How to Use an Invoice Template Form for Effortless Billing

Efficient billing is essential for smooth business operations, ensuring that transactions are recorded accurately and payments are received on time. Creating professional documents for each service or product sold can be time-consuming, but using the right tools can simplify the process significantly. With a well-designed solution, you can save time, reduce errors, and improve your overall workflow.

Customizable templates allow businesses to generate clear, organized statements quickly, providing essential details to both clients and the company. Whether you are an entrepreneur or managing a larger enterprise, having a standardized document for invoicing helps maintain consistency and professionalism in every transaction.

From including payment terms to listing services provided, a well-structured bill ensures that all necessary information is conveyed. This not only enhances transparency but also helps prevent misunderstandings between parties. By understanding how to create and use these documents effectively, you can focus more on growing your business and less on administrative tasks.

Understanding Invoice Template Forms

Efficient financial documentation plays a crucial role in the smooth functioning of any business. Having a well-structured document to record transactions ensures clarity and consistency while helping both parties involved in the exchange of goods or services. With the right tool, businesses can automate and streamline the billing process, avoiding errors and delays.

Key Components of a Billing Document

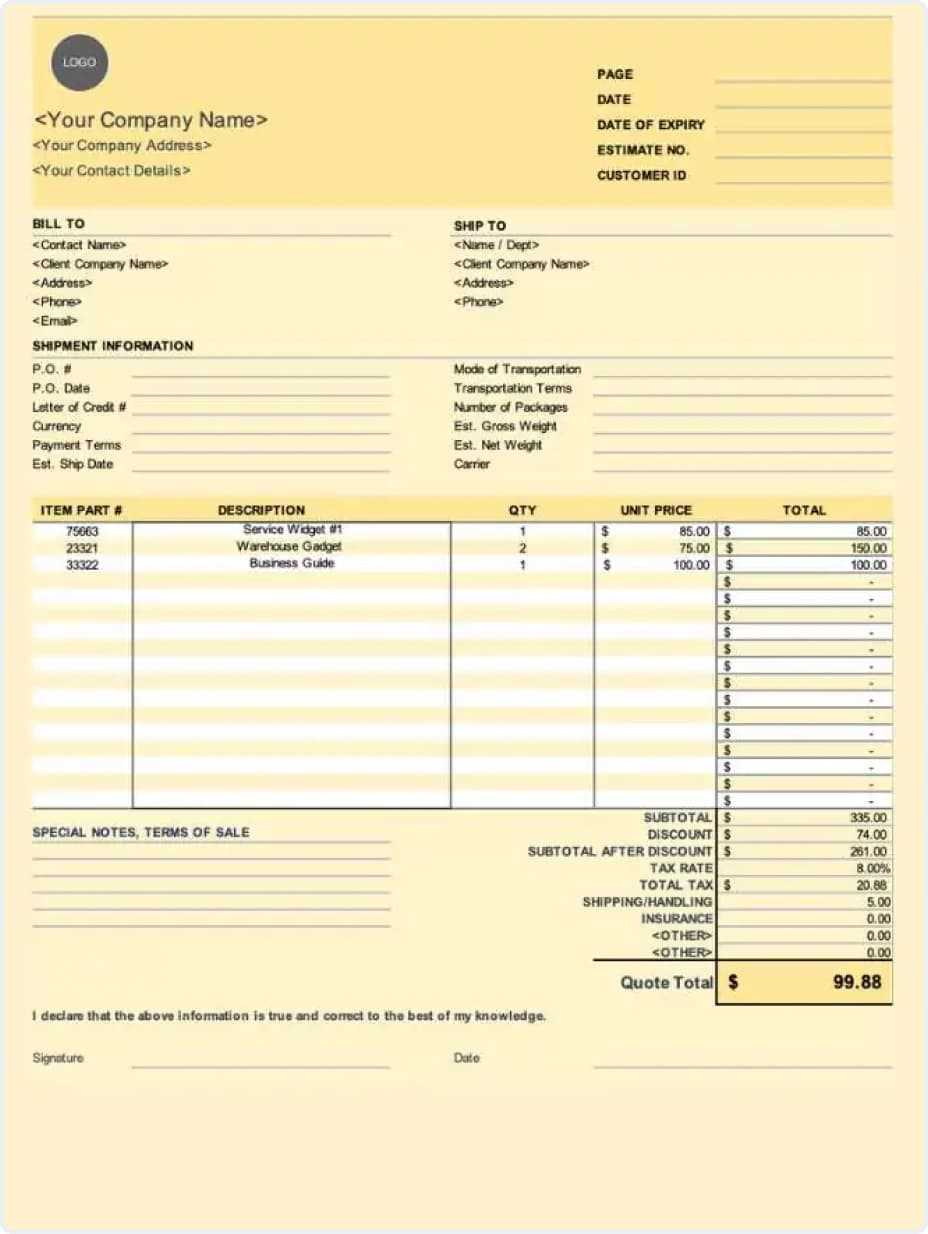

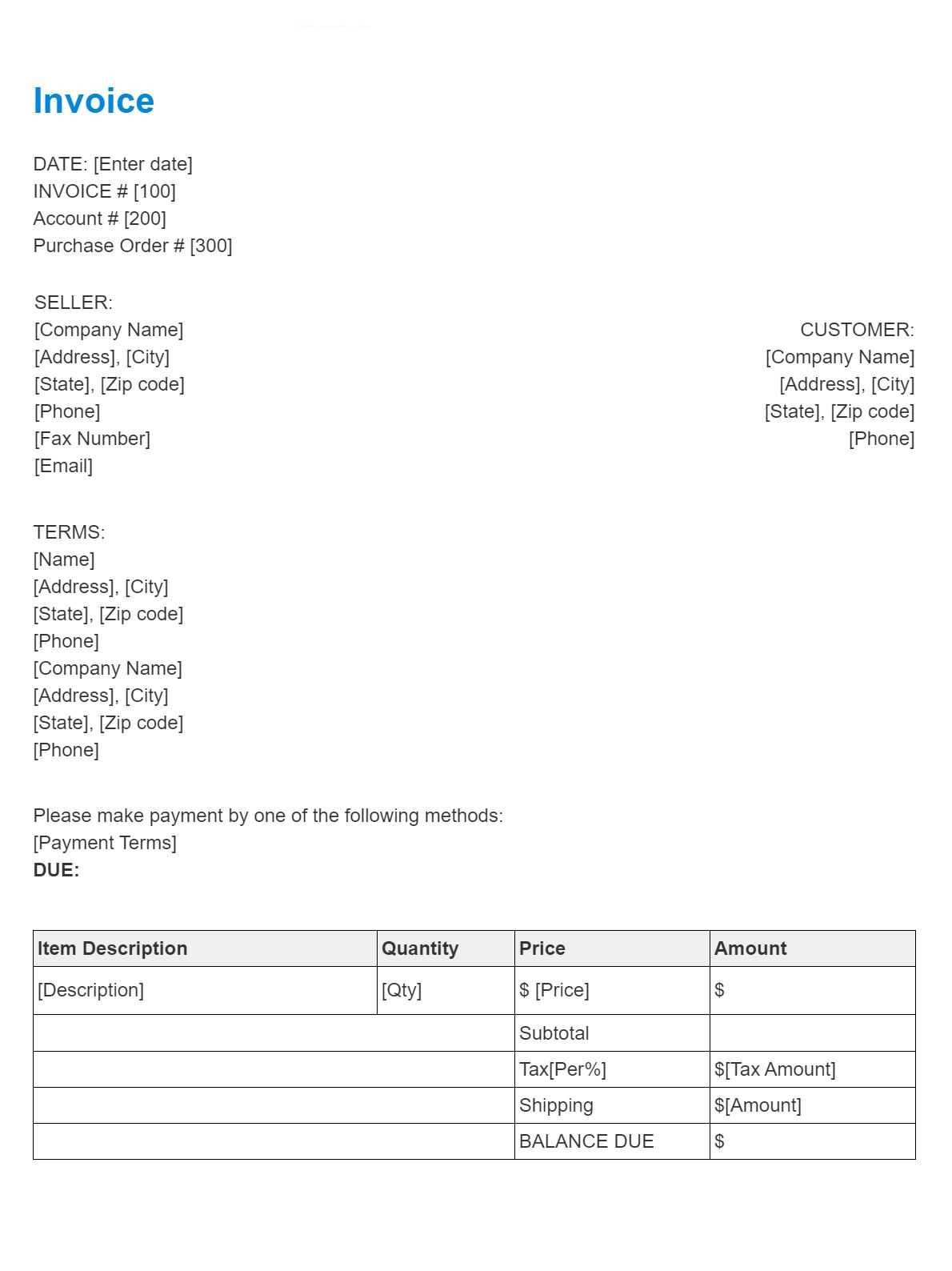

A comprehensive document should include several essential elements to guarantee clarity and ensure the transaction is fully understood. Each section serves a specific purpose, providing important details such as contact information, itemized lists of goods or services, and payment instructions. Below are the key components that should be included in any billing document:

