Hotel Billing Invoice Template for Efficient Payment Management

Managing financial transactions in a service-oriented business requires precision and organization. Streamlining the process can save time and reduce errors, ensuring both clients and providers are satisfied. By utilizing well-designed tools, businesses can handle their payment records more effectively and focus on delivering excellent service.

One of the most essential aspects of smooth financial management is having a reliable system for documenting charges. A structured record-keeping method helps to track services provided, amounts due, and payment status. This method not only simplifies the process but also ensures transparency between the business and its customers.

In this article, we will explore how adopting organized documentation can optimize the payment procedure, offering clear examples of how to set up and utilize these systems. Whether for small establishments or large enterprises, having a reliable framework is critical for maintaining financial clarity and operational efficiency.

Comprehensive Guide to Hotel Billing Templates

In any guest service business, having a system in place to track payments and charges is crucial for operational efficiency. The ability to document all transactions in a clear and organized manner not only improves accuracy but also builds trust with clients. Whether you’re running a small guest house or a large resort, understanding how to design an effective record-keeping system can save you time and prevent costly mistakes.

Key Elements of Effective Financial Records

A well-structured payment record includes all essential information such as services provided, dates, amounts, and customer details. This data should be presented clearly, with a straightforward layout that makes it easy to reference past transactions. Utilizing comprehensive structures can ensure all necessary information is captured, reducing the risk of errors and disputes.

Benefits of Structured Financial Documentation

Having a standardized system for documenting customer charges helps businesses track payments, identify any discrepancies, and streamline the overall accounting process. Clear and consistent documentation ensures that no details are overlooked, creating a smooth experience for both business owners and their guests.

Why Use an Invoice Template for Hotels

Implementing an organized system for managing payments in guest service businesses is essential for maintaining consistency and minimizing errors. By adopting a standardized approach to recording financial transactions, businesses can ensure accuracy, improve transparency, and simplify the overall accounting process. This approach reduces the likelihood of mistakes and disputes with customers while also streamlining administrative tasks.

Streamlined Processes and Time Savings

Using a pre-designed framework for documenting charges allows businesses to save time and effort on repetitive tasks. Instead of manually creating each transaction record from scratch, an organized structure speeds up the process, allowing employees to focus on more valuable tasks. Additionally, this system can be easily updated and customized to fit the unique needs of different types of establishments.

Ensuring Accuracy and Professionalism

One of the most significant advantages of using a structured system for payment records is the increased accuracy it provides. A well-structured layout ensures that all necessary details are captured, minimizing the chances of missing or miscalculating any amounts. It also conveys a sense of professionalism to customers, reinforcing their trust in the business.

| Feature | Benefit |

|---|---|

| Standardized Layout | Improves accuracy and reduces errors |

| Quick Customization | Saves time and meets specific needs |

| Professional Appearance | Enhances customer trust and satisfaction |

Benefits of Streamlining Hotel Billing

Optimizing financial processes in guest services leads to more efficient operations and better customer experiences. When payment documentation is organized and simplified, both businesses and their clients benefit from reduced confusion and faster processing times. A streamlined approach to managing financial records ensures that all transactions are completed promptly and accurately, contributing to smoother daily operations.

Improved Efficiency and Time Savings

One of the primary advantages of simplifying financial documentation is the significant time savings. By automating or standardizing the way charges are recorded, employees spend less time on repetitive tasks and can focus on providing better service. This allows businesses to reduce administrative workload while maintaining a high level of accuracy.

Enhanced Customer Satisfaction

When payment procedures are clear and quick, guests experience less frustration, leading to greater satisfaction. A simplified approach also allows for faster dispute resolution and reduces the chances of errors in the final charges. This level of transparency and professionalism builds trust with customers, encouraging repeat business and positive reviews.

Key Benefits of Streamlining Financial Management:

- Faster Processing: Reduces time spent on manual tasks

- Better Accuracy: Minimizes human errors in documentation

- Improved Customer Trust: Transparency leads to better relationships

Customizing Hotel Invoice Templates

Tailoring your payment documentation system to fit the specific needs of your business can significantly improve both efficiency and client satisfaction. Customization allows for greater flexibility, ensuring that all relevant information is captured in a format that works best for your operations. Whether you’re managing a small inn or a large resort, adapting the structure of your financial records can help streamline processes and present a professional image to your guests.

