Invoice Template for Services Rendered Simple and Effective Billing Solution

Managing payments and ensuring clear communication with clients is a crucial aspect of running a successful business. A well-structured document that outlines the terms of payment, details of the work performed, and due dates can streamline the entire billing process. It helps maintain professionalism, avoid confusion, and reduce the chances of delayed payments.

By utilizing a clear and organized billing format, entrepreneurs, freelancers, and small business owners can save time and avoid errors. The right approach not only enhances your financial operations but also builds trust with your clients. With the proper structure, you can create a seamless and efficient system for invoicing that benefits both parties.

In this guide, we will explore the key components of an effective billing document, how to personalize it for your needs, and the best practices to ensure accuracy and professionalism in every transaction.

Invoice Document for Completed Work

Having a reliable document to request payment for completed tasks is essential for maintaining smooth business operations. A properly structured bill ensures clarity in communication, prevents misunderstandings, and helps ensure timely payments from clients. This kind of document is an important tool for freelancers, contractors, and businesses of all sizes who provide specific deliverables or completed work.

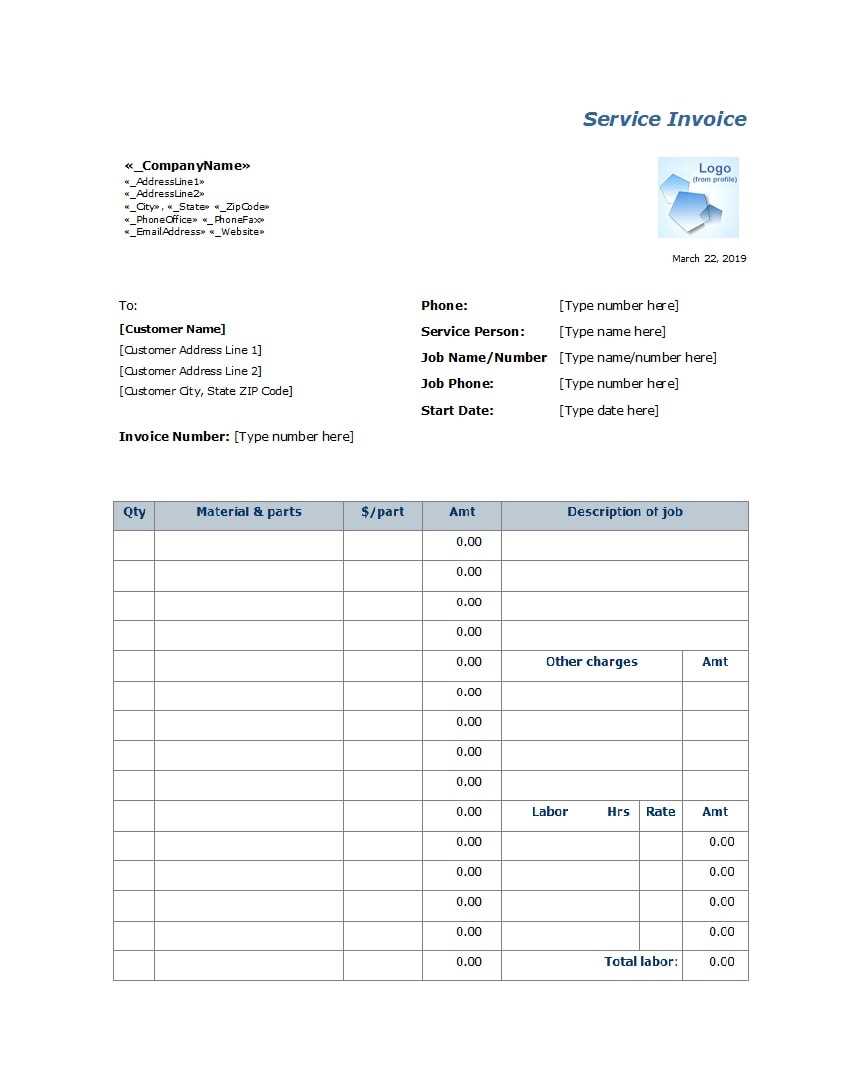

When creating such a document, there are several key components to consider. These elements not only make the billing process clear but also professional. Here’s what should typically be included:

- Header: Your business name, contact details, and logo (if applicable) should be at the top of the document.

- Client Information: Include the name, address, and contact information of the person or company receiving the bill.

- Work Description: Clearly outline what tasks or projects were completed, including any specific details that will help the client understand what they’re paying for.

