Invoice Template for Website Development to Simplify Your Billing

Managing payments efficiently is a crucial aspect of any online service. Whether you’re a freelancer or part of a larger agency, clear and professional financial communication ensures smooth transactions with clients. A well-structured document not only helps in receiving timely payments but also reflects the quality and reliability of your work.

Proper billing practices can help avoid misunderstandings and improve the overall client experience. By using the right tools to generate detailed and accurate statements, you can maintain trust and professionalism in your business relationships. These records serve as proof of work completed and can also assist in tax preparation and financial tracking.

With the right approach, creating these documents can become an easy task. Whether you need to customize a format or follow a standard layout, the process can be streamlined with the right resources. This section will explore how to craft an effective billing statement that meets both legal and practical requirements, ensuring that you’re always paid for the services you provide.

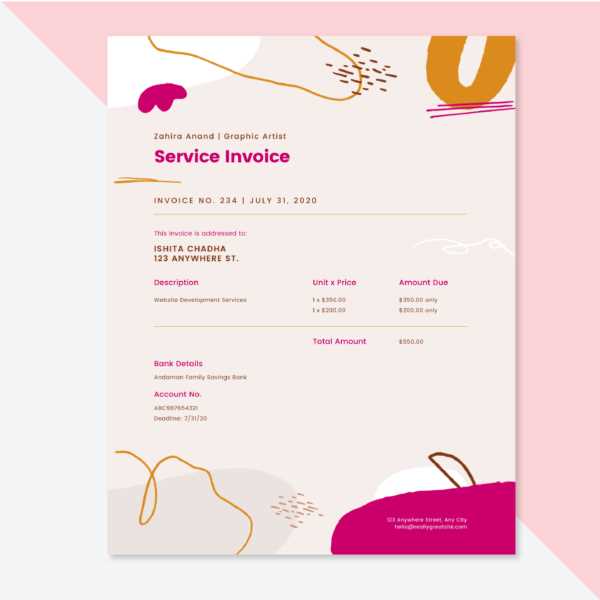

Invoice Template for Website Development

When managing financial transactions in digital projects, creating a well-organized document is key to ensuring both clarity and professionalism. A structured format allows clients to easily review the work completed and understand the associated costs. This section highlights how to craft an effective billing statement that aligns with industry standards and meets both your and your client’s expectations.

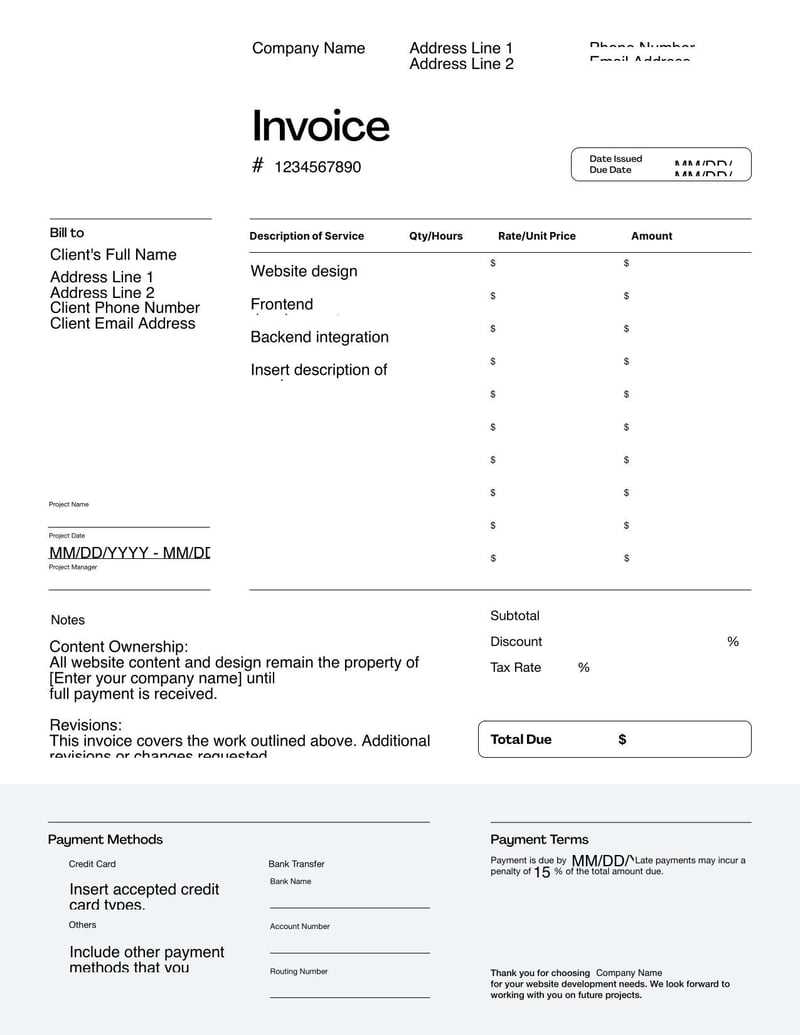

Essential Elements to Include

To create a clear and comprehensive document, certain details are critical. These elements help ensure all important information is covered and the final amount is justified. Here are the key components:

- Client Information: Include the name, address, and contact details of the client.

- Project Description: A brief overview of the services provided, outlining the scope and any specific tasks completed.

- Breakdown of Costs: Clearly itemize each task, its associated cost, and any additional expenses incurred during the project.

