Download Free Invoice Template for Word and Simplify Your Billing

Creating professional and organized billing documents is essential for maintaining a smooth financial operation. Having a reliable tool to quickly generate these records saves time and reduces errors, helping businesses and freelancers present themselves as trustworthy and efficient. A well-structured document can ensure clarity and improve the payment process for both parties involved.

There are various options available to help streamline this task, allowing you to customize and adjust the details according to your specific needs. By utilizing an editable file format, you can quickly input your data, adjust designs, and ensure that all necessary information is included. Whether you’re running a small business or working as a freelancer, using the right tool can greatly simplify this aspect of your daily routine.

Customizable documents provide flexibility while maintaining a professional appearance. The ability to personalize each bill allows you to add unique branding elements, making your communications stand out. Additionally, by choosing a platform that supports easy editing and formatting, you can create high-quality records without the hassle of complicated software or time-consuming procedures.

Invoice Template Free Word Download

Accessing editable billing documents can significantly simplify the process of creating professional payment requests. With customizable options available, users can quickly generate clear and accurate records that meet their specific needs. Having a readily available, easy-to-use format ensures that the creation process is efficient and that all necessary information is included for proper documentation.

How to Access Editable Billing Documents

Many platforms offer downloadable options for customizable billing sheets. These are typically provided in a format that allows users to input data with minimal effort. Once downloaded, the documents can be easily modified to reflect different amounts, dates, and details relevant to each transaction. This flexibility is especially helpful for those who need to manage multiple accounts or projects.

Features of Customizable Billing Sheets

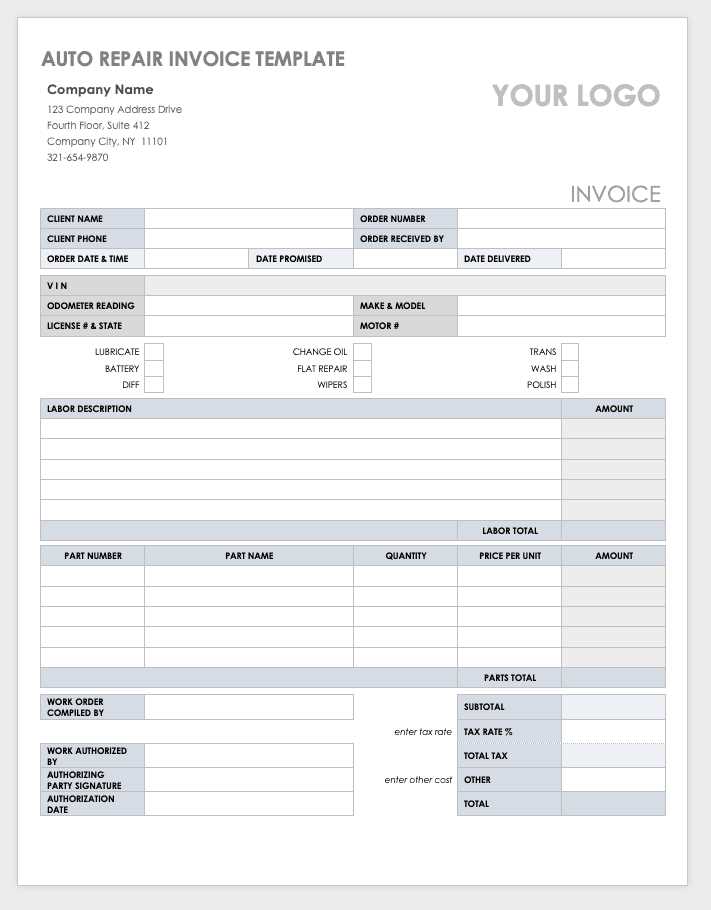

When selecting the right option, it’s important to look for features that allow for quick adjustments and easy formatting. Common features include editable fields for services or products, clear areas for dates and amounts, and the ability to incorporate branding elements such as logos or color schemes. A simple and professional design can enhance the clarity and presentation of your request for payment.

| Feature | Description |

|---|---|

| Custom Fields | Ability to edit service details, dates, and amounts. |

| Branding Options | Option to add logos, colors, and personalized text. |

| Professional Design | Clear, easy-to-read format for smooth transactions. |

| Editable Format | Quick adjustments with no need for advanced software. |

Choosing the right format ensures that your payment requests are both functional and visually appealing, helping you maintain a professional image in all your business transactions.