- Payment Terms: Specify the total amount due, due date, and any terms related to payment (e.g., late fees, discounts for early payments).

- Unique Identification Number: Assigning a unique reference number helps you track payments and organize records efficiently.

- Payment Instructions: Provide clear instructions on how the client can settle the amount, including bank details or online payment links.

By ensuring these details are present, you not only create a professional image but also avoid confusion and disputes down the line. A clear, consistent format for every bill you send will enhance your credibility and build better client relationships.

Consider the specific needs of your business or industry when designing the layout of your document. Depending on the nature of the work, some elements might need more emphasis, while others can be simplified. The goal is to make the process as smooth and transparent as possible for both you and your client.

Why Use an Invoice Template

Utilizing a structured document for billing purposes brings numerous benefits to any business or independent professional. It provides a consistent and organized way to communicate payment details, reducing the chance of errors or misunderstandings. By using a standardized format, you ensure that every transaction is handled in a clear and professional manner, which is crucial for building trust with clients and maintaining smooth financial operations.

One of the key advantages of using a pre-designed document is time-saving. With a ready-made format, you don’t need to start from scratch each time you bill a client. Instead, you can focus on inputting the specific details of the work completed, such as the amount owed, payment terms, and due dates. This speeds up the process and ensures that nothing important is overlooked.

Additionally, such documents help maintain consistency across all your business transactions. When all bills follow the same structure, it not only looks more professional but also makes it easier to track payments and manage records. This consistency is especially important for small businesses or freelancers who might have to deal with multiple clients and varied projects.

Moreover, using a pre-structured format reduces the risk of missing vital information that could lead to delays in payment. Common elements such as the client’s contact information, work descriptions, and payment terms are clearly outlined, helping you avoid omissions that could affect your cash flow.

Benefits of Customizable Invoice Formats

Having the ability to adjust and personalize your billing documents offers significant advantages for businesses and freelancers alike. Customizing your billing structure allows you to align it with your brand identity, specific business needs, and client expectations. This flexibility ensures that every transaction is handled in a way that reflects your unique style and requirements.

Branding and Professional Appearance

One of the main benefits of customizing your billing structure is the opportunity to integrate your business’s branding. By adding your logo, brand colors, and tailored fonts, you can create a more professional and cohesive experience for your clients. A personalized approach not only boosts your brand visibility but also reinforces the image of professionalism and reliability.

Adaptation to Different Client Needs

Every client and project may have specific billing requirements. Customizable formats allow you to tailor each document to the specific terms of the job. Whether you’re dealing with a long-term contract, a one-off project, or different pricing structures, a flexible format lets you adjust details like payment terms, rates, and additional notes to suit each situation.

Additionally, this customization can help you streamline the billing process, as you can pre-fill common fields and modify only the necessary information. This leads to faster creation of documents, reduced chances for errors, and ensures that you meet any client-specific billing preferences with ease.

Ultimately, the ability to tailor your billing documents enhances both the client experience and your internal workflow, making it a valuable tool for any business owner or freelancer.

Key Information to Include on Invoices

Creating a clear and effective billing document requires including certain essential details to ensure both parties understand the terms of payment. These elements not only help avoid confusion but also streamline the payment process, ensuring that clients know exactly what they are paying for and when. Including the right information in each bill is crucial for maintaining professionalism and securing timely payments.

Here are the key pieces of information that should be present in every billing document:

- Business Information: Your business name, address, and contact details should always be at the top. Including your logo, if applicable, helps to personalize the document and reinforces your brand identity.

- Client Information: Clearly state the name, address, and contact details of the client receiving the payment request. This ensures the bill is directed to the correct recipient.

- Unique Reference Number: Assigning a unique identification number to each document helps track payments, manage records, and avoid any duplication or confusion.

- Description of Work: Provide a detailed breakdown of the tasks completed, including specific deliverables or milestones. This section helps clarify the purpose of the payment and prevents any misunderstandings.

- Payment Amount: Clearly indicate the total amount due, breaking it down if necessary (e.g., hourly rate, fixed price). If applicable, specify taxes or additional charges.

- Due Date: Include the exact date by which payment is expected. This helps set clear expectations and promotes timely payment.

- Payment Terms: Specify the terms of payment, such as late fees, early payment discounts, or any other conditions that apply. This section helps protect your business from delayed payments.

- Payment Instructions: Provide clear and easy-to-follow instructions on how to make the payment, including bank account details, online payment links, or any other preferred payment methods.

