Invoice Template in Word for Easy Customization

When running a business, having clear and accurate billing is crucial. A well-organized document can streamline the payment process, avoid confusion, and enhance professionalism in the eyes of clients. With the right tools, creating such documents is simple and efficient.

Utilizing a customizable format allows you to create personalized records that suit your business needs. This flexibility ensures that all the necessary details are included, from the payer’s information to the payment terms, making the process smooth for both parties.

Whether you’re handling payments for services, goods, or any other transactions, having a reliable and easy-to-use structure for these documents can save time and reduce errors. The ability to adjust the content as necessary means you can cater to different client requirements and maintain consistency across your records.

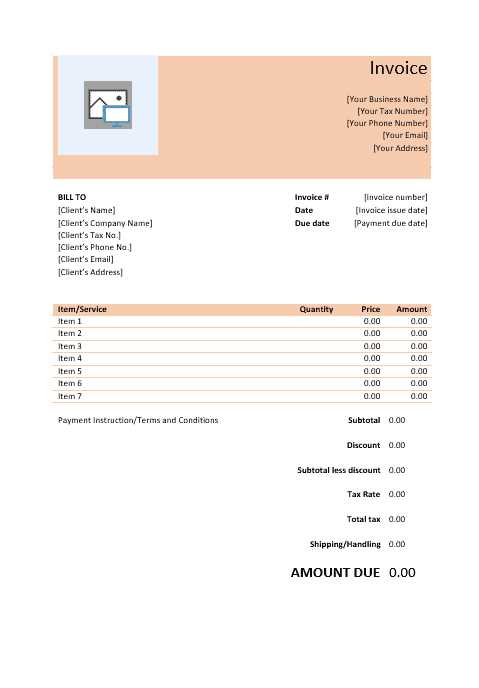

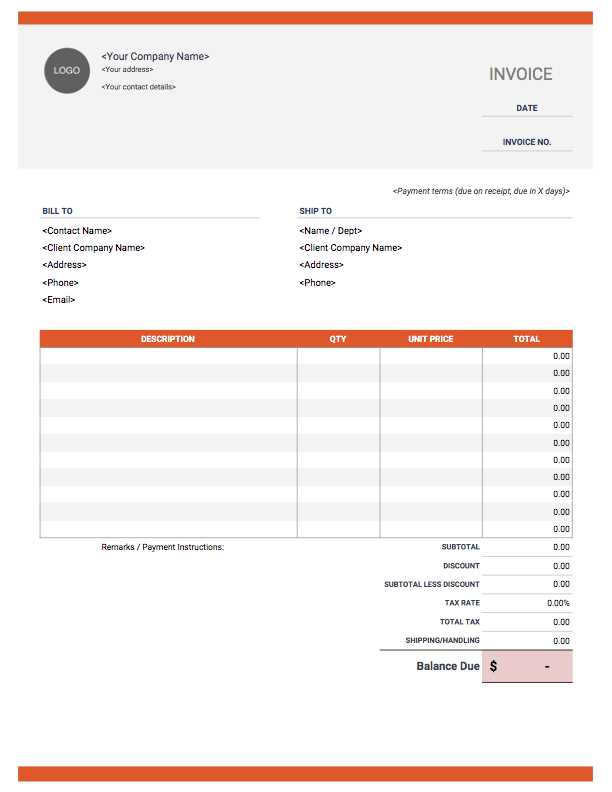

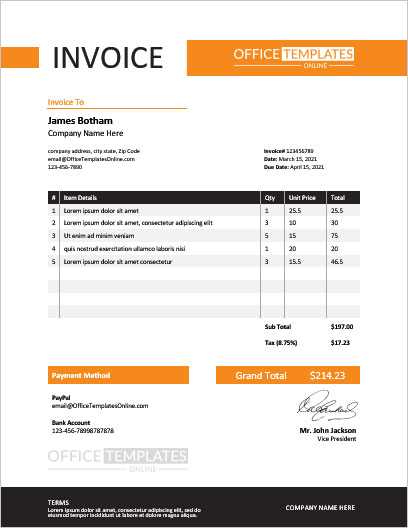

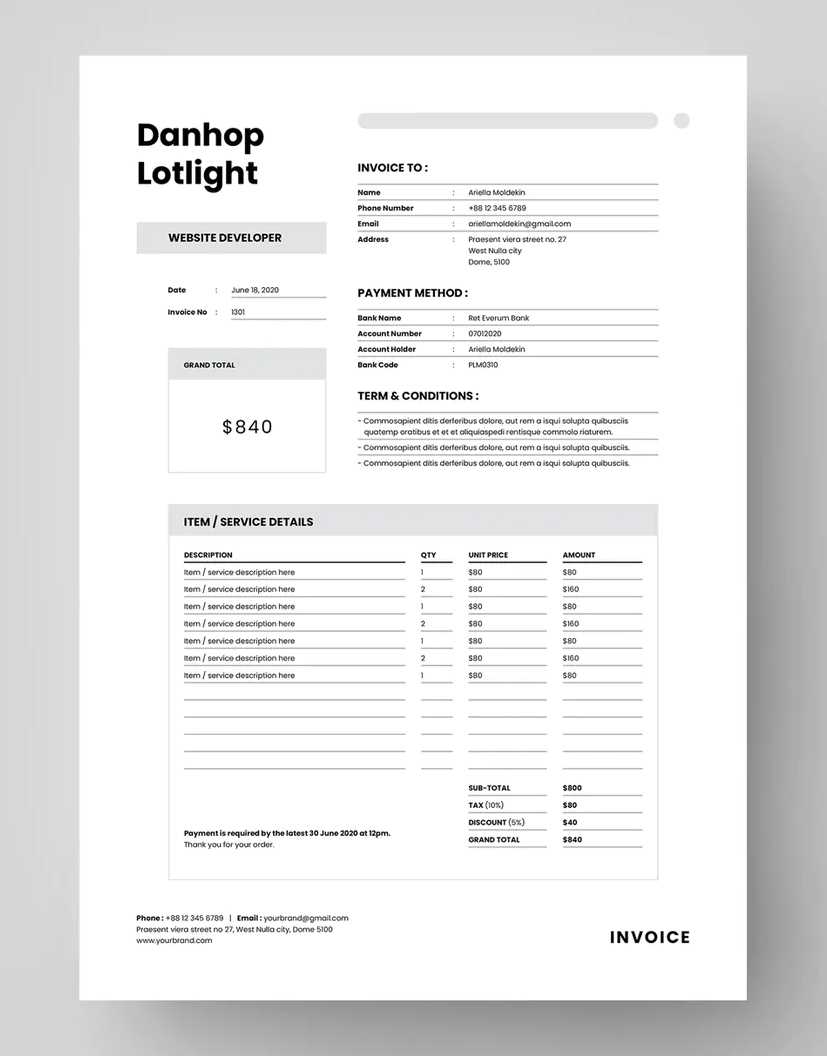

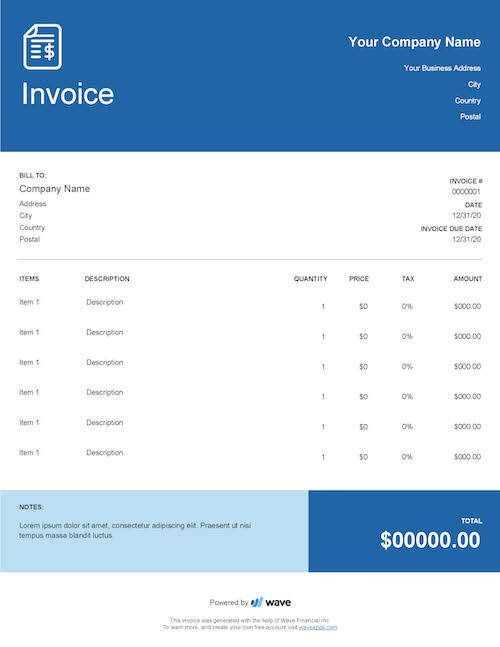

Invoice Template in Word Overview

Creating professional billing documents doesn’t have to be a complicated task. With the right format, you can quickly generate clear and accurate records for your transactions. These structured documents ensure that all necessary details are included, helping to avoid misunderstandings and ensuring timely payments.