- Payment Terms: Include the due date, late fees (if applicable), and payment methods accepted.

- Legal Information: Any necessary business details such as tax ID numbers or contractual references.

Best Practices for Clear Documentation

When structuring these documents, clarity and precision are crucial to avoid misunderstandings. The more detailed and transparent the billing statement, the smoother the payment process will be. Consider the following best practices:

- Always use a professional tone, even in informal client relationships.

- Double-check the accuracy of all calculations before finalizing the document.

- Keep a record of all versions and revisions for tracking purposes.

- Use clean, easy-to-read formatting to improve client understanding.

By following these guidelines, you ensure that both you and your client have a clear understanding of the financial aspects of the project. This not only helps in preventing disputes but also enhances the overall professionalism of your services.

Why Use an Invoice Template

Streamlining the billing process is essential for any service provider, especially in the digital sector. Using a pre-designed structure to generate payment records saves time, reduces errors, and ensures consistency across all transactions. Whether you’re a freelancer or running a business, this approach ensures that the financial documentation is both professional and clear for your clients.

Time and Efficiency Benefits

One of the primary advantages of using a pre-set document structure is the time saved in preparing financial statements. Rather than manually creating a new record from scratch each time, a consistent format allows for quick updates and adjustments. Here’s how it can improve efficiency:

| Benefit | Description |

|---|---|

| Consistency | Having a standard format reduces mistakes and ensures all necessary information is included every time. |

| Time-saving | With a pre-made structure, you only need to input relevant details, which speeds up the process. |

| Less Paperwork | Digitally generating these records reduces the need for physical copies and manual entry. |

Professionalism and Accuracy

Another key reason to use a pre-structured document is to maintain a high level of professionalism. Clients appreciate clear, organized records that are easy to read and understand. Moreover, a consistent layout helps prevent errors in financial calculations and ensures all aspects of the service are clearly outlined. This not only improves trust with clients but also makes it easier to track and manage payments.

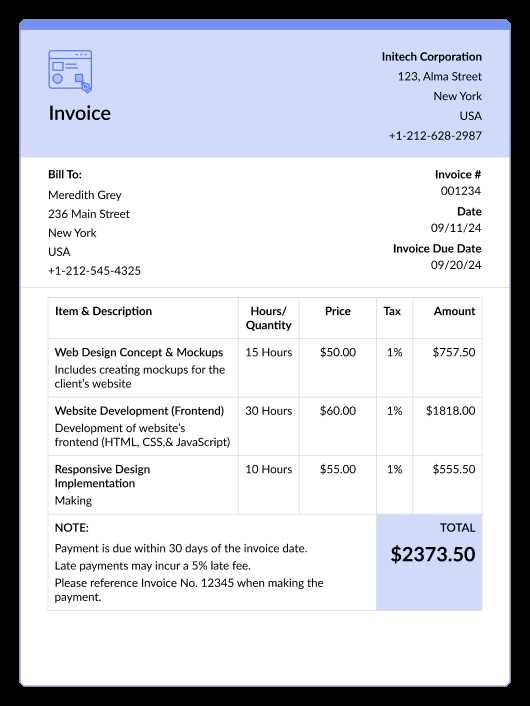

Key Features of a Website Development Invoice

When creating a document to request payment for digital services, it is important to include specific details that not only ensure clarity but also promote professionalism. A well-organized record helps both parties understand the work completed, the amount owed, and the payment terms. Each element plays a crucial role in ensuring smooth transactions and avoiding misunderstandings.

Clear Breakdown of Services is essential to justify the costs. A detailed list that outlines each task or milestone will help the client understand what they are being charged for. Whether it’s coding, design, or content creation, each service should be listed with its respective cost to avoid confusion.

Payment Terms are equally important. Clearly stating when the payment is due, as well as the method of payment, ensures both parties are on the same page. Additionally, including late fees and discounts for early payments can help establish expectations and encourage timely settlements.

Contact Information should be prominently displayed. This includes your business name, address, and preferred contact details. Including both your details and your client’s helps keep the document organized and serves as a reference point for any future communication regarding the payment.

Tax Information is necessary for legal and financial reasons. If applicable, including your tax identification number or any applicable sales tax details ensures compliance with local regulations.

These key features make the document both functional and professional, reducing the chances of disputes and ensuring that the client has a clear understanding of the amount due and the work completed.

How to Customize Your Invoice Template

Tailoring your billing document to suit your specific needs is an essential step in making sure all relevant information is included and presented clearly. Customization ensures that the record aligns with your branding, reflects the services provided, and meets the client’s expectations. By adjusting certain elements, you can make the document more professional, personalized, and easier to understand.

Adjust the Layout to reflect your brand. This can include adding your logo, choosing specific fonts, or adjusting the color scheme to match your company’s visual identity. A personalized layout not only makes the document more visually appealing but also reinforces your business image.

Include Client-Specific Information such as their name, address, and any relevant account or project details. Customizing this section helps the client identify the document as specifically related to their project, which can reduce confusion and make the billing process smoother.

Specify the Services Provided in detail. While a general overview may work for some, providing an in-depth breakdown of the tasks completed helps the client understand what they are being billed for. Use bullet points or numbered lists to make this section clear and easy to follow.

Set Payment Terms clearly by customizing the payment due date, the accepted methods, and any applicable discounts or late fees. This section should leave no room for ambiguity to avoid potential disputes over payment schedules.

