Invoice Template for Yoga Teachers to Simplify Billing

Managing financial transactions is a critical aspect of any professional practice, especially when it comes to independent instruction. As an instructor, ensuring that payments are processed efficiently and clearly is vital not only for maintaining a steady income but also for fostering professionalism and trust with clients. One of the easiest ways to ensure smooth transactions is by utilizing a well-organized document to outline the payment terms and details.

These documents help instructors communicate payment expectations clearly and avoid misunderstandings, ensuring a seamless exchange of services. With the right structure, it becomes easier to keep track of outstanding amounts, handle different payment methods, and stay organized throughout the billing process. Using customizable solutions designed for this purpose can save time and reduce errors in the long run.

Whether you’re a seasoned professional or just starting out, having a reliable way to handle payments can improve not only your financial management but also your overall business operations. From formatting to essential information, the proper setup can make all the difference when it comes to professionalism and ease of use.

Invoice Template for Yoga Teachers

Effective financial documentation is essential for any independent professional offering services. An organized approach to billing ensures that both the instructor and the client understand payment expectations and terms clearly. This practice not only minimizes confusion but also promotes a sense of professionalism. Using a consistent format for all transactions makes it easier to manage accounts and track payments.

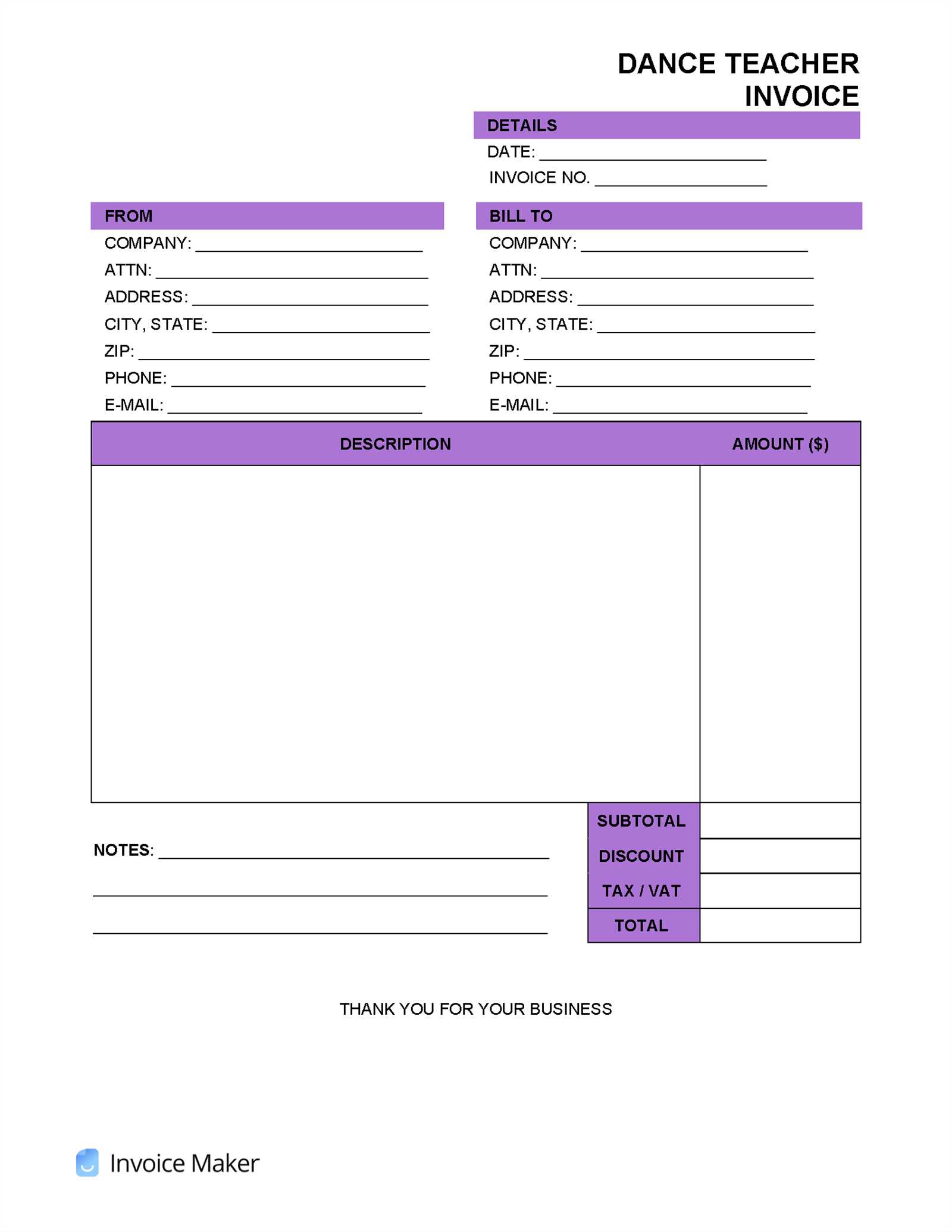

Creating a streamlined billing document is a simple yet powerful way to maintain a professional image. The document should clearly outline the services provided, the total amount due, and any payment deadlines or conditions. Additionally, it’s important to include contact details, the date of the service, and a unique reference number to ensure easy tracking of each transaction.

By customizing such a document to suit personal preferences, it becomes easier to manage payments, maintain a smooth cash flow, and stay organized. Whether you are offering private sessions, group classes, or workshops, an efficient way to document the exchange is vital. With a clean, professional format, you can save time, reduce mistakes, and focus on growing your practice.

