Easy to Use Invoice Template in Excel Format for Your Business

Managing financial transactions and keeping accurate records is crucial for businesses of all sizes. One of the simplest ways to streamline the process is by using ready-made documents that can be easily customized to fit your needs. These tools help ensure consistency and professionalism in every financial interaction, allowing you to focus on growing your business.

With the right document structure, calculating totals, tracking payments, and organizing details becomes significantly easier. Whether you’re a freelancer, small business owner, or part of a large enterprise, having a system that handles the administrative side of transactions can save valuable time and reduce errors. Simple, user-friendly options are now available that help you create professional-grade billing records with just a few clicks.

In this guide, we will explore how you can take advantage of customizable solutions designed to meet your billing needs. By using tools that are widely accessible, you can ensure accurate and reliable financial documentation every time you issue a payment request.

Invoice Template in Excel Format

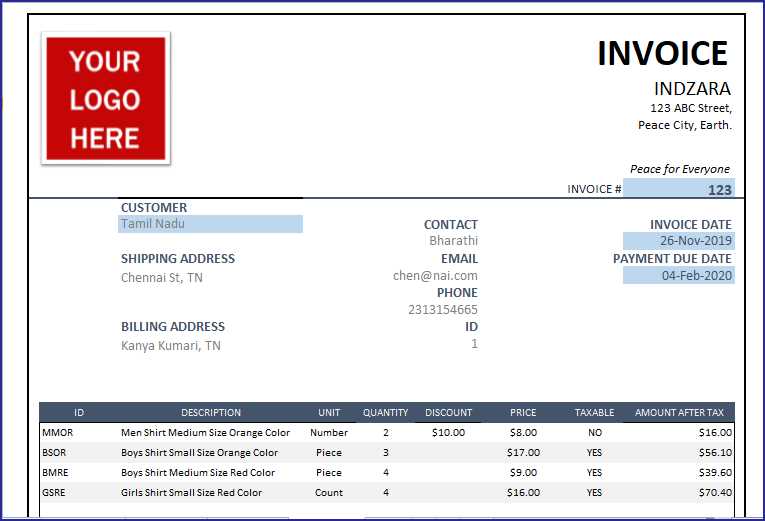

When it comes to managing financial records and ensuring smooth transactions, using a structured document that can be easily adapted to your needs is essential. These pre-designed tools offer a simple way to organize billing details, including the amounts owed, payment terms, and client information. By leveraging an adaptable structure, you can quickly generate accurate records with minimal effort, saving time and reducing the risk of mistakes.

These customizable files allow you to input relevant data such as pricing, services, and payment conditions, ensuring everything is neatly arranged and easy to follow. Whether you’re handling a few requests or managing multiple clients, these solutions help streamline the process and maintain professional standards across all interactions. Plus, with built-in calculations, you can easily track totals and apply taxes or discounts without manually adjusting each entry.

Accessibility and flexibility are key benefits of

Why Use an Excel Invoice Template

Efficient financial documentation is crucial for businesses, whether they are small startups or large corporations. Using pre-made documents for billing can significantly reduce the time and effort needed to create professional records from scratch. These tools help ensure that each transaction is documented consistently, minimizing the chances of errors and ensuring that clients receive clear and accurate details every time.

One of the main reasons to adopt these solutions is the ease of customization. They allow users to quickly adapt fields to suit their specific needs, whether it’s adding discounts, tax rates, or adjusting service descriptions. The flexibility to modify and personalize the structure of each document ensures that businesses can cater to diverse client requirements without compromising on professionalism.

Another key advantage is automation. By using a ready-made document, complex calculations such as totals, taxes, and discounts are automatically applied. This eliminates the need for manual calculations, which can often lead to mistakes. With just a few inputs, these tools will produce accurate, formatted records that meet professional standards every time.

Benefits of Customizing Excel Invoices

Customizing your billing records provides a level of flexibility and control that pre-made documents cannot offer. By tailoring the structure to fit your specific needs, you can create a more professional appearance and ensure that all necessary information is included. Whether you’re adjusting the layout, adding unique sections, or including specific payment terms, personalizing your documents helps improve clarity and efficiency in your financial dealings.

Increased Professionalism

One of the primary advantages of customizing billing records is the ability to present a polished, branded document to clients. By incorporating your company logo, color scheme, and business details, you can establish a consistent and professional identity. This attention to detail not only enhances your business’s reputation but also builds trust with clients, reinforcing the idea that you are organized and reliable.

Improved Accuracy and Efficiency

Customization also allows you to streamline the way you present and calculate amounts. By adding specific fields for discounts, taxes, and services, you can ensure that every aspect of the transaction is clearly outlined. This reduces the chance of confusion, making it easier for clients to understand the charges, and also allows for faster processing on both ends. Additionally, customizing your records enables you to track payments and outstanding amounts more efficiently, keeping everything organized in one place.

