How to Create and Use an Invoice Template for WordPad

Managing payments and keeping track of transactions is essential for any business or freelance work. One of the most straightforward ways to organize this process is by using a ready-made layout that simplifies creating formal requests for payment. These layouts help ensure that all necessary details are included and presented clearly, giving your communications a professional touch.

With the right tools, customizing such documents can be a breeze, allowing you to add your business information, customer details, and a breakdown of charges. Whether you’re just starting out or need a quick solution for occasional billing, using a simple text editor with built-in formatting options can be both effective and cost-efficient.

Efficiency and organization are key when crafting these financial documents. The ability to quickly adapt the structure to suit specific needs saves time and avoids errors that can occur when creating a new format each time. A simple, customizable format ensures that every document remains consistent while also offering flexibility for different types of services or products provided.

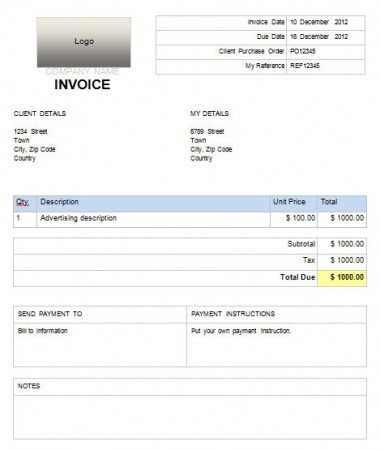

Invoice Template for WordPad Overview

Creating professional billing documents is essential for maintaining clear communication with clients. Using a simple text editor with built-in formatting capabilities makes the process easy and accessible for anyone. These documents can be customized to fit specific business needs while keeping a clean, organized structure. The use of pre-designed layouts can significantly reduce the time spent on formatting and help ensure consistency across all transactions.

Key Features of Customizable Billing Layouts

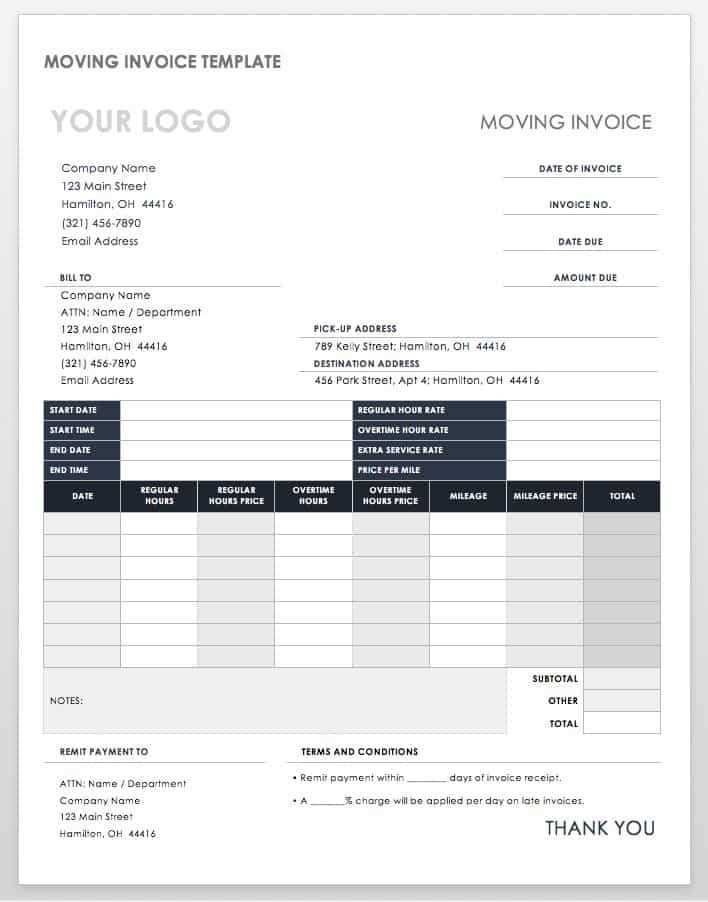

A well-structured document includes several important sections, such as sender and recipient information, payment terms, and itemized details of services or products provided. By utilizing a flexible editor, you can quickly adapt each section to suit your specific requirements. Additionally, the ability to adjust fonts, spacing, and other formatting elements gives you full control over the final look.

Why Choose a Simple Text Editor?

Opting for a straightforward text editor allows users to focus on content rather than complicated software features. These tools are typically easy to use, even for beginners, and can be run on nearly any computer without the need for expensive programs. Whether you’re a freelancer, small business owner, or someone looking for a hassle-free solution, these editors provide an ideal balance of simplicity and functionality.

Why Use WordPad for Invoices

When it comes to creating professional documents that request payments, simplicity and accessibility are crucial. Using an easy-to-navigate text editor provides a practical solution for businesses and individuals alike. Unlike more complex software options, this tool allows for quick setup and customizability without requiring a steep learning curve. Here are some key reasons why this text editor is a great choice:

- Cost-effective: It comes pre-installed on most devices, meaning no additional software purchase is necessary.

- Easy to use: The interface is simple and intuitive, making it accessible even for those with limited technical knowledge.

- Flexibility: You can easily adjust layout, fonts, and spacing to meet your specific needs.

- Compatibility: Documents can be opened on different devices without requiring special software or updates.

- No internet required: Unlike cloud-based solutions, you can work offline and store files securely on your computer.

These advantages make it an excellent choice for anyone looking for a straightforward way to handle payment requests, particularly when the focus is on efficiency and ease of use. The combination of accessibility and functionality allows you to maintain a professional image without unnecessary complexity.

How to Create an Invoice from Scratch

Creating a formal document requesting payment involves organizing key details clearly and professionally. Whether you’re starting with a blank page or customizing an existing format, the process requires attention to the essential elements. Follow these steps to build a complete and effective payment request from the ground up.

Step-by-Step Guide

Start by setting up the basic structure of the document. Here are the critical sections you should include:

- Header: Add your business name, logo, and contact information at the top.

- Recipient’s Information: Include the client’s name, address, and contact details below the header.

- Date: Clearly indicate the date the document is being created, and if applicable, the due date for payment.

