Invoice Template for Self Employed Professionals

Managing payments and maintaining professional financial records is essential for anyone working independently. Proper documentation ensures that you stay organized, receive compensation on time, and avoid potential disputes with clients. Having the right structure for your billing process can simplify tasks and improve your overall workflow.

Using a structured format for issuing requests for payment allows you to present a clear, professional image to your clients. With the right tools, you can easily track transactions, add necessary details, and ensure accuracy with each request. Whether you’re offering services or products, consistency is key to building trust and efficiency in your business operations.

Creating clear and easy-to-understand billing documents helps avoid confusion and ensures that both parties are aligned on payment terms. Streamlined financial documents save time, reduce errors, and improve cash flow management, allowing you to focus more on growing your business.

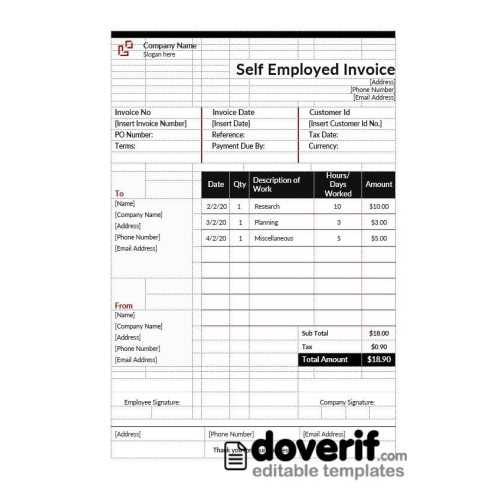

Invoice Template for Self Employed

Creating a structured document to request payments is a fundamental part of managing finances when working independently. A well-designed form helps ensure that all necessary details are included, enabling smooth transactions and clear communication between you and your clients. By using a consistent layout, you can streamline the process and avoid potential misunderstandings regarding the terms of payment.

