Invoice Template for Sole Proprietor Easy and Effective Billing Solutions

As a small business owner or freelancer, keeping track of financial transactions is essential for maintaining a professional image and ensuring smooth operations. The ability to quickly and accurately document payments and services rendered is crucial, not only for your clients but also for your own record-keeping. A well-organized system can help you avoid confusion and prevent errors when it comes to managing your income.

Creating an efficient document for requesting payment doesn’t have to be complicated. By using a structured format, you can easily present all the necessary details to your clients in a clear and organized manner. This allows for better communication and ensures you get paid on time. Whether you’re just starting your business or have been operating for years, having a reliable method for billing is a key component of financial success.

In this guide, we’ll explore practical options to help you design an effective payment request form that suits your needs. We’ll look at what to include, how to personalize it, and how to manage the process with ease. With the right tools in place, you’ll find that handling financial transactions becomes one less thing to worry about in your daily business operations.

Invoice Template for Sole Proprietor

Creating a formal document to request payment is essential for any business, especially for independent workers. Having a structured format that includes all necessary information makes the process simpler and ensures both parties are clear on the transaction details. With a well-organized form, you can easily keep track of amounts owed and ensure timely payments from your clients.

Key Information to Include

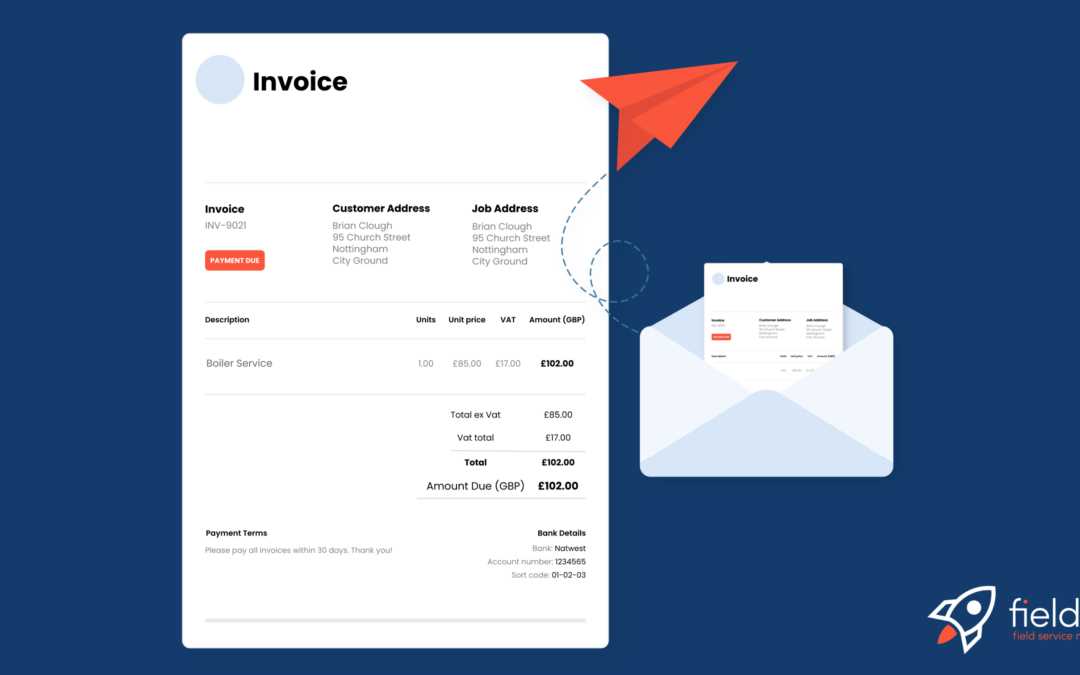

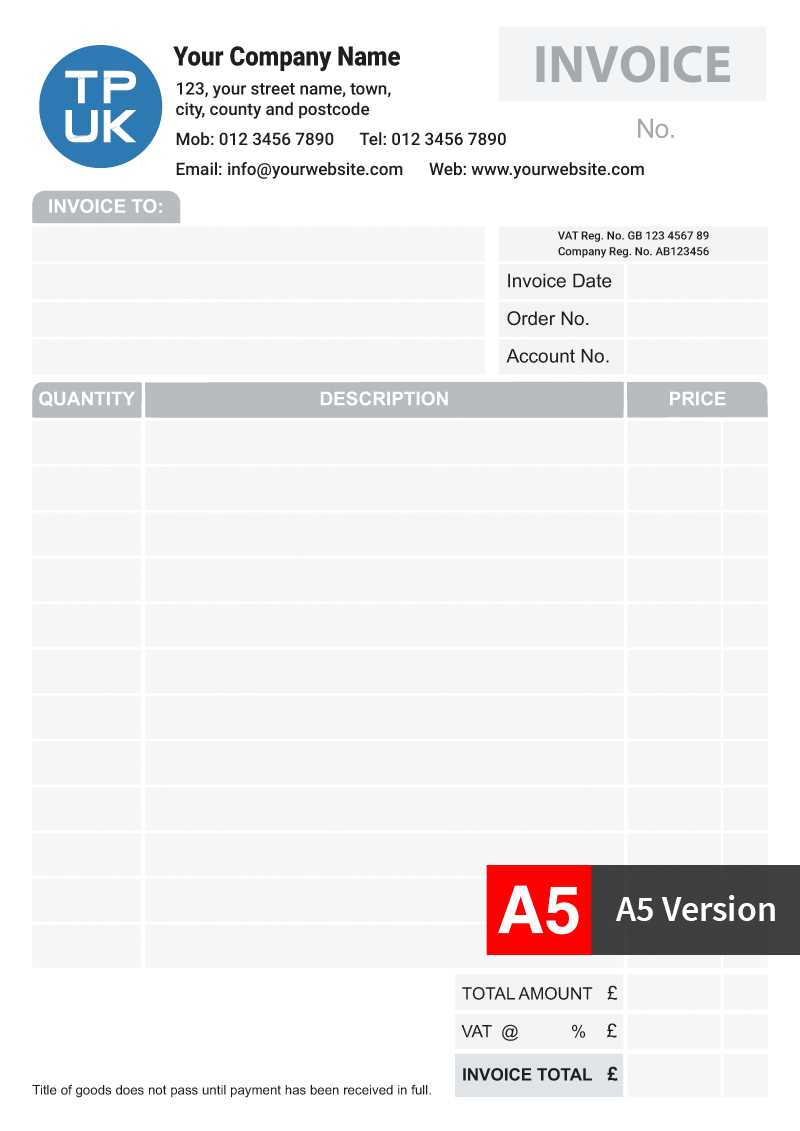

A comprehensive billing document should feature specific details such as your contact information, the client’s details, a description of the services or products provided, the amount due, and the payment terms. Clear dates, including when the work was completed and the payment due date, should also be mentioned. A professional-looking structure makes these documents easier to read, helping to avoid any confusion for your clients.