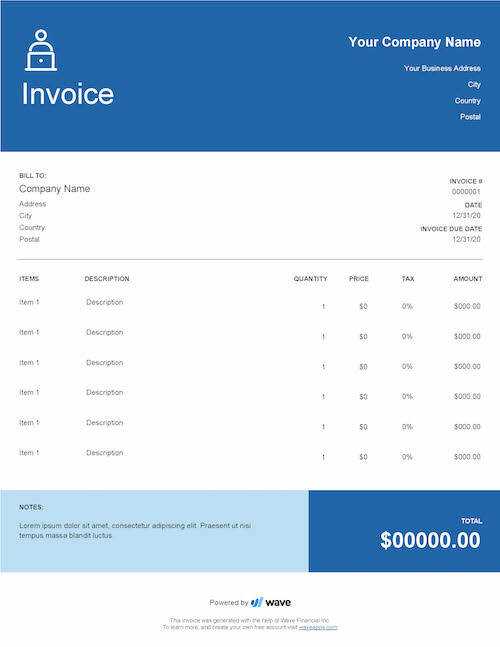

How to Create an Invoice in Excel

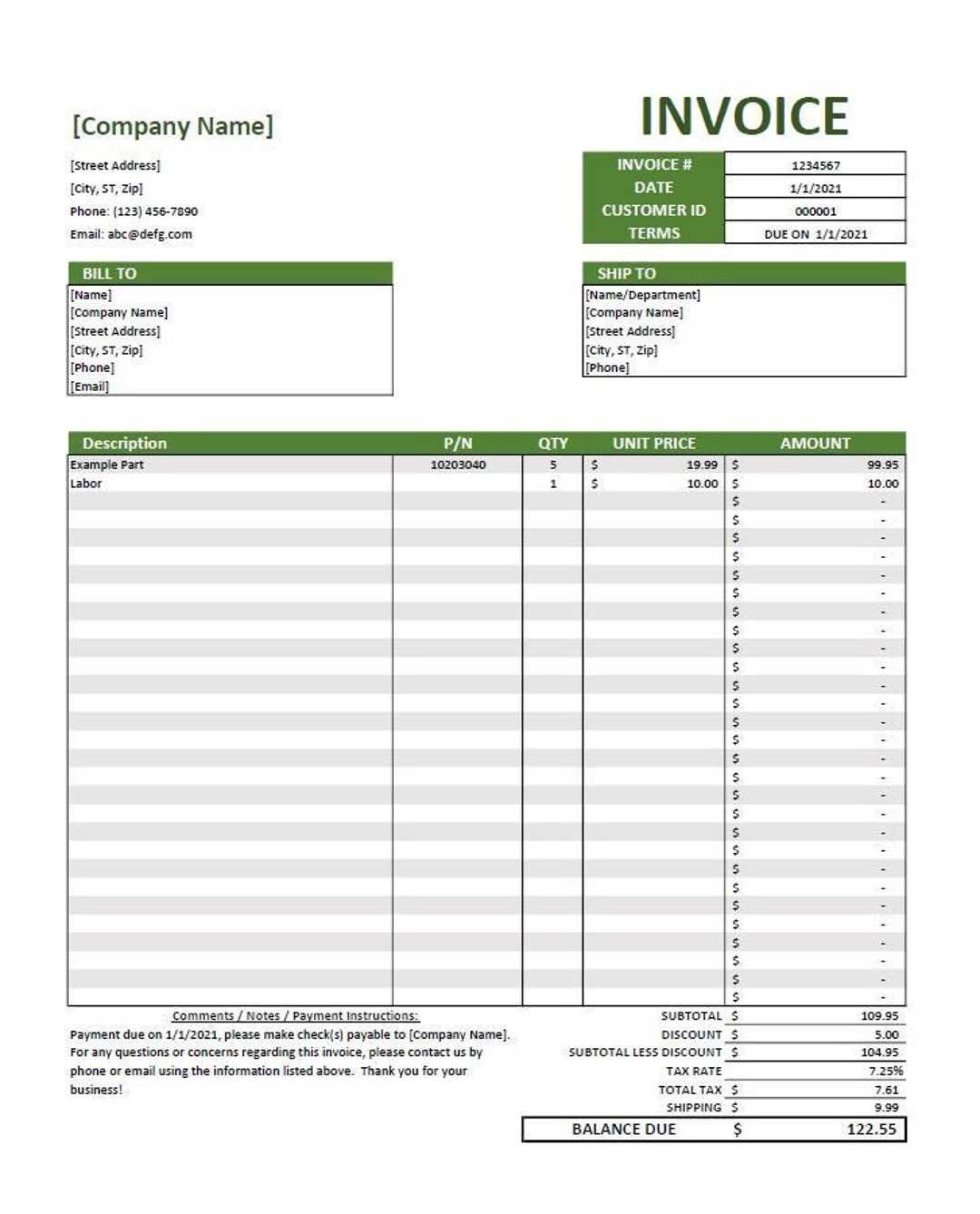

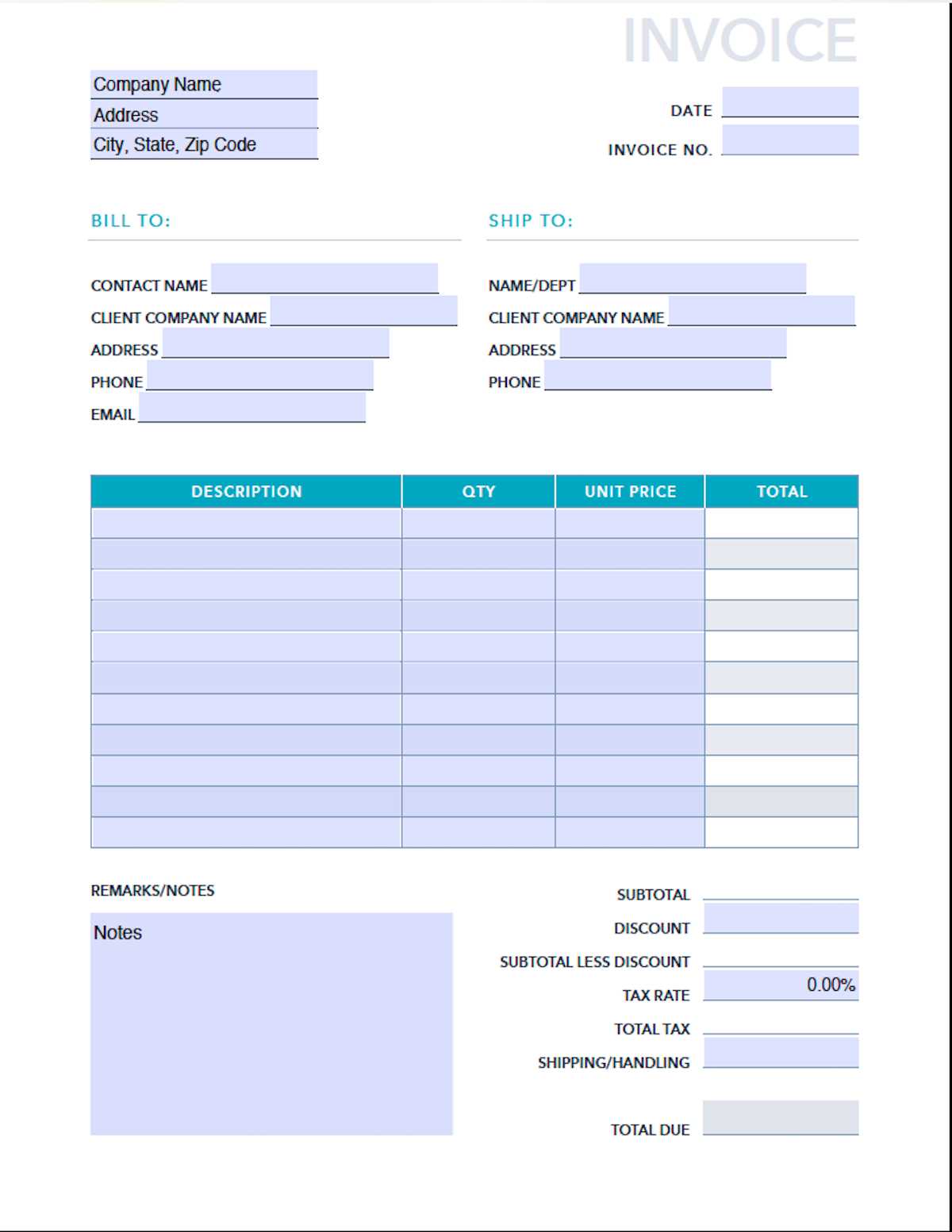

Creating a professional billing record is simple and can be done in just a few steps using a spreadsheet application. By organizing the necessary information into a clear structure, you can easily generate a document that looks both polished and accurate. This process allows you to input relevant details such as the services provided, amounts owed, and payment terms, while also ensuring everything is calculated automatically for efficiency.

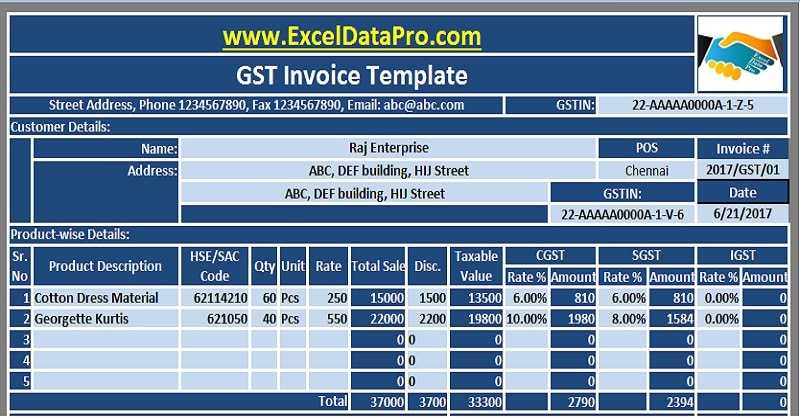

To begin, open a new spreadsheet and start by setting up the layout. Include sections for the client’s name, contact information, and your business details. You can also add rows for the individual items or services being billed, specifying their description, quantity, price, and total cost. Make sure to include columns for taxes, discounts, and any other relevant charges, and use basic formulas to calculate totals.