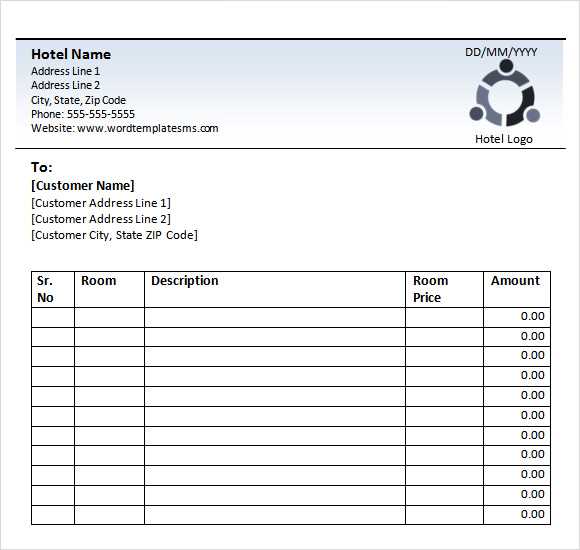

Personalizing the Layout for Your Business

Adjusting the design and content of your payment records can enhance clarity and functionality. You may wish to highlight certain details, such as room charges, taxes, or additional services, making them easy to find for both employees and customers. A customized layout also enables you to include your business logo, contact details, and any other relevant branding elements, reinforcing your identity.

Adding Relevant Fields and Details

Each business has unique requirements when it comes to the information it needs to track. Customizing fields, such as customer name, room number, dates of stay, or special requests, ensures that you capture all necessary details. This personalization allows your staff to manage transactions more effectively while offering a more tailored experience to guests.

| Customization Option | Benefit |

|---|---|

| Personalized Layout | Improves clarity and branding |

| Relevant Fields | Captures all necessary details for each transaction |

| Flexible Design | Allows for quick adjustments based on business needs |

Essential Features in a Billing Template

To ensure smooth financial transactions, certain elements must be included in every record of payment. These key features not only help maintain accuracy but also ensure that both the business and its customers are on the same page. A well-structured payment document should be clear, comprehensive, and easy to understand, offering all necessary details in an organized manner.