Why Yoga Teachers Need Invoices

Proper documentation of financial transactions is crucial for any independent professional providing services. Clear and organized records not only ensure smooth operations but also establish credibility and trust with clients. For instructors, having a reliable system for detailing services rendered and payment terms is essential for maintaining a healthy business practice.

Here are several reasons why using a well-structured billing system is important:

- Professionalism: A formal record enhances your image and helps clients take your services seriously.

- Clear Communication: It sets clear expectations for payment amounts, due dates, and services provided, reducing misunderstandings.

- Legal Protection: Documentation serves as proof of services rendered and agreed-upon terms in case of disputes.

- Easy Tracking: Helps you track income, outstanding payments, and avoid potential errors in your financial records.

- Tax Compliance: Having accurate records simplifies tax reporting and ensures you’re prepared for audits.

By implementing a simple yet effective way to document financial transactions, instructors can ensure a smoother workflow, reduce stress around payments, and maintain a professional standing with clients.

How to Create an Invoice Template

Building a well-organized billing document can save time and reduce errors. Creating a custom form that clearly outlines services, payment terms, and other important details is a simple yet powerful way to streamline your business operations. Here’s a step-by-step guide on how to design a professional document to ensure accurate and timely payments.

1. Gather Essential Information

Before creating a document, make sure you have all the necessary information at hand. This includes:

- Your full name and contact details

- Client’s name and contact information

- Date of service

- Detailed description of services provided

- Total amount due

- Payment terms and due date

2. Choose the Right Format

Once you have all the details, select a format that suits your needs. A simple, clean layout is key. You can either create your own document in a word processor or use online tools that offer pre-designed options. Make sure the layout is easy to read, with clear sections for each piece of information.

Having a customizable design allows you to tailor each document to fit different services or clients, while keeping all the necessary details in a professional structure.