| Component | Description |

|---|---|

| Business Information | Includes the company name, contact details, and legal address. |

| Recipient Details | Lists the name, address, and contact info of the customer or client. |

| Itemized List | A detailed breakdown of the products or services provided, including prices. |

| Payment Terms | Includes the due date, payment method, and any applicable late fees. |

| Total Amount | The total sum due after including taxes, discounts, and other adjustments. |

How Structured Documents Improve Efficiency

Using a standardized document for every transaction simplifies the overall process and reduces the chances of mistakes. With all necessary fields pre-designed, businesses can focus on adjusting only the unique details of each sale, such as pricing or quantity, without having to manually create a document from scratch each time. This approach enhances productivity, reduces administrative costs, and ensures compliance with financial best practices.

Why Use an Invoice Template

Maintaining consistency in financial documentation is vital for any business. Having a predefined structure to record transactions not only speeds up the process but also ensures that all necessary details are included each time. By using a structured layout, businesses can create accurate and professional records without the need to reinvent the wheel for every transaction.

Standardization is one of the primary benefits of using a set framework. A consistent approach helps avoid mistakes such as missing information or incorrect calculations. With pre-defined fields, all you need to do is enter the relevant details, reducing human error significantly.

Time-saving is another key advantage. Rather than starting from scratch each time, businesses can quickly modify an existing structure for each transaction. This is particularly useful for businesses with frequent billing cycles, as it reduces the time spent on administrative tasks and allows more focus on core operations.

