Best Invoice Template for Individuals

For freelancers, entrepreneurs, or anyone managing their personal finances, having a clear and well-structured billing document is essential. These documents not only ensure you get paid on time but also convey professionalism to your clients. Whether you’re offering services or selling products, a well-designed bill helps maintain transparency and trust in your financial transactions.

In this guide, we will explore how to easily create and customize a document that suits your specific needs. From essential fields to design tips, you’ll learn how to craft a professional-looking bill that covers all the necessary details. This process can be simplified with the right tools, making it quick and easy to generate documents whenever needed.

Efficiently managing your finances starts with having a system that works for you, and a clear billing document is the first step toward achieving that goal. Whether you’re sending it electronically or in print, understanding the key elements of a professional bill can save you time and reduce errors, making every transaction smoother.

How to Create an Invoice for Personal Use

Creating a billing document for personal transactions can seem like a daunting task, but with a few simple steps, it becomes an easy process. Whether you’re working as a freelancer, selling products, or offering services, having a clear and organized record of payments is crucial. This document serves as a formal request for payment and outlines the services or goods provided, along with the agreed-upon amount.

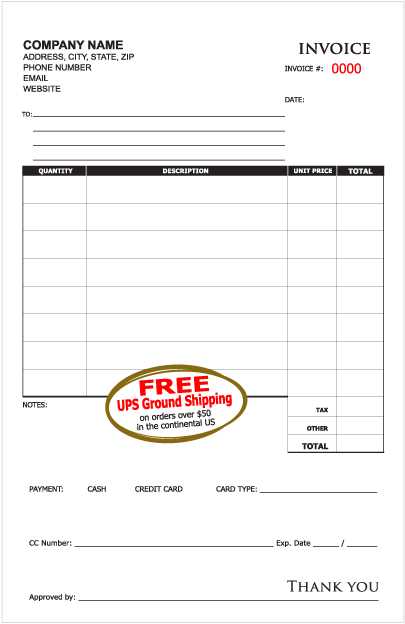

To start, you’ll need to include key details such as your name, contact information, and the recipient’s details. A unique reference number can also help track the document, especially if you issue multiple requests over time. Next, specify the items or services rendered, the quantity, unit price, and the total amount due. Make sure to clearly state payment terms, such as the due date and any late fees if applicable.

Designing a clean, simple layout is equally important to ensure your document looks professional. Avoid clutter, and focus on making all the important information easy to find. Using a consistent format will make future transactions more efficient, helping both you and your clients stay organized.

Why You Need an Invoice Template

Having a structured document for requesting payment is essential for any business or personal transaction. It ensures clarity and professionalism while preventing misunderstandings between you and your clients. Whether you’re a freelancer, a small business owner, or simply handling personal sales, a standardized document makes the payment process more efficient and reliable.

By using a pre-designed format, you can quickly generate documents with all the necessary information, saving you time and effort. It reduces the chances of missing important details like payment terms, contact information, or item descriptions. Moreover, having a consistent format makes it easier to keep track of past transactions, ensuring nothing slips through the cracks.

Using a structured approach can also help you maintain a professional image, reinforcing your credibility with clients. When you provide a polished, clear document, it reflects positively on your business practices and encourages prompt payments. Additionally, well-organized records are invaluable for tax purposes and financial tracking, allowing for smoother audits and financial planning.

