How to Use the Best Invoice Template on iPad for Easy Billing

Managing your financial records on the go has never been easier with the right tools. With modern mobile devices, creating and managing professional documents for transactions can be done quickly and efficiently. No more relying on bulky software or complex setups; everything you need is available right at your fingertips.

For those who need to generate professional invoices and financial documents while working remotely or from various locations, mobile solutions provide the flexibility to handle these tasks seamlessly. By using specialized applications, you can create polished, accurate statements that align with your business needs in just a few taps.

Whether you are a freelancer, small business owner, or part of a larger organization, optimizing how you manage financial documentation is crucial. Leveraging mobile-friendly tools allows you to keep your work organized, track payments, and ensure timely deliveries–all with minimal effort and maximum efficiency.

Choosing the Right Invoice Template for iPad

Selecting the right document creation tool for managing transactions on your mobile device is essential for efficiency and professionalism. With a wide range of options available, it can be challenging to determine which one will best meet your needs. The key is to consider factors that align with the way you work, the type of information you need to track, and the design elements that reflect your brand identity.

To help narrow down your options, here are a few things to consider when choosing the ideal solution:

- Customization Options: Look for tools that allow flexibility in adjusting layout, fields, and content, so you can tailor each document to fit your specific requirements.

- Ease of Use: The tool should be simple to navigate, with an intuitive interface that allows you to create and send documents with minimal steps.

- Compatibility: Ensure the application works seamlessly with other systems, such as accounting software or email clients, for easy integration.

- Professional Appearance: Choose a solution that offers high-quality, polished designs that give your documents a professional and consistent look.

- Cloud Integration: A tool with cloud support will help you store and access your documents from anywhere, making it easier to manage and update your files on the go.

- Security Features: Protect sensitive financial data with tools that offer encryption and password protection for peace of mind.

By focusing on these key aspects, you can confidently choose the right solution to meet your mobile document needs, ensuring your financial records are accurate, secure, and easy to manage.

Benefits of Using iPad for Invoicing

Utilizing a mobile device for creating and managing financial documents brings numerous advantages that can enhance both productivity and professionalism. With the convenience of portability and powerful applications, handling transactions on the go becomes easier than ever before. The ability to manage such tasks directly from a compact device offers both flexibility and efficiency, especially for business owners and freelancers who are always on the move.

Portability and Flexibility

The greatest benefit of using a mobile device for your business documentation is its portability. Whether you’re at a client meeting, on a business trip, or working from home, you can create and send professional documents within minutes. This mobility allows you to handle administrative tasks without being tied to a desk, offering freedom and flexibility in your daily routine.

Streamlined Workflow

Mobile applications designed for financial documents provide a streamlined experience, reducing the number of steps needed to complete each task. With templates and automation features, you can quickly generate accurate records, track payments, and send them to clients or colleagues–all without the need for complex software or extra devices. This efficiency can save you time and minimize errors, improving your overall workflow.

Increased Efficiency: Tasks that once required multiple devices or lengthy software programs can now be handled with a few taps on your mobile device, reducing friction and speeding up the process.

Professional Appearance: The polished, customizable designs available on mobile applications ensure that every document you send reflects the quality of your work, helping build a professional reputation with clients and partners.

How to Download Invoice Templates on iPad

Getting started with generating professional financial documents on your mobile device begins with selecting the right application and downloading the necessary resources. Whether you’re looking for pre-designed forms or customizable options, there are various ways to find and install the tools that suit your business needs. Once the correct app is installed, you can easily access and download forms to create polished records with minimal effort.

Finding the Right Application

The first step is to choose a reliable app that allows you to create and manage your documents. There are plenty of options available on the App Store, ranging from free apps to premium solutions with advanced features. Look for apps that offer:

- Customization options for designing your documents

- Pre-built forms that save time on manual entry

- Integration with cloud storage for easy access

- Security features to protect sensitive information

Downloading and Installing Forms

Once you’ve chosen the right app, the next step is to download and install your required forms. Most apps allow you to:

- Search for forms within the app’s library

- Select your preferred design or layout

- Download and save the form to your device

- Customize the fields and details as needed

With these simple steps, you’ll have everything you need to start generating professional documents on your mobile device without the need for additional software or tools. Whether you’re on the go or working remotely, accessing these forms is quick and hassle-free.