Types of Invoice Templates Available

There are various types of structured billing documents designed to meet the specific needs of different businesses. Each type varies in format, level of detail, and customization options, allowing businesses to select the one that best fits their particular transaction processes. Choosing the right layout can significantly improve the efficiency and professionalism of your financial documentation.

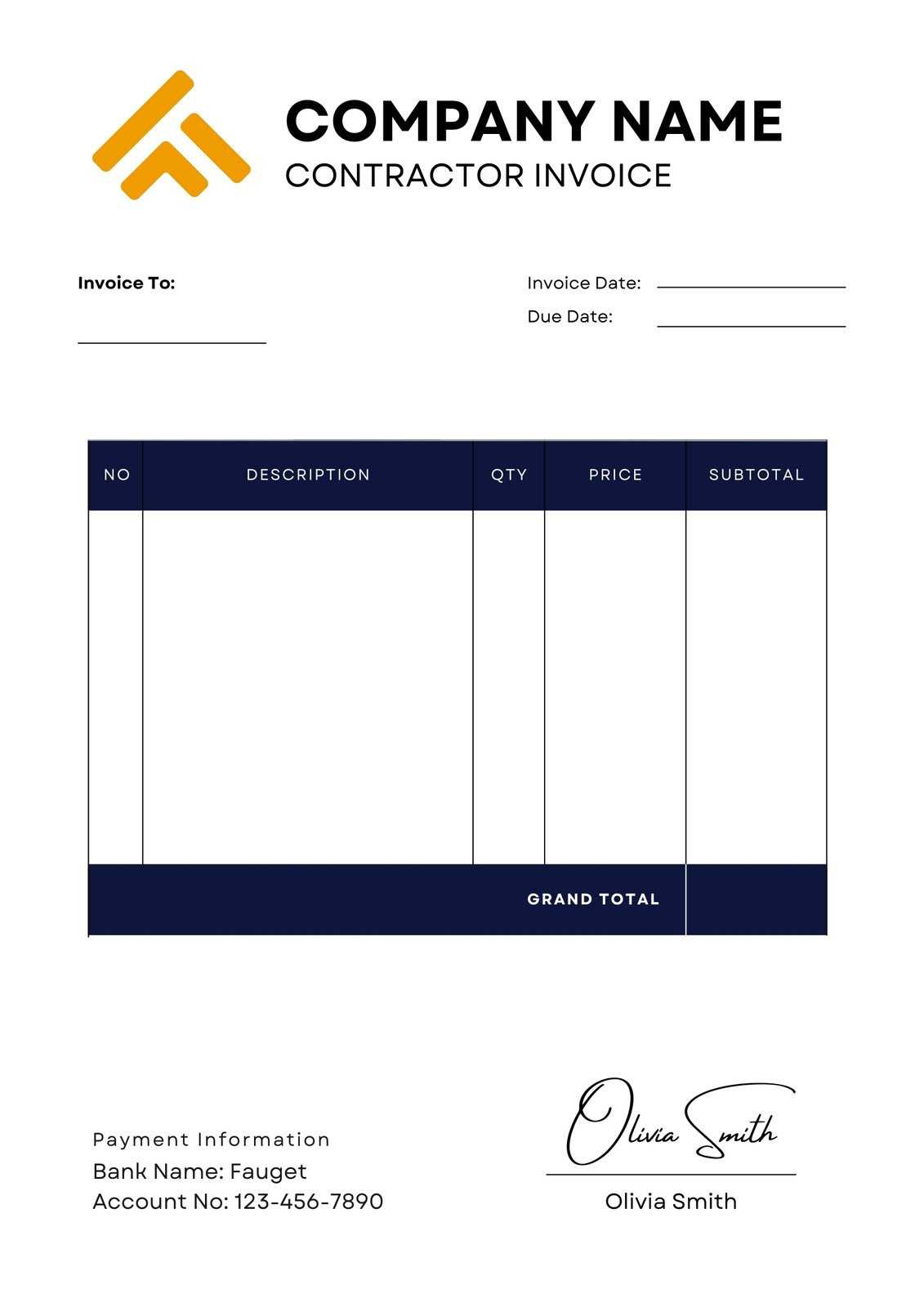

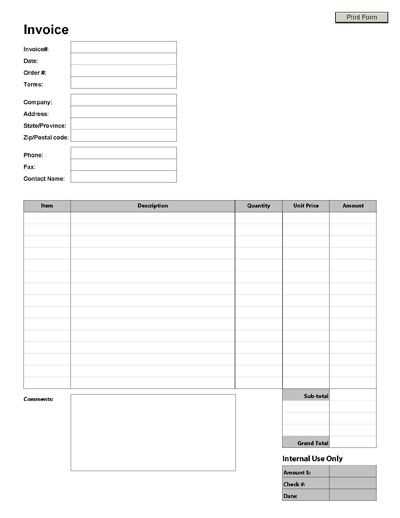

Basic Layouts are often the simplest and most straightforward option, ideal for small businesses or freelancers. These documents typically include essential fields such as the recipient’s details, services provided, and total amount due. They are easy to fill out and work well for businesses with fewer items or services to bill for.