- Itemized List: Provide a breakdown of services or products, including quantity, description, unit

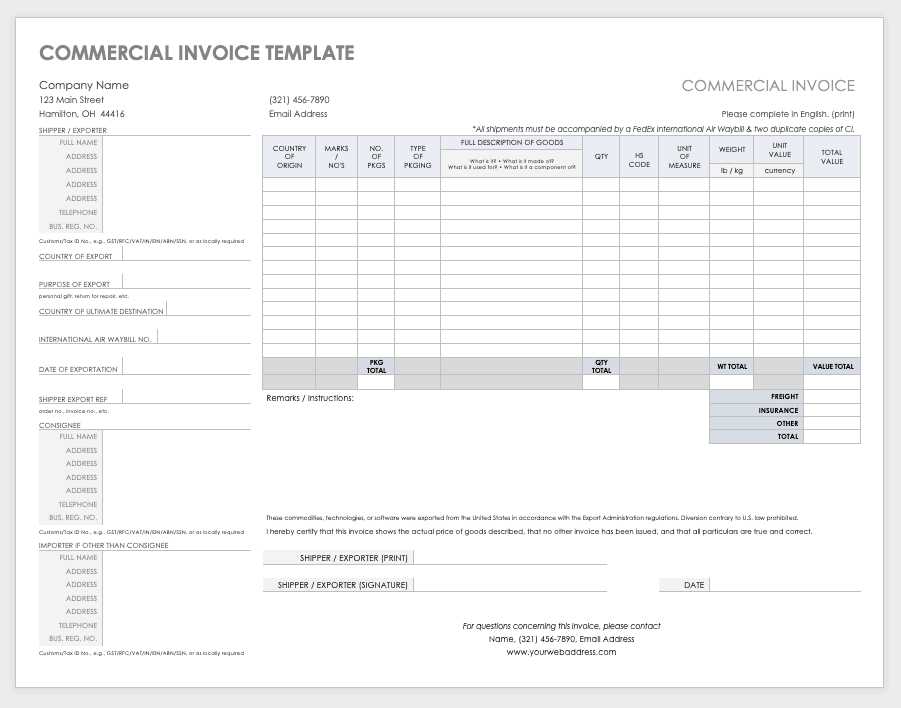

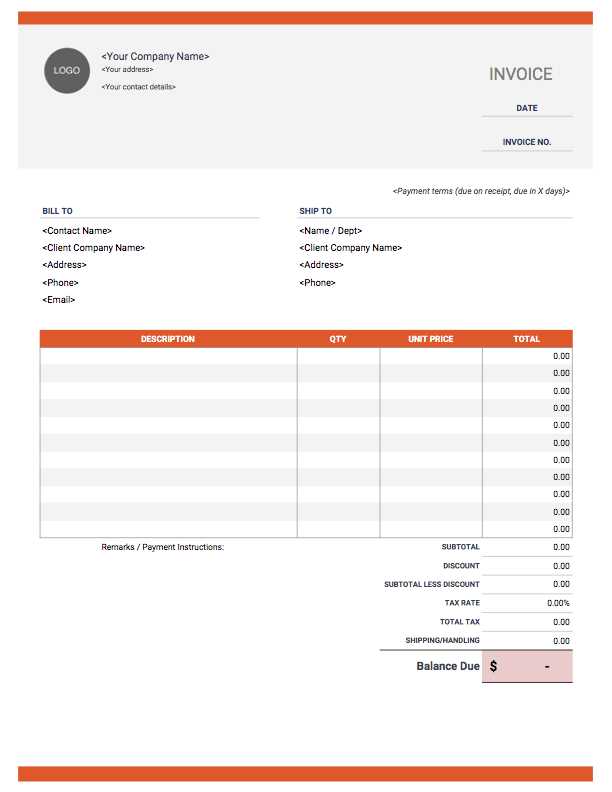

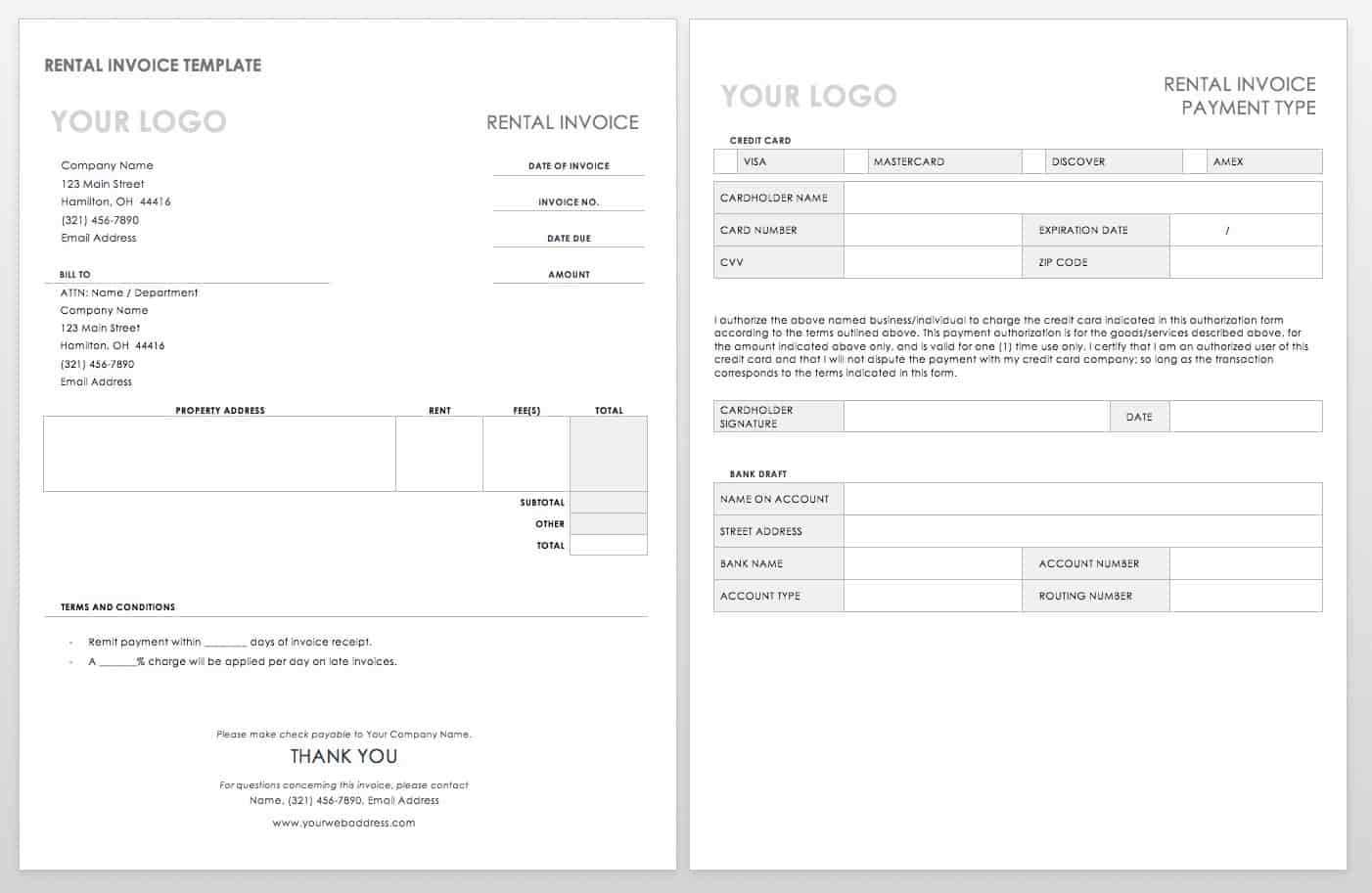

Choosing the Right Invoice Template Style

Selecting the correct format for a payment request document is crucial to ensure that the information is clearly presented and the layout aligns with your business needs. A well-chosen structure not only makes the document look professional but also helps recipients easily identify key details such as amounts, services, and payment terms. The style you choose should reflect your brand’s image while remaining functional and straightforward.

Factors to Consider

When choosing a format, think about the following elements to ensure it suits your specific requirements:

- Professionalism: Choose a clean, simple design that avoids unnecessary embellishments.

- Readability: Ensure the layout allows easy navigation through the sections of the document.

- Flexibility: Opt for a structure that can be easily customized to fit different types of services or products.

- Branding: The style should align with your company’s visual identity, including logo placement and color scheme.

Common Layout Styles

