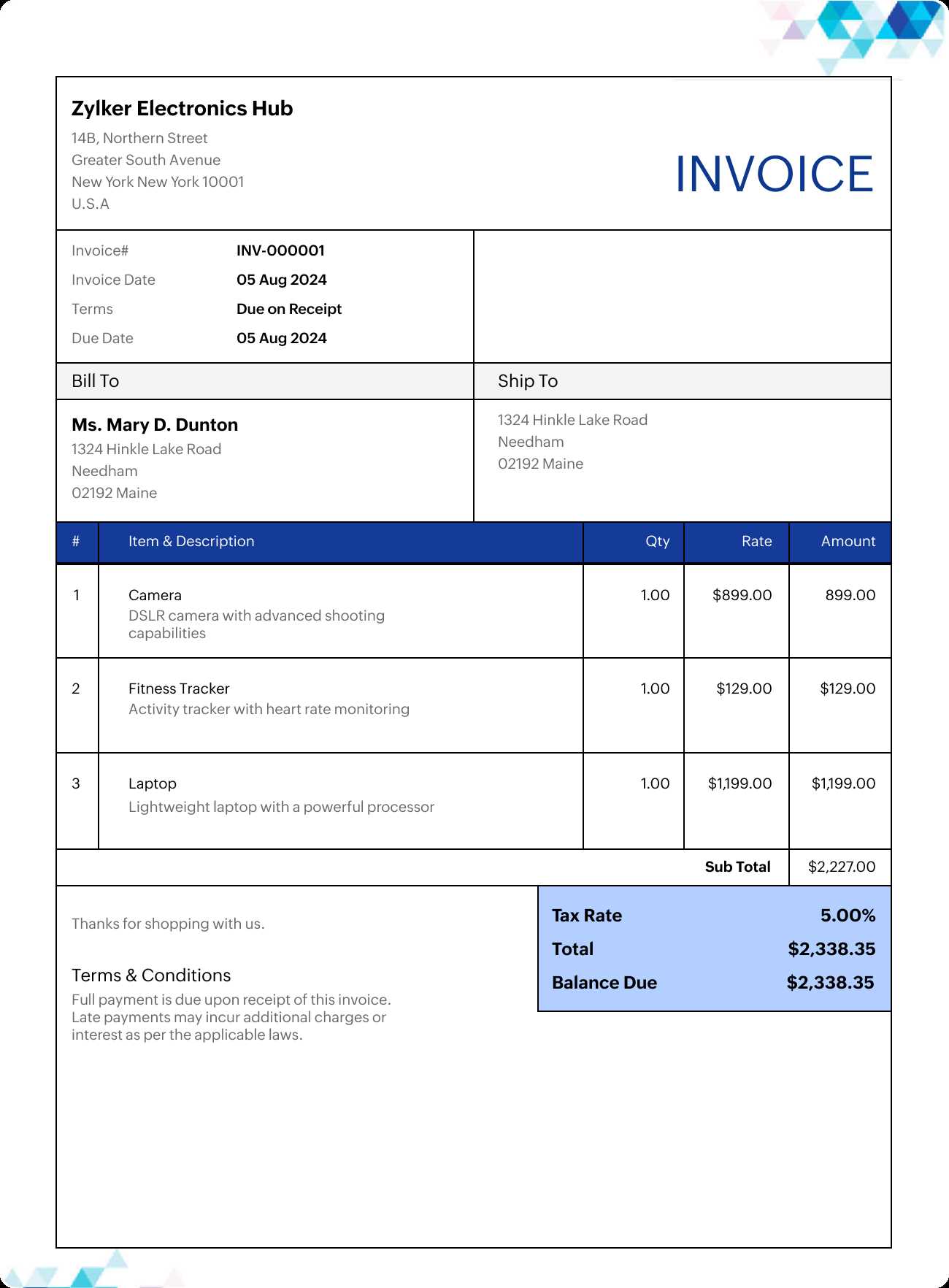

Download Free Invoice Template in Excel

In today’s fast-paced business world, managing payments and transactions efficiently is crucial. One of the most effective ways to streamline this process is by using structured and reusable documents. These documents not only ensure consistency but also help save time, reduce errors, and maintain professionalism in communication with clients.

Streamlining your billing process is made easier with tools that allow you to create customized records quickly. Whether you’re a freelancer, a small business owner, or part of a larger organization, having a ready-made format that suits your specific needs can significantly improve your workflow.

With the right tools, it’s possible to generate accurate and clear records with just a few clicks, ensuring that your financial operations run smoothly. These documents can be personalized to fit various business models, from one-time projects to long-term client relationships, making them a versatile solution for businesses of any size.

Why You Need an Invoice Template

Having a well-organized, standardized document for financial transactions is essential for maintaining professionalism and efficiency in business. Using a predefined structure saves time and ensures accuracy in all your dealings. Whether you’re working with clients, suppliers, or partners, consistency in your paperwork is key to fostering trust and avoiding misunderstandings.

Here are some key reasons why a predefined format is a valuable tool for any business:

- Time-saving: A reusable structure eliminates the need to create a new document from scratch every time you need to send a request for payment.

- Accuracy: Predefined fields reduce the likelihood of errors, ensuring that all the required information is included and formatted correctly.

- Professionalism: A polished and consistent layout gives your business a more professional appearance, which helps build credibility and trust with clients.

- Customization: These documents can be easily adapted to fit specific needs, whether you’re billing for different services, products, or contract terms.

- Organization: A structured layout helps keep track of payments, deadlines, and client information, making it easier to manage your finances.

Ultimately, using a structured approach for managing payments makes your business more efficient and helps you stay on top of your financial operations, reducing stress and providing clarity for both you and your clients. A good document is more than just a tool – it’s an essential part of your daily operations that can help improve your bottom line.

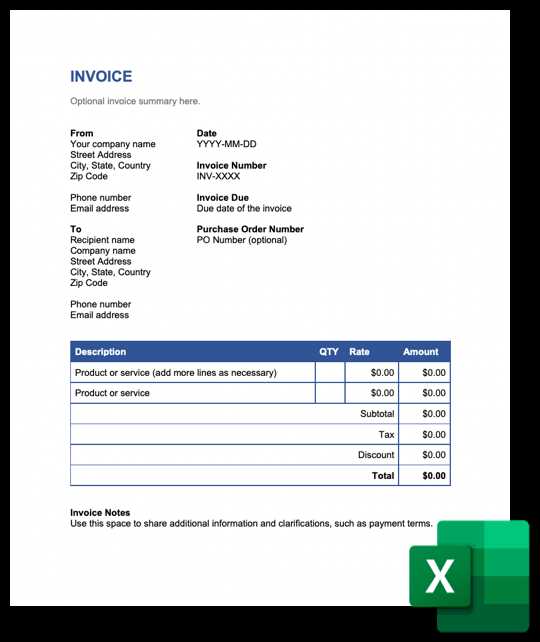

How to Access Financial Document Formats

Getting your hands on a well-organized file to manage financial transactions is easier than ever. With just a few clicks, you can access a variety of structured documents that allow you to create professional billing records quickly. These formats are designed to be user-friendly, customizable, and suitable for a wide range of business needs.

Steps to Access Your Financial Document

Follow these simple steps to get your hands on a professional document that fits your business needs:

- Visit a reputable source that offers free or paid financial documents.

- Select the file that best suits your business requirements, whether it’s for freelance work, product sales, or services.

- Click the download link or button to save the file to your computer or cloud storage.

- Once downloaded, open the file using a compatible program to begin customization.