Why Use a Free Invoice Template

Utilizing pre-designed billing documents can greatly simplify the process of generating accurate and professional payment requests. Instead of creating such documents from scratch, ready-made, editable formats offer a quick and efficient solution. These options are designed to save time and ensure that all necessary information is clearly presented, making them invaluable for both small businesses and independent contractors.

Time and Cost Efficiency

One of the key advantages of using an accessible document format is the amount of time it saves. Instead of designing and formatting a record from the ground up, you can focus on entering specific transaction details. This reduces the time spent on administrative tasks, allowing you to allocate more time to your core business activities. Additionally, these easily available files eliminate the need for expensive software or tools, making it a cost-effective solution.

Professional Appearance

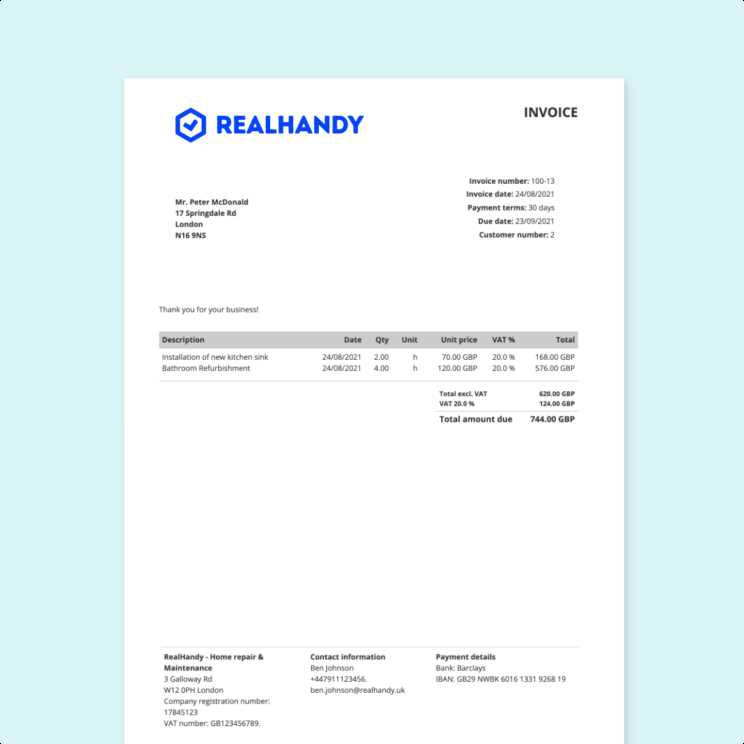

Pre-designed records are crafted to reflect a polished and organized image, which can help foster trust with clients. A clean and structured layout ensures that your request for payment is easily understood and reflects professionalism. With customizable elements, you can also personalize the document to match your brand, further enhancing your image.

Incorporating well-organized documents into your workflow ensures clarity, enhances professionalism, and improves communication with clients. Whether for one-time projects or ongoing services, using a reliable and customizable format streamlines the entire billing process.

Benefits of Customizing Your Invoice

Personalizing your payment request forms offers a range of advantages that go beyond basic functionality. By tailoring the document to suit your specific needs, you not only enhance its relevance but also present a more professional and cohesive brand image. Customization allows you to adapt each record to reflect the nature of the transaction, adding clarity and precision to the billing process.