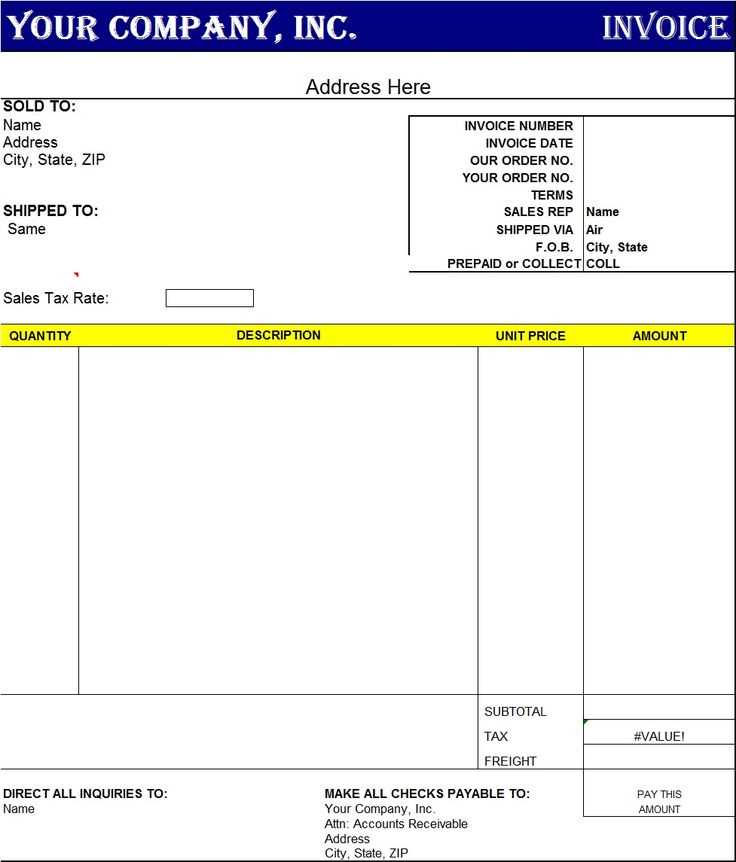

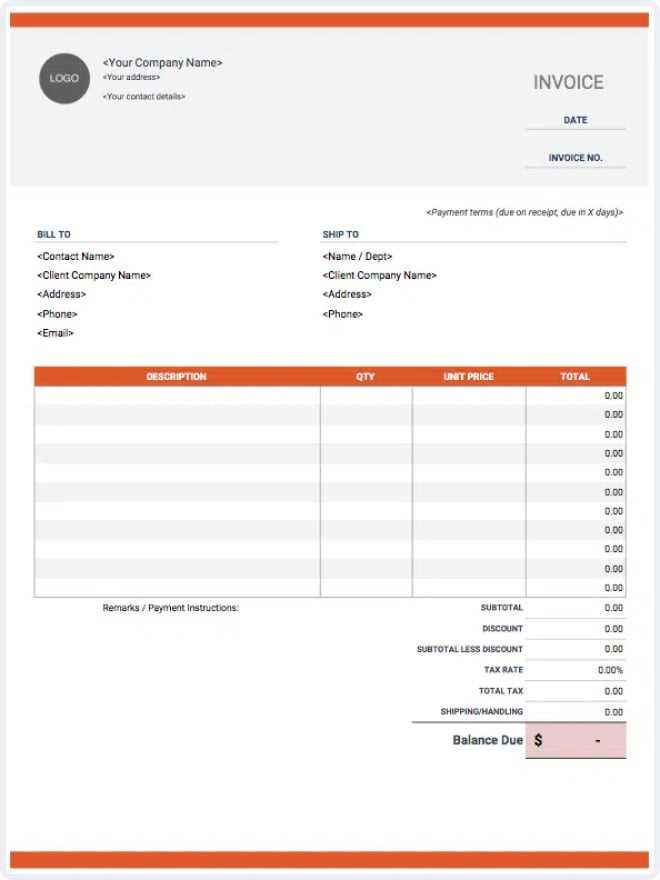

Detailed Formats include more comprehensive sections such as itemized lists, taxes, and discounts. These types are beneficial for businesses that deal with multiple products or services in a single transaction, providing a clear breakdown of each component. The added detail ensures that both parties have a clear understanding of the charges and payments.

Automated Solutions offer greater convenience by integrating with accounting software. These options allow businesses to generate and track documents more efficiently, automatically calculating totals, taxes, and discounts. This is particularly helpful for larger organizations with a high volume of transactions.

How to Create a Custom Invoice

Designing a personalized document for recording transactions allows businesses to ensure accuracy and reflect their brand’s identity. By adjusting the structure to match your business needs, you can create a streamlined and professional record for each sale or service provided. Customization also ensures that all relevant details are captured efficiently and in a format that suits your workflow.

Start with the Basics – Begin by including essential fields such as your company name, contact details, and legal information. Ensure the recipient’s name, address, and contact information are also clearly visible. These are fundamental elements that help identify both parties involved and provide context for the transaction.

Incorporate Additional Details – Depending on the nature of your business, you might need to include more specific information. This could include an itemized list of services or products provided, the quantities and prices of each, as well as any applicable taxes or discounts. By breaking down the costs in detail, both you and your customer can better understand the charges.

Finalize with Payment Instructions – Include clear payment terms such as due dates, accepted payment methods, and any penalties for late payments. These instructions help ensure timely payments and avoid misunderstandings. It’s also useful to have a unique reference number for each document to track payments and correspondence easily.

