Invoice Template for Web Design Services Easy Customization and Use

In any industry where custom projects are delivered, it’s essential to have a streamlined method for billing clients. Clear, well-structured documents ensure both parties are on the same page and that payments are processed smoothly. Whether you’re a freelancer or running a small agency, having a reliable system in place can save time and prevent misunderstandings.

For those working in fields that require tailored solutions, organizing financial transactions with ease is crucial. Having the right document layout allows you to quickly outline the details of the project, payment terms, and deadlines. This not only reflects professionalism but also simplifies the workflow for both the service provider and the client.

With the proper tools, you can avoid confusion and keep financial matters clear and organized. It’s important to choose a format that can be adapted to different situations, whether it’s a one-time project or an ongoing partnership. Flexibility and accuracy are key to building trust and maintaining positive relationships with clients.

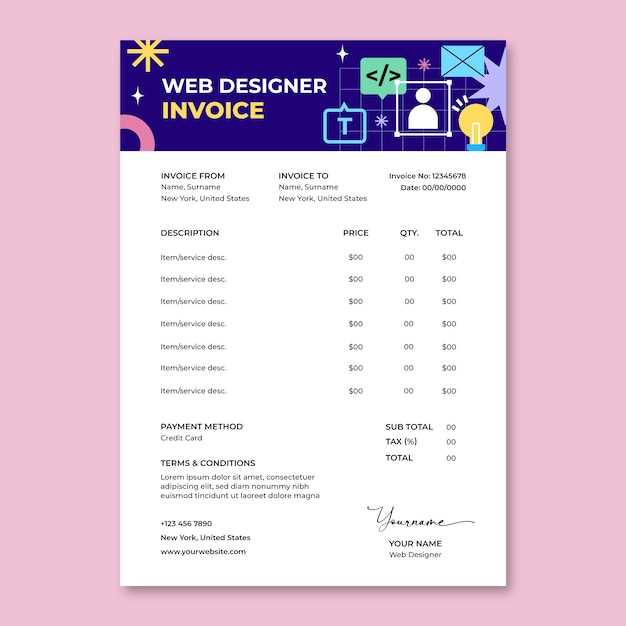

Invoice Template for Web Design Services

When handling projects that involve creative and technical work, it’s important to have a structured document that communicates all necessary details to clients. This document should clearly outline the work completed, payment expectations, and any additional terms that are relevant to the agreement. A well-organized layout can make transactions more efficient and reduce the risk of confusion.

The structure of such a document often includes sections that describe the scope of work, timelines, payment terms, and client information. Customizing these elements based on each client’s project ensures accuracy and helps establish clear expectations. This is particularly important when working with clients who might have varying preferences regarding the style of communication or specific payment schedules.

Having a standardized approach also streamlines the billing process, saving time on every project. It can easily be adapted to different contracts and payment plans, making it a versatile solution for businesses offering tailored solutions. This allows professionals to maintain a consistent and organized approach to managing client payments.

Why Use an Invoice Template

Having a standardized document to outline the terms of payment and project details is essential for both clients and professionals. It helps ensure that all key information is clearly presented and reduces the chances of misunderstanding. With a well-structured approach, both parties can easily track the status of transactions and obligations, leading to smoother interactions.

Using a consistent format also saves time. Instead of creating a new document from scratch for every client, a predefined layout allows you to fill in specific details quickly. This makes the billing process more efficient, enabling you to focus on what matters most: delivering high-quality work. Additionally, it minimizes the risk of errors and ensures that all necessary sections are included.

Another advantage of a standardized document is that it enhances professionalism. Clients appreciate receiving clear, organized documents that reflect the quality and reliability of your work. This simple practice can significantly improve client satisfaction and contribute to building long-term relationships.

Key Features of a Good Invoice

A well-structured document plays a vital role in ensuring clarity and preventing confusion in any financial transaction. It must provide both the client and the service provider with essential details to facilitate timely payments and avoid disputes. Certain key elements should be present to make the document professional, clear, and easy to understand.

Essential Information

A complete document should contain all relevant data, including the following:

- Client Information: Name, address, and contact details of both parties.

- Work Description: A detailed breakdown of the tasks completed or the product delivered.

- Payment Terms: Information about how and when payments should be made, including any late fees.

- Due Date: The exact deadline for payment submission.

- Unique Reference Number: A specific identifier for each transaction, making it easier to track.