Ensure Legal Compliance by including any necessary tax information or business identifiers. Depending on your location or type of business, certain legal details may be required, such as a tax ID number or a reference to applicable sales tax rates.

By personalizing these elements, you create a clear and professional document that represents your work, aligns with your business practices, and is easy for clients to understand and act upon. Customizing your document not only makes the billing process easier but also enhances your brand image and helps build trust with your clients.

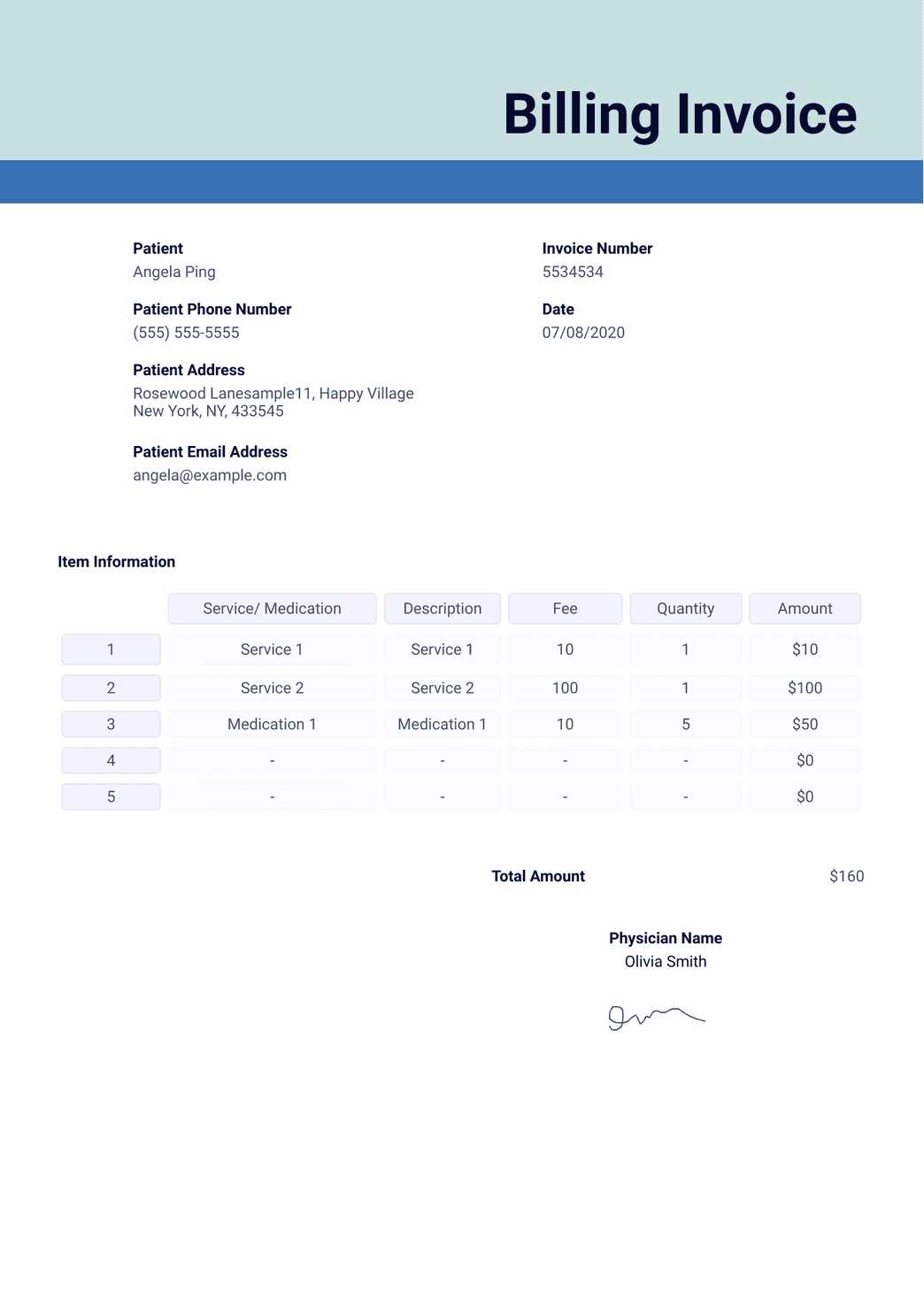

Essential Information for Web Developer Invoices

When requesting payment for digital services, including all necessary details ensures clarity and prevents any misunderstandings. The more comprehensive the document, the easier it is for the client to understand the scope of the work and the corresponding charges. A well-detailed record not only protects both parties but also fosters professionalism and trust.

Client Details should be clearly stated. This includes the client’s name, company name (if applicable), address, and contact information. It is important to make sure this information is accurate, as it allows for proper record-keeping and ensures that the client can be easily contacted if necessary.

Detailed Breakdown of Services is essential. It’s crucial to list each task performed or milestone completed, such as design, coding, content creation, or testing. Itemizing the work helps to justify the costs and gives the client a transparent view of the work they are paying for.

Payment Terms must be unambiguous. Include the payment due date, payment methods (e.g., bank transfer, credit card, PayPal), and any penalties for late payments. It’s also helpful to state any agreed-upon discounts for early payments, if applicable, to encourage timely settlements.

Project Timeline should be noted if it has been agreed upon with the client. Including start and end dates (or milestones) can help ensure that both parties are on the same page regarding project completion and payment schedules.