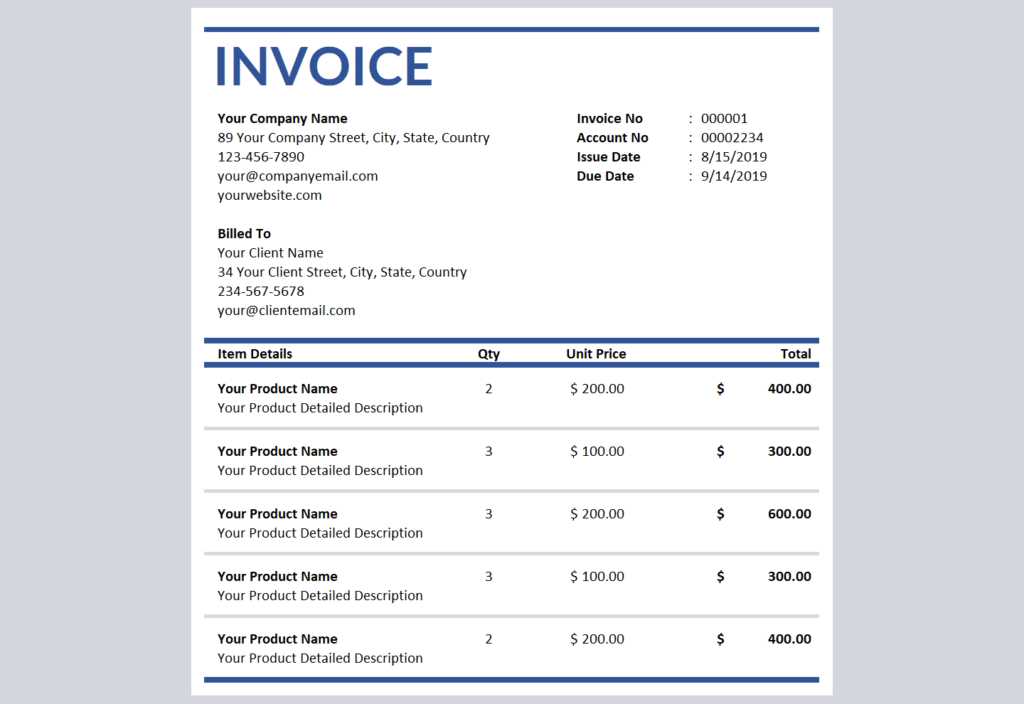

Essential Elements of an Invoice

Creating a professional document to request payment requires including all the necessary details to ensure clarity and avoid confusion. Each document should be structured in a way that both parties can easily understand the terms, services, and payment expectations. Below are the key components that must be present in any financial record for services rendered.

1. Contact Information

Start by including both your details and those of the client. This ensures that there’s no ambiguity about who is issuing the request and who is expected to make the payment. Essential contact information includes:

- Your name, business name (if applicable), and contact details

- Client’s full name or business name and their contact information

2. Description of Services and Amount Due

Clearly state the services provided, including the date and duration if relevant. It’s important to break down the charges in a transparent way so the client can see exactly what they’re being billed for. Additionally, make sure to include the total amount due and any taxes or additional fees if applicable.

- A detailed description of each service provided

- The corresponding fee for each service or hour worked

- Any applicable discounts or promotional offers

- The total amount due, including tax and additional charges

Including these elements will help ensure that the financial document is comprehensive and leaves no room for misunderstandings. Having all the details laid out clearly can lead to faster payments and a more professional image.

Choosing the Right Format for Your Invoice

Selecting the appropriate structure for your payment request is essential for ensuring clarity and professionalism. The right format should be easy to read, well-organized, and visually appealing. It helps streamline the billing process for both you and your clients, making sure all the necessary details are included without overwhelming the recipient with unnecessary information.

There are several format options available depending on your preferences and the tools you have at hand. You can choose between simple handwritten records, digital spreadsheets, or specialized online platforms that provide pre-built designs. The key is to select one that aligns with your business needs and fits the way you manage transactions.

Consider the following when choosing a format:

- Simplicity: Keep the structure clean and straightforward to avoid confusion.

- Customization: Choose a format that allows you to adjust details like rates, services, and payment terms.

- Professional Appeal: Select a layout that reflects the professional nature of your work.

- Ease of Use: Whether digital or paper, the format should be simple to fill out and deliver to clients.

By considering these factors, you can select the right structure that suits your practice and enhances your business operations.

Customizing Your Yoga Invoice Template

Personalizing your billing documents allows you to reflect your unique business style while ensuring that all the essential details are included. A customized format not only makes the document more relevant to your services but also helps establish a professional, cohesive brand image. By making adjustments to the structure, you can tailor it to better suit your specific needs and preferences.

1. Tailor Design and Layout

The design of your document plays a big role in how professional it appears. Consider adjusting the colors, fonts, and layout to match your personal brand or business aesthetic. This makes the document feel more personalized and can leave a lasting impression on your clients. A clean, well-organized design will also make it easier for clients to understand the charges and terms.

2. Include Business-Specific Information

Customizing the document should also include adding any relevant details specific to your work. Some ideas for personalization include:

- Adding your logo and business name for a more branded appearance

- Incorporating your payment methods and terms for easier reference

- Including a short note or message to clients, such as a thank you or reminder

By making these small yet impactful changes, you can create a more professional and client-friendly experience, enhancing both the transaction process and your brand image.

How to Calculate Your Rates

Setting the right price for your services is crucial for running a sustainable business. The amount you charge should reflect the value of your expertise, the time you invest, and the costs associated with your work. Calculating a fair and competitive rate is not only important for maintaining profitability but also for ensuring that your pricing is in line with industry standards and client expectations.

Here are some key factors to consider when determining your rates:

1. Assess Your Experience and Skill Level

Your level of expertise and experience plays a significant role in the pricing process. If you have advanced certifications, years of experience, or a strong reputation, you may be able to charge higher rates. It’s important to evaluate the value you bring to your clients and set a price that reflects your qualifications and the quality of your services.