Clear and Professional Presentation

How the document looks matters as much as what it contains. A clean, professional layout contributes to a positive impression and ensures that the content is easy to navigate. Key elemen

How to Customize Your Template

Adapting a pre-built document to suit your specific needs is an important step in maintaining professionalism and ensuring accuracy. Customization allows you to tailor the structure to match the unique requirements of each project, ensuring that all relevant details are clearly communicated to clients. This process involves adjusting sections, adding specific terms, and ensuring that the document reflects your branding and workflow.

Here are key steps to personalize your document:

- Adjust Client Information: Make sure to include accurate details such as the client’s name, contact information, and project address.

- Outline the Scope of Work: Clearly describe the tasks completed, deliverables, and any special agreements. This ensures that both parties are aligned on the expectations.

- Set Payment Terms: Specify the payment schedule, accepted methods, and any late fee policies. This provides clarity on when and how payment should be made.

- Add Branding Elements: Include your logo, business name, and contact details in the header or footer. This helps reinforce your brand’s identity and professionalism.

- Ensure Consistency in Formatting: Maintain a consistent font, style, and layout throughout the document to enhance readability and make it easy to navigate.

By taking the time to personalize the document, you not only streamline the billing process but also create a consistent, professional experience for your clients. A customized document helps in avoiding misunderstandings and contributes to a smoother business relationship.

Essential Information for Web Design Invoices

When creating a billing document for creative work, it is essential to include key details that ensure clarity and prevent any misunderstandings between the client and the service provider. A well-prepared statement should outline all the necessary information to facilitate smooth financial transactions and establish clear expectations on both sides.

Here are the critical elements that must be included in such a document:

- Client and Provider Details: Full names, addresses, and contact information for both the service provider and the client are essential for proper identification.

- Project Description: A clear breakdown of the tasks completed, the scope of the work, and any deliverables provided. This helps the client understand exactly what they are paying for.

- Payment Terms: A clear explanation of payment expectations, including the due date, accepted methods, and any late fee policies, ensuring that both parties agree on the timing and method of payment.

- Payment Amount and Breakdown: The total amount owed should be itemized with specific costs for each task or phase of the project. This transparency builds trust and allows the client to verify the charges.

- Unique Identifier: Each document should have a unique reference number or code that makes it easy to track and reference in case of future inquiries or disputes.

Incorporating these essential details into the document not only enhances professionalism but also ensures smooth and timely transactions. A well-structured document minimizes confusion and helps both parties maintain a positive working relationship.

Design Tips for Professional Invoices

When creating a document to request payment for completed work, its visual appeal and clarity are just as important as the information it contains. A clean, professional layout not only makes the document easier to read but also helps establish credibility with clients. The goal is to make the document look organized, polished, and reflective of the quality of work you deliver.

Here are some design tips to ensure your billing documents are both professional and easy to understand:

- Use a Clean Layout: Avoid clutter. Keep your content well-organized with clear headings, ample white space, and a logical flow. This makes the document easy to scan and ensures that important information stands out.

- Choose Legible Fonts: Use easy-to-read fonts like Arial, Helvetica, or Times New Roman. Keep font sizes consistent and ensure that text is large enough to be read without strain. Headings should be bold or slightly larger than body text to create a clear visual hierarchy.

- Incorporate Branding Elements: Include your logo, company name, and contact information at the top. This adds a professional touch and reinforces your brand identity. Make sure the colors and fonts match your business’s visual style.

- Keep Color Scheme Simple: Stick to a limited color palette that complements your brand. Using too many colors can make the document look chaotic and unprofessional. Use color sparingly to highlight key details, such as the total amount due or payment due date.

- Use Dividers and Lines: Incorporate horizontal lines or dividers to separate sections clearly. This helps break up the content and makes it easier to read, especially in longer documents with many details.

- Align Information Properly: Ensure that all columns, especially those with financial data, are properly aligned. This creates a neat, organized appearance and reduces the chances of errors in reading the figures.

By following these simple design guidelines, you can create a polished, professional document that will leave a positive impression on your clients and encourage timely payments. A visually appealing billing statement reflects well on your business and demonstrates attention to detail, which is important in building trust and long-lasting relationships with clients.

Benefits of Digital Invoices for Web Designers

Switching from paper to digital documents offers a wide range of advantages, especially for creative professionals handling client projects. Not only does it streamline the billing process, but it also enhances overall efficiency, reduces administrative tasks, and contributes to a more organized workflow. Adopting digital formats for requesting payment allows professionals to focus more on their craft while ensuring smooth financial operations.