Tax Information might be necessary depending on local regulations. If applicable, make sure to include your tax identification number, and reference any sales tax or VAT that may apply. This helps ensure the payment complies with legal requirements.

By including these essential components, you create a document that is clear, professional, and legally sound. A well-structured record not only helps streamline the payment process but also strengthens your professional image and ensures that both parties understand the terms of the agreement.

Benefits of Using a Digital Invoice

Adopting an electronic format for payment requests offers numerous advantages over traditional paper records. Digital documents provide a faster, more efficient way to manage billing, and they can be easily customized, tracked, and shared. Transitioning to a digital method ensures smoother operations and better overall financial management.

Key Advantages of Going Digital

- Time Efficiency: Creating and sending an electronic document is much quicker than printing and mailing physical copies. You can instantly share the record with clients, speeding up the payment process.

- Cost-Effective: Going digital eliminates costs related to paper, ink, and postage, saving you money in the long run.

- Environmental Impact: Reducing paper usage is beneficial for the environment, contributing to sustainability efforts.

- Convenience: Digital records can be stored and accessed easily, reducing clutter and making it simple to retrieve past transactions when needed.

- Security: Electronic documents can be encrypted, password-protected, and backed up, ensuring that your financial records remain secure and protected from physical loss or theft.

Improved Tracking and Management

Another significant benefit of using a digital system is the ability to track payments and manage records with ease. By storing your documents electronically, you can quickly check which payments have been received and which are still pending. Many digital tools also integrate with accounting software, allowing you to automate financial tracking, reducing human error and providing a clearer overview of your financial situation.

In addition, digital records are easily searchable, making it simple to find specific transactions, customer information, or any updates made to the original document. This leads to more organized record-keeping and a more efficient way to handle your finances.

Choosing the Right Invoice Format

Selecting the proper structure for your payment request is crucial for ensuring clarity, professionalism, and efficiency. The format you choose should align with the complexity of the project, your business needs, and your client’s preferences. A well-structured document not only helps you maintain organization but also ensures a smooth transaction process.

Factors to Consider When Choosing a Format

- Project Complexity: For simple projects, a basic, straightforward format may be sufficient. However, more complex projects may require detailed breakdowns and additional sections to capture all aspects of the work completed.

- Client Preferences: Some clients may prefer a minimalist format, while others may require a more detailed structure. Understanding your client’s expectations can help guide the design of your payment request.

- Customization Needs: Choose a format that allows you to adjust elements easily, such as adding specific tasks, expenses, or payment terms based on the nature of the service provided.

- Legal Requirements: Make sure the format accommodates any necessary legal information, such as tax identification numbers, sales tax details, or references to contracts or agreements.