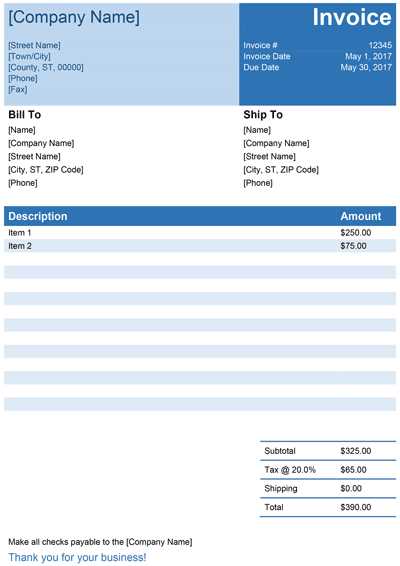

Increased Professionalism and Branding

When you design a payment document that aligns with your company’s branding, it helps create a consistent and professional image. Including elements such as your logo, color scheme, and business contact information communicates a sense of credibility and organization. A well-branded document adds to the perception that your business is serious and trustworthy, which can make a positive impact on clients.

Enhanced Clarity and Accuracy

Customizing the layout of your billing document allows you to structure the information in a way that makes the most sense for your specific transactions. By prioritizing key details like payment terms, service descriptions, and amounts due, you reduce the likelihood of confusion. Clear, well-organized records help ensure that both you and your client are on the same page, improving communication and reducing the risk of disputes.

By personalizing your billing forms, you can streamline your financial processes, present a more polished appearance, and improve overall accuracy. Whether you’re an entrepreneur or a freelancer, the ability to adapt your documents to your unique needs is an invaluable tool for maintaining professionalism and efficiency in your business dealings.

How to Download Invoice Templates for Word

Finding and obtaining editable billing documents is a simple process that can be done in just a few steps. These ready-made formats can be accessed from various online sources, offering a wide range of styles and layouts to suit your business needs. By following these steps, you can easily get the right document for creating professional payment requests without hassle.

Steps to Obtain Editable Billing Forms

To begin, follow these straightforward steps to access the right format:

- Visit a reputable website offering customizable documents.

- Browse through the available options and select the layout that fits your needs.

- Choose the appropriate file format that works with your preferred software.

- Click the download link or button to obtain the document.

- Save the file to your device, making it easy to access whenever needed.

Where to Find Editable Billing Documents

There are numerous websites that provide these formats at no cost. Some of the most popular platforms include:

- Business tool websites offering various document solutions.

- Freelancer resources that cater specifically to independent contractors.

- Template sharing platforms that offer a variety of file formats for different needs.

By selecting a trustworthy source, you ensure that you get a high-quality, secure file that can be easily modified according to your requirements. Once downloaded, the document can be quickly customized and ready for use in your next billing cycle.

Choosing the Right Invoice Template

Selecting the right document for generating payment requests is essential for ensuring clarity, professionalism, and efficiency in your financial dealings. The correct layout should not only meet your business needs but also reflect your brand identity. Whether you’re a freelancer, small business owner, or working within a larger organization, choosing the appropriate design and format can make a significant impact on the perception of your services.

Key Features to Consider

When selecting the right option, there are a few important factors to keep in mind:

- Clarity and Simplicity – The layout should be easy to read, with clearly defined sections for item descriptions, payment terms, and amounts.

- Customization Options – Choose a document that allows you to add your logo, contact details, and customize text fields to suit your business needs.

- Professional Design – Ensure that the overall design looks polished, with a modern and professional appearance that represents your brand effectively.

- Compatibility – Make sure the format you select is compatible with your software, allowing you to make edits quickly and easily.

Tailoring Your Document for Specific Needs

While many options are available, consider your business model when choosing the right document. For instance, if you’re working on long-term projects, you may want a format with space for detailed service descriptions and payment schedules. On the other hand, if you’re dealing with one-off transactions, a simpler layout might be more appropriate. Customizing your document to suit your unique requirements ensures that the final result is not only functional but also aligned with your brand’s values.

By carefully selecting and adjusting your document, you can create a billing system that enhances professionalism, reduces errors, and promotes better communication with your clients.

Understanding Basic Invoice Elements

To create clear and professional payment requests, it’s important to understand the key components that make up these documents. Each section serves a specific purpose, ensuring that both the business and the client have a clear understanding of the transaction details. Knowing what information to include and how to structure it is essential for generating accurate and effective payment records.

Essential Information to Include

Regardless of the format you use, there are a few critical pieces of information that must be included in every document:

- Business Details – This includes your company or personal name, address, and contact information to make it clear who is issuing the request.

- Client Information – You must also include the client’s name and contact information so that both parties are clearly identified.

