Invoice Template for Security Services to Simplify Your Billing Process

Managing payments and keeping track of financial records can be a challenging task for professionals offering safety and surveillance solutions. Whether you are an independent contractor or part of a larger firm, having a clear and structured approach to billing is essential for maintaining efficiency and professionalism.

By utilizing a well-designed document, you can easily detail the work completed, the amount due, and the payment terms. This not only ensures transparency with clients but also helps maintain consistency across your entire business operation.

In this article, we will explore how to simplify your financial documentation process, offering tips and guidance on creating a streamlined and effective billing system tailored to your line of work. A professional, easy-to-understand structure can make a significant difference in client relations and overall business growth.

Why Use an Invoice Template for Security Services

Keeping track of payments and ensuring proper documentation is an essential part of running a business, especially when providing specialized protection solutions. A structured approach to creating billing records saves time and reduces the chances of mistakes, making the entire process more efficient. Adopting a well-organized system helps both the provider and the client stay on the same page regarding the scope of work and payment expectations.

Consistency and Professionalism

Having a standardized format allows businesses to present a consistent and professional image to clients. Clients are more likely to trust providers who present clear, well-organized financial statements. Consistency in how payments are requested not only helps build credibility but also ensures that there are no misunderstandings about what services were provided and what amounts are owed.

Time and Effort Savings

Using a pre-structured document cuts down the time spent on administrative tasks. Instead of creating a new document from scratch for each billing cycle, a pre-built format allows you to fill in specific details, making the process quick and easy. This approach significantly reduces the time spent on creating financial paperwork and allows you to focus on other important tasks within the business.

Benefits of Professional Security Service Invoices

Creating well-organized billing records is crucial for maintaining smooth operations and positive client relationships. A professional financial statement not only facilitates payment processing but also helps build trust and credibility with clients. Ensuring clarity and accuracy in your documents can lead to faster payments and fewer disputes.

Clear Communication with Clients

Professional billing records provide a transparent breakdown of the work completed and the corresponding charges. This transparency helps eliminate confusion and allows clients to understand exactly what they are paying for. A detailed, clear structure fosters better communication and minimizes the chance of misunderstandings, improving client satisfaction in the long run.

Improved Cash Flow Management

Properly formatted documents help businesses manage their cash flow more effectively. With clear payment terms and itemized lists of services rendered, businesses can ensure that clients are more likely to pay on time. Efficient cash flow management allows businesses to allocate resources better, invest in growth, and maintain a steady income stream.

