Customizable Invoice Template for Independent Contractors

For those working on a freelance basis, managing finances can often become a daunting task. Clear and organized documentation of work completed and payments due is crucial to ensure timely compensation. By utilizing a structured approach, individuals can streamline their payment process and avoid confusion with clients.

Having a well-organized billing method not only saves time but also reflects professionalism. The ability to clearly outline the services provided, rates, and payment terms ensures transparency between both parties. This helps foster trust and encourages prompt payments for services rendered.

In this guide, we will explore the most effective strategies for creating customized documents that meet your specific needs, ensuring smooth transactions and reducing the chances of delays or misunderstandings.

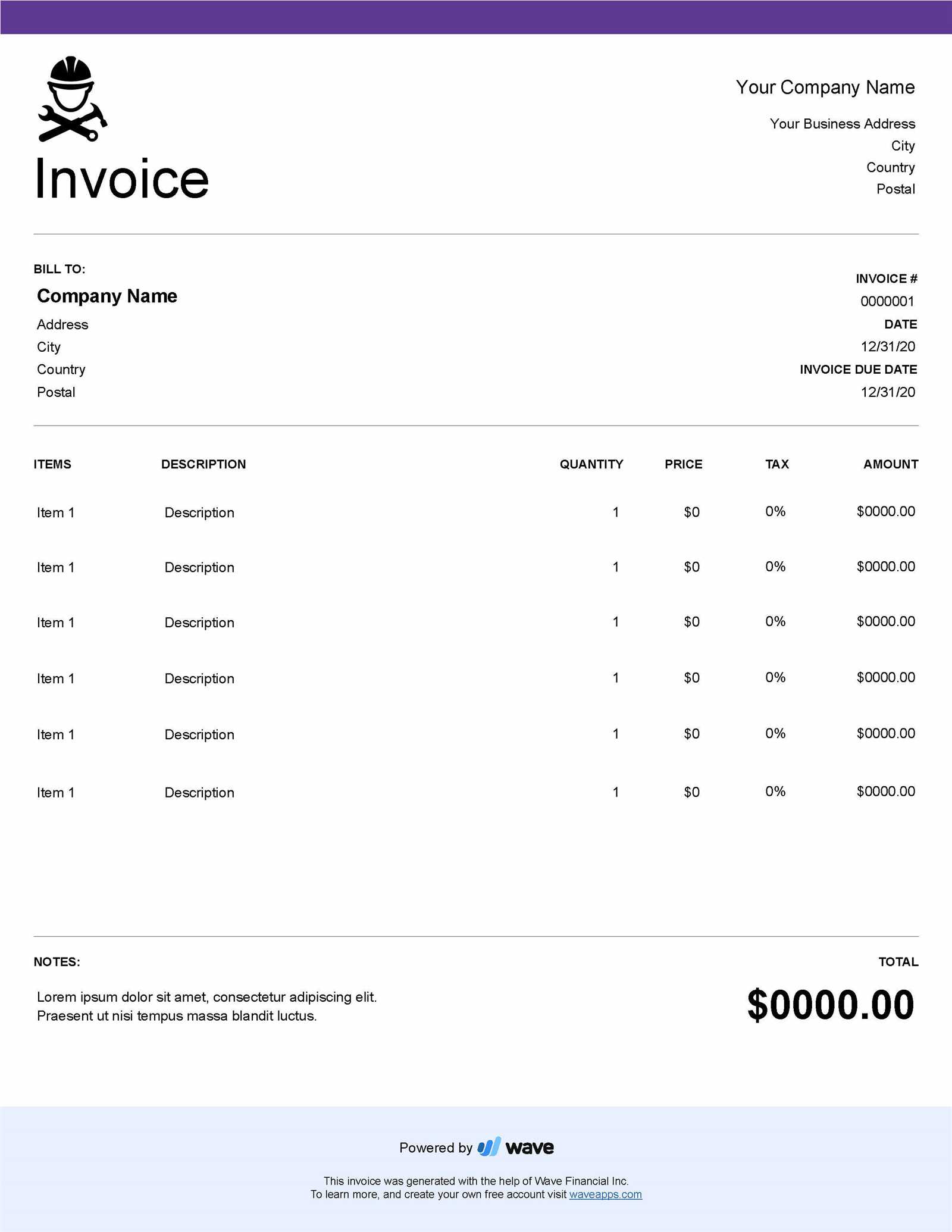

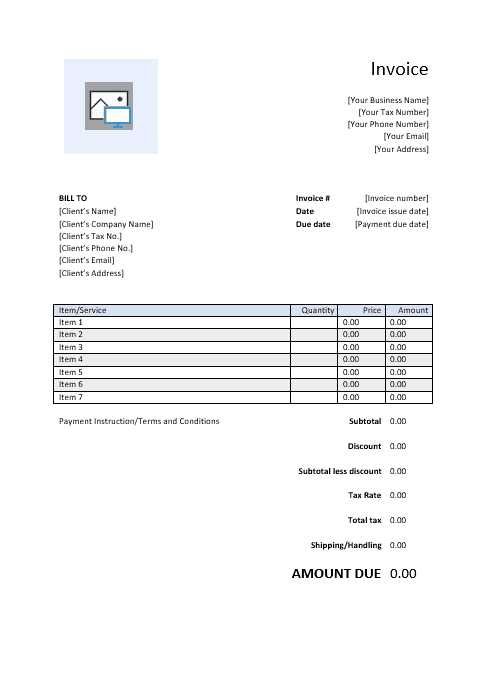

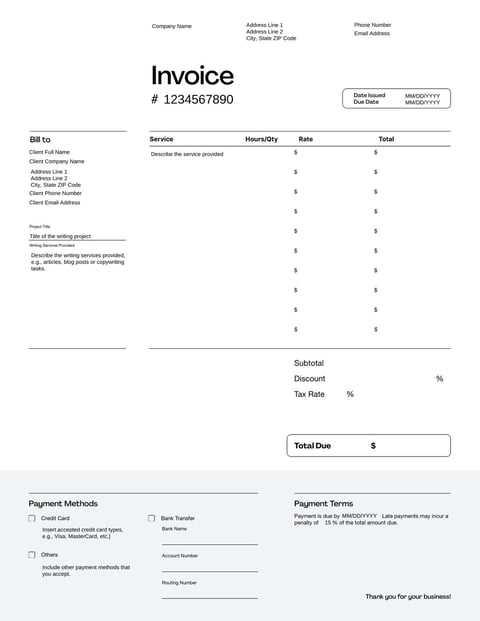

How to Create an Invoice Template

Creating a well-structured document for billing purposes is essential for smooth financial transactions. It ensures that both parties are clear about the services rendered, the amount due, and the payment terms. A well-designed form not only makes the process easier but also presents a professional image to clients.