- Unique Identification Number – A reference number is important for tracking and organizing records.

- Itemized List of Services or Products – Detail each item or service provided, along with quantities and pricing, to avoid confusion.

- Payment Terms – Include payment due dates, methods, and any applicable late fees to establish clear expectations.

- Total Amount Due – Clearly state the total sum owed, including any taxes or discounts, to avoid any ambiguity.

Formatting for Clarity

When laying out these elements, it’s important to prioritize readability and organization. Clear headings, neat columns, and appropriate spacing can make a significant difference in how easily the document is understood. Proper formatting ensures that clients can quickly find and verify the information they need, making the entire billing process more efficient and professional.

By understanding and properly incorporating these basic elements, you can create documents that are not only functional but also reflect well on your business practices. Keeping things clear, concise, and well-structured will help avoid misunderstandings and promote smoother transactions.

Top Features to Look for in Templates

When selecting a document for generating payment requests, it’s important to consider the features that will make the process smoother and more efficient. The right features can save time, ensure accuracy, and present a polished, professional appearance. Below are some key attributes to look for when choosing the perfect format for your billing needs.

Key Features for Efficiency and Professionalism

The ideal billing document should include several essential features to streamline the creation process and ensure clarity. Consider the following:

- Customizable Fields – The ability to easily edit text fields allows you to personalize each document for different transactions or clients.

- Itemized Sections – A clear breakdown of goods or services provided helps avoid confusion and provides transparency for both parties.

- Branding Options – Look for designs that allow you to incorporate your business logo, color scheme, and contact details, helping to maintain a professional image.

- Automated Calculations – Some documents come with built-in formulas that automatically calculate totals, taxes, and discounts, reducing the chances of manual errors.

- Clear Payment Terms – A section that clearly displays payment deadlines, methods, and any applicable late fees ensures mutual understanding between you and your client.

Design and Layout Considerations

In addition to functional features, design plays an important role in how your document is perceived. A clean, modern layout will make your records easier to read and more visually appealing. Look for the following design elements:

- Minimalist Design – A simple and clean structure makes it easy for clients to quickly locate important information.

- Logical Flow – Ensure that the document sections are logically organized, with headings that guide the reader through the payment request.

- Responsive Design – Choose a format that displays well on both printed and digital copies, ensuring consistency across different mediums.

By focusing on these essential features, you can ensure that your payment requests are not only efficient and accurate but also reflect a professional image, fostering trust and clarity with your clients.

How to Edit an Invoice in Word

Editing a payment request document is a simple and efficient process when you have the right tools. The ability to modify details like dates, amounts, and service descriptions ensures that each document is accurate and tailored to the specific transaction. Using a familiar software program for editing allows you to make changes quickly without needing advanced technical skills.

Step-by-Step Editing Process

Follow these straightforward steps to modify your document:

- Open the Document – Start by opening the file you want to edit. If it’s saved on your device, simply double-click to launch it in the appropriate software.

- Edit Text Fields – Click on any text you need to change, such as the client name, description of services, or amounts. Highlight the text and type in the new information.

- Adjust Formatting – If necessary, adjust the font size, style, or alignment to match your desired layout. You can also modify table columns or rows to better fit the content.

- Add or Remove Sections – If your payment request requires more details, you can add additional lines or sections. Conversely, if some areas are not needed, simply delete them to keep the document clean and concise.

- Update Payment Terms – Be sure to update payment deadlines, methods, and any applicable discounts or fees to reflect the current transaction.

- Save Your Changes – Once all edits are complete, save the document under a new file name to preserve the original or save over the existing file if you’re confident in the changes.

Additional Customization Options

Beyond basic editing, you may want to add personalized elements to the document, such as:

- Company Branding – Insert your company logo, adjust the color scheme, or add a custom header/footer to reflect your business identity.

- Professional Fonts – Choose professional, easy-to-read fonts that give the document a polished look.

- Custom Sections – If needed, you can add extra sections like notes or special instructions for your clients.

Editing your document is quick and easy, ensuring you can provide accurate and professional payment requests every time.

