How to Create and Use an Invoice Template in Google Docs

Managing payments and keeping track of financial transactions is essential for any business or freelancer. A well-organized system can save valuable time and reduce the chance of errors, allowing you to focus on what really matters: growing your business. With the right tools, invoicing can be efficient, clear, and easy to handle, regardless of your industry.

Customizable documents provide a flexible way to create professional billing statements, enabling you to adapt them to your specific needs. These digital solutions offer a wide range of features to ensure accuracy and consistency, making them an ideal choice for individuals and companies alike. Whether you’re just starting out or looking to refine your current processes, a smart approach to creating financial documents can make a significant difference.

In this guide, we’ll explore how you can easily create, edit, and manage your billing records without needing complex software or expensive tools. By leveraging simple yet effective platforms, you can maintain control over your invoicing process and ensure every transaction is accurately recorded.

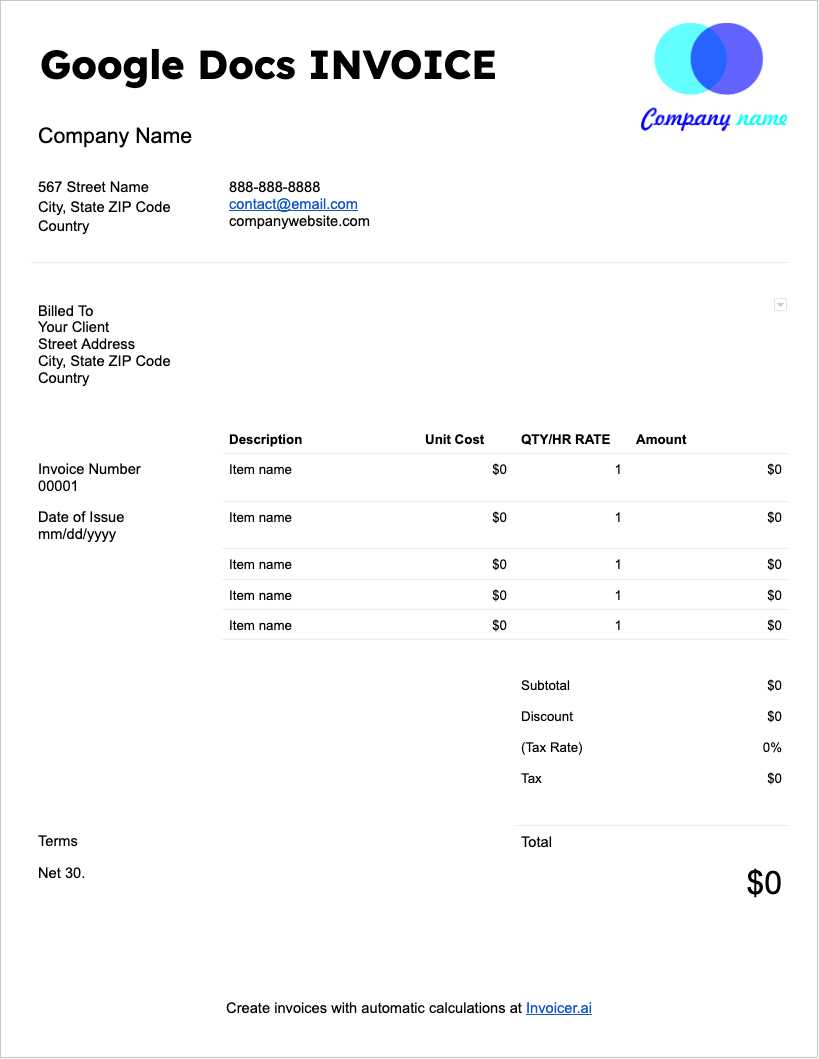

Why Use Google Docs for Invoices

Creating professional and accurate financial records doesn’t have to be complicated. Using online tools for your billing needs offers a simple, efficient way to manage transactions while ensuring that your documents are easy to customize and share. With the right approach, handling payment requests becomes less time-consuming and more organized, freeing up resources for other important tasks.

Accessibility and Collaboration

One of the main advantages of using cloud-based platforms is the ability to access your documents from anywhere. Whether you’re at the office, working from home, or traveling, you can quickly generate or update records with ease. Additionally, real-time collaboration allows you to work with clients or team members seamlessly, making edits, discussing changes, and ensuring everyone is on the same page.

