Freelance Invoice Template for Graphic Designers

For independent professionals, managing payments and maintaining a professional image are key to growing a successful business. One of the most important aspects of this process is the method used to request payment from clients. A well-organized and clear request for compensation can enhance credibility and ensure smooth transactions. By focusing on clarity and professionalism, you can make your work stand out even before it’s completed.

Customizable billing formats provide the flexibility to cater to the specific needs of each client while also saving time. When crafted thoughtfully, these documents do more than just outline the work completed–they communicate the value of your services. They reflect your attention to detail and organizational skills, setting the tone for long-lasting, positive client relationships.

In this guide, we’ll explore various aspects of creating and managing these essential documents, offering tips for those looking to elevate their business practices. Whether you’re working on a short-term project or an ongoing partnership, having the right approach to invoicing can make a significant difference in both your workflow and your client interactions.

Creating the Perfect Document for Independent Professionals

For independent professionals, crafting a clear and professional billing request is essential for building trust with clients and ensuring timely payments. A well-organized document not only details the work completed but also highlights your professionalism and attention to detail. It serves as a reflection of your business practices, helping to create a positive impression and reinforce your credibility.

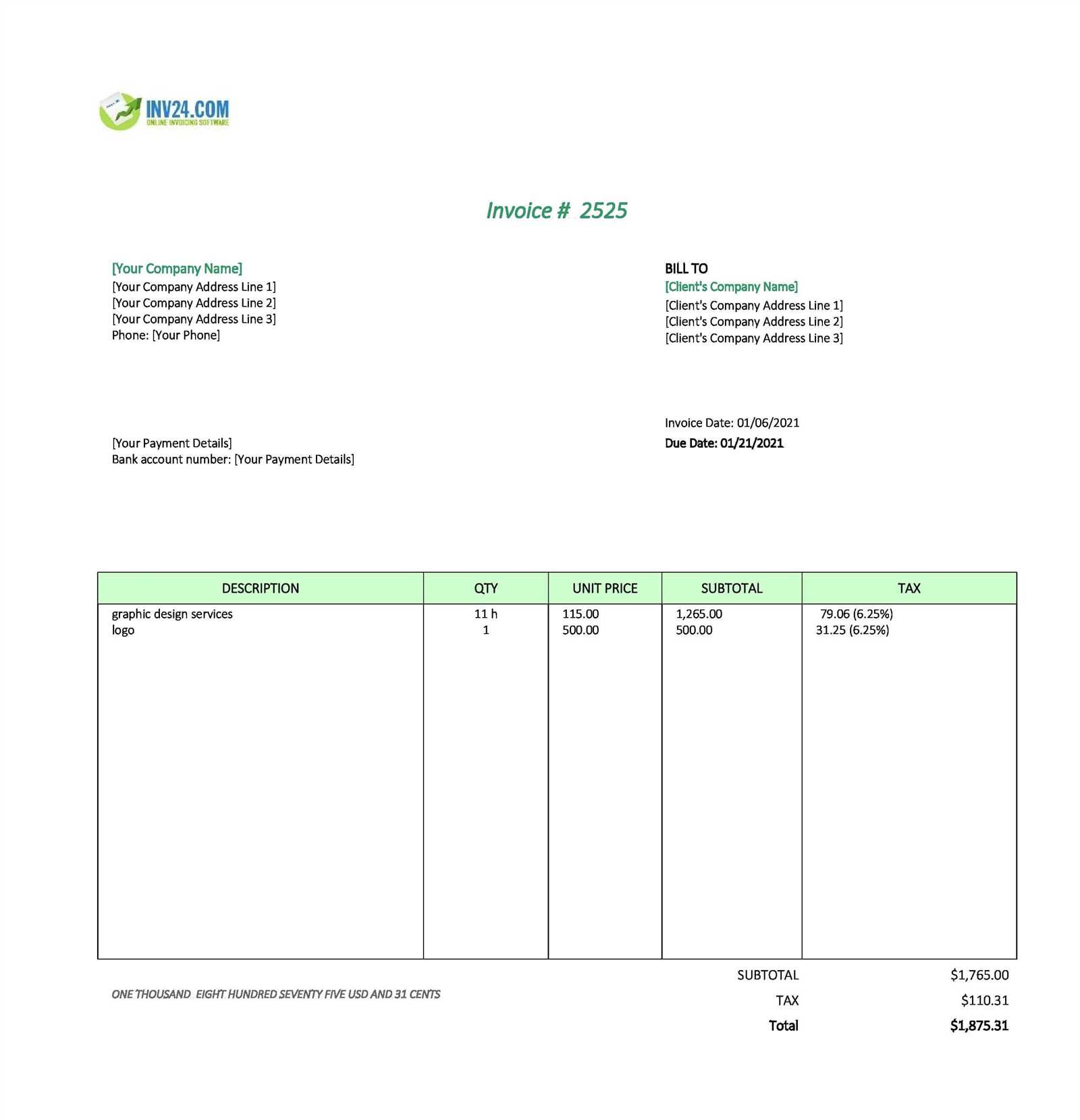

When creating the ideal payment request, it’s important to focus on both functionality and presentation. The format should be straightforward, easy to read, and customized to reflect your unique style. At the same time, it needs to include all the necessary details, such as services rendered, payment terms, and client information, to avoid any confusion and ensure that the transaction goes smoothly.