Once you’ve organized the main sections, it’s important to personalize the document with your business logo and color scheme, if applicable. This helps reinforce your brand identity and ensures that the final product is professional and easily recognizable. After filling in all the necessary details and performing the calculations, save the document and send it to your client. The process is straightforward and can be repeated as needed, making it an efficient solution for managing multiple billing requests.

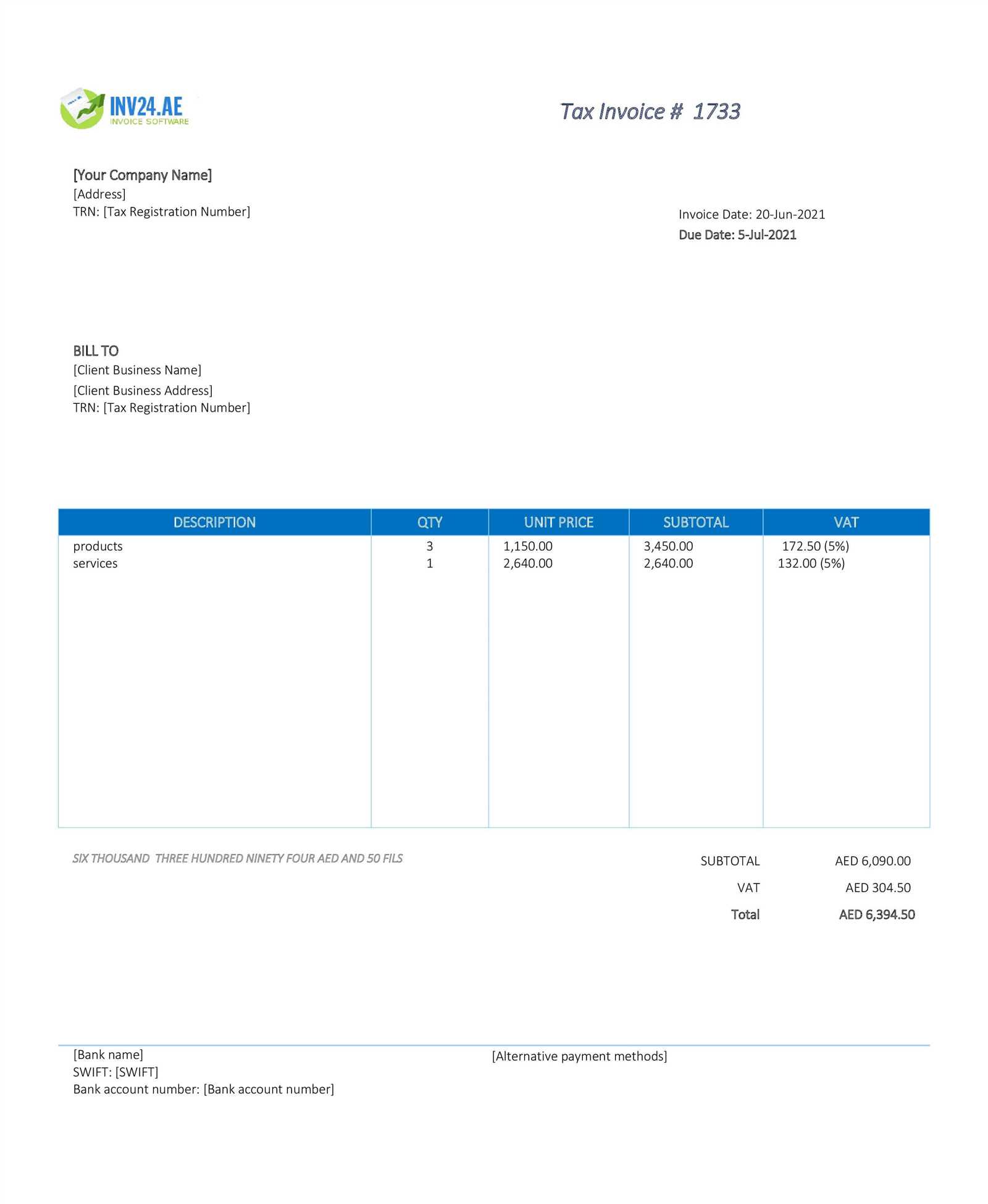

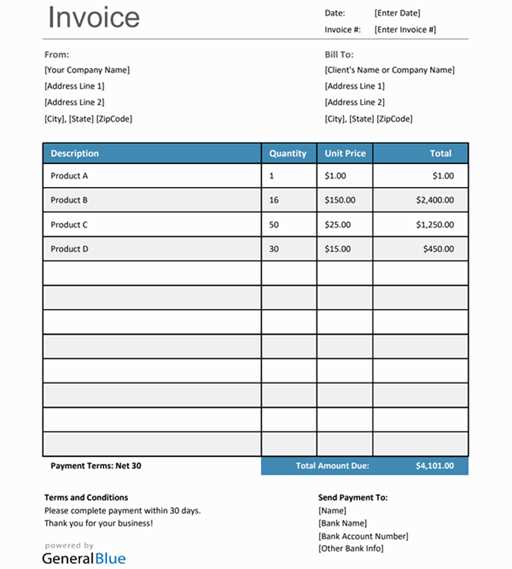

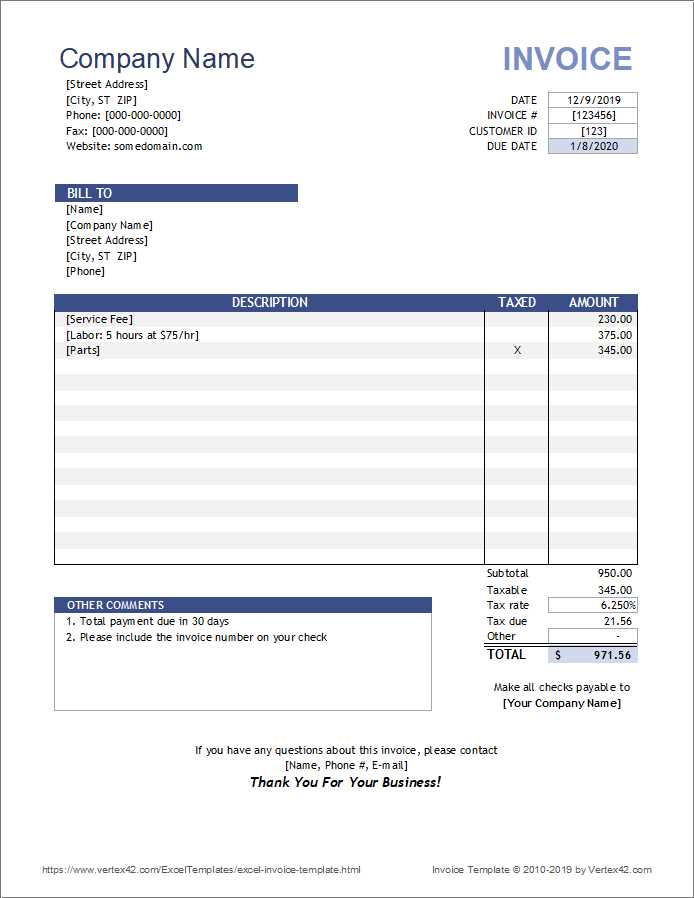

Essential Elements of an Invoice Template

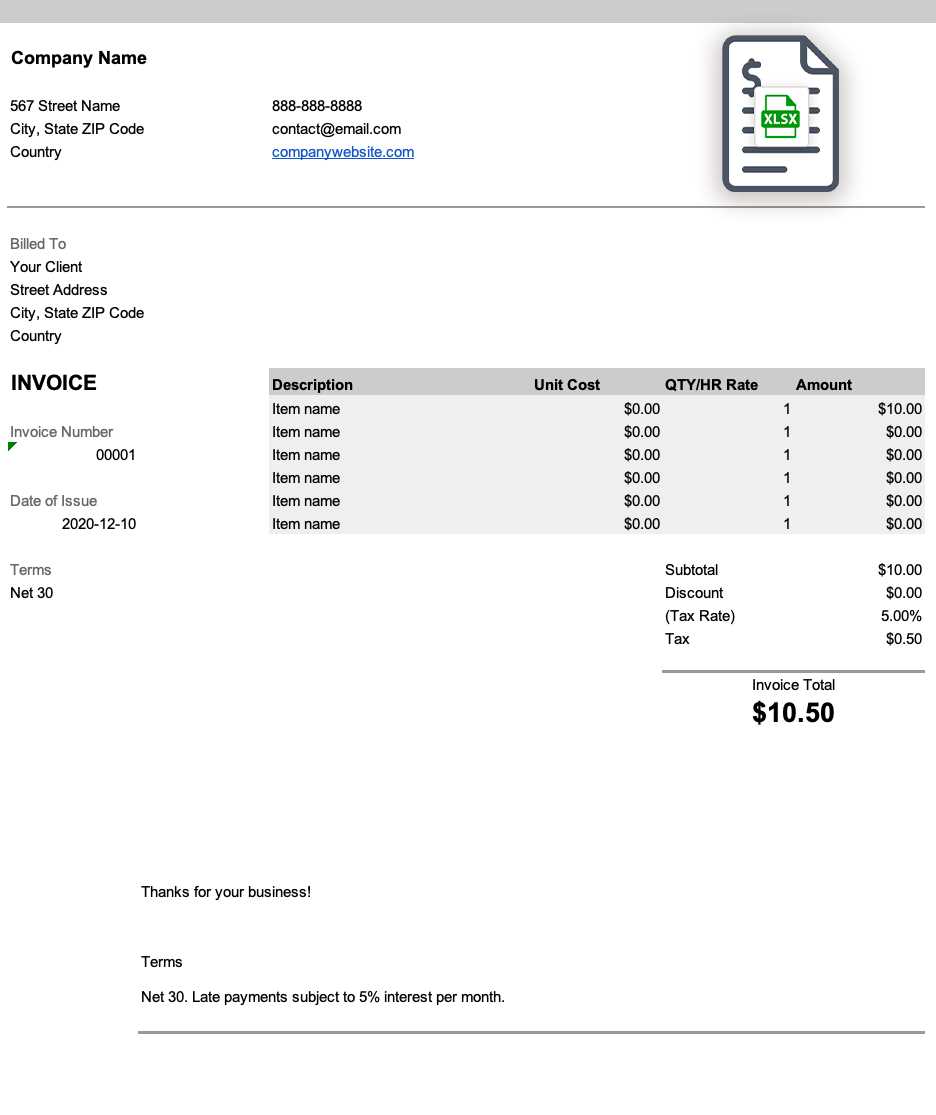

For a billing document to be clear and effective, it must include certain key details that ensure both the service provider and client understand the terms of the transaction. A well-structured document helps avoid confusion and promotes timely payments. Each section plays a critical role in conveying necessary information, from identifying the parties involved to breaking down costs and payment instructions.

Contact Information is one of the most important elements. This section should clearly list the service provider’s name, business name, phone number, email, and address, as well as the client’s details. Having this information at the top ensures that both parties can easily verify the document’s origin and recipient.

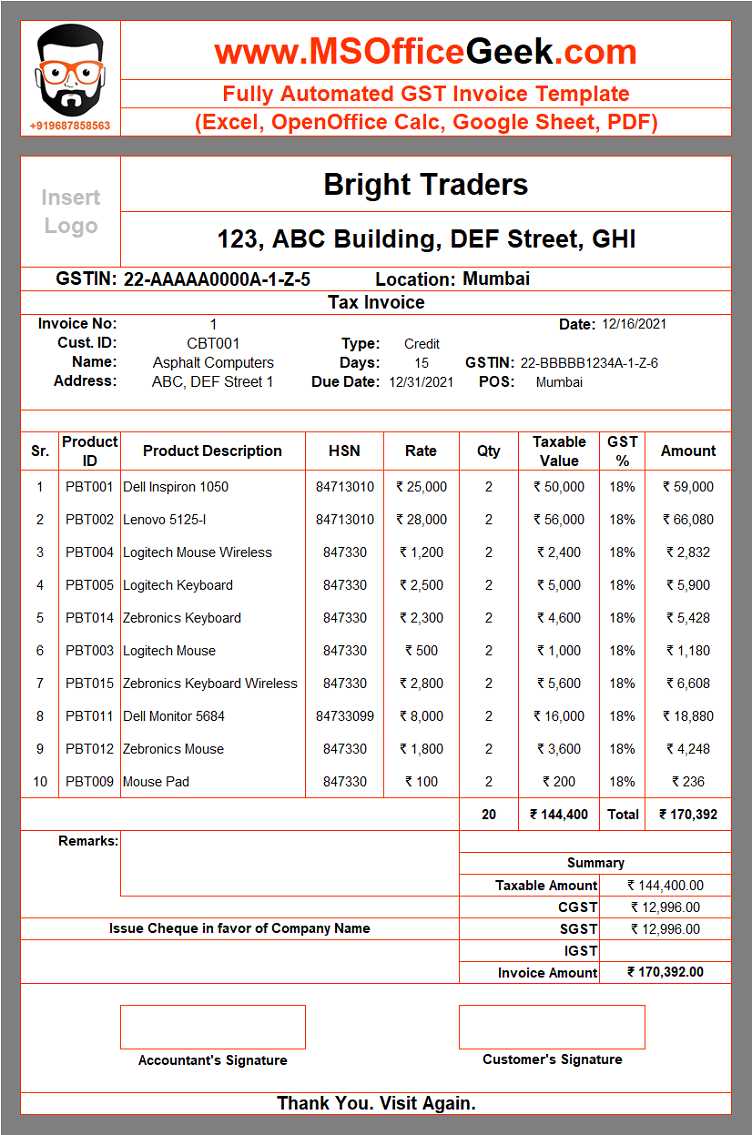

Description of Goods or Services follows next. This section outlines what was delivered or provided, specifying each item or service with a brief description, quantity, rate, and total cost. Clear descriptions reduce the risk of disputes over what was billed and ensure transparency between both parties.

Finally, the payment terms section is essential for setting expectations. This includes the total amount due, any applicable taxes or discounts, and the due date. Including payment instructions, such as acceptable payment methods and late fees, helps clarify how the client should proceed once they’ve received the document.

Free vs Paid Excel Invoice Templates

When choosing a solution for generating billing records, businesses often face a decision between free and paid options. Both have their advantages and drawbacks, depending on your needs and the level of customization required. While free tools may offer simplicity and ease of use, paid options can provide more advanced features and professional designs, tailored to meet specific business needs.

Advantages of Free Billing Solutions

Free tools are a great starting point for small businesses or freelancers who need a quick and easy way to generate billing documents without spending money. Here are some key benefits:

- Cost-effective: Free tools are accessible to everyone, without any upfront investment.

- Basic Functionality: They typically include all the essential features such as calculations, payment terms, and client details.