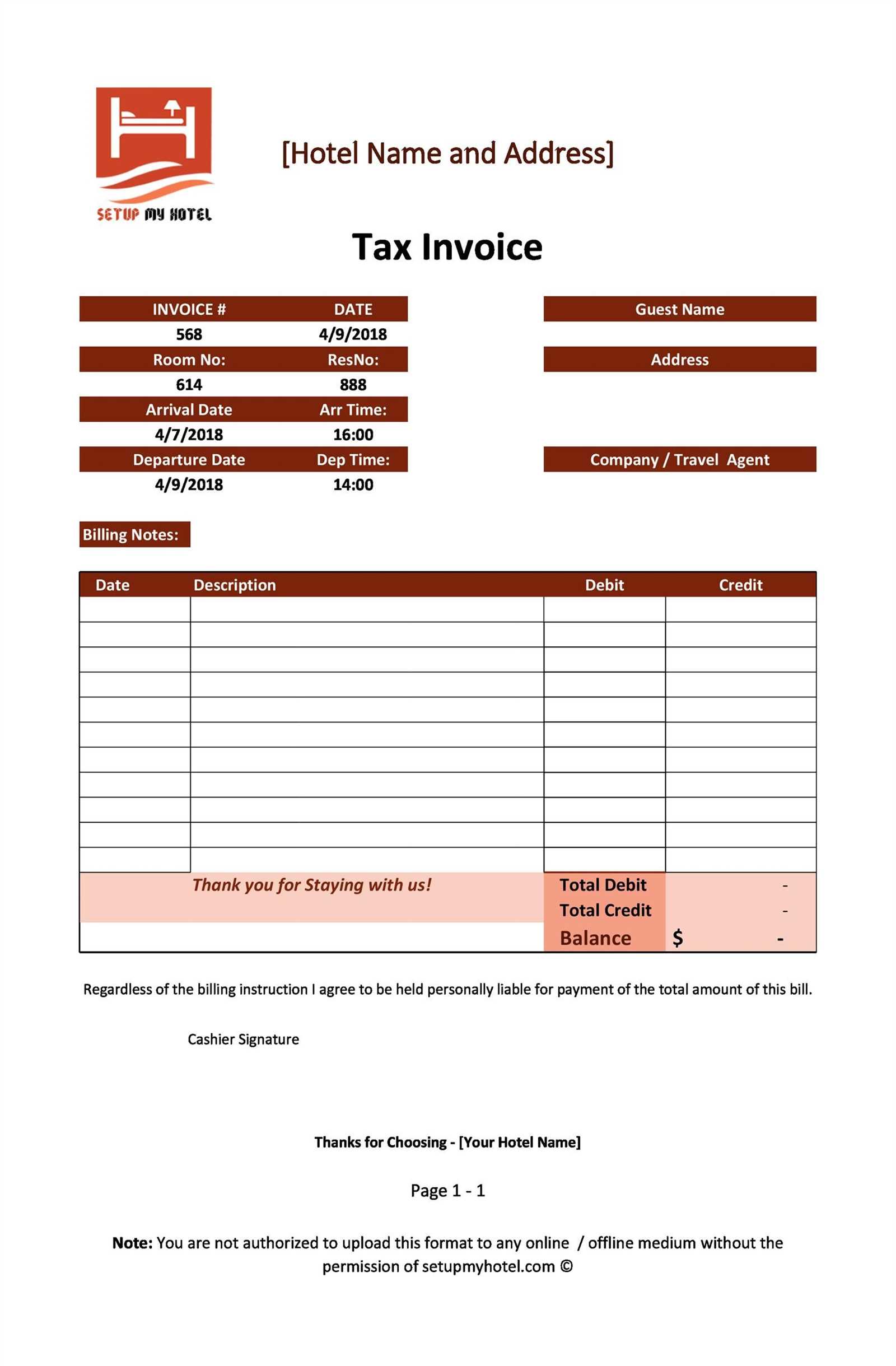

Key Information to Include

Every record should capture essential data such as customer details, dates of stay, services provided, and amounts charged. Including specific fields for taxes, discounts, and additional fees ensures that the final amount is clear and transparent. This information helps prevent disputes and provides a reliable reference for both clients and staff.

Design and Usability

The layout of your financial documentation should be user-friendly. It should allow for quick entry and easy readability. A clean, professional design ensures that all parties involved can access and understand the information without confusion. Prioritizing simplicity in design makes it easier to manage records and reduces the risk of mistakes during processing.

| Feature | Benefit |

|---|---|

| Clear Customer Information | Ensures accurate identification and easy reference |

| Service Details and Charges | Provides a complete breakdown for transparency |

| User-Friendly Layout | Reduces confusion and minimizes errors |

How to Create a Hotel Invoice Template

Designing an effective record-keeping system for financial transactions requires careful planning and attention to detail. The goal is to ensure that all necessary information is captured in a clear, consistent, and easily accessible format. By following a few simple steps, you can create a document that meets your needs while providing transparency and efficiency in processing payments.

Step 1: Gather Essential Information

The first step in creating a functional payment document is determining the necessary details to include. This typically involves capturing customer information, dates of service, the services rendered, and applicable fees. Make sure to include areas for taxes, discounts, or additional charges that may apply, as well as a final total. This will ensure a complete and accurate record.

Step 2: Organize the Layout

Once the necessary fields are identified, focus on arranging them in a logical order. Group related details together, such as contact information, dates, and charges, to make the document easy to read and understand. A well-organized structure prevents confusion and helps speed up the payment process. Use clear headings and sections to separate the different types of information for clarity.

By following these simple guidelines, you can create a professional and reliable system for documenting financial transactions, improving both the efficiency and transparency of your operations.

Best Practices for Hotel Billing

Maintaining an organized and efficient payment process is essential for any guest service business. By following certain best practices, you can ensure accuracy, transparency, and customer satisfaction. These practices help streamline financial transactions, reduce errors, and enhance the overall guest experience.