Top Features to Look for in Templates

When choosing a solution to create professional financial documents on your mobile device, it’s important to select a tool with the right set of features to meet your specific needs. The right features can enhance your workflow, improve document quality, and ensure ease of use. Whether you’re working on a small project or managing multiple clients, these features will help you streamline the process and produce polished results with minimal effort.

- Customization Options: Look for a solution that allows you to personalize the design and layout, including adding your business logo, adjusting fonts, and changing the color scheme to match your brand.

- Pre-built Fields: Choose a tool that includes common fields such as client information, payment terms, and itemized lists, which can save time and reduce errors when filling out documents.

- Ease of Use: Ensure that the interface is intuitive, with simple navigation that allows you to quickly create and edit documents without needing advanced technical skills.

- Cloud Integration: The ability to store and access documents on cloud platforms like Google Drive or Dropbox ensures that your files are easily accessible from any device, no matter where you are.

- Export and Sharing Options: Select a solution that allows you to easily export documents to various file formats (PDF, Excel, etc.) and share them via email or other communication tools directly from the app.

- Security Features: Protect sensitive data by choosing a solution with encryption and password protection options to keep your financial records safe and secure.

- Integration with Other Tools: Opt for a solution that integrates with accounting software or payment platforms to streamline your entire financial workflow and ensure consistency across all your systems.

By considering these key features, you can ensure that your solution will not only meet your immediate needs but also scale with your business as it grows. The right features will allow you to create and manage your documents more efficiently while maintaining a high level of professionalism.