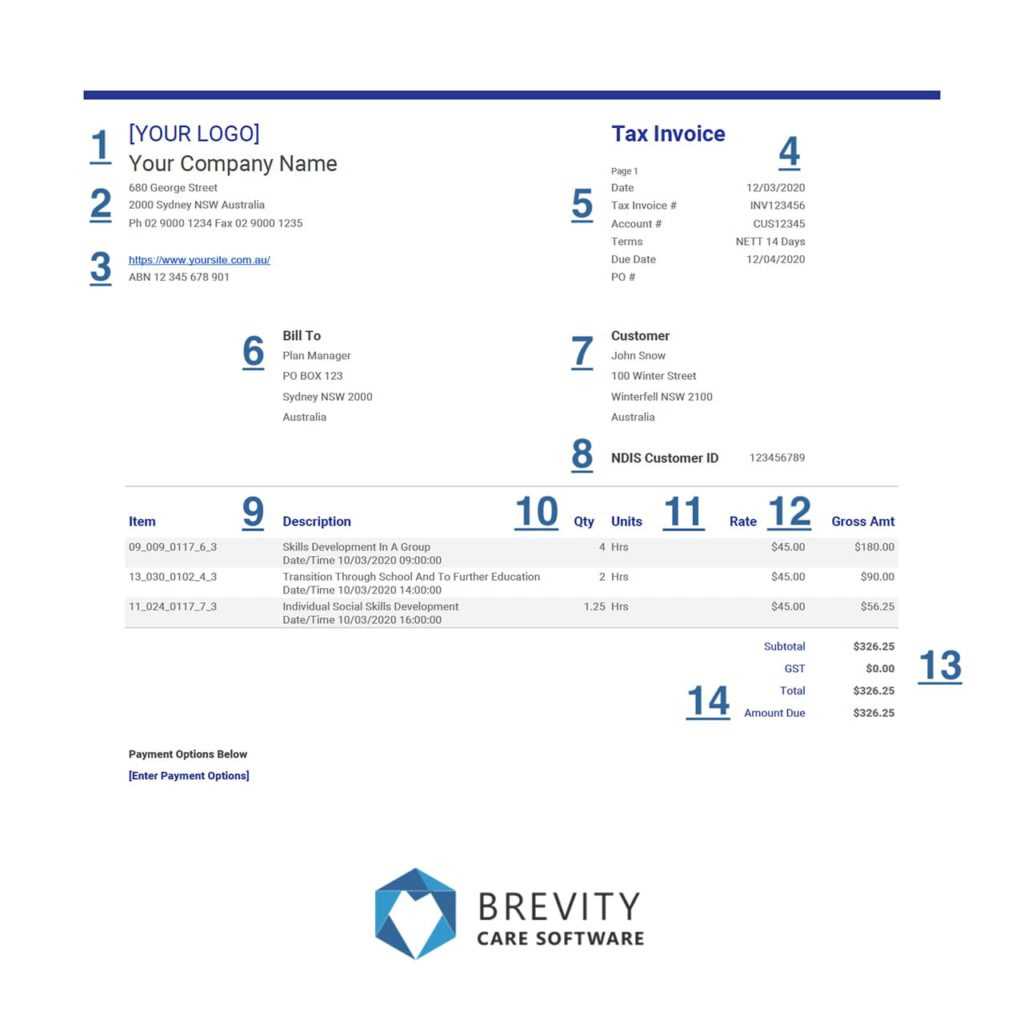

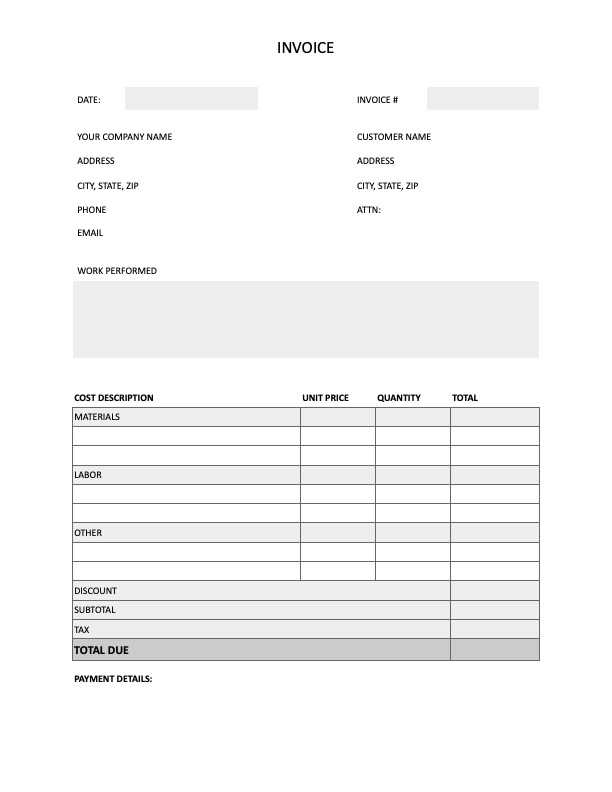

Key Elements of an Individual Invoice

To ensure that a payment request is clear, accurate, and professional, it’s important to include certain details in every document you send. These elements help both you and your client understand the terms of the transaction, the amount due, and any deadlines for payment. A well-structured bill provides clarity, reducing the chance of confusion or delays.

Essential Information

Start with basic contact details, including your name or business name, address, and phone number, along with the recipient’s details. You should also include the document’s unique number for easy reference and tracking. Clearly stating the date of the transaction and the due date for payment is equally important, as it sets expectations for both parties involved.

Services or Products Provided

List the items or services rendered, including descriptions, quantities, and unit prices. This breakdown is essential for both clarity and transparency. Be sure to add up the total amount due, including any applicable taxes, discounts, or additional fees. This ensures the client knows exactly what they’re paying for and helps avoid disputes later on.