Below are some common layout options, each suitable for different types of businesses:

Style Best For Features Minimalist Freelancers and small businesses Simple design, clear sections, no distractions Professional Corporate clients and large businesses Includes company logo, formal language, and detailed breakdown Creative Designers and creative professionals Colorful elements, modern fonts, personalized layout Standard General use across multiple industries Balanced layout, clean design, good for multiple purposes By choosing the right structure, you can create a document that not only meets your needs but also presents your information in a clear, professional manner. Make sure to customize the style to reflect your brand while keeping it easy to understand for your clients.

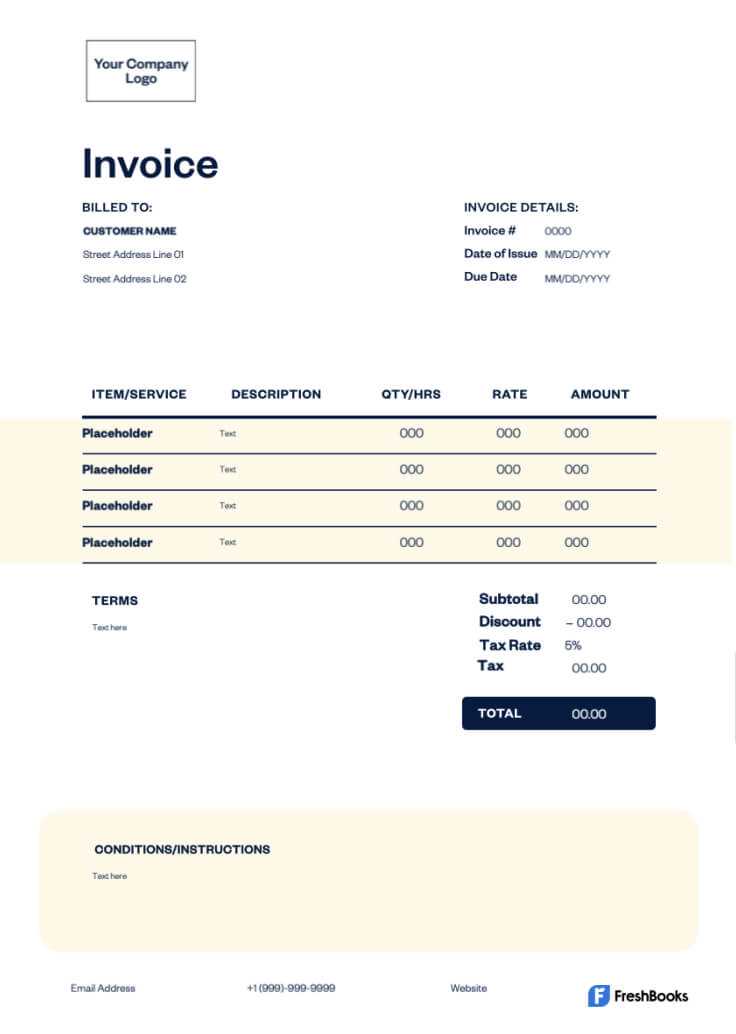

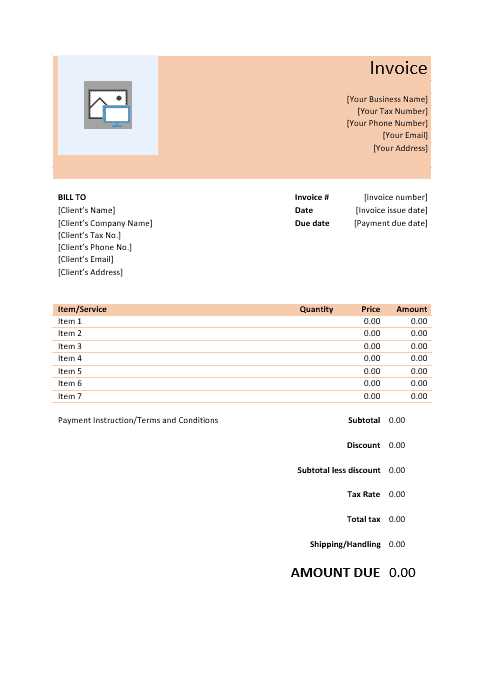

Customizing Your WordPad Invoice Template

Personalizing your payment request layout is essential to reflect your business identity while ensuring all necessary details are clear and accessible. By adjusting key elements such as fonts, layout, and content organization, you can make the document both functional and aligned with your branding. Customization allows you to tailor the structure to your specific needs, enhancing its effectiveness and professionalism.