Essential Elements of an Invoice Form

For any financial record to be clear, effective, and legally sound, it must contain specific key details. These elements ensure that both parties in a transaction have a shared understanding of the agreement, payment expectations, and services or products exchanged. A well-structured document should leave no room for confusion and provide all the necessary information for prompt payment.

Basic Information

Business and Customer Details – Your document should begin with the full name, address, and contact information of both the company issuing the statement and the recipient. This ensures clarity regarding the parties involved and serves as a point of reference in case of disputes or future communications.

Document Number and Date – Each document should have a unique reference number for tracking purposes. Additionally, the issue date and payment due date must be included to avoid confusion about when payment is expected.

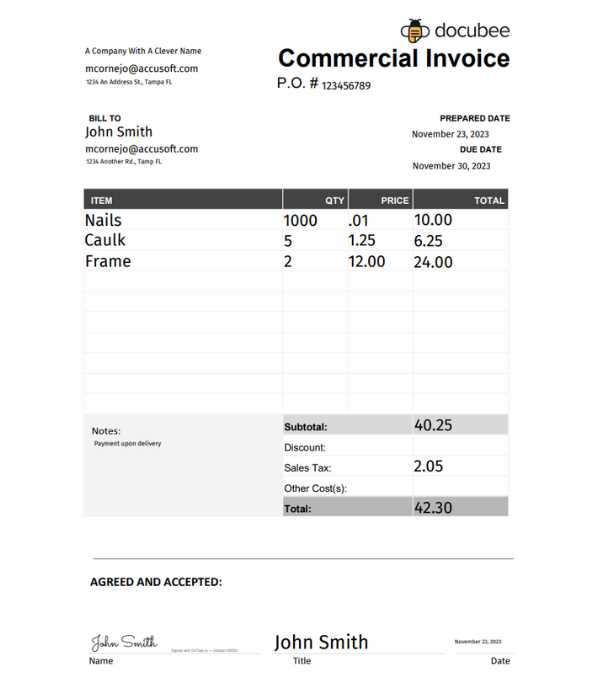

Transaction Details

Itemized List – The core of any billing document is the clear breakdown of goods or services provided. Include descriptions, quantities, unit prices, and totals for each item. This level of detail helps to prevent misunderstandings and ensures transparency in the transaction.

Total Amount Due – At the end of the document, sum up all amounts, including taxes and any discounts or adjustments. The final amount due should be clearly visible, making it easy for the recipient to identify what is owed.

Benefits of Digital Invoice Templates

Switching to electronic documents for recording transactions offers numerous advantages over traditional paper-based methods. Not only does it streamline the process, but it also enhances accuracy, reduces overhead costs, and improves the overall efficiency of your business operations. By embracing digital solutions, you can take advantage of modern technology to simplify administrative tasks.

Time Savings – One of the most immediate benefits of using digital solutions is the reduction in time spent on creating and sending documents. Pre-designed structures allow you to quickly fill in relevant details, generate documents instantly, and send them directly to clients via email or online platforms. This eliminates the need for manual calculations and reduces the risk of errors.

Cost Efficiency – Digital records eliminate the costs associated with printing, paper, and mailing physical documents. You also save on storage space, as electronic files can be stored and organized in cloud systems, making retrieval quick and simple. This reduction in overhead costs adds up significantly for small and medium-sized businesses over time.

Improved Accuracy and Consistency – Automated features in digital solutions, such as automatic tax calculations or discount applications, help ensure that your records are error-free. Additionally, using a standardized layout for each transaction guarantees consistency across all your financial documents, which fosters professionalism and reliability.

Free vs Paid Invoice Templates

When it comes to choosing the right tool for creating professional billing documents, businesses often face the decision of whether to use a free solution or invest in a paid option. Both choices come with their own set of advantages and limitations, and the right choice largely depends on the specific needs and scale of your business. Understanding the differences can help you make an informed decision that aligns with your goals.

Advantages of Free Options

Cost-Effective – The most obvious benefit of using a free solution is the cost. Many free platforms offer basic templates that allow businesses to create and send documents without spending a dime. For freelancers or small businesses just starting out, these free tools can be more than sufficient to handle basic billing tasks.

Ease of Use – Free solutions often come with simple, user-friendly interfaces that make it easy for anyone to create a document without a steep learning curve. They provide all the essential fields for basic transactions and are ideal for businesses with a low volume of transactions or straightforward needs.

Advantages of Paid Options

Customization and Features – Paid solutions typically offer more advanced features, such as customization options, automation, and integration with other business tools (like accounting software). These additional features can save time, increase accuracy, and help manage larger volumes of transactions more efficiently.

Professionalism and Branding – Premium services often allow you to fully customize the appearance of your documents, adding your company’s logo, color scheme, and brand elements. This not only enhances your professional image but also provides consistency across all your communications.

Choosing the Right Format for Invoices

Selecting the appropriate format for your billing documents is crucial for ensuring clarity and professionalism. The format you choose should align with the nature of your business, the complexity of your transactions, and your clients’ expectations. A well-chosen format can help streamline your administrative tasks, reduce errors, and create a more positive impression for your customers.

Simplicity vs. Detail

Simple Layouts – If your business typically deals with straightforward transactions, a simple format with basic fields for service description, amounts, and payment terms may be sufficient. Simple formats are quick to generate, easy to read, and are often ideal for freelancers, consultants, or small businesses with minimal product offerings.