Customization and Flexibility

The beauty of using a customizable format is the flexibility it offers. You can tailor the document according to your business needs, adding or removing sections as required. For example, you can include a section for taxes, discounts, or additional notes. This adaptability ensures that your documents remain relevant to the type of work you do and the nature of your client relationships.

Why Invoices Are Important for Sole Proprietors

Properly documenting financial transactions is essential for any entrepreneur. Having a formal record of the services rendered or products sold not only helps ensure timely payments but also contributes to maintaining a professional reputation. This practice is vital for managing cash flow and ensuring your business remains organized and compliant with tax regulations.

Without a clear and detailed payment request, misunderstandings and delays are more likely to occur. Clients may forget the agreed terms, or they might dispute the amount due. By providing an official document, you eliminate potential confusion and set clear expectations. Additionally, this record serves as proof of the transaction, which can be important for both tax purposes and legal protection.

Incorporating these documents into your workflow also aids in tracking earnings, which is crucial when it comes time to file taxes. Maintaining an organized system of payment requests helps you stay on top of outstanding amounts, reducing the risk of overdue balances and improving your financial management practices overall.

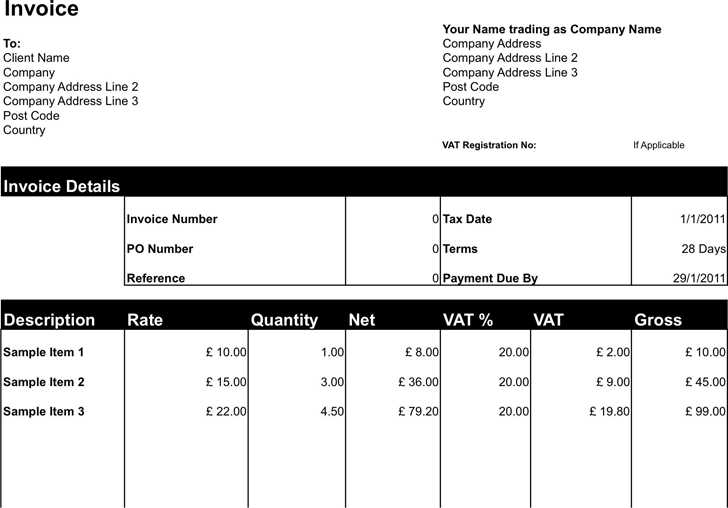

Key Elements of a Professional Invoice

Creating a polished and effective document to request payment requires including several essential components. Each part of the document plays a role in ensuring clarity, professionalism, and smooth communication with clients. A well-organized record not only facilitates the transaction but also strengthens your business’s reputation and helps with financial tracking.