Key Elements to Include

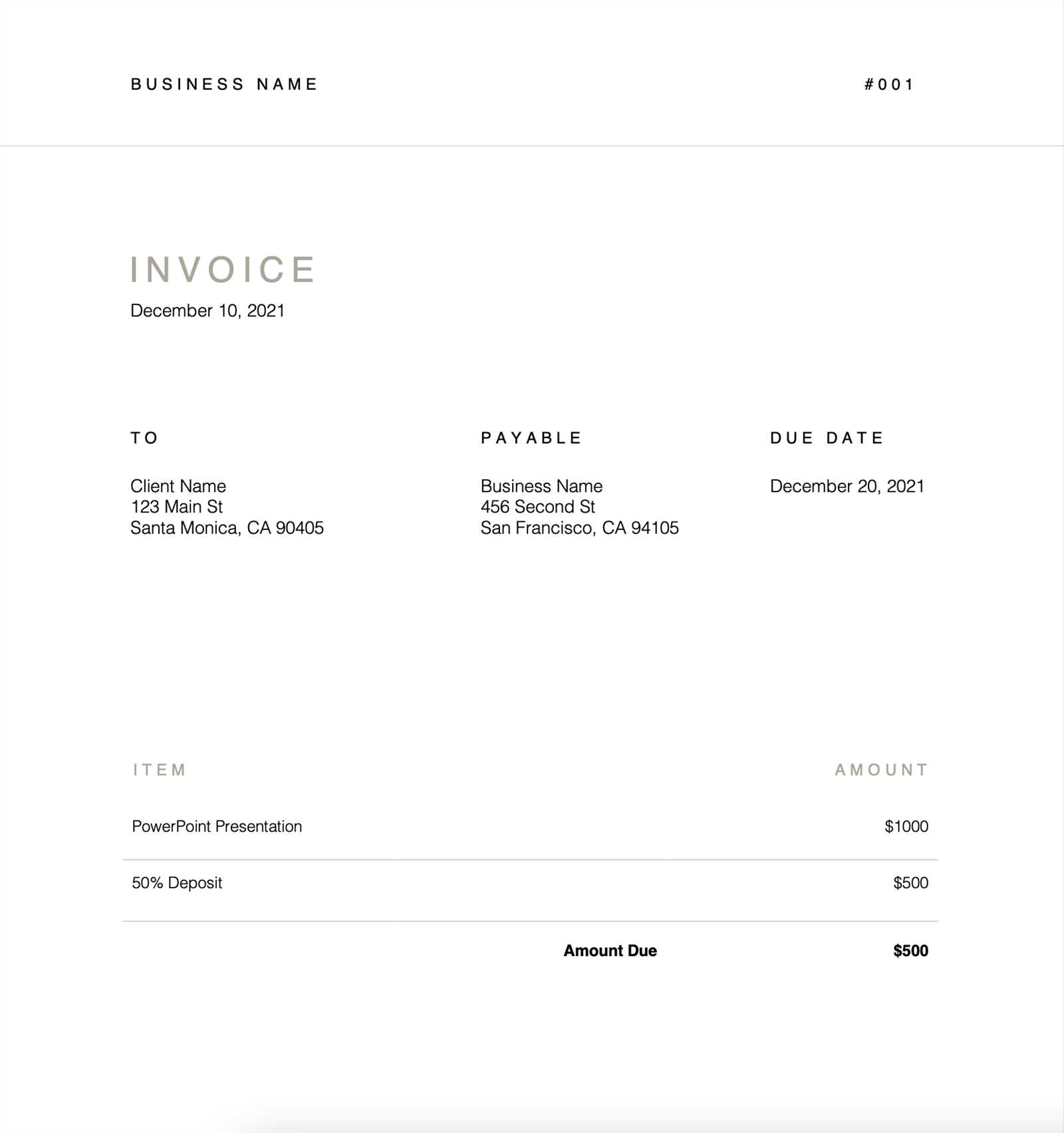

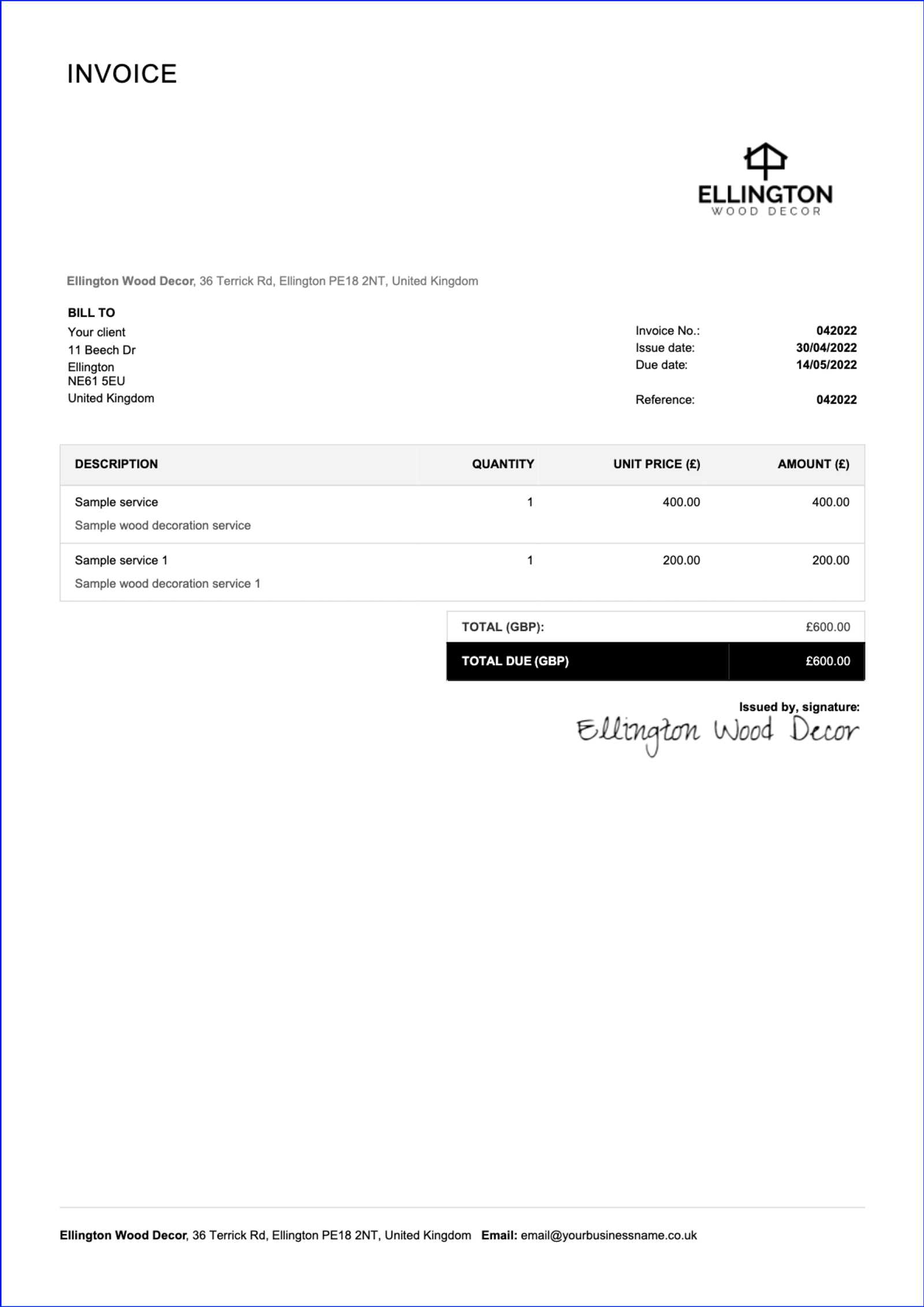

Each payment request should clearly outline the work completed, the amount due, and the payment terms. Essential elements include your contact information, the client’s details, a breakdown of services or goods provided, the total cost, and the payment deadline. This clarity ensures that both parties are on the same page, which reduces the likelihood of delays or disputes.

Why a Professional Layout Matters

A well-organized document not only promotes efficiency but also boosts your credibility as a professional. Clients are more likely to take your requests seriously when they are presented in a polished, easy-to-read format. Including all relevant details, such as due dates and payment methods, further enhances the professionalism of your communications.

Consistency in formatting and detail is crucial for long-term business success. Adopting a standardized approach will make it easier to track payments and maintain accurate financial records, allowing you to focus more on your work and less on administrative tasks.

Why Self Employed Need Invoice Templates

When working on your own, maintaining an organized approach to financial matters is essential. Having a clear, standardized way to request payments ensures that your business runs smoothly and that both you and your clients are aligned on terms. It helps to create a professional image, stay consistent, and avoid confusion or delays when receiving compensation for your work.

Streamlining the Billing Process

Without a structured format, it can become easy to overlook important details, like payment deadlines or agreed-upon amounts. By using a consistent framework for payment requests, you ensure all critical information is included, making the entire process faster and more efficient. This reduces the risk of errors and unnecessary back-and-forth with clients, allowing you to focus on your core work.

Enhancing Professionalism and Trust

A well-designed document not only makes the transaction process easier but also helps establish trust with clients. When your payment requests look organized and professional, it reflects your attention to detail and reliability. This can make a significant difference, especially when working with new clients or larger businesses who expect a formal approach.

Staying organized with a consistent method for handling payments is an investment in your business’s long-term success. It creates a sense of structure and control, allowing you to manage your finances confidently and build better relationships with clients.