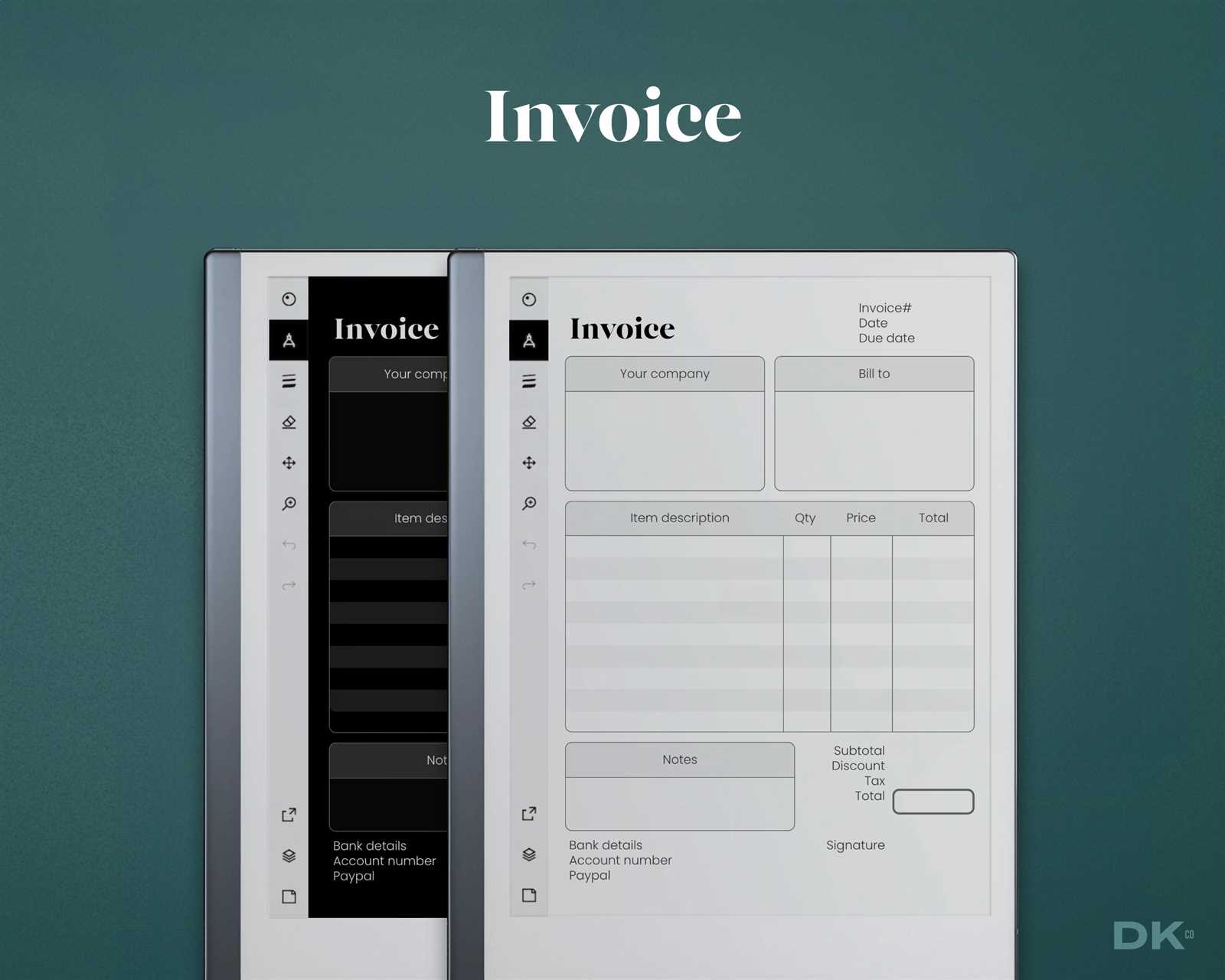

Customizing Your Invoice Template on iPad

Personalizing the documents you create on your mobile device is essential to ensure they accurately reflect your business’s identity and meet your specific needs. Whether you are generating financial records for a client or a project, customization allows you to tailor the content, layout, and design for maximum impact. Most mobile applications offer a range of tools that let you easily adjust every aspect of your document.

Adjusting Layout and Design

Many apps offer simple drag-and-drop features that allow you to modify the structure of your document. You can reposition key sections, such as contact details, line items, and totals, ensuring that the most important information stands out. Customizing colors, fonts, and borders helps align the design with your branding, making your documents look professional and cohesive.

Adding and Modifying Fields

Most mobile tools let you modify existing fields or add new ones to meet your unique requirements. This might include adding sections for discounts, taxes, or additional notes. Adjusting the size and layout of these fields ensures that your document contains all necessary details while maintaining a clean and readable format.

Flexible Design: Many solutions allow you to create a fully customized appearance with a variety of templates and layouts, providing endless possibilities to match your business style.

Easy Updates: Once you’ve customized your document, you can easily save your changes for future use, so you don’t have to start from scratch each time. This saves you valuable time and ensures consistency across all documents.

Free vs Paid Invoice Templates for iPad

When selecting a solution for creating professional financial documents on your mobile device, you have the option to choose between free and paid resources. Both options offer unique advantages, but the decision largely depends on your specific needs and the level of customization or functionality you require. Understanding the key differences between these two types of resources can help you make an informed choice that best suits your business or personal requirements.

Free Resources: Free options are an excellent starting point, especially for individuals or small businesses with minimal documentation needs. These solutions often come with basic features, including pre-designed layouts and standard fields. While they may not offer extensive customization, they can still meet the needs of many users who require simple, straightforward documents.

Paid Resources: Paid options typically provide enhanced features, such as advanced customization, more professional designs, and additional functionality. These solutions often come with cloud integration, better security options, and the ability to sync across multiple devices. If you require more flexibility or handle a high volume of transactions, investing in a paid solution can provide the tools necessary to streamline your workflow and maintain a consistent, polished appearance across all documents.

Consider your needs carefully: If you are just starting out or working on occasional projects, free tools may be all you need. However, if you require specialized features, such as recurring billing, reporting, or integration with other business systems, a paid option may be worth the investment for improved efficiency and professionalism.