Time-Saving and Efficiency

Digital solutions offer numerous time-saving benefits that make managing financial transactions easier:

- Instant Delivery: Once completed, digital documents can be sent immediately to clients via email, eliminating the need for printing, mailing, and waiting for delivery.

- Easy Editing: Making changes or updates to a document is simple and fast. With digital tools, you can adjust payment details, amounts, or descriptions without starting over.

- Automated Reminders: Many digital platforms allow you to set reminders for clients, prompting them to make payments on time, reducing the chances of missed or late payments.

Professionalism and Tracking

Digital formats contribute to an enhanced level of professionalism and offer better tracking capabilities:

- Consistent Branding: You can easily customize the layout to reflect your branding, including logos, color schemes, and fonts, making the documents look polished and cohesive.

- Centralized Records: All digital documents are stored in one place, making it easier to access past transactions, track payments, and monitor the financial health of your business.

- Environmental Benefits: By going digital, you reduce paper waste, contributing to a more sustainable business model.

Overall, switching to digital billing not only simplifies the process but also increases accuracy, reduces manual errors, and saves time. This ultimately leads to a smoother experience for both you and your clients, ensuring that all aspects of the business run more efficiently and professionally.

Common Mistakes to Avoid in Invoices

Creating a billing document might seem straightforward, but even small errors can cause confusion, delay payments, or damage professional relationships. It’s essential to ensure that all details are correct and presented clearly. By avoiding common mistakes, you can ensure that your documents are effective, professional, and minimize the chance of disputes with clients.

Missing or Incorrect Information

One of the most frequent mistakes is failing to include or miswriting essential details. Here are some critical elements to double-check:

- Client Information: Incorrect or incomplete client names, addresses, or contact details can lead to confusion or delays.

- Scope of Work: Failing to provide a detailed description of completed tasks can result in misunderstandings about the work delivered.

- Payment Terms: Be sure to clearly outline payment deadlines, methods, and any agreed-upon late fees. Missing these details can lead to confusion about when and how payment is expected.

- Unique Reference Number: Skipping this crucial element makes it harder to track payments or reference the document in case of future inquiries.

Formatting and Readability Issues

Even if all the necessary details are included, poor formatting can make your document difficult to understand. Here are some common formatting issues to avoid:

- Unclear Layout: A cluttered, unorganized structure can confuse clients and make it harder for them to find essential information. Use headings, bullet points, and adequate spacing to keep the content clear.

- Poor Font Choices: Hard-to-read fonts or inconsistent font sizes can make the document look unprofessional. Choose legible fonts and maintain a consistent style throughout.

- Inconsistent Currency Formatting: If the document includes multiple currencies, be sure to format them consistently. For example, always use the same symbol or format for dollar amounts, ensuring that the figures are easy to read and interpret.

By addressing these common mistakes, you can ensure that your billing documents are not only accurate but also professional and easy for your clients to understand. This reduces the likelihood of payment delays, misunderstandings, and disputes, helping you maintain a positive business relationship.

How to Save Time with Templates

Using pre-structured documents is a powerful way to reduce the time spent on repetitive administrative tasks. Instead of creating a new financial statement from scratch for each client, you can rely on a ready-made layout that only requires minor adjustments. This efficiency allows you to focus more on your actual work while ensuring that each document is professional, accurate, and consistent.

Here’s how utilizing a pre-made structure can save you time:

- Faster Setup: With a consistent structure, you only need to input client-specific information, project details, and amounts. This eliminates the need to start over every time, speeding up the process significantly.

- Reduced Errors: When you use a standardized document, you’re less likely to forget important details or misplace information. This reduces the time spent correcting mistakes later.

- Easy Adjustments: You can easily modify or update the document layout as your business needs evolve, ensuring that you don’t have to reinvent the wheel with each new project.

- Consistency Across Clients: A structured document ensures that all client communications follow the same format, making it easier to track payments and maintain a professional appearance in all your transactions.

By incorporating a streamlined approach, you can quickly produce documents that meet all your professional standards, freeing up more time for creative tasks. This efficient system benefits both you and your clients, making the entire process smoother and faster.