Choosing the Right Invoice Format

Selecting the appropriate structure for requesting payments is crucial to ensure smooth transactions and clear communication with clients. A well-chosen format not only enhances clarity but also helps manage your finances effectively. The right structure will depend on the type of work you do, your preferences, and the needs of your clients.

Factors to Consider When Choosing a Format

When selecting the best structure for your payment requests, several factors should be considered to ensure it fits your business operations:

- Business Type: Different professions may require different layouts depending on the complexity of services or products offered.

- Client Preferences: Some clients may prefer a simple, straightforward layout, while others may need more detailed documentation.

- Legal or Tax Requirements: Make sure to include all necessary elements that comply with local laws and tax regulations.

- Personal Branding: A consistent and professional design can help reinforce your brand identity.

Simple vs Detailed Structures

There are various formats, ranging from simple to more detailed ones. Choosing between them depends on your specific needs:

- Simple Format: Ideal for small projects or clients who prefer quick and easy transactions. It typically includes only essential information such as amounts, services, and deadlines.

- Detailed Format: Suitable for larger projects or ongoing work. It often includes a breakdown of tasks, taxes, payment terms, and additional notes to avoid misunderstandings.

Ultimately, the right format will make your billing process more efficient and professional, ensuring smooth communication and timely payments.

Essential Information to Include in Invoices

When preparing a document to request payment, it is crucial to ensure that all necessary details are included to avoid any confusion or delays. A clear and comprehensive layout provides clients with the information they need to process your payment efficiently. Each item listed should serve a specific purpose, ensuring both parties understand the terms of the transaction.

Key Components of a Payment Request

There are several important elements that should be included in every payment request to ensure clarity and compliance. These details help define the terms of the transaction and serve as a reference for both you and your clients:

| Detail | Description |

|---|---|

| Contact Information | Include both your and the client’s name, address, and contact details for easy reference. |

| Unique Reference Number | Assign a unique identifier to each request to track payments and avoid confusion. |

| Description of Services or Products | Clearly outline what has been provided, including quantities, rates, and specific details of work completed. |

| Total Amount Due | Include the full amount payable, along with any applicable taxes or additional charges. |

| Payment Terms | Specify the due date, preferred payment methods, and any late payment penalties if applicable. |

| Notes or Additional Information | Include any relevant terms, references, or instructions for the client to ensure smooth processing of payment. |

Why These Details Matter

Including all the relevant details ensures that there is no ambiguity about the work performed or the payment expected. Clear communication about amounts due and terms of payment can prevent delays, disputes, or misunderstandings, helping maintain positive relationships with clients. This level of professionalism also builds credibility, which can lead to repeat business and referrals.

Customizing Your Invoice Template

Personalizing your payment request format allows you to create a professional and consistent appearance that reflects your brand identity. Customization not only enhances the visual appeal but also ensures that the document includes all the necessary details that are important to you and your clients. Tailoring your layout to fit your business needs can improve clarity and streamline the billing process.