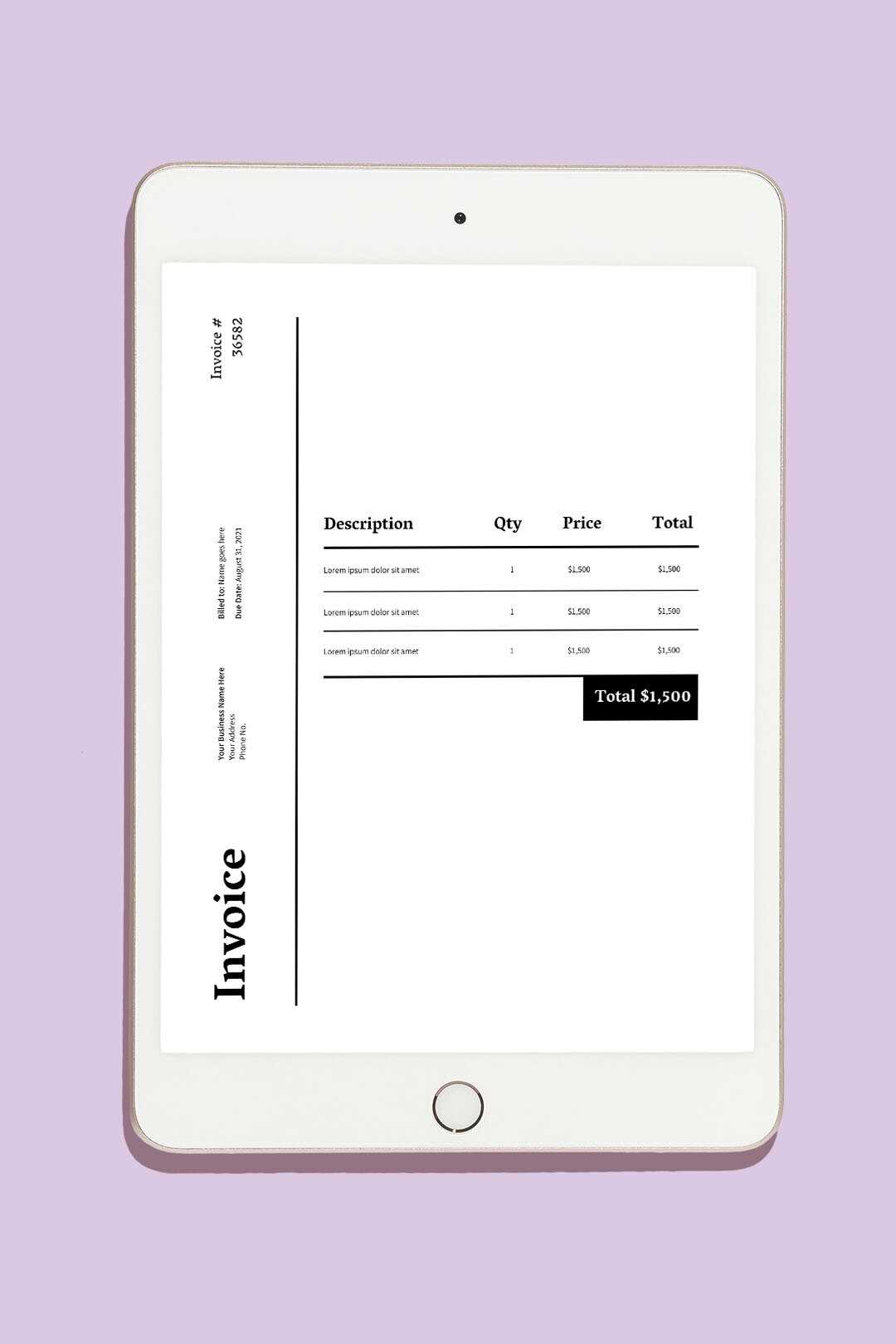

How to Create a Professional Invoice on iPad

Creating polished and professional documents on your mobile device doesn’t have to be complicated. With the right tools, you can design and generate business records that reflect your professionalism and attention to detail. By focusing on layout, branding, and the necessary information, you can produce documents that will impress clients and ensure accuracy in your financial records.