Including all these details ensures that your billing documents are complete, professional, and easy for your clients to process. A well-organized and transparent payment request reduces the likelihood of disputes and promotes a smoother transaction process.

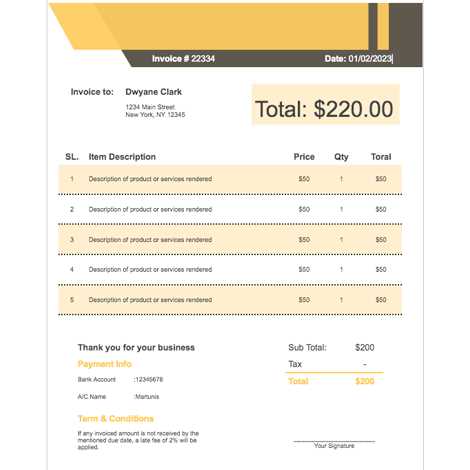

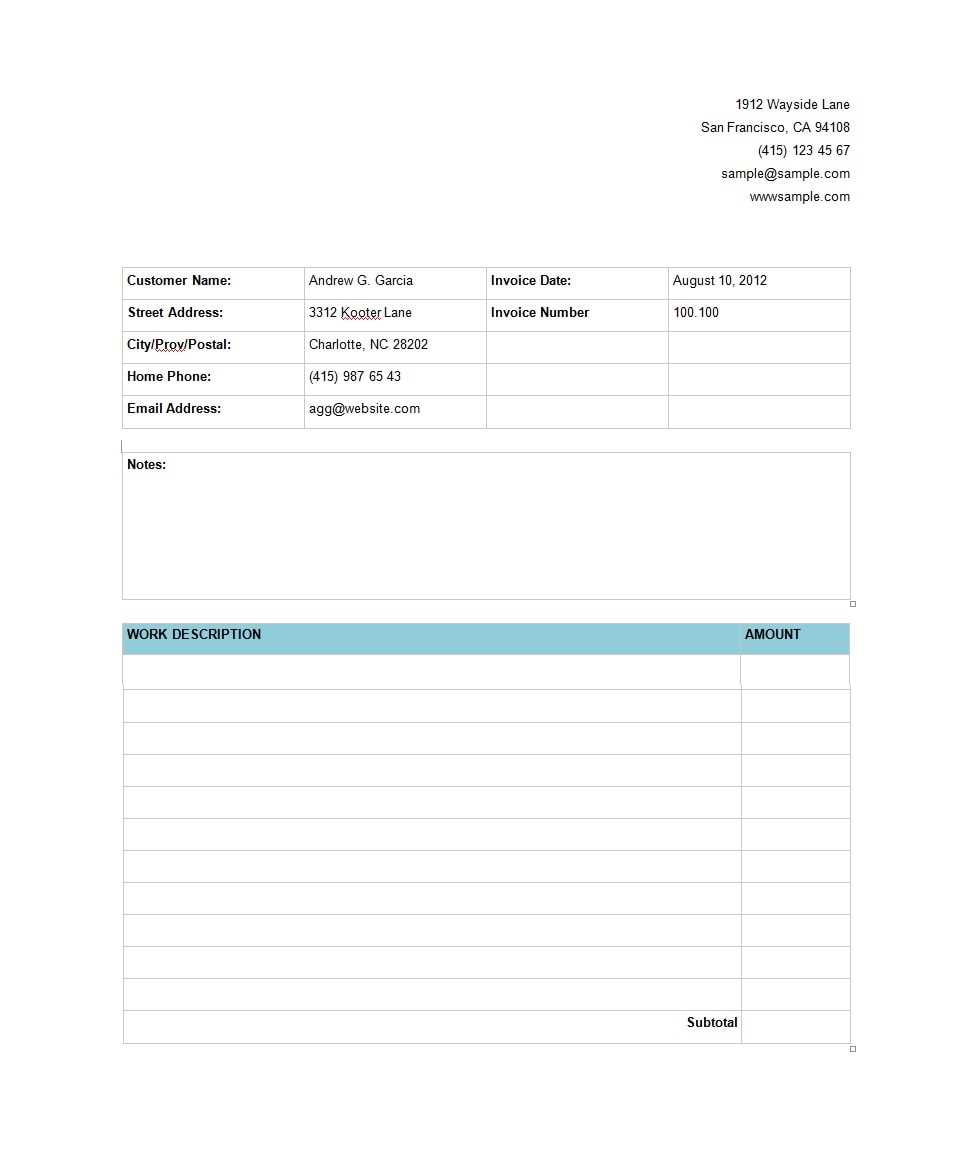

How to Design a Professional Invoice

Creating a well-structured document to outline transactions is crucial for maintaining clear communication with clients. This record should present all necessary details in an organized and visually appealing way. A successful layout ensures both clarity and professionalism, making the document easy to understand while upholding a high standard of business presentation.