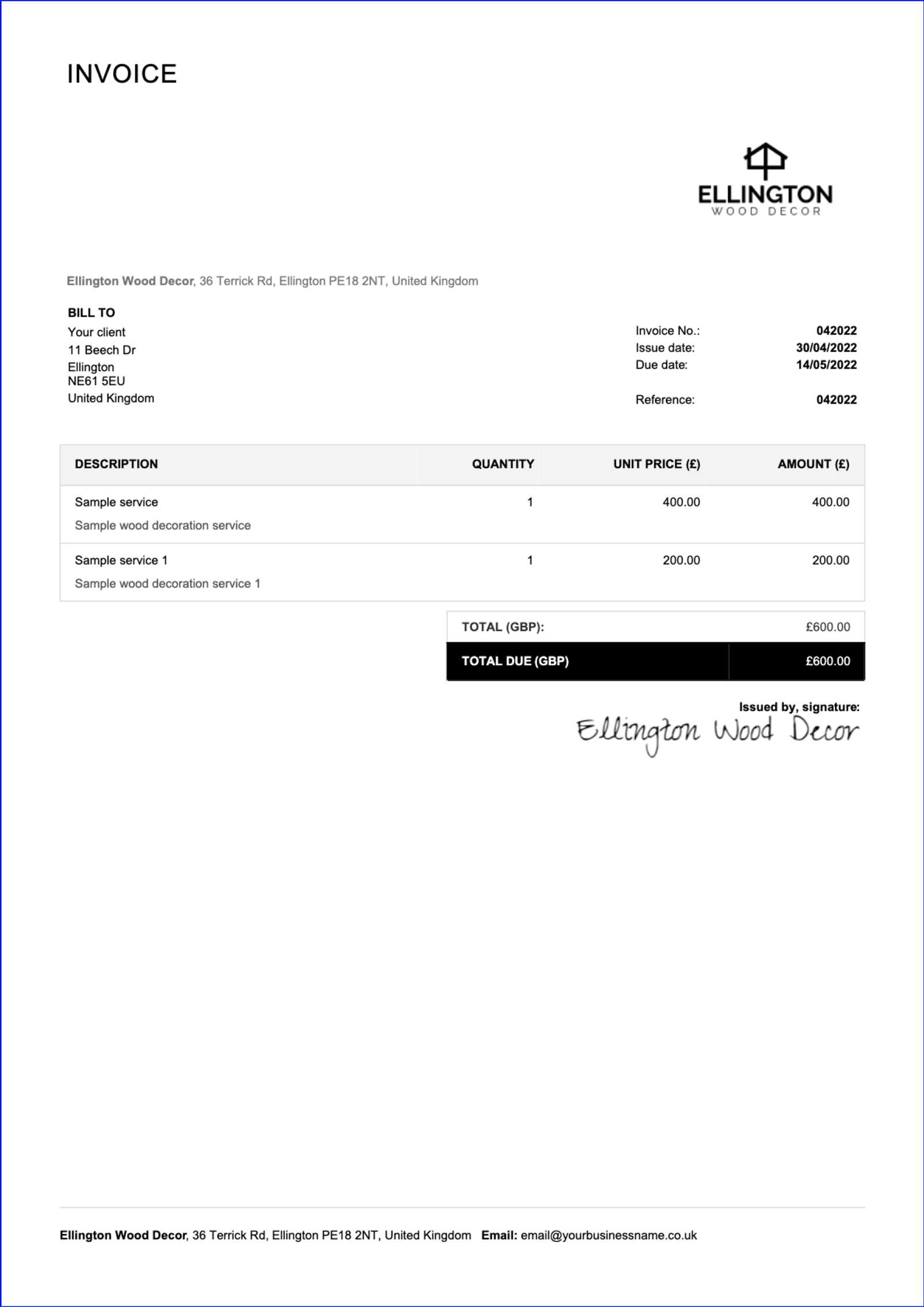

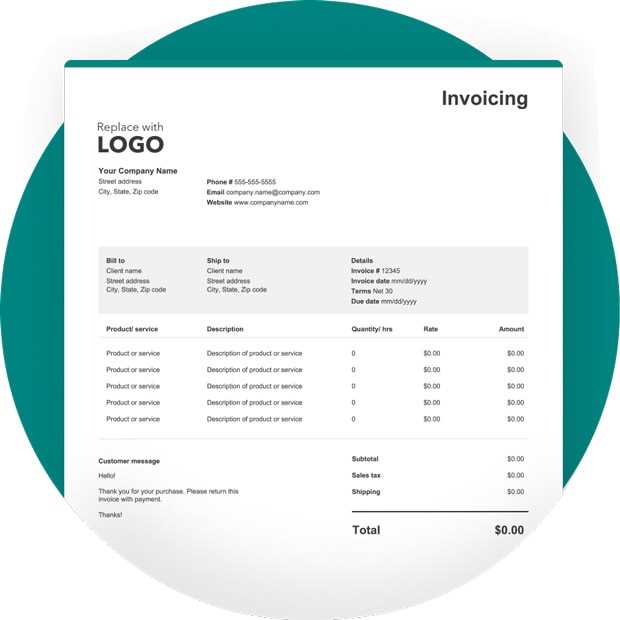

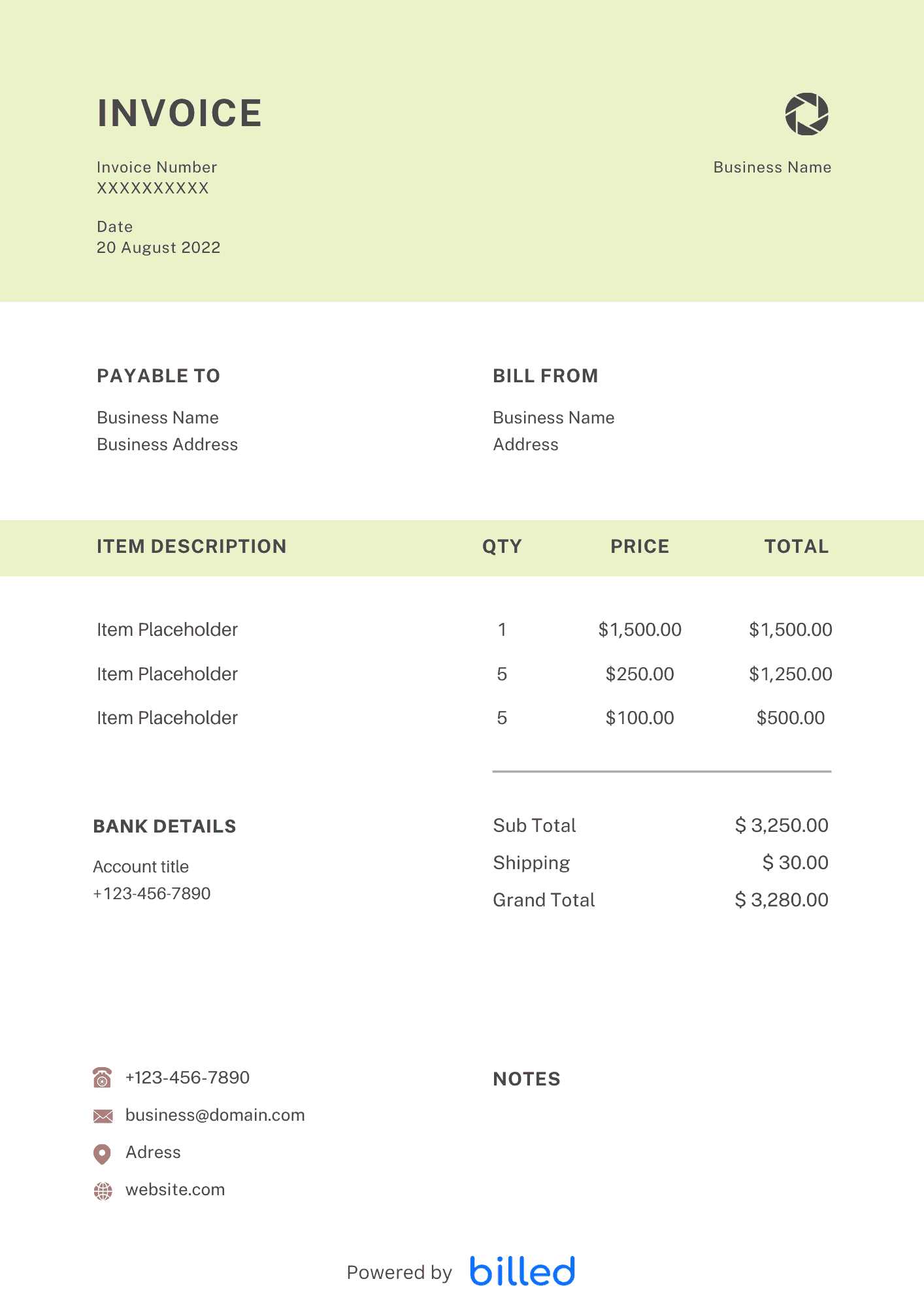

How to Create a Custom Invoice for Security Services

Creating a personalized billing document is essential for accurately reflecting the work done and ensuring timely payments. A customized format allows you to include specific details that are relevant to your business, whether it’s the type of tasks completed, the duration of services, or additional charges. By following a few simple steps, you can craft a professional record that suits your needs and enhances your business operations.