Adding Your Branding to Invoices

Incorporating your company’s branding into payment requests is a powerful way to reinforce your business identity while ensuring professionalism. Personalizing these documents with visual elements that represent your brand creates a cohesive experience for your clients. By adding logos, colors, and custom fonts, you can make your records look more polished and aligned with your company’s overall image.

Why Branding Matters

Including your branding on billing documents not only enhances the visual appeal but also communicates consistency and reliability to your clients. Here are some key benefits of integrating your business identity:

- Professional Appearance – A branded document presents a clean, cohesive look, showcasing your business as organized and trustworthy.

- Recognition – Consistent branding helps clients instantly recognize your business and builds a stronger relationship over time.

- Brand Loyalty – By regularly exposing clients to your branding, you increase the chances of building brand recognition and loyalty.

Steps to Add Branding Elements

Here are some simple steps to include your company’s branding in the document:

- Insert Your Logo – Position your company logo at the top of the page, either in the header or alongside your contact information, to ensure visibility.

- Choose Custom Colors – Use your brand’s color palette to adjust the background, headers, or text highlights for a unified design.

- Apply Business Fonts – Select fonts that match your brand guidelines to give the document a professional and cohesive feel.

- Add Your Contact Information – Include your website, phone number, and email address at the footer or header to make it easy for clients to contact you.

By adding these elements, you ensure that your payment documents are not only functional but also serve as an extension of your business, helping to enhance your brand’s image with every interaction.

How to Save and Organize Invoice Files

Properly saving and organizing payment request documents is crucial for maintaining an efficient workflow and ensuring that all records are easily accessible when needed. A clear system helps you avoid lost files, track payments, and stay on top of important deadlines. By following best practices for organizing your documents, you can ensure that your financial records remain secure and well-structured.

Best Practices for Saving Files

Here are some tips for saving your billing documents effectively:

- Use Descriptive File Names – Name your files in a way that makes it easy to identify them later. For example, use the client’s name and the date of the transaction (e.g., “JohnDoe_Invoice_2024_10_15”).

- Choose a Standard File Format – Save all documents in a common, easily accessible format such as PDF or DOCX. This ensures compatibility with most devices and software.

- Organize by Date or Client – Store files in folders categorized by date or client name for quick reference. For instance, create a separate folder for each year or client.

Effective Organizational Methods

To make your billing documents even easier to find and manage, consider the following organizational strategies:

| Organization Method | Description |

|---|---|

| Folder by Client | For each client, create a folder with subfolders for each year or transaction. This method is ideal for freelancers or businesses with repeat clients. |

| Folder by Date | Create folders for each year and subfolders for each month or quarter. This method works well for businesses that issue a high volume of records. |

| Cloud Storage | Utilize cloud-based services such as Google Drive, Dropbox, or OneDrive to store your documents, ensuring they’re accessible from any device and protected from data loss. |

Implementing a consistent system for saving and organizing your payment records helps prevent errors, ensures you have easy access to any document when needed, and provides a reliable way to manag

Making Invoices Look Professional

Creating polished and professional payment requests is essential for building trust with clients and ensuring smooth transactions. A well-designed document not only reflects the quality of your work but also reinforces your business’s credibility. Small details, such as layout, font choice, and clarity, can make a significant difference in how your clients perceive the document and, by extension, your services.

To ensure that your payment requests look polished and professional, it’s important to focus on the overall layout, consistency, and ease of understanding. The following tips can help elevate the presentation of your billing documents:

- Use Clean and Simple Design – Avoid clutter and excessive details. A clean, straightforward layout ensures that the document is easy to read and highlights the most important information.

- Consistency is Key – Stick to a uniform font style and size throughout the document. This consistency not only looks professional but also improves readability.

- Include Your Branding – Adding your business logo, colors, and contact information reinforces your brand’s identity and adds a personal touch to the document.

- Highlight Important Information – Use bold or larger fonts for key details like totals or due dates to make them stand out and avoid confusion.

- Organize Information Clearly – Ensure that all sections are well-defined, with clear headings for each part of the document (e.g., “Services Provided,” “Total Amount Due,” “Payment Terms”).