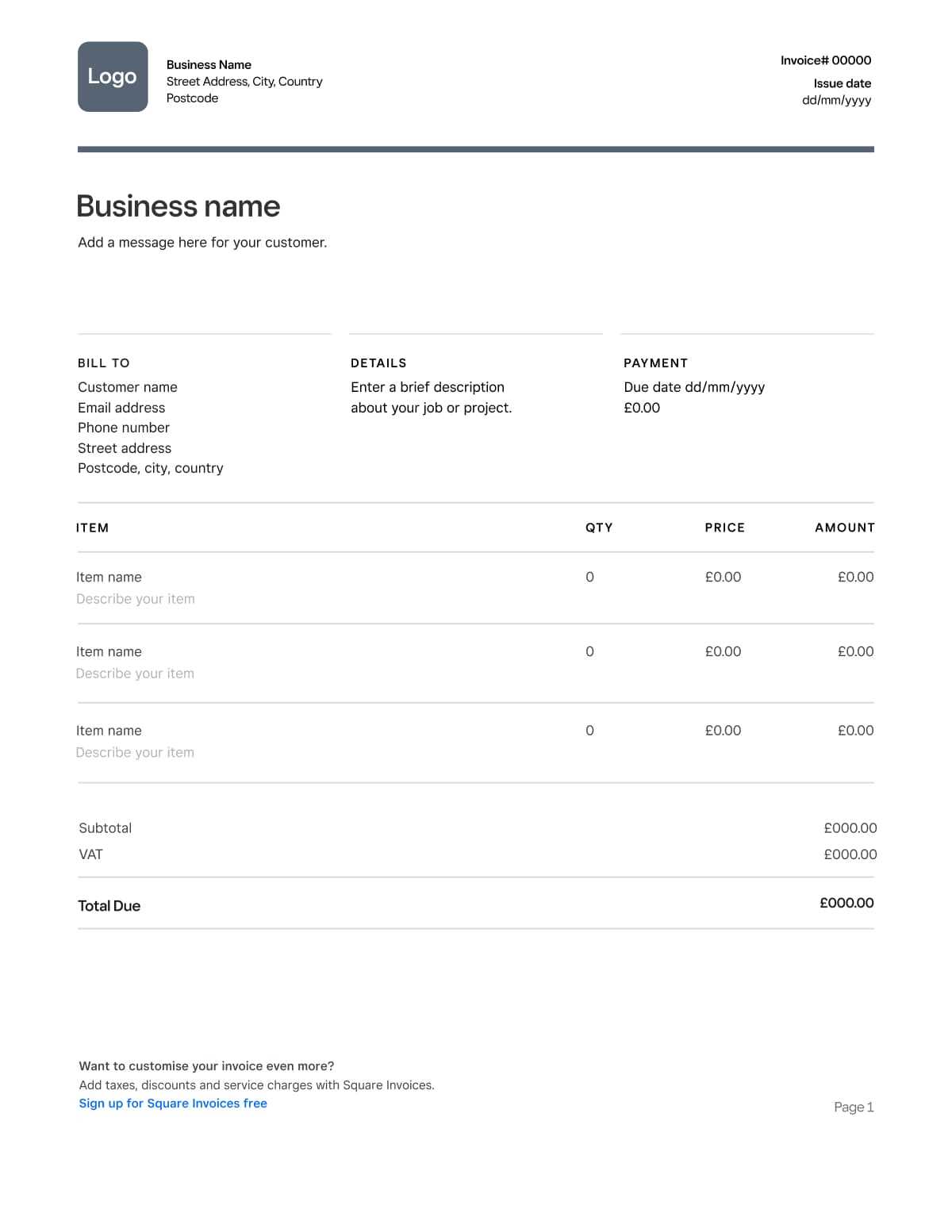

Choosing the Right Invoice Format

Selecting the correct layout for your billing document is crucial for ensuring it meets both your needs and your clients’ expectations. A well-chosen format helps convey professionalism and makes it easier for your clients to process payments quickly and accurately. There are several factors to consider when deciding which structure works best for your specific situation.

- Simple vs. Detailed: Depending on the complexity of the goods or services you’re offering, you may want to choose a more detailed format or keep it simple. A basic structure works well for straightforward transactions, while a detailed version is ideal for projects with multiple components.

- Digital vs. Paper: If you’re handling transactions online, an electronic document format (such as PDF) is often preferred. For physical transactions, a printed version may be more suitable.

- Branding and Customization: Choose a format that allows for easy customization with your business logo, colors, and fonts, to create a more personalized and cohesive appearance.

The right format ensures that the document is clear, organized, and tailored to the specifics of the transaction. Choosing a professional, easy-to-read design will not only make payment collection smoother but also build trust with your clients.

Customizing Your Invoice Template

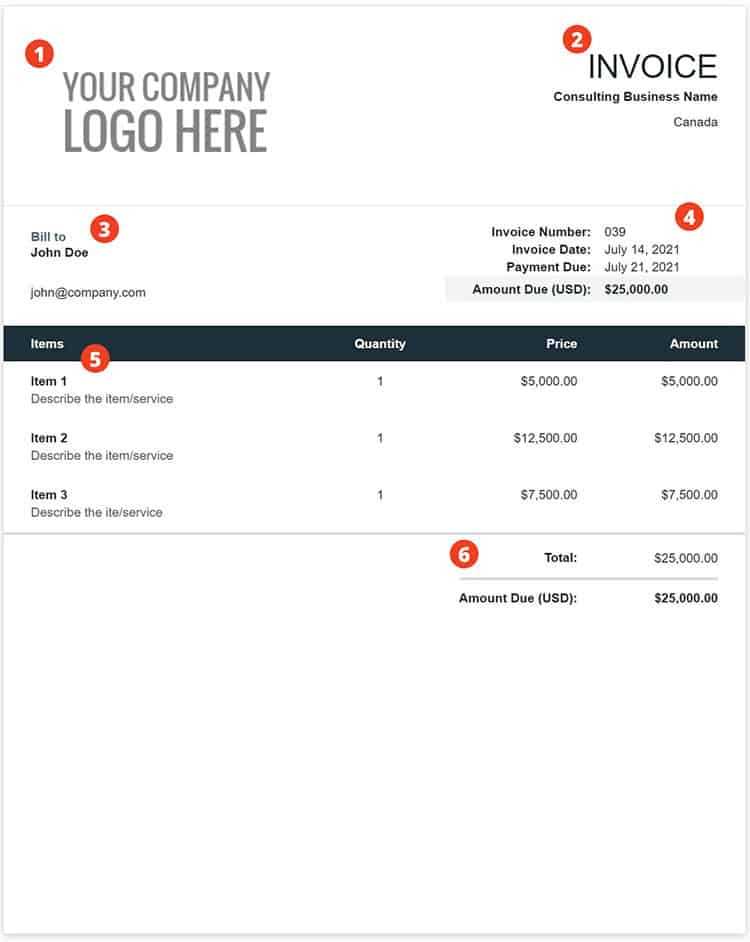

Personalizing your billing document is an important step in creating a professional and recognizable look for your business. By adjusting the layout and content to reflect your unique style and needs, you ensure that each request for payment is consistent and aligned with your brand. Customization also allows you to include all necessary details in a way that suits both you and your clients.

Start by adding your business logo and contact information at the top, which not only provides clarity but also reinforces your brand identity. You can further personalize the document by choosing colors and fonts that match your business aesthetic. Custom sections like payment instructions, due dates, or specific terms can also be adjusted to reflect your particular processes and policies.

Organizing the layout is key to making your document easy to read. For example, grouping related information like item descriptions and totals in separate sections ensures that clients can quickly find the details they need. Customizing your request for payment helps convey professionalism and makes it easier for clients to understand the terms of your agreement.