1. Keep It Simple and Organized

Start by organizing information in a clean, straightforward manner. Use headings, bullet points, and well-spaced sections to ensure that all details are easy to find. The key is to avoid clutter and focus on essential data like dates, amounts, and payment terms.

2. Include All Necessary Details

Ensure that the document includes critical details such as the recipient’s name, the total amount due, a breakdown of the transaction, and the payment due date. Clear identification of both parties, along with itemized charges, helps avoid confusion and strengthens credibility.

3. Add Branding Elements

Including your company’s logo, contact details, and business information helps reinforce your brand identity. These elements also give a polished and consistent feel, which contributes to building trust with your clients.

4. Use Readable Fonts and Consistent Formatting

Opt for legible fonts and maintain a consistent style throughout the document. Headings should be easy to distinguish from regular text, and sufficient spacing should be used to separate sections. Consistency in formatting shows professionalism and attention to detail.

Understanding Invoice Numbering and Dates

Properly assigning identifiers and tracking important dates is an essential part of documenting transactions. These elements help establish the timeline and ensure clear references to each recorded agreement. Without them, it would be challenging to organize and retrieve relevant information when necessary.

- Numbering: A unique identifier for each document is vital to prevent confusion and ensure easy reference. It should be consistent and follow a logical sequence. For example, using a combination of letters and numbers or starting from a specific number for each fiscal period.

- Issue Date: This marks the official creation date and sets the clock for payment terms. It’s crucial to ensure that this date reflects when the document was officially prepared, as it often determines deadlines for payment and any applicable late fees.

- Due Date: Establishing when payment is expected ensures clarity for both parties. A clear deadline helps manage expectations and encourages timely settlements. It’s often based on terms such as “Net 30” or “Due on Receipt”.

By including accurate numbering and carefully chosen dates, you create a reliable system for managing and referencing documents in future transactions. This not only simplifies record-keeping but also enhances professionalism in client interactions.