Detailed Formats – On the other hand, businesses that offer multiple products or services, or need to account for taxes, discounts, or special terms, may require a more detailed structure. A format with more fields for itemized lists, tax calculations, and payment options helps ensure all details are accurately captured, leaving less room for confusion or miscommunication.

Digital vs. Paper Formats

Digital Formats – Digital billing documents are becoming increasingly popular, as they allow for easy customization, faster delivery, and easier storage. These formats can be sent electronically via email or through payment platforms, making them more convenient for both the business and the customer.

Paper Formats – Although digital formats are widely used, some businesses or clients may prefer or require physical copies. If this is the case, ensure that your document is well-organized and printed clearly. While printing may incur additional costs, it can still be an important option in certain industries or geographical locations.

How to Edit an Invoice Template

Editing a pre-designed billing document allows businesses to tailor each record to their specific needs. Customizing the structure helps ensure that every transaction is accurately captured, including all the necessary details. Whether you’re adjusting basic information or adding complex data fields, the process is straightforward and can be done in just a few steps.

Follow these simple steps to make adjustments to your billing document:

- Choose Your Editing Tool: Select the platform or software that suits your needs. Common options include word processors, spreadsheet tools, and specialized online solutions. Many of these tools offer easy-to-use interfaces for quick changes.

- Update Business Information: Make sure your company’s name, address, and contact details are correct. You may also want to add a logo or adjust branding elements to match your current business identity.

- Modify Transaction Details: Edit the fields that describe the products or services provided. Ensure that quantities, unit prices, and totals are accurate, and include any applicable taxes or discounts.

- Adjust Payment Terms: Review the payment due date, methods of payment, and any other relevant terms. You may need to change these if the terms have been modified or if you are working with a new client.

- Save the Document: Once all changes are made, save the updated version in the appropriate format. If you’re working with digital tools, you may want to save a copy to a cloud service for easy access later.

By regularly updating your document structure, you ensure that it remains relevant and aligned with your business processes. Whether you’re editing a single document or creating multiple versions, keeping your records organized and current helps maintain professionalism and efficiency.

Common Mistakes in Invoice Creation

Creating accurate and professional billing records is essential for maintaining healthy cash flow and good client relationships. However, even with the best intentions, mistakes can occur during the creation process. These errors can lead to confusion, delayed payments, and damage to your business’s reputation. It’s important to be aware of the most common pitfalls and how to avoid them.

Missing or Incorrect Information

One of the most frequent issues businesses face is failing to include all the necessary details or providing inaccurate information. Here are some common mistakes in this area:

- Incorrect Contact Details: Ensure that both your business’s and the client’s contact information are up to date and accurate.

- Missing Dates: Forgetting to include the issue date or payment due date can lead to confusion about when payment is expected.

- Incomplete Descriptions: Failing to provide a clear breakdown of the services or products provided can result in misunderstandings or disputes.

Calculation and Formatting Errors

Errors in calculations or poor formatting can also create problems, especially when clients feel that the totals are incorrect. Some common mistakes include:

- Wrong Totals: Always double-check the total amount due, especially when adding taxes or applying discounts. Use automated tools if available to avoid manual errors.

- Inconsistent Formatting: A cluttered or inconsistent layout can make it hard for clients to understand the document. Ensure that your document is clean and easy to follow.

- Missing Terms and Conditions: Not specifying payment terms or deadlines can lead to confusion and delayed payments.

By avoiding these common errors and maintaining accuracy in every document you create, you can ensure smoother transactions and maintain positive relationships with your clients.

How to Include Taxes in an Invoice

When preparing billing documents, it is important to account for taxes to ensure both accuracy and compliance with local laws. Including taxes in your financial records not only helps you stay transparent with your customers, but it also ensures that you’re meeting legal requirements. Understanding the different types of taxes and how to calculate them can simplify the process and avoid costly mistakes.

Types of Taxes to Include

Before you can calculate the tax amounts, it is essential to determine which type of taxes apply to your products or services. The most common tax types include:

- Sales Tax: This is the most common tax, typically added to the price of goods or services sold. The rate varies by location, so make sure to use the correct rate for your area or your client’s area.

- Value-Added Tax (VAT): In some countries, VAT is applied instead of or in addition to sales tax. This tax is added at each stage of the production and distribution process.

- Service Tax: Some businesses, especially those in certain service industries, may need to apply a specific service tax on their offerings.

How to Calculate and Add Taxes

Once you’ve determined which taxes apply to your transaction, follow these steps to calculate and include them:

- Determine the Tax Rate: Find the appropriate tax rate for the product or service being sold. Be sure to check whether the rate is based on the customer’s location or your own.

- Calculate the Tax Amount: Multiply the price of each item or service by the tax rate. For example, if a product costs $100 and the sales tax rate is 10%, the tax amount would be $10.

- Include the Tax Breakdown: Clearly show the tax amount in your document, listing it separately from the subtotal. This provides transparency and helps avoid any confusion for your customer.

- Show the Total Amount Due: Add the tax amount to the subtotal to calculate the total amount due. Ensure that the total is clearly visible at the bottom of the document.

Including taxes i

Tracking Payments with Invoice Templates

Accurately tracking payments is essential for maintaining financial clarity and ensuring timely collections. A well-structured document not only provides a detailed record of each transaction but also allows businesses to monitor whether payments have been received. By incorporating clear tracking features into your documents, you can streamline the process of managing accounts and reduce the risk of overdue payments.