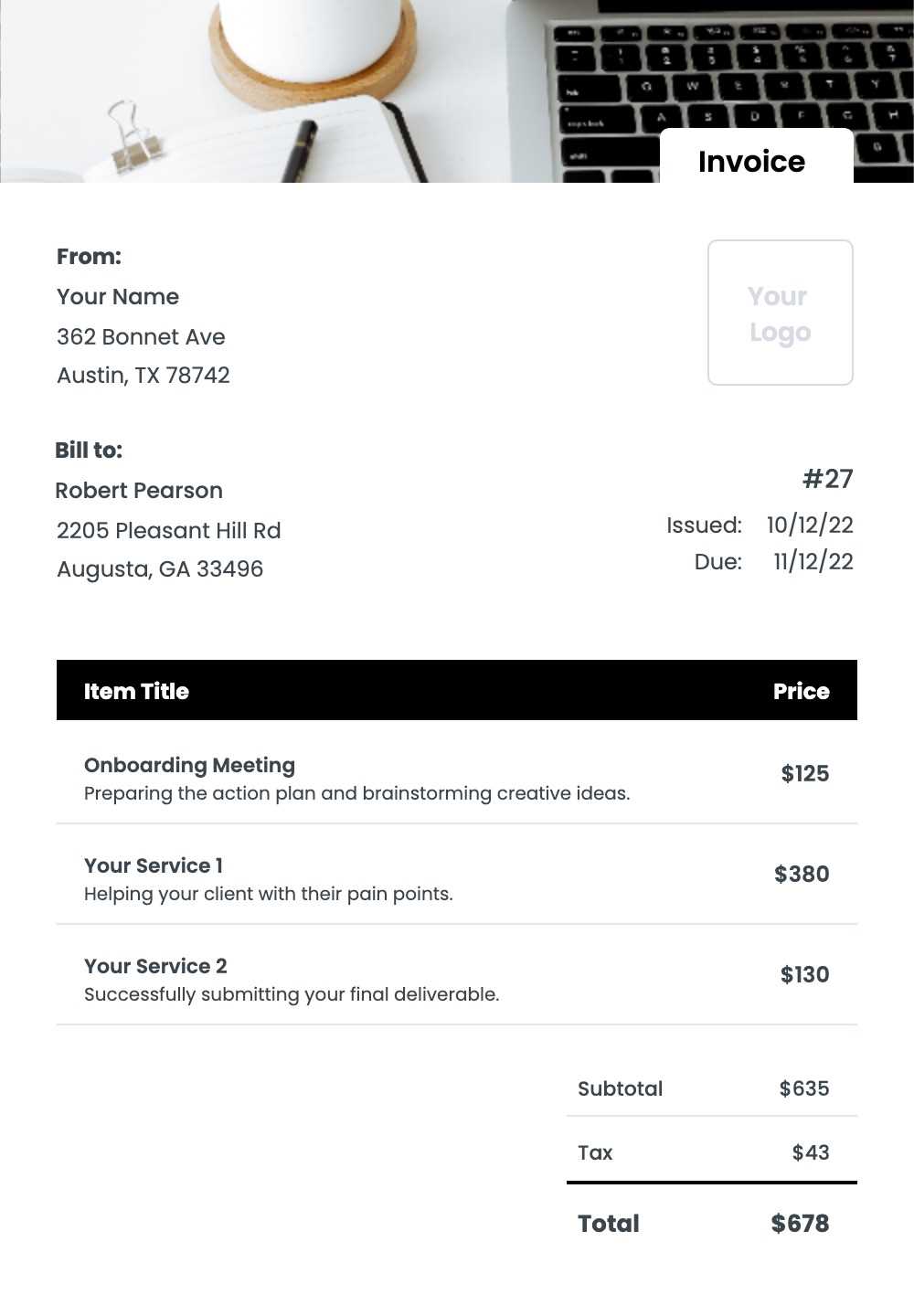

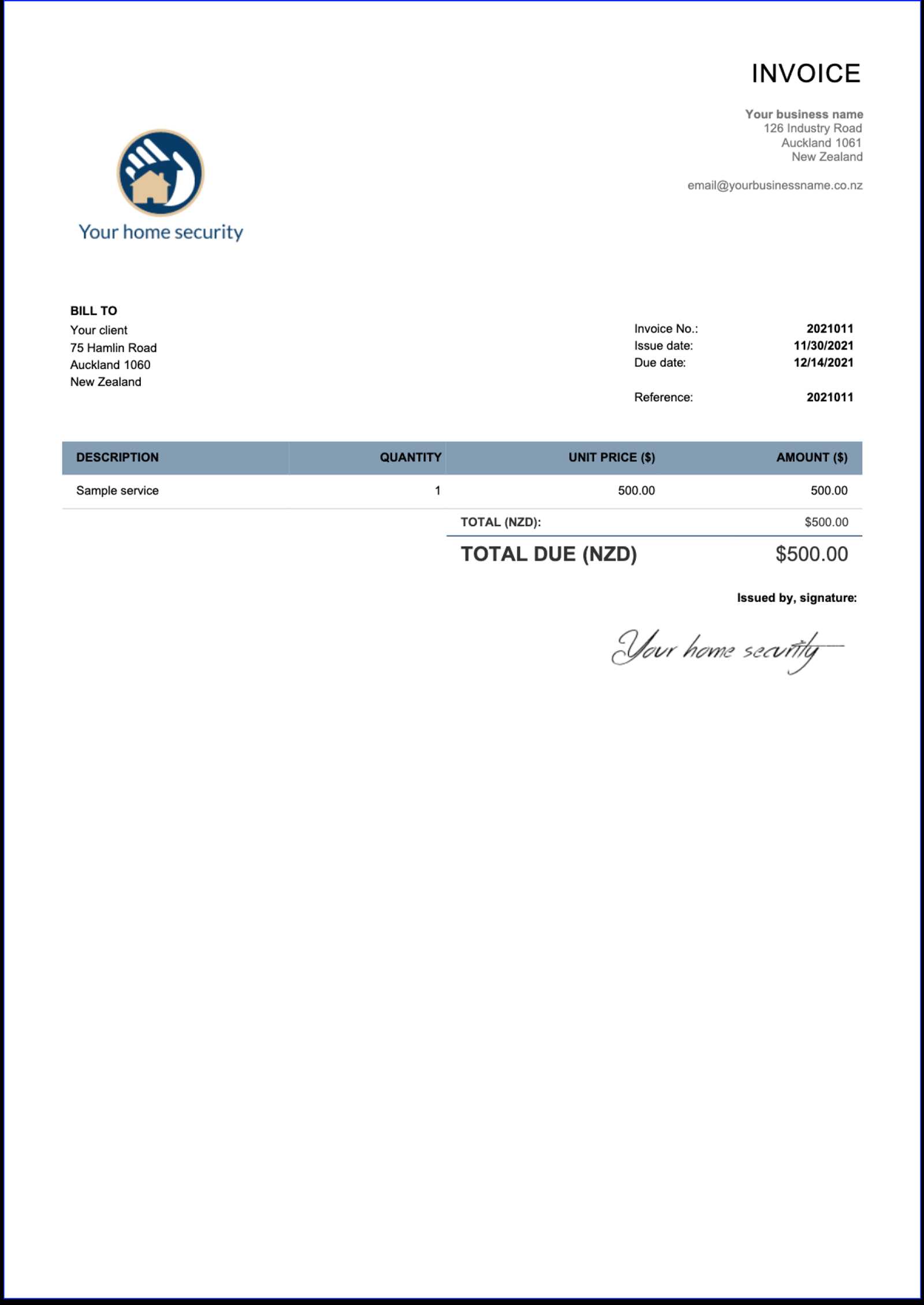

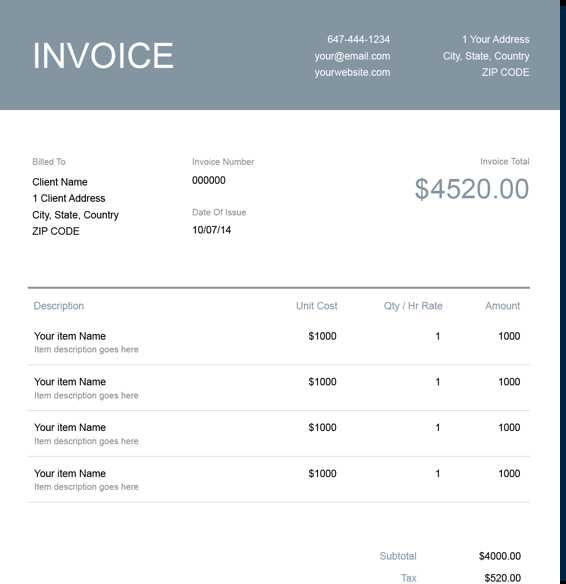

Business and Client Information: Your contact details and the client’s information should always be at the top. This includes the business name, address, email, and phone number, as well as the client’s details. Having this clear information allows both parties to know who is involved in the transaction and makes the process more transparent.

Description of Products or Services: Provide a detailed account of what was delivered. This can include the type of work, product, or service provided, along with relevant dates, quantities, or hours worked. A thorough description helps avoid confusion and clarifies exactly what the client is paying for.

Payment Terms: Clearly outline how much is owed and when payment is due. This may include the total amount, tax rates, and any applicable discounts. It’s also crucial to mention late fees or penalties for delayed payments, setting expectations upfront.

By ensuring these key elements are included, you create a document that is easy to understand and professional, making the payment process smoother for both you and your clients.