Choosing the Right Tool

First, you’ll need to select a reliable app that allows for customization and provides all the necessary features. Look for apps that offer professional-looking layouts, simple editing options, and the ability to store and manage your documents easily. Once you’ve chosen the app, it’s time to start creating your document.

Step-by-Step Creation Process

Follow these steps to ensure your document looks professional:

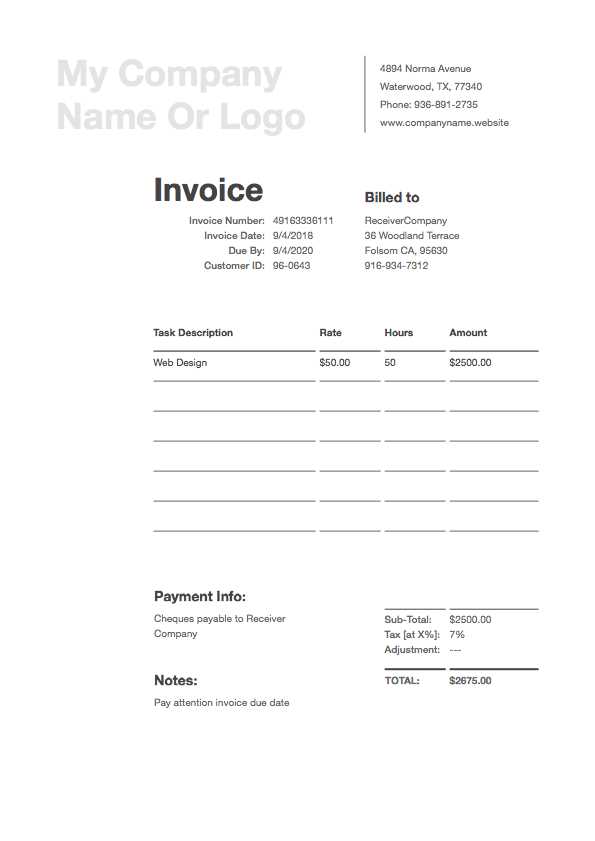

- Step 1: Input essential information such as your company name, contact details, and the recipient’s information. Always ensure these fields are accurate to avoid any confusion.

- Step 2: List the products or services provided, including clear descriptions, quantities, and prices. This transparency helps build trust with your clients.

- Step 3: Include any additional information, such as payment terms, due dates, or tax details, if relevant.

- Step 4: Customize the design to reflect your brand by adjusting the font, adding your logo, and choosing appropriate colors that match your business identity.

- Step 5: Review your document for accuracy, ensuring that all details are correct before saving or sending it out.

Tip: Make sure the document looks clean and well-organized to avoid overwhelming your clients with too much information. Clear, easy-to-read documents make the payment process smoother and faster.

Best Apps for Editing Invoice Templates

When it comes to creating and customizing financial documents on a mobile device, selecting the right application can make all the difference. The best apps for editing documents offer a combination of user-friendly interfaces, robust editing tools, and flexibility to meet various business needs. Whether you’re a freelancer, small business owner, or working on personal projects, the following apps stand out for their ease of use, functionality, and customization options.

Here are some of the top apps to consider for editing your documents on a mobile device:

- QuickBooks: A comprehensive tool that not only helps you create documents but also manage your accounting and finances. It offers pre-designed forms that you can easily customize, as well as integration with various payment systems.

- Zoho Invoice: This app allows you to generate highly customizable documents with options for adding your branding, setting payment terms, and managing client details. It also features recurring billing and automation options.

- Wave: A free, simple-to-use app for creating and managing documents. It includes basic editing features, an intuitive layout, and the ability to track payments, making it perfect for small businesses or freelancers.