Key Guidelines for Effective Payment Management

To maintain smooth financial operations, it is important to implement practices that promote consistency and clarity. Here are some of the most important guidelines to follow:

- Clear Communication: Always communicate costs upfront to guests to avoid confusion during checkout.

- Detailed Records: Keep comprehensive records of services rendered, additional charges, taxes, and payments received.

- Timely Updates: Ensure that payment documents are updated regularly and accurately to reflect any changes or additional services.

Tools for Streamlining the Payment Process

In addition to following best practices, it is helpful to use tools that simplify the payment documentation process. Here are some recommended options:

- Automated Systems: Use software to automatically generate and update payment records.

- Customization: Personalize records to capture only the necessary details, ensuring all relevant charges are accounted for.

- Security Features: Implement security measures to protect sensitive customer information and payment details.

By incorporating these practices, businesses can improve the efficiency of their payment processes and build stronger relationships with their guests.

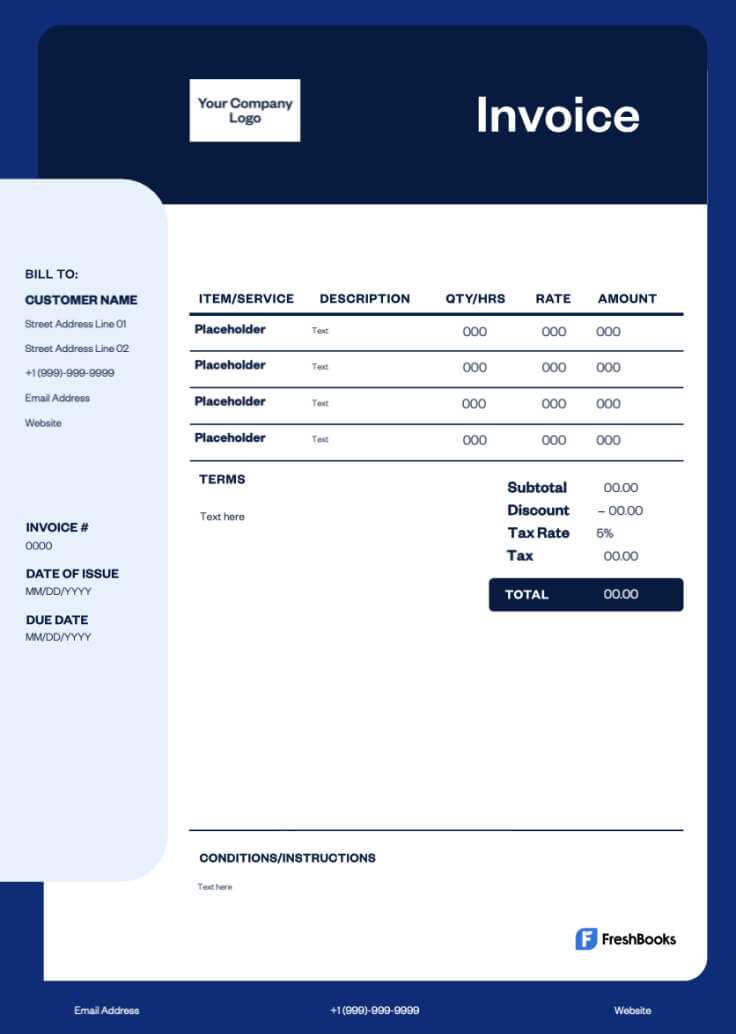

Choosing the Right Invoice Format

Selecting the appropriate format for financial documents is crucial to ensuring clarity and efficiency in transactions. The right structure makes it easier to capture all necessary details, avoid mistakes, and provide a professional presentation to customers. By choosing the best format, businesses can streamline their record-keeping process and enhance the overall guest experience.

Factors to Consider When Choosing a Format

Several elements should influence your decision when selecting a format for financial documents. These include the level of detail required, ease of use, and the ability to customize the layout for different needs. A good format will make it easy for staff to input and review information, while also being clear and understandable for customers.

Standard vs. Custom Formats

Standard formats are often simple and widely recognized, making them easy for staff to use and guests to understand. However, a custom format can be tailored to your business needs, allowing for more detailed breakdowns, unique services, and branding elements. Choosing between these two depends on your business size, complexity of services, and the level of personalization you want to provide.