Choosing the Right File for Your Needs

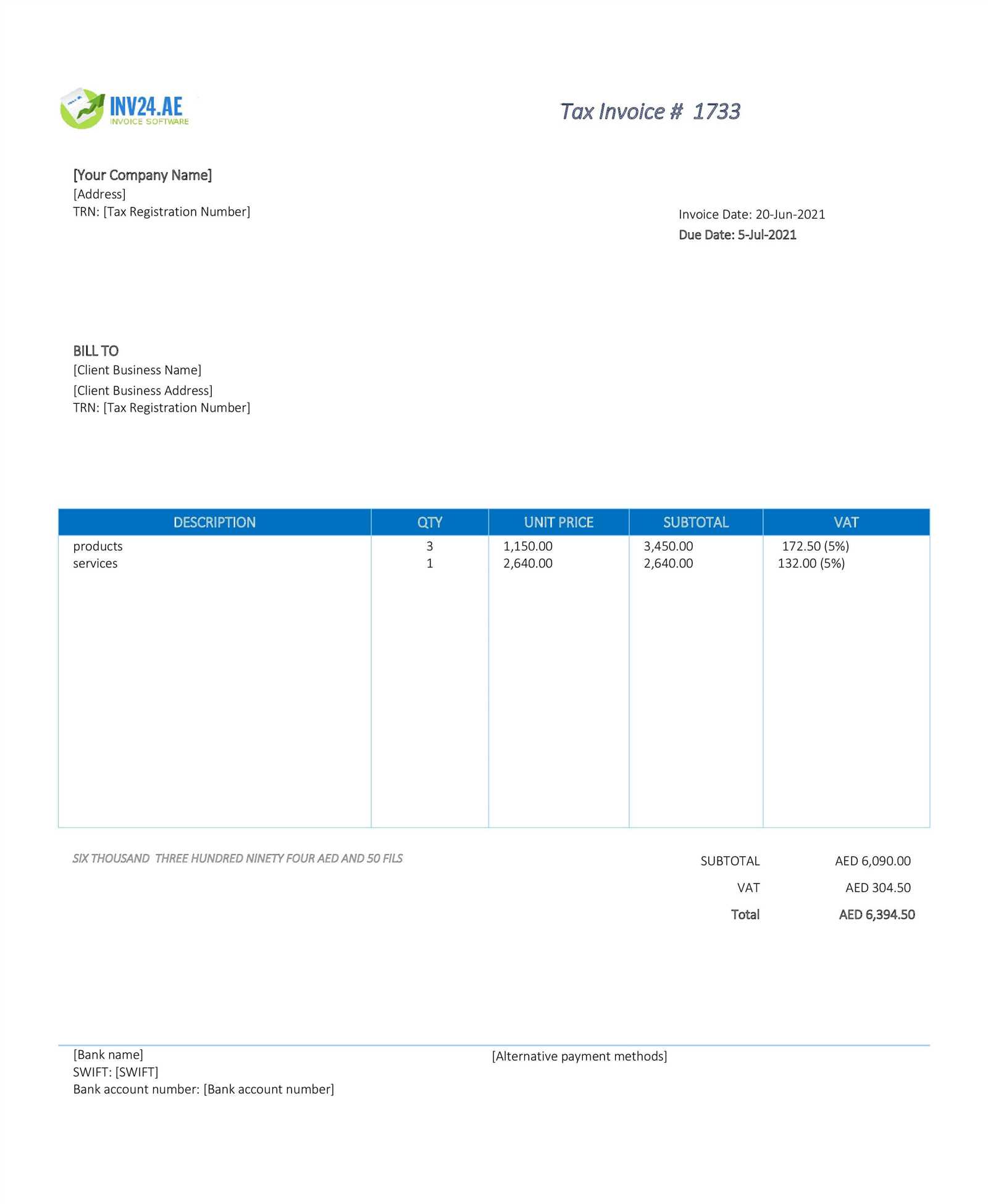

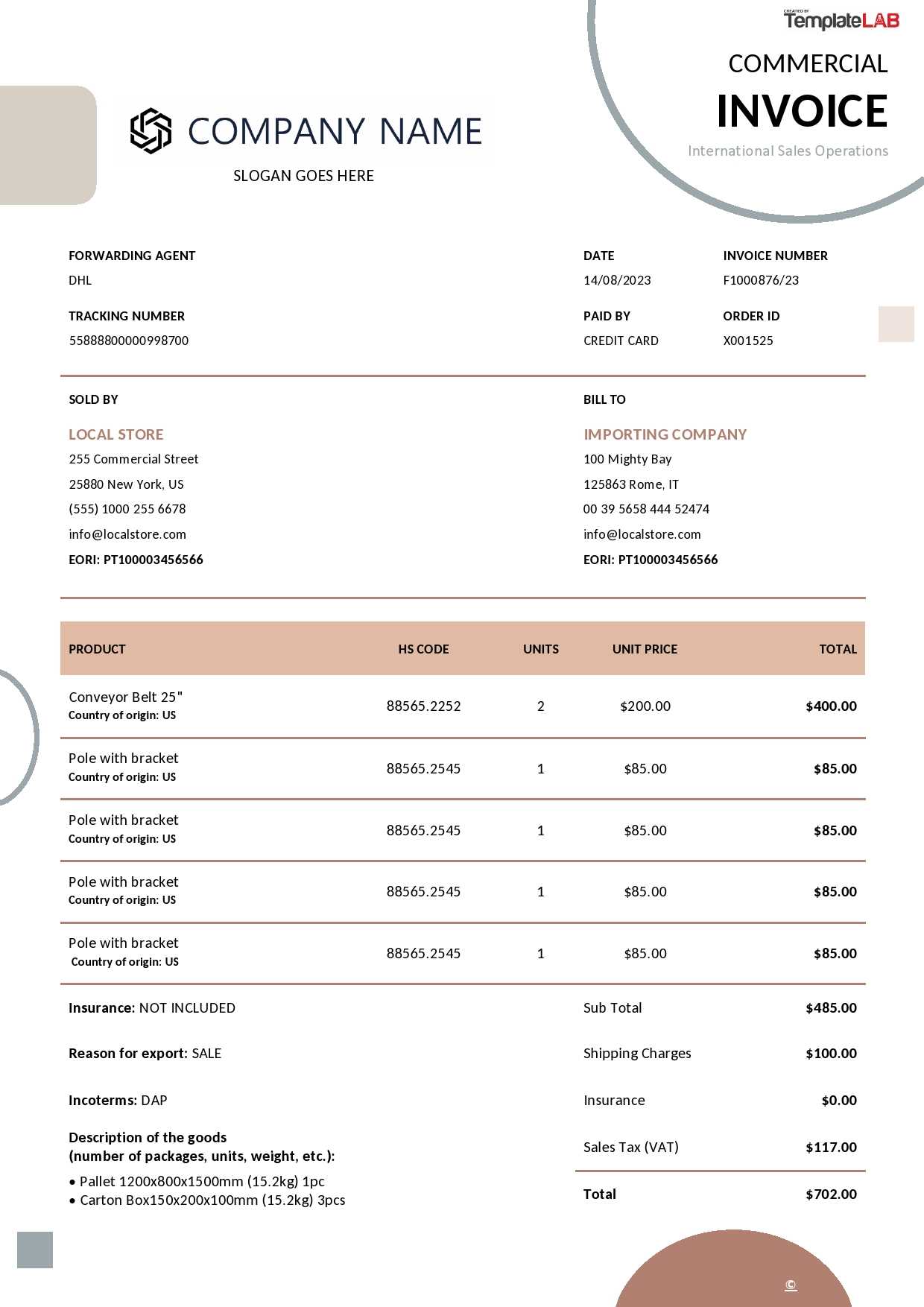

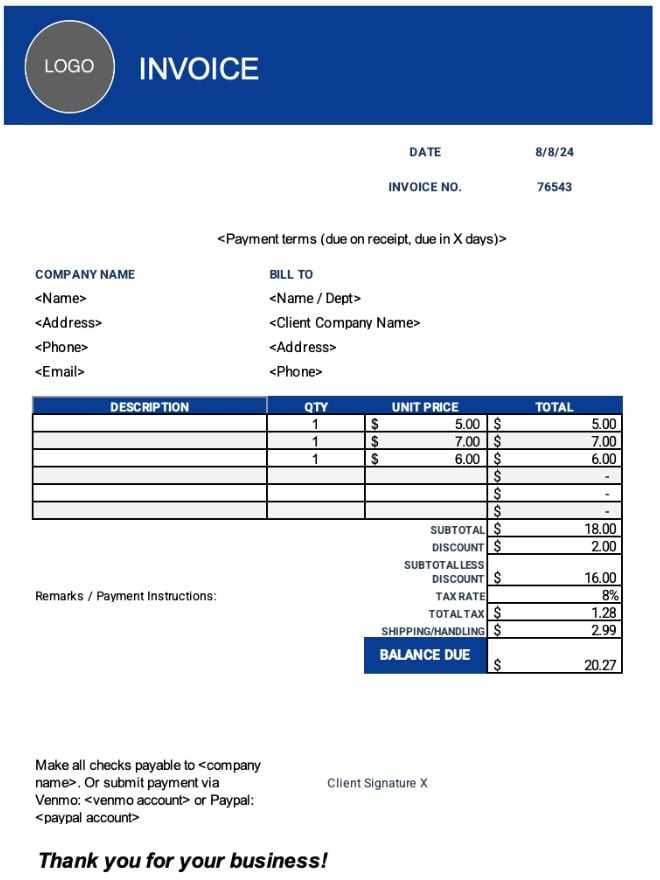

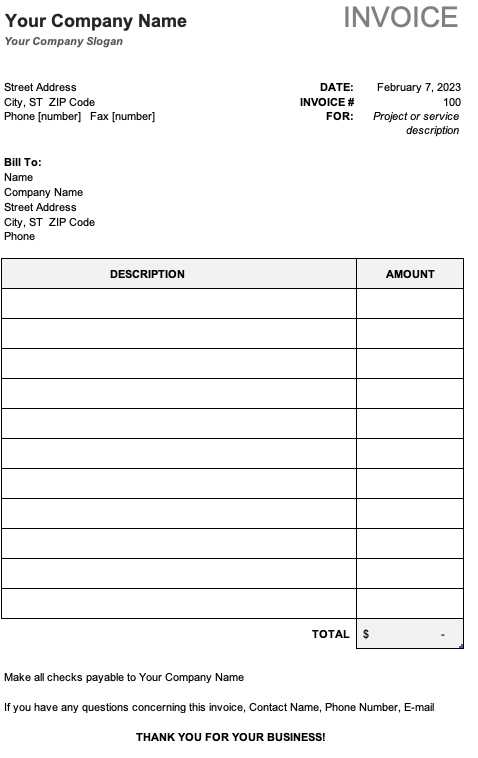

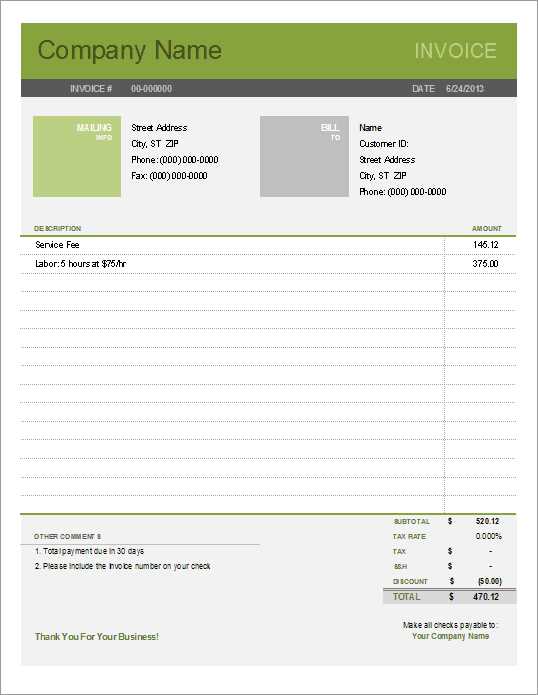

It’s essential to choose a document that matches the type of business or transaction you are conducting. Below is a quick guide to help you make the right choice:

| Document Type | Best For |

|---|---|

| Basic Format | Small businesses or freelancers with simple billing needs. |

| Detailed Layout | Companies that need to itemize products or services with advanced calculations. |

| Professional Design | Enterprises that require a polished and branded format for high-end clients. |

Once you’ve chosen and accessed the right document, it’s easy to personalize the fields, adjust the layout, and begin generating accurate financial records to suit your needs.

Top Features of Financial Document Formats

A well-designed financial document is more than just a means of recording transactions; it’s a tool that enhances accuracy, consistency, and efficiency in business operations. Whether you’re managing a small freelance project or overseeing large-scale operations, certain features can make these documents indispensable for smooth business processes.

Here are some of the key features that make these documents effective for any business:

- Customizable Fields: Easily adjust the fields to reflect your specific business needs, including adding company logos, payment terms, and detailed service descriptions.

- Automated Calculations: Built-in formulas for adding totals, taxes, and discounts save you time and reduce the risk of human error.

- Professional Design: A clean and consistent layout ensures your financial documents look polished and credible, enhancing your company’s professional image.

- Simple Data Entry: Structured fields allow for quick and straightforward input of all essential information, from client details to payment amounts.

- Compatibility: These documents are compatible with various software, making it easy to open, edit, and share them across different platforms.

- Tracking Features: Many formats include space for tracking payment statuses and due dates, helping you stay on top of finances and ensure timely payments.

- Multi-Currency Support: Some designs allow you to include multiple currencies, making them ideal for international transactions.

These features collectively ensure that you can quickly generate accurate, professional financial records that streamline the payment process and help maintain organized business operations.

