends on your business’s specific needs, budget, and level of complexity required for your payment documen

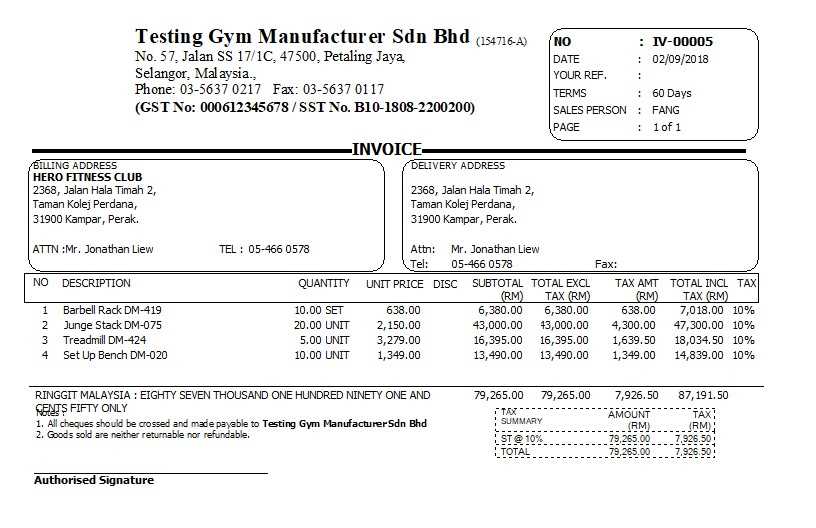

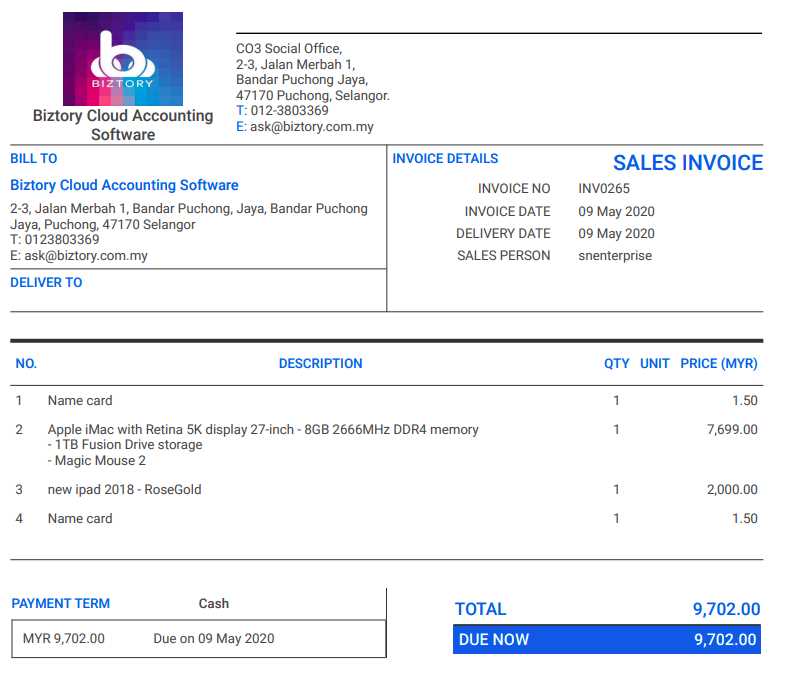

Legal Requirements for Invoices in Malaysia

When conducting business transactions, it is essential to adhere to legal guidelines to ensure that payment records are compliant with local regulations. In many countries, including Malaysia, there are specific rules regarding the information that must be included in a billing document. Failure to meet these requirements can result in legal complications, delays in payments, or issues with tax authorities. Understanding these legal obligations is crucial for businesses of all sizes.

In Malaysia, businesses are required to issue proper documents for all commercial transactions, especially for tax purposes. The Malaysian government has set out clear standards to ensure that all necessary details are accurately recorded and easily traceable. Below are some of the most important legal elements that should be included in every document related to payments:

- Business Information: The name, address, and tax identification number (TIN) of the business must be clearly stated.