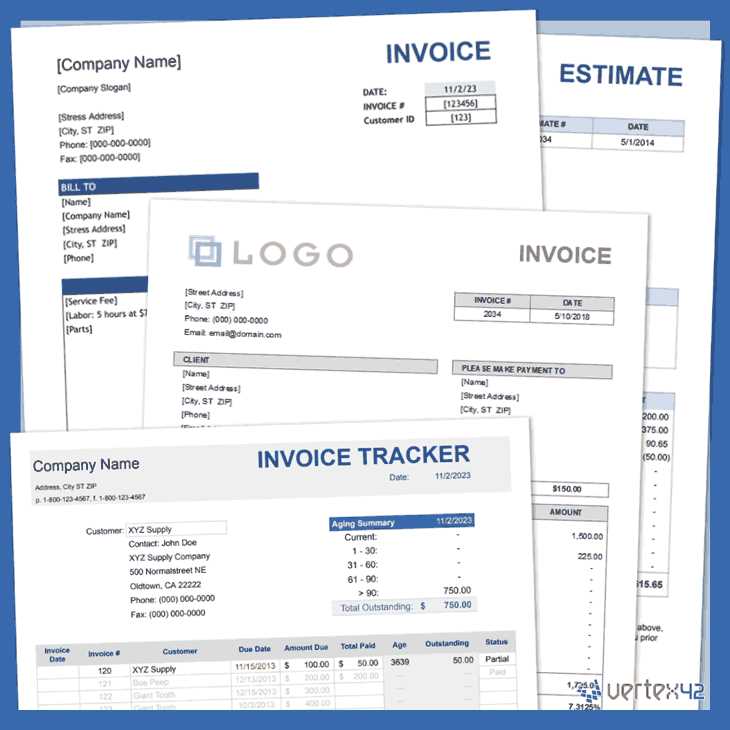

Popular Formats to Consider

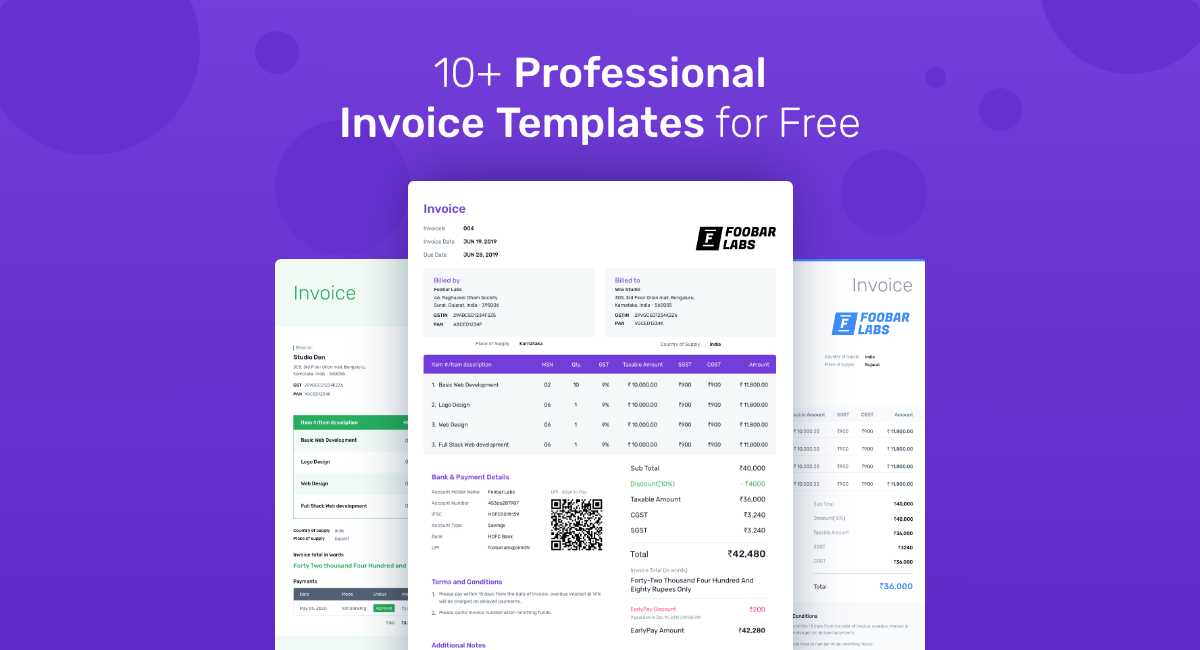

- Basic Format: A simple structure with key details, suitable for straightforward services with minimal additional information.

- Itemized Format: Provides a detailed list of each task or service provided, with individual prices, ideal for larger projects or when clear cost breakdowns are necessary.

- Professional Template: A fully branded, customizable layout that includes logos, business information, and other professional touches, suitable for maintaining a polished image.

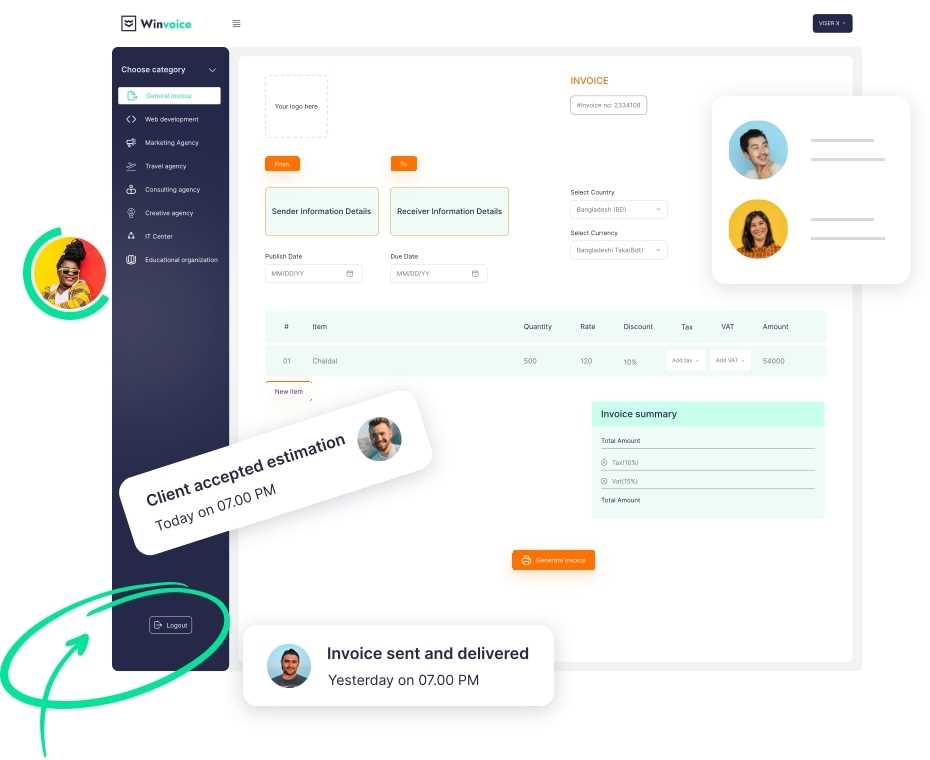

- Automated Format: Using software or tools that generate documents automatically, ideal for freelancers or agencies managing multiple projects at once.

By considering the specific needs of both your business and your clients, you can select the right structure that makes financial communication clear, efficient, and professional.

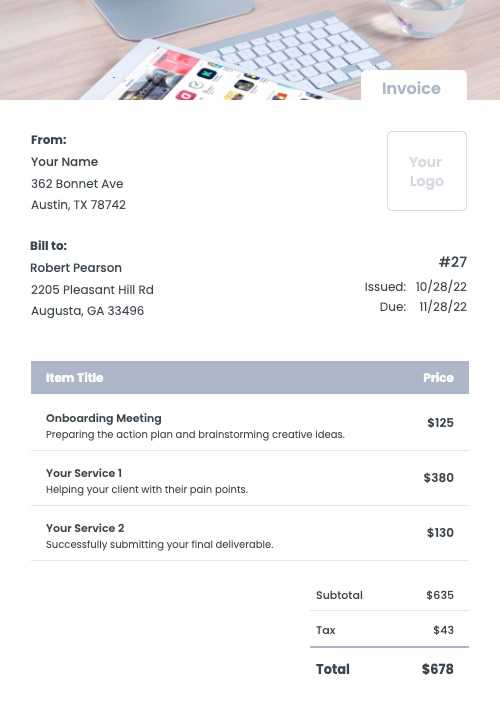

Invoice Template for Freelance Developers

Freelancers working on digital projects often handle their own billing, making it essential to have a well-organized structure that reflects the services provided and ensures timely payments. A personalized payment request can streamline the process, reduce confusion, and maintain a professional image. For freelancers, a clear and effective structure is a key part of managing their business operations.

