Invoice Template in Microsoft Word for Easy Customization and Use

When managing business transactions, having a clear and organized way to request payments is essential. A well-structured document helps to maintain professionalism and ensures both parties understand the terms of the agreement. Whether you are a freelancer, small business owner, or part of a larger company, knowing how to efficiently create and customize this important document can save time and reduce errors.

Using a widely accessible text editing program, you can easily craft a professional billing statement without the need for complex software. With the right structure and design, you can create a document that looks polished, reflects your brand identity, and includes all the necessary details for the recipient to process the payment quickly.

Customizing your document allows you to adjust the layout, include relevant fields, and incorporate important details such as payment terms, itemized services, or taxes. This flexibility makes it a great choice for businesses of all sizes, providing an adaptable solution for generating accurate billing forms in a format that’s both easy to use and share.

How to Create an Invoice in Word

Creating a professional billing document in a text editing program is a straightforward process. With a few key steps, you can design a custom form that includes all necessary information and looks polished. This approach allows for easy adjustments, ensuring that every detail is accurate and tailored to your needs.

To start, open your text editor and begin by setting up the layout. You’ll want to create sections for essential details such as your business name, client information, itemized list of services or products, and payment terms. A clean, simple structure will help keep the document easy to read and understand.

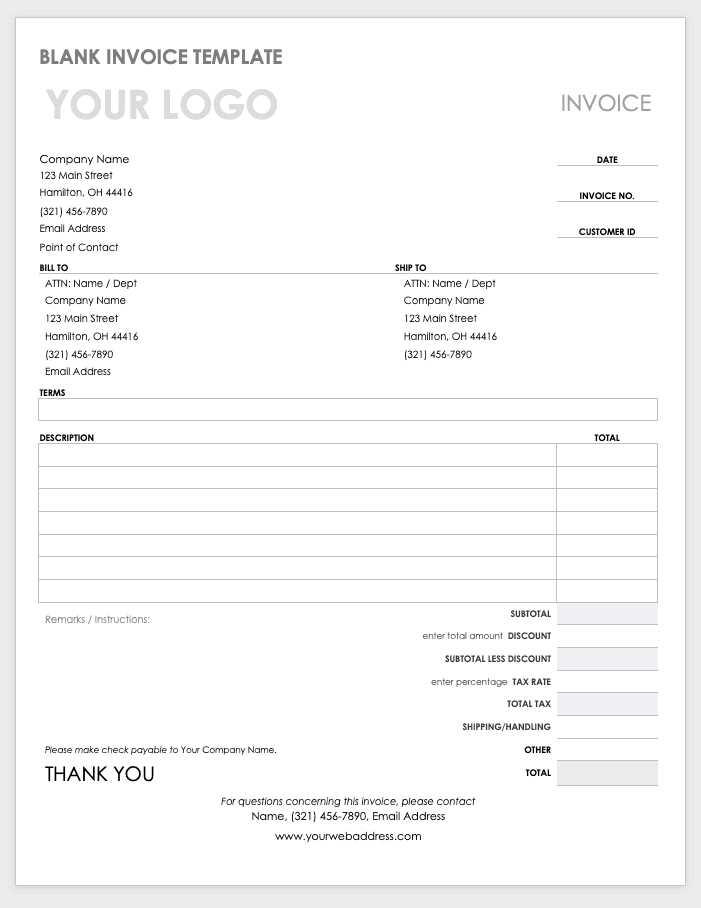

| Section | Details |

|---|---|

| Header | Your business name, logo, and contact details |

| Client Information | Recipient’s name, address, and contact info |

| Itemized List | Details of services or products with quantities and prices |

| Terms | Payment due date, tax information, and any discounts |

| Total Amount | Sum of the charges including tax |

Once the structure is in place, you can easily format the document by adjusting fonts, spacing, and alignment. Make sure to add a section that clearly states the total amount due, as this is the most critical part of the document. After finalizing the content and design, save the file, and it’s ready to be sent or printed for use.