A well-crafted document also acts as a tool for maintaining organized records. It provides a clear timeline for both you and your client, outlining what was delivered and when payment is expected. By keeping everything transparent, you ensure both sides are on the same page, reducing the likelihood of disputes and building a strong foundation for future collaborations.

Why Independent Professionals Need Custom Billing Documents

For independent workers, having a tailored payment request form is not just about asking for payment–it’s an opportunity to enhance professionalism and establish trust with clients. Generic forms may lack the necessary details or flexibility needed for different types of work. A custom form, on the other hand, can be fully adjusted to meet the specific needs of each project, making the process smoother and more efficient for both parties.

Enhancing Professionalism

When clients receive a polished, personalized document, it leaves a strong impression of your business acumen. A customized request conveys that you pay attention to detail, which can make all the difference in securing repeat clients. It shows that you take your work seriously and are committed to providing a seamless experience, from the initial collaboration to final payment.

Simplifying Payment Processing

Having a pre-designed structure for your billing makes it easier to track and manage payments. With a custom setup, you can ensure that all the necessary information is included, such as clear breakdowns of services, deadlines, and payment terms. This reduces confusion and ensures that both you and your client are aligned in terms of expectations, helping to avoid delays or misunderstandings.

Key Elements of a Professional Billing Document

Creating a polished and effective payment request requires more than just listing the amount owed. A well-crafted document should include key details that make it easy for clients to understand the work completed and the payment terms. These elements not only ensure clarity but also present you as a serious and organized professional.