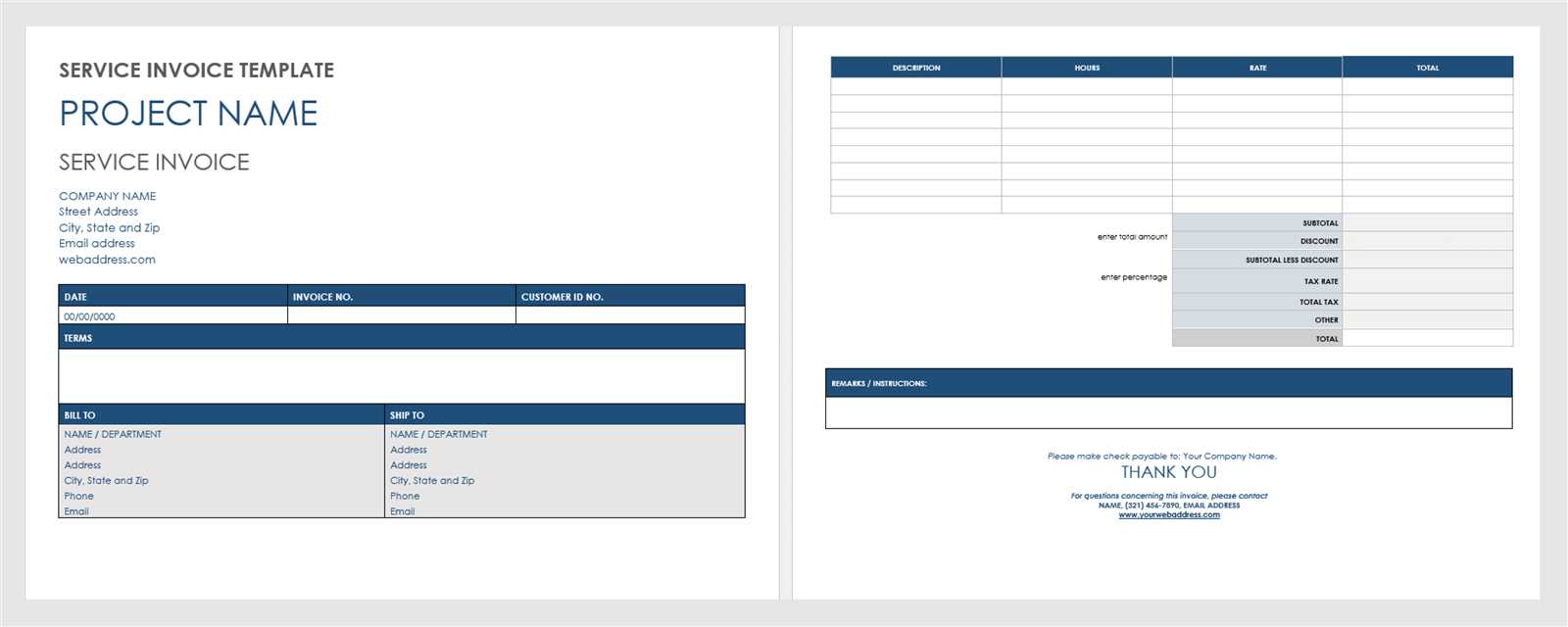

Choosing the Right Template for Your Business

Selecting the right layout for documenting transactions is essential to maintaining professionalism and efficiency. The right format should reflect your business identity, meet industry standards, and streamline the process of recording and tracking agreements. A well-suited design can enhance clarity, reduce errors, and improve the overall client experience.

Consider factors such as the type of transactions, the volume of records, and your branding requirements when choosing a format. It’s important to balance simplicity with thoroughness, ensuring that all necessary details are included without overwhelming the recipient with unnecessary information.