2. Understand Market Rates

Researching what others in your area or industry charge can help you stay competitive. Compare the pricing of similar professionals to determine if your rates are reasonable. However, don’t solely rely on averages–consider your own skills, target audience, and the demand for your services when setting your prices.

Additional Considerations:

- Time invested in preparation and travel

- Costs related to maintaining your practice (e.g., insurance, equipment, marketing)

- Seasonal demand and client availability

By factoring in these elements, you can establish a pricing structure that is both fair to clients and sustainable for your business.

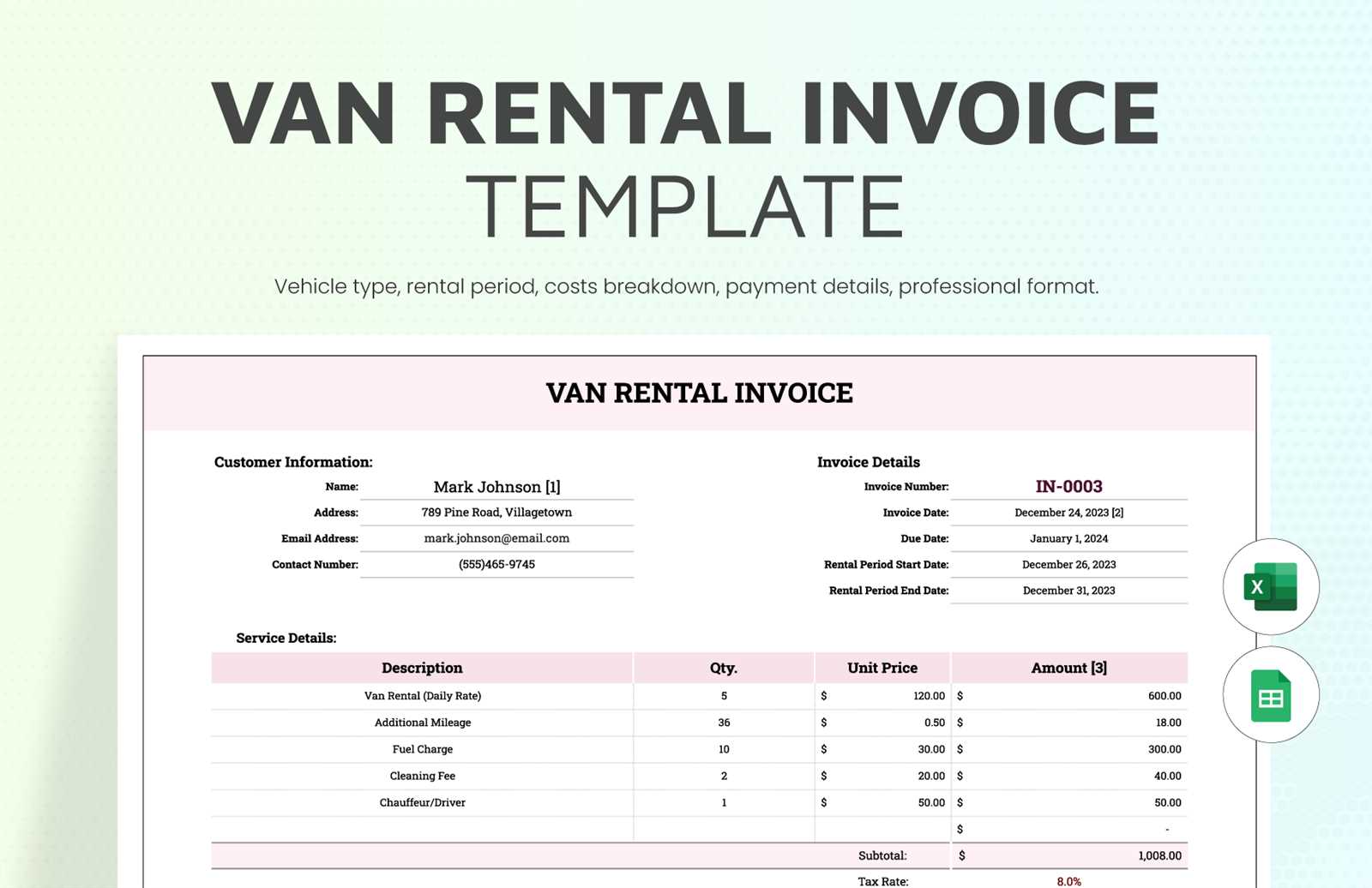

Digital vs Paper Invoices for Yoga Teachers

Choosing between digital or paper records for requesting payment can significantly impact your business operations. Each method comes with its own set of advantages and drawbacks, which can influence your efficiency, client satisfaction, and overall workflow. Understanding the pros and cons of both options can help you decide which suits your practice best.