Ease of Use and Flexibility

Customizability is key when it comes to creating records that suit your unique needs. These online tools offer a range of options to modify layout, fonts, and content. You can add your business logo, adjust the layout to fit your style, and save your work for future use. Furthermore, since these platforms are intuitive, even those with limited technical skills can create professional-looking financial documents without difficulty.

Additionally, integration with other software makes it easier to track and manage your transactions over time. By storing your records in the cloud, you eliminate the need for manual backups and reduce the risk of losing important data due to device failures.

Benefits of Customizing Invoice Templates

Personalizing your billing documents offers several advantages, from enhancing professionalism to streamlining the entire payment process. Tailoring each document to fit your business’s identity and specific needs ensures consistency and clarity, making it easier for both you and your clients to understand the terms of each transaction. This approach can also help establish a strong brand presence while simplifying repetitive tasks.

Improved Professionalism

Customizing your documents gives them a polished and professional appearance, which can build trust with your clients. By incorporating your company’s logo, colors, and branding elements, you create a cohesive look that reflects your business’s identity. A professional-looking statement not only strengthens your brand but also shows clients that you are organized and detail-oriented, which can lead to better relationships and repeat business.

Time Savings and Efficiency

Another significant advantage of personalizing your billing statements is the time saved on repetitive tasks. By creating a base document that fits your preferred layout and design, you can easily update the details for each transaction without starting from scratch. This streamlined process saves valuable time, especially for businesses that need to generate multiple records regularly.

Consistency is also a key benefit. With customized documents, you ensure that every record is formatted in the same way, making them easier to read and review. Whether you’re sending out invoices weekly or monthly, having a consistent structure helps to minimize errors and ensures all necessary information is included in every statement.

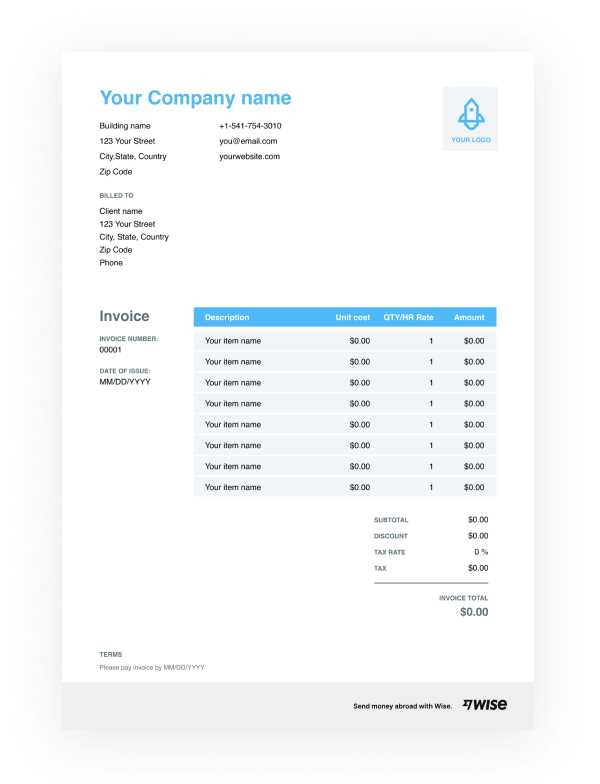

How to Create Your First Invoice

Creating a billing statement for the first time can seem overwhelming, but with a simple structure and the right details, it becomes a straightforward task. The key is ensuring that all essential information is included and presented clearly. Once you understand the basic components, you’ll be able to generate accurate records quickly and efficiently, even as a beginner.

Here’s a step-by-step guide to help you get started:

| Field | Description | |||

|---|---|---|---|---|

| Your Business Information | Include your name, address, phone number, and email address to make it easy for clients to contact you. | |||

| Client Information | Ensure your client’s name, company (if applicable), and contact details are clearly listed. | |||

| Transaction Date | Indicate the date the goods or services were provided. This is crucial for accurate record-keeping. | |||

| Details of Goods or Services | Describe what was provided, including quantities, rates, and any relevant descriptions. | |||

| Total Amount Due | Clearly state the total amount due, including any taxes, discounts, or additional fees. | |||

| Payment Terms | Specify when payment is due, including any late fees or discounts for early payment. |