Key Components to Include

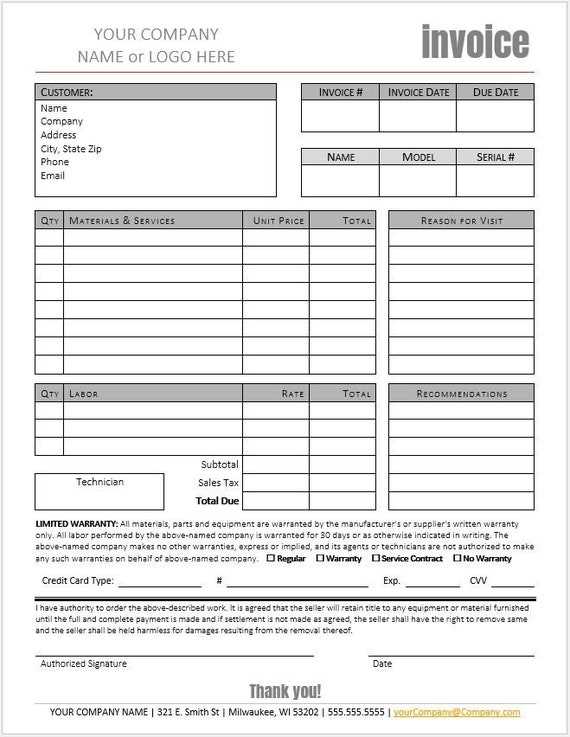

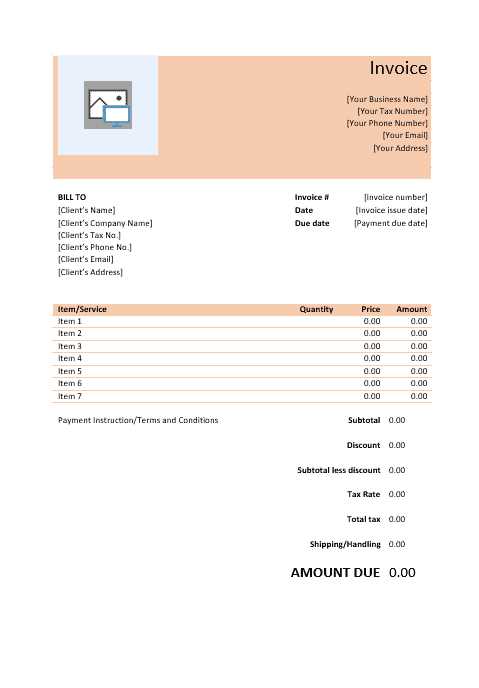

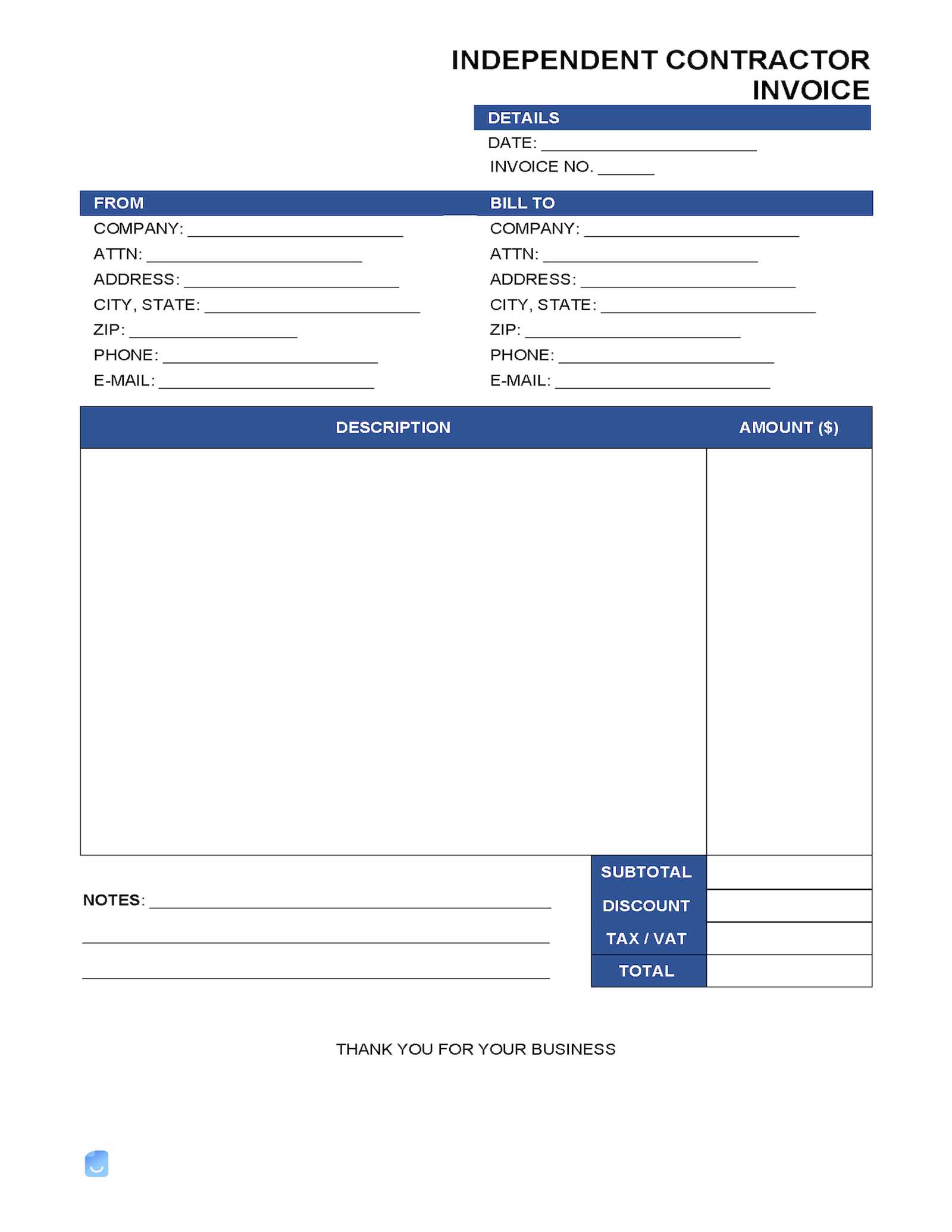

When designing your billing document, include essential details such as your name or business name, contact information, and the client’s details. It’s important to clearly list the services provided, the rate or fee for each, and the total amount owed. Additionally, include a unique reference number for each bill, the due date, and payment instructions. This will ensure that both you and your client have all the necessary information to process the transaction smoothly.

Choosing the Right Format

The format of your document should be easy to read and navigate. Use clear headings, bullet points, and a logical layout to make the information accessible. Consider using a digital format, such as a PDF or Word document, to allow for easy customization and sharing with clients. Choose fonts and colors that are simple and professional, avoiding anything that might distract from the main content.

Benefits of Using a Template for Billing

Using a standardized document for charging clients offers numerous advantages, especially when it comes to efficiency and professionalism. A consistent approach to recording charges helps ensure accuracy and streamlines the overall billing process. With a pre-structured form, you can minimize errors and save valuable time, which allows you to focus more on your work.

One of the key benefits is the ability to maintain consistency in your financial records. By utilizing a set format, you ensure that each bill contains the necessary details, making it easier to track payments and resolve any disputes. Additionally, using a template helps you create a professional appearance, which can positively influence your client relationships and improve trust.

| Benefit | Explanation |

|---|---|

| Time Efficiency | Pre-designed forms save time by eliminating the need to recreate the layout for each new charge. |

| Accuracy | A consistent structure reduces the chances of missing important details, ensuring correct amounts and terms. |

| Professional Appearance | A well-formatted document enhances your business image and instills confidence in your clients. |

| Record Keeping | Using a standard form makes it easier to organize and retrieve past records for future reference or tax purposes. |