Key Areas to Personalize

When customizing the structure, focus on these important aspects to ensure the document looks professional and serves its purpose efficiently:

- Business Information: Add your company name, address, and contact details at the top. This helps reinforce your brand’s presence and ensures clients can easily get in touch if needed.

- Client Details: Clearly list the recipient’s information, including their name, address, and contact number to avoid confusion.

- Itemized List: Adjust the columns and descriptions to match the specific products or services you are providing. Include additional information such as quantity, unit price, and applicable discounts if needed.

- Design Elements: Incorporate your company logo, choose a font that fits your business style, and select a color scheme that aligns with your brand identity.

- Payment Terms: Specify payment due dates, late fees, or any other terms relevant to your business operations.

Formatting Tips for a Professional Appearance

Formatting is crucial for readability and clarity. Keep the following tips in mind as you adjust the layout:

- Use clear headings: Make the sections of your document stand out by using bold or larger fonts for headings, like “Billing Information” and “Payment Summary.”

- Keep sections organized: Group similar items together and make sure there is enough space between different sections to avoid clutter.

- Align text properly: Ensure that all information is neatly aligned (e.g., right-align the total amount due for easy reading).

- Incorporate tables for clarity: If your document includes multiple items or charges, using a table format can improve legibility and make it easier for clients to follow the breakdown.

By carefully customizing these areas, you can create a personalized and professional document that effectively communicates payment details to your clients.