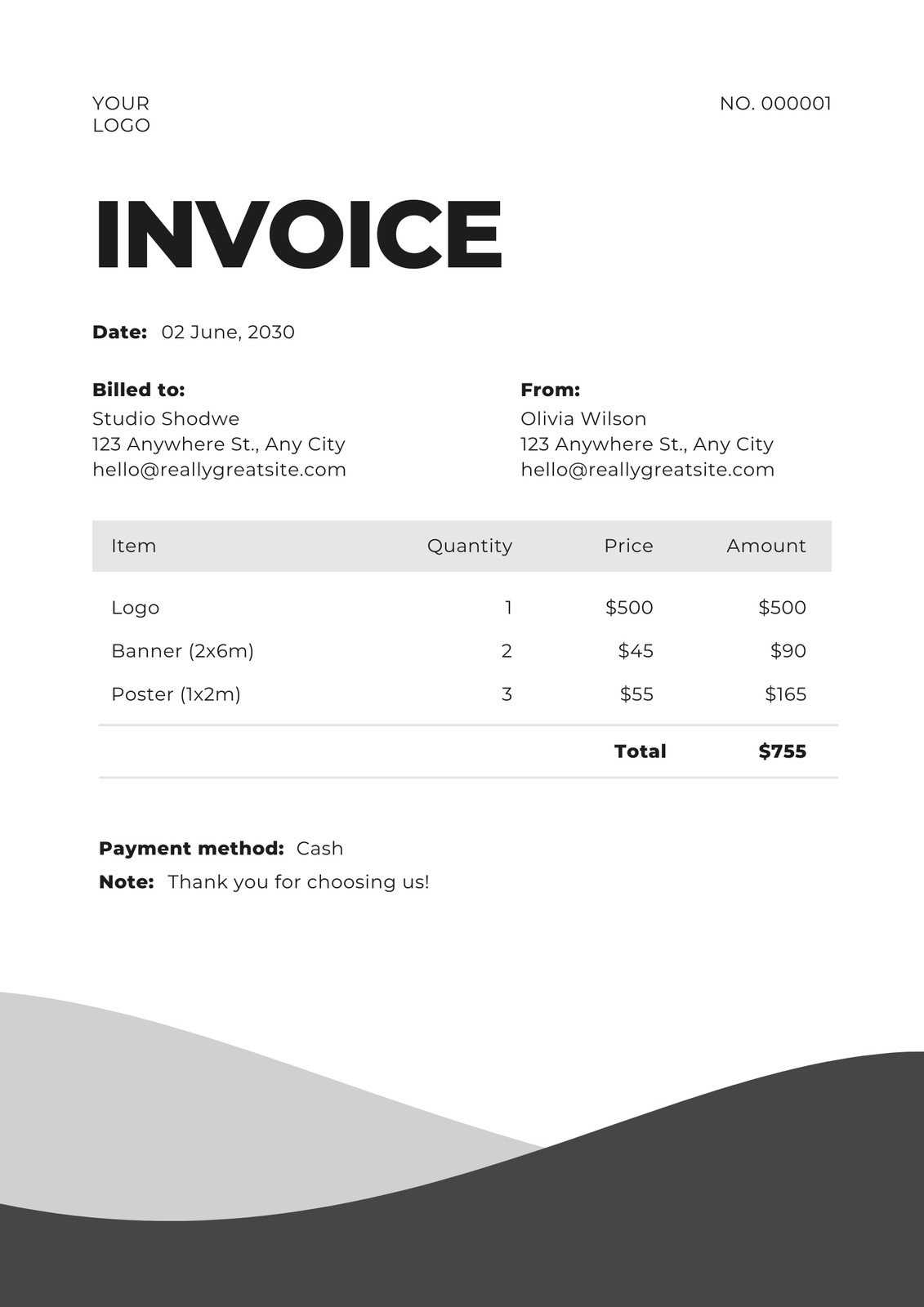

Client Information is one of the first details that should appear at the top of the document. This includes the client’s name, business name (if applicable), and contact information. Ensuring this is clearly visible helps avoid confusion and makes it easier for both parties to reference the document in future communications.

Clear Description of Services is another critical element. Each task or project milestone should be listed with a brief but clear description. This gives the client a transparent view of the work that has been completed and shows that you are accountable for your services.

Payment Terms play a significant role in ensuring timely compensation. Include clear information about the payment due date, late fees (if any), and accepted payment methods. This reduces the chance of misunderstandings and sets expectations for both you and your client.