Why Use Microsoft Word for Invoices

Creating a billing document using a popular text editor offers several advantages for businesses and freelancers alike. This software is widely accessible, easy to use, and provides the flexibility to design a professional-looking form quickly. Whether you are working on a simple transaction or a more complex service, this tool can help you generate accurate documents with minimal effort.

One key benefit is its user-friendly interface, which allows even those with minimal technical skills to create clean, structured documents. With pre-built formats and customizable options, it’s possible to adjust the design, add specific fields, and make the document reflect your unique business needs. You don’t need to worry about advanced software or spending hours learning new programs.

Additionally, the ability to save and edit these files in a familiar format means you can easily track and update previous entries. Whether you need to modify an existing document or create a new one, the process remains efficient and straightforward. Sharing the completed form via email or printing it for physical delivery is also simple, making this solution perfect for various business environments.

Benefits of Customizing Invoice Templates

Customizing your billing forms offers a wide range of advantages for businesses of all sizes. By adjusting the layout, design, and content of your document, you can ensure it meets your specific needs while maintaining a professional appearance. A personalized document helps build brand recognition and improves communication with clients.

Here are some of the key benefits of customizing your billing forms:

- Brand Consistency: Customizing allows you to incorporate your logo, business colors, and other branding elements, ensuring your documents reflect your company’s identity.

- Professional Appearance: A tailored design looks more polished and organized, making a positive impression on clients and reinforcing your credibility.

- Accurate Information: Adjusting the layout ensures that all essential details such as payment terms, tax information, and itemized charges are included and easy to find.

- Time-Saving: Having a personalized document format reduces the time spent on creating new forms for every transaction, making the process more efficient.

- Flexibility: Customization gives you the freedom to modify the layout for different types of services or products, helping to accommodate various business needs.

Ultimately, the ability to tailor your billing documents enhances your professionalism, boosts efficiency, and ensures your business presents itself in the best possible light. By having full control over the design and structure, you can create forms that perfectly suit your operations and client expectations.

Step-by-Step Guide to Invoice Creation

Creating a billing document from scratch may seem complicated, but following a simple process can help you produce a professional and accurate form. With just a few basic steps, you can customize the layout, input the necessary details, and ensure that the document meets your business needs. This guide will walk you through each stage of the creation process, from setting up the structure to finalizing the content.

Step 1: Set Up the Layout

The first step is to create the structure of the document. This includes determining the sections you need and organizing them in a logical order. The layout should be clear and easy to follow, ensuring that each part of the document is distinguishable. Here are the key sections to include:

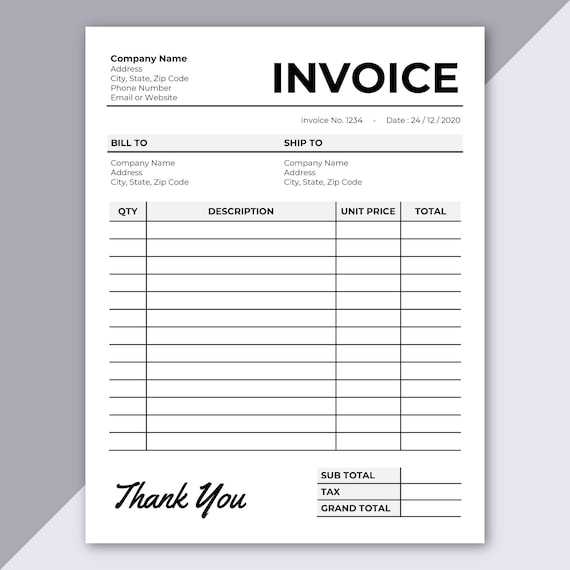

| Section | Details |

|---|---|

| Header | Your business name, logo, and contact information |

| Client Information | Client’s name, address, and contact details |

| Service or Product List | Details of the services provided or products sold, with quantities and prices |

| Payment Terms | Due date, payment methods, and any applicable taxes or discounts |

| Total | Sum of the charges including tax |

Step 2: Customize the Content

Once the layout is set, you can begin adding the specific details of the transaction. This includes entering information about the client, listing the products or services provided, and specifying the payment terms. Be sure to double-check all figures, such as unit prices, quantities, and tax rates, to ensure accuracy. Personalizing this content according to each transaction will help avoid mistakes and make the document more relevant to the client.