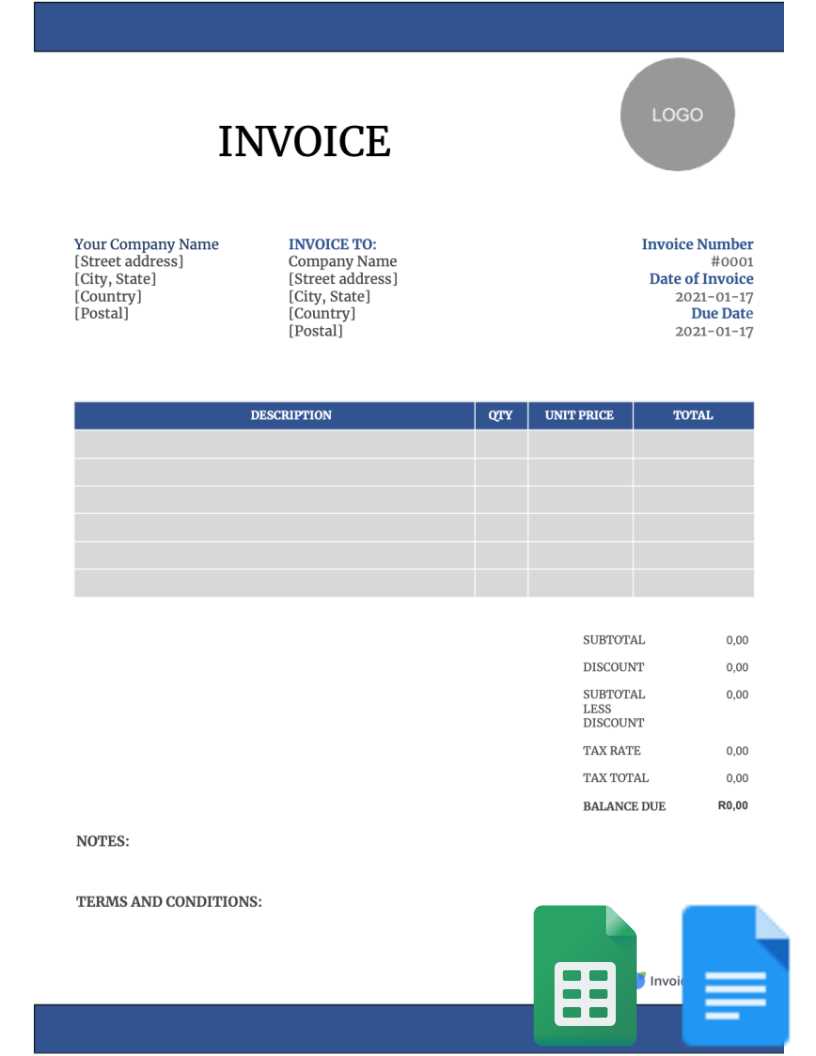

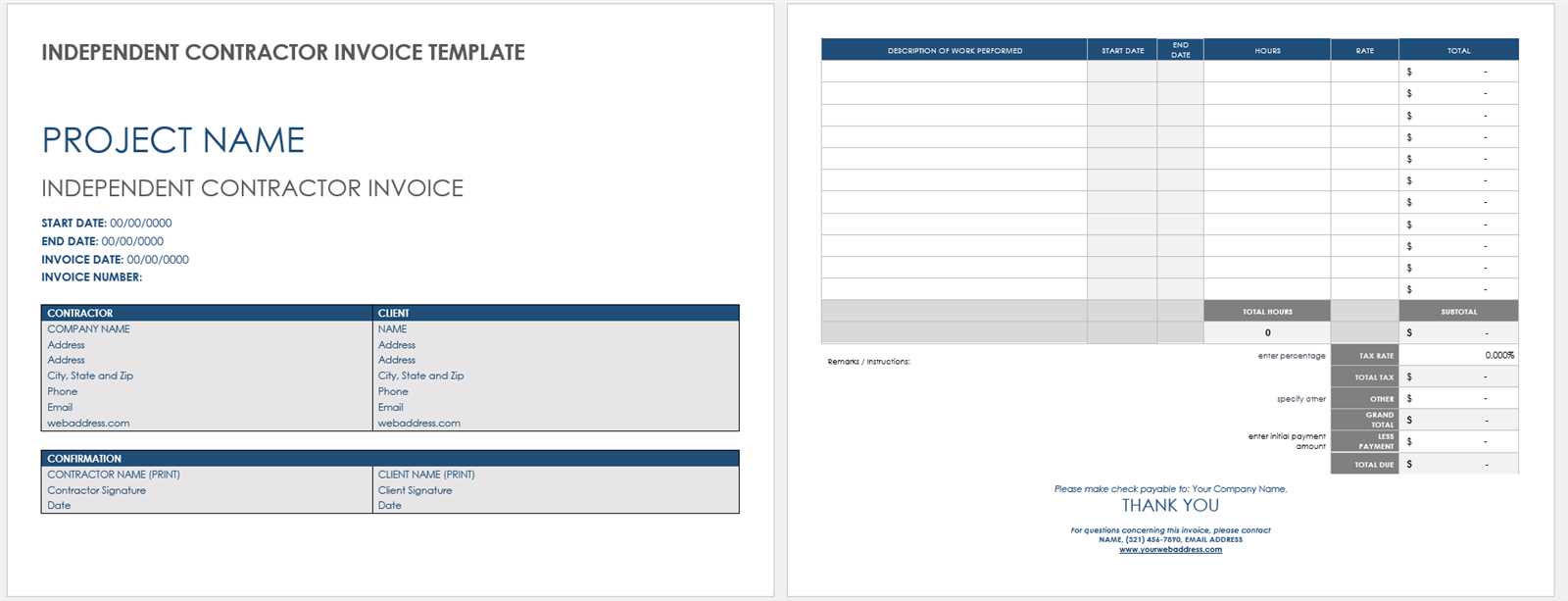

Free Invoice Templates for Personal Use

When you’re managing personal transactions, having access to no-cost billing documents can be a great way to save time and effort. These ready-made documents help you quickly generate accurate and professional requests for payment, whether you’re offering services or selling products. Many free options are available online, allowing you to customize the format to meet your needs without any financial commitment.