| Client Name | Service Provided | Billing Cycle | Next Payment Due | Status |

|---|---|---|---|---|

| Client A | Web Hosting | Monthly | December 1, 2024 | Pending |

| Client B | Consulting | Quarterly | January 15, 2025 | Paid |

| Client Name | Amount Due | Due Date | Payment Date | Status |

|---|---|---|---|---|

| Client A | $500 | December 1, 2024 | December 5, 2024 | Paid |

| Client B | $300 | December 15, 2024 | Pending | |

| Client C | $700 | January 10, 2025 | Pending |

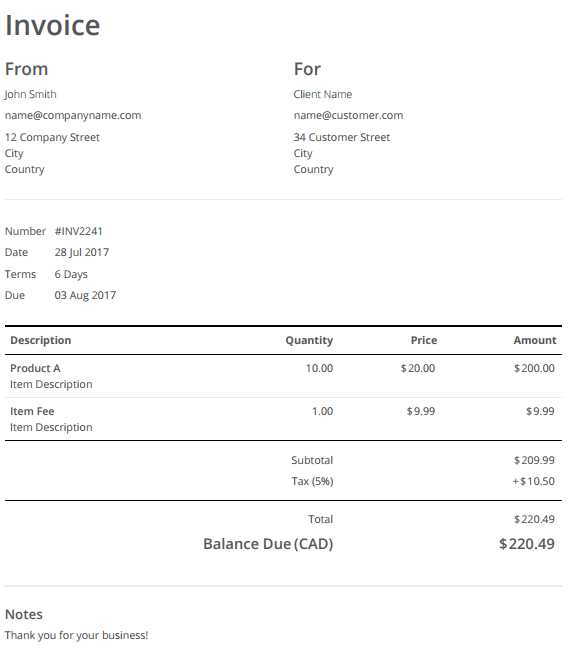

Updating Payment Status

Once payments are made, you can easily update the payment date and mark the status as “Paid”. This simple tracking system will give you a clear overview of outstanding balances an

Integrating Google Sheets for Invoice Management

Managing payment records and tracking financial transactions can be a complex task, especially as your business grows. Using a spreadsheet application to organize and manage these documents can help simplify the process. By integrating this tool with your payment tracking system, you can efficiently handle the details of your transactions, from generating requests to keeping track of payments received. Below are some steps on how to leverage a spreadsheet for seamless management of your financial records.

Setting Up Your Spreadsheet for Payment Management

To get started with integrating a spreadsheet into your billing process, follow these steps:

- Organize Data into Columns: Set up your spreadsheet with clear columns for client name, transaction date, service provided, amount due, payment due date, and payment status.

- Use Formulas for Calculations: You can create formulas to automatically calculate totals, overdue amounts, or track outstanding balances, which will save you time and reduce the risk of manual errors.

- Conditional Formatting: Use conditional formatting to highlight overdue payments or status updates. For example, you can set cells to turn red if the payment date has passed without payment, making it easy to identify overdue accounts.

Benefits of Using Spreadsheets for Managing Payments

- Real-Time Updates: Cloud-based spreadsheets allow you to make real-time updates, which are accessible from any device. This feature makes it easy to keep your financial records current, whether you’re in the office or on the go.

- Data Sharing and Collaboration: Sharing access to the spreadsheet with your team members or accountants can improve collaboration. Everyone can track updates and manage payment statuses without needing multiple versions of the same file.

- Efficient Tracking: By using filters and sorting features, you can easily track client payment histories, view outstanding balances, and quickly generate reports for financial analysis.

By integrating spreadsheets into your payment management process, you can save time, improve accuracy, and gain better control over your financial transactions. This approach ensures that you can efficiently monitor payments, update records, and streamline your overall workflow.