- Microsoft Word: Though not specialized in financial documents, Word offers robust customization options. With various templates available, you can easily edit and format documents, while saving them in multiple file types.

- Invoice2go: Known for its quick setup and ease of use, this app offers a wide range of professional templates, customization options, and automatic reminders to keep your financial records up to date.

Each of these apps provides a unique set of features that can help you tailor your financial documents to suit your business’s needs. Depending on your requirements–whether it’s simple editing or advanced automation–there’s an app to fit every workflow.

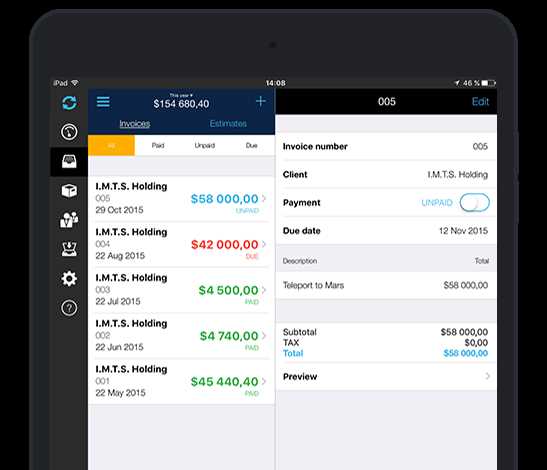

Managing Multiple Clients with iPad Invoices

Handling several clients at once can be challenging, especially when it comes to keeping track of payments and deadlines. With the right tools, managing multiple accounts becomes much simpler and more organized. Mobile devices, with their range of apps and features, provide an effective way to handle client communications and document generation in one place, allowing you to stay on top of your tasks and ensure timely payments.

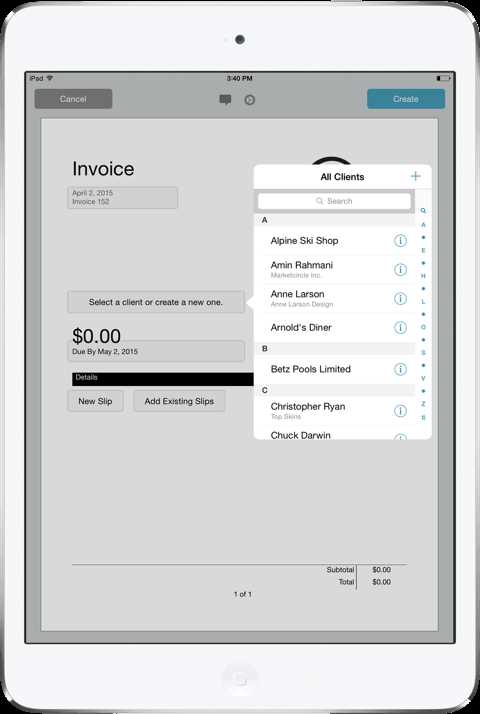

Streamlining Client Management

To effectively manage multiple clients, it’s crucial to keep your documents well-organized. Mobile apps allow you to create, store, and access client-specific records with ease. You can organize by client name, project type, or payment due dates, ensuring that nothing slips through the cracks. Many apps also provide features for tracking the status of each project or service, allowing you to stay up to date on pending payments and upcoming deadlines.

Automating Follow-Ups and Reminders

Automating reminders and follow-up tasks is one of the most helpful features for managing several clients. With mobile solutions, you can set up automatic reminders for due dates, overdue payments, or important tasks. This ensures you never miss a follow-up and helps keep your relationships with clients professional and timely.

By utilizing these features, you can streamline your workflow, reduce administrative overhead, and focus on what matters most–delivering excellent service to your clients. Whether you’re dealing with a few or many, the right tools can make all the difference in how you manage client interactions and financial records.

Exporting Invoices from iPad Templates

Once you’ve created and customized your financial documents, the next step is often sharing them with clients or storing them for future reference. Exporting your documents is a critical part of the process, allowing for easy distribution and record-keeping. Most mobile applications designed for business documentation offer multiple options for exporting, making it straightforward to send or save your work in various formats.