Where to Find Free Options

There are various websites that offer free billing documents, ranging from basic designs to more elaborate ones with advanced features. Many of these resources allow you to download documents in formats like PDF, Word, or Excel, so you can easily edit and customize them. Look for platforms that offer a wide range of styles and layouts, enabling you to choose one that best suits your transaction type.

Advantages of Free Options

Using a free billing document can save you both time and money, especially when you’re just starting out or only need occasional use. These resources often come with built-in fields for all the essential details, like item descriptions, dates, and totals. By using a free option, you can focus on the content rather than spending time creating a format from scratch.

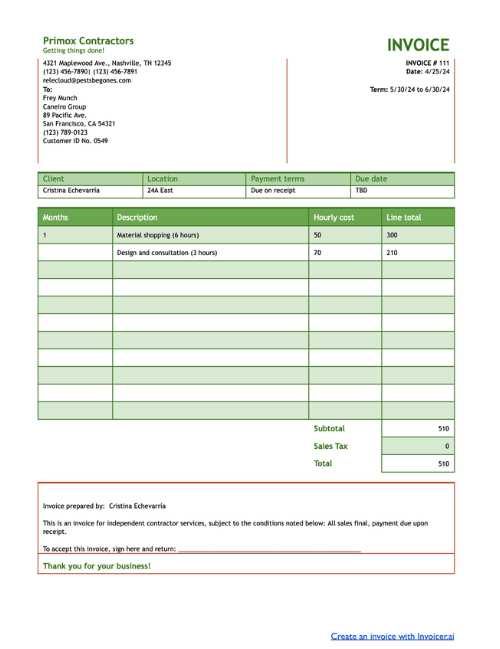

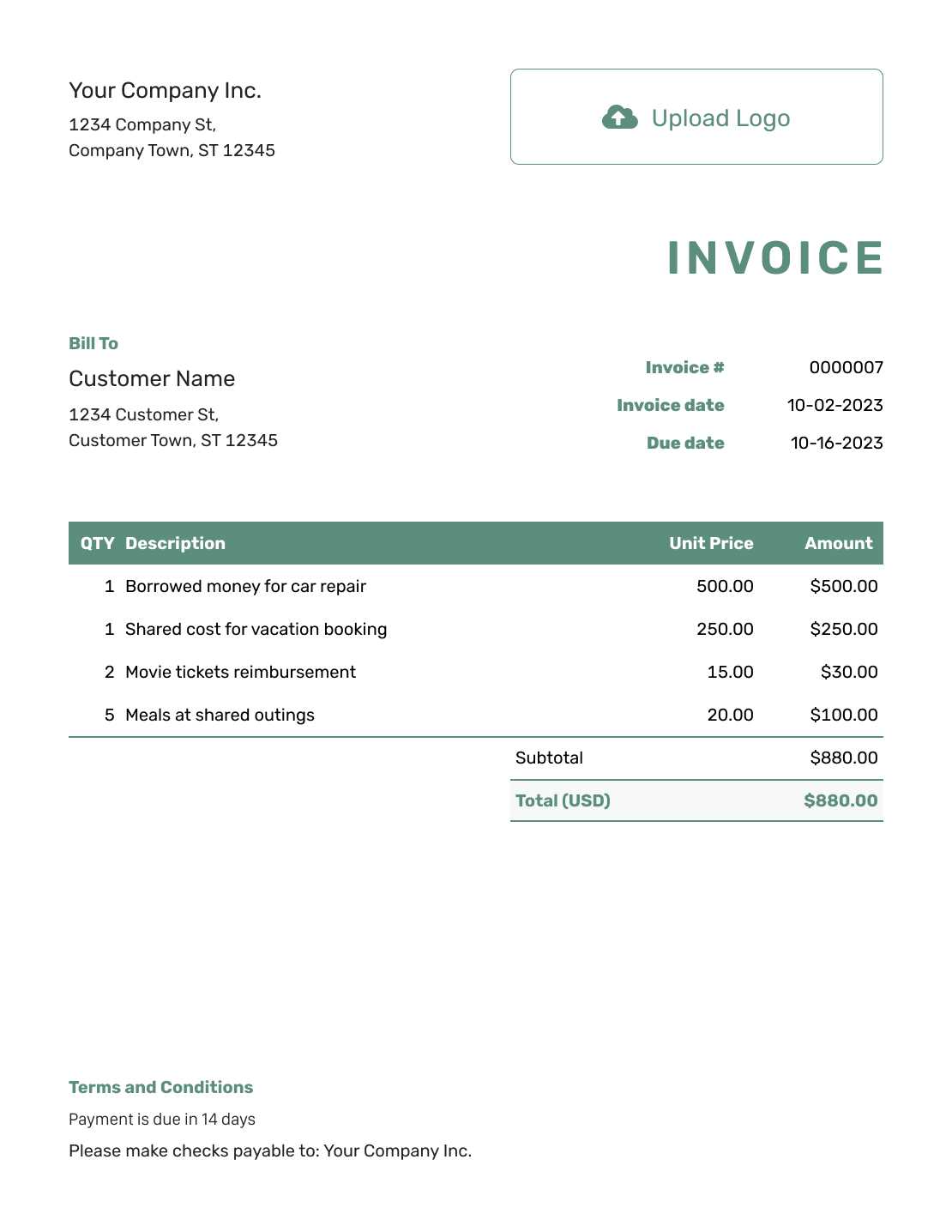

How to Include Payment Terms in Invoices

Including clear payment terms in your billing document is essential for ensuring both you and your client are on the same page. Payment terms outline when and how the client should pay, as well as any penalties for late payment. Clearly defined terms help avoid confusion and ensure that you receive timely payments for your services or products.

Key Elements of Payment Terms

- Due Date: Specify when the payment is expected. This could be a specific date or a number of days after the transaction (e.g., “Due within 30 days”).