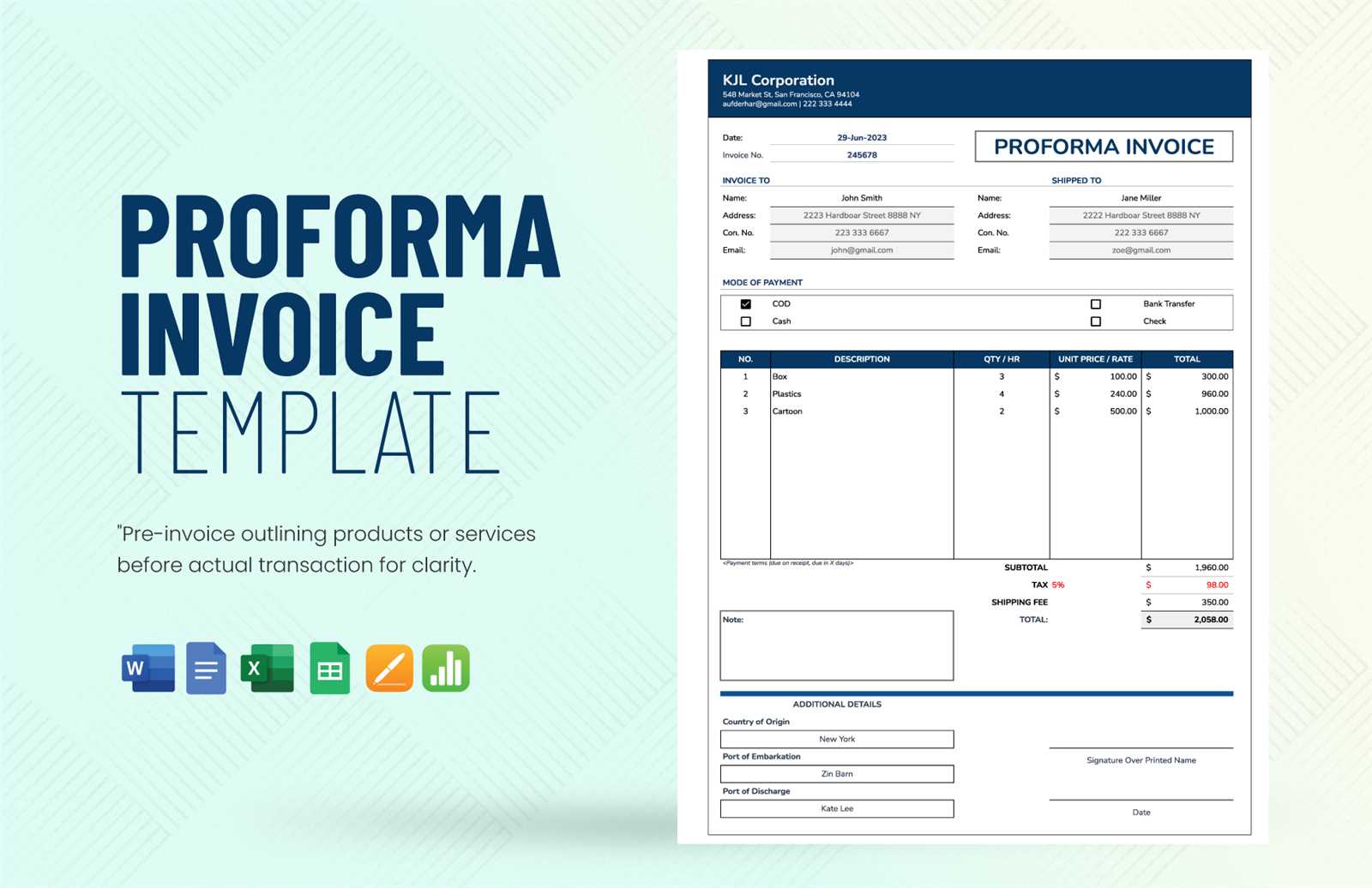

Invoice Template Alternatives for Google Docs

While many people rely on a specific document editing tool to create and manage their billing records, there are several other methods and tools available to efficiently handle this task. Whether you’re looking for an alternative that offers advanced features, easier customization, or better integration with other systems, there are multiple options to explore. Below are some alternatives that can enhance your billing process without using the usual document creation platform.

1. Microsoft Excel or Excel Online

Excel is a powerful tool for managing payment records and creating customized billing statements. The application offers a wide range of functions that allow for automatic calculations, advanced data organization, and seamless integration with other Microsoft tools. Here’s why many opt for Excel:

- Advanced Formula Capabilities: Use built-in functions to automate calculations such as totals, taxes, and discounts.

- Customization and Flexibility: Excel allows you to design highly customized documents suited to your specific needs.

- Data Analysis Features: Create pivot tables and charts to analyze payment trends or track overdue payments.

2. Accounting Software Solutions

If you need a more comprehensive solution for managing your financial records, accounting software might be a better fit. These platforms often come with pre-built features designed specifically for billing, tracking, and generating reports. Examples include QuickBooks, FreshBooks, and Zoho Books. Key benefits include:

- Automatic Billing: Set up recurring billing schedules and automate invoice generation.

- Real-Time Payment Tracking: Track payments in real-time and sync data with your bank account for easy reconciliation.

- Financial Reporting: Generate reports that summarize your earnings, o