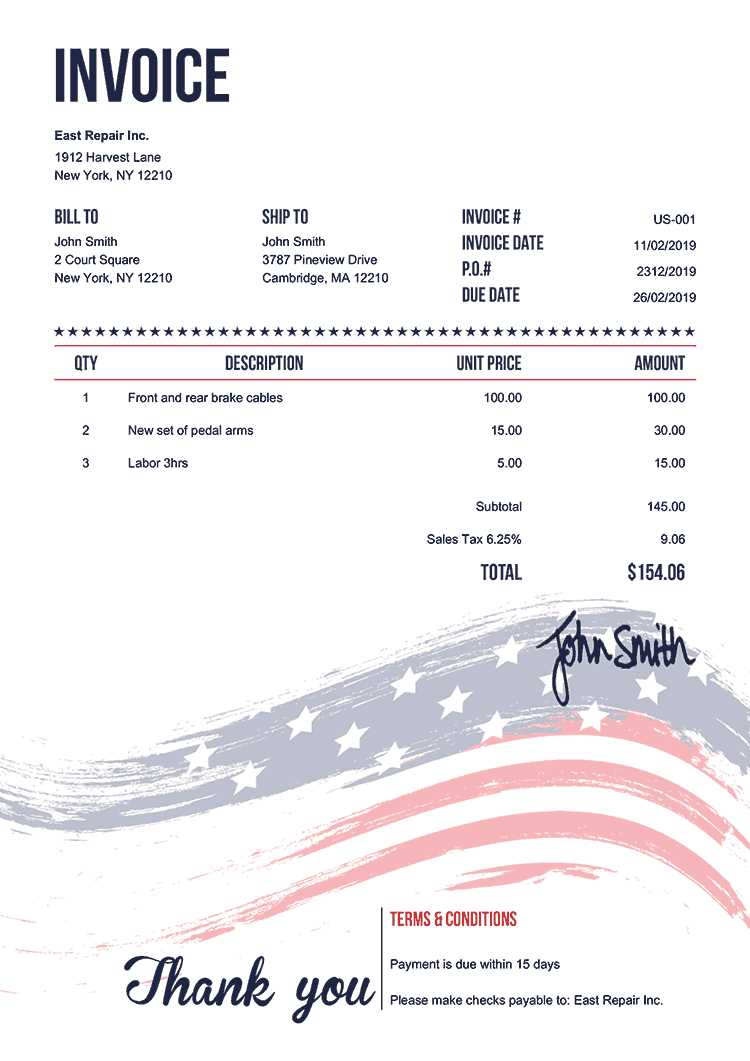

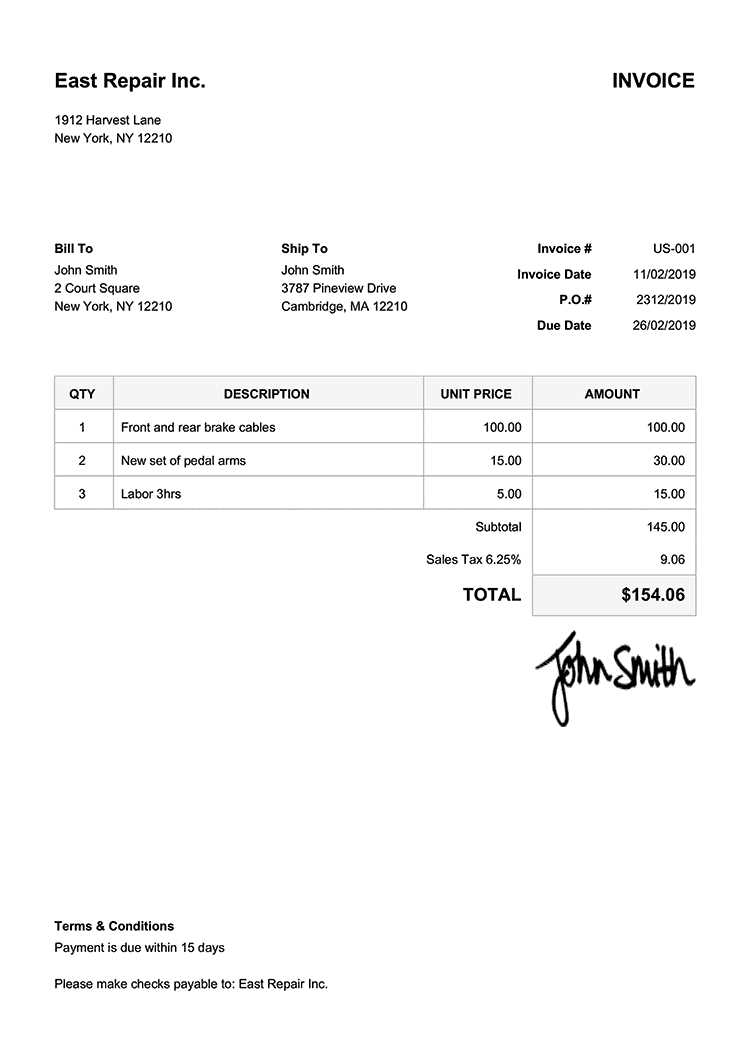

Essential Elements of an Invoice

When creating a formal request for payment, certain details must always be included to ensure clarity and professionalism. A well-structured document should contain all necessary information, leaving no room for confusion. The essential components help both the sender and recipient stay organized and make the transaction process smoother.

Below are the core elements that should be present in any payment request document:

- Business Information: Always include your company name, address, phone number, and email address. This ensures that the recipient can contact you if there are any questions regarding the payment.

- Client’s Information: The recipient’s details should be clearly listed, including their name, company name (if applicable), and address. This is critical for identifying who the payment is due from.

- Document Number: Each document should have a unique identifier to track and reference. This could be a number or code that distinguishes this particular request from others.

- Date of Issue: The date when the payment request is issued should be clearly noted, as this helps define the payment timeline.

- Itemized Breakdown: Provide a detailed list of the products or services provided, including quantity, description, unit price, and total amount for each item. This transparency ensures that the recipient understands what they are being charged for.

- Subtotal and Taxes: Clearly display the subtotal before taxes and any additional fees. This breakdown helps the recipient understand the total cost and any applicable tax rates.

- Total Amount Due: Highlight the final amount due, including taxes and fees. This is the amount the recipient is expected to pay, so it should be easy to identify.

- Payment Terms: Include details on payment due dates, accepted payment methods, and any late fees or penalties for overdue payments.

These elements are fundamental to ensuring that your payment request is clear, professional, and legally compliant. Including all of these details helps avoid misunderstandings and ensures that both parties are on the same page regarding the transaction.

How to Add Company Details in WordPad

Including your business details at the top of a formal document is essential for establishing your identity and ensuring that the recipient can easily contact you. By incorporating this information at the beginning, you create a professional appearance and provide all necessary contact details for future correspondence. Adding company details in a clear and organized way ensures that the recipient knows who issued the request and how to reach out if needed.

Here’s how to add your business details in an organized manner within your document:

Information Example Business Name Your Company Name Business Address 1234 Main St, City, Country, 12345 Phone Number (123) 456-7890 Email Address [email protected] Website (if applicable) www.yourcompany.com To add these details in your document, follow these steps:

- Step 1: Open your text editor and create a new document.

- Step 2: At the very top of the page, type your company name and other essential details like address, contact number, and email. If your business has a website, be sure to add it as well.

- Step 3: Use bold or slightly larger fonts to highlight your business name, making it stand out at the top of the page.

- Step 4: Adjust the alignment to ensure the text is properly positioned. Centering the company name and left-aligning the other details often works best.

By following these steps, you can ensure that your business information is clear, accessible, and professional at the top of your document.

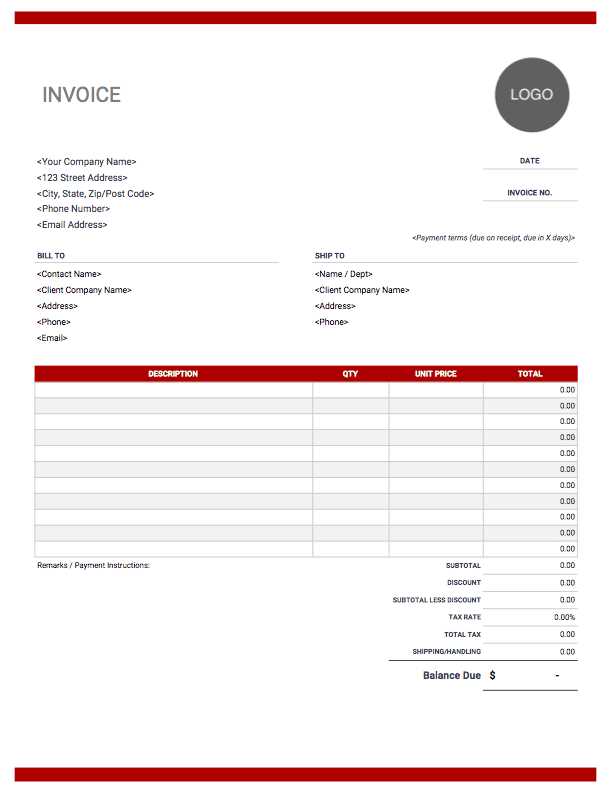

Formatting Tips for Professional Invoices

When creating a payment request, the way it looks plays a significant role in its effectiveness. A well-organized and clearly formatted document conveys professionalism and makes it easier for the recipient to understand the details. Proper formatting not only helps ensure clarity but also enhances the document’s overall appearance, creating a positive impression on clients.

Key Formatting Principles

To achieve a polished and professional look, follow these formatting guidelines:

- Consistency: Use the same font type and size throughout the document. Consistency in text formatting ensures that the document appears uniform and easy to read.

- Clear Structure: Divide the document into clearly marked sections, such as “Contact Information,” “Services Provided,” and “Payment Terms.” This makes it easier for the recipient to navigate and locate specific details.

- Spacing: Adequate spacing between sections and lines improves readability. Avoid overcrowding the page with too much text in a small area.

- Alignment: Ensure that all information is aligned properly. For instance, align monetary amounts to the right and the description of services to the left to create a clean, organized look.