| Aspect | Digital | Paper |

|---|---|---|

| Cost | Low cost, no printing or postage fees | Higher costs for paper, ink, and postage |

| Convenience | Instant delivery, can be automated and sent via email | Requires manual creation and mailing |

| Accessibility | Accessible from anywhere, can be stored digitally | Requires physical storage and can be misplaced |

| Professionalism | More modern and widely accepted | May appear outdated to some clients |

| Environmental Impact | Eco-friendly, paperless process | Less environmentally friendly due to paper waste |

When deciding between digital and paper records, consider your business needs, client preferences, and operational goals. Digital records tend to be more efficient, cost-effective, and environmentally friendly, while paper records may still have a place with certain clients or in specific situations where physical copies are preferred.

Benefits of Using Invoice Software

Leveraging specialized software to manage payment requests can greatly enhance the efficiency of your business operations. These tools offer numerous advantages over traditional methods, streamlining processes, and reducing the likelihood of errors. By automating tasks such as calculations, record keeping, and document generation, software allows you to focus more on delivering quality services while ensuring your financial documentation is accurate and professional.

Here are several key benefits of using software for managing payment requests:

- Automation: Software automates repetitive tasks like calculating totals, taxes, and due dates, saving you time and effort.

- Accuracy: Reduces the risk of human error, ensuring that all amounts and details are correct.

- Customization: You can easily customize documents to fit your specific business needs, such as adjusting formats, adding branding, or changing payment terms.

- Tracking and Reporting: Many programs allow you to track outstanding balances, generate financial reports, and monitor your cash flow with ease.

- Professionalism: Using software can help create polished, well-designed documents that enhance your professional image.

- Time Savings: Quickly create and send requests with just a few clicks, allowing you to spend more time on your core work.

Overall, software can simplify the billing process, making it faster, more reliable, and less stressful for both you and your clients.

Including Payment Terms in Your Invoice

Clearly stating the payment expectations in your billing document is essential for maintaining smooth transactions and preventing misunderstandings. Payment terms outline when and how the client should settle their balance, as well as any penalties or late fees that may apply. These terms not only ensure you get paid on time but also foster transparency and professionalism in your business relationships.

Here are some key elements to include when specifying payment terms:

- Due Date: Clearly state the date by which the payment should be made. This helps set expectations and avoid delays.

- Accepted Payment Methods: List the payment options you accept, such as bank transfers, checks, or online payment systems.

- Late Fees: Specify any penalties or interest charges that will apply if the payment is not made by the due date.

- Early Payment Discounts: If applicable, offer a discount for clients who pay before the due date to encourage prompt payment.

- Payment Plans: If you’re offering installment payments, outline the schedule and terms of the plan.

By including these details, you can create a clear and professional payment structure, which will help ensure timely and smooth financial transactions with your clients.

Best Practices for Sending Invoices

Sending payment requests in a timely and professional manner is key to maintaining a smooth cash flow and positive relationships with clients. By following best practices when issuing your billing documents, you can ensure clarity, prevent misunderstandings, and encourage prompt payments. Here are some essential tips to help you streamline the process and improve your financial operations.

1. Send Payment Requests Promptly

As soon as the service is completed, make sure to send your request for payment. Delaying the process can result in clients forgetting the transaction or the agreed-upon amount, leading to late payments. Ideally, send the document within a few days of providing the service, or set a consistent schedule for monthly or weekly billing if applicable.

2. Use Professional Channels for Delivery

Ensure your payment request reaches your client through a secure and professional method. Email is a common and efficient choice, but some clients may prefer physical mail or online payment systems that integrate billing. Whatever method you choose, ensure it’s reliable and includes clear instructions for payment.

Additional Tips:

- Include all details: Ensure the payment request contains all necessary information, such as services provided, the amount due, and payment terms.

- Follow up politely: If the due date passes without payment, send a polite reminder or follow-up to ensure the request hasn’t been overlooked.

- Track your records: Keep a record of all requests sent and payments received for easier tracking of your financial status.

By implementing these best practices, you can ensure a smoother billing process, prompt payments, and maintain a professional reputation with your clients.