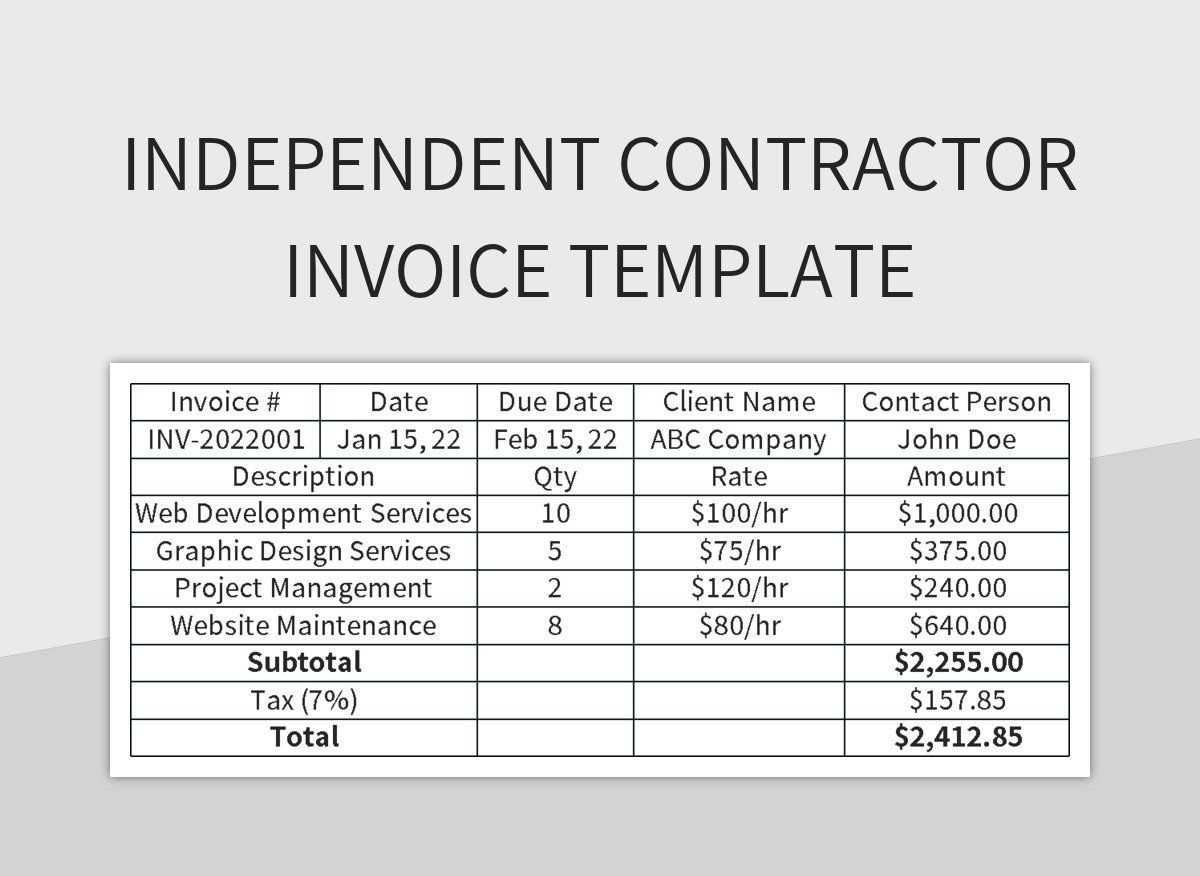

Key Elements of a Contractor Invoice

Creating a clear and well-organized document for payment requests involves including several key pieces of information. These elements ensure that the client fully understands what is being billed, the services rendered, and the total amount due. By outlining these details clearly, you can avoid confusion and ensure timely payment.

- Contact Information: Include your name or business name, address, phone number, and email, as well as the client’s contact details.

- Unique Identification Number: Assign a unique reference number to each document to help with tracking and organization.

- Description of Services: List the services provided in detail, including the time frame or number of hours worked, if applicable.

- Rate or Fee: Specify the rate charged for each service or hour, along with any agreed-upon discounts or adjustments.

- Total Amount Due: Calculate the total amount to be paid, ensuring that all charges are added up correctly.

- Due Date: Clearly state when the payment is due to avoid any misunderstandings.

- Payment Instructions: Provide clear information on how to pay, including bank details or links to online payment platforms.

Incorporating these elements into your document will help maintain clarity and professionalism, ensuring both parties are on the same page regarding the transaction.

Design Tips for Professional Invoices

Creating a polished and clear document for billing is essential for maintaining professionalism and ensuring clients understand the charges. The design of this document should be simple, organized, and easy to follow. By focusing on clarity and consistency, you can avoid misunderstandings and project a professional image.

Consistency is Key: Use a consistent layout and font style across all documents. This helps clients easily recognize your brand and ensures that the document is easy to read. Choose a clean and simple font, such as Arial or Times New Roman, and keep font sizes consistent throughout.

Use Proper Spacing: Make sure there’s enough white space between sections to prevent the page from looking crowded. Proper margins and line breaks help the document feel organized and easier to navigate. Don’t cram too much information into a small space–spread out the details to keep it visually appealing.

Highlight Key Information: Use bold or underlined text to emphasize important details like due dates, totals, or payment instructions. This helps draw attention to the most important sections, making it easier for the client to process the payment on time.

Branding Matters: Including your logo and business name at the top of the page can add a personal touch and reinforce your business identity. This creates a sense of professionalism and helps clients recognize your documents immediately.