Choosing the Right Format: When exporting, it’s essential to choose the appropriate file format for your needs. Common formats include PDF, which ensures the document maintains its format and can be easily opened by clients on any device, and Excel or CSV for those who prefer to work with the data in spreadsheets. Each format serves a different purpose, so it’s important to know what will work best for your situation.

Sending and Sharing: Most mobile apps allow you to directly email or share your documents through cloud services, such as Google Drive, Dropbox, or iCloud. This ensures you can send your documents quickly and efficiently without worrying about file compatibility. Some apps even allow you to send reminders or follow-up emails along with the exported document, ensuring that your clients stay informed about due dates or payment statuses.

Tip: Always double-check the exported document to ensure all information is correct before sending it to clients. This prevents errors and maintains a professional standard for your business transactions.

Storing and Organizing Invoices on iPad

Effectively managing your financial documents is key to staying organized and ensuring you can easily access important records whenever needed. With the right tools, mobile devices allow you to store and organize your documents in a way that simplifies tracking and retrieval. By utilizing apps and cloud-based services, you can create a well-organized system for storing business records, making it easier to keep everything in order and find the right document quickly.

Utilizing Cloud Storage

One of the most effective ways to store documents on your device is by using cloud storage solutions. These platforms, such as Google Drive, Dropbox, or iCloud, allow you to upload and store files securely, ensuring that your documents are accessible from any device. You can organize your files into folders based on clients, project types, or dates, and search for them using keywords. Cloud storage also offers the benefit of automatic backup, so you don’t have to worry about losing important documents.

Organizing Files Locally

If you prefer not to rely on cloud services, there are also options to store documents directly on your device. Many apps allow you to create custom folders within the app, enabling you to keep your files neatly organized. Additionally, you can use file management tools to arrange your documents by client name, date, or project status. Regardless of where you store your files, keeping them well-organized will save you time and prevent unnecessary stress when you need to find specific records.

Tip: Regularly back up your files to prevent data loss. Whether you use cloud storage or local options, having a backup ensures your documents are safe in case of device failure or accidental deletion.

How to Add Payment Terms in Templates

In any financial document, it’s crucial to clearly outline the expectations regarding payment deadlines and conditions. By specifying payment terms, you ensure both parties are on the same page, preventing confusion and potential disputes. Adding these details is straightforward, and most digital tools offer easy ways to include them within your documents.

To include payment conditions, first determine the key elements you want to communicate. Common terms include payment due dates, late fees, and acceptable payment methods. Once you’ve identified the necessary information, it’s important to place these terms in a prominent location, such as at the bottom or near the total amount section, to make sure they’re easily visible to the recipient.

Most business management applications allow you to customize sections of your document, making it simple to insert standard payment terms. Some platforms even have pre-built fields for payment information, which you can modify to suit your needs. For those looking to create more complex terms, there are options to add custom text fields where you can input specific conditions or discounts.

Integrating iPad Templates with Accounting Software

Efficient financial management often involves connecting different tools and systems to streamline processes. By linking your document generation system with accounting software, you can automate many tasks, reduce the chance of errors, and improve overall workflow. This integration allows for seamless data transfer between your generated documents and your accounting records, making it easier to track payments, manage expenses, and generate reports.

Linking Documents to Financial Records

One of the main benefits of integration is the ability to directly connect the documents you create with your accounting system. This means that once you generate a financial document, you can instantly update client accounts, track outstanding balances, and even generate reports with minimal manual input. Many accounting platforms allow you to import data from external sources, so you can link your custom documents directly to your financial records for a smoother workflow.

Automating Data Entry and Calculations

By integrating your document creation system with accounting software, you can automate repetitive tasks like entering payment amounts, calculating totals, and applying taxes. This reduces the risk of errors and saves time, allowing you to focus on other important aspects of your business. Some systems also allow you to set up automatic invoicing or billing cycles, further reducing manual work and ensuring you stay on top of payments.