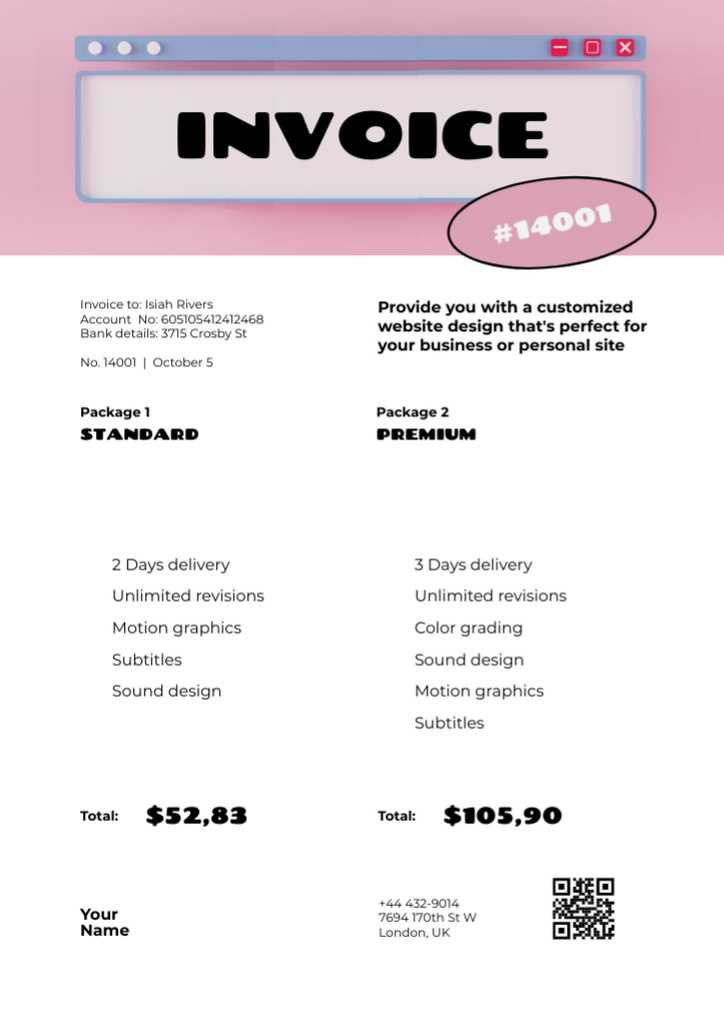

Choosing the Right Template Format

Selecting the proper layout for creating financial documents is a crucial step in ensuring clarity and efficiency. The right format not only makes the document easy to complete and read but also suits the needs of your workflow and client expectations. Whether you’re sending an electronic file or printing it for physical delivery, the format should enhance both usability and professionalism.

Factors to Consider When Choosing a Format

Here are several factors to take into account when selecting the ideal document format:

- Client Preferences: Some clients prefer receiving electronic documents, while others may want a printed copy. Understanding their preference will help you choose the best format for quick delivery and smooth communication.

- Ease of Customization: Choose a format that allows for easy adjustments, whether you’re updating a specific amount, task description, or deadline. A flexible layout ensures that you can personalize documents without starting from scratch every time.

- File Size and Compatibility: Consider how easy it is to send the document via email or upload it to a project management system. File formats like PDF are widely compatible across different platforms, ensuring that your client can easily open and view the document without issues.

- Professional Appearance: The format should ensure a clean and polished look. Avoid overly complex layouts that may distract from the main content, and stick to a simple design that highlights the important details clearly.

Popular Formats to Consider

There are various formats available, each with its own strengths and use cases:

- PDF: This is one of the most commonly used formats for digital billing documents. It preserves the design, ensures easy sharing, and can be opened on almost any device without altering the layout.

- Word Document: Ideal if you need to frequently adjust or update the content, as it allows for easy text editing. However, it may not maintain the formatting as securely as PDF when sent to clients.

- Excel or Google Sheets: Best suited for projects with multiple billing stages or ongoing payments. These formats allow you to calculate totals and automatically update amounts based on changes.