- Client Details: The name, address, and contact information of the customer should also be included, ensuring proper identification of both parties.

- Unique Reference Number: A distinct reference number for the document must be issued for tracking and future reference.

- Description of Goods/Services: A clear breakdown of the products or services provided, including quantities, prices, and total amounts.

- Tax Information: If applicable, the Goods and Services Tax (GST) or other relevant taxes must be itemized and clearly shown on the document.

- Payment Terms: It is important to specify the payment due date, any discounts for early payments, and penalties for late payments.

Incorporating these details into your billing documents not only ensures compliance with local laws but also helps in maintaining a transparent and professional relationship with your clients. This is especially important when dealing with tax authorities or if your business undergoes audits. By following the correct legal procedures, you c

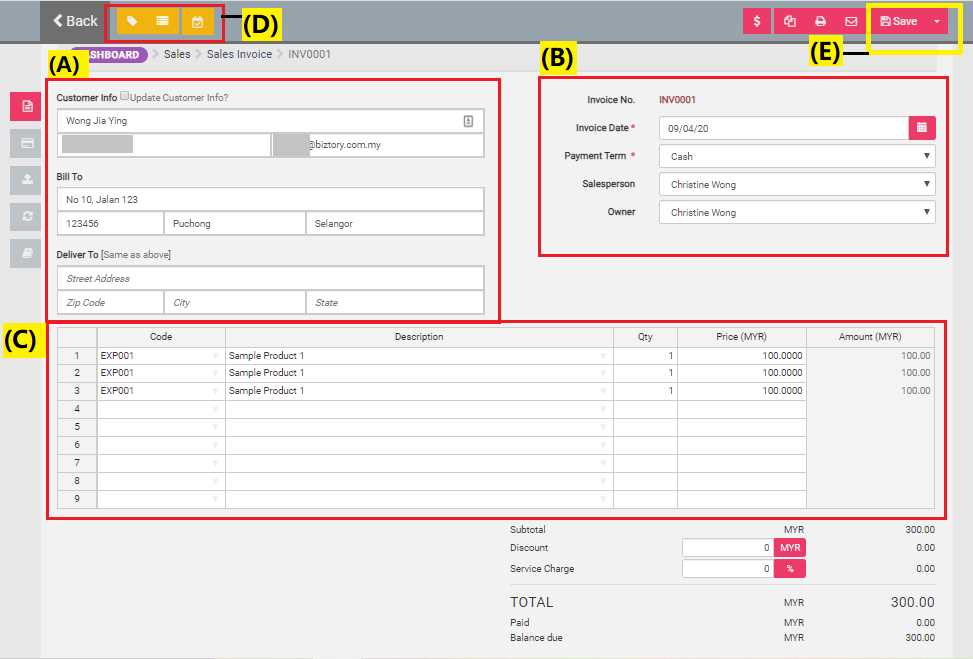

Best Invoice Software for Malaysian Businesses

For businesses looking to streamline their payment processes, choosing the right software is essential. The right solution can automate many aspects of record-keeping, from creating documents to tracking payments and managing client information. With so many options available, it’s important to select software that suits your specific business needs, whether you’re a freelancer, small business, or large enterprise.

When selecting software for your financial documentation, there are a few key factors to consider: ease of use, customization options, integration with other tools, and local compliance with tax laws. Below are some of the best software options for businesses operating in the region, which offer a range of features to help manage transactions efficiently.

- QuickBooks: A popular choice for small businesses, QuickBooks offers a range of invoicing tools that can be easily customized. It also integrates well with other accounting and tax software, making it ideal for companies looking to manage finances comprehensively.

- Zoho Books: Known for its user-friendly interface, Zoho Books provides automated billing and reporting features. It also supports local tax calculations and offers multi-currency support, making it a solid choice for businesses working with international clients.