By paying attention to these elements, you can create a payment document that conveys professionalism and builds a stronger relationship with your clients, making it clear that you value both the work you provide and the way you manage your business.

Common Mistakes to Avoid in Invoices

Creating accurate and professional payment requests is essential for maintaining a smooth business operation. However, there are several common errors that can lead to confusion, delays, or even missed payments. By being aware of these pitfalls and ensuring that your documents are free from mistakes, you can streamline your billing process and maintain positive client relationships.

Here are some of the most common mistakes to avoid when creating payment documents:

- Missing or Incorrect Contact Information – Ensure that both your business and the client’s details are accurate and complete. Incorrect information can lead to confusion and delays in payment.

- Failure to Include a Unique Reference Number – Not having a reference number makes it difficult to track and organize payments. Always assign a unique number for easy identification and future reference.

- Ambiguous Payment Terms – Vague terms or unclear due dates can cause misunderstandings. Be specific about when payment is due, preferred payment methods, and any applicable late fees.

- Not Itemizing Services or Products – If you fail to clearly list the services provided or products delivered, clients may question the charges. Always break down the services or items in detail to avoid confusion.

- Incorrect Calculations – Double-check all totals, taxes, and discounts before sending out any document. Simple mathematical errors can harm your credibility and cause delays in payment.

- Failure to Proofread – Grammatical mistakes or typos can reduce the professionalism of your document. Always proofread before sending to ensur

Invoice Template for Small Businesses

For small business owners, creating and managing billing documents efficiently is key to maintaining a smooth cash flow and ensuring prompt payments from clients. A well-structured payment request is not only crucial for financial tracking but also helps project a professional image to customers. Having a standardized document that can be quickly customized for each client or transaction can save time and avoid confusion.

Using a customizable format designed specifically for small businesses provides several advantages. These documents often come with essential fields and formatting that help ensure consistency and accuracy across all financial records. By choosing a reliable design, small business owners can focus on their core tasks while ensuring their administrative processes are streamlined and professional.

Here are some benefits of using a well-organized billing format tailored for small businesses:

- Efficiency – A pre-designed document with customizable fields allows for quick updates and adjustments, saving time on manual entry.

- Professional Appearance – A polished format helps project a serious and trustworthy image, making clients feel more confident in your business.

- Consistency – Using the same format for all transactions ensures consistency, which makes it easier to track and compare records over time.

- Accuracy – With clear sections for services rendered, amounts, taxes, and totals, these documents help reduce errors and misunderstandings.

- Organization – Organizing all payment documents in one format allows for easy storage and retrieval, making it easier to maintain records for accounting or tax purposes.

By using a standardized format that fits the needs of a small business, you can simplify the billing process and focus more on growing your company while maintaining a professional image with every transaction.