- Printed Format: Som

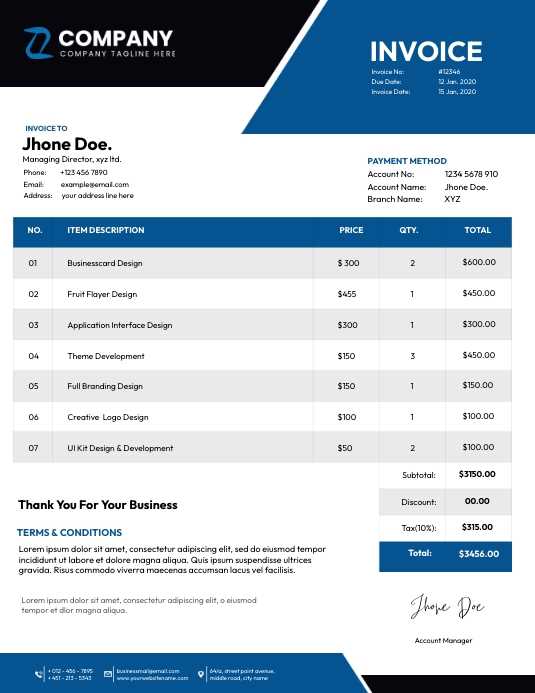

Understanding Invoice Numbering Systems

A proper numbering system for financial documents is essential for maintaining order and ensuring smooth tracking of transactions. Each document needs a unique identifier that helps both you and your client reference specific transactions easily. By establishing a clear and consistent numbering scheme, you can simplify your record-keeping, make it easier to track payments, and ensure compliance with accounting best practices.

Why a Numbering System Matters

The right system brings structure to your financial documents. It helps avoid confusion when multiple projects are involved, ensures no duplicate entries, and makes it easier to organize and locate records when needed. Whether you are managing a handful of transactions or dealing with a large volume of projects, a systematic approach to numbering will save you time and effort.

Popular Numbering Formats

There are different approaches to numbering that can suit various types of projects and businesses. Below are some commonly used formats:

Format Description Example Sequential Numbering This is the most basic approach, where each new document simply gets the next number in line. 1001, 1002, 1003, … Date-Based Numbering Includes the year and month (or even day) in the number, making it easy to identify when the transaction occurred. 2024-001, 2024-002, … Client-Specific Numbering This method adds a client code or abbreviation, making it easier to track projects for specific clients. ABC-001, XYZ-004, … Project-Based Numbering Uses the project code followed by a number, ideal for businesses working on multiple projects at once. PRJ001-001, PRJ001-002, … By selecting the right numbering method that fits your business model, you can create a clear and efficient system that helps you stay organized, ensures accurate record-keeping, and simplifies your accounting process. Whether you opt for simple sequential numbering or a more complex project-based system

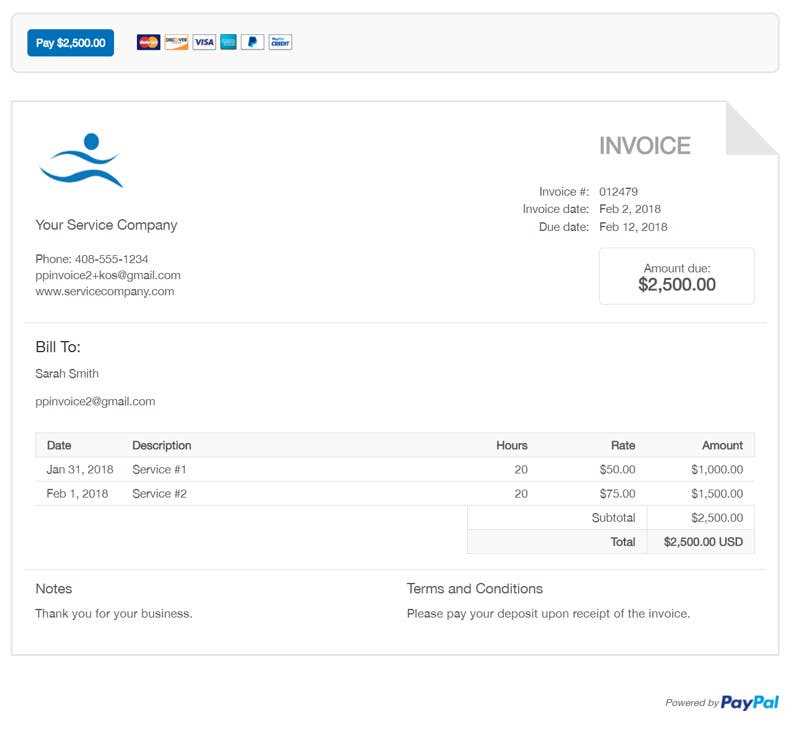

Including Payment Terms in Invoices

Clearly outlining the payment terms in your financial documents is crucial for avoiding confusion and ensuring that both parties are on the same page. This section establishes expectations for when and how payments should be made, and it can help prevent misunderstandings or delays. By specifying details such as deadlines, late fees, and payment methods, you ensure a smooth transaction process and maintain professionalism.