The ease of customization is a key benefit. By starting with a predefined layout, you can tailor the content to reflect your business style while maintaining a standardized structure. This flexibility makes it simple to include important information such as payment terms, itemized lists, and contact details, adapting them to fit your specific needs.

Using such a format not only saves time but also ensures consistency across all your financial communications. With a reliable and easy-to-manage structure, you can focus more on growing your business while maintaining professional standards in your administrative tasks.

How to Customize Your Invoice

Personalizing your billing documents ensures that they reflect your brand and meet your specific business requirements. By customizing key elements, you can create a professional and cohesive look that enhances the overall presentation of your records and improves clarity for your clients.

Essential Customization Steps

When adjusting the layout and details of your document, focus on the following key areas:

- Company Branding: Add your logo, business name, and contact information at the top to make your document recognizable.

- Client Information: Ensure the recipient’s name, address, and relevant contact details are clearly displayed.

- Itemization: Clearly list the goods or services provided with accurate descriptions and quantities.

- Payment Terms: Include due dates, payment methods, and any relevant late fees.

- Footer Details: Add any additional notes such as tax ID numbers, legal disclaimers, or special terms.

Formatting Tips

To further enhance the appearance and functionality of your document, consider the following formatting tips:

- Fonts and Colors: Choose legible fonts and use colors that align with your brand identity.

- Table Layouts: Organize itemized details in neat tables for easy readability.

- Spacing: Adjust line spacing and margins to ensure everything fits cleanly on the page.

With these adjustments, you can ensure that your billing documents are not only professional but also aligned with your unique business needs.

Benefits of Using Word for Invoices

Creating professional billing records is essential for every business, and using familiar software can streamline the process. One of the most popular tools for this task is word processing software, which offers a range of advantages for generating clear, customizable documents that meet your business needs.

- Ease of Use: Word processors are user-friendly, making it simple for anyone to create and modify records without requiring advanced technical skills.

- Customizability: These tools provide flexibility, allowing you to tailor the structure and content of your documents according to your specific preferences.

- Cost-Effective: Many people already have access to word processing software, making it an affordable option for small businesses or freelancers who need an efficient solution.

- Consistency: Once you create a layout, you can easily reuse it for all your billing records, ensuring consistency across all your business documents.

- Compatibility: Documents created in word processing software can be easily shared across different devices and platforms, allowing for easy collaboration with clients or team members.

By utilizing this tool, businesses can enjoy both the simplicity and professional quality of their financial documentation, improving both efficiency and clarity.

Choosing the Right Invoice Layout

Selecting the appropriate layout for your billing documents is crucial for presenting information clearly and professionally. A well-organized structure ensures that all essential details are easy to read and understand, reducing the chances of confusion or errors in communication.

The right layout should reflect the nature of your business and the type of transactions you handle. Whether you provide products, services, or a mix of both, the format should highlight the most important information, such as payment terms, itemized descriptions, and contact details. This clarity helps your clients quickly identify what is being charged and how to proceed with payment.

Consider the following when choosing a layout:

- Clean and Simple Design: Avoid clutter by keeping the layout straightforward and easy to follow.

- Clear Sections: Use distinct sections for client information, services rendered, and payment details.

- Brand Consistency: Align the design with your company’s visual identity, including logo placement and color schemes.

- Space for Custom Notes: Ensure there is room for any additional terms, instructions, or personal messages.

A well-chosen layout not only enhances the document’s appearance but also builds trust and professionalism with your clients, leading to smoother transactions and fewer disputes.

Step-by-Step Guide to Creating Invoices

Creating detailed billing records is essential for smooth financial operations in any business. A structured approach ensures that all relevant details are captured accurately, leading to fewer errors and misunderstandings. By following a clear process, you can efficiently create documents that help ensure timely payments and maintain professionalism.