Best Invoice Templates for Freelancers

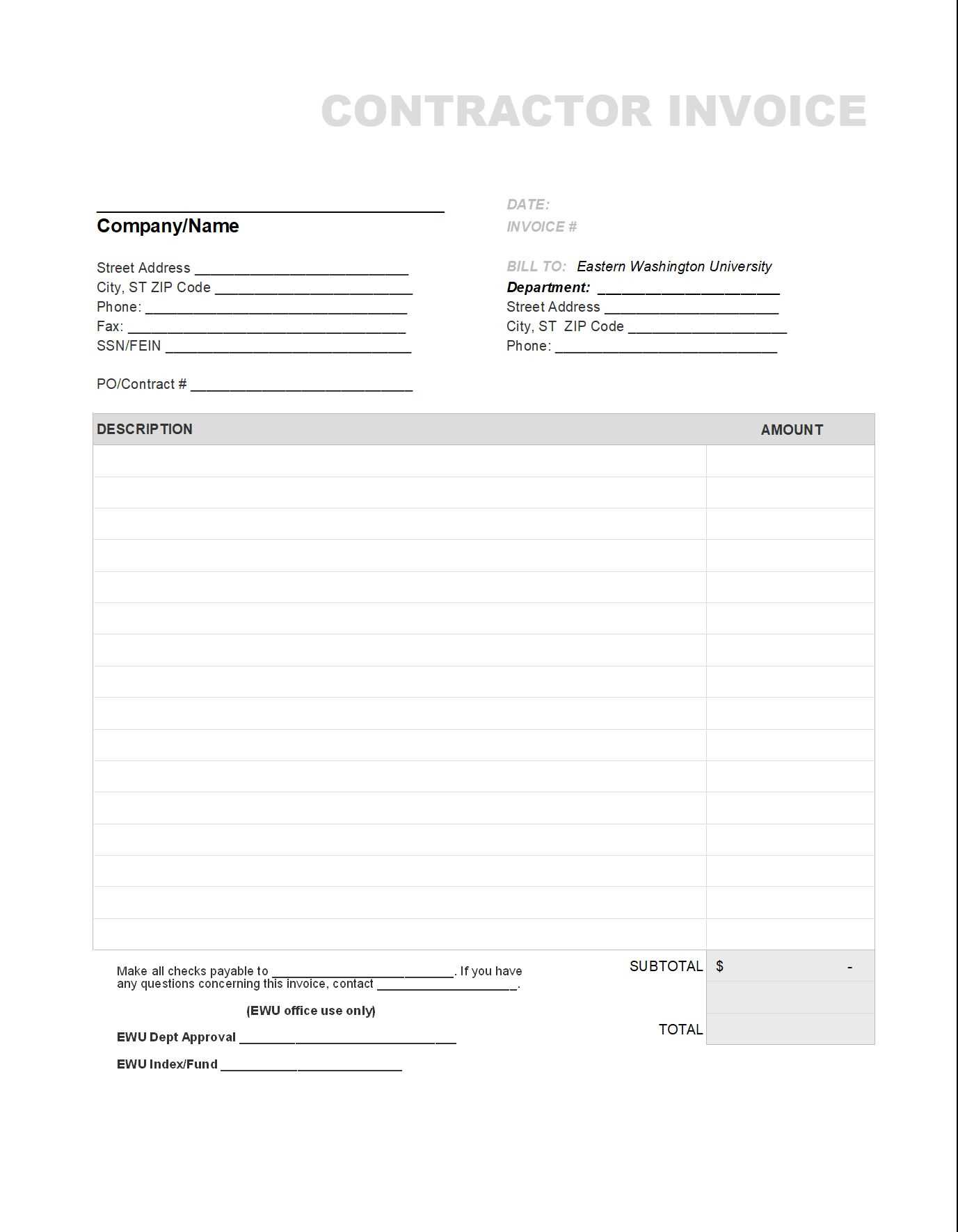

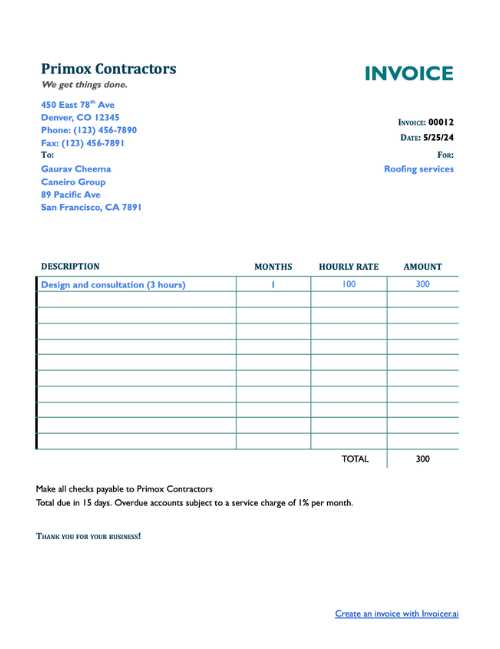

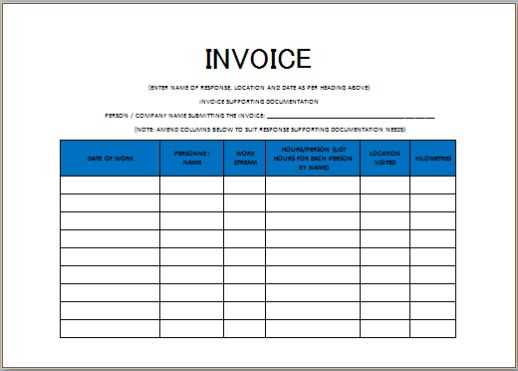

For freelancers, selecting the right document format to request payments is crucial for maintaining a professional image and ensuring clarity. There are a variety of formats available, each designed to streamline the billing process, making it easier to track services provided and payments received. Below are some of the best options available for freelancers looking to create a polished and effective payment request.

| Template Name | Features | Best For |

|---|---|---|

| Simple and Clean | Basic structure with clear headings, easy to customize, and user-friendly. | Freelancers who need a straightforward, no-frills option for regular billing. |

| Professional with Branding | Includes space for logo, business name, and personalized details, offering a branded look. | Freelancers looking to present a polished image to clients and reinforce their business identity. |

| Hourly Rate Based | Perfect for projects billed by the hour; includes a time tracker and hourly rate breakdown. | Freelancers offering services based on time, such as consulting or design work. |

| Project-Based | Organized by specific tasks or deliverables, with separate sections for each phase. | Freelancers who work on long-term projects with clear milestones and phases. |

Choosing the right format allows freelancers to manage their financial transactions more effectively, ensuring both accuracy and professionalism in every request for payment.