- Accepted Payment Methods: Clearly state the methods through which payment can be made (e.g., bank transfer, PayPal, check, etc.).

- Late Payment Fees: Indicate any additional charges for overdue payments, such as a flat fee or a percentage of the total amount due.

- Discounts for Early Payment: Offer incentives, such as a discount for clients who pay before the due date.

How to Present Payment Terms

Place the payment terms in a prominent position, typically towards the bottom of the document or in a dedicated section near the total amount due. This ensures that clients can easily locate the details they need. Be concise and specific to avoid any ambiguity and to encourage prompt payment.

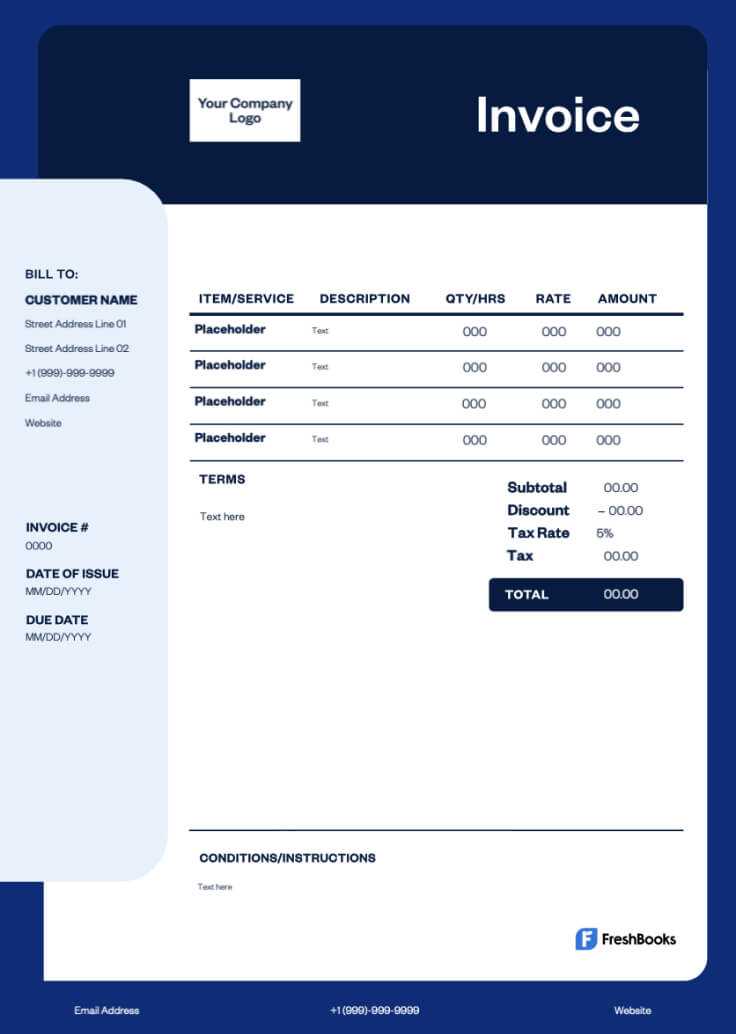

Tips for Professional Invoice Design

Designing a clean, professional document not only helps you make a great impression but also ensures that all important information is easy to find. A well-structured layout increases the likelihood that your clients will process the payment quickly and accurately. By focusing on clarity and simplicity, you can create a polished document that reflects your professionalism.

Here are some essential design tips to enhance your billing documents:

- Keep It Simple: Avoid clutter by using ample white space and organizing information in clear sections. Stick to essential details and keep the design minimalistic.

- Use a Consistent Font: Select a clean, legible font and use it consistently throughout the document. This helps ensure readability and gives the document a cohesive look.

- Align Information Properly: Group related details together, such as payment amounts, services provided, and contact information. Proper alignment guides the reader’s eye, making the document easier to understand.

- Highlight Key Information: Use bold or larger fonts to emphasize the total amount due, due date, and any important instructions. This ensures that critical details are immediately visible.

- Maintain a Professional Color Scheme: Stick to neutral or subtle colors that match your branding. Avoid using too many colors, as it can make the document look unprofessional.

By following these tips, you’ll create a document that not only looks professional but also functions effectively, helping your clients quickly understand the details and make timely payments.

Common Mistakes When Creating Invoices

When creating a payment request, it’s easy to overlook certain details that can lead to confusion or delayed payments. Even small mistakes can create unnecessary issues, which is why it’s important to ensure that your document is accurate and complete. Here are some common errors to avoid when preparing a payment document.

Typical Errors in Billing Documents

- Missing or Incorrect Contact Information: Failing to include the correct names, addresses, or contact details of both parties can lead to confusion and delays in processing payments.

- Omitting a Unique Reference Number: Without a reference number, it becomes difficult to track payments, especially if you’re issuing multiple requests over time. Always include a unique number for each request.

- Incorrect Amounts or Calculations: Even small errors in pricing or totals can lead to disputes. Double-check all figures to ensure accuracy.

- Unclear Payment Terms: If your payment instructions or deadlines aren’t clear, clients might misinterpret them, causing delays. Be specific about when and how the payment should be made.

Design and Formatting Mistakes

- Poor Layout and Organization: A cluttered or disorganized document can make it difficult for the recipient to find important details. Keep the design clean and well-structured.

- Using Inconsistent Fonts or Colors: Multiple fonts or overly bright colors can make your document look unprofessional. Stick to one or two fonts and a simple color scheme.

- Not Including Payment Instructions: Ensure that payment methods are clearly listed, so your client knows how to send the money. Include details like account numbers or links to online payment options.

Avoiding these common mistakes ensures that your document looks professional, is easy to understand, and increases the chances of timely payment.