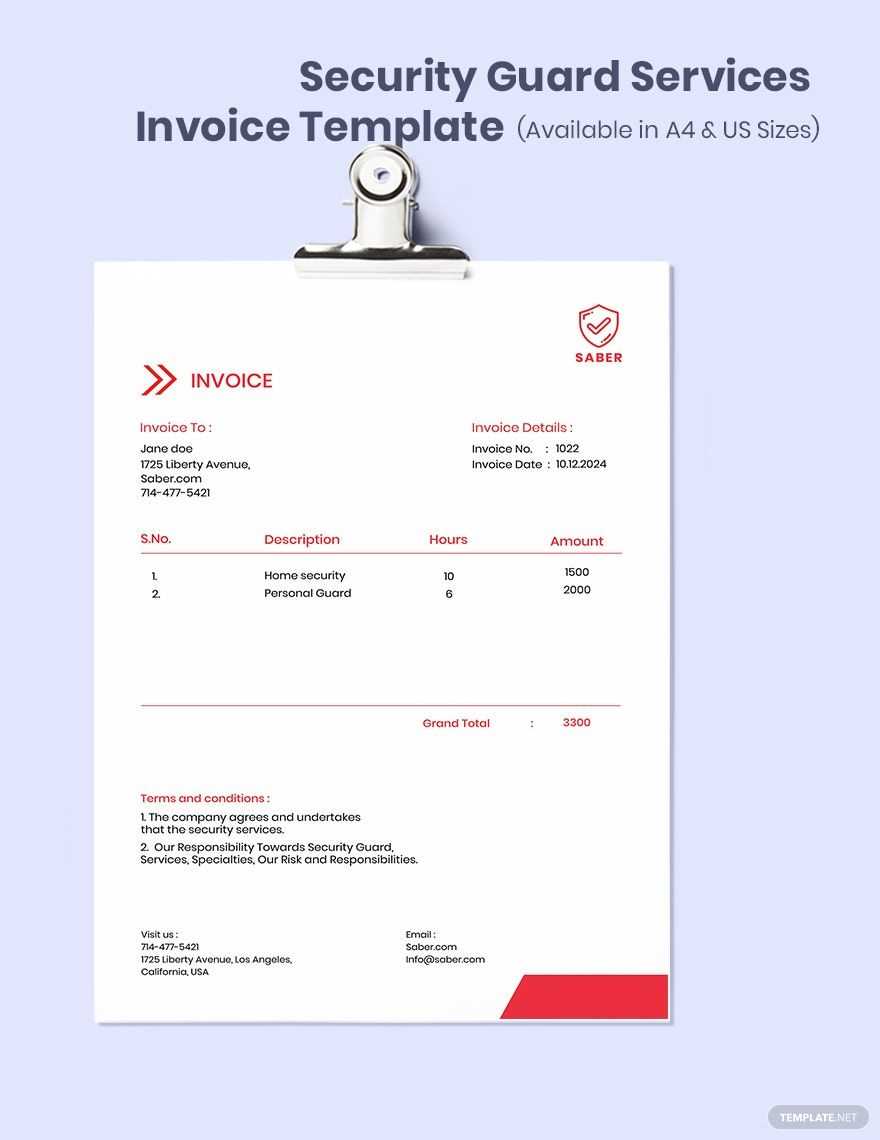

Step 1: Include Basic Information

Start by adding the necessary information to the document, such as your business name, contact details, and the client’s information. This ensures both parties can easily identify the transaction. Don’t forget to include a unique reference number for easy tracking, as well as the date when the work was completed or when payment is due.

Step 2: Itemize the Services and Costs

Clearly list each task or service performed, along with its corresponding cost. This itemization ensures transparency and gives the client a full understanding of what they are paying for. Be specific with your descriptions, and make sure to calculate the total amount due. Clarity in pricing helps avoid confusion and potential disputes later on.

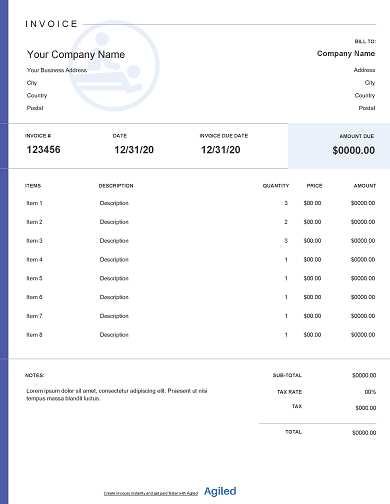

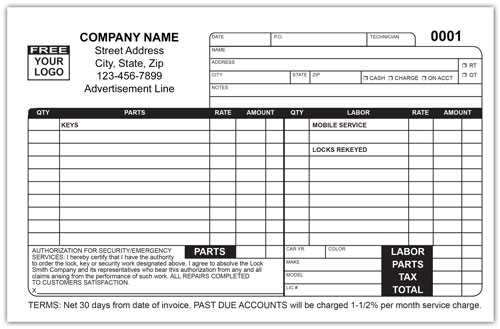

Key Elements to Include in Security Service Invoices

To ensure smooth financial transactions and clear communication with clients, it’s essential to include specific details in every billing document. A well-structured record not only helps in tracking payments but also ensures that both parties understand the terms and expectations. There are several key components that should be present to make the document both professional and efficient.

Essential Contact and Transaction Information

First, include the basic information of both the provider and the client. This should consist of business contact details, the client’s name and address, and the date of the transaction. Additionally, it’s important to assign a unique reference number to each document for easier tracking. A clear reference number helps both you and your client stay organized, especially for future correspondence or inquiries.

Detailed Descriptions of Work and Charges

Be sure to list each task or service provided, including the amount of time spent and any additional fees. Providing a breakdown of charges ensures transparency and helps the client understand exactly what they are paying for. An itemized list not only builds trust but also minimizes any potential misunderstandings regarding the final total amount due.