- Headings: Use bold or larger fonts for section titles and totals. This draws attention to key information and helps the reader quickly locate important details.

Additional Design Tips

While clarity is crucial, a few design elements can further enhance the overall presentation:

- Use Tables: If you have multiple items or charges to list, a table format is perfect for breaking down costs and quantities in an organized way.

- Incorporate Your Brand: If applicable, include your logo and choose a color scheme that matches your business’s branding. This adds a personal touch and reinforces your company’s identity.

- Avoid Clutter: Keep the design minimalistic. Too many colors or fonts can distract from the key information and make the document look less professional.

By following these formatting tips, you ensure that your payment request is not only easy to read but also reflects a professional image that enhances your business’s reputation.

Adding Itemized Charges and Taxes

Breaking down the costs clearly is vital for both transparency and professionalism when requesting payment. Providing an itemized list of charges helps the recipient understand exactly what they are paying for and ensures there are no misunderstandings. Additionally, properly calculating and displaying taxes or additional fees ensures compliance and avoids any confusion about the final amount due.

Itemized Breakdown

To create a clear and organized breakdown of charges, follow these steps:

- List Each Item or Service: Start by listing every item or service provided, along with a short description of each. Include quantities, unit prices, and any other relevant details.

- Subtotal for Each Line: After each item, calculate the total for that specific product or service (e.g., quantity x unit price). This makes it easy for the recipient to understand the cost for each individual item.

- Include Discounts (if applicable): If any discounts are applied, clearly note them next to the corresponding line item, and show the adjusted price.

Calculating and Displaying Taxes

Once all charges have been itemized, the next step is to calculate any applicable taxes. Taxes can vary depending on the region or type of service, so it’s important to display them clearly:

- Specify Tax Rates: Include the applicable tax rate (e.g., 10% sales tax) and ensure that the tax amount is calculated correctly for each relevant item.

- Show Total Tax Amount: Sum up all the taxes from the itemized list and show the total amount to be added to the final cost.

- Display Final Total: After adding taxes, display the final amount due, including the itemized charges, tax, and any other applicable fees or discounts.

By clearly listing itemized charges and taxes, you ensure that the recipient fully understands what they are being charged for, helping to foster trust and professionalism in the transaction.

Saving and Storing Your Invoice Files

Once you’ve created a payment request document, it’s crucial to store it in a secure and organized manner. Properly saving and organizing these files ensures that you can easily retrieve them when needed, whether for future reference, legal purposes, or accounting. An efficient file management system will save you time and prevent confusion as your business grows.

Here are some key tips for saving and storing your payment documents:

Saving Your Files

When saving your payment request documents, consider the following steps to ensure they are secure and easily accessible:

- Choose a Consistent File Format: Save your documents in a format that is widely accessible and easily readable, such as PDF. This ensures that clients can open and view the document without compatibility issues.

- Use Clear File Names: Name each document clearly to make future searches easier. A common convention is to use the client’s name, followed by the date, and a unique identifier (e.g., “ClientName_2024-11-06”).

- Save Multiple Versions: If you make updates or corrections to a document, save different versions with clear version identifiers (e.g., “Invoice_1”, “Invoice_2”). This helps you track changes and avoid losing important information.

Storing Your Files

Storing payment request documents properly is just as important as saving them. A good storage system will help you organize files, minimize the risk of loss, and ensure easy retrieval when needed:

- Use Cloud Storage: Storing documents in the cloud (e.g., Google Drive, Dropbox) provides easy access from anywhere and ensures that your files are backed up securely.

- Create a Folder System: Organize your documents by client name, date, or project. This folder structure helps you quickly find the right document when needed.

- Backup Regularly: Always back up your files to prevent data loss due to unforeseen circumstances. Make regular backups to external drives or cloud services.

- Keep a Paper Copy (Optional): For legal or personal record-keeping, consider printing or scanning a copy of the document for your physical archives.

By following these practices, you ensure that your payment request documents are stored securely, making it easier to manage your business records and maintain a professional approach to documentation.

How to Print or Send Invoices

After preparing your payment request document, the next step is to deliver it to your client. Whether you choose to print a physical copy or send it electronically, the process should be straightforward and professional. How you send the document can affect the perception of your business, so it’s important to choose the right method and ensure the document reaches the recipient in a timely manner.

Printing Your Payment Request

If you prefer to send a physical copy, printing your document correctly is key to making a professional impression. Here are the steps to ensure your document is ready for printing:

- Check Layout: Before printing, review the document to ensure all content is correctly aligned, and there are no cut-off sections. Use the print preview feature to confirm how the document will appear on paper.

- Choose the Right Paper Size: Typically, payment requests are printed on standard letter-sized paper (8.5 x 11 inches). Ensure that your printer is set to this size to avoid distortion.

- Print Quality: Make sure your printer is set to high-quality printing to ensure the text and any graphics (such as your logo) appear crisp and clear.

- Print a Test Page: Run a test print to check for any issues with the formatting, alignment, or print quality before printing the final version.

Sending Payment Requests Electronically

For a quicker, more convenient option, sending your document via email or other electronic methods is often the best choice. Here are a few tips for sending your payment request efficiently:

- Save as PDF: Saving your document as a PDF ensures that the formatting remains intact when it is opened by the recipient, regardless of the software they are using.

- Attach and Email: Attach the PDF file to an email, and include a clear subject line such as “Payment Request for [Service/Product]”. In the email body, politely ask the recipient to review the attached document and process the payment according to the agreed terms.

- Alternative Electronic Methods: In addition to email, you can use invoicing software or cloud storage services (like Dropbox or Google Drive) to share your document. Just make sure that the recipient has access to the platform and can download the file easily.

- Follow Up: If you don’t receive payment or acknowledgment within a reasonable time, don’t hesitate to follow up with a polite reminder email or message.

By following these steps, you

Common Invoice Mistakes to Avoid

When creating a payment request, even small errors can cause delays or confusion, leading to potential frustration for both you and your clients. Whether it’s a missing detail or a formatting oversight, these mistakes can undermine your professionalism. Being aware of common pitfalls and avoiding them will help ensure your payment requests are clear, accurate, and efficient.