Incorporating Payment Status Features

Payment Tracking Fields – Include a designated area within your document to mark the payment status. Common statuses include “Paid,” “Pending,” and “Overdue.” This helps both you and your client quickly understand where the transaction stands at any given time. Additionally, you can add a section for partial payments if clients make payments over time.

Payment Reference Numbers – Including a unique reference number for each transaction not only helps identify the document but also provides an easy way to track payment history. This reference number can be used to match the payment to the corresponding billing record in your system.

Tracking Payments Over Time

Record of Payment Dates – When payments are made, ensure that the date of payment is noted clearly on your document. This helps to keep a comprehensive history of transactions and can be useful for both bookkeeping and resolving any potential disputes in the future.

Outstanding Balances – If a payment is overdue, clearly display the remaining balance owed on the document. Include payment terms that outline penalties or interest rates for late payments to encourage clients to settle their debts promptly.

By integrating these tracking elements, businesses can effectively manage payment histories and ensure smoother cash flow management. Additionally, tracking payments with detailed records helps build a transparent relationship with clients and strengthens financial accountability.

How to Save Time with Invoices

Managing billing documents efficiently is a key aspect of running a smooth business operation. The more streamlined and automated your process, the less time you will spend on administrative tasks. By adopting effective strategies for creating, sending, and tracking transactions, you can significantly reduce the time spent on invoicing and focus more on growing your business.

Automate and Standardize

Use Pre-Designed Templates: One of the easiest ways to save time is by using pre-built layouts that include all the essential fields for transactions. These ready-made designs can be quickly filled out with minimal effort, eliminating the need to start from scratch every time you need to issue a document.

Integrate with Accounting Tools: Many modern accounting platforms allow you to generate and send billing records directly from their software. This integration minimizes the need for manual entry and ensures that your financial records are automatically updated as you create new documents.

Optimize Document Management

Centralize Your Records: Storing all your billing records in a digital format allows you to easily access, update, and manage them. Cloud-based storage systems also enable quick retrieval of past transactions, reducing the time spent searching for specific records.

Track Payments Automatically: Many invoicing systems come with features that automatically track when payments are made and update the status of each transaction. This reduces the need for manual tracking and follow-ups, saving you time and effort.

| Strategy | Benefit |

|---|---|

| Use Pre-Designed Layouts | Quick creation of billing records with minimal effort |

| Integrate with Accounting Tools | Automation of record updates and faster processing |

| Centralize Digital Records | Easy access and management of all past transactions |

| Track Payments Automatically | Real-time payment tracking without manual updates |

By implementing these time-saving strategies, businesses can reduce the hours spent on administrative tasks, enabling more time to focus on core operations and customer service.