How to Handle Late Payments

Late payments can be a common challenge for independent professionals, but how you handle them can make a significant difference in maintaining a healthy business. Addressing overdue payments professionally and efficiently is essential to ensure your cash flow remains stable and your client relationships stay positive. Here are some practical steps you can take to manage late payments effectively.

1. Send a Friendly Reminder

If the due date has passed and you haven’t received payment, a polite reminder is often the first step. Sometimes clients simply forget or overlook the payment request, so a friendly email or message can help resolve the issue quickly. Be clear about the due date, the amount owed, and any potential late fees, but maintain a courteous and professional tone.

2. Set Clear Payment Terms in Advance

To prevent late payments in the future, ensure you establish clear payment terms with clients upfront. Let them know when payment is due, the accepted methods, and any penalties for late payments. When these terms are agreed upon from the beginning, clients are more likely to take them seriously and make timely payments.

Additional Strategies:

- Charge Late Fees: Set a clear late fee policy to incentivize timely payments. Make sure clients are aware of the fees before starting work with them.

- Offer Payment Plans: If clients are struggling to pay in full, offer them a payment plan that allows them to pay in smaller, more manageable installments.

- Consider Legal Action: As a last resort, if payments remain unpaid for an extended period, you may need to consider seeking legal advice or using a collections agency to recover the funds.

By addressing late payments professionally and setting clear expectations, you can maintain a strong, healthy business while avoiding conflicts with your clients.

Legal Requirements for Yoga Invoices

When issuing payment requests, it’s important to be aware of the legal requirements in your area to ensure compliance with tax laws and regulations. These legal guidelines help protect both you and your clients, providing clarity and avoiding potential disputes. Understanding what needs to be included in your payment requests ensures that you meet the standards set by local tax authorities and other regulatory bodies.

Essential Legal Information to Include

Regardless of location, there are certain details that should always be included in your payment documentation. These elements are crucial for both tax purposes and for maintaining professionalism in your business practices.

| Required Information | Purpose |

|---|---|

| Business Name and Address | Identifies the service provider for legal and tax purposes |

| Client Name and Address | Ensures the payment request is tied to the correct individual or organization |

| Unique Reference Number | Helps identify and track each transaction for record-keeping |

| Date of Service | Indicates when the service was provided, which is important for tax reporting |

| Tax Identification Number (TIN) | Required in some regions for tax filing purposes |

| Amount Due and Payment Terms | Clarifies how much is owed and when it should be paid |

Additional Legal Considerations

In some jurisdictions, there may be additional rules to follow when issuing payment requests, such as providing specific tax information or handling VAT charges. It’s important to research local laws or consult with a tax professional to ensure full compliance with all regulations.

By including the necessary legal details, you protect your business from potential issues and help ensure your financial records are clear, accurate, and compliant with local laws.

Tracking Income with Invoice Templates

Accurately tracking your earnings is essential for managing your finances and ensuring the long-term success of your business. Using structured documents to record each transaction not only helps you keep track of the amount you’re earning but also provides clarity on the services you’ve provided. This method allows you to monitor your cash flow, assess the financial health of your business, and simplify tax filing.

Here are some ways you can track your income effectively using payment request documents:

- Record Every Transaction: For each service you provide, generate a clear payment request. This will serve as both a record of the transaction and a reference for any future correspondence regarding payment.

- Organize by Date: Keep track of when each payment is due and when it’s received. This helps you monitor overdue payments and maintain a clear timeline of your business activities.

- Label and Categorize Services: When listing services, categorize them according to the type of work performed. This makes it easier to track earnings by category and can help you identify areas where you may need to increase your rates or focus more of your efforts.

- Utilize Unique Reference Numbers: Assign a unique number to each request. This practice will help you easily locate any past transactions when reviewing financial records or communicating with clients.

Benefits of Using Structured Records:

- Simplified Financial Reporting: Having organized records makes it easier to generate reports on your income for tax purposes or to assess your financial progress.

- Clear Financial Overview: Tracking all earnings ensures that you have a comprehensive view of your cash flow and can easily spot trends or changes in your business income.

- Prevents Mistakes: By using a structured approach, you reduce the likelihood of missing payments or overlooking discrepancies in your records.

By consistently using well-structured payment records, you’ll be able to stay on top of your income, avoid financial confusion, and ensure that you’re making informed decisions to grow your business.

How to Use Invoices for Tax Purposes

Proper documentation of your business transactions is essential for tax reporting. Using structured records of your earnings helps ensure you comply with tax regulations and can easily track deductible expenses. Well-organized records not only simplify the filing process but also protect you in case of audits or financial reviews. By keeping accurate records of your services and payments, you can avoid potential tax issues and claim allowable expenses effectively.