Here are the key payment terms that should be included in any financial document:

- Due Date: Always state the exact date by which the payment should be made. This removes ambiguity and sets clear expectations for your clients.

- Accepted Payment Methods: Specify the methods by which you accept payments, whether it’s bank transfers, credit cards, PayPal, or others. This ensures that clients know how to proceed with the payment.

- Late Fees: If applicable, include information on late payment penalties. Clearly outline the additional charges that will apply if the payment is not made on time, such as a percentage of the total or a fixed fee.

- Deposit Requirements: For large projects, you may request an upfront deposit. Mention the amount or percentage required before beginning the work and clarify whether the deposit is refundable or non-refundable.

- Installments: If the project involves multiple phases, specify how payments will be divided. For example, an initial payment may be required before starting, with further payments due upon completion of milestones or at the end of the project.

- Currency: Make sure to clearly state the currency in which the payment is expected, especially if working with international clients.

Including these payment terms not only protects your business but also builds trust with your clients. It ensures that both sides are fully aware of the financial expectations, reducing the likelihood of disputes or delayed payments.

Best Practices for Invoicing Web Projects

Creating clear and professional financial documents is essential when managing client projects. In the realm of digital development, where the scope of work can often evolve, having a consistent invoicing process ensures that both parties are on the same page regarding payment expectations. By following best practices, you can avoid common pitfalls, enhance client relationships, and ensure timely payments.

Here are some key practices to follow when invoicing for digital projects:

- Detail the Project Scope: Always include a clear description of the tasks completed. This allows your client to see exactly what they are being billed for, which helps avoid any confusion or disputes.

- Break Down the Costs: Instead of listing one total amount, break down the costs for each task or phase of the project. This transparency helps your client understand the pricing structure and justifies the charges.

- Set Clear Payment Milestones: For larger projects, consider dividing the total amount into smaller payments tied to specific project phases or milestones. This helps manage cash flow and ensures you’re paid as the project progresses.

- Use Consistent Formatting: Keep the layout consistent for all your documents. A standardized structure ensures that your clients easily recognize your invoices and can quickly find the important information, such as due dates and payment methods.

- Specify Payment Terms: Always outline the payment terms, including the due date, accepted payment methods, and any late fees. This reduces the likelihood of delayed payments and ensures that both parties are aware of their obligations.

- Include Contact Information: Make it easy for your clients to contact you by including your business details, such as phone numbers, email addresses, and business address. This shows professionalism and offers your clients a direct way to reach you if they have questions about the payment.

- Use Professional Language: Always maintain a formal tone in your communication, even if you have an established relationship with the client. A well-written document reflects your professionalism and commitment to the project.

- Keep Track of Payment History: Always keep a record of past transactions, including the amounts and payment dates. This helps you track your income and avoid any confusion in case you need to refer back to previous payments.

By adhering to these best practices, you not only streamline your invoicing process but also create a more professional and efficient experience for your clients. A well-organized billing system fosters trust, reduces misunderstandings, and helps you get paid on time, allowing you to focus on delivering exceptional results.

Creating Recurring Invoices for Clients

For businesses that offer ongoing or subscription-based work, it’s essential to set up a system for recurring billing. By automating the process, you can save time and ensure that clients are billed consistently without the need to manually generate a new document each time. This approach streamlines cash flow management, minimizes administrative tasks, and improves client satisfaction by providing clear expectations for regular payments.

Here are the key steps to follow when creating recurring financial documents for your clients:

- Set a Clear Billing Cycle: Decide on the frequency of payments, whether they are weekly, monthly, or quarterly. Make sure your client is aware of this schedule and agrees to it upfront, ensuring there are no surprises later on.

- Define the Payment Amount: Ensure that the agreed-upon amount for each billing cycle is clearly specified. If there are different rates depending on the scope of work or if adjustments will be made during the term, outline these details clearly.

- Include Automatic Renewal Terms: If the contract is based on a subscription model, indicate the renewal terms. This can include how often the agreement is renewed (e.g., annually) and how clients can opt-out or cancel if they choose to discontinue the arrangement.