- Easy to Use: Most free options are user-friendly, with simple interfaces that don’t require much experience or training to use effectively.

- Widely Available: You can find free tools on various platforms, and many are compatible with popular spreadsheet applications.

Advantages of Paid Billing Solutions

While paid options come with a price tag, they often provide additional benefits that make them more suitable for businesses with more complex needs. Some of the advantages include:

- Customization: Paid solutions often allow for greater flexibility, offering more options for branding, layout, and specialized features.

- Advanced Features: These may include automatic tax calculations, integration with accounting software, or support for multiple currencies and languages.

- Premium Support: Paid tools often come with customer support services, helping you resolve any issues quickly and efficiently.

- Professional Design: Paid options tend to have more polished, aesthetically pleasing designs that can enhance your business’s reputation.

Ultimately, the choice between free and paid solutions depends on your business’s size, requirements, and budget. Small businesses or individuals with basic needs may find free options sufficient, while larger businesses or those with more complex billing processes may benefit from the additional features of paid tools.

Top Features of a Good Invoice Template

For a billing document to be effective and efficient, it must include key features that make it both professional and easy to use. A well-designed document not only ensures clarity but also speeds up the billing process, reducing errors and streamlining communication between the service provider and the client. Below are some essential elements that a high-quality document should include.

- Clear Identification: The document should prominently display your business name, logo, and contact details, as well as the client’s information. This ensures both parties can easily identify the document and communicate if necessary.

- Detailed Breakdown of Charges: The document should clearly list all products or services provided. Each item should include a description, quantity, unit price, and total cost. This transparency helps prevent misunderstandings and simplifies the payment process.

- Automatic Calculations: A good document will include built-in formulas that automatically calculate totals, taxes, and discounts. This reduces the risk of manual errors and ensures the figures are accurate each time.

- Customizable Payment Terms: The document should allow you to specify payment conditions such as due date, late fees, and accepted payment methods. Customization ensures that your specific requirements are met for each transaction.

- Professional Layout and Design: A visually appealing, organized layout makes the document easy to read and understand. Clear section headings, a clean design, and logical structure reflect w

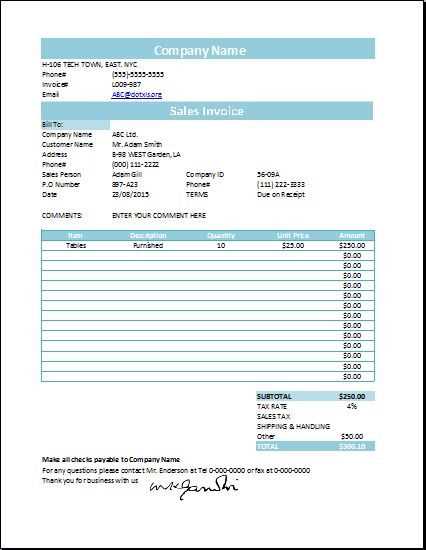

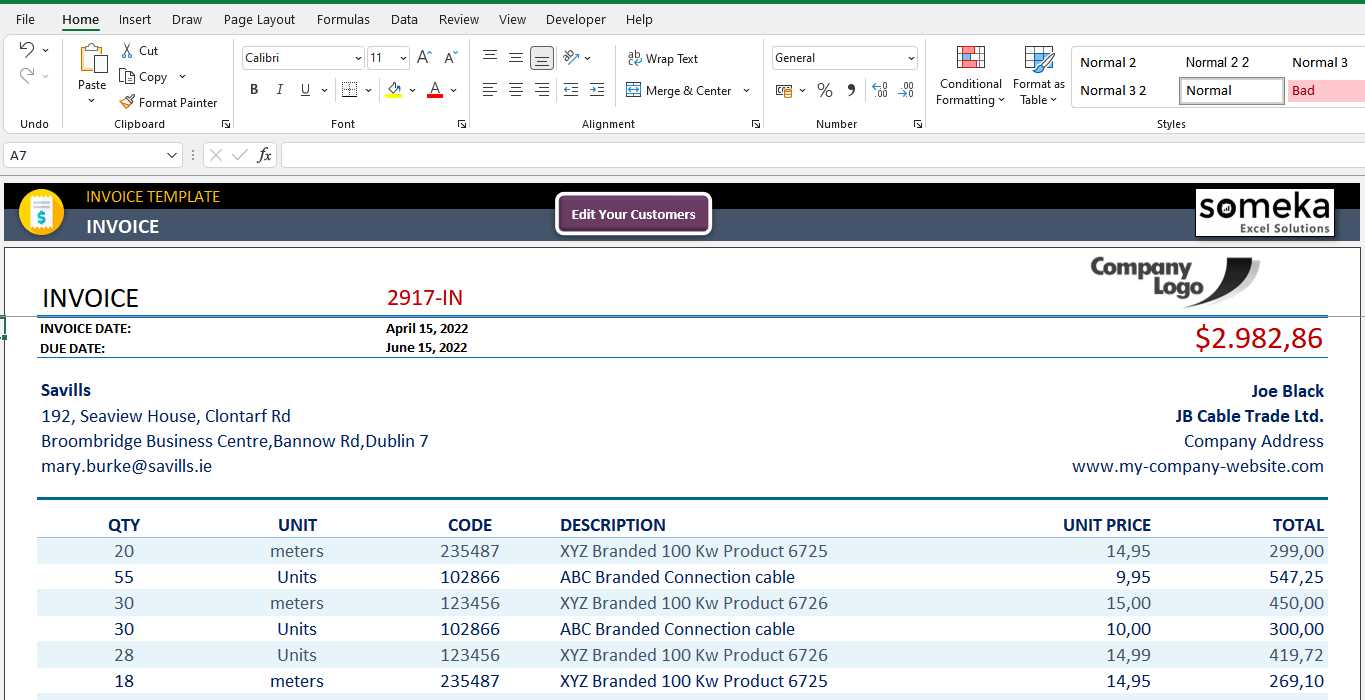

How to Edit Invoice Template in Excel

Modifying a pre-built document to suit your business needs is simple and allows you to customize essential sections such as client information, services rendered, and payment terms. Editing a document in a spreadsheet application provides flexibility in both design and content. Whether you’re adding new fields, adjusting calculations, or changing the layout, this process can be done with just a few clicks to ensure your billing records reflect your unique requirements.

Step 1: Open the Document

Begin by opening the document you wish to modify. If you’re using a pre-designed file, locate the document in your file directory and double-click to open it. If it’s a template that’s available online or through an application, simply download it and open it within the spreadsheet program. Once opened, you’ll be able to view the existing layout and identify sections you need to change.

Step 2: Modify Basic Information

The first edits should focus on updating the general details. This includes replacing placeholder information with your business name, address, contact information, and logo. You should also update the client’s details, such as name, contact information, and billing address. These fields are typically located at the top of the document for easy access.

To modify any of the text or fields: simply click on the cell containing the data and type in the new information. For items like the business name or client name, be sure to check for spelling errors and formatting consistency.

Step 3: Adjusting Itemized Charges and Calculations

Next, update the itemized section where goods or services are listed. Change the descriptions, quantities, and unit prices as necessary. If you’re adding new products or services, simply add new rows and input the relevant information.

To adjust calculations: Make sure the formulas for totals and tax calculations are working correctly. In most cases, these formulas are already set up, but if you’ve added new items, you may need to extend the formula range to include the new rows. Double-check that any discounts or additional charges are also reflected in the calculations.

Step 4: Save and Export

Once you’ve finished making all necessary changes, save the document. If this is the final version to be sent to a client, you can also export the document to a PDF to ensure that formatting remains intact when shared. Saving the file in both formats ensures you can easily make future edits or send the completed document quickly.