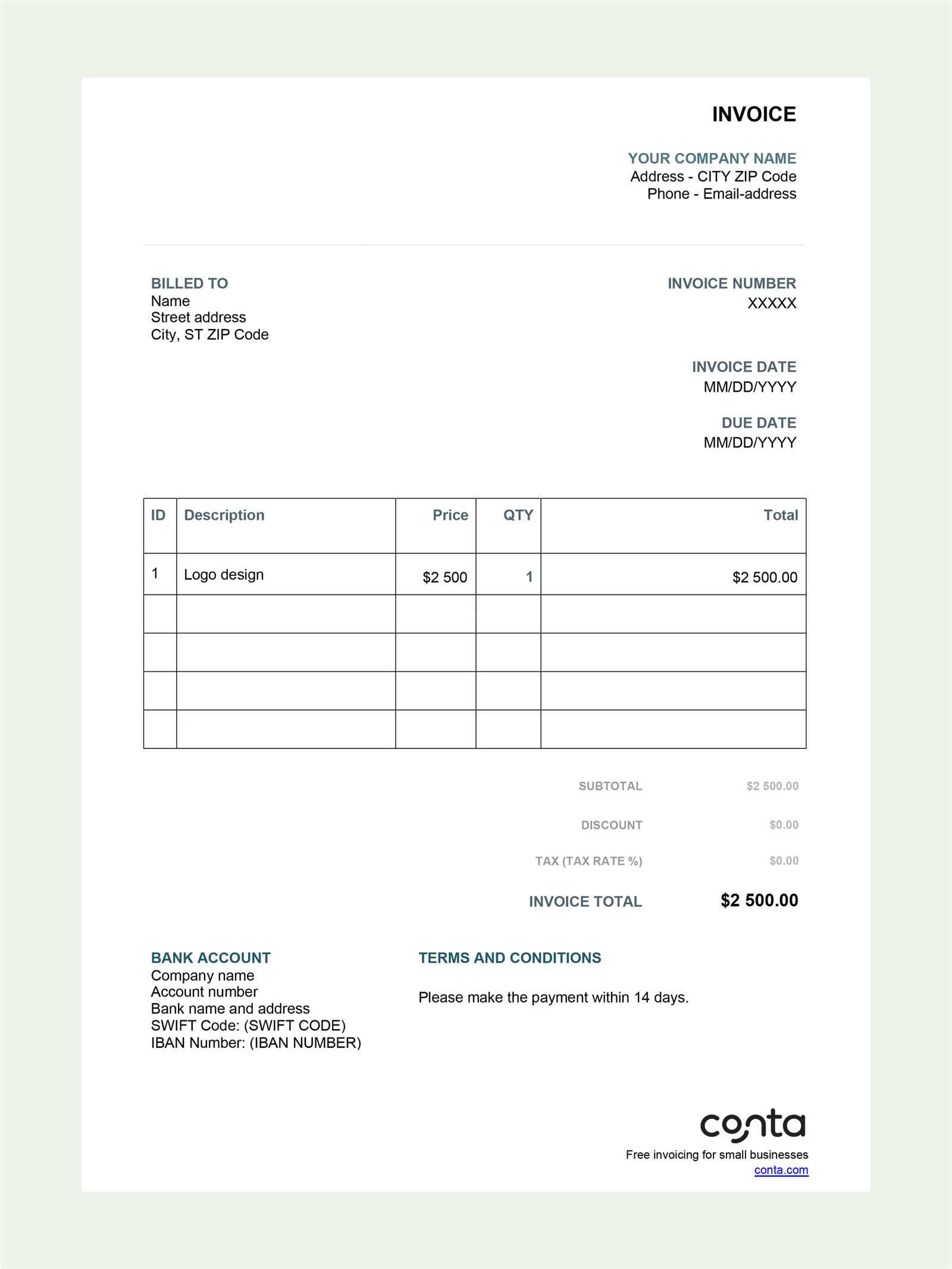

One of the key aspects of customizing your payment request is incorporating your business logo, colors, and fonts. This simple step helps reinforce your brand and ensures that your documents stand out as professional and well-organized. Additionally, you can adjust the sections to highlight the most important information based on your type of work.

Personalization can also involve adding:

- Your business tagline: Include a short slogan or mission statement to convey your values and make your documents more personal.

- Payment terms: Customize the terms and conditions to reflect your preferences, such as due dates, early payment discounts, or late fees.

- Custom fields: Add extra fields specific to your business, such as project codes, reference numbers, or specific task descriptions.

Customizing your payment request documents helps create a polished, professional impression, making it easier for clients to understand the details of the transaction. It’s not just about the appearance–it’s about presenting the information in a clear, concise manner that reflects the quality and professionalism of your work.

Free vs Paid Invoice Templates

When deciding how to create a structured document for requesting payments, one of the key choices is whether to use a free or paid option. Each approach has its advantages and potential drawbacks, depending on the level of customization you require and the complexity of your business needs. Understanding the differences between free and paid options will help you choose the best solution for managing your financial transactions.

Advantages of Free Options

Free formats are often a good choice for those just starting out or running smaller operations. They provide a simple, no-cost solution with essential features, making them ideal for individuals with limited budgets. Many free options come with basic customization, allowing users to adjust colors, fonts, and layouts to some extent.

Advantages of Paid Options

Paid solutions typically offer a wider range of features, greater customization, and enhanced support. They may include automatic tax calculations, more advanced design options, and integrations with accounting software, saving you time and effort in managing your finances. For businesses that require more detailed and professional-looking documents, a paid option is often worth the investment.

| Feature | Free Options | Paid Options |

|---|---|---|

| Customization | Basic customization options | Advanced customization with branding options |

| Support | Limited or community-based support | Priority customer support |

| Automated Features | Manual calculations and data entry | Automatic calculations, integration with accounting software |

| Design Options | Simple, standard designs | Professional, customizable designs |

Ultimately, the choice between free and paid options comes down to your business’s needs, budget, and the level of sophistication you require. Free formats may be suitable for freelancers or small businesses with simple requirements, while paid options are better suited for those needing more features and ad

How to Design a Professional Invoice

Creating a polished and professional document to request payment is essential for any business, especially when working independently. A well-designed document not only ensures clarity but also communicates trustworthiness and reliability to your clients. By focusing on layout, details, and functionality, you can make a lasting impression while keeping the process efficient and easy to follow.

When designing your payment request, keep in mind that simplicity and professionalism are key. The document should be easy to read, organized, and consistent with your brand identity. Here are some key tips to consider:

- Choose a clean and organized layout: Avoid clutter and ensure there is enough white space to make the document easy on the eyes. Sections should be clearly defined, and the flow of information should be logical.

- Include your branding: Incorporate your logo, business name, and any other branding elements to make the document recognizable and professional. Consistent fonts, colors, and design elements help reinforce your business identity.

- Clearly highlight key information: Important details such as the total amount due, payment terms, and due date should be easy to find. Use bold text or larger fonts to make these elements stand out.

- Ensure readability: Use legible fonts and avoid excessive design elements that could distract from the key information. Stick to simple, professional fonts like Arial or Times New Roman.

- Keep it simple: Avoid over-complicating the design. Focus on providing clear, concise details that are easy to understand, especially when it comes to payment terms and amounts due.

By following these guidelines, you can create a streamlined and effective document that not only serves its purpose but also strengthens your professional image. Remember, a clean and well-designed payment request is more likely to be paid promptly and can help build trust with your clients over time.