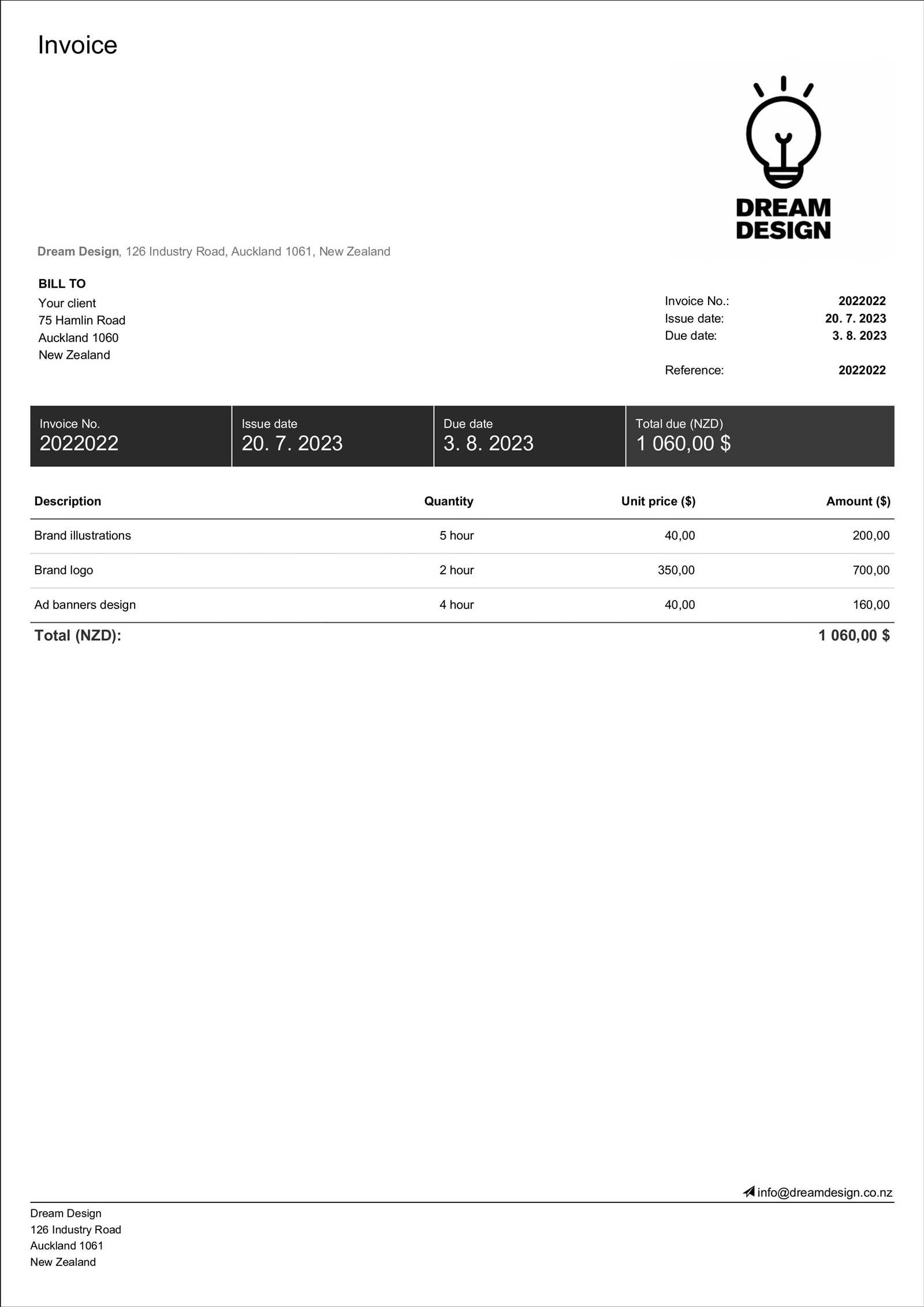

Unique Document Number is an often-overlooked yet important feature. Assigning a unique number to each request helps keep records organized and easily accessible for both you and your client. This is especially useful for tax purposes or when reviewing past projects.

How to Personalize Your Billing Document

Adding a personal touch to your payment requests can help you stand out and reinforce your professional brand. Customizing your billing document doesn’t just make it look unique–it also shows that you take your work seriously and pay attention to the details that matter to clients. By incorporating your branding elements and style, you make every interaction feel more personalized and professional.

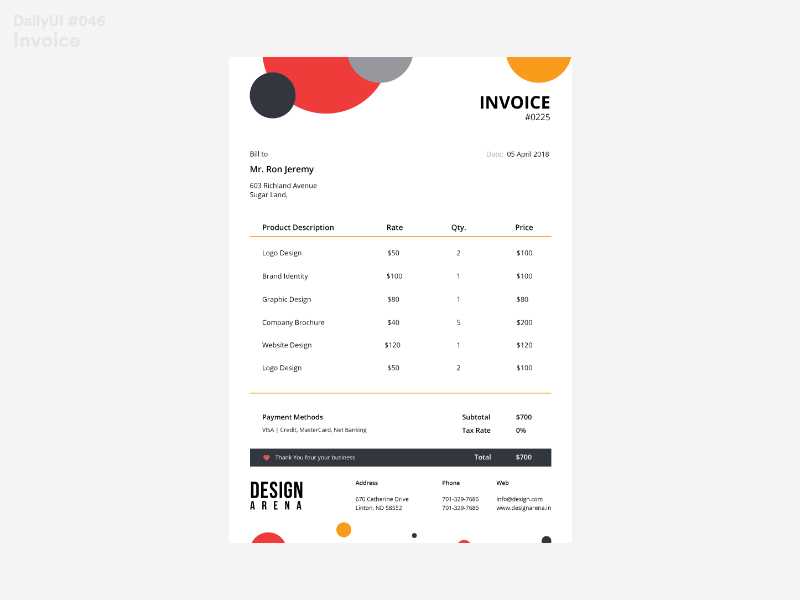

Incorporating Your Brand Colors and Logo is a simple yet effective way to create a cohesive and professional look. Use your brand’s color palette and logo to reflect your identity. This helps reinforce your brand presence and adds a polished, consistent feel to all client communications, making them instantly recognizable.

Custom Fonts and Layouts can also make a significant difference in how your document is perceived. Choose fonts that align with your brand’s personality, whether they are modern and clean or more traditional and formal. A well-structured layout ensures that all the necessary information is easy to read and understand, providing a positive experience for the client.

Personalized Message or Notes is another way to connect with your client. Adding a brief thank you note or a custom message can make a big impact. A small touch like this shows appreciation for their business and encourages a positive relationship, leaving a lasting impression even after the transaction is complete.