Editing a billing record in a spreadsheet application is straightforward and allows you to personalize it for every transaction. With just a few simple steps, you can maintain ac

Automating Invoice Calculations in Excel

One of the most efficient ways to manage billing is by automating the calculations for totals, taxes, discounts, and other charges. Automating these steps not only saves time but also reduces the risk of human error. By using built-in formulas and functions, you can ensure that your records are accurate and up-to-date with minimal manual input.

Setting Up Basic Calculations

Automating calculations begins with setting up the basic formulas for subtotal, tax, and total amounts. Here are the main calculations you’ll want to automate:

- Subtotal: This is the total cost before taxes or discounts. It is calculated by multiplying the quantity of each item by its unit price, then summing these amounts for all items.

- Tax Calculation: Once you have the subtotal, you can apply the tax rate. Use a formula like

=Subtotal * Tax Rateto calculate the tax. - Discounts: If you offer discounts, you can apply them by multiplying the subtotal by the discount percentage. For example, use

=Subtotal - (Subtotal * Discount Percentage)to calculate the price after the discount is applied. - Total Amount: This is the final price, including taxes and discounts. The total is calculated by adding the subtotal and tax, then subtracting any discounts.

Using Advanced Functions

For more advanced automation, you can use functions like IF, SUM, and VLOOKUP to automate specific scenarios. For example:

- IF Function: This function allows you to apply different calculations based on certain conditions. For example, you could set it to apply a discount only if the total exceeds a certain amount:

=IF(Total > 1000, Total * 0.1, 0). - SUM Function: Use this to add up multiple items or categories. For instance, you can sum up the costs of different services or products:

=SUM(A2:A10). - VLOOKUP Function: This function helps automate the retrieval of prices or tax rates from a table. If you have a list of standard rates or prices, you can use

=VLOOKUP(Item, Table, Column, FALSE)to automatically pull the correct data into your document.

By automating these calculations, you reduce the need for manual adjustments and ensure that your financial records are always accurate. It also speeds up the process, allowing you to focus on more important aspects of your business, like customer relationships and service quality.

Saving and Sharing Your Excel Invoice

Once you’ve created and customized your billing document, the next step is to save it in a format that ensures it’s easily accessible and sharable. Whether you’re sending it via email or storing it for future reference, choosing the right saving method and sharing options can make a significant difference in maintaining a professional workflow. Here are the best practices for saving and sharing your billing document effectively.

Saving Your Billing Record

After finalizing the document, it’s important to save it in a way that preserves its formatting and can be easily retrieved or updated in the future. Here are some common options:

- Save in Native Format: Keeping the file in the native format of your spreadsheet software allows you to make future edits easily. This is useful if you expect to update the document regularly or need to make minor changes between billing cycles.

- Export as PDF: Converting the document to PDF format ensures that the formatting remains intact when you send it to clients. PDFs are universally accessible, easy to view, and ensure that no one can accidentally edit the content. This is the ideal option when the document is finalized and ready to be shared.

- Cloud Storage: Saving your document in a cloud storage service, such as Google Drive, Dropbox, or OneDrive, gives you access from any device with internet connectivity. It also ensures your files are backed up and secure.

Sharing Your Billing Document

Once the document is saved in the appropriate format, sharing it with clients or colleagues is the next step. Here are several ways to send your document:

- Email Attachment: The most common method is to attach the document as a PDF or spreadsheet file to an email. Ensure that the subject line is clear (e.g., “Billing Record for Services Rendered – [Client Name]”) and the body of the email is professional and concise.

- Cloud Links: If you’ve saved your document in cloud storage, you can share a link directly with the recipient. This is convenient for ongoing access and allows clients to download the file whenever needed.

- File Sharing Services: For larger documents or when sharing with multiple clients or team members, consider using a file-sharing platform. These services often offer additional features like password protection and access control.

By saving your document in a versatile format and using secure sharing methods, you ensure that your billing process is both efficient and professional. Whether you’re sending it for the first time or sharing an update, these steps will make it easier to manage and distribute your financial records.

Common Mistakes in Excel Invoices

Creating a billing document requires attention to detail, as even small errors can cause confusion and affect the payment process. Many common mistakes can be avoided with careful review and by following best practices. Understanding these pitfalls will help ensure that your records are accurate, professional, and free of issues that could delay payment or lead to misunderstandings.

Calculation Errors

One of the most frequent mistakes is incorrect calculations. Since billing documents often involve summing costs, applying taxes, or offering discounts, any errors in these formulas can lead to inaccurate totals. Common errors include:

- Wrong Formulas: If formulas aren’t set up correctly, totals, taxes, and discounts may be calculated incorrectly. Double-check that all necessary cells are included in the calculation range.

- Incorrect Tax Rates: Applying the wrong tax percentage can lead to overcharging or undercharging clients. Always verify the correct rate for each transaction.

- Manual Overrides: Manually entering a total when a formula should be used can disrupt automated calculations. Ensure that all fields are driven by formulas, not manual entries.

Missing or Inaccurate Information

Another common issue is missing or inaccurate information. This can range from forgetting to include a client’s contact details to using incorrect descriptions or pricing. Here are some areas to check:

- Client Information: Ensure that the client’s name, address, and contact details are accurate. An incorrect address or contact number can delay payment or cause confusion.

- Descriptions and Pricing: Always double-check the descriptions of goods or services provided, along with their unit price and quantities. Mistakes in pricing or item descriptions can lead to disputes.

- Terms and Conditions: Missing or vague payment terms, such as the due date or late fees, can lead to misunderstandings. Be clear and specific about payment expectations.

By being mindful of these common mistakes, you can improve the accuracy and professionalism of your billing process. Taking time to review the details and verify all calculations can help avoid confusion and ensure timely payments.

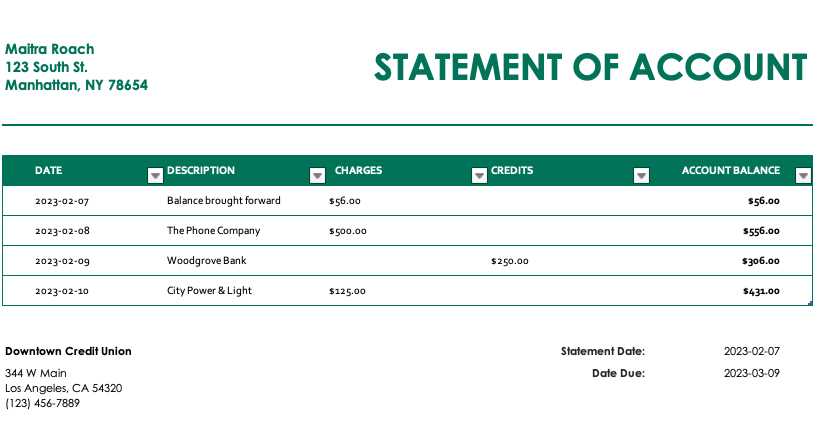

Tracking Payments with Excel Templates

Managing payments and keeping track of outstanding balances is a crucial aspect of any business. Without a clear and organized method for tracking payments, it can be easy to lose track of who has paid, who hasn’t, and what amounts are still due. Using a well-structured document can help you stay on top of transactions and ensure timely follow-ups with clients when necessary. Here’s how you can effectively track payments using a customizable spreadsheet solution.

Setting Up a Payment Tracking System

The first step is to create a system that captures key information about each transaction. Here are some essential columns you should include in your payment tracking record:

- Client Name/ID: This allows you to identify which client the payment is for, especially if you’re dealing with multiple clients or projects.