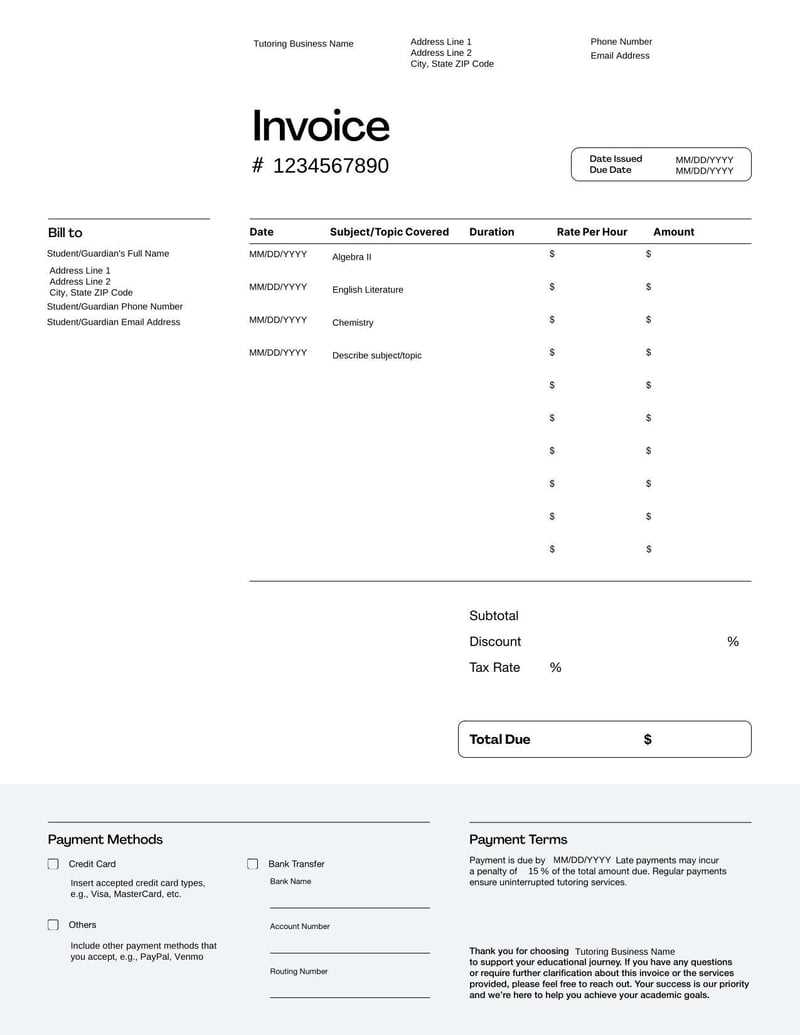

Invoice Templates for Different Professions

Each type of work often requires a specific approach when it comes to requesting payment. Whether you’re a freelancer, contractor, or small business owner, the structure of your payment request should reflect the nature of the services or products you’re offering. Customizing your format to suit your profession not only enhances clarity but also ensures that you provide all the relevant details your clients expect.

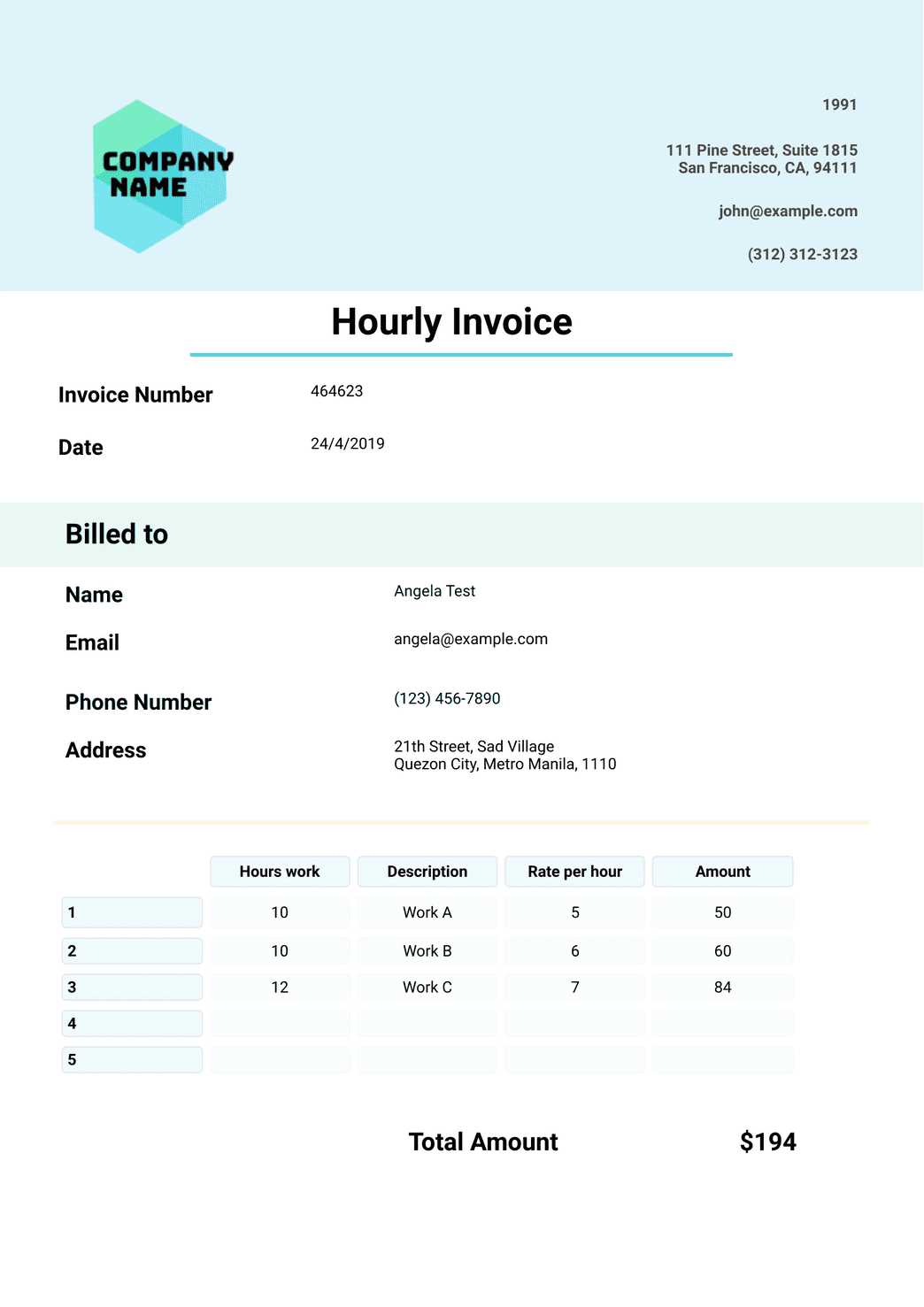

Creative Professionals

For those in creative fields, such as designers, writers, or photographers, a clear breakdown of the work completed is crucial. These professionals often bill by the hour or project, so their payment requests should include detailed descriptions of the tasks performed, time spent, and any agreed-upon rates. It’s also common to include milestones or stages of the project, especially for larger, ongoing work.