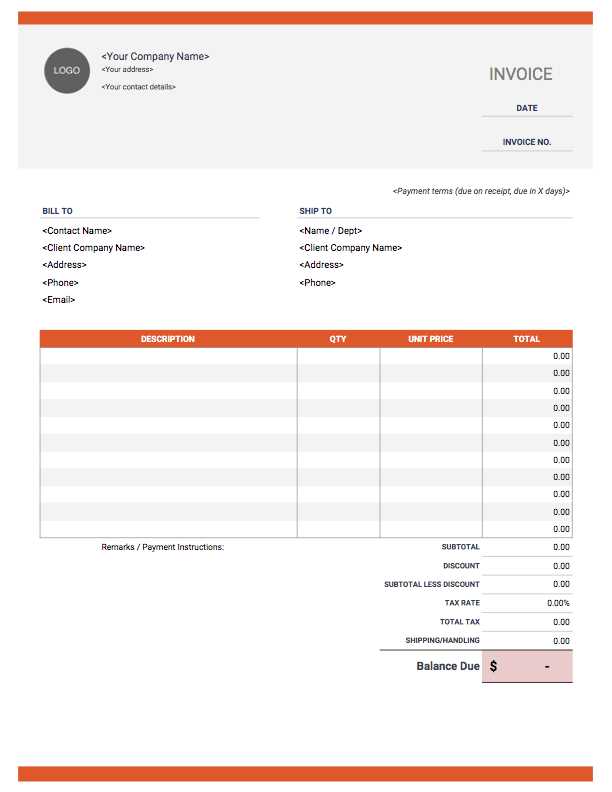

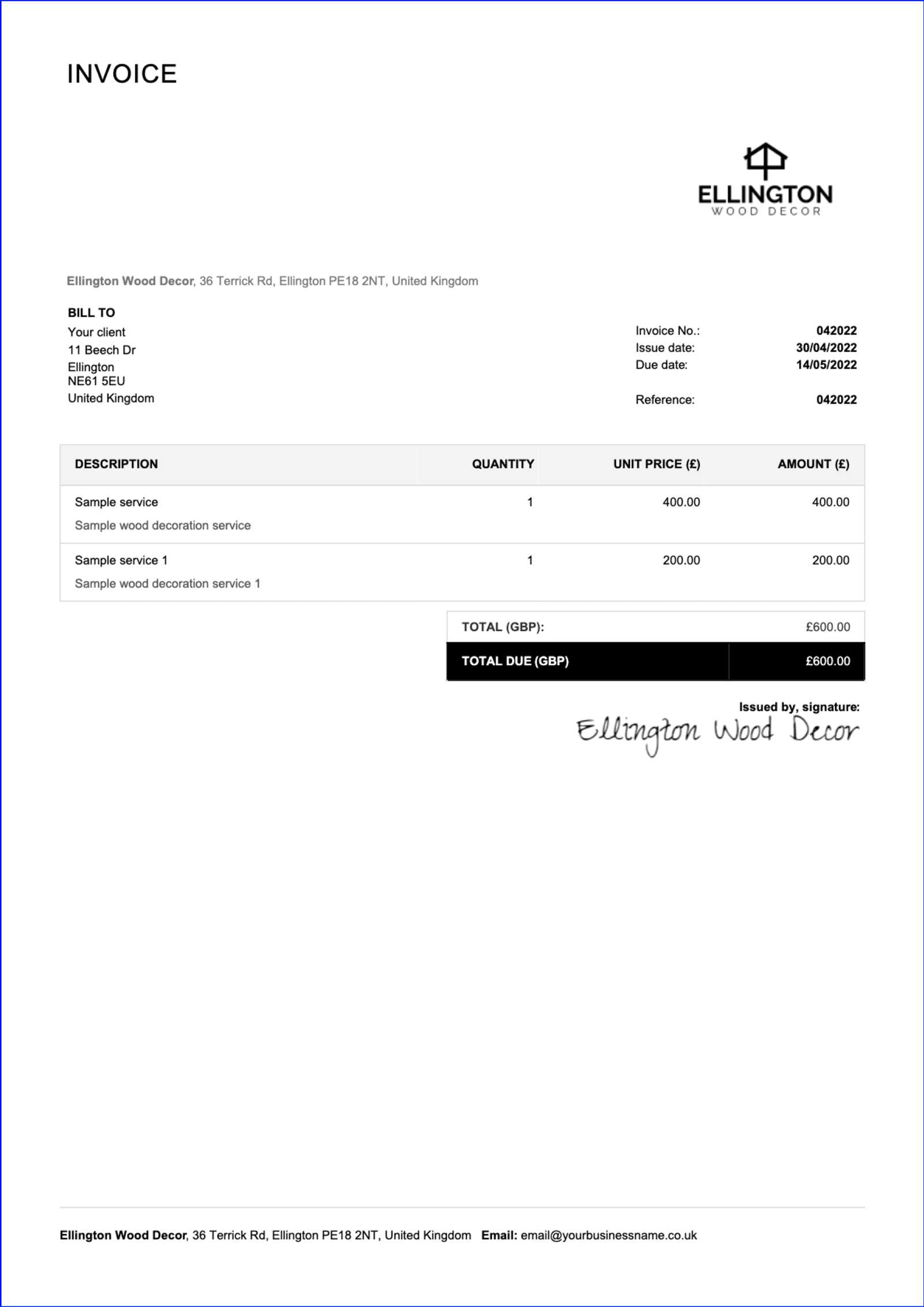

Customizing Your Financial Document for Business

Personalizing your financial records to match the unique needs of your business is crucial for creating professional and effective communications with your clients. Tailoring the structure and content ensures that every detail is aligned with your brand identity, service offerings, and payment requirements. Customization also helps streamline your workflow by including only the information you need, making it easier to generate accurate and consistent documents.

Here are some steps you can take to personalize your financial document:

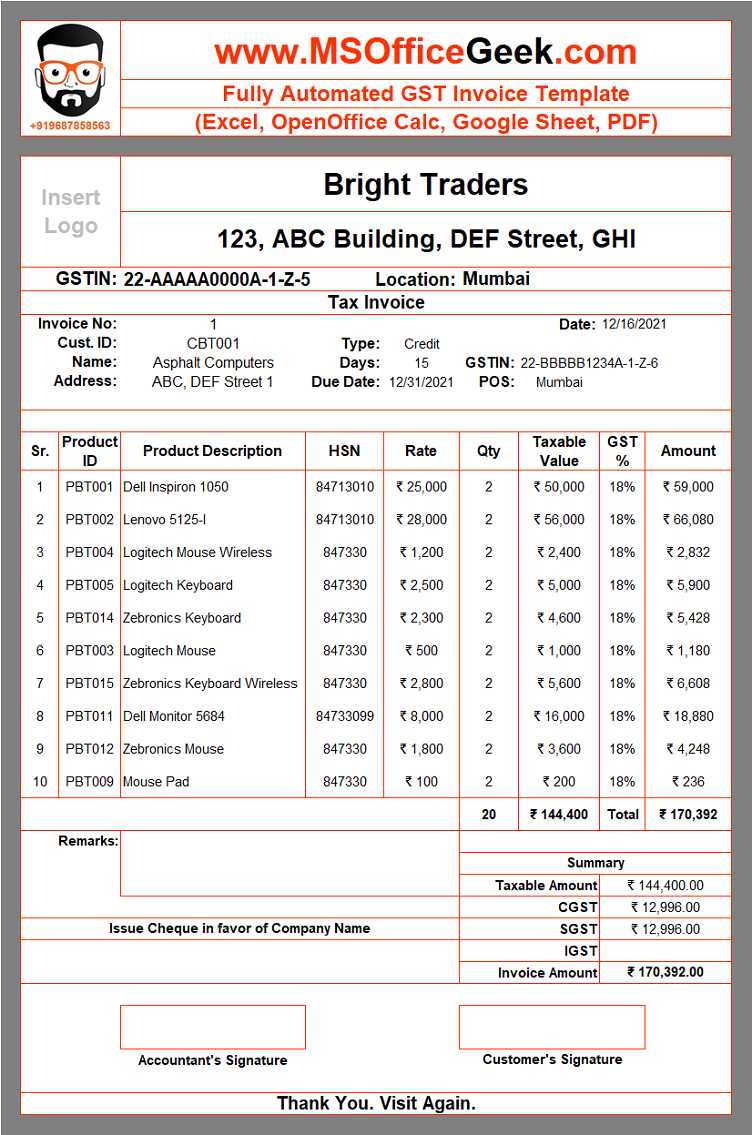

- Branding: Add your company logo, name, and contact details at the top of the document to make it easily recognizable and professional.

- Payment Terms: Customize the payment terms section to reflect your standard practices, such as payment due dates, late fees, and preferred payment methods.