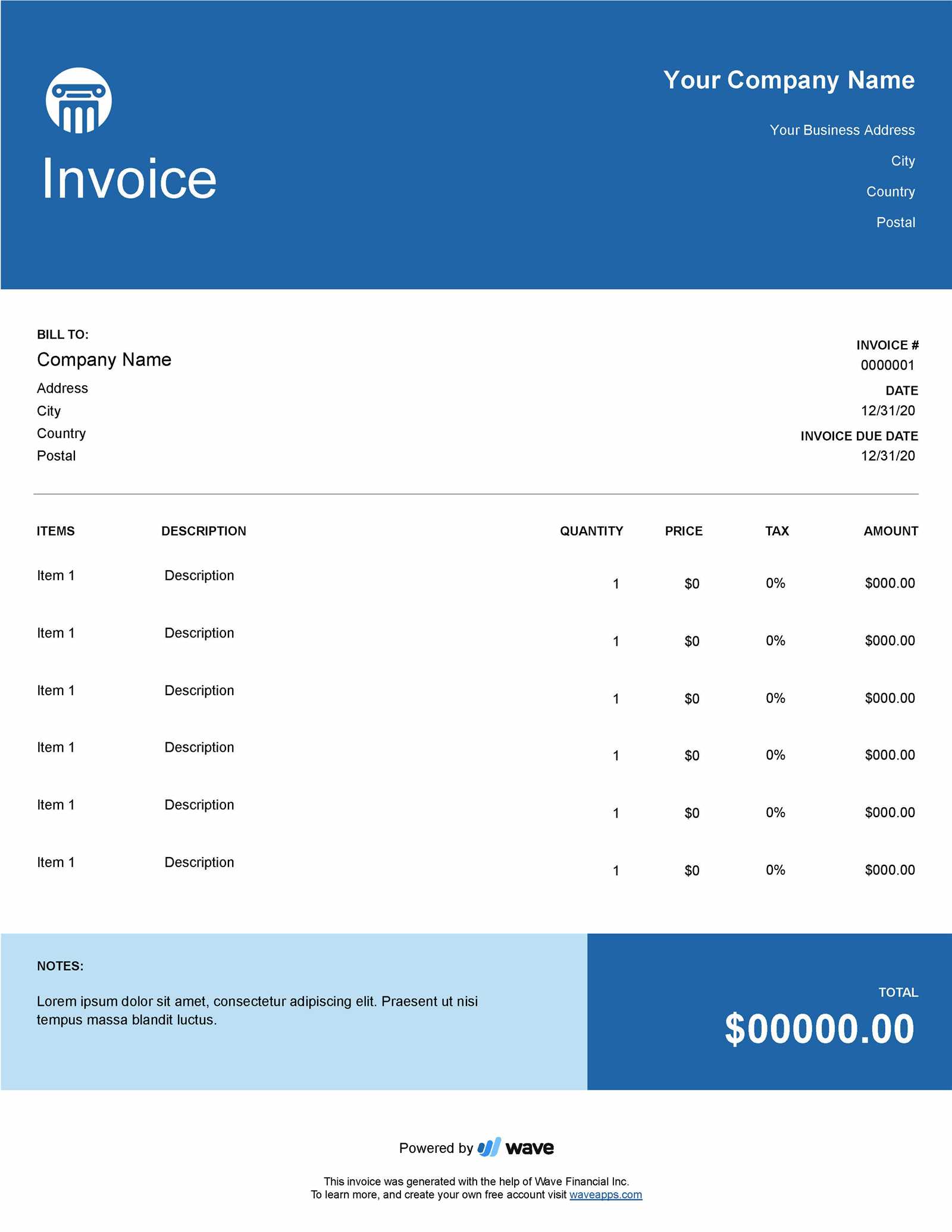

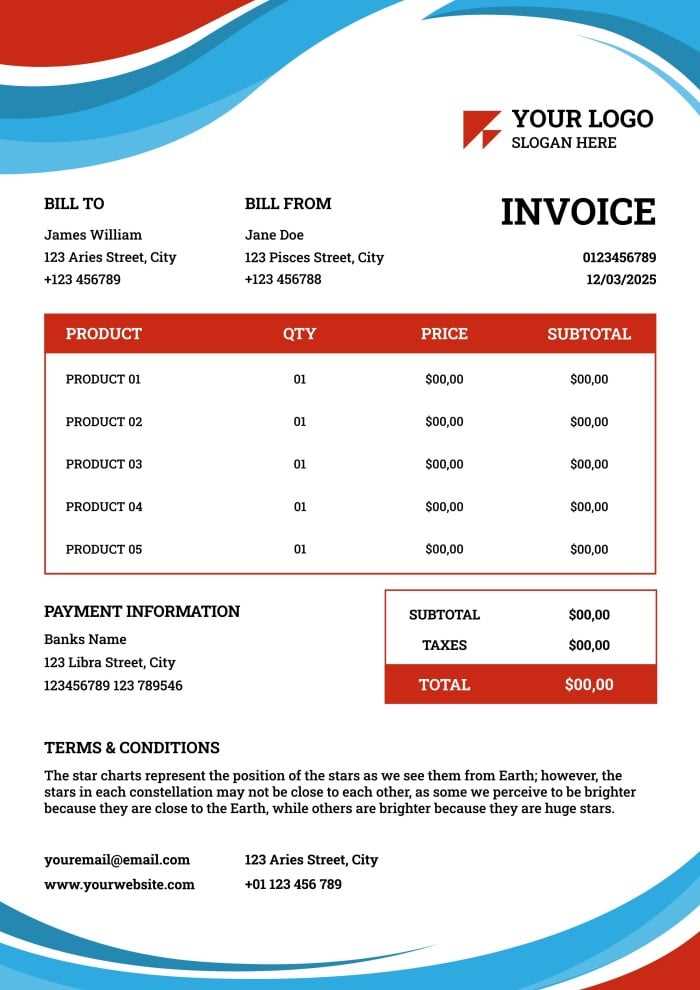

Choosing the Right Format for Security Invoices

When it comes to managing financial records, selecting the appropriate structure for your billing documents can make a significant difference in how efficiently you handle transactions. The right layout not only makes the document easy to understand but also ensures all necessary details are presented clearly. Whether you prefer a digital or paper-based format, it’s essential to choose one that supports your business needs while maintaining professionalism.

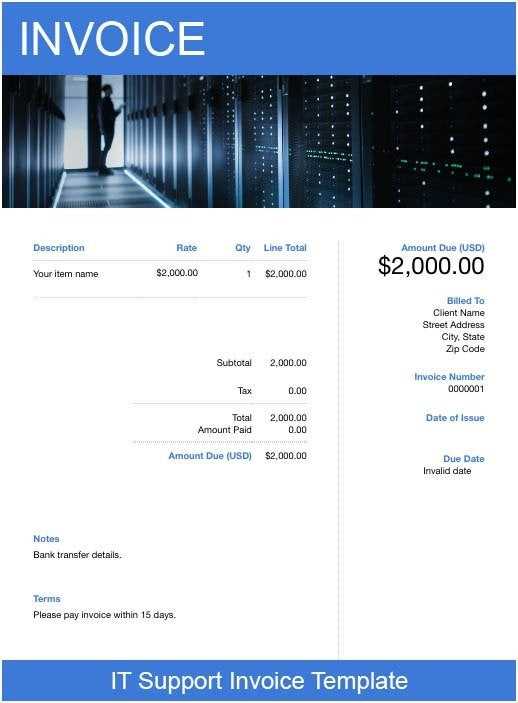

Digital vs. Paper Formats

In today’s fast-paced world, many businesses are shifting toward digital records due to their convenience and ease of management. Digital formats can be quickly generated, edited, and shared, saving both time and resources. However, some clients may still prefer printed copies for their records. Choosing the right format depends on your client base and the tools you have available. Digital formats allow for easy integration with accounting software, while paper copies offer a more traditional, tangible option.

Simple vs. Detailed Layouts

Deciding between a simple or detailed layout largely depends on the nature of the work performed. If you’re providing a variety of services or custom solutions, a more detailed format that clearly outlines each charge is essential. On the other hand, if your work is straightforward and easy to summarize, a simple layout may suffice. Whatever you choose, ensure the format is clear and easy to follow, with all necessary information easily accessible.

Common Mistakes to Avoid in Security Service Invoices

Creating accurate and professional billing documents is essential for maintaining smooth financial operations and building trust with clients. However, there are several common errors that can undermine the effectiveness of your records and create confusion or delays in payment. Avoiding these mistakes will help ensure that your billing process is efficient and error-free.

Incorrect or Missing Information

One of the most frequent mistakes is failing to include all the necessary details in the document. Missing information can cause delays in payment or create misunderstandings between you and your clients. Ensure you avoid these common errors:

- Not including your business name, contact details, and client information.