Invoice Templates for Different Industries

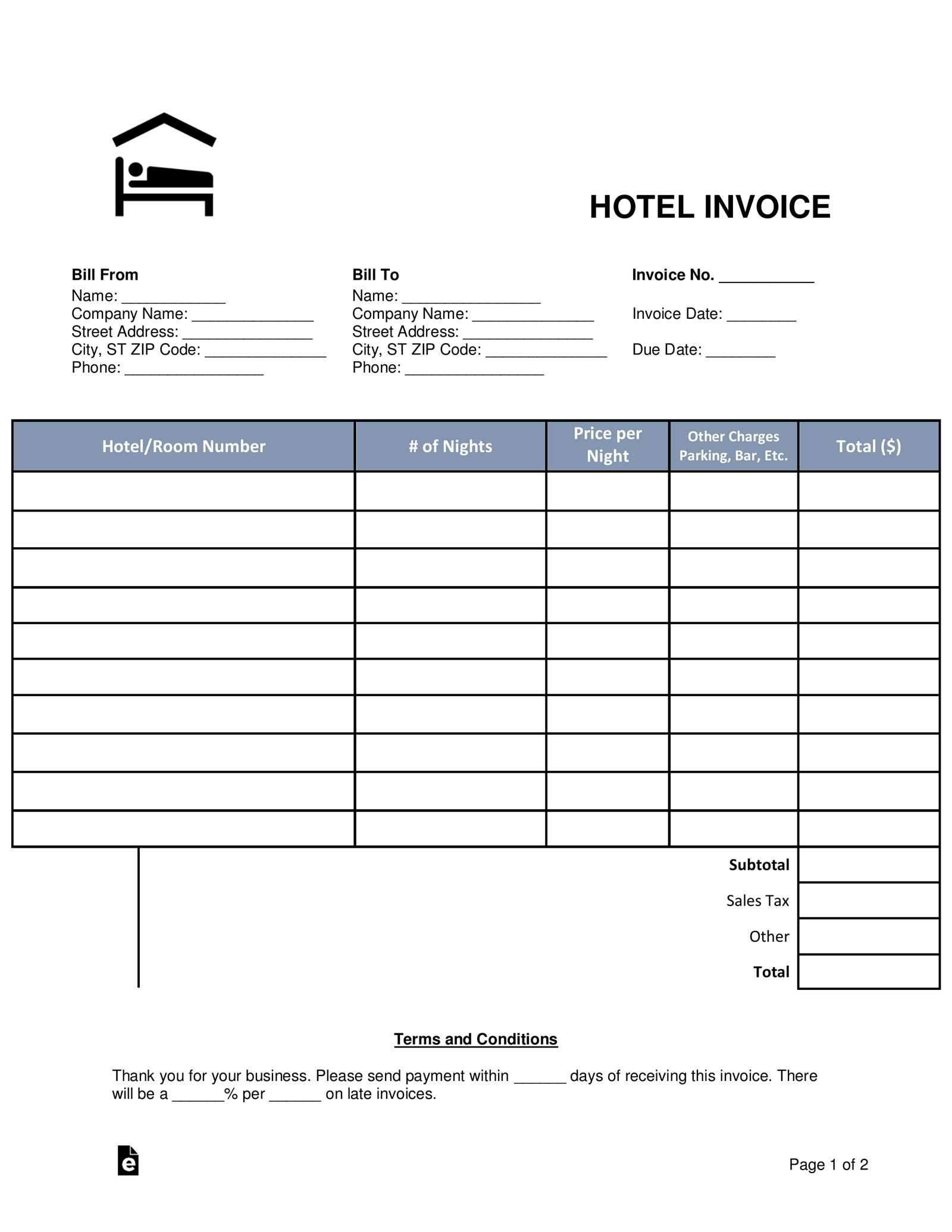

Each business sector has its own unique needs when it comes to generating financial documents. Whether you’re working in retail, freelancing, or offering specialized services, tailoring your billing records to the specific requirements of your industry can improve clarity, professionalism, and efficiency. The right structure ensures that all necessary details are included, helping both you and your clients stay organized and informed.

For Service Providers

Simple and Clear Documentation – Service-based businesses, such as consultants, freelancers, and contractors, often require a straightforward format. The essential details for this type of transaction include a description of the services rendered, the hours worked, and the agreed-upon rates. Since many service providers deal with varying amounts of time or different types of services, it’s important to break down charges clearly to avoid confusion.

Key Elements: Service description, hourly or flat rate, hours worked, project milestones (if applicable), and total amount due.

For Retail and Product-Based Businesses

Itemized Billing Records – In retail or e-commerce businesses, where products are sold, more detailed documentation is required. An itemized breakdown of each product or service, including quantities, unit prices, and any applicable taxes, should be included. It’s also essential to account for discounts, shipping fees, or other additional charges that may apply to the transaction.

Key Elements: Product description, quantity, unit price, discounts, shipping, and total cost including taxes.

By customizing your records to fit the specific requirements of your industry, you ensure your transactions are transparent and reduce the likelihood of misunderstandings with clients.

Automating Invoices with Template Software

Automation is a powerful tool that can streamline administrative tasks, and one of the most beneficial areas to apply this technology is in the creation and management of billing documents. Using software designed to generate and manage these records can save time, reduce errors, and improve overall efficiency. By automating the process, you can ensure that your documents are accurate, consistent, and delivered on time without the need for manual input at every step.

With the right software, you can set up customizable templates, automate data entry, and schedule regular delivery, making invoicing faster and more reliable. These solutions allow businesses to focus on their core operations while ensuring that financial documentation is handled efficiently and correctly.

| Feature | Benefit |

|---|---|

| Automated Data Entry | Reduces human error and speeds up the process by pre-filling standard information like customer details and pricing. |

| Customizable Layouts | Allows you to design billing documents that suit your business needs while maintaining a professional appearance. |

| Scheduled Delivery | Ensures that records are sent out on time, reducing the risk of delayed payments and missed deadlines. |

| Payment Tracking Integration | Automatically tracks payments and updates the status of each record, saving time on follow-ups. |

By incorporating automation into your billing process, you can streamline your workflow, maintain consistency, and reduce the time spent on manual tasks. Template software makes managing your financial records more efficient, helping you stay organized and improve cash flow.

Legal Requirements for Invoices

When creating billing documents, it’s important to ensure that they meet legal standards to avoid complications with tax authorities and ensure clear, enforceable agreements between you and your clients. Certain details must be included in every billing record to comply with local, regional, or international regulations. Failing to include the necessary information could result in penalties or delays in payments, so it’s vital to be aware of the legal requirements in your jurisdiction.

Key Legal Information to Include

Regardless of the industry, all financial documents should contain specific details that legally define the transaction and ensure compliance. These include:

- Business Identification: The name, address, and tax identification number (TIN) of both the seller and the buyer are crucial to verifying the transaction and ensuring proper tax reporting.

- Document Number: A unique reference number for each document is necessary to keep track of transactions and provide a clear audit trail.

- Date of Issue and Due Date: The document must include the date it was created and the payment due date to establish a clear timeline for payment and any potential penalties for late payment.

- Itemized List of Goods or Services: A detailed description of the products or services provided, including the quantity and price, ensures transparency and prevents disputes over what was delivered.

- Tax Information: In most regions, it is mandatory to include tax rates applied (e.g., VAT, sales tax), as well as the total tax amount collected.

Other Regional Variations

International Transactions: For businesses engaging in cross-border transactions, additional requirements may apply, such as including currency types, the country of origin, and customs details.

Record Keeping: In many jurisdictions, businesses must keep copies of all financial documents for a set period (often between 5 to 10 years) to comply with tax laws and auditing requirements.

By including all legally required information, you not only protect your business from legal issues but also build trust with your clients, ensuring smooth and professional transactions.