- Specify Payment Methods: Include the available methods for payment, whether it’s through credit card, bank transfer, or another method. For recurring payments, it’s often best to offer automated options, such as through a payment processor or subscription platform, to ensure timely transactions.

- Set Reminders: Establish automated reminders that notify clients a few days before their next payment is due. This can help avoid late payments and keep clients informed about upcoming charges.

- Include Detailed Descriptions: Even though the billing is recurring, it’s still important to include a brief description of the work being done. This ensures transparency and lets clients know exactly what they are being billed for in each cycle.

By setting up recurring billing with clear terms, you can create a smoother experience for both you and your clients. This not only saves you time but also helps you maintain consistent revenue streams, making it easier to plan for future projects and business growth.

How to Handle Late Payments in Invoices

Late payments are a common challenge faced by businesses, especially in client-based industries. When clients miss payment deadlines, it can disrupt your cash flow and delay the completion of other projects. To manage this issue effectively, it’s important to have a clear policy in place that encourages timely payments while offering solutions for late payers. Properly handling overdue payments ensures that your business remains financially stable and maintains a professional relationship with clients.

Steps to Handle Late Payments

Here are some best practices to follow when managing overdue payments:

- Set Clear Payment Terms: Ensure that your payment terms are clearly stated in all project agreements. This includes the due date, accepted payment methods, and penalties for late payments. The clearer the terms, the easier it will be to manage overdue accounts.

- Send Payment Reminders: A polite reminder sent a few days before or after the payment due date can often encourage clients to pay promptly. Consider using automated reminders to streamline this process and ensure consistency.

- Offer a Grace Period: In some cases, clients may need a little extra time. Offering a short grace period (e.g., 5-7 days) can help preserve your relationship while still encouraging timely payments. Make sure this is clearly communicated in the payment terms.

- Apply Late Fees: If your terms specify a late fee, apply it consistently to motivate clients to pay on time. These fees should be clearly outlined from the beginning, ensuring clients understand the consequences of missing deadlines.

- Contact the Client Directly: If reminders and grace periods don’t work, contact the client directly by phone or email. Keep the conversation professional and polite, emphasizing the importance of paying on time and discussing any issues the client may be facing.

Escalating Late Payments

If payments remain overdue despite your efforts, you may need to escalate the situation to protect your business interests:

- Partial Payments: In some cases, you might agree to accept a partial payment until the full amount can be settled. This option can help you manage cash flow while still maintaining the relationship with the client.

- Legal Action: As a last resort, if the payment is significantly overdue and the client is unresponsive, you may need to consider legal action. Consult with a lawyer to understand the process of pursuing unpaid debts through small clai

Where to Find Free Invoice Templates

Creating professional financial documents doesn’t have to be time-consuming or expensive. Many online platforms offer free resources that allow businesses to generate high-quality billing documents with ease. These resources can be especially helpful for freelancers, small business owners, or startups looking for a cost-effective solution to manage client payments. The availability of free options ensures that you can get started quickly without the need for expensive software or complex designs.

Here are some of the best places to find free billing documents:

- Microsoft Office Templates: Microsoft offers a variety of customizable templates for different types of financial documents. You can find free downloadable options in Excel and Word, which are easy to edit and tailor to your business needs.

- Google Docs and Sheets: Google provides free templates that can be accessed and edited directly in Google Drive. These templates are perfect for those who prefer cloud-based solutions and need easy access to documents from anywhere.

- Invoice Generator Websites: There are many online platforms, such as Invoice Simple or FreshBooks, that offer free invoicing tools. These sites allow you to quickly fill in the necessary information, customize the document, and download it without the need for a subscription.

- Freelancer Websites: Many freelancer marketplaces like Upwork or Fiverr provide free downloadable financial templates to help users manage their projects. These templates are specifically created with freelancers and small business owners in mind.

- Accounting Software: Some accounting software, like Wave, offers free templates as part of their basic features. These tools are great if you’re looking to manage finances and create professional documents at the same time.

- Template Directories: Websites like Template.net and Vertex42 offer an extensive library of free and customizable business templates. You can browse by category, such as billing documents, and choose one that fits your needs.

Using these free resources, you can easily find the right solution for creating professional billing documents without the added cost. Whether you need a basic format or a more detailed option, these tools can help streamline your invoicing process and keep your financial transactions organized.