Choosing the Right Billing Format for Your Business

Selecting the appropriate format for your payment request is crucial for creating a smooth and professional process. The right structure can help you maintain clarity, consistency, and organization in your transactions. Whether you’re working with individual clients or larger companies, the format you choose should reflect both the nature of your services and the expectations of your clients.

Simple and Straightforward vs. Detailed Layouts are two common approaches. A minimalist design with just the essentials is ideal for smaller projects or when working with clients who prefer efficiency. On the other hand, a more detailed layout may be necessary for complex services or long-term projects, where you need to break down the tasks and deliverables in more depth.

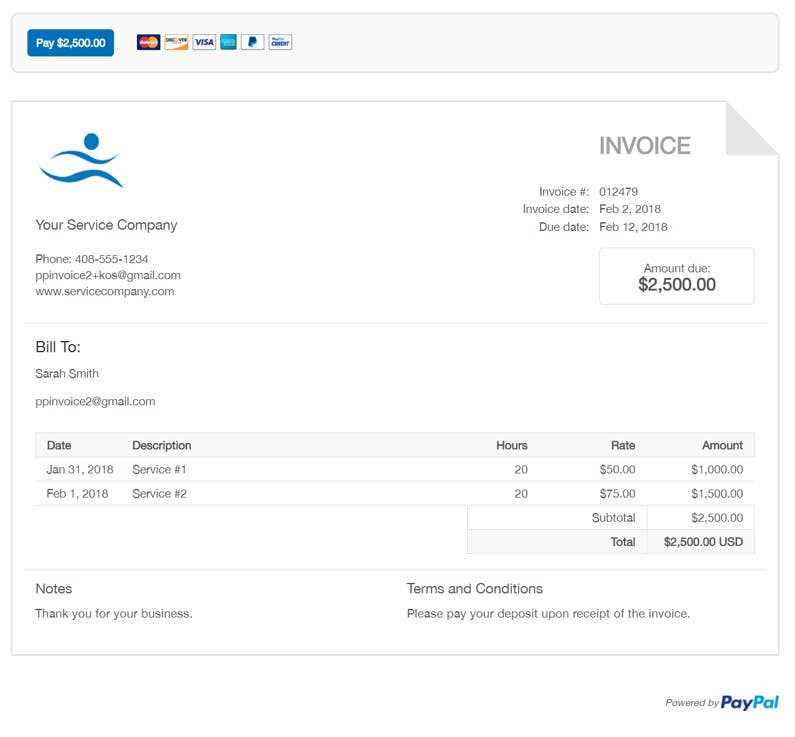

Digital vs. Printed Versions is another important consideration. While digital formats are more convenient and cost-effective, offering a printed version can add a personal touch, especially for high-end clients or special projects. Regardless of the medium, the format should be professional, easily editable, and designed to suit your brand’s identity and the client’s needs.

Essential Features for Billing Documents in Creative Work

When creating a payment request for creative services, it’s important to include specific elements that reflect the nature of the work and help avoid any confusion. A well-structured request will not only ensure timely payments but also convey professionalism. Here are the key features that should be present in any document related to creative projects.

| Feature | Description |

|---|---|

| Client Information | The client’s full name or business name, along with contact details, should be clearly stated at the top. |

| Detailed Service Breakdown | A clear list of services provided, with individual pricing for each item or task, helps avoid confusion and ensures transparency. |

| Payment Terms | Include payment methods, due dates, and any late fees to clarify expectations and ensure timely payments. |

| Project or Task Description | Briefly outline the scope of work, including deadlines and deliverables, to ensure both parties are aligned. |

| Personalized Branding | Use your logo and brand colors to maintain consistency and make your document look professional and unique. |

How to Include Payment Terms Effectively

Clearly outlining payment expectations is crucial for maintaining smooth business transactions. When clients understand the terms upfront, the likelihood of delays or misunderstandings is greatly reduced. Including payment terms in a clear, concise manner ensures both you and the client are on the same page, leading to better working relationships and timely compensation.

Key Elements to Include

- Payment Due Date: Clearly state when the payment is expected, whether it’s upon completion, within a set number of days, or based on a specific milestone.

- Late Fees: If applicable, specify the consequences for late payments, such as a percentage fee or a flat amount for overdue invoices.

- Accepted Payment Methods: List the payment methods you accept, such as bank transfers, credit cards, or online payment systems.

- Deposit Requirements: If a deposit is required before starting work, make this clear. Specify the percentage and when it’s due.

- Discounts for Early Payments: If offering a discount for early settlement, outline the percentage and the time frame in which it applies.