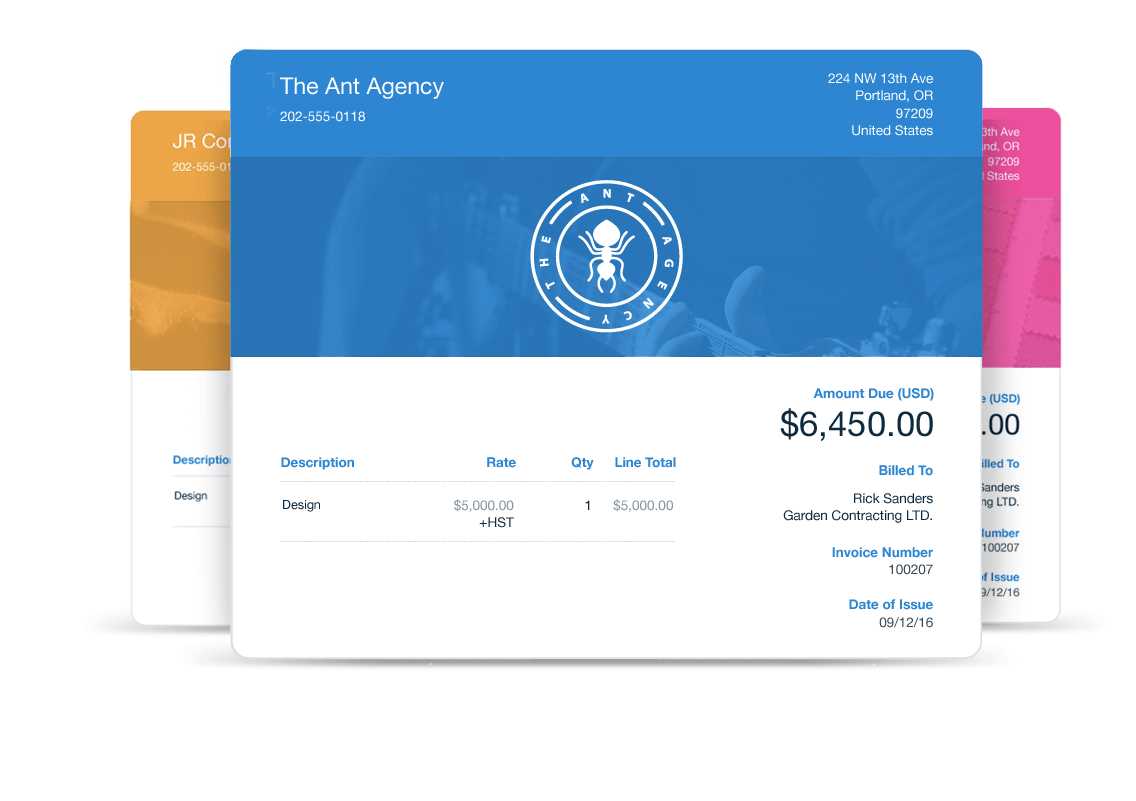

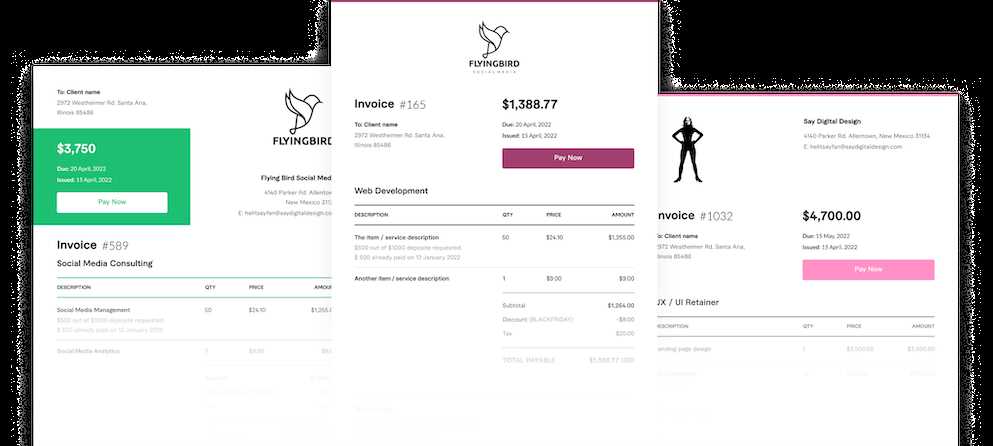

How to Customize Your Invoice Template

Personalizing your payment request document allows you to align it with your brand and make it more tailored to your specific business needs. A customized document can help make a stronger impression on clients, improve clarity, and ensure that all relevant information is included. By adjusting key sections, you can create a more functional and professional-looking record that reflects your unique offerings.

The first step in customization is adding your business logo, name, and contact details. This ensures that clients can easily recognize your company and reach you if needed. You should also consider adjusting the color scheme, font styles, and layout to match your branding, making your document visually appealing and cohesive with the rest of your marketing materials.

Next, consider including specific terms or additional sections that apply to your business. For example, if you offer installment payments, discounts, or need to note special taxes, make sure these elements are part of the document. Customizing these sections can save time and reduce the likelihood of errors or misunderstandings with clients.

Lastly, ensure that all sections are logically arranged and easy to read. Group related information, such as services rendered and pricing, in a structured manner. A clean and well-organized format will help your clients quickly grasp the details, reducing confusion and speeding up the payment process.

Free vs Paid Invoice Templates for Entrepreneurs

When it comes to creating a formal document to request payment, entrepreneurs often face the choice between using free resources or investing in a premium service. Both options have their pros and cons, and selecting the right one depends on your business needs, budget, and the level of customization you require. Understanding the differences between free and paid options can help you make an informed decision that best suits your workflow.

Free Options: Many entrepreneurs opt for free solutions, which are readily available online. These can be a great starting point, especially if you’re just beginning your business or have a limited budget. Free versions typically offer basic functionality, such as a simple structure to include service details, payment terms, and contact information. While they are cost-effective, free options may come with limited features or less flexibility in design and customization.

Paid Options: On the other hand, premium services often provide more advanced features and a greater degree of customization. Paid solutions may allow you to create more professional, branded documents with unique layouts, automatic tax calculations, and integration with accounting software. Additionally, many paid platforms offer customer support and regular updates, which can save you time and reduce the risk of errors. However, the main drawback is the cost, which may not be justified for businesses with minimal invoicing needs.

Ultimately, the choice between free and paid options comes down to your business’s complexity, your need for advanced features, and your budget. If you require a simple, no-frills solution, a free option might suffice. But if you want a more professional and scalable approach, investing in a premium service could be worthwhile.

Choosing the Right Format for Your Invoice

Selecting the right structure for your payment request document is essential for maintaining professionalism and ensuring clear communication with clients. The format you choose can impact how easy it is for clients to understand the details of the transaction, as well as how effectively you manage your own records. Whether you’re creating the document from scratch or using a pre-designed option, it’s important to choose a format that suits both your business needs and the preferences of your clients.

Types of Formats

- Traditional PDF: One of the most widely used formats due to its reliability and ease of sharing. It maintains a consistent layout across different devices and operating systems, making it a safe choice for most entrepreneurs.

- Excel or Google Sheets: Ideal for those who need to track multiple transactions or manage complex calculations. This format allows you to easily adjust pricing, track payments, and create custom formulas. However, it may lack the professional appearance of a PDF.

- Online Platforms: Many entrepreneurs choose invoicing software or online tools that offer built-in formats. These platforms typically allow for easy customization and integration with accounting systems, but they may come with a subscription fee.

Factors to Consider

- Professional Appearance: A clean, well-organized format makes a strong impression on clients. Choose a layout that aligns with your brand and is easy to read.

- Ease of Use: The format you choose should be easy for both you and your clients to navigate. Opt for a design that includes all the necessary fields, but doesn’t overwhelm the reader.

- Customization Needs: Consider how much flexibility you need to adapt the structure to your specific business. If you frequently offer discounts, calculate taxes, or need to include additional notes, choose a format that allows for such customization.

By carefully selecting the right structure, you ensure that both you and your clients are on the same page, making the entire billing process more efficient and transparent.

Legal Requirements for Sole Proprietor Invoices

When managing financial transactions, it is crucial for small business owners to adhere to legal guidelines to ensure that their records are compliant with local tax and business regulations. Certain details must be included in any document requesting payment to make it legally valid and to avoid potential issues with clients or tax authorities. These requirements vary by jurisdiction, but there are common elements that should always be considered when creating such documents.

The first requirement is typically the inclusion of clear contact information. This includes the name of the business owner, their business address, and any other relevant identifiers, such as a tax ID number or VAT registration number, if applicable. These details help establish the identity of the person or business issuing the payment request.