1. Keep Detailed Records of Earnings

Every time you provide a service, ensure that a payment record is created. This includes recording the amount received, the date of payment, and any applicable taxes or fees. Maintaining a thorough history of your transactions helps track your total income throughout the year, which is vital for accurate tax filings. When these records are organized and clear, you’ll have all the necessary information at hand when preparing your tax return.

2. Track Business Expenses

In addition to keeping track of income, it’s equally important to document your business expenses. Many business-related costs, such as supplies, equipment, and software subscriptions, can be deducted from your taxable income. By keeping copies of your transaction records, you’ll have the proof needed to substantiate any claims for deductions. This will not only reduce your taxable income but also ensure that you’re fully compliant with tax laws.

Key Benefits of Using Structured Records for Tax Purposes:

- Accurate Tax Filings: Organized records help you file your tax returns correctly and on time.

- Claiming Deductions: Clear documentation allows you to easily identify and claim deductible expenses.

- Reducing Tax Liabilities: Properly tracking earnings and expenses may help reduce the amount of tax you owe.

- Avoiding Audits: Comprehensive records can protect you in the event of a tax audit, as they provide proof of your financial activities.

Using well-documented payment records not only supports proper tax filing but also allows you to manage your finances with confidence, ensuring that you pay only what is required and claim all eligible deductions.

Creating a Professional Image with Invoices

How you present your payment requests plays a crucial role in shaping your business image. A well-designed and clear document reflects your professionalism and can positively influence your clients’ perception of your services. By ensuring that your billing documents are properly formatted and free from errors, you send a message that you take your work seriously and that you are committed to maintaining a high level of service.

Here are some key elements to consider when creating payment documents that convey a professional image:

- Consistency: Use a consistent format for all your payment records. This not only makes your business look more organized but also helps your clients recognize your brand every time they receive a request.

- Clear and Detailed Information: Ensure that all necessary information, such as your contact details, service description, and payment terms, are clearly stated. This reduces confusion and shows clients that you are transparent and thorough.

- Simple and Elegant Design: While it’s important to include all relevant details, avoid cluttering the document with unnecessary elements. A clean and easy-to-read layout gives your business a polished and professional appearance.

- Branding: Incorporate your logo, business name, and color scheme into the payment request. This creates brand recognition and adds a personal touch, making your business more memorable.

Benefits of a Professional Image:

- Client Trust: A well-organized and professional-looking document can help build trust with your clients, making them more likely to continue doing business with you.

- Increased Payment Promptness: Clients are more likely to pay promptly when they see that you are organized and professional.

- Enhanced Business Reputation: A consistent and high-quality presentation helps establish you as a credible and reliable professional in your field.

By putting effort into creating clear, consistent, and professional payment documents, you not only streamline your financial process but also build a strong and positive reputation for your business.

Free Invoice Templates for Yoga Teachers

When running a business, having access to customizable payment request documents is essential for staying organized and maintaining a professional image. Fortunately, there are various free options available that can help simplify this process. These free resources allow you to create accurate and professional payment requests without having to invest in expensive software or hire a designer. By choosing the right free document templates, you can ensure your business operations remain efficient and streamlined.

Why Choose Free Templates?

Opting for free resources comes with several benefits that make them a practical choice, especially for independent professionals just starting or those with a limited budget.

- Cost-Effective: Free resources save you money, especially if you are just starting your business and need to keep overhead costs low.

- Time-Saving: Templates are pre-designed, meaning you don’t have to create payment documents from scratch. You can easily customize them to fit your needs.

- Customizable: Most free resources allow you to modify the layout, add or remove information, and adjust branding to suit your business identity.

- Professional Design: Even though they are free, many options feature clean, organized, and professional designs that will help elevate your business image.

Where to Find Free Payment Request Documents?

There are several websites and platforms where you can find free, easy-to-use options for creating payment records. Many offer downloadable files in formats like Word, Excel, and PDF, making them compatible with various devices and software programs. Here are some popular sources:

- Online Template Websites: Websites such as Template.net, Invoice Simple, and Canva offer free and customizable options suitable for different types of businesses.

- Google Docs and Sheets: Google offers free document and spreadsheet templates that you can modify and save in the cloud for easy access.

- Microsoft Office: Microsoft Office’s free templates in Word and Excel also include many pre-designed options tailored for small businesses.

Using free resources ensures that you have access to professional-quality tools without breaking the bank, allowing you to focus on growing your business while staying organized and compliant.