- Standard Format: Simple, widely used, and easy to understand.

- Custom Format: Tailored to specific needs and offers more flexibility in design.

Whichever format you choose, it should always prioritize clarity, accuracy, and ease of use to ensure smooth financial transactions.

Automating Payment Collection with Templates

Automating the process of collecting payments can significantly improve efficiency and reduce human error. By using structured documents that can be easily generated and processed, businesses can save time and ensure accuracy. Automation streamlines the entire process, making it quicker for both customers and staff, while providing a more reliable and consistent approach to financial transactions.

Benefits of Automation

Automation brings numerous advantages to the payment collection process. It eliminates the need for manual entry, which can lead to mistakes, and ensures that all relevant information is included each time a document is generated. Additionally, automation allows for faster processing, helping businesses manage their cash flow more effectively and improving customer satisfaction by offering quick and clear payment instructions.

Key Features of Automated Payment Systems

To fully leverage automation, certain features should be integrated into your system:

- Instant Document Generation: Quickly create payment records without manual input, ensuring accuracy and speed.

- Real-Time Payment Updates: Automatically track payments and provide updates to both staff and customers.

- Customizable Options: Tailor documents to include specific services, charges, and taxes based on customer needs.

By automating these tasks, businesses can focus more on customer service and less on administrative work, all while ensuring that payments are collected promptly and accurately.

Invoice Templates for Different Hotel Types

Each type of accommodation offers unique services and experiences, and as such, the records of payment must reflect these differences. Whether you run a luxury resort, a budget-friendly guesthouse, or a boutique property, your financial documents should be tailored to match the level of service and the range of offerings. By customizing your payment records for different types of establishments, you ensure that all details are accurately captured and presented in a way that is clear to both your team and guests.

Payment Records for Different Accommodation Styles

Different lodging types may require specific features in their payment documentation. Here are some common variations:

- Luxury Resorts: Detailed documents with separate sections for high-end services, spa treatments, excursions, and special requests.

- Budget Guesthouses: Simpler records focusing on room charges, taxes, and basic services like breakfast or Wi-Fi.

- Boutique Hotels: Customized invoices that highlight unique services such as room upgrades, personalized amenities, and curated experiences.

Key Elements to Include Based on Accommodation Type

When designing records of payment for different types of accommodation, the following elements should be included according to the property’s specific offerings:

- Luxury Properties: Include high-value items, taxes, gratuities, and additional services like private events or meals.

- Budget Accommodations: Focus on clear, straightforward room charges, with space for any standard amenities provided (e.g., breakfast, parking).

- Unique Boutique Hotels: List bespoke services and personal touches that set your establishment apart from more conventional properties.

By aligning your financial documents with the nature of your property, you not only enhance transparency but also improve guest satisfaction by providing them with a clear and relevant breakdown of their charges.

Common Mistakes in Hotel Billing

Errors in financial records can create confusion for both guests and staff, leading to disputes and affecting the business’s reputation. Whether it’s a simple miscalculation or a failure to properly document services, these mistakes can have significant consequences. Understanding and addressing these common errors helps ensure smoother transactions and enhances overall guest satisfaction.

Frequent Mistakes to Avoid

Several mistakes are commonly made during the process of creating and managing financial records for guests. Here are the most typical issues:

- Incorrect Charges: Adding the wrong amounts for services, such as room rates, additional amenities, or taxes, can confuse guests and lead to complaints.

- Lack of Transparency: Failing to provide clear breakdowns of charges can leave guests unsure about what they are paying for.

- Inaccurate Payment Recording: Not updating records in real-time can cause discrepancies between what is paid and what is recorded.

- Omitting Discounts or Promotions: Forgetting to apply discounts or special offers can lead to overcharging guests who are expecting reduced rates.

- Missed Charges: Failing to charge for extra services, like late check-out fees or room service, can result in revenue loss.

How to Prevent These Errors

Implementing the following strategies can help prevent common billing mistakes:

- Double-Check Rates and Services: Always verify the accuracy of charges before finalizing the document.

- Provide Detailed Breakdown: Ensure that all charges are clearly listed, including taxes, extra services, and discounts.