Tips for Clarity and Understanding

- Be Direct: Use simple and direct language to avoid confusion. Avoid legal jargon unless necessary.

- Highlight Important Details: Bold or underline key terms, such as due dates or fees, to draw attention to them.

- Keep It Brief: Payment terms should be clear but concise. Avoid long paragraphs or unnecessary details that might confuse the client.

Incorporating Your Branding into Billing Documents

Your payment requests should reflect your brand’s identity, as they are an extension of your professional image. By including elements of your brand in the document, you create a cohesive and polished experience for your clients. A personalized, branded request not only makes a strong impression but also reinforces the professionalism and consistency of your business.

Key Branding Elements to Include

- Logo: Place your logo prominently at the top of the document. It ensures that your business is easily recognizable and helps reinforce your brand’s presence.

- Color Scheme: Use your brand’s colors throughout the document. Consistent color usage across all your materials enhances brand recognition and creates a cohesive look.

- Font Style: Choose fonts that reflect your brand’s personality. Whether your style is formal, modern, or creative, keeping font usage consistent reinforces your visual identity.

- Brand Message or Tagline: If applicable, include a short tagline or slogan that aligns with your brand’s values or mission. It serves as a reminder of your business ethos and can leave a lasting impression on clients.

Additional Tips for Effective Branding

- Maintain Consistency: Ensure that your brand’s visual elements are consistent with other materials you send to clients, such as contracts, proposals, or portfolios.

- Keep It Professional: While branding is important, make sure it doesn’t overpower the content of your request. The focus should still be on clarity and professionalism.

- Use White Space: Allow space for your brand elements to breathe. Overcrowding the document can distract from its main purpose and make it harder to read.

Best Practices for Billing Document Layout and Presentation

A well-structured and visually appealing document plays a crucial role in ensuring clear communication with clients and helping you get paid on time. The layout should be organized and easy to follow, making it simple for the client to review details and process payment efficiently. By following best practices, you ensure that your document is not only functional but also professional and aligned with your business standards.

Key Elements to Consider

| Element | Best Practice |

|---|---|

| Clear Header | Include your business name, logo, and contact information at the top. This ensures your document is easily recognizable and establishes a professional tone from the outset. |

| Itemized Breakdown | Provide a clear, itemized list of services or products, with individual pricing for each. This allows clients to understand exactly what they are paying for and prevents any confusion. |

| Readable Fonts | Choose simple, readable fonts like Arial or Times New Roman. Avoid overly decorative fonts that may make the document difficult to read, especially on mobile devices. |

| Appropriate Spacing | Ensure there is enough space between sections for readability. Don’t overcrowd the document with too much information or too many visual elements. |

Other Considerations

- Consistent Alignment: Keep text and numbers aligned properly to make the document easier to follow and more professional in appearance.

- Highlight Key Details: Make important information such as total amounts, due dates, and payment instructions stand out by using bold text or larger fonts.

- Use Simple Colors: Stick to a minimal color palette that reflects your brand. Too many colors can make the document look cluttered and unprofessional.

How to Manage Multiple Client Billing Requests

Handling multiple clients and their respective payment requests can quickly become overwhelming without the right system in place. Keeping track of each client’s details, payment due dates, and amounts owed is crucial to ensuring timely payments and maintaining professional relationships. By organizing your process, you can avoid mistakes and stay on top of your finances.

Organizational Tips for Managing Requests

- Create a Centralized System: Use a digital tool or spreadsheet to track all your payment requests. Having everything in one place helps avoid confusion and provides easy access to important information.

- Set Clear Payment Deadlines: Establish and stick to clear deadlines for all your clients. This helps both you and your clients know exactly when payments are expected.

- Track Payment Status: Regularly update the status of each payment. Whether it’s paid, pending, or overdue, knowing where each payment stands can help you take action when necessary.

Automation and Tools for Efficiency

- Use Payment Management Software: There are many tools available that automate the process of creating and tracking payment requests. These platforms can send reminders and allow clients to pay online, saving time and reducing errors.

- Set Up Recurring Payments: For long-term clients or ongoing projects, setting up recurring billing can help streamline your workflow and avoid missed payments.

Tips for Organizing Your Billing Records

Efficient record-keeping is essential for managing your business finances. Whether you’re keeping track of payments, overdue amounts, or client interactions, having a structured system in place helps ensure that you never miss a detail. Proper organization not only saves time but also simplifies tax filing and financial reporting.

Here are a few effective strategies to help you stay organized:

- Use Digital Tools: Digital platforms or software can automate record-keeping and track payments easily. This allows for quick access to data and reduces the risk of losing information.