- Detailed Descriptions: Specify the work done, such as design drafts, writing hours, or photography sessions.

- Project Milestones: If the project is ongoing, highlight which phase the work is in, including any deliverables already completed.

- Time Tracking: Include hourly rates and hours worked if you charge by the hour.

Consultants and Coaches

Consultants, coaches, and advisors typically offer advice or strategic guidance. In these cases, it is important to outline the scope of services provided, the number of consultation hours, or any fixed pricing for packages. Payment requests for this profession often highlight the specific services, agreed-upon sessions, and any additional costs such as travel or preparation time.

- Session Breakdown: List the number of sessions or hours spent with the client.

- Package Pricing: If offering a package deal, clearly list the services included in that package and the total cost.

- Additional Expenses: Include any extra fees like travel, materials, or other related costs.

Adapting your payment request to the specifics of your profession helps build trust with your clients and makes the payment process smoother for both parties. By presenting your work in a clear, professional format, you ensure that your clients understand the value you’re providing and are more likely to process your payment promptly.

How to Add Taxes to Your Invoices

When managing payments, it’s essential to account for taxes to ensure compliance with local regulations and avoid future complications. Including tax information in your billing requests not only keeps you transparent with your clients but also ensures that you collect the correct amounts for tax reporting purposes. Knowing how to calculate and add taxes properly is a vital part of maintaining financial accuracy.

The first step is understanding the tax rates that apply to your business. Tax rates vary by location and type of service or product, so it’s important to research the specific rates that apply in your region or industry. Once you have this information, you can calculate the appropriate amount to include on each payment request.

Steps to Add Taxes:

- Identify the Tax Rate: Research and apply the correct tax rate based on your service type or product and the location of your business or client.

- Calculate the Tax Amount: Multiply the total cost of your services or products by the applicable tax rate. For example, if your service costs $500 and the tax rate is 10%, you would add $50 in taxes.

- Clearly Display Taxes: Make sure to separate the tax amount from the total cost on the document, listing it as a distinct line item so your client can clearly see the tax charged.

- Include Tax Identification Numbers (If Applicable): Some regions require that you include a tax ID or VAT number for proper reporting and transparency.

Adding taxes accurately to your payment requests ensures that you are following the law and prevents any misunderstandings with your clients regarding the final amount due. It also simplifies your tax reporting process, making it easier to calculate what you owe during tax season.

Tracking Payments with Invoice Templates

Keeping track of payments is essential for any independent business. It ensures you stay on top of your cash flow, manage outstanding balances, and avoid any financial discrepancies. By using a structured format to request payment, you can easily monitor whether clients have settled their dues or if follow-up is required. A well-organized system helps maintain smooth business operations and prevents payment-related issues.

To effectively track payments, it’s important to include specific fields in your request document that allow you to mark the status of each transaction. These fields make it easy to see which payments have been received, which are overdue, and which need further action.

Key Elements for Tracking Payments

- Payment Status: Include a section where you can indicate whether the payment has been completed, is pending, or is overdue.

- Due Date: Make sure the due date is clearly marked, allowing you to easily track when payments should be made.

- Payment Method: Specify how the payment was made (e.g., bank transfer, cash, check) to avoid confusion and ensure you can verify the transaction.

- Amount Paid: Clearly indicate the amount paid, including any deposits or partial payments, to help track balances due.

- Balance Remaining: Deduct any paid amount from the total sum due and indicate the remaining balance to avoid errors.

Additional Tips for Effective Payment Tracking

- Number Your Documents: Assign a unique reference number to each document to track payments and avoid mixing up multiple transactions.

- Set Reminders: If payments are overdue, use your system to set reminders to follow up with clients.

- Maintain Digital Records: Use accounting software or digital tools to keep all payment requests and records organized in one place.

By keeping detailed records of your payment requests and their statuses, you can easily track who has paid, who needs a reminder, and when payments are due. This ensures that your cash flow stays steady and allows you to act quickly if any issues arise.

Benefits of Digital Invoices for Freelancers

Adopting digital payment requests has become a popular choice for freelancers due to the convenience, speed, and efficiency they offer. Moving away from traditional paper-based methods not only saves time but also helps streamline the payment process. Digital records are easy to track, more environmentally friendly, and can significantly reduce administrative tasks, allowing freelancers to focus on their work instead of paperwork.

Key Advantages of Going Digital

- Faster Processing: Digital requests are delivered instantly via email or online platforms, ensuring faster client review and payment processing compared to traditional mail.

- Improved Organization: Storing and organizing digital documents is much easier. Freelancers can access their records anytime, anywhere, without the hassle of managing physical paperwork.

- Reduced Risk of Errors: Digital tools often include features like automatic calculations, which reduce the risk of human errors in totaling amounts or taxes, ensuring more accurate transactions.

- Easy Follow-ups: With digital records, freelancers can quickly identify overdue payments and send automated reminders, saving time on manual follow-up tasks.

- Missing Contact Information: Failing to include both your and your client’s contact details can lead to confusion, especially if there are issues with the payment. Always ensure you have the correct address, email, and phone number listed.

- Unclear Payment Terms: Not specifying when the payment is due, or failing to outline payment methods, can lead to delayed or missed payments. Always state the due date and acceptable methods of payment clearly.

- Not Including a Unique Reference Number: Without a unique reference number for each payment request, tracking payments can become difficult, and clients may confuse documents. This can result in delayed processing or miscommunication.

- Overlooking Tax Calculations: Inaccurate or missing tax calculations can cause confusion and lead to financial discrepancies. Always ensure the proper tax rate is applied, and show the tax amount separately for clarity.