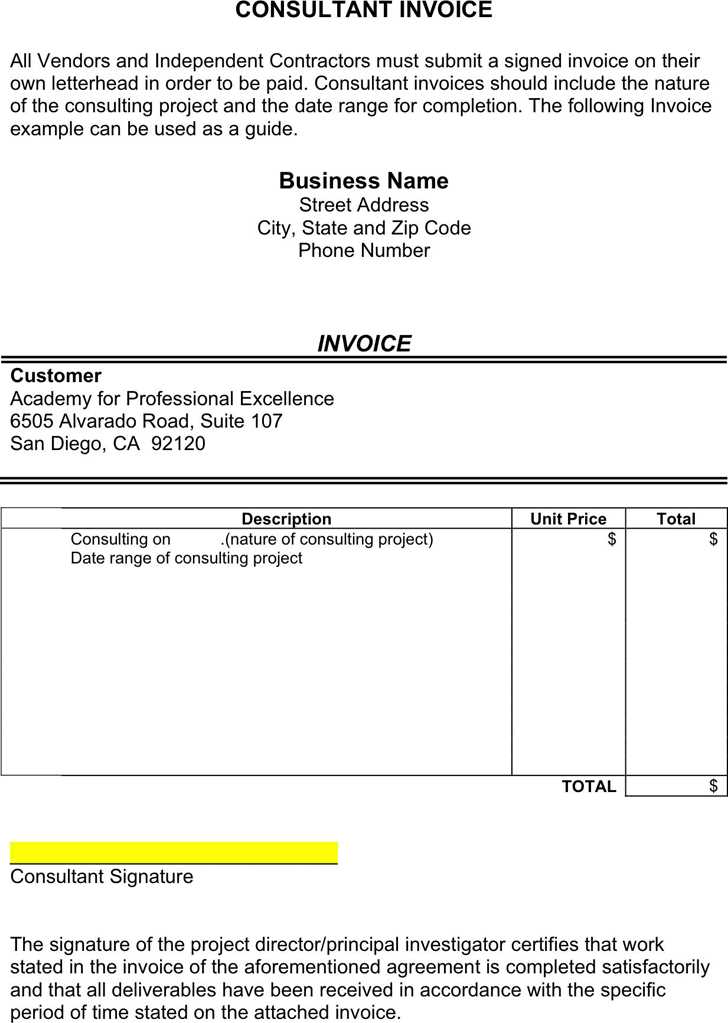

Customizing Templates for Specific Jobs

When working on different types of projects, tailoring your billing documents to reflect the specific nature of each job can enhance clarity and professionalism. Customizing these documents ensures that the client understands the scope of work, the payment terms, and the amount owed for each particular service. Below are some ways to adjust the format for various job types.

| Job Type | Customization Suggestions |

|---|---|

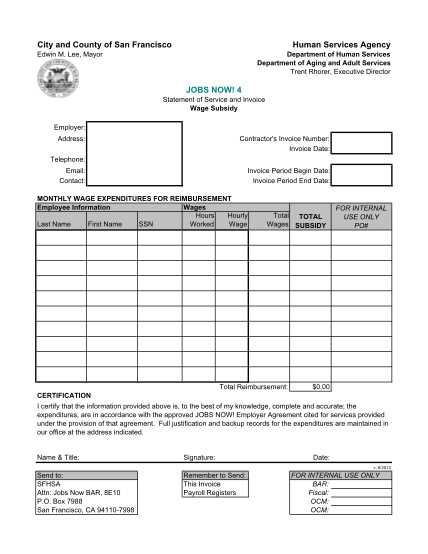

| Hourly Work | Include a section for time logs with hours worked, the hourly rate, and the total cost for each task or day worked. |

| Project-Based | Break the document into phases or milestones, with each task listed separately, including its cost and expected completion date. |

| Retainer Agreements | Specify the amount of retainer paid, the services covered, and the billing cycle (e.g., monthly or quarterly). |

| Consulting Services | Provide a detailed description of each consulting session, the time spent, and the agreed rate for each service rendered. |

Customizing billing documents for specific jobs helps maintain transparency and ensures that clients are fully informed about the work and the associated costs. By adjusting the format based on the job type, freelancers can better manage their client relationships and enhance the professionalism of their billing process.

Managing Payments with an Invoice

Effectively managing payments is a critical part of running a business, and clear documentation plays a key role in this process. When clients receive a well-structured document outlining the charges for services rendered, it makes it easier for them to understand what they owe, when payment is due, and how to settle the balance. Properly managing these payment requests ensures smoother transactions and promotes timely payments.

Clear Breakdown of Charges: Ensure that all costs are clearly itemized so that the client can easily understand what they are paying for. This includes separating labor, materials, or additional costs, with a clear description of each item.

Include Payment Terms: Clearly outline the payment due date, and specify accepted payment methods. This helps prevent delays and confusion. If applicable, include information about late fees or interest charges for overdue payments.

Track Payment Status: Using a well-organized record system can help track when payments are made and when they are overdue. This makes follow-ups easier and helps ensure you maintain a steady cash flow.

By creating clear and precise documentation, you not only make it easier for your clients to pay on time but also enhance your own business efficiency. Well-managed payment requests can help streamline the financial aspect of your work and build stronger relationships with clients.

Common Mistakes in Invoice Creation

Creating accurate billing documents is essential for maintaining professionalism and ensuring smooth transactions with clients. However, even experienced professionals can make mistakes that lead to confusion, delays, or payment disputes. Recognizing these errors and avoiding them can help streamline the billing process and keep client relationships intact.

Omitting Key Information: One of the most common errors is failing to include critical details such as the date, payment terms, or itemized list of services. Without this information, clients may struggle to understand the breakdown of charges and the due date, potentially delaying payments.