- Xero: Xero is a cloud-based software solution that provides a complete suite of financial management tools, including customizable payment documents. It is especially useful for businesses looking for scalability and seamless integration with various financial platforms.

- FreshBooks: This software is ideal for freelancers and service-based businesses, offering simple yet effective tools for managing payments and tracking time. FreshBooks allows users to send personalized documents and track expenses, making it a great option for those just starting out.

- Wave: A free software solution, Wave is a great option for small businesses on a budget. It offers features like unlimited invoicing and receipt scanning, though it lacks some advanced features found in paid alternatives.

Choosing the right software depends on your business’s specific needs. Consider factors such as the volume of transactions, customer base, and integration with existing systems to find the solution that will best support your financial operations.

How to Create an Invoice in Excel

Microsoft Excel is a versatile tool that can be easily used to create professional documents for tracking payments and managing transactions. It allows for full customization, offering a simple and cost-effective way to maintain financial records without the need for expensive software. In this section, we’ll guide you through the process of creating a basic document that meets your business needs.

Follow these steps to create a payment record in Excel:

| Step | Action | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Step 1: Open a New Spreadsheet | Start by opening a blank spreadsheet in Excel. This will serve as your working document. | |||||||||||||||||||

| Step 2: Set Up Your Header | In the first few rows, include your business name, logo (if you have one), address, contact details, and tax identification number (if applicable). This will be the header of your document. | |||||||||||||||||||

| Step 3: Add Client Information | Below your business details, create a section for your client’s name, address, and contact information. This is essential for identifying the recipient of the document. | |||||||||||||||||||

| Step 4: Insert a Table for Items/Services | Create a table with columns for the item or service description, quantity, unit price, and total price. This will help itemize the transaction clearly. You can use Excel’s “SUM” function to calculate totals automatically. | |||||||||||||||||||

| Step 5: Add Payment Terms | At the bottom of the document, include any payment terms, such as due date, accepted payment methods, and any discounts or penalties for early/late payments. | |||||||||||||||||||

| Step 6: Finalize and Save |

| Section | Purpose |

|---|---|

| Payment Status | Indicate whether a payment has been made, is pending, or is overdue. This provides clear insight into the status of the transaction. |

| Payment Date | Record the date when payment was received or when it is expected. This helps track the timeliness of payments. |

| Amount Paid | Clearly state the amount that has been paid, along with any remaining balance due. This allows you to track partial payments and the overall amount settled. |

| Outstanding Balance | Provide the remaining balance for clients who have not fully paid. This helps in identifying amounts due for future follow-ups. |

Utilizing Tracking Tools and Software

Many businesses also leverage accounting software or online platforms to automate the payment tracking process. These tools often allow for integration with payment gateways, automatically updating payment statuses and sending reminders to clients. For smaller businesses or freelancers, using simple spreadsheets or accounting t

How to Send Invoices Professionally

Sending a payment request in a professional manner is crucial for maintaining a positive relationship with clients and ensuring timely payments. The way you present and communicate your payment request reflects your business’s professionalism and helps set the tone for future interactions. A well-crafted, clear, and courteous message can make the difference between a prompt payment and an overdue balance.

When sending a payment request, it’s important to include all necessary information while maintaining a polite and professional tone. Clear communication can prevent misunderstandings and ensure that clients have all the details they need to settle their accounts promptly. Below are key steps to follow when sending your request for payment:

1. Choose the Right Delivery Method

The method you choose to send your payment request depends on the client’s preferences and the nature of your relationship. Common delivery methods include:

- Email: Sending via email is the most common and efficient method for most businesses today. Attach the document and write a brief message explaining the contents.

- Postal Mail: For formal transactions or clients who prefer physical documentation, mailing a hard copy can be effective. Ensure that the document is neatly printed and properly addressed.

- Online Platforms: Many businesses use online tools such as PayPal, QuickBooks, or invoicing software that allow you to send a payment request directly from the platform, often with automated reminders.

2. Include a Professional Message

When sending a payment request, it’s important to maintain professionalism in your message. Your email or communication should be clear, polite, and to the point. Here is a sample of what your message could include:

- Greeting: Address the client formally using their name.