After filling in the required fields, save your document, and it will be ready for printing or emailing to the client. By following these steps, you’ll be able to generate a precise and professi

Choosing the Right Invoice Format

Selecting the appropriate format for your billing document is crucial to ensure clarity, accuracy, and professionalism. The right structure not only makes the document easy to read but also helps avoid confusion and errors in the transaction. With various options available, it’s important to choose a design that fits your business needs and effectively communicates all necessary details to your client.

Factors to Consider

When choosing the format, consider the following factors:

- Business Type: Different industries may require specific layouts. For example, a service-based business might need a more detailed breakdown of hours worked, while a product-based business would emphasize itemized goods.

- Client Preferences: Some clients may prefer a simple format, while others might need additional details, such as payment terms or tax calculations. Tailoring the format to suit client expectations can improve satisfaction.

- Clarity and Simplicity: A clean and straightforward layout helps prevent confusion. Use clear headings, organized sections, and enough white space to make the document easy to follow.

- Customization Flexibility: The ability to add or remove sections as needed makes a format versatile. This flexibility ensures the document can be adjusted based on the type or scope of the service or product provided.

Common Formats to Choose From

There are several types of layouts that you can opt for depending on your specific needs:

- Basic Layout: A simple, no-frills format that includes the essentials: business and client information, services or products, and payment details.

- Detailed Layout: A more comprehensive format that includes a breakdown of services, project milestones, or time spent on tasks.

- Itemized Layout: A detailed list of each product or service provided, showing quantities, individual prices, and total cost per item.

- Minimalist Layout: A straightforward, clean design with just the essential details, ideal for small transactions or freelancers.

By considering these factors and choosing the right format, you can ensure your billing documents are both professional and functional, helping to maintain clear communication with your clients.