- Omitting the reference number or date of the transaction.

- Failing to specify payment terms or deadlines.

Lack of Clarity and Detail

Another mistake is providing vague descriptions of the work completed or the charges incurred. Without clear itemization, your clients may not fully understand the breakdown of costs, leading to confusion or disputes. Be sure to:

- Clearly list each task or service provided.

- Include the duration of each task or the hourly rate, if applicable.

- Provide detailed explanations for any additional charges or fees.

Failing to Double-Check Calculations

Mathematical errors can undermine your professionalism and potentially harm your reputation. Always double-check the totals, tax calculations, and any discounts offered before sending out a billing document. Small mistakes in addition or multiplication can result in inaccurate amounts due and cause unnecessary confusion.

How Invoice Templates Save Time and Effort

Managing financial records can be a time-consuming task, especially when creating each billing document from scratch. However, by using a pre-designed structure, you can significantly streamline the process. These structured formats allow you to quickly generate accurate and professional statements without having to start over every time. The result is less administrative work and more time to focus on growing your business.

Faster Document Creation

One of the main advantages of using a structured approach is the ability to create documents quickly. Instead of manually inputting the same information into each new record, you simply fill in specific details like dates, amounts, and services provided. This reduces the amount of time spent on each transaction and helps you keep your billing process efficient.

Consistency and Accuracy

Using a set structure ensures that all the necessary components are included in every document. This consistency reduces the risk of missing important details or making errors in calculations. Additionally, having a standard format helps avoid confusion, as clients will always receive documents that look and function in the same way. With a clear, consistent approach, your financial records become more reliable and easier to manage.

Security Invoice Template vs. Manual Billing

When it comes to handling billing tasks, businesses often face the choice between using a structured format or relying on manual processes. While creating custom records for each transaction may seem more personalized, it can also be time-consuming and prone to errors. On the other hand, using a pre-designed structure can help streamline the process, reduce mistakes, and ensure consistency across all transactions. Let’s compare both approaches to understand their benefits and drawbacks.

Manual Billing: Challenges and Drawbacks

Manual billing requires more effort and attention to detail. Each time a transaction occurs, you need to start from scratch, entering all the required information and performing calculations by hand. This method can lead to:

- Increased risk of errors: Human mistakes in calculations or missing details are more common.

- Time-consuming process: Creating new records for every billing cycle takes away time that could be better spent on other tasks.

- Lack of consistency: Each document may look different, making it harder to maintain a professional and unified appearance.

Using a Pre-Designed Structure: Benefits

Opting for a pre-designed structure offers several advantages that manual methods simply cannot match:

- Time savings: You only need to fill in specific details for each transaction, making the process much faster.

- Accuracy and consistency: With fields already set up, there’s less chance of missing important information or making calculation mistakes.

- Professional appearance: A consistent layout ensures that each document looks polished and reliable, improving client trust.

While both methods have their place, a pre-designed structure significantly reduces the time and effort involved in the billing process, allowing businesses to focus on delivering quality work rather than worrying about administrative tasks.

How to Set Payment Terms on Your Invoice

Establishing clear payment terms is essential to ensuring smooth financial transactions with your clients. Setting well-defined expectations around payment deadlines, methods, and penalties can help avoid delays and misunderstandings. It’s crucial to communicate these terms upfront so both parties are on the same page, fostering a transparent and professional relationship.

Key Elements to Include in Payment Terms

When outlining payment terms, be specific about the details to avoid confusion. The following elements should always be included:

- Payment Due Date: Specify the exact date by which payment should be made. Common due dates are 30, 60, or 90 days from the completion of work, but you can adjust it according to your business needs.

- Accepted Payment Methods: List the payment methods you accept, such as bank transfers, credit cards, or checks. Offering multiple options can make it easier for clients to pay on time.

- Late Payment Fees: Include a clear penalty for overdue payments, whether it’s a fixed fee or an interest rate on the outstanding balance. This encourages clients to pay promptly.

- Discounts for Early Payment: Some businesses offer a small discount for early payment, incentivizing clients to settle their accounts ahead of schedule.

Tips for Clear Payment Terms

To ensure that your terms are both clear and fair, follow these tips:

- Be concise and direct: Avoid using ambiguous language or complex legal jargon. Simple, clear statements will prevent confusion.

- Make the terms visible: Highlight the payment terms near the top or bottom of the document so they are easy to find.

- Communicate changes ahead of time: If you need to adjust payment terms, notify clients in advance to avoid surprises.

By setting clear payment expectations, you’ll reduce the chances of payment delays and ensure a smoother financial relationship with your clients.