In addition to identifying the issuer, the document should clearly state the transaction date, along with the terms for payment, such as the amount due, any applicable taxes, and due dates. Many countries also require that the document clearly identifies the nature of the goods or services provided, so clients can understand exactly what they are paying for. This is particularly important in case of disputes or audits, as it provides evidence of the transaction’s legitimacy.

Finally, some jurisdictions require that businesses include specific wording or phrases on such records, such as “taxable” or “paid in full,” to ensure transparency in the financial transaction. It’s also important to check whether your location has any specific formatting rules, such as whether to display prices with or without tax included.

Ensuring that your payment request documents meet these legal criteria not only protects you and your business but also builds trust with clients, showing that you are a professional who takes compliance seriously.

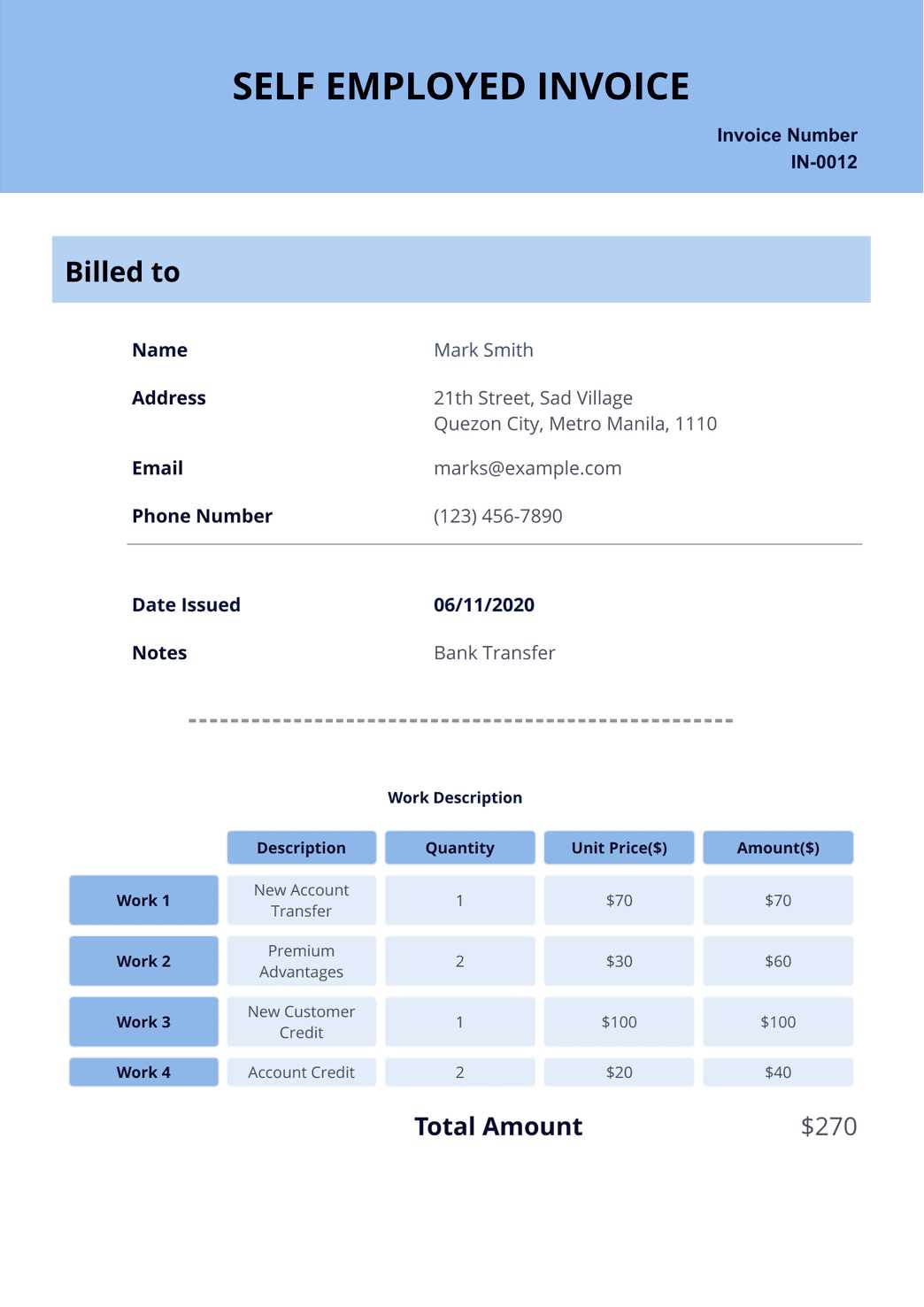

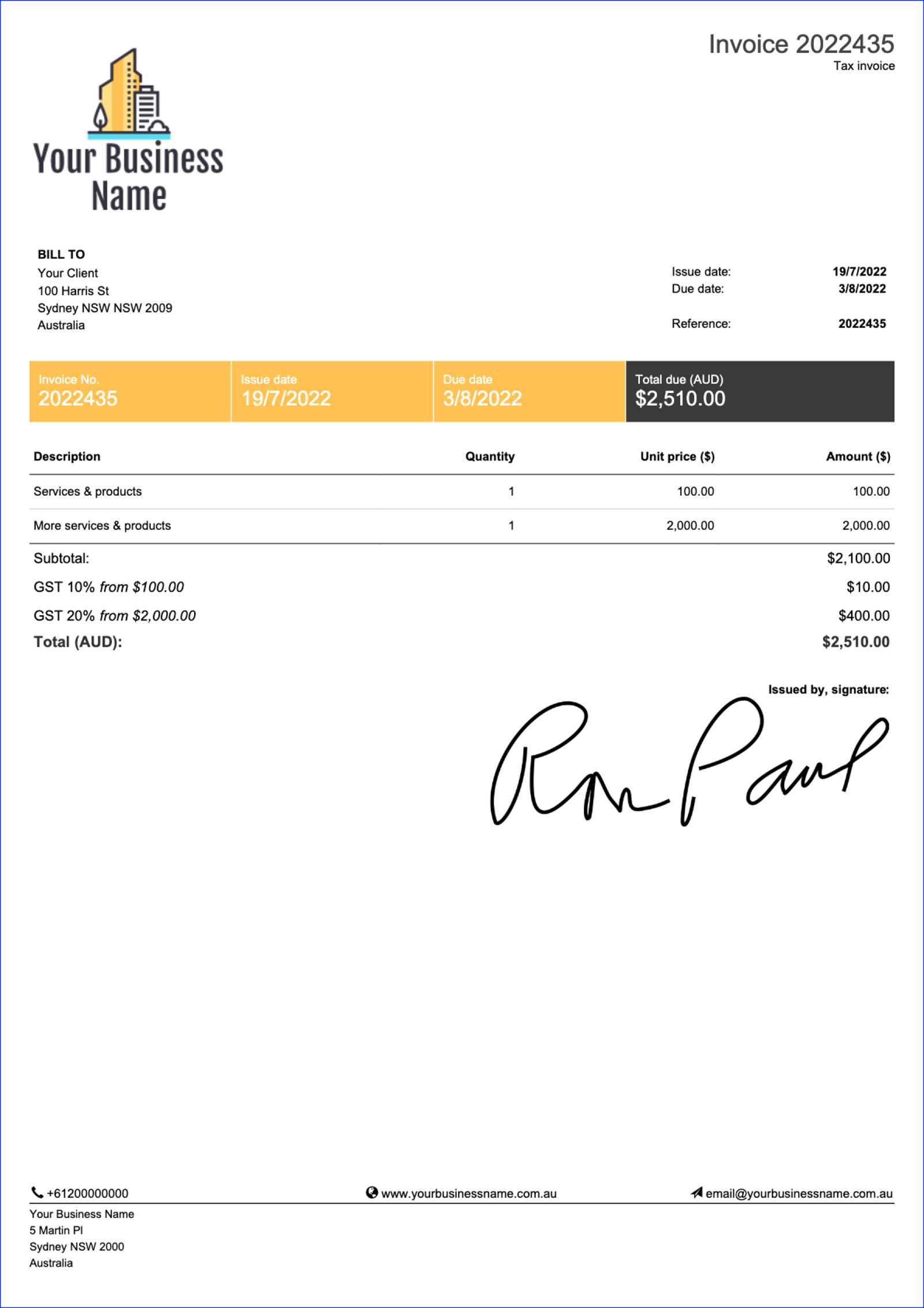

How to Include Taxes in Your Invoice

Incorporating taxes into your payment request is an essential part of ensuring that your financial records are accurate and comply with tax regulations. Depending on your location and the nature of your business, you may need to charge different types of taxes, such as sales tax or VAT, on your products or services. Properly displaying these taxes on the document not only keeps you compliant but also makes the payment process transparent for your clients.