Incorrect Amounts or Rates: Mistakes in calculations, such as entering incorrect hourly rates or failing to adjust for agreed-upon discounts, can lead to discrepancies. Double-checking the numbers before sending a request for payment ensures that clients are charged accurately and prevents disputes later on.

Missing Contact Information: Failing to include the correct contact details, such as business name, phone number, and email address, can make it difficult for clients to reach out with questions or payment confirmations. Always make sure your contact information is clear and easy to find.

Unclear Payment Terms: If payment terms aren’t explicitly stated, such as the due date or accepted payment methods, clients may delay payments or misunderstand the terms. Always include a specific payment due date, preferred payment methods, and any applicable late fees or penalties.

By avoiding these common mistakes, you can ensure that your billing process runs smoothly, clients have the information they need, and payments are processed efficiently. Taking the time to check for these errors before submitting a payment request can save you time and prevent misunderstandings down the line.

Why Contractors Should Use Invoices

For individuals providing services on a project-by-project basis, maintaining clear financial records is crucial. A well-organized payment request not only ensures that clients are billed properly but also protects the service provider’s interests. By using structured documents to request payment, it becomes easier to track income, reduce confusion, and promote timely transactions.

Professionalism and Clarity

Using a formal billing document signals professionalism and helps establish trust with clients. It clearly outlines the details of the work completed, the agreed-upon charges, and the payment terms. This transparency helps clients feel more confident in the services provided and ensures there is no ambiguity regarding payment expectations.

Legal Protection and Financial Tracking

Incorporating detailed payment requests into your workflow not only provides a written record of the work completed but also offers legal protection in case of disputes. If issues arise regarding payment, the document serves as evidence of the agreed terms. Additionally, having a consistent system for payments helps track income, manage taxes, and maintain organized financial records.

Faster Payments: A well-structured billing document with all the necessary information can speed up the payment process. Clients can easily review the charges and settle the balance promptly without needing to request further clarification.

Minimized Errors: By using a standardized format, you reduce the risk of making mistakes in the payment request, such as forgetting key details or miscalculating the charges. This helps ensure that both parties are on the same page and reduces the likelihood of disputes.

Legal Requirements for Independent Contractors

When providing services as a self-employed individual, there are several legal obligations that need to be met to ensure compliance with tax and business regulations. Understanding and adhering to these requirements is essential for protecting both the service provider and their clients. The following aspects should be carefully considered when working without formal employment contracts.

Tax Responsibilities

One of the primary legal obligations for self-employed individuals is managing tax responsibilities. As a non-employee, you are responsible for reporting income and paying taxes on your earnings. Key considerations include:

- Self-employment tax: This covers Social Security and Medicare contributions, which must be paid by individuals working outside of a standard employer-employee relationship.

- Estimated taxes: Since there is no employer to withhold taxes, individuals must make estimated tax payments throughout the year.

- Business deductions: Eligible expenses such as office supplies, business-related travel, and other costs can be deducted, reducing taxable income.

Contracts and Agreements

Though not all jobs require formal contracts, it is highly recommended to have a written agreement that outlines the scope of work, payment terms, and deadlines. Some key elements to include are:

- Payment terms: Specify the amount, payment schedule, and any penalties for late payments.

- Scope of services: Clarify the tasks to be completed and the expected quality and deadlines.

- Intellectual property rights: Define ownership of any work created during the job.

Insurance and Liability

Self-employed individuals are typically not covered by the same insurance protections as employees. It may be necessary to purchase your own insurance to protect against accidents or damage related to your work. Common types of coverage include:

- Professional liability insurance: Protects against claims of negligence, errors, or omissions in the services provided.

- General liability insurance: Covers damages resulting from accidents, injuries, or property damage while on the job.

By staying informed about these legal requirements and ensuring all necessary protections are in place, self-employed professionals can operate with confidence and avoid potential issues with clients or tax authorities.

How to Format Your Invoice Properly

Creating a clear and professional billing document is essential for ensuring smooth transactions with clients. A well-structured document not only conveys professionalism but also helps avoid misunderstandings regarding payments and services rendered. The following guide will help you properly format your billing document to ensure accuracy and clarity.

First, it’s important to make sure the document contains all the necessary details in an organized and easy-to-read format. Key components should be clearly labeled, and the layout should be simple yet informative.

Essential Components to Include

Start by incorporating the following crucial details into your document:

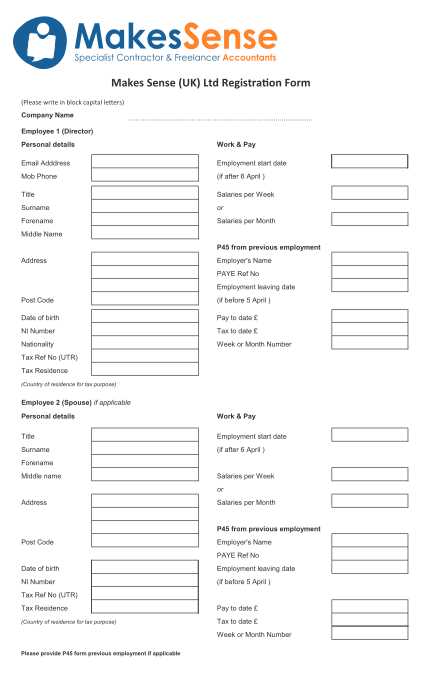

- Your contact information: Include your full name, business name (if applicable), address, phone number, and email.