- Real-Time Updates: Keep records up-to-date to reflect any changes in charges or payments as soon as they occur.

- Regular Training: Make sure staff is properly trained to handle financial transactions and avoid common mistakes.

By being mindful of these potential errors and taking steps to avoid them, businesses can improve the accuracy of their financial records and offer a more seamless experience for guests.

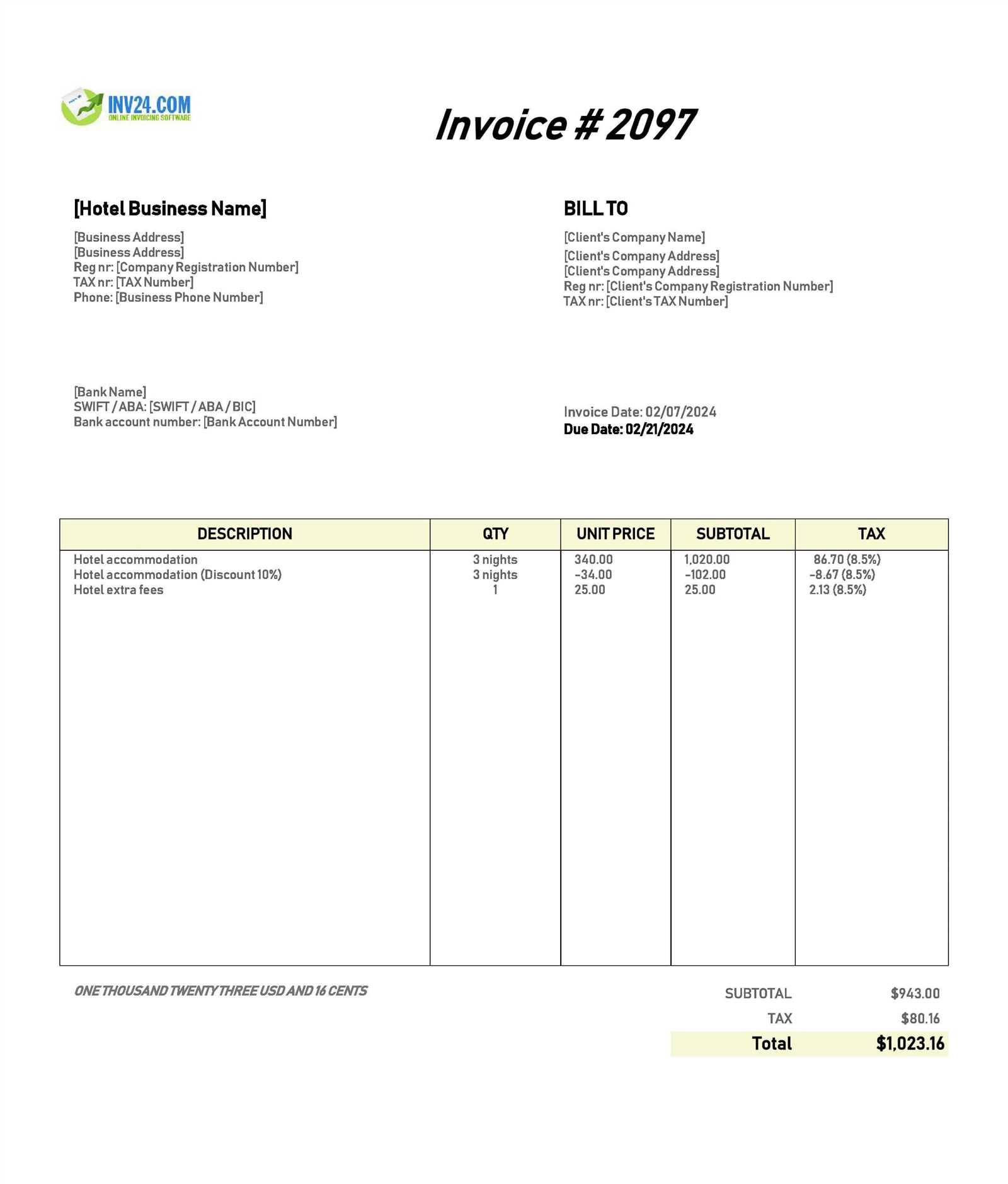

How to Manage Taxes in Hotel Invoices

Accurate tax management is a crucial aspect of financial documentation in any accommodation business. Properly calculating and displaying taxes ensures compliance with local regulations and provides transparency for guests. By carefully handling the tax details in your financial records, you can avoid errors, reduce disputes, and build trust with your guests.