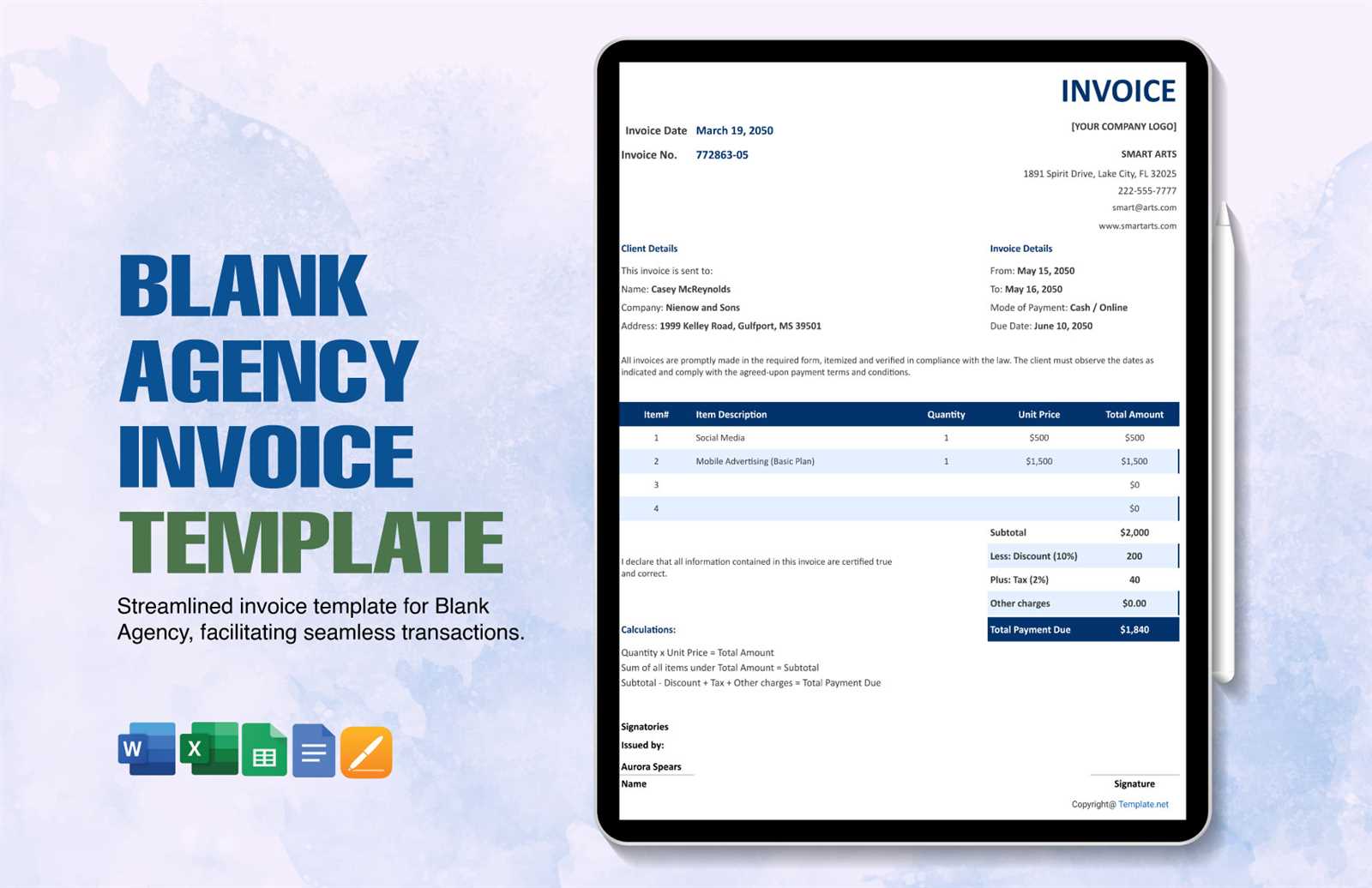

Free Invoice Templates for Microsoft Word

There are numerous free resources available online that offer ready-to-use billing document formats for easy customization. These pre-designed layouts allow you to quickly generate a professional document without starting from scratch. Whether you need a simple, straightforward layout or a more complex, detailed design, you can find free options that suit your business needs.

Here are some common places to find these free resources:

- Official Software Websites: Many programs offer free downloadable formats directly from their website, ensuring compatibility and ease of use.

- Online Template Libraries: Websites like Canva, Template.net, and others provide a wide variety of free designs, allowing you to choose and personalize according to your preferences.

- Community Forums and Blogs: Many businesses and freelancers share their own custom formats for free on various forums and blogs. These templates can be a great source of inspiration or a quick solution for your needs.

- Open Source Platforms: Platforms such as GitHub host open-source projects where you can find and download free formats contributed by others.

These free resources are often highly customizable, allowing you to add your business logo, modify text, and adjust layouts to better match your style. They provide an efficient way to produce accurate, polished documents quickly without the need for expensive software or design experience.

Whether you’re a freelancer, small business owner, or working within a larger organization, these free designs offer a great starting point to streamline the billing process and enhance your professionalism.

Design Tips for Professional Invoices

Creating a visually appealing and easy-to-understand billing document can make a big difference in how your business is perceived. A professional design not only enhances the document’s readability but also strengthens your brand’s identity. By following some simple design tips, you can ensure your documents look polished, clear, and organized, while also conveying professionalism to your clients.