There are several ways to break down taxes in your document, and it’s important to clearly indicate the tax amount, the rate applied, and whether it’s included in the total amount or added separately. Here’s a simple example of how to structure it:

| Description | Amount |

|---|---|

| Service Provided | $500.00 |

| Sales Tax (10%) | $50.00 |

| Total Due | $550.00 |

In the example above, the tax amount is calculated separately, which makes it clear to the client how much they are paying in taxes. Make sure to specify the tax rate applied, especially if it varies based on location or type of service. If the tax is already included in the price, you should clearly state that as well to avoid confusion.

Lastly, if you are required to register for tax purposes (e.g., VAT or sales tax) or if you’re collecting taxes on behalf of a local or national government, be sure to include your tax identification number on the document. This adds another layer of transparency and compliance, helping to establish your business as a trustworthy and legally compliant entity.

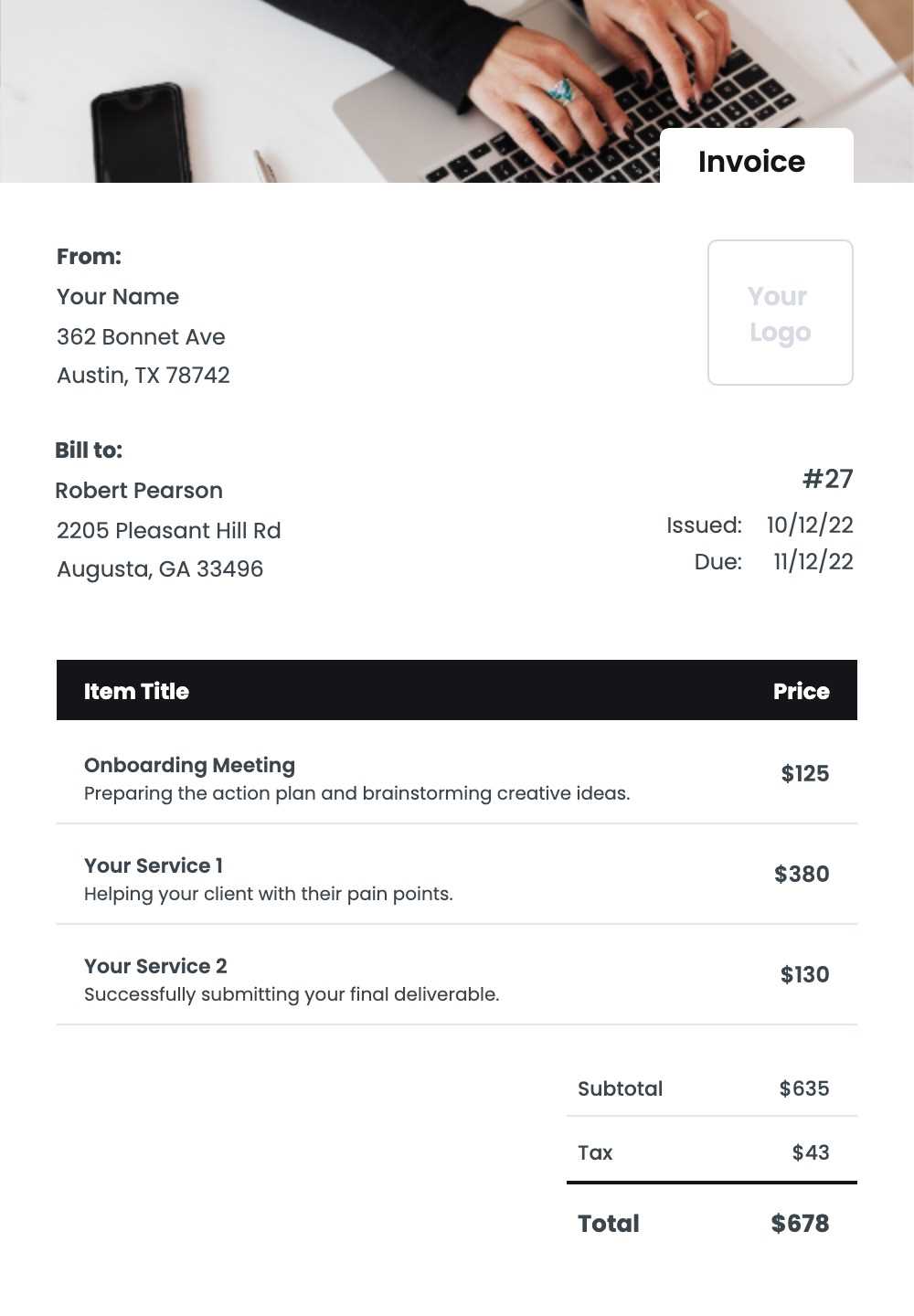

Best Practices for Invoice Design and Layout

The appearance and structure of your payment request document play a crucial role in ensuring that clients understand the details of the transaction clearly and efficiently. A well-designed layout not only improves readability but also reflects professionalism, helping to build trust and credibility with your clients. Whether you’re designing your own document or using a pre-built option, following a few key design principles can make a big difference in the effectiveness of your communications.