Understanding Tax Components

Taxes applied to accommodation charges can vary depending on the location and the type of services provided. Typically, taxes are categorized into different components, such as:

- Sales Tax: A tax applied to the room rate or other purchased services like dining and amenities.

- Tourism Tax: A specific tax levied on guests staying in tourist destinations, often calculated per night.

- Service Charges: Additional fees, sometimes considered a form of tax, that are used to cover specific services such as cleaning or concierge assistance.

Tips for Managing Taxes Effectively

To ensure your financial records are accurate and comply with tax laws, follow these guidelines:

- Know Your Local Tax Laws: Familiarize yourself with the local tax regulations to ensure proper application of the correct rates.

- Itemize Taxes Clearly: Display taxes as separate line items on the payment record, so guests can see the exact amount charged for each tax.

- Update Tax Rates Regularly: Tax rates may change, so it’s important to update your system and records accordingly to reflect any new rates.

- Apply Taxes on Relevant Services: Be sure to apply taxes only to services that are taxable under local laws, avoiding errors by including tax on non-taxable services.

By correctly managing taxes, you maintain a clear and accurate financial record, which helps ensure compliance, improves transparency, and reduces the risk of legal issues related to tax discrepancies.

Integrating Payments with Invoice Templates

Efficiently handling payments alongside financial records is key to ensuring smooth transactions and transparent communication with guests. When payment systems are integrated seamlessly with record-keeping tools, it reduces errors, accelerates the payment process, and enhances overall customer experience. A well-integrated payment system ensures that all charges are accounted for and payments are processed securely.

How Payment Integration Improves Efficiency

Integrating payment methods into financial systems provides several benefits, including:

- Real-Time Payment Updates: Payments are recorded instantly, minimizing delays in reflecting changes on financial records.

- Accuracy in Payment Allocation: Direct integration ensures that payments are applied correctly to corresponding charges, reducing the risk of errors.

- Faster Checkout Process: Guests can make payments and receive confirmation in a seamless manner, improving satisfaction and reducing wait times.

Steps to Integrate Payments Effectively

To integrate payments with your financial management system, follow these steps:

- Select a Reliable Payment Processor: Choose a secure, reliable payment gateway that offers smooth integration with your financial system.

- Ensure Compatibility: Ensure that the payment system is compatible with the tools you are using to manage transactions and records.

- Automate Payment Updates: Set up automatic synchronization between your payment processor and financial records to reduce manual entry.

- Provide Multiple Payment Options: Offer guests various payment methods, such as credit cards, digital wallets, and online transfers, for greater flexibility.

By effectively integrating payment systems with your financial management processes, you can streamline operations, reduce administrative burdens, and enhance the overall guest experience.

Tracking Payments Through Invoice Templates

Effectively monitoring payments is essential for maintaining accurate financial records and ensuring that all transactions are completed. By tracking payments in a systematic way, businesses can easily verify that all charges have been paid, identify any outstanding balances, and resolve discrepancies quickly. Clear and transparent tracking helps maintain trust with clients and improves cash flow management.

Why Payment Tracking is Important

Having a reliable system to track payments ensures that your financial records reflect the true status of accounts. Some key reasons to implement payment tracking include:

- Reduce Payment Errors: Tracking ensures that payments are correctly applied to the right charges, preventing mistakes like double charges or missed payments.

- Maintain Clear Records: A good tracking system allows for easy reference of past payments, making audits and financial reviews more straightforward.

- Identify Outstanding Balances: With accurate tracking, you can quickly identify any outstanding payments and follow up with clients to resolve them.

Best Practices for Payment Tracking

To ensure that payments are tracked effectively, consider implementing the following best practices:

- Use Unique Payment Identifiers: Assign a unique reference number to each payment to easily track it across your records.

- Automate Payment Updates: Integrate your payment system with financial management tools to automatically update payment statuses, reducing manual entry.