- Maintain Clear Categories: Separate your records into distinct categories such as “paid,” “pending,” and “overdue.” This will make it easier to identify the status of each transaction and avoid confusion.

- Keep Regular Backups: Regularly back up your digital records to prevent data loss. Whether using cloud storage or external drives, ensure that your documents are securely stored.

- Establish a Consistent Naming Convention: Use clear and consistent file names for your records, such as including the client’s name and the date of the transaction. This makes it easier to search for specific documents later on.

Creating Billing Documents for International Clients

When working with clients from different countries, it’s important to adapt your billing practices to accommodate various international standards and preferences. The right approach helps build trust, ensures clear communication, and facilitates smooth payment transactions across borders. Tailoring your documents to meet these needs will make the payment process easier for both you and your clients.

Here are some key considerations for creating billing documents for clients around the world:

- Include Local Currency and Taxes: Make sure to specify the currency in which payment is expected. Additionally, include any applicable taxes based on the client’s country of residence, if necessary.

- Provide Clear Payment Instructions: Different countries may have different payment preferences and systems. Ensure that you include all relevant details for international transfers, such as SWIFT codes or IBAN numbers, to avoid confusion.

- Account for Time Zones: Be mindful of the time difference when setting payment deadlines or sending reminders. Providing the deadline in both your local time zone and the client’s time zone can help avoid misunderstandings.

- Understand Regional Legal Requirements: Different countries may have specific legal requirements regarding invoicing. Familiarize yourself with the invoicing rules for the countries where your clients are based to ensure compliance.

Using Software to Automate Billing

Automating your billing process with the help of specialized software can save valuable time and reduce the likelihood of errors. By streamlining repetitive tasks such as creating and sending payment requests, reminders, and tracking payment statuses, you can focus more on your work and less on administrative tasks. Automation also ensures that your clients receive consistent, professional communication, which can enhance their experience and improve cash flow.

Benefits of Automation

- Efficiency: Automating the billing process eliminates the need for manual data entry, reducing the time spent on each transaction.

- Accuracy: Automated systems minimize the risk of errors, ensuring that all client details, amounts, and deadlines are accurate.

- Consistency: With automated reminders and scheduling, your clients are more likely to make payments on time, improving your cash flow.

Choosing the Right Software

When selecting billing software, consider the following factors:

| Feature | Importance |

|---|---|

| Customization | Ability to tailor documents to match your brand and business needs. |

| Integration | Compatibility with other tools you use, such as accounting software or payment gateways. |

| Support for Multiple Currencies | Useful for international clients, allowing for payments in different currencies. |

| Reporting and Analytics | Helps you track payments and outstanding balances, offering insights into your financial health. |

Common Mistakes to Avoid in Billing

Inaccurate or poorly structured billing can lead to confusion, delayed payments, and strained client relationships. It’s important to ensure that each request for payment is clear, professional, and error-free. Avoiding common mistakes in this process can help you maintain a smooth workflow and improve your overall business practices. Here are some key mistakes to watch out for when creating payment documents:

Common Pitfalls

- Missing or Incorrect Client Details: Always double-check the client’s name, address, and other essential information. Incorrect details can cause delays or errors in the payment process.

- Unclear Payment Terms: Ensure that the payment terms are easily understandable. Ambiguous payment conditions can create confusion and disputes.

- Failure to Include Due Dates: Not specifying the exact due date or payment schedule can result in missed or delayed payments.

- Forgetting Additional Charges: If there are late fees or other charges, make sure these are clearly mentioned. Overlooking this can result in clients not paying the correct amount.

Tips for Accuracy

Here are some best practices to help avoid mistakes:

| Mistake | How to Avoid |

|---|---|

| Unclear Item Descriptions | Be specific about the services or products being billed for to prevent any confusion. |

| Lack of Professional Appearance | Ensure the layout is clean and professional, reflecting your business identity. |

| Missing Contact Information | Always include a phone number or email for clients to reach you if they have questions. |

| Not Tracking Payments | Use accounting software or systems to monitor which payments have been made and which are pending. |

How to Send Requests for Payment Professionally

Sending a payment request professionally is an important aspect of managing client relationships and maintaining your business’s reputation. A well-crafted communication can ensure timely payments and present your business in a reliable and organized manner. Here are key tips on how to send these documents professionally:

1. Use a Professional Email

When sending a request for payment, always use your business email address. This creates a formal tone and ensures that the document is recognized as legitimate. Avoid sending payment requests from personal email accounts, as this can undermine professionalism.