Key Design Principles

- Clarity and Simplicity: Keep the layout clean and straightforward. Avoid unnecessary graphics or clutter that could distract from the important details. Use a simple, legible font and maintain consistent formatting throughout.

- Logical Organization: Information should be grouped logically. Start with your business details at the top, followed by the client’s information, a list of services or products, and finally, the payment terms. A clear flow makes the document easier to follow.

- Highlight Important Information: Use bold or larger font sizes to emphasize crucial information like the total amount due or the payment due date. This ensures that your clients don’t miss key details.

- Consistent Branding: Incorporate your company’s logo, colors, and fonts to create a cohesive brand experience. This helps to reinforce your business identity and adds a professional touch.

- Whitespace: Don’t be afraid of leaving space. Adequate spacing between sections, lines, and columns will improve readability and make the document look less crowded and more approachable.

Essential Sections to Include

- Business and Client Information: Clearly state the names, addresses, and contact details of both parties involved in the transaction.

- Itemized List of Services or Products: Break down each service or item provided with quantities, rates, and a short description, so your client understands exactly what they are paying for.

- Tax and Total Calculations: Include clear breakdowns for any applicable taxes and the final amount due, ensuring transparency in the pricing structure.

- Payment Terms: Outline the payment method, due date, and any penalties or discounts related to early or late payments. This ensures both you and your client are on the same page.

By adhering to these best practices, you not only improve the chances of timely payment but also create a more professional experience for your clients, strengthening the relationship and encouraging repeat business.

Common Mistakes to Avoid in Invoicing

Managing payments effectively is crucial for any business, but even the most seasoned entrepreneurs can make errors in their billing process. Simple mistakes can lead to delayed payments, misunderstandings with clients, or even legal complications. By understanding and avoiding common errors, you can ensure that your billing system runs smoothly and your financial records stay accurate.

Common Errors to Watch Out For

- Missing or Incorrect Contact Information: Failing to include accurate details, such as your business name, address, or the client’s contact information, can lead to confusion and delays. Always double-check the details before sending.

- Unclear Payment Terms: If payment due dates, late fees, or accepted payment methods aren’t specified clearly, clients may hesitate to pay on time or misunderstand your expectations. Make sure these terms are prominently displayed.

- Failure to Include a Detailed Breakdown: Clients should never be left guessing what they are paying for. Avoid vague descriptions and provide a detailed list of services or products, including quantities and rates.

- Incorrect Tax Calculations: Miscalculating taxes or omitting them altogether can create confusion and cause legal issues. Always ensure that taxes are calculated correctly and clearly listed on the document.

- Not Including a Unique Reference Number: Every payment request should have a unique reference number. This helps you and your client keep track of the transaction and is especially useful for your accounting records.

- Not Following Up on Late Payments: Many entrepreneurs forget to follow up with clients after the payment due date has passed. Setting up a reminder system for overdue payments can help ensure timely collections.

How to Avoid These Mistakes

- Use Automated Tools: Many invoicing platforms or accounting software can automate calculations, ensure consistent formatting, and send reminders for overdue payments, reducing the risk of mistakes.

- Double-Check All Information: Before finalizing any document, verify the details. Check both your information and the client’s to ensure accuracy.

- Set Clear Terms Upfront: Clearly outline your payment terms, including due dates, accepted methods, and any penalties for late payments, right from the start of the business relationship.

By being proactive and taking the time to carefully review your documents, you can avoid these common invoicing mistakes and maintain a professional, efficient payment process that benefits both you and your clients.

How to Manage Unpaid Invoices Effectively

Dealing with overdue payments can be one of the more challenging aspects of running a business. However, managing unpaid balances effectively is essential for maintaining cash flow and ensuring the sustainability of your operations. By adopting a proactive approach and implementing clear strategies, you can minimize the negative impact of late payments and encourage clients to settle their accounts promptly.

Strategies for Managing Late Payments

- Send Polite Reminders: Many clients simply forget to pay or overlook the payment due date. Sending a friendly reminder early on can often resolve the situation without much hassle.

- Establish Clear Payment Terms: From the outset, be transparent with your clients about your payment terms, including the due date, accepted payment methods, and any penalties for late payments. Clear expectations reduce confusion down the line.

- Offer Payment Plans: If a client is struggling to pay the full amount, consider offering a payment plan or a discounted rate for early settlement. This can encourage them to pay off the balance in installments.

- Charge Late Fees: To incentivize timely payments, you may want to implement late fees for overdue balances. Ensure these fees are clearly outlined in your payment terms.

Tracking Unpaid Balances

To keep track of overdue payments, it’s important to organize and monitor your financial records effectively. Using an accounting system or simple spreadsheet can help you stay on top of unpaid balances. Below is an example of how you might track overdue accounts:

| Client Name | Amount Due | Due Date | Days Overdue | Status |

|---|---|---|---|---|

| Client A | $350.00 | September 15 | 10 | Unpaid |

| Client B | $500.00 | September 20 | 5 | Unpaid |

| Client C | $1,200.00 | September 10 | 15 | Unpaid |

By organizing overdue accounts in a table like the one above, you can quickly identify which clients require follow-up. This approach allows you to take action promptly, whether it’s sending a reminder or discussing alternative payment arrangements.

Finally, if payments continue to be overdue despite your efforts, it may be necessary to consider more

Integrating Invoices with Accounting Software

Efficiently managing business transactions is essential for keeping your financial records organized and up-to-date. Integrating payment request documents directly with accounting software can streamline your bookkeeping process, reduce human error, and save time. By connecting your records to a reliable system, you can automatically track payments, generate financial reports, and ensure that every transaction is accurately recorded in real-time.

Benefits of Integration

- Time-Saving: Automating the process of transferring transaction details to your accounting system eliminates the need for manual data entry, allowing you to focus on other aspects of your business.

- Improved Accuracy: Reducing the risk of errors ensures that all financial information is accurate, making it easier to prepare for tax filing, audits, and financial reporting.

- Better Financial Insights: By integrating your payment requests with accounting tools, you can easily monitor cash flow, track outstanding payments, and analyze business performance at any time.

- Streamlined Reporting: Accounting software can automatically generate reports based on the integrated data, helping you understand your revenue, expenses, and profitability without the need for complex calculations.

How to Set Up Integration

Setting up an integration between your payment records and accounting software is typically a straightforward process. Many accounting tools offer direct integrations with popular invoicing platforms. Here’s how you can get started:

- Choose Your Accounting Software: Select a reliable accounting system that suits your business needs, such as QuickBooks, Xero, or FreshBooks.

- Link Your Invoicing Platform: Many invoicing platforms, like Zoho Invoice or PayPal, offer built-in integrations with major accounting software. Enable the integration feature in your invoicing tool settings.

- Sync Your Accounts: After linking your invoicing tool with your accounting software, make sure to sync the data. This will automatically import transaction details into your accounting system for easy tracking.

- Set Up Automatic Updates: Configure the software to automatically update whenever a new payment request is issued or paid, ensuring that your financial records are always up to date.

By integrating your payment documents with accounting software, you can create a more efficient, accurate, and organized workflow that simplifies managing your business finances.