- Regularly Reconcile Accounts: Perform regular reconciliations to ensure that your payment records align with bank statements and client reports.

- Provide Detailed Payment Information: Include detailed payment information such as dates, amounts, and methods to give clients clear visibility of their transactions.

By following these practices, you can efficiently track payments, reduce errors, and maintain accurate financial records for your business.

How to Edit and Update Hotel Invoices

Making adjustments to financial documents is an essential part of maintaining accuracy and ensuring that all details are up to date. Whether correcting errors, adding new charges, or revising customer information, knowing how to edit and update these records efficiently is vital. The process of making changes can be simple, but it requires careful attention to detail to ensure that everything is accurate and compliant.

Here are a few key steps to follow when updating your financial documents:

Steps for Editing Financial Documents

Editing documents typically involves the following steps:

- Identify the Changes: Before making any edits, ensure you know exactly what needs to be changed. Whether it’s updating a guest’s name, adjusting charges, or correcting an error, clear identification of the issue is the first step.

- Use Editable Formats: Work with formats that allow for easy editing, such as spreadsheets or text documents. Avoid using locked or non-editable files unless absolutely necessary.

- Make Necessary Updates: Once you’ve identified what needs to be changed, carefully update the document, making sure all relevant sections are adjusted. If you’re adding new charges, ensure they are clearly marked.

- Double-Check for Accuracy: Review the entire document after making edits. Look for typos, mismatches, or any other discrepancies to ensure the document is flawless.

- Save the Updated Document: After making changes, save the updated file with a new name or version number. This ensures you can track changes and retain previous versions if needed.

Best Practices for Updating Documents

When editing or updating documents, there are a few best practices to follow:

- Consistency: Ensure that all updated details are consistent with your standard formats. This includes using the same font, layout, and style for all documents.

- Transparency: Be transparent about changes. If you’re updating prices, charges, or services, make sure customers are aware of the changes through clear communication.

- Version Control: Keep a record of all updates and revisions. This is particularly important for auditing and reviewing previous transactions.

By following these steps and best practices, you can ensure that your financial documents remain accurate and up to date, providing both clarity and professionalism in your financial management.

Using Software to Enhance Invoice Efficiency

In today’s fast-paced business environment, managing financial records manually can be both time-consuming and prone to errors. Leveraging the power of software can streamline the process, improve accuracy, and save valuable time. With the right digital tools, tasks such as generating, tracking, and managing payment records become much more efficient and straightforward.

By automating key processes, businesses can significantly reduce the likelihood of human error while also providing a more professional and consistent experience for clients. Software solutions offer a wide range of features that cater to various aspects of financial record management, from automated calculations to customizable reports and payment reminders.

Key Benefits of Using Software for Financial Records

Here are some advantages that software can provide to enhance your financial documentation process:

- Automation of Calculations: Software can automatically calculate totals, taxes, discounts, and apply them to customer records, ensuring accuracy and reducing manual input errors.

- Quick Access to Records: Digital tools store and organize your data, allowing for quick and easy access when needed. No more sorting through piles of paper records.

- Customizability: Many software options allow you to tailor documents according to your business needs, including customized logos, fields, and design preferences.

- Reporting Features: Software often includes reporting features that let you generate financial summaries, outstanding payments, and transaction history reports at the click of a button.

- Cloud Integration: Many tools offer cloud-based options, ensuring that your financial records are accessible from any device and are securely stored online.

Popular Software Features to Consider

When selecting software to manage your financial records, there are several key features to look for:

| Feature | Benefit |

|---|---|

| Automated Reminders | Automatically reminds customers of pending payments, reducing the need for manual follow-ups. |

| Multiple Payment Options | Allows clients to pay via various methods, such as credit cards, bank transfers, or online payment platforms. |

| Multi-Currency Support | Helps businesses operate internationally by supporting multiple currencies for global transactions. |

| Real-Time Updates | Ensures that your records are always up to date, reflecting changes in payments, taxes, and other variables instantly. |

Incorporating software into your financial management practices enhances not only the accuracy and efficiency of your processes but also your overall workflow, allowing you to focus more on your business and less on administrative tasks.