- Invoice Number/Reference: Use a unique identifier for each transaction to easily reference past records.

- Amount Due: This column should reflect the total amount owed for each transaction or billing period.

- Amount Paid: Record the amount that has already been paid by the client. This will help track partial payments if applicable.

- Outstanding Balance: A running total of how much is still owed after payments are made. This can be automatically calculated by subtracting the amount paid from the amount due.

- Payment Date: This helps track when the payment was made, which is useful for accounting and for ensuring payments are received within the agreed terms.

- Payment Method: It’s important to note how the payment was made (e.g., bank transfer, credit card, cash) for record-keeping purposes.

Automating Payment Tracking

Automating the tracking process makes managing payments much easier and reduces the risk of errors. You can use simple formulas to keep your records up to date:

- Outstanding Balance Formula: You can use a formula like

=Amount Due - Amount Paidto automatically calculate how much is still owed. - Conditional Formatting: Set up rules to highlight overdue payments. For example, if the payment date is past due and the balance is not zero, the row can automatically turn red, making overdue payments easy to spot.

- SUM Function: To track total payments received, use the

SUMfunction to calculate the total of all payments made. This can be used for both individual clients or for the entire business. - Payment Reminder System: Set up a notification system within your spreadsheet to remind you when payments are due. You can use an alert column that calculates days remaining before the payment deadline, for example, using

=Due Date - TODAY().

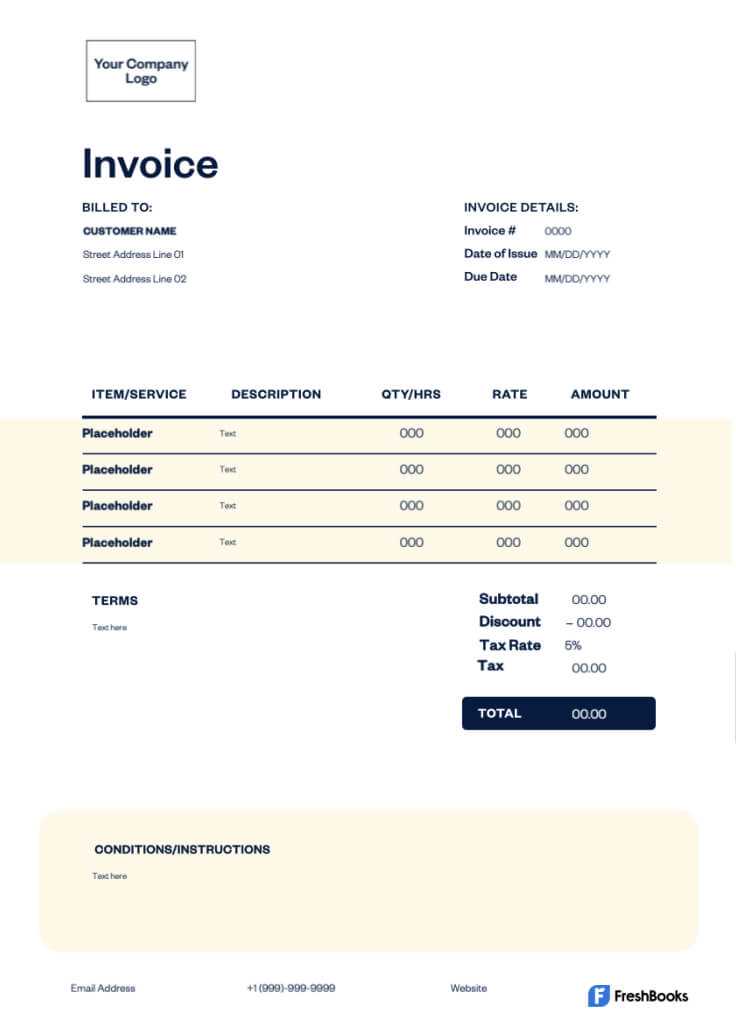

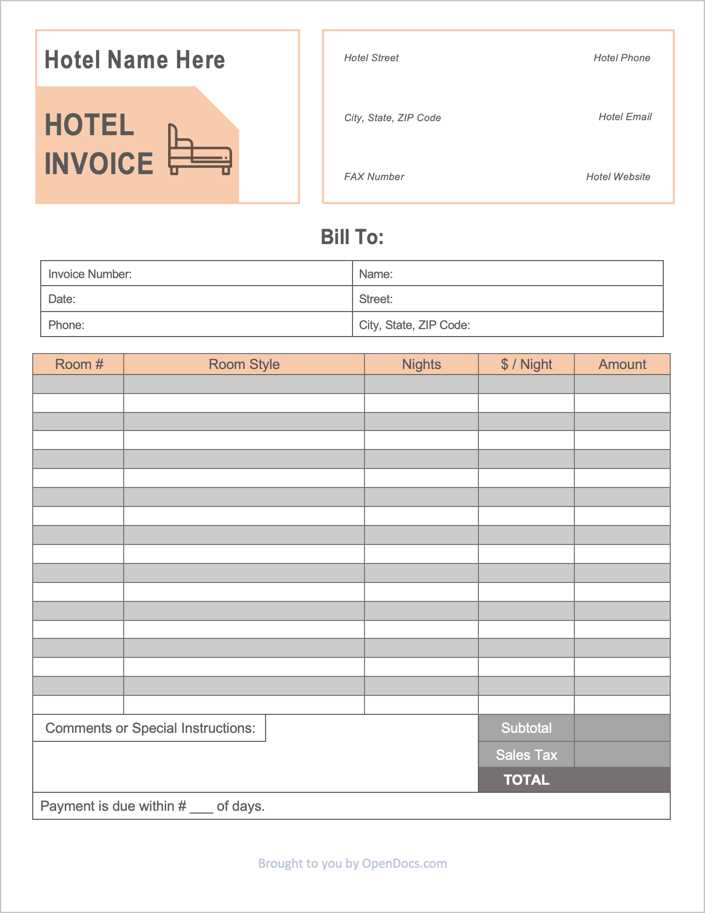

How to Design a Professional Invoice

Creating a polished and professional billing document is essential for maintaining a strong business image and ensuring clear communication with clients. A well-designed record not only helps convey important payment details but also reinforces the professionalism of your business. The goal is to make the document visually appealing, easy to understand, and organized, while ensuring that all essential information is included and easy to locate.

To achieve this, focus on the layout, design elements, and the structure of the content. The document should reflect your brand, be easy to read, and facilitate a smooth transaction process. Here are a few key elements to include when designing a professional record:

- Clear Header: Include your business name, logo, and contact details at the top of the page. This ensures the client knows who the document is from and provides them with easy access to your contact information if they need to reach you.

- Client Information: Below the header, add the client’s name, address, and other relevant contact information. This helps avoid any confusion and makes it easier for both parties to identify the transaction.

- Structured Item List: Organize the list of services or products in a clean, easy-to-read table format. Use columns for item descriptions, quantities, unit prices, and totals. Ensure that each item is clearly explained to avoid confusion.

- Payment Terms: Clearly state the payment due date, accepted methods of payment, and any applicable late fees or discounts. This helps avoid misunderstandings regarding the terms of payment.

- Professional Fonts and Colors: Use easy-to-read fonts and maintain consistency throughout the document. Stick to a simple color scheme that matches your brand and doesn’t distract from the essential information.

- Itemized Totals: Include clear sections for subtotal, tax, any discounts, and the final total. Break down the amounts so the client can see exactly what they are paying for and verify all calculations.