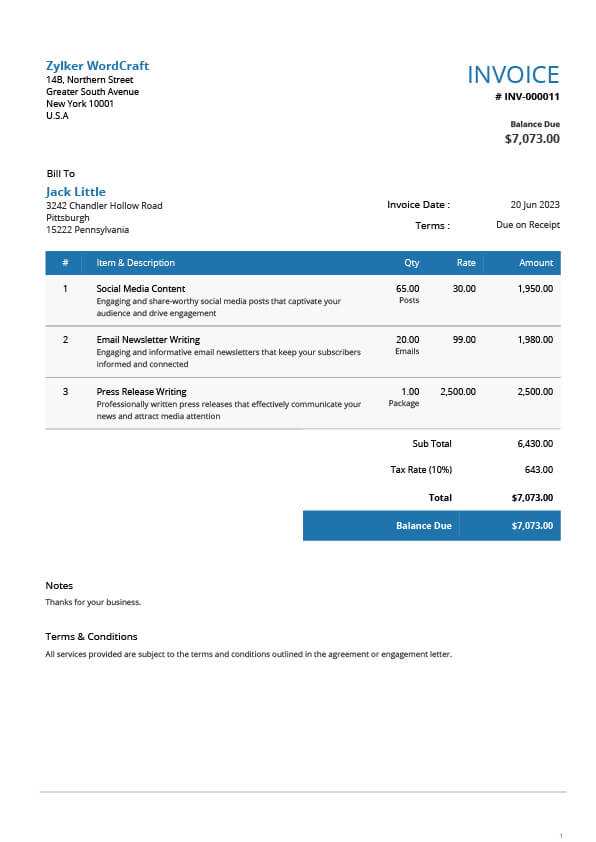

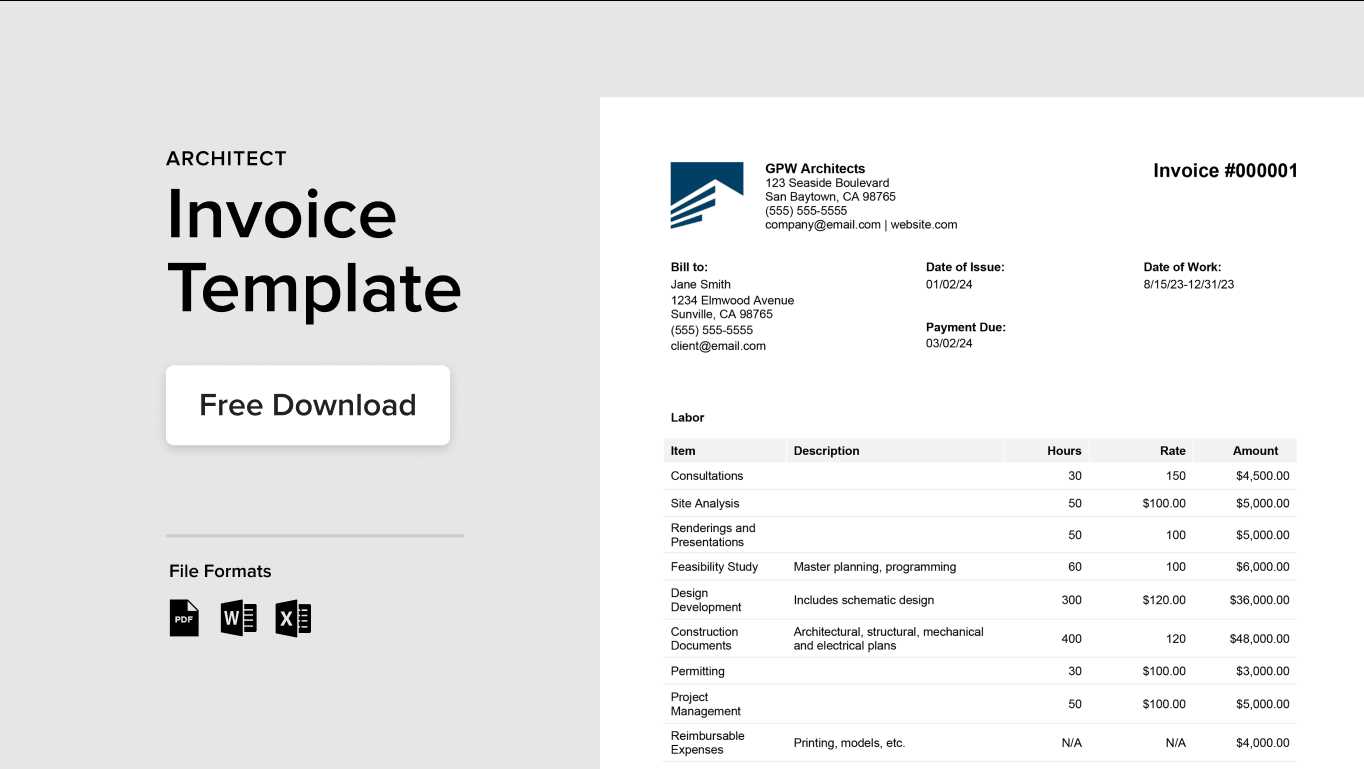

Invoice Template for Freelancers

Freelancers often need a clear and concise way to document completed tasks and the associated fees. A well-structured layout helps professionals manage payments and keeps transactions organized. It not only ensures proper documentation but also fosters trust and transparency with clients.

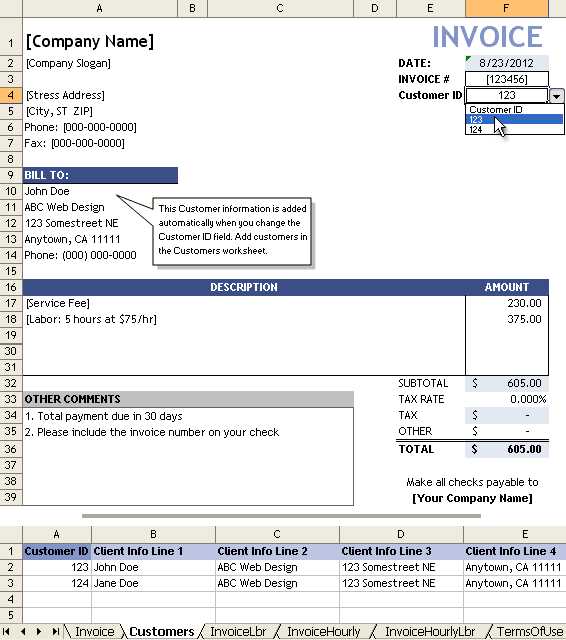

A suitable format for independent workers should include essential information, such as the work description, payment terms, and a breakdown of costs. Below is an example of how such a structure could look:

| Description | Quantity | Rate | Total |

|---|---|---|---|

| Graphic design work | 10 hours | $50/hour | $500 |

| Website consultation | 5 hours | $75/hour | $375 |

| Total | $875 |

This format allows freelancers to provide a clear, itemized account of the work completed, ensuring both parties are on the same page regarding payment expectations.

Essential Fields for Service-Based Invoices

When documenting work completed and requesting payment, it’s important to include specific details that ensure clarity and transparency. Including all necessary fields helps to avoid confusion and ensures that the terms are clearly understood by both parties. Properly structured records make the process of financial transactions straightforward and professional.