- Client’s information: Include the client’s name, business name, address, and contact details.

- Document title: Label the document clearly as a “Billing Statement” or “Payment Request” for easy identification.

- Unique reference number: Assign a specific number to each document for tracking purposes.

- Date of issue: Include the date the document is created and, if applicable, the due date for payment.

Itemization of Services or Goods

List all the services provided or goods sold in a clear and detailed manner. This section should include:

- Description of services or products: Provide a brief but accurate description of what was offered or delivered.

- Quantity: Specify how many units or hours were involved.

- Rate: Clearly state the price per unit or the hourly rate.

- Total amount: Include the total cost for each service or item provided, and then calculate the grand total at the end.

Payment Instructions

Ensure the payment terms are easy to follow by including clear instructions. Specify:

- Accepted payment methods: Indicate which methods you accept (e.g., bank transfer, PayPal, check).

- Payment terms: Clearly state the payment deadline (e.g., “Due within 30 days”).

- Late payment fees: If applicable, outline any penalties for late payments.

By following these formatting guidelines, you will create a document that is not only professional but also helps ensure timely and accurate payments for your services or products.

Tips for Efficient Invoicing and Tracking

Managing the process of requesting payment for services rendered and keeping track of payments is crucial for any professional. Streamlining this process not only saves time but also ensures timely payments and reduces the risk of errors. Here are some strategies to help you stay organized and efficient in tracking your earnings.

One of the first steps to success is using a consistent method for creating and managing your billing documents. By automating and organizing the process, you can avoid mistakes and stay on top of deadlines.

1. Automate Your Process

Automation tools can help you save time and reduce human error. Consider using software or online platforms that allow you to generate and send documents instantly, keeping track of payment status as well. Many tools also offer automatic reminders for unpaid balances, helping you stay on top of overdue payments.

2. Keep Detailed Records

To ensure a smooth experience, it’s important to maintain detailed records of all transactions. Keep track of:

- Client details: Always have up-to-date information for each client, including contact details and payment preferences.

- Service history: Maintain an organized log of services provided, including dates, descriptions, and amounts charged.

- Payment status: Track when payments are made and mark overdue amounts to follow up promptly.

3. Set Clear Payment Terms

Establish clear terms for payments to avoid confusion. Clearly define due dates, late fees, and accepted payment methods upfront. Setting expectations from the start will help prevent misunderstandings and ensure that clients know exactly what is expected of them.

4. Use Cloud Storage

For easy access to your records, consider using cloud storage services. This allows you to store your billing documents in one place, making it easier to retrieve them whenever needed. Cloud storage also ensures that your data is backed up and protected from loss or damage.

By adopting these strategies, you can optimize your payment request process, ensuring that you are paid promptly while keeping your administrative workload manageable.

Invoice Software for Freelancers

For professionals managing their own business, using the right software to handle billing and payment tracking is essential. With a variety of tools available, finding the one that best suits your needs can help streamline the financial side of your work. These solutions can automate time-consuming tasks, track payments, and help ensure that all records are properly organized.

1. Key Features to Look for

When selecting software to manage your payment requests, consider tools with the following features:

- Customizable templates: The ability to easily adjust and personalize billing documents to match your business needs.

- Payment tracking: Automatic updates on the status of payments, helping you to stay on top of overdue accounts.

- Time tracking: If you charge hourly, the ability to log time worked is invaluable for accurate billing.

- Client management: Storing client contact information and transaction history in one place.

2. Popular Software Options

Several tools stand out in the market for their user-friendly interfaces and robust features:

- FreshBooks: A comprehensive solution known for its ease of use, offering invoicing, expense tracking, and client management features.

- QuickBooks Self-Employed: Tailored for freelancers, this software offers simple billing and integrates seamlessly with tax tracking.

- Zoho Invoice: A cloud-based solution that provides invoicing, automated reminders, and multi-currency support for international clients.

These software options can help simplify the invoicing process, reduce the chances of human error, and ensure you stay organized and on top of your financial transactions.

How to Avoid Late Payments

Ensuring timely payments for the services you provide is essential for maintaining a healthy cash flow and business operations. There are several strategies that can help minimize delays and encourage clients to make payments promptly, reducing the risk of financial strain.

1. Set Clear Payment Terms

One of the most important steps to avoid delays is to establish clear expectations upfront. Specify the payment due dates, accepted methods of payment, and any late fees in your initial agreement with clients. Be transparent about your payment policies to avoid confusion later on.

2. Send Reminders and Follow-ups

To keep clients on track, consider sending timely reminders before and after the due date. Automating reminders through email or your payment management software can ensure that clients are constantly aware of their outstanding balances. If necessary, follow up with a polite, but firm, communication to encourage prompt payment.

By clearly defining payment terms and maintaining open communication, you can significantly reduce the likelihood of delays and ensure more predictable revenue for your business.

Choosing Between Digital and Paper Invoices

When deciding how to manage billing, you have two main options: digital or paper-based documents. Each approach comes with its own advantages and challenges, and selecting the best method can depend on factors like convenience, cost, and client preferences. Understanding the pros and cons of both formats will help you determine which works best for your business operations and client relationships.

Digital records offer a high level of efficiency, with faster delivery and the ability to easily track payments through automated systems. On the other hand, paper-based documents might appeal to clients who prefer physical copies, offering a more personal touch but often involving higher costs and manual effort.