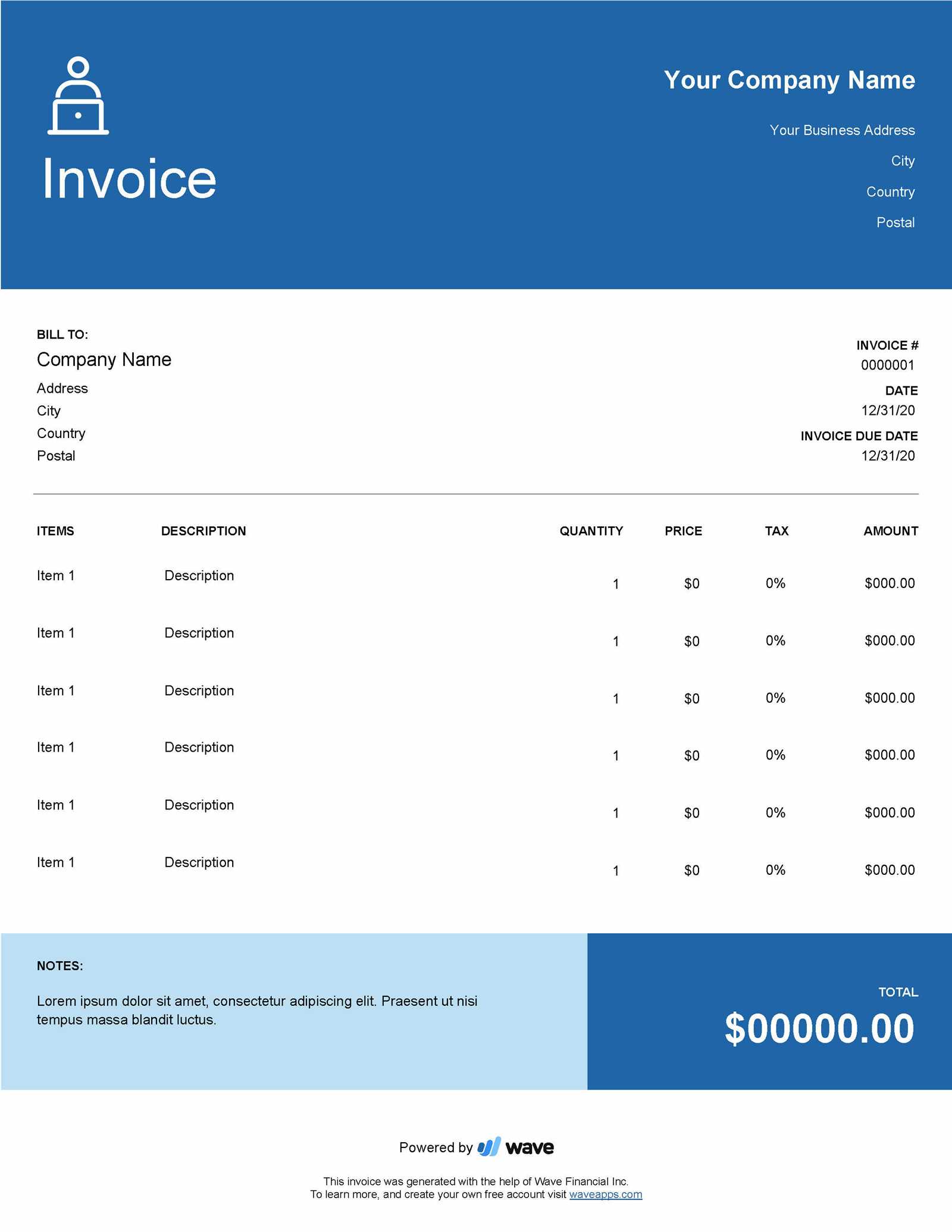

Best Tools for Invoice Generation

Creating billing documents manually can be time-consuming and error-prone. Thankfully, there are many tools available that make the process quick, efficient, and professional. These tools allow you to generate documents instantly, with customizable features to suit your specific needs. Whether you need a simple layout or advanced options, the right software can help streamline your payment requests and keep your finances organized.

Top Software for Creating Billing Documents

- FreshBooks: A popular choice for freelancers and small businesses, FreshBooks offers easy-to-use templates and features like automated reminders, expense tracking, and client management.

- Wave: A free tool that provides customizable billing options, including professional designs and automatic calculations. It also allows for direct payment integration via credit card or bank transfer.

- Zoho Invoice: Known for its customizable features, Zoho Invoice allows users to create tailored billing documents, track payments, and manage recurring billing with ease.

- Invoicely: This tool offers both free and paid plans, with features that include customizable layouts, online payment options, and multi-currency support for international transactions.

- QuickBooks: Popular among small business owners, QuickBooks offers comprehensive invoicing tools that integrate with accounting features, making it easier to track finances and manage taxes.

Why Use These Tools?

- Time-Saving: Automate many aspects of the billing process, such as calculations and recurring invoices, to save time on administrative tasks.

- Professional Appearance: These tools offer polished, customizable designs that ensure your documents look professional and consistent.

- Integrated Payment Options: Many platforms include integrated payment systems, making it easier for clients to pay directly through the document, streamlining the payment process.

Using these tools allows you to focus more on your work while ensuring that your billing process is accurate, professional, and efficient.

How to Save and Send Invoices

Once you’ve created a billing document, it’s important to save and send it in a way that ensures both you and your client can access it easily. Proper file management and delivery are essential to maintaining a professional workflow. Whether you choose to send your document electronically or in print, knowing the best practices for saving and sharing your request for payment can prevent issues later on.