- Itemized List: Include specific categories of services or products you offer, with clear descriptions, quantities, and prices to make it easy for clients to understand what they are being charged for.

- Currency and Taxes: Adjust the currency and tax rate according to your region or the client’s location, especially if you’re handling international transactions.

- Field Customization: Modify or add new fields to include additional information, such as discounts, reference numbers, or project milestones, depending on your business needs.

By customizing your document, you not only reinforce your business identity but also ensure that the document meets the specific needs of both you and your clients. A well-tailored financial record reflects attention to detail and professionalism, helping to build trust and improve payment processing efficiency.

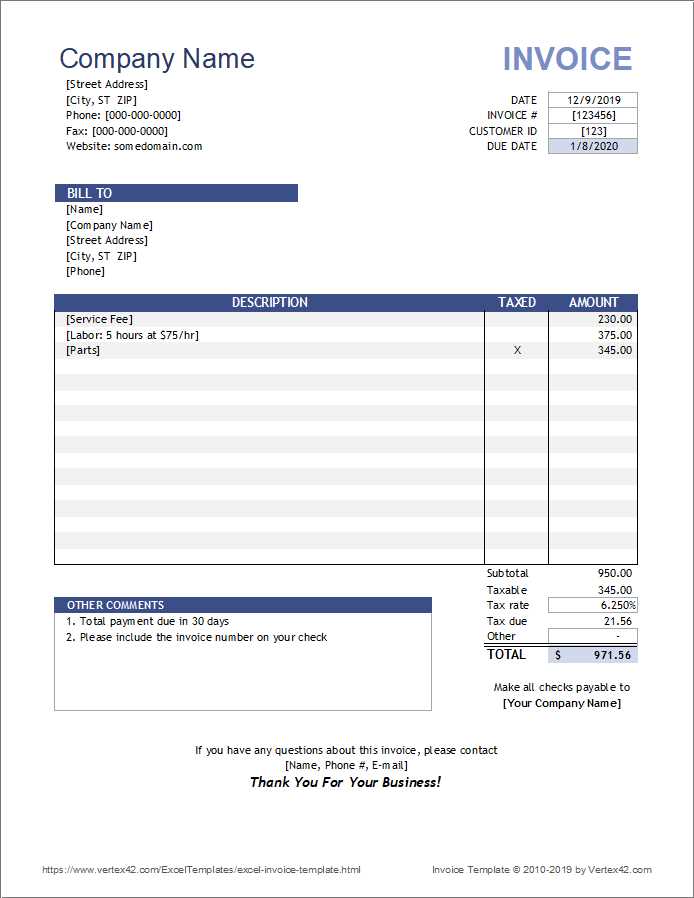

Step-by-Step Guide to Create Financial Documents

Creating a structured financial record doesn’t have to be a complicated task. By following a clear, organized approach, you can quickly generate professional and accurate documents for any transaction. This guide will walk you through the essential steps to create an effective and easily understandable record for your clients or partners.

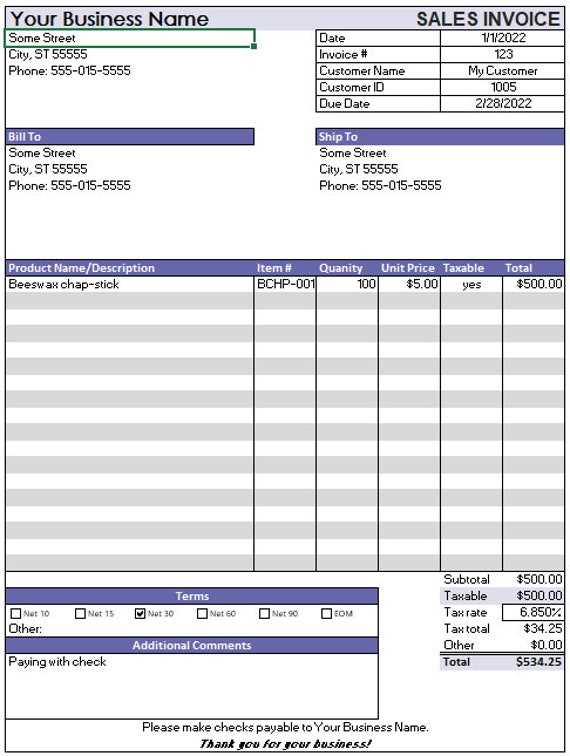

Step 1: Set Up Your Document

Start by choosing a layout that suits your business needs. Many platforms and tools offer pre-built formats that you can modify to fit your requirements. Here’s how you can get started:

- Open your preferred document editor (such as spreadsheet software).

- Create a new file or open a pre-existing format you plan to use for future transactions.

- Include your business details at the top of the document, such as name, address, phone number, and email.

- Designate space for client information, including their name, address, and contact details.

Step 2: Add Transaction Details

Once the layout is set up, proceed to input the specific details of the transaction. This is the core part of your document and should be clear and organized:

- Itemize the goods or services by listing each product or service provided, along with a description and unit price.

- Include quantities for each item or service and multiply them by the unit price to calculate the total cost.

- Apply taxes or any applicable fees, making sure to adjust based on your location or business requirements.

- Calculate the final amount by adding up the subtotals and including any discounts or additional charges.

Step 3: Review and Send

Before finalizing, double-check the information for accuracy and ensure that all the required fields are filled in. Once satisfied, you can:

- Save the document in your preferred format (e.g., PDF, CSV) for easy sharing.

- Send the record to your client via email, print it out, or use your preferred communication method.

Following this simple, step-by-step process will help ensure that each document you create is professional, accurate, and ready for any transaction.

How to Save and Organize Your Documents

Effectively managing your financial documents is essential for maintaining organization and streamlining your workflow. Proper storage and categorization can save you valuable time and ensure that you can quickly access the necessary files when needed. By following a few simple steps, you can ensure that all your documents are well-organized and easy to retrieve for future use.

Step 1: Choose the Right Storage System

First, decide where to save your files. There are several options available, depending on your preference for cloud-based or local storage:

- Cloud Storage: Services like Google Drive, Dropbox, or OneDrive allow you to store files online, making them accessible from any device with an internet connection.

- Local Storage: Saving files on your computer or external hard drive offers offline access and increased security if properly backed up.

Step 2: Create a Logical Folder Structure

Once you’ve chosen your storage method, it’s time to set up a logical folder system. Here’s an example of how you could organize your files:

| Folder Name | Purpose |

|---|---|

| Client Records | Store documents for each client, sorted by name or project. |

| Templates | Keep reusable formats for easy access and future use. |

| Archived Files | Organize old files that are no longer in active use but may need to be referenced later. |

| Completed Projects | Store finalized documents for projects that are finished or pending payment. |

This method will help ensure that you can easily locate a specific document without wasting time searching. Additionally, organizing your files by client or project ensures that similar documents are grouped together, making the retrieval process much faster.

Step 3: Implement Version Control

If you’re working on multiple versions of a document, it’s important to keep track of changes and updates. Here are some simple tips:

- Version Numbering: Add a version number or date to the file name (e.g., “ProjectName_v2_2024”).

- Backup Regularly: Ensure that all versions are backed up in case of data loss or corruption.