Key Design Elements

There are several design aspects to keep in mind when creating your billing forms:

- Use Consistent Branding: Incorporate your business logo, brand colors, and fonts. This helps make your document instantly recognizable and aligns with your company’s visual identity.

- Clear Sectioning: Use bold headings and ample white space to clearly separate different sections of the document, such as client details, services, and payment terms. This improves the readability and flow of the document.

- Legible Fonts: Choose professional, easy-to-read fonts. Avoid overly decorative fonts that can be difficult to read, and ensure the font size is large enough for clear visibility.

- Minimalist Design: Keep the design clean and uncluttered. A simple, well-structured layout with just the necessary information makes your document look more professional and prevents confusion.

- Include Contact Information: Clearly display your business’s contact details at the top, including phone number, email, and website. This ensures your clients can easily reach you if needed.

Additional Tips for Polished Documents

To further elevate the professionalism of your billing forms, consider these additional tips:

- Use Borders or Shading: Add subtle borders or shaded sections to create a distinct visual hierarchy. This helps emphasize key areas like the total amount due or payment terms.

- Align Information Properly: Ensure that all details are aligned neatly, such as aligning the item list with its respective prices and totals. This gives the document a structured and organized appearance.

- Provide Clear Payment Instructions: Make sure the payment terms are prominent and easy to follow. Clearly state the due date, accepted payment methods, and any late fees,

How to Add Your Business Logo

Including your business logo in your billing documents adds a professional touch and reinforces brand identity. A logo helps clients instantly recognize your company and can make the document look more official and polished. Adding your logo is a simple process that can be done in just a few steps, and it helps elevate the overall appearance of the form.

Here’s how to easily add your business logo to your document:

Step Action Step 1 Open your document and position the cursor where you want the logo to appear, typically in the header section. Step 2 Click on the “Insert” tab from the menu and choose “Picture” from the options. Step 3 Locate the logo image file saved on your computer and select it. Step 4 Adjust the size of the logo by clicking and dragging the corners to fit the space without distorting its proportions. Step 5 Use the “Text Wrapping” options to position the logo properly. “Square” or “Behind Text” works well for this purpose. Step 6 Once positioned, save your document to retain the changes. By following these simple steps, you can add your business logo to your billing document and create a more professional and branded appearance. This small yet impactful detail enhances the overall prese

Customizing Invoice Fields for Accuracy

Ensuring the accuracy of all fields in your billing document is essential for smooth transactions and clear communication with clients. By customizing each section to suit the specifics of your business and the services provided, you can eliminate errors and make the document more relevant. Whether you need to modify existing fields or add new ones, fine-tuning the details ensures everything is captured correctly and professionally.

Key areas to customize for accuracy include:

- Client Information: Double-check that the client’s name, address, and contact details are correct. Small errors in this section can cause confusion and delay payments.

- Service or Product Details: Ensure that the description, quantity, unit price, and total amount are accurate for each item or service provided. Mispricing or incorrect descriptions can lead to disputes or delayed payments.

- Payment Terms: Clearly specify payment deadlines, accepted methods, and any applicable late fees. This avoids misunderstandings and sets expectations for both parties.

- Tax Calculations: If taxes are applicable, make sure the correct rates and calculations are included. Incorrect tax information can result in legal issues or incorrect payments.

- Discounts or Additional Fees: If offering a discount or adding additional charges (such as shipping or handling), ensure these are accurately reflected in the document. Both positive and negative adjustments should be clear and visible.

To further enhance accuracy, consider using formulas or automatic calculations where possible. This reduces the chance of human error, especially when adding up totals or applying taxes. Additionally, reviewing the document before sending it can help catch any overlooked mistakes.

By customizing each field to match the specific details of your business and transaction, you create a more accurate and professional document. This not only builds trust with clients but also streamlines the payment process and ensures a smooth business operation.