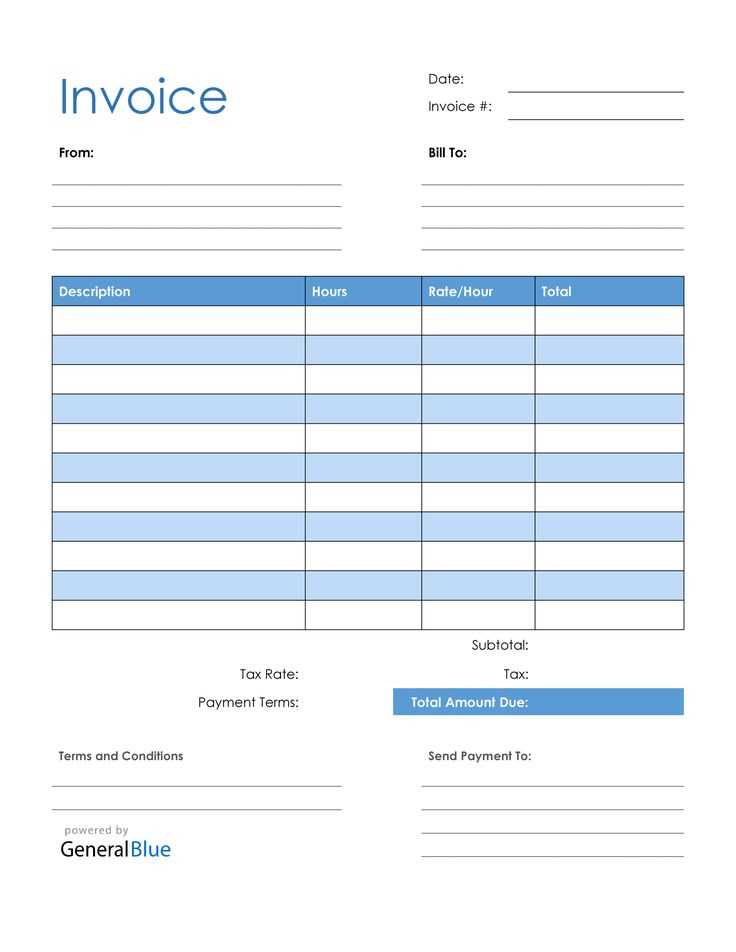

Free Invoice Templates for Freelancers

Freelancers often face the challenge of managing their own administrative tasks, including preparing and sending payment requests. Having an efficient, easy-to-use document format that can be customized for each project is crucial for keeping things organized and ensuring timely payments. With the right tools, freelancers can quickly create professional-looking billing statements, allowing them to focus more on their work and less on paperwork.

Using ready-made billing formats specifically designed for freelancers can help save time and improve the overall workflow. These formats are tailored to suit the needs of independent contractors, ensuring that essential information is always included, while maintaining a polished and consistent appearance.

Here are some key features that make these documents ideal for freelancers:

- Customizable Fields – Easily add project details, client names, hours worked, and rates, allowing you to personalize each document quickly.

- Clear Breakdown – Organized sections for each service or task, with space for additional notes, make it easy for clients to understand what they’re paying for.

- Professional Design – Ready-made formats often feature clean layouts and modern styles that project professionalism, building trust with clients.

- Time-Saving – Pre-designed formats allow freelancers to focus on their work, reducing the time spent on creating billing documents from scratch.

- Tracking and Record-Keeping – Standardized billing forms make it easier to track payments and maintain organized records for future reference or tax purposes.

By using a structured and easy-to-edit billing form, freelancers can enhance their business operations, ensure that their payment requests are clear, and avoid delays in payments. These tools make the administrative side of freelancing simpler, allowing freelancers to focus on delivering quality work to their clients.

How to Send Invoices via Email

Sending payment requests through email is a fast and efficient method for freelancers and businesses to ensure their clients receive the necessary documentation for transactions. Email allows you to deliver professional documents directly to the client’s inbox, helping to speed up the payment process. However, there are some important steps to follow to ensure that your payment documents are sent correctly and received without any issues.

Here’s how to send payment requests via email effectively:

- Attach the Document – Always attach the payment document in a commonly used format, such as PDF, to ensure it’s easy for the client to open and review.

- Write a Clear Subject Line – Make the subject line clear and direct, such as “Payment Request for [Project Name] – [Due Date]”. This helps the client quickly identify the purpose of the email.

- Include a Professional Message – In the body of the email, briefly introduce the attached document, mention the due date, and provide any necessary instructions or payment details. Keep the tone polite and professional.

- Check for Errors – Before hitting “send,” carefully review both the email body and the attached document for any mistakes, such as incorrect amounts or typos.

- Use a Clear File Name – Name the document something clear and specific, such as “[Client Name]_[Project]_Invoice_[Date].pdf,” to avoid confusion and make it easy for clients to locate the file later.

- Confirm Delivery – After sending, follow up with the client if needed to confirm receipt of the payment request and address any questions they may have.

By following these steps, you ensure that your payment requests are delivered professionally, making it easier for your clients to process payments on time. This method also reduces the need for physical paperwork, streamlining the entire process for both parties.

When to Use a Printable Invoice

In today’s digital age, many businesses and freelancers opt for electronic methods of sending payment documents. However, there are still situations where having a physical version of a payment request is necessary or beneficial. Whether it’s for legal reasons, client preference, or certain industries, knowing when to use a printable document is important to maintaining professionalism and ensuring timely payments.