- Details of the Request: Briefly outline the work completed or goods delivered, and state the amount due. Be sure to mention the payment deadline clearly.

- Polite Reminder: End with a gentle reminder that the payment is due and express appreciation for their business.

For example:

Dear [Client's Name], I hope you are doing well. I am writing to kindly remind you that the payment for [description of goods/services] is due on [due date]. The total amount due is [amount]. Please find the payment request attached for your reference. If you have any questions, feel free to reach out.Digital vs Paper Invoices in Malaysia

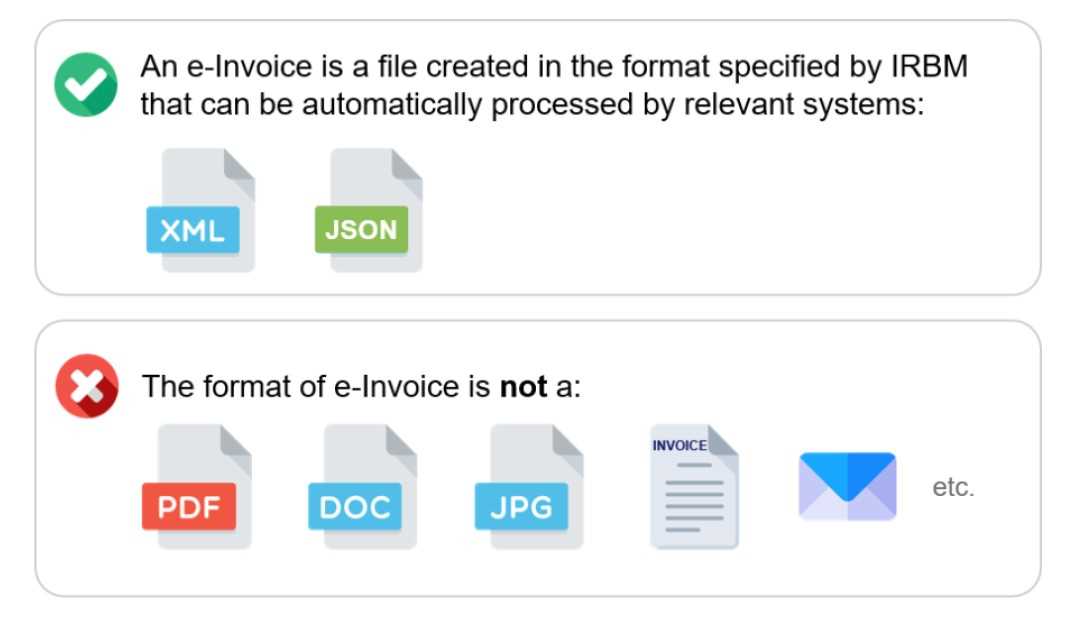

With the rise of digital technologies, businesses now have a choice between traditional paper documents and digital records for managing payments. Each method offers distinct advantages and potential drawbacks, and choosing the right option can greatly impact the efficiency of your operations. Understanding the key differences between these two methods can help you decide which is best suited for your business needs and client preferences.

Advantages of Digital Records

Digital documents have become increasingly popular due to their convenience and efficiency. Here are some of the key benefits of using digital methods for managing payment requests:

- Speed and Efficiency: Digital documents can be created, sent, and tracked instantly. This reduces the time spent on physical mailing and the potential for delays in receiving payments.

- Cost-Effective: Sending documents via email or through online platforms eliminates the cost of paper, printing, and postage. This is particularly beneficial for small businesses or freelancers.

- Easy Storage and Organization: Digital records can be stored and organized in a cloud-based system, making it easy to retrieve and manage past transactions at any time.

- Environmentally Friendly: Reducing paper use contributes to a greener, more sustainable business practice.