Setting Payment Terms in Word Templates

Establishing clear and precise payment terms is crucial for ensuring timely payments and avoiding misunderstandings with clients. By setting these terms in your billing document, you create a mutual understanding of when and how payments should be made. This section will guide you on how to properly include payment conditions in your document design, helping to maintain professionalism and clarity in every transaction.

Here are the essential payment terms you should consider including:

- Due Date: Specify the exact date by which payment is expected. This helps prevent delays and sets clear expectations.

- Payment Methods: Clearly list all accepted payment options, such as bank transfers, credit card payments, or online platforms like PayPal.

- Late Fees: If you charge a fee for late payments, include the rate or percentage to be applied and when it will take effect. This encourages timely payments.

- Early Payment Discounts: Offer incentives for clients who pay before the due date, such as a percentage off the total amount, to encourage prompt payment.

- Payment Instructions: Provide clear instructions on how the payment should be made, including account numbers or links to online payment portals if necessary.

To set these terms, simply create a section at the bottom of your billing form, where clients can easily find and review the payment guidelines. Make sure to use bold or italic text to highlight important details, such as the due date or late fees, for maximum clarity.

By clearly outlining these terms in your document, you create a professional and transparent agreement that helps avoid payment delays and builds trust with your clients. Accurate payment terms are key to maintaining positive business relationships and ensuring financial stability.

Including Tax Information in Your Invoice

When creating a billing document, it’s essential to include accurate tax details to ensure compliance and transparency. Tax information not only reflects the legal requirements of your country or region but also helps clients understand the breakdown of costs. Including this data clearly in your document avoids confusion and ensures both you and your clients are on the same page regarding financial transactions.

Key Elements of Tax Information

Here are the key tax-related details you should include:

- Tax Rate: Indicate the applicable tax rate or percentage for your product or service. This should be based on the location of the transaction or the client’s tax jurisdiction.

- Tax Amount: Clearly show the tax amount being charged. This can be calculated based on the total cost of the service or product and the tax rate.

- Tax Identification Number: Depending on your local tax laws, you may need to include your business’s tax identification number (TIN) or VAT registration number.

- Tax Category: Specify if the tax is standard, reduced, exempt, or any other relevant category, depending on the item or service being sold.

How to Present Tax Information

To present tax information clearly, organize it in a separate section or under the “Total” or “Amount Due” section of the document. Here’s a suggested breakdown:

- Subtotal (pre-tax amount)

- Tax rate and tax amount

- Total amount (including tax)

For example, if the service or product costs $100 and the tax rate is 10%, you would list the subtotal as $100, the tax amount as $10, and the total amount due as $110.

By clearly presenting tax information, you help clients understand the charges and avoid disputes. This also ensures your business remains compliant with tax regulations and simplifies record-keeping for both parties.

How to Save and Edit Your Invoice

Once you’ve created your billing document, it’s essential to know how to save it properly for future use and how to make edits as needed. Whether you’re updating the details for a new transaction or keeping a record of your past sales, saving and editing your document efficiently will save you time and help maintain accuracy.

Here’s a step-by-step guide to saving and editing your document:

Step Action Step 1 Click on the “File” tab in the upper-left corner of the document. Step 2 Select “Save As” from the dropdown menu to save a new version of your document. Step 3 Choose a location on your computer or cloud storage to store the file. Give it a clear name, such as the client’s name or the transaction number, to make it easier to find later. Step 4 Save the document in your preferred format, usually .docx for easy future edits or .pdf for sending to clients in a non-editable form. Step 5 If you need to make edits, open the saved file, modify the necessary details such as client information, services, or amounts, and then save again. For recurring transactions, you can create a master version of your document with placeholder fields for key information like client name, service description, and total cost. This will allow you to easily customize and save each new copy quickly.