Key Elements for Freelancers

When creating a payment record, freelancers should include specific details to ensure clarity and avoid misunderstandings. Here are the essential components:

- Client Information: Always include the client’s name, address, and contact details. This ensures the document is properly addressed and can be referenced easily.

- Services Rendered: Break down the specific tasks completed, such as design, coding, or consultation. Detailing each service ensures transparency and justifies the charges.

- Rates and Hours: If hourly rates are used, be sure to list the number of hours worked and the rate charged. This helps the client understand how the total amount is calculated.

- Payment Terms: Clearly state the due date, accepted payment methods, and any penalties for late payments. Setting expectations upfront prevents confusion later.

- Business Information: Include your business name, tax ID, and any other legal information required for compliance, such as sales tax rates or tax identification numbers.

Why Customization Matters for Freelancers

Freelancers often work with a diverse range of clients, which means their billing structures need to be adaptable. Customizing each payment request to reflect the unique aspects of the project helps maintain professionalism and ensures that both parties are on the same page. A personalized approach also shows that the freelancer values the client’s business and is committed to delivering a high level of service.

Tools and Software for Freelancers

There are several tools available that can make the billing process easier and more efficient. From automated systems to customizable designs, using digital tools can save time and reduce errors. Many freelancers rely on accounting software that integrates directly with payment gateways, making it easier to generate, send, and track payments.

How to Calculate Website Development Costs

When creating a project estimate or requesting payment for a digital service, it’s essential to accurately calculate the total cost. Properly assessing the time, effort, and resources required ensures that you are compensated fairly for the work you do. Understanding how to break down costs can also help you provide clients with transparent pricing and avoid disputes over final amounts.

Key Factors to Consider

To calculate the total cost of a digital project, consider the following factors:

- Time and Effort: The number of hours you expect to spend on the project plays a major role in cost estimation. If you charge an hourly rate, this is simply a matter of multiplying your hourly rate by the estimated hours of work.

- Complexity: More intricate projects, such as custom features or intricate designs, will generally take more time and thus increase the cost. Be sure to factor in the complexity of the tasks involved.

- Resources and Tools: If special software, licenses, or external tools are required, these costs should be included in the overall calculation. This can include things like premium plugins, hosting fees, or stock images.

- Revisions and Maintenance: Some projects require ongoing updates, bug fixes, or adjustments after the initial delivery. If this is part of the agreement, be sure to factor in the cost of future revisions or maintenance.

- Project Scope: The larger the scope of work, the higher the cost. This i

Managing Multiple Projects with One Template

Handling multiple projects simultaneously can be a challenge, especially when it comes to keeping track of payments, tasks, and deadlines. Using a unified structure for all your billing and project tracking can help streamline your workflow. With the right approach, one customizable document can serve as a versatile tool for managing various projects, ensuring consistency and saving you time.

By customizing a single format to handle the specifics of different jobs, you can easily update and adapt it for each unique client and project. This method reduces the need to recreate or adjust the structure for every new task, allowing you to focus on the actual work rather than spending time on administrative details.

The ability to modify key sections, such as project descriptions, pricing, and payment terms, allows you to keep everything organized without the risk of overlooking important details. Each project can have its own dedicated space within the document, and with a few quick adjustments, you can create a tailored billing record that matches the needs of the specific job.

Additionally, using a single format makes it easier to track progress and manage multiple clients simultaneously. By maintaining consistency in the structure, you can easily reference past projects, identify patterns, and spot any potential issues without sifting through multiple files or formats. This helps you stay on top of your workload and maintain a professional, organized approach to managing several assignments at once.

How to Include Payment Terms Effectively

Clearly outlining payment expectations is a crucial part of any professional agreement. Having well-defined payment conditions helps ensure that both parties are aligned and reduces the risk of misunderstandings or delayed payments. Including payment terms in a clear and straightforward manner promotes transparency and helps establish trust with clients.

Be Specific About the Due Date. The payment due date should be clearly stated, leaving no room for ambiguity. Whether it’s a specific calendar date or a certain number of days after project completion, make sure it’s easy for the client to understand when the payment is expected.

Outline Accepted Payment Methods. Specify the methods through which payment can be made, such as bank transfers, credit cards, PayPal, or checks. This ensures the client knows their options and helps avoid any delays due to payment method confusion.

State Late Fees or Penalties if applicable. If you charge a late fee, be sure to include it in the payment terms. Clearly outline the penalty for overdue payments, such as a percentage of the total amount due after a specific number of days past the due date. This encourages clients to pay on time and sets a professional tone for the transaction.

Include Discounts for Early Payment, if relevant. Offering a small discount for early settlement can incentivize clients to pay ahead of schedule. This can help improve cash flow and foster a positive working relationship.