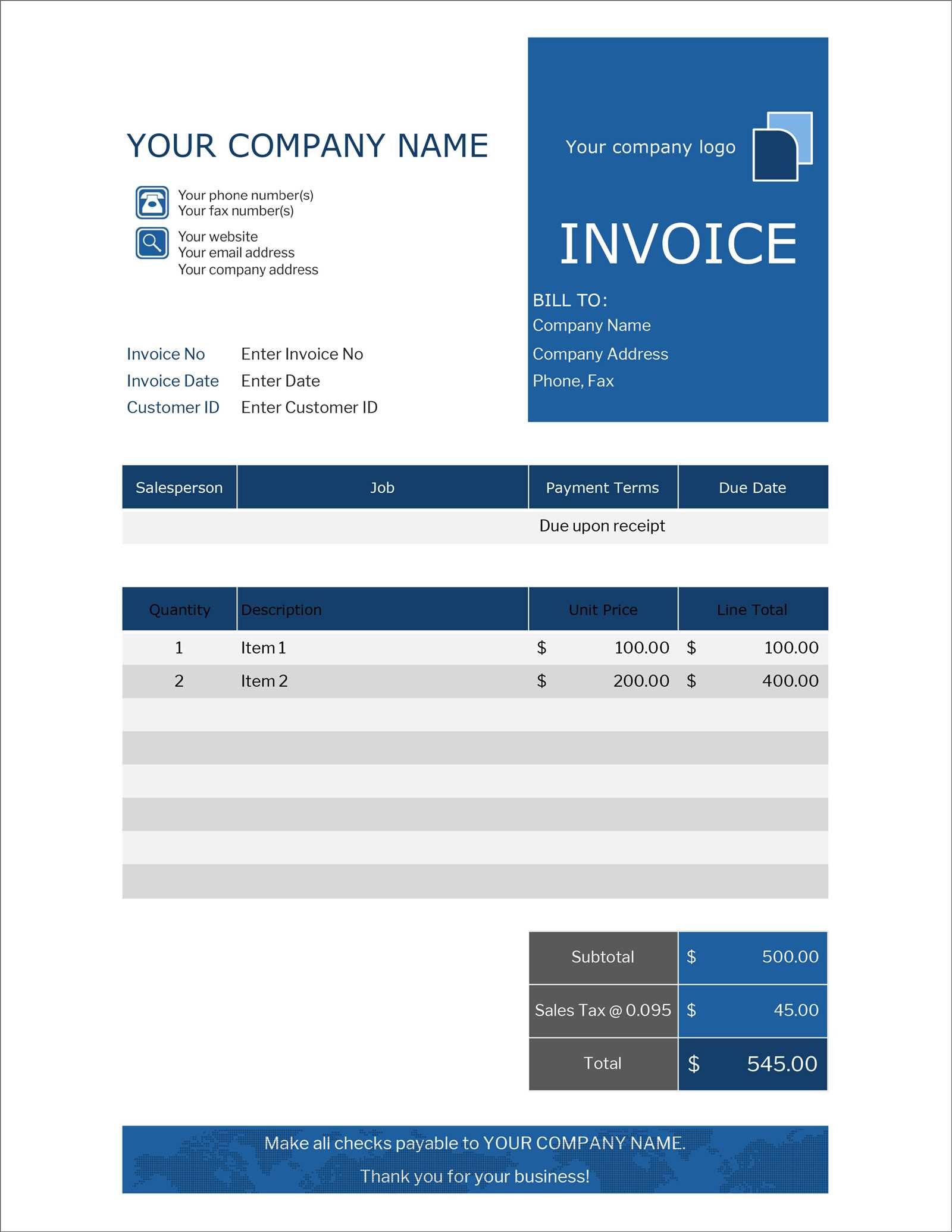

Design Tips for a Professional Invoice

A well-designed billing document plays a critical role in maintaining professionalism and clarity when dealing with clients. A polished, organized layout not only makes a strong impression but also ensures that all the necessary details are easy to find and understand. Whether you are creating a document from scratch or customizing an existing layout, following key design principles can enhance both the appearance and functionality of your financial records.

Keep It Clean and Simple

The key to a professional design is simplicity. A cluttered or overly complicated document can confuse clients and make it harder for them to locate essential information. Stick to a clean layout with plenty of white space. Organize sections logically, with clear headings and well-spaced text. This will make it easier for the reader to quickly absorb the information. Clarity and readability should always be your priority when choosing fonts, sizes, and formatting.

Brand Consistency and Customization

Your billing document should reflect your brand’s identity. Use consistent colors, logos, and fonts that align with your business’s overall visual style. This helps reinforce your brand image and adds a layer of professionalism. Additionally, customize the design to suit the specific needs of your business. For instance, if your work involves multiple tasks or clients with unique requirements, ensure that the format allows for detailed descriptions and itemized charges. Personalizing the document makes it feel more tailored to your business and clients.

Incorporating these design elements will ensure that your billing documents are not only functional but also presentable, reinforcing your commitment to professionalism in all aspects of your business operations.

Free vs Paid Invoice Templates for Security Services

When choosing a structure for your billing documents, you’ll often face the decision between using free or paid options. Both types offer advantages, but they also come with limitations. Understanding the key differences can help you determine which choice is the best fit for your business needs. Whether you’re just starting out or looking to enhance your billing process, it’s important to weigh the pros and cons of each.

Advantages of Free Options

Free billing structures can be a great starting point, especially for small businesses or those just beginning to organize their financial records. Here are some benefits:

- Cost-effective: The most obvious benefit is that they come at no cost, making them ideal for startups or those with limited budgets.

- Basic functionality: Free designs usually include the core features needed for standard billing, such as itemized lists and total amounts due.

- Ease of use: Many free options are simple and straightforward, allowing you to quickly generate and send documents without a steep learning curve.

Advantages of Paid Options

On the other hand, paid structures typically come with more advanced features and benefits. Here are some reasons why businesses might choose a paid option:

- Customization: Paid designs often allow for greater flexibility in terms of layout, branding, and personalization, which can help make your documents look more professional and aligned with your business image.

- Advanced features: Paid options may include automated calculations, built-in tax rates, and integration with accounting software, reducing manual input and minimizing errors.

- Customer support: With paid options, you often have access to customer support in case you encounter issues, ensuring a smoother experience when using the structure.

Ultimately, whether you choose a free or paid option depends on the scale of your business and your specific needs. If you’re looking for a no-cost solution with basic functionality, a free structure may suffice. However, if you need advanced features, a more polished design, or greater customization, investing in a paid version might be the better choice.

How to Handle Late Payments with Your Invoice

Late payments are a common challenge for businesses of all sizes, and managing them effectively is essential to maintaining a steady cash flow. While you can’t always prevent delays, you can set clear terms and take steps to handle overdue payments professionally. By establishing a firm approach and maintaining clear communication, you can encourage clients to pay on time and minimize disruptions to your financial operations.

Set Clear Payment Terms Upfront

One of the most effective ways to prevent late payments is to set clear expectations from the beginning. Ensure that your payment terms are specified and easily visible on every billing document. Key elements to include are:

- Due date: Clearly state the date by which payment should be made.

- Late fees: Specify any penalties for overdue payments, such as interest rates or fixed fees.

- Payment methods: List the accepted payment options and any associated fees for specific methods.

Steps to Take When Payments Are Late

When a client’s payment becomes overdue, it’s important to address the situation promptly and professionally. Here’s a step-by-step guide for handling late payments:

- Send a polite reminder: Contact the client a few days after the due date, politely reminding them of the outstanding balance. Often, clients simply forget or overlook the due date.

- Issue a formal notice: If the payment remains unpaid, send a more formal reminder, outlining the amount due, any late fees, and the final deadline for payment.

- Offer a payment plan: If the client is facing financial difficulties, offer the option to set up a payment plan. This shows flexibility and a willingness to work with your clients.

- Consider legal action: If the payment remains unpaid for an extended period, you may need to explore legal options, such as hiring a collections agency or pursuing small claims court action, depending on the amount owed.

By setting clear terms and taking proactive steps, you can reduce the impact of late payments on your business and ensure that clients remain aware of their financial obligations.

Customizing Invoice Templates for Different Services

Tailoring your billing documents to fit the unique needs of different types of work can enhance clarity and professionalism. Each service may require specific details, whether it’s the breakdown of hours worked, materials used, or unique rates for certain tasks. Customizing your structure helps to reflect the nature of the work accurately and ensures that all required information is included, making it easier for clients to understand the charges.