By following these simple steps, you ensure your documents are stored securely, and you’re always able to make the necessary updates as business needs change. Properly saving and editing your documents also helps you stay organized and keep track of all financial record

Printing and Sending Invoices via Email

Once your billing document is ready, it’s important to know how to distribute it to clients efficiently. Printing a hard copy and sending it through postal mail is one option, but emailing the document is often quicker and more convenient. Knowing how to properly print and email your document ensures a professional delivery and reduces the risk of delays.

How to Print Your Document

Printing a copy of your billing document allows you to maintain a physical record or send it via traditional mail. Here are the steps to print:

- Step 1: Open your saved document and make sure all details are correct.

- Step 2: Click on the “File” menu and select the “Print” option.

- Step 3: Choose your printer and adjust settings such as the number of copies or page orientation, if necessary.

- Step 4: Once everything is set, click “Print” to create a hard copy.

How to Send Your Document via Email

Sending your billing document by email is a faster and more efficient method of communication. Follow these steps to email your document:

- Step 1: Save your document in PDF format to ensure it cannot be edited by the recipient.

- Step 2: Open your email client and compose a new message. In the subject line, include clear information, such as “Billing for [Service/Product Name] – Due [Date].”

- Step 3: Attach the saved PDF file by clicking the “Attach” button in your email client and selecting the document from your computer.

- Step 4: In the body of the email, briefly explain the contents of the attachment and remind the client of the payment terms and due date.

- Step 5: Review your message, add the client’s email address, and click “Send.”

Emailing your document not only speeds up the delivery but also makes it easier for clients to respond promptly. By attaching a PDF, you ensure the integrity of the document, and by including a clear subject line and message, you maintain professionalism.

Whether you print or email your document, both

Tracking Payments with Word Invoices

Tracking payments is essential for maintaining a smooth financial operation. When you send out a billing document, it’s important to monitor when payments are made to ensure that all outstanding amounts are settled in a timely manner. Having a clear system in place for tracking payments helps you stay organized and avoid missing any important transactions.

Here’s how you can track payments effectively:

- Payment Status Section: Include a payment status field in your document, where you can mark whether the payment is pending, completed, or overdue. This will help you quickly review the payment status of each client.

- Payment Date: Note the exact date when a payment is received. This helps you keep a record and ensures accurate tracking for accounting purposes.

- Amount Paid: Specify the exact amount the client has paid. If only part of the amount is settled, note the partial payment and the remaining balance.

- Payment Method: Record the payment method used, such as credit card, bank transfer, or cash. This can be useful for any follow-up or queries.

- Unique Payment Reference: If available, include a payment reference number or transaction ID. This makes it easier to track payments in your bank statement or accounting software.

By regularly updating the payment status in your document, you create a reliable record of all transactions. You can either update the payment status directly on the document or maintain a separate ledger where all relevant details are logged. This will provide you with a clear overview of what has been paid and what remains outstanding.

Using these simple strategies, you can effectively track payments, ensuring that your business stays organized and you don’t miss any important financial milestones.

Common Invoice Mistakes to Avoid

When creating and sending billing documents, it’s easy to overlook certain details that could lead to confusion or delays in payments. Making mistakes can affect your cash flow and may harm your relationship with clients. It’s crucial to ensure that every element is accurate and well-organized. Here are some common errors to watch out for and how to avoid them.

Key Mistakes to Avoid

- Incorrect Client Information: One of the most common errors is misentering the client’s name, address, or contact details. Always double-check this information before sending the document to avoid delays in payments or miscommunications.

- Missing or Incorrect Payment Terms: Failing to specify the due date, payment methods, or late fees can lead to confusion. Be sure to clearly outline all terms, including when the payment is due and how it should be made.

- Unclear Descriptions: Providing vague or unclear descriptions of the services or products delivered can cause misunderstandings. List each item or service with enough detail to avoid disputes over what was provided.

- Omitting Taxes: If applicable, make sure to include the correct tax rate and amount. Not specifying taxes can lead to incorrect payments and potential legal issues, so be sure to factor them into the total amount correctly.