With these strategies in place, you’ll be ab

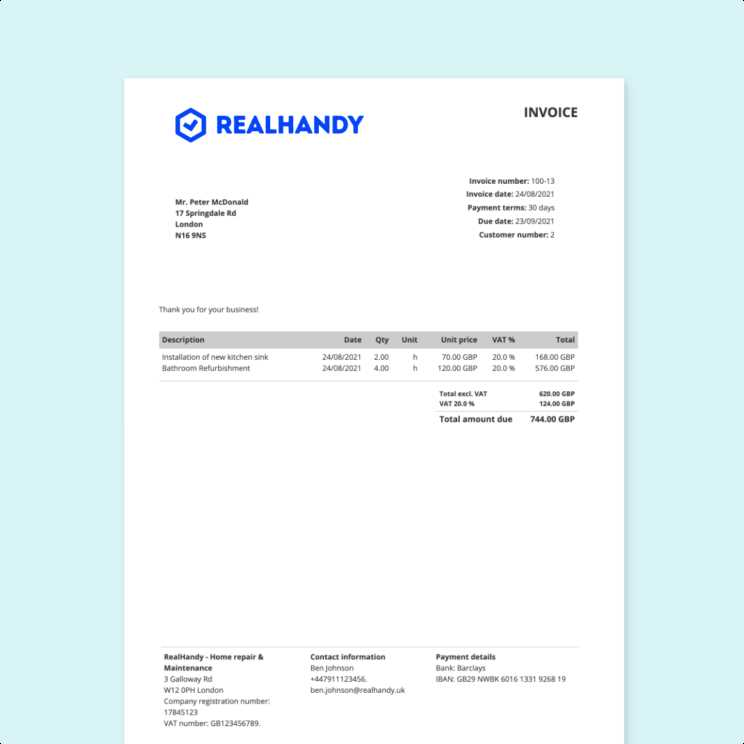

Free vs Paid Financial Document Formats

When selecting a document format for your business, you’ll often face the decision between using a free version or investing in a paid option. Both types offer distinct advantages and drawbacks, so it’s important to weigh your options carefully. The right choice depends on your specific business needs, budget, and desired level of customization.

Here’s a breakdown of the key differences between free and paid financial document options:

- Cost: Free formats are, as the name suggests, available without any charge, making them an attractive option for startups, small businesses, or individuals with a tight budget. Paid formats, however, come at a cost but often provide additional features and support that can justify the investment for larger businesses.

- Customization: Free formats tend to have limited customization options, offering basic fields and design elements. Paid formats often come with advanced customization tools, allowing you to create documents that closely match your branding, include complex calculations, or support advanced business needs.

- Design Quality: Free formats may have basic designs that lack polish or look generic. Paid formats usually offer more professional, visually appealing designs that reflect your business’s branding and help make a positive impression on clients.

- Support: Free options often come with minimal or no customer support, leaving you to troubleshoot any issues on your own. Paid formats usually include access to customer service, helping you resolve issues quickly and efficiently when needed.

- Features: Paid options may come with additional tools, such as built-in calculators for taxes, discounts, or multi-currency support, which can be valuable for more complex billing needs. Free versions may lack these advanced features, limiting their functionality for businesses with more intricate requirements.

Ultimately, the decision between free and paid formats comes down to your specific needs. If you only need basic functionality and have limited resources, a free version might be sufficient. However, if you’re looking for a more polished, feature-rich solution with additional customization and support, a paid option may be worth the investment.

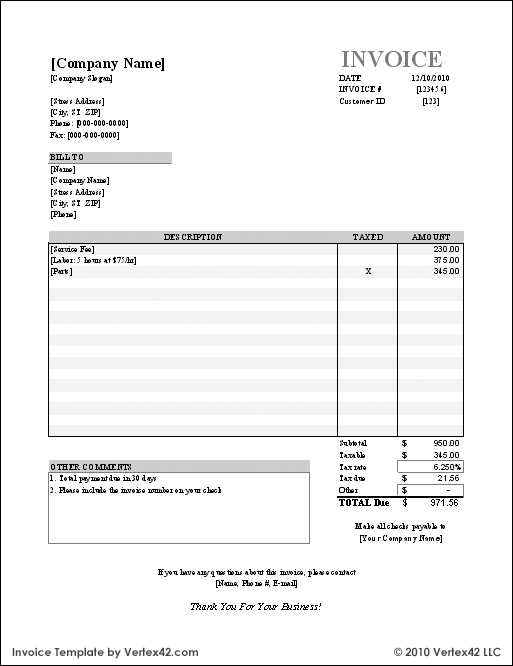

Common Mistakes in Financial Document Creation

Creating accurate and professional financial records is crucial for maintaining a smooth business operation and avoiding potential disputes with clients. However, several common mistakes can lead to confusion, errors in payments, or even damage to your business reputation. Understanding these pitfalls can help you avoid them and ensure that your documents are always clear, correct, and professional.

Here are some of the most common mistakes made when preparing financial documents:

- Incorrect or Missing Contact Information: Always ensure that both your details and those of your client are correctly listed. Missing or incorrect contact information can lead to confusion and delays in payment.

- Failing to Include Payment Terms: Without clear payment terms, clients may not know when payment is due, what payment methods are accepted, or if any late fees apply. Always specify these details to avoid misunderstandings.

- Unclear Descriptions of Products or Services: Vague descriptions of what was delivered can lead to disputes. Be as specific as possible when listing products or services, including quantities, unit prices, and any applicable discounts.

- Missing Tax Information: Failing to include the correct tax rate or forgetting to account for taxes can cause issues with compliance. Ensure that the tax rate is accurate and clearly displayed, especially for international transactions.

- Mathematical Errors: Even small mistakes in calculations can lead to overcharging or undercharging. Double-check all calculations, including totals, taxes, and any applied discounts, to ensure accuracy.

- Not Including a Unique Reference Number: A unique reference number or code for each transaction helps both you and your client track payments. Without it, it can be difficult to reference specific transactions later on, leading to potential confusion.

- Unprofessional Layout: A cluttered or inconsistent document layout can create a negative impression and make the information harder to read. A clean, organized design ensures your document looks professional and easy to navigate.

By avoiding these common errors and paying attention to the details, you can ensure that your financial documents are not only accurate but also serve as a reflection of your professionalism. A well-prepared record can help build trust with your clients and improve the overall efficiency of your business transactions.