Key Information to Include

Every document should clearly identify both the client and the professional. This includes the names, contact information, and relevant business details of both parties. Additionally, including the project or task description, along with the time spent or materials used, gives a complete picture of the work involved.

Payment Details

It is crucial to include the payment amount, due date, and any terms related to late fees or discounts for early payments. A well-defined payment section helps avoid misunderstandings and ensures timely processing of payments. Being clear about these terms enhances professionalism and encourages timely transactions.

How to Avoid Common Billing Mistakes

Accurate billing is essential to maintaining a smooth financial relationship with clients. Even small errors can lead to confusion, delayed payments, or dissatisfaction. By being meticulous and following a systematic approach, professionals can avoid these common issues and ensure a more seamless process.

Double-Check Amounts and Rates

Verify your calculations before sending any document requesting payment. A simple miscalculation of rates, hours worked, or materials used can lead to significant discrepancies. Always double-check numbers to avoid causing unnecessary confusion or delays.

Clear and Consistent Terms

Ensure that payment terms are clearly defined and consistent across all documents. This includes setting expectations regarding due dates, late fees, and any discounts for early settlement. If these terms are ambiguous or inconsistent, it can result in misunderstandings and delayed payments. Make sure clients are well-informed about the timeframes and conditions surrounding payment.

By paying attention to details and maintaining clear communication, professionals can significantly reduce the risk of billing errors and foster positive, long-term relationships with clients.

Digital vs Paper Invoices: Which to Choose

When deciding how to document transactions and request payment, one key choice is between using electronic or physical formats. Both methods have distinct advantages, but selecting the right one depends on your business needs, client preferences, and efficiency goals.

Advantages of Digital Formats

- Speed: Digital records can be sent instantly, allowing for faster processing and quicker payment times.

- Cost-Effective: Electronic records eliminate the need for printing, paper, and postage fees.

- Eco-Friendly: Reduces paper waste and contributes to sustainability efforts.

- Organization: Easier to track, store, and search for electronic documents, reducing the risk of losing records.

Benefits of Paper Records

- Traditional Preference: Some clients may prefer physical documentation, especially in industries with less digital engagement.

- Perceived Formality: Physical copies might seem more formal or professional to some clients.

- Reliability: No need for internet access or technical issues, as paper copies are tangible and easy to handle.

Ultimately, the choice between digital and physical documentation depends on your specific business requirements and the preferences of your clients. Each method offers its own set of benefits that can enhance how you manage and track financial transactions.

Creating Recurring Invoice Templates

For businesses that offer ongoing or subscription-based work, setting up an automatic method to document and request payment on a regular basis can save both time and effort. A recurring structure ensures consistency, reduces administrative workload, and ensures that clients are billed correctly at regular intervals.

When setting up a recurring format, it’s important to clearly define the frequency of billing, the specific amounts due, and any other relevant details that apply to each cycle. Below is an example layout that could serve this purpose:

| Description | Frequency | Amount | Due Date |

|---|---|---|---|

| Monthly subscription | Monthly | $50 | 1st of each month |

| Annual membership | Yearly | $600 | 1st of January |

| Total | $650 |

By clearly outlining the recurring details, businesses can avoid confusion and ensure that the payment process remains seamless for both parties over the long term.

Legal Requirements for Invoices in Your Region

When documenting transactions and requesting payment, it is essential to comply with local laws and regulations. Different regions have specific requirements about what must be included in these documents to ensure their legality and acceptance. Being aware of and adhering to these guidelines helps businesses avoid legal complications and ensures proper handling of taxes and financial reporting.

Below is a table outlining some common legal requirements that businesses should include when creating these records:

| Required Information | Explanation |

|---|---|

| Business Information | Name, address, and registration number of both the issuing and receiving parties. |

| Unique Reference Number | Each document should have a unique identifier to help with tracking and legal reference. |

| Date of Issuance | The exact date when the document is created or issued to the client. |

| Payment Terms | Details on when payment is due, any applicable late fees, and any other relevant terms. |

| Tax Information | Specific tax rates or applicable VAT, depending on local regulations. |

| Breakdown of Charges | A detailed description of the products or tasks involved, with the respective amounts or rates. |

By following these requirements, businesses can ensure that they remain compliant with the law and provide a transparent and professional financial document to clients.