- Math Errors: Simple math mistakes, such as incorrect totals or tax calculations, are easy to make but can lead to major issues. Double-check all figures and use automated calculations wherever possible to reduce errors.

- Not Saving a Copy: Always save a copy of each document you send out. Failing to do so can make it difficult to track payments or resolve any disputes that may arise.

How to Prevent These Mistakes

- Review Everything: Before sending, carefully proofread the entire document. Double-check client details, dates, and all amounts.

- Use Automated Tools: Use tools that can automatically calculate totals and ta

How to Protect Your Invoice Documents

Ensuring the security of your billing documents is crucial to maintaining the integrity of your business operations. Whether you’re dealing with sensitive financial data or client details, protecting these documents from unauthorized access, tampering, or loss should be a priority. Fortunately, there are several strategies you can use to safeguard your documents and ensure they are kept secure.

Methods to Secure Your Documents

- Password Protection: One of the simplest and most effective ways to protect your billing files is by adding a password. This ensures that only authorized users can access or make changes to the document.

- Encryption: Encrypting your files adds an additional layer of protection, making it difficult for unauthorized individuals to read the document even if they gain access to it.

- Save as PDF: Converting your documents to PDF format prevents easy editing or alteration. PDFs are typically harder to manipulate compared to text-based formats, and they can also be encrypted for further security.

- Use Cloud Storage with Encryption: Storing your documents in a secure cloud service with built-in encryption ensures that your files are protected both during transfer and while stored online. Many services also offer automatic backups, so you won’t lose your data in case of an emergency.

- Track Access: If you’re sharing your files with clients or colleagues, consider using services that allow you to track who opens or downloads the document. This provides an extra layer of accountability and transparency.

Best Practices for Physical Protection

- Secure Backup: Always keep a backup of your files in a safe place. Whether it’s an external hard drive or a secure cloud service, ensuring you have a copy of your important documents can help prevent data loss.

- Physical Security: If you’re working with printed versions of your documents, ensure they are stored in a locked and secure location. Restrict access to only trusted individuals to minimize the risk of theft or misuse.

By following these protective measures, you can ensure the confidentiality, integrity, and availability of your financial documents. Taking the time to implement proper security measures will help you build trust with your clients and pro

Updating Your Invoice Template for Future Use

As your business grows and evolves, it’s important to keep your billing documents up to date. Regularly reviewing and modifying your billing formats ensures that they remain accurate, professional, and aligned with any changes in your business operations. Making periodic updates not only improves efficiency but also helps you stay compliant with any legal or tax changes that may arise.

Here are some key steps for updating your document format:

- Review Company Information: Over time, your business details such as address, phone number, or logo may change. Make sure to keep these elements updated to avoid sending outdated contact information.

- Adjust Payment Terms: If your payment policies change–whether it’s adjusting due dates, adding late fees, or changing accepted payment methods–be sure to update these sections in your document to reflect the new terms.

- Incorporate New Tax Rates: Tax rates can change depending on jurisdiction. Keep your billing documents current by revising any tax-related fields to account for updates in local, state, or national tax laws.

- Add or Remove Services: If your business introduces new services or products, include these in your billing structure. Similarly, if you discontinue certain offerings, make sure they are removed to avoid confusion.

- Improve Layout and Design: Consider periodically enhancing the design or layout of your billing document. A cleaner, more professional design can enhance your brand’s image and improve the readability of your document.

Tips for Efficient Updates:

- Save Versions: Create and save multiple versions of your billing document as you update it. This ensures that you can easily revert to a previous version if needed, or use different formats for specific clients.

- Test Before Sending: Before you send out the updated version, do a test run with a sample document to make sure everything appears correctly and functions as expected.

By regularly updating your billing documents, you ensure that your clients receive accurate, professional communications and that your business stays aligned with any operational changes or industry regulations.