Essential Steps to Follow

Follow these steps to craft your billing document:

- Choose a Layout: Start by selecting a clear and organized layout that aligns with your business needs.

- Include Your Company Details: At the top of the document, add your company’s name, address, and contact information.

- Add Client Information: Ensure that the client’s full name, address, and any necessary contact details are included for clarity.

- List Products or Services: Provide a detailed list of what was delivered or provided, including quantities, descriptions, and prices.

- Specify Payment Terms: Clearly outline the payment due date, methods of payment, and any applicable late fees.

- Include Total Amount: Sum up the total amount due, including any taxes, discounts, or additional fees.

- Add a Personal Note: Leave space for a message or thank you note to show appreciation for the client’s business.

- Review and Save: Double-check the document for accuracy, then save it in the desired format for easy distribution.

Formatting and Final Touches

Ensure your document is well-formatted for clarity:

- Use Clear Fonts: Choose easy-to-read fonts for all the text, making sure it’s legible at different sizes.

- Organize Information: Separate sections with lines or whitespace for better readability.

- Include a Footer: Add your company’s tax identification number or other legal details at the bottom.

By following these simple steps, you can create professional and ac

Essential Elements of an Invoice

Creating clear and professional billing documents requires including key components that ensure all relevant information is communicated effectively. These elements help both the business and the client understand the transaction and payment terms, reducing confusion and errors.

Key Components to Include

To create a comprehensive document, make sure to incorporate the following elements:

- Business Information: Include your company’s name, address, contact details, and logo at the top for easy identification.

- Client Information: Clearly list the recipient’s name, address, and any other relevant contact details to avoid mistakes.

- Unique Reference Number: Assign a unique identifier to each document for easy tracking and record-keeping.

- Itemized List of Products/Services: Provide a detailed breakdown of what was delivered, including descriptions, quantities, and unit prices.

- Payment Terms: Specify the payment due date, accepted payment methods, and any applicable penalties for late payment.

- Total Amount Due: Include a clear total, showing the sum of all charges, taxes, and discounts.

- Additional Notes: Leave space for any special instructions, messages, or legal disclaimers.

Formatting Tips for Clarity

To make the document more readable, consider these formatting guidelines:

- Consistent Layout: Organize the content into clearly separated sections for ease of navigation.

- Readable Fonts: Use legible font types and sizes to ensure that all text is easy to read.

- Whitespace: Include enough space between sections to avoid a cluttered appearance.

Including these essential components ensures that the document is both functional and professional, making it easier for clients to process and respond to your payment requests.

Free Word Invoice Templates Available

For businesses looking to create professional billing records without the need to design them from scratch, there are numerous free resources available. These pre-designed layouts allow you to focus on the content while providing a structured format that ensures all necessary details are included. Many of these options are customizable, making it easy to tailor them to fit your business needs.

Whether you’re a freelancer, small business owner, or large company, free billing documents can save time and reduce the stress of creating new records for every transaction. These formats are designed to meet industry standards and are typically easy to modify, enabling you to include all the essential elements such as client information, payment terms, and itemized charges.

With a quick online search, you can find a variety of designs that suit different industries and preferences, from simple layouts to more detailed ones with logos and branding options. Once downloaded, these formats can be opened and adjusted in your preferred software, allowing you to generate accurate and professional documents quickly.

How to Add Your Branding to Invoices

Incorporating your brand’s identity into your billing documents is essential for maintaining a professional appearance and promoting your business. By adding visual elements such as logos, color schemes, and fonts that reflect your brand, you not only make your documents look more cohesive but also strengthen your brand presence with every transaction.

Steps to Add Branding

Follow these steps to personalize your documents:

- Include Your Logo: Place your company’s logo at the top of the document, ideally near your business details. This helps clients immediately recognize your brand.

- Choose Your Brand Colors: Use your brand’s colors for text, borders, and headings. Consistent use of color reinforces your identity.

- Use Custom Fonts: If your brand uses specific fonts, integrate them into the document to align with your overall style guide.