Clarify Payment Installments if the project is being paid in stages. If you require multiple payments based on project milestones, specify how much is due at each phase and when those payments are expected. This keeps both parties accountable and ensures fair compensation as work progresses.

By including these details effectively, you ensure that both parties understand the financial terms and can avoid unnecessary delays or disputes. Clear payment conditions set the stage for a smoother, more professional transaction process.

Best Practices for Professional Invoicing

Maintaining professionalism in your billing practices is essential to establishing credibility and fostering trust with your clients. A well-crafted payment request reflects the quality of your work and ensures that you are compensated fairly and promptly. Following best practices when issuing billing records can streamline the process, minimize errors, and ensure timely payments.

Ensure Accuracy. Always double-check the details before sending a request for payment. Ensure that all client information, project details, and amounts are correct. This prevents confusion and reduces the likelihood of disputes or delayed payments.

Use Clear and Concise Language. Avoid jargon or overly complex terms that may confuse your client. Use straightforward language to describe the services rendered, payment amounts, and due dates. Being clear and to the point helps the client understand exactly what they are paying for and when payment is expected.

Include All Necessary Information. Make sure your billing document contains all essential elements, including client contact details, payment terms, your business information, and the breakdown of services provided. Missing details can lead to delays or miscommunication.

Set Clear Payment Terms. Define your payment expectations clearly, including due dates, accepted payment methods, late fees, and any discounts for early payment. Clear payment terms help avoid confusion and encourage timely payments, ensuring a smooth transaction process.

Keep It Professional. Design your billing records to reflect your brand’s professionalism. Use a consistent format, include your logo and business information, and maintain a clean, organized layout. A professional appearance enhances the perception of your business and reinforces your credibility.

Send Promptly. Send your payment requests as soon as the work is completed or according to the terms of your agreement. Timely invoicing demonstrates professionalism and sets a positive tone for future payments.

Follow Up If Necessary. If a payment is delayed, don’t hesitate to send a polite reminder. Following up on overdue payments is a standard part of doing business. A courteous yet firm reminder helps ensure that payments are processed without issue.

By adhering to these best practices, you can streamline your billing process, reduce the chances of errors or misunderstandings, and ensure that your professional relationships remain positi

Free vs Paid Invoice Templates

When it comes to managing payment requests, there are many options available, ranging from free to premium solutions. Choosing between a free and a paid solution depends on your specific needs, the complexity of your projects, and the level of customization required. Both options come with their own set of advantages and limitations, making it important to consider what best aligns with your workflow.

Benefits of Free Options

Free tools are often a great starting point for individuals or small businesses that need basic functionality without extra costs. Here are some reasons why free solutions might be ideal:

- No Cost: Free options don’t require any financial investment, which makes them an attractive choice for those just starting out or working on a tight budget.

- Simplicity: Free solutions tend to be straightforward and easy to use, which makes them suitable for users who need a quick and simple way to create payment requests.

- Basic Functionality: For many freelancers or small projects, basic features such as fields for amounts, payment terms, and client details are all that’s needed. Free tools often provide all of these essential elements.

Drawbacks of Free Solutions

- Limited Customization: Many free options come with restrictions, such as fixed layouts or fewer customization choices. This can limit your ability to tailor the design to your brand’s identity.

- Basic Features: Free tools may lack advanced features like automated calculations, payment tracking, or integrations with accounting software.

- Ads or Watermarks: Some free tools include branding, such as watermarks or ads, which can reduce the professionalism of your documents.

Advantages of Paid Solutions

Paid tools offer enhanced features and greater flexibility, making them a strong choice for businesses looking for efficiency, branding, and advanced functionality. Consider the following benefits:

- Advanced Customization: Paid options often allow for full customization, enabling you to modify layouts, add logos, and personalize the design to fit your brand.

- Time-Saving Features: Many premium tools include automated calculations, recurring billing options, and seamless integrations with payment processors or accounting software.

- Professional Design: Paid solutions tend to offer more polished, professional-looking documents, which helps maintain a higher level of credibility with clients.

- Customer Support: Wi

Common Mistakes in Web Development Invoices

When creating payment requests for digital projects, even small errors can lead to confusion or delays. It’s essential to ensure that all necessary details are accurate and clear to avoid misunderstandings with clients. Below are some of the most common mistakes that freelancers and agencies should be aware of when drafting financial documents.

Overlooking Key Details

Missing essential information can complicate the payment process and lead to unnecessary delays. Here are a few common oversights:

- Missing Client Information: Failing to include the client’s correct contact details, such as name, company, and address, can cause confusion and delays in processing payments.

- Unclear Project Descriptions: If the services provided aren’t outlined clearly, the client might question the charges or request further clarification. It’s essential to provide concise descriptions for each task performed.

- Incorrect Dates: If the dates of completion or payment due dates are inaccurate, clients may be unsure when to pay, leading to delays.

Pricing and Payment Term Issues

Errors related to pricing and payment conditions are some of the most common sources of disputes. These issues can be easily avoided with careful attention:

- Vague Pricing: If pricing isn’t broken down clearly or lacks enough detail, clients might not understand the charges. Always ensure that each service is listed with its corresponding cost.

- Missing Payment Terms: Not specifying due dates, accepted payment methods, or late fees can create confusion. Be sure to outline the payment schedule, including when and how the payment should be made.