Adjusting for Various Job Types

Different jobs require different levels of detail. For example, a one-time project may not need as much explanation as ongoing work. Here are some common adjustments to consider:

- Hourly vs. Fixed Rates: If your pricing is based on time worked, be sure to clearly indicate the rate per hour and the total time spent. For fixed-rate jobs, include a detailed breakdown of what is covered under the agreed price.

- Material Costs: For tasks that involve supplies or materials, list these separately to ensure transparency. Include the cost of each item and the quantity used.

- Specialized Services: If you’re providing a specialized service, such as emergency response or high-security coverage, ensure that this is clearly outlined and priced accordingly.

Including Relevant Details for Each Job

Beyond pricing adjustments, the description of the work completed is also crucial. Ensure that the following details are customized based on the type of work:

- Task Descriptions: Provide a clear summary of what was done, with specifics that highlight the scope and complexity of the task.

- Dates and Timeframes: Be sure to note the dates of service or the timeline for ongoing work, especially if the tasks were spread out over time.

- Client-Specific Notes: Tailor the document to include any client-specific requests, requirements, or terms that were discussed or agreed upon during the course of the work.

Customizing your billing document for different jobs helps to avoid confusion, reinforces professionalism, and ensures that all parties involved have a clear understanding of the work completed and the costs associated with it.

Integrating Your Invoice Template with Accounting Software

Streamlining your financial processes is essential for efficiency, especially when managing multiple clients or ongoing projects. One of the most effective ways to do this is by integrating your billing structure with accounting software. This integration allows for automatic data transfer between your billing system and your accounting records, reducing manual entry, minimizing errors, and saving valuable time.

Benefits of Integration

When your billing system is connected to accounting software, you can enjoy several key advantages that improve both workflow and financial accuracy:

- Reduced Errors: Automated data entry minimizes the risk of human mistakes, such as incorrect calculations or missing information.

- Faster Processing: With data automatically transferred, there’s no need to input the same information multiple times. This speeds up your entire billing process.

- Real-time Updates: Integrated systems allow you to track payments in real-time, offering instant visibility into your cash flow and outstanding balances.

- Better Reporting: Syncing your billing with accounting software provides more accurate financial reports, making it easier to analyze profits, track expenses, and prepare for taxes.

How to Integrate Your Systems

Integrating your billing structure with accounting software typically involves a few steps, depending on the platform you choose. Here’s a general guide on how to get started:

- Choose Compatible Software: Ensure that your accounting software supports integrations with your chosen billing system. Popular platforms like QuickBooks, Xero, and FreshBooks offer integration options with various billing tools.

- Sync Data Fields: Align the fields in your billing system with those in your accounting software. This ensures that information like client names, amounts due, and payment statuses are transferred correctly.

- Automate Payment Updates: Set up the system to automatically update your accounts when payments are received or processed. This helps keep everything up-to-date without requiring manual adjustments.

- Test the System: Before fully relying on the integration, run test transactions to make sure that the data flows seamlessly between both systems.

Integrating your billing system with accounting software can significantly improve your business’s efficiency, accuracy, and overall financial management. By automating key tasks, you can focus more on growing your business and less on administrative work.

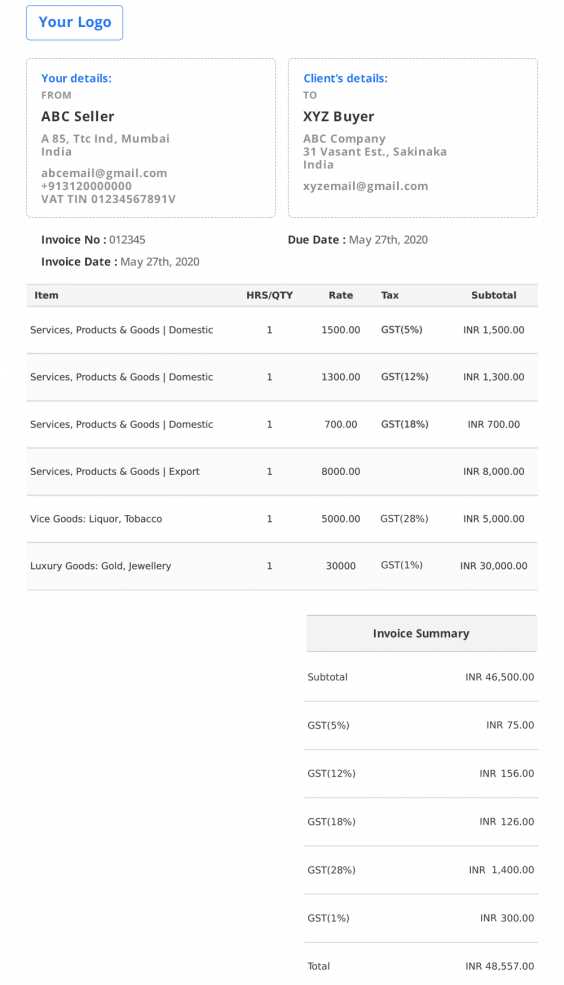

Why Clear Itemization Matters in Security Invoices

Clear itemization is crucial when detailing charges in any billing document, especially in industries where multiple tasks and varying rates apply. By breaking down the costs associated with each individual task, client expectations are better managed, and transparency is maintained. This not only helps clients understand the value of the work completed but also reduces the chances of disputes and ensures prompt payment.

Benefits of Clear Itemization

Itemizing charges ensures that every aspect of the work provided is accounted for and that the client knows exactly what they are paying for. Here are some key advantages:

- Transparency: Clients appreciate when they can easily see the breakdown of charges, as it builds trust and avoids confusion.

- Prevention of Disputes: By outlining each task or charge separately, you reduce the likelihood of disagreements about pricing and scope.

- Better Cash Flow: A well-structured, itemized bill encourages timely payments, as clients can see exactly what they owe.