- Incorrect or Vague Descriptions of Services: Lack of detailed descriptions of the services provided or products delivered can make clients unsure about what they are paying for. Be specific and clear about the work done or products provided to avoid disputes.

- Forgetting to Proofread: Simple spelling or grammatical errors can harm your professional reputation. Always proofread your documents before sending them out to ensure they are error-free and professional.

- Failure to Follow Up: If a payment is overdue, it’s easy to forget about it. Ensure you have a system in place to follow up on unpaid invoices in a timely and professional manner.

- Choose Your Delivery Method: Decide whether to send your payment request via email, through an online platform, or via traditional mail. The quickest and most efficient method is often email or digital platforms, which allow you to reach clients instantly.

- Attach Relevant Documents: When sending the request, include all necessary documents or proof of work to support the amount being charged. This can include contracts, receipts, or work samples, ensuring clients understand what they are paying for.

- Confirm Receipt: Ensure that the client has received the payment request. Request a read receipt or follow up to verify they have received the details and understand the payment terms.

- Track Due Dates: Keep a record of all due dates for your requests. Many freelancers use digital tools or accounting software that sends automated reminders when a payment is due or overdue.

- Follow Up Professionally: If a payment is late, it’s important to follow up with clients in a polite and professional manner. You can send a gentle reminder email or make a quick phone call to discuss the payment status.

- Organize Your Records: Keep track of all sent payment requests in a central location, whether it’s a digital tool or a well-organized file system. This allows you to quickly find past records for reference or during tax season.

- Track Payments: Once payment is received, mark the request as paid in your records, and send a receipt to confirm that the transaction has been completed. This helps avoid any confusion about outstanding balances.

- Time Savings: Automating payment requests means you no longer need to manually create each one from scratch. Templates and pre-set information help speed up the process, freeing up time for other important tasks.

- Consistent Documentation: Automation ensures that all payment requests are formatted the same way, maintaining a professional appearance and minimizing discrepancies between documents.

- Timely Reminders: Automation tools can send automatic reminders to clients about upcoming or overdue payments, reducing the need for manual follow-ups and improving your cash flow.

- Reduced Errors: By using automation, you can reduce the risk of mistakes, such as incorrect calculations or missing details, which can affect your financial records and client relationships.

- Use Accounting Software: Many accounting platforms offer built-in automation features that allow you to create, send, and track payment requests. These tools often integrate with your bank accounts and payment systems for seamless transactions.

- Set Up Recurring Invoices: If you have clients with regular payments, set up automated billing cycles to generate and send requests automatically on a schedule, ensuring that payments are consistently processed.

- Integrate Payment Gateways: Some software tools also allow you to integrate payment options directly into your documents, enabling clients to pay with just a click, improving convenience and accelerating the payment process.

- Unique Identification Number: Each document should have a unique reference number, allowing both parties to track and manage payments easily.

- Business Information: Clearly display your name, address, and contact details. If applicable, include your tax identification number (TIN) or VAT registration number.

- Client Information: Include the client’s name, address, and contact details. This is crucial for maintaining accurate records and ensuring the document is properly directed to the right recipient.

- Description of Goods or Services: Provide a detailed description of the products or services provided, including quantities, unit prices, and any applicable discounts.

- Amount Due: Clearly state the total amount due, breaking it down into individual line items if necessary. Be sure to specify the currency being used.

- Payment Terms: Indicate the payment deadline and any applicable late fees or discounts for early payment. This ensures both parties understand the payment timeline.

- Tax Details: If applicable, include the tax rate applied and the total amount of tax charged. This is crucial for both the business and the client, especially for VAT or sales tax purposes.

- Issue Date and Payment Due Date: The document should clearly state the date it was issued, as well as the due date for payment, to avoid any confusion over deadlines.

- Sales Tax or VAT: Depending on your location, you may be required to charge sales tax or VAT on goods and services. Make sure to research your country’s tax rules and include the correct tax rate on your payment requests.

- Record Keeping: Most jurisdictions require businesses to retain copies of payment requests and related documents for a specified period, typically 5 to 7 years. Keep organized and accurate records to comply with tax audits.

- Electronic vs Paper Records: Many countries accept digital versions of payment requests as legal documents, but check your local laws to ensure that electronic copies are acceptable for your tax filings and l

How to Create Recurring Invoices

When you provide services or products on a regular basis, creating and sending payment requests can quickly become repetitive and time-consuming. Instead of manually generating a new document for every transaction, setting up a recurring payment structure can save you time and ensure consistency. Recurring billing allows you to automate the process of invoicing for clients with regular payments, helping you stay organized and ensuring you get paid on time.

Steps to Create Recurring Payment Requests

- Determine Payment Frequency: Decide how often the client will be billed. Common options include weekly, monthly, quarterly, or annually, depending on your business model and the terms of your agreement.

- Set Clear Payment Terms: Ensure the payment terms are clear from the start. This includes specifying the due date, any early payment discounts or late fees, and the acceptable payment methods.

- Use Billing Software: To automate the process, use accounting or billing software that offers recurring payment features. These tools allow you to set up automatic billing cycles and even send reminders for upcoming payments.

- Customize the Payment Details: Tailor each payment request to reflect the correct amount, frequency, and client details. While the structure remains the same, ensure each document is personalized to meet the specific needs of the client.

- Confirm Client Consent: Make sure your client agrees to the recurring payment structure in writing. This protects both parties and clarifies expectations regarding the frequency and terms of the payments.

Managing Recurring Payments

- Track Payment Dates: Keep a calendar or automated reminders to ensure payments are processed according to the schedule. If using software, set up alerts to notify you of upcoming due dates.

- Monitor Payment Status: Regularly check to confirm payments are received on time. Most billing software allows you to track the status of each payment and send reminders automatically if a payment is missed.