- Not Including Discounts or Extra Fees: If you offer early payment discounts or charge for extra work beyond the original agreement, ensure this is clearly stated so clients know what to expect.

Formatting and Professionalism Mistakes

Presentation matters when it comes to billing. Sloppy formatting or poor presentation can damage the professionalism of your business:

- Unorganized Layout: A cluttered or difficult-to-read document can confuse clients and make it harder for them to process the payment. Ensure the layout is clean and all important details are easy to find.

- Lack of Branding: Not including your logo, business name, or contact details makes your payment requests look less professional and could hurt your brand’s image.

- Errors in Math: Simple arithmetic mistakes, such as miscalculating totals or tax, can result in unnecessary corrections and delays. Always double-check your calculations before sending.

By avoiding these common mistakes, you can create clearer, more professional billing records that streamline the payment process and reduce the risk of confusion or disputes with clients.

Legal Considerations for Invoices

When issuing payment requests for completed work, it is important to understand the legal requirements and regulations that govern them. These documents are not just a means of tracking payments, but also serve as a formal agreement between the service provider and the client. Properly formatted and legally compliant payment records can help avoid disputes, ensure timely payments, and protect your business in case of legal issues.

Key Legal Elements to Include

There are several essential details that must be included in any legally binding payment record. These elements help define the terms of the transaction and ensure both parties are clear on the expectations:

- Business Information: Always include your legal business name, address, and contact information. This confirms your identity as the service provider and provides a point of contact for the client.

- Client Information: Include the client’s full name or company name, address, and contact details. This ensures that both parties are clearly identified.

- Unique Reference Number: Each document should have a unique reference number or code. This allows for easy tracking and referencing in case of disputes or record-keeping.

- Detailed Description of Services: Clearly outline the services provided, including the scope, project milestones, or deliverables. This is essential to avoid misunderstandings about the work completed and agreed-upon charges.

- Payment Terms: State the payment due date, accepted payment methods, and any late fees or penalties for overdue payments. This establishes a clear understanding of financial expectations.

Tax and Compliance Considerations

Depending on the jurisdiction in which you operate, there may be specific tax obligations and legal requirements you must comply with. Understanding and including the relevant tax details is essential:

- Sales Tax or VAT: If your business is required to charge sales tax or VAT, make sure to include this in the payment record. Clearly specify the tax rate and amount applied to the total cost of the services.

- Tax Identification Number: Many countries require you to include a tax identification number (TIN) or VAT number on any official payment request. This is particularly important for businesses operating internationally or across borders.

- Legal Jurisdiction: Specify the legal jurisdiction under which any disputes will be resolved. This clarifies the legal framework in which both parties agree to settle potential conflicts.

By adhering to these legal considerations, yo

Integrating Invoices with Accounting Tools

Streamlining the billing process by connecting payment requests with accounting tools can save time, reduce errors, and improve financial management. By integrating these records with software designed for tracking income, expenses, and taxes, businesses can automate various tasks and gain better insights into their financial health. This integration ensures a smooth flow of data between your billing and accounting systems, allowing for quicker and more accurate financial reporting.

One of the key benefits of integration is the reduction of manual data entry. By linking your payment requests directly to accounting software, the information entered into the payment document is automatically recorded in your financial system. This minimizes human error and ensures that all transactions are properly accounted for without the need for duplicate data entry.

Additionally, integrating payment records with accounting tools can help with tax compliance. Many accounting programs have built-in features that automatically calculate and track applicable taxes, such as VAT or sales tax. This can be especially useful when dealing with multiple clients across different regions or countries, where tax rates may vary.

Many accounting platforms, such as QuickBooks, Xero, or FreshBooks, offer seamless integration with other business tools, including project management, time tracking, and payment processing systems. This allows you to create a unified workflow, where all business operations are connected, reducing the time spent on administrative tasks.

Integrating with accounting tools also provides better financial visibility. With real-time updates, you can track outstanding payments, monitor cash flow, and generate financial reports without having to manually reconcile your records. This allows you to stay on top of your finan

Why Consistency Matters in Billing

Maintaining uniformity in how you handle payment requests is essential for fostering professionalism and trust with your clients. When each document follows the same format, structure, and delivery method, it helps create a predictable and organized approach to managing finances. Consistent billing practices are not only crucial for smooth transactions but also vital for maintaining a positive business reputation.

One of the main reasons consistency is important is that it ensures clarity. When all documents follow a similar structure, clients know exactly where to find important information such as payment amounts, due dates, and terms. This reduces the likelihood of confusion or disputes, making it easier for both parties to stay aligned on expectations.

Consistency also streamlines internal processes. When you have a standard approach to generating payment requests, it becomes easier to track payments, manage cash flow, and stay organized. By reducing the need to reinvent the wheel each time, you save valuable time and minimize the risk of human error.

Moreover, a consistent approach helps reinforce your brand identity. Whether it’s the design, format, or tone of the document, a cohesive billing strategy ensures that your clients receive a professional and uniform experience every time. This small touch can leave a lasting impression and contribute to the long-term trust and loyalty of your clients.

Inconsistencies, on the other hand, can lead to confusion, delays, and missed payments. If clients receive payment requests that look or feel different each time, they may question the validity of the document or forget essential details. This can result in a slower payment cycle and potentially strained relationships.

By ensuring consistency in your financial documents, you create a more efficient and professional system that benefits both you and your clients. It reduces errors, improves communication, and ultimately leads to better business practices.