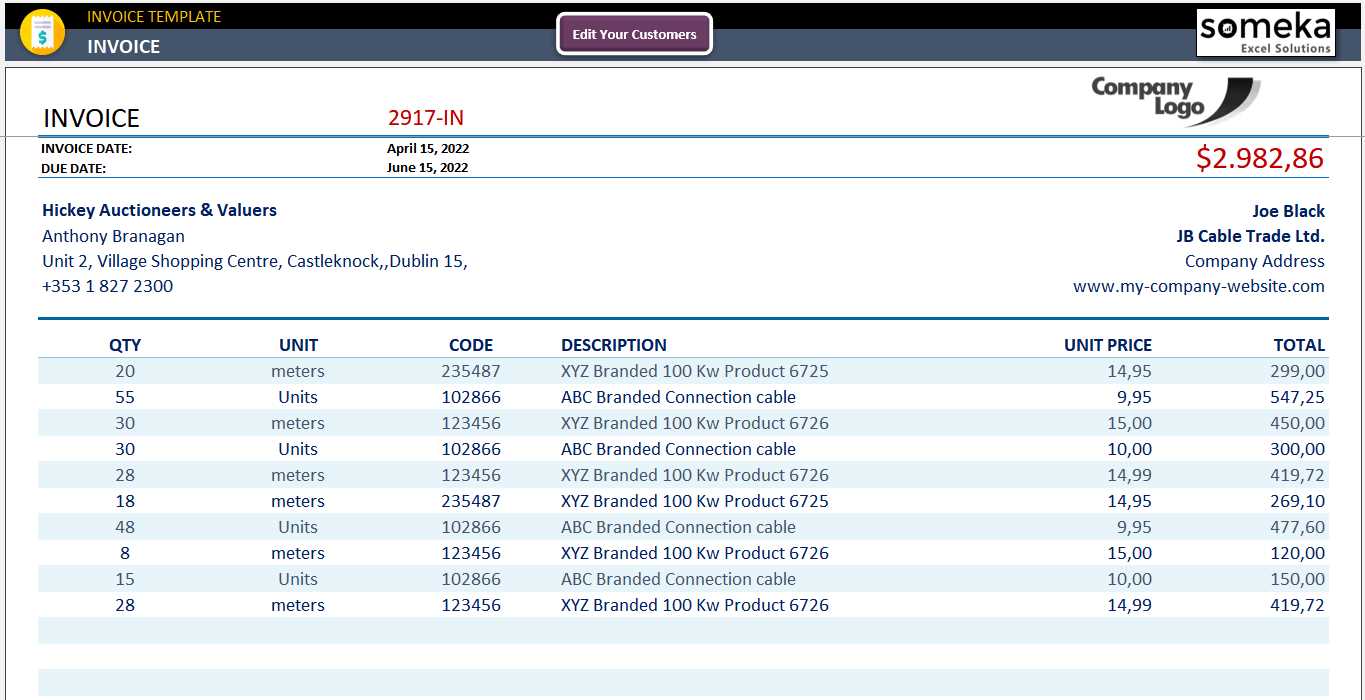

Excel vs Other Financial Software

When it comes to managing financial records and transactions, there are many options available to business owners. Two popular choices are using a spreadsheet program or specialized software designed specifically for generating financial documents. Both have their advantages and drawbacks, depending on the needs of your business, budget, and the complexity of the tasks you need to perform.

Key Differences Between Spreadsheet Programs and Specialized Software

While spreadsheet software offers flexibility and is widely accessible, financial software tends to provide more robust features tailored to billing and accounting needs. Here’s a comparison of the two:

| Feature | Spreadsheet Program | Specialized Software |

|---|---|---|

| Ease of Use | Requires more manual setup but familiar to most users. | Designed for ease of use with intuitive interfaces and templates. |

| Customization | Highly customizable; you can modify documents as needed. | Limited customization, but templates are often professional and efficient. |

| Automation | Limited automation; requires manual entry for calculations. | Automated calculations for taxes, totals, and discounts, reducing the risk of error. |

| Cost | Often free or included with other office software. | Typically requires a subscription or one-time purchase, which can be costly. |

| Integration with Other Tools | Basic integration with other office applications (e.g., word processors, email). | Seamless integration with accounting, CRM, and other business tools. |

| Support | Limited customer support or troubleshooting. | Dedicated customer support and regular updates to the software. |

When to Use Each Option

Choosing between a spreadsheet program and specialized software depends on the specific needs of your business. If you’re a freelancer or a small business with basic billing requirements, a spreadsheet can be an effective and low-cost option. Howeve

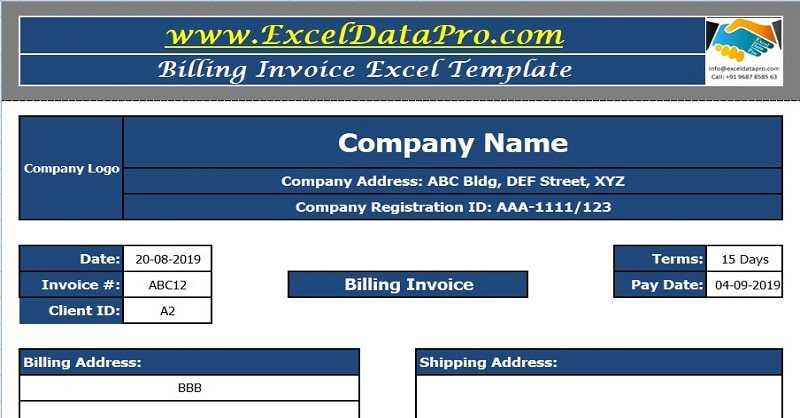

How to Automate Document Generation in Spreadsheet Software

Automating the creation of financial documents can save you a significant amount of time and reduce errors in calculations. By using the built-in features of spreadsheet software, you can streamline the process, ensuring that every document is accurate, consistent, and professionally formatted. With just a few simple steps, you can set up automation to handle repetitive tasks like calculations, date entries, and data population, making the process more efficient.

Here’s how you can automate document creation in spreadsheet programs:

Step 1: Set Up Your Basic Structure

Start by setting up the basic layout of your document. Ensure that you have fields for key information such as your business details, client details, services/products provided, and payment terms. Leave space for totals and calculations.

Step 2: Use Built-In Formulas for Automation

One of the easiest ways to automate is by using formulas. Here are some examples of formulas you can use to automate certain calculations:

| Formula | Purpose |

|---|---|

| =SUM() | Automatically adds up the total for a list of services or products. |

| =IF() | Automatically applies conditions (e.g., a discount if the total exceeds a certain amount). |

| =TODAY() | Automatically inserts the current date as the document’s issue date. |

| =VLOOKUP() | Fetches client details or product information based on a reference (e.g., a client’s name or ID). |

By using these formulas, you can set up calculations that automatically adjust based on the values you enter, saving time and reducing the chances of errors.

Step 3: Automate Client Information Population

Another useful feature is automating client data entry. You can set up a database of client information on a separate sheet, and use formulas like VLOOKUP or INDEX/MATCH to automatically pull in the client’s name, address, and payment terms into the document as soon as you enter a reference ID or client name.

Step 4: Creat

Benefits of Using Spreadsheet Software for Financial Documents

Using spreadsheet programs for creating financial records offers a range of advantages that can help streamline your business operations. From the ability to automate calculations to the flexibility in design, these tools make managing transactions more efficient and less prone to error. Whether you are a freelancer, a small business owner, or part of a larger organization, spreadsheet software provides numerous benefits when it comes to handling billing and payment documents.

Here are some key benefits of using spreadsheet software for managing your financial records:

- Cost-Effective: Spreadsheet programs are often included in office software packages or available for free, making them an affordable option for businesses of all sizes. Unlike dedicated billing software that often requires a subscription, using a spreadsheet can help you save money without sacrificing functionality.

- Customizability: One of the main advantages of using spreadsheets is the high level of customization they offer. You can easily adjust the layout, colors, and design of your document to match your branding or business style. This flexibility ensures that your documents are tailored to your specific needs and preferences.

- Ease of Use: Spreadsheet programs are widely known and understood by most users, making them easy to navigate and work with. There is no steep learning curve, and many users are already familiar with basic functions like summing totals, applying taxes, and adjusting quantities.

- Automation and Accuracy: By using built-in formulas and functions, you can automate repetitive tasks such as calculating totals, taxes, and discounts. This reduces the chances of errors, ensuring that your documents are accurate every time. Automation also saves you time and effort, especially when dealing with large volumes of data.

- Data Management and Organization: Spreadsheet software allows you to store, organize, and retrieve data easily. You can create separate sheets for client details, transaction history, or even financial reports, ensuring that everything is kept in one place and easy to access. This organization can help streamline your workflow and reduce the chances of losing important information.

- Integration with Other Tools: Spreadsheet software can be integrated with other tools and platforms. You can link it to accounting software, customer relationship management (CRM) systems, or even payment gateways, making it easier to track payments, manage clients, and generate reports.

- Portability and Flexibility: Files created with spreadsheet software are portable and can be accessed on various devices, whether it’s a laptop, tablet, or smartphone. This makes it easy to manage your financial records on the go and share them with clients or colleagues when needed.