By following these design guidelines, you can create a visually appealing and functional billing document that enhances your business professionalism and improves the client experience.

Managing Multiple Invoices in Excel

When handling numerous billing records, organization and efficiency become paramount. Managing multiple transactions, especially across different clients or projects, requires a system that allows you to easily track, update, and retrieve data. By using a structured approach in a spreadsheet, you can stay on top of outstanding balances, avoid errors, and quickly generate reports. This section outlines how to streamline the management of multiple records to keep your workflow organized and efficient.

Creating a Centralized Tracking System

One of the most effective ways to manage multiple records is to set up a centralized system. Instead of creating separate documents for each transaction, you can keep everything in one master file. Here’s how:

- Use Separate Sheets for Different Categories: If you’re dealing with various clients or different types of services, consider organizing the records into separate sheets within the same workbook. For example, one sheet can be dedicated to clients in New York, while another tracks international clients.

- Maintain a Master Overview Sheet: In addition to individual sheets, it’s helpful to have a summary sheet that consolidates key information, such as total amounts due, due dates, and payment statuses. This sheet can be automatically updated using formulas, helping you quickly monitor the entire billing cycle.

- Use Unique Identifiers: Assign a unique ID number for each transaction or client. This makes it easier to search for specific records and track payments across different projects or clients.

Using Automation to Streamline Updates

Automating key calculations and tasks can save significant time when managing multiple records. Here are some ways to automate processes:

- Linking Data Between Sheets: Use formulas like

=Sheet1!A1to pull data from one sheet to another. This allows you to create a master summary without manually entering data from multiple records. - Conditional Formatting: Use conditional formatting to highlight overdue payments, or to color-code payments by status (e.g., “Paid,” “Pending,” or “Overdue”). This makes it easy to spot important changes at a glance.

- Pivot Tables: Pivot tables are powerful tools that help you analyze large amounts of data. By summarizing key information such as total amounts, payment dates, or outstanding balances, pivot tables can give you insights into your financials without having to manually filter through hundreds of rows.

By setting up a clear system and automating your processes, you ca

Ensuring Invoice Accuracy in Excel

Accuracy is essential when preparing billing documents, as even the smallest mistake can lead to confusion, delayed payments, or disputes. Whether you’re calculating totals, applying taxes, or listing items, ensuring that your financial records are correct is a key part of maintaining professionalism and efficiency. This section focuses on the best practices and tools you can use to double-check and verify the accuracy of your billing statements.

Double-Check Calculations

One of the most common errors in billing documents involves incorrect calculations. Whether it’s summing amounts, calculating taxes, or applying discounts, mistakes in these areas can lead to significant discrepancies. Here are some ways to ensure your calculations are correct:

- Use Built-in Formulas: Utilize built-in spreadsheet functions such as

SUM(),PRODUCT(), andSUBTOTAL()to automatically calculate totals and subtotals. This reduces the risk of human error when entering numbers manually. - Cross-Check Calculations: After applying formulas, manually cross-check the totals with a calculator or use a different method to verify the results. This can be especially important for complex calculations involving multiple variables.

- Check for Consistency: Ensure that all amounts are consistently formatted and correctly aligned. Even small discrepancies, such as extra decimal places or misplaced commas, can cause confusion and affect the document’s overall accuracy.

Verify Client Information

Accurate client details are just as important as correct calculations. Mistakes in client information, such as incorrect addresses or payment terms, can lead to delayed payments or disputes. Follow these steps to verify client data:

- Confirm Contact Information: Always double-check the client’s name, address, and contact details before finalizing the document. Ensure that any changes to the client’s information are updated in your records.

- Verify Terms: Double-check the payment terms, due dates, and any other specific instructions related to payment. Ensuring that these are clearly outlined helps avoid confusion and ensures both parties are on the same page.

- Use Templates with Pre-Loaded Information: If you regularly work with the same clients, use a pre-filled document with their standard details. This ensures that repetitive tasks like entering contact information are done accurately every time.

Automate Repetitive Tasks

By automating common tasks in your billing process, you reduce the chance of errors and streamline your workflow. Here are a few tips:

- Use Predefined Formulas: Automate calculations for taxes, discounts, and totals us

How Excel Templates Save Time

Efficiency is key when managing business tasks, and one of the most time-consuming activities is creating detailed billing records from scratch. However, by using pre-built solutions, you can eliminate much of the manual effort, significantly speeding up the process. These ready-made structures allow you to quickly generate professional documents without having to format or organize every element each time. Here’s how this approach saves time in your workflow.

Quick Setup and Customization

One of the main benefits of using pre-made solutions is the time it saves when setting up a new document. Instead of building a record from the ground up, you can simply adjust existing elements to suit your needs:

- Pre-Designed Layouts: Ready-made documents come with a clean, structured layout, which means you don’t have to worry about organizing the design or deciding on the placement of key information. The layout is already optimized for readability and ease of use.

- Pre-Filled Fields: Common fields such as client details, dates, or payment terms can be automatically populated or quickly updated, saving time on data entry and reducing the chance of errors.

- Customizable Sections: With a few quick adjustments, you can tailor sections like pricing or descriptions to match your specific needs. This flexibility lets you quickly adapt the structure without reinventing the wheel each time.

Automating Repetitive Tasks

Automating calculations and repetitive processes is another way these tools save time. Rather than manually computing totals, taxes, or discounts for each transaction, automation ensures that these tasks are handled with precision:

- Built-In Formulas: Many pre-built solutions come with formulas already set up to calculate totals, tax rates, and other important values. This eliminates the need for manual calculations, reducing time spent on data entry and potential errors.

- Consistent Updates: When you need to make changes (e.g., updating pricing or tax rates), you can quickly adjust the necessary fields without having to redo the entire document.

- Quick Conversion to Different Formats: Once your document is complete, many solutions allow you to quickly save or export the record in different formats (e.g., PDF, Word), streamlining the process of sharing or printing the document.

By reducing the amount of manual work, automating tasks, and providing a streamlined framework for your documentation, these ready-made solutions free up time to focus on more important aspects of your business. The result is faster, more efficient, and error-free documentation that saves you both time and effort.

Where to Find Excel Invoice Templates

Finding the right structure for your billing documents is essential for ensuring efficiency and professionalism in your business operations. There are many resources available online where you can download or create customized sheets that fit your specific needs. Whether you’re looking for free options or more advanced, feature-rich solutions, there are plenty of ways to get started without starting from scratch. Below are some of the best places to find these resources.

Free Online Resources

If you’re looking for cost-effective options, many websites offer free versions of ready-made solutions. These resources are often easy to customize and can be a great starting point for small businesses:

- Microsoft Office Templates: Microsoft offers a wide range of free templates directly through their platform. You can access these templates from within the program or through the online template gallery on their website.

- Google Sheets Templates: If you’re using Google Sheets, there are free templates available through their template gallery. These are cloud-based and easily customizable for different needs.

- Third-Party Websites: Websites like Smartsheet, Vertex42, and Office Templates offer a variety of free, downloadable files that can be tailored to fit your specific business requirements.

Paid Solutions for Advanced Features

If you need more specialized options with advanced features such as automation, customer management, or recurring billing, paid options may be a good choice. These solutions often come with additional support, more sophisticated designs, and greater flexibility:

- Premium Template Marketplaces: Platforms like Envato Market or TemplateMonster offer high-quality paid templates with advanced functionality. These often include more complex layouts and built-in features such as payment tracking or data analysis.

- Accounting Software Providers: Many accounting software providers like FreshBooks, QuickBooks, or