Tip: Before integrating, ensure that both your document tool and accounting software support the integration features you need. Look for platforms with user-friendly setup options to make the process easier and more efficient.

Sending Invoices Directly from iPad

Efficient communication with clients is essential, and sending financial documents directly from your device offers a quick and convenient solution. By leveraging mobile applications and email services, you can instantly send professional documents without the need for a desktop computer. This not only saves time but also helps maintain a smooth business operation, especially when on the go.

Most mobile applications allow you to generate and send documents directly via email or cloud-based platforms. Once you’ve created the document, simply select the recipient, attach the file, and hit send. Many apps also enable you to track the status of your sent documents, ensuring that you’re aware when they’ve been received or opened by the client.

Tip: Make sure to double-check the contact details and format before sending, as this will help prevent delays and ensure that your documents are delivered accurately.

How to Track Invoice Status on iPad

Keeping track of the status of financial documents is crucial to ensure timely payments and avoid any misunderstandings. With the right tools, it’s easy to monitor when a document has been received, opened, or paid. Most modern apps and software offer tracking features that allow you to stay on top of these details directly from your mobile device, providing real-time updates and notifications.

Using Tracking Features in Apps

Many document management apps come with built-in tracking features. These allow you to see when a recipient has viewed your document or even when they’ve taken specific actions, such as downloading or printing the file. Some tools also send you automatic alerts when a document has been opened or when a payment is due, helping you stay informed without needing to check manually.

Integrating with Payment Systems

Some financial management tools integrate directly with payment systems, allowing you to track whether a payment has been completed. By linking your document tool with your payment platform, you can quickly see if a transaction has been processed, saving you time and reducing the chances of errors. These integrations also allow you to issue reminders or notifications to clients who haven’t yet made a payment.

Tip: Ensure that you’re using a platform that provides reliable tracking capabilities and integrates well with your existing business systems to streamline the monitoring process.

How to Track Invoice Status on iPad

Keeping track of the status of financial documents is crucial to ensure timely payments and avoid any misunderstandings. With the right tools, it’s easy to monitor when a document has been received, opened, or paid. Most modern apps and software offer tracking features that allow you to stay on top of these details directly from your mobile device, providing real-time updates and notifications.

Using Tracking Features in Apps

Many document management apps come with built-in tracking features. These allow you to see when a recipient has viewed your document or even when they’ve taken specific actions, such as downloading or printing the file. Some tools also send you automatic alerts when a document has been opened or when a payment is due, helping you stay informed without needing to check manually.

Integrating with Payment Systems

Some financial management tools integrate directly with payment systems, allowing you to track whether a payment has been completed. By linking your document tool with your payment platform, you can quickly see if a transaction has been processed, saving you time and reducing the chances of errors. These integrations also allow you to issue reminders or notifications to clients who haven’t yet made a payment.

Tip: Ensure that you’re using a platform that provides reliable tracking capabilities and integrates well with your existing business systems to streamline the monitoring process.

Common Mistakes to Avoid When Using Templates

While pre-designed documents can make your workflow faster and more efficient, it’s important to be aware of common pitfalls that can lead to mistakes. Whether it’s overlooked details or misalignment with client expectations, small errors can make a big difference in the final result. Knowing what to avoid can help you use these tools more effectively and maintain a professional image in your business.

Overlooking Customization Options

One of the most common mistakes is failing to customize the document enough to reflect your unique business style and needs. Pre-designed formats may not always capture the specifics of your work, such as unique branding, payment terms, or client preferences. Always take time to modify the design, adding your logo, adjusting the layout, and personalizing the content to make it relevant to each client.

Leaving Out Important Details

Another common error is neglecting to include key information. Double-check that all required fields such as the recipient’s contact details, dates, amounts, and descriptions are filled out correctly. Omitting this information can create confusion and delay the process, leading to unhappy clients and payment issues.

Tip: Before sending out any document, review it carefully to ensure that all critical information is present and accurate. This includes reviewing amounts, services provided, and any applicable tax information.