Common Invoice Mistakes to Avoid

Ensuring that payment requests are accurate and professional is crucial for maintaining a smooth business operation and avoiding misunderstandings with clients. While it might seem simple, even small errors can lead to delayed payments, confusion, or even damage to your professional reputation. By being mindful of common mistakes, you can streamline your billing process and make sure your clients are satisfied with both your services and your documentation.

1. Missing Essential Information

Omitting key details is one of the most common errors when creating payment requests. Without essential information, your clients may not know how to make the payment or may question the legitimacy of the document. Always ensure the following details are included:

- Client Name and Contact Info: Include the name, address, and contact details of the person or company being billed.

- Service Description: Clearly list the services provided, including dates and quantities, if applicable.

- Payment Terms: State your payment terms, such as the due date and accepted payment methods.

- Your Business Details: Your name, business name, address, and contact information should always be easy to find.

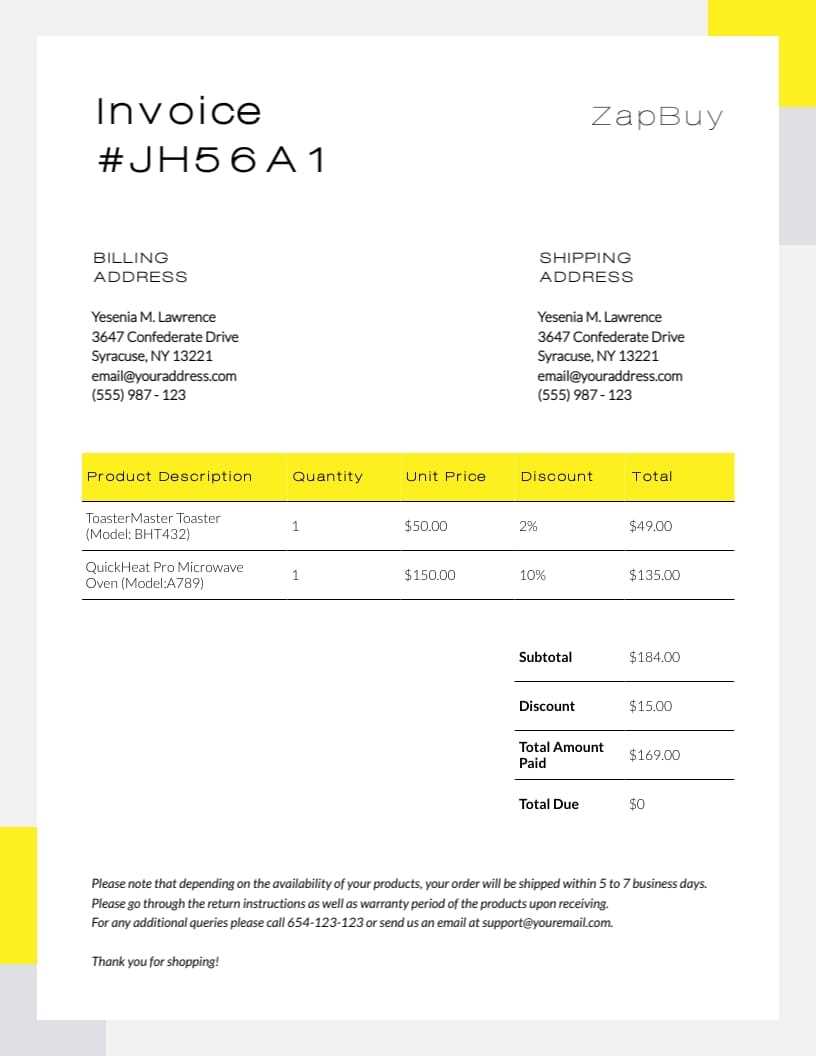

2. Incorrect Calculations

Errors in pricing or the total amount can cause confusion and delay payments. Always double-check the rates for each service and ensure any taxes, discounts, or extra charges are correctly applied. Even small miscalculations can lead to frustration for both you and your client. Some tips to avoid this include:

- Check Pricing: Ensure that hourly rates, package prices, or product costs are accurate.

- Verify Tax and Discounts: Make sure tax amounts are calculated based on local regulations and that any discounts are applied correctly.

- Proofread Totals: Double-check the final amount to ensure it matches the sum of individual items or hours worked.

By avoiding these common mistakes, you’ll help ensure smoother transactions, quicker payments, and stronger professional relationships with your clients.