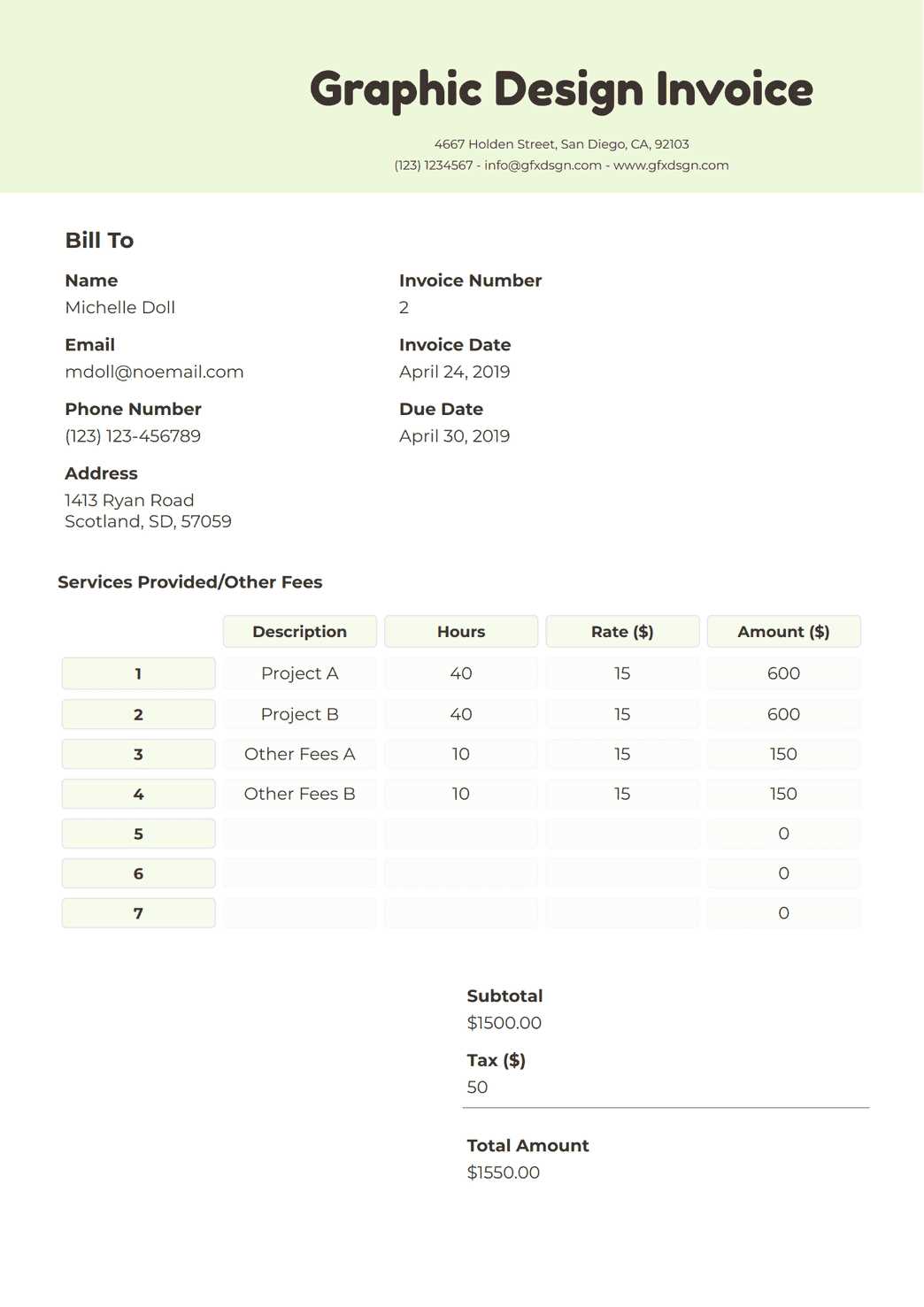

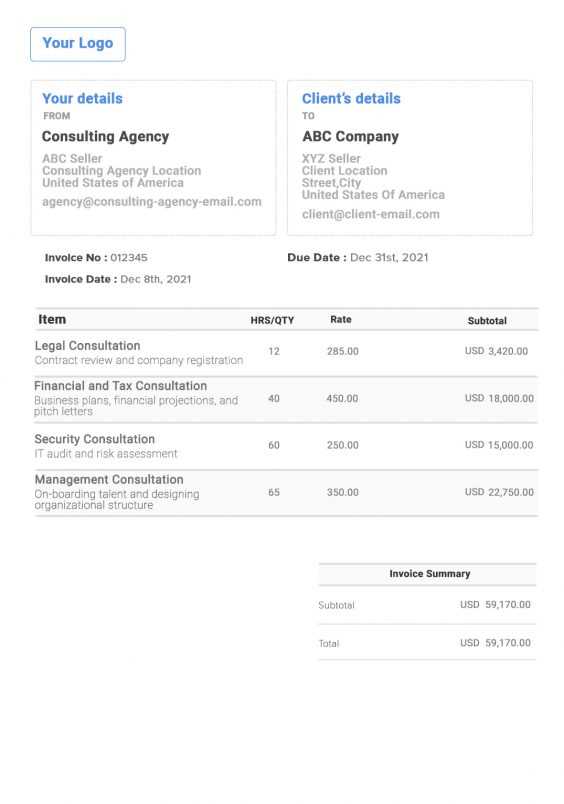

Example of Itemization

To further illustrate how itemization works, here’s a basic example of how charges might be broken down in a billing document:

| Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Site visit and assessment | 1 | $100 | $100 |

| Monitoring system setup | 2 | $75 | $150 |

| Night patrol services | 10 hours | $50 | $500 |

| Total | $750 |

By providing clear itemization, each individual task and its associated cost are visible, which makes it easier for the client to understand the charges and prevents misunderstandings.

Best Practices for Security Service Invoicing

Creating a professional billing document is more than just listing charges. It’s about providing a clear, transparent, and accurate representation of the work completed, while maintaining good relationships with clients. Following best practices in the billing process can help ensure timely payments, reduce disputes, and improve the overall client experience.

Key Best Practices

To ensure your billing process is efficient and professional, here are several key practices to follow:

- Be Clear and Detailed: Ensure that all charges are broken down into easily understandable categories. Include detailed descriptions for each task performed and specify rates, quantities, and totals.

- Set Payment Terms Early: Define the payment terms clearly from the beginning of the project. This includes due dates, acceptable payment methods, and any penalties for late payments.

- Maintain Consistency: Use a consistent format for all billing documents. This includes font, layout, and the order in which information is presented. Consistency promotes professionalism and avoids confusion.

- Include Contact Information: Ensure that your contact information (phone number, email address, business address) is easily visible, so clients can reach you quickly if they have any questions or issues.

- Track Payments: Regularly monitor outstanding balances and set up reminders for overdue payments. Consider using software to automatically send reminders and keep track of what has been paid.

Additional Considerations

Aside from the basics, there are a few additional things you can do to make the process even smoother:

- Offer Flexible Payment Options: Accept multiple payment methods, such as credit cards, bank transfers, or online payment platforms, to make it as easy as possible for clients to pay.

- Incorporate Late Fees: If you are willing to include penalties for overdue payments, be sure to include this information upfront in your agreement. Late fees should be clearly defined and consistently enforced.

- Provide Recurring Billing Options: If you work with clients on a regular basis, consider setting up a recurring billing system to simplify the process for both you and your clients.

By following these best practices, you can improve the billing process, build stronger client relationships, and ensure a steady cash flow for your business.