- Update When Necessary: If there are any changes in the terms of the agreement, such as price adjustments or modifications to services, ensure that both you and the client agree to the new terms, and update the recurring payment details accordingly.

By setting up recurring billing, you can simplify the process of managing regular payments and avoid the hassle of generating a new request each time. This efficient system helps you maintain consistent cash flow and provides your clients with a predictable, hassle-free payment experience.

Best Tools for Invoice Creation

Creating professional payment requests can be a time-consuming task, especially if you’re doing it manually. Fortunately, several tools are available to simplify the process, ensuring that your documents are not only accurate but also polished and professional. These tools offer a variety of features, from pre-designed layouts to automation options, making it easier to manage your finances and save valuable time.

Top Tools to Consider

- FreshBooks: This popular accounting software provides an easy-to-use platform for generating payment requests. It offers features like automatic reminders, customizable designs, and the ability to accept online payments directly, making it a great choice for freelancers and small business owners.

- Wave: A free and user-friendly option, Wave allows you to create customized billing documents quickly. It also includes accounting tools to help track your expenses and income, making it ideal for those just starting out or operating on a tight budget.

- Zoho Invoice: Zoho’s platform is excellent for businesses that need more advanced features like multi-currency support, automated billing, and integration with other Zoho products. It’s suitable for those who need a scalable solution that grows with their business.

- QuickBooks: Known for its comprehensive accounting features, QuickBooks also offers robust payment request creation tools. It provides templates, automatic tax calculations, and the ability to track outstanding payments, making it a favorite for businesses of all sizes.

- PayPal Invoicing: If you’re looking for a simple, no-fuss tool, PayPal’s invoicing feature allows you to create and send payment requests quickly. It also includes options for clients to pay directly through PayPal, streamlining the entire process.

Why Use These Tools?

- Time Efficiency: Automated tools save time by reducing the need for manual entry, allowing you to focus on your core business activities.

- Professional Appearance: These platforms offer professionally designed layouts, ensuring your documents appear polished and well-organized.

- Customization: Most tools allow you to customize your documents with logos, branding, and specific terms, ensuring that your payment requests match your business style.

- Tracking and Management: Many of these tools offer features to track sent requests, overdue payments, and status updates, helping you stay on top of your financial situation.

Choosing the right tool can help you streaml

Using Invoice Templates for Financial Organization

Maintaining financial order is crucial for any independent worker, and using a structured document to request payment plays a significant role in achieving that goal. By implementing a consistent format for billing, you can streamline your financial records, making it easier to track income, monitor overdue payments, and simplify tax preparation. A well-organized approach to requesting payments ensures that all details are clearly presented and easily accessible, helping you stay on top of your finances.

Having a reliable system in place allows you to quickly track the status of outstanding payments, identify trends in client behavior, and assess your overall cash flow. This not only enhances your financial transparency but also supports better decision-making when it comes to budgeting and forecasting future earnings.

| Financial Benefit | Description |

|---|---|

| Efficient Record Keeping | By consistently using the same structure for all payment requests, you make it easier to categorize and store your financial records, reducing confusion when you need to reference them. |

| Quick Tracking of Payments | A well-organized document helps you quickly see whether clients have paid on time, whether you need to send reminders, or if any payments remain overdue. |

| Tax Readiness | Clear records with detailed information about services, rates, and taxes make the process of filing taxes simpler, reducing the likelihood of errors or missed deductions. |

| Client Professionalism | A consistent, professional approach to payment requests helps build a trustworthy image, encouraging clients to respect payment deadlines and terms. |

By using a structured method to track payments, you not only keep your finances in order but also build a foundation for future growth. Financial organization is key to sustaining your independent work, and the right approach to managing payments is one of the most effective ways to stay on top of your financial game.

Common Mistakes to Avoid in Invoicing

When managing payments, even small mistakes in your payment requests can lead to confusion, delays, or potential financial losses. It’s essential to be aware of the common errors that can occur during the billing process so that you can avoid them and ensure smooth transactions with your clients. By paying attention to detail and following best practices, you can create clear, accurate, and professional documents that will help maintain a good relationship with your clients and keep your cash flow on track.

Common Mistakes to Avoid:

Avoiding these common mistakes ensures a smoother and more efficient payment process. By keeping your documents accurate, clear, and professional, you can build stronger client relationships and maintain steady cash flow for your business.

How to Send and Manage Invoices

Sending and managing payment requests effectively is an essential part of maintaining smooth operations for any independent worker. It involves not just creating accurate documents but also ensuring they reach the client promptly and are followed up on when necessary. Having a clear process in place for handling this task helps to reduce delays and confusion, leading to better financial organization and timely payments.

Steps to Sending a Payment Request

Managing Payment Requests

Managing payment requests effectively not only ensures you get paid on time but also establishes a professional and efficient workflow that can help you grow your business. By staying organized and proactive, you can minimize payment delays and keep your financial operations running smoothly.

Automating Invoicing for Self Employed

Automating the process of creating and sending payment requests can save significant time and effort for independent workers. Instead of manually generating and tracking each request, automation tools allow you to streamline the entire process. This not only reduces human error but also ensures consistency, improves efficiency, and helps maintain timely follow-ups with clients.

Benefits of Automation

How to Automate the Process

Automating payment request management can significantly improve your workflow, reduce the administrative burden, and ensure that you never miss an opportunity for timely payment. The right tools make it easier to stay on top of your financial operations and focus on growing your business.

Legal Requirements for Invoices

When running an independent business, it is essential to ensure that your payment requests meet legal standards. Many countries have specific regulations that govern what information must be included to ensure that the request is valid and compliant with tax laws. Adhering to these rules not only helps avoid legal complications but also ensures smooth financial transactions with clients and tax authorities.