Common Errors in Payment Requests

Here are some of the most common mistakes to avoid when preparing a payment request document:

- Missing or Incorrect Contact Information: Ensure that both your contact details and the recipient’s are clearly listed and accurate. Any incorrect information can lead to delays or miscommunication.

- Failure to Include a Unique Reference Number: Always assign a unique number to each payment request to help both you and your client keep track of the transaction. This prevents confusion and improves record-keeping.

- Ambiguous Payment Terms: Be clear about payment deadlines, accepted methods, and late fees. Vague terms can lead to misunderstandings or late payments.

- Incorrect Calculations: Double-check all totals, taxes, and discounts. Arithmetic errors can make your payment request seem unprofessional and lead to disputes.

- Not Itemizing Charges: Be specific about what products or services you are charging for. Vague descriptions can cause confusion and make the request harder to process.

- Failure to Proofread: Spelling and grammatical errors can reduce the professionalism of your document. Always proofread before sending.

Additional Tips for Accuracy

To further minimize mistakes and improve the accuracy of your payment requests, consider the following tips:

- Review Payment Details: Always double-check the amounts, payment method, and due dates before sending. This ensures that all information is correct and that there are no misunderstandings about the payment.

- Use a Clear Layout: A clean, easy-to-read layout reduces the likelihood of mistakes being overlooked. Use bold text, tables, and adequate spacing to make the document organized and straightforward.

- Keep Records: Maintain a copy of each request and correspondence related to the transaction. This helps resolve any potential disputes or confusion in the future.

By avoiding these common mistakes, you can ensure that your payment requests are clear, professional, and processed smoothly, leading to faster payments and better client relationships.

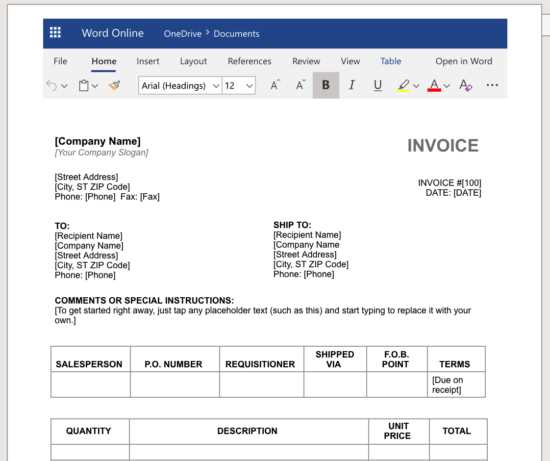

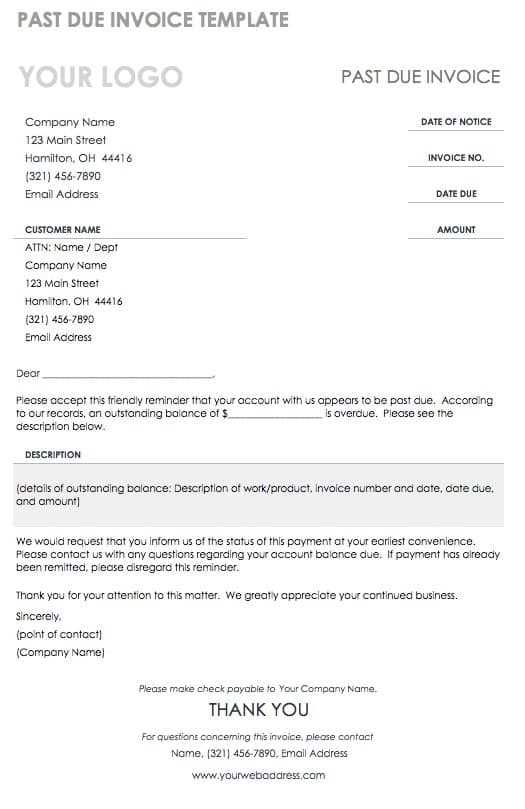

Free Invoice Templates for WordPad

If you’re looking for a simple and cost-effective way to create professional payment requests, using a pre-designed format can save you time and effort. Free document designs are available online that you can easily download and customize for your business needs. These ready-made formats help you quickly generate detailed and organized documents without the need for specialized software or technical skills.

Where to Find Free Document Formats

There are various platforms where you can download pre-made payment request formats at no cost. Here are some popular sources:

- Online Template Websites: Websites like Template.net, Vertex42, and Invoice Simple offer free document formats that are easy to customize with basic word processors.

- Office Software Providers: Some office software providers offer free downloadable designs that you can use in any word processing program.

- Open-Source Platforms: Platforms like Google Docs and Microsoft Office Online often have free customizable templates available for download and use.

Benefits of Using Free Document Formats

Using a free pre-made format can offer several benefits:

- Time-Saving: Pre-designed formats allow you to skip the setup and start customizing immediately, saving time on document creation.

- Professional Design: Many free formats come with built-in organization and attractive design, ensuring your document looks polished and business-like.

- Easy Customization: These formats are often simple to modify, allowing you to add your logo, change fonts, and update payment details without difficulty.

- Free of Charge: Unlike paid software, these templates are available at no cost, making them a perfect option for small businesses or freelancers on a budget.

By using free formats, you can quickly create clear, professional documents without investing in expensive tools or services, making them a practical solution for small businesses and entrepreneurs.

How to Maintain Invoice Records

Properly managing payment request records is crucial for both business operations and compliance with tax laws. Keeping accurate and organized records ensures you can track payments, monitor outstanding balances, and quickly access past transactions when needed. An efficient filing system can save time, reduce errors, and provide peace of mind when it comes to financial management.

Here are some essential steps for maintaining accurate and reliable payment records:

- Establish a Clear Filing System: Whether digital or physical, create a consistent organization system for storing payment request documents. This could be by client, date, or project. Ensure all documents are clearly labeled and easy to locate.

- Store Both Digital and Physical Copies: If you keep digital records, back them up regularly to prevent data loss. For physical records, consider using a filing cabinet or secure location to protect sensitive information.

- Track Payments and Due Dates: Keep a record of when payments are due and when they are received. This can be done using a simple spreadsheet or a financial software tool that allows you to track both paid and unpaid balances.