2. Include a Clear Subject Line

The subject line should be simple yet informative, allowing your client to immediately understand the purpose of the email. For example, “Payment Request for Services Rendered – [Date]” ensures that the recipient knows what the email pertains to before even opening it.

3. Attach the Document Correctly

Make sure that your request is attached as a PDF or another universally accessible format. Avoid sending files in formats that might be difficult for clients to open or view. Include a clear file name, such as “Payment_Request_[ClientName]_[Date].pdf” for easy reference.

4. Provide Context in the Email Body

In the body of the email, briefly explain the attached document and mention the due date for the payment. If necessary, remind the client of any previous discussions related to the services provided or payment terms. Be polite and clear, avoiding any language that could be perceived as aggressive.

5. Be Polite and Professional

Always use polite language, even if the payment is overdue. A professional tone will help maintain positive relationships with your clients and increase the likelihood of prompt payments.

6. Follow Up If Necessary

If the payment has not been received by the due date, send a polite follow-up email. Reiterate the details of the payment request, offer assistance if there are any issues, and remind them of the due date.

By following these steps, you can ensure that your payment requests are sent in a professional manner, fostering trust and improving the chances of timely payments.

Ensuring Your Request for Payment is Legally Compliant

When managing your business, it’s essential to ensure that your requests for payment meet all the legal requirements. These documents not only serve as proof of services rendered but also as a formal agreement between you and your clients. To avoid any legal complications, it’s important to include the correct details and follow local regulations. Here are the key steps to ensure your request is legally compliant:

1. Include Accurate Business Information

Always ensure that your business name, address, and contact details are correct and clearly visible on the payment request. This is important for legal documentation purposes and will help avoid confusion in case of disputes. If you are registered as a business, make sure to include your registration number, VAT number, or any other relevant identification required by your local government.

2. Clearly Mention Payment Terms

Define the terms of payment clearly in the document, including due dates, payment methods, and any applicable late fees. By outlining the agreed-upon payment conditions, you ensure that both parties have the same expectations. If there are any penalties for late payments, they should be stated in accordance with the law to ensure they are enforceable.

3. Reflect Applicable Taxes

Depending on your location and the nature of your business, you may need to apply taxes to your charges. Make sure to include any relevant taxes, such as VAT or sales tax, and clearly indicate the tax rate on the document. Failure to account for taxes correctly can lead to legal issues or audits from tax authorities.

4. Include a Unique Reference Number

Each request for payment should have a unique reference or identification number. This makes it easier to track and manage records for both parties. It also serves as a way to differentiate between different transactions if there is ever a need to refe

How an Invoice Template Saves Time

Creating a request for payment from scratch each time can be a time-consuming process, especially for small business owners or independent contractors. By utilizing a pre-designed structure, you can eliminate much of the repetitive work and focus on the essential tasks. With the right system in place, you can generate documents quickly and efficiently, ensuring that you get paid promptly while saving valuable time. Here’s how having a standardized system helps:

1. Faster Document Creation

Using a pre-set format allows you to input the necessary information without starting from scratch. Instead of manually designing each section every time, all you need to do is enter your client’s details, services provided, and payment terms. This speeds up the process significantly and ensures consistency in every transaction.

2. Reduces Errors and Omissions

When you rely on a consistent layout, you reduce the likelihood of forgetting important details. A standardized structure ensures that all the necessary fields, such as payment terms, tax rates, and your business information, are always included. This reduces errors and the need for corrections, saving time and avoiding confusion with clients.

3. Streamlines Record-Keeping

By using the same format for each request for payment, you can easily track and organize your financial records. You’ll have a clearer overview of past transactions, which can help during tax season or when reviewing financials. The consistency makes it easier to manage your documents and retrieve them whenever needed.

4. Customizable for Different Clients

A good pre-made structure can be easily adjusted to meet the needs of different clients. Whether you’re billing for a one-time project or a recurring service, you can simply modify the necessary details without altering the entire document. This level of customization makes it adaptable to various business needs while still maintaining a uniform look.

5. Professional and Consistent Appearance

Having a set system in place ensures that every document sent to clients looks polished and professional. Consistency in your requests for payment reflects well on your business and builds trust with clients. A uniform layout is an important aspect of creating a cohesive brand image and can contribute to a positive client experience.

| Time-Saving Benefit | How it Helps |

|---|---|

| Faster Document Creation | Quickly input necessary details into a pre-set format |

| Reduces Errors and Omissions | Ensures all required fields are included, minimizing mistakes |