Here are some scenarios when opting for a printed document might be the best choice:

Scenario Reason for Using Printable Version Client Requests Physical Copies Some clients may prefer to keep a hard copy for their records, particularly in industries where paperwork is the norm, such as legal or construction. Offline Transactions For businesses that deal in cash or check payments, providing a physical document helps with transparency and record-keeping. Compliance with Regulations Certain industries or jurisdictions may require hard copies for tax purposes, audits, or legal compliance. Mailing or Hand Delivering If you need to physically mail a payment document or hand it over to a client, a printable document is necessary for the transaction. While electronic methods of submitting documents are faster and more efficient in many cases, understanding when a printed version is necessary ensures that you can meet your client’s needs and comply with industry requirements. By offering both options, you can maintain flexibility and professionalism in your billing processes.

Legal Considerations for Invoices

When preparing payment requests, it’s essential to consider the legal requirements and regulations that may apply to your documents. Properly structured and legally compliant payment records can help protect both your business and your clients in case of disputes, audits, or legal proceedings. Understanding what should and shouldn’t be included, as well as the format of these documents, is crucial for ensuring smooth transactions and maintaining professional standards.

Several legal aspects should be taken into account when creating and sending billing statements. Below are some key considerations to keep in mind:

Essential Information for Legal Compliance

Required Information Purpose Business Information Include the full name, address, and contact details of your business. This is essential for identification and legal clarity. Client Information Clearly state the client’s name or business name, address, and contact details for identification and to ensure accurate record-keeping. Unique Reference Number A unique identifier or reference number for each document helps in tracking, organizing, and managing payments for legal and organizational purposes. Clear Payment Terms State the due date, late fees (if applicable), and payment methods to avoid disputes over payment deadlines or accepted methods. Tax Information Ensure that your business’s tax identification number (TIN) and any relevant sales tax rates are included, as required by local regulations. Maintaining Legal Protections

In addition to including all necessary information, it’s important to be mindful of how payment documents are handled and stored. Retaining accurate records and keeping a copy of each transaction can protect you in the event of a dispute or audit. Furthermore, clearly stating payment terms, delivery dates, and agreed services helps to ensure both parties are on the same page and can avoid future legal complications.

By taking the necessary legal considerations into account, businesses can avoid common pitfalls and ensure that their payment records are not only professional but also compliant with industry regulations.

Other Tools for Invoice Management

Managing payment requests and tracking financial transactions can be a complex and time-consuming task. However, there are various tools and software available that can help streamline the process, making it more efficient and less prone to errors. These tools not only assist with creating and sending billing documents but also provide features for tracking payments, automating reminders, and organizing financial records, all in one place.

Here are some popular tools that can aid in managing billing documents and improving overall financial workflow:

- Accounting Software – Comprehensive platforms such as QuickBooks, Xero, or FreshBooks offer integrated billing solutions that allow users to create, send, and track payment requests. They often include features for expense tracking, financial reporting, and tax preparation, making them ideal for both small businesses and freelancers.

- Payment Gateways – Services like PayPal, Stripe, or Square provide not only payment processing but also tools for creating and managing payment records. These platforms allow businesses to send electronic bills, receive online payments, and easily reconcile transactions.

- Project Management Tools – Tools like Trello, Asana, and Monday.com allow businesses to manage tasks, timelines, and client communication. While they are not directly designed for creating payment documents, they can be integrated with billing systems, helping track project progress and facilitate smoother invoicing at the end of a project.

- Document Automation Tools – Platforms like PandaDoc or DocuSign allow users to create professional documents, including payment requests, with customizable fields. They also provide the ability to sign documents electronically, streamlining the entire process of document exchange and approval.

- Spreadsheet Software – Programs like Microsoft Excel or Google Sheets can be used for basic invoice management. While these are not as advanced as dedicated invoicing software, they offer customization and tracking features, making them a good choice for those just starting out or running a small operation.

By utilizing the right combination of these tools, businesses and freelancers can automate much of the invoicing process, ensuring accuracy, reducing administrative workload, and improving cash flow management. Whether you’re managing a few clients or many, these tools can significantly enhance efficiency and professionalism in your bil