In conclusion, using spreadsheet programs for your financial records offers many advantages, from cost savings to increased flexibility and accuracy. These tools are accessible, efficient, and customizable, making them an excellent choice for businesses looking to manage their transactions professionally and effectively.

Using Formulas for Accurate Calculations

Accurate calculations are essential when managing financial documents, and formulas in spreadsheet software provide a powerful tool to ensure precision. Whether you’re calculating totals, applying taxes, or managing discounts, using the built-in functions can eliminate human error and save valuable time. These formulas allow you to automate complex calculations, ensuring that your records are always correct and consistent.

Here are some of the most useful formulas for ensuring accuracy in your financial documents:

- SUM: The =SUM() formula is one of the simplest and most frequently used functions. It automatically adds up a range of numbers, making it perfect for totaling costs, prices, or quantities.

- IF: The =IF() function is helpful when applying conditions. For example, you can use it to automatically apply discounts if certain criteria are met, such as a minimum purchase amount or a specific client status.

- PRODUCT: The =PRODUCT() function is ideal for multiplying values, such as calculating the cost of multiple items or determining the total cost after applying a quantity multiplier.

- VLOOKUP: With =VLOOKUP(), you can search for specific values in a table and return corresponding information. This is useful for quickly pulling client details, product prices, or tax rates from a database.

- ROUND: When working with numbers that involve decimals, the =ROUND() formula ensures that all values are rounded to the correct number of decimal places. This is especially useful for consistency in financial records.

- DATE: The =DATE() function can be used to automatically insert dates, such as the transaction date or payment due date. This ensures that your documents are always current and eliminates the risk of entering incorrect dates manually.

By using these formulas, you can automate much of the calculation process, making it faster, easier, and more reliable. This reduces the chances of errors that can occur from manual entries and ensures that your financial records are always up to date and accurate. Whether you’re managing a few transactions or hundreds, using formulas helps keep everything in order and improves your overall workflow.

Protecting Your Financial Files

When handling sensitive financial records, it’s essential to ensure that your files are secure. Whether you’re storing personal information, payment details, or business data, protecting these documents from unauthorized access is critical to maintaining privacy and preventing potential fraud. There are several ways to safeguard your files, ranging from password protection to secure cloud storage options. By taking the necessary precautions, you can reduce the risk of data breaches and ensure that your business operations remain secure.

Here are some strategies for protecting your financial documents:

- Password Protection: One of the simplest ways to secure your files is by using passwords. Many office software programs allow you to set up password protection for individual files. This ensures that only authorized users can open or edit the document, adding an extra layer of security.

- Encrypt Your Files: Encryption converts your file into a format that can only be read by someone with the decryption key. This is particularly useful when sharing sensitive information over email or storing it in the cloud. Encryption helps protect your files even if they are intercepted or accessed without permission.

- Backup Regularly: Regular backups ensure that even if your files are lost or corrupted, you can easily recover them. Consider using external drives, network storage, or cloud-based backup solutions to ensure your documents are stored safely and accessible when needed.

- Limit Access: Restrict access to your financial records by only allowing authorized personnel to view or edit them. You can set permissions in most file-sharing systems, which helps prevent unauthorized changes and ensures that only those who need to access the files can do so.

- Use Secure Cloud Storage: Storing your files in a secure cloud-based service adds an extra layer of protection, as most cloud storage providers offer encryption and advanced security features. These platforms also offer the advantage of automatic backups and easy sharing options.

- Update Software Regularly: Keeping your software up to date is crucial in protecting your files from security vulnerabilities. Ensure that your office software and any file storage systems you use have the latest security patches installed.

By implementing these strategies, you can significantly reduce the risk of unauthorized access and ensure that your financial records remain safe. Taking proactive steps to protect your documents not only helps prevent fraud but also builds trust with your clients by demonstrating your commitment to data security.

Sharing and Sending Financial Documents Effectively

Efficiently sharing and sending financial records is an important part of business operations. Whether you’re sending a payment request to a client or submitting a transaction record, ensuring that your documents are delivered quickly, securely, and professionally is crucial. The method you choose for sending these documents can impact the clarity of your message, the speed of payment, and even your business’s reputation. It’s essential to understand the best practices for sharing these documents to avoid delays or misunderstandings.

Here are some strategies for sharing and sending your financial records effectively:

- Use Secure Channels: When sending sensitive documents, it’s important to choose secure communication methods. For example, use encrypted email services or secure file-sharing platforms to prevent unauthorized access. Avoid sending confidential records over unprotected channels, like regular email, as these can be intercepted by third parties.

- Ensure Professional Formatting: Presenting well-structured, clear, and professional documents is key to building trust with clients. Ensure that your financial records are free of errors, with easy-to-read fonts, consistent formatting, and all necessary details included. This helps prevent confusion and ensures that your client understands the details without needing clarification.

- Provide Clear Instructions: When sending payment requests or transaction records, always include clear instructions or due dates. This makes it easier for your clients to understand what is expected of them and when. Clear instructions can help prevent delays and improve the chances of prompt payment.

- Offer Multiple Payment Options: Providing clients with a variety of payment methods can speed up the process. If possible, include information on different payment options such as bank transfers, online payment systems, or credit card payments. Make sure these options are clearly listed within the document or in the accompanying communication.

- Follow Up Promptly: After sending a document, follow up with your clients if you don’t receive a response or payment within the expected time frame. A polite reminder can go a long way in ensuring timely payments and maintaining strong business relationships.

- Track and Confirm Deliveries: When sending important documents, especially those that require payment, it’s a good idea to track deliveries or request a confirmation receipt. This provides an added layer of accountability and ensures that your financial records are successfully received and processed.

By following these practices, you can streamline your process of sharing and sending financial records. Whether you are communicating with clients, vendors, or business partners, sending professional, secure, and clear documents can make a significant difference in the efficiency and success of yo

How to Track Payments with Spreadsheet Software

Tracking payments is essential for maintaining a smooth cash flow and ensuring your business operations run efficiently. Whether you are tracking client payments, monitoring overdue balances, or reconciling your accounts, spreadsheet software offers powerful features to help you manage and organize payment information effectively. By using structured tables and formulas, you can easily keep track of all incoming payments and identify any discrepancies quickly.

Step 1: Set Up Your Payment Tracking Sheet

Begin by creating a dedicated sheet in your spreadsheet program where you will log each payment. Include columns for essential details such as:

- Client Name

- Transaction Date

- Amount Due

- Amount Paid

- Payment Method

- Outstanding Balance

- Payment Status (Paid, Pending, Overdue)

Ensure that the layout is clear and organized so that you can easily update it with new payments and quickly access the necessary information when needed.

Step 2: Use Formulas for Automated Calculations

Spreadsheet software allows you to automate much of the tracking process using formulas. Here are a few useful formulas you can apply:

- =SUM(): Use this formula to calculate the total amount paid by a client or for a specific period.

- =IF(): The =IF() function can be used to automatically flag overdue payments. For example, you can set up a formula to check if the payment due date has passed and update the payment status to “Overdue” accordingly.

- =-BALANCE: To track outstanding amounts, subtract the paid amount from the due amount using a simple subtraction formula, such as =Amount Due – Amount Paid.

By incorporating these formulas, you can automate many calculations, reducing the time spent on manual updates and ensuring accuracy in your records.

With these two simple steps–setting up a payment tracking sheet and using formulas to automate calculations–you can easily monitor incoming payments, track outstanding balances, and ensure that your financial records are always up to date. This helps improve cash flow management and makes it easier to spot any issues that need attention.