Tracking Invoice Payments and Deadlines

Efficiently tracking payments and due dates is essential for maintaining a steady cash flow in any business. When payments are not properly monitored, it can lead to missed deadlines, late fees, and overall disorganization. Implementing a system to track outstanding balances and deadlines ensures that payments are made on time and clients are reminded of their obligations. A clear tracking process helps you stay on top of your financials and reduces the likelihood of overlooking overdue payments.

To make tracking easier and more organized, it’s helpful to maintain a record of all transactions, including payment due dates, amounts owed, and any past payments made. Below is an example of how you can track payment status and deadlines effectively:

| Client Name | Amount Due | Due Date | Days Overdue | Payment Status |

|---|---|---|---|---|

| Client A | $350.00 | September 15 | 10 | Unpaid |

| Client B | $500.00 | September 20 | 5 | Unpaid |

| Client C | $1,200.00 | September 10 | 15 | Paid |

In this table, you can track important details such as the client’s name, the amount owed, the due date, and the current payment status. This allows you to identify which clients are overdue and which payments have been settled. You can also calculate how many days a payment is late, making it easier to decide when to send reminders or follow up.

By regularly reviewing and updating your records, you can avoid letting deadlines slip through the cracks and ensure that your clients are always aware of their financial responsibilities. An organized approach to payment tracking can help prevent cash flow disruptions and contribute to the long-term success of your business.

How to Handle International Invoices

When doing business with clients from different countries, managing payment requests becomes more complex due to varying tax laws, currencies, and international payment methods. Understanding how to properly structure and send requests for payment across borders ensures that you remain compliant with regulations and receive payments efficiently. Properly handling international transactions requires attention to detail, as errors in currency conversion or incorrect tax rates can lead to delays or misunderstandings.

Here are key factors to consider when handling payments across borders:

Key Considerations for International Transactions

- Currency Conversion: Always specify the currency in which the payment is expected. If you’re working internationally, you may need to use a currency converter to calculate the equivalent amount in the client’s currency. Consider using online tools or payment platforms that can handle this automatically.

- Clear Payment Terms: Make sure your terms are clear regarding exchange rates and any potential fluctuations in the currency value. Clients should know whether they are required to cover any additional fees that might arise due to currency conversion.

- Tax Regulations: Different countries have different tax rates and regulations. Be sure to understand whether VAT or other taxes apply to international sales. You may need to charge different rates or follow specific reporting requirements depending on the jurisdiction of the buyer.

- Payment Methods: Offer a variety of international payment methods such as wire transfers, PayPal, or other global payment processors. Different countries may have preferred or more accessible payment platforms, so providing multiple options is a smart strategy.

Important Documentation for International Transactions

- Include Relevant Tax Identification Numbers: If applicable, include both your tax ID number and your client’s. This is often required for international transactions and ensures compliance with tax regulations in both countries.

- Language Considerations: If your client speaks a different language, consider providing translations of your payment request. This can prevent miscommunication and ensure that all terms are clear, helping to avoid disputes later on.

- Delivery and Shipping Costs: If you are selling products internationally, be sure to include shipping costs and terms for delivery. Make it clear who is responsible for import duties and customs charges.

By addressing these factors, you can reduce the chances of payment delays and complications, helping you maintain positive business relationships and smooth financial operations even when dealing with international clients.

Invoicing Tips for Freelancers and Consultants

As a freelancer or consultant, getting paid promptly and correctly is crucial for the sustainability of your business. Clear and professional payment requests help ensure that clients understand the terms of your services, the amount due, and the deadlines for payment. By following a few best practices, you can avoid common pitfalls and streamline your billing process, allowing you to focus more on your work and less on chasing payments.

Here are some essential tips to improve the invoicing process for freelancers and consultants:

- Set Clear Payment Terms: Always define your payment terms upfront. Whether you require a deposit, work on a retainer, or expect payment upon completion, make sure the client knows when and how much they need to pay. Clear payment terms help avoid confusion and late payments.

- Include Detailed Descriptions: Break down your services in a clear and understandable way. Instead of just listing a lump sum, itemize the work performed, the hours worked, or the deliverables provided. This helps clients understand what they’re paying for and shows transparency.

- Use Professional Language: Maintain a professional tone in your payment requests, even if you’re on friendly terms with the client. A well-worded request shows that you take your work seriously and expect to be compensated accordingly.

- Consider Advance Payments: If you’re working on a long-term project or providing ongoing services, it’s a good idea to request a deposit or advance payment. This protects your time and ensures that clients are committed before you begin major work.

- Keep Track of Due Dates: Use a system to track deadlines and payment status. Setting up reminders for both you and your clients can help ensure that payments are made on time and avoid unnecessary delays.

By applying these tips, you can create a more efficient and professional billing process, improve cash flow, and avoid payment disputes in your freelance or consulting business. Being proactive and organized in your billing helps foster trust with clients and establishes your business as a reliable partner in any project.

How to Send Invoices Professionally and Securely

Sending payment requests in a professional and secure manner is vital to maintaining trust with clients and ensuring that your transactions are handled efficiently. A secure and well-organized delivery method not only protects sensitive financial information but also reinforces your business’s credibility. There are several key practices to follow in order to ensure your requests are sent smoothly, securely, and with a professional touch.

Steps to Send Payment Requests Securely

- Use Secure Delivery Channels: Always send payment requests through secure methods, such as encrypted email services or trusted invoicing platforms. Avoid sending sensitive information via unencrypted email to protect your business and client data.

- Include Clear Contact Information: Ensure that your contact details, including a phone number or email address, are clearly visible in the document. This provides clients with a direct way to reach out if they have any questions or concerns.

- Verify Client Details: Double-check the recipient’s details, including their name, address, and payment information, before sending. This helps avoid errors and ensures that the request reaches the correct person or department.

- Leverage Online Payment Platforms: Consider using reputable payment processors like PayPal, Stripe, or bank transfers. These platforms provide secure transaction processing, often with built-in invoicing features that ensure both you and your clients are protected.

Best Practices for Professional Delivery

- Customize the Document: Personalize your payment requests with your company logo, a professional font, and a clear structure. This helps reinforce your brand image and presents a polished and professional appearance.

- Maintain a Consistent Format: Use a consistent format for all payment requests. This makes your communications easily recognizable and simplifies the process for your clients when they need to review or refer back to the document.

- Set Clear Payment Terms: Make sure your terms, such as due dates, accepted payment methods, and late fees, are clearly outlined. This reduces ambiguity and ensures that both parties understand their obligations upfront.

- Send Reminders: If a payment is overdue, send polite reminders to your clients. Use your invoicing system to automatically generate follow-up reminders, or send a friendly email to maintain a professional relationship while ensuring timely payments.

By following these steps, you can ensure that your payment requests are delivered securely and professionally, fostering trust and improving the likelihood of timely payments. Proper delivery methods protect sensitive information while reinforcing your commitment to professionalism in every aspect of your business.