- Keep Notes on Communication: Record any communication related to payments, such as emails or phone calls regarding disputes, delays, or confirmations. This will help you resolve issues faster and keep a clear history of interactions with clients.

- Review Regularly: Set aside time to periodically review your records to ensure everything is up-to-date. This can help identify overdue payments, and reduce errors or miscommunication.

Maintaining thorough and organized records not only helps streamline financial management but also ensures that your business stays compliant with tax regulations and ready for any future audits. Proper documentation provides a solid foundation for long-term success and helps build trust with clients.

Integrating WordPad with Other Tools

While using a simple word processor to create business documents is effective, integrating it with other tools can enhance productivity and improve the workflow. By combining different software applications, you can automate tasks, streamline processes, and ensure that your documents are consistent and easily shareable across various platforms.

Popular Tools for Integration

Here are some common tools that can be integrated with a basic word processor to improve document creation and management:

Tool Integration Benefits Cloud Storage (Google Drive, Dropbox) Store documents online, easily share with clients, and access from multiple devices. Synchronize changes across all platforms. Spreadsheet Software (Microsoft Excel, Google Sheets) Easily import financial data and track payments. Automatically calculate totals and taxes, and then export to your document. Email Clients (Outlook, Gmail) Send your completed documents directly from your word processor or cloud storage. Automate email reminders for overdue payments. Accounting Software (QuickBooks, FreshBooks) Sync payment information with accounting systems to automatically update your financial records and track expenses. Document Management Systems (Evernote, OneNote) Organize and archive documents securely, allowing for easy retrieval and searching across different projects. How to Use Integrations Effectively

To make the most of these integrations, follow these tips:

- Cloud Storage Sync: Save your documents to cloud storage to easily collaborate with colleagues or clients, and ensure your files are backed up safely.

- Data Import and Export: Use spreadsheet software to quickly import data like pricing or tax rates into your document, minimizing manual entry errors.

- Email Automation: Set up automated email notifications through your email client, ensuring clients are reminded of payment deadlines without additional effort.

- Financial Tracking: Integrate accounting software to automatically track payments and generate reports, ensuring your records are always up-to-date.

Integrating your word processor with other business tools enhances the efficiency of document creation, improves data accuracy, and helps automate time-consuming tasks. By streamlining these processes, you can focus more on growing your business and maintaining client relationships.

Why WordPad is a Cost-Effective Option

When it comes to creating business documents, many people assume that advanced software is necessary for professional results. However, there are simple and free alternatives that offer all the essential tools without the hefty price tag. One such option is a basic text editor that provides all the functionality needed for document creation while keeping costs minimal. By using this straightforward tool, you can streamline your workflow without sacrificing quality.

Here’s why this simple software is an affordable solution for individuals and small businesses alike:

- No Additional Costs: Unlike premium software options that require an upfront purchase or ongoing subscription, this tool comes pre-installed on most computers, meaning there are no additional costs to start using it.

- Minimal Learning Curve: The interface is user-friendly and doesn’t require a long learning period. You can start creating professional documents right away, without the need for complex tutorials or training.

- Basic Yet Effective Features: While it may lack some advanced features found in high-end software, it still offers all the essential tools needed to create clean, organized documents, such as text formatting, tables, and easy text editing.

- Accessibility: Since it is built into most operating systems, you don’t need to worry about compatibility issues or licensing problems. You can quickly open, edit, and save documents on virtually any device with the software installed.

- No Internet Dependency: Unlike cloud-based services, this tool doesn’t rely on an internet connection to function, allowing you to work offline whenever necessary, which is especially useful in areas with limited or unstable internet access.

For small businesses or individuals who need to create and manage documents without incurring additional costs, using this simple tool offers a highly cost-effective solution. With no need for expensive software or subscriptions, you can focus more on your work and less on overhead costs.

Security Tips for Your Invoice Files

When handling important business documents, it’s essential to prioritize security to prevent unauthorized access, loss, or theft of sensitive information. Ensuring that your payment requests and related records are well-protected can help safeguard your business and client relationships. Implementing a few simple security practices can greatly reduce the risk of data breaches and help keep your documents secure.

Here are some valuable tips to protect your documents:

Security Tip Description Use Strong Passwords Always protect your files with strong, unique passwords. Avoid using easily guessed combinations and consider using a password manager to store and generate secure passwords. Enable Encryption Encrypt your files to ensure they remain unreadable to anyone without the correct decryption key. Many programs offer encryption options to secure your documents before sharing them. Limit Access Restrict access to sensitive files by only sharing them with authorized individuals. If possible, use a secure system for sharing files to track who has access and when. Back Up Your Files Regularly back up your documents to an external hard drive or cloud service to protect against data loss due to hardware failure or accidental deletion. Secure Your Device Ensure that the device you use to store and edit your documents is protected with strong security features, such as antivirus software, firewalls, and up-to-date operating systems. By taking these simple steps to protect your business documents, you can significantly reduce the risk of data loss or unauthorized access. Prioritizing security not only helps safeguard your sensitive information but also promotes trust with your clients and partners.

Benefits of Using Invoice Templates

Using pre-designed formats to create your business documents can save time, reduce errors, and ensure consistency across all your records. These ready-to-use structures provide a reliable framework that can be easily customized to fit your specific needs. By leveraging these formats, businesses can streamline their processes and improve their overall efficiency.

Here are some key advantages of using such structured formats:

- Time Efficiency: Pre-built layouts allow you to focus on adding relevant details rather than starting from scratch. This significantly speeds up document creation, making your workflow more efficient.

- Consistency: Using a consistent design ensures all your documents follow the same format, which enhances professionalism and makes it easier for clients to understand and track payments.

- Accuracy: Pre-designed structures typically include all the necessary fields and calculations, reducing the risk of forgetting important information or making mistakes during manual entry.

- Customization: These formats can be easily adjusted to suit your business style, branding, and specific requirements, ensuring they reflect your company’s identity.

- Cost-Effectiveness: Many such formats are available for free or at a very low cost, allowing businesses to maintain a professional image without the need for expensive software or tools.

By using these pre-structured formats, businesses can focus on what matters most–providing excellent products and services–while ensuring their administrative tasks are handled efficiently and accurately.