Advantages of Paper Records

Despite the convenience of digital methods, paper documents still have their place in certain business settings. Here are some of the reasons why businesses may choose paper over digital alternatives:

- Client Preference: Some clients may prefer physical documents, especially older businesses or those in regions with less digital infrastructure.

- Legal and Compliance Considerations: In some cases, local regulations or client requirements may mandate the use of physical records for official purposes.

- Tangible Evidence: For clients who prefer having physical copies, paper documents provide a tangible reference that can be stored in their files.

Ultimately, the decision between digital and paper records depends on your business model, client base, and the nature of your transactions. For many businesses, a hybrid approach that combines the speed of digital with the reliability of paper can offer the best of both worlds.

VAT and Tax Considerations for Invoices

When managing financial transactions, understanding the tax implications is crucial for ensuring compliance with local regulations. For businesses that provide goods or services, incorporating the correct tax rates and ensuring accurate reporting on payment requests can prevent legal issues and fines. Taxation, including VAT (Value Added Tax), is often a significant component of the total amount due, and it’s essential to follow the required guidelines when calculating and presenting it.

In many regions, businesses are required to add VAT or other taxes to their total amounts due. Failing to include the appropriate tax can lead to discrepancies in financial records, potential disputes with clients, and complications with the tax authorities. Below are some important tax-related considerations when preparing your payment requests:

Key Tax Elements to Include

| Tax Element | Description |

|---|---|

| Tax Identification Number | Your business should display its unique tax ID number on each document, ensuring that the transaction is correctly associated with your company for tax purposes. |

| Applicable Tax Rate | Ensure that you apply the correct tax rate based on your location and the type of goods or services provided. This can vary based on the region and industry. |

| Total Tax Amount | Clearly state the amount of tax charged, separate from the base price, to avoid confusion for clients and to maintain transparency. |

| Exemption Details | If any tax exemptions apply (e.g., for certain goods or services), specify this clearly, including any relevant reference numbers or documentation. |

Ensuring Compliance with Local Regulations

Tax regulations vary widely depending on the region and the nature of your business. It is essential to stay informed about the specific tax laws that apply to your business activities, including VAT, sales tax, and any other relevant taxes. Keep in mind that tax laws can change, so regular updates are necessary to ensure your records remain accurate and compliant.

Incorporating accurate tax information on your payment documents not only ensures compl

How to Integrate Invoicing with Accounting Software

Integrating your payment request process with accounting software can streamline your financial management and reduce errors. By automating the flow of data between your payment records and accounting system, you can save time on manual entry, improve accuracy, and gain real-time insights into your business’s financial health. This integration simplifies processes like tracking income, generating reports, and ensuring tax compliance.

Setting up an effective integration requires a few key steps to ensure smooth operation between your invoicing system and accounting software. Here’s how you can integrate these two systems efficiently:

Steps to Integrate Your Systems

- Choose Compatible Software: Ensure that the accounting software you choose is compatible with your invoicing solution. Many popular platforms, such as QuickBooks, Xero, and FreshBooks, offer built-in integrations with invoicing tools or third-party applications.

- Sync Customer Data: Integrate customer information from your accounting system into your payment requests to avoid duplication and errors. This can include client names, addresses, and payment terms.

- Automate Payment Updates: Link your accounting software to automatically update payment statuses once a payment has been made. This reduces the need for manual tracking and ensures accurate financial reporting.

- Customize for Business Needs: Configure the integration to reflect your specific requirements. This could involve setting up tax rates, currency options, and customizable fields for different products or services.

- Generate Financial Reports: Once integrated, you can generate real-time financial reports that pull from both your accounting system and payment records, giving you a complete picture of your cash flow and overall business performance.

Benefits of Integration

- Improved Accuracy: Automatically transferring data between systems reduces the risk of human error in calculations, helping to maintain accurate financial records.

- Time-Saving: By automating processes, you free up time for other tasks, such as focusing on business growth and client relations.

- Seamless Reporting: Integration makes it easier to create financial reports that provide a detailed view of your business’s performance, taxes, and outstanding payments.

- Better Cash Flow Manageme