How to Customize Invoices for Different Clients

Each client may have unique preferences or requirements when it comes to the documentation they receive. Customizing your financial documents to match these specific needs not only enhances your professionalism but also ensures smoother transactions and better client relationships. Tailoring these records allows you to meet the individual expectations and specific demands of each client, ultimately fostering trust and satisfaction.

1. Understand Client Preferences

Some clients may prefer a simple, straightforward breakdown, while others may require a more detailed description of each task or product provided. It’s important to discuss these preferences before finalizing your documents.

2. Adjust Formatting and Branding

Customizing the layout to fit your client’s branding or incorporating their company logo can make the document feel more personalized. This small detail can make a significant difference in your client’s perception of your business.

3. Include Specific Terms or Conditions

Different clients may require special payment terms or additional clauses. Some might prefer more detailed terms regarding late fees or payment schedules. Be sure to customize the terms section based on their needs.

4. Tailor the Language and Tone

Adapt the tone of the document based on the client’s industry or relationship with your business. For formal corporate clients, use a professional tone, while for smaller or more casual clients, a friendly approach may be more appropriate.

By making these adjustments, you ensure that your financial documents are clear, relevant, and well-suited to each client, improving the overall transaction experience.

Tracking Payments with Invoice Templates

Efficiently monitoring payments is a crucial part of managing your financial records. By maintaining accurate documentation that clearly indicates outstanding balances, due dates, and payment statuses, you can ensure smooth cash flow and avoid potential misunderstandings with clients. A well-organized system helps you track payments and identify any overdue amounts, making it easier to follow up and keep your business finances in check.

1. Record Payment Status

Make sure to include a section on each document where you can mark whether the amount has been paid, is pending, or overdue. This will allow both you and your client to easily see the current status of the transaction.

2. Include Payment Methods

Specify the payment methods you accept (e.g., bank transfer, check, online payment) and ensure this information is clearly visible. Tracking the method used can help you match payments with the corresponding records more accurately.

3. Add Clear Payment Terms

Clearly state the payment due date and any applicable late fees. This will help avoid confusion and ensure that both parties understand the expectations surrounding the payment timeline.

4. Monitor Payment History

Maintaining a record of each transaction, including previous payments and any adjustments made, will help you stay on top of your accounts. This can be tracked either manually or through accounting software that integrates with your documentation process.

By implementing these practices, you can ensure that payments are tracked efficiently and discrepancies are minimized, helping you maintain financial stability in your business.

Free vs Paid Invoice Template Options

When deciding on the best documentation solution for your business, it’s important to weigh the benefits and limitations of both free and paid options. Each choice offers different features, and understanding these can help you select the right solution that fits your business needs and budget. While free options can be appealing due to their lack of cost, paid versions often come with added features that provide greater flexibility and customization.

Free Options

Free solutions are widely available and can be a great starting point for small businesses or freelancers. They typically include basic functionality, such as simple formatting and essential fields. However, free versions often have limitations, such as limited customization, fewer features, and the absence of customer support. They might be suitable for short-term use or businesses with minimal documentation needs.

Paid Options

Paid versions offer a higher level of customization and advanced features, such as automation, integration with accounting software, and the ability to store client records. These solutions are ideal for businesses with ongoing or complex documentation needs. While they come at a cost, the added benefits can save time and improve accuracy in the long run. Paid options also typically include dedicated support, ensuring that any issues are addressed promptly.

Choosing between free and paid options depends on your specific requirements. Free tools may suffice for basic needs, while paid solutions provide more robust capabilities for growing businesses.

Using Invoices to Improve Cash Flow

Managing cash flow is crucial for any business, and having a clear, organized system for requesting payment can greatly impact your financial stability. Properly structured documents for billing can help ensure timely payments, reducing the risk of late fees and maintaining a steady cash inflow. By leveraging effective billing practices, businesses can streamline their operations and keep their finances healthy.

Set Clear Payment Terms

One of the most important steps in optimizing cash flow is setting clear expectations with clients. By specifying payment deadlines and outlining any penalties for late payments, you ensure that clients understand when payments are due. Clear terms help reduce confusion and can encourage timely transactions.

Automate Reminders

Utilizing automated reminders for upcoming and overdue payments is an efficient way to stay on top of financial obligations. Automated notifications reduce the need for manual follow-ups and keep clients informed about their outstanding balance, promoting quicker responses and reducing delays.

By incorporating these strategies into your billing practices, you can enhance cash flow management and keep your business running smoothly. A proactive approach to payments ensures that you maintain a steady stream of revenue and avoid financial disruptions.