- Contact Information and Tagline: Ensure your business contact information, including website and social media links, is clearly displayed. If you have a tagline, include it as a reminder of your brand’s message.

Enhancing the Design

Make sure your branding doesn’t overpower the document’s functionality. Keep the layout clean and organized, ensuring that the key information remains easy to find. A subtle design that complements the content will make your billing records both professional and memorable.

Common Invoice Mistakes to Avoid

When creating billing records, small errors can lead to confusion and delays in payments. Ensuring accuracy and clarity is vital for maintaining a professional relationship with clients. By being mindful of common mistakes, you can create clear and effective documents that streamline your financial processes.

Here are some common mistakes to avoid:

- Incorrect Client Details: Always double-check the client’s name, address, and contact information. Mistakes here can cause the document to be misdirected or delayed.

- Missing or Incorrect Dates: Failing to include the date of issue or the payment due date can cause confusion and lead to late payments. Make sure to clearly state both.

- Not Itemizing Services or Products: Avoid vague descriptions. Clearly list all items or services provided, including quantities and individual prices, to ensure transparency.

- Omitting Payment Terms: Always specify the payment methods accepted and the due date. If you don’t include these, it can lead to misunderstandings about when and how to pay.

- Math Errors: Double-check the calculations for the total amount, including taxes and discounts. Even small errors in the total can create doubts and complicate the payment process.

- Unclear Payment Instructions: Ensure that the instructions for making payments are easy to follow. Specify the payment methods, account details, or any relevant information to avoid delays.

- Lack of Professional Appearance: A disorganized or poorly designed document can damage your reputation. Keep the layout simple, clean, and consistent with your branding.

By being aware of these common pitfalls, you can ensure that your billing documents are clear, accurate, and professional, helping you maintain positive client relationships and timely payments.

Best Practices for Professional Invoices

Creating a professional billing document is essential for maintaining clear communication and ensuring timely payments. By following a few key practices, you can produce documents that reflect your business’s professionalism and make the transaction process smoother for both you and your clients.

Key Practices to Follow

- Clarity: Ensure that all details are easy to read and understand. The document should be structured logically with clearly marked sections.

- Consistency: Use the same fonts, colors, and styles throughout the document to create a cohesive and polished look that aligns with your brand.

- Timeliness: Always issue billing records promptly after providing the service or delivering goods. This helps to maintain a steady cash flow.

- Accuracy: Double-check all figures and client information to avoid errors. Inaccurate details can delay payment or cause misunderstandings.

Sample Structure of a Professional Document

| Section | Description | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Header | Include your company logo, name, and contact information, as well as the client’s details. | ||||||||||||||

| Unique Reference Number | Each document should have a distinct number for tracking purposes. | ||||||||||||||

| Itemized List | Provide a breakdown of the products or services rendered with quantities, unit prices, and total amounts. | ||||||||||||||

| Payment Details | Specify the total amount due, accepted payment methods, and the due date. | ||||||||||||||

| Footer | Provide any additional information, such as payment instructions, terms, or a thank-you

How to Automate Your Invoicing ProcessAutomating your billing system can save significant time and reduce errors, allowing you to focus on growing your business rather than dealing with manual paperwork. By leveraging automation tools and processes, you can ensure that each transaction is recorded promptly, accurately, and consistently, helping to maintain a smooth cash flow. Steps to Automate Your Billing Process

Benefits of Automation

By automating the process, you not only streamline your operations but also enhance client experience with quicker and more accurate billing. The right system can take the hassle out of managing financial records and help your business run more efficiently. How to Include Taxes and DiscountsIncorporating taxes and discounts into your billing records is essential for ensuring accuracy and transparency in financial transactions. Properly applying these charges or reductions not only complies with regulations but also ensures that your clients are aware of the exact amounts they need to pay. It’s crucial to know where and how to add them to avoid errors and confusion. Steps to Include TaxesWhen adding taxes, it’s important to clearly separate them from the base prices to maintain transparency. Here are the basic steps:

Steps to Include DiscountsApplying discounts requires clarity, especially when offering percentage-based reductions or fixed-amount discounts. Here’s how to do it:

By following these steps, you can ensure that taxes and discounts are correctly applied, providing a clear and professional document for your clients. Transparency in how these charges are calculated can help avoid misunderstandings and maintain strong client relationships. How to Handle Multiple Payments on InvoicesManaging payments in multiple installments or from different sources can be complex, but it’s a necessary process for businesses that deal with large transactions or clients who prefer flexible payment terms. When handling multiple payments, it’s important to clearly track the amounts paid, the outstanding balance, and the payment methods used, to ensure that all transactions are properly recorded and reconciled. Steps to Track Multiple Payments

Organizing Payment RecordsTo keep your records organized and to avoid any discrepancies, it’s important to maintain a systematic approach to tracking each payment:

Properly managing multiple payments can improve your cash flow and customer satisfaction, as it e Using Word to Track Invoice PaymentsKeeping track of payments is crucial for maintaining accurate financial records. While there are specialized tools for managing this task, using a document editor can also be an effective way to monitor payment status, especially for small businesses or freelancers. By manually updating a payment log within a document, you can maintain a clear overview of amounts received, due dates, and outstanding balances. Steps to Create a Payment Tracking Log

Tips for Effective Tracking

Using a document editor like this to track payments allows you to maintain a simple, customized record. It’s an accessible option for anyone looking to keep on top of financial transactions without using specialized software. Legal Considerations for InvoicingWhen issuing payment requests, it’s important to be aware of the legal requirements that ensure clarity and protect both the business and the client. There are specific guidelines and regulations that dictate what information must be included and how it should be presented. Understanding these legal considerations helps prevent misunderstandings, disputes, and ensures compliance with tax laws and contractual obligations. Key Legal Requirements

Considerations for International Transactions

By adhering to these legal guidelines, you can protect both your business and your clients while ensuring smooth, transparent transactions. Legal considerations provide the structure and reliability that are essential for maintaining trust and compliance in business relationships. Printing and Sharing Your InvoiceOnce you’ve created a payment request document, it’s important to know how to effectively share and print it to ensure it reaches the recipient in a professional and timely manner. Whether you choose to deliver it digitally or in physical form, your method of distribution can affect how quickly the payment is processed and how professional your communication appears. Printing Your Payment Request For businesses that prefer physical copies, printing a payment request is a straightforward process. Ensure that the document is clearly formatted and includes all necessary details before printing. High-quality paper and a professional printer can help enhance the appearance of your document, making it look polished and official. Always review the printed copy to ensure there are no formatting errors or missing information. Sharing via Email Digital sharing is a fast and efficient way to send your payment requests. Attach your document to an email, ensuring the subject line is clear and concise. Include a polite message with all the essential information about the payment request, and make sure the recipient has all the necessary instructions for completing the transaction. PDFs are a common file format to use, as they preserve the document’s formatting and ensure that the recipient sees it as intended. Using Cloud Storage or Online Platforms If you’re managing multiple clients or wish to automate your processes, using cloud storage or online platforms for sharing payment requests can streamline the process. Platforms like Google Drive or Dropbox allow you to store documents securely and share them via a link, providing easy access for clients. These platforms also allow for easy tracking of shared files, which can be especially useful for businesses handling numerous transactions. Ensuring Security When sharing payment documents, especially digitally, it’s important to protect sensitive information. Use encrypted email services or password-protected documents to ensure that payment details remain secure. Always verify the recipient’s email address to avoid errors or potential fraud. By understanding the best practices for printing and sharing your documents, you can ensure a seamless experience for both your business and your clients. Whether in physical form or digitally, clear and professional communication is key to maintaining positive business relationships and ensuring timely payments. Frequently Asked Questions About InvoicesWhen it comes to creating and managing payment requests, many people have common questions. Understanding the best practices, legal requirements, and the overall process can help you navigate the complexities of handling payments more effectively. Below, we address some of the most frequently asked questions that can help clarify any confusion.

These questions address the most common concerns when managing payment requests. Understanding the process and addressing these points can help streamline your operations, ensuring smoother transactions and better financial management. |