Saving Your Document

After completing your payment request, you’ll need to save it in a suitable format. The most common options include PDF and Word documents. PDFs are generally preferred, as they preserve the layout and design of the document, making it easier for recipients to view and print it without alteration. Here are some important tips for saving your document:

| File Format | Benefits |

|---|---|

| Preserves design, widely accepted, cannot be edited easily | |

| Word | Easy to edit and update, compatible with many software programs |

| Excel | Useful for complex calculations and itemized lists |

Sending Your Document

When it comes to delivering your payment request, electronic methods are usually the most efficient. Here are the common ways to send the document to your client:

- Email: The most common method for sending digital copies. Attach the saved document and include a brief message explaining the details.

- Online Payment Platforms: Some payment platforms allow you to send requests for payment directly through their system, making it easy for clients to pay immediately.

- Mail: If your client prefers a hard copy, print the document and mail it to their address. Make sure to keep a copy for your records.

By properly saving and sending your payment requests, you ensure that the process is clear, professional, and efficient for bo

What to Do After Sending an Invoice

Once you’ve sent your payment request, your job is not over. It’s important to stay organized and proactive to ensure that your client processes the payment on time. By following up and keeping track of the transaction, you can address any potential issues before they escalate. Here’s what you should do after sending a payment request.

Track the Payment Status

After delivering the payment document, keep an eye on whether or not the payment is received on time. Many tools and platforms allow you to monitor whether the client has opened the document or made a payment. Be proactive in checking for updates to avoid any surprises.

- Set Reminders: Use your calendar or invoicing software to set a reminder a few days before the due date to check the status of the payment.

- Check Payment Methods: If you’re expecting an electronic payment, verify the transaction through your payment processor or bank. For checks or cash, ensure they are received.

Follow Up if Necessary

If the payment is overdue, it’s important to send a polite follow-up. A gentle reminder can often prompt action without causing any tension. Be clear about the overdue amount and provide any necessary details to help the client complete the transaction.

- Send a Reminder: A short, professional email or message reminding the client of the due payment and providing instructions on how to pay.

- Contact by Phone: If there’s no response to your email, a phone call can be a more personal way to ensure the issue is addressed.

- Offer Payment Solutions: If there are payment delays due to financial difficulties, be open to negotiating extended terms or alternative payment methods.

By staying on top of the payment process, you ensure that you maintain a smooth and professional relationship with your clients and receive compensation in a timely manner.

Handling Late Payments on Invoices

Dealing with overdue payments can be one of the more challenging aspects of managing your business finances. Late payments can affect your cash flow and create unnecessary stress, but it’s important to approach the situation professionally and calmly. By having clear policies in place and taking the right steps, you can handle delayed payments effectively and maintain good client relationships.

When a payment is late, the first step is to review your payment terms to ensure they were clearly communicated and agreed upon. If everything is in order, a polite follow-up is usually all it takes to remind the client of their outstanding balance. In some cases, it may be necessary to escalate the situation, but handling it professionally is key to ensuring a positive outcome for both parties.

Here are some steps to follow when managing late payments:

- Send a Reminder: Start by sending a friendly reminder email or message. Often, clients simply forget or overlook the due date.

- Be Clear About Penalties: If your payment terms include late fees or interest, politely remind your client of these terms in your follow-up communication.

- Offer Flexible Solutions: In some cases, clients may be experiencing financial difficulties. Offering extended payment terms or an installment plan can be a helpful solution to ensure you still get paid.

- Maintain Professionalism: Always keep your communication polite and professional, even if you are frustrated. This helps maintain a good relationship with your client and encourages prompt payment.

By staying organized and proactive, you can minimize the impact of late payments and ensure a smoother financial process for your business.

How to Track Invoice Status

Tracking the status of your payment requests is essential to ensuring that payments are processed on time. It allows you to stay on top of which requests have been paid, which are still pending, and which may need a follow-up. By using the right tracking methods, you can reduce the risk of missed payments and improve your cash flow management.

There are several ways to keep track of your payment requests, including manual methods like spreadsheets or automated tools that integrate directly with your payment platform. Choosing the best approach depends on the volume of transactions and your preference for managing your records.

Tracking Methods

| Tracking Method | Benefits | Best For |

|---|---|---|

| Spreadsheet | Simple, flexible, and free. Easily customizable. | Small businesses with a few transactions. |

| Accounting Software | Automated tracking, real-time updates, integrated with payments. | Businesses with regular transactions and clients. |

| Online Payment Platforms | Instant status updates, direct payment tracking, notification alerts. | Freelancers or businesses that use digital payment methods. |

Regardless of the method you choose, it’s important to regularly update the status of your payment requests and set reminders for follow-up actions when necessary. If you use accounting software or an online payment platform, many of these systems will provide real-time updates, helping you track the status with minimal effort.

How to Avoid Invoice Scams

Scammers often use fake billing documents as a way to trick businesses and individuals into making fraudulent payments. It’s important to stay vigilant and know how to identify these scams before making any payments. By following a few simple precautions, you can protect yourself from falling victim to this type of fraud.

One of the first signs of a potential scam is unfamiliar contact information. If you receive a request from a supplier or service provider you don’t recognize, or if the contact details seem suspicious, it’s worth double-checking the legitimacy of the request.

Steps to Avoid Scams

- Verify the Sender’s Information: Always double-check the contact details and compare them with previous communications. Be cautious if the sender’s email address or phone number seems unusual.

- Look for Red Flags in the Request: Be wary of requests with urgent language, unusual payment methods (such as cryptocurrency), or discrepancies in the amount owed.

- Check the Payment Details: Ensure that bank account numbers or payment links match the ones you have on file for the legitimate service provider. Scammers often use altered payment details.

- Use Secure Payment Methods: Always use trusted and secure platforms for transactions. Avoid making payments through unfamiliar or unverified methods.

- Confirm Before Paying: When in doubt, contact the company or individual directly using contact details from their official website, not the ones provided in the suspicious request.

By staying cautious and verifying all payment requests, you can minimize the risk of